| | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| Walmart reports

second quarter results | | |

| | | | | | | |

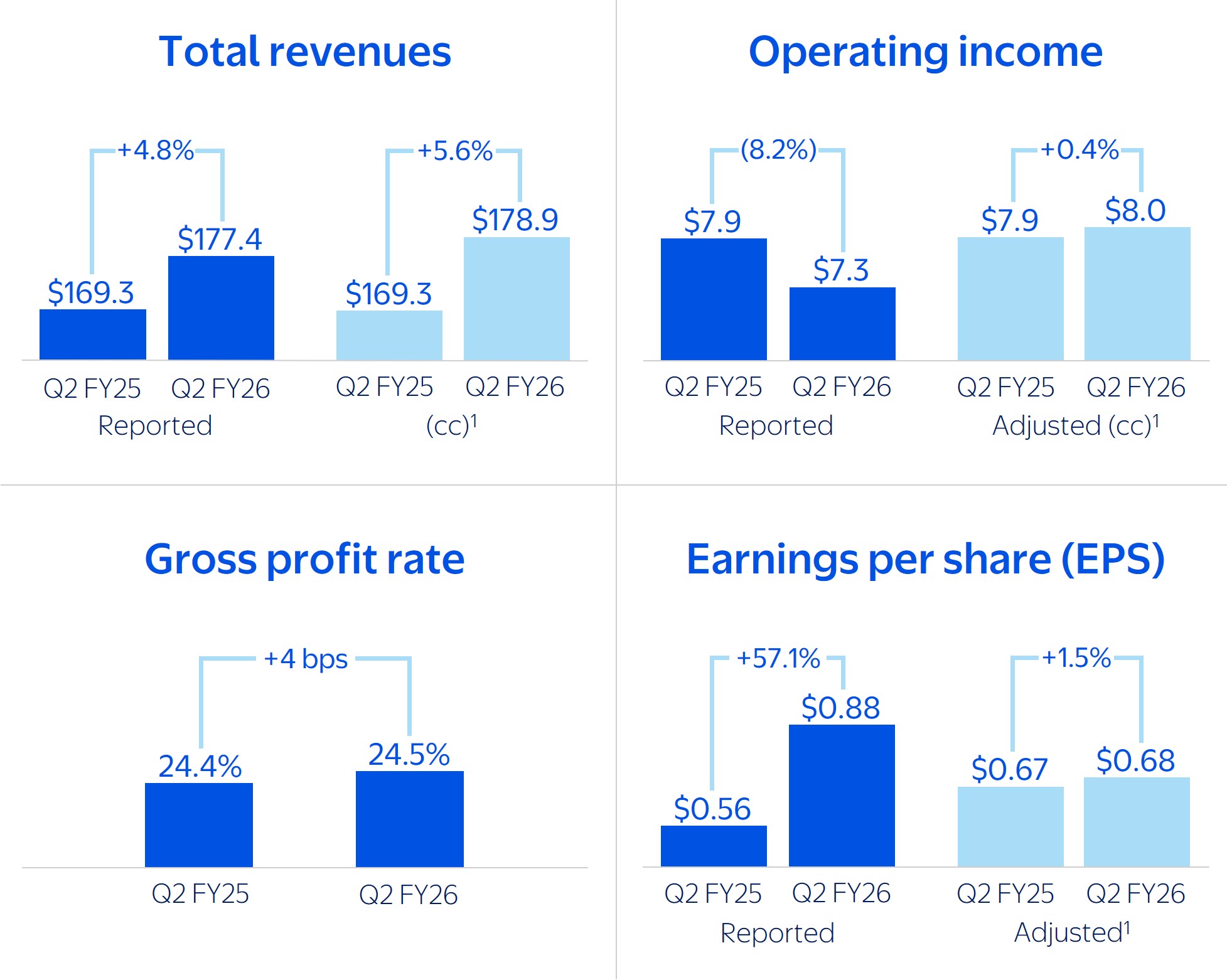

| •Revenue growth of 4.8%, up 5.6% in constant currency (cc)1 •Operating income decreased 8.2%, up 0.4% adjusted (cc)1 •eCommerce up 25% globally •GAAP EPS of $0.88; Adjusted EPS1 of $0.68 •Company issues guidance for Q3; raises net sales and EPS outlook for FY26 | |

| | | | | | | |

| | | | “ | | | |

| BENTONVILLE, Ark., August 21, 2025 – Walmart Inc. (NYSE: WMT) announces second-quarter results with strong growth in revenue for each business segment. Globally, eCommerce grew 25% with digital mix up across all segments. Walmart U.S. comp sales2 up 4.6% with strong growth in grocery and health & wellness. Looking ahead, the Company issues guidance for the third quarter with net sales expected to increase 3.75% to 4.75% and operating income to increase 3.0% to 6.0%, both in constant currency (“cc”).1 The Company raises outlook for net sales growth to 3.75% to 4.75% and adjusted EPS1 to $2.52 to $2.62 for fiscal year 2026. Adjusted operating income1 guidance remains unchanged from at 3.5% to 5.5%. | | | | | |

| | | The top-line momentum we have in our business comes from how we’re innovating and executing. Connecting with our customers and members through digital experiences is helping to drive our business, and the way we’re deploying AI will make these experiences even better. We’re people-led and tech-powered, and I love how our associates continue to drive change and results for our company.” Doug McMillon President and CEO, Walmart | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | |

| Second Quarter Highlights | | | | | | |

| •Revenue of $177.4 billion, up 4.8%, or 5.6% (cc)1 •Global eCommerce sales grew 25%, led by store-fulfilled pickup & delivery and marketplace •Global advertising business3 grew 46%, including VIZIO; Walmart Connect in the U.S. up 31% •Membership and other income up 5.4%, including 15.3% growth in membership income globally •Gross margin rate up 4 bps, led by Walmart U.S. •Operating income decreased $0.7 billion, or 8.2%, affected by discrete legal & restructuring costs; adjusted up 0.4% (cc)1 due to strong sales and continued execution on our financial framework; growth also affected ~560 bps from higher self-insured general liability claims expense •Adjusted EPS1 of $0.68 excludes the effect, net of tax, of a net gain of $0.26 on equity and other investments, $0.05 from charges related to certain legal matters, and $0.01 from business restructuring charges •ROA at 8.3%; ROI1 at 15.1%

| | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | |

1 See additional information at the end of this release regarding non-GAAP financial measures. 2 Comp sales for the 13-week period ended August 1, 2025 compared to the 13-week period ended July 26, 2024 and excludes fuel. See Supplemental Financial Information for additional information. 3 Our global advertising business is recorded in either net sales or as a reduction to cost of sales, depending on the nature of the advertising arrangement. “cc” - constant currency |

|

|

|

|

|

| | | | | | | | | | | | | | | | | |

| | | | | |

Key Financial Metrics Dollars in billions, except per share data. Dollar and percentage changes may not recalculate due to rounding. Charts may not be to scale. | | |

| | | | | |

| | | | | | | | | | | | | | |

| Balance Sheet and Liquidity |

| | | | |

•Cash and cash equivalents of $9.4 billion |

•Total debt of $50.3 billion2 |

•Operating cash flow of $18.4 billion, an increase of $2.0 billion |

•Free cash flow1 of $6.9 billion, an increase of $1.1 billion |

•Repurchased 67.4 million shares YTD, or $6.2 billion3 |

•Inventory of $57.7 billion, an increase of $2.1 billion, or 3.8% |

1 See additional information at the end of this release regarding non-GAAP financial measures. 2 Debt includes short-term borrowings, long-term debt due within one year, finance lease obligations due within one year, long-term debt and long-term finance lease obligations. 3 $5.9 billion remaining of $20 billion authorization approved in November 2022. cc - constant currency |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Business Highlights and Strategic Initiatives Dollars in billions, except as noted. Dollar and percentage changes may not recalculate due to rounding. | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Walmart U.S. | Q2 FY26 | Q2 FY25 | Change | | | | |

| Net sales | $120.9 | $115.3 | $5.6 | 4.8% | | | | | |

Comp sales (ex. fuel)2 | 4.6% | 4.2% | NP | NP | | | | | |

| Transactions | 1.5% | 3.6% | NP | NP | | | | | |

| Average ticket | 3.1% | 0.6% | NP | NP | | | | | |

| eCommerce contribution to comp | ~420 bps | ~300 bps | NP | NP | | | | | |

| Operating income | $6.7 | $6.6 | $0.1 | 2.0% | | | | | |

| | | | | | | | | |

Walmart U.S.

•Strong sales growth reflects share gains across key categories; customers are responding to the increased convenience of eCommerce/omnichannel offerings as well as more Rollbacks in pricing

•eCommerce sales accelerated with 26% growth reflecting strength in store-fulfilled delivery, advertising and marketplace; sales through store-fulfilled delivery channels grew nearly 50%, with ~1/3rd of orders expedited

•Momentum in advertising continued, including a 31% increase in Walmart Connect sales (ex-VIZIO)

•Gross profit rate increased 26 bps; membership income up double-digits; operating expense deleveraged 43 bps

•Operating income up 2.0% reflects strong inventory management and improved eCommerce economics, aided by continued improvement in business mix; largely offset by 620 bps headwind from increased self-insured general liability claims expense

•Inventory increased 2.2% while maintaining healthy in-stock levels

| | | | | | | | | | | | | | | | | | | |

| Walmart International | Q2 FY26 | Q2 FY25 | Change | | | | |

| Net sales | $31.2 | $29.6 | $1.6 | 5.5% | | | | | |

Net sales (cc)1 | $32.7 | $29.6 | $3.1 | 10.5% | | | | | |

| Operating income | $1.2 | $1.4 | $(0.1) | (9.8%) | | | | | |

Operating income (cc)1 | $1.3 | $1.4 | $0.0 | (2.8%) | | | | | |

| | | | | | | | | |

Walmart International

•Growth in net sales (cc)1 led by China, Walmex, and Flipkart; transaction counts & unit volumes up across markets

•Continued strength in food & consumables and general merchandise

•eCommerce sales up 22%, led by store-fulfilled pickup & delivery and marketplace; digital mix up across markets

•Advertising business3 grew 15%, led by Flipkart

•Operating income (cc)1 decline affected by strategic growth investments in India, Canada and Mexico

•Currency rate fluctuations negatively affected sales by $1.5 billion and operating income by $0.1 billion

1 See additional information at the end of this release regarding non-GAAP financial measures.

2 See Supplemental Financial Information for additional information.

3 Our global advertising business is recorded in either net sales or as a reduction to cost of sales, depending on the nature of the advertising arrangement.

NP - Not provided

cc - constant currency

| | | | | | | | | | | | | | | | | | | |

| Sam’s Club U.S. | Q2 FY26 | Q2 FY25 | Change | | | | |

| Net sales | $23.6 | $22.9 | $0.8 | 3.4% | | | | | |

| Net sales (ex. fuel) | $21.2 | $20.0 | $1.2 | 6.0% | | | | | |

Comp sales (ex. fuel)1 | 5.9% | 5.2% | NP | NP | | | | | |

| Transactions | 3.9% | 6.1% | NP | NP | | | | | |

| Average ticket | 2.0% | -0.8% | NP | NP | | | | | |

| eCommerce contribution to comp | ~350 bps | ~230 bps | NP | NP | | | | | |

| Operating income | $0.5 | $0.6 | $(0.1) | (15.8%) | | | | | |

Adjusted operating income2 | $0.6 | $0.6 | $0.0 | (2.1%) | | | | | |

Sam’s Club U.S.

•Sales strength led by grocery and health & wellness; continued growth in general merchandise sales

•Comp sales momentum driven by higher units; continued strength in transactions

•eCommerce sales up 26% with continued strong growth in club-fulfilled pickup & delivery

•Membership income grew 7.6% with steady growth in member counts, renewal rates, and Plus members

•Operating income negatively affected by $80 million from strategic supply chain reorganization charges

•Adjusted operating income2 growth negatively affected by ~710 bps from higher general liability claims expense

1 See Supplemental Financial Information for additional information.

2 See additional information at the end of this release regarding non-GAAP financial measures.

NP - Not provided

| | | | | | | | | | | |

| The following forward-looking statements reflect the Company’s expectations as of August 21, 2025, and are subject to substantial uncertainty. The Company’s results may be materially affected by many factors, such as fluctuations in foreign currency exchange rates, changes in global economic and geopolitical conditions, tariff and trade policies, customer demand and spending, inflation, interest rates, world events, expenses pertaining to general liability claims, for which we self-insure, and the various other factors detailed in this release, including those set forth below under the heading Forward-looking statements. Additionally, guidance is provided on a non-GAAP basis as the Company cannot predict certain elements that are included in reported GAAP results, such as the changes in fair value of the Company’s equity and other investments. Growth rates reflect an adjusted basis for prior year results. | |

| | |

| Third quarter | |

| | | |

| The Company’s third quarter fiscal 2026 guidance is based on the following Q3 FY25 figures: Net sales: $168.0 billion, operating income: $6.7 billion, and adjusted EPS1: $0.58. | |

| | | |

| Consolidated metric | Q3 FY26 | |

| Net sales (cc) | Increase 3.75% to 4.75% •Including approximately 20 bps tailwind from acquisition of VIZIO | |

| Operating income (cc) | Increase 3.0% to 6.0% •Including approximately 140 bps headwind from acquisition of VIZIO | |

| Adjusted EPS | $0.58 to $0.60 | |

| | | | | | | | | | | | | | | | | |

| | | | | |

| Fiscal year 2026 | | |

| | | | | |

| The Company’s fiscal year guidance is based on the following FY25 figures: Net sales: $674.5 billion, adjusted operating income1: $29.5 billion, and adjusted EPS1: $2.51. | |

| | | | | |

| Consolidated metric | Original from 2.20.2025 | As of 5.15.2025 | As of 8.21.2025 | |

| Net sales (cc) | Increase 3.0% to 4.0% •Including approximately 20 bps headwind from lapping leap year •Including approximately 20 bps tailwind from acquisition of VIZIO | Unchanged | Increase 3.75% to 4.75% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Adj. operating income (cc) | Increase 3.5% to 5.5% •Including approximately 70 bps headwind from lapping leap year •Including approximately 80 bps headwind from acquisition of VIZIO | Unchanged | Unchanged | |

| Interest, net | Increase approximately $100M to $200M | Unchanged | Unchanged | |

| Effective tax rate | Approximately 23.5% to 24.5% | Unchanged | Unchanged | |

| Non-controlling interest | Relatively flat | Unchanged | Unchanged | |

| Adjusted EPS | $2.50 to $2.60, including approximately $0.05 headwind from currency | Unchanged | $2.52 to $2.62, including $0.02 to $0.03 headwind from currency | |

| Capital expenditures | Approximately 3.0% to 3.5% of net sales | Unchanged | Unchanged | |

| 1 For relevant non-GAAP reconciliations, see Q3 FY25 and Q4 FY25 earnings releases furnished on Form 8-K on November 19, 2024 and February 20, 2025, respectively. cc - constant currency | |

| | |

|

|

About Walmart Walmart Inc. (NYSE: WMT) is a people-led, tech-powered omnichannel retailer helping people save money and live better - anytime and anywhere - in stores, online, and through their mobile devices. Each week, approximately 270 million customers and members visit more than 10,750 stores and numerous eCommerce websites in 19 countries. With fiscal year 2025 revenue of $681 billion, Walmart employs approximately 2.1 million associates worldwide. Walmart continues to be a leader in sustainability, corporate philanthropy, and employment opportunity. Additional information about Walmart can be found by visiting corporate.walmart.com, on Facebook at facebook.com/walmart, on X (formerly known as Twitter) at twitter.com/walmart, and on LinkedIn at linkedin.com/company/walmart.

Investor Relations contact: Steph Wissink – ir@walmart.com Media Relations contact: Molly Blakeman – (800) 331-0085 |

| | | | | | | | | | | | | | | | | |

| | | | | |

| Forward-looking statements | | |

| | | | | |

| | | | | |

| This release and related management commentary contains statements that may be "forward-looking statements" as defined in, and are intended to enjoy the protection of the safe harbor for forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Assumptions on which such forward-looking statements are based are also forward-looking statements. Statements of our guidance, projections, estimates, expectations, plans, and objectives for the second quarter and remainder of fiscal 2026 in this release and related management commentary are forward-looking statements. Assumptions on which such forward-looking statements are based are also forward-looking statements. Such forward-looking statements are not statements of historical facts, but instead express our estimates or expectations for our consolidated economic performance or results of operations for future periods or as of future dates or events or developments that may occur in the future or discuss our plans, objectives or goals. These forward-looking statements can be identified by their use of words or phrases such as “anticipate,” “could,” “could be,” “believe,” “expect,” “forecast,” “plan,” “projected,” “will be” “will improve,” variations of such words or phrases or similar words and phrases denoting anticipated or expected occurrences or results. The forward-looking statements that we make are based on our knowledge of our business and our operating environment and assumptions that we believe to be or will believe to be reasonable when such forward-looking statements were or are made. Our actual results may differ materially from those expressed in or implied by any of these forward-looking statements as a result of changes in circumstances, assumptions not being realized or other risks, uncertainties and factors including: the impact of pandemics on our business and the global economy; economic, capital markets and business conditions; trends and events around the world and in the markets in which we operate; currency exchange rate fluctuations, changes in market interest rates and market levels of wages; changes in the size of various markets, including eCommerce markets; unemployment levels; inflation or deflation, generally and in particular product categories; consumer confidence, disposable income, credit availability, spending levels, shopping patterns, debt levels and demand for certain merchandise; the effectiveness of the implementation and operation of our strategies, plans, programs and initiatives; unexpected changes in our objectives and plans; the impact of acquisitions, investments, divestitures, store or club closures, and other strategic decisions; our ability to successfully integrate acquired businesses, including within the eCommerce space; changes in the trading prices of certain equity investments we hold; initiatives of competitors, competitors' entry into and expansion in our markets, and competitive pressures; customer traffic and average ticket in our stores and clubs and on our eCommerce websites; the mix of merchandise we sell, the cost of goods we sell and the shrinkage we experience; trends in consumer shopping habits around the world and in the markets in which we operate; our gross profit margins; the financial performance of Walmart and each of its segments, including the amounts of our cash flow during various periods; transportation, energy and utility costs; commodity prices and the price of gasoline and diesel fuel; supply chain disruptions and disruptions in seasonal buying patterns; the availability of goods from suppliers and the cost of goods acquired from suppliers; consumer acceptance of and response to our stores, clubs, eCommerce platforms, programs, merchandise offerings and delivery methods; cyber security events affecting us and related costs and impact to the business; developments in, outcomes of, and costs incurred in legal or regulatory proceedings to which we are a party or are subject, and the liabilities, obligations and expenses, if any, that we may incur in connection therewith; expenses pertaining to general liability claims, for which we self-insure, and insurance costs; consumer enrollment in health and drug insurance programs and such programs’ reimbursement rates and drug formularies; our effective tax rate and the factors affecting our effective tax rate, including assessments of certain tax contingencies, valuation allowances, changes in law, administrative audit outcomes, impact of discrete items and the mix of earnings between the U.S. and Walmart's international operations; changes in existing tax, labor and other laws and regulations and changes in tax rates including the enactment of laws and the adoption and interpretation of administrative rules and regulations; the imposition of new taxes on imports, new tariffs and changes in existing tariff rates; the imposition of new trade restrictions and changes in existing trade restrictions; adoption or creation of new, and modification of existing, governmental policies, programs, initiatives and actions in the markets in which Walmart operates and elsewhere and actions with respect to such policies, programs and initiatives; changes in accounting estimates or judgments; the level of public assistance payments; natural disasters, changes in climate, geopolitical events and catastrophic events; and changes in generally accepted accounting principles in the United States. Our most recent annual report on Form 10-K and subsequent quarterly report filed with the SEC discusses other risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in the release and related management commentary. We urge you to consider all of the risks, uncertainties and factors identified above or discussed in such reports carefully in evaluating the forward-looking statements in this release. Walmart cannot assure you that the results reflected in or implied by any forward-looking statement will be realized or, even if substantially realized, that those results will have the forecasted or expected consequences and effects for or on our operations or financial performance. The forward-looking statements made in the release are as of the date of this release. Walmart undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances. This release and related management commentary references certain non-GAAP measures as defined under SEC rules, including net sales and operating income on a constant currency basis, adjusted operating income, free cash flow, and return on investment. Information about the non-GAAP measures as required by Regulation G and Item 10(e) of Regulation S-K regarding non-GAAP measures for the applicable periods can be found in our previously filed reports on Form 10-K and earnings releases filed via Form 8-K with the SEC, which are available at stock.walmart.com.

| |

| | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Walmart Inc. Condensed Consolidated Statements of Income (Unaudited) | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | July 31, | | July 31, |

| (Amounts in millions, except per share data) | | 2025 | | 2024 | | Percent Change | | 2025 | | 2024 | | Percent Change |

| Revenues: | | | | | | | | | | | | |

| Net sales | | $ | 175,750 | | | $ | 167,767 | | | 4.8 | % | | $ | 339,731 | | | $ | 327,705 | | | 3.7 | % |

| Membership and other income | | 1,652 | | | 1,568 | | | 5.4 | % | | 3,280 | | | 3,138 | | | 4.5 | % |

| Total revenues | | 177,402 | | | 169,335 | | | 4.8 | % | | 343,011 | | | 330,843 | | | 3.7 | % |

| Costs and expenses: | | | | | | | | | | | | |

| Cost of sales | | 132,771 | | | 126,810 | | | 4.7 | % | | 257,074 | | | 248,241 | | | 3.6 | % |

| Operating, selling, general and administrative expenses | | 37,345 | | | 34,585 | | | 8.0 | % | | 71,516 | | | 67,821 | | | 5.4 | % |

| Operating income | | 7,286 | | | 7,940 | | | (8.2 | %) | | 14,421 | | | 14,781 | | | (2.4 | %) |

| Interest: | | | | | | | | | | | | |

| Debt | | 651 | | | 557 | | | 16.9 | % | | 1,170 | | | 1,154 | | | 1.4 | % |

| Finance lease | | 118 | | | 122 | | | (3.3 | %) | | 236 | | | 239 | | | (1.3 | %) |

| Interest income | | (94) | | | (114) | | | (17.5 | %) | | (187) | | | (228) | | | (18.0 | %) |

| Interest, net | | 675 | | | 565 | | | 19.5 | % | | 1,219 | | | 1,165 | | | 4.6 | % |

| | | | | | | | | | | | |

| Other (gains) and losses | | (2,708) | | | 1,162 | | | NM | | (2,111) | | | 368 | | | NM |

| Income before income taxes | | 9,319 | | | 6,213 | | | 50.0 | % | | 15,313 | | | 13,248 | | | 15.6 | % |

| Provision for income taxes | | 2,168 | | | 1,502 | | | 44.3 | % | | 3,523 | | | 3,230 | | | 9.1 | % |

| | | | | | | | | | | | |

| Consolidated net income | | 7,151 | | | 4,711 | | | 51.8 | % | | 11,790 | | | 10,018 | | | 17.7 | % |

| Consolidated net income attributable to noncontrolling interest | | (125) | | | (210) | | | (40.5 | %) | | (277) | | | (413) | | | (32.9 | %) |

| Consolidated net income attributable to Walmart | | $ | 7,026 | | | $ | 4,501 | | | 56.1 | % | | $ | 11,513 | | | $ | 9,605 | | | 19.9 | % |

| | | | | | | | | | | | |

| Net income per common share: | | | | | | | | | | | | |

| Basic net income per common share attributable to Walmart | | $ | 0.88 | | | $ | 0.56 | | | 57.1 | % | | $ | 1.44 | | | $ | 1.19 | | | 21.0 | % |

| Diluted net income per common share attributable to Walmart | | $ | 0.88 | | | $ | 0.56 | | | 57.1 | % | | $ | 1.43 | | | $ | 1.19 | | | 20.2 | % |

| | | | | | | | | | | | |

| Weighted-average common shares outstanding: | | | | | | | | | | | | |

| Basic | | 7,978 | | | 8,044 | | | | | 7,994 | | | 8,048 | | | |

| Diluted | | 8,016 | | | 8,081 | | | | | 8,033 | | | 8,082 | | | |

| | | | | | | | | | | | |

| Dividends declared per common share | | $ | — | | | $ | — | | | | | $ | 0.94 | | | $ | 0.83 | | | |

NM: Not Meaningful

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Walmart Inc. Condensed Consolidated Balance Sheets (Unaudited) | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | July 31, | | January 31, | | July 31, |

| (Amounts in millions) | | 2025 | | 2025 | | 2024 |

| ASSETS | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 9,431 | | | $ | 9,037 | | | $ | 8,811 | |

| Receivables, net | | 10,518 | | | 9,975 | | | 8,650 | |

| Inventories | | 57,729 | | | 56,435 | | | 55,611 | |

| Prepaid expenses and other | | 4,355 | | | 4,011 | | | 3,438 | |

| | | | | | |

| Total current assets | | 82,033 | | | 79,458 | | | 76,510 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Property and equipment, net | | 125,476 | | | 119,993 | | | 113,818 | |

| Operating lease right-of-use assets | | 13,953 | | | 13,599 | | | 13,579 | |

| Finance lease right-of-use assets, net | | 6,128 | | | 6,112 | | | 6,341 | |

| Goodwill | | 29,060 | | | 28,792 | | | 27,930 | |

| Other long-term assets | | 14,187 | | | 12,869 | | | 16,262 | |

| Total assets | | $ | 270,837 | | | $ | 260,823 | | | $ | 254,440 | |

| | | | | | |

| LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST, AND SHAREHOLDERS’ EQUITY | | | | | | |

| Current liabilities: | | | | | | |

| Short-term borrowings | | $ | 3,837 | | | $ | 3,068 | | | $ | 3,195 | |

| Accounts payable | | 60,086 | | | 58,666 | | | 56,716 | |

| Dividends payable | | 3,783 | | | — | | | 3,343 | |

| Accrued liabilities | | 28,821 | | | 29,345 | | | 27,656 | |

| Accrued income taxes | | 620 | | | 608 | | | 576 | |

| Long-term debt due within one year | | 4,011 | | | 2,598 | | | 1,495 | |

| Operating lease obligations due within one year | | 1,580 | | | 1,499 | | | 1,493 | |

| Finance lease obligations due within one year | | 828 | | | 800 | | | 786 | |

| | | | | | |

| Total current liabilities | | 103,566 | | | 96,584 | | | 95,260 | |

| | | | | | |

| Long-term debt | | 35,640 | | | 33,401 | | | 35,364 | |

| Long-term operating lease obligations | | 13,171 | | | 12,825 | | | 12,811 | |

| Long-term finance lease obligations | | 5,947 | | | 5,923 | | | 6,161 | |

| Deferred income taxes and other | | 15,656 | | | 14,398 | | | 14,072 | |

| | | | | | |

| Commitments and contingencies | | | | | | |

| | | | | | |

| Redeemable noncontrolling interest | | 307 | | | 271 | | | 207 | |

| | | | | | |

| Shareholders’ equity: | | | | | | |

| Common stock | | 797 | | | 802 | | | 803 | |

| Capital in excess of par value | | 5,718 | | | 5,503 | | | 5,010 | |

| Retained earnings | | 96,328 | | | 98,313 | | | 90,788 | |

| Accumulated other comprehensive loss | | (12,733) | | | (13,605) | | | (12,178) | |

| Total Walmart shareholders’ equity | | 90,110 | | | 91,013 | | | 84,423 | |

| Nonredeemable noncontrolling interest | | 6,440 | | | 6,408 | | | 6,142 | |

| Total shareholders’ equity | | 96,550 | | | 97,421 | | | 90,565 | |

| Total liabilities, redeemable noncontrolling interest, and shareholders’ equity | | $ | 270,837 | | | $ | 260,823 | | | $ | 254,440 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Walmart Inc. Condensed Consolidated Statements of Cash Flows (Unaudited) | | |

| | | | | | |

| | | | | | | | | | | | | | |

| | Six Months Ended |

| | July 31, |

| (Amounts in millions) | | 2025 | | 2024 |

| Cash flows from operating activities: | | | | |

| Consolidated net income | | $ | 11,790 | | | $ | 10,018 | |

| | | | |

| | | | |

| Adjustments to reconcile consolidated net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 6,856 | | | 6,339 | |

| Investment (gains) and losses, net | | (2,066) | | | 519 | |

| | | | |

| | | | |

| Deferred income taxes | | 1,551 | | | (244) | |

| | | | |

| Other operating activities | | 1,370 | | | 866 | |

| Changes in certain assets and liabilities, net of effects of acquisitions and dispositions: | | | | |

| Receivables, net | | (405) | | | 80 | |

| Inventories | | (659) | | | (1,234) | |

| Accounts payable | | 1,302 | | | 1,166 | |

| Accrued liabilities | | (1,453) | | | (1,410) | |

| Accrued income taxes | | 66 | | | 257 | |

| Net cash provided by operating activities | | 18,352 | | | 16,357 | |

| | | | |

| Cash flows from investing activities: | | | | |

| Payments for property and equipment | | (11,409) | | | (10,507) | |

| Proceeds from the disposal of property and equipment | | 41 | | | 292 | |

| | | | |

| Proceeds from disposal of certain strategic investments | | 775 | | | 149 | |

| | | | |

| Other investing activities | | (606) | | | (62) | |

| Net cash used in investing activities | | (11,199) | | | (10,128) | |

| | | | |

| Cash flows from financing activities: | | | | |

| Net change in short-term borrowings | | 759 | | | 2,315 | |

| Proceeds from issuance of long-term debt | | 3,983 | | | — | |

| Repayments of long-term debt | | (875) | | | (2,817) | |

| | | | |

| Dividends paid | | (3,755) | | | (3,336) | |

| Purchase of Company stock | | (6,200) | | | (2,072) | |

| | | | |

| | | | |

| | | | |

| Other financing activities | | (905) | | | (1,035) | |

| Net cash used in financing activities | | (6,993) | | | (6,945) | |

| | | | |

| Effect of exchange rates on cash, cash equivalents and restricted cash | | 181 | | | (340) | |

| | | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | | 341 | | | (1,056) | |

| | | | |

| Cash, cash equivalents and restricted cash at beginning of year | | 9,536 | | | 9,935 | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 9,877 | | | $ | 8,879 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Walmart Inc. Supplemental Financial Information (Unaudited) | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Segment information | Three Months Ended | | Six Months Ended |

| July 31, | | July 31, |

| (dollars in millions) | 2025 | 2024 | | | 2025 | 2024 | |

| Walmart U.S. | $ | % of Net Sales1 | $ | % of Net Sales1 | % Chg | | $ | % of Net Sales1 | $ | % of Net Sales1 | % Chg |

| Net sales | $ | 120,911 | | NP | $ | 115,347 | | NP | 4.8% | | $ | 233,074 | | NP | $ | 224,017 | | NP | 4.0 | % |

Membership and other income2 | 649 | | NP | 604 | | NP | 7.5% | | 1,285 | | NP | 1,217 | | NP | 5.6 | % |

Gross profit3 | 33,674 | | 27.9 | % | 31,827 | | 27.6% | 5.8 | % | | 64,485 | | 27.7 | % | 61,402 | | 27.4 | % | 5.0 | % |

Operating expenses3 | 27,603 | | 22.8 | % | 25,840 | | 22.4% | 6.8 | % | | 53,345 | | 22.9 | % | 50,696 | | 22.6 | % | 5.2 | % |

| Operating income | 6,720 | | 5.6 | % | $ | 6,591 | | 5.7% | 2.0 | % | | $ | 12,425 | | 5.3 | % | $ | 11,923 | | 5.3 | % | 4.2 | % |

Adjusted operating income4 | 6,720 | | 5.6 | % | $ | 6,591 | | 5.7% | 2.0 | % | | $ | 12,425 | | 5.3 | % | $ | 12,053 | | 5.4 | % | 3.1 | % |

| | | | | | | | | | | |

| Walmart International | | | | | | | | | | | |

| Net sales | $ | 31,201 | | NP | $ | 29,567 | | NP | 5.5% | | $ | 60,955 | | NP | $ | 59,400 | | NP | 2.6 | % |

Membership and other income2 | 381 | | NP | 371 | | NP | 2.7% | | 760 | | NP | 755 | | NP | 0.7 | % |

Gross profit3 | 6,729 | | 21.6% | 6,615 | | 22.4% | 1.7% | | 13,019 | | 21.4 | % | 13,120 | | 22.1 | % | (0.8 | %) |

Operating expenses3 | 5,883 | | 18.9% | 5,626 | | 19.0% | 4.6% | | 11,288 | | 18.5 | % | 10,982 | | 18.5 | % | 2.8 | % |

| Operating income | $ | 1,227 | | 3.9% | $ | 1,360 | | 4.6% | (9.8%) | | $ | 2,491 | | 4.1 | % | $ | 2,893 | | 4.9 | % | (13.9 | %) |

| | | | | | | | | | | |

| Sam’s Club U.S. | | | | | | | | | | | |

| Net sales | $ | 23,638 | | NP | $ | 22,853 | | NP | 3.4% | | $ | 45,702 | | NP | $ | 44,288 | | NP | 3.2 | % |

Membership and other income2 | 617 | | NP | 579 | | NP | 6.6% | | 1,224 | | NP | 1,140 | | NP | 7.4 | % |

Gross profit3 | 2,576 | | 10.9% | 2,515 | | 11.0% | 2.4% | | 5,153 | | 11.3 | % | 4,942 | | 11.2 | % | 4.3 | % |

Operating expenses3 | 2,704 | | 11.4% | 2,513 | | 11.0% | 7.6% | | 5,202 | | 11.4 | % | 4,886 | | 11.0 | % | 6.5 | % |

| Operating income | $ | 489 | | 2.1% | $ | 581 | | 2.5% | (15.8%) | | $ | 1,175 | | 2.6 | % | $ | 1,196 | | 2.7 | % | (1.8 | %) |

Adjusted operating income4 | $ | 569 | | 2.4% | $ | 581 | | 2.5% | (2.1%) | | $ | 1,255 | | 2.7 | % | $ | 1,196 | | 2.7 | % | 4.9 | % |

| | | | | | | | | | | |

| Corporate and support | | | | | | | | | | | |

Membership and other income2 | $ | 5 | | NP | $ | 14 | | NP | (64.3%) | | $ | 11 | | NP | $ | 26 | | NP | (57.7 | %) |

Operating expenses3 | 1,155 | | 0.7% | 606 | | 0.4% | 90.6% | | 1,681 | | 0.5 | % | 1,257 | | 0.4 | % | 33.7 | % |

| Operating loss | $ | (1,150) | | (0.7%) | $ | (592) | | (0.4%) | 94.3% | | $ | (1,670) | | (0.5 | %) | $ | (1,231) | | (0.4 | %) | 35.7 | % |

| | | | | | | | | | | |

| Consolidated | | | | | | | | | | | |

| Net sales | $ | 175,750 | | NP | $ | 167,767 | | NP | 4.8% | | $ | 339,731 | | NP | $ | 327,705 | | NP | 3.7 | % |

Membership and other income2 | 1,652 | | NP | 1,568 | | NP | 5.4% | | 3,280 | | NP | 3,138 | | NP | 4.5 | % |

Gross profit3 | 42,979 | | 24.5 | % | 40,957 | | 24.4% | 4.9 | % | | 82,657 | | 24.3 | % | 79,464 | | 24.2 | % | 4.0 | % |

Operating expenses3 | 37,345 | | 21.2 | % | 34,585 | | 20.6% | 8.0 | % | | 71,516 | | 21.1 | % | 67,821 | | 20.7 | % | 5.4 | % |

| Operating income | $ | 7,286 | | 4.1 | % | $ | 7,940 | | 4.7% | (8.2 | %) | | $ | 14,421 | | 4.2 | % | $ | 14,781 | | 4.5 | % | (2.4 | %) |

Adjusted operating income4 | $ | 7,876 | | 4.5 | % | $ | 7,940 | | 4.7% | (0.8 | %) | | $ | 15,011 | | 4.4 | % | $ | 15,036 | | 4.6 | % | (0.2 | %) |

| | | | | | | | | | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

1 Corporate and support shown as percentage of consolidated net sales.

2 Membership and other income includes membership fees and other items such as rental and tenant income, recycling income, gift card breakage income, as well as other income from corporate campus facilities.

3 Gross profit defined as net sales less cost of sales. Operating expenses refers to operating, selling, general and administrative expenses.

4 See additional information at the end of the release regarding non-GAAP financial measures.

NP - Not provided

U.S. comparable sales results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | With Fuel | | Without Fuel | | Fuel Impact |

| | | 13 Weeks Ended | | 13 Weeks Ended | | 13 Weeks Ended |

| | 8/1/2025 | | 7/26/2024 | | 8/1/2025 | | 7/26/2024 | | 8/1/2025 | | 7/26/2024 |

| Walmart U.S. | | 4.5% | | 4.2% | | 4.6% | | 4.2% | | (0.1%) | | 0.0% |

| Sam’s Club U.S. | | 3.3% | | 4.6% | | 5.9% | | 5.2% | | (2.6%) | | (0.6%) |

| Total U.S. | | 4.3% | | 4.3% | | 4.8% | | 4.3% | | (0.5%) | | 0.0% |

| | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Comparable sales is a metric that indicates the performance of our existing stores and clubs by measuring the change in sales for such stores and clubs, and it is important to review in conjunction with the company’s financial results reported in accordance with GAAP. Walmart's definition of comparable sales includes sales from stores and clubs open for the previous 12 months, including remodels, relocations, expansions and conversions, as well as eCommerce sales. Comparable sales excluding fuel is also an important, separate metric that indicates the performance of our existing stores and clubs without considering fuel, which is volatile and unpredictable. Other companies in our industry may calculate comparable sales differently, limiting the comparability of the metric.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Walmart Inc. Reconciliations of and Other Information Regarding Non-GAAP Financial Measures (Unaudited) | | |

| | | | | | |

The following information provides reconciliations of certain non-GAAP financial measures presented in the press release to which this reconciliation is attached to the most directly comparable financial measures calculated and presented in accordance with U.S. generally accepted accounting principles (GAAP). The company has provided the non-GAAP financial information presented in the press release, which is not calculated or presented in accordance with GAAP, as information supplemental and in addition to the financial measures presented in the press release that are calculated and presented in accordance with GAAP. Such non-GAAP financial measures should not be considered superior to, as a substitute for or alternative to, and should be considered in conjunction with, the GAAP financial measures presented in the press release. The non-GAAP financial measures in the press release may differ from similar measures used by other companies.

Constant currency

In discussing our operating results, the term currency exchange rates refers to the currency exchange rates we use to convert the operating results for countries where the functional currency is not the U.S. dollar into U.S. dollars. We calculate the effect of changes in currency exchange rates as the difference between current period activity translated using the current period's currency exchange rates and the comparable prior year period's currency exchange rates. Additionally, no currency exchange rate fluctuations are calculated for non-USD acquisitions until owned for 12 months.

Throughout our discussion, we refer to the results of this calculation as the impact of currency exchange rate fluctuations. When we refer to constant currency operating results, this means operating results without the impact of the currency exchange rate fluctuations. The disclosure of constant currency amounts or results permits investors to better understand Walmart’s underlying performance without the effects of currency exchange rate fluctuations.

The table below reflects the calculation of constant currency for total revenues, net sales and operating income for the three and six months ended July 31, 2025.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended July 31, 2025 | | Six Months Ended July 31, 2025 |

| Walmart International | | Consolidated | | Walmart International | | Consolidated |

| (Dollars in millions) | 2025 | Percent Change1 | | 2025 | Percent Change1 | | 2025 | Percent Change1 | | 2025 | Percent Change1 |

| Total revenues: | | | | | | | | | | | |

| As reported | $ | 31,582 | | 5.5 | % | | $ | 177,402 | | 4.8 | % | | $ | 61,715 | | 2.6 | % | | $ | 343,011 | | 3.7 | % |

| Currency exchange rate fluctuations | 1,478 | | N/A | | 1,478 | | N/A | | 3,895 | | N/A | | 3,895 | | N/A |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total revenues (cc) | $ | 33,060 | | 10.4 | % | | $ | 178,880 | | 5.6 | % | | $ | 65,610 | | 9.1 | % | | $ | 346,906 | | 4.9 | % |

| | | | | | | | | | | |

| Net sales: | | | | | | | | | | | |

| As reported | $ | 31,201 | | 5.5 | % | | $ | 175,750 | | 4.8 | % | | $ | 60,955 | | 2.6 | % | | $ | 339,731 | | 3.7 | % |

| Currency exchange rate fluctuations | 1,466 | | N/A | | 1,466 | | N/A | | 3,858 | | N/A | | 3,858 | | N/A |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net sales (cc) | $ | 32,667 | | 10.5 | % | | $ | 177,216 | | 5.6 | % | | $ | 64,813 | | 9.1 | % | | $ | 343,589 | | 4.8 | % |

| | | | | | | | | | | |

| Operating income: | | | | | | | | | | | |

| As reported | $ | 1,227 | | (9.8 | %) | | $ | 7,286 | | (8.2 | %) | | $ | 2,491 | | (13.9 | %) | | $ | 14,421 | | (2.4 | %) |

| Currency exchange rate fluctuations | 95 | | N/A | | 95 | | N/A | | 265 | | N/A | | 265 | | N/A |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Operating income (cc) | $ | 1,322 | | (2.8 | %) | | $ | 7,381 | | (7.0 | %) | | $ | 2,756 | | (4.7 | %) | | $ | 14,686 | | (0.6 | %) |

1 Change versus prior year comparable period reported results.

N/A - Not applicable

Adjusted operating income

Adjusted operating income is considered a non-GAAP financial measure under the SEC’s rules because it excludes certain charges included in operating income calculated in accordance with GAAP. Management believes that adjusted operating income is a meaningful measure to share with investors because it best allows comparison of the performance with that of the comparable period. In addition, adjusted operating income affords investors a view of what management considers Walmart’s core earnings performance and the ability to make a more informed assessment of such core earnings performance as compared with that of the prior year.

When we refer to adjusted operating income in constant currency, this means adjusted operating results without the impact of currency exchange rate fluctuations. The disclosure of constant currency amounts or results permits investors to better understand Walmart’s underlying performance without the effects of currency exchange rate fluctuations. The table below reflects the calculation of adjusted operating income and adjusted operating income in constant currency for the three and six months ended July 31, 2025, and the calculation of adjusted operating income for the three and six months ended July 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended July 31, |

| Sam’s Club U.S. | | Consolidated |

| (Dollars in millions) | 2025 | | 2024 | | 2025 | | 2024 |

| Operating income: | | | | | | | |

| Operating income, as reported | $ | 489 | | $ | 581 | | | $ | 7,286 | | $ | 7,940 | |

Certain legal matters1 | — | | — | | | 440 | | — | |

Business reorganization charges2 | 80 | | — | | | 150 | | $ | — | |

| Adjusted operating income | $ | 569 | | $ | 581 | | | $ | 7,876 | | $ | 7,940 | |

Percent change3 | (2.1 | %) | | NP | | (0.8 | %) | | NP |

| Currency exchange rate fluctuations | | | | | 95 | | — | |

| Adjusted operating income (cc) | | | | | $ | 7,971 | | $ | 7,940 | |

Percent change3 | | | | | 0.4 | % | | NP |

| | | | | | | |

| |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six Months Ended July 31, |

| Walmart U.S. | | Sam’s Club U.S. | | Consolidated |

| (Dollars in millions) | 2025 | | 2024 | | 2025 | | 2024 | | 2025 | | 2024 |

| Operating income: | | | | | | | | | | | |

| Operating income, as reported | $ | 12,425 | | $ | 11,923 | | | $ | 1,175 | | $ | 1,196 | | | $ | 14,421 | | $ | 14,781 | |

Certain legal matters1 | — | | — | | | — | | — | | | 440 | | — | |

Business reorganization charges2 | — | | 130 | | | 80 | | — | | | 150 | | 255 | |

| Adjusted operating income | $ | 12,425 | | $ | 12,053 | | | $ | 1,255 | | $ | 1,196 | | | $ | 15,011 | | $ | 15,036 | |

Percent change3 | 3.1 | % | | NP | | 4.9 | % | | NP | | (0.2 | %) | | NP |

| Currency exchange rate fluctuations | | | | | | | | | 265 | | — | |

| Adjusted operating income (cc) | | | | | | | | | $ | 15,276 | | $ | 15,036 | |

Percent change3 | | | | | | | | | 1.6 | % | | NP |

1 Represents charges related to certain legal matters which were outside the normal course of our operations and recorded in Corporate and support.

2 Business reorganization charges for the three and six months ended July 31, 2025 primarily relate to expenses incurred in connection with strategic supply chain decisions made in the Sam’s Club U.S. segment, as well as incremental business reorganization charges recorded in Corporate and support. Business reorganization charges for the six months ended July 31, 2024 primarily relate to expenses incurred in connection with strategic decisions made in the Walmart U.S. segment, as well as incremental business reorganization expenses recorded in Corporate and support.

3 Change versus prior year comparable period.

NP - Not provided

“cc” - constant currency

Free cash flow

Free cash flow is considered a non-GAAP financial measure. Management believes, however, that free cash flow, which measures our ability to generate additional cash from our business operations, is an important financial measure for use in evaluating the Company's financial performance. Free cash flow should be considered in addition to, rather than as a substitute for, consolidated net income as a measure of our performance and net cash provided by operating activities as a measure of our liquidity.

We define free cash flow as net cash provided by operating activities in a period minus payments for property and equipment made in that period. Net cash provided by operating activities was $18.4 billion for the six months ended July 31, 2025, which represents an increase of $2.0 billion when compared to the same period in the prior year. The increase was primarily due to timing of certain payments, lower cash tax payments and increased cash provided by operating income. Free cash flow for the six months ended July 31, 2025 was $6.9 billion, which represents an increase of $1.1 billion when compared to the same period in the prior year. The increase in free cash flow was due to the increase in net cash provided by operating activities described above, partially offset by an increase of $0.9 billion in capital expenditures to support our investment strategy.

Walmart’s definition of free cash flow is limited, in that it does not represent residual cash flows available for discretionary expenditures, due to the fact that the measure does not deduct the payments required for debt service and other contractual obligations or payments made for business acquisitions. Therefore, we believe it is important to view free cash flow as a measure that provides supplemental information to our Consolidated Statements of Cash Flows.

Although other companies report their free cash flow, numerous methods may exist for calculating a company’s free cash flow. As a result, the method used by Walmart’s management to calculate our free cash flow may differ from the methods used by other companies to calculate their free cash flow.

The following table sets forth a reconciliation of free cash flow, a non-GAAP financial measure, to net cash provided by operating activities, which we believe to be the GAAP financial measure most directly comparable to free cash flow, as well as information regarding net cash used in investing activities and net cash used in financing activities.

| | | | | | | | | | | | | | |

| | Six Months Ended |

| | | July 31, |

| (Dollars in millions) | | 2025 | | 2024 |

| Net cash provided by operating activities | | $ | 18,352 | | | $ | 16,357 | |

| Payments for property and equipment (capital expenditures) | | (11,409) | | | (10,507) | |

| Free cash flow | | $ | 6,943 | | | $ | 5,850 | |

| | | | |

Net cash used in investing activities1 | | $ | (11,199) | | | $ | (10,128) | |

| Net cash used in financing activities | | (6,993) | | | (6,945) | |

1 "Net cash used in investing activities" includes payments for property and equipment, which is also included in our computation of free cash flow.

Adjusted EPS

Adjusted diluted earnings per share attributable to Walmart (adjusted EPS) is considered a non-GAAP financial measure under the SEC’s rules because it excludes certain amounts included in the diluted earnings per share attributable to Walmart calculated in accordance with GAAP (EPS), the most directly comparable financial measure calculated in accordance with GAAP. Management believes that adjusted EPS is a meaningful measure to share with investors because it best allows comparison of the performance with that of the comparable period. In addition, adjusted EPS affords investors a view of what management considers Walmart’s core earnings performance and the ability to make a more informed assessment of such core earnings performance with that of the prior year.

We adjust for the unrealized and realized gains and losses on our equity and other investments each quarter because although the investments are strategic decisions for our retail operations, management’s measurement of each strategy is primarily focused on the operational results rather than the fair value of such investments. Additionally, management does not forecast changes in the fair value of its equity and other investments. Accordingly, management adjusts EPS each quarter for the unrealized and realized gains and losses related to those investments.

Tax impacts are calculated based on the nature of the item, including any realizable deductions, and statutory rates in effect for relevant jurisdictions. NCI impacts are based on the ownership percentages of our noncontrolling interests, where applicable.

We have calculated adjusted EPS for the three and six months ended July 31, 2025 by adjusting EPS for the following:

1.unrealized and realized gains and losses on our equity and other investments

2.charges related to certain legal matters which were outside the normal course of our operations and recorded in Corporate and support; and

3.business reorganization charges, primarily related to expenses incurred in connection with strategic supply chain decisions made in the Sam’s Club U.S. segment, as well as incremental business reorganization charges recorded in Corporate and support.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended July 31, 20251 |

| Diluted earnings per share: | | | | | | | | |

| Reported EPS | | | | | | | | $0.88 |

| | | | | | | | |

| Adjustments: | | Pre-Tax Impact | | Tax Impact2 | | NCI Impact | | Net Impact |

| Unrealized and realized (gains) and losses on equity and other investments | | $(0.33) | | $0.07 | | $— | | $(0.26) |

Certain legal matters3 | | 0.06 | | (0.01) | | — | | 0.05 |

| Business reorganization charges | | 0.02 | | (0.01) | | — | | 0.01 |

| Net adjustments | | | | | | | | $(0.20) |

| | | | | | | | |

| Adjusted EPS | | | | | | | | $0.68 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended July 31, 20251 |

| Diluted earnings per share: | | | | | | | | |

| Reported EPS | | | | | | | | $1.43 |

| | | | | | | | |

| Adjustments: | | Pre-Tax Impact | | Tax Impact2 | | NCI Impact | | Net Impact |

| Unrealized and realized (gains) and losses on equity and other investments | | $(0.26) | | $0.06 | | $— | | $(0.20) |

Certain legal matters3 | | 0.06 | | (0.01) | | — | | 0.05 |

| Business reorganization charges | | 0.02 | | (0.01) | | — | | 0.01 |

| Net adjustments | | | | | | | | $(0.14) |

| | | | | | | | |

| Adjusted EPS | | | | | | | | $1.29 |

1 Quarterly adjustments or adjusted EPS may not sum to YTD adjustments or YTD adjusted EPS due to rounding. Additionally, the individual components in the tables above may include immaterial rounding.

2 The reported effective tax rate was 23.3% and 23.0% for the three and six months ended July 31, 2025, respectively. Adjusted for the above items, the effective tax rate was 24.3% and 23.6% for the three and six months ended July 31, 2025.

3 Impact includes $440 million of costs recorded in operating, selling, general and administrative expenses and $75 million of costs recorded in interest, net.

As previously disclosed in our second quarter ended July 31, 2024 press release, we have calculated adjusted EPS for the three and six months ended July 31, 2024 for the following:

1.unrealized and realized gains and losses on our equity and other investments; and

2.business reorganization charges, primarily related to expenses incurred in connection with strategic decisions made in the Walmart U.S. segment, as well as incremental business reorganization expenses recorded in Corporate and support.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended July 31, 20241 |

| Diluted earnings per share: | | | | | | | | |

| Reported EPS | | | | | | | | $0.56 |

| | | | | | | | |

| Adjustments: | | Pre-Tax Impact | | Tax Impact2 | | NCI Impact | | Net Impact |

| | | | | | | | |

| Unrealized and realized (gains) and losses on equity and other investments | | $0.14 | | $(0.03) | | $— | | $0.11 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted EPS | | | | | | | | $0.67 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended July 31, 20241 |

| Diluted earnings per share: | | | | | | | | |

| Reported EPS | | | | | | | | $1.19 |

| | | | | | | | |

| Adjustments: | | Pre-Tax Impact | | Tax Impact2 | | NCI Impact | | Net Impact |

| | | | | | | | |

| Unrealized and realized (gains) and losses on equity and other investments | | $0.06 | | $— | | $— | | $0.06 |

| Business reorganization charges | | 0.03 | | (0.01) | | — | | 0.02 |

| Net adjustments | | | | | | | | $0.08 |

| | | | | | | | |

| Adjusted EPS | | | | | | | | $1.27 |

1 Quarterly adjustments or adjusted EPS may not sum to YTD adjustments or YTD adjusted EPS due to rounding. Additionally, the individual components in the tables above may include immaterial rounding.

2 The reported effective tax rate was 24.2% and 24.4% for the three and six months ended July 31, 2024, respectively. Adjusted for the above items, the effective tax rate was 24.2% for both the three and six months ended July 31, 2024.

Return on investment

We include return on assets ("ROA") and return on investment (“ROI”) as metrics to assess our return on capital. ROA is the most directly comparable measure based on our financial statements presented in accordance with GAAP, while ROI is considered a non-GAAP financial measure. Management believes ROI is a meaningful metric to share with investors because it helps investors assess how effectively Walmart is deploying its assets. Trends in ROI can fluctuate over time as management balances long-term strategic initiatives with possible short-term impacts.

Our calculation of ROI is considered a non-GAAP financial measure because we calculate ROI using financial measures that exclude and include amounts that are included and excluded in ROA, the most directly comparable GAAP financial measure. ROA is consolidated net income for the period divided by average total assets for the period. We define ROI as operating income plus interest income, depreciation and amortization, and rent expense for the trailing 12 months divided by average invested capital during that period. We consider average invested capital to be the average of our beginning and ending total assets, plus average accumulated depreciation and amortization, less average accounts payable and average accrued liabilities for that period. Although ROI is a standard financial measure, numerous methods exist for calculating a company's ROI. As a result, the method used by management to calculate our ROI may differ from the methods used by other companies to calculate their ROI.

ROA was 8.3 percent and 6.4 percent for the trailing 12 months ended July 31, 2025 and 2024, respectively. The increase in ROA was primarily due to an increase in net income as a result of net increases in the fair value of our equity and other investments combined with higher operating income, offset by an increase in average total assets due to higher purchases of property and equipment. ROI was 15.1 percent for the trailing 12 months ended July 31, 2025 and 2024 as a result of increased operating income, primarily due to improvements in business performance, offset by an increase in average invested capital due to higher purchases of property and equipment.

The calculation of ROA and ROI, along with a reconciliation of ROI to the calculation of ROA, the most comparable GAAP financial measure, is as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| CALCULATION OF RETURN ON ASSETS |

| | | | | | |

| | | | | | |

| | | | Trailing Twelve Months Ended |

| | | | July 31, |

| (Dollars in millions) | | | | 2025 | | 2024 |

| Numerator | | | | | | |

| Consolidated net income | | | | $ | 21,929 | | | $ | 16,339 | |

| Denominator | | | | | | |

Average total assets1 | | | | 262,639 | | | 254,781 | |

| Return on assets (ROA) | | | | 8.3 | % | | 6.4 | % |

| | | | | | |

| | | | | | |

| | | | | | |

| CALCULATION OF RETURN ON INVESTMENT |

| | | | | | |

| | | | | | |

| | | | Trailing Twelve Months Ended |

| | | | July 31, |

| (Dollars in millions) | | | | 2025 | | 2024 |

| Numerator | | | | | | |

| Operating income | | | | $ | 28,988 | | | $ | 28,237 | |

| + Interest income | | | | 442 | | | 519 | |

| + Depreciation and amortization | | | | 13,491 | | | 12,440 | |

| + Rent | | | | 2,374 | | | 2,306 | |

| ROI operating income | | | | $ | 45,295 | | | $ | 43,502 | |

| | | | | | |

| | | | | | |

| Denominator | | | | | | |

Average total assets1 | | | | $ | 262,639 | | | $ | 254,781 | |

'+ Average accumulated depreciation and amortization1 | | | | 124,255 | | | 118,077 | |

'- Average accounts payable1 | | | | 58,401 | | | 56,646 | |

'- Average accrued liabilities1 | | | | 28,239 | | | 28,448 | |

| Average invested capital | | | | $ | 300,254 | | | $ | 287,764 | |

| Return on investment (ROI) | | | | 15.1 | % | | 15.1 | % |

|

|

| | July 31, |

| Certain Balance Sheet Data | | 2025 | | 2024 | | 2023 |

| | | | | | |

| Total assets | | $ | 270,837 | | | $ | 254,440 | | | $ | 255,121 | |

| Accumulated depreciation and amortization | | 128,234 | | | 120,275 | | | 115,878 | |

| Accounts payable | | 60,086 | | | 56,716 | | | 56,576 | |

| Accrued liabilities | | 28,821 | | | 27,656 | | | 29,239 | |

1 The average is based on the addition of the account balance at the end of the current period to the account balance at the end of the prior period and dividing by 2.