Exhibit 99.1

Investor Presentation August 2025 Driving Value in Therapeutic and Aesthetic

Dermatology NASDAQ: SSKN

Safe Harbor Statement 2 This presentation includes “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks, uncertainties and other factors. All statements other than statements of historical fact are statements that could be deemed

forward-looking statements, including any statements of the plans, strategies and objectives of management for future operations; any statements regarding product development, product extensions, product integration or product marketing; any

statements regarding continued compliance with government regulations, changing legislation or regulatory environments; any statements of expectation or belief and any statements of assumptions underlying any of the foregoing. In addition,

there are risks and uncertainties related to successfully integrating the products and employees of the Company, as well as the ability to ensure continued regulatory compliance, performance and/or market growth. These risks, uncertainties

and other factors, and the general risks associated with the businesses of the Company described in the reports and other documents filed with the SEC, could cause actual results to differ materially from those referred to, implied or

expressed in the forward-looking statements. The Company cautions readers not to rely on these forward-looking statements. All forward-looking statements are based on information currently available to the Company and are qualified in their

entirety by this cautionary statement. The Company anticipates that subsequent events and developments will cause its views to change. The information contained in this presentation speaks as of the date hereof and the Company has or

undertakes no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

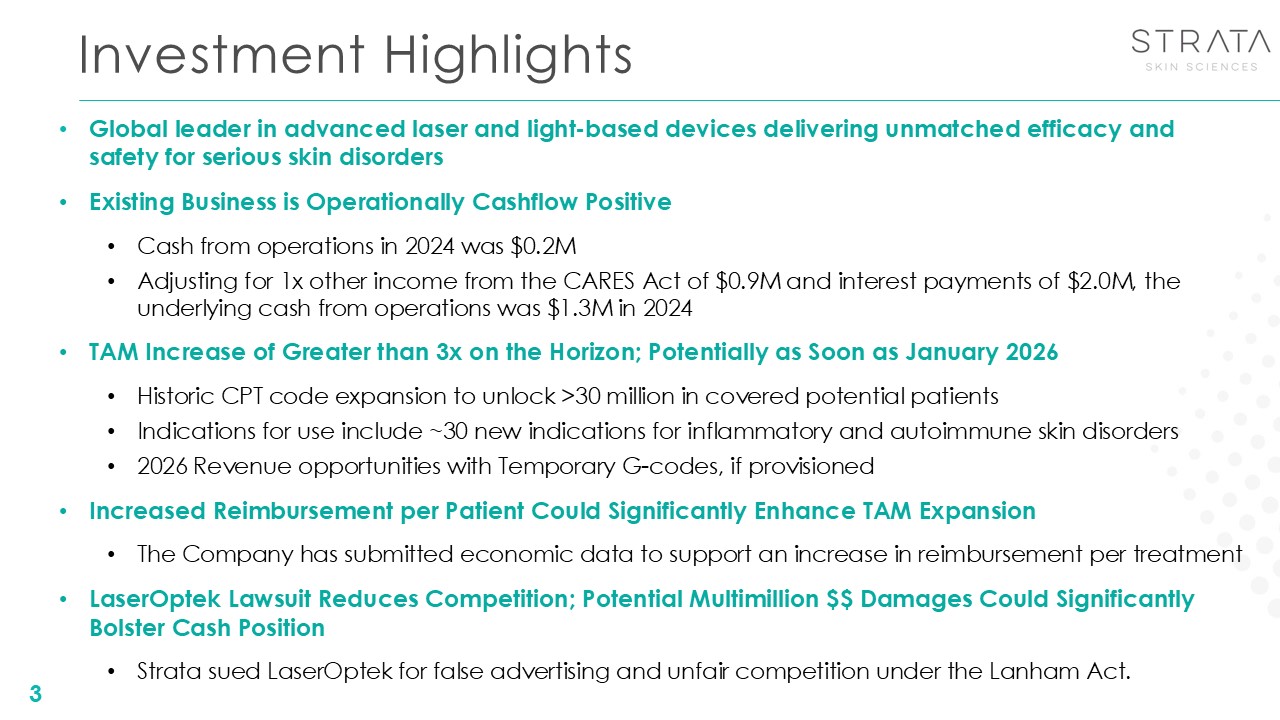

Investment Highlights 3 Global leader in advanced laser and light-based

devices delivering unmatched efficacy and safety for serious skin disorders Existing Business is Operationally Cashflow Positive Cash from operations in 2024 was $0.2M Adjusting for 1x other income from the CARES Act of $0.9M and interest

payments of $2.0M, the underlying cash from operations was $1.3M in 2024 TAM Increase of Greater than 3x on the Horizon; Potentially as Soon as January 2026 Historic CPT code expansion to unlock >30 million in covered potential

patients Indications for use include ~30 new indications for inflammatory and autoimmune skin disorders 2026 Revenue opportunities with Temporary G-codes, if provisioned Increased Reimbursement per Patient Could Significantly Enhance TAM

Expansion The Company has submitted economic data to support an increase in reimbursement per treatment LaserOptek Lawsuit Reduces Competition; Potential Multimillion $$ Damages Could Significantly Bolster Cash Position Strata sued

LaserOptek for false advertising and unfair competition under the Lanham Act.

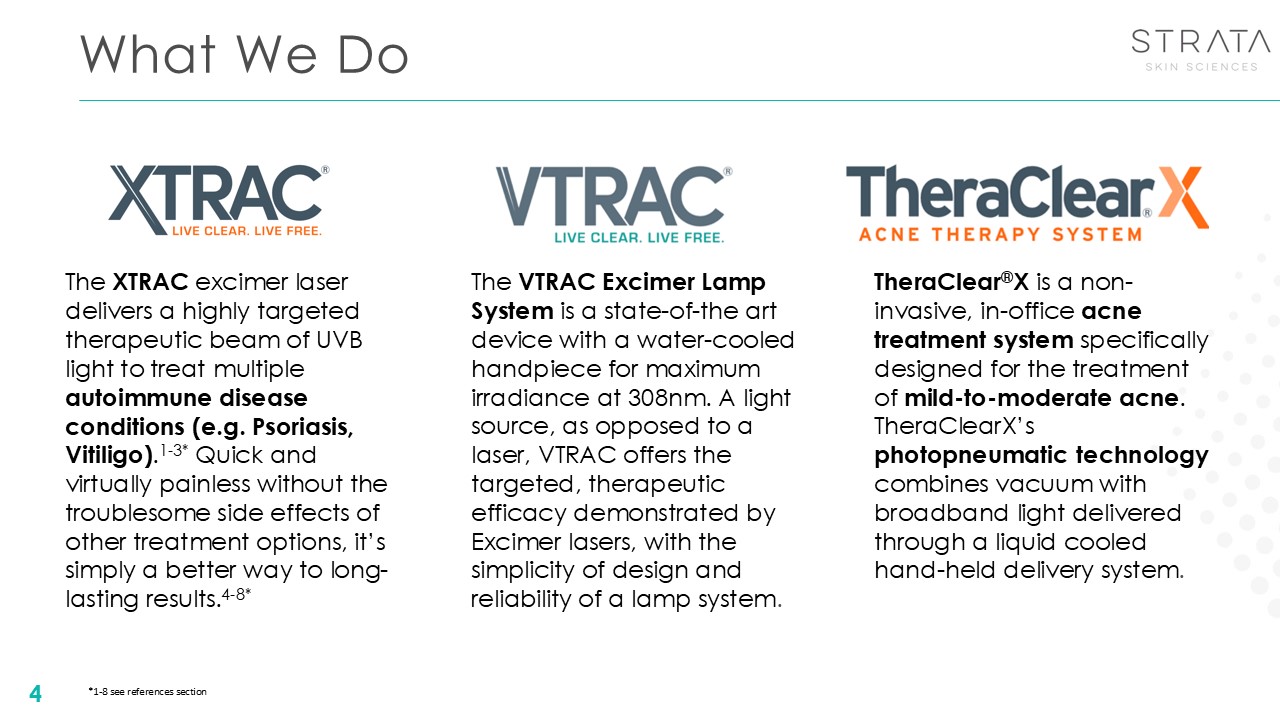

What We Do 4 The XTRAC excimer laser delivers a highly targeted therapeutic

beam of UVB light to treat multiple autoimmune disease conditions (e.g. Psoriasis, Vitiligo).1-3* Quick and virtually painless without the troublesome side effects of other treatment options, it’s simply a better way to long-lasting

results.4-8* TheraClear®X is a non-invasive, in-office acne treatment system specifically designed for the treatment of mild-to-moderate acne. TheraClearX’s photopneumatic technology combines vacuum with broadband light delivered through a

liquid cooled hand-held delivery system. The VTRAC Excimer Lamp System is a state-of-the art device with a water-cooled handpiece for maximum irradiance at 308nm. A light source, as opposed to a laser, VTRAC offers the targeted, therapeutic

efficacy demonstrated by Excimer lasers, with the simplicity of design and reliability of a lamp system. *1-8 see references section

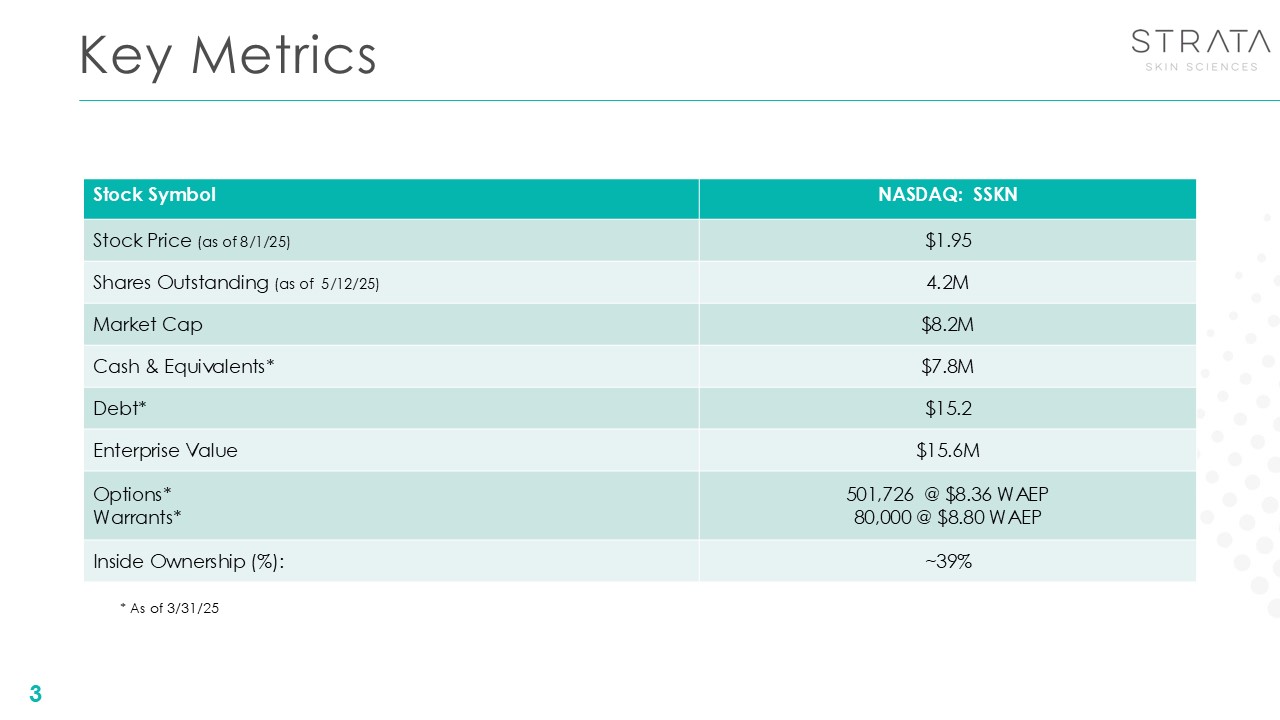

Key Metrics 3 Stock Symbol NASDAQ: SSKN Stock Price (as of

8/1/25) $1.95 Shares Outstanding (as of 5/12/25) 4.2M Market Cap $8.2M Cash & Equivalents* $7.8M Debt* $15.2 Enterprise Value $15.6M Options* Warrants* 501,726 @ $8.36 WAEP 80,000 @ $8.80 WAEP Inside Ownership

(%): ~39% * As of 3/31/25

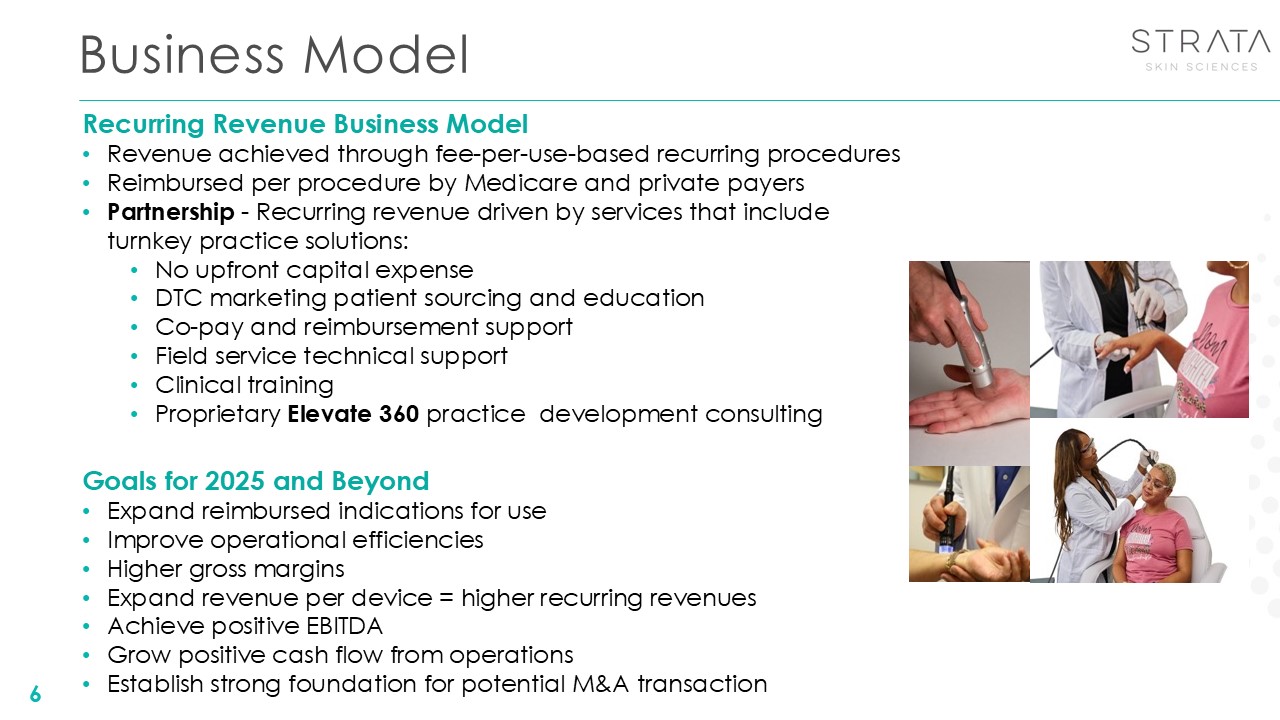

Business Model Recurring Revenue Business Model Revenue achieved through

fee-per-use-based recurring procedures Reimbursed per procedure by Medicare and private payers Partnership - Recurring revenue driven by services that include turnkey practice solutions: No upfront capital expense DTC marketing patient

sourcing and education Co-pay and reimbursement support Field service technical support Clinical training Proprietary Elevate 360 practice development consulting Goals for 2025 and Beyond Expand reimbursed indications for use Improve

operational efficiencies Higher gross margins Expand revenue per device = higher recurring revenues Achieve positive EBITDA Grow positive cash flow from operations Establish strong foundation for potential M&A transaction 6

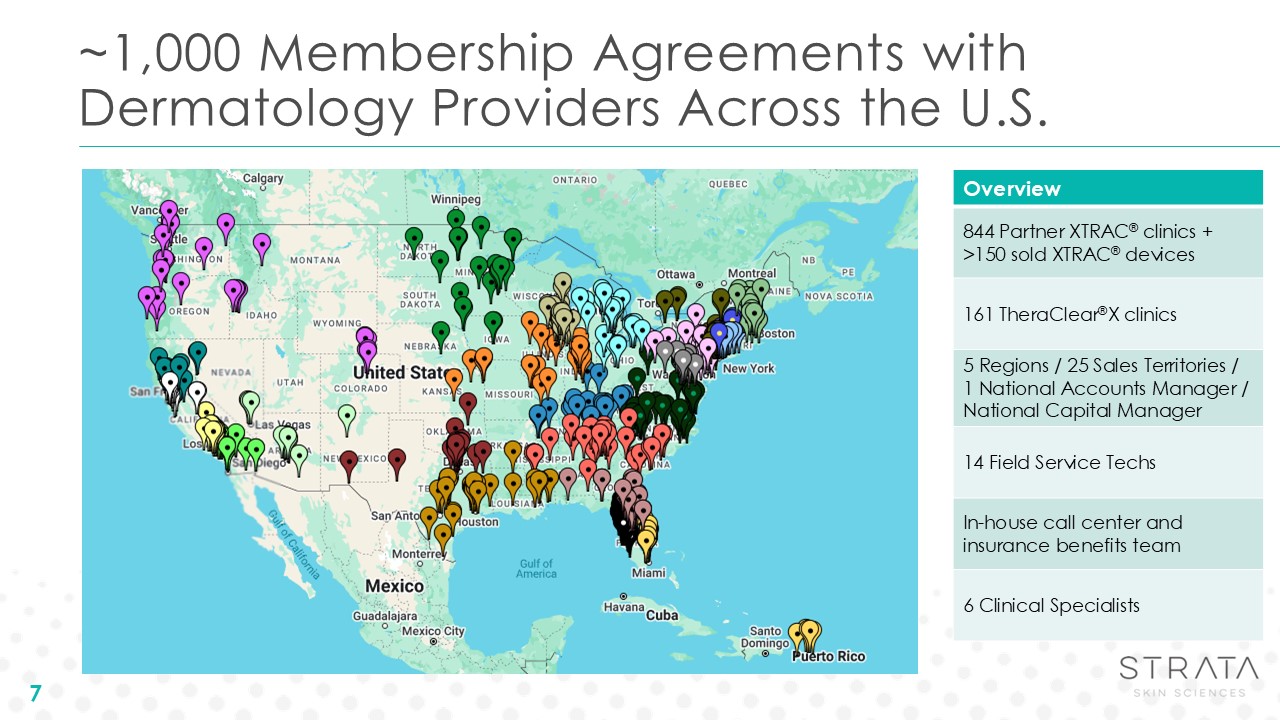

~1,000 Membership Agreements with Dermatology Providers Across the

U.S. 7 Overview 844 Partner XTRAC® clinics + >150 sold XTRAC® devices 161 TheraClear®X clinics 5 Regions / 25 Sales Territories / 1 National Accounts Manager / National Capital Manager 14 Field Service Techs In-house call center and

insurance benefits team 6 Clinical Specialists

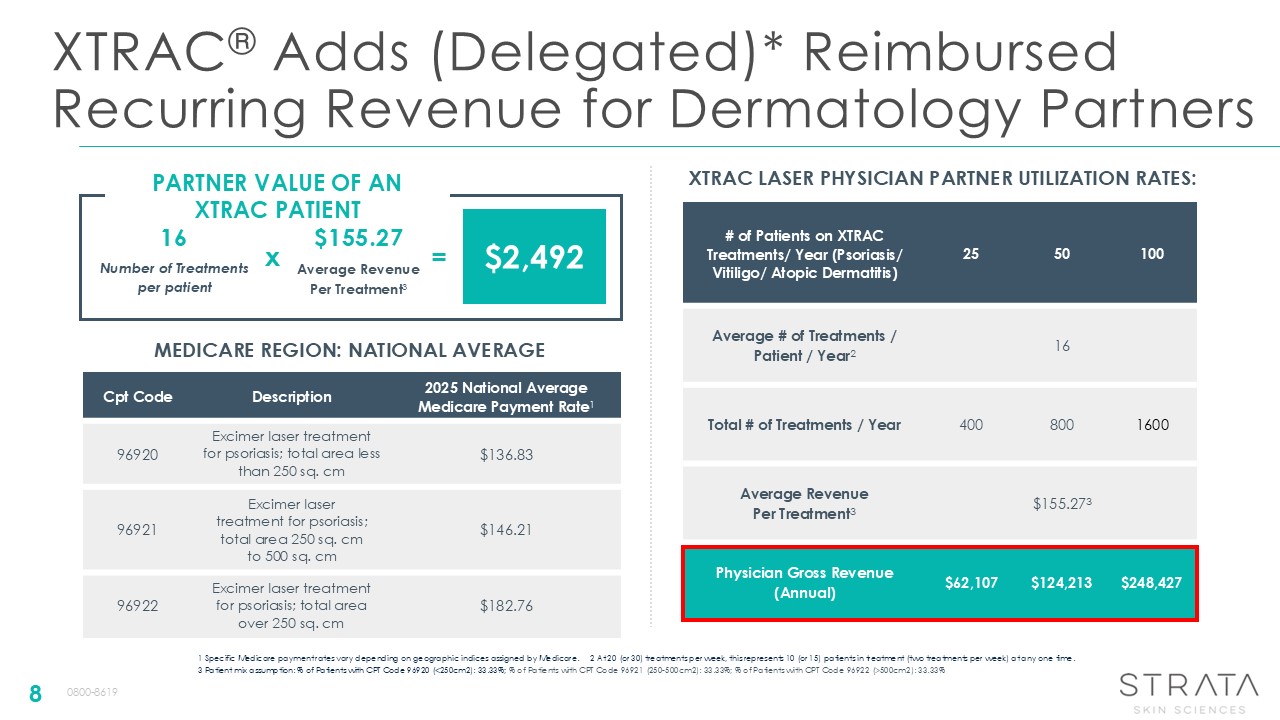

XTRAC® Adds (Delegated)* Reimbursed Recurring Revenue for Dermatology

Partners 8 1 Specific Medicare payment rates vary depending on geographic indices assigned by Medicare. 2 At 20 (or 30) treatments per week, this represents 10 (or 15) patients in treatment (two treatments per week) at any one time. 3

Patient mix assumption: % of Patients with CPT Code 96920 (<250cm2): 33.33%; % of Patients with CPT Code 96921 (250-500cm2): 33.33%; % of Patients with CPT Code 96922 (>500cm2): 33.33% Cpt Code Description 2025 National Average

Medicare Payment Rate1 96920 Excimer laser treatment for psoriasis; total area less than 250 sq. cm $136.83 96921 Excimer laser treatment for psoriasis; total area 250 sq. cm to 500 sq. cm $146.21 96922 Excimer laser treatment for

psoriasis; total area over 250 sq. cm $182.76 MEDICARE REGION: NATIONAL AVERAGE # of Patients on XTRAC Treatments/ Year (Psoriasis/ Vitiligo/ Atopic Dermatitis) 25 50 100 Average # of Treatments / Patient / Year2 16 Total # of

Treatments / Year 400 800 1600 Average Revenue Per Treatment3 $155.273 Physician Gross Revenue (Annual) $62,107 $124,213 $248,427 XTRAC LASER PHYSICIAN PARTNER UTILIZATION RATES: PARTNER VALUE OF AN XTRAC PATIENT Number of

Treatments per patient Average Revenue Per Treatment3 16 $155.27 $2,492 x = 0800-8619

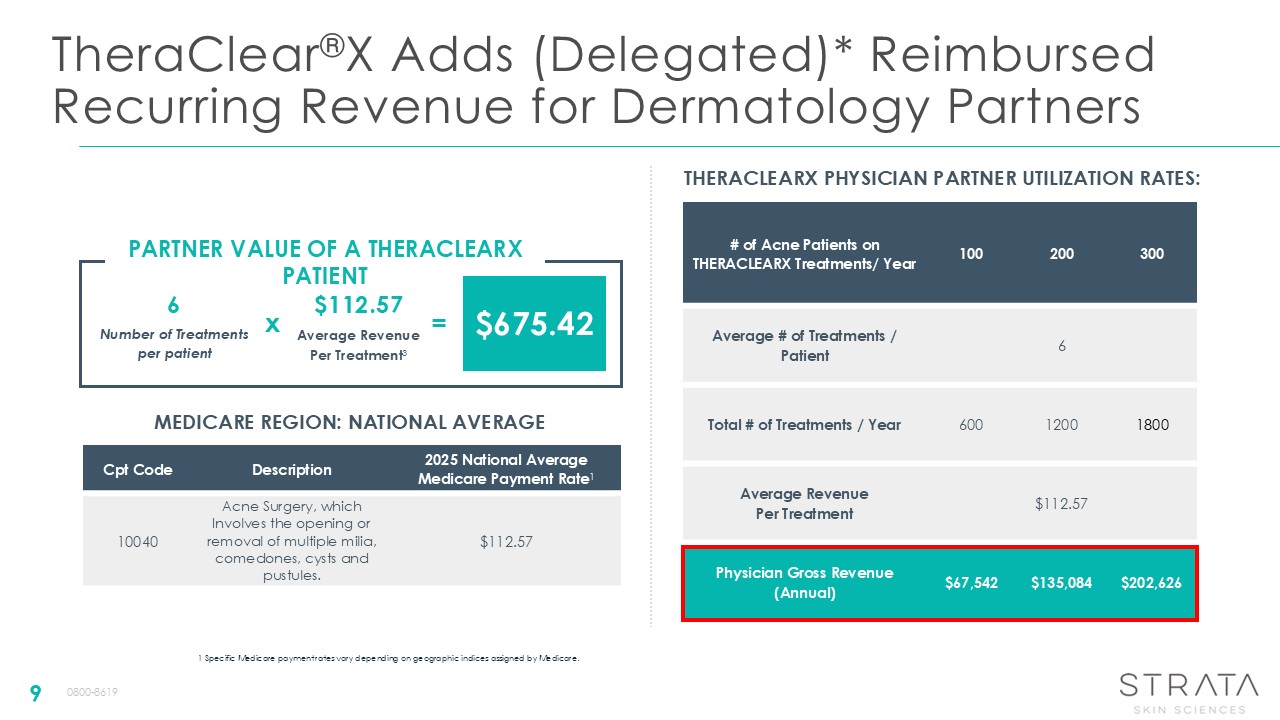

TheraClear®X Adds (Delegated)* Reimbursed Recurring Revenue for Dermatology

Partners 9 1 Specific Medicare payment rates vary depending on geographic indices assigned by Medicare. Cpt Code Description 2025 National Average Medicare Payment Rate1 10040 Acne Surgery, which Involves the opening or removal of

multiple milia, comedones, cysts and pustules. $112.57 MEDICARE REGION: NATIONAL AVERAGE # of Acne Patients on THERACLEARX Treatments/ Year 100 200 300 Average # of Treatments / Patient 6 Total # of Treatments /

Year 600 1200 1800 Average Revenue Per Treatment $112.57 Physician Gross Revenue (Annual) $67,542 $135,084 $202,626 THERACLEARX PHYSICIAN PARTNER UTILIZATION RATES: PARTNER VALUE OF A THERACLEARX PATIENT Number of Treatments per

patient Average Revenue Per Treatment3 6 $112.57 $675.42 x = 0800-8619

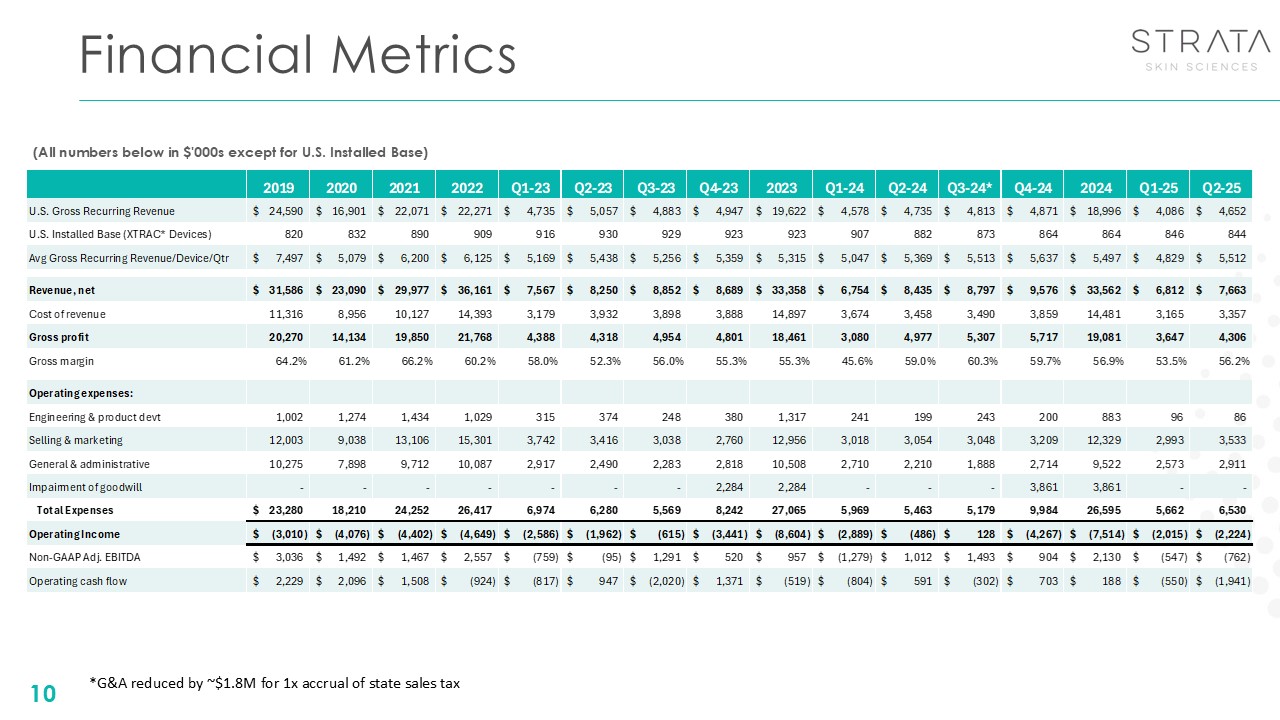

Financial Metrics 10 (All numbers below in $'000s except for U.S. Installed

Base) *G&A reduced by ~$1.8M for 1x accrual of state sales tax

Diverse Dermatology Market OpportunitiesPsoriasis - $20.1B1, Vitiligo - $1.2B2,

Eczema - $11.8B3, Acne - $5.5B4 11 30M Patients in the U.S. Psoriasis – 8M / Vitiligo - 5M / Eczema - 18M Fortune Business Insights Market Report 2019; 2016-2018 historical, 2019 base year, 2020-2027 projected Fortune Business Insights

Market Report 2018; 2015-2017 historical, 2018 base year, 2019-2026 projected Market Data Forecast Analysis Report 2020; 2020 base year, 2021-2026 projected Strata Skin Sciences 50M+ Acne Patients in the U.S.

STRATA – Expansion and Growth Leverage Strata’s Unique and Proven Business

Model Best-in-class devices Recurring revenue driven by DTC and internally-driven, growing installed base Turn-key services suite for practices without an upfront capital spend Elevate 360 Consulting - Optimizing growth through Recurring

Revenue per Device DTC marketing in U.S. with potential 40% revenue increase /device More rigorous sales and marketing strategy Focused growth initiatives targeting double digit revenue growth and positive cash flow 12

Newly Expanded Indications & Enhanced Reimbursement Unlocking

Growth 13 May 2025: CPT ® Editorial Summary of Panel Actions | AMA AMA accepted CPT code revision is effective from 1/1/202 Triples Strata’s XTRAC Addressable Patient Population From ~10M (psoriasis only) to 30M+ patients covering all

Inflammatory Skin Diseases, including vitiligo, atopic dermatitis, alopecia areata, and more, effective 1/1/27 Increases Economic Value for both Providers & Strata Accelerating access through Temporary G-codes to potentially commence

new treatment revenue in 2026 Clear Path to Value: Bigger patient pool & improved economics for providers and Strata Higher per-procedure revenue potential from proposed increases for device-related practice expense values In May 2025,

the AMA CPT Editorial Panel revised CPT codes, enabling reimbursement for 30 new indications with its the XTRAC excimer laser

Value Drivers 2025 Initiatives To Increase Growth In Recurring Revenue Per

Device In The U.S. Market 14 Emphasis on higher per practice performance through improved patient lead-to-procedure conversion and high touch, value-add support services i.e., reimbursement administration, scheduling, and enhanced process

efficiencies Strategic Placements - Reduce lower performing practices, redistributing devices among growing Greater Efficiency and Treatment Capacity - Enhanced turn-key marketing, administration and reimbursement More rigorous sales and

marketing strategies and processes Increased revenue/device - Emphasis on DTC marketing (social media advertising) in U.S. Initiatives could collectively grow revenue by double digit percent

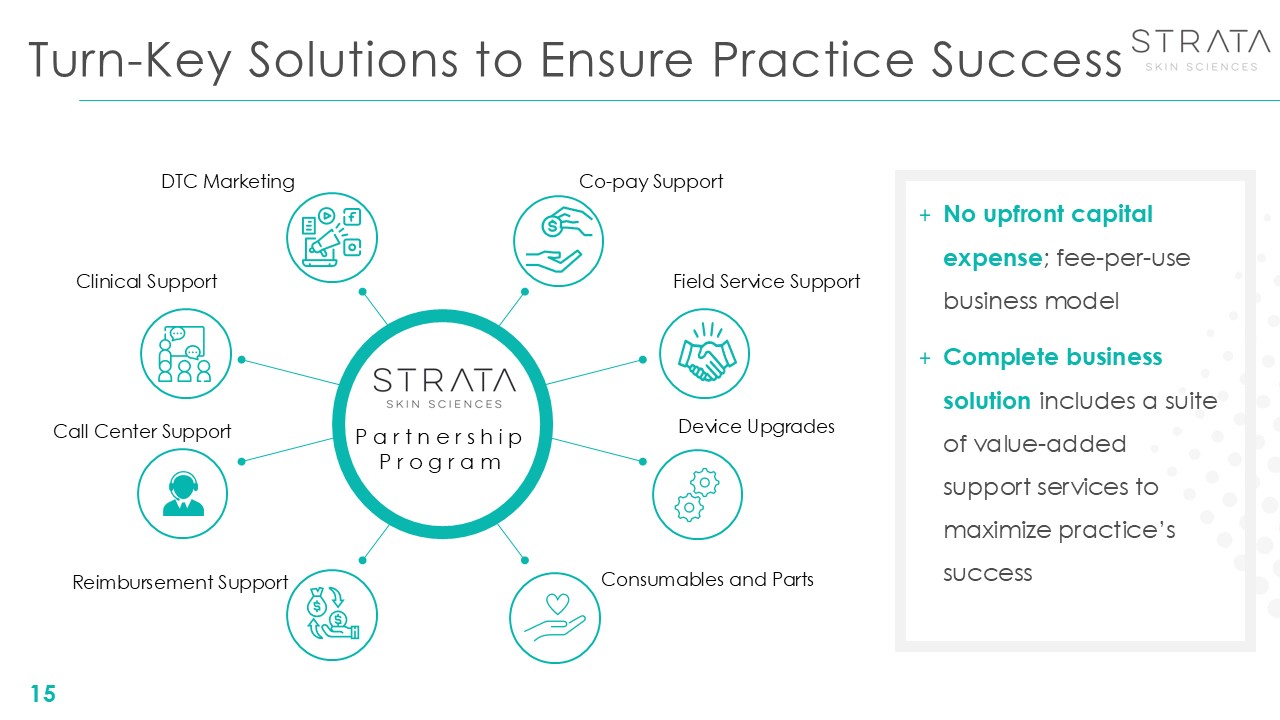

Turn-Key Solutions to Ensure Practice Success 15 No upfront capital expense;

fee-per-use business model Complete business solution includes a suite of value-added support services to maximize practice’s success Clinical Support Reimbursement Support Call Center Support Field Service Support Consumables and

Parts Device Upgrades Co-pay Support DTC Marketing PartnershipProgram

Unique Go-to-Market Strategy 16 Partners supported through a complete business

solution model PE-backed Group Partnership accounts represent 37% of XTRAC domestic recurring accounts

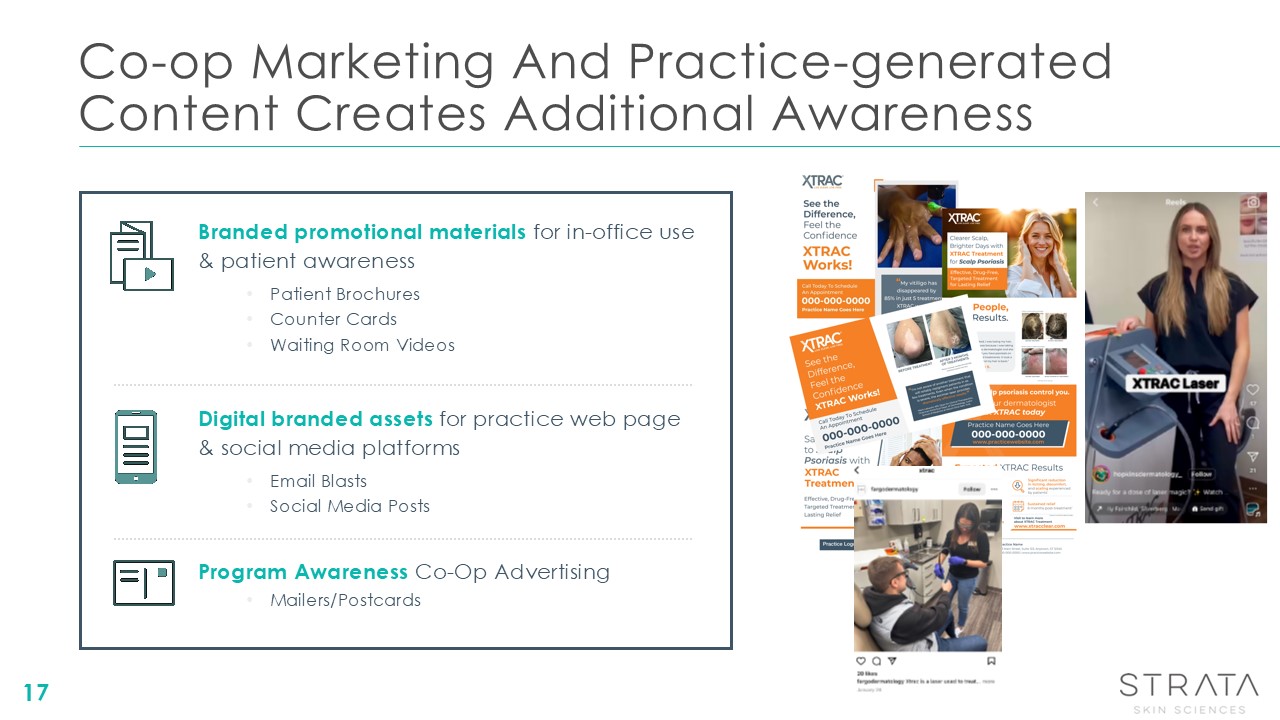

Co-op Marketing And Practice-generated Content Creates Additional

Awareness 17 Branded promotional materials for in-office use & patient awareness Patient Brochures Counter Cards Waiting Room Videos Digital branded assets for practice web page & social media platforms Email Blasts Social

Media Posts Program Awareness Co-Op Advertising Mailers/Postcards

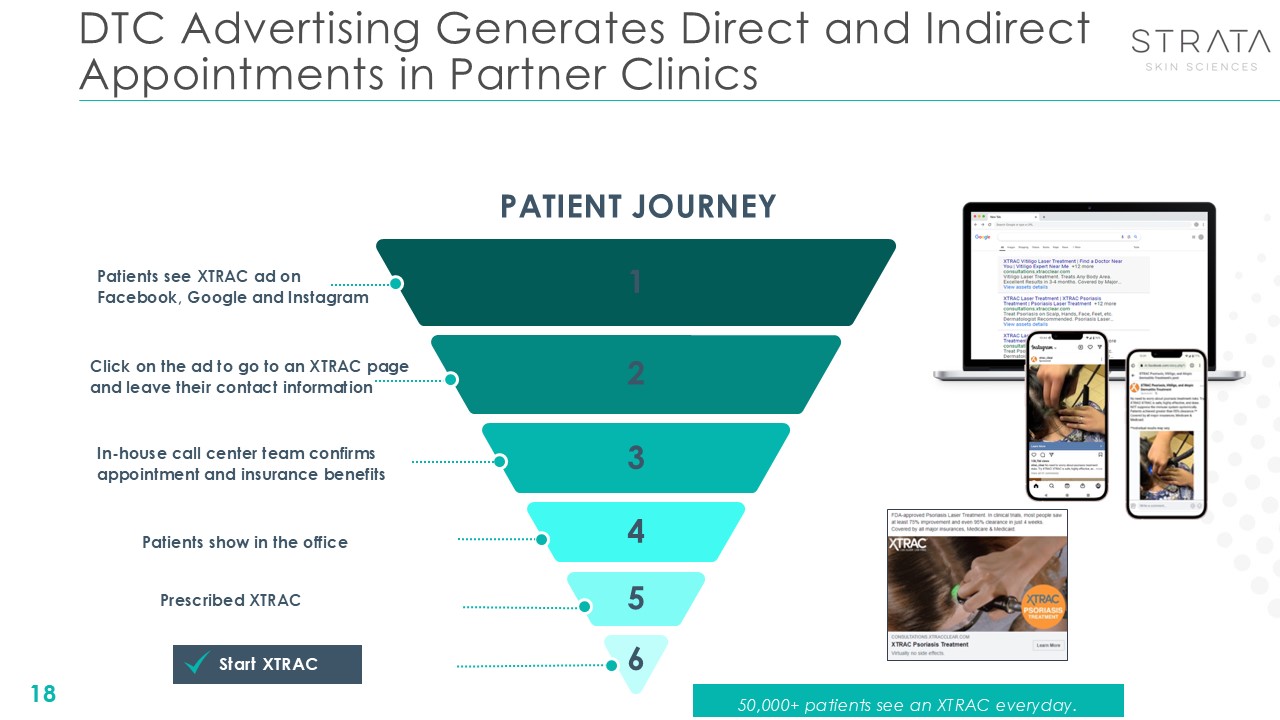

DTC Advertising Generates Direct and Indirect Appointments in Partner Clinics

18 PATIENT JOURNEY Patients see XTRAC ad on Facebook, Google and Instagram Click on the ad to go to an XTRAC page and leave their contact information In-house call center team confirms appointment and insurance benefits Patients show

in the office Prescribed XTRAC Start XTRAC 1 2 3 4 5 6 50,000+ patients see an XTRAC everyday.

DTC Core Driver for Recurring Revenue 19 DTC drives patient population in

the clinic at a 2:1 ratio, increasing organic prescribed patients (Halo Effect).

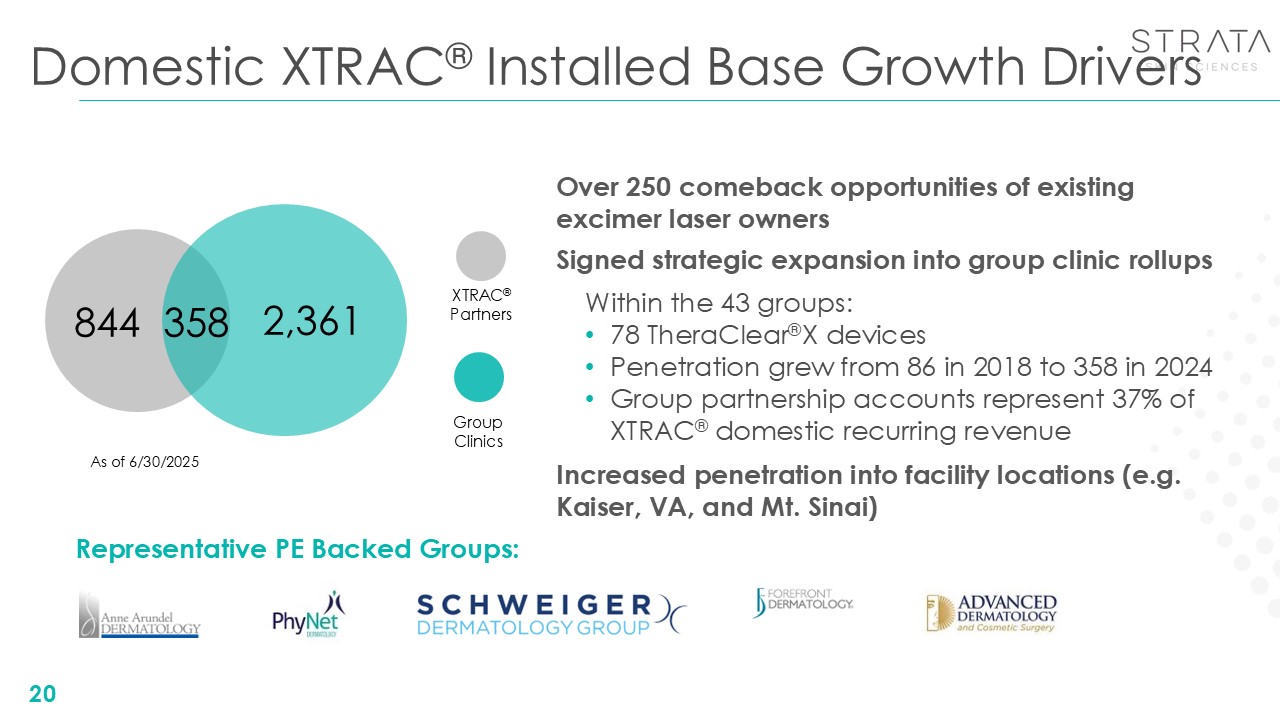

Domestic XTRAC® Installed Base Growth Drivers 844 2,361 358 As of

6/30/2025 Signed strategic expansion into group clinic rollups Within the 43 groups: 78 TheraClear®X devices Penetration grew from 86 in 2018 to 358 in 2024 Group partnership accounts represent 37% of XTRAC® domestic recurring

revenue XTRAC®Partners GroupClinics 20 Representative PE Backed Groups: Over 250 comeback opportunities of existing excimer laser owners Increased penetration into facility locations (e.g. Kaiser, VA, and Mt. Sinai)

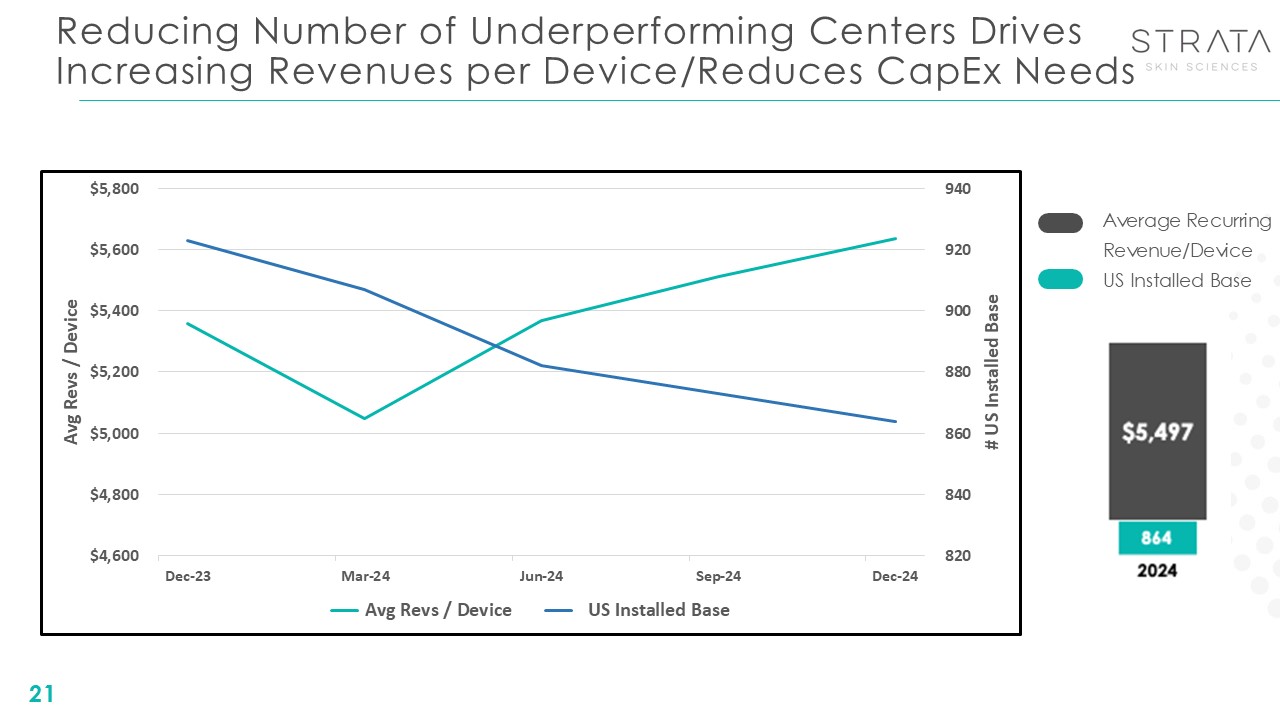

Reducing Number of Underperforming Centers Drives Increasing Revenues per

Device/Reduces CapEx Needs 21 Average Recurring Revenue/Device US Installed Base

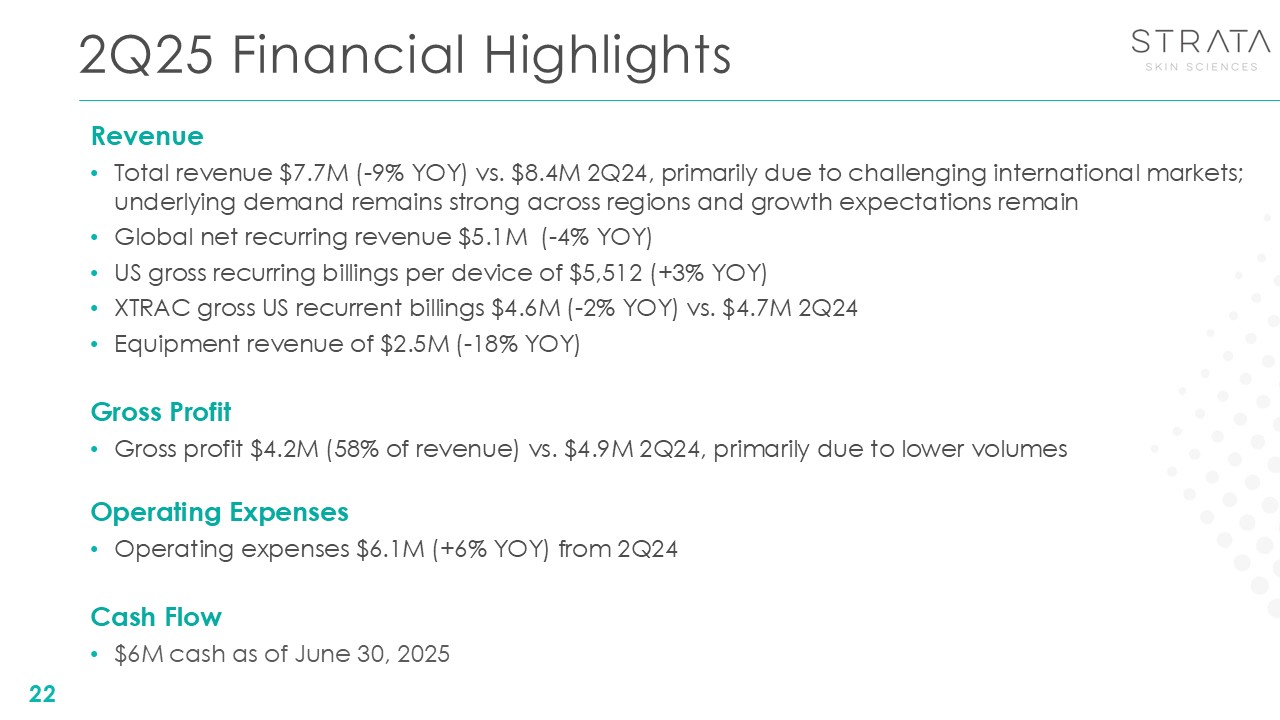

2Q25 Financial Highlights 22 Revenue Total revenue $7.7M (-9% YOY) vs. $8.4M

2Q24, primarily due to challenging international markets; underlying demand remains strong across regions and growth expectations remain Global net recurring revenue $5.1M (-4% YOY) US gross recurring billings per device of $5,512 (+3%

YOY) XTRAC gross US recurrent billings $4.6M (-2% YOY) vs. $4.7M 2Q24 Equipment revenue of $2.5M (-18% YOY) Gross Profit Gross profit $4.2M (58% of revenue) vs. $4.9M 2Q24, primarily due to lower volumes Operating Expenses Operating

expenses $6.1M (+6% YOY) from 2Q24 Cash Flow $6M cash as of June 30, 2025

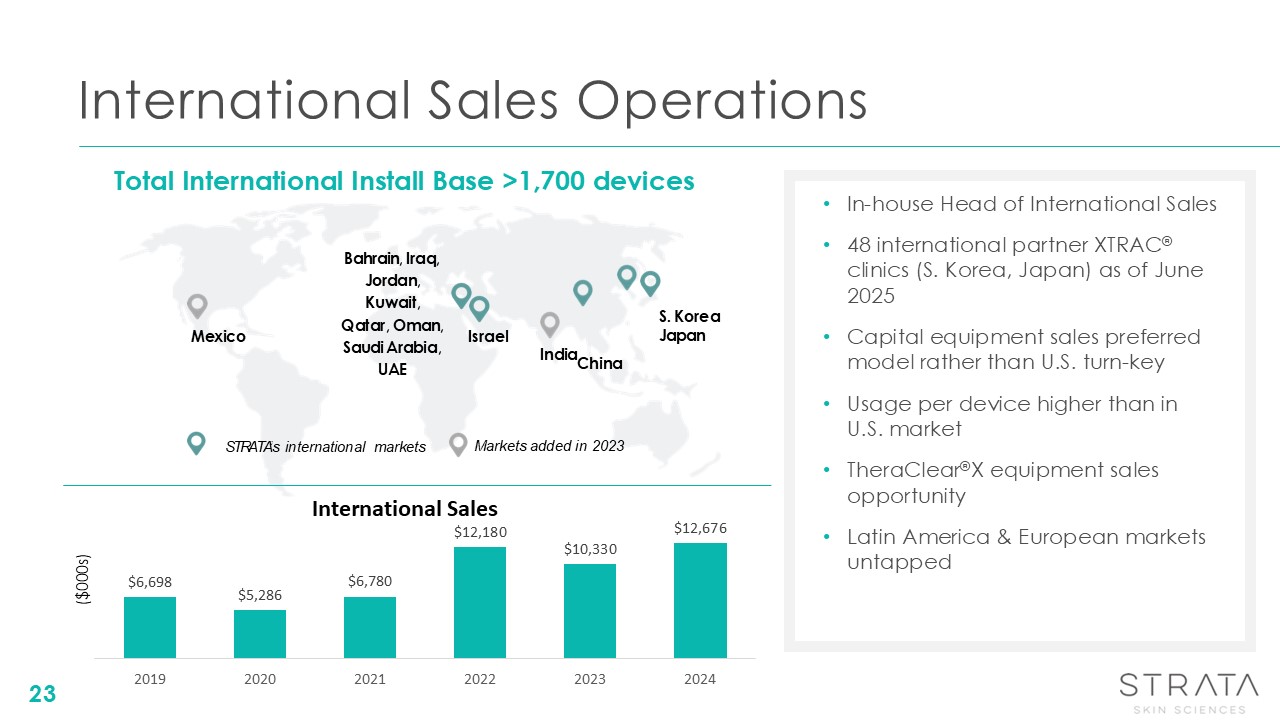

International Sales Operations India Israel S. Korea Japan China Bahrain,

Iraq, Jordan, Kuwait, Qatar, Oman, Saudi Arabia, UAE Mexico In-house Head of International Sales 48 international partner XTRAC® clinics (S. Korea, Japan) as of June 2025 Capital equipment sales preferred model rather than U.S. turn-key

Usage per device higher than in U.S. market TheraClear®X equipment sales opportunity Latin America & European markets untapped Total International Install Base >1,700 devices Markets added in 2023 STRATA’s international

markets 23 ($000s) International Sales

Affiliated Academic Institutions STRATA has placed over 50 XTRAC® machines in

residency programs across academic institutions 24 Affiliated Academic Institutions STRATA devices are available at over 50 academic institutes that offer dermatology residency programs 24

XTRAC for Psoriasis, Vilitigo, and Eczema

XTRAC®: Overview Safe, effective treatment 350+ peer-reviewed clinical

studies Psoriasis treatment is the number 1 domestic use for XTRAC® lasers – 80% of treatments Opportunities exist for expanding use for other approved indications like vitiligo and eczema Clinical support team focused on: In-office

training Best practices 26

Indicated for Chronic Dermatological Diseases Visible skin disorders can limit

healthy psychosocial development and have profoundly negative consequences on quality of life3-5 VITILIGO ~7.5 million adults in the US1,a PSORIASIS ATOPIC DERMATITIS ~2–3 million adults in the US2 ~16.5 million adults in the US3 1.

Armstrong AW et al. JAMA Dermatol. 2021;157(8):940-946.aIncludes people 20 years of age and older. 2. Gandhi K et al. JAMA Dermatol. 2022;158(1):43-50. 3. Fuxench ZCC et al. J Invest Dermatol. 2019;139(3):583-590.4. Elbuluk N, Ezzedine K.

Dermatol Clin. 2017;35:117-128. 5. Armstrong AW, Read C. JAMA. 2020;323(19):1945-1960. 27

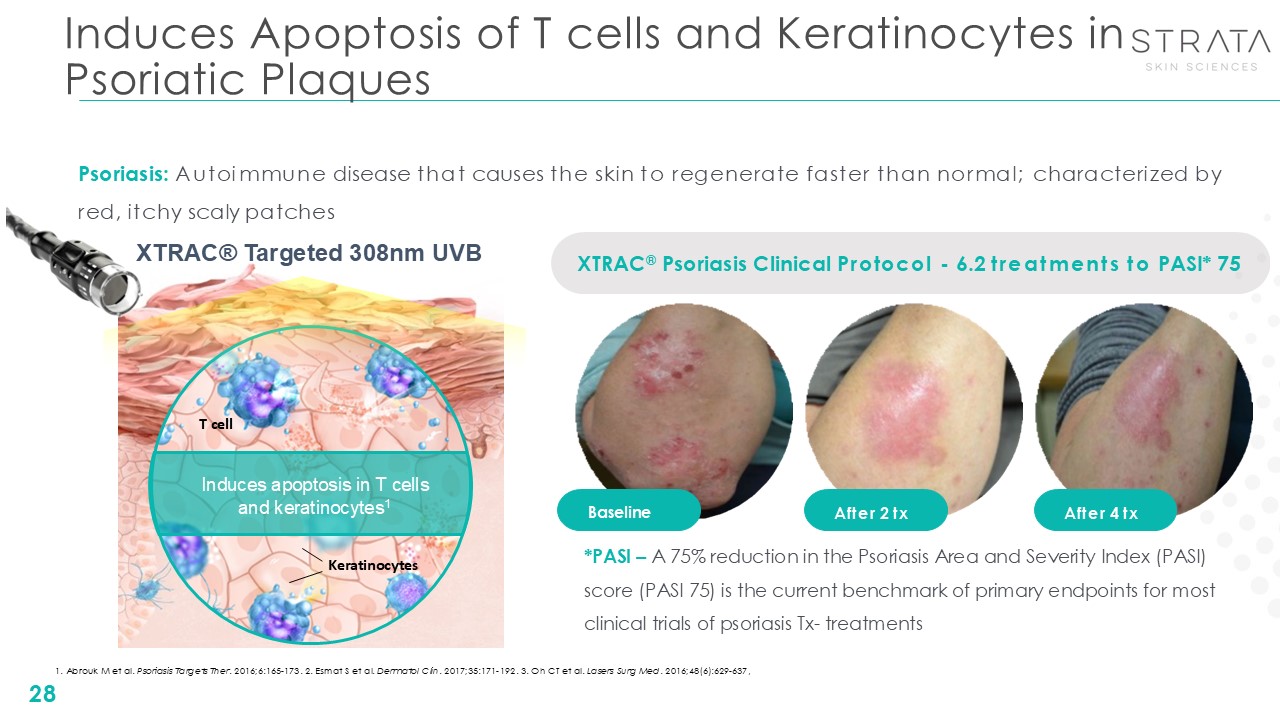

Induces Apoptosis of T cells and Keratinocytes in Psoriatic

Plaques 28 Baseline After 2 tx After 4 tx XTRAC® Psoriasis Clinical Protocol - 6.2 treatments to PASI* 75 Induces apoptosis in T cells and keratinocytes1 T cell Keratinocytes Psoriasis: Autoimmune disease that causes the skin to

regenerate faster than normal; characterized by red, itchy scaly patches *PASI – A 75% reduction in the Psoriasis Area and Severity Index (PASI) score (PASI 75) is the current benchmark of primary endpoints for most clinical trials of

psoriasis Tx- treatments 1. Abrouk M et al. Psoriasis Targets Ther. 2016;6:165-173. 2. Esmat S et al. Dermatol Clin. 2017;35:171-192. 3. Oh CT et al. Lasers Surg Med. 2016;48(6):629-637, XTRAC® Targeted 308nm UVB

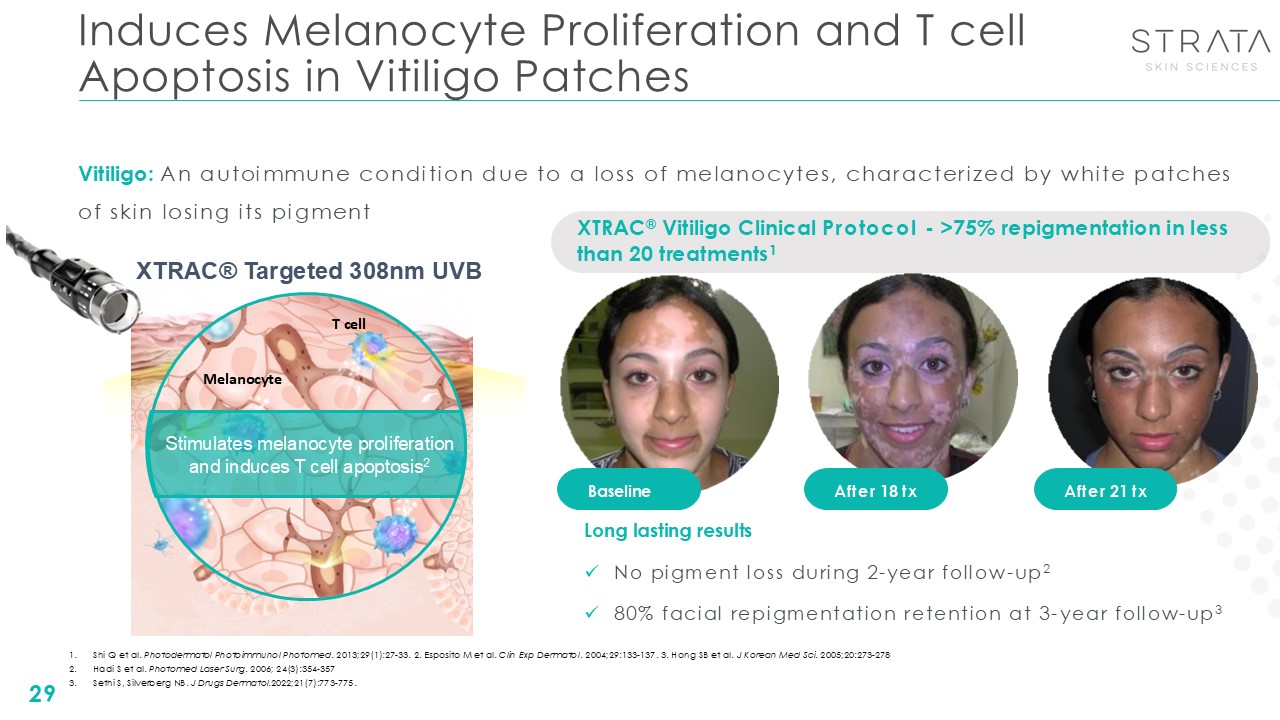

Induces Melanocyte Proliferation and T cell Apoptosis in Vitiligo

Patches 29 Baseline After 18 tx After 21 tx XTRAC® Vitiligo Clinical Protocol - >75% repigmentation in less than 20 treatments1 Vitiligo: An autoimmune condition due to a loss of melanocytes, characterized by white patches of skin

losing its pigment Long lasting results No pigment loss during 2-year follow-up2 80% facial repigmentation retention at 3-year follow-up3 XTRAC® Targeted 308nm UVB Stimulates melanocyte proliferation and induces T cell

apoptosis2 Melanocyte T cell Shi Q et al. Photodermatol Photoimmunol Photomed. 2013;29(1):27-33. 2. Esposito M et al. Clin Exp Dermatol. 2004;29:133-137. 3. Hong SB et al. J Korean Med Sci. 2005;20:273-278 Hadi S et al. Photomed Laser

Surg. 2006; 24(3):354-357 Sethi S, Silverberg NB. J Drugs Dermatol.2022;21(7):773-775.

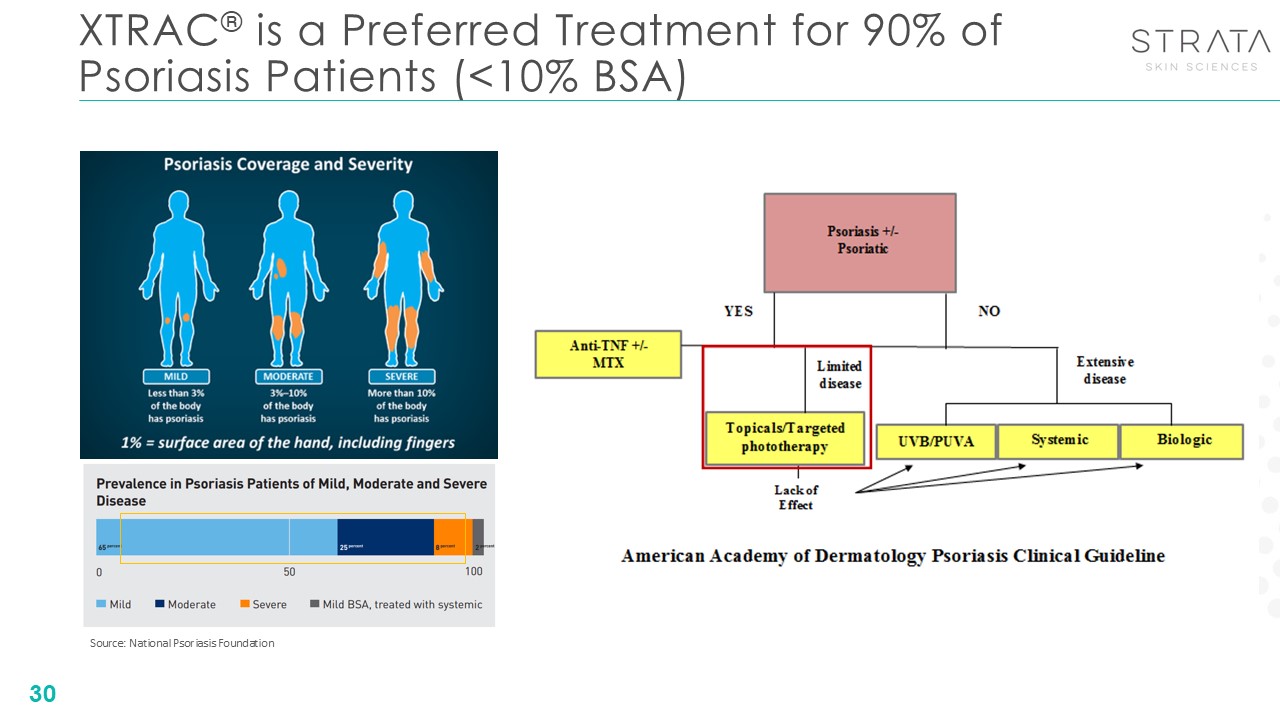

Source: National Psoriasis Foundation XTRAC® is a Preferred Treatment for 90%

of Psoriasis Patients (<10% BSA) 30

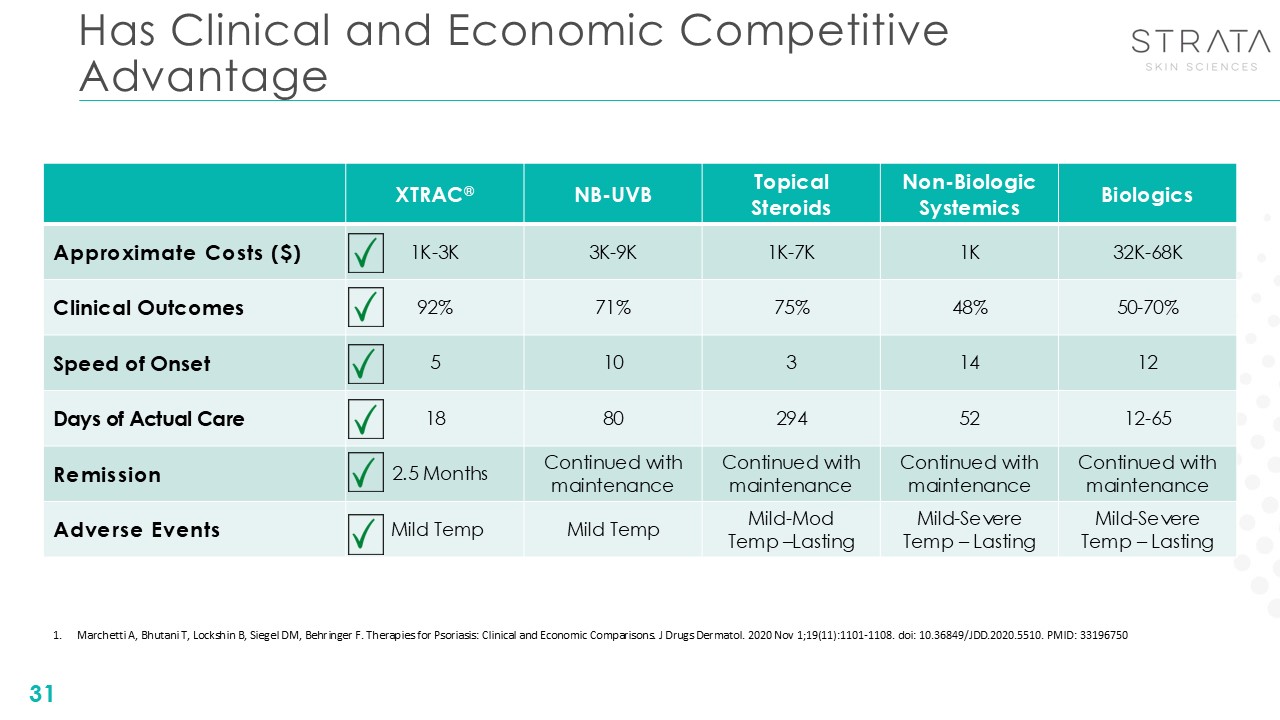

Has Clinical and Economic Competitive Advantage 31 XTRAC® NB-UVB Topical

Steroids Non-Biologic Systemics Biologics Approximate Costs ($) 1K-3K 3K-9K 1K-7K 1K 32K-68K Clinical Outcomes 92% 71% 75% 48% 50-70% Speed of Onset 5 10 3 14 12 Days of Actual Care 18 80 294 52 12-65 Remission

2.5 Months Continued with maintenance Continued with maintenance Continued with maintenance Continued with maintenance Adverse Events Mild Temp Mild Temp Mild-Mod Temp –Lasting Mild-Severe Temp – Lasting Mild-Severe Temp –

Lasting Marchetti A, Bhutani T, Lockshin B, Siegel DM, Behringer F. Therapies for Psoriasis: Clinical and Economic Comparisons. J Drugs Dermatol. 2020 Nov 1;19(11):1101-1108. doi: 10.36849/JDD.2020.5510. PMID: 33196750

TheraClearXfor Acne

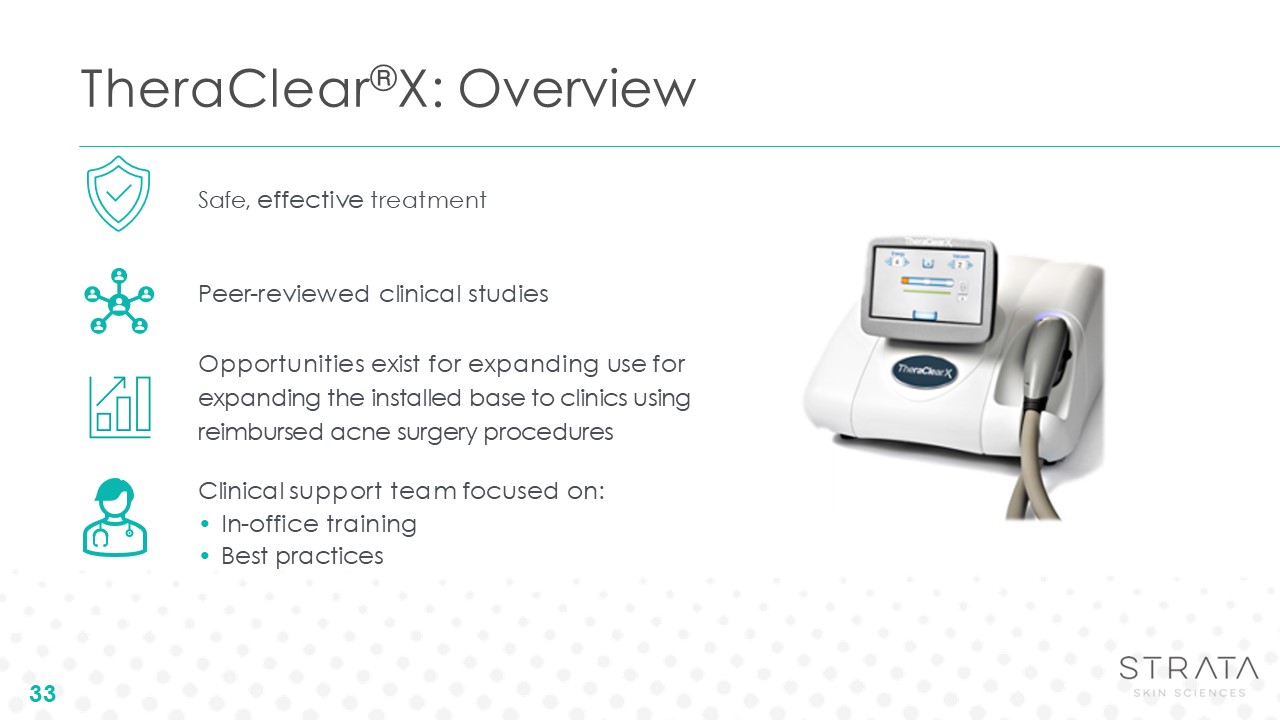

TheraClear®X: Overview Safe, effective treatment Peer-reviewed clinical

studies Opportunities exist for expanding use for expanding the installed base to clinics using reimbursed acne surgery procedures Clinical support team focused on: In-office training Best practices 33

Acne is the Most Common Skin Condition in Dermatology Up to 50 Million

Americans affected annually2 ~85% of all adolescents experience some degree of acne from the ages of 12 to 24 years3 >50% of US women experience acne in their 20s4 Acne occurring in adults is increasing5 #1 skin disease in the US1

Bickers DR et al. J Am Acad Dermatol. 2006;55:490-500. Tan JKL, Bhate K. Br J Dermatol. 2015;172 (Suppl 10:3-12. White GM. J Am Acad Dermatol. 1998;39:S34-S37. Collier CN et al. J Am Acad Dermatol. 2008;58:56-59. Holzmann R, Shakery K.

Skin Pharmacol Physiol. 2014;27 (Suppl 1):3-8. 34

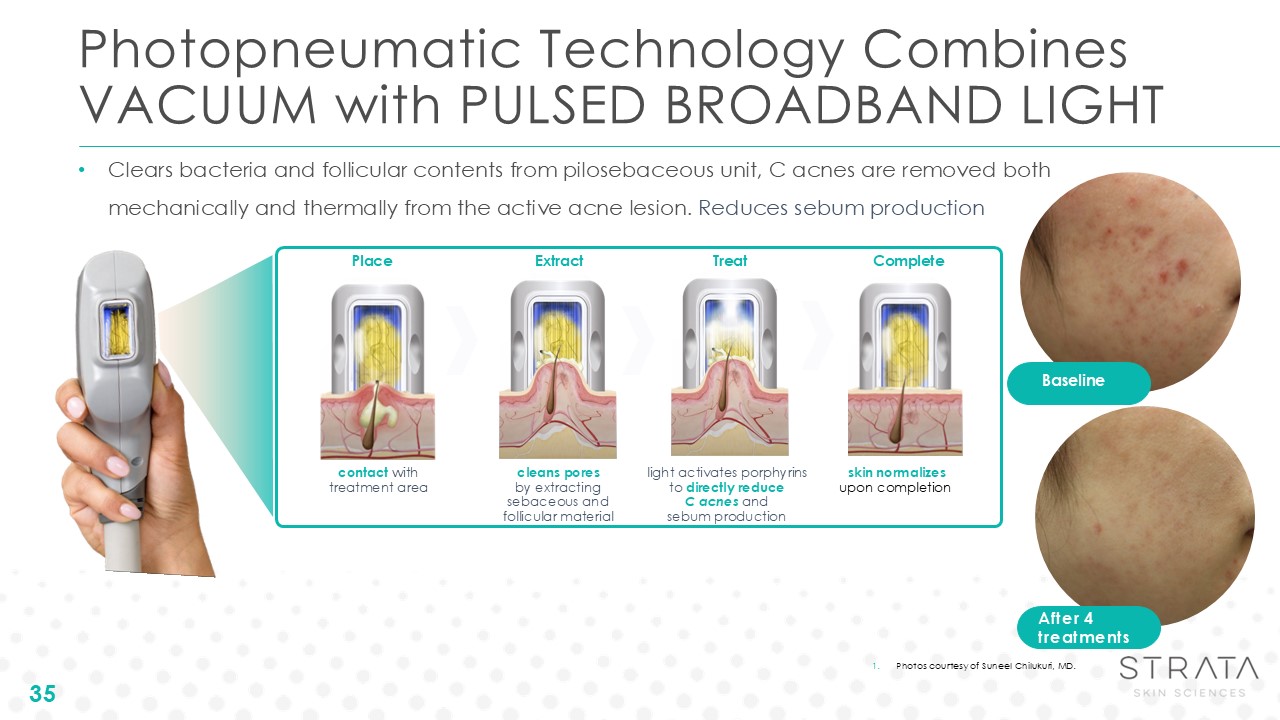

Photopneumatic Technology Combines VACUUM with PULSED BROADBAND LIGHT

35 Clears bacteria and follicular contents from pilosebaceous unit, C acnes are removed both mechanically and thermally from the active acne lesion. Reduces sebum production cleans pores by extracting sebaceous and follicular

material light activates porphyrins to directly reduce C acnes and sebum production skin normalizes upon completion Place Extract Treat Complete contact with treatment area Baseline After 4 treatments Photos courtesy of Suneel

Chilukuri, MD.

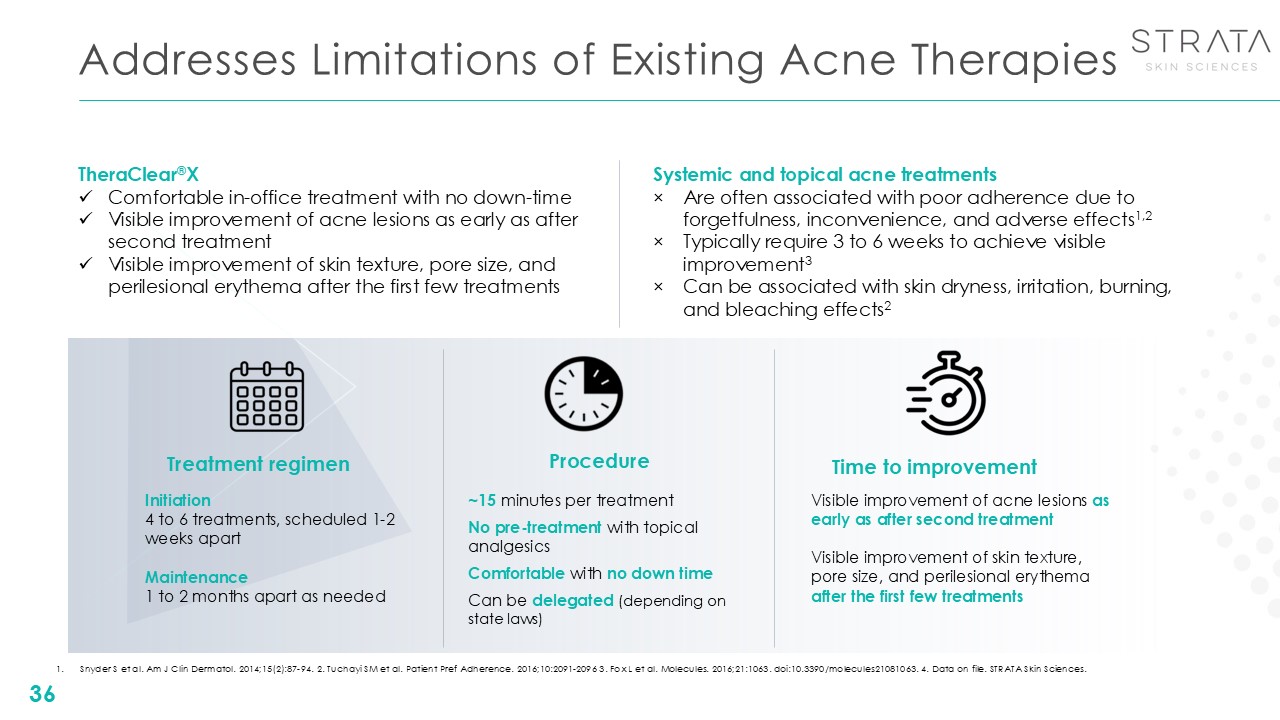

Addresses Limitations of Existing Acne Therapies 36 Visible improvement of

acne lesions as early as after second treatment Visible improvement of skin texture, pore size, and perilesional erythema after the first few treatments Time to improvement Initiation 4 to 6 treatments, scheduled 1-2 weeks

apart Maintenance1 to 2 months apart as needed Treatment regimen Procedure ~15 minutes per treatment No pre-treatment with topical analgesics Comfortable with no down time Can be delegated (depending on state laws) Systemic and

topical acne treatments Are often associated with poor adherence due to forgetfulness, inconvenience, and adverse effects1,2 Typically require 3 to 6 weeks to achieve visible improvement3 Can be associated with skin dryness, irritation,

burning, and bleaching effects2 TheraClear®X Comfortable in-office treatment with no down-time Visible improvement of acne lesions as early as after second treatment Visible improvement of skin texture, pore size, and perilesional

erythema after the first few treatments Snyder S et al. Am J Clin Dermatol. 2014;15(2):87-94. 2. Tuchayi SM et al. Patient Pref Adherence. 2016;10:2091-2096 3. Fox L et al. Molecules. 2016;21:1063. doi:10.3390/molecules21081063. 4. Data on

file. STRATA Skin Sciences.

Seasoned Management Team Sales and Operational Dermatology Experience Chief

Executive Officer Dr. Dolev Rafaeli V.P. Finance John Gillings Chief Operating Officer Shmuel Gov 37

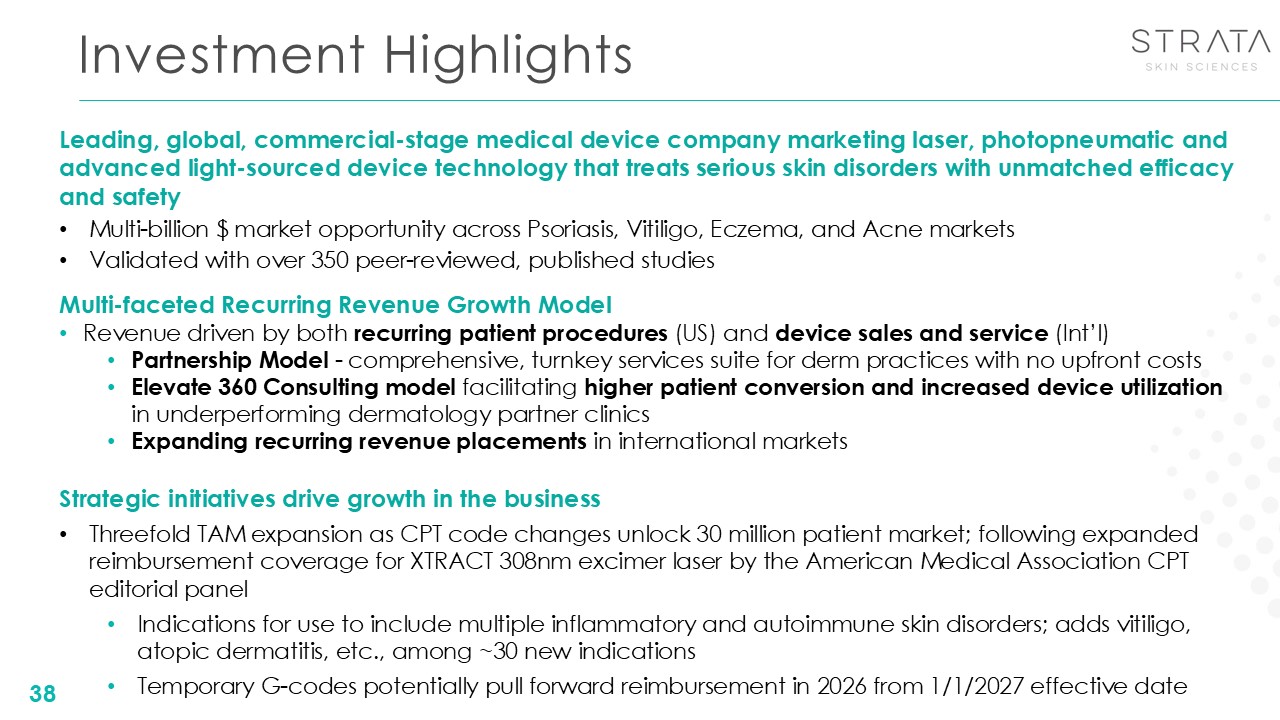

Investment Highlights 38 Leading, global, commercial-stage medical device

company marketing laser, photopneumatic and advanced light-sourced device technology that treats serious skin disorders with unmatched efficacy and safety Multi-billion $ market opportunity across Psoriasis, Vitiligo, Eczema, and Acne

markets Validated with over 350 peer-reviewed, published studies Multi-faceted Recurring Revenue Growth Model Revenue driven by both recurring patient procedures (US) and device sales and service (Int’l) Partnership Model -

comprehensive, turnkey services suite for derm practices with no upfront costs Elevate 360 Consulting model facilitating higher patient conversion and increased device utilization in underperforming dermatology partner clinics Expanding

recurring revenue placements in international markets Strategic initiatives drive growth in the business Threefold TAM expansion as CPT code changes unlock 30 million patient market; following expanded reimbursement coverage for XTRACT

308nm excimer laser by the American Medical Association CPT editorial panel Indications for use to include multiple inflammatory and autoimmune skin disorders; adds vitiligo, atopic dermatitis, etc., among ~30 new indications Temporary

G-codes potentially pull forward reimbursement in 2026 from 1/1/2027 effective date

References 39 XTRAC 510K Summary. Published January 14, 2020. Niwa Y,

Hasegawa T, Ko S, et al. Efficacy of 308-nm excimer light for Japanese patients with psoriasis. J Dermatol. 2009;36(11):579-582. Feldman SR, Mellen BG, Housman TS, et al. Efficacy of the 308-nm excimer laser for treatment of psoriasis:

Results of a multicenter study. J Am Acad of Dermatol. 2002;46(6):900-906. Taneja A, Trehan M, Taylor C. 308-nm Excimer Laser for the Treatment of Psoriasis –Induration-Based Dosimetry. Arch Dermatol. 2003;139(6):759-764. Menter A,

Gottlieb A, Feldman SR, et al. Guidelines of care for the management of psoriasis and psoriatic arthritis. Section 1. Overview of psoriasis and guidelines of care for the treatment of psoriasis with biologics. J Am Acad of Dermatol.

2008;58:826-50. Menter A, Korman NJ, Elmets CA, et al. Guidelines of care for the management of psoriasis and psoriatic arthritis. Section 4. Guidelines of care for the management and treatment of psoriasis with traditional systemic

agents. J Am Acad of Dermatol. 2009;61:451-85 Menter A, Korman NJ, Elmets CA. Guidelines of care for the management of psoriasis and psoriatic arthritis. Section 3. Guidelines of care for the management and treatment of psoriasis with

topical therapies. J Am Acad of Dermatol. 2009;60:643-59. Fikrle T and Pizinger K. The use of the 308 nm excimer laser for the treatment of psoriasis.

For More Information Investor Contact: CORE

IR 516-222-2560 IR@strataskin.com www.strataskinsciences.com Thank You.

APPENDIX

Provider engagement and education and through conferences/

webinars 42 AAD Global Vitiligo Foundation CalDerm Fall Clinical

Acquisitions to Drive Top-line Growth January 2022 August 2021 $3.7M

Acquisition Minimal acquisition cost compared to exclusivity in external laser market $1M Acquisition Adds attractive business segment to address $5.5B acne market 43

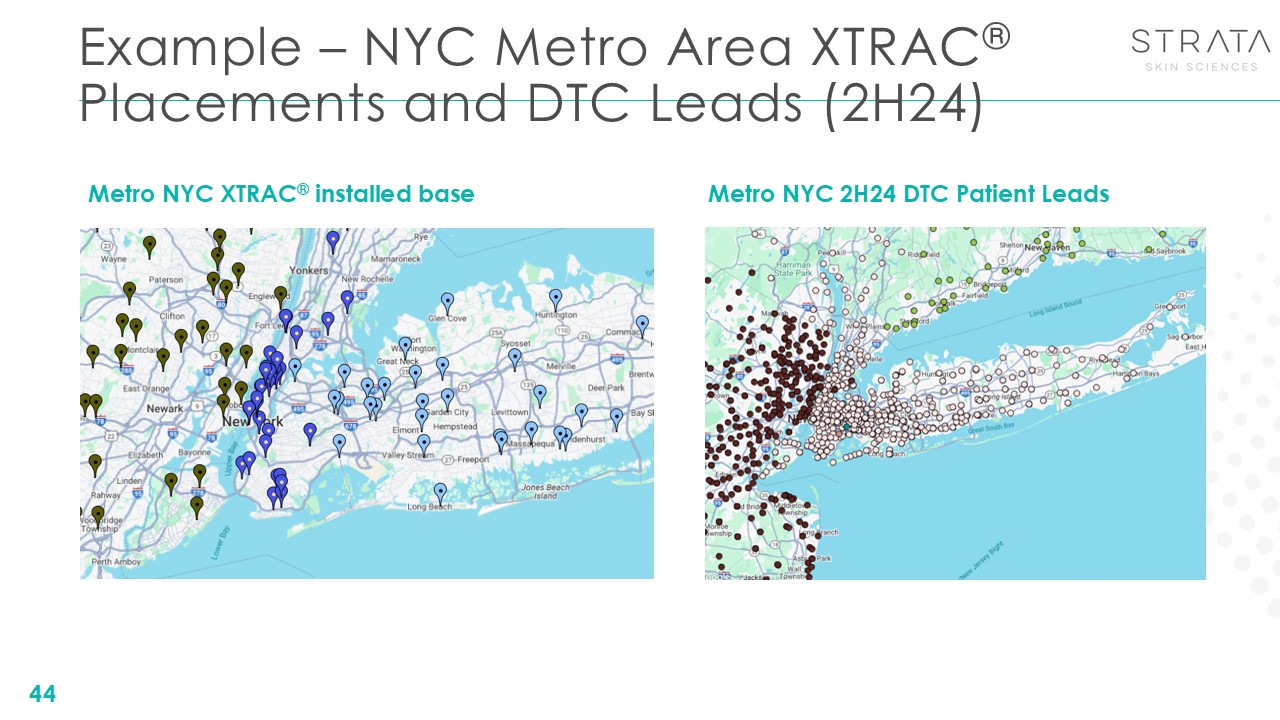

Example – NYC Metro Area XTRAC® Placements and DTC Leads (2H24) 44 Metro NYC

XTRAC® installed base Metro NYC 2H24 DTC Patient Leads

Psoriasis Case Study: Patient I.B., Lewisburg, PA 45 Treatment

Room After Before