Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

EMPOWER FUNDS, INC.

|

| Entity Central Index Key |

0000356476

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jun. 30, 2025

|

| Empower Real Estate Index Fund - Institutional Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Empower Real Estate Index Fund

|

| Class Name |

Institutional Class

|

| Trading Symbol |

MXSFX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Empower Real Estate Index Fund (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.empower.com/investments/empower-funds/fund-documents . You may also request this information by contacting us at

|

| Additional Information Phone Number |

1-866-831-7129

|

| Additional Information Website |

https://www.empower.com/investments/empower-funds/fund-documents

|

| Expenses [Text Block] |

Fund Expenses for the period ended June 30, 2025 (Based on a hypothetical $10,000 investment)

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Empower Real Estate Index Fund

(Institutional Class/MXSFX) |

$ 30 |

0.30 % |

|

| Expenses Paid, Amount |

$ 30

|

| Expense Ratio, Percent |

0.30%

|

| Net Assets |

$ 1,031,000,000

|

| Holdings Count | Holding |

106

|

| Advisory Fees Paid, Amount |

$ 1,300,000

|

| Investment Company, Portfolio Turnover |

1.00%

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to.

Fund net assets |

$ 1,031M |

Total number of portfolio holdings |

106 |

Total advisory fee paid |

$ 1.3M |

Portfolio turnover rate as of the end of the reporting period |

1 % |

|

| Holdings [Text Block] |

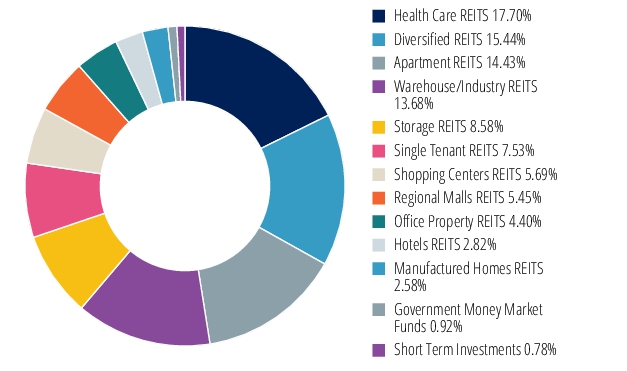

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total investments of the Fund.

| Prologis Inc REIT |

9.35 % |

| Welltower Inc REIT |

9.16 % |

| Equinix Inc REIT |

7.46 % |

| Digital Realty Trust Inc REIT |

5.29 % |

| Realty Income Corp REIT |

4.99 % |

| Simon Property Group Inc REIT |

4.73 % |

| Public Storage REIT |

4.44 % |

| Extra Space Storage Inc REIT |

3.00 % |

| AvalonBay Communities Inc REIT |

2.77 % |

| Ventas Inc REIT |

2.73 % |

|

| Largest Holdings [Text Block] |

| Prologis Inc REIT |

9.35 % |

| Welltower Inc REIT |

9.16 % |

| Equinix Inc REIT |

7.46 % |

| Digital Realty Trust Inc REIT |

5.29 % |

| Realty Income Corp REIT |

4.99 % |

| Simon Property Group Inc REIT |

4.73 % |

| Public Storage REIT |

4.44 % |

| Extra Space Storage Inc REIT |

3.00 % |

| AvalonBay Communities Inc REIT |

2.77 % |

| Ventas Inc REIT |

2.73 % |

|

| Material Fund Change [Text Block] |

There were no material changes to the Fund d uring the reporting period. |

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with the Fund's accountants during the reporting period.

|

| Empower Real Estate Index Fund - Investor Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Empower Real Estate Index Fund

|

| Class Name |

Investor Class

|

| Trading Symbol |

MXREX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Empower Real Estate Index Fund (the "Fund”) for the period of January 1, 2025, to June 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.empower.com/investments/empower-funds/fund-documents . You may also request this information by contacting us at

|

| Additional Information Phone Number |

1-866-831-7129

|

| Additional Information Website |

https://www.empower.com/investments/empower-funds/fund-documents

|

| Expenses [Text Block] |

Fund Expenses for the period ended June 30, 2025 (Based on a hypothetical $10,000 investment)

Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Empower Real Estate Index Fund

(Investor Class/MXREX) |

$ 65 |

0.65 % |

|

| Expenses Paid, Amount |

$ 65

|

| Expense Ratio, Percent |

0.65%

|

| Net Assets |

$ 1,031,000,000

|

| Holdings Count | Holding |

106

|

| Advisory Fees Paid, Amount |

$ 1,300,000

|

| Investment Company, Portfolio Turnover |

1.00%

|

| Additional Fund Statistics [Text Block] |

The following table outlines key fund statistics that you should pay attention to.

Fund net assets |

$ 1,031M |

Total number of portfolio holdings |

106 |

Total advisory fee paid |

$ 1.3M |

Portfolio turnover rate as of the end of the reporting period |

1 % |

|

| Holdings [Text Block] |

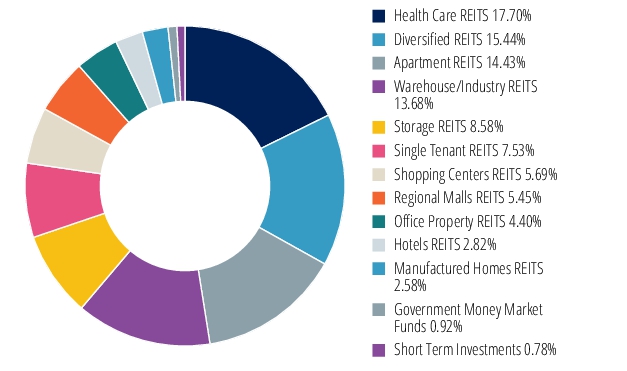

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total investments of the Fund.

| Prologis Inc REIT |

9.35 % |

| Welltower Inc REIT |

9.16 % |

| Equinix Inc REIT |

7.46 % |

| Digital Realty Trust Inc REIT |

5.29 % |

| Realty Income Corp REIT |

4.99 % |

| Simon Property Group Inc REIT |

4.73 % |

| Public Storage REIT |

4.44 % |

| Extra Space Storage Inc REIT |

3.00 % |

| AvalonBay Communities Inc REIT |

2.77 % |

| Ventas Inc REIT |

2.73 % |

|

| Largest Holdings [Text Block] |

| Prologis Inc REIT |

9.35 % |

| Welltower Inc REIT |

9.16 % |

| Equinix Inc REIT |

7.46 % |

| Digital Realty Trust Inc REIT |

5.29 % |

| Realty Income Corp REIT |

4.99 % |

| Simon Property Group Inc REIT |

4.73 % |

| Public Storage REIT |

4.44 % |

| Extra Space Storage Inc REIT |

3.00 % |

| AvalonBay Communities Inc REIT |

2.77 % |

| Ventas Inc REIT |

2.73 % |

|

| Material Fund Change [Text Block] |

There were no material changes to the Fund during the reporting period.

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with the Fund's accountants during the reporting period.

|