Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

AIM Variable Insurance Funds (Invesco Variable Insurance Funds)

|

|

| Entity Central Index Key |

0000896435

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| Invesco Oppenheimer V.I. International Growth Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Oppenheimer V.I. International Growth Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco Oppenheimer V.I. International Growth Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco Oppenheimer V.I. International Growth Fund

(Series I) | $ 53 | 1.00 % † |

* | | | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

|

|

| Expenses Paid, Amount |

$ 53

|

|

| Expense Ratio, Percent |

1.00%

|

[1],[2] |

| Net Assets |

$ 317,591,332

|

|

| Holdings Count | Holding |

63

|

|

| Investment Company, Portfolio Turnover |

28.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 317,591,332 | | Total number of portfolio holdings | 63 | | Portfolio turnover rate | 28 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Taiwan Semiconductor Manufacturing Co. Ltd. | 3.65 % | | Dollarama, Inc. | 3.46 % | | BAE Systems PLC | 3.02 % | | Reliance Industries Ltd. | 2.90 % | | ResMed, Inc. | 2.84 % | | Siemens AG | 2.78 % | | Universal Music Group N.V. | 2.77 % | | Tencent Holdings Ltd. | 2.64 % | | AstraZeneca PLC | 2.39 % | | Sartorius Stedim Biotech | 2.38 % | | * Excluding money market fund holdings, if any. | |

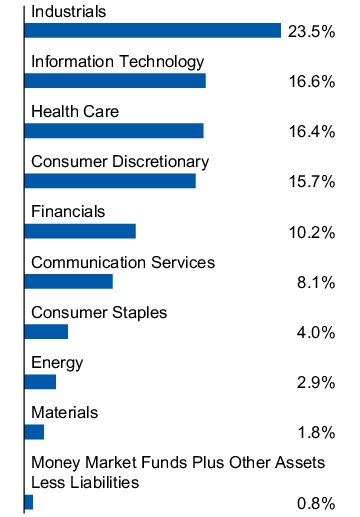

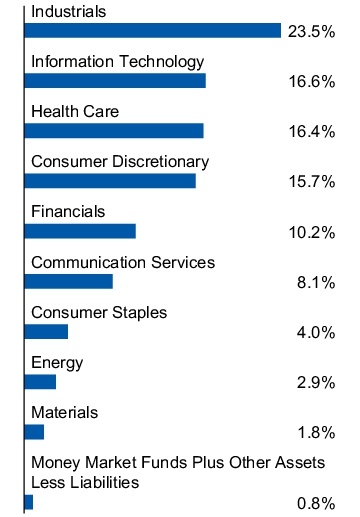

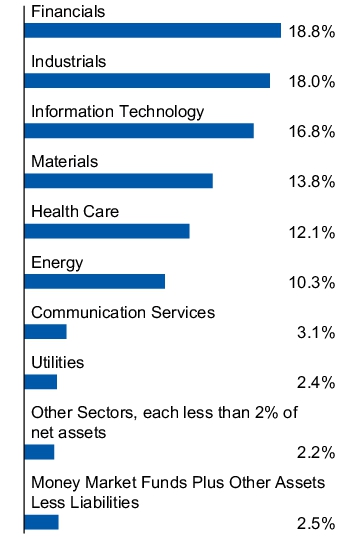

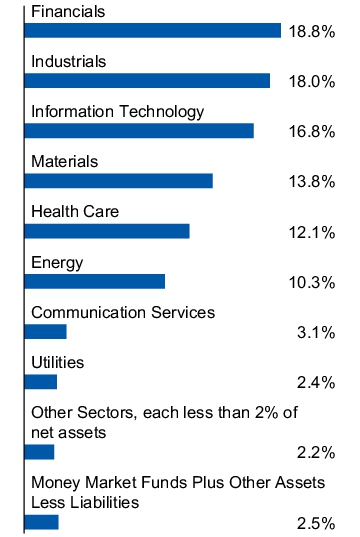

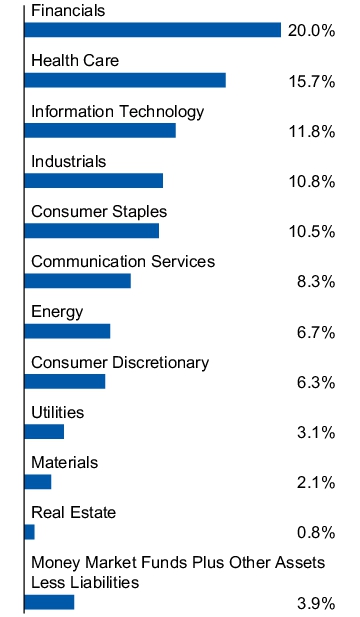

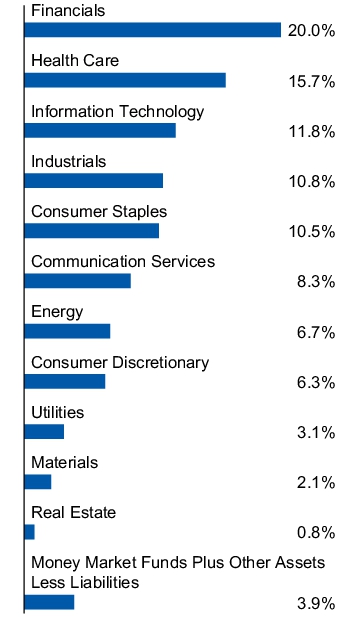

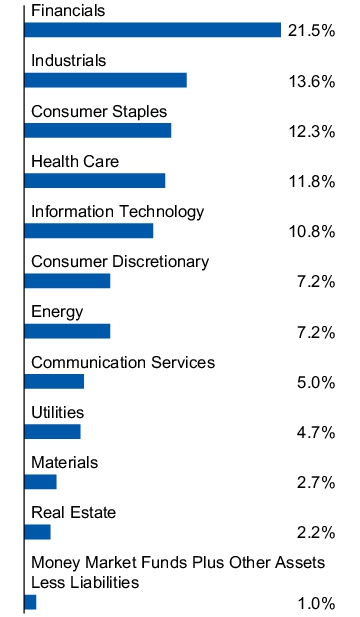

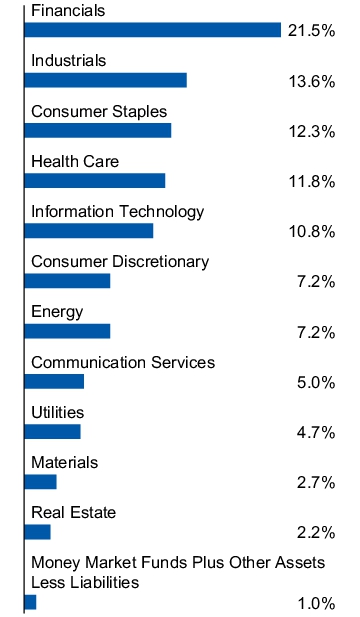

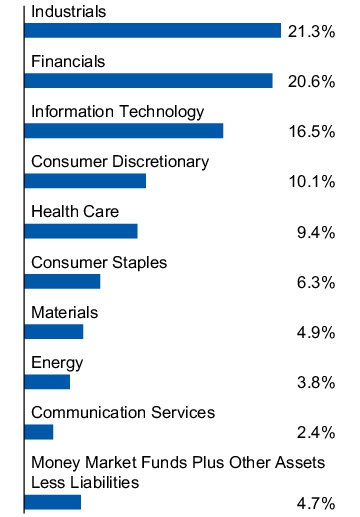

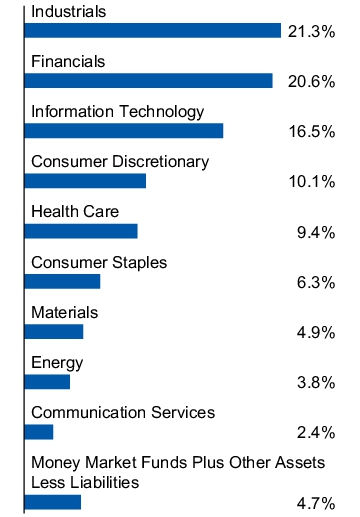

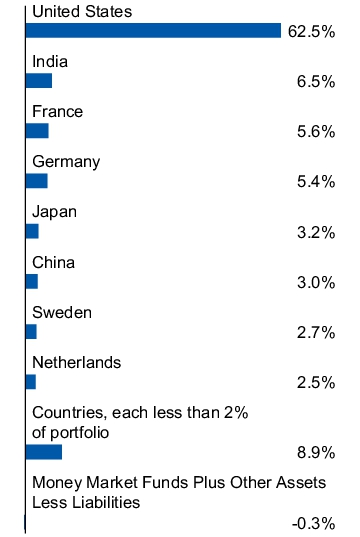

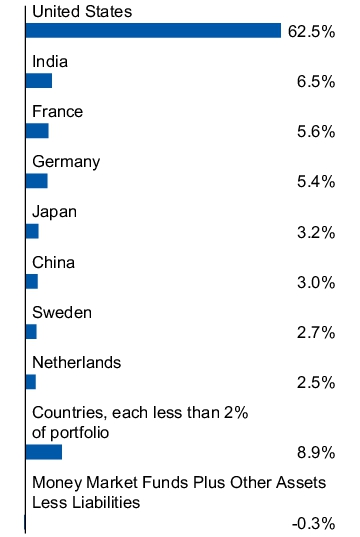

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Taiwan Semiconductor Manufacturing Co. Ltd. | 3.65 % | | Dollarama, Inc. | 3.46 % | | BAE Systems PLC | 3.02 % | | Reliance Industries Ltd. | 2.90 % | | ResMed, Inc. | 2.84 % | | Siemens AG | 2.78 % | | Universal Music Group N.V. | 2.77 % | | Tencent Holdings Ltd. | 2.64 % | | AstraZeneca PLC | 2.39 % | | Sartorius Stedim Biotech | 2.38 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco Oppenheimer V.I. International Growth Fund - Series II |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco Oppenheimer V.I. International Growth Fund

|

|

| Class Name |

Series II

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco Oppenheimer V.I. International Growth Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco Oppenheimer V.I. International Growth Fund

(Series II) | $ 66 | 1.25 % † |

* | | | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

|

|

| Expenses Paid, Amount |

$ 66

|

|

| Expense Ratio, Percent |

1.25%

|

[1],[2] |

| Net Assets |

$ 317,591,332

|

|

| Holdings Count | Holding |

63

|

|

| Investment Company, Portfolio Turnover |

28.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 317,591,332 | | Total number of portfolio holdings | 63 | | Portfolio turnover rate | 28 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Taiwan Semiconductor Manufacturing Co. Ltd. | 3.65 % | | Dollarama, Inc. | 3.46 % | | BAE Systems PLC | 3.02 % | | Reliance Industries Ltd. | 2.90 % | | ResMed, Inc. | 2.84 % | | Siemens AG | 2.78 % | | Universal Music Group N.V. | 2.77 % | | Tencent Holdings Ltd. | 2.64 % | | AstraZeneca PLC | 2.39 % | | Sartorius Stedim Biotech | 2.38 % | | * Excluding money market fund holdings, if any. | |

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Taiwan Semiconductor Manufacturing Co. Ltd. | 3.65 % | | Dollarama, Inc. | 3.46 % | | BAE Systems PLC | 3.02 % | | Reliance Industries Ltd. | 2.90 % | | ResMed, Inc. | 2.84 % | | Siemens AG | 2.78 % | | Universal Music Group N.V. | 2.77 % | | Tencent Holdings Ltd. | 2.64 % | | AstraZeneca PLC | 2.39 % | | Sartorius Stedim Biotech | 2.38 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. American Franchise Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. American Franchise Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. American Franchise Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. American Franchise Fund

(Series I) | $ 43 | 0.85 % |

|

|

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.85%

|

[1] |

| Net Assets |

$ 894,987,483

|

|

| Holdings Count | Holding |

62

|

|

| Investment Company, Portfolio Turnover |

27.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 894,987,483 | | Total number of portfolio holdings | 62 | | Portfolio turnover rate | 27 % |

|

|

| Holdings [Text Block] |

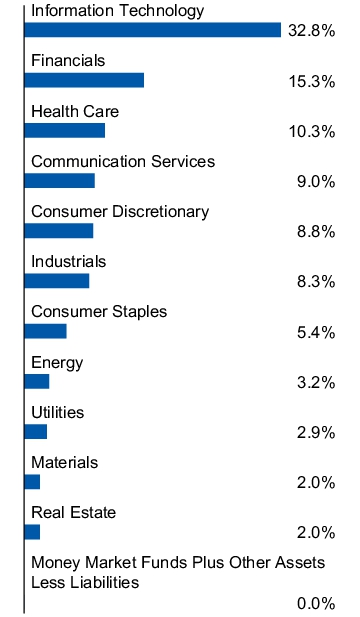

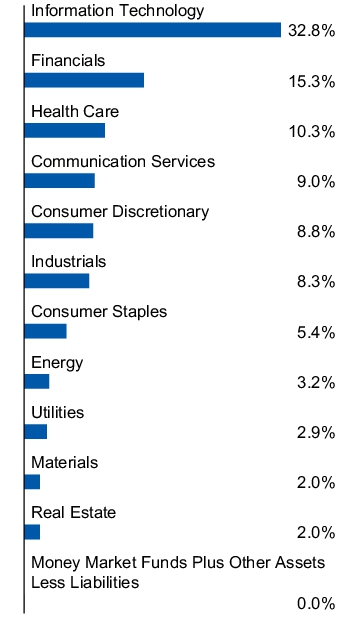

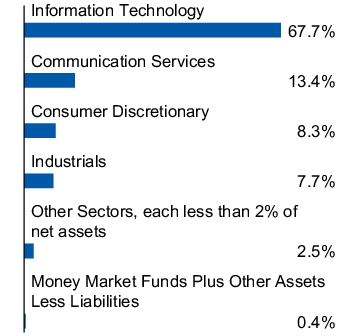

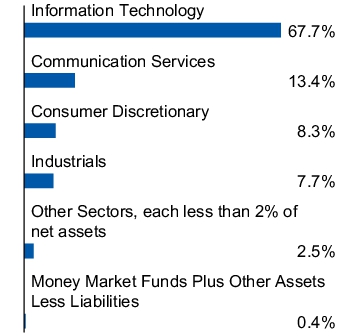

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | NVIDIA Corp. | 11.39 % | | Microsoft Corp. | 9.34 % | | Amazon.com, Inc. | 7.21 % | | Meta Platforms, Inc., Class A | 6.74 % | | Broadcom, Inc. | 4.24 % | | Apple, Inc. | 3.49 % | | Netflix, Inc. | 3.46 % | | Alphabet, Inc., Class A | 3.06 % | | Visa, Inc., Class A | 2.57 % | | ServiceNow, Inc. | 2.46 % | | * Excluding money market fund holdings, if any. | |

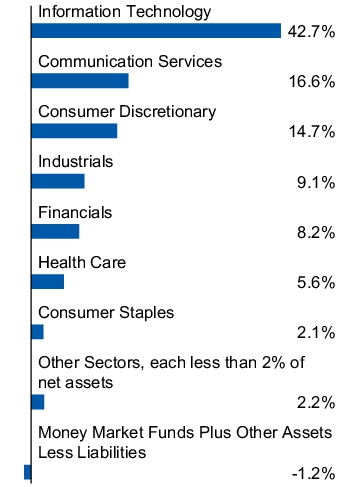

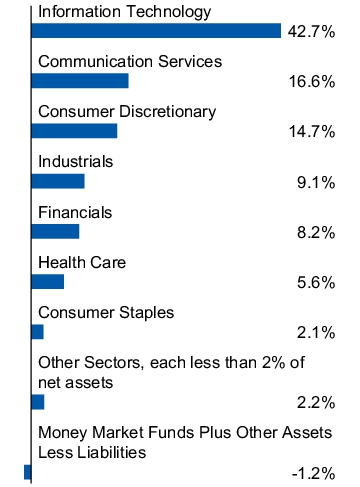

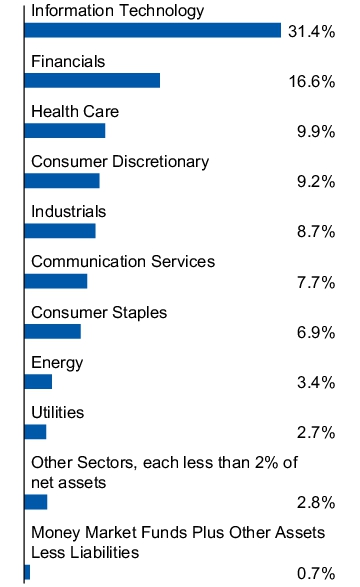

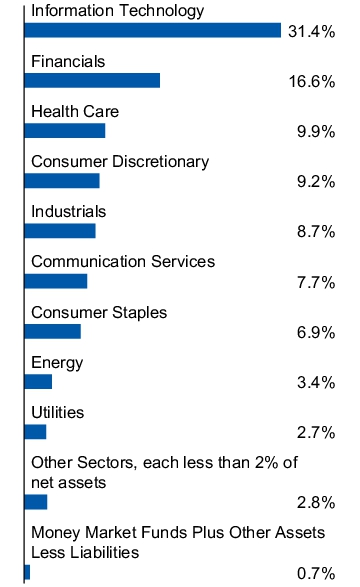

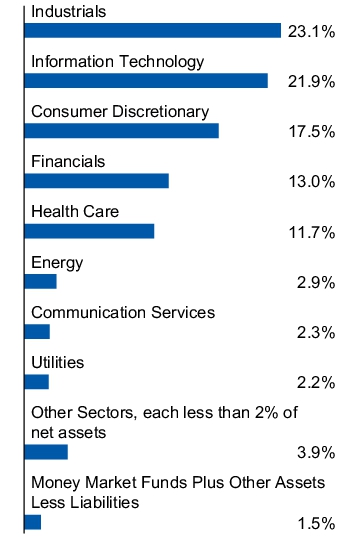

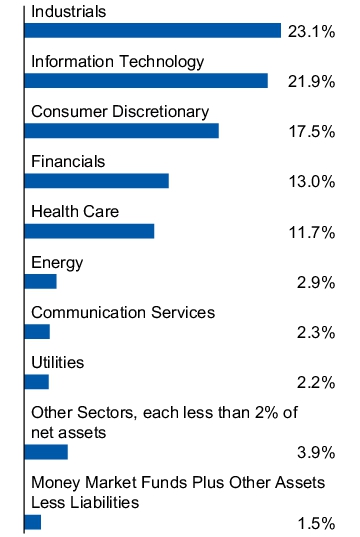

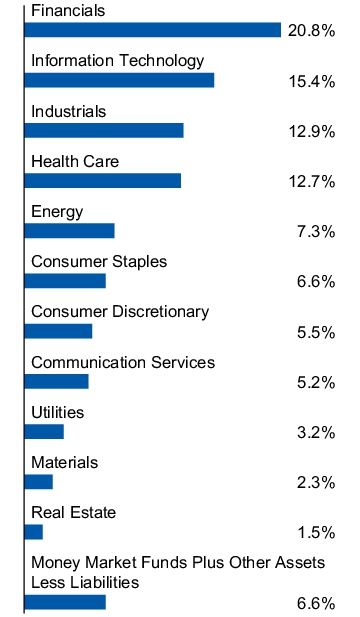

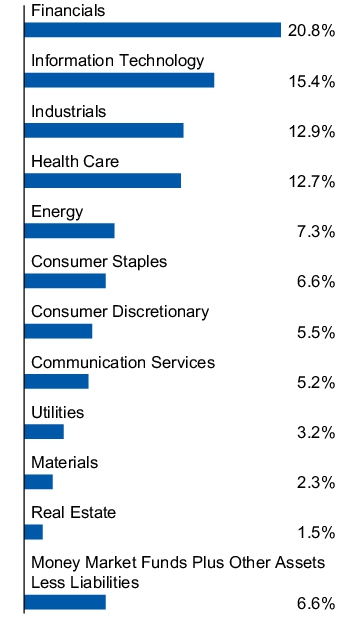

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | NVIDIA Corp. | 11.39 % | | Microsoft Corp. | 9.34 % | | Amazon.com, Inc. | 7.21 % | | Meta Platforms, Inc., Class A | 6.74 % | | Broadcom, Inc. | 4.24 % | | Apple, Inc. | 3.49 % | | Netflix, Inc. | 3.46 % | | Alphabet, Inc., Class A | 3.06 % | | Visa, Inc., Class A | 2.57 % | | ServiceNow, Inc. | 2.46 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. American Franchise Fund - Series II |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. American Franchise Fund

|

|

| Class Name |

Series II

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. American Franchise Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. American Franchise Fund

(Series II) | $ 56 | 1.10 % |

|

|

| Expenses Paid, Amount |

$ 56

|

|

| Expense Ratio, Percent |

1.10%

|

[1] |

| Net Assets |

$ 894,987,483

|

|

| Holdings Count | Holding |

62

|

|

| Investment Company, Portfolio Turnover |

27.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 894,987,483 | | Total number of portfolio holdings | 62 | | Portfolio turnover rate | 27 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | NVIDIA Corp. | 11.39 % | | Microsoft Corp. | 9.34 % | | Amazon.com, Inc. | 7.21 % | | Meta Platforms, Inc., Class A | 6.74 % | | Broadcom, Inc. | 4.24 % | | Apple, Inc. | 3.49 % | | Netflix, Inc. | 3.46 % | | Alphabet, Inc., Class A | 3.06 % | | Visa, Inc., Class A | 2.57 % | | ServiceNow, Inc. | 2.46 % | | * Excluding money market fund holdings, if any. | |

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | NVIDIA Corp. | 11.39 % | | Microsoft Corp. | 9.34 % | | Amazon.com, Inc. | 7.21 % | | Meta Platforms, Inc., Class A | 6.74 % | | Broadcom, Inc. | 4.24 % | | Apple, Inc. | 3.49 % | | Netflix, Inc. | 3.46 % | | Alphabet, Inc., Class A | 3.06 % | | Visa, Inc., Class A | 2.57 % | | ServiceNow, Inc. | 2.46 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. American Value Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. American Value Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. American Value Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. American Value Fund

(Series I) | $ 44 | 0.88 % |

|

|

| Expenses Paid, Amount |

$ 44

|

|

| Expense Ratio, Percent |

0.88%

|

[1] |

| Net Assets |

$ 359,100,783

|

|

| Holdings Count | Holding |

75

|

|

| Investment Company, Portfolio Turnover |

38.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 359,100,783 | | Total number of portfolio holdings | 75 | | Portfolio turnover rate | 38 % |

|

|

| Holdings [Text Block] |

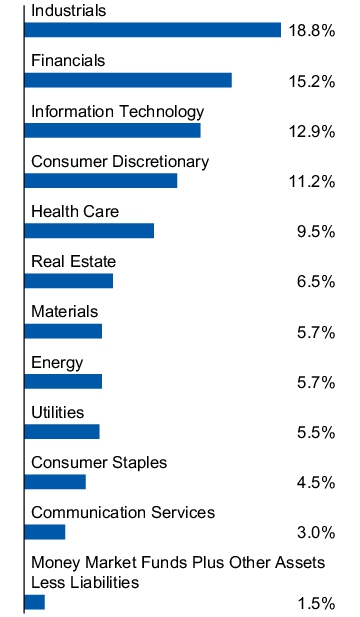

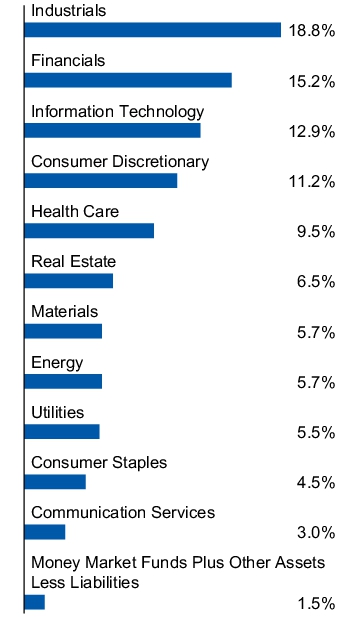

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Fidelity National Information Services, Inc. | 3.18 % | | AppLovin Corp., Class A | 2.95 % | | Lumentum Holdings, Inc. | 2.71 % | | Coherent Corp. | 2.69 % | | Newmont Corp. | 2.58 % | | Huntington Bancshares, Inc. | 2.47 % | | Cameco Corp. | 2.46 % | | Centene Corp. | 2.45 % | | NRG Energy, Inc. | 2.43 % | | Globe Life, Inc. | 2.36 % | | * Excluding money market fund holdings, if any. | |

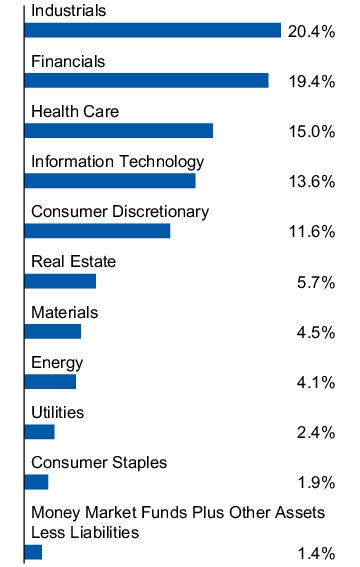

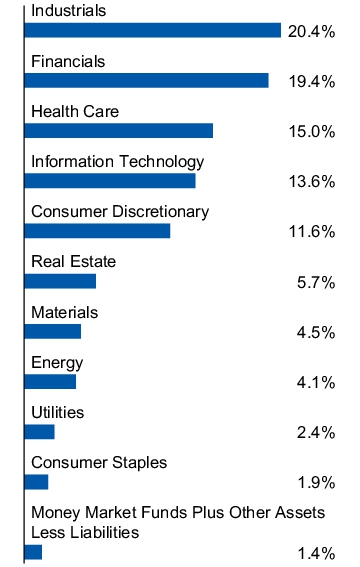

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Fidelity National Information Services, Inc. | 3.18 % | | AppLovin Corp., Class A | 2.95 % | | Lumentum Holdings, Inc. | 2.71 % | | Coherent Corp. | 2.69 % | | Newmont Corp. | 2.58 % | | Huntington Bancshares, Inc. | 2.47 % | | Cameco Corp. | 2.46 % | | Centene Corp. | 2.45 % | | NRG Energy, Inc. | 2.43 % | | Globe Life, Inc. | 2.36 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. American Value Fund - Series II |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. American Value Fund

|

|

| Class Name |

Series II

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. American Value Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. American Value Fund

(Series II) | $ 57 | 1.13 % |

|

|

| Expenses Paid, Amount |

$ 57

|

|

| Expense Ratio, Percent |

1.13%

|

[1] |

| Net Assets |

$ 359,100,783

|

|

| Holdings Count | Holding |

75

|

|

| Investment Company, Portfolio Turnover |

38.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 359,100,783 | | Total number of portfolio holdings | 75 | | Portfolio turnover rate | 38 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Fidelity National Information Services, Inc. | 3.18 % | | AppLovin Corp., Class A | 2.95 % | | Lumentum Holdings, Inc. | 2.71 % | | Coherent Corp. | 2.69 % | | Newmont Corp. | 2.58 % | | Huntington Bancshares, Inc. | 2.47 % | | Cameco Corp. | 2.46 % | | Centene Corp. | 2.45 % | | NRG Energy, Inc. | 2.43 % | | Globe Life, Inc. | 2.36 % | | * Excluding money market fund holdings, if any. | |

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Fidelity National Information Services, Inc. | 3.18 % | | AppLovin Corp., Class A | 2.95 % | | Lumentum Holdings, Inc. | 2.71 % | | Coherent Corp. | 2.69 % | | Newmont Corp. | 2.58 % | | Huntington Bancshares, Inc. | 2.47 % | | Cameco Corp. | 2.46 % | | Centene Corp. | 2.45 % | | NRG Energy, Inc. | 2.43 % | | Globe Life, Inc. | 2.36 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Balanced-Risk Allocation Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Balanced-Risk Allocation Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Balanced-Risk Allocation Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Balanced-Risk Allocation Fund

(Series I) | $ 35 | 0.70 % † |

* | | | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

|

|

| Expenses Paid, Amount |

$ 35

|

|

| Expense Ratio, Percent |

0.70%

|

[1],[2] |

| Net Assets |

$ 414,866,345

|

|

| Holdings Count | Holding |

142

|

|

| Investment Company, Portfolio Turnover |

14.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 414,866,345 | | Total number of portfolio holdings | 142 | | Portfolio turnover rate | 14 % |

|

|

| Holdings [Text Block] |

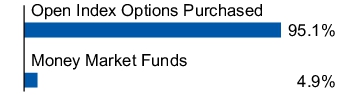

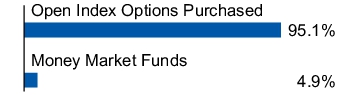

What Comprised The Fund's Holdings? (as of June 30, 2025) Target risk contribution and notional asset weights Asset Class | Target Risk Contribution* | Notional Asset Exposure Weights** | | Equities and Options | 49.94 % | 54.79 % | | Fixed Income | 21.33 % | 59.00 % | | Commodities | 28.73 % | 20.98 % | | Total | 100.00 % | 134.77 % | * Reflects the risk that each asset class is expected to contribute to the overall risk of the Fund as measured by standard deviation and estimates of risk based on historical data. Standard deviation measures the annualized fluctuations (volatility) of monthly returns.

** Proprietary models determine the Notional Asset Weights necessary to achieve the Target Risk Contributions. Total Notional Asset Weight greater than 100% is achieved through derivatives and other instruments that create leverage. | | |

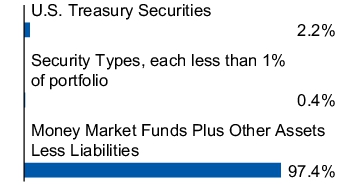

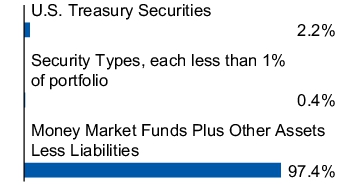

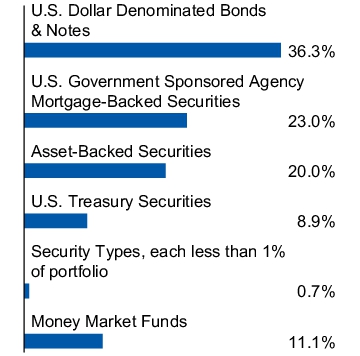

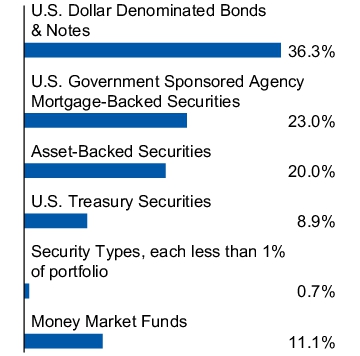

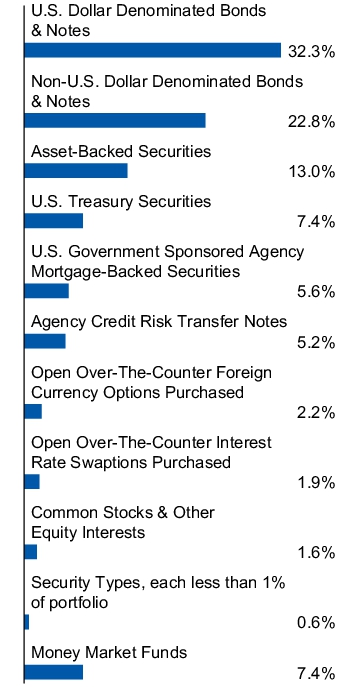

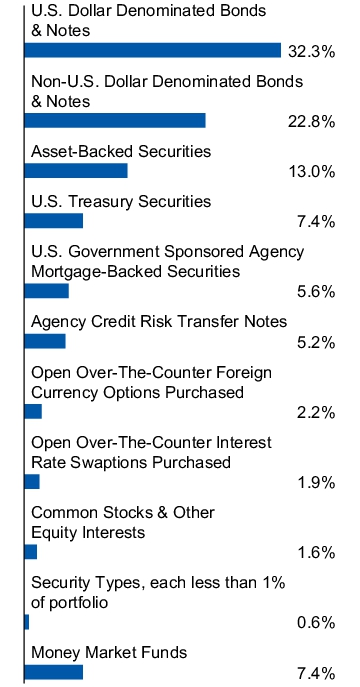

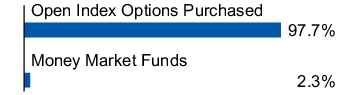

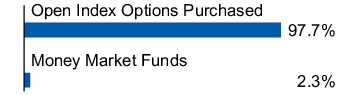

Security type allocation (% of net assets) |

|

| Invesco V.I. Balanced-Risk Allocation Fund - Series II |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Balanced-Risk Allocation Fund

|

|

| Class Name |

Series II

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Balanced-Risk Allocation Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Balanced-Risk Allocation Fund

(Series II) | $ 48 | 0.95 % † |

* | | | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

|

|

| Expenses Paid, Amount |

$ 48

|

|

| Expense Ratio, Percent |

0.95%

|

[1],[2] |

| Net Assets |

$ 414,866,345

|

|

| Holdings Count | Holding |

142

|

|

| Investment Company, Portfolio Turnover |

14.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 414,866,345 | | Total number of portfolio holdings | 142 | | Portfolio turnover rate | 14 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Target risk contribution and notional asset weights Asset Class | Target Risk Contribution* | Notional Asset Exposure Weights** | | Equities and Options | 49.94 % | 54.79 % | | Fixed Income | 21.33 % | 59.00 % | | Commodities | 28.73 % | 20.98 % | | Total | 100.00 % | 134.77 % | * Reflects the risk that each asset class is expected to contribute to the overall risk of the Fund as measured by standard deviation and estimates of risk based on historical data. Standard deviation measures the annualized fluctuations (volatility) of monthly returns.

** Proprietary models determine the Notional Asset Weights necessary to achieve the Target Risk Contributions. Total Notional Asset Weight greater than 100% is achieved through derivatives and other instruments that create leverage. | | |

Security type allocation (% of net assets) |

|

| Invesco V.I. Comstock Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Comstock Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Comstock Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Comstock Fund

(Series I) | $ 39 | 0.75 % |

|

|

| Expenses Paid, Amount |

$ 39

|

|

| Expense Ratio, Percent |

0.75%

|

[1] |

| Net Assets |

$ 1,440,735,376

|

|

| Holdings Count | Holding |

96

|

|

| Investment Company, Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 1,440,735,376 | | Total number of portfolio holdings | 96 | | Portfolio turnover rate | 11 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Bank of America Corp. | 3.33 % | | Microsoft Corp. | 2.97 % | | Wells Fargo & Co. | 2.89 % | | Cisco Systems, Inc. | 2.73 % | | CVS Health Corp. | 2.35 % | | State Street Corp. | 2.15 % | | Meta Platforms, Inc., Class A | 2.04 % | | Alphabet, Inc., Class A | 2.04 % | | Johnson Controls International PLC | 1.95 % | | Philip Morris International, Inc. | 1.84 % | | * Excluding money market fund holdings, if any. | |

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Bank of America Corp. | 3.33 % | | Microsoft Corp. | 2.97 % | | Wells Fargo & Co. | 2.89 % | | Cisco Systems, Inc. | 2.73 % | | CVS Health Corp. | 2.35 % | | State Street Corp. | 2.15 % | | Meta Platforms, Inc., Class A | 2.04 % | | Alphabet, Inc., Class A | 2.04 % | | Johnson Controls International PLC | 1.95 % | | Philip Morris International, Inc. | 1.84 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Comstock Fund - Series II |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Comstock Fund

|

|

| Class Name |

Series II

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Comstock Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Comstock Fund

(Series II) | $ 51 | 1.00 % |

|

|

| Expenses Paid, Amount |

$ 51

|

|

| Expense Ratio, Percent |

1.00%

|

[1] |

| Net Assets |

$ 1,440,735,376

|

|

| Holdings Count | Holding |

96

|

|

| Investment Company, Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 1,440,735,376 | | Total number of portfolio holdings | 96 | | Portfolio turnover rate | 11 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Bank of America Corp. | 3.33 % | | Microsoft Corp. | 2.97 % | | Wells Fargo & Co. | 2.89 % | | Cisco Systems, Inc. | 2.73 % | | CVS Health Corp. | 2.35 % | | State Street Corp. | 2.15 % | | Meta Platforms, Inc., Class A | 2.04 % | | Alphabet, Inc., Class A | 2.04 % | | Johnson Controls International PLC | 1.95 % | | Philip Morris International, Inc. | 1.84 % | | * Excluding money market fund holdings, if any. | |

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Bank of America Corp. | 3.33 % | | Microsoft Corp. | 2.97 % | | Wells Fargo & Co. | 2.89 % | | Cisco Systems, Inc. | 2.73 % | | CVS Health Corp. | 2.35 % | | State Street Corp. | 2.15 % | | Meta Platforms, Inc., Class A | 2.04 % | | Alphabet, Inc., Class A | 2.04 % | | Johnson Controls International PLC | 1.95 % | | Philip Morris International, Inc. | 1.84 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Core Equity Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Core Equity Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Core Equity Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Core Equity Fund

(Series I) | $ 41 | 0.80 % |

|

|

| Expenses Paid, Amount |

$ 41

|

|

| Expense Ratio, Percent |

0.80%

|

[1] |

| Net Assets |

$ 756,391,604

|

|

| Holdings Count | Holding |

72

|

|

| Investment Company, Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 756,391,604 | | Total number of portfolio holdings | 72 | | Portfolio turnover rate | 17 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Microsoft Corp. | 7.95 % | | NVIDIA Corp. | 7.18 % | | Apple, Inc. | 4.56 % | | Amazon.com, Inc. | 4.56 % | | Alphabet, Inc., Class A | 3.85 % | | Meta Platforms, Inc., Class A | 3.32 % | | JPMorgan Chase & Co. | 3.21 % | | Broadcom, Inc. | 2.74 % | | Walmart, Inc. | 1.88 % | | Procter & Gamble Co. (The) | 1.79 % | | * Excluding money market fund holdings, if any. | |

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Microsoft Corp. | 7.95 % | | NVIDIA Corp. | 7.18 % | | Apple, Inc. | 4.56 % | | Amazon.com, Inc. | 4.56 % | | Alphabet, Inc., Class A | 3.85 % | | Meta Platforms, Inc., Class A | 3.32 % | | JPMorgan Chase & Co. | 3.21 % | | Broadcom, Inc. | 2.74 % | | Walmart, Inc. | 1.88 % | | Procter & Gamble Co. (The) | 1.79 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Core Equity Fund - Series II |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Core Equity Fund

|

|

| Class Name |

Series II

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Core Equity Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Core Equity Fund

(Series II) | $ 54 | 1.05 % |

|

|

| Expenses Paid, Amount |

$ 54

|

|

| Expense Ratio, Percent |

1.05%

|

[1] |

| Net Assets |

$ 756,391,604

|

|

| Holdings Count | Holding |

72

|

|

| Investment Company, Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 756,391,604 | | Total number of portfolio holdings | 72 | | Portfolio turnover rate | 17 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Microsoft Corp. | 7.95 % | | NVIDIA Corp. | 7.18 % | | Apple, Inc. | 4.56 % | | Amazon.com, Inc. | 4.56 % | | Alphabet, Inc., Class A | 3.85 % | | Meta Platforms, Inc., Class A | 3.32 % | | JPMorgan Chase & Co. | 3.21 % | | Broadcom, Inc. | 2.74 % | | Walmart, Inc. | 1.88 % | | Procter & Gamble Co. (The) | 1.79 % | | * Excluding money market fund holdings, if any. | |

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Microsoft Corp. | 7.95 % | | NVIDIA Corp. | 7.18 % | | Apple, Inc. | 4.56 % | | Amazon.com, Inc. | 4.56 % | | Alphabet, Inc., Class A | 3.85 % | | Meta Platforms, Inc., Class A | 3.32 % | | JPMorgan Chase & Co. | 3.21 % | | Broadcom, Inc. | 2.74 % | | Walmart, Inc. | 1.88 % | | Procter & Gamble Co. (The) | 1.79 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Core Plus Bond Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Core Plus Bond Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Core Plus Bond Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Core Plus Bond Fund

(Series I) | $ 30 | 0.59 % † |

* | | | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

|

|

| Expenses Paid, Amount |

$ 30

|

|

| Expense Ratio, Percent |

0.59%

|

[1],[2] |

| Net Assets |

$ 141,884,572

|

|

| Holdings Count | Holding |

1,451

|

|

| Investment Company, Portfolio Turnover |

282.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 141,884,572 | | Total number of portfolio holdings | 1,451 | | Portfolio turnover rate | 282 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Uniform Mortgage-Backed Securities, TBA, 5.50%, 07/01/2055 | 4.20 % | | Uniform Mortgage-Backed Securities, TBA, 2.50%, 07/01/2055 | 3.76 % | | Uniform Mortgage-Backed Securities, TBA, 5.00%, 07/01/2055 | 3.50 % | | Uniform Mortgage-Backed Securities, TBA, 3.00%, 07/01/2055 | 3.34 % | | Uniform Mortgage-Backed Securities, TBA, 6.00%, 07/01/2055 | 3.22 % | | U.S. Treasury Notes, 4.25%, 05/15/2035 | 3.18 % | | U.S. Treasury Bonds, 4.63%, 02/15/2055 | 2.47 % | | U.S. Treasury Bonds, 5.00%, 05/15/2045 | 2.29 % | | U.S. Treasury Notes, 3.75%, 06/30/2027 | 2.06 % | | Uniform Mortgage-Backed Securities, TBA, 3.50%, 07/01/2055 | 1.86 % | | * Excluding money market fund holdings, if any. | |

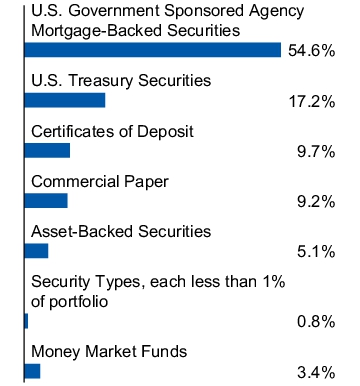

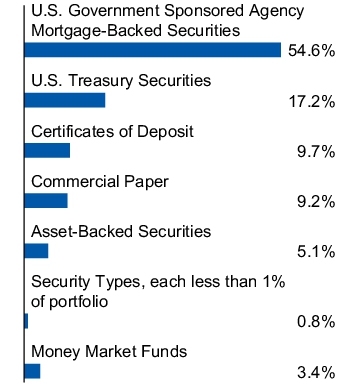

Security type allocation (% of total investments) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Uniform Mortgage-Backed Securities, TBA, 5.50%, 07/01/2055 | 4.20 % | | Uniform Mortgage-Backed Securities, TBA, 2.50%, 07/01/2055 | 3.76 % | | Uniform Mortgage-Backed Securities, TBA, 5.00%, 07/01/2055 | 3.50 % | | Uniform Mortgage-Backed Securities, TBA, 3.00%, 07/01/2055 | 3.34 % | | Uniform Mortgage-Backed Securities, TBA, 6.00%, 07/01/2055 | 3.22 % | | U.S. Treasury Notes, 4.25%, 05/15/2035 | 3.18 % | | U.S. Treasury Bonds, 4.63%, 02/15/2055 | 2.47 % | | U.S. Treasury Bonds, 5.00%, 05/15/2045 | 2.29 % | | U.S. Treasury Notes, 3.75%, 06/30/2027 | 2.06 % | | Uniform Mortgage-Backed Securities, TBA, 3.50%, 07/01/2055 | 1.86 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Core Plus Bond Fund - Series II |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Core Plus Bond Fund

|

|

| Class Name |

Series II

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Core Plus Bond Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Core Plus Bond Fund

(Series II) | $ 42 | 0.84 % † |

* | | | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

|

|

| Expenses Paid, Amount |

$ 42

|

|

| Expense Ratio, Percent |

0.84%

|

[1],[2] |

| Net Assets |

$ 141,884,572

|

|

| Holdings Count | Holding |

1,451

|

|

| Investment Company, Portfolio Turnover |

282.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 141,884,572 | | Total number of portfolio holdings | 1,451 | | Portfolio turnover rate | 282 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Uniform Mortgage-Backed Securities, TBA, 5.50%, 07/01/2055 | 4.20 % | | Uniform Mortgage-Backed Securities, TBA, 2.50%, 07/01/2055 | 3.76 % | | Uniform Mortgage-Backed Securities, TBA, 5.00%, 07/01/2055 | 3.50 % | | Uniform Mortgage-Backed Securities, TBA, 3.00%, 07/01/2055 | 3.34 % | | Uniform Mortgage-Backed Securities, TBA, 6.00%, 07/01/2055 | 3.22 % | | U.S. Treasury Notes, 4.25%, 05/15/2035 | 3.18 % | | U.S. Treasury Bonds, 4.63%, 02/15/2055 | 2.47 % | | U.S. Treasury Bonds, 5.00%, 05/15/2045 | 2.29 % | | U.S. Treasury Notes, 3.75%, 06/30/2027 | 2.06 % | | Uniform Mortgage-Backed Securities, TBA, 3.50%, 07/01/2055 | 1.86 % | | * Excluding money market fund holdings, if any. | |

Security type allocation (% of total investments) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Uniform Mortgage-Backed Securities, TBA, 5.50%, 07/01/2055 | 4.20 % | | Uniform Mortgage-Backed Securities, TBA, 2.50%, 07/01/2055 | 3.76 % | | Uniform Mortgage-Backed Securities, TBA, 5.00%, 07/01/2055 | 3.50 % | | Uniform Mortgage-Backed Securities, TBA, 3.00%, 07/01/2055 | 3.34 % | | Uniform Mortgage-Backed Securities, TBA, 6.00%, 07/01/2055 | 3.22 % | | U.S. Treasury Notes, 4.25%, 05/15/2035 | 3.18 % | | U.S. Treasury Bonds, 4.63%, 02/15/2055 | 2.47 % | | U.S. Treasury Bonds, 5.00%, 05/15/2045 | 2.29 % | | U.S. Treasury Notes, 3.75%, 06/30/2027 | 2.06 % | | Uniform Mortgage-Backed Securities, TBA, 3.50%, 07/01/2055 | 1.86 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Discovery Large Cap Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Discovery Large Cap Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Discovery Large Cap Fund (the “Fund”), formerly Invesco V.I. Capital Appreciation Fund, for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last ? (Based on a hypothetical $10,000 investment)

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

Invesco V.I. Discovery Large Cap Fund

(Series I) |

$ 41 |

0.80 % † |

* |

|

|

|

Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

|

|

| Expenses Paid, Amount |

$ 41

|

|

| Expense Ratio, Percent |

0.80%

|

[1],[2] |

| Net Assets |

$ 807,154,336

|

|

| Holdings Count | Holding |

62

|

|

| Investment Company, Portfolio Turnover |

32.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025)

| Fund net assets |

$ 807,154,336 |

| Total number of portfolio holdings |

62 |

| Portfolio turnover rate |

32 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025)

Top ten holdings* (% of net assets)

| NVIDIA Corp. |

11.17 % |

| Microsoft Corp. |

8.95 % |

| Amazon.com, Inc. |

6.79 % |

| Meta Platforms, Inc., Class A |

6.32 % |

| Broadcom, Inc. |

4.00 % |

| Netflix, Inc. |

3.93 % |

| Apple, Inc. |

3.37 % |

| Alphabet, Inc., Class C |

2.95 % |

| Boston Scientific Corp. |

2.19 % |

| Mastercard, Inc., Class A |

1.93 % |

| * Excluding money market fund holdings, if any. |

|

Sector allocation (% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets)

| NVIDIA Corp. |

11.17 % |

| Microsoft Corp. |

8.95 % |

| Amazon.com, Inc. |

6.79 % |

| Meta Platforms, Inc., Class A |

6.32 % |

| Broadcom, Inc. |

4.00 % |

| Netflix, Inc. |

3.93 % |

| Apple, Inc. |

3.37 % |

| Alphabet, Inc., Class C |

2.95 % |

| Boston Scientific Corp. |

2.19 % |

| Mastercard, Inc., Class A |

1.93 % |

| * Excluding money market fund holdings, if any. |

|

|

|

| Invesco V.I. Discovery Large Cap Fund - Series II |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Discovery Large Cap Fund

|

|

| Class Name |

Series II

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Discovery Large Cap Fund (the “Fund”), formerly Invesco V.I. Capital Appreciation Fund, for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment)

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment* |

Invesco V.I. Discovery Large Cap Fund

(Series II) |

$ 53 |

1.05 % † |

* |

|

|

|

Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

|

|

| Expenses Paid, Amount |

$ 53

|

|

| Expense Ratio, Percent |

1.05%

|

[1],[2] |

| Net Assets |

$ 807,154,336

|

|

| Holdings Count | Holding |

62

|

|

| Investment Company, Portfolio Turnover |

32.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025)

| Fund net assets |

$ 807,154,336 |

| Total number of portfolio holdings |

62 |

| Portfolio turnover rate |

32 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025)

Top ten holdings* (% of net assets)

| NVIDIA Corp. |

11.17 % |

| Microsoft Corp. |

8.95 % |

| Amazon.com, Inc. |

6.79 % |

| Meta Platforms, Inc., Class A |

6.32 % |

| Broadcom, Inc. |

4.00 % |

| Netflix, Inc. |

3.93 % |

| Apple, Inc. |

3.37 % |

| Alphabet, Inc., Class C |

2.95 % |

| Boston Scientific Corp. |

2.19 % |

| Mastercard, Inc., Class A |

1.93 % |

| * Excluding money market fund holdings, if any. |

|

Sector allocation (% of net assets)

|

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets)

| NVIDIA Corp. |

11.17 % |

| Microsoft Corp. |

8.95 % |

| Amazon.com, Inc. |

6.79 % |

| Meta Platforms, Inc., Class A |

6.32 % |

| Broadcom, Inc. |

4.00 % |

| Netflix, Inc. |

3.93 % |

| Apple, Inc. |

3.37 % |

| Alphabet, Inc., Class C |

2.95 % |

| Boston Scientific Corp. |

2.19 % |

| Mastercard, Inc., Class A |

1.93 % |

| * Excluding money market fund holdings, if any. |

|

|

|

| Invesco V.I. Discovery Mid Cap Growth Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Discovery Mid Cap Growth Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Discovery Mid Cap Growth Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Discovery Mid Cap Growth Fund

(Series I) | $ 43 | 0.86 % |

|

|

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.86%

|

[1] |

| Net Assets |

$ 956,849,323

|

|

| Holdings Count | Holding |

84

|

|

| Investment Company, Portfolio Turnover |

55.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 956,849,323 | | Total number of portfolio holdings | 84 | | Portfolio turnover rate | 55 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Hilton Worldwide Holdings, Inc. | 2.77 % | | Howmet Aerospace, Inc. | 2.74 % | | Axon Enterprise, Inc. | 2.64 % | | Palantir Technologies, Inc., Class A | 2.20 % | | Cloudflare, Inc., Class A | 2.20 % | | Encompass Health Corp. | 2.18 % | | Flex Ltd. | 2.05 % | | CyberArk Software Ltd. | 2.03 % | | Cencora, Inc. | 1.97 % | | Tradeweb Markets, Inc., Class A | 1.94 % | | * Excluding money market fund holdings , if any. | |

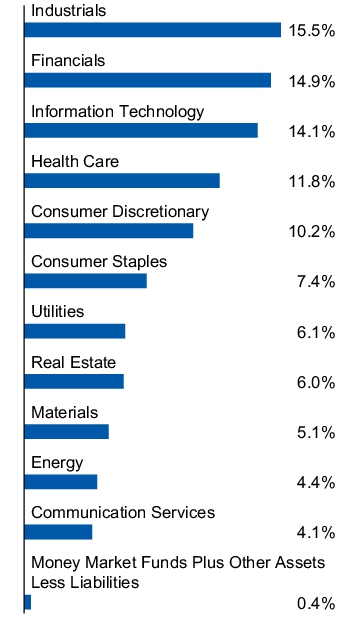

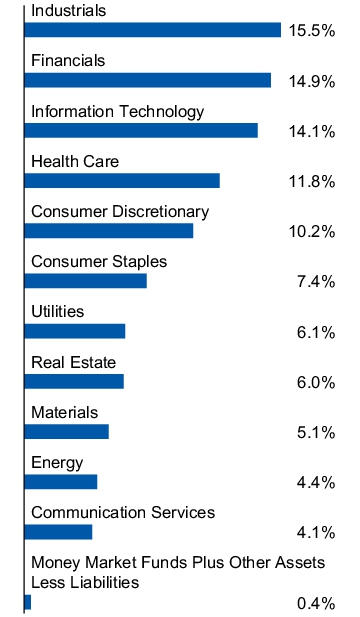

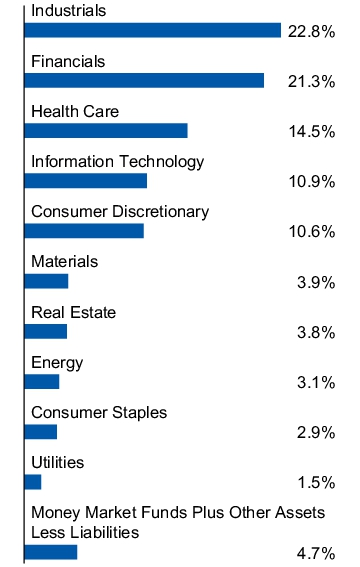

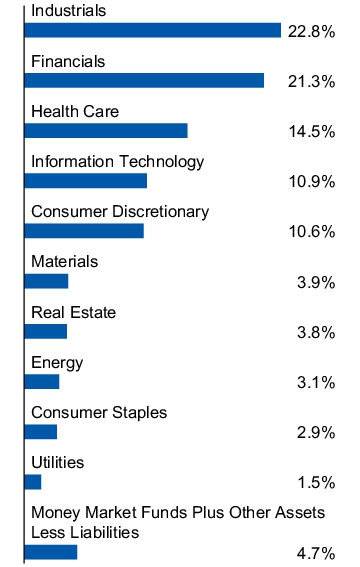

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Hilton Worldwide Holdings, Inc. | 2.77 % | | Howmet Aerospace, Inc. | 2.74 % | | Axon Enterprise, Inc. | 2.64 % | | Palantir Technologies, Inc., Class A | 2.20 % | | Cloudflare, Inc., Class A | 2.20 % | | Encompass Health Corp. | 2.18 % | | Flex Ltd. | 2.05 % | | CyberArk Software Ltd. | 2.03 % | | Cencora, Inc. | 1.97 % | | Tradeweb Markets, Inc., Class A | 1.94 % | | * Excluding money market fund holdings , if any. | |

|

|

| Invesco V.I. Discovery Mid Cap Growth Fund - Series II |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Discovery Mid Cap Growth Fund

|

|

| Class Name |

Series II

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Discovery Mid Cap Growth Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Discovery Mid Cap Growth Fund

(Series II) | $ 56 | 1.11 % |

|

|

| Expenses Paid, Amount |

$ 56

|

|

| Expense Ratio, Percent |

1.11%

|

[1] |

| Net Assets |

$ 956,849,323

|

|

| Holdings Count | Holding |

84

|

|

| Investment Company, Portfolio Turnover |

55.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 956,849,323 | | Total number of portfolio holdings | 84 | | Portfolio turnover rate | 55 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Hilton Worldwide Holdings, Inc. | 2.77 % | | Howmet Aerospace, Inc. | 2.74 % | | Axon Enterprise, Inc. | 2.64 % | | Palantir Technologies, Inc., Class A | 2.20 % | | Cloudflare, Inc., Class A | 2.20 % | | Encompass Health Corp. | 2.18 % | | Flex Ltd. | 2.05 % | | CyberArk Software Ltd. | 2.03 % | | Cencora, Inc. | 1.97 % | | Tradeweb Markets, Inc., Class A | 1.94 % | | * Excluding money market fund holdings, if any. | |

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Hilton Worldwide Holdings, Inc. | 2.77 % | | Howmet Aerospace, Inc. | 2.74 % | | Axon Enterprise, Inc. | 2.64 % | | Palantir Technologies, Inc., Class A | 2.20 % | | Cloudflare, Inc., Class A | 2.20 % | | Encompass Health Corp. | 2.18 % | | Flex Ltd. | 2.05 % | | CyberArk Software Ltd. | 2.03 % | | Cencora, Inc. | 1.97 % | | Tradeweb Markets, Inc., Class A | 1.94 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Diversified Dividend Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Diversified Dividend Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Diversified Dividend Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Diversified Dividend Fund

(Series I) | $ 35 | 0.68 % |

|

|

| Expenses Paid, Amount |

$ 35

|

|

| Expense Ratio, Percent |

0.68%

|

[1] |

| Net Assets |

$ 445,397,960

|

|

| Holdings Count | Holding |

83

|

|

| Investment Company, Portfolio Turnover |

33.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 445,397,960 | | Total number of portfolio holdings | 83 | | Portfolio turnover rate | 33 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | JPMorgan Chase & Co. | 4.06 % | | Walmart, Inc. | 2.61 % | | Bank of America Corp. | 2.53 % | | Chevron Corp. | 2.51 % | | Philip Morris International, Inc. | 2.43 % | | Microsoft Corp. | 2.42 % | | Lowe's Cos., Inc. | 2.28 % | | Cisco Systems, Inc. | 2.22 % | | Wells Fargo & Co. | 2.15 % | | Johnson & Johnson | 2.12 % | | * Excluding money market fund holdings, if any. | |

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | JPMorgan Chase & Co. | 4.06 % | | Walmart, Inc. | 2.61 % | | Bank of America Corp. | 2.53 % | | Chevron Corp. | 2.51 % | | Philip Morris International, Inc. | 2.43 % | | Microsoft Corp. | 2.42 % | | Lowe's Cos., Inc. | 2.28 % | | Cisco Systems, Inc. | 2.22 % | | Wells Fargo & Co. | 2.15 % | | Johnson & Johnson | 2.12 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Diversified Dividend Fund - Series II |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Diversified Dividend Fund

|

|

| Class Name |

Series II

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Diversified Dividend Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Diversified Dividend Fund

(Series II) | $ 48 | 0.93 % |

|

|

| Expenses Paid, Amount |

$ 48

|

|

| Expense Ratio, Percent |

0.93%

|

[1] |

| Net Assets |

$ 445,397,960

|

|

| Holdings Count | Holding |

83

|

|

| Investment Company, Portfolio Turnover |

33.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 445,397,960 | | Total number of portfolio holdings | 83 | | Portfolio turnover rate | 33 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | JPMorgan Chase & Co. | 4.06 % | | Walmart, Inc. | 2.61 % | | Bank of America Corp. | 2.53 % | | Chevron Corp. | 2.51 % | | Philip Morris International, Inc. | 2.43 % | | Microsoft Corp. | 2.42 % | | Lowe's Cos., Inc. | 2.28 % | | Cisco Systems, Inc. | 2.22 % | | Wells Fargo & Co. | 2.15 % | | Johnson & Johnson | 2.12 % | | * Excluding money market fund holdings, if any. | |

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | JPMorgan Chase & Co. | 4.06 % | | Walmart, Inc. | 2.61 % | | Bank of America Corp. | 2.53 % | | Chevron Corp. | 2.51 % | | Philip Morris International, Inc. | 2.43 % | | Microsoft Corp. | 2.42 % | | Lowe's Cos., Inc. | 2.28 % | | Cisco Systems, Inc. | 2.22 % | | Wells Fargo & Co. | 2.15 % | | Johnson & Johnson | 2.12 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Equally-Weighted S&P 500 Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Equally-Weighted S&P 500 Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Equally-Weighted S&P 500 Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Equally-Weighted S&P 500 Fund

(Series I) | $ 17 | 0.33 % |

|

|

| Expenses Paid, Amount |

$ 17

|

|

| Expense Ratio, Percent |

0.33%

|

[1] |

| Net Assets |

$ 484,766,714

|

|

| Holdings Count | Holding |

509

|

|

| Investment Company, Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 484,766,714 | | Total number of portfolio holdings | 509 | | Portfolio turnover rate | 11 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Coinbase Global, Inc., Class A | 0.27 % | | Oracle Corp. | 0.24 % | | Jabil, Inc. | 0.24 % | | Carnival Corp. | 0.23 % | | Advanced Micro Devices, Inc. | 0.23 % | | Northern Trust Corp. | 0.23 % | | Royal Caribbean Cruises Ltd. | 0.23 % | | Vistra Corp. | 0.23 % | | Estee Lauder Cos., Inc. (The), Class A | 0.23 % | | Western Digital Corp. | 0.23 % | | * Excluding money market fund holdings, if any. | |

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Coinbase Global, Inc., Class A | 0.27 % | | Oracle Corp. | 0.24 % | | Jabil, Inc. | 0.24 % | | Carnival Corp. | 0.23 % | | Advanced Micro Devices, Inc. | 0.23 % | | Northern Trust Corp. | 0.23 % | | Royal Caribbean Cruises Ltd. | 0.23 % | | Vistra Corp. | 0.23 % | | Estee Lauder Cos., Inc. (The), Class A | 0.23 % | | Western Digital Corp. | 0.23 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Equally-Weighted S&P 500 Fund - Series II |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Equally-Weighted S&P 500 Fund

|

|

| Class Name |

Series II

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Equally-Weighted S&P 500 Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Equally-Weighted S&P 500 Fund

(Series II) | $ 29 | 0.58 % |

|

|

| Expenses Paid, Amount |

$ 29

|

|

| Expense Ratio, Percent |

0.58%

|

[1] |

| Net Assets |

$ 484,766,714

|

|

| Holdings Count | Holding |

509

|

|

| Investment Company, Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 484,766,714 | | Total number of portfolio holdings | 509 | | Portfolio turnover rate | 11 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Coinbase Global, Inc., Class A | 0.27 % | | Oracle Corp. | 0.24 % | | Jabil, Inc. | 0.24 % | | Carnival Corp. | 0.23 % | | Advanced Micro Devices, Inc. | 0.23 % | | Northern Trust Corp. | 0.23 % | | Royal Caribbean Cruises Ltd. | 0.23 % | | Vistra Corp. | 0.23 % | | Estee Lauder Cos., Inc. (The), Class A | 0.23 % | | Western Digital Corp. | 0.23 % | | * Excluding money market fund holdings, if any. | |

Sector allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Coinbase Global, Inc., Class A | 0.27 % | | Oracle Corp. | 0.24 % | | Jabil, Inc. | 0.24 % | | Carnival Corp. | 0.23 % | | Advanced Micro Devices, Inc. | 0.23 % | | Northern Trust Corp. | 0.23 % | | Royal Caribbean Cruises Ltd. | 0.23 % | | Vistra Corp. | 0.23 % | | Estee Lauder Cos., Inc. (The), Class A | 0.23 % | | Western Digital Corp. | 0.23 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Equity and Income Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Equity and Income Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Equity and Income Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Equity and Income Fund

(Series I) | $ 28 | 0.56 % |

|

|

| Expenses Paid, Amount |

$ 28

|

|

| Expense Ratio, Percent |

0.56%

|

[1] |

| Net Assets |

$ 1,381,922,511

|

|

| Holdings Count | Holding |

1,220

|

|

| Investment Company, Portfolio Turnover |

59.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 1,381,922,511 | | Total number of portfolio holdings | 1,220 | | Portfolio turnover rate | 59 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Wells Fargo & Co. | 2.34 % | | Bank of America Corp. | 2.18 % | | U.S. Treasury Notes, 3.75%, 06/30/2027 | 2.06 % | | Amazon.com, Inc. | 1.89 % | | Microsoft Corp. | 1.67 % | | U.S. Treasury Notes, 3.88%, 06/15/2028 | 1.52 % | | U.S. Treasury Notes, 4.00%, 06/30/2032 | 1.47 % | | Microchip Technology, Inc. | 1.45 % | | Philip Morris International, Inc. | 1.44 % | | Parker-Hannifin Corp. | 1.31 % | | * Excluding money market fund holdings, if any. | |

Security type allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Wells Fargo & Co. | 2.34 % | | Bank of America Corp. | 2.18 % | | U.S. Treasury Notes, 3.75%, 06/30/2027 | 2.06 % | | Amazon.com, Inc. | 1.89 % | | Microsoft Corp. | 1.67 % | | U.S. Treasury Notes, 3.88%, 06/15/2028 | 1.52 % | | U.S. Treasury Notes, 4.00%, 06/30/2032 | 1.47 % | | Microchip Technology, Inc. | 1.45 % | | Philip Morris International, Inc. | 1.44 % | | Parker-Hannifin Corp. | 1.31 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. Equity and Income Fund - Series II |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. Equity and Income Fund

|

|

| Class Name |

Series II

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. Equity and Income Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. Equity and Income Fund

(Series II) | $ 41 | 0.81 % |

|

|

| Expenses Paid, Amount |

$ 41

|

|

| Expense Ratio, Percent |

0.81%

|

[1] |

| Net Assets |

$ 1,381,922,511

|

|

| Holdings Count | Holding |

1,220

|

|

| Investment Company, Portfolio Turnover |

59.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 1,381,922,511 | | Total number of portfolio holdings | 1,220 | | Portfolio turnover rate | 59 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Wells Fargo & Co. | 2.34 % | | Bank of America Corp. | 2.18 % | | U.S. Treasury Notes, 3.75%, 06/30/2027 | 2.06 % | | Amazon.com, Inc. | 1.89 % | | Microsoft Corp. | 1.67 % | | U.S. Treasury Notes, 3.88%, 06/15/2028 | 1.52 % | | U.S. Treasury Notes, 4.00%, 06/30/2032 | 1.47 % | | Microchip Technology, Inc. | 1.45 % | | Philip Morris International, Inc. | 1.44 % | | Parker-Hannifin Corp. | 1.31 % | | * Excluding money market fund holdings, if any. | |

Security type allocation (% of net assets) |

|

| Largest Holdings [Text Block] |

Top ten holdings* (% of net assets) | Wells Fargo & Co. | 2.34 % | | Bank of America Corp. | 2.18 % | | U.S. Treasury Notes, 3.75%, 06/30/2027 | 2.06 % | | Amazon.com, Inc. | 1.89 % | | Microsoft Corp. | 1.67 % | | U.S. Treasury Notes, 3.88%, 06/15/2028 | 1.52 % | | U.S. Treasury Notes, 4.00%, 06/30/2032 | 1.47 % | | Microchip Technology, Inc. | 1.45 % | | Philip Morris International, Inc. | 1.44 % | | Parker-Hannifin Corp. | 1.31 % | | * Excluding money market fund holdings, if any. | |

|

|

| Invesco V.I. EQV International Equity Fund - Series I |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Invesco V.I. EQV International Equity Fund

|

|

| Class Name |

Series I

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Invesco V.I. EQV International Equity Fund (the “Fund”) for the period January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at invesco.com/reports . You can also request this information by contacting us at (800) 959-4246.

|

|

| Additional Information Phone Number |

(800) 959-4246

|

|

| Additional Information Website |

invesco.com/reports

|

|

| Expenses [Text Block] |

What Were The Fund Costs For The Last Six Months ? (Based on a hypothetical $10,000 investment) Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment* | Invesco V.I. EQV International Equity Fund

(Series I) | $ 47 | 0.90 % |

|

|

| Expenses Paid, Amount |

$ 47

|

|

| Expense Ratio, Percent |

0.90%

|

[1] |

| Net Assets |

$ 1,186,444,521

|

|

| Holdings Count | Holding |

84

|

|

| Investment Company, Portfolio Turnover |

22.00%

|

|

| Additional Fund Statistics [Text Block] |

What Are Key Statistics About The Fund? (as of June 30, 2025) | Fund net assets | $ 1,186,444,521 | | Total number of portfolio holdings | 84 | | Portfolio turnover rate | 22 % |

|

|

| Holdings [Text Block] |

What Comprised The Fund's Holdings? (as of June 30, 2025) Top ten holdings* (% of net assets) | Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 3.68 % | | Investor AB, Class B | 3.20 % | | HDFC Bank Ltd., ADR | 2.24 % | | RELX PLC | 2.19 % | | RB Global, Inc. | 2.12 % | | FinecoBank Banca Fineco S.p.A. | 1.95 % | | Keyence Corp. | 1.92 % | | Sony Group Corp. | 1.88 % | | BAE Systems PLC | 1.76 % | | Techtronic Industries Co. Ltd. | 1.75 % | | * Excluding money market fund holdings, if any. | |

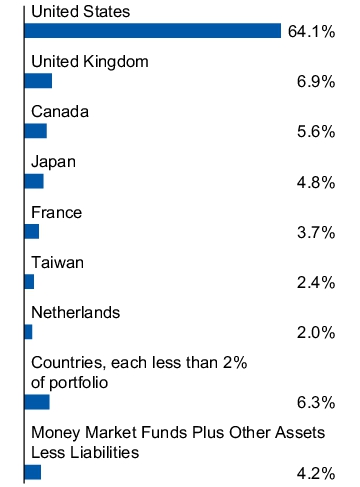

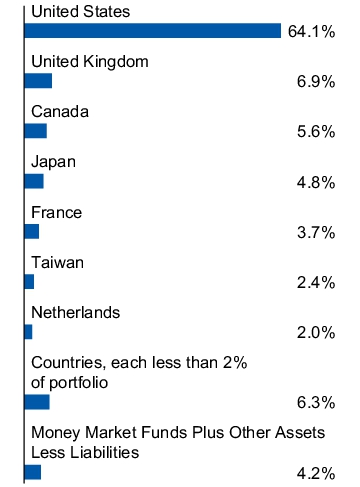

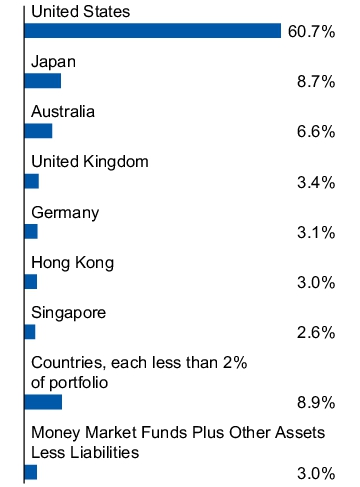

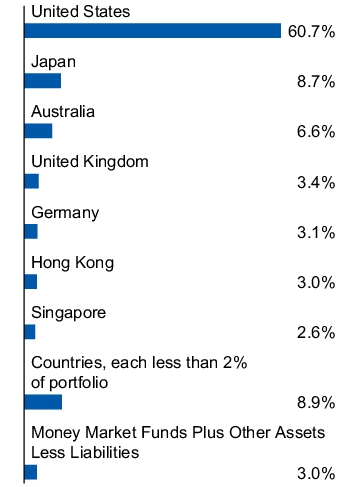

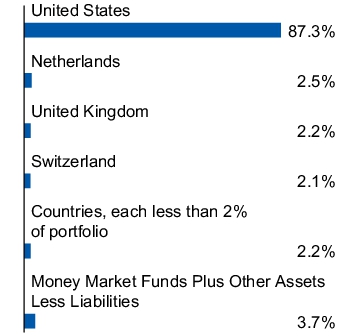

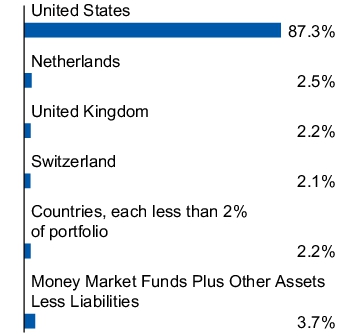

Sector allocation (% of net assets) |

|