|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

Operating and Financial Highlights | 03 |

| |

||

|

Senior Management Quotes

|

04 |

|

|

||

|

Second Quarter 2025 Earnings Conference Call

|

05 |

|

|

||

|

Summary of Financial Performance and Outlook

|

06 |

|

Financial Overview | 11 |

|

Credicorp’s Strategy Update | 12 |

|

Analysis of 2Q25 Consolidated Results |

|

01

|

Loan Portfolio

|

16

|

|

|

02

|

Deposits

|

19

|

|

|

03

|

Interest Earning Assets and Funding

|

22

|

|

|

04

|

Net Interest Income (NII)

|

24

|

|

|

05

|

Portfolio Quality and Provisions

|

27 | |

|

06

|

Other Income

|

32

|

|

|

07

|

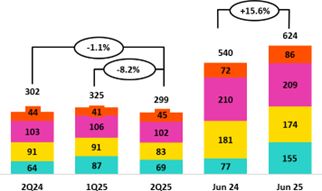

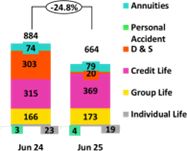

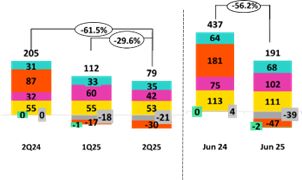

Insurance Underwriting Results and the Medical Services

|

36

|

|

|

08

|

Operating Expenses

|

38 | |

|

09

|

Operating Efficiency

|

40 | |

|

10

|

Regulatory Capital

|

41 | |

|

11

|

Economic Outlook

|

43 | |

|

12

|

Appendix

|

47 |

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

| |

|||

| • |

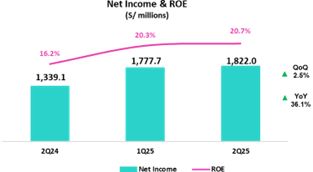

Net Income attributable to Credicorp increased 36.1% YoY and 2.5% QoQ to S/1,822.0 million, translating into an ROE of 20.7%.

These results include a positive 120 bps impact related to a relevant gain in BCP’s investment portfolio.

|

| • |

In 2Q25 Credicorp revalued Bolivia’s balance sheet using a market-reflective FX rate, resulting in an accounting contraction of 2.8% in Credicorp Total Assets with no impact on cash flow. The loan and

deposit figures cited below exclude this adjustment.

|

| • |

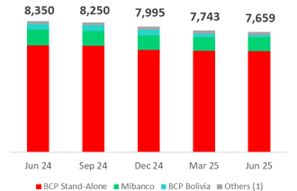

Total Loans measured in quarter-end balances declined 0.3% YoY, but up 2.6% FX Neutral mainly led by BCP through Retail Banking, where stand-out performers were

Mortgage and Consumer (Yape), and by Mibanco. QoQ, total Loans rose 1.2%, with 2.5% FX Neutral growth driven by the same segments, along with Wholesale Banking at BCP.

|

| • |

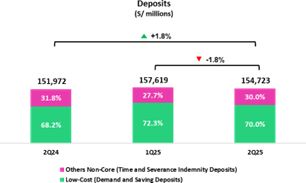

Total Deposits increased 6.2% (+10.2% FX Neutral) YoY reflecting growth in Low-cost deposits, amid higher system liquidity, and contracted 0.5% (+1.0% FX Neutral)

QoQ. Low-cost deposits accounted for 71.8% of total deposits and 57.2% of the total funding base.

|

| • |

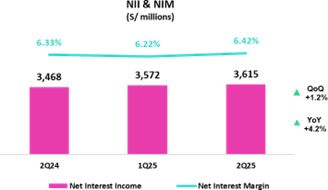

Net Interest Income (NII) increased 4.2% YoY mainly supported by lower Interest and Similar Expenses. QoQ, NII increased 1.2%. Net

Interest Margin (NIM) stood at 6.42%, increasing 9 bps YoY and 20 bps QoQ.

|

| • |

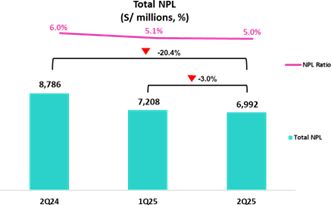

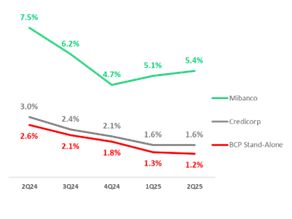

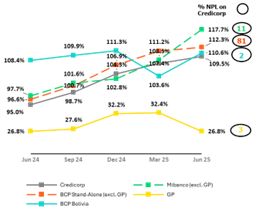

NPL Ratio contracted across segments, improving 102 bps YoY to 5.0%, driven by debt repayments at BCP Stand-alone and a drop in overdue loans at BCP and Mibanco.

QoQ, the NPL Ratio improved 14 bps.

|

| • |

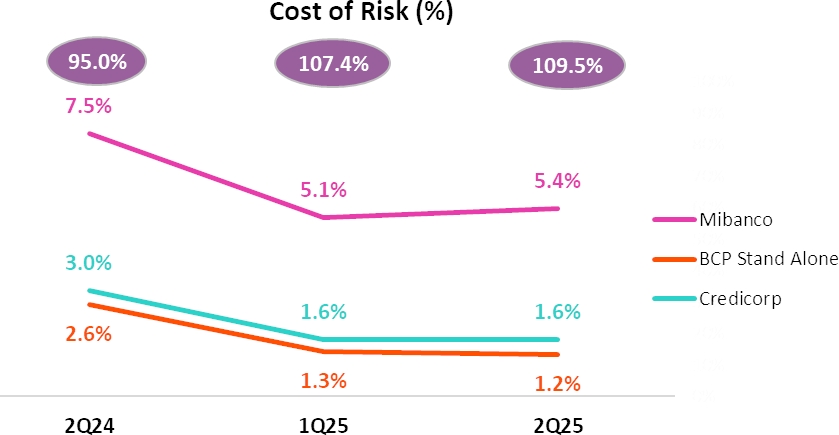

Provisions declined by 47.4% YoY, driven by BCP and Mibanco, supported by strengthened risk management, improved payment behavior, benefiting from an economic

recovery, and a higher share of lower-risk vintages within the portfolio. QoQ, provisions dropped 1.2%. As a result, Cost of Risk hit a low of 1.6% and Risk-Adjusted

NIM reached a record-high of 5.44%.

|

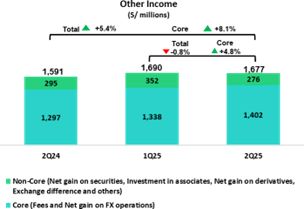

| • |

Core Income increased 5.3% YoY, reflecting a stronger NII and ongoing diversification in revenue streams, which drove growth of 8.2% in Fee income and 7.9% in Net

Gain on FX Transactions.

|

| • |

Other Non-Core Income reported a relevant gain of S/106 million, which was associated with a sovereign bond exchange at BCP.

|

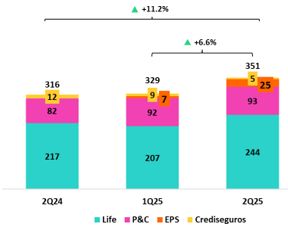

| • |

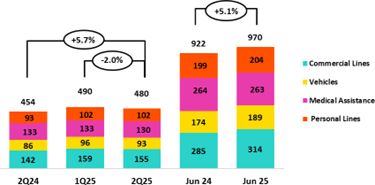

Insurance Underwriting Results increased 11.2% YoY, driven primarily by lower insurance service expenses in the Life business and secondarily, by higher insurance

service income in P & C; and was up 6.6% QoQ.

|

| • |

Yape reached 14.9 million Monthly Active Users (MAU), with an operating leverage continuing to expand and accounting for 5.5% of Credicorp’s total risk-adjusted

revenue.

|

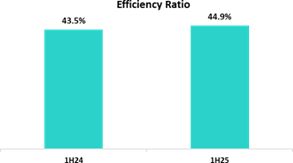

| • |

Efficiency Ratio for 1H25 reached 44.9%, aligned with our full-year guidance. Operating expenses during this period increased 11.4% YoY, driven mainly by the core

business at BCP Stand-alone and investments in our innovation portfolio initiatives.

|

| • |

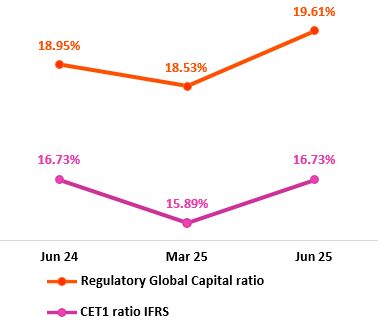

IFRS CET 1 Ratio stood at 12.56% for BCP Stand-alone and at 16.73% for Mibanco.

|

| • |

After quarter-end, on August 13, 2025, Credicorp announced the cancellation of approximately 1.6 billion soles in Tax resolutions issued by Sunat on June 27, 2025.

The company will record this cash outflow as an asset. As the contingency remains classified as remote, no provision is required in accordance with International Accounting Standards.

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

| |

|||

|

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

Second Quarter 2025 Earnings Conference Call

|

|||

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

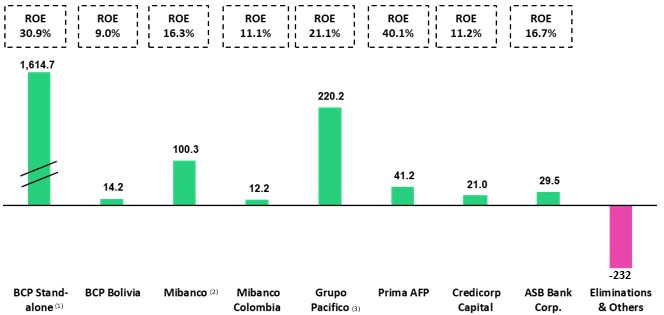

| (1) |

In BCP Stand-alone, the figure is lower than the net profit since the contribution eliminates investment gains in other subsidiaries of Credicorp (Mibanco). ROE excludes the impact of 200 bps related

to the relevant gain associated with the sovereign bond exchange.

|

| (2) |

In Mibanco, the figure is less than the net profit because Credicorp owns (directly and indirectly) 99.921% of Mibanco.

|

| (3) |

The contribution for Grupo Pacifico presented here is greater than the profit of Pacifico Seguros since 100% of Crediseguros is being included (including 48% under Grupo Crédito).

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

Universal Banking

|

|

|

|

BCP posted a noteworthy profitability this quarter, supported by a low level of the cost of risk and a resilient NIM, on the back of economic recovery and

a decrease in the cost of funding, respectively. Core income remained solid, underpinned by a growing and diversified revenue base. Other Non-Core Income benefited from gains related to a sovereign bond exchange. Operating

efficiency remained strong, with expenses well contained.

|

|

|

|

Insurance and Pensions

|

|

Net income at Grupo Pacífico reflect solid underlying business performance, particularly in the Life and General Insurance segments, which continue to

deliver strong underwriting results. The consolidation of Empresas Banmédica’s operations has further strengthened Medical Services. These positive dynamics were partially offset by the impact of a credit downgrade on a

couple of assets in the investment portfolio.

|

|

Microfinance

|

|

Profitability at Mibanco rose YoY, driven mainly by a rebound in disbursements; strengthened risk management; and effective interest-rate strategies. NIM

remained strong, fueled by active management of loan pricing and a reduction in the funding cost.

Results at Mibanco Colombia continued to improve on the back of turnaround measures taken last year and a more supportive environment for the microfinance

sector. Growth remained stable and the risk levels, controlled.

|

|

|

|

Investment Management and

Advisory

|

|

Operating profitability in the Investment Management and Advisory line of business remained resilient in 2Q25. Core income- generating businesses delivered

robust results this quarter, reflecting broad-based business strength that helped partially offset the absence of last year’s one-off income from our now-discontinued Corporate Finance Business. Our Asset Management and

Wealth Management businesses reported significant growth in AUMs.

|

|

|

|

Outlook

|

|

We revised our 2025 ROE guidance to around 19.0%. We anticipate that this result will be

driven by: (i) acceleration of our loan portfolio growth, particularly in the retail segment, (ii) the resilience of

our NIM, and (iii) a lower than initially expected cost of risk.

We have also raised our long-term ROE target to 19.5%, driven by stronger retail loan growth dynamics, an improvement in risk-adjusted NIM and enhanced expectations for

diversified sources of income.

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

Financial Overview

|

|

Credicorp Ltd.

|

|

Quarter |

% change

|

Up to

|

% change

|

|||

|

S/ 000

|

2Q24

|

1Q25

|

2Q25

|

QoQ

|

YoY

|

Jun 24

|

Jun 25

|

Jun 25 / Jun 24

|

|

Net interest, similar income and expenses

|

3,468,464

|

3,572,012

|

3,615,371

|

1.2%

|

4.2%

|

6,894,587

|

7,187,383

|

4.2%

|

|

Provision for credit losses on loan portfolio, net of recoveries

|

(1,093,371)

|

(581,893)

|

(575,159)

|

-1.2%

|

-47.4%

|

(1,908,070)

|

(1,157,052)

|

-39.4%

|

|

Net interest, similar income and expenses, after provision for credit losses on loan portfolio

|

2,375,093

|

2,990,119

|

3,040,212

|

1.7%

|

28.0%

|

4,986,517

|

6,030,331

|

20.9%

|

|

Other income

|

1,591,330

|

1,690,216

|

1,677,373

|

-0.8%

|

5.4%

|

2,983,889

|

3,367,589

|

12.9%

|

|

Insurance underwriting result

|

315,500

|

329,134

|

350,873

|

6.6%

|

11.2%

|

594,562

|

680,007

|

14.4%

|

|

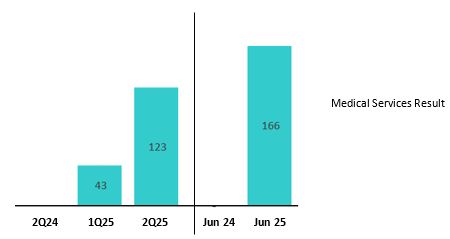

Medical services result

|

-

|

42,689

|

123,319

|

188.9%

|

n.a.

|

-

|

166,008

|

n.a.

|

|

Total expenses

|

(2,395,205)

|

(2,532,874)

|

(2,630,310)

|

3.8%

|

9.8%

|

(4,607,687)

|

(5,163,184)

|

12.1%

|

|

Profit before income tax

|

1,886,718

|

2,519,284

|

2,561,467

|

1.7%

|

35.8%

|

3,957,281

|

5,080,751

|

28.4%

|

|

Income tax

|

(519,344)

|

(704,469)

|

(696,969)

|

-1.1%

|

34.2%

|

(1,047,810)

|

(1,401,438)

|

33.7%

|

|

Net profit

|

1,367,374

|

1,814,815

|

1,864,498

|

2.7%

|

36.4%

|

2,909,471

|

3,679,313

|

26.5%

|

|

Non-controlling interest

|

28,278

|

37,118

|

42,483

|

14.5%

|

50.2%

|

58,718

|

79,601

|

35.6%

|

|

Net profit attributable to Credicorp

|

1,339,096

|

1,777,697

|

1,822,015

|

2.5%

|

36.1%

|

2,850,753

|

3,599,712

|

26.3%

|

|

Dividends paid to third parties

|

2,791,652

|

-

|

3,181,440

|

n.a.

|

14.0%

|

2,791,652

|

3,181,440

|

14.0%

|

|

Net income / share (S/)

|

16.8

|

22.3

|

22.8

|

2.5%

|

36.1%

|

36

|

45

|

26.3%

|

|

Dividends per Share (S/)

|

-

|

-

|

40

|

n.a.

|

n.a.

|

35

|

40

|

14.0%

|

|

Loans

|

146,946,546

|

141,196,646

|

140,961,978

|

-0.2%

|

-4.1%

|

146,946,546

|

140,961,978

|

-4.1%

|

|

Deposits and obligations

|

151,971,984

|

157,619,082

|

154,723,334

|

-1.8%

|

1.8%

|

151,971,984

|

154,723,334

|

1.8%

|

|

Net equity

|

32,413,767

|

35,843,202

|

34,459,012

|

-3.9%

|

6.3%

|

32,413,767

|

34,459,012

|

6.3%

|

|

Profitability

|

||||||||

|

Net interest margin(1)

|

6.3%

|

6.2%

|

6.4%

|

20 bps

|

9 bps

|

6.3%

|

6.3%

|

1 bps

|

|

Risk-adjusted Net interest margin

|

4.4%

|

5.2%

|

5.4%

|

20 bps

|

104 bps

|

4.6%

|

5.3%

|

72 bps

|

|

Funding cost(2)

|

2.9%

|

2.4%

|

2.4%

|

2 bps

|

-42 bps

|

0.03

|

2.4%

|

-50 bps

|

|

ROAE

|

16.2%

|

20.3%

|

20.7%

|

40 bps

|

450 bps

|

17.6%

|

20.9%

|

330 bps

|

|

ROAA

|

2.2%

|

2.8%

|

2.9%

|

10 bps

|

70 bps

|

2.3%

|

2.9%

|

51 bps

|

|

Loan portfolio quality

|

||||||||

|

Internal overdue ratio(3)

|

4.2%

|

3.7%

|

3.6%

|

-11 bps

|

-66 bps

|

4.2%

|

3.6%

|

-66 bps

|

|

Internal overdue ratio over 90 days

|

3.2%

|

3.0%

|

3.0%

|

-4 pbs

|

-28 pbs

|

3.2%

|

3.0%

|

-28 pbs

|

|

NPL ratio(4)

|

6.0%

|

5.1%

|

5.0%

|

-14 bps

|

-102 bps

|

6.0%

|

5.0%

|

-102 bps

|

|

Cost of risk(5)

|

3.0%

|

1.6%

|

1.6%

|

1 bps

|

-141 bps

|

2.6%

|

1.6%

|

-100 bps

|

|

Coverage ratio of IOLs

|

134.0%

|

148.7%

|

151.8%

|

310 bps

|

1780 bps

|

134.0%

|

151.8%

|

1780 bps

|

|

Coverage ratio of NPLs

|

95.0%

|

107.4%

|

109.5%

|

210 bps

|

1450 bps

|

95.0%

|

109.5%

|

1450 bps

|

|

Operating efficiency

|

||||||||

|

Operating income(6)

|

5,143,084

|

5,340,199

|

5,529,301

|

3.5%

|

7.5%

|

10,076,862

|

10,869,500

|

7.9%

|

|

Operating expenses(7)

|

2,270,785

|

2,442,089

|

2,441,547

|

0.0%

|

7.5%

|

4,383,595

|

4,883,636

|

11.4%

|

|

Efficiency ratio(8)

|

44.2%

|

45.7%

|

44.2%

|

-150 bps

|

0 bps

|

43.5%

|

44.9%

|

143 bps

|

|

Operating expenses / Total average assets

|

3.7%

|

3.8%

|

3.9%

|

9 bps

|

19 bps

|

3.6%

|

3.9%

|

27 bps

|

|

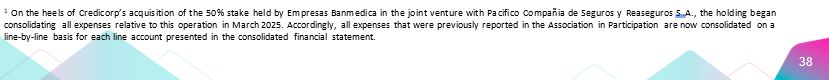

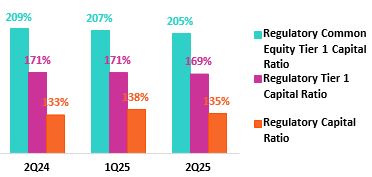

Capital adequacy - BCP Stand-alone

|

||||||||

|

Global Capital Ratio(9)

|

16.2%

|

16.9%

|

17.3%

|

47 bps

|

109 bps

|

16.2%

|

17.3%

|

109 bps

|

|

Ratio Tier 1(10)

|

11.9%

|

11.3%

|

12.2%

|

91 bps

|

34 bps

|

11.9%

|

12.2%

|

34 bps

|

|

Ratio common equity tier 1(11) (13)

|

11.9%

|

11.3%

|

12.2%

|

91 bps

|

34 bps

|

11.9%

|

12.2%

|

34 bps

|

|

Capital adequacy - Mibanco

|

||||||||

|

Global Capital Ratio(9)

|

18.9%

|

18.5%

|

19.6%

|

108 bps

|

66 bps

|

18.9%

|

19.6%

|

66 bps

|

|

Ratio Tier 1(10)

|

16.6%

|

15.5%

|

16.5%

|

100 bps

|

-15 bps

|

16.6%

|

16.5%

|

-14 bps

|

|

Ratio common equity tier 1(11) (13)

|

16.7%

|

15.9%

|

16.7%

|

84 bps

|

0 bps

|

16.7%

|

16.7%

|

0 bps

|

|

Employees(14)

|

38,641

|

46,621

|

46,423

|

-0.4%

|

20.1%

|

38,641

|

46,423

|

20.1%

|

|

Share Information

|

||||||||

|

Issued Shares

|

94,382

|

94,382

|

94,382

|

0.0%

|

0.0%

|

94,382

|

94,382

|

0.0%

|

|

Treasury Shares(12)

|

14,949

|

15,016

|

15,016

|

0.0%

|

0.4%

|

14,949

|

15,016

|

0.4%

|

|

Outstanding Shares

|

79,433

|

79,366

|

79,366

|

0.0%

|

-0.1%

|

79,433

|

79,366

|

-0.1%

|

| (1) |

Net Interest Margin = Net Interest Income (Excluding Net Insurance Financial Expenses)/ Average Interest Earning Assets

|

| (2) |

Funding Cost = Interest Expense (Does not include Net Insurance Financial Expenses) / Average Funding

|

| (3) |

Internal Overdue Loans: include overdue loans and loans under legal collection, according to our internal policy for overdue loans. Internal Overdue Ratio: Internal overdue loans/ Total loans

|

| (4) |

Non-performing loans (NPL): Internal overdue loans + Refinanced loans. NPL ratio: NPL / Total loans.

|

| (5) |

Cost of risk = Annualized provision for loan losses, net of recoveries/ Total loans.

|

| (6) |

Operating Income = Net interest, similar income and expenses + Fee Income+ Net gain on foreign exchange transactions + Net Gain From associates + Net gain on derivatives held for trading + Result on exchange differences +

Insurance Underwriting Result + Results for Medical Services

|

| (7) |

Operating Expenses = Salaries and employee benefits + Administrative expenses + Depreciation and amortization + Association in participation + Acquisition cost.

|

| (8) |

Efficiency Ratio = (Salaries and employee benefits + Administrative expenses + Depreciation and amortization + Association in participation) / (Net interest, similar income and expenses + Fee Income+ Net gain on foreign

exchange transactions + Net Gain From associates + Net gain on derivatives held for trading + Result on exchange differences + Insurance Underwriting Result)

|

| (9) |

Regulatory Capital/ Risk-weighted assets (legal minimum = 10% since July 2011).

|

| (10) |

Tier 1 = Capital + Legal and other capital reserves + Accumulated earnings with capitalization agreement + (0.5 x Unrealized profit and net income in subsidiaries) - Goodwill - (0.5 x Investment in subsidiaries) + Perpetual

subordinated debt (the maximum amount that can be included is 17.65% of Capital + Reserves + Accumulated earnings with capitalization agreement + Unrealized profit and net income in subsidiaries - Goodwill).

|

| (11) |

Common Equity TierI = Capital + Reserves – 100% of applicable deductions (investment in subsidiaries, goodwill, intangibles, and net deferred taxes that rely on future profitability) + retained earnings + unrealized gains.

|

| (12) |

Consider shares held by Atlantic Security Holding Corporation (ASHC) and stock awards.

|

| (13) |

Common Equity Tier I calculated based on IFRS Accounting.

|

| (14) |

Internal management figures. Since 1Q25, it has included corporate health and medical services employees.

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

Main Strategic Milestones at Credicorp

|

|

Core Businesses Transformation (1)

|

Quarter

|

Up to

|

|||

|

2Q24

|

1Q25

|

2Q25

|

Jun 24

|

Jun 25

|

|

|

Credicorp

|

|||||

|

Innovation Portfolio Risk-Adjusted Revenue Share (2)

|

3.4%

|

5.4%

|

6.2%

|

3.3%

|

5.8%

|

|

BCP Stand-alone

|

|||||

|

Digital clients (3)

|

72%

|

78%

|

79%

|

70%

|

78%

|

|

Digital monetary transactions (4)

|

85%

|

89%

|

90%

|

84%

|

89%

|

|

Cashless transactions (5)

|

61%

|

66%

|

66%

|

58%

|

65%

|

|

Mibanco

|

|||||

|

Disbursements through leads (6)

|

68%

|

70%

|

65%

|

69%

|

68%

|

|

Disbursements through alternative channels (7)

|

23%

|

26%

|

23%

|

23%

|

25%

|

|

Relationship managers productivity (8)

|

21.9

|

28.2

|

25.9

|

23.8

|

25.6

|

|

Pacifico

|

|||||

|

Digital Policies (thousands) (9)

|

582.0

|

722.3

|

579.0

|

1111.5

|

1301.3

|

| (1) |

Management figures. Figures for June 2024, March 2025, and June 2025.

|

| (2) |

As a percentage of Credicorpʼs total Risk-Adjusted Revenue.

|

| (3) |

Retail clients that made 70%, or more, of their transactions through digital channels in the last 6 months (including Yape).

|

| (4) |

Monetary Transactions conducted through Mobile Banking, Internet Banking, Yape and Telecredito/Total Monetary Transactions in Retail Banking.

|

| (5) |

Amount transacted through Mobile Banking, Internet Banking, Yape y POS/Total amount transacted through Retail Banking.

|

| (6) |

Disbursements generated through leads/Total disbursements.

|

| (7) |

Disbursements conducted through alternative channels/Total disbursements. Figures differ from previously reported due to a methodological change.

|

| (8) |

Number of loans disbursed/Total relationship managers.

|

| (9) |

Number of insurance policies issued through digital channels.

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

Credicorp’s Strategy Update

|

|

Management KPI's (1)

|

Quarter

|

|

Change %

|

Up to

|

Change %

|

|||

|

2Q24

|

1Q25

|

2Q25

|

QoQ

|

YoY

|

Jun 24

|

Jun 25

|

Jun 25 / Jun 24

|

|

|

Users

|

||||||||

|

Users (millions)

|

15.9

|

18.0

|

18.6

|

3.5%

|

17.3%

|

15.9

|

18.6

|

17.3%

|

|

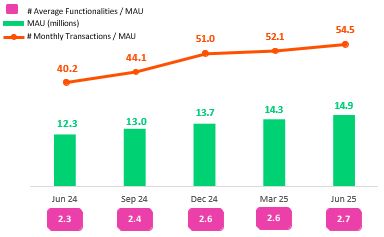

Monthly Active Users (MAU) (millions) (2)

|

12.3

|

14.3

|

14.9

|

4.2%

|

21.9%

|

12.3

|

14.9

|

21.9%

|

|

Revenue Generating MAU (millions)

|

9.5

|

12.0

|

12.6

|

4.9%

|

32.5%

|

9.5

|

12.6

|

32.5%

|

|

Engagement

|

||||||||

|

# Transactions (millions)

|

1,400.6

|

2,025.4

|

2,384.9

|

17.8%

|

70.3%

|

2,528.3

|

4,410.3

|

74.4%

|

|

# Transactions / MAU

|

40.2

|

52.1

|

54.5

|

4.6%

|

35.6%

|

40.2

|

54.5

|

35.6%

|

|

# Average Functionalities / MAU

|

2.3

|

2.6

|

2.7

|

1.5%

|

14.2%

|

2.3

|

2.7

|

14.2%

|

|

Experience

|

||||||||

|

NPS (3)

|

76

|

77

|

77

|

0.0%

|

60.0%

|

77

|

77

|

-40.0%

|

|

Unit Economics

|

||||||||

|

Monthly Indicators (4)

|

||||||||

|

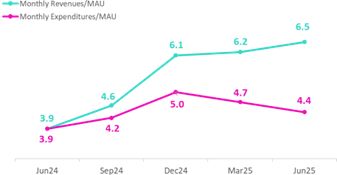

Revenues / MAU (S/)

|

3.9

|

6.2

|

6.5

|

3.8%

|

64.3%

|

3.9

|

6.5

|

64.3%

|

|

Expenses / MAU (S/)

|

-3.9

|

-4.7

|

-4.4

|

-6.9%

|

11.5%

|

-3.9

|

-4.4

|

11.5%

|

|

Quarterly Indicators (5)

|

||||||||

|

Revenues / MAU (S/)

|

3.8

|

5.5

|

6.4

|

15.4%

|

69.4%

|

3.5

|

6.0

|

69.2%

|

|

Expenses / MAU (S/)

|

-3.9

|

-4.2

|

-4.5

|

5.3%

|

15.1%

|

-3.8

|

-4.3

|

12.8%

|

|

Drivers Monetization

|

||||||||

|

Total TPV (S/, billions) (6)

|

62.1

|

91.6

|

103.4

|

12.9%

|

66.3%

|

103.5

|

174.2

|

68.3%

|

|

Total Revenue Generating TPV (S/, billions) (7)

|

4.9

|

8.7

|

10.1

|

16.6%

|

107.6%

|

8.7

|

18.8

|

117.9%

|

|

Payments

|

||||||||

|

# Bill Payments transactions (millions)

|

28.6

|

45.0

|

50.1

|

11.4%

|

75.0%

|

52.1

|

95.2

|

82.7%

|

|

Financials

|

||||||||

|

# Loans Disbursements (thousands)

|

751.9

|

3,100.4

|

3,855.1

|

24.3%

|

412.7%

|

1,264.3

|

6,955.6

|

450.1%

|

|

E-Commerce

|

||||||||

|

GMV (S/, millions) (8)

|

75.0

|

124.6

|

129.1

|

3.6%

|

72.1%

|

134.1

|

253.7

|

89.2%

|

| (1) |

Management Figures.

|

| (2) |

Yape users that have made at least one outgoing transaction in the measurement month.

|

| (3) |

Net Promoter Score.

|

| (4) |

Monthly indicators consider the results of the last month of the quarter for the numerator and denominator.

|

| (5) |

Quarterly indicators are calculated using the sum of the three months in the period for numerator accounts, and the average of the denominator—based on last month’s data from both the current and previous quarters."

|

| (6) |

Total Payment Volume.

|

| (7) |

Revenue Generating Total Payment Volume (TPV).

|

| (8) |

Gross Merchant Volume, includes the following functionalities: Yape Promos, Yape Store, Ticketing, Gaming, Delivery, Buses, Insurance, Gas, Brand Solutions and Insurance.

|

|

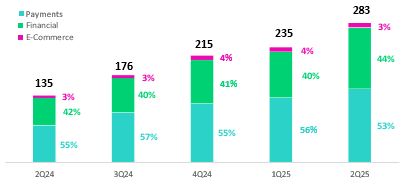

Financial Results (1)

|

Quarter

|

Change %

|

Up to

|

Change %

|

||||

|

S/ millions

|

2Q24

|

1Q25

|

2Q25

|

QoQ

|

YoY

|

Jun 24

|

Jun 25

|

Jun 25 / Jun 24

|

|

Net Interest Income after Provisions (2)

|

56.2

|

93.0

|

123.9

|

33.2%

|

120.4%

|

106.9

|

216.9

|

103.0%

|

|

Other Income (3)

|

80.0

|

141.6

|

158.5

|

11.9%

|

98.2%

|

139.7

|

300.1

|

114.8%

|

|

Total Income

|

136.2

|

234.6

|

282.4

|

20.4%

|

107.4%

|

246.6

|

517.0

|

109.7%

|

|

Total Operating Expenses

|

-139.5

|

-179.1

|

-196.6

|

9.7%

|

40.9%

|

-268.4

|

-375.7

|

40.0%

|

|

(1)

|

Management figures. Beginning in 1Q25, reclassifications between Operating Expenses and Fee Income have been incorporated, along with new accounting allocations

—primarily related to interest expenses associated with the Deposit Insurance Fund. Figures for prior periods have been restated for comparability and may differ from those previously reported.

|

|

(2)

|

Includes interest income, interest expense and net provisions.

|

|

(3)

|

Includes Other income recorded in BCP and in Yape Market

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

Credicorp’s Strategy Update

|

|

Monetization Drivers

Yape continues to strengthen its monetization strategy, with sustained growth in operational leverage per user. As of 2Q25, the gap between revenue (S/6.5) and expense (S/4.4) per

MAU continues to widen steadily.

|

|

The pace of growth in the Financial business rose across business lines, driven by the balance increase of the loan portfolio. The

number of disbursements continues to rise, which reflects an uptick in the effectiveness of leads. The portfolio composition remained stable, with single installment and multi-installment loans each representing 50% of the

loans’s balance. In June, a new credit line targeting SMEs was launched, offering higher amounts and longer terms. Its impact is expected to materialize over the coming quarters. At the end of 2Q25, Yape reached the 3-million

user mark for clients with at least one loan disbursement, as we move closer to our goal of 5 million for 2026. Almost 30% of Yape’s borrowers accessed their first formal financial system loan through the app, reaffirming its

role as an agent of financial inclusion. Finally, growth in net interest income was bolstered by an uptick in the Floating generated by Yape, which rose on the back of growth in the entry volume.

In the E-Commerce business, the GMV totaled S/129.1 million. This performance was driven by Yape Proms, which maintains solid transactions levels and

is registering improvement in the conversion of visits to sales.

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

Credicorp’s Strategy Update

|

|

o

|

BCP and Yape financially included 100 thousand people in 2Q25, and cumulative growth stands at 6.1 million since 2020. More than 1.9 million clients disbursed loans through Yape

and 190 thousand were financially included through this channel during the quarter.

|

|

o

|

BCP achieved a change in behavior among more than 159 thousand clients this quarter through financial education initiatives, focused on promoting healthy personal financial

practices and preventing over-indebtedness, late payments, overdrawing credit cards, among others.

|

|

o

|

Yape rolled out an in-app version of its financial education material to give users access to its modules. By the end of 2Q25, clients had completed +122 thousand modules.

|

|

o

|

Pacifico reported that as of 2Q25, 2.9 million clients had received inclusive insurance protection1 through channels at BCP, Mibanco and Yape. Pacifico provided

insurance coverage to 391 thousand people by the end of the quarter, highlighting the launch of its new product Salud Yape.

|

|

o

|

Mibanco Peru signed a financing contract for up to US$100 million with IDB Invest and JICA to drive access to credit for micro, small and medium enterprises (MSMEs) in Peru, including those led by

women.

|

|

o

|

The Crediagua product at Mibanco Peru, which provides financing for household drinking water and sewage connections, disbursed 190 million soles to serve more than 12 thousand people in 2Q25.

|

|

o

|

As of May 31, BCP disbursed USD 1,150 million in sustainable financing, including working capital loans for the agricultural sector.

|

|

o

|

BCP, in the framework of the program “Contigo Emprendedor,” served more than 122 thousand MSMEs clients through its Whatsapp accompaniment programs, promoting improvements in

financial management.

|

|

o

|

Pacifico continued to drive training in risk prevention to strengthen resilience through its “ABC de Pacifico”, “Comunidad Segura” and “Protege365” programs, which have educated

more than 74 thousand people thus far this year, including clients, non-clients and employees at companies.

|

|

o

|

We published and presented a study on emissions factors for economic activities in Peru, which we developed with Universidad del Pacifico. This pioneering tool in the region

enables financial institutions to estimate their financed emissions, supporting more informed and responsible climate management of their portfolios.

|

|

o

|

For the second consecutive year, we worked alongside Peru Sostenible2 and Valora Consultores to promote the CFO Program to strengthen sustainability leadership in

finance areas. More than 38 leading companies actively participate in this initiative, which attests to our commitment to addressing the country’s development goals and promoting responsible and sustainability-based business

management practices.

|

|

Indicator

|

Company

|

Unit

|

2024

|

1Q24

|

1Q25

|

|

|

Inclusion

|

||||||

|

People included financially through BCP and Yape – cumulative since 20203

|

BCP Peru and Yape

|

Million

|

5.7

|

4.2

|

6.1

|

|

|

Clients included in inclusive insurance services

|

Pacifico

|

Million

|

2.7

|

N.D.

|

2.9

|

|

|

Finance for the Future

|

||||||

|

Total loan balance for micro and small businesses

|

Mibanco Peru

|

S/ Million

|

11,356

|

11,303

|

11,894

|

|

|

Disbursements of sustainable financings - YTD

|

BCP Peru

|

$ Million

|

+1500

|

796

|

1,150 4

|

|

1

|

Simple and affordable optional insurance products with single or monthly payments of S/40 or less.

|

| 2 |

Perú Sostenible: A network of companies that promotes sustainable development in Peru.

|

|

3

|

Stock of financially included clients through BCP since 2020: (i) New clients with savings accounts or affiliated to Yape. (ii) New clients without debt in

the financial system or BCP products in the last twelve months. (iii) Clients with 3 monthly average transactions in the last three months.

|

|

4

|

Up to May.

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

| 01 |

Loan Portfolio

|

|

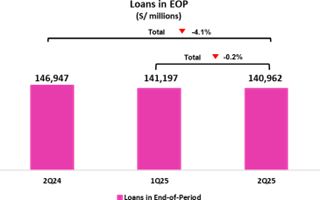

This quarter, total loans in quarter-end balances fell 0.2% QoQ. This contraction was driven by a non-cash accounting adjustment at the Credicorp level to incorporate a revaluation of

BCP Bolivia’s asset balance. If we exclude the impact of this adjustment, loans rose 1.2% QoQ (+2.5% FX neutral). The main dynamics that drove this evolution were (i) an increase in the demand for short-term financing in

Middle Market banking, (ii) growth in disbursements in Mortgage and (iii) a decline in write-offs at Mibanco.

YoY, total loans in quarter-end balances dropped 4.1% (-0.3% excluding the aforementioned accounting effect and +2.6% FX Neutral). This FX Neutral

result was driven mainly by (i) growth in disbursements in Mortgage, (ii) an uptick in disbursements mainly through Yape in Consumer and (iii) an upswing in disbursements in the first half of the year at Mibanco.

|

| 1.1. |

Loans

|

|

Total Loans

(S/ Millions)

|

Jun 24

|

As of

Mar 25

|

Jun 25

|

Volume change

QoQ YoY

|

% change

QoQ YoY

|

% Part. in total

Jun 24 Mar 25

|

loans

Jun 25

|

|||

|

BCP Stand-alone

|

121,056

|

119,379

|

120,999

|

1,620

|

-57

|

1.4%

|

0.0%

|

82.4%

|

84.5%

|

85.8%

|

|

Mibanco

|

12,706

|

12,525

|

12,785

|

260

|

80

|

2.1%

|

0.6%

|

8.6%

|

8.9%

|

9.1%

|

|

Mibanco Colombia

|

1,757

|

1,904

|

1,976

|

72

|

219

|

3.8%

|

12.5%

|

1.2%

|

1.3%

|

1.4%

|

|

Bolivia

|

10,229

|

6,294

|

4,189

|

-2,105

|

-6,040

|

-33.4%

|

-59.0%

|

7.0%

|

4.5%

|

3.0%

|

|

ASB Bank Corp.

|

1,953

|

1,777

|

1,559

|

-218

|

-394

|

-12.3%

|

-20.2%

|

1.3%

|

1.3%

|

1.1%

|

|

Others (1)

|

-754

|

-682

|

-546

|

135

|

207

|

-19.9%

|

-27.5%

|

-0.5%

|

-0.5%

|

-0.4%

|

|

Total Loans BAP

|

146,947

|

141,197

|

140,962

|

-235

|

-5,985

|

-0.2%

|

-4.1%

|

100.0%

|

100.0%

|

100.0%

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

01. Loan Portfolio

|

|

Total Loans

(S/ Millions)

|

As of

|

Volume change

|

% change

|

% Part. in total

|

loans | |||||

|

Jun 24

|

Mar 25

|

Jun 25

|

QoQ

|

YoY

|

QoQ

|

YoY

|

Jun 24

|

Mar 25

|

Jun 25

|

|

|

BCP Stand-alone

|

121,056

|

119,379

|

120,999

|

1,620

|

-57

|

1.4%

|

0.0%

|

82.4%

|

84.5%

|

85.8%

|

|

Wholesale Banking

|

54,320

|

52,602

|

53,025

|

423

|

-1,294

|

0.8%

|

-2.4%

|

37.0%

|

37.3%

|

37.6%

|

|

Corporate

|

32,010

|

31,369

|

30,496

|

-873

|

-1,514

|

-2.8%

|

-4.7%

|

21.8%

|

22.2%

|

21.6%

|

|

Middle - Market

|

22,310

|

21,234

|

22,529

|

1,296

|

220

|

6.1%

|

1.0%

|

15.2%

|

15.0%

|

16.0%

|

|

Retail Banking

|

64,827

|

64,875

|

66,176

|

1,301

|

1,349

|

2.0%

|

2.1%

|

44.1%

|

45.9%

|

46.9%

|

|

SME - Business

|

7,936

|

7,711

|

7,692

|

-20

|

-245

|

-0.3%

|

-3.1%

|

5.4%

|

5.5%

|

5.5%

|

|

SME - Pyme

|

16,369

|

15,922

|

16,091

|

169

|

-278

|

1.1%

|

-1.7%

|

11.1%

|

11.3%

|

11.4%

|

|

Mortgage

|

21,554

|

22,115

|

22,824

|

710

|

1,270

|

3.2%

|

5.9%

|

14.7%

|

15.7%

|

16.2%

|

|

Consumer

|

12,900

|

13,173

|

13,446

|

273

|

545

|

2.1%

|

4.2%

|

8.8%

|

9.3%

|

9.5%

|

|

Credit Card

|

6,068

|

5,955

|

6,124

|

169

|

57

|

2.8%

|

0.9%

|

4.1%

|

4.2%

|

4.3%

|

|

Others (1)

|

1,909

|

1,901

|

1,797

|

-103

|

-112

|

-5.4%

|

-5.8%

|

1.3%

|

1.3%

|

1.3%

|

|

Total Loans BAP

|

146,947

|

141,197

|

140,962

|

-235

|

-5,985

|

-0.2%

|

-4.1%

|

100.0%

|

100.0%

|

100.0%

|

|

|

|

Mortgage, where loan demand was boosted by improvements in the economic environment and lower interest

rates.

|

|

|

Consumer, due to an upswing in disbursements, mainly through BCP and Yape.

|

|

|

Middle Market Banking, which registered an uptick in demand for working capital loans after the first

fishing campaign began in April.

|

|

|

Corporate Banking, due to growth in amortizations of short-term loans.

|

|

|

Mortgage, due to the same dynamics in play QoQ.

|

|

|

Consumer, spurredmainly by growth

in disbursements through Yape.

|

|

|

Middle Market Banking (+5.8%), due to an uptick in demand for short-term financing.

|

|

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

01. Loan Portfolio

|

|

Total Loans

(S/ Millions) |

Local Currency (LC) - S/ millions

|

% change

|

Foreign Currency (FC) - S/ millions

|

% change

|

% part. by currency

|

|||||||

|

Total

|

Total |

Jun 25

|

||||||||||

|

Jun 24

|

Mar 25

|

Jun 25

|

QoQ

|

YoY

|

Jun 24

|

Mar 25

|

Jun 25

|

QoQ

|

YoY

|

MN

|

ME

|

|

|

BCP Stand-alone

|

80,749

|

79,702

|

81,217

|

1.9%

|

0.6%

|

40,307

|

39,677

|

39,782

|

0.3%

|

-1.3%

|

67.1%

|

32.9%

|

|

Wholesale Banking

|

23,538

|

22,209

|

22,475

|

1.2%

|

-4.5%

|

30,781

|

30,407

|

30,551

|

0.5%

|

-0.7%

|

42.4%

|

57.6%

|

|

Corporate

|

14,475

|

13,049

|

13,194

|

1.1%

|

-8.8%

|

17,535

|

18,334

|

17,302

|

-5.6%

|

-1.3%

|

43.3%

|

56.7%

|

|

Middle - Market

|

9,064

|

9,160

|

9,281

|

1.3%

|

2.4%

|

13,246

|

12,073

|

13,249

|

9.7%

|

0.0%

|

41.2%

|

58.8%

|

|

Retail Banking

|

56,733

|

56,911

|

58,176

|

2.2%

|

2.5%

|

8,115

|

7,911

|

7,953

|

0.5%

|

-2.0%

|

87.9%

|

12.1%

|

|

SME - Business

|

4,683

|

4,525

|

4,471

|

-1.2%

|

-4.5%

|

3,205

|

3,074

|

3,122

|

1.6%

|

-2.6%

|

58.1%

|

41.9%

|

|

SME - Pyme

|

16,225

|

15,791

|

15,949

|

1.0%

|

-1.7%

|

144

|

131

|

142

|

8.3%

|

-1.6%

|

99.1%

|

0.9%

|

|

Mortgage

|

19,574

|

20,325

|

21,130

|

4.0%

|

7.9%

|

1,981

|

1,789

|

1,694

|

-5.3%

|

-14.5%

|

92.6%

|

7.4%

|

|

Consumer

|

11,209

|

11,329

|

11,517

|

1.7%

|

2.8%

|

1,760

|

1,902

|

1,979

|

4.1%

|

12.5%

|

85.7%

|

14.3%

|

|

Credit Card

|

5,043

|

4,941

|

5,109

|

3.4%

|

1.3%

|

1,025

|

1,014

|

1,015

|

0.1%

|

-0.9%

|

83.4%

|

16.6%

|

|

Others (1)

|

478

|

582

|

567

|

-2.7%

|

18.6%

|

1,411

|

1,359

|

1,278

|

-5.9%

|

-9.4%

|

31.5%

|

68.5%

|

|

Mibanco

|

12,691

|

12,515

|

12,776

|

2.1%

|

0.7%

|

14

|

10

|

9

|

-11.3%

|

-35.0%

|

99.9%

|

0.1%

|

|

Mibanco Colombia

|

-

|

-

|

-

|

-

|

-

|

1,757

|

1,904

|

1,976

|

3.8%

|

12.5%

|

-

|

100%

|

|

Bolivia

|

-

|

-

|

-

|

-

|

-

|

10,229

|

6,294

|

4,189

|

-33.4%

|

-59.0%

|

-

|

100%

|

|

ASB Bank Corp.

|

-

|

-

|

-

|

-

|

-

|

1,953

|

1,777

|

1,559

|

-12.3%

|

-20.2%

|

-

|

100%

|

|

Others (2)

|

-756

|

-573

|

-883

|

54.2%

|

16.8%

|

2

|

-109

|

336

|

-408.1%

|

n.a.

|

-

|

-

|

|

Total Loans BAP

|

92,685

|

91,644

|

93,110

|

1.6%

|

0.5%

|

54,261

|

49,553

|

47,852

|

-3.4%

|

-11.8%

|

66.1%

|

33.9%

|

|

For consolidation purposes. Loans generated in Foreign Currency (FC) are converted into Local Currency (LC).

|

|

| (1) |

Includes other assets and accruals.

|

|

(2)

|

Includes eliminations for intercompany transactions |

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

| 02 |

Deposits

|

|

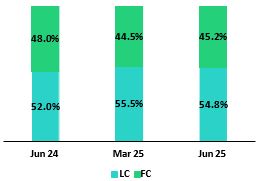

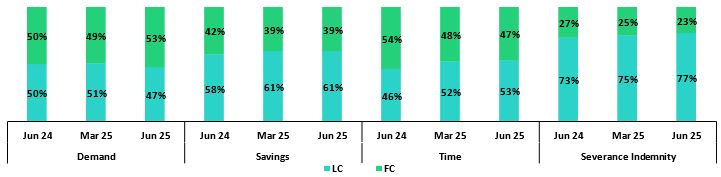

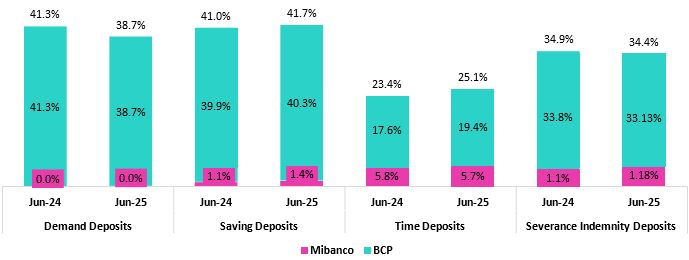

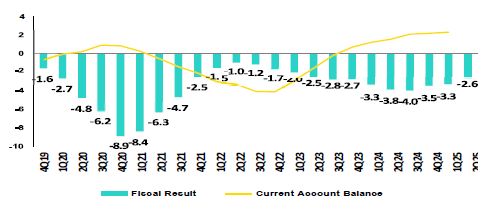

This quarter, total Deposits fell 1.8% QoQ. This contraction was driven by a

non-cash accounting adjustment to reflect a revaluation of BCP Bolivia’s balance sheet. If we exclude the impact of this adjustment total deposits fell slightly QoQ (+ 1% FX neutral), driven primarily

by a 7.7% drop in the balance for Demand Deposits due a seasonal effect related to income tax payments. This decline was partially offset by an 8.4% increase in the balance for Time Deposits, which

was spurred by an uptick in onboarding of wholesale clients. YoY, deposits rose 6.2% (+10.2% FX neutral), driven by Savings, which rose on the back of growth in transactional offerings that stimulate

deposit captures in a high-liquidity environment, and by Time Deposits, which increased via the same dynamics seen QoQ.

At the end of 2Q25, 69.2% of total deposits were low-cost (Demand + Savings).

Credicorp continues to lead the low-cost deposit market with a 40.3% share at the end of June.

|

|

Deposits

|

As of

|

% change

|

Currency

|

||||

|

S/000

|

Jun 24

|

Mar 25

|

Jun 25

|

QoQ

|

YoY

|

LC

|

FC

|

|

Demand deposits

|

50,657,031

|

53,992,480

|

49,237,039

|

-8.8%

|

-2.8%

|

47.2%

|

52.8%

|

|

Saving deposits

|

53,015,745

|

59,969,559

|

59,086,275

|

-1.5%

|

11.5%

|

61.3%

|

38.7%

|

|

Time deposits

|

43,504,883

|

39,779,546

|

42,361,180

|

6.5%

|

-2.6%

|

53.3%

|

46.7%

|

|

Severance indemnity deposits

|

3,358,408

|

2,921,196

|

3,268,583

|

11.9%

|

-2.7%

|

77.0%

|

23.0%

|

|

Interest payable

|

1,435,917

|

956,301

|

770,257

|

-19.5%

|

-46.4%

|

36.2%

|

63.8%

|

|

Low-cost deposits (1)

|

103,672,776

|

113,962,039

|

108,323,314

|

-4.9%

|

4.5%

|

54.9%

|

45.1%

|

|

Total Deposits

|

151,971,984

|

157,619,082

|

154,723,334

|

-1.8%

|

1.8%

|

54.8%

|

45.2%

|

|

|

A 7.7% reduction (-6.0% FX neutral) in the Demand Deposit balance; this evolution was mainly driven by a drop

in wholesale deposit volumes in LC, which reflects a seasonal impact associated with income tax payments, and secondarily, by a base effect given a temporary large deposit related to a Wholesale

client by last-quarter-end.

|

|

|

A 8.4% growth in (+10.2% FX neutral) in the balance for Time Deposits, which rose on the back of strategic

growth in deposit captures from wholesale clients at BCP Stand-alone.

|

|

|

A 14.1% increase (+17.7% FX neutral) in the balance for Savings Accounts, which was fueled mainly by BCP Stand-alone via Individuals. Growth was driven primarily by an uptick in LC deposits, which have been positively impacted by a differentiated transactional

offering that allows us to capture deposits in a high-liquidity environment, and secondarily by growth in the FC deposit balance, which was impacted by a drop in the exchange rate, which led clients

to dollarize their funds.

|

|

|

Growth of 3.8% (+7.9% FX neutral) in the balance for Time Deposits, which was fueled by an increase in volume at

BCP Stand-alone. This growth was primarily spurred by Wholesale Banking via the same dynamics seen QoQ.

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

02. Deposits

|

|

|

An increase of 1.2% (+5.5% neutral exchange rate) in the balance for Demand Deposits, which was mainly

driven by an uptick in the FC balance at BCP Stand-alone via wholesale deposits. This effect was partially offset by a decrease in the LC balance, which was

driven by the same dynamics in play QoQ.

|

|

Deposits by Currency and Type

(measured at quarter-end balance)

|

|

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

02. Deposits

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

| 03 |

Interest-earning Assets (IEA) and Funding

|

|

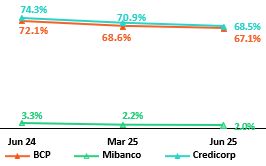

Excluding the impact on Credicorp’s balance sheet resulting from an accounting adjustment at BCP Bolivia, intended to reflect the currency

devaluation, the evolution of IEA and Funding presented the following dynamics:

QoQ, IEA dropped 1.1% following a contraction in the investment balance, which was driven mainly by a reduction in the portfolio of BCRP

certificates of deposits. Cash and due from banks also declined, following payment of an expired bond at BCP. Funding, in turn, dropped 0.8%, primarily on the back of a reduction in the balance for

Bonds and, secondarily, due to a drop in BCRP instruments after less liquidity was taken via this mechanism.

YoY, IEA grew 4.1%, fueled by growth in the balance of Cash and due from banks, which peaked in 4Q24 due to high liquidity last year. Finally, funding increased

3.2%, fueled by growth in Deposits, which was led by low-cost deposits. Growth in the latter was spurred by economic recovery and a consequent increase in transactional activity.

|

| 3.1. |

IEA

|

|

Interest earning assets

|

As of

|

% change

|

|||

|

S/000

|

Jun 24

|

Mar 25

|

Jun 25

|

QoQ

|

YoY

|

|

Cash and due from banks

|

27,157,901

|

37,521,839

|

34,206,000

|

-8.8%

|

26.0%

|

|

Total investments

|

52,426,146

|

55,604,610

|

51,603,447

|

-7.2%

|

-1.6%

|

|

Cash collateral, reverse repurchase agreements and securities borrowing

|

1,777,491

|

1,835,893

|

4,593,501

|

150.2%

|

158.4%

|

|

Loans

|

146,946,546

|

141,196,646

|

140,961,978

|

-0.2%

|

-4.1%

|

|

Total interest earning assets

|

228,308,084

|

236,158,988

|

231,364,926

|

-2.0%

|

1.3%

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

03. Interest-earning Assets (IEA) and Funding

|

| 3.2. |

Funding

|

|

Funding

|

As of

|

% change

|

|||

|

S/ 000

|

Jun 24

|

Mar 25

|

Jun 25

|

QoQ

|

YoY

|

|

Deposits and obligations

|

151,971,984

|

157,619,082

|

154,723,334

|

-1.8%

|

1.8%

|

|

Due to banks and correspondents

|

12,620,346

|

10,899,579

|

11,152,813

|

2.3%

|

-11.6%

|

|

BCRP instruments

|

5,542,892

|

7,064,476

|

5,096,459

|

-27.9%

|

-8.1%

|

|

Repurchase agreements with clients and third parties

|

2,146,797

|

3,094,138

|

6,168,934

|

99.4%

|

187.4%

|

|

Bonds and notes issued

|

17,953,508

|

14,391,733

|

12,112,403

|

-15.8%

|

-32.5%

|

|

Total funding

|

190,235,527

|

193,069,008

|

189,253,943

|

-2.0%

|

-0.5%

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

| 04 |

Net Interest income (NII)

|

|

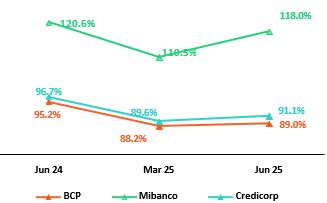

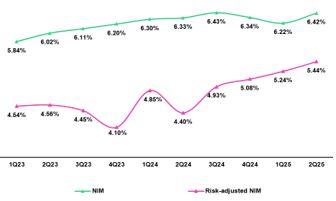

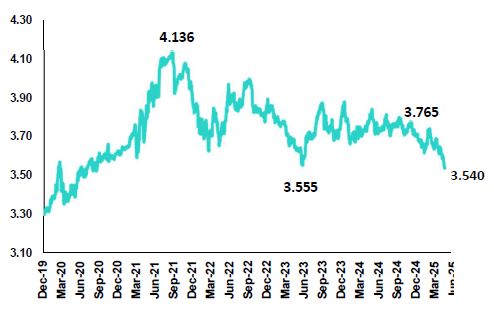

In 2Q25, Net Interest Income (NII) rose 1.2% QoQ mainly due to a drop

in interest on deposits, amid a downward trend in market interest rates.

YoY, NII ticked up 4.2%, driven mainly by a reduction in Interest and similar

expenses. This decrease was fueled by a drop in expenses for deposits, which were impacted primarily by declining interest rates and secondarily by an uptick in low-cost deposits’ share of the

funding structure.

NIM rose 20 bps QoQ to stand at 6.42%, driven mainly by a shift in the IEA mix

toward higher-yielding assets. It is important to note that risk-adjusted NIM continued to trend upward and hit a new high1 of 5.44%.

|

|

Net interest income

|

Quarter |

% change

|

Up to

|

% Change

|

||||

|

S/000

|

2Q24

|

1Q25

|

2Q25

|

QoQ

|

YoY

|

Jun 24

|

Jun 25

|

Jun 25 / Jun 24

|

|

Interest and Similar Income

|

4,935,238

|

4,894,790

|

4,922,292

|

0.6%

|

-0.3%

|

9,861,164

|

9,817,082

|

-0.4%

|

|

Interest and Similar Expenses

|

(1,466,774)

|

(1,322,778)

|

(1,306,921)

|

-1.2%

|

-10.9%

|

(2,966,577)

|

(2,629,699)

|

-11.4%

|

|

Interest Expense (excluding Net Insurance Financial Expenses)

|

(1,342,088)

|

(1,187,156)

|

(1,167,866)

|

-1.6%

|

-13.0%

|

(2,719,887)

|

(2,355,023)

|

-13.4%

|

|

Net Insurance Financial Expenses

|

(124,686)

|

(135,622)

|

(139,055)

|

2.5%

|

11.5%

|

(246,690)

|

(274,676)

|

11.3%

|

|

Net Interest, similar income and expenses

|

3,468,464

|

3,572,012

|

3,615,371

|

1.2%

|

4.2%

|

6,894,587

|

7,187,383

|

4.2%

|

|

Balances

|

||||||||

|

Average Interest Earning Assets (IEA)

|

227,161,179

|

238,435,117

|

233,761,957

|

-2.0%

|

2.9%

|

226,444,444

|

236,038,086

|

4.2%

|

|

Average Funding

|

187,904,862

|

195,997,306

|

191,161,476

|

-2.5%

|

1.7%

|

187,491,207

|

194,089,774

|

3.5%

|

|

Yields

|

||||||||

|

Yield on IEAs

|

8.69%

|

8.21%

|

8.42%

|

21 bps

|

-27 bps

|

8.71%

|

8.32%

|

-39 bps

|

|

Cost of Funds(1)

|

2.86%

|

2.42%

|

2.44%

|

2 bps

|

-42 bps

|

2.90%

|

2.43%

|

-47 bps

|

|

Net Interest Margin (NIM)(1)

|

6.33%

|

6.22%

|

6.42%

|

20 bps

|

9 bps

|

6.31%

|

6.32%

|

1 bps

|

|

Risk-Adjusted Net Interest Margin(1)

|

4.40%

|

5.24%

|

5.44%

|

20 bps

|

104 bps

|

4.62%

|

5.34%

|

72 bps

|

|

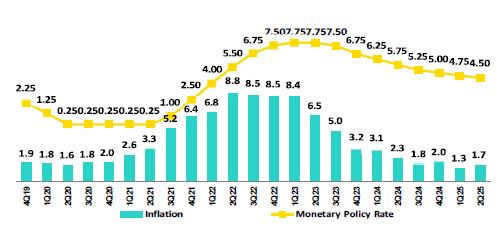

Peru's Reference Rate

|

5.75%

|

4.75%

|

4.50%

|

-25 bps

|

-125 bps

|

5.75%

|

4.50%

|

-125 bps

|

|

FED funds rate

|

5.50%

|

4.50%

|

4.50%

|

0 bps

|

-100 bps

|

5.50%

|

4.50%

|

-100 bps

|

|

1

|

Since the implementation of IFRS 9 in 2018.

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

04. Net Interest income (NII)

|

|

Interest Income / IEA

|

2Q24 |

|

1Q25

|

|

2Q25 |

|

Jun 24

|

|

Jun 25

|

|||||||

|

S/ millions

|

Average

|

|

|

Average

|

|

|

Average

|

|

|

Average

|

Average

|

|||||

|

Balance

|

Income | Yields |

Balance

|

Income | Yields |

Balance

|

Income | Yields |

Balance

|

Income

|

Yields

|

Balance

|

Income

|

Yields

|

||

|

Total (LC + FC)

|

||||||||||||||||

|

Cash and equivalents

|

29,146

|

320

|

4.4%

|

38,821

|

345

|

3.6%

|

35,864

|

342

|

3.8%

|

26,568

|

654

|

4.9%

|

37,162

|

687

|

3.7%

|

|

|

Other IEA

|

1,652

|

26

|

6.3%

|

1,434

|

19

|

5.3%

|

3,215

|

69

|

8.6%

|

1,594

|

54

|

6.8%

|

2,813

|

89

|

6.3%

|

|

|

Investments

|

52,491

|

668

|

5.1%

|

54,716

|

683

|

5.0%

|

53,604

|

670

|

5.0%

|

52,320

|

1,362

|

5.2%

|

52,715

|

1,353

|

5.1%

|

|

|

Loans

|

143,873

|

3,922

|

10.9%

|

143,465

|

3,848

|

10.7%

|

141,079

|

3,841

|

10.9%

|

145,961

|

7,790

|

10.7%

|

143,348

|

7,688

|

10.7%

|

|

|

Total IEA

|

227,162

|

4,936

|

8.7%

|

238,436

|

4,895

|

8.2%

|

233,762

|

4,922

|

8.4%

|

226,443

|

9,860

|

8.7%

|

236,038

|

9,817

|

8.3%

|

|

|

IEA (LC)

|

57.4%

|

69.4%

|

10.5%

|

55.6%

|

70.5%

|

10.4%

|

56.5%

|

71.1%

|

10.6%

|

57.2%

|

69.6%

|

10.6%

|

55.6%

|

70.8%

|

10.6%

|

|

|

IEA (FC)

|

42.6%

|

30.6%

|

6.2%

|

44.4%

|

29.5%

|

5.5%

|

43.5%

|

28.9%

|

5.6%

|

42.8%

|

30.4%

|

6.2%

|

44.4%

|

29.2%

|

5.5%

|

|

Interest Income / Funding

|

2Q24 | 1Q25 |

|

2Q25 |

|

Jun 24

|

|

Jun 25

|

||||||||

|

S/ millions

|

Average

|

|

|

Average

|

|

|

Average

|

|

|

Average

|

Average

|

|||||

|

Balance

|

Expense | Yields |

Balance

|

Expense |

Yields |

Balance

|

Expense |

Yields |

Balance

|

Expense

|

Yields

|

Balance

|

Expense

|

Yields

|

||

|

Total (LC + FC)

|

||||||||||||||||

|

Deposits

|

149,914

|

738

|

2.0%

|

159,731

|

620

|

1.6%

|

156,171

|

541

|

1.4%

|

149,839

|

1,518

|

2.0%

|

158,283

|

1,160

|

1.5%

|

|

|

BCRP + Due to Banks

|

17,851

|

268

|

6.0%

|

17,683

|

266

|

6.0%

|

17,107

|

265

|

6.2%

|

18,952

|

532

|

5.6%

|

16,825

|

532

|

6.3%

|

|

|

Bonds and Notes

|

17,747

|

200

|

4.5%

|

15,830

|

168

|

4.2%

|

13,252

|

193

|

5.8%

|

16,274

|

398

|

4.9%

|

14,690

|

362

|

4.9%

|

|

|

Others

|

2,392

|

261

|

43.6%

|

2,754

|

269

|

39.1%

|

4,632

|

307

|

26.5%

|

2,427

|

519

|

42.8%

|

4,291

|

576

|

26.8%

|

|

|

Total Funding

|

187,904

|

1,467

|

3.1%

|

195,998

|

1,323

|

2.7%

|

191,162

|

1,306

|

2.7%

|

187,492

|

2,967

|

3.2%

|

194,089

|

2,630

|

2.7%

|

|

|

Funding (LC)

|

49.5%

|

51.7%

|

3.3%

|

51.7%

|

53.4%

|

2.8%

|

52.4%

|

51.9%

|

2.7%

|

49.7%

|

51.8%

|

3.3%

|

51.1%

|

52.7%

|

2.8%

|

|

|

Funding (FC)

|

50.5%

|

48.3%

|

3.0%

|

48.3%

|

46.6%

|

2.6%

|

47.6%

|

48.1%

|

2.8%

|

50.3%

|

48.2%

|

3.0%

|

48.9%

|

47.3%

|

2.6%

|

|

|

NIM(1)

|

227,162

|

3,469

|

6.1%

|

238,436

|

3,572

|

6.0%

|

233,762

|

3,616

|

6.2%

|

226,443

|

6,893

|

6.1%

|

236,038

|

7,187

|

6.1%

|

|

|

NIM (LC)

|

57.4%

|

76.9%

|

8.2%

|

55.6%

|

76.8%

|

8.3%

|

56.5%

|

78.0%

|

8.5%

|

57.2%

|

77.3%

|

8.2%

|

55.6%

|

77.4%

|

8.5%

|

|

|

NIM (FC)

|

42.6%

|

23.1%

|

3.3%

|

44.4%

|

23.2%

|

3.1%

|

43.5%

|

22.0%

|

3.1%

|

42.8%

|

22.7%

|

3.2%

|

44.4%

|

22.6%

|

3.1%

|

|

(1)

|

Unlike the NIM figure calculated according to the formula in Appendix 12.8, the NIM presented in this table includes “Financial Expense associated with the

insurance and reinsurance activity, net”.

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

04. Net Interest income (NII)

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

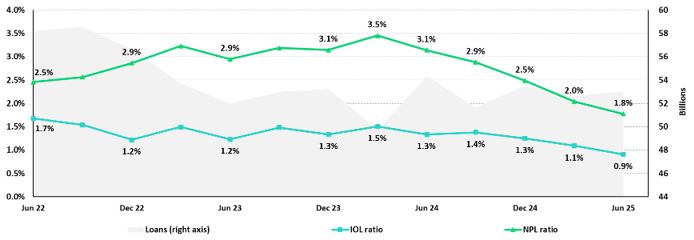

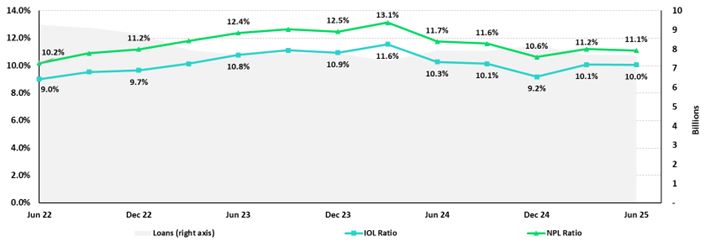

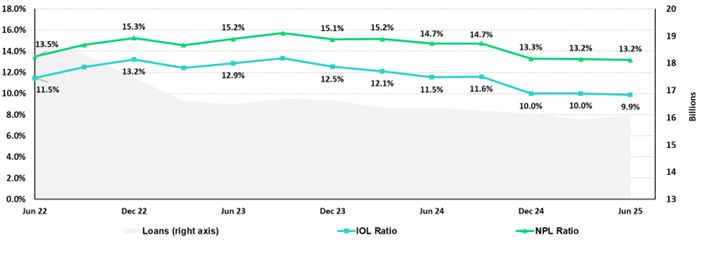

| 05 |

Portfolio Quality and Provisions

|

|

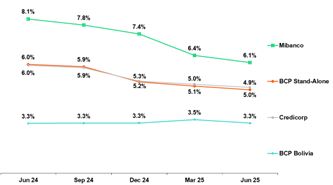

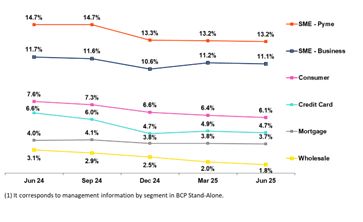

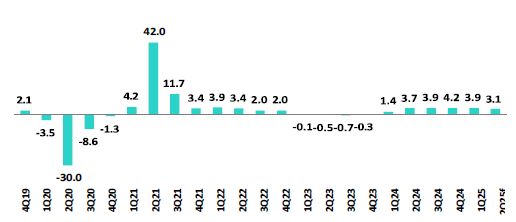

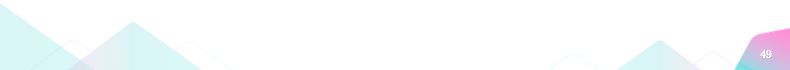

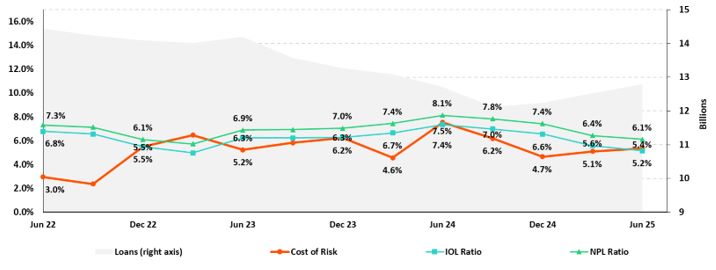

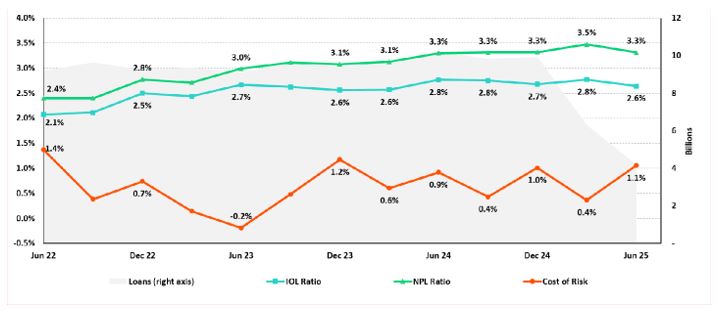

Portfolio quality ratios have reported substantial and continuous

improvements over the last year, driven by strengthened risk management measures and supported by improvements in payment performance and in the Peruvian economy.

QoQ, the drop in NPLs at BCP Stand-alone was fueled primarily by debt payments in Wholesale. At

Mibanco, the reduction in NPLs was driven by a decrease in overdue loans. In this context, the NPL ratio dropped 14 bps and 102 bps QoQ and YoY respectively to stand at 5.0% at quarter-end.

QoQ, provisions dropped, fueled by BCP Stand-Alone and mainly through (i) an improvement in

payment performance in Wholesale Banking, and secondarily (ii) through risk model calibrations in Individuals. This evolution was partially offset by growth in provisions at Mibanco, which

reported a shift in the portfolio mix. In this context, the cost of risk remained stable QoQ but fell 141 bps YoY to stand at 1.6% for 2Q25.

|

|

5.1

|

Portfolio Quality

|

|

Loan Portfolio quality and Delinquency ratios

|

As of

|

% change

|

|||

|

S/000

|

2Q24

|

1Q25

|

2Q25

|

QoQ

|

YoY

|

|

Total loans (Quarter-end balance)

|

146,946,546

|

141,196,646

|

140,961,978

|

-0.2%

|

-4.1%

|

|

Write-offs

|

994,556

|

716,585

|

581,373

|

-18.9%

|

-41.5%

|

|

Internal overdue loans (IOLs)

|

6,230,761

|

5,206,395

|

5,044,212

|

-3.1%

|

-19.0%

|

|

Internal overdue loans over 90-days

|

4,760,837

|

4,232,843

|

4,171,379

|

-1.5%

|

-12.4%

|

|

Refinanced loans

|

2,555,135

|

2,001,282

|

1,947,709

|

-2.7%

|

-23.8%

|

|

Non-performing loans (NPLs)

|

8,785,896

|

7,207,677

|

6,991,921

|

-3.0%

|

-20.4%

|

|

IOL ratio

|

4.2%

|

3.7%

|

3.6%

|

-11 bps

|

-66 bps

|

|

IOL over 90-days ratio

|

3.2%

|

3.0%

|

3.0%

|

-4 bps

|

-28 bps

|

|

NPL ratio

|

6.0%

|

5.1%

|

5.0%

|

-14 bps

|

-102 bps

|

|

|

|

|

|

|

|

| |

Earnings Release 2Q / 2025

|

Analysis of 2Q25 Consolidated Results

|

|

05. Portfolio Quality and Provisions

|

|

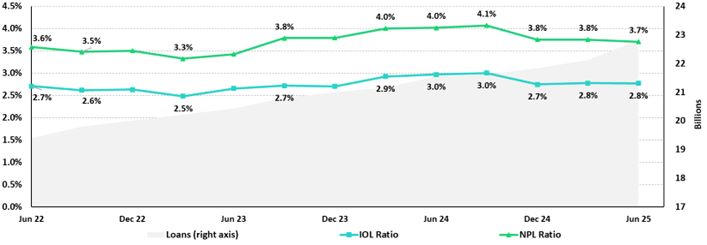

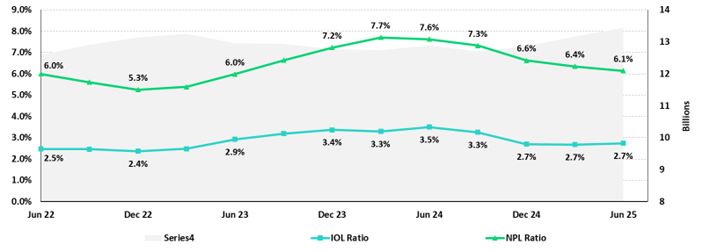

NPL Ratio for Total Loans

|

|

|

|

•

|

Mibanco, where the NPL ratio fell 32 bps, driven mainly by a drop in NPL loan volumes and secondarily by loan growth.

|

|

NPL Ratio for Total Loans at BCP (1)

|

|

|

|

|

•