New York Life Investments

Code of Ethics

December 2024

SECTION 1 GENERAL FIDUCIARY PRINCIPLES

As fiduciaries to our clients’ assets, New York Life Investments1 and its employees have a duty to act in good faith and in the best interest of its clients. To this end, this Code of Ethics (“Code”) sets forth practices and standards to assist employees avoid potential conflicts that may arise from their personal trading. In conducting personal trading, Employees have the following responsibilities, for example: · Place the interest of clients before your own personal trading. Employees may not engage in insider trading, front-running or scalping; · Conduct personal trading in a manner as to avoid any actual or potential conflict of interest or abuse of an individual’s position of trust and responsibility; · Avoid taking inappropriate advantage of your position at the Company when conducting personal trading; and · Act with integrity and in accordance with both the letter and spirit of applicable laws. Employees may not do anything indirectly that, if done directly, would violate the Code. For example, never use a derivative, or any other instrument or technique, to circumvent Code restrictions. Such actions would be the equivalent of direct Code violations. |

|

1 Apogem Capital LLC, Flatiron RR LLC Manager Series, MacKay Shields LLC, MacKay Shields UK LLP, NYL Investments Europe Investment Management Limited, NYLIFE Distributors LLC, New York Life Investment Management LLC, New York Life Investment Management (UK) Limited, NYLIM Service Company LLC, and the following New York Life Insurance Company subsidiaries: New York Life Trust Company and NYL Investors LLC. Each registered investment adviser referred to above may be referred to individually as an “Investment Adviser.”

This Code does not attempt to identify all possible circumstances. When in doubt, exercise good judgment and ask for help when you need it.

SECTION 2 PERSONAL INVESTING ACTIVITIES PROCEDURES

2.1 Applicable to all Employees

The following requirements governing personal trading are applicable to all Employees:

· Active personal trading (e.g., day trading) is discouraged. While there is currently no limitation on the number of trades that an Employee may execute or trade requests that an Employee may submit, personal trading limitations may be placed on any Employee if: (i) it is believed to be in the best interest of the Company or its clients, (ii) such trading interferes with an Employee’s professional duties, or (iii) there are excessive violations of the Code.

· No personal trades may be effected through Company’s traders and trading systems.

· Employees may not purchase and sell (or exchange), or sell and purchase (or exchange), shares of the same NYLI Mutual Fund within 30 days. The 30-day holding period is measured from the time of the most recent purchase of shares of the relevant NYLI Mutual Fund by the Employee. This applies to all NYLI Funds, including shares owned through a 401(K) plan or similar account, or through a variable insurance product. It does not apply to purchases that are effected as part of an automatic dividend reinvestment plan, an automatic investment plan, a payroll deduction plan or program, or transactions in money market funds.

2.2 Additional Requirements for Access Persons and Investment Personnel

Access Persons, Investment Personnel and Index Personnel are subject to the following additional requirements:

2.2.1 Preclearance of Covered Securities

· Access Persons must preclear all transactions in Covered Securities (see Appendix B for a list of Covered Securities). Each Access Person must submit their requests through the Employee Trade Pre-Clearance System (“ComplySci”) available on the intranet (nylife.complysci.com) between the hours of 9:00 a.m. and 4:00 p.m. EST. Automated feedback will be provided to the Employee as to whether the request is approved or denied. In the event that the system is unavailable, Access Persons must contact Investments Compliance (“Compliance”). Compliance will provide approval or denial via email.

· Access Persons must preclear all transactions in Covered Securities (see Appendix B for a list of Covered Securities). Each Access Person must submit their requests through the Employee Trade Pre-Clearance System (“ComplySci”) available on the intranet (nylife.complysci.com) between the hours of 9:00 a.m. and 4:00 p.m. EST. Automated feedback will be provided to the Employee as to whether the request is approved or denied. In the event that the system is unavailable, Access Persons must contact Investments Compliance (“Compliance”). Compliance will provide approval or denial via email. |

|

· Access Persons must preclear all transactions in NYLI ETFs and Single Stock ETFs.

· Pre-clearance approval is only good during U.S. market hours (9:30 a.m. to 4:00 p.m. EST). If you do not trade during the market session for which you were granted approval, the approval expires. If your transaction is not executed during that market session, a new request must be submitted.

· All stop orders and good to cancel orders are prohibited.

2.2.2 Holding Period/Short Swing Rule

· Access Persons may not purchase and sell (or exchange) or sell and purchase (or exchange) the same (or equivalent) Covered Security within sixty (60) calendar days. The holding period is measured from the time of the most recent purchase of shares of the relevant Covered Security by the Employee (Last In First Out method). Exceptions may be made by Compliance to accommodate special circumstances.

· Transactions in NYLI ETFs are subject to a seven-day Holding Period. · Access Persons who receive a grant of options through an Employee Stock Option Plan, or who chooses to exercise those options in a Cashless Exercise, will be allowed an exception from the sixty-day holding period, but only after obtaining approval by email from Compliance. |

|

2.2.3 Trading /Black-Out Periods

· Access Persons may not purchase or sell a Covered Security on a day when there is a transaction for a Client of their respective Investment Adviser. Access Persons deemed Investment Personnel and Index Personnel are further restricted during black-out periods.

· Investment Personnel and Index Personnel may not purchase or sell a Covered Security if any purchase or sale of such securities has been made for an Investment Adviser Client account in the prior seven calendar days or can reasonably be anticipated for a Company Client account in the next seven calendar days. · Exceptions may be granted to the black-out period related to Investment Personnel and Index Personnel on days when there is no Buy or Sell order for a Client of the Company and your personal trading involves one of the following: |

|

(i) 2000 shares or less in securities in the Russell 1000 Index; or

(ii) 500 shares or less in securities NOT in the Russell 1000 Index

· Blackout exceptions will not apply to Index Personnel or the NYLIM Multi-Asset Solutions team during a black-out period resulting from an Index Rebalance.

2.2.4 Preclearance Exceptions

· Requirements pertaining to preclearance, hold and blackout periods (Sections 2.2.1 through 2.2.3) do not apply to the following transactions:

Certain securities and transaction types set forth in Section 2.2.1 through 2.2.3. See Appendix B for a list of exempt securities and transactions.

In Discretionary Managed Accounts provided the Employee provides Compliance with a copy of the fully executed investment management agreement, which provides for the investment advisor’s complete discretion and control over the account. The Employee (and his/her investment advisor) are required to certify that he/she will not have any direct or indirect influence or control over the account. Employees that have Discretionary Managed Accounts managed by an immediate family member are subject to preclearance requirements. Access Persons are prohibited from investing in and/or holding Private Placements and IPOs in Third-Party Discretionary Managed Accounts.

That are non-volitional in nature: e.g., stock splits, stock dividends, exchanges and conversions, mandatory tenders, pro rata distributions to all holders of a class of securities, gifts, inheritances, margin/maintenance calls (where the securities to be sold are not directed by the covered person), and sales pursuant to regulated tender offers.

Even though pre-clearance requirements may not apply in certain situations, Employees are reminded of their fiduciary duty, and must place the interest of clients before your own personal trading, and conduct personal trading in a manner that avoids any actual or potential conflict of interest.

2.3 Initial Public Offerings, Limited Offerings (e.g., Private Placements, Private Equity and Hedge Funds and/or Alternative Investments) and Initial Coin Offerings

· Access Person or Employees who are Registered Representatives of NYLIFE Distributors may not directly or indirectly acquire Beneficial Ownership in any securities in an Initial Public Offering of securities, a Limited Offering (e.g., private placement, private equity hedge fund and/or alternative investments) or a virtual currency token offered in an initial or digital coin offering (also called ICOs or token sales) except with the express written prior approval of Compliance. Employees must submit a preclearance request through ComplySci. If ComplySci is unavailable,

employees must contact Compliance.

2.4 Options Trading

· Transactions by Access Persons

Access Persons may trade options on individual securities but must ensure that expiration dates meet or exceed the 60-day holding period and short swing rule.

Access Persons are also prohibited from trading in uncovered options on individual securities (i.e., trading in a position where the seller of an option contract does not own any, or enough, of the underlying security). Should an Access Person decide to exercise any option prior to expiration, a separate preclearance request would also need to be entered prior to exercise. As discussed above, options on individual ETFs (excluding single-stock ETFs and NYLI ETFs) are excluded from the pre-clearance, 60-day holding period and short swing rule requirements.

· Transactions by Investment Personnel

Investment Personnel may not trade in options with respect to individual securities. Transactions in index options effected on a broad-based index are permitted.

Transactions by Access Persons and Investment Personnel in index options effected on a broad-based index, options on individual ETFs (excluding single-stock ETFs and NYLI ETFs) and options on commodities are permitted, and, these types of options do not require pre-clearance, nor are they subject to the 60-day holding period and short swing rule.

2.5 NYLI Funds and NYLI ETFs Independent Trustees

The following requirements apply only to the Independent Trustees of the NYLI Funds and NYLI ETFs.

· Pre Clearance

An Independent Trustee need only obtain prior approval from the Adviser CCO or Senior Compliance Officer before directly or indirectly acquiring or disposing of beneficial ownership in a Covered Security if he/she knew or, in the ordinary course of fulfilling his/her duties as a Trustee should have known2, (i) that during the 15-day period immediately before or after a transaction in that security, a NYLI Fund or ETF, or any series thereof, purchased or sold that security, or (ii) an Adviser or subadvisers considered purchasing or selling that security on behalf of the NYLI Fund or ETF.

With respect to the NYLI ETF Independent Trustees, the preclearance requirement to obtain prior approval from the CCO does not apply to purchases and sales of any non-NYLI ETF.

· Initial Certification

Each newly appointed Independent Trustee is required to provide an initial certification stating that he/she has received a copy of the Code and that he/she understands the relevant requirements.

· Annual Certification

Each Independent Trustee is also required to certify on an annual basis that he/she has received, read, understood and complied with this Code.

2.6 Section 16 Requirements (NYLI Closed End Funds and NYLI Interval Funds)

2 The “should have known” standard implies no duty of inquiry, does not presume there should have been any deduction or extrapolation from discussions or memoranda dealing with tactics to be employed meeting a Funds’ investment objectives, or that any knowledge is to be imputed because of prior knowledge of the Fund’s portfolio holdings, market considerations, or the Fund’s investment policies, objectives and restrictions.

· Certain Employees, including NYLI Independent Trustees, are considered “Fund Insiders” pursuant to Section 16 of the Exchange Act with respect to closed-end funds (including interval funds). Pre-clearance by Fund Insiders is required prior to transacting in closed-end fund shares, including closed-end fund shares purchased or sold in Discretionary Managed Accounts.

· In addition, transactions in closed-end fund shares by Fund Insiders require additional reporting to the U.S. Securities and Exchange Commission and are subject to holding periods. Please refer to the NYLI Funds’ Policies and Procedures for Compliance with Section 16 of the Securities Act of 1934 or contact Compliance for more information.

SECTION 3 RECORDKEEPING AND REPORTING REQUIREMENTS

|

|

3.1 Initial Securities Holdings and Account Reports

· Access Persons must, no later than 10 days after becoming an employee, submit an initial holdings and account report and certification electronically through ComplySci. The holdings information presented in this report must be current as of 45 days prior to employment.

· Access Persons must also disclose all broker, dealer or bank accounts in which any Securities (including Covered Securities) are held. Non-Access Persons are only required to disclose where Affiliated or Reportable Fund shares are held. Additionally, each new Employee shall file an “Acknowledgement of Receipt of the Code of Ethics and Related Policies” via ComplySci.

· In addition, NYLIFE Distributors Registered Representatives are also required to notify Compliance of any crypto currency accounts. Upon opening any new brokerage and/or crypto currency accounts, Registered Representatives must notify Compliance of the new account in accordance with NYLIFE Distributors procedures.

3.2 Quarterly Reporting

· Access Persons must, no later than 30 calendar days following quarter end, certify to all transactions in any Covered Security and Affiliated Funds or, alternatively, must confirm that there were no such transactions in the applicable quarter. This does not apply to transactions in Discretionary Managed Accounts as described in Section 2.2.4. Employees must complete this requirement electronically through ComplySci.

3.3 Annual Reporting

· No later than January 30th each year: (i) all Employees must file an annual certification indicating that the Employee has complied with the Code; and (ii) Access Persons must also file an annual holdings report or submit updated, complete brokerage statements and certify to their brokerage accounts as of year-end. Employees must complete these requirements electronically through ComplySci.

3.4 Opening of Brokerage Accounts

· Access Persons shall promptly notify Compliance of any new account opened with a broker, dealer or bank including Discretionary Managed Accounts. Access Persons must provide Compliance with sufficient information so that Compliance can arrange for duplicate confirmations and accounts statements to be provided to Compliance.

· Access Persons may only open brokerage accounts with a firm that provides Compliance with an electronic feed of trade confirmations and statements. Contact Compliance for the complete list of firms. Exceptions are limited and require the approval of Compliance.

· Non-Access Persons are only required to notify Compliance of any new accounts opened with a broker, dealer or bank in which Affiliated Fund shares or Reportable Fund shares are held.

SECTION 4 ADMINISTRATION

4.1 Sanctions and Review

· Upon discovering a violation of the Code, the Company shall take whatever remedial steps it deems necessary and available to correct an actual or apparent conflict (e.g., trade reversal etc.). Following those corrective efforts, Compliance may impose sanctions if, based upon all of the facts and circumstances considered, such action is

deemed appropriate.

· The magnitude of these penalties varies with the severity of the violation, although repeat offenders will likely be subjected to harsher sanctions. These sanctions may include, among others, the reversal of trades, disgorgement of profits, suspension of trading privileges or, in more serious cases, inclusion in annual performance evaluations, suspension or termination of employment.

· It is important to note that violations of the Code may occur without employee fault (e.g., despite preclearance). In those cases, punitive action may not be warranted, although remedial steps may still be necessary.

4.2 Acknowledgment and Training

· Each Employee must certify initially and annually thereafter that he or she has read and understood, is subject to and has complied with the Code and its related polices. Each Employee must attend a Code of Ethics training session conducted by Compliance within a reasonable time of becoming an Employee.

4.3 Exceptions

· The CCO or LCO, as applicable, in consultation with Compliance, may grant an exception to the Code in circumstances on a case-by-case basis if it is determined that the proposed conduct involves no opportunity for abuse and does not conflict with interests. Exceptions shall be structured to be as narrow as is reasonably practicable with appropriate safeguards designed to prevent abuse of the exception. Exceptions are expected to be rare. Notwithstanding the foregoing, however, no exception to a provision of the Code shall be granted where such exception would result in a violation of Rule 17j-1 or Rule 204A-1.

Appendix A DEFINITIONS

Affiliated Fund - The NYLI Funds and NYLI Exchange Traded Funds (“NYLI ETFs”)

Beneficial Ownership - interpreted in the same manner as it would be under Rule 16a-1(a)(2) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) in determining whether a person is the beneficial owner of a security for purposes of the Exchange Act and the rules and regulations thereunder. A beneficial owner is any person who, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, has or shares a direct or indirect pecuniary interest in the securities. A pecuniary interest in securities means the opportunity, directly or indirectly, to profit or share in any profit derived from a transaction in those securities. A person is presumed to have an indirect pecuniary interest in securities held by members of a person’s Immediate Family who either reside with, or are financially dependent upon, or whose investments are controlled by, that person. A person also has a beneficial interest in securities held: (i) in a trust which he or she is a trustee, has a beneficial interest or is the settlor with a power to revoke; (ii) by another person and he or she has a contract or an understanding with such person that the securities held in that person’s name are for his or her benefit; (iii) in the form of a right to acquisition of such security through the exercise of warrants, options, rights, or conversion rights; (iv) by a partnership of which he or she is a member; (v) by a corporation that he or she uses as a personal trading medium; or (vi) by a holding company that he or she controls.

Chief Compliance Officer (“CCO”) – CCO, as applicable, of each New York Life Investments entity.

Covered Security - means any security as defined in Section 202(a)(18) of the Advisers Act. Please see Appendix B for a list of Covered Securities, Exempt Securities, Prohibited Activities and Holding Periods. If you have a question regarding whether a security is considered a “Covered Security,” please contact Compliance.

Discretionary Managed Account – an account managed on a discretionary basis by a person (or Robo-Adviser) other than an Employee over which the Employee has no direct or indirect influence or control over the selection or disposition of securities and no advance knowledge of transactions therein.

Immediate Family - any of the following individuals: child, stepchild, grandchild, parent, stepparent, grandparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, sister-in-law, including adoptive relationships who reside in the same household. The term also includes (i) any related or unrelated individual who resides with, and (ii) whose investments are controlled by, or whose financial support is materially contributed to by, the employee, such as a “significant other.”

NYLI Independent Board Member - a trustee of a registered fund who is not an “interested person” of the NYLI Funds or NYLI ETFs, as defined in Section 2(a)(19)(B) of the 1940 Act.

Index Rebalance - a time period when a NYLI ETF or other accounts for which New York Life Investment Management LLC (“NYLIM”) acts as advisor and/or sub-advisor receives its rebalance or reconstitution information with respect to an underlying index for which (i) NYLIM or (ii) an unaffiliated entity serves as the index provider.

Index Personnel – employees who maintain affiliated indexes and are responsible for rebalancing, validating and delivering index component securities and weightings of each affiliated index to the trading team.

Local Compliance Officer (“LCO”) – CCO or designee of an applicable NYL Investments entity.

NYLI ETFs – each exchange traded fund series of the New York Life Investments ETF Trust and New York Life Investments Active ETF Trust.

NYLI Funds – each open-end fund and closed-end fund series of the New York Life Investments Funds.

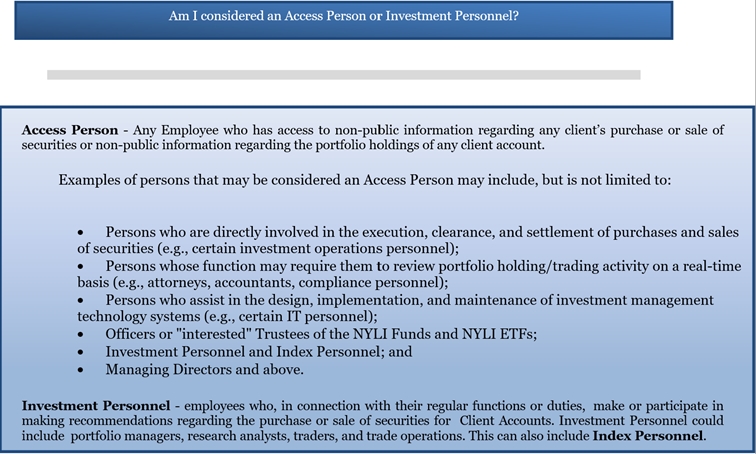

Non-Access Person – employees that do not fall into the definition of Access Person.

Private Placement - an offering that is exempt from registration under the Securities Act of 1933 under Sections 4(a)(2) or 4(a)(6), or Rules 504, 505 or 506 thereunder.

Reportable Fund – an investment company, whether or not affiliated, advised or subadvised by the Company.

Restricted List – a listing of securities maintained by Compliance in which trading by Access Persons is generally prohibited.

Registered Representative - an Employee who is registered as such with a member firm of the Financial Industry Regulatory Authority (“FINRA”).

Supervised Person – partners, officers, directors (or other persons occupying a similar status or performing similar functions) and employees, as well as any other persons who provide advice on behalf of an adviser and are subject to the adviser’s supervision and control.

COMPLYSCI System availability

9:00 a.m. to 4:00 p.m. Eastern Standard Time APPENDIX B

Securities and Transaction Types Not Requiring Preclearance or Subject to a Holding Period and Requiring Disclosure |

· Open-end mutual funds (not including NYLI Funds which are subject to a 30-day hold) |

· Direct obligations of the U.S. government |

· Direct obligations of the U.K. government |

· Government-sponsored enterprises fixed income securities (e.g., FNMA, FHLMC) |

· Variable Rate Demand Notes (VRDN’s) and variable rate demand obligations (VRDO’s) |

· Money Market Funds (does not require disclosure) |

· Bankers' acceptances, Bank CDs, commercial paper (does not require disclosure) |

· Securities futures and options on direct obligations of the US government or Non-U.S. governments and associated derivatives |

· Options, forwards, and futures on commodities and foreign exchange, and associated derivatives |

· ETFs (not including NYLI ETFs or single stock ETFs) |

· Unit Investment Trusts |

· Options on ETFs not issued though NYLIM or that are not single stock ETFs |

· Municipal Bonds (except for employees of MacKay Shields) |

· Municipal auction rate securities (“ARS”) with short-term coupon resets (e.g., 7 days) and closed-end municipal auction rate “Preferred” shares (except for employees of MacKay Shields) |

· Transfers of cash or securities, including gifts of stock given or received |

· Sales of previously approved private investments |

· Commodities, futures, currencies or precious metals (except for single stock futures and initial coin offerings. |

· Transactions in approved discretionary managed accounts |

· Crypto Index Funds and Single Asset products invested in cryptocurrencies, which are traded on a public exchange |

· Automatic Investment Plans such as Dividend Reinvestment Plans, Employee Stock Purchase Plans or similar accounts |

· Securities that are not “Covered Securities” |

· Stock options issued by a corporation as part of a compensation package (e.g., board memberships) do not require pre-clearance. However, a subsequent sale of the stock obtained by means of the exercise must receive prior clearance |

· High quality short-term debt instruments, including repurchase agreements |

· Interests in qualified state college tuition programs (529 Plans) and 529 ABLE accounts (does not require disclosure) |

· Cryptocurrencies or digital currencies, such as Bitcoin, Ethereum, Litecoin and Dogecoin, which are a virtual or digital representations of value. However, a virtual currency token offered in an initial or digital coin offering will be deemed a Covered Security for purposes of the Code and subject to preclearance requirements |

· That are non-volitional in nature: e.g., stock splits, stock dividends, exchanges and conversions, mandatory tenders, pro rata distributions to all holders of a class of securities, gifts, inheritances, margin/maintenance calls (where the securities to be sold are not directed by the covered person), and sales pursuant to regulated tender offers |

· Involving stock options issued by a corporation as part of a compensation package (e.g., board memberships) do not require pre-clearance. However, a subsequent sale of the stock obtained by means of the exercise must receive prior clearance |

· Interval Funds |

Accounts Not Requiring Disclosure |

· Non-NYL 401K accounts (unless they hold NYLI Funds or ETFs, common stock or stock options). (However, if an Access Person’s immediate family member has a NYL 401k account or has a 401k account which can hold the types of securities mentioned above, the Access Person must report the account.) |

· Annuities (Unless they hold NYLI Funds) |

· Accounts that cannot hold or trade covered securities regardless of intent (i.e., commodities, currencies). If the account is a brokerage account regardless of intent, it must be disclosed. |

· Banking or savings accounts |

· Mutual fund accounts held directly with the fund family to hold and trade that family of mutual funds only (i.e., account held with American Funds to hold and trade American Funds only). |

Preclearance and Reporting of Securities Transactions Required |

· Corporate Bonds |

· Stock (common and preferred) or other equity securities, including any security convertible into equity securities |

· Closed-end funds (including Business Development Companies (BDCs)) |

· NYLI ETFs and Single Stock ETFs |

· Options on securities (but not their non-volitional exercise or expiration), excluding ETFs not requiring preclearance. Options on NYLI ETFs and Single Stock ETFs do require preclearance and are subject to the holding periods of the underlying instrument as mentioned below. Transactions in index options effected on a broad-based index do not require preclearance |

· Warrants |

· Rights |

· Limited Offerings (e.g., private placements, hedge funds and/or alternative investments). (Access Persons are prohibited from investing in and/or holding limited offerings in Third-Party Discretionary Managed Accounts) |

· Initial Public Offerings (IPOs)(Registered Representative are prohibited from investing in IPOs. Access Persons are prohibited from investing in and/or holding IPOs in Third-Party Discretionary Managed Accounts) |

Prohibited Investments and Activities |

· Initial public offerings (IPOs) by Registered Representatives |

· Selling of naked call or naked puts |

· Options trading in covered securities by Investment Personnel. However, transactions by Access Persons (including Investment Personnel) in index options effected on a broad-based index, options on individual ETFs (excluding single-stock ETFs and NYLI ETFs) and options on commodities are permitted, and, these types of options do not require pre-clearance, nor are they subject to the 60-day holding period and short swing rule |

· Good until Canceled or Stop Loss Orders |

· Securities on the Restricted List |

Security Holding Periods |

· Covered securities (and Options on such securities) requiring preclearance - 60-calendar days (last in, first out) |

· NYLI Funds - 30-calendar days (last in, first out) |

· NYLI ETFs - 7-calendar days (last in, first out) |