NEWS RELEASE

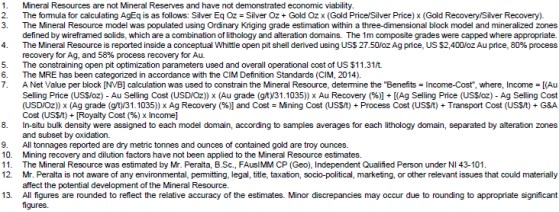

EMX Highlights an Updated MRE and Other Advancements at the

Diablillos Silver-Gold Royalty Property in Argentina

Vancouver, British Columbia, August 20, 2025 (NYSE American: EMX; TSX Venture: EMX) - EMX Royalty Corporation (the "Company" or "EMX") congratulates AbraSilver Resource Corp. (TSX: ABRA) ("AbraSilver") on its recent updated Diablillos mineral resource estimate ("MRE") that increased total open pit constrained, oxide mineral resources to 199 million ounces of contained silver (+34%) and 1.72 million ounces of contained gold (+27%) in the measured and indicated ("MI") categories.1,2 AbraSilver is also further enhancing project economics with ongoing drilling, advancing other priority initiatives (e.g., engineering optimization, investment incentives, among others), and is expected to receive EIA approval in the latter half of 2025 and on schedule to deliver a definitive feasibility study ("DFS") for the Project in Q1 2026. EMX retains a 1% NSR royalty on the Diablillos Project, and all known mineralization occurs within EMX's royalty ground.

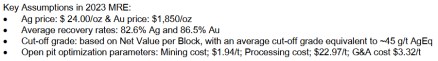

The updated Diablillos MRE reports tank leach resources, which previously was the sole metallurgical processing assumption for the Project, as well as contributions from a maiden heap leach MRE. The additional heap leach resources represent a milestone advancement in converting near surface and peripheral lower grade "waste" material within the constraining open pit configuration to mineralization potentially recoverable via a low-cost processing route. AbraSilver reported total (i.e., tank and heap leach) oxide MI resources as 104 Mtonnes averaging 59 g/t silver and 0.51 g/t gold. The tank leach MI resources account for approximately 70% of the tonnes and over 90% of the contained silver and gold, with the heap leach resources contributing the balance which provides the potential to reduce the strip ratio and enhance project economics.

There were significant MI increases across all five resource deposits (i.e., Oculto, JAC, Fantasma, Laderas and Sombra) (see Figure 1 reference map), with the largest tonnage and contained metal increases driven by the JAC deposit, which is characterized by high-grade, near-surface silver-gold mineralization, as well as the Oculto deposit. The Sombra deposit, a recent discovery immediately south of Oculto and JAC, represents a first-time addition to the Project MRE totals.

There is significant district scale exploration upside at Diablillos with an ongoing Phase V 20,000 meter drill program scheduled for completion by early 2026. This program includes step-out drilling at Oculto East, JAC, and Sombra, as well as exploration drilling at the Cerro Viejo and Cerro Blanco porphyry targets.

EMX congratulates AbraSilver for its success in rapidly building value at the Diablillos royalty property. In addition to the significant increases in silver-gold mineral resources via drilling and metallurgical advancements, AbraSilver is currently evaluating other initiatives to further enhance project economics as inputs to the H1 2026 DFS (e.g., connecting to national grid for power, upgrading the fleet size, outsourcing waste movement, and optimizing TSF design to co-locate waste with tailings).3 Moreover, Diablillos is eligible for Argentina's Incentive Regime for Large Investments (i.e., RIGI), which includes lower tax rates, elimination of export duties, and accelerated depreciation; an investment decision by Q2 2027 is required to fully qualify. Clearly, AbraSilver is on a fast track in advancing Diablillos to a production decision, and thereby unlocking the value of EMX's royalty interest.

Comments on the Updated MRE. The updated Diablillos MRE reports total (i.e., tank and heap leach) measured resources of 33,218 Ktonnes @ 98 g/t Ag (105,050 Koz contained) and 0.59 g/t Au (634 Koz contained) and indicated resources of 70,686 Ktonnes @ 41 g/t Ag (93,593 Koz contained) and 0.48 g/t Au (1,081 Koz contained). In addition, the updated MRE includes total inferred resources of 19,628 Ktonnes @ 21 g/t Ag (13,427 Koz contained) and 0.38 g/t Au (241 Koz contained).

_________________________

1 See AbraSilver news release dated July 29, 2025 and Appendix 1 of this news release

2 Increases referenced to the November 2023 MRE

3 See AbraSilver "August 2025" Corporate Presentation

Comments on the December 2024 PFS. AbraSilver's PFS study updated in December 2024 outlined an average 14 year life of mine with annual production of 7.6 Moz of silver and 72 Koz of gold yielding an NPV(5) of US$747 million, 28% IRR, and a two year payback using base case prices of $25.50/oz silver and $2,050/oz gold.4 Importantly, the PFS production profile over the first five years of full mine production averages 11.7 Moz silver and 59 Koz gold which underlines the Project's early-stage potential for strong cash-flow generation and corresponding royalty payments to EMX. AbraSilver's ongoing initiatives and sustained silver and gold bull market prices suggest significant additional Project upside.

About the Diablillos Silver-Gold Royalty Property. Diablillos is a high sulfidation silver-gold project located in the Puna region of Salta Province, Argentina. There are multiple mineralized zones in a district scale area covered by EMX's uncapped 1% NSR royalty ground. Of note, in April of this year the Company received an early final property payment from AbraSilver totaling US$6.85 million.

Michael P. Sheehan, CPG, a Qualified Person as defined by National Instrument 43-101 and employee of the Company, has reviewed, verified and approved the disclosure of the technical information contained in this news release.

About EMX. EMX is a precious and base metals royalty company. EMX's investors are provided with discovery, development, and commodity price optionality, while limiting exposure to risks inherent to operating companies. The Company's common shares are listed on the NYSE American Exchange and TSX Venture Exchange under the symbol "EMX". Please see www.EMXroyalty.com for more information.

For further information contact:

| David M. Cole President and CEO Phone: (303) 973-8585 Dave@EMXroyalty.com |

Stefan Wenger Chief Financial Officer Phone: (303) 973-8585 SWenger@EMXroyalty.com |

Isabel Belger Investor Relations Phone: +49 178 4909039 IBelger@EMXroyalty.com |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Forward-Looking Statements

This news release may contain "forward looking statements" that reflect the Company's current expectations and projections about its future results. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, timelines, strategic plans, market prices for precious and base metal, or other statements that are not statements of fact. When used in this news release, words such as "estimate," "intend," "expect," "anticipate," "will", "believe", "potential" and similar expressions are intended to identify forward-looking statements, which, by their very nature, are not guarantees of the Company's future operational or financial performance, and are subject to risks and uncertainties and other factors that could cause the Company's actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and factors may include, but are not limited to unavailability of financing, failure to identify commercially viable mineral reserves, fluctuations in the market valuation for commodities, difficulties in obtaining required approvals for the development of a mineral project, increased regulatory compliance costs, expectations of project funding by joint venture partners and other factors.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this news release or as of the date otherwise specifically indicated herein. Due to risks and uncertainties, including the risks and uncertainties identified in this news release, and other risk factors and forward-looking statements listed in the Company's MD&A for the quarter June 30, 2025 (the "MD&A"), and the most recently filed Annual Information Form ("AIF") for the year ended December 31, 2024, actual events may differ materially from current expectations. More information about the Company, including the MD&A, the AIF and financial statements of the Company, is available on SEDAR at www.sedarplus.ca and on the SEC's EDGAR website at www.sec.gov.

_________________________

4 See AbraSilver news release dated December 3, 2024

|

Figure 1. Diablillos Project Plan View of Mineral Resource Estimate (taken from Figure 2, AbraSilver news release dated July 29, 2025). |

|

|

Appendix 1

Notes on Current Diablillos Mineral Resource Estimate

(taken from AbraSilver news release dated July 29, 2025)

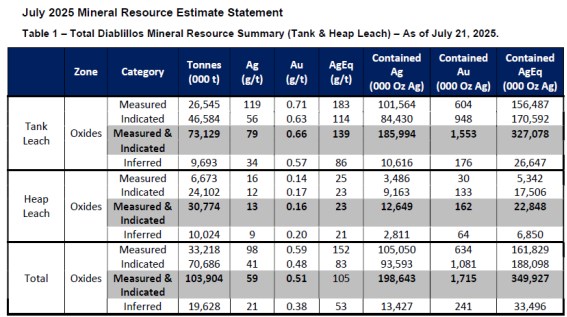

Tank Leach MRE Footnotes

Heap Leach MRE Footnotes

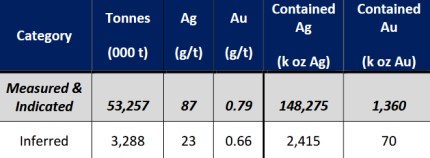

Previous Diablillos Mineral Resource Estimate

(taken from AbraSilver news release dated November 27, 2023)