Exhibit 99.2

Q2 2025 EARNINGS CALL OFER HAVIV | PRESIDENT & CEO August 19, 2025

This presentation contains "forward-looking statements" relating to future

events, and Evogene Ltd. (the “Company”), may from time to time make other statements, regarding our outlook or expectations for future financial or operating results and/or other matters regarding or affecting us that are considered

“forward-looking statements” as defined in the U.S. Private Securities Litigation Reform Act of 1995 (the “PSLRA”) and other securities laws, as amended. Statements that are not statements of historical fact may be deemed to be

forward-looking statements. Such forward-looking statements may be identified by the use of such words as “believe”, “expect”, “anticipate”, “should”, “planned”, “estimated”, “intend” and “potential” or words of similar meaning. We are using

forward-looking statements in this presentation when we discuss our value drivers, commercialization efforts and timing, product development and launches, estimated market sizes and milestones, pipeline, as well as our capabilities and

technology. Such statements are based on current expectations, estimates, projections and assumptions, describe opinions about future events, involve certain risks and uncertainties which are difficult to predict and are not guarantees of

future performance. Readers are cautioned that certain important factors may affect the Company's actual results and could cause such results to differ materially from any forward-looking statements that may be made in this presentation.

Therefore, actual future results, performance or achievements, and trends in the future may differ materially from what is expressed or implied by such forward-looking statements due to a variety of factors, many of which are beyond our

control, including, without limitation, the current war between Israel, Hamas and Hezbollah and any worsening of the situation in Israel such as further mobilizations or escalation in the northern border of Israel, those described in greater

detail in Evogene's Annual Report on Form 20-F and in other information Evogene files and furnishes with the Israel Securities Authority and the U.S. Securities and Exchange Commission, including those factors under the heading “Risk

Factors”. Except as required by applicable securities laws, we disclaim any obligation or commitment to update any information contained in this presentation or to publicly release the results of any revisions to any statements that may be

made to reflect future events or developments or changes in expectations, estimates, projections and assumptions. The information contained herein does not constitute a prospectus or other offering document, nor does it constitute or form

part of any invitation or offer to sell, or any solicitation of any invitation or offer to purchase or subscribe for, any securities of Evogene or the Company, nor shall the information or any part of it or the fact of its distribution form

the basis of, or be relied on in connection with, any action, contract, commitment or relating thereto or to the securities of Evogene or the Company. The trademarks included herein are the property of the owners thereof and are used for

reference purposes only. Such use should not be construed as an endorsement of our products or services. 2 2 FORWARD LOOKING STATEMENT

Earnings Call Q2 2025 AGENDA Q&A 3 CEO Update - By Ofer Haviv CFO

Update - By Yaron Eldad

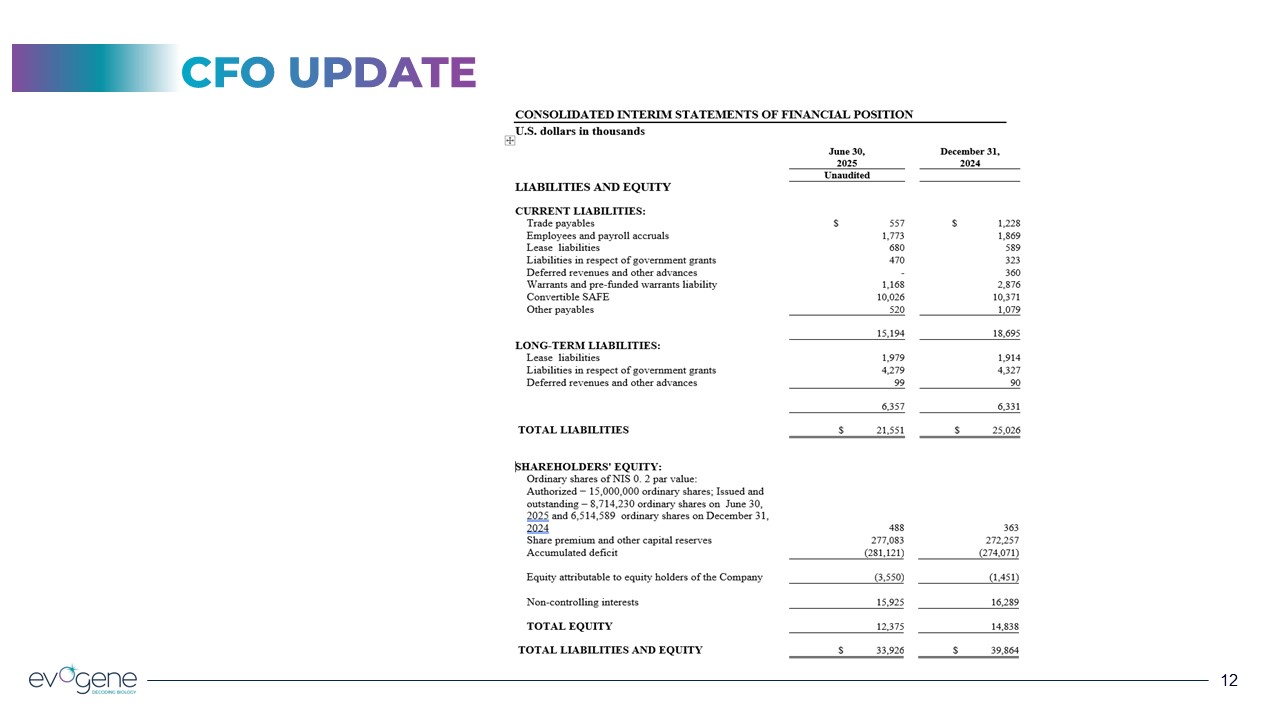

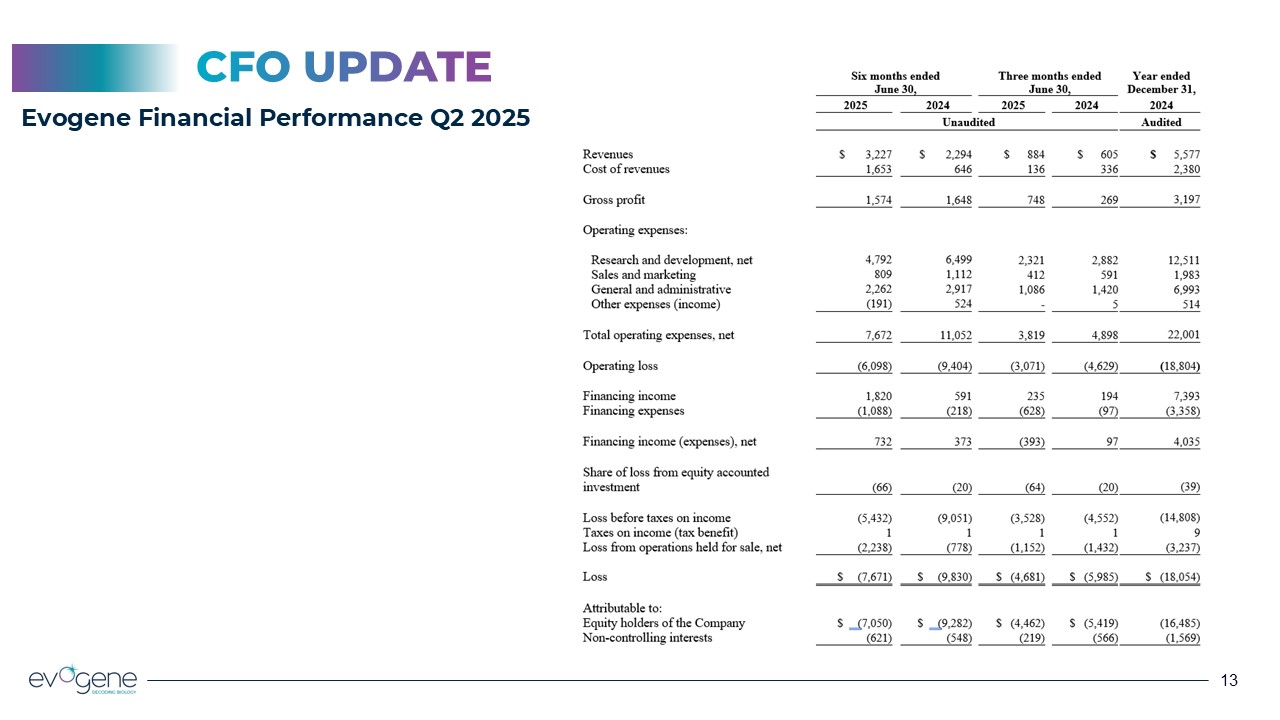

4 4 CEO UPDATE Financial Highlights: The financial results for the first

half of 2025 of Lavie Bio, a subsidiary of Evogene and the MicroBoost AI for Ag operations, are presented as a single-line item in Evogene’s consolidated P&L statements for the first half of 2025. Their results are included under the line

titled: "Loss from operations held for sale, net.". This accounting treatment follows the intention to sell the majority of Lavie Bio’s activities and the MicroBoost AI for Ag as of June 30, 2025. In the first half of 2025, total revenues

amounted to approximately $3.2 million, compared to $2.3 million in the first half of 2024. The increase was primarily driven by higher seed sales generated by Casterra. During the first half of 2025, Evogene implemented a cost reduction

plan, most of which was completed by the end of the second quarter. The initial impact of these reductions is partially reflected in the first half results, with the full effect expected to be realized in the second half of 2025.

5 5 CEO UPDATE Financial Highlights: Total research and development expenses

in the first half of 2025 were approximately $4.8 million, compared to approximately $6.5 million in the first half of 2024. The decrease is primarily attributable to a reduction in Biomica’s R&D activities and the discontinuation of

Canonic’s operations. Sales and marketing expenses for the first half of 2025 totaled approximately $0.8 million, compared to approximately $1.1 million in the first half of 2024. The decrease is mainly due to a reduction in headcount across

the subsidiaries. In the first half of 2025, total Operating Expenses net were approx. $7.7 million compared to approx. $11.1 million in the first half of 2024. This decrease is mainly due to the decrease in our subsidiaries' activity. As

of the end of the first half of 2025, the company’s cash and short-term bank deposits balance was approx. $11.7 million. This cash balance does not reflect the expected proceeds from the sale of Lavie Bio’s assets and the MicroBoost AI for Ag

tech-engine to ICL. This transaction was completed in the third quarter of 2025.

6 6 CEO UPDATE New Strategic Focus Enhancing ChemPass AI’s value proposition

in the field of AI powered small molecule discovery and optimization and expanding its utilization for the pharmaceutical and agriculture industries. 2025 Strategic Priorities Strengthening ChemPass AI as a core asset Expanding

collaboration efforts in drug discovery Integrating AgPlenus into Evogene; expanding its business collaborations Generating cash flow, primarily from our subsidiaries Streamlining operations expenses in line with strategy

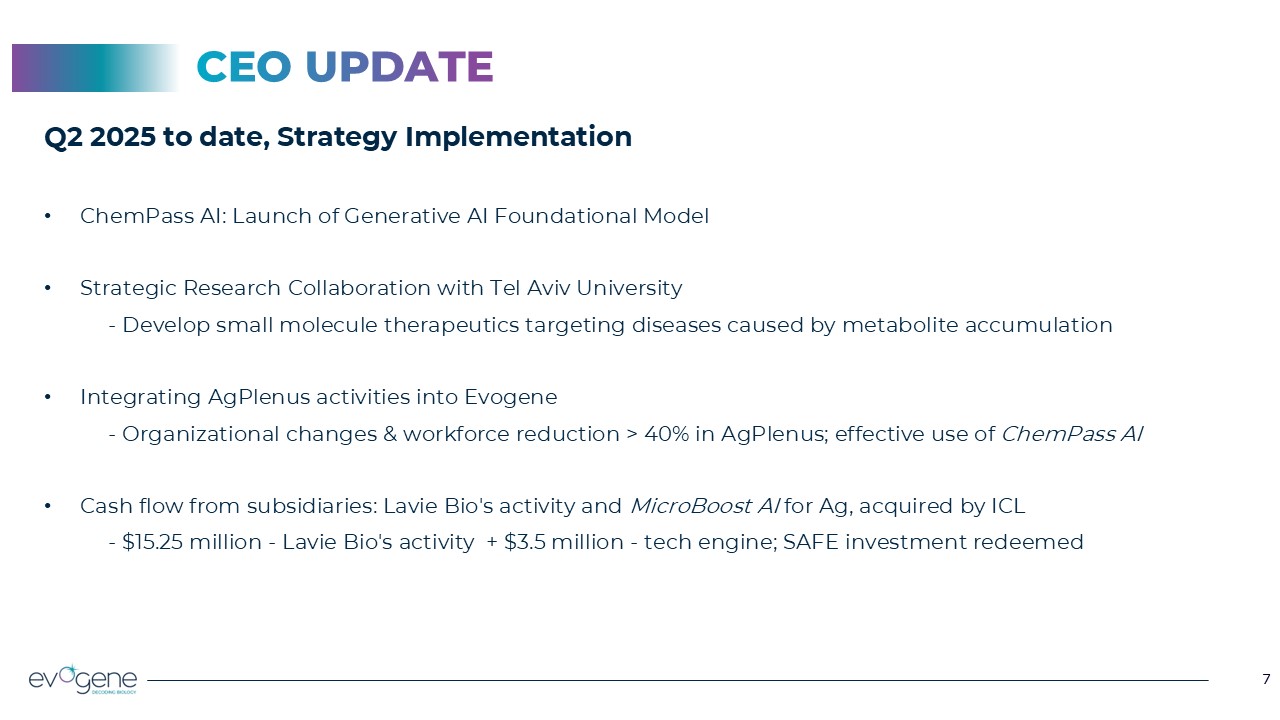

7 7 CEO UPDATE Q2 2025 to date, Strategy Implementation ChemPass AI: Launch

of Generative AI Foundational Model Strategic Research Collaboration with Tel Aviv University - Develop small molecule therapeutics targeting diseases caused by metabolite accumulation Integrating AgPlenus activities into Evogene -

Organizational changes & workforce reduction > 40% in AgPlenus; effective use of ChemPass AI Cash flow from subsidiaries: Lavie Bio's activity and MicroBoost AI for Ag, acquired by ICL - $15.25 million - Lavie Bio's activity +

$3.5 million - tech engine; SAFE investment redeemed

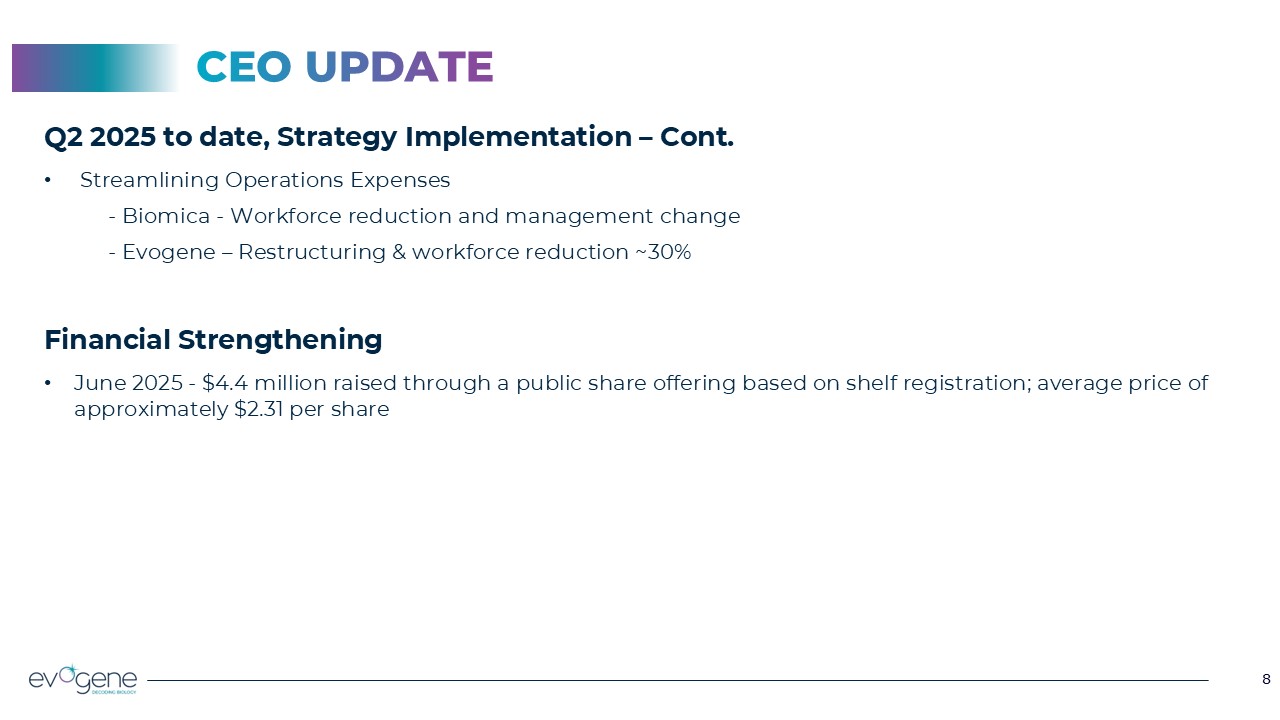

8 8 CEO UPDATE Q2 2025 to date, Strategy Implementation – Cont. Streamlining

Operations Expenses - Biomica - Workforce reduction and management change - Evogene – Restructuring & workforce reduction ~30% Financial Strengthening June 2025 - $4.4 million raised through a public share offering based on

shelf registration; average price of approximately $2.31 per share

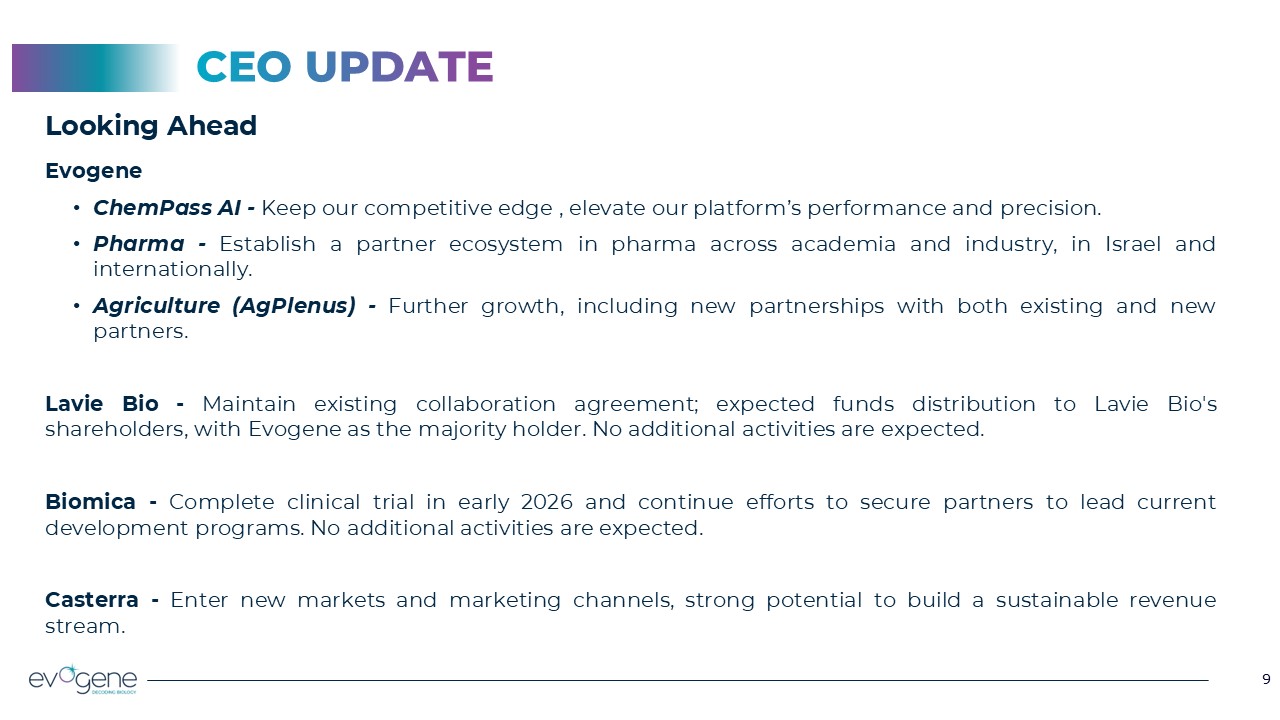

Looking Ahead Evogene ChemPass AI - Keep our competitive edge , elevate our

platform’s performance and precision. Pharma - Establish a partner ecosystem in pharma across academia and industry, in Israel and internationally. Agriculture (AgPlenus) - Further growth, including new partnerships with both existing and

new partners. Lavie Bio - Maintain existing collaboration agreement; expected funds distribution to Lavie Bio's shareholders, with Evogene as the majority holder. No additional activities are expected. Biomica - Complete clinical trial in

early 2026 and continue efforts to secure partners to lead current development programs. No additional activities are expected. Casterra - Enter new markets and marketing channels, strong potential to build a sustainable revenue stream.

9 9 CEO UPDATE

Earnings Call Q2 2025 AGENDA Q&A 10 CEO Update - By Ofer Haviv CFO

Update - By Yaron Eldad

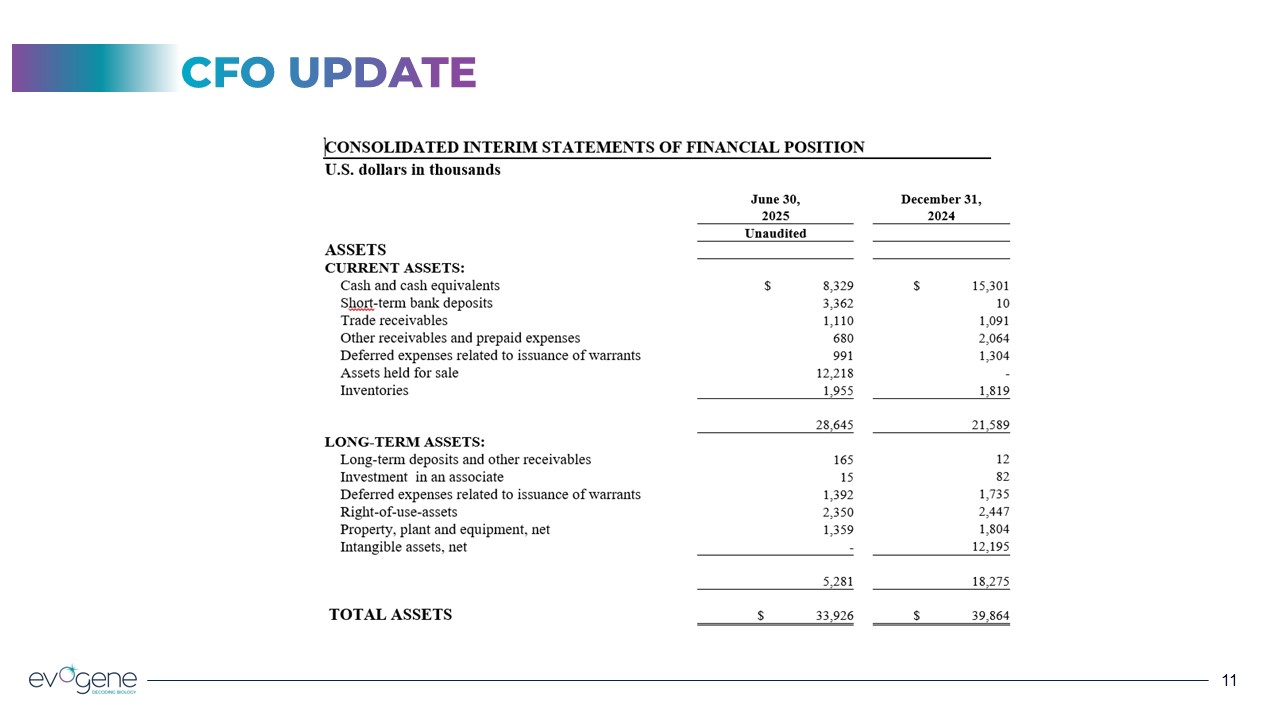

CFO UPDATE ה ה 11

CFO UPDATE ה ה 12

CFO UPDATE Evogene Financial Performance Q2 2025 13

Earnings Call Q2 2025 AGENDA Q&A 14 CEO Update / By Ofer Haviv CFO

Update / By Yaron Eldad

THANK YOU