Fourth Quarter and Fiscal Year 2025 Earnings Conference Call Exhibit 99.2 June 29, 2025 (Unaudited results) (Amounts and dollars in millions, unless otherwise noted) UNIFI, INC.

Cautionary Statements Forward-Looking Statements Certain statements included herein contain “forward-looking statements” within the meaning of federal securities laws about the financial condition and results of operations of the Company that are based on management’s beliefs, assumptions, and expectations about our future economic performance, considering the information currently available to management. An example of such forward-looking statements include, among others, guidance pertaining to our financial outlook. The words “believe,” “may,” “could,” “will,” “should,” “would,” “anticipate,” “plan,” “estimate,” “project,” “expect,” “intend,” “seek,” “strive,” and words of similar import, or the negative of such words, identify or signal the presence of forward-looking statements. These statements are not statements of historical fact, and they involve risks and uncertainties that may cause our actual results, performance, or financial condition to differ materially from the expectations of future results, performance, or financial condition that we express or imply in any forward-looking statement. Factors that could contribute to such differences include, but are not limited to: the competitive nature of the textile industry and the impact of global competition; changes in the trade regulatory environment and governmental policies and legislation; the availability, sourcing, and pricing of raw materials; general domestic and international economic and industry conditions in markets where the Company competes, including economic and political factors over which the Company has no control; changes in consumer spending, customer preferences, fashion trends, and end-uses for UNIFI’s products; the financial condition of the Company’s customers; the loss of a significant customer or brand partner; natural disasters, industrial accidents, power or water shortages; extreme weather conditions, and other disruptions at one of our facilities; the disruption of operations, global demand, or financial performance as a result of catastrophic or extraordinary events, including, but not limited to, epidemics or pandemics; the success of the Company’s strategic business initiatives; the volatility of financial and credit markets, including the impacts of counterparty risk (e.g., deposit concentration and recent depositor sentiment and activity); the ability to service indebtedness and fund capital expenditures and strategic business initiatives; the availability of and access to credit on reasonable terms; changes in foreign currency exchange, interest, and inflation rates; fluctuations in production costs; the ability to protect intellectual property; the strength and reputation of our brands; employee relations; the ability to attract, retain, and motivate key employees; the impact of climate change or environmental, health, and safety regulations; and the impact of tax laws, the judicial or administrative interpretations of tax laws, and/or changes in such laws or interpretations. All such factors are difficult to predict, contain uncertainties that may materially affect actual results, and may be beyond our control. New factors emerge from time to time, and it is not possible for management to predict all such factors or to assess the impact of each such factor on the Company. Any forward-looking statement speaks only as of the date on which such statement is made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, except as may be required by federal securities laws. The above and other risks and uncertainties are described in the Company’s most recent Annual Report on Form 10-K, and additional risks or uncertainties may be described from time to time in other reports filed by the Company with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended. Non-GAAP Financial Measures Certain non-GAAP financial measures are designed to complement the financial information presented in accordance with GAAP. These non-GAAP financial measures include Earnings Before Interest, Taxes, Depreciation, and Amortization (“EBITDA”), Adjusted EBITDA, Adjusted Net (Loss) Income, Adjusted EPS, Adjusted Working Capital, and Net Debt (collectively, the “non-GAAP financial measures”). The non-GAAP financial measures are not determined in accordance with GAAP and should not be considered a substitute for performance measures determined in accordance with GAAP. The calculations of the non-GAAP financial measures are subjective, based on management’s belief as to which items should be included or excluded in order to provide the most reasonable and comparable view of the underlying operating performance of the business. The Company may, from time to time, modify the amounts used to determine its non-GAAP financial measures. We believe that these non-GAAP financial measures better reflect the Company’s underlying operations and performance and that their use, as operating performance measures, provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and ages of related assets, among otherwise comparable companies. In evaluating non-GAAP financial measures, investors should be aware that, in the future, we may incur expenses similar to the adjustments included herein. Our presentation of non-GAAP financial measures should not be construed as indicating that our future results will be unaffected by unusual or non-recurring items. Each of our non-GAAP financial measures has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results or liquidity measures as reported under GAAP. Some of these limitations are (i) it is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows; (ii) it does not reflect the impact of earnings or charges resulting from matters we consider not indicative of our ongoing operations; (iii) it does not reflect changes in, or cash requirements for, our working capital needs; (iv) it does not reflect the cash requirements necessary to make payments on our debt; (v) it does not reflect our future requirements for capital expenditures or contractual commitments; (vi) it does not reflect limitations on or costs related to transferring earnings from our subsidiaries to us; and (vii) other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative measure. Because of these limitations, these non-GAAP financial measures should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or as a measure of cash that will be available to us to meet our obligations, including those under our outstanding debt obligations. You should compensate for these limitations by relying primarily on our GAAP results and using these measures only as supplemental information. 2

Today’s Speakers Al Carey Executive Chairman Eddie Ingle CEO and Director A.J. Eaker EVP, CFO, and Treasurer 3

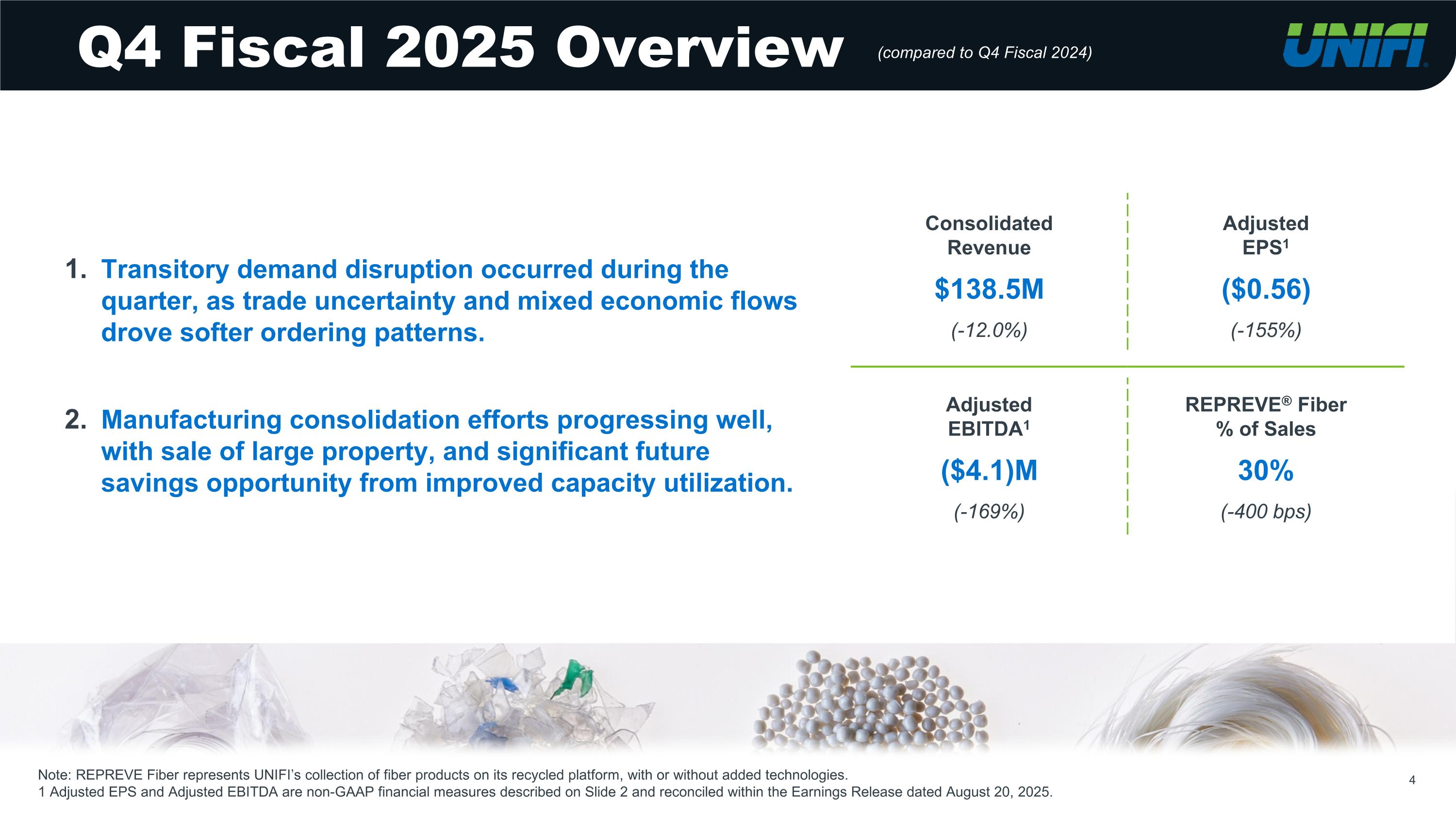

Consolidated Revenue $138.5M (-12.0%) Adjusted EPS1 ($0.56) (-155%) Adjusted EBITDA1 ($4.1)M (-169%) REPREVE® Fiber % of Sales 30% (-400 bps) Q4 Fiscal 2025 Overview Note: REPREVE Fiber represents UNIFI’s collection of fiber products on its recycled platform, with or without added technologies. 1 Adjusted EPS and Adjusted EBITDA are non-GAAP financial measures described on Slide 2 and reconciled within the Earnings Release dated August 20, 2025. (compared to Q4 Fiscal 2024) 4 Transitory demand disruption occurred during the quarter, as trade uncertainty and mixed economic flows drove softer ordering patterns. Manufacturing consolidation efforts progressing well, with sale of large property, and significant future savings opportunity from improved capacity utilization.

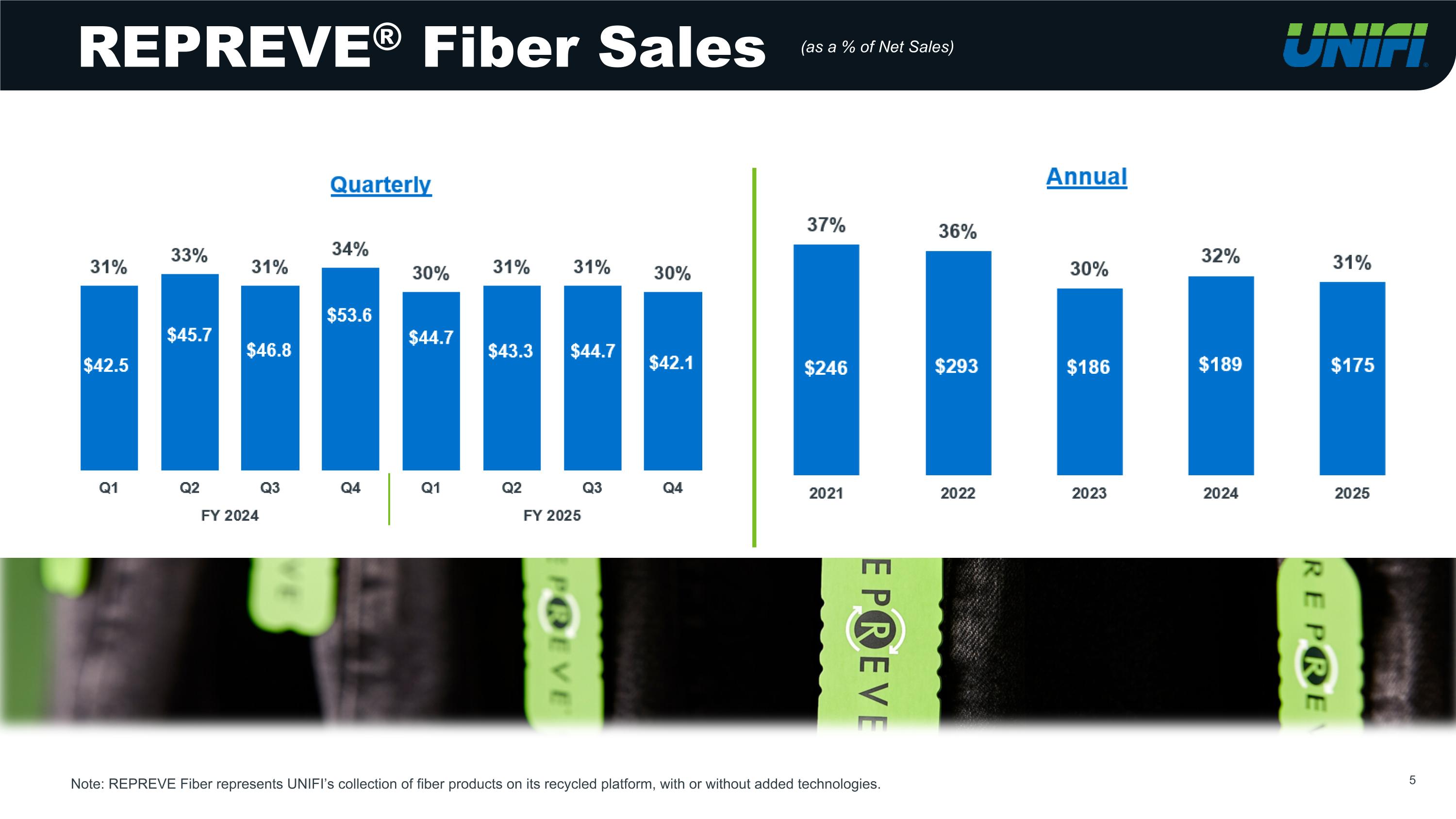

Note: REPREVE Fiber represents UNIFI’s collection of fiber products on its recycled platform, with or without added technologies. $180 $186 $246 $293 $186 $186 $246 $293 $186 $189 5 $293 $186 $189 REPREVE® Fiber Sales $175 (as a % of Net Sales)

100% Textile Waste 100% Textile Waste New Launches & Innovation 6

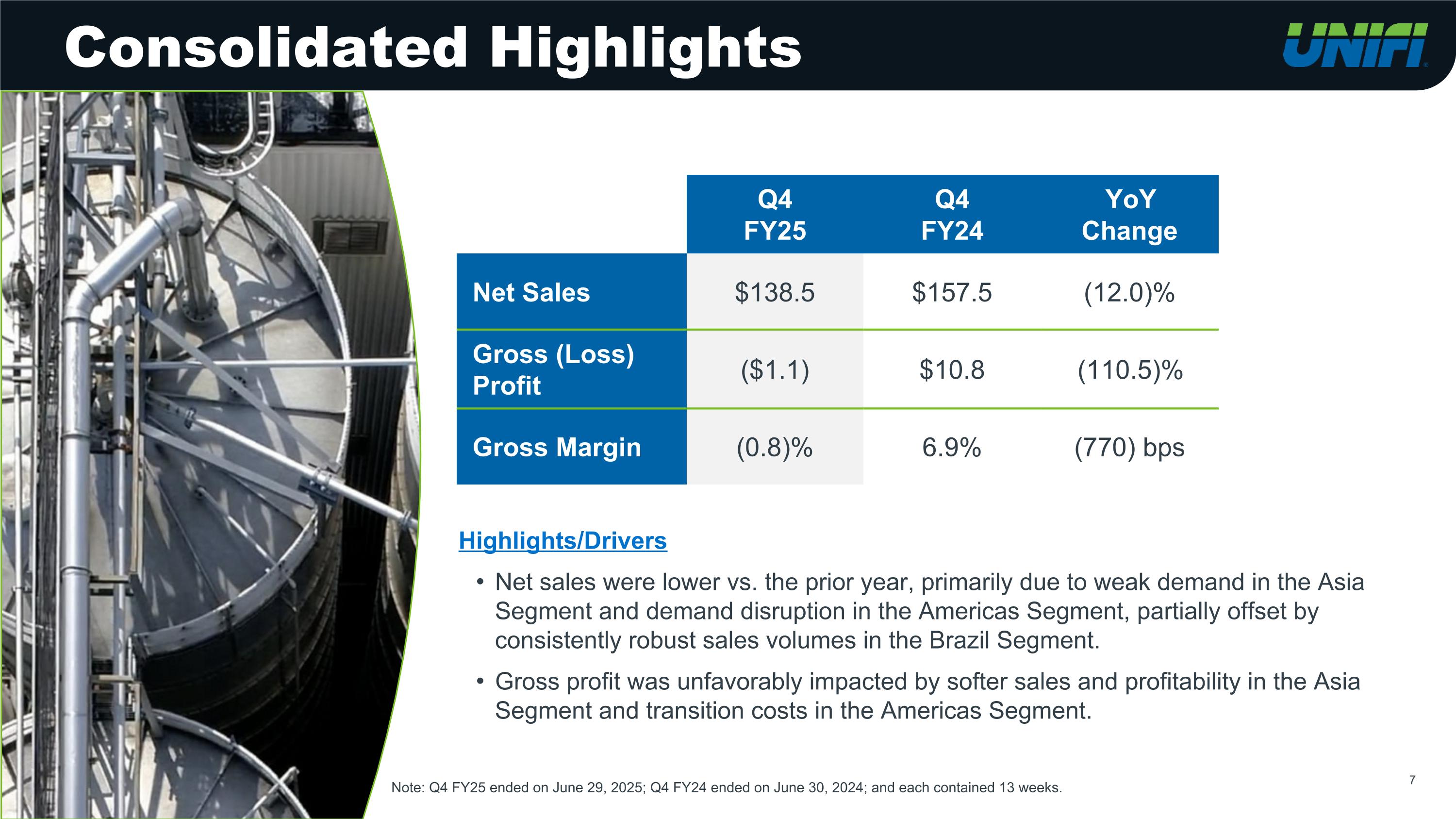

Consolidated Highlights Q4 FY25 Q4 FY24 YoY Change Net Sales $138.5 $157.5 (12.0)% Gross (Loss) Profit ($1.1) $10.8 (110.5)% Gross Margin (0.8)% 6.9% (770) bps Highlights/Drivers Net sales were lower vs. the prior year, primarily due to weak demand in the Asia Segment and demand disruption in the Americas Segment, partially offset by consistently robust sales volumes in the Brazil Segment. Gross profit was unfavorably impacted by softer sales and profitability in the Asia Segment and transition costs in the Americas Segment. Note: Q4 FY25 ended on June 29, 2025; Q4 FY24 ended on June 30, 2024; and each contained 13 weeks. 7

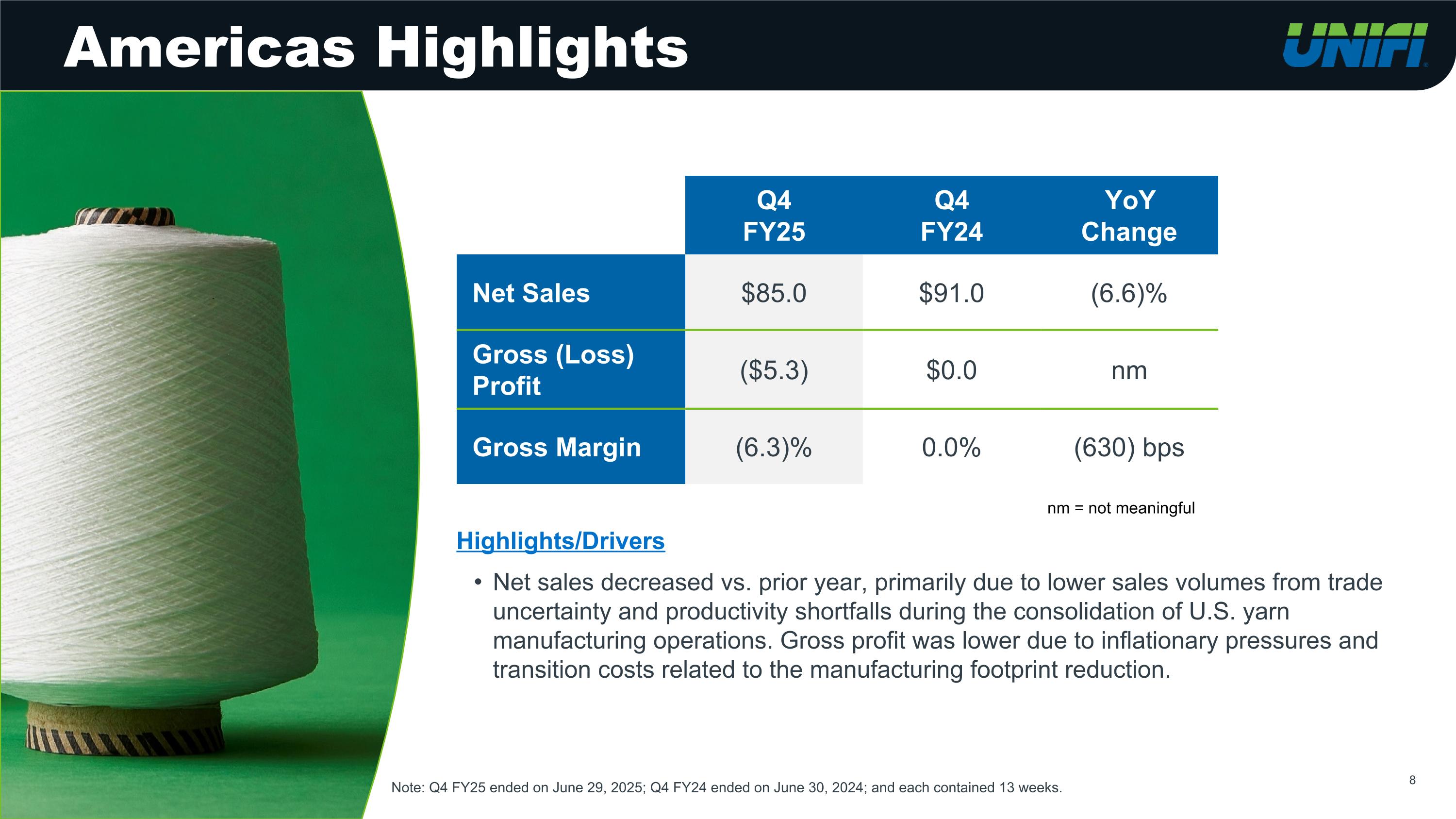

Q4 FY25 Q4 FY24 YoY Change Net Sales $85.0 $91.0 (6.6)% Gross (Loss) Profit ($5.3) $0.0 nm Gross Margin (6.3)% 0.0% (630) bps Highlights/Drivers Net sales decreased vs. prior year, primarily due to lower sales volumes from trade uncertainty and productivity shortfalls during the consolidation of U.S. yarn manufacturing operations. Gross profit was lower due to inflationary pressures and transition costs related to the manufacturing footprint reduction. 8 Americas Highlights Note: Q4 FY25 ended on June 29, 2025; Q4 FY24 ended on June 30, 2024; and each contained 13 weeks. nm = not meaningful

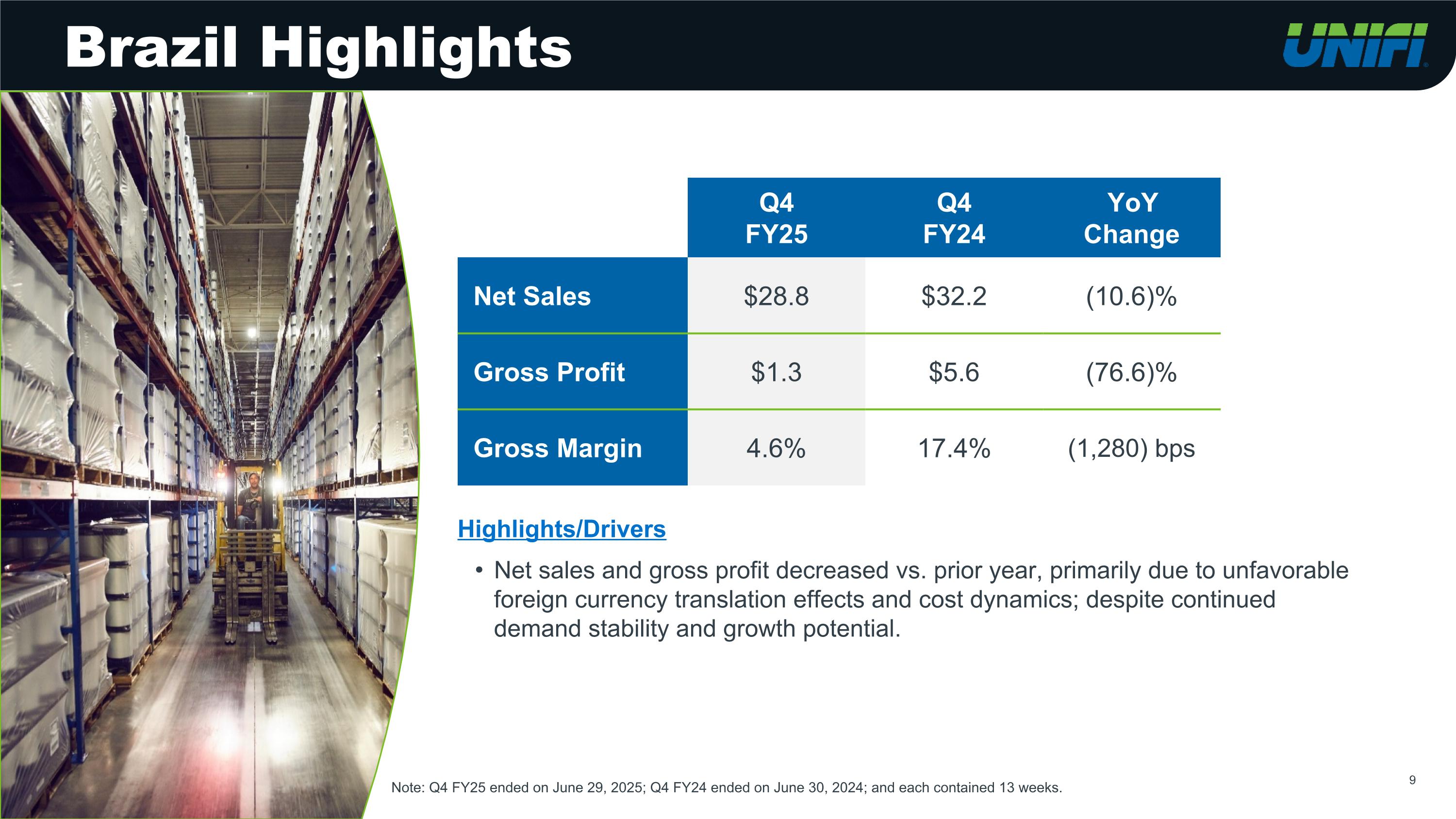

9 Q4 FY25 Q4 FY24 YoY Change Net Sales $28.8 $32.2 (10.6)% Gross Profit $1.3 $5.6 (76.6)% Gross Margin 4.6% 17.4% (1,280) bps Highlights/Drivers Net sales and gross profit decreased vs. prior year, primarily due to unfavorable foreign currency translation effects and cost dynamics; despite continued demand stability and growth potential. 9 Brazil Highlights Note: Q4 FY25 ended on June 29, 2025; Q4 FY24 ended on June 30, 2024; and each contained 13 weeks.

Q4 FY25 Q4 FY24 YoY Change Net Sales $24.7 $34.2 (27.7)% Gross Profit $2.9 $5.2 (44.1)% Gross Margin 11.7% 15.1% (340) bps Highlights/Drivers Net sales and gross profit decreased vs. prior year, primarily due to lower sales volumes and a less favorable sales mix in China. 10 Asia Highlights Note: Q4 FY25 ended on June 29, 2025; Q4 FY24 ended on June 30, 2024; and each contained 13 weeks.

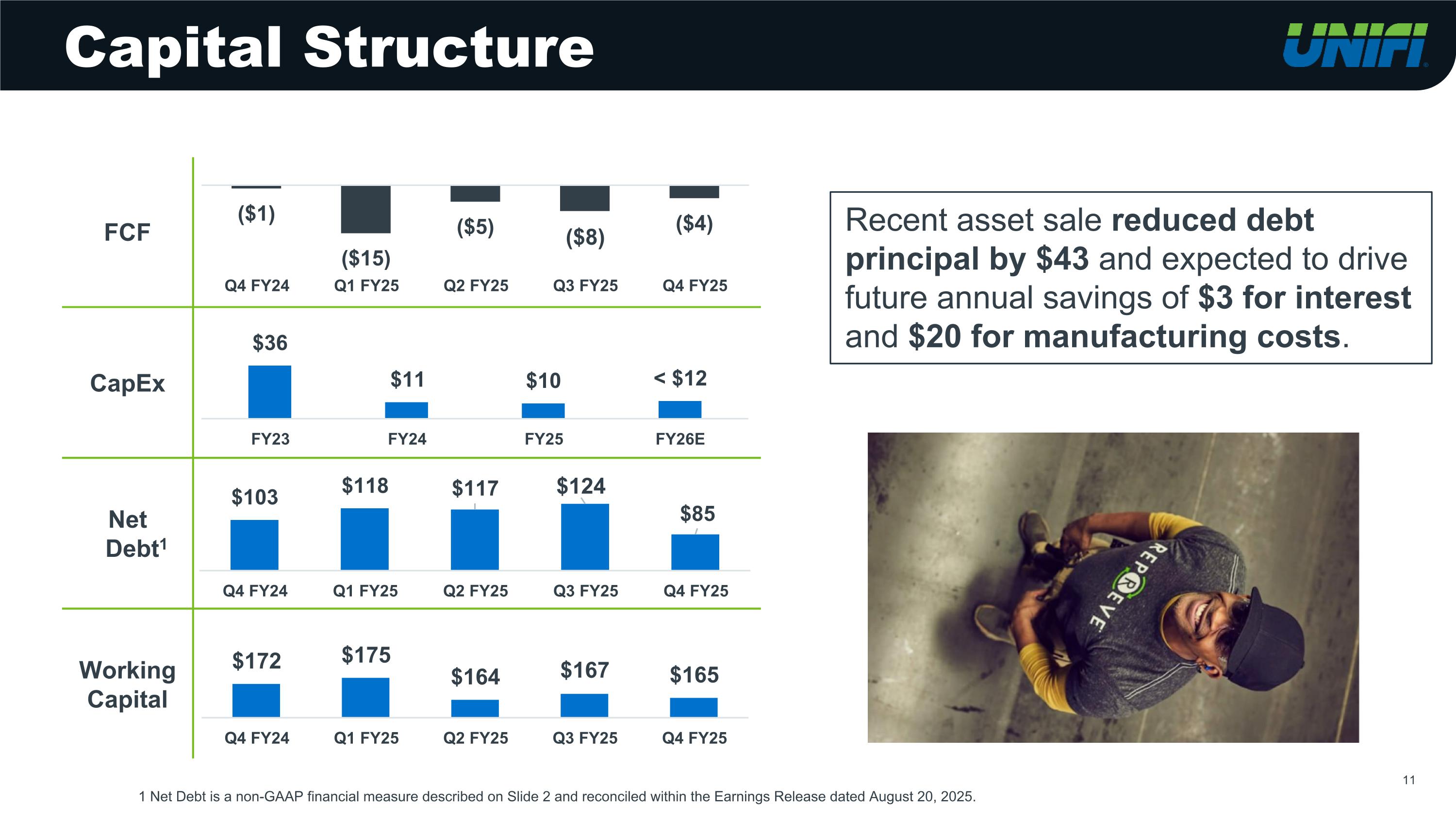

FCF CapEx Net Debt1 Working Capital 1 Net Debt is a non-GAAP financial measure described on Slide 2 and reconciled within the Earnings Release dated August 20, 2025. 11 Capital Structure Recent asset sale reduced debt principal by $43 and expected to drive future annual savings of $3 for interest and $20 for manufacturing costs.

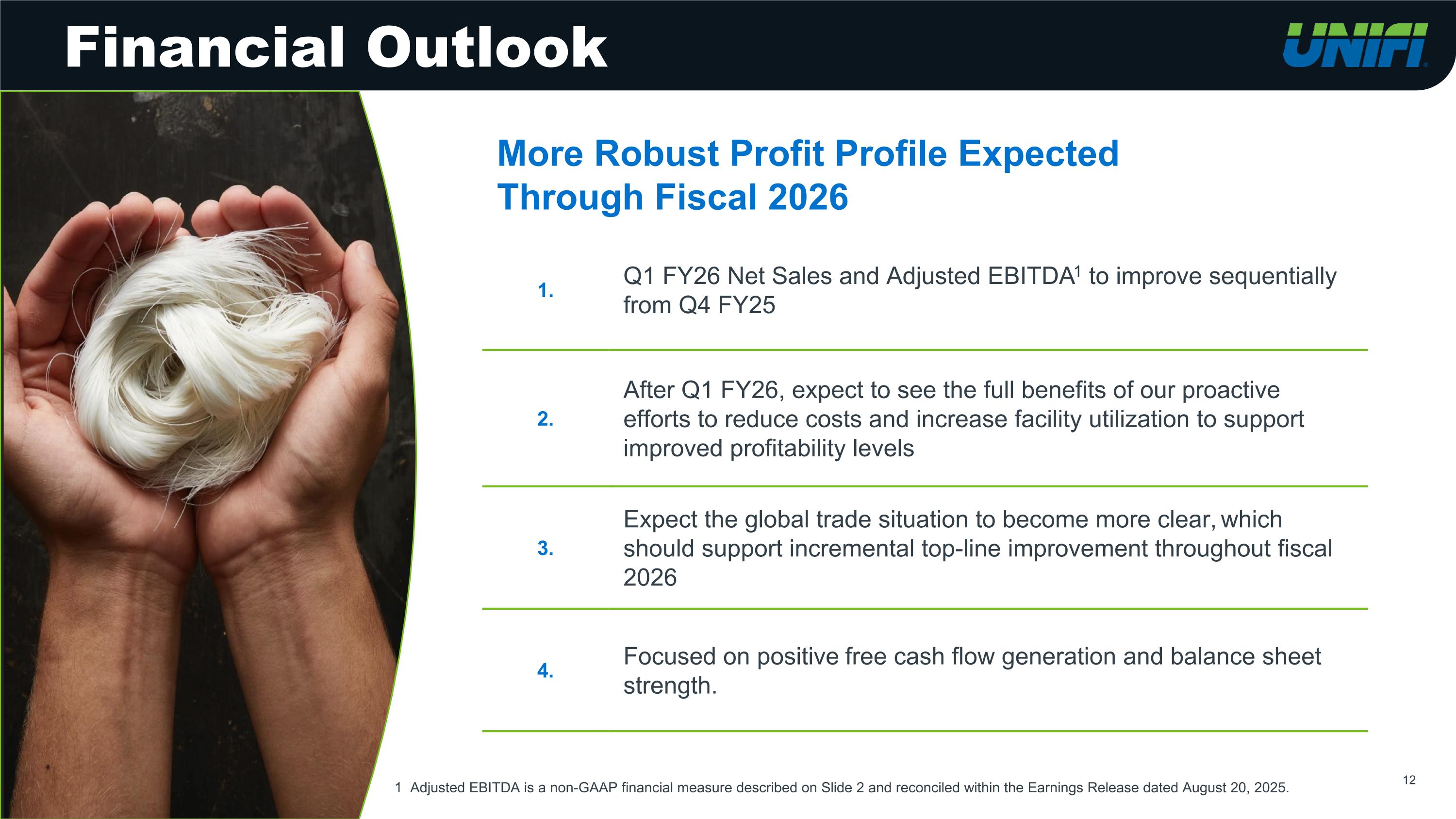

1 Adjusted EBITDA is a non-GAAP financial measure described on Slide 2 and reconciled within the Earnings Release dated August 20, 2025. 12 Financial Outlook More Robust Profit Profile Expected Through Fiscal 2026 1. Q1 FY26 Net Sales and Adjusted EBITDA1 to improve sequentially from Q4 FY25 2. After Q1 FY26, expect to see the full benefits of our proactive efforts to reduce costs and increase facility utilization to support improved profitability levels 3. Expect the global trade situation to become more clear, which should support incremental top-line improvement throughout fiscal 2026 4. Focused on positive free cash flow generation and balance sheet strength.

13 Strategic Priorities 1. Optimizing operations and footprint to improve financial profile. 2. Investing in innovation, REPREVE® platform, and Beyond Apparel products for richer product mix. 3. Increasing customer engagement to promote value-added portfolio. 4. Positioning each business segment for long-term margin expansion. Continued Focus on Returning to Profitability

Contact Investor Relations: UFI@alpha-ir.com 14