| Creating a premier regional regulated electric and natural gas utility company + Black Hills Corp. and NorthWestern Energy to Combine |

| Forward + 2 -Looking Statements Information in this communication, other than statements of historical facts, may constitute forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements about the benefits of the proposed transaction between Black Hills and NorthWestern Energy, including future financial and operating results (including the anticipated impact of the transaction on Black Hills’ and NorthWestern Energy’s respective earnings), statements related to the expected timing of the completion of the transaction, the plans, objectives, expectations and intentions of either company or of the combined company following the merger, anticipated future results of either company or of the combined company following the merger, the anticipated benefits and strategic and financial rationale of the merger, including estimated rate bases, investment opportunities, cash flows and capital expenditure rates and other statements that are not historical facts. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “targets,” “scheduled,” “plans,” “intends,” “goal,” “anticipates,” “expects,” “believes,” “forecasts,” “outlook,” “estimates,” “potential,” or “continue” or negatives of such terms or other comparable terminology. The forward-looking statements are based on Black Hills and NorthWestern Energy’s current expectations, plans and estimates. Black Hills and NorthWestern Energy believe these assumptions to be reasonable, but there is no assurance that they will prove to be accurate. All forward-looking statements are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of Black Hills or NorthWestern Energy to differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others, (1) the risk of delays in consummating the potential transaction, including as a result of required regulatory and shareholder approvals, which may not be obtained on the expected timeline, or at all, (2) the risk of any event, change or other circumstance that could give rise to the termination of the merger agreement, (3) the risk that required regulatory approvals are subject to conditions not anticipated by Black Hills and NorthWestern Energy, (4) the possibility that any of the anticipated benefits and projected synergies of the potential transaction will not be realized or will not be realized within the expected time period, (5) disruption to the parties’ businesses as a result of the announcement and pendency of the transaction, including potential distraction of management from current plans and operations of Black Hills or NorthWestern Energy and the ability of Black Hills or NorthWestern Energy to retain and hire key personnel, (6) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the transaction, (7) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (8) the outcome of any legal or regulatory proceedings that may be instituted against Black Hills or NorthWestern Energy related to the merger agreement or the transaction, (9) the risks associated with third party contracts containing consent and/or other provisions that may be triggered by the proposed transaction, (10) legislative, regulatory, political, market, economic and other conditions, developments and uncertainties affecting Black Hills’ or NorthWestern Energy’s businesses; (11) the evolving legal, regulatory and tax regimes under which Black Hills and NorthWestern Energy operate; (12) restrictions during the pendency of the proposed transaction that may impact Black Hills’ or NorthWestern Energy’s ability to pursue certain business opportunities or strategic transactions; and (13) unpredictability and severity of catastrophic events, including, but not limited to, extreme weather, natural disasters, acts of terrorism or outbreak of war or hostilities, as well as Black Hills’ and NorthWestern Energy’s response to any of the aforementioned factors. Additional factors which could affect future results of Black Hills and NorthWestern Energy can be found in Black Hills’ Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8- K, and NorthWestern Energy’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the SEC and available on the SEC’s website at http://www.sec.gov. Black Hills and NorthWestern Energy disclaim any obligation and do not intend to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by federal securities laws. Several of Black Hills Corp.'s subsidiaries do business as Black Hills Energy. As this trade name is the commonly recognized name by many of our customers and shareholders, Black Hills Energy and Black Hills Corp. are used interchangeably throughout communications with respect to the merger for ease of reference. Additional Information No Offer or Solicitation This document is for informational purposes only and is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Important Information and Where to Find It Black Hills intends to file a registration statement on Form S-4 with the SEC to register the shares of Black Hills’s common stock that will be issued to NorthWestern Energy stockholders in connection with the proposed transaction. The registration statement will include a joint proxy statement of Black Hills and NorthWestern Energy that will also constitute a prospectus of Black Hills. The definitive joint proxy statement/prospectus will be sent to the stockholders of each of Black Hills and NorthWestern Energy in connection with the proposed transaction. Additionally, Black Hills and NorthWestern Energy will file other relevant materials in connection with the merger with the SEC. Investors and security holders are urged to read the registration statement and joint proxy statement/prospectus when they become available (and any other documents filed with the sec in connection with the transaction or incorporated by reference into the joint proxy statement/prospectus) because such documents will contain important information regarding the proposed transaction and related matters. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Black Hills or NorthWestern Energy through the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of Black Hills or NorthWestern Energy at investorrelations@blackhillscorp.com or travis.meyer@northwestern.com, respectively. Before making any voting or investment decision, investors and security holders of Black Hills and NorthWestern Energy are urged to read carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto (and any other documents filed with the SEC in connection with the transaction) because they will contain important information about the proposed transaction. Free copies of these documents may be obtained as described above. Participants in Solicitation Black Hills, NorthWestern Energy and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of each of Black Hills and NorthWestern Energy in connection with the proposed transaction. Information regarding the directors and executive officers of Black Hills and NorthWestern Energy and other persons who may be deemed participants in the solicitation of the stockholders of Black Hills or of NorthWestern Energy in connection with the proposed transaction will be included in the joint proxy statement/prospectus related to the proposed transaction, which will be filed by Black Hills with the SEC. Information about the directors and executive officers of Black Hills and their ownership of Black Hills common stock can also be found in Black Hills’ filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed on February 12, 2025, under the header “Information About Our Executive Officers,” and its Proxy Statement on Schedule 14A, which was filed on March 14, 2025, under the headers “Election of Directors” and “Security Ownership of Management and Principal Shareholders,” and other documents subsequently filed by Black Hills with the SEC. Information about the directors and executive officers of NorthWestern Energy and their ownership of NorthWestern Energy common stock can also be found in NorthWestern Energy’s filings with the SEC, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed on February 13, 2025, under the header “Information About Our Executive Officers” and its Proxy Statement on Schedule 14A, which was filed on March 12, 2025, under the headers “Election of Directors” and “Who Owns our Stock”. To the extent any such person's ownership of Black Hills’ or NorthWestern Energy’s securities, respectively, has changed since the filing of such proxy statement, such changes have been or will be reflected on Forms 3, 4 or 5 filed with the SEC. Additional information regarding the interests of such participants will be included in the joint proxy statement/prospectus and other relevant documents regarding the proposed transaction filed with the SEC when they become available. + 2 |

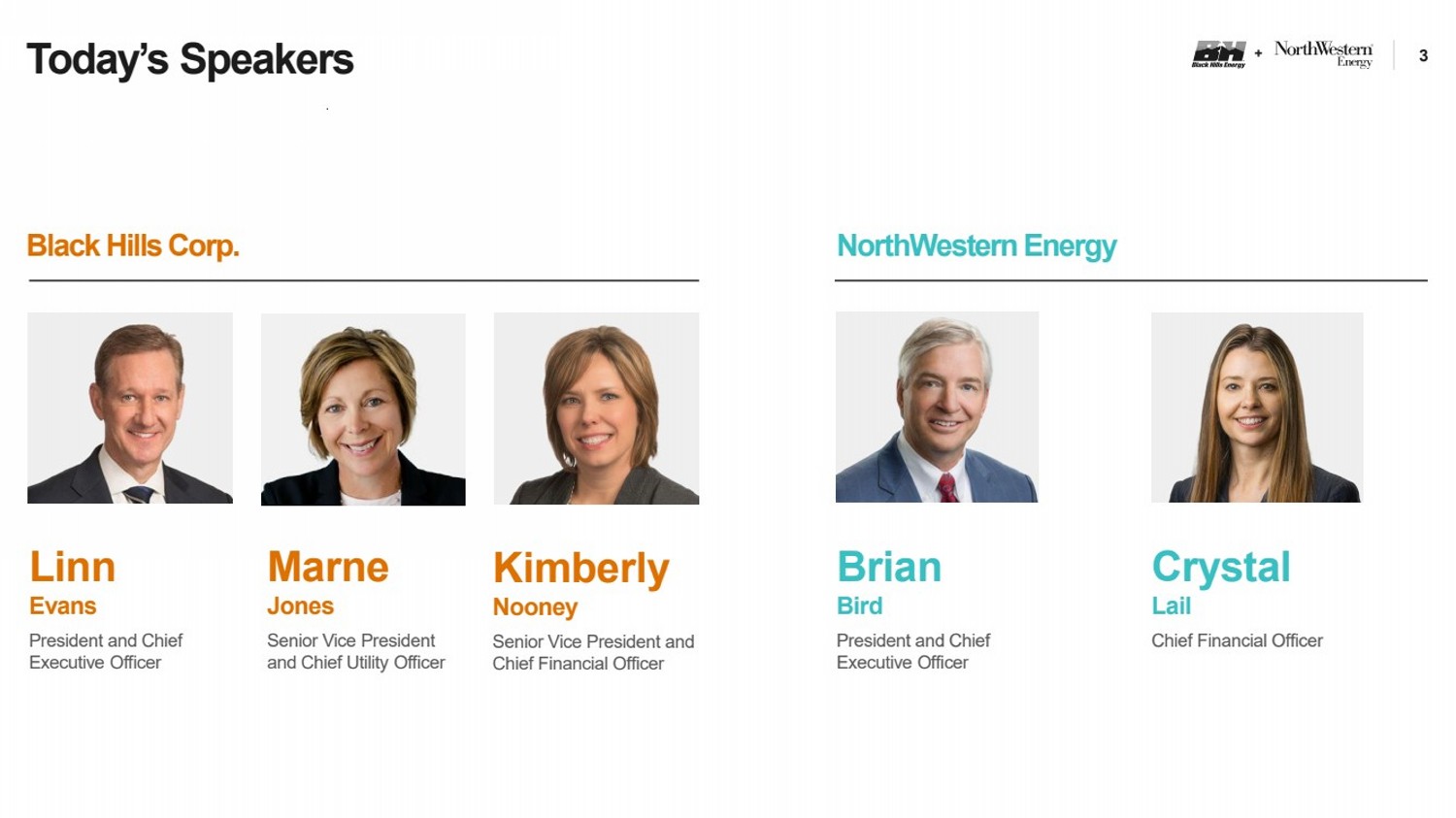

| + 3 Kimberly Nooney Senior Vice President and Chief Financial Officer Today’s Speakers Linn Evans President and Chief Executive Officer Crystal Lail Chief Financial Officer Brian Bird President and Chief Executive Officer Black Hills Corp. NorthWesternEnergy Marne Jones Senior Vice President and Chief Utility Officer |

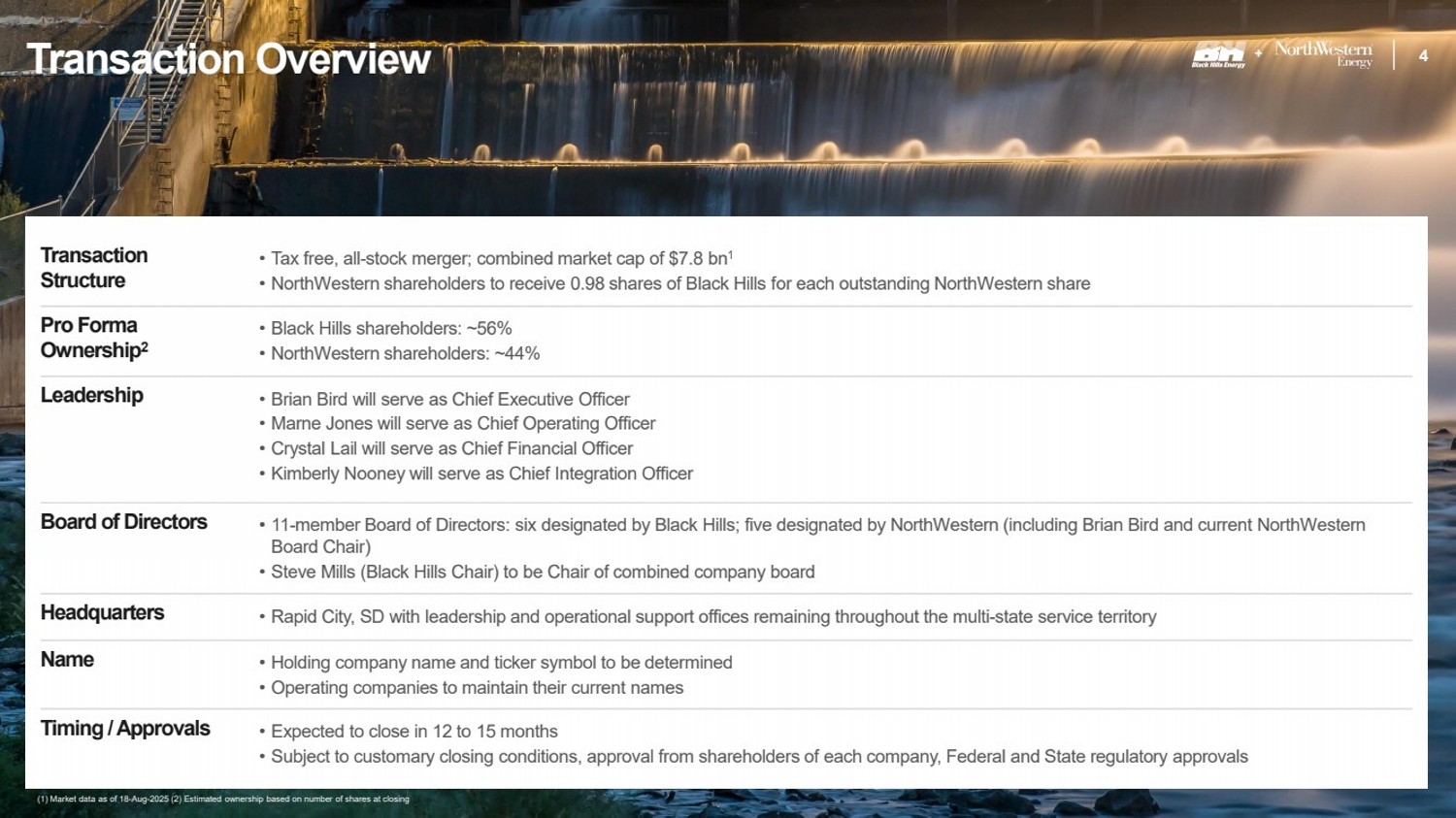

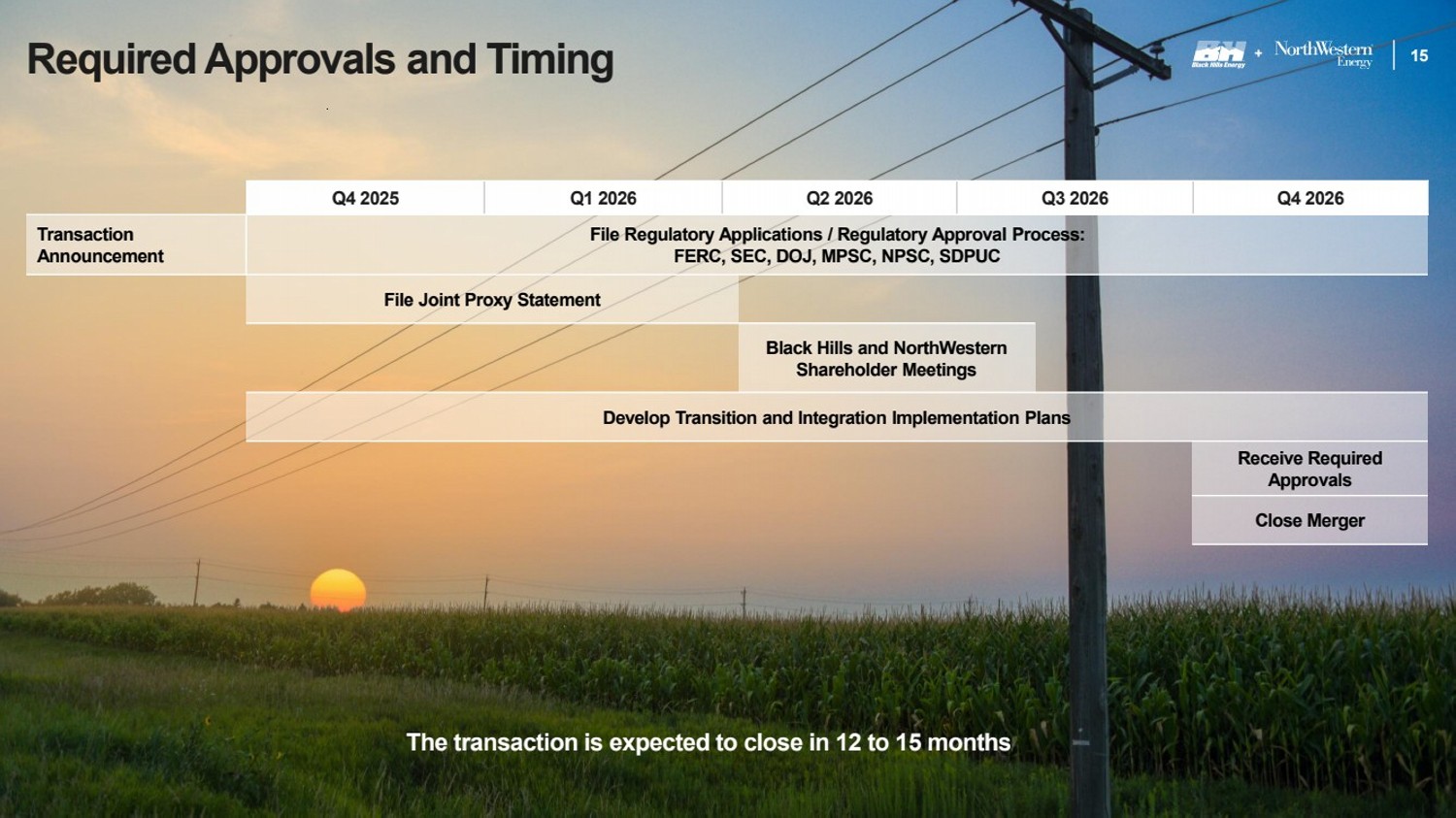

| + 4 Transaction Structure • Tax free, all-stock merger; combined market cap of $7.8 bn1 • NorthWestern shareholders to receive 0.98 shares of Black Hills for each outstanding NorthWestern share Pro Forma Ownership2 • Black Hills shareholders: ~56% • NorthWestern shareholders: ~44% Leadership • Brian Bird will serve as Chief Executive Officer • Marne Jones will serve as Chief Operating Officer • Crystal Lail will serve as Chief Financial Officer • Kimberly Nooney will serve as Chief Integration Officer Board of Directors • 11-member Board of Directors: six designated by Black Hills; five designated by NorthWestern (including Brian Bird and current NorthWestern Board Chair) • Steve Mills (Black Hills Chair) to be Chair of combined company board Headquarters • Rapid City, SD with leadership and operational support offices remaining throughout the multi-state service territory Name • Holding company name and ticker symbol to be determined • Operating companies to maintain their current names Timing / Approvals • Expected to close in 12 to 15 months • Subject to customary closing conditions, approval from shareholders of each company, Federal and State regulatory approvals (1) Market data as of 18-Aug-2025 (2) Estimated ownership based on number of shares at closing Transaction Overview + 4 |

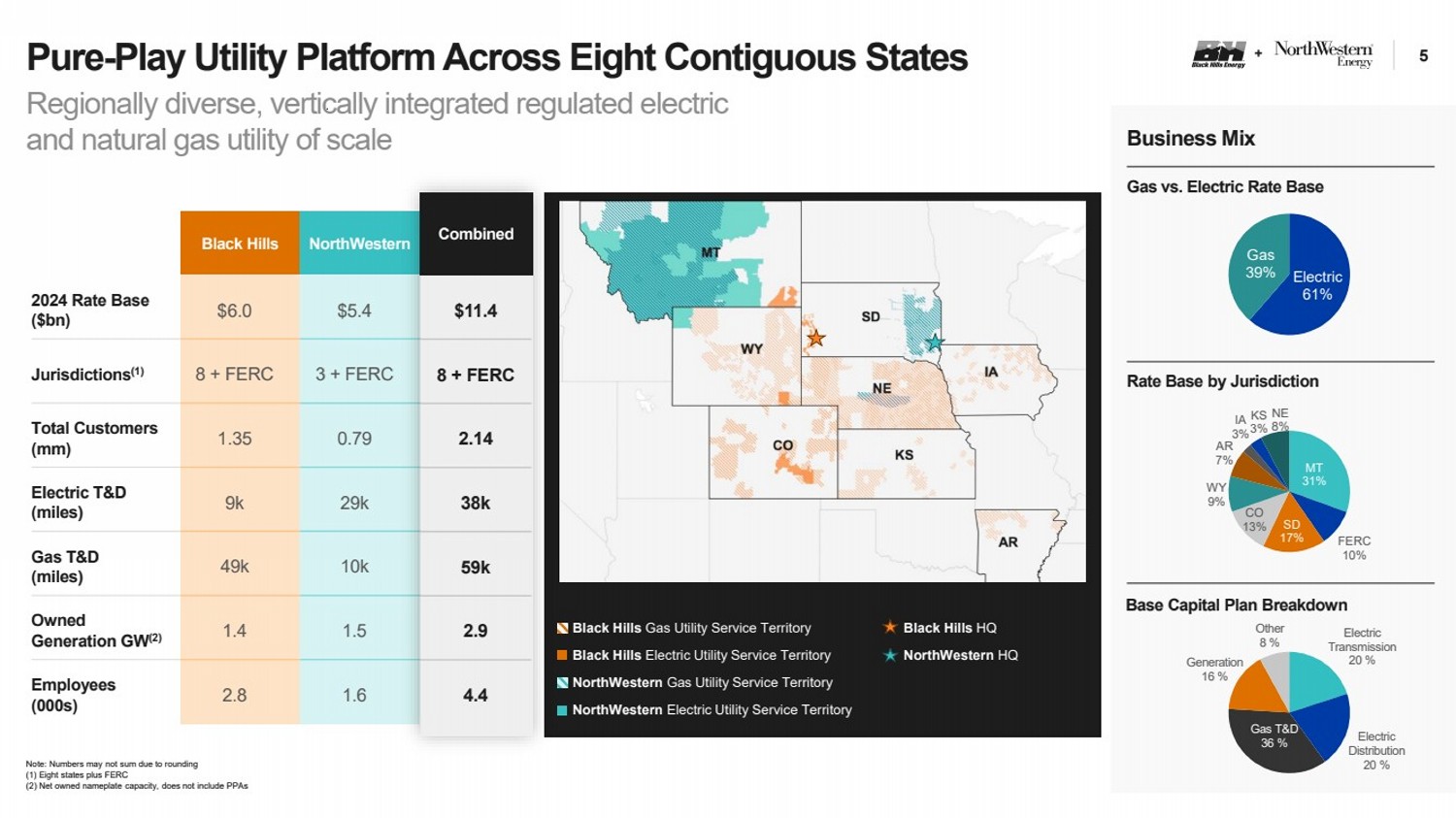

| + 5 Black Hills Gas Utility Service Territory Black Hills HQ Black Hills Electric Utility Service Territory NorthWestern HQ NorthWestern Gas Utility Service Territory NorthWestern Electric Utility Service Territory MT 31% FERC 10% SD 17% CO 13% WY 9% AR 7% KS 3% IA 3% NE 8% Base Capital Plan Breakdown Pure-Play Utility Platform Across Eight Contiguous States Business Mix Regionally diverse, vertically integrated regulated electric and natural gas utility of scale Note: Numbers may not sum due to rounding (1) Eight states plus FERC (2) Net owned nameplate capacity, does not include PPAs Black Hills NorthWestern Combined 2024 Rate Base ($bn) $6.0 $5.4 $11.4 Jurisdictions(1) 8 + FERC 3 + FERC 8 +FERC Total Customers (mm) 1.35 0.79 2. Electric T&D (miles) 9k 29k 38k Gas T&D (miles) 49k 10k 59k Owned Generation GW(2) 1.4 1.5 2.9 Employees (000s) 2.8 1.6 4.4 Gas vs. Electric Rate Base Electric 61% Gas 39% Rate Base by Jurisdiction Electric Transmission 20 % Electric Distribution 20 % Gas T&D 36 % Generation 16 % Other 8 % Combined $11.4 8 + FERC 2.14 38k 59k 2.9 4.4 |

| Combination Presents Compelling + 6 Strategic and Financial Rationale Increased scale across contiguous service territory enhances diversification, resulting in a more resilient utility to safely, reliably, and cost-effectively meet customers’ growing energy needs Increases combined company's long term targeted EPS growth rate to 5-7%, up from 4-6% individually for each company Expected to be accretive to each company’s EPS in the first year following the close of the transaction Strong and predictable earnings and cash flows with more efficient access to capital to be credit enhancing and support a high-quality credit profile Better positioned to capture accretive growth opportunities together than either company could achieve independently Combines two complementary teams with shared cultures focused on operational excellence and exceptional customer service + 6 |

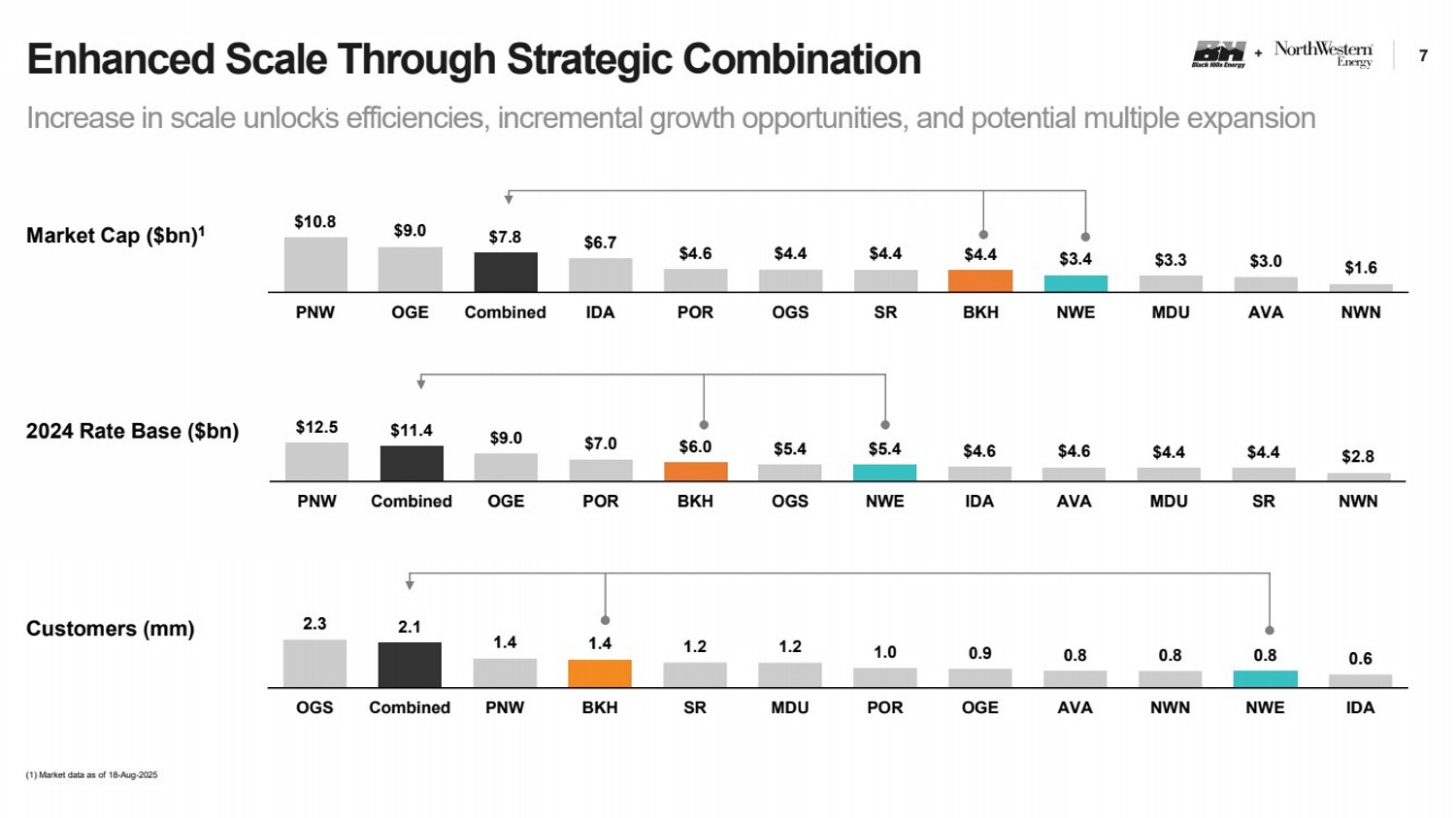

| Enhanced Scale Through Strategic Combination + 7 Increase in scale unlocks efficiencies, incremental growth opportunities, and potential multiple expansion Market Cap ($bn)1 2024 Rate Base ($bn) Customers (mm) (1) Market data as of 18-Aug-2025 $10.8 $9.0 $7.8 $6.7 $4.6 $4.4 $4.4 $4.4 $3.4 $3.3 $3.0 $1.6 PNW OGE Combined IDA POR OGS SR BKH NWE MDU AVA NWN $12.5 $11.4 $9.0 $7.0 $6.0 $5.4 $5.4 $4.6 $4.6 $4.4 $4.4 $2.8 PNW Combined OGE POR BKH OGS NWE IDA AVA MDU SR NWN 2.3 2.1 1.4 1.4 1.2 1.2 1.0 0.9 0.8 0.8 0.8 0.6 OGS Combined PNW BKH SR MDU POR OGE AVA NWN NWE IDA |

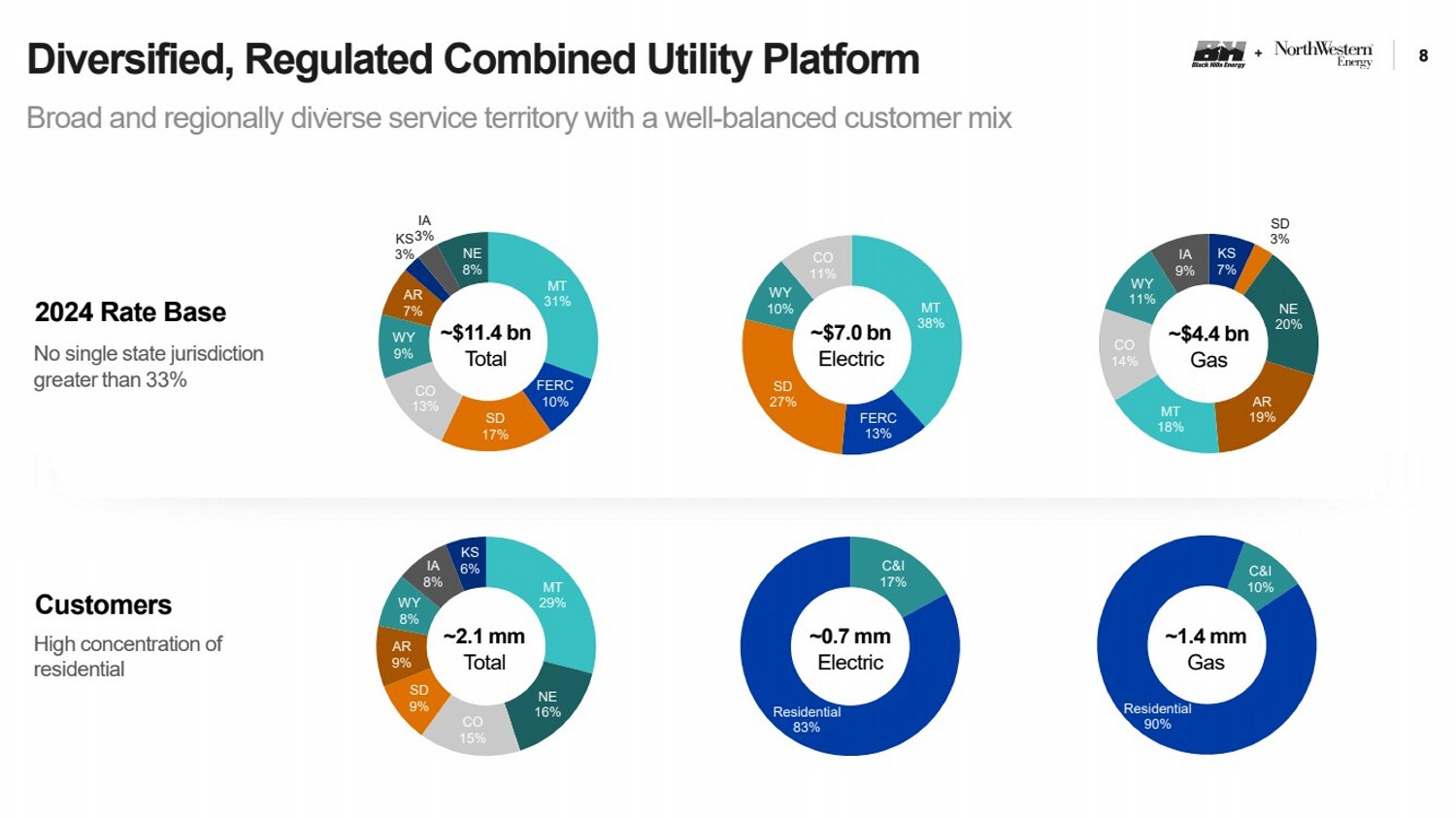

| + 8 MT 29% NE 16% CO 15% SD 9% AR 9% WY 8% IA 8% KS 6% C&I 17% Residential 83% C&I 10% Residential 90% Diversified, Regulated Combined Utility Platform Customers ~2.1 mm Total Broad and regionally diverse service territory with a well-balanced customer mix 8 ~1.4 mm Gas ~0.7 mm Electric High concentration of residential MT 31% FERC 10% SD 17% CO 13% WY 9% AR 7% KS 3% IA 3% NE 8% MT 38% FERC 13% SD 27% WY 10% CO 11% KS 7% SD 3% NE 20% AR MT 19% 18% CO 14% WY 11% IA 9% 2024 Rate Base ~$11.4 bn No single state jurisdiction Total greater than 33% ~$4.4 bn Gas ~$7.0 bn Electric |

| Delivering Benefits to Stakeholders + 9 Continued commitment to delivering safe, reliable, and cost-effective energy consistent with how both companies operate today Continue to be an employer of choice, attracting and maintaining a highly skilled workforce, while providing enhanced opportunities Maintain current strong operational and leadership presence in each of the service territories where combined company conducts business, with continued support for civic and philanthropic organizations Customers Employees Communities |

| Bringing Together Best + 10 -in-Class Customer-Focused Operators Combining two demonstrated track records of operational excellence across key safety and reliability metrics, while maintaining better than national average costs to customers Above industry average SAIDI (System Average Interruption Duration Index) AGA top quartile for leaks per 1,000 miles of pipe Committed to the safety of our customers, co-workers, and communities + 10 Proven reliability record supporting customers’ growing and changing energy needs Above industry average DART (Days Away, Restricted, or Transferred) Above industry average PMVI (Preventable Motor Vehicle Incident Rate) |

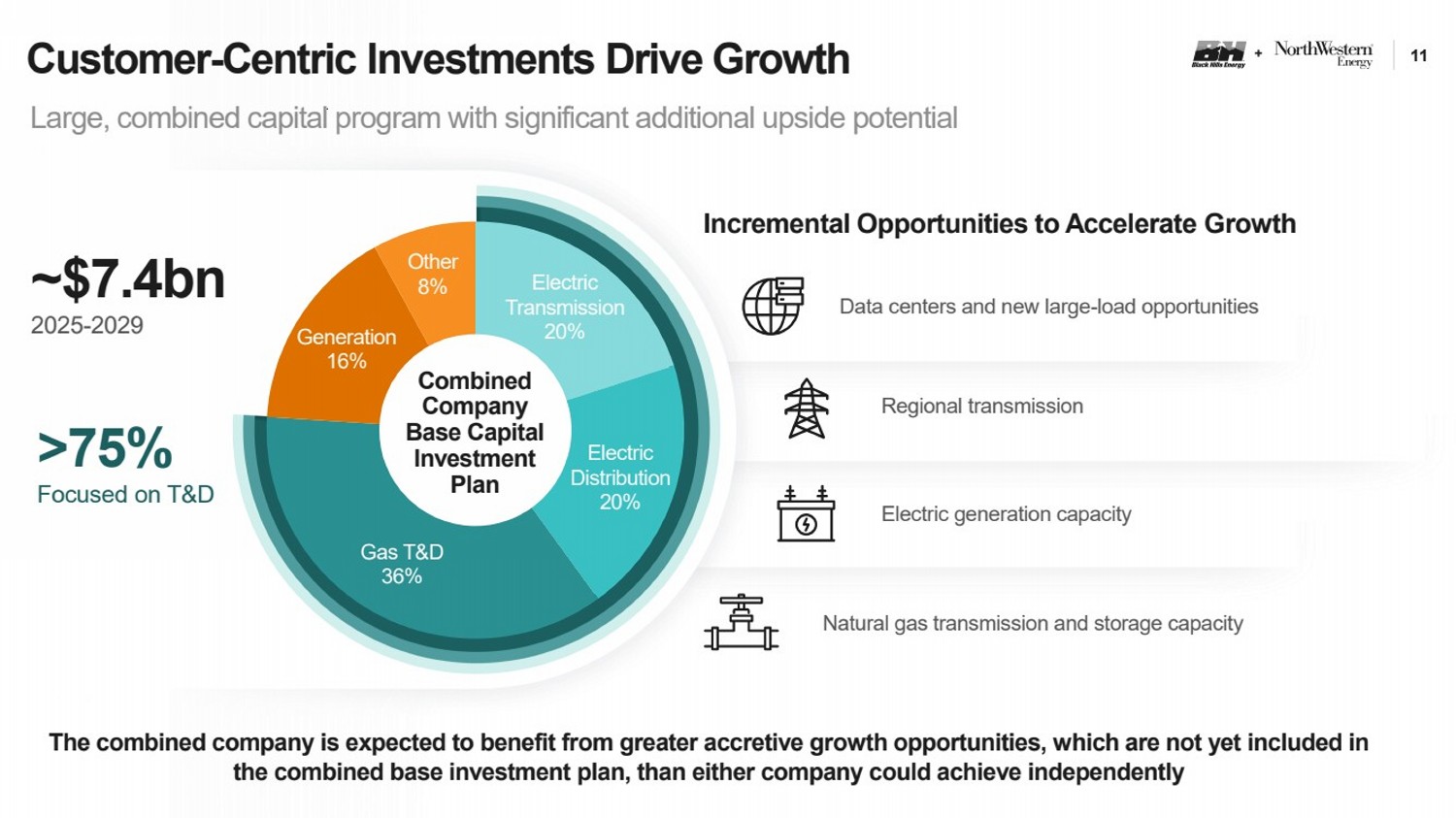

| Customer + 11 -Centric Investments Drive Growth Large, combined capital program with significant additional upside potential Incremental Opportunities to Accelerate Growth Electric Transmission 20% Electric Distribution 20% Gas T&D 36% Generation 16% Other ~$7.4bn 8% 2025-2029 >75% Focused on T&D The combined company is expected to benefit from greater accretive growth opportunities, which are not yet included in the combined base investment plan, than either company could achieve independently Combined Company Base Capital Investment Plan Data centers and new large-load opportunities Regional transmission Electric generation capacity Natural gas transmission and storage capacity |

| Pro Forma Total Return Proposition + 12 Pro Forma Common Stock Dividend Both companies to continue existing dividend policies through closing Pro forma dividend growth expected to balance competitive dividend growth with incremental, accretive organic growth opportunities + 12 Pro Forma EPS Profile Accretive to EPS for both companies in first year following close and over the long-term supported by financial benefits and operational optimization Further supports long-term target of 5-7% EPS growth Doubles rate bases and provides incremental capital investment opportunities beyond current plans |

| Committed to Solid Investment Grade Financial Profile + 13 Enhanced credit profile Strong balance sheet health 100% stock transaction; no debt issuance related to transaction Strong investment grade credit metrics target Low-risk utility cash flows with highly diversified regulatory environment No equity issuance post-2026 for current base capital plan Well-balanced and manageable debt maturity schedule No required prepayment of debt as part of the transaction Combined company to maintain balance sheet strength and improve credit profile |

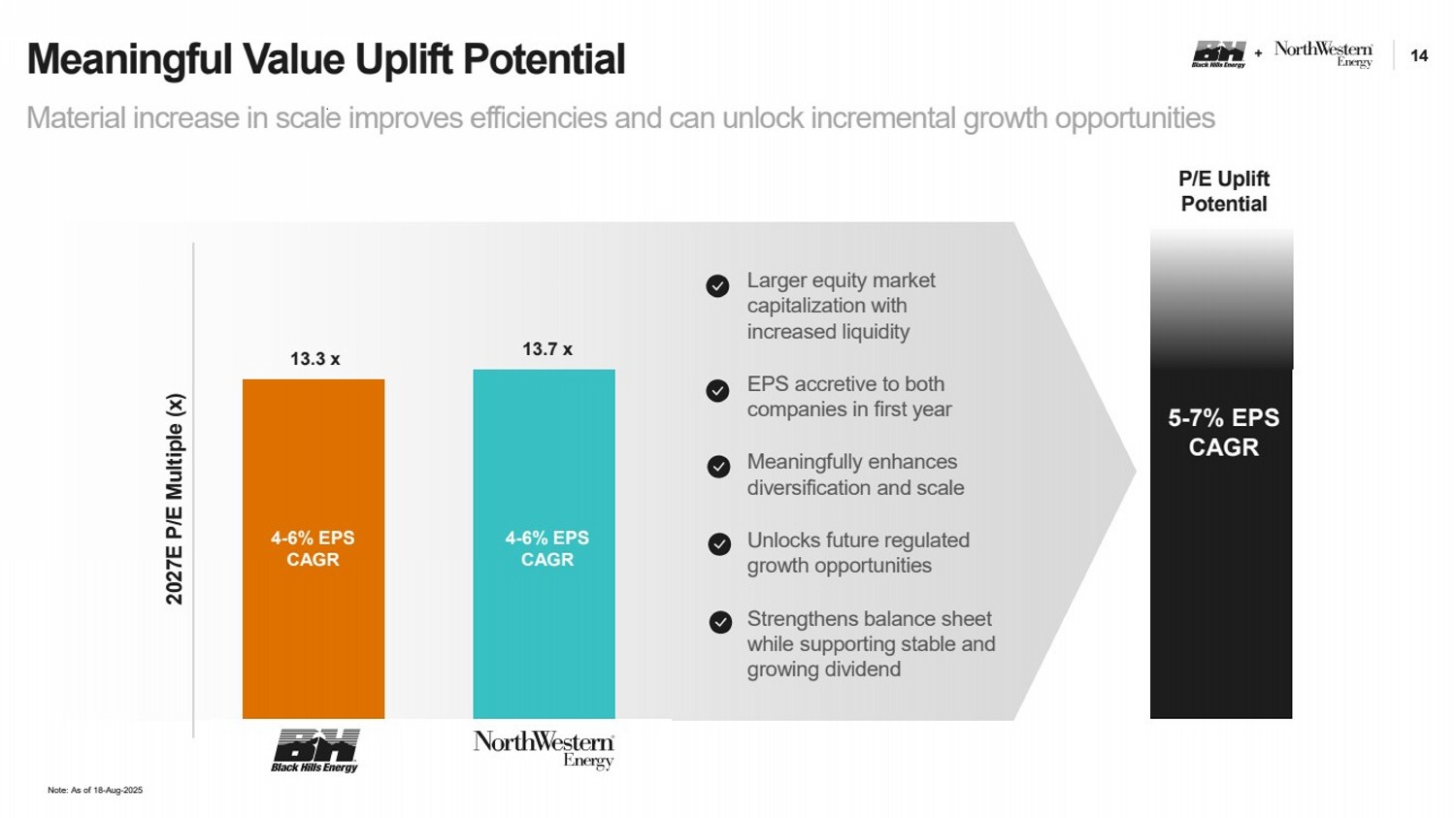

| Meaningful Value Uplift Potential + 14 Note: As of 18-Aug-2025 P/E Uplift Potential 2027E P/E Multiple (x) 13.3 x 13.7 x Material increase in scale improves efficiencies and can unlock incremental growth opportunities Larger equity market capitalization with increased liquidity EPS accretive to both companies in first year Meaningfully enhances diversification and scale Unlocks future regulated growth opportunities Strengthens balance sheet while supporting stable and growing dividend 4-6% EPS CAGR 4-6% EPS CAGR 5-7% EPS CAGR |

| Required Approvals and Timing + 15 Q4 2025 Q1 2026 Q2 2026 Q3 2026 Q4 2026 Transaction Announcement File Regulatory Applications / Regulatory Approval Process: FERC, SEC, DOJ, MPSC, NPSC, SDPUC File Joint Proxy Statement Black Hills and NorthWestern Shareholder Meetings Develop Transition and Integration Implementation Plans Receive Required Approvals Close Merger The transaction is expected to close in 12 to 15 months |

| + 16 Strategic combination represents a highly attractive value creation opportunity for both companies Increases Scale Position and Growth Increases the combined company target EPS growth rate to 5-7%, supported by the doubling of each company’s rate base to total of ~$11 bn with significant growth opportunities Expands Investment Opportunity Leverages enhanced resources to make strategic investments that foster economic development, including addressing the growing demand for energy, including from data centers Key Takeaways Substantial Long-Term Value for Customers Enhances Business Diversity Delivering energy to more than 2.1 mm customers across multiple contiguous jurisdictions, served by a highly skilled workforce focused on safety and reliability Strengthens Balance Sheet Strong and predictable cash flows support a customer-focused capital investment program while producing high-quality, investment-grade credit metrics Bringing together two complementary teams focused on reliability and exceptional customer service to deliver even greater value. |