| (CONVENIENCE TRANSLATION INTO ENGLISH OF CONSOLIDATED FINANCIAL STATEMENTS ORIGINALLY ISSUED IN TURKISH) D-MARKET ELEKTRONİK HİZMETLER VE TİCARET A.Ş. AND ITS SUBSIDIARIES CONSOLIDATED FINANCIAL STATEMENTS AT 1 JANUARY - 31 DECEMBER 2024 TOGETHER WITH INDEPENDENT AUDITOR’S REPORT |

| PwC Bağımsız Denetim ve Serbest Muhasebeci Mali Müşavirlik A.Ş. Kılıçali Paşa Mah. Meclis-i Mebusan Cad. No:8 İç Kapı No:301 Beyoğlu/İstanbul T: +90 212 326 6060, F: +90 212 326 6050, www.pwc.com.tr Mersis Numaramız: 0-1460-0224-0500015 CONVENIENCE TRANSLATION INTO ENGLISH OF INDEPENDENT AUDITOR’S REPORT ORIGINALLY ISSUED IN TURKISH INDEPENDENT AUDITOR’S REPORT To the General Assembly of D-Market Elektronik Hizmetler ve Ticaret A.Ş. A. Audit of the consolidated financial statements 1. Our opinion We have audited the accompanying consolidated financial statements of D-Market Elektronik Hizmetler ve Ticaret A.Ş. (the “Company”) and its subsidiaries (collectively referred to as the “Group”) which comprise the consolidated statement of financial position as at 31 December 2024, the consolidated statement of profit or loss and other comprehensive income, the consolidated statement of changes in equity and the consolidated statement of cash flows for the year then ended and notes to the consolidated financial statements comprising a summary of significant accounting policies. In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Group as at 31 December 2024, and its financial performance and its cash flows for the year then ended in accordance with Turkish Financial Reporting Standards (“TFRS”). 2. Basis for opinion Our audit was conducted in accordance with the Standards on Independent Auditing (the “SIA”) that are part of Turkish Standards on Auditing issued by the Public Oversight Accounting and Auditing Standards Authority (the “POA”). Our responsibilities under these standards are further described in the “Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements” section of our report. We hereby declare that we are independent of the Group in accordance with the Ethical Rules for Independent Auditors (including Independence Standards) (the “Ethical Rules”) the ethical requirements regarding independent audit in regulations issued by the POA; are relevant to our audit of the financial statements. We have also fulfilled our other ethical responsibilities in accordance with the Ethical Rules and regulations. We believe that the audit evidence we have obtained during the independent audit provides a sufficient and appropriate basis for our opinion. 3. Key audit matters Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the consolidated financial statements of the current period. Key audit matters were addressed in the context of our independent audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. |

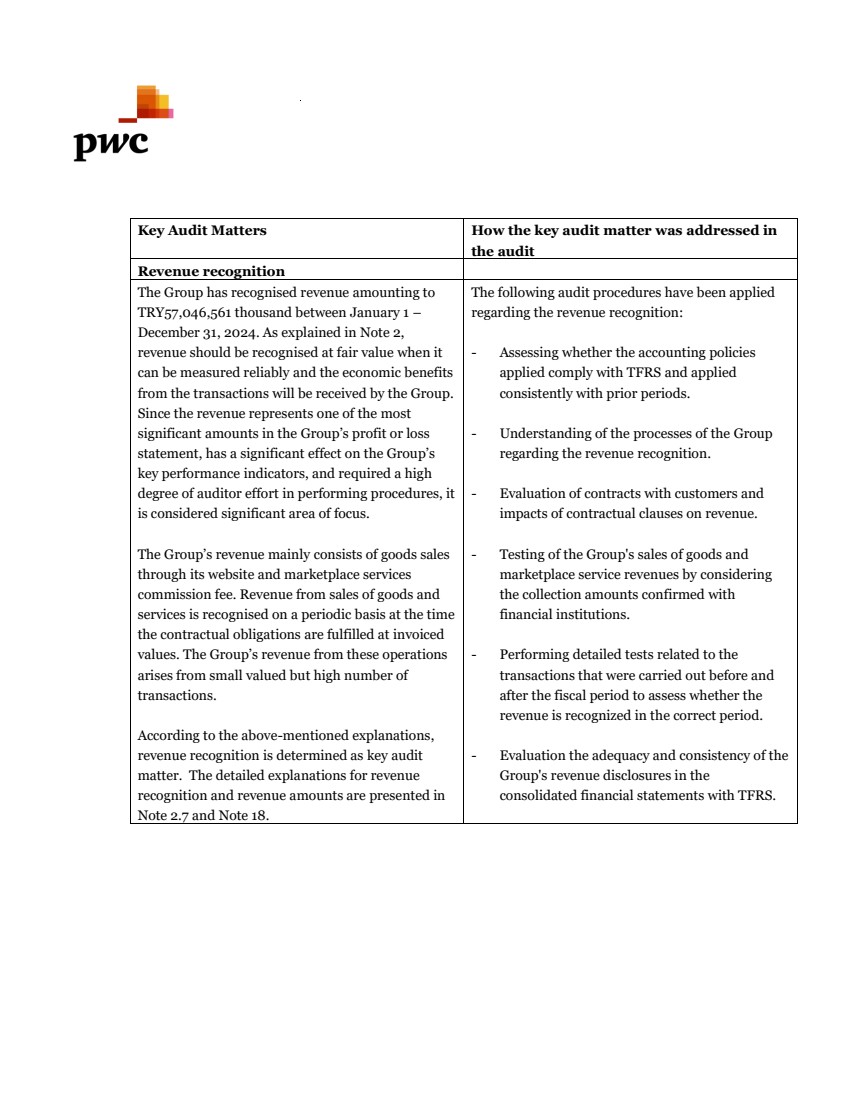

| Key Audit Matters How the key audit matter was addressed in the audit Revenue recognition The Group has recognised revenue amounting to TRY57,046,561 thousand between January 1 – December 31, 2024. As explained in Note 2, revenue should be recognised at fair value when it can be measured reliably and the economic benefits from the transactions will be received by the Group. Since the revenue represents one of the most significant amounts in the Group’s profit or loss statement, has a significant effect on the Group’s key performance indicators, and required a high degree of auditor effort in performing procedures, it is considered significant area of focus. The Group’s revenue mainly consists of goods sales through its website and marketplace services commission fee. Revenue from sales of goods and services is recognised on a periodic basis at the time the contractual obligations are fulfilled at invoiced values. The Group’s revenue from these operations arises from small valued but high number of transactions. According to the above-mentioned explanations, revenue recognition is determined as key audit matter. The detailed explanations for revenue recognition and revenue amounts are presented in Note 2.7 and Note 18. The following audit procedures have been applied regarding the revenue recognition: - Assessing whether the accounting policies applied comply with TFRS and applied consistently with prior periods. - Understanding of the processes of the Group regarding the revenue recognition. - Evaluation of contracts with customers and impacts of contractual clauses on revenue. - Testing of the Group's sales of goods and marketplace service revenues by considering the collection amounts confirmed with financial institutions. - Performing detailed tests related to the transactions that were carried out before and after the fiscal period to assess whether the revenue is recognized in the correct period. - Evaluation the adequacy and consistency of the Group's revenue disclosures in the consolidated financial statements with TFRS. |

| 4. Responsibilities of management and those charged with governance for the consolidated financial statements The Group management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with TFRS, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is responsible for assessing the Group’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Group or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Group’s financial reporting process. 5. Auditor’s responsibilities for the audit of the consolidated financial statements Responsibilities of independent auditors in an independent audit are as follows: Our aim is to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an independent auditor’s report that includes our opinion. Reasonable assurance expressed as a result of an independent audit conducted in accordance with SIA is a high level of assurance but does not guarantee that a material misstatement will always be detected. Misstatements can arise from fraud or error. Misstatements are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements. As part of an independent audit conducted in accordance with SIA, we exercise professional judgment and maintain professional scepticism throughout the audit. We also: • Identify and assess the risks of material misstatement in the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. |

| • Assess the internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group’s internal control. • Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. • Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Group’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our independent auditor’s report. However, future events or conditions may cause the Group to cease to continue as a going concern. • Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. • Plan and perform the group audit to obtain sufficient appropriate audit evidence regarding the financial information of the entities or business units within the Group as a basis for forming an opinion on the consolidated financial statements. We are responsible for the direction, supervision and review of the audit work performed for purposes of the Group audit. We remain solely responsible for our audit opinion. We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the consolidated financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication. |

| B. Other responsibilities arising from regulatory requirements 1. No matter has come to our attention that is significant according to subparagraph 4 of Article 402 of Turkish Commercial Code (“TCC”) No. 6102 and that causes us to believe that the Company’s bookkeeping activities concerning the period from 1 January to 31 December 2024 period are not in compliance with the TCC and provisions of the Company’s articles of association related to financial reporting. 2. In accordance with subparagraph 4 of Article 402 of the TCC, the Board of Directors submitted the necessary explanations to us and provided the documents required within the context of our audit. PwC Bağımsız Denetim ve Serbest Muhasebeci Mali Müşavirlik A.Ş. Mehmet Cenk Uslu, SMMM Independent Auditor Istanbul, 30 July 2025 |

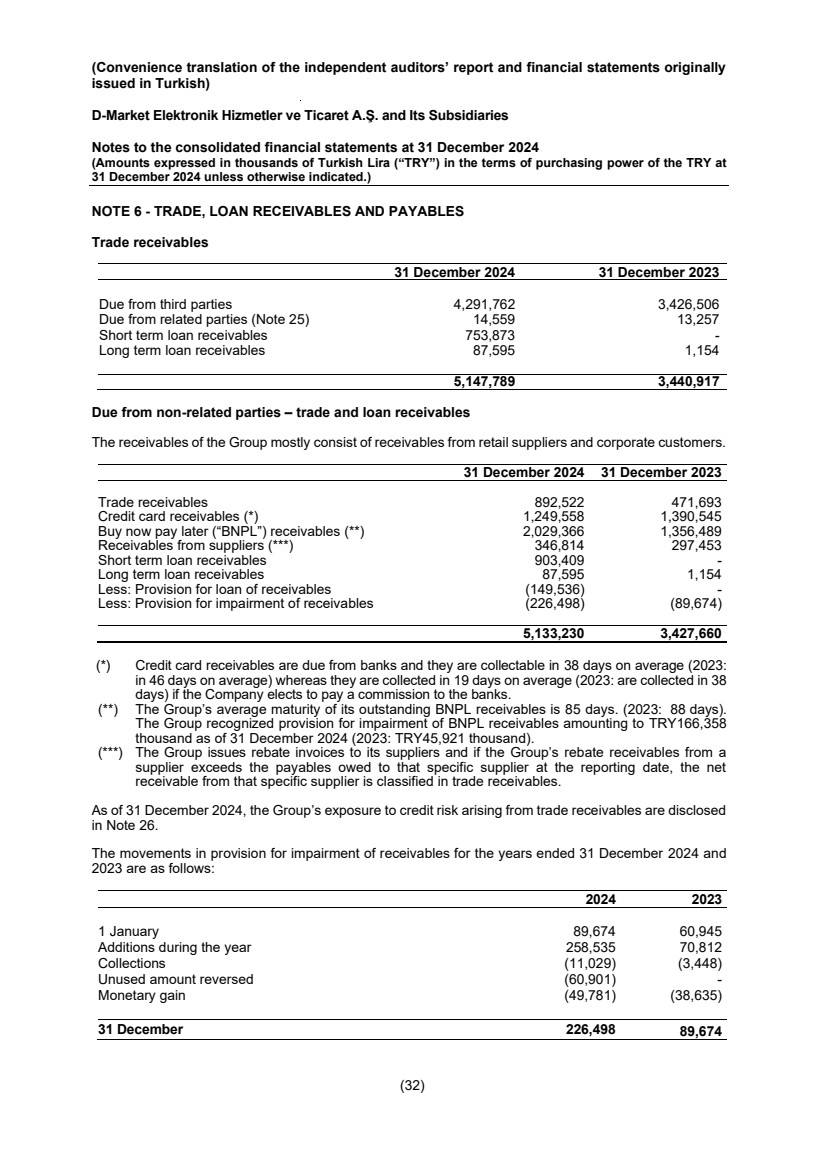

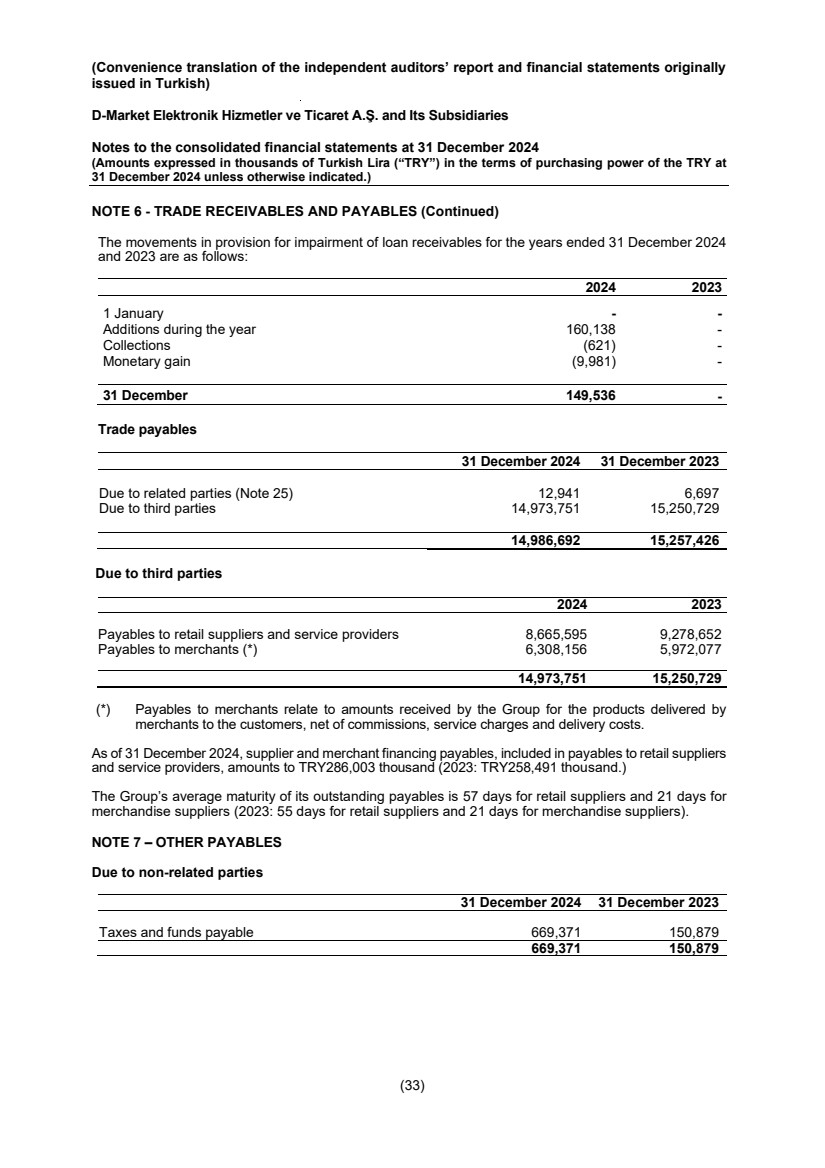

| Contents Page Consolidated statement of financial position..................................................................................... 1-2 Consolidated statement of profit or loss............................................................................................ 3 Consolidated statement of other comprehensive income................................................................. 3 Consolidated statement of changes in equity ................................................................................... 4 Consolidated statement of cash flow ................................................................................................ 5 Notes to the consolidated financial statements................................................................................. 6-64 |

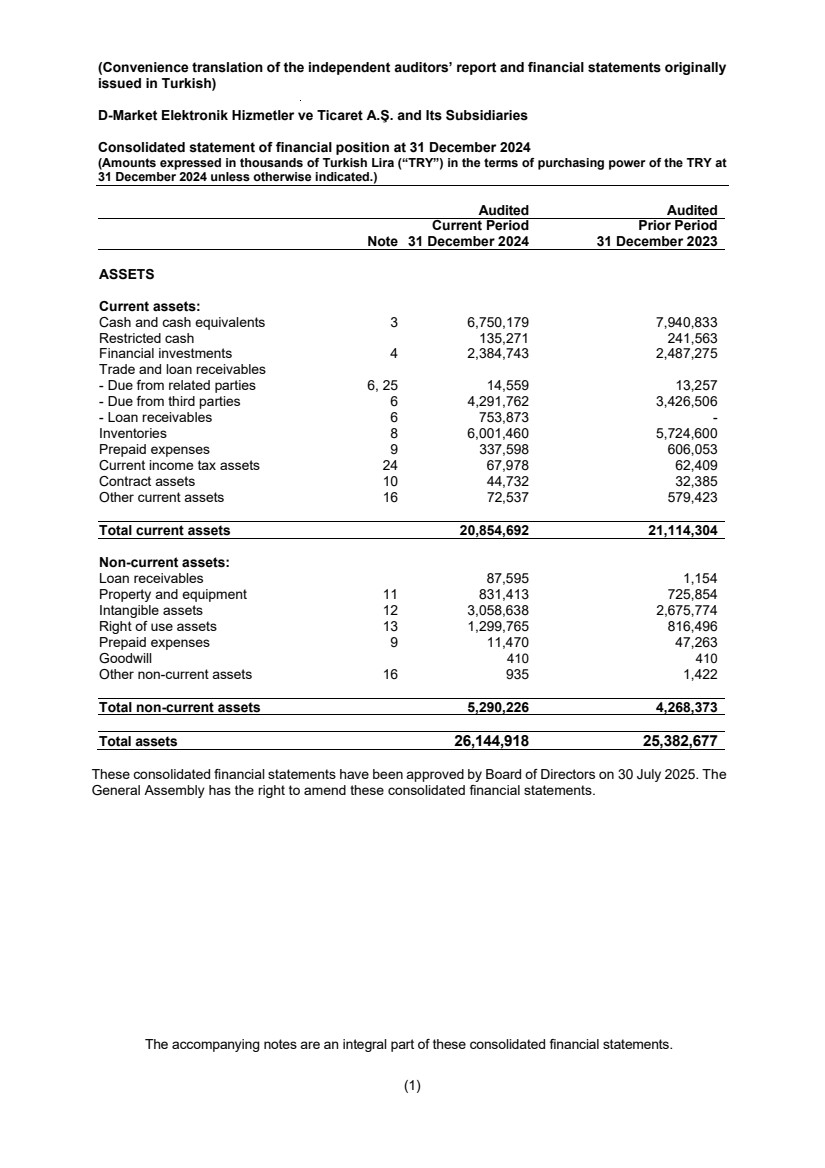

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Consolidated statement of financial position at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (1) Audited Audited Current Period Prior Period Note 31 December 2024 31 December 2023 ASSETS Current assets: Cash and cash equivalents 3 6,750,179 7,940,833 Restricted cash 135,271 241,563 Financial investments 4 2,384,743 2,487,275 Trade and loan receivables - Due from related parties 6, 25 14,559 13,257 - Due from third parties 6 4,291,762 3,426,506 - Loan receivables 6 753,873 - Inventories 8 6,001,460 5,724,600 Prepaid expenses 9 337,598 606,053 Current income tax assets 24 67,978 62,409 Contract assets 10 44,732 32,385 Other current assets 16 72,537 579,423 Total current assets 20,854,692 21,114,304 Non-current assets: Loan receivables 87,595 1,154 Property and equipment 11 831,413 725,854 Intangible assets 12 3,058,638 2,675,774 Right of use assets 13 1,299,765 816,496 Prepaid expenses 9 11,470 47,263 Goodwill 410 410 Other non-current assets 16 935 1,422 Total non-current assets 5,290,226 4,268,373 Total assets 26,144,918 25,382,677 These consolidated financial statements have been approved by Board of Directors on 30 July 2025. The General Assembly has the right to amend these consolidated financial statements. The accompanying notes are an integral part of these consolidated financial statements. |

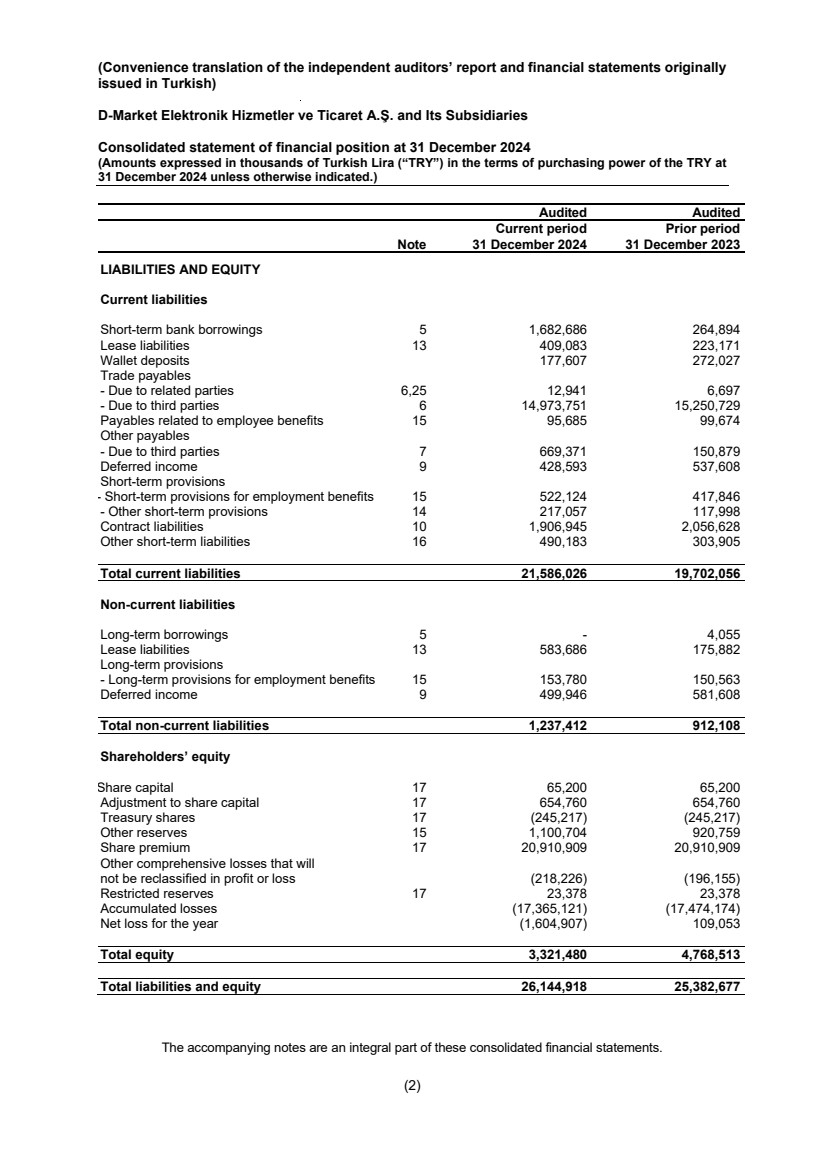

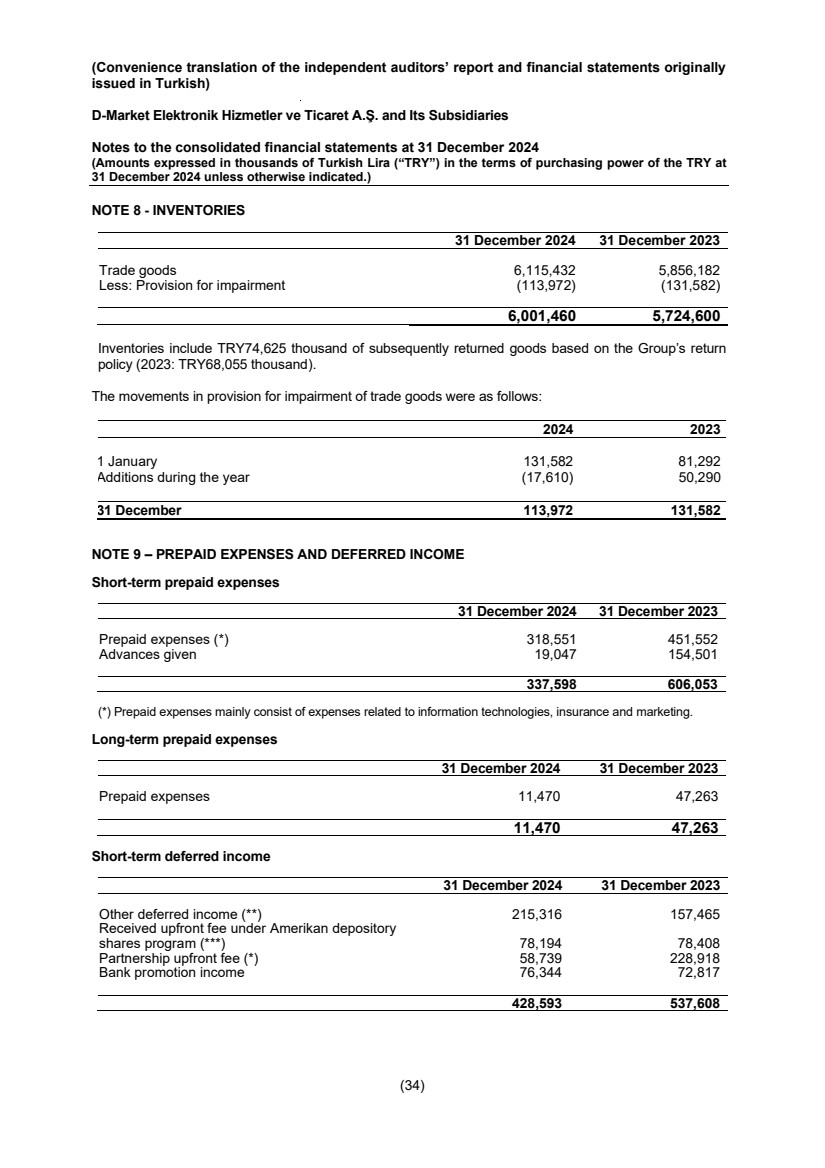

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Consolidated statement of financial position at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (2) Audited Audited Current period Prior period Note 31 December 2024 31 December 2023 LIABILITIES AND EQUITY Current liabilities Short-term bank borrowings 5 1,682,686 264,894 Lease liabilities 13 409,083 223,171 Wallet deposits 177,607 272,027 Trade payables - Due to related parties 6,25 12,941 6,697 - Due to third parties 6 14,973,751 15,250,729 Payables related to employee benefits 15 95,685 99,674 Other payables - Due to third parties 7 669,371 150,879 Deferred income 9 428,593 537,608 Short-term provisions - Short-term provisions for employment benefits 15 522,124 417,846 - Other short-term provisions 14 217,057 117,998 Contract liabilities 10 1,906,945 2,056,628 Other short-term liabilities 16 490,183 303,905 Total current liabilities 21,586,026 19,702,056 Non-current liabilities Long-term borrowings 5 - 4,055 Lease liabilities 13 583,686 175,882 Long-term provisions - Long-term provisions for employment benefits 15 153,780 150,563 Deferred income 9 499,946 581,608 Total non-current liabilities 1,237,412 912,108 Shareholders’ equity Share capital 17 65,200 65,200 Adjustment to share capital 17 654,760 654,760 Treasury shares 17 (245,217) (245,217) Other reserves 15 1,100,704 920,759 Share premium 17 20,910,909 20,910,909 Other comprehensive losses that will not be reclassified in profit or loss (218,226) (196,155) Restricted reserves 17 23,378 23,378 Accumulated losses (17,365,121) (17,474,174) Net loss for the year (1,604,907) 109,053 Total equity 3,321,480 4,768,513 Total liabilities and equity 26,144,918 25,382,677 The accompanying notes are an integral part of these consolidated financial statements. |

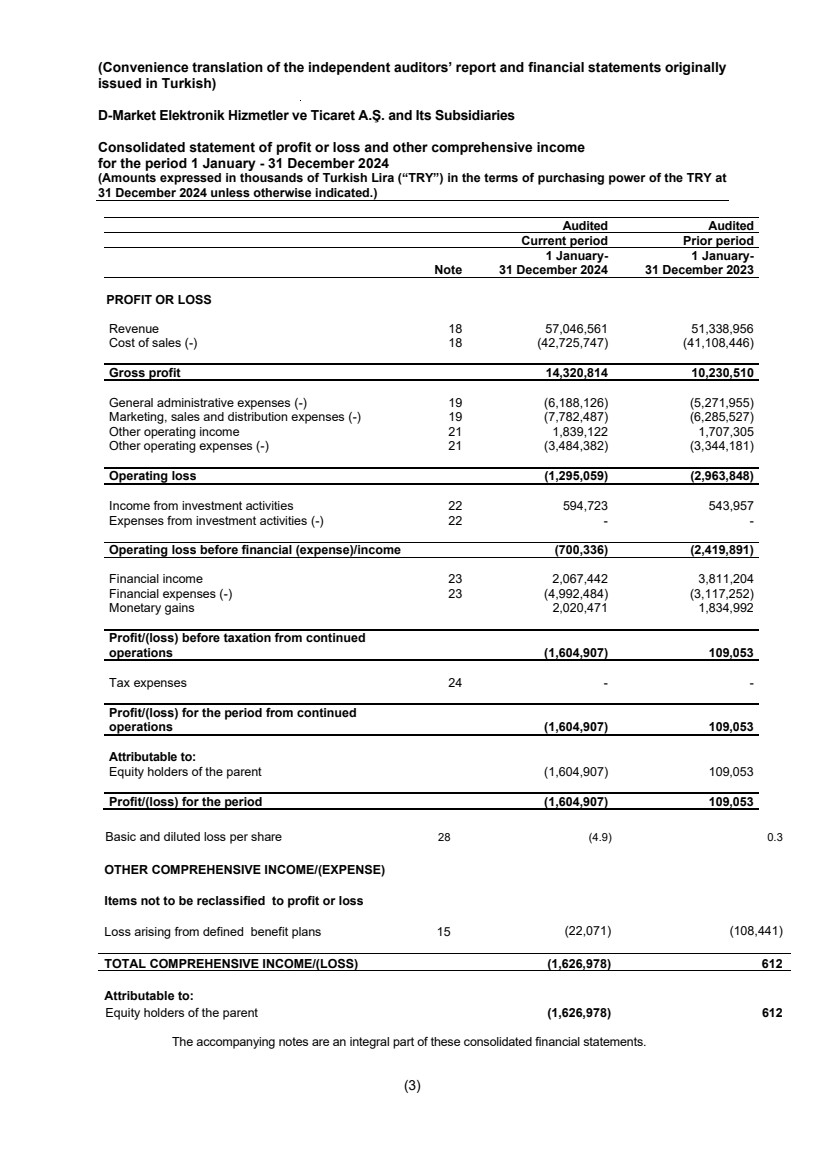

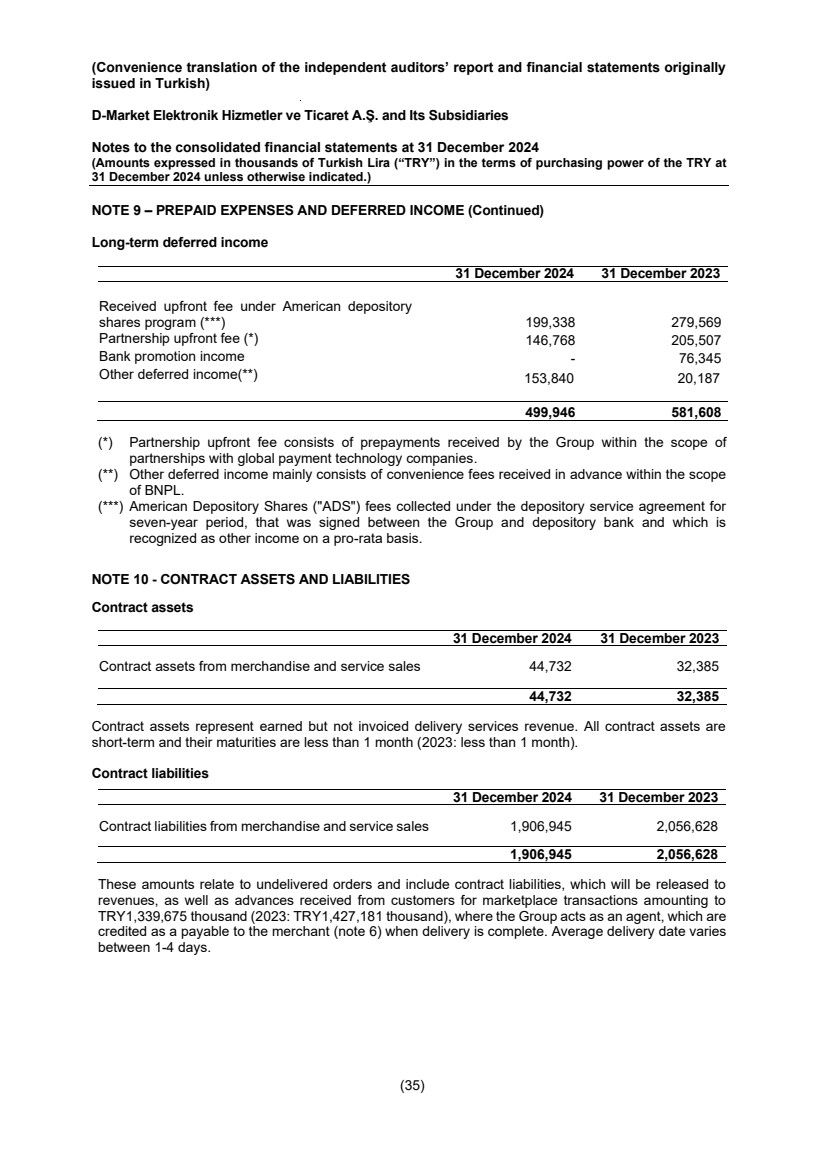

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Consolidated statement of profit or loss and other comprehensive income for the period 1 January - 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (3) Audited Audited Current period Prior period Note 1 January-31 December 2024 1 January-31 December 2023 PROFIT OR LOSS Revenue 18 57,046,561 51,338,956 Cost of sales (-) 18 (42,725,747) (41,108,446) Gross profit 14,320,814 10,230,510 General administrative expenses (-) 19 (6,188,126) (5,271,955) Marketing, sales and distribution expenses (-) 19 (7,782,487) (6,285,527) Other operating income 21 1,839,122 1,707,305 Other operating expenses (-) 21 (3,484,382) (3,344,181) Operating loss (1,295,059) (2,963,848) Income from investment activities 22 594,723 543,957 Expenses from investment activities (-) 22 - - Operating loss before financial (expense)/income (700,336) (2,419,891) Financial income 23 2,067,442 3,811,204 Financial expenses (-) 23 (4,992,484) (3,117,252) Monetary gains 2,020,471 1,834,992 Profit/(loss) before taxation from continued operations (1,604,907) 109,053 Tax expenses 24 - - Profit/(loss) for the period from continued operations (1,604,907) 109,053 Attributable to: Equity holders of the parent (1,604,907) 109,053 Profit/(loss) for the period (1,604,907) 109,053 Basic and diluted loss per share 28 (4.9) 0.3 OTHER COMPREHENSIVE INCOME/(EXPENSE) Items not to be reclassified to profit or loss Loss arising from defined benefit plans 15 (22,071) (108,441) TOTAL COMPREHENSIVE INCOME/(LOSS) (1,626,978) 612 Attributable to: Equity holders of the parent (1,626,978) 612 The accompanying notes are an integral part of these consolidated financial statements. |

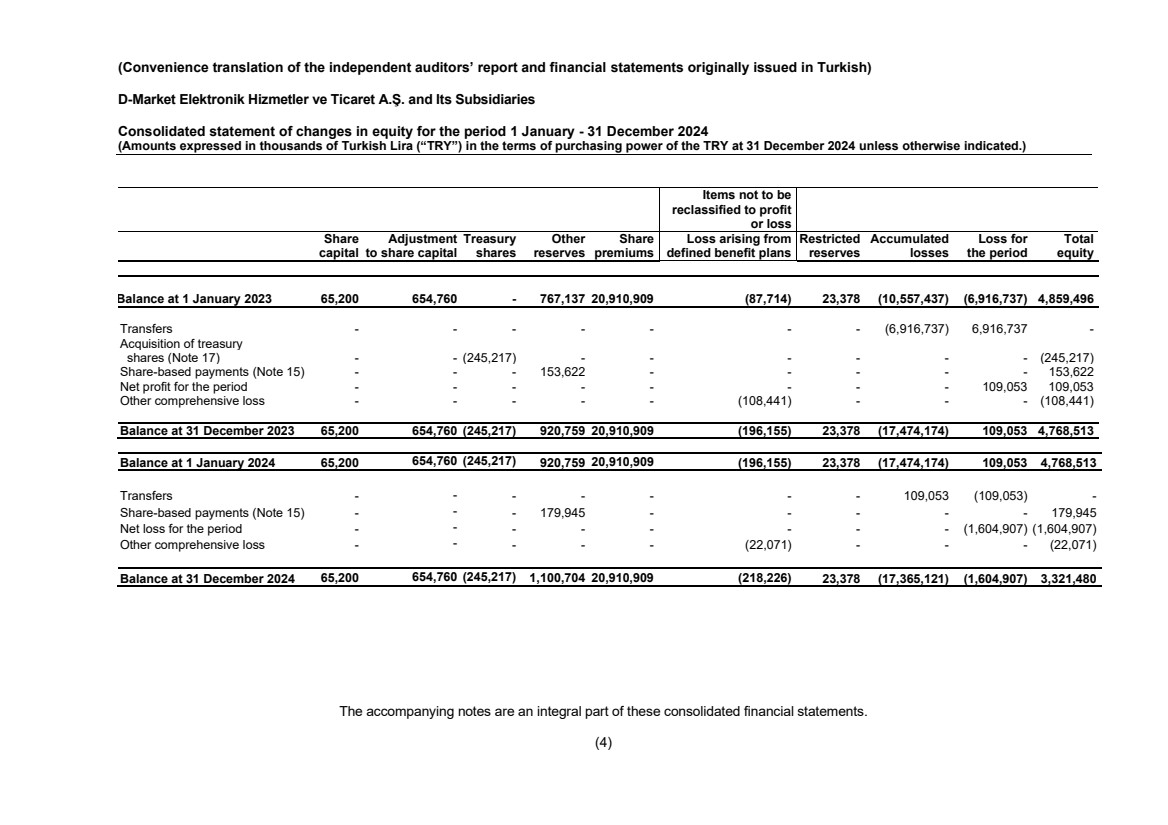

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Consolidated statement of changes in equity for the period 1 January - 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (4) Items not to be reclassified to profit or loss Share Adjustment Treasury Other Share Loss arising from Restricted Accumulated Loss for Total capital to share capital shares reserves premiums defined benefit plans reserves losses the period equity Balance at 1 January 2023 65,200 654,760 - 767,137 20,910,909 (87,714) 23,378 (10,557,437) (6,916,737) 4,859,496 Transfers - - - - - - - (6,916,737) 6,916,737 - Acquisition of treasury shares (Note 17) - - (245,217) - - - - - - (245,217) Share-based payments (Note 15) - - - 153,622 - - - - - 153,622 Net profit for the period - - - - - - - - 109,053 109,053 Other comprehensive loss - - - - - (108,441) - - - (108,441) Balance at 31 December 2023 65,200 654,760 (245,217) 920,759 20,910,909 (196,155) 23,378 (17,474,174) 109,053 4,768,513 Balance at 1 January 2024 65,200 654,760 (245,217) 920,759 20,910,909 (196,155) 23,378 (17,474,174) 109,053 4,768,513 Transfers - - - - - - - 109,053 (109,053) - Share-based payments (Note 15) - - - 179,945 - - - - - 179,945 Net loss for the period - - - - - - - - (1,604,907) (1,604,907) Other comprehensive loss - - - - - (22,071) - - - (22,071) Balance at 31 December 2024 65,200 654,760 (245,217) 1,100,704 20,910,909 (218,226) 23,378 (17,365,121) (1,604,907) 3,321,480 The accompanying notes are an integral part of these consolidated financial statements. |

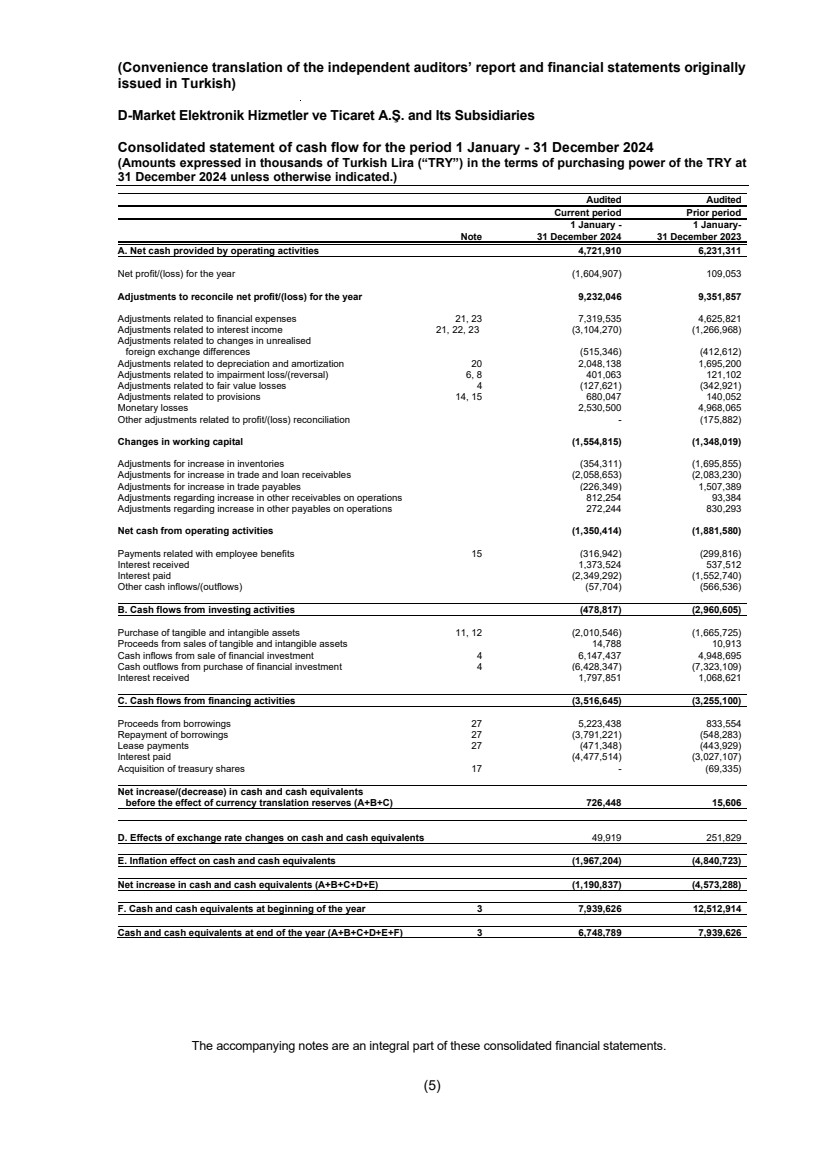

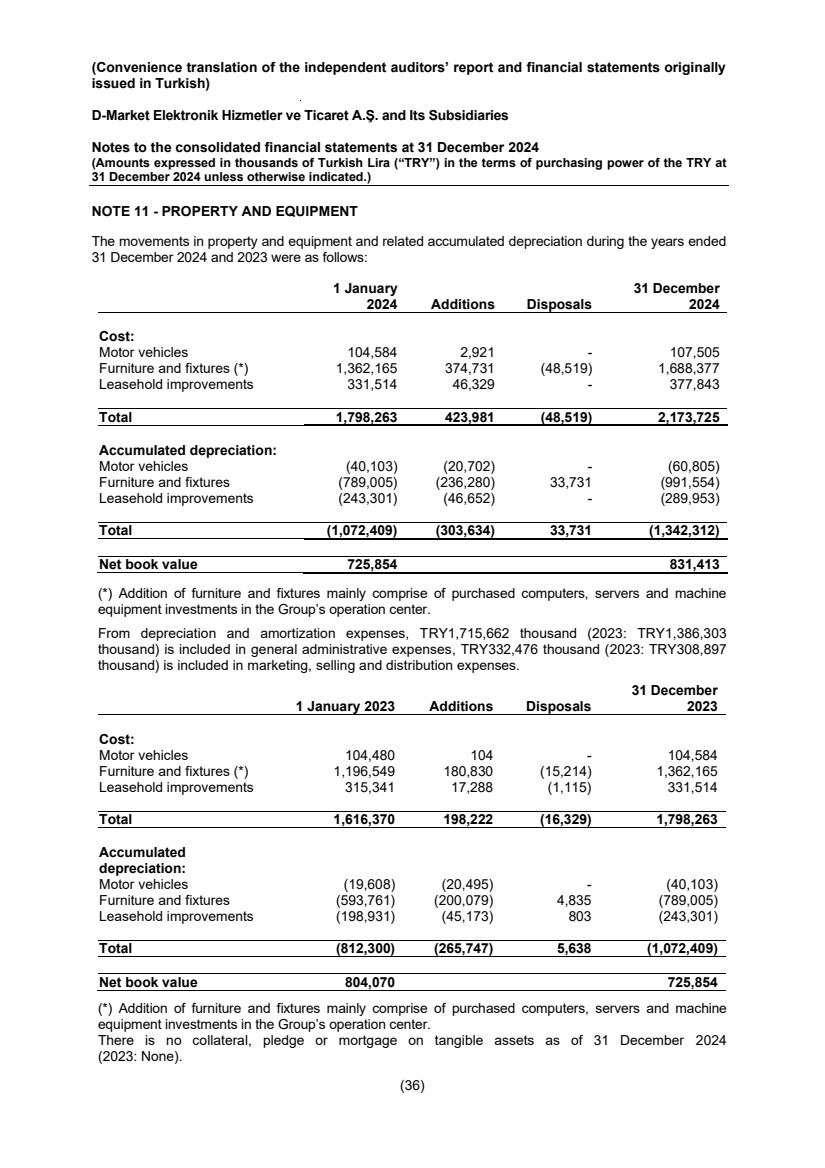

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Consolidated statement of cash flow for the period 1 January - 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (5) Audited Audited Current period Prior period 1 January - 1 January-Note 31 December 2024 31 December 2023 A. Net cash provided by operating activities 4,721,910 6,231,311 Net profit/(loss) for the year (1,604,907) 109,053 Adjustments to reconcile net profit/(loss) for the year 9,232,046 9,351,857 Adjustments related to financial expenses 21, 23 7,319,535 4,625,821 Adjustments related to interest income 21, 22, 23 (3,104,270) (1,266,968) Adjustments related to changes in unrealised foreign exchange differences (515,346) (412,612) Adjustments related to depreciation and amortization 20 2,048,138 1,695,200 Adjustments related to impairment loss/(reversal) 6, 8 401,063 121,102 Adjustments related to fair value losses 4 (127,621) (342,921) Adjustments related to provisions 14, 15 680,047 140,052 Monetary losses 2,530,500 4,968,065 Other adjustments related to profit/(loss) reconciliation - (175,882) Changes in working capital (1,554,815) (1,348,019) Adjustments for increase in inventories (354,311) (1,695,855) Adjustments for increase in trade and loan receivables (2,058,653) (2,083,230) Adjustments for increase in trade payables (226,349) 1,507,389 Adjustments regarding increase in other receivables on operations 812,254 93,384 Adjustments regarding increase in other payables on operations 272,244 830,293 Net cash from operating activities (1,350,414) (1,881,580) Payments related with employee benefits 15 (316,942) (299,816) Interest received 1,373,524 537,512 Interest paid (2,349,292) (1,552,740) Other cash inflows/(outflows) (57,704) (566,536) B. Cash flows from investing activities (478,817) (2,960,605) Purchase of tangible and intangible assets 11, 12 (2,010,546) (1,665,725) Proceeds from sales of tangible and intangible assets 14,788 10,913 Cash inflows from sale of financial investment 4 6,147,437 4,948,695 Cash outflows from purchase of financial investment 4 (6,428,347) (7,323,109) Interest received 1,797,851 1,068,621 C. Cash flows from financing activities (3,516,645) (3,255,100) Proceeds from borrowings 27 5,223,438 833,554 Repayment of borrowings 27 (3,791,221) (548,283) Lease payments 27 (471,348) (443,929) Interest paid (4,477,514) (3,027,107) Acquisition of treasury shares 17 - (69,335) Net increase/(decrease) in cash and cash equivalents before the effect of currency translation reserves (A+B+C) 726,448 15,606 D. Effects of exchange rate changes on cash and cash equivalents 49,919 251,829 E. Inflation effect on cash and cash equivalents (1,967,204) (4,840,723) Net increase in cash and cash equivalents (A+B+C+D+E) (1,190,837) (4,573,288) F. Cash and cash equivalents at beginning of the year 3 7,939,626 12,512,914 Cash and cash equivalents at end of the year (A+B+C+D+E+F) 3 6,748,789 7,939,626 The accompanying notes are an integral part of these consolidated financial statements. |

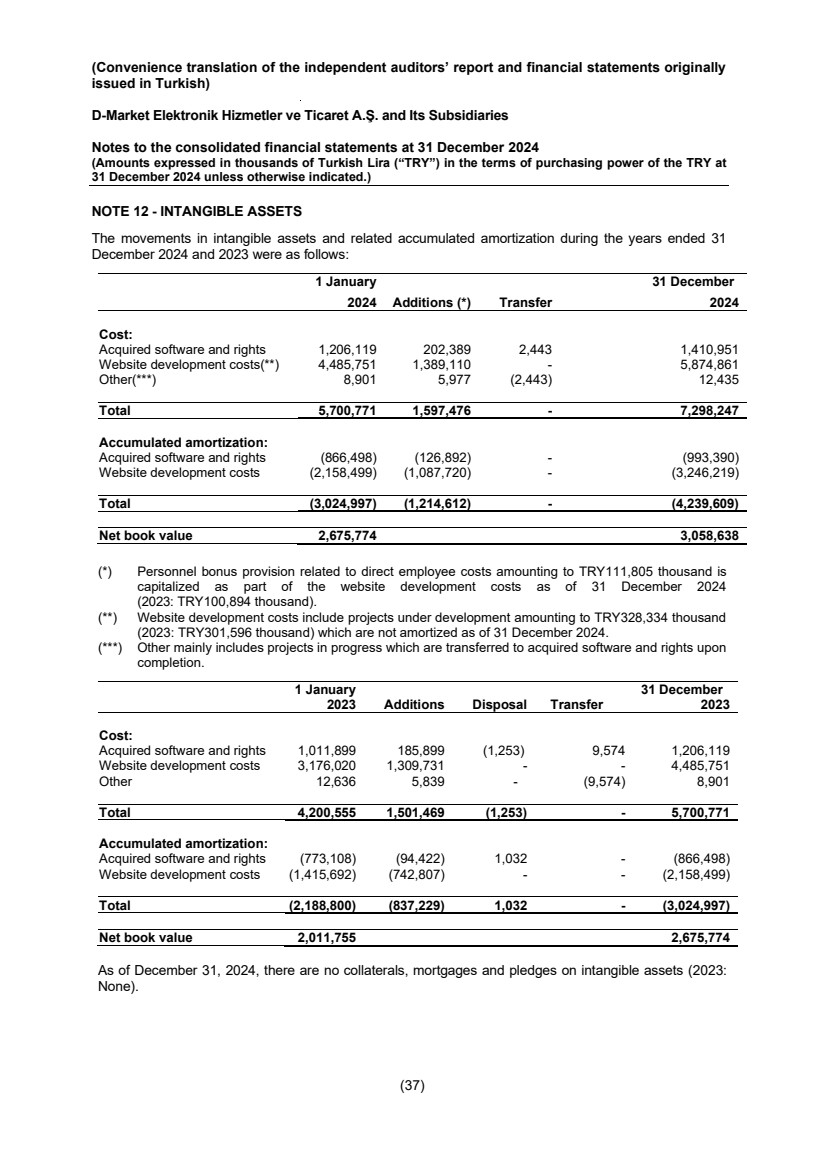

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (6) NOTE 1 - ORGANISATION AND NATURE OF OPERATIONS D-Market Elektronik Hizmetler ve Ticaret A.Ş. (“D-Market” or “Hepsiburada” or together with its subsidiaries the “Group”) was established in April 2000. D-Market currently operates as a retail website (www.hepsiburada.com) offering its retail customers a wide selection of merchandise including electronics and non-electronics (including books, sports, toys, kids and baby products, cosmetics, furniture, etc.). As of 31 December 2024, the ultimate shareholders of D-Market are the members of Doğan Family and Turk Commerce B.V. (Note 17). On July 6, 2021, the Company completed an initial public offering (“IPO”) of 65,251,000 American Depositary Shares (“ADSs”) representing 65,251,000 Class B ordinary shares, at a price to the public of $12.00 per ADS on Nasdaq. The offering included 41,670,000 ADSs offered by the Company and 23,581,000 ADSs offered by a selling shareholder, which included 8,511,000 ADSs sold by the selling shareholder pursuant to the underwriters’ exercise in full of their over-allotment option. The ADSs began trading on the Nasdaq Global Select Market under the ticker symbol “HEPS” on July 1, 2021. On 17 October 2024, the Group’s then-controlling shareholders, being Hanzade Vasfiye Doğan Boyner, our Founder, and Vuslat Doğan Sabancı, Yaşar Begümhan Doğan Faralyalı, Arzuhan Doğan Yalçındağ and Işıl Doğan (collectively, the “Selling Shareholders”), entered into a stock purchase agreement (the “Stock Purchase Agreement”) with Joint Stock Company Kaspi.kz (“Kaspi”), a joint stock company incorporated under the laws of Kazakhstan, for all outstanding Class A shares and Class B shares of the Company held by the Selling Shareholders, corresponding to 65.41% of the Group’s share capital (the “Change of Control”). The Change of Control was subject to regulatory approvals of the Turkish Competition Board, the Banking Regulation and Supervision Agency, the Information Technologies and Communications Authority and the Central Bank of the Republic of Türkiye and was completed on January 29, 2025, on which date Kaspi became our new controlling shareholder. Following the Change of Control, in accordance with former Article 7/A of the Articles of Association, all outstanding Class A shares automatically converted into Class B shares. As of 31 December 2024, the Group has 3,743 employees (2023: 3,213). The address of the registered office is as follows: Kuştepe Mahallesi, Mecidiyeköy Yolu Caddesi No: 12 Kule 2 Kat 2 Şişli, Istanbul - Türkiye Subsidiaries The Subsidiaries included in these consolidated financial statements are as follows: • D Ödeme Elektronik Para ve Ödeme Hizmetleri A.Ş. (“D-Ödeme” or “Hepsipay”) • D Fast Dağıtım Hizmetleri ve Lojistik A.Ş. (“D-Fast” or “Hepsijet”) • Hepsi Finansal Danışmanlık A.Ş. (“Hepsi Finansal”) • Hepsi Finansman A.Ş. (“Hepsi Finansman”) (former trade name “Doruk Finansman A.Ş”) • Hepsiburada Global B.V. (“Hepsiburada Global”) • Hepsiburada Global Elektronik Hizmetler Ticaret ve Pazarlama A.Ş. (“Hepsiburada Global A.Ş.“) D Ödeme was founded on 4 June 2015 and operates as a payment services provider offering payment gateway and e-money services. D Ödeme obtained its operational licence from Banking Regulation and Supervision Agency of Türkiye (“BRSA”) on 20 February 2016. D Ödeme commenced its first payment service transaction on 15 June 2016. D Ödeme launched Hepsipay Cüzdanım (Wallet) in June 2021, an embedded digital wallet product on Hepsiburada platform. D Fast was founded on 26 February 2016 and operates as a cargo and logistic firm which provides last mile delivery services to the customers of Hepsiburada and other customers. |

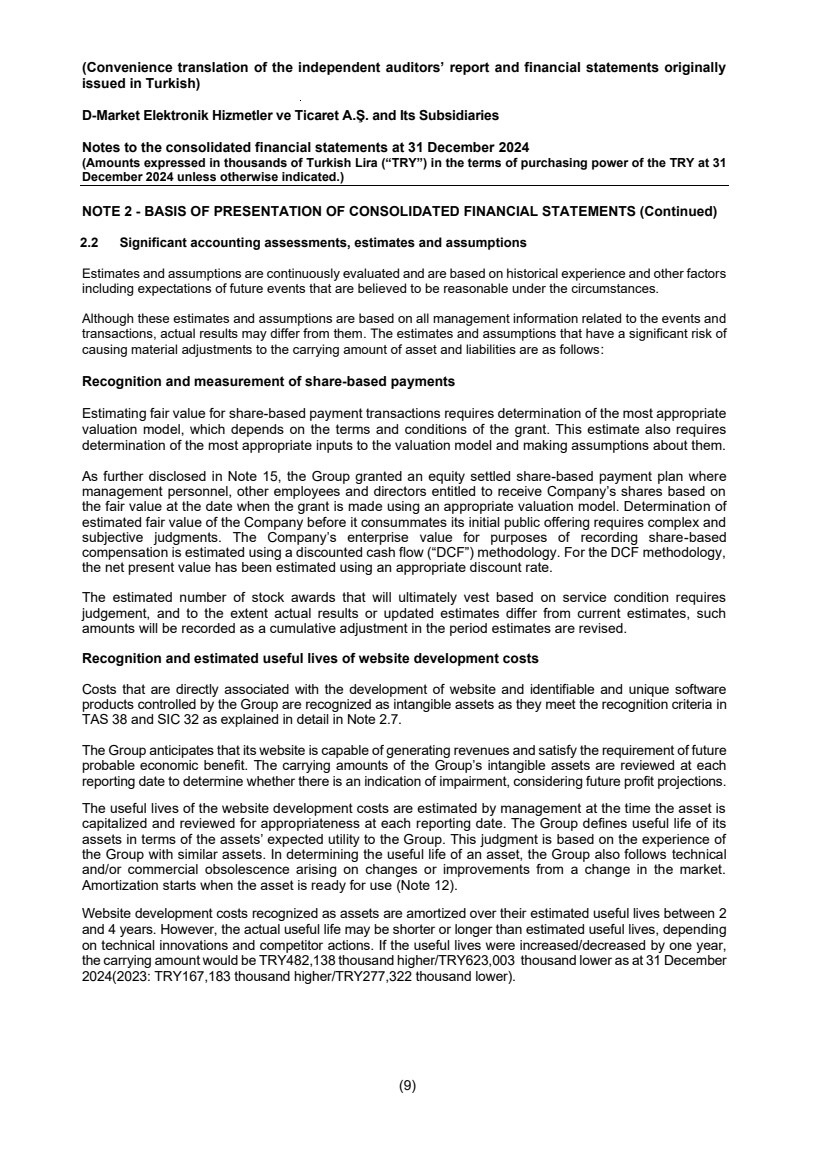

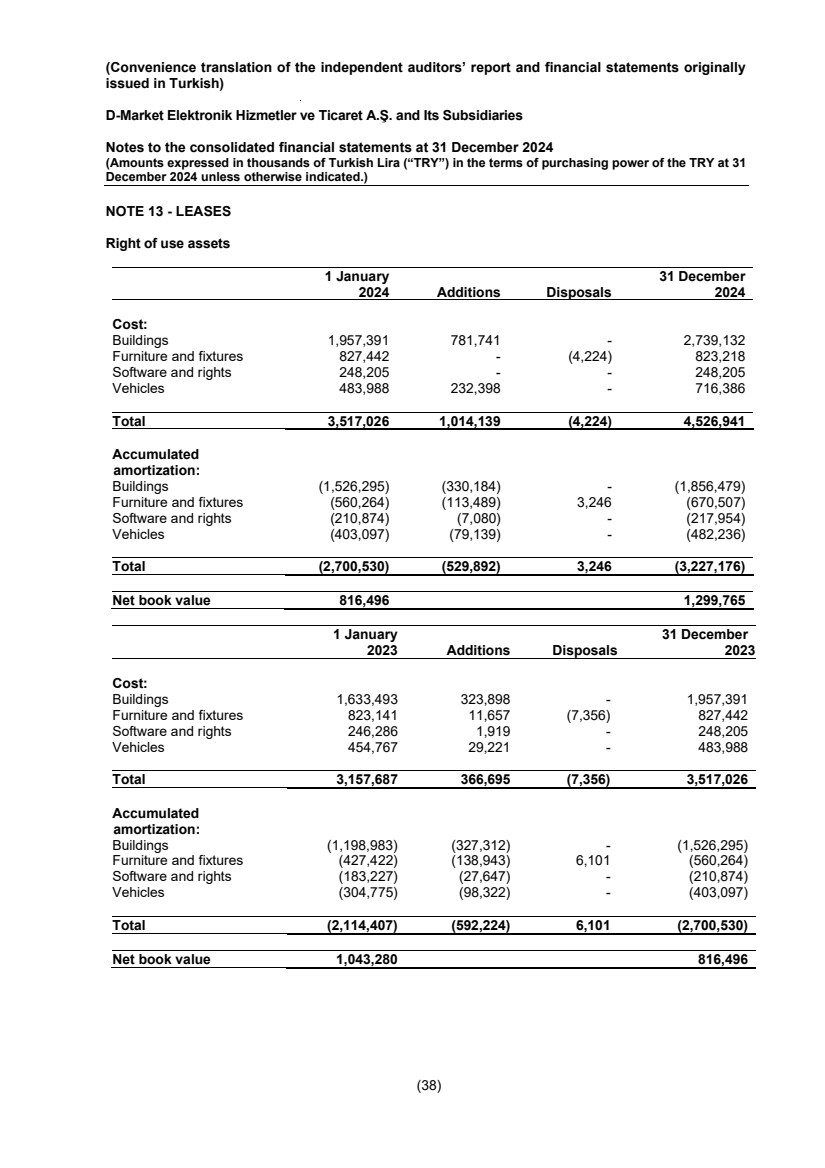

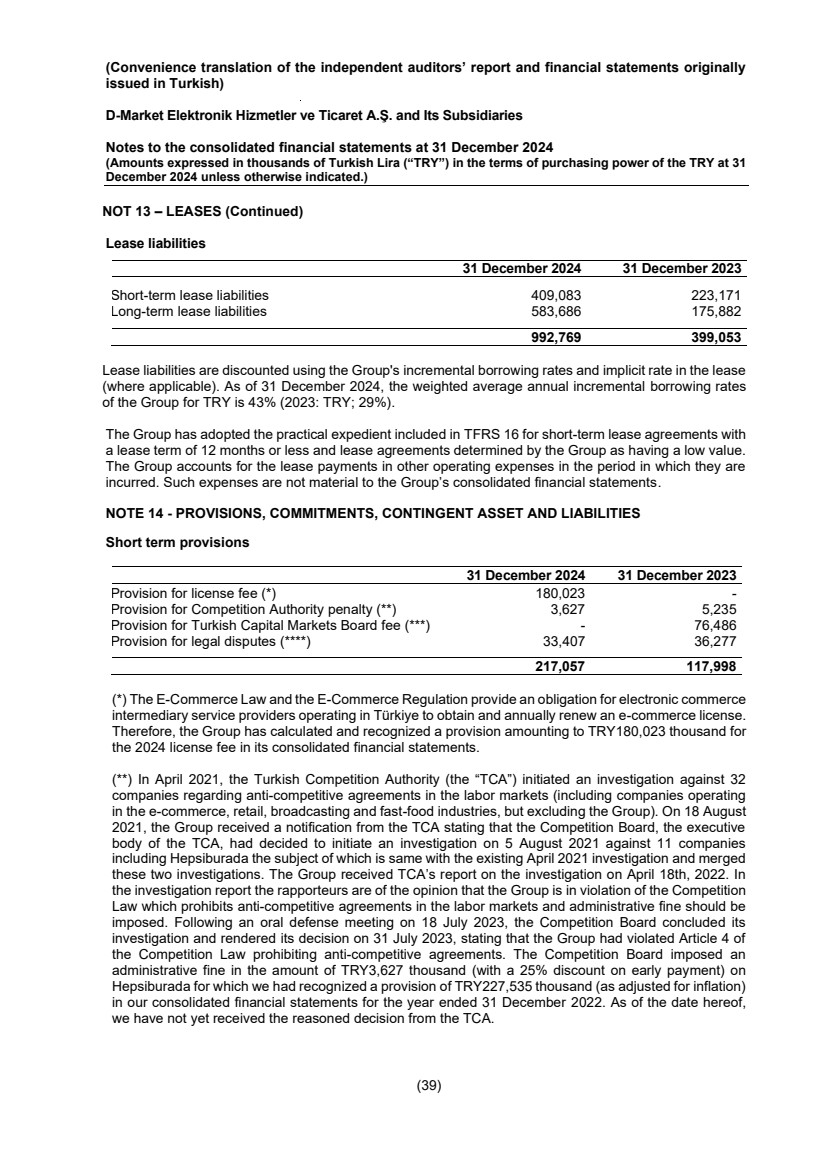

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (7) NOTE 1 - ORGANISATION AND NATURE OF OPERATIONS (Continued) Hepsi Finansal was founded on 1 December 2021. Hepsi Finansal aims to operate as a holding company for the fintech operations of the Group and to provide financial solutions to the customers of Hepsiburada. Hepsi Finansal is the parent company of the Hepsi Finansman A.Ş. which was acquired in February 2022. Hepsi Finansman was acquired by the Group on 28 February 2022 and the Group aims to offer its customers consumer financing solutions through Hepsi Finansman. Hepsi Finansman was founded on 24 April 2006 and obtained its operational license from the BRSA in 2008. Hepsi Finansman operates as a consumer financing company in Türkiye. Hepsiburada Global was founded on 28 July 2023 in the Netherlands. Hepsiburada Global aims to facilitate Hepsiburada’s integration with European payment solutions and marketplaces. Hepsiburada Global A.Ş. was founded on 29 March 2024 in Türkiye. Hepsiburada Global A.Ş. aims to facilitate to manage Hepsiburada’s cross border e-commerce operations. NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS 2.1 Basis of preparation The accompanying consolidated financial statements are prepared in accordance with Turkish Financial Reporting Standards (“TFRS”) issued by the Public Oversight Accounting and Auditing Standards Authority (“POA”). The Company maintais its books of account in Turkish Lira (“TRY”) based on the Turkish Commercial Code (“TCC”), Turkish tax legislation and the Uniform Chart of Accounts issued by the Ministry of Finance of Türkiye. In addition, the Company has prepared its consolidated financial statements in accordance with the accounting policies disclosed in Note 2.7 for the purpose of fair presentation in accordance with TFRS. Consolidated financial statements have been presented in accordance with the TAS taxonomy published by the POA on 4 October 2022. Financial reporting in hyperinflationary economy With the announcements made by the Public Oversight Accounting and Auditing Standards Authority (POA) on 23 November 2023, entities applying TFRSs have started to apply inflation accounting in accordance with “TAS 29 Financial Reporting in Hyperinflation Economies as of financial statements for the annual reporting period ending on or after 31 December 2024”. TAS 29 is applied to the financial statements, including the consolidated financial statements, of any entity whose functional currency is the currency of a hyperinflationary economy. According to the standard, financial statements prepared in the currency of a hyperinflationary economy are presented in terms of the purchasing power of that currency at the balance sheet date. Prior period financial statements are also presented in the current measurement unit at the end of the reporting period for comparative purposes. The Group has therefore presented its consolidated financial statements as of December 31, 2023, on the purchasing power basis as of December 31, 2024. The adjustments made in accordance with IAS 29 were made using the adjustment coefficient obtained from the Consumer Price Index (CPI) of Turkey published by the Turkish Statistical Institute (TÜİK). As of December 31, 2024, the indices and adjustment coefficients used in the adjustment of the consolidated financial statements are as follows: Date Index Adjustment Coefficient Three years compound inflation rates 31 December 2024 2684.55 1.000 291% 31 December 2023 1859.38 1.444 268% 31 December 2022 1128.45 2.379 156% |

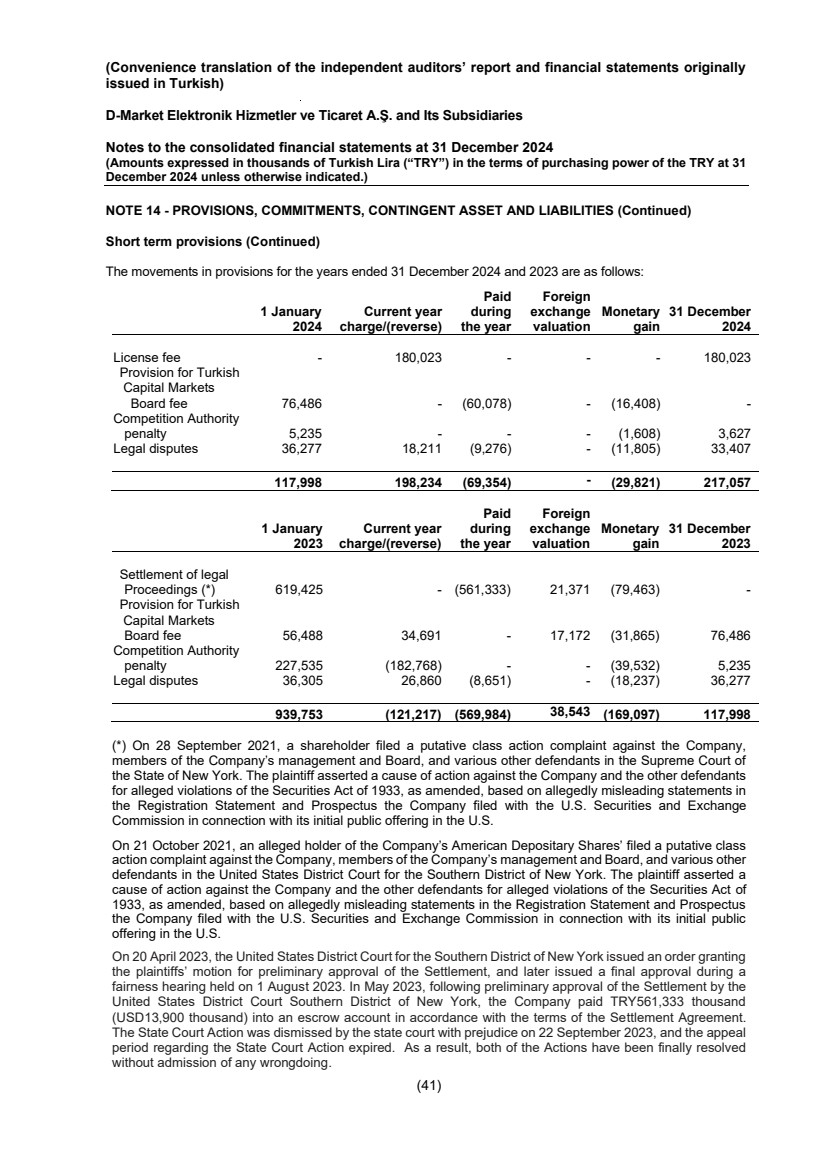

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (8) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.1 Basis of preparation (Continued) The main elements of the Group's adjustment process for financial reporting in hyperinflationary economies are as follows: - Current period consolidated financial statements prepared in TRY are expressed in terms of the purchasing power at the balance sheet date, and amounts from previous reporting periods are also adjusted and expressed in terms of the purchasing power at the end of the reporting period. - Monetary assets and liabilities are not adjusted as they are already expressed in terms of the current purchasing power at the balance sheet date. In cases where the inflation-adjusted values of non-monetary items exceed their recoverable amount or net realizable value, the provisions of TAS 36 “Impairment of Assets” and TAS 2 “Inventories” are applied, respectively. - Non-monetary assets and liabilities and equity items that are not expressed in terms of the current purchasing power at the balance sheet date have been adjusted using the relevant adjustment coefficients. - All items in the comprehensive income statement, except for those that have an impact on the comprehensive income statement of non-monetary items on the balance sheet, have been indexed using the coefficients calculated for the periods when the income and expense accounts were first reflected in the financial statements. - The impact of inflation on the Group's net monetary asset position in the current period is recorded in the net monetary gain/(loss) account in the consolidated income statement. Functional and presentation currency Items included in the consolidated financial statements of each of the Group’s entities are measured using the currency of the primary economic environment in which they operate (“the functional currency”). The consolidated financial statements are presented in thousand Turkish Lira (TRY), which is both the functional and the presentation currency of the Group. Going concern The Group has recurring operating losses, the total operating loss for the year ended 31 December 2024 amounted to TRY1.3 billion, while accumulated deficit as of 31 December 2024 amounted to TRY17,4 billion. The Group generated positive operating cash flows amounting to TRY4,7 billion in 2024 and its cash and cash equivalents as of 31 December 2024 amounts to TRY6,8 billion. Based on its current business plan, the Group’s cash and cash equivalents will be sufficient to fund its operations for at least twelve months from the issuance date of these consolidated financial statements. Management of the Group believes that it will be in a position to cover its liquidity needs through cash on hand, cash generated from operations, available credit lines or a combination thereof, when necessary. The consolidated financial statements have been prepared assuming that the Group will continue as a going concern. |

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (9) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.2 Significant accounting assessments, estimates and assumptions Estimates and assumptions are continuously evaluated and are based on historical experience and other factors including expectations of future events that are believed to be reasonable under the circumstances. Although these estimates and assumptions are based on all management information related to the events and transactions, actual results may differ from them. The estimates and assumptions that have a significant risk of causing material adjustments to the carrying amount of asset and liabilities are as follows: Recognition and measurement of share-based payments Estimating fair value for share-based payment transactions requires determination of the most appropriate valuation model, which depends on the terms and conditions of the grant. This estimate also requires determination of the most appropriate inputs to the valuation model and making assumptions about them. As further disclosed in Note 15, the Group granted an equity settled share-based payment plan where management personnel, other employees and directors entitled to receive Company’s shares based on the fair value at the date when the grant is made using an appropriate valuation model. Determination of estimated fair value of the Company before it consummates its initial public offering requires complex and subjective judgments. The Company’s enterprise value for purposes of recording share-based compensation is estimated using a discounted cash flow (“DCF”) methodology. For the DCF methodology, the net present value has been estimated using an appropriate discount rate. The estimated number of stock awards that will ultimately vest based on service condition requires judgement, and to the extent actual results or updated estimates differ from current estimates, such amounts will be recorded as a cumulative adjustment in the period estimates are revised. Recognition and estimated useful lives of website development costs Costs that are directly associated with the development of website and identifiable and unique software products controlled by the Group are recognized as intangible assets as they meet the recognition criteria in TAS 38 and SIC 32 as explained in detail in Note 2.7. The Group anticipates that its website is capable of generating revenues and satisfy the requirement of future probable economic benefit. The carrying amounts of the Group’s intangible assets are reviewed at each reporting date to determine whether there is an indication of impairment, considering future profit projections. The useful lives of the website development costs are estimated by management at the time the asset is capitalized and reviewed for appropriateness at each reporting date. The Group defines useful life of its assets in terms of the assets’ expected utility to the Group. This judgment is based on the experience of the Group with similar assets. In determining the useful life of an asset, the Group also follows technical and/or commercial obsolescence arising on changes or improvements from a change in the market. Amortization starts when the asset is ready for use (Note 12). Website development costs recognized as assets are amortized over their estimated useful lives between 2 and 4 years. However, the actual useful life may be shorter or longer than estimated useful lives, depending on technical innovations and competitor actions. If the useful lives were increased/decreased by one year, the carrying amount would be TRY482,138 thousand higher/TRY623,003 thousand lower as at 31 December 2024(2023: TRY167,183 thousand higher/TRY277,322 thousand lower). |

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (10) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.2 Significant accounting assessments, estimates and assumptions (Continued) TFRS 16 application and discount rates used for measurement of lease liability The Group, as a lessee, measures the lease liability at the present value of the unpaid lease payments at the commencement date. The lease payments are discounted using the interest rate implicit in the lease, if that rate can be readily determined or if that rate cannot be readily determined, the Group uses its incremental borrowing rate. Incremental borrowing rate is the rate of interest that the Group would have to pay to borrow over a similar term, and with a similar security, the funds necessary to obtain an asset of similar value of the right of use assets in similar economic environment. The Group determines its incremental borrowing rate with reference to its existing and historical cost of borrowing adjusted for the term and security against such borrowing. In addition, the management assesses the expected length of the leases and this assessment takes into account non-cancellation and extension options. The Group evaluate whether it is reasonably certain to exercise the option to renew. That is, it considers all relevant factors that create an economic incentive for it to exercise the renewal. After the commencement date, the Group reassesses the lease term if there is a significant event or change in circumstances that is within its control and affects its ability to exercise (or not to exercise) the option to renew (as a change in business strategy). Recognition and measurement of deferred tax assets The Group has not recognised any deferred income tax assets (except to the extent they are covered by taxable temporary differences) in regarding to its carry forward tax losses, unused tax incentives and other deductible temporary differences due to macroeconomic challenges giving rise to uncertainties as to the generation of future taxable profits for realization of such deferred tax assets in the foreseeable future. If actual events differ from the Group’s estimates, or to the extent that these estimates are adjusted in the future, changes in the amount of an unrecognized deferred tax asset could materially impact the Group’s results of operations. Provisions In determining the provisions, the possibilities of negative outcome and the liabilities that may arise are evaluated by the Company’s legal counsel taking into account expert opinions, if necessary. The Group management determines the amount of the provisions based on its best estimate (Note 14). Allowance for doubtful receivables The Group maintains an allowance for doubtful receivables for estimated losses resulting from the inability of the Group’s customers to make required payments. The Group bases the allowance on the likelihood of recoverability of trade receivables, Buy Now Pay Later (“BNPL”) receivables, loan receivables and credit card receivables; when there is objective evidence of impairment as a result of one or more events that occurred after the initial recognition of asset and those events have an impact on the estimated future cash flows of the financial asset or group of financial assets that could be reliably estimated. The allowance is periodically reviewed. The allowance charged to expenses is determined in respect of receivable balances, calculated as a specified percentage of the outstanding balance in each aging group, with the percentage of the allowance increasing as the aging of the receivable progresses. |

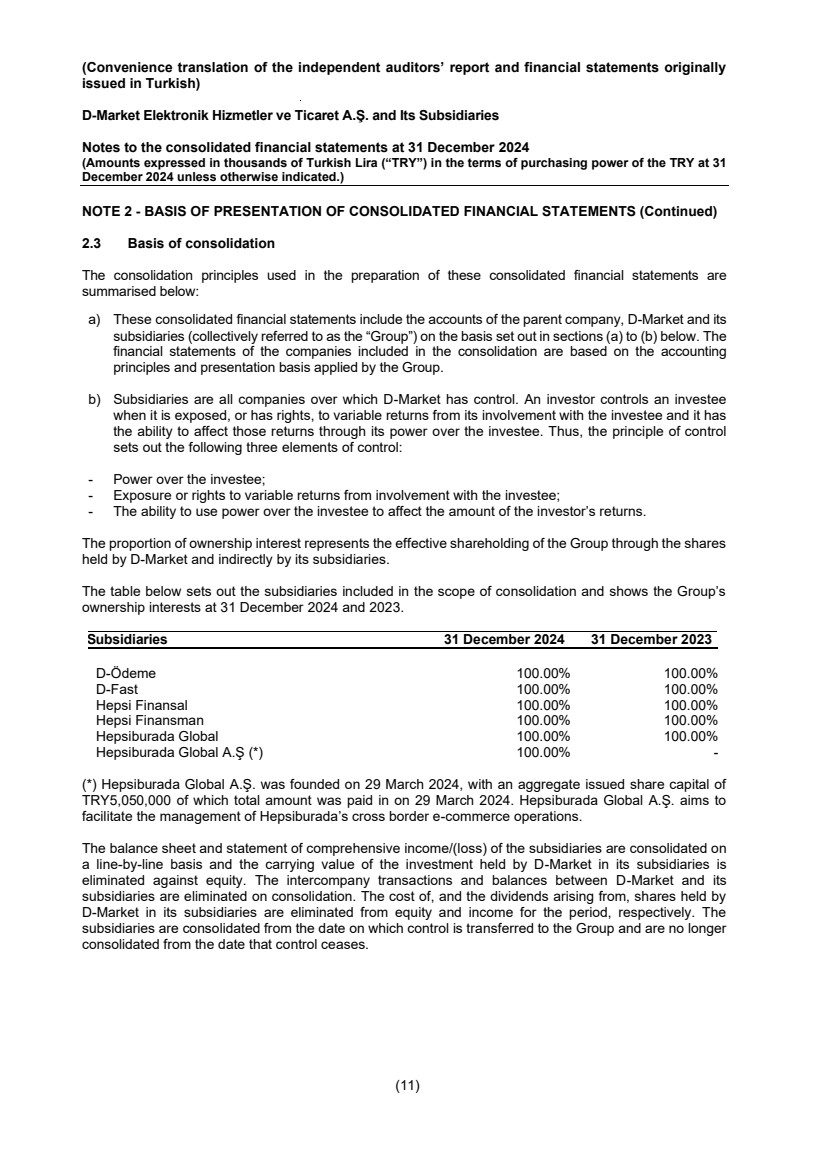

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (11) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.3 Basis of consolidation The consolidation principles used in the preparation of these consolidated financial statements are summarised below: a) These consolidated financial statements include the accounts of the parent company, D-Market and its subsidiaries (collectively referred to as the “Group”) on the basis set out in sections (a) to (b) below. The financial statements of the companies included in the consolidation are based on the accounting principles and presentation basis applied by the Group. b) Subsidiaries are all companies over which D-Market has control. An investor controls an investee when it is exposed, or has rights, to variable returns from its involvement with the investee and it has the ability to affect those returns through its power over the investee. Thus, the principle of control sets out the following three elements of control: - Power over the investee; - Exposure or rights to variable returns from involvement with the investee; - The ability to use power over the investee to affect the amount of the investor’s returns. The proportion of ownership interest represents the effective shareholding of the Group through the shares held by D-Market and indirectly by its subsidiaries. The table below sets out the subsidiaries included in the scope of consolidation and shows the Group’s ownership interests at 31 December 2024 and 2023. Subsidiaries 31 December 2024 31 December 2023 D-Ödeme 100.00% 100.00% D-Fast 100.00% 100.00% Hepsi Finansal 100.00% 100.00% Hepsi Finansman 100.00% 100.00% Hepsiburada Global 100.00% 100.00% Hepsiburada Global A.Ş (*) 100.00% - (*) Hepsiburada Global A.Ş. was founded on 29 March 2024, with an aggregate issued share capital of TRY5,050,000 of which total amount was paid in on 29 March 2024. Hepsiburada Global A.Ş. aims to facilitate the management of Hepsiburada’s cross border e-commerce operations. The balance sheet and statement of comprehensive income/(loss) of the subsidiaries are consolidated on a line-by-line basis and the carrying value of the investment held by D-Market in its subsidiaries is eliminated against equity. The intercompany transactions and balances between D-Market and its subsidiaries are eliminated on consolidation. The cost of, and the dividends arising from, shares held by D-Market in its subsidiaries are eliminated from equity and income for the period, respectively. The subsidiaries are consolidated from the date on which control is transferred to the Group and are no longer consolidated from the date that control ceases. |

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (12) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.4 Offsetting Financial assets and liabilities are offset and the net amount is reported in the consolidated balance sheet when there is a legally enforceable right to set-off the recognised amounts and there is an intention to settle on a net basis, or realise the asset and settle the liability simultaneously. 2.5 The new standards, amendments and interpretations The accounting policies adopted in preparation of the consolidated financial statements as at 31 December 2024 are consistent with those of the previous financial year, except for the adoption of new and amended TFRS and TFRIC interpretations effective as of 1 January 2024 and thereafter. The effects of these amendments and interpretations on the Group’s financial position and performance have been disclosed in the related paragraphs. i) Standards, amendments and interpretations applicable as of 31 December 2024: • Amendment to TAS 1 – Non-current liabilities with covenants; effective from annual periods beginning on or after 1 January 2024. These amendments clarify how conditions with which an entity must comply within twelve months after the reporting period affect the classification of a liability. The amendments also aim to improve information an entity provides related to liabilities subject to these conditions. This change had no impact on the financial position and performance of the Group. • Amendment to TFRS 16 – Leases on sale and leaseback; effective from annual periods beginning on or after 1 January 2024. These amendments include requirements for sale and leaseback transactions in TFRS 16 to explain how an entity accounts for a sale and leaseback after the date of the transaction. Sale and leaseback transactions where some or all the lease payments are variable lease payments that do not depend on an index or rate are most likely to be impacted. This change had no impact on the financial position and performance of the Group. • Amendments to TAS 7 and TFRS 7 on Supplier finance arrangements; effective from annual periods beginning on or after 1 January 2024. These amendments require disclosures to enhance the transparency of supplier finance arrangements and their effects on a company’s liabilities, cash flows and exposure to liquidity risk. The disclosure requirements are the International Accounting Standards Board’s response to investors’ concerns that some companies’ supplier finance arrangements are not sufficiently visible, hindering investors’ analysis. This change was assessed by the Group and impacts are disclosed in Note 5. ii) Standards, amendments, and interpretations that are issued but not effective as of 31 December 2024: ● Amendments to TAS 21 - Lack of Exchangeability; effective from annual periods beginning on or after 1 January 2025. An entity is impacted by the amendments when it has a transaction or an operation in a foreign currency that is not exchangeable into another currency at a measurement date for a specified purpose. A currency is exchangeable when there is an ability to obtain the other currency (with a normal administrative delay), and the transaction would take place through a market or exchange mechanism that creates enforceable rights and obligations. Management has assessed that the amendment will have no impact on the consolidated financial statements. |

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (13) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.5 The new standards, amendments and interpretations (Continued) ii) Standards, amendments, and interpretations that are issued but not effective as of 31 December 2024: (Continued) ● Amendment to TFRS 9 and TFRS 7 - Classification and Measurement of Financial Instruments; effective from annual reporting periods beginning on or after 1 January 2026 (early adoption is available). These amendments: • clarify the requirements for the timing of recognition and derecognition of some financial assets and liabilities, with a new exception for some financial liabilities settled through an electronic cash transfer system; • clarify and add further guidance for assessing whether a financial asset meets the solely payments of principal and interest (SPPI) criterion; • add new disclosures for certain instruments with contractual terms that can change cash flows (such as some instruments with features linked to the achievement of environment, social and governance (ESG) targets); and • make updates to the disclosures for equity instruments designated at Fair Value through Other Comprehensive Income (FVOCI). Management has assessed that these amendments will have no impact on the consolidated financial statements. • Annual improvements to TFRS – Volume 11; Annual improvements are limited to changes that either clarify the wording in an Accounting Standard or correct relatively minor unintended consequences, oversights or conflicts between the requirements in the Accounting Standards. The 2024 amendments are to the following standards: • TFRS 1 First-time Adoption of International Financial Reporting Standards; • TFRS 7 Financial Instruments: Disclosures and its accompanying Guidance on implementing TFRS 7; • TFRS 9 Financial Instruments; • TFRS 10 Consolidated Financial Statements; and • TAS 7 Statement of Cash Flows. Management has assessed that these amendments will have no impact on the consolidated financial statements. • TFRS 18 Presentation and Disclosure in Financial Statements; effective from annual periods beginning on or after 1 January 2027. This is the new standard on presentation and disclosure in financial statements, with a focus on updates to the statement of profit or loss. The key new concepts introduced in TFRS 18 relate to: (i) the structure of the statement of profit or loss; (ii) required disclosures in the financial statements for certain profit or loss performance measures that are reported outside an entity’s financial statements (that is, management-defined performance measures); and (iii) enhanced principles on aggregation and disaggregation which apply to the primary financial statements and notes in general. The Group is in the process of assessing the impact of the amendment on financial position or performance of the Group. • TFRS 19 Subsidiaries without Public Accountability: Disclosures; effective from annual periods beginning on or after 1 January 2027. Earlier application is permitted. This new standard works alongside other TFRS Accounting Standards. An eligible subsidiary applies the requirements in other TFRS Accounting Standards except for the disclosure requirements and instead applies the reduced disclosure requirements in TFRS 19. TFRS 19’s reduced disclosure requirements balance the information needs of the users of eligible subsidiaries’ financial statements with cost savings for preparers. TFRS 19 is a voluntary standard for eligible subsidiaries. A subsidiary is eligible if: • it does not have public accountability; and • it has an ultimate or intermediate parent that produces consolidated financial statements available for public use that comply with TFRS Accounting Standards. Management has assessed that the amendment will have no impact on the consolidated financial statements. |

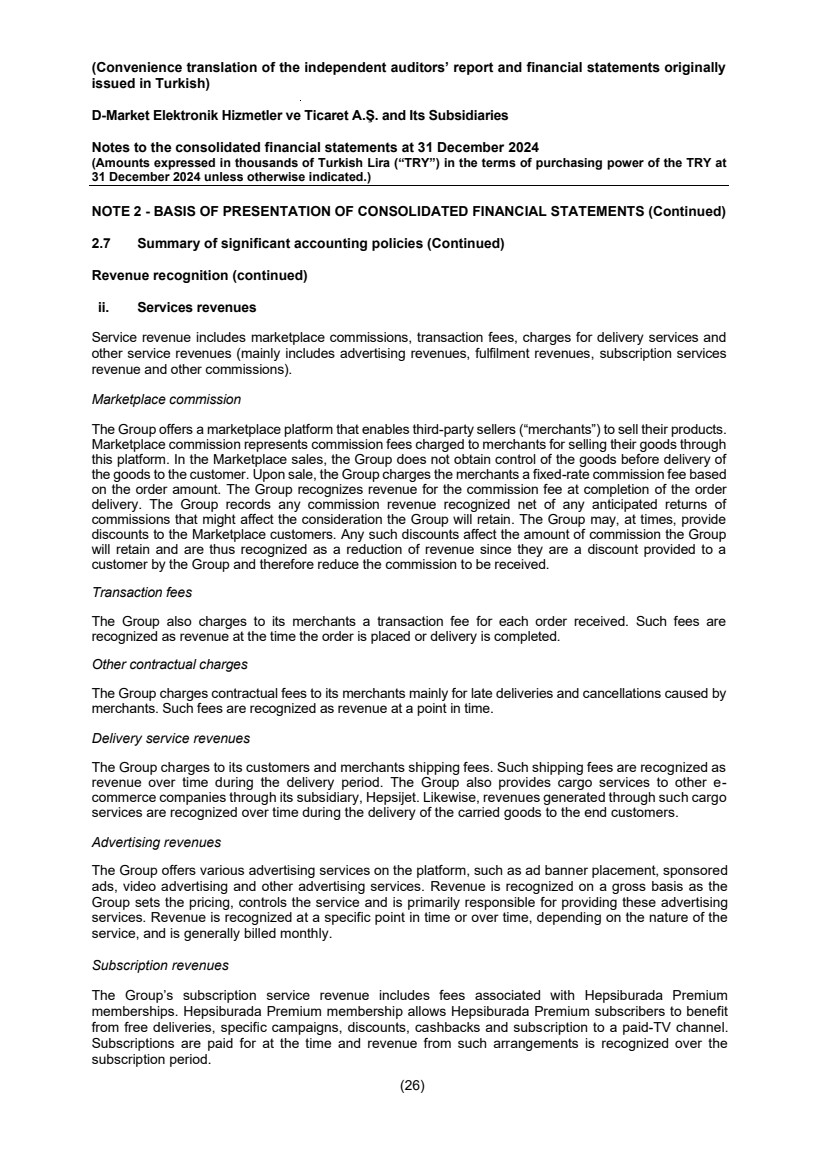

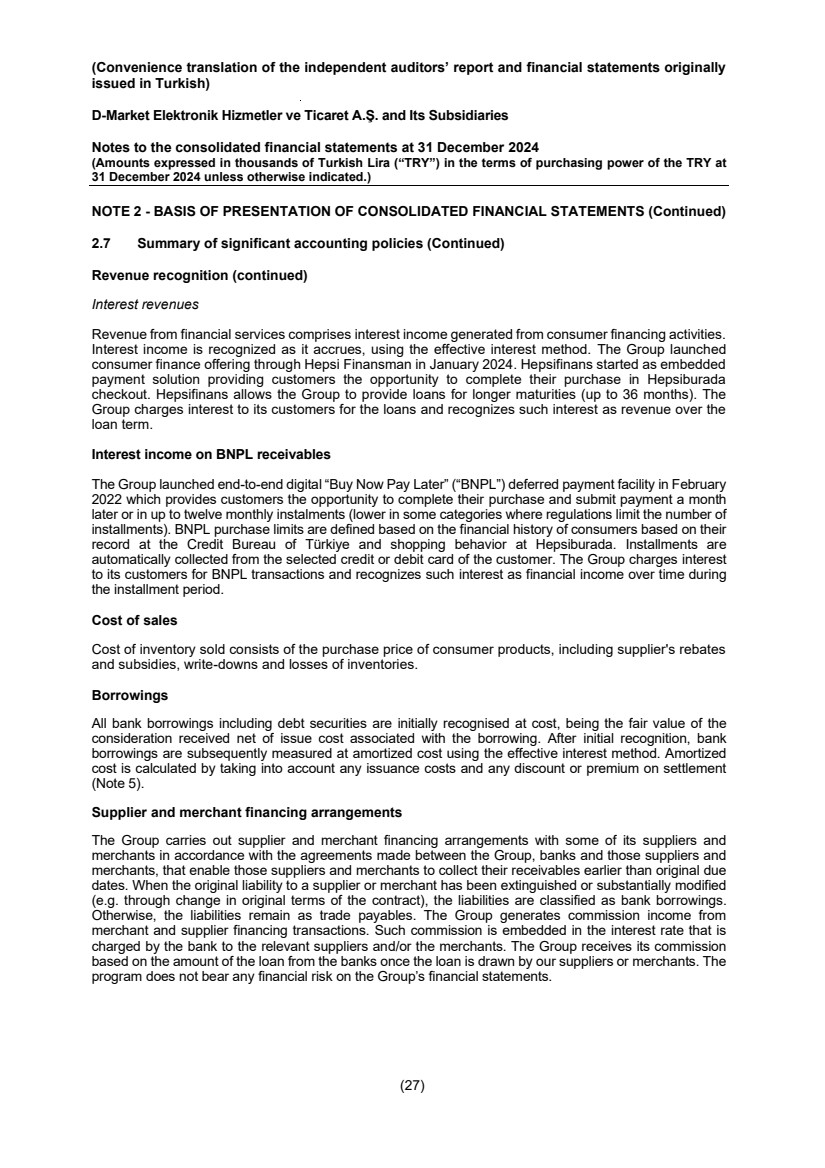

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (14) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.6 Comparative information The consolidated financial statements of the Group include comparative financial information to enable the determination of the trends in the financial position and performance. Comparative figures are reclassified, where necessary, to conform to changes in presentation in the current period consolidated financial statements and the significant changes are explained. As of December 31, 2023, interest income on credit sales amounting to 56,741 TL from the "Buy Now Pay Later" ("BNPL") deferred payment service which was previously classified under "Financial income", has been reclassified as "Other operating income" The impact of this amount on cash flows, which was previously classified under "Cash Flows from Investing Activities" as of the relevant date, has been reclassified under "Cash Flows from Operating Activities" as a result of the assessment considered. These classifications do not have any impact on the undistributed profits or net profit for the relevant period. 2.7 Summary of significant accounting policies The significant accounting policies followed in the preparation of these consolidated financial statements are summarised below: Cash and cash equivalents Cash and cash equivalents includes cash on hand, demand and time deposits with financial institutions and other short-term, highly liquid investments with original maturities of three months or less that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value. Restricted cash and wallet deposits Restricted cash represents fund deposits received from customers for the Group’s payment solution by digital wallet. These deposits are subject to regulatory restrictions and therefore are not available for use by the Group. These deposits are kept separately from the Group’s cash accounts. A corresponding liability is recorded as wallet deposits in the consolidated balance sheet. These amounts are maintained in the digital wallet until withdrawal is requested or used by the customer. In accordance with the Law on payment and securities settlement systems, payment services and electronic money institutions, number 6493, the Group is liable to compensate for the rights of the fund holders. Considering these facts and circumstances, the Group has recognised restricted cash and the corresponding wallet deposit liability in its consolidated financial statements. Trade receivables A receivable is the Group’s right to consideration that is unconditional. A right to consideration is unconditional if only the passage of time is required before payment of that consideration is due. Trade receivables that do not contain a significant financing component or for which the Group has applied the practical expedient are measured initially at the transaction price, and subsequently at amortized cost using the effective interest rate method, less provision for impairment. Loan receivables (Receivables from finance sector operations) Financial assets generated as a result of providing a loan are classified as loan receivables and are carried at amortized cost, less any impairment. All loans are recognised in the consolidated financial statements when the customer is funded by the Group for an e-commerce transaction. |

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (15) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.7 Summary of significant accounting policies (Continued) Contract balances Contract assets When the Group performs by transferring goods or services to a customer before the customer pays consideration or before payment is due, the Group presents the contract as a contract asset, excluding any amounts presented as a receivable. Contract assets are subject to impairment assessment within the scope of expected credit loss calculation. Contract liabilities and merchant advances If a customer pays consideration, or the Group has a right to an amount of consideration that is unconditional (i.e., a receivable), before the Group transfers a good or service, the Group presents the contract as a contract liability when the payment is made or the payment is due (whichever is earlier). Contract liabilities are recognised as revenue when the Group performs under the contract (i.e., transfers control of the related goods or services). Merchant advances consists of advances received from customers for marketplace transactions, which relate to undelivered orders and where the Group acts as an agent. The Group earns a commission for these transactions. The amount of advances payable to a merchant, net of commissions, is credited as a payable to the merchant when delivery is complete. Financial assets The Group classified its financial assets in three categories; financial assets carried at amortized cost, financial assets carried at fair value through profit or loss, financial assets carried at fair value through other comprehensive income. Classification is performed in accordance with the business model determined based on the purpose of benefits from financial assets and expected cash flows. Management performs the classification of financial assets at the acquisition date. The Group did not hold any financial assets in the “fair value through other comprehensive income” category as at 31 December 2024. a) Financial assets carried at amortized cost Assets that are held for collection of contractual cash flows where those cash flows represent solely payments of principal and interest, whose payments are fixed or predetermined, which are not actively traded and which are not derivative instruments are measured at amortized cost. They are included in current assets, except for maturities more than 12 months after the balance sheet date. Those with maturities more than 12 months are classified as non-current assets. The Group’s financial assets carried at amortized cost comprise “trade receivables”, “loan receivables”, “contract assets”, “financial investments”, “restricted cash” and “cash and cash equivalents” in the consolidated balance sheet. Impairment of trade receivables and customer contract assets The Group applies the TFRS 9 simplified approach to measuring expected credit losses which uses a lifetime expected loss allowance for all trade receivables and contract assets. To measure the expected credit losses, trade receivables and contract assets have been grouped based on shared credit risk characteristics and the days past due. The Group has further concluded that the expected loss rates for trade receivables are a reasonable approximation of the loss rates for the contract assets. The expected loss rates are based on the payment profiles of sales over a period before reporting date and the corresponding credit losses experienced within this period. The historical loss rates are adjusted to reflect current and forward-looking information on macroeconomic factors affecting the ability of the customers to settle the receivables. While cash and cash equivalents and financial investments carried at amortized cost are also subject to the impairment requirements of TFRS 9, the identified impairment loss was immaterial. |

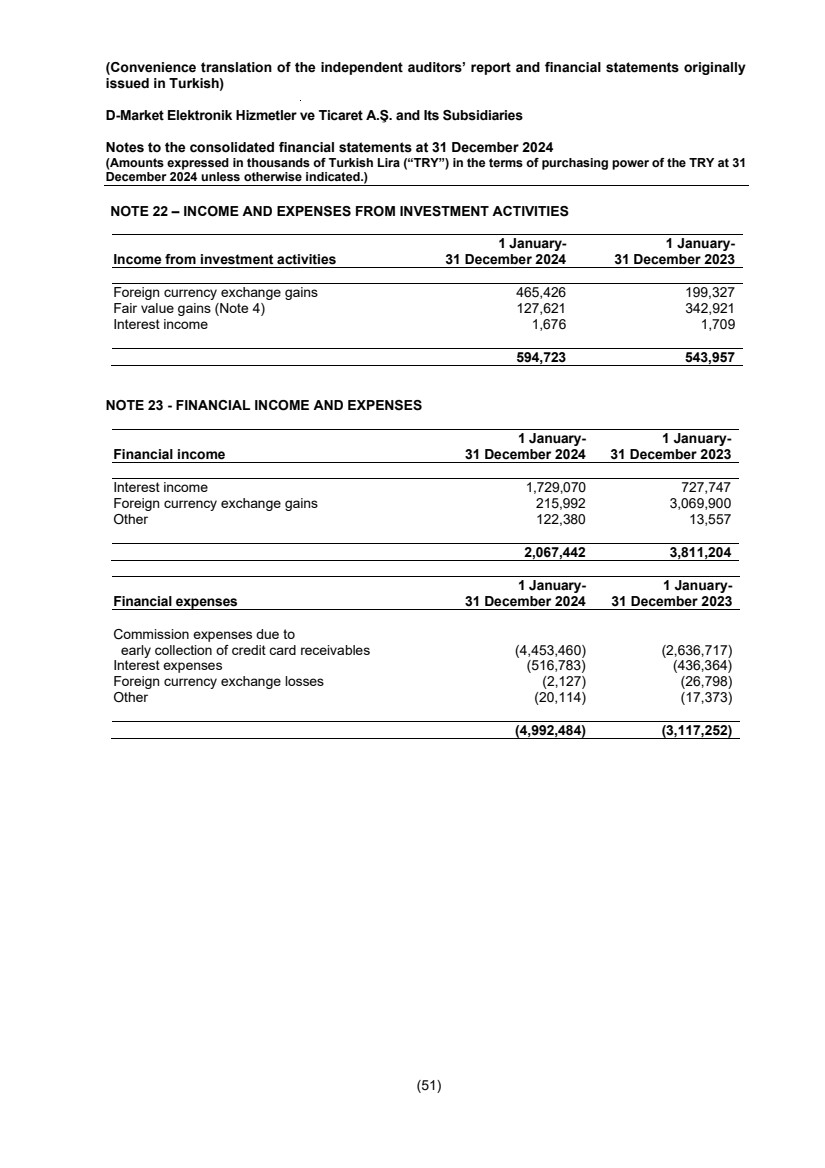

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (16) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.7 Summary of significant accounting policies (Continued) Impairment for loan and BNPL receivables The Group has adopted “three level impairment approach (general model)” defined in TFRS 9 for the recognition of impairment losses on on loan and BNPL receivables from finance sector operations, carried at amortized cost. General model considers the changes in the credit quality of the financial instruments after the initial recognition. Three levels defined in the general model are as follows: “Level 1”, includes financial instruments that have not had a significant increase in credit risk since initial recognition or that have low credit risk at the reporting date. For these assets, 12-month expected credit losses (“ECL”) are recognised and interest revenue is calculated on the gross carrying amount of the asset (that is, without deduction for credit allowance). 12-month ECL are the expected credit losses that result from default events that are possible within 12 months after the reporting date. “Level 2”, includes financial instruments that have had a significant increase in credit risk since initial recognition but those do not have objective evidence of impairment. For these assets, lifetime expected credit losses are recognised and interest revenue is calculated on the gross carrying amount of the asset. Lifetime ECL are the expected credit losses that result from all possible default events over the expected life of the financial instrument. “Level 3”, includes financial assets that have objective evidence of impairment at the reporting date. For these assets, lifetime expected credit losses are recognised. Group appropriately classifies its financial instruments considering common risk factors (such as the type of the instrument, credit risk rating, guarantees, time to maturity and sector) to determine whether the credit risk on a financial instrument has increased significantly and to account appropriate amount of credit losses in the consolidated financial statements. The changes in the expected credit losses on receivables from finance sector operations are accounted for under “other operating income/expenses” account of the consolidated statement of income. Derecognition A financial asset (or a part of a financial asset or group of similar financial asset) is derecognized when the rights to receive cash flows from the asset have expired or the Group has transferred its rights to receive cash flows from the asset or has assumed an obligation to pay the received cash flows in full without material delay to a third party under a ‘pass-through’ arrangement; and either (a) the Group has transferred substantially all the risks and rewards of the asset, or (b) the Group has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control of the asset. Where the Group has transferred its rights to receive cash flows from an asset and has neither transferred nor retained substantially all the risks and rewards of the asset nor transferred control of the asset, the asset is recognized to the extent of the Group’s continuing involvement in the consolidated financial statements. b) Financial assets carried at fair value through profit or loss Financial assets at fair value through profit or loss are carried in the consolidated balance sheet at fair value with net changes in fair value recognised in the consolidated statement of profit or loss. Financial assets at fair value through profit or loss consist of financial investments which are acquired to benefit from short-term price or other fluctuations in the market or which are a part of a portfolio aiming to earn profit in the short-run, irrespective of the reason of acquisition, and kept for trading purposes. |

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (17) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.7 Summary of significant accounting policies (Continued) Trade payables and payables to merchants Trade payables mainly arise from the payables to retail suppliers related to the inventory purchases and services payables. It also includes payables to the marketplace merchants for amounts received by the Group for products delivered by merchants to customers net of commissions, services charges and delivery costs and payables to other service providers. Trade payables and payables to merchants are recognized initially at fair value and subsequently measured at amortized cost using the effective interest method. Related parties For the purpose of these consolidated financial statements, shareholders who have control or joint control over the Group, key management personnel and Board members, in each case together with their close family members and the legal entities over which these related parties exercise control and significant influence, subsidiaries and joint ventures are considered and referred to as related parties. Inventories Inventories, comprising of trade goods, are valued at the lower of cost and net realisable value. Costs incurred in bringing each product to its present location and condition is defined as the initial cost. An entity may purchase inventories on deferred settlement terms. When the arrangement effectively contains a financing element, that element, for example a difference between the purchase price for normal credit terms and the amount paid, is recognised as interest expense over the period of the financing. The cost of inventories is determined using the weighted average method. Net realisable value is the estimated selling price in the ordinary course of business, less estimated costs necessary to make the sale. Provision for inventories is accounted in cost of sales. Rebates The Group periodically receives consideration from certain suppliers, representing rebates for sold out products or purchased products from supplier for a specified period. The Group considers those rebates as a reduction to costs of inventory when the amounts are reliably measurable. Impairment of non-financial assets The Group assesses, at each reporting date, whether there is objective evidence that an asset is impaired. If any indication exists, the Group estimates the asset’s recoverable amount. When the carrying amount of an asset exceeds its recoverable amount, the asset is considered impaired. Impairment losses are recognized in statement of comprehensive income/(loss). The recoverable amount is the higher of an asset’s fair value less costs to sell and value in use (discounted cash flows an asset is expected to generate based upon management’s expectations of future economic and operating conditions). For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are separately identifiable cash inflows (cash-generating units). An assessment is made at each reporting date to determine whether there is an indication that previously recognised impairment losses no longer exist or have decreased. Subsequent increase in the asset’s recoverable amount due to the reversal of a previously recognized impairment loss cannot be higher than the previous carrying value (net of depreciation and amortization). |

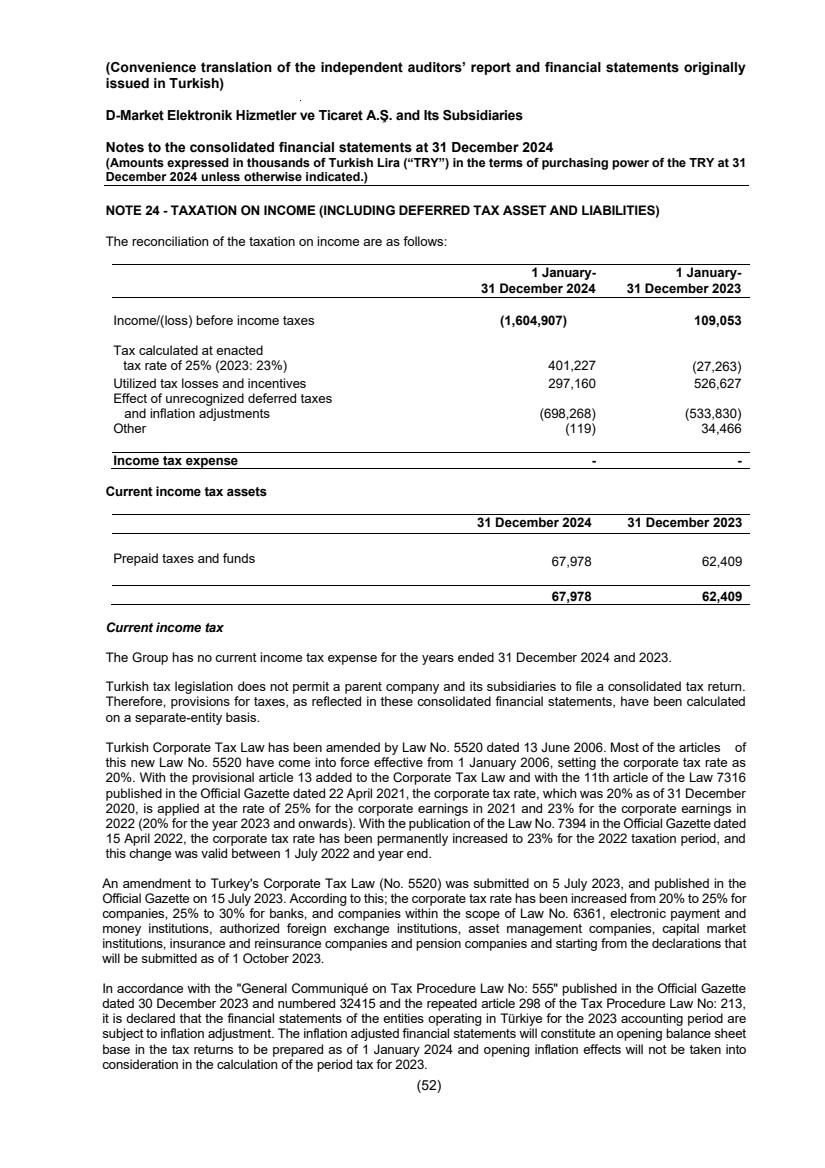

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (18) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.7 Summary of significant accounting policies (Continued) Property and equipment and related depreciation Property and equipment are carried at cost less accumulated depreciation and are amortized on a straight-line basis. Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Group and the cost of the item can be measured reliably. The carrying amount of the replaced part is derecognised. Repairs and maintenance are charged to the profit or loss of the statement of comprehensive income/(loss) as incurred. The cost includes expenditure that is directly attributable to the acquisition of the items. The assets’ residual values and estimated useful economic lives are reviewed at the end of each reporting period and adjusted prospectively if appropriate. The depreciation periods for property and equipment, which approximate the useful lives of such assets, are as follows: Furniture and fixtures 5 -10 years Leasehold improvements 2 - 5 years Motor vehicles 5 years An impairment loss is charged to profit and loss for the amount by which the carrying amount of the asset exceeds its recoverable amount, which is the higher of the asset’s net selling price and value in use. Gains or losses on disposals of property and equipment, which is determined by comparing the proceeds with the carrying amount, are included in the related income and expense accounts, as appropriate. Intangible assets Intangible assets comprise acquired software and rights. Acquired computer software licenses and rights are capitalized on the basis of costs incurred to acquire and bring to use the specific software. Software and rights costs are amortized over their estimated useful lives of 3 to 15 years. Website development costs Costs that are directly associated with the development of website and unique software products controlled by the Group are recognized as internally generated intangible assets when the following criteria are met: • it is technically feasible to complete the software so that it will be available for use or sale; • management intends to complete the software and use or sell it; • there is an ability to use or sell the software; • it can be demonstrated how the software will generate probable future economic benefits; • adequate technical, financial and other resources to complete the development and to use or sell the software are available; and • the expenditure attributable to the software during its development can be reliably measured. Directly attributable costs that are capitalized as part of the development website and software include direct employee costs, an appropriate portion of relevant overhead and service costs incurred as part of the development. Development costs that do not meet the criteria above are recognized as expense as incurred. Development costs previously recognized as expense are not recognized as an asset in a subsequent period. Development costs recognized as an asset are amortized over their estimated useful lives between 2 and 4 years. Amortization starts when the asset is ready for use (Note 12). Capitalized development costs, stages of website development and useful lives are assessed in accordance with the requirements of SIC 32 Intangible Assets: Web Site Costs and TAS 38 Intangible Assets. |

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (19) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.7 Summary of significant accounting policies (Continued) Leases At the inception of a contract, the Group assesses whether the contract is, or contains, a lease. A contract is, or contains, a lease if the contract conveys right to control the use of an identified asset for a period of time in exchange for consideration. For a contract that is, or contains, a lease, the Group accounts for each lease component within the contract as lease separately from non-lease components of the contract. The Group determines the lease term as the non-cancellable period of lease, together with both: - periods covered by an option to extend the lease if the lessee is reasonably certain to exercise that option; and - periods covered by an option to terminate the lease if the lessee is reasonably certain not to exercise that option. In assessing whether a lessee is reasonably certain to exercise an option to extend a lease, or not to exercise an option to terminate a lease, the Group considers all relevant facts and circumstances that create an economic incentive for the lessee to exercise the option to extend the lease, or not to exercise the option to terminate the lease. The Group revises the lease term if there is a change in the non-cancellable period of lease. The Group as a lessee For a contract that contains a lease component and one or more additional lease or non-lease components, the Group allocates the consideration in the contract to each component on the basis of the relative stand-alone price of the lease component and the aggregate stand-alone price of the non-lease components. The relative stand-alone price of lease and non-lease components is determined on the basis of the price the lessor, or a similar supplier, would charge an entity for that component, or a similar component, separately. If an observable stand-alone price is not readily available, the Group estimates the stand-alone price, maximising the use of observable information. The non-lease components are not accounted for within the scope of TFRS 16. For determination of the lease term, the Group reassesses whether it is reasonably certain to exercise an extension option, or not to exercise a termination option, upon the occurrence of either a significant event or a change in circumstances that: - Is within the control of the Group, - Affects whether the Group is reasonably certain to exercise an option not previously included in its determination of the lease term, or not to exercise an option previously included in its determination of the lease term. |

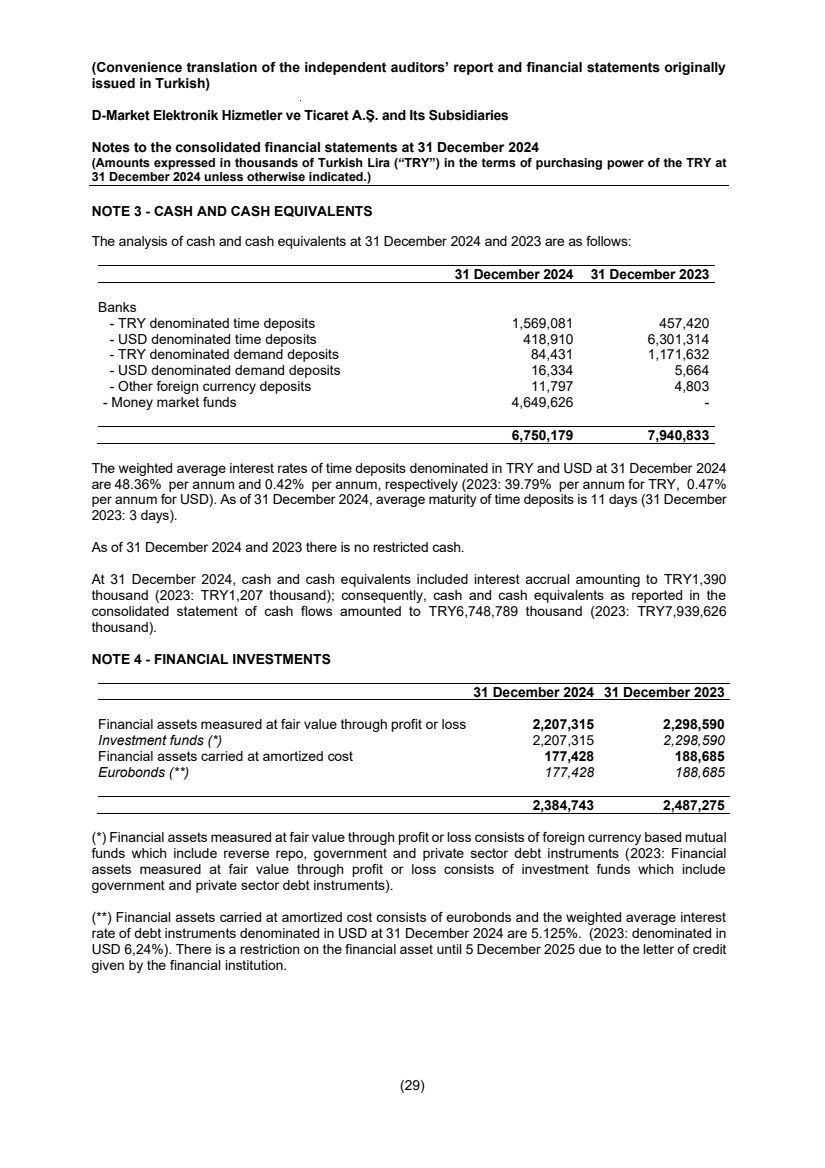

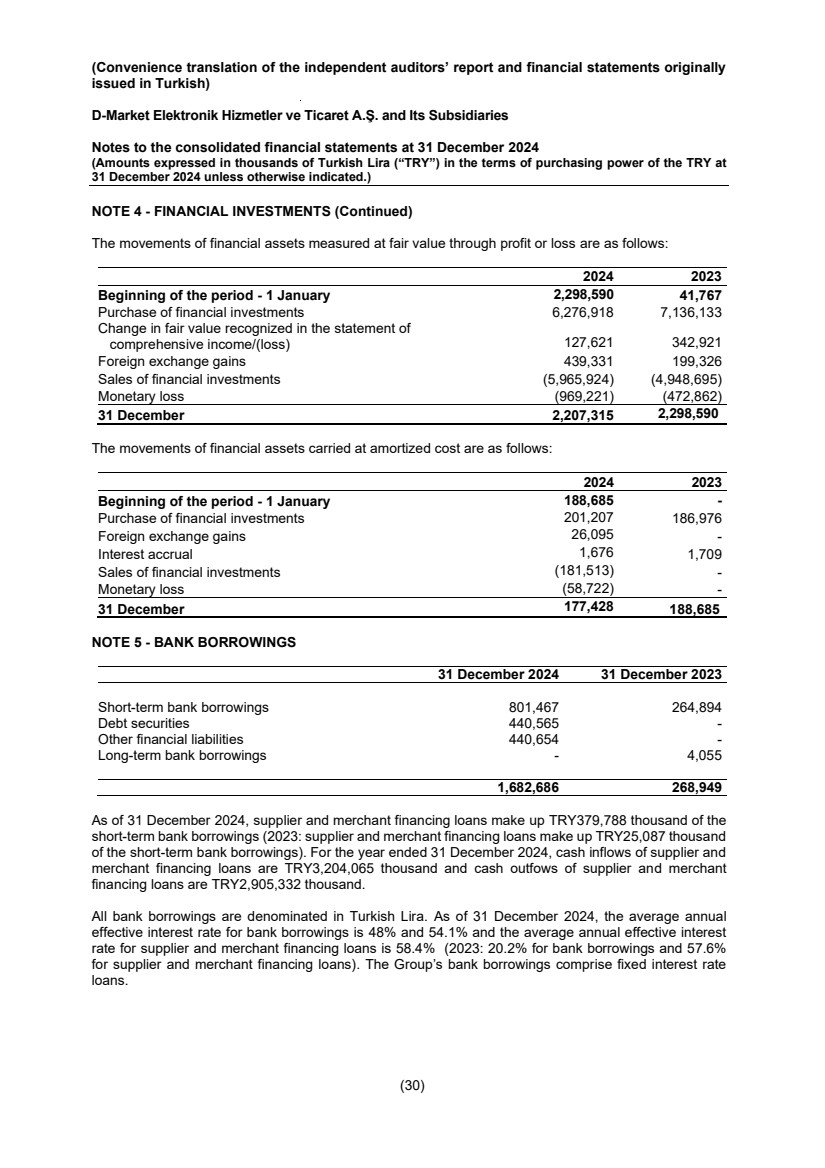

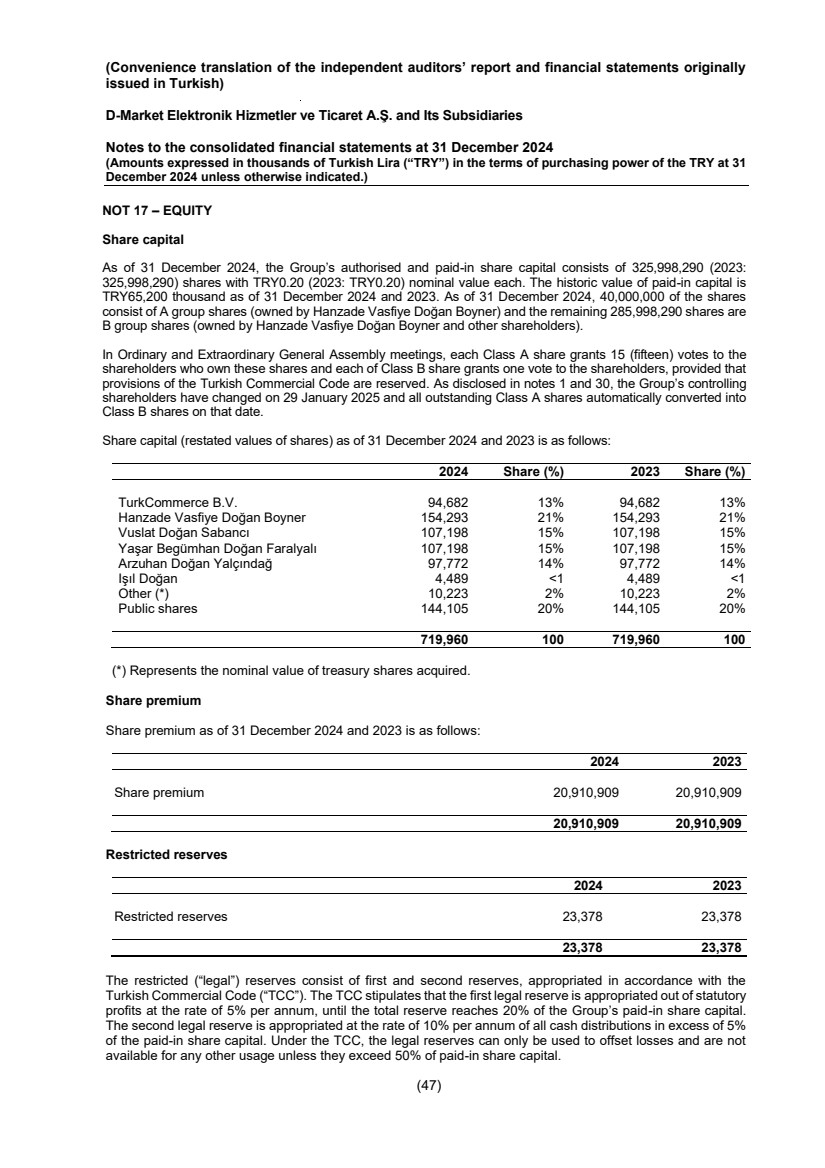

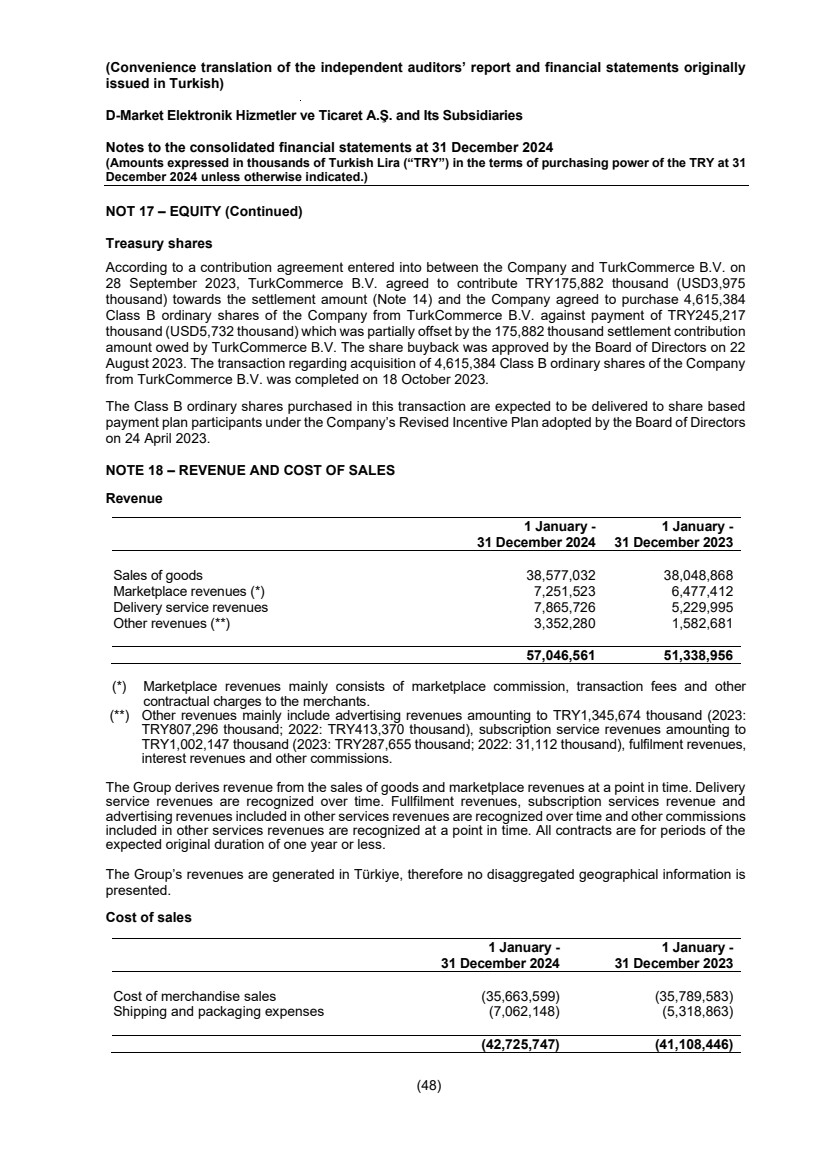

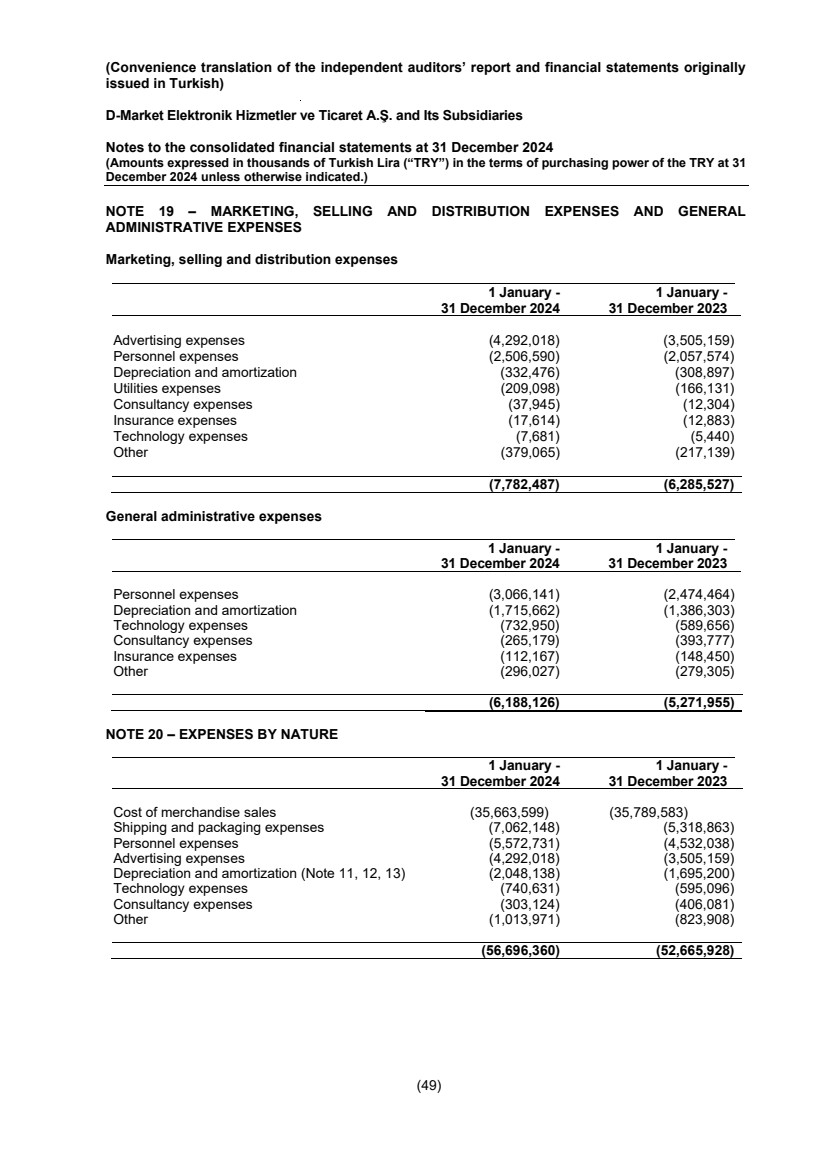

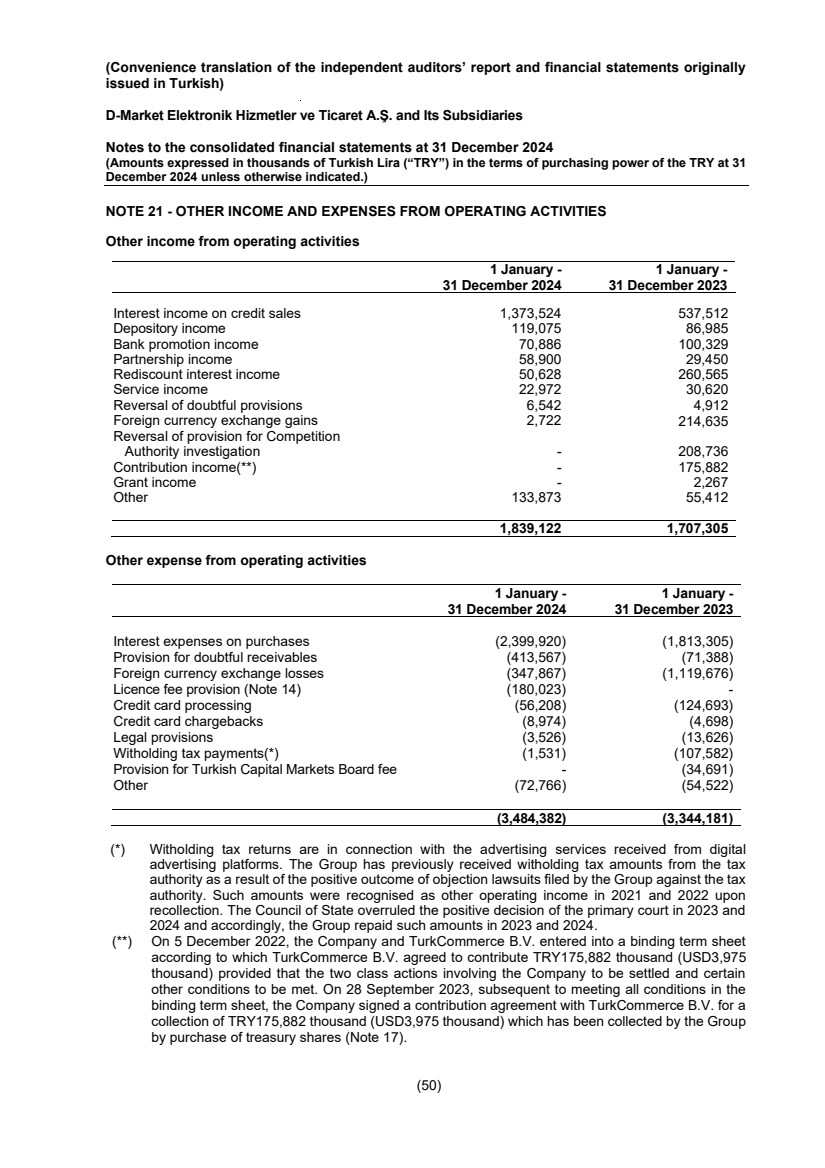

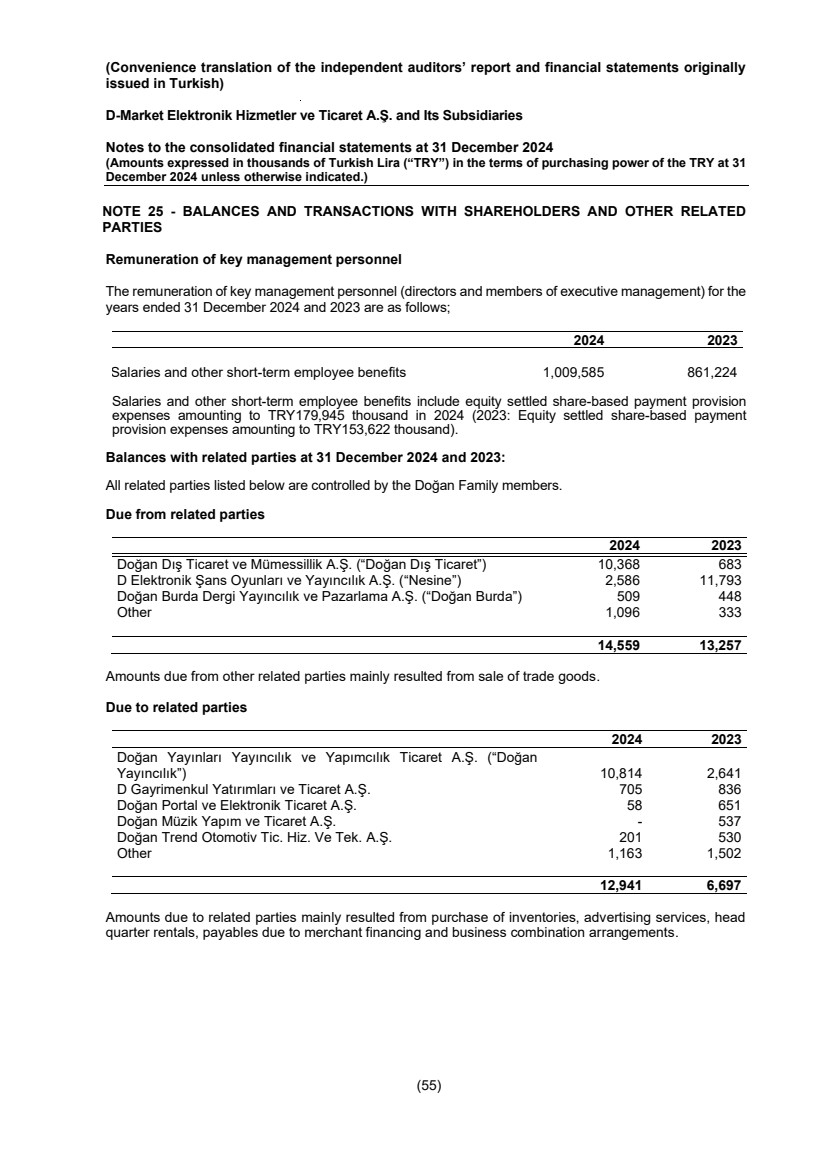

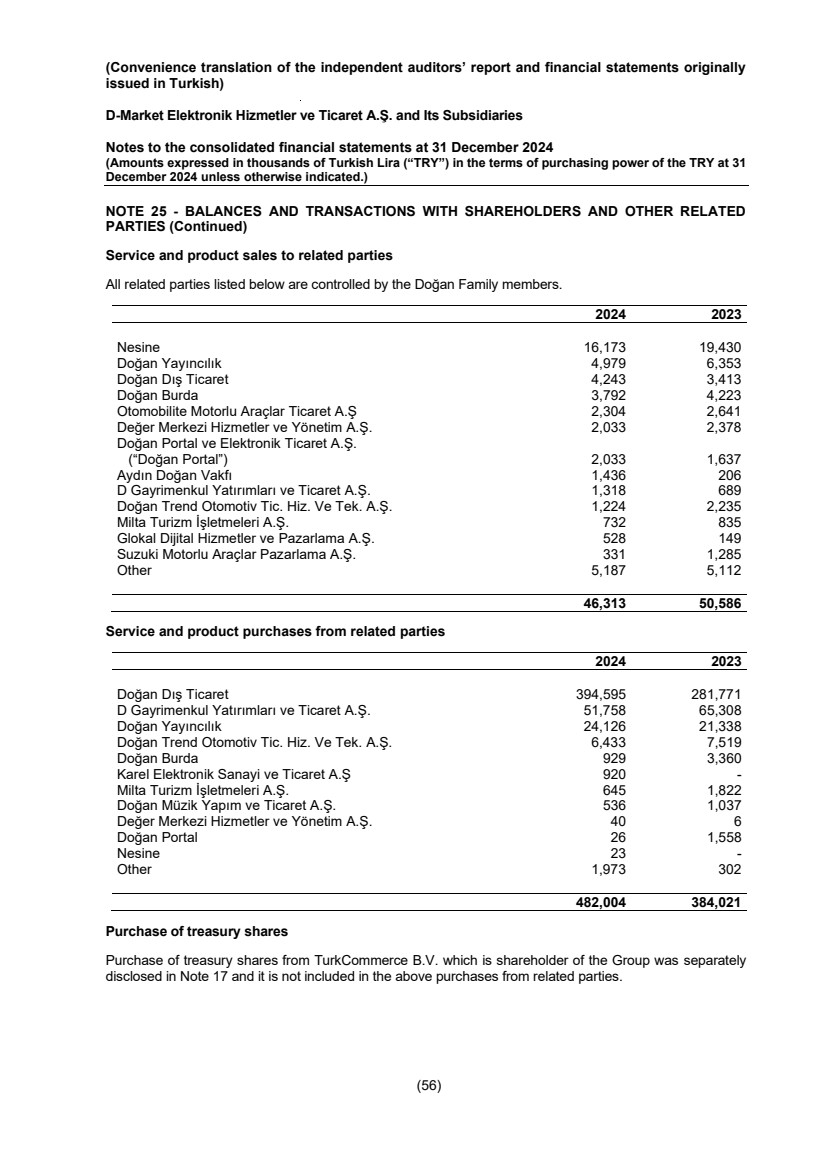

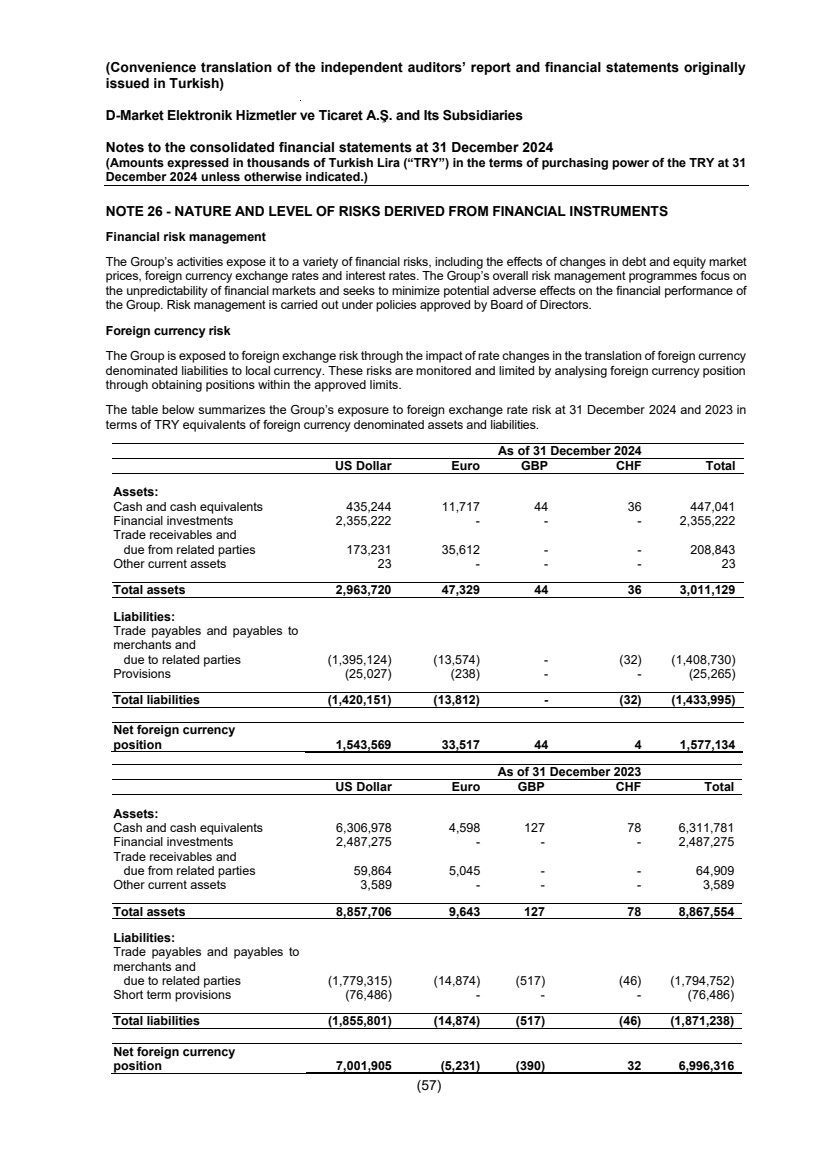

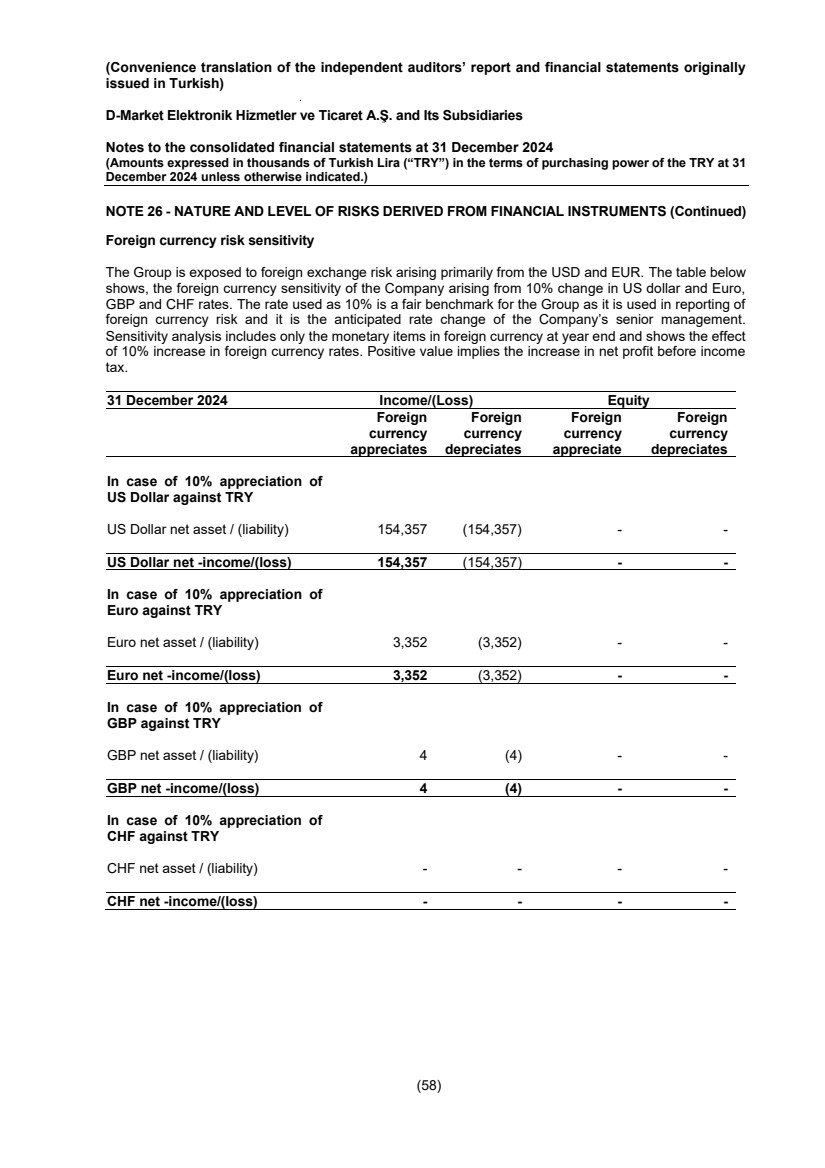

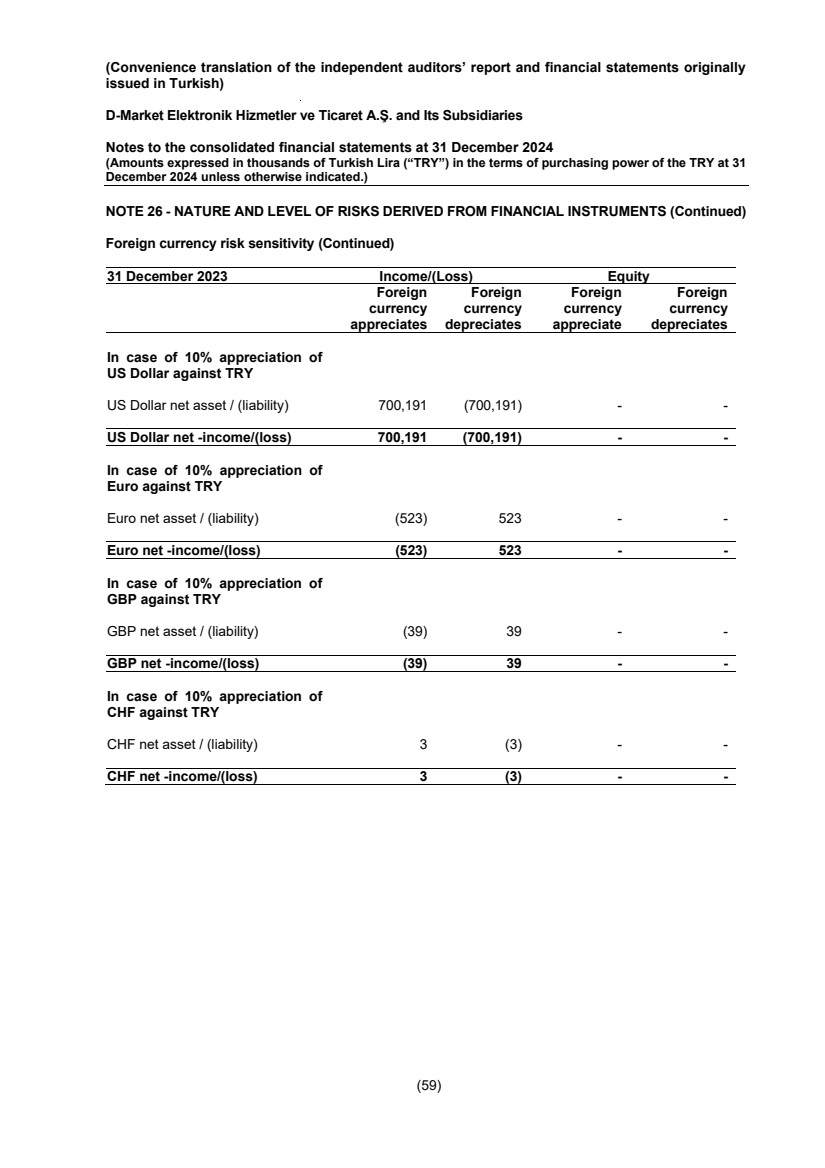

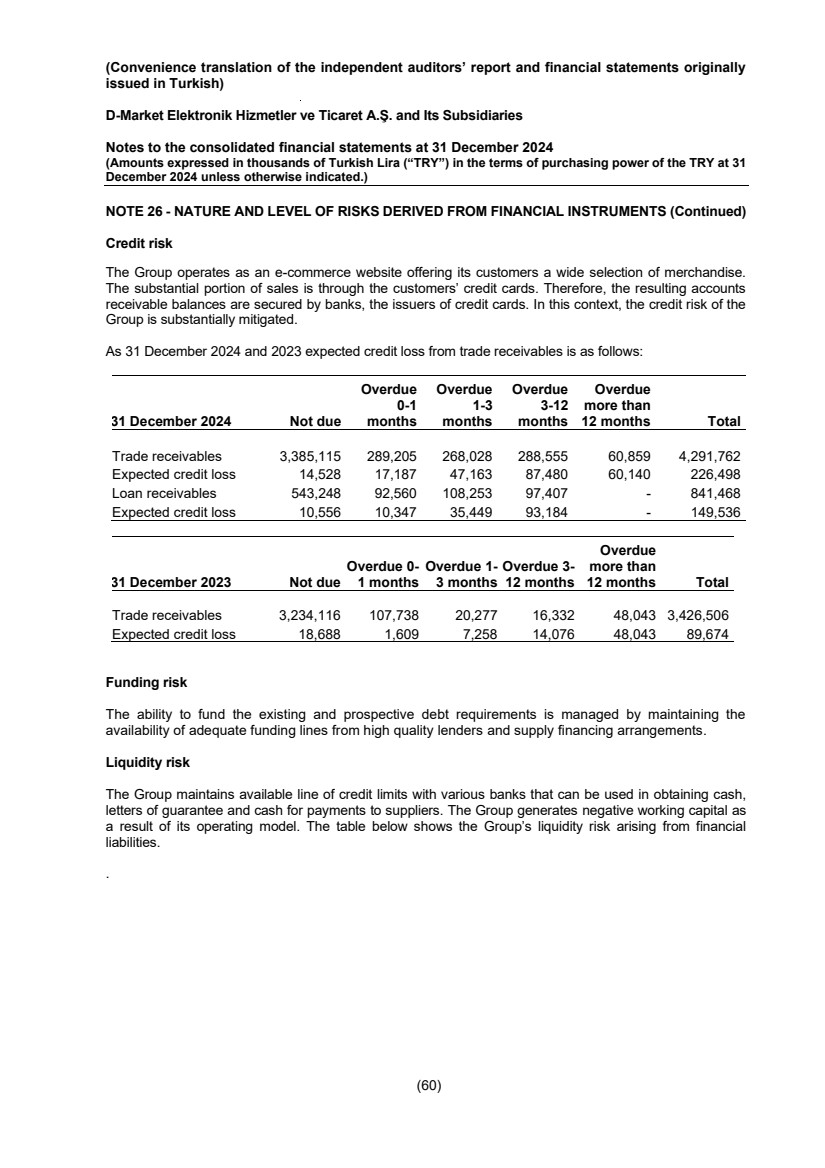

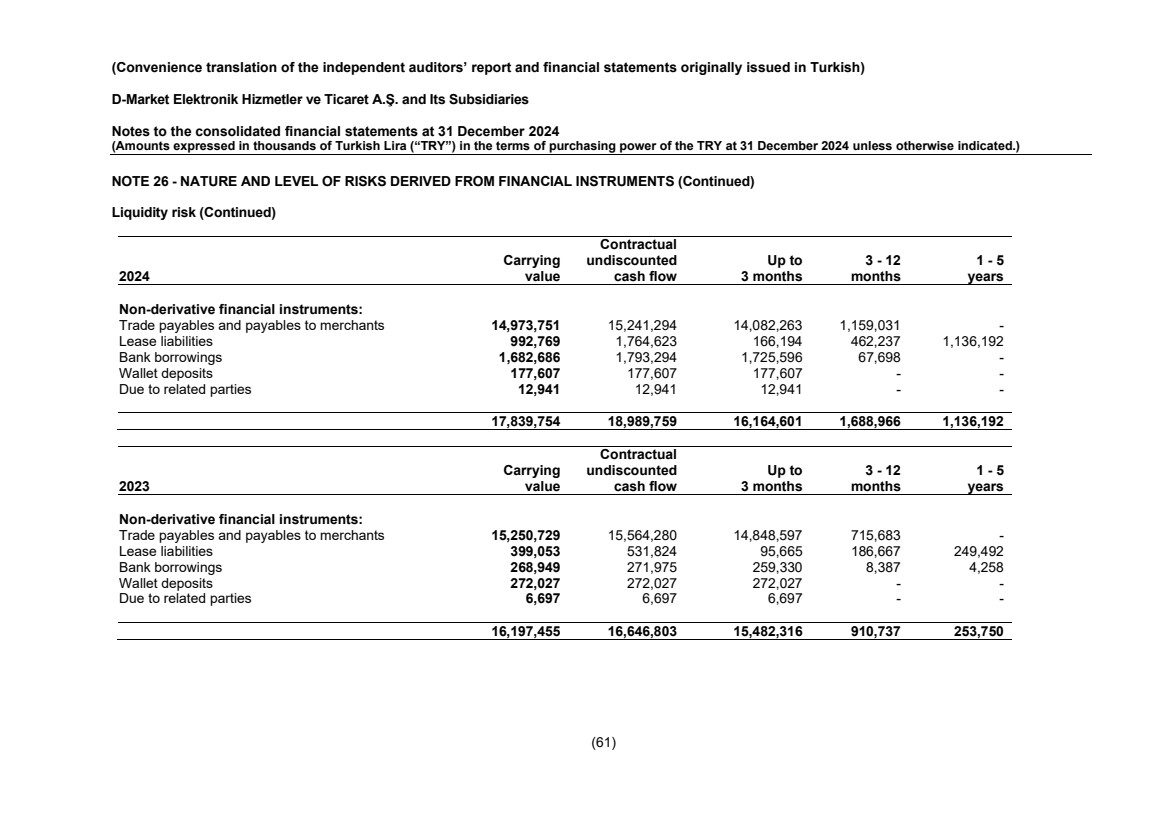

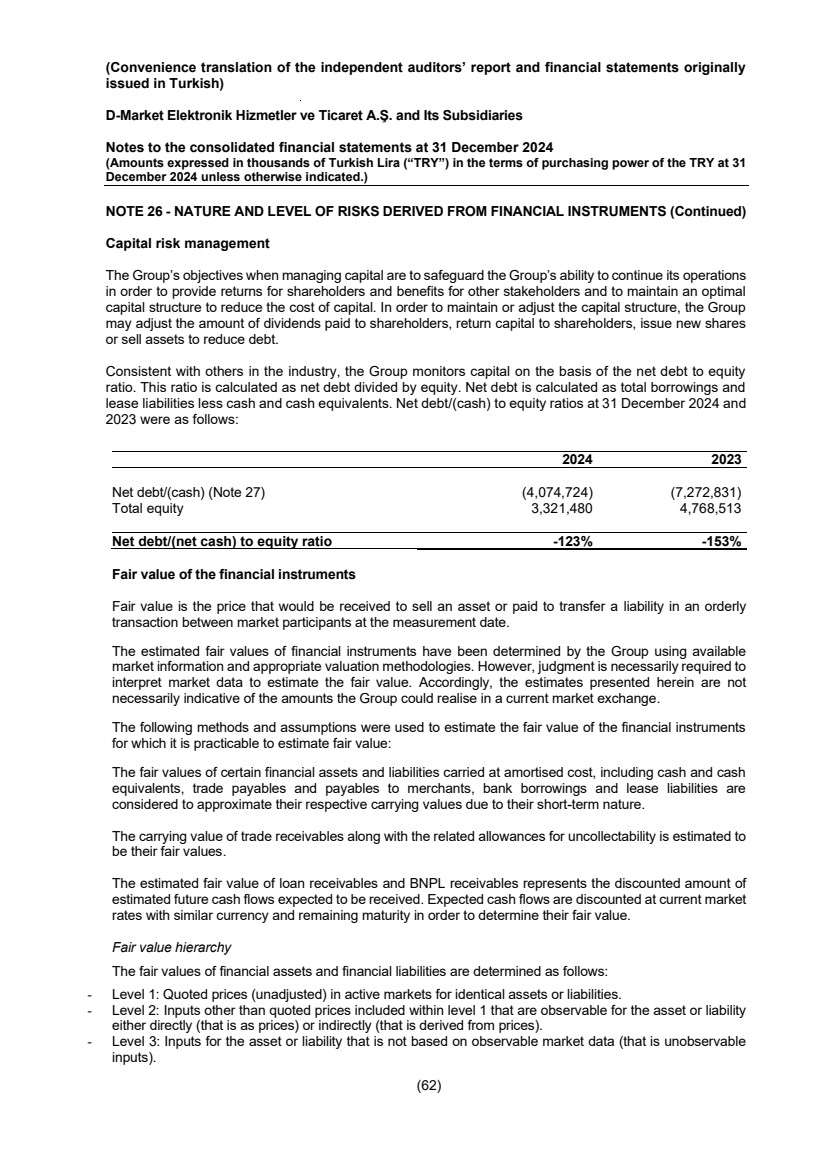

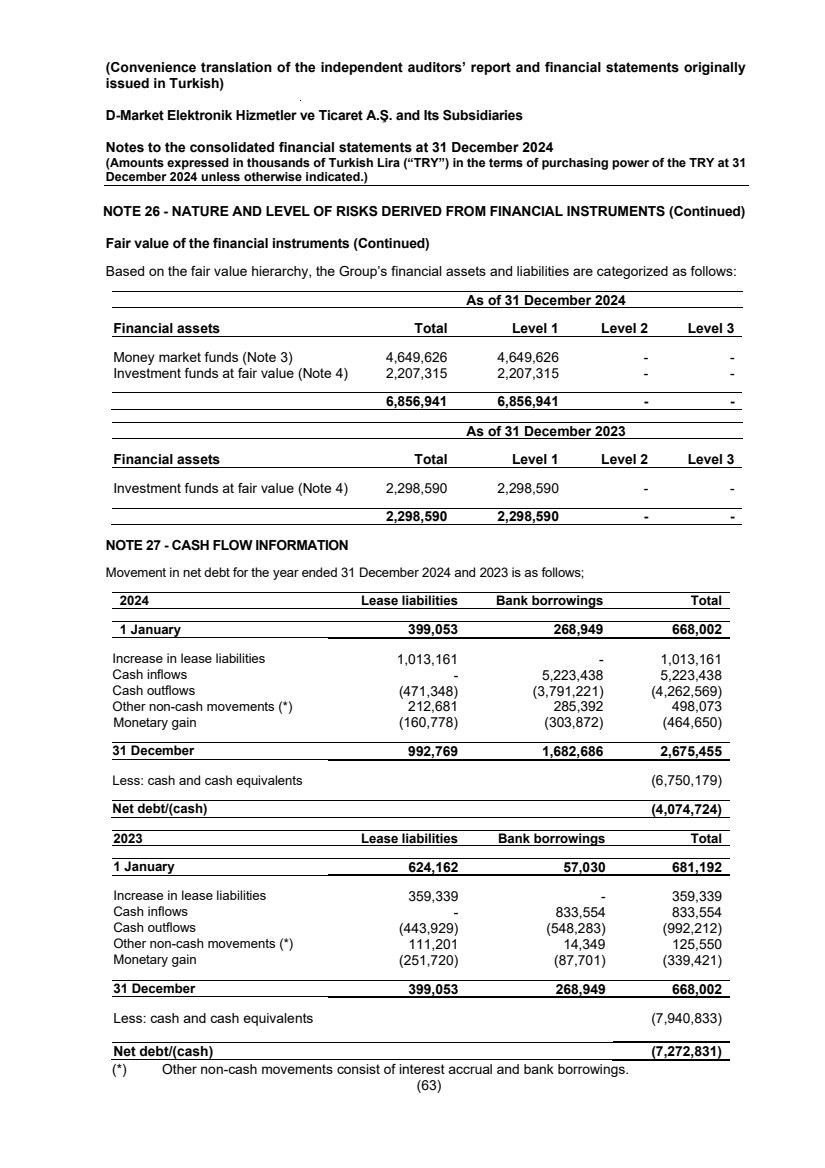

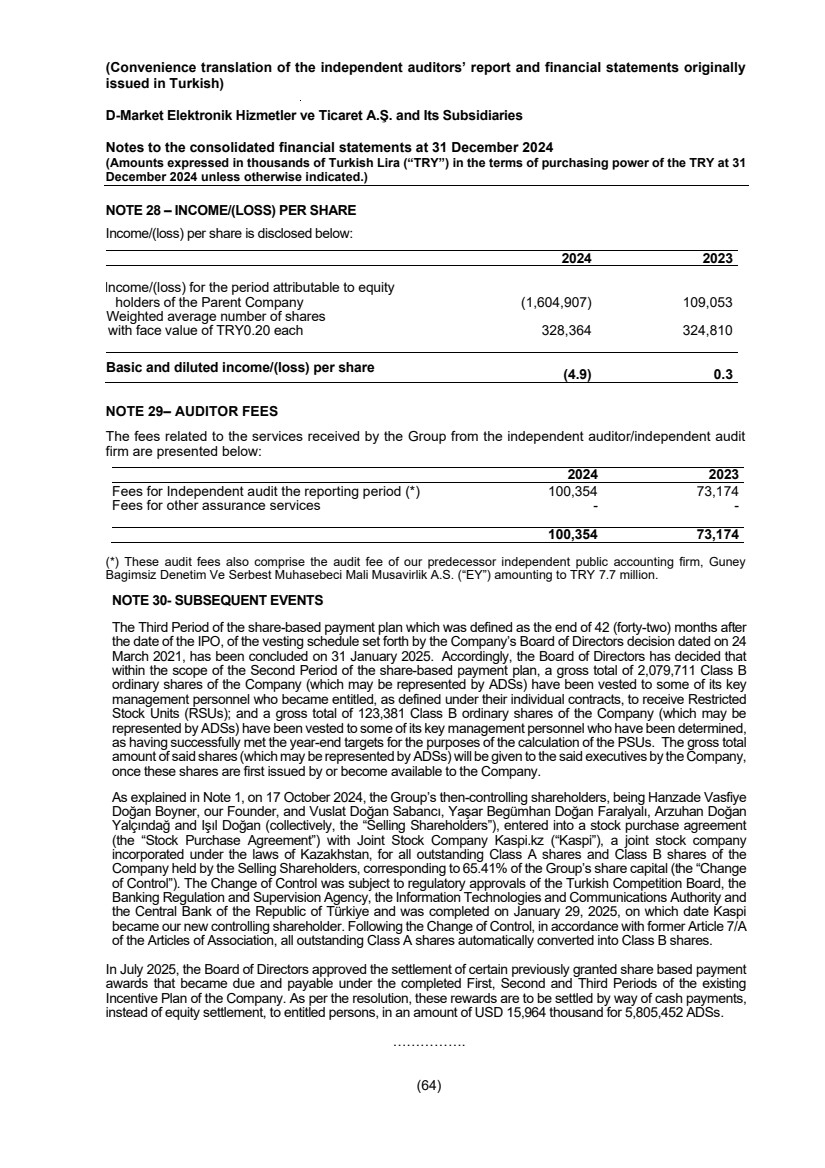

| (Convenience translation of the independent auditors’ report and financial statements originally issued in Turkish) D-Market Elektronik Hizmetler ve Ticaret A.Ş. and Its Subsidiaries Notes to the consolidated financial statements at 31 December 2024 (Amounts expressed in thousands of Turkish Lira (“TRY”) in the terms of purchasing power of the TRY at 31 December 2024 unless otherwise indicated.) (20) NOTE 2 - BASIS OF PRESENTATION OF CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2.7 Summary of significant accounting policies (Continued) Leases (continued) At the commencement date, the Group recognises a right of use asset and a lease liability under the lease contract. Short-term lease agreements with a lease term of 12 months or less and agreements determined by the Group as low value have been determined to be within the scope of the practical expedient included in TFRS 16. For these agreements, the lease payments are recognized as an other operating expense in the period in which they are incurred. Such expenses have no significant impact on Group’s consolidated financial statements. Lease liability Lease liability is initially recognised at the present value of future lease payments that are not paid at the commencement date. The lease payments are discounted using the interest rate implicit in the lease, if that rate can be readily determined. If that rate cannot be readily determined, the Group uses its incremental borrowing rate. After initial recognition, the lease liability is measured by: (a) increasing the carrying amount to reflect interest on the lease liability; (b) reducing the carrying amount to reflect the lease payments made; and (c) remeasuring the carrying amount to reflect any reassessment or lease modifications or to reflect revised in-substance fixed lease payments. The Group remeasures the lease liabilities to reflect changes to lease payments by discounting the revised lease payments using a revised discount rate when: (a) there is a change in the lease term as a result of reassessment of the expectation to exercise a renewal option, or not to exercise a termination option as discussed above; or (b) there is a change in the assessment of an option to purchase the underlying asset. The Group determines the revised discount rate as the interest rate implicit in the lease for the remainder of the lease term if that rate can be readily determined, or if not, its incremental borrowing rate at the date of reassessment. Where: (a) there is a change in the amounts expected to be payable under a residual value guarantee; or (b) there is a change in the future lease payments resulting from a change in an index or a rate used to determine those payments, including changes to reflect changes in market rental rates following a market rent review, the Group remeasures the lease liabilities by discounting the revised lease payments using an unchanged discount rate unless the change in lease payments results from a change in floating interest rates. In such case, the Group uses the revised discount rate that reflects the changes in the interest rate. The Group recognises the amount of the remeasurement of lease liability as an adjustment to the right of use asset. When the carrying amount of the right of use asset is reduced to zero and there is further reduction in the measurement of the lease liability, the Group recognises any remaining amount of the remeasurement in profit or loss. |