Pay versus Performance

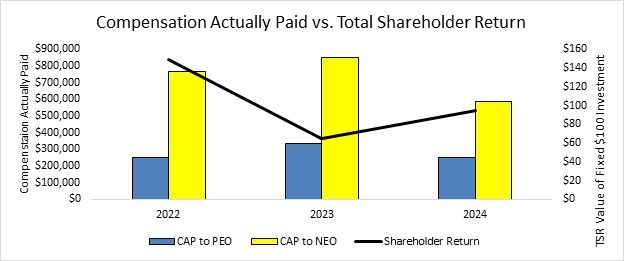

As required by Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive “compensation actually paid” (as defined by SEC rules) and certain financial performance metrics of the Corporation for the last three fiscal years. In determining the “compensation actually paid” to our named executive officers, we are required to make various adjustments to amounts that have been previously reported in the Summary Compensation Table (“SCT”), as the SEC’s valuation methods for this section differ from those required in the SCT. The table below summarizes compensation values both as previously reported in our SCT, as well as the adjusted values required in this section for the 2022, 2023 and 2024 calendar years. As the pay versus performance requirements are relatively new, the Compensation Committee did not consider the pay versus performance disclosure when making its incentive compensation decisions.

The following table sets forth information concerning the compensation of our principal executive officer, or “PEO,” and, on an average basis, the compensation of our other named executive officers, or “NEOs,” for each of the years ending December 31, 2024, 2023 and 2022, as such compensation relates to our financial performance for each such year. The PEO for each of the years presented within the following tables was Donald Taylor, Chief Executive Officer. The NEOs for each of the years presented were Richard Warke, Executive Chairman, Michael McClelland (resigned March 31, 2024), Ty Minnick, Interim Chief Financial Officer (effective March 31, 2024), Chief Financial Officer, Johnny Pappas, Vice President, Environmental and Permitting, and Jim Wickens (resigned April 4, 2024), Vice President, Operations.

| Year | SCT Total for PEO | Compensation Actually Paid to PEO(1) | Average SCT Total for Non-PEO NEOs | Average Compensation Actually Paid to Non-PEO NEOs(2) | Value of Initial Fixed $100 Investment Based on Total Shareholder Return(3) | Net Loss (Income) (Dollars in thousands) | ||||||||||||||||||

| 2024 | $ | 543,292 | $ | 250,000 | $ | 249,573 | $ | 146,280 | $ | 94.68 | $ | 6,588 | ||||||||||||

| 2023 | $ | 337,500 | $ | 337,500 | $ | 212,189 | $ | 212,189 | $ | 64.89 | $ | (6,658 | ) | |||||||||||

| 2022 | $ | 343,283 | $ | 250,000 | $ | 293,230 | $ | 192,345 | $ | 148.94 | $ | 19,720 | ||||||||||||

| (1) | The dollar amounts reported for the PEO under “Compensation Actually Paid” represent the amount of “Compensation Actually Paid” to the PEO, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to the PEO during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the adjustments in the table below were made to the PEO’s total compensation for each year to determine the compensation actually paid: |

| Reconciliation of PEO SCT Total and Compensation Actually Paid | 2024 | 2023 | 2022 | |||||||||

| Total Compensation as reported in SCT | $ | 543,292 | $ | 337,500 | $ | 343,283 | ||||||

| Fair value of equity awards granted during year as reported in SCT | $ | 293,292 | $ | 0 | $ | 93,283 | ||||||

| Fair value of equity compensation granted in current year—value at end of year-end | $ | 0 | $ | 0 | $ | 0 | ||||||

| Change in fair value for end of prior year to vesting date for awards made in prior years that vested during current year | $ | 0 | $ | 0 | $ | 0 | ||||||

| Change in fair value from end of prior year to end of current year for awards made in prior years that were unvested at end of current year | $ | 0 | $ | 0 | $ | 0 | ||||||

| Fair value of awards forfeited in current year determined at end of prior year | $ | 0 | $ | 0 | $ | 0 | ||||||

| Compensation Actually Paid | $ | 250,000 | $ | 337,500 | $ | 250,000 | ||||||

| (2) | The dollar amounts reported for the NEOs under “Compensation Actually Paid” represent the average amount of “Compensation Actually Paid” to the NEOs, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual average amount of compensation earned by or paid to the NEOs during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the adjustments in the table below were made to the NEOs’ average total compensation for each year to determine the compensation actually paid: |

| Reconciliation of NEO SCT Total and Compensation Actually Paid | 2024 | 2023 | 2022 | |||||||||

| Total Compensation as reported in SCT | $ | 998,292 | $ | 848,756 | $ | 1,172,918 | ||||||

| Fair value of equity awards granted during year as reported in SCT | $ | 413,172 | $ | 0 | $ | 403,540 | ||||||

| Fair value of equity compensation granted in current year—value at end of year-end | $ | 0 | $ | 0 | $ | 0 | ||||||

| Change in fair value for end of prior year to vesting date for awards made in prior years that vested during current year | $ | 0 | $ | 0 | $ | 0 | ||||||

| Change in fair value from end of prior year to end of current year for awards made in prior years that were unvested at end of current year | $ | 0 | $ | 0 | $ | 0 | ||||||

| Fair value of awards forfeited in current year determined at end of prior year | $ | 0 | $ | 0 | $ | 0 | ||||||

| Compensation Actually Paid | $ | 585,120 | $ | 848,756 | $ | 769,378 | ||||||

| (3) | For purposes of calculating the cumulative total Shareholder return, the measurement period is the market close on the last trading day of 2021, through and including the end of the year for which cumulative total Shareholder return is being calculated. |

| Reconciliation of PEO SCT Total and Compensation Actually Paid | 2024 | 2023 | 2022 | |||||||||

| Total Compensation as reported in SCT | $ | 543,292 | $ | 337,500 | $ | 343,283 | ||||||

| Fair value of equity awards granted during year as reported in SCT | $ | 293,292 | $ | 0 | $ | 93,283 | ||||||

| Fair value of equity compensation granted in current year—value at end of year-end | $ | 0 | $ | 0 | $ | 0 | ||||||

| Change in fair value for end of prior year to vesting date for awards made in prior years that vested during current year | $ | 0 | $ | 0 | $ | 0 | ||||||

| Change in fair value from end of prior year to end of current year for awards made in prior years that were unvested at end of current year | $ | 0 | $ | 0 | $ | 0 | ||||||

| Fair value of awards forfeited in current year determined at end of prior year | $ | 0 | $ | 0 | $ | 0 | ||||||

| Compensation Actually Paid | $ | 250,000 | $ | 337,500 | $ | 250,000 | ||||||

| Reconciliation of NEO SCT Total and Compensation Actually Paid | 2024 | 2023 | 2022 | |||||||||

| Total Compensation as reported in SCT | $ | 998,292 | $ | 848,756 | $ | 1,172,918 | ||||||

| Fair value of equity awards granted during year as reported in SCT | $ | 413,172 | $ | 0 | $ | 403,540 | ||||||

| Fair value of equity compensation granted in current year—value at end of year-end | $ | 0 | $ | 0 | $ | 0 | ||||||

| Change in fair value for end of prior year to vesting date for awards made in prior years that vested during current year | $ | 0 | $ | 0 | $ | 0 | ||||||

| Change in fair value from end of prior year to end of current year for awards made in prior years that were unvested at end of current year | $ | 0 | $ | 0 | $ | 0 | ||||||

| Fair value of awards forfeited in current year determined at end of prior year | $ | 0 | $ | 0 | $ | 0 | ||||||

| Compensation Actually Paid | $ | 585,120 | $ | 848,756 | $ | 769,378 | ||||||

| [1] | The dollar amounts reported for the PEO under “Compensation

Actually Paid” represent the amount of “Compensation Actually Paid” to the PEO, as computed in accordance with Item

402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to the PEO during the

applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the adjustments in the table below were made to

the PEO’s total compensation for each year to determine the compensation actually paid:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| [2] | The dollar amounts reported for the NEOs under “Compensation

Actually Paid” represent the average amount of “Compensation Actually Paid” to the NEOs, as computed in accordance

with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual average amount of compensation earned by or paid to

the NEOs during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the adjustments in the table

below were made to the NEOs’ average total compensation for each year to determine the compensation actually paid:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| [3] | For purposes of calculating the cumulative total Shareholder return, the measurement period is the market close on the last trading day of 2021, through and including the end of the year for which cumulative total Shareholder return is being calculated. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||