| PwC Bağımsız Denetim ve Serbest Muhasebeci Mali Müşavirlik A.Ş. Kılıçali Paşa Mah. Meclis-i Mebusan Cad. No:8 İç Kapı No:301 Beyoğlu/İstanbul T: +90 212 326 6060, F: +90 212 326 6050, www.pwc.com.tr Mersis Numaramız: 0-1460-0224-0500015 CONVENIENCE TRANSLATION INTO ENGLISH OF INDEPENDENT AUDITOR’S REPORT ON THE BOARD OF DIRECTORS’ ANNUAL REPORT ORIGINALLY ISSUED IN TURKISH To the General Assembly of D-Market Elektronik Hizmetler ve Ticaret A.Ş. 1. Opinion We have audited the annual report of D-Market Elektronik Hizmetler ve Ticaret A.Ş. (the “Company”) and its subsidiaries (collectively referred to as the “Group”) for the period 1 January - 31 December 2024. In our opinion, the financial information and the analysis made by the Board of Directors by using the information included in the audited financial statements regarding the Group’s position in the Board of Directors’ Annual Report are consistent and presented fairly, in all material respects, with the audited full set consolidated financial statements and with the information obtained in the course of independent audit. 2. Basis for Opinion Our independent audit was conducted in accordance with the Independent Standards on Auditing that are part of the Turkish Standards on Auditing (the “TSA”) issued by the Public Oversight Accounting and Auditing Standards Authority (“POA”). Our responsibilities under those standards are further described in the Auditor’s Responsibilities in the Audit of the Board of Directors’ Annual Report section of our report. We hereby declare that we are independent of the Group in accordance with the Ethical Rules for Independent Auditors (including Independence Standards) (the “Ethical Rules”) and the ethical requirements regarding independent audit in regulations issued by POA that are relevant to our audit of the financial statements. We have also fulfilled our other ethical responsibilities in accordance with the Ethical Rules and regulations. We believe that the audit evidence we have obtained during the independent audit provides a sufficient and appropriate basis for our opinion. 3. Our Audit Opinion on the Full Set Consolidated Financial Statements We expressed an unqualified opinion in the auditor’s report dated 30 July 2025 on the full set consolidated financial statements for the period 1 January - 31 December 2024. 4. Board of Director’s Responsibility for the Annual Report Group management’s responsibilities related to the annual report according to Articles 514 and 516 of Turkish Commercial Code (“TCC”) No. 6102 are as follows: a) to prepare the annual report within the first three months following the balance sheet date and present it to the General Assembly; b) to prepare the annual report to reflect the Group’s operations in that year and the financial position in a true, complete, straightforward, fair and proper manner in all respects. In this report financial position is assessed in accordance with the financial statements. Also in the report, developments and possible risks which the Group may encounter are clearly indicated. The assessments of the Board of Directors in regards to these matters are also included in the report. |

| c) to include the matters below in the annual report: − events of particular importance that occurred in the Company after the operating year, − the Group’s research and development activities, − financial benefits such as salaries, bonuses, premiums and allowances, travel, accommodation and representation expenses, benefits in cash and in kind, insurance and similar guarantees paid to members of the Board of Directors and senior management. When preparing the annual report, the Board of Directors considers secondary legislation arrangements enacted by the Ministry of Trade and other relevant institutions. 5. Independent Auditor’s Responsibility in the Audit of the Annual Report Our aim is to express an opinion and issue a report comprising our opinion within the framework of TCC provisions regarding whether or not the financial information and the analysis made by the Board of Directors by using the information included in the audited financial statements in the annual report are consistent and presented fairly with the audited consolidated financial statements of the Group and with the information we obtained in the course of independent audit. Our audit was conducted in accordance with the TSAs. These standards require that ethical requirements are complied with and that the independent audit is planned and performed in a way to obtain reasonable assurance of whether or not the financial information and the analysis made by the Board of Directors by using the information included in the audited financial statements in the annual report are consistent and presented fairly with the audited consolidated financial statements and with the information obtained in the course of audit. PwC Bağımsız Denetim ve Serbest Muhasebeci Mali Müşavirlik A.Ş. Mehmet Cenk Uslu, SMMM Independent Auditor Istanbul, 30 July 2025 |

| 1 D-MARKET ELEKTRONİK HİZMETLER VE TİCARET A.Ş. 2024 ANNUAL ACTIVITY REPORT Dear Shareholders, We hereby submit for your review and approval the Board of Directors' report containing the results of operations for the fiscal period from January 1, 2024, to December 31, 2024 ("2024 Fiscal Period"). In this Activity Report (“Activity Report”), D-Market Elektronik Hizmetler ve Ticaret A.Ş. (“Company”) and its subsidiaries (collectively referred to as “Group”) shall be referred to. 1. GENERAL INFORMATION Company Corporate Title : D-Market Elektronik Hizmetler ve Ticaret A.Ş. Trade Registry Number : 436165 Registered Office Address : Kuştepe Mahallesi, Mecidiyeköy Yolu Caddesi, No:12, Kat:2, Kule 2, 34387 Şişli/Istanbul Website : kurumsal.hepsiburada.com 1.1. Our Scope of Activity The Company was established in April 2000 and offers a wide range of products in various categories, including electronics and non-electronics (books, sports, toys, children's and baby products, cosmetics, furniture, etc.), through its retail website www.hepsiburada.com. On July 6, 2021, the Company completed the public offering of 65,251,000 ADRs (American Depository Receipt) representing 65,251,000 Class B shares at a price of US$12.00 per ADR on the Nasdaq Stock Exchange in the United States. In connection with the public offering, the Company offered 41,670,000 ADRs, and the shareholders sold 23,581,000 ADRs. This number includes 8,511,000 ADRs sold by the shareholders pursuant to the underwriters' exercise of their over-allotment option in full. The ADRs began trading on the Nasdaq Global Select Market under the ticker symbol "HEPS" on July 1, 2021. 1.2. Statements Regarding Capital Structure, Changes During the Fiscal Period, Privileged Shares and Voting Rights The Company's capital consists of a total of 325,998,290 shares with a total value of TRY 65,199,658, each with a par value of 0.20 Turkish Lira. The entire share capital has been paid in full. The Company does not have any privileged shares. |

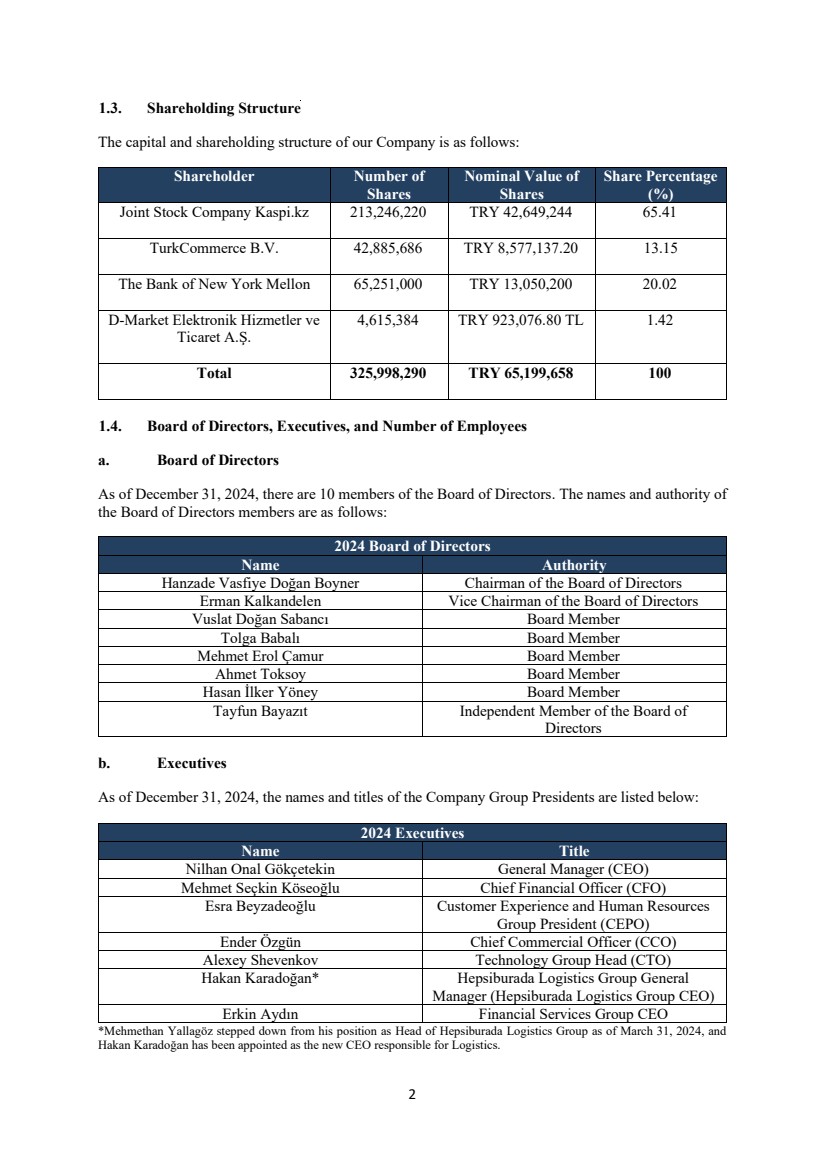

| 2 1.3. Shareholding Structure The capital and shareholding structure of our Company is as follows: Shareholder Number of Shares Nominal Value of Shares Share Percentage (%) Joint Stock Company Kaspi.kz 213,246,220 TRY 42,649,244 65.41 TurkCommerce B.V. 42,885,686 TRY 8,577,137.20 13.15 The Bank of New York Mellon 65,251,000 TRY 13,050,200 20.02 D-Market Elektronik Hizmetler ve Ticaret A.Ş. 4,615,384 TRY 923,076.80 TL 1.42 Total 325,998,290 TRY 65,199,658 100 1.4. Board of Directors, Executives, and Number of Employees a. Board of Directors As of December 31, 2024, there are 10 members of the Board of Directors. The names and authority of the Board of Directors members are as follows: 2024 Board of Directors Name Authority Hanzade Vasfiye Doğan Boyner Chairman of the Board of Directors Erman Kalkandelen Vice Chairman of the Board of Directors Vuslat Doğan Sabancı Board Member Tolga Babalı Board Member Mehmet Erol Çamur Board Member Ahmet Toksoy Board Member Hasan İlker Yöney Board Member Tayfun Bayazıt Independent Member of the Board of Directors b. Executives As of December 31, 2024, the names and titles of the Company Group Presidents are listed below: 2024 Executives Name Title Nilhan Onal Gökçetekin General Manager (CEO) Mehmet Seçkin Köseoğlu Chief Financial Officer (CFO) Esra Beyzadeoğlu Customer Experience and Human Resources Group President (CEPO) Ender Özgün Chief Commercial Officer (CCO) Alexey Shevenkov Technology Group Head (CTO) Hakan Karadoğan* Hepsiburada Logistics Group General Manager (Hepsiburada Logistics Group CEO) Erkin Aydın Financial Services Group CEO *Mehmethan Yallagöz stepped down from his position as Head of Hepsiburada Logistics Group as of March 31, 2024, and Hakan Karadoğan has been appointed as the new CEO responsible for Logistics. |

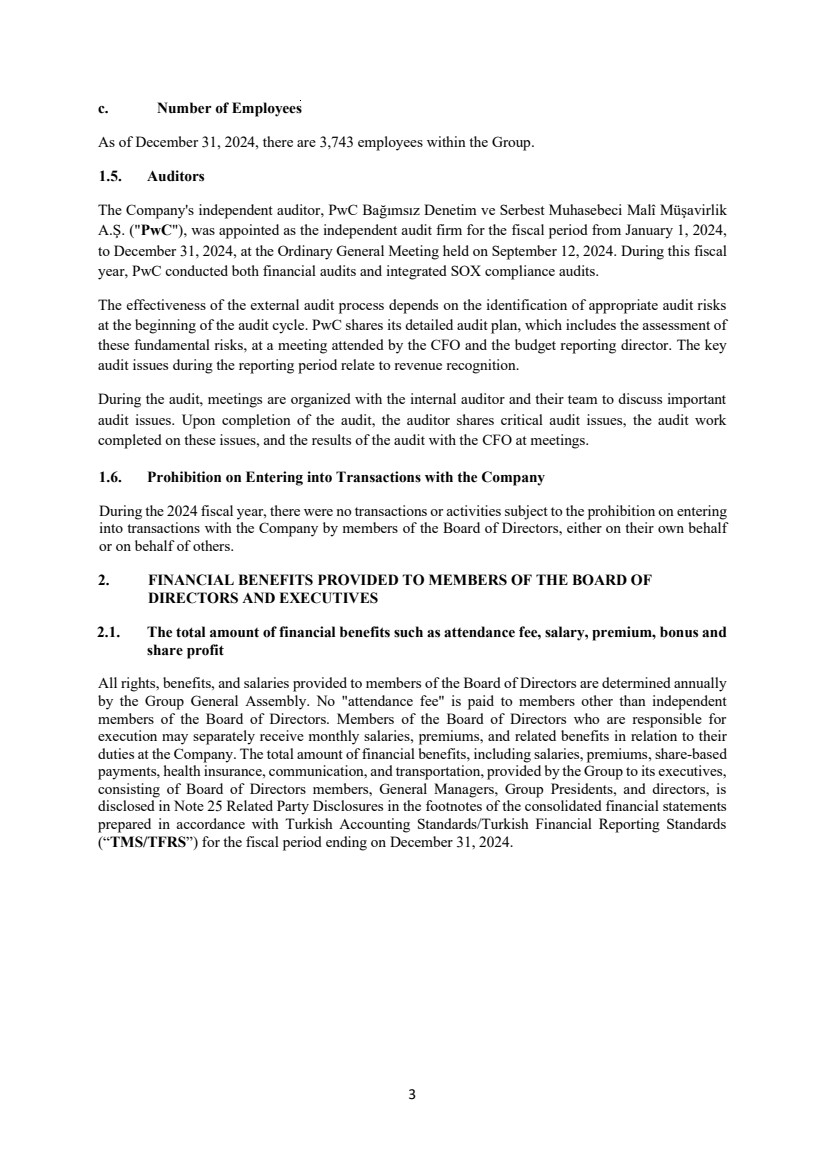

| 3 c. Number of Employees As of December 31, 2024, there are 3,743 employees within the Group. 1.5. Auditors The Company's independent auditor, PwC Bağımsız Denetim ve Serbest Muhasebeci Malî Müşavirlik A.Ş. ("PwC"), was appointed as the independent audit firm for the fiscal period from January 1, 2024, to December 31, 2024, at the Ordinary General Meeting held on September 12, 2024. During this fiscal year, PwC conducted both financial audits and integrated SOX compliance audits. The effectiveness of the external audit process depends on the identification of appropriate audit risks at the beginning of the audit cycle. PwC shares its detailed audit plan, which includes the assessment of these fundamental risks, at a meeting attended by the CFO and the budget reporting director. The key audit issues during the reporting period relate to revenue recognition. During the audit, meetings are organized with the internal auditor and their team to discuss important audit issues. Upon completion of the audit, the auditor shares critical audit issues, the audit work completed on these issues, and the results of the audit with the CFO at meetings. 1.6. Prohibition on Entering into Transactions with the Company During the 2024 fiscal year, there were no transactions or activities subject to the prohibition on entering into transactions with the Company by members of the Board of Directors, either on their own behalf or on behalf of others. 2. FINANCIAL BENEFITS PROVIDED TO MEMBERS OF THE BOARD OF DIRECTORS AND EXECUTIVES 2.1. The total amount of financial benefits such as attendance fee, salary, premium, bonus and share profit All rights, benefits, and salaries provided to members of the Board of Directors are determined annually by the Group General Assembly. No "attendance fee" is paid to members other than independent members of the Board of Directors. Members of the Board of Directors who are responsible for execution may separately receive monthly salaries, premiums, and related benefits in relation to their duties at the Company. The total amount of financial benefits, including salaries, premiums, share-based payments, health insurance, communication, and transportation, provided by the Group to its executives, consisting of Board of Directors members, General Managers, Group Presidents, and directors, is disclosed in Note 25 Related Party Disclosures in the footnotes of the consolidated financial statements prepared in accordance with Turkish Accounting Standards/Turkish Financial Reporting Standards (“TMS/TFRS”) for the fiscal period ending on December 31, 2024. |

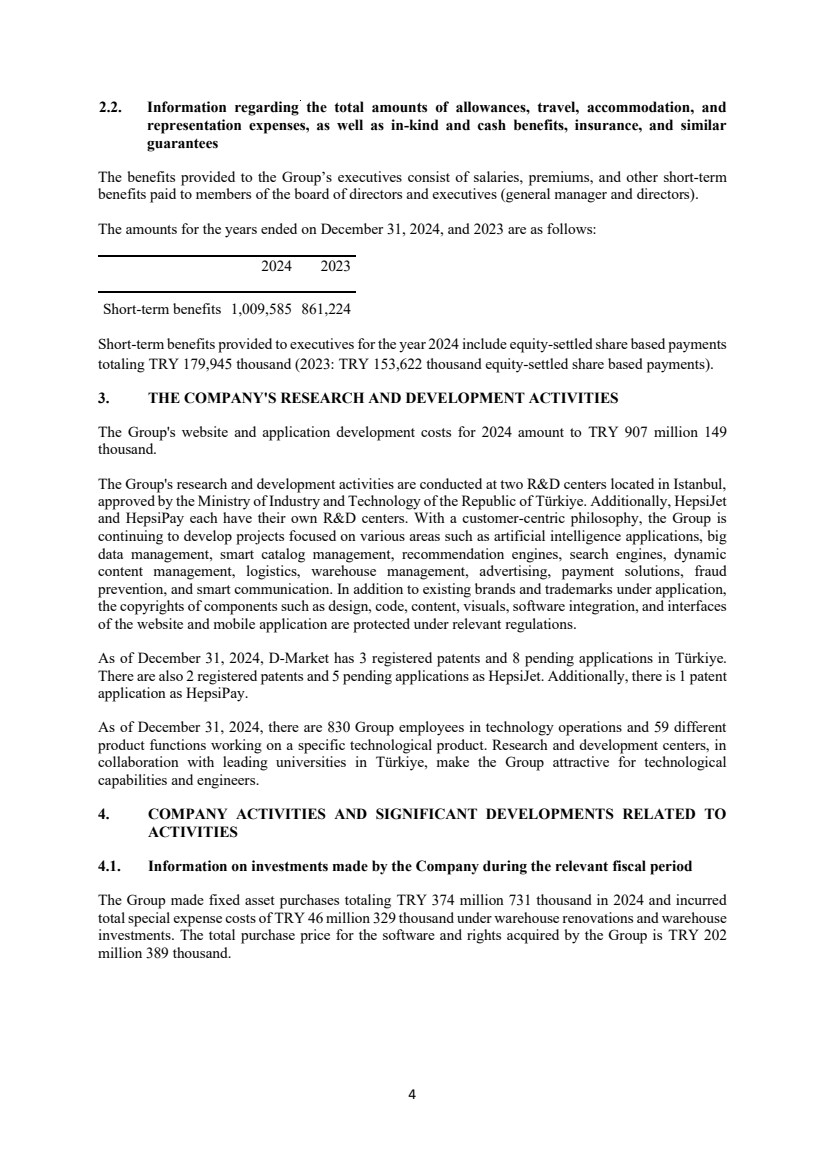

| 4 2.2. Information regarding the total amounts of allowances, travel, accommodation, and representation expenses, as well as in-kind and cash benefits, insurance, and similar guarantees The benefits provided to the Group’s executives consist of salaries, premiums, and other short-term benefits paid to members of the board of directors and executives (general manager and directors). The amounts for the years ended on December 31, 2024, and 2023 are as follows: 2024 2023 Short-term benefits 1,009,585 861,224 Short-term benefits provided to executivesfor the year 2024 include equity-settled share based payments totaling TRY 179,945 thousand (2023: TRY 153,622 thousand equity-settled share based payments). 3. THE COMPANY'S RESEARCH AND DEVELOPMENT ACTIVITIES The Group's website and application development costs for 2024 amount to TRY 907 million 149 thousand. The Group's research and development activities are conducted at two R&D centers located in Istanbul, approved by the Ministry of Industry and Technology of the Republic of Türkiye. Additionally, HepsiJet and HepsiPay each have their own R&D centers. With a customer-centric philosophy, the Group is continuing to develop projects focused on various areas such as artificial intelligence applications, big data management, smart catalog management, recommendation engines, search engines, dynamic content management, logistics, warehouse management, advertising, payment solutions, fraud prevention, and smart communication. In addition to existing brands and trademarks under application, the copyrights of components such as design, code, content, visuals, software integration, and interfaces of the website and mobile application are protected under relevant regulations. As of December 31, 2024, D-Market has 3 registered patents and 8 pending applications in Türkiye. There are also 2 registered patents and 5 pending applications as HepsiJet. Additionally, there is 1 patent application as HepsiPay. As of December 31, 2024, there are 830 Group employees in technology operations and 59 different product functions working on a specific technological product. Research and development centers, in collaboration with leading universities in Türkiye, make the Group attractive for technological capabilities and engineers. 4. COMPANY ACTIVITIES AND SIGNIFICANT DEVELOPMENTS RELATED TO ACTIVITIES 4.1. Information on investments made by the Company during the relevant fiscal period The Group made fixed asset purchases totaling TRY 374 million 731 thousand in 2024 and incurred total special expense costs of TRY 46 million 329 thousand under warehouse renovations and warehouse investments. The total purchase price for the software and rights acquired by the Group is TRY 202 million 389 thousand. |

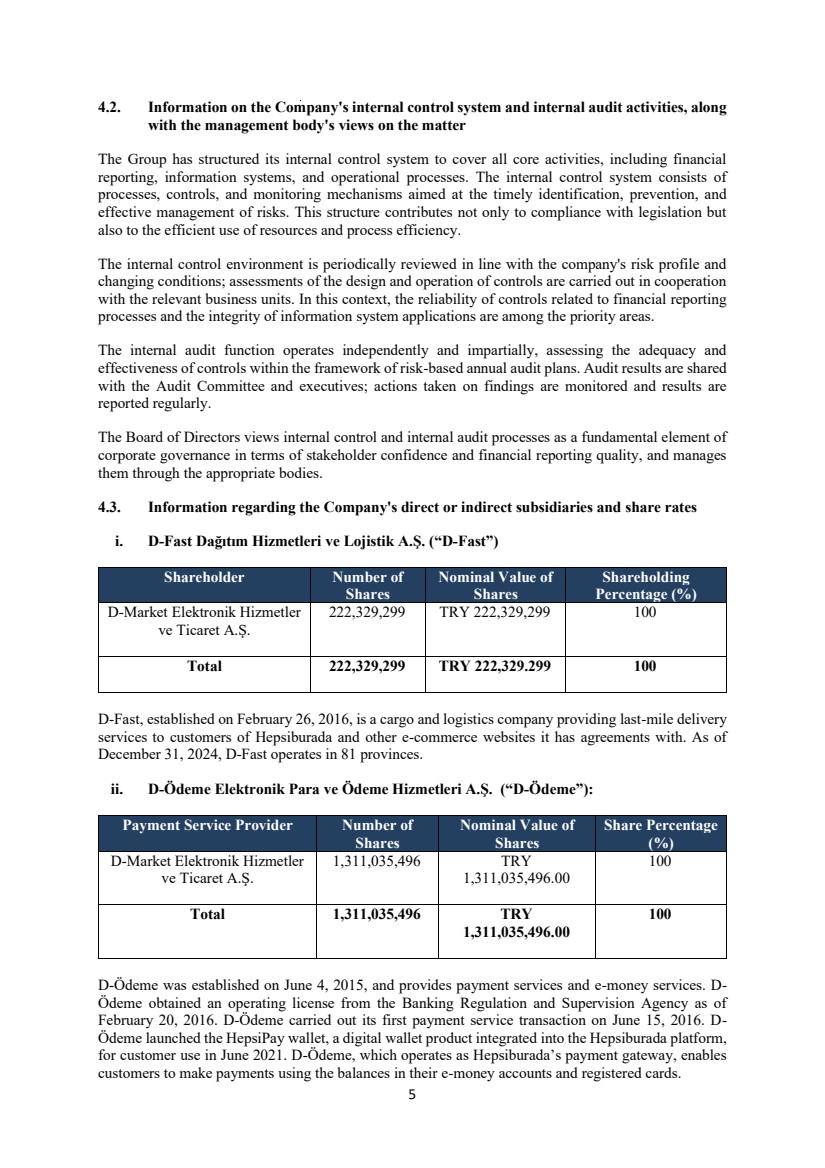

| 5 4.2. Information on the Company's internal control system and internal audit activities, along with the management body's views on the matter The Group has structured its internal control system to cover all core activities, including financial reporting, information systems, and operational processes. The internal control system consists of processes, controls, and monitoring mechanisms aimed at the timely identification, prevention, and effective management of risks. This structure contributes not only to compliance with legislation but also to the efficient use of resources and process efficiency. The internal control environment is periodically reviewed in line with the company's risk profile and changing conditions; assessments of the design and operation of controls are carried out in cooperation with the relevant business units. In this context, the reliability of controls related to financial reporting processes and the integrity of information system applications are among the priority areas. The internal audit function operates independently and impartially, assessing the adequacy and effectiveness of controls within the framework of risk-based annual audit plans. Audit results are shared with the Audit Committee and executives; actions taken on findings are monitored and results are reported regularly. The Board of Directors views internal control and internal audit processes as a fundamental element of corporate governance in terms of stakeholder confidence and financial reporting quality, and manages them through the appropriate bodies. 4.3. Information regarding the Company's direct or indirect subsidiaries and share rates i. D-Fast Dağıtım Hizmetleri ve Lojistik A.Ş. (“D-Fast”) Shareholder Number of Shares Nominal Value of Shares Shareholding Percentage (%) D-Market Elektronik Hizmetler ve Ticaret A.Ş. 222,329,299 TRY 222,329,299 100 Total 222,329,299 TRY 222,329.299 100 D-Fast, established on February 26, 2016, is a cargo and logistics company providing last-mile delivery services to customers of Hepsiburada and other e-commerce websites it has agreements with. As of December 31, 2024, D-Fast operates in 81 provinces. ii. D-Ödeme Elektronik Para ve Ödeme Hizmetleri A.Ş. (“D-Ödeme”): Payment Service Provider Number of Shares Nominal Value of Shares Share Percentage (%) D-Market Elektronik Hizmetler ve Ticaret A.Ş. 1,311,035,496 TRY 1,311,035,496.00 100 Total 1,311,035,496 TRY 1,311,035,496.00 100 D-Ödeme was established on June 4, 2015, and provides payment services and e-money services. D-Ödeme obtained an operating license from the Banking Regulation and Supervision Agency as of February 20, 2016. D-Ödeme carried out its first payment service transaction on June 15, 2016. D-Ödeme launched the HepsiPay wallet, a digital wallet product integrated into the Hepsiburada platform, for customer use in June 2021. D-Ödeme, which operates as Hepsiburada’s payment gateway, enables customers to make payments using the balances in their e-money accounts and registered cards. |

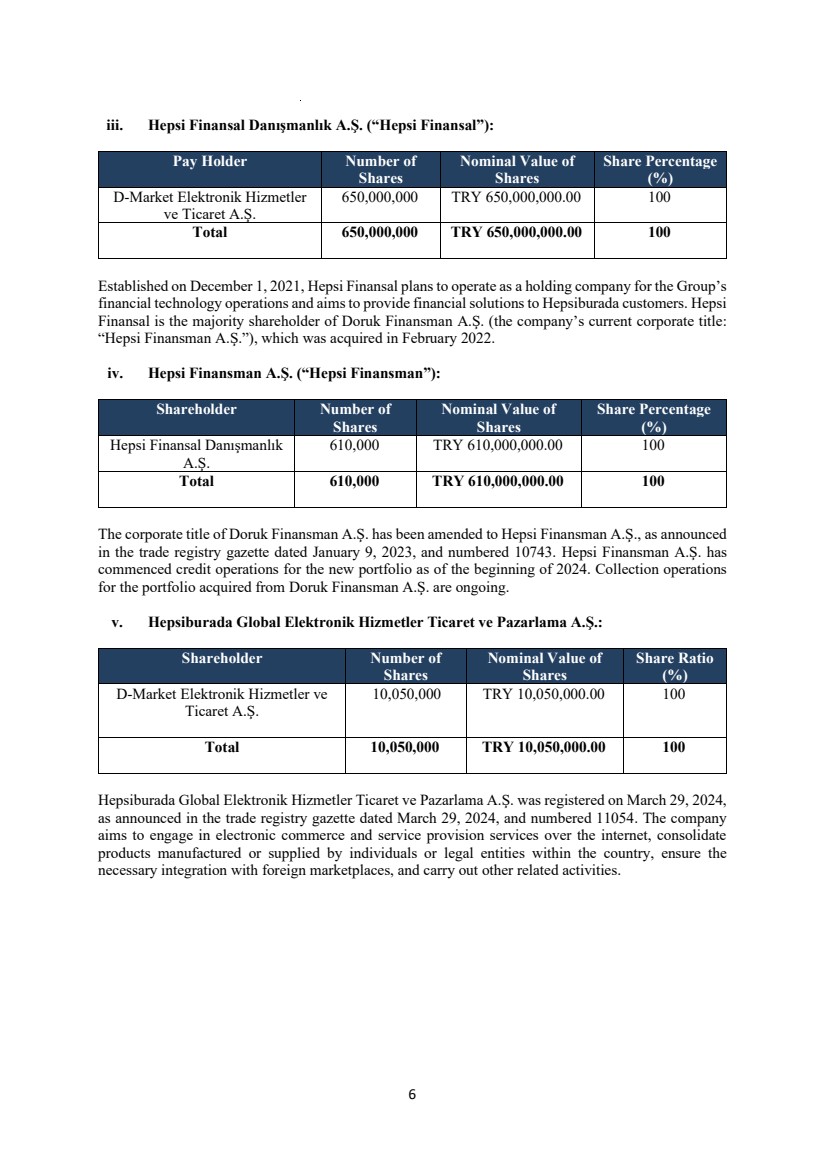

| 6 iii. Hepsi Finansal Danışmanlık A.Ş. (“Hepsi Finansal”): Pay Holder Number of Shares Nominal Value of Shares Share Percentage (%) D-Market Elektronik Hizmetler ve Ticaret A.Ş. 650,000,000 TRY 650,000,000.00 100 Total 650,000,000 TRY 650,000,000.00 100 Established on December 1, 2021, Hepsi Finansal plans to operate as a holding company for the Group’s financial technology operations and aims to provide financial solutions to Hepsiburada customers. Hepsi Finansal is the majority shareholder of Doruk Finansman A.Ş. (the company’s current corporate title: “Hepsi Finansman A.Ş.”), which was acquired in February 2022. iv. Hepsi Finansman A.Ş. (“Hepsi Finansman”): Shareholder Number of Shares Nominal Value of Shares Share Percentage (%) Hepsi Finansal Danışmanlık A.Ş. 610,000 TRY 610,000,000.00 100 Total 610,000 TRY 610,000,000.00 100 The corporate title of Doruk Finansman A.Ş. has been amended to Hepsi Finansman A.Ş., as announced in the trade registry gazette dated January 9, 2023, and numbered 10743. Hepsi Finansman A.Ş. has commenced credit operations for the new portfolio as of the beginning of 2024. Collection operations for the portfolio acquired from Doruk Finansman A.Ş. are ongoing. v. Hepsiburada Global Elektronik Hizmetler Ticaret ve Pazarlama A.Ş.: Shareholder Number of Shares Nominal Value of Shares Share Ratio (%) D-Market Elektronik Hizmetler ve Ticaret A.Ş. 10,050,000 TRY 10,050,000.00 100 Total 10,050,000 TRY 10,050,000.00 100 Hepsiburada Global Elektronik Hizmetler Ticaret ve Pazarlama A.Ş. was registered on March 29, 2024, as announced in the trade registry gazette dated March 29, 2024, and numbered 11054. The company aims to engage in electronic commerce and service provision services over the internet, consolidate products manufactured or supplied by individuals or legal entities within the country, ensure the necessary integration with foreign marketplaces, and carry out other related activities. |

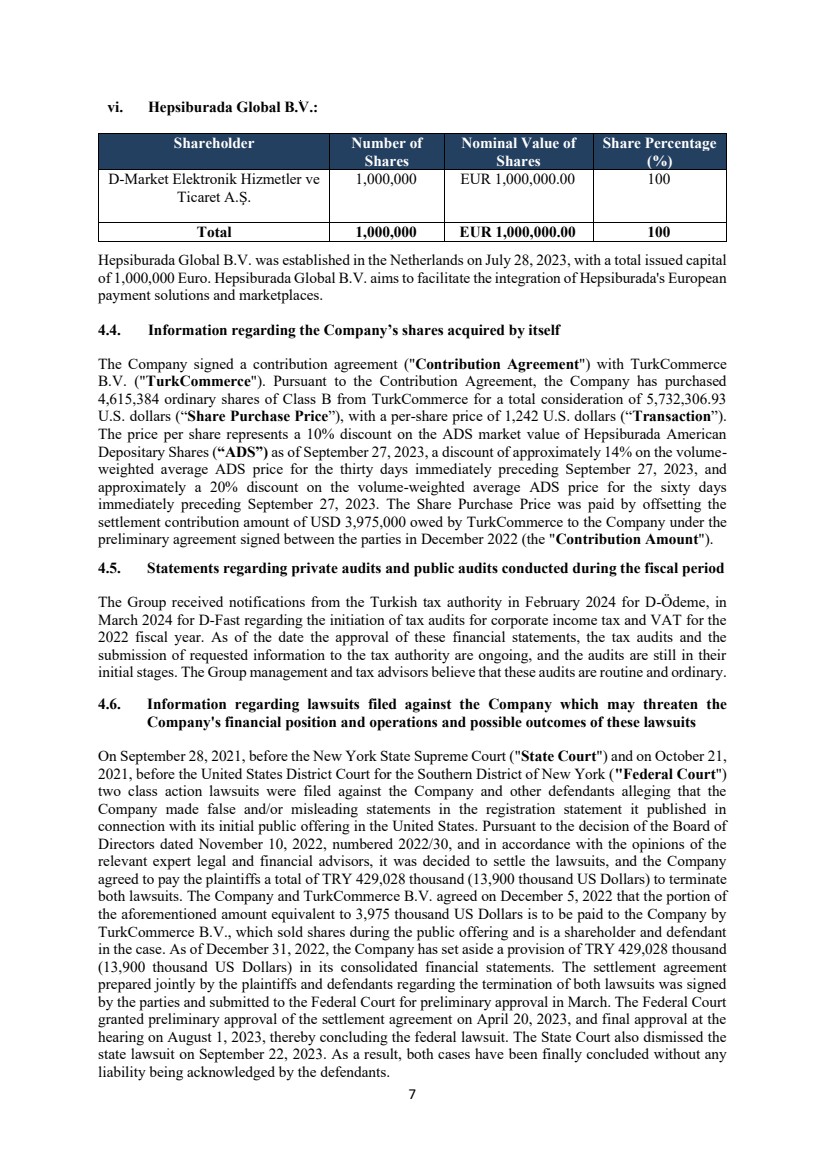

| 7 vi. Hepsiburada Global B.V.: Shareholder Number of Shares Nominal Value of Shares Share Percentage (%) D-Market Elektronik Hizmetler ve Ticaret A.Ş. 1,000,000 EUR 1,000,000.00 100 Total 1,000,000 EUR 1,000,000.00 100 Hepsiburada Global B.V. was established in the Netherlands on July 28, 2023, with a total issued capital of 1,000,000 Euro. Hepsiburada Global B.V. aims to facilitate the integration of Hepsiburada's European payment solutions and marketplaces. 4.4. Information regarding the Company’s shares acquired by itself The Company signed a contribution agreement ("Contribution Agreement") with TurkCommerce B.V. ("TurkCommerce"). Pursuant to the Contribution Agreement, the Company has purchased 4,615,384 ordinary shares of Class B from TurkCommerce for a total consideration of 5,732,306.93 U.S. dollars (“Share Purchase Price”), with a per-share price of 1,242 U.S. dollars (“Transaction”). The price per share represents a 10% discount on the ADS market value of Hepsiburada American Depositary Shares (“ADS”) as of September 27, 2023, a discount of approximately 14% on the volume-weighted average ADS price for the thirty days immediately preceding September 27, 2023, and approximately a 20% discount on the volume-weighted average ADS price for the sixty days immediately preceding September 27, 2023. The Share Purchase Price was paid by offsetting the settlement contribution amount of USD 3,975,000 owed by TurkCommerce to the Company under the preliminary agreement signed between the parties in December 2022 (the "Contribution Amount"). 4.5. Statements regarding private audits and public audits conducted during the fiscal period The Group received notifications from the Turkish tax authority in February 2024 for D-Ödeme, in March 2024 for D-Fast regarding the initiation of tax audits for corporate income tax and VAT for the 2022 fiscal year. As of the date the approval of these financial statements, the tax audits and the submission of requested information to the tax authority are ongoing, and the audits are still in their initial stages. The Group management and tax advisors believe that these audits are routine and ordinary. 4.6. Information regarding lawsuits filed against the Company which may threaten the Company's financial position and operations and possible outcomes of these lawsuits On September 28, 2021, before the New York State Supreme Court ("State Court") and on October 21, 2021, before the United States District Court for the Southern District of New York ("Federal Court") two class action lawsuits were filed against the Company and other defendants alleging that the Company made false and/or misleading statements in the registration statement it published in connection with its initial public offering in the United States. Pursuant to the decision of the Board of Directors dated November 10, 2022, numbered 2022/30, and in accordance with the opinions of the relevant expert legal and financial advisors, it was decided to settle the lawsuits, and the Company agreed to pay the plaintiffs a total of TRY 429,028 thousand (13,900 thousand US Dollars) to terminate both lawsuits. The Company and TurkCommerce B.V. agreed on December 5, 2022 that the portion of the aforementioned amount equivalent to 3,975 thousand US Dollars is to be paid to the Company by TurkCommerce B.V., which sold shares during the public offering and is a shareholder and defendant in the case. As of December 31, 2022, the Company has set aside a provision of TRY 429,028 thousand (13,900 thousand US Dollars) in its consolidated financial statements. The settlement agreement prepared jointly by the plaintiffs and defendants regarding the termination of both lawsuits was signed by the parties and submitted to the Federal Court for preliminary approval in March. The Federal Court granted preliminary approval of the settlement agreement on April 20, 2023, and final approval at the hearing on August 1, 2023, thereby concluding the federal lawsuit. The State Court also dismissed the state lawsuit on September 22, 2023. As a result, both cases have been finally concluded without any liability being acknowledged by the defendants. |

| 8 4.7. Statements regarding administrative or judicial sanctions imposed on the Company and the members of board of directors in relation to practices against legislation There are no significant administrative or judicial sanctions imposed on the Group and members of the board of directors in relation to practices against legislation. More detailed information is provided in Note 15 of the footnotes of the consolidated financial statements prepared in accordance with TMS/TFRS for the fiscal period ending December 31, 2024. 4.8. Information and evaluations regarding whether the targets set in previous periods were achieved, whether the decisions of the general assembly were implemented, and the reasons if the targets were not achieved or the decisions were not implemented The Company's Annual General Assembly Meeting pertaining to 2023 year was held on September 12, 2024, at the Company's registered office address. At the aforementioned Annual General Assembly Meeting, a quorum was achieved with 228,668,790 shares, and decisions were made by open voting. There are no outstanding targets set in previous periods or related general assembly decisions that have not been implemented. 4.9. Information regarding the extraordinary general assembly meetings held during the fiscal period No extraordinary general assembly meeting was held during the fiscal period. 4.10. Information regarding donations and contributions made by the Company during the year, as well as expenditures made within the framework of social responsibility projects The Group made donations totaling approximately TRY 4,250,886.35 to various institutions and organizations during the year. 4.11. If the Company is part of a corporate group; legal transactions conducted with the controlling company, a company affiliated with the controlling company, on the direction of the controlling company for the benefit of the controlling company or a company affiliated with it, and all other measures taken or avoided during the previous fiscal year for the benefit of the controlling company or a company affiliated with it None. 4.12. If the company is part of a corporate group; at the time the legal transaction referred in sub-clause 4.11. was made or the measure was taken or avoided, based on the circumstances and conditions known to them at that time, whether an appropriate counterperformance was provided in each legal transaction and whether the measure taken or avoided caused the Company any loss, and if the Company suffered any loss, whether it was compensated Not applicable. |

| 9 5. FINANCIAL CONDITION 5.1. The management body's analysis and assessment of the consolidated financial position and operating results, the extent to which planned activities have been realized, and the Company's position in relation to the strategic objectives set Despite the challenging macroeconomic conditions throughout 2024, the Company successfully completed the year with strong increases in key operational metrics. In 2024, compared to the previous year, a 11.1% increase in revenue and a 40.0% increase in gross profit were achieved on a real basis. In addition to this performance, the gross contribution margin increased by 2.1 percentage points year-on-year to reach 11.3%, while the EBITDA margin rose by 0.7 percentage points to 1.1%. These improvements reflect the positive impact of the Company's profitability-focused growth strategy and disciplined cost management. In 2024, order frequency increased by 14% year-on-year, rising from 9.5 per customer per year in 2023 to 10.8 in 2024. The total number of orders placed through the Hepsiburada platform increased by 16.2% compared to the previous year, reaching 131.4 million. Additionally, the average order value per order (excluding digital products) increased by 3.9% in 2024 compared to 2023. The increase in the average order value (excluding digital products) is primarily due to the higher increase in average selling prices compared to inflation and the higher share of non-electronic high-priced products in 2024 compared to 2023. According to the results of an independent market research conducted by the Company, Hepsiburada has maintained its sector leadership in the highest Net Promoter Score (NPS) in the Turkish e-commerce market in 2024 with its exclusive delivery and payment services. The paid customer loyalty program Hepsiburada Premium, launched in July 2022, reached 3.7 million members by the end of 2024. This program has proven effective in increasing customer loyalty and order frequency. It is valued for the higher engagement and order frequency it creates among members. Hepsiburada's wallet and payment gateway solution, HepsiPay, reached 17.9 million users as of December 31, 2024. As of December 31, 2024, the "Buy Now, Pay Later" solution offered has been used by over 561,000 customers, and approximately 3.3 million orders have been processed through cardless payment solutions (including Buy Now, Pay Later and shopping credits). In 2024, the Company's active seller count was approximately 100.2 thousand, while the number of products offered on the platform increased from 230.4 million in 2023 to 297.5 million in 2024. The "Hepsiburada Business Partner" program, which offers comprehensive services to sellers, continued with the member business application. The Company organized various campaigns that benefited both customers and supported sellers in increasing their sales. The share of marketplace sales in the total sales volume was 69.8%. As one of Hepsiburada's key strategic investments aimed at achieving excellence in customer satisfaction, the logistics company D-Fast, operating under the HepsiJet brand, expanded its operations to all 81 provinces of Türkiye with 3,911 vehicles, marking a 22% increase compared to the previous year. As of the end of 2024, we have 10 logistics centers. In 2024, HepsiJet delivered 72% of direct sales and marketplace packages made through the Hepsiburada platform. The "Return at Your Doorstep" service, one of the first in the industry and offered by the Company since 2021, continues to be provided through HepsiJet. As of December 31, 2024, the number of HepsiJet couriers increased by 27% compared to the previous year. In 2024, the Company expects that the further expansion of HepsiJet's last-mile delivery services "on-platform" and "off-platform" for third parties will enable the Company to offer delivery services at a more cost-effective manner. |

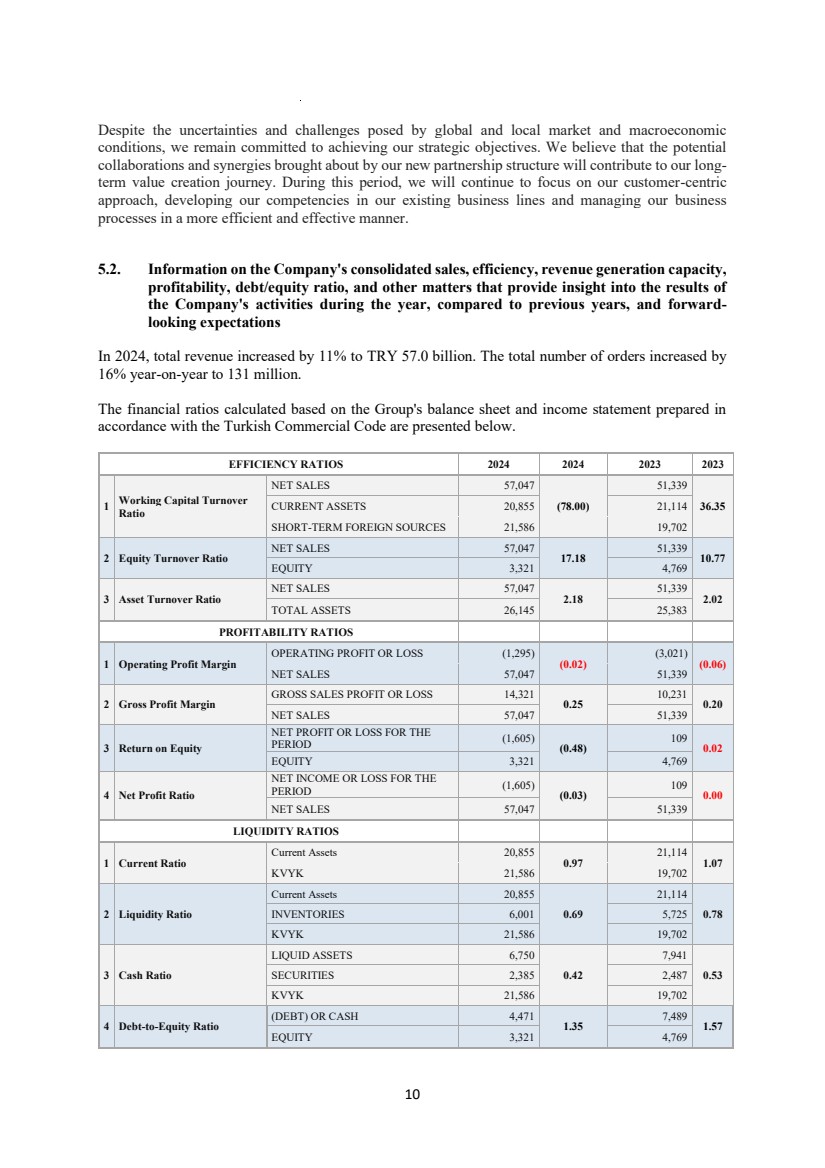

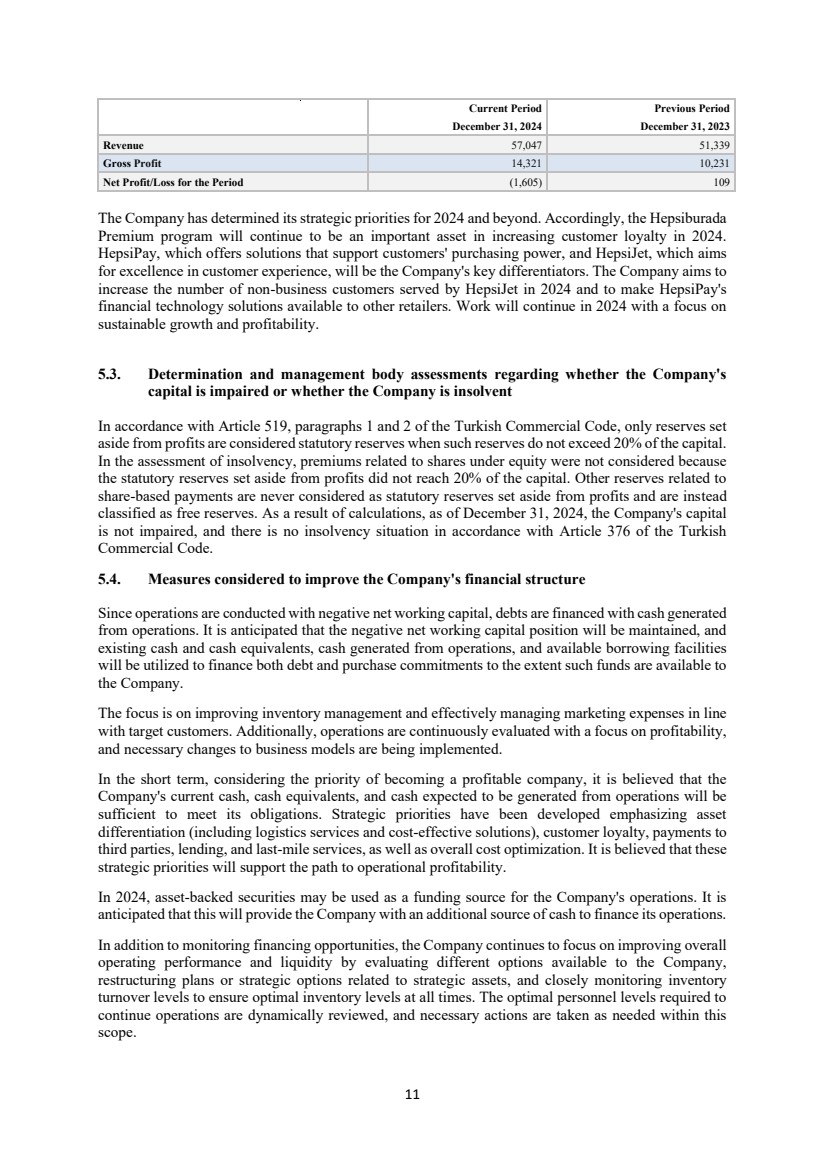

| 10 Despite the uncertainties and challenges posed by global and local market and macroeconomic conditions, we remain committed to achieving our strategic objectives. We believe that the potential collaborations and synergies brought about by our new partnership structure will contribute to our long-term value creation journey. During this period, we will continue to focus on our customer-centric approach, developing our competencies in our existing business lines and managing our business processes in a more efficient and effective manner. 5.2. Information on the Company's consolidated sales, efficiency, revenue generation capacity, profitability, debt/equity ratio, and other matters that provide insight into the results of the Company's activities during the year, compared to previous years, and forward-looking expectations In 2024, total revenue increased by 11% to TRY 57.0 billion. The total number of orders increased by 16% year-on-year to 131 million. The financial ratios calculated based on the Group's balance sheet and income statement prepared in accordance with the Turkish Commercial Code are presented below. EFFICIENCY RATIOS 2024 2024 2023 2023 1 Working Capital Turnover Ratio NET SALES 57,047 (78.00) 51,339 CURRENT ASSETS 20,855 21,114 36.35 SHORT-TERM FOREIGN SOURCES 21,586 19,702 2 Equity Turnover Ratio NET SALES 57,047 17.18 51,339 10.77 EQUITY 3,321 4,769 3 Asset Turnover Ratio NET SALES 57,047 2.18 51,339 2.02 TOTAL ASSETS 26,145 25,383 PROFITABILITY RATIOS 1 Operating Profit Margin OPERATING PROFIT OR LOSS (1,295) (0.02) (3,021) (0.06) NET SALES 57,047 51,339 2 Gross Profit Margin GROSS SALES PROFIT OR LOSS 14,321 0.25 10,231 0.20 NET SALES 57,047 51,339 3 Return on Equity NET PROFIT OR LOSS FOR THE PERIOD (1,605) (0.48) 109 0.02 EQUITY 3,321 4,769 4 Net Profit Ratio NET INCOME OR LOSS FOR THE PERIOD (1,605) (0.03) 109 0.00 NET SALES 57,047 51,339 LIQUIDITY RATIOS 1 Current Ratio Current Assets 20,855 0.97 21,114 1.07 KVYK 21,586 19,702 2 Liquidity Ratio Current Assets 20,855 0.69 21,114 INVENTORIES 6,001 5,725 0.78 KVYK 21,586 19,702 3 Cash Ratio LIQUID ASSETS 6,750 0.42 7,941 SECURITIES 2,385 2,487 0.53 KVYK 21,586 19,702 4 Debt-to-Equity Ratio (DEBT) OR CASH 4,471 1.35 7,489 1.57 EQUITY 3,321 4,769 |

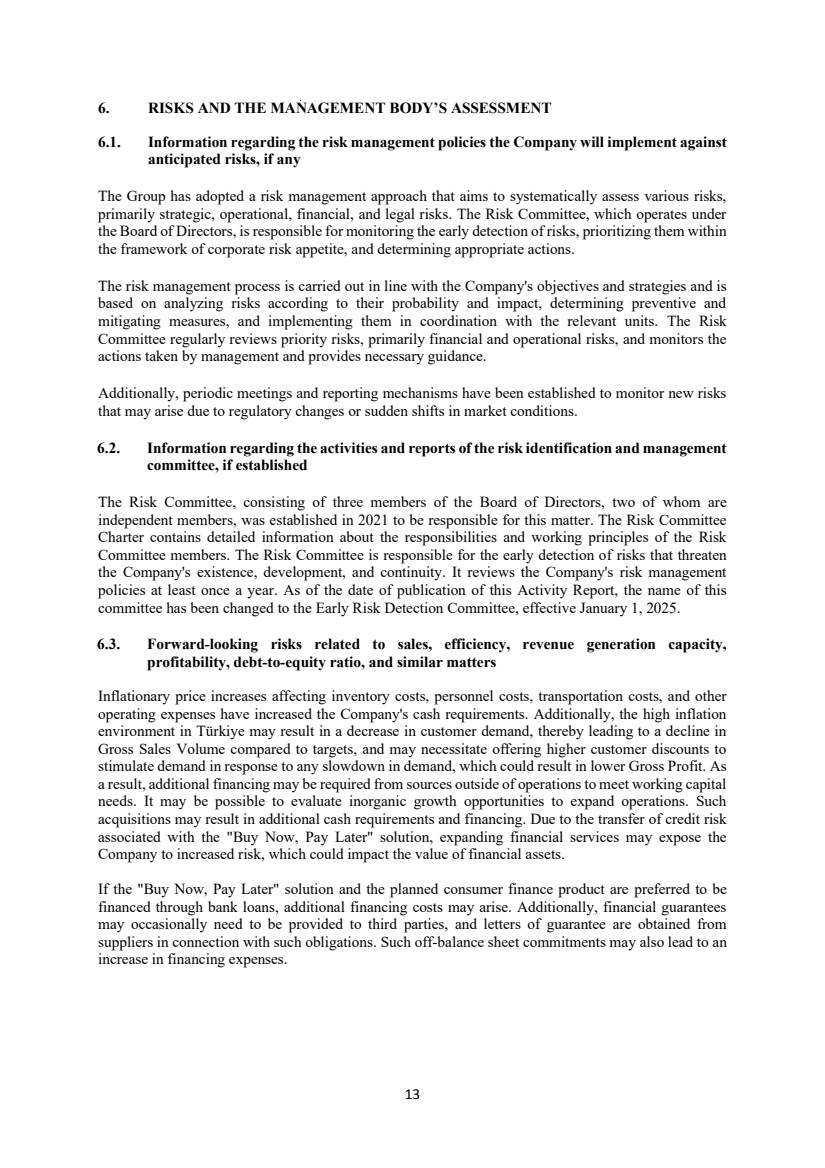

| 11 Current Period Previous Period December 31, 2024 December 31, 2023 Revenue 57,047 51,339 Gross Profit 14,321 10,231 Net Profit/Loss for the Period (1,605) 109 The Company has determined its strategic priorities for 2024 and beyond. Accordingly, the Hepsiburada Premium program will continue to be an important asset in increasing customer loyalty in 2024. HepsiPay, which offers solutions that support customers' purchasing power, and HepsiJet, which aims for excellence in customer experience, will be the Company's key differentiators. The Company aims to increase the number of non-business customers served by HepsiJet in 2024 and to make HepsiPay's financial technology solutions available to other retailers. Work will continue in 2024 with a focus on sustainable growth and profitability. 5.3. Determination and management body assessments regarding whether the Company's capital is impaired or whether the Company is insolvent In accordance with Article 519, paragraphs 1 and 2 of the Turkish Commercial Code, only reserves set aside from profits are considered statutory reserves when such reserves do not exceed 20% of the capital. In the assessment of insolvency, premiums related to shares under equity were not considered because the statutory reserves set aside from profits did not reach 20% of the capital. Other reserves related to share-based payments are never considered as statutory reserves set aside from profits and are instead classified as free reserves. As a result of calculations, as of December 31, 2024, the Company's capital is not impaired, and there is no insolvency situation in accordance with Article 376 of the Turkish Commercial Code. 5.4. Measures considered to improve the Company's financial structure Since operations are conducted with negative net working capital, debts are financed with cash generated from operations. It is anticipated that the negative net working capital position will be maintained, and existing cash and cash equivalents, cash generated from operations, and available borrowing facilities will be utilized to finance both debt and purchase commitments to the extent such funds are available to the Company. The focus is on improving inventory management and effectively managing marketing expenses in line with target customers. Additionally, operations are continuously evaluated with a focus on profitability, and necessary changes to business models are being implemented. In the short term, considering the priority of becoming a profitable company, it is believed that the Company's current cash, cash equivalents, and cash expected to be generated from operations will be sufficient to meet its obligations. Strategic priorities have been developed emphasizing asset differentiation (including logistics services and cost-effective solutions), customer loyalty, payments to third parties, lending, and last-mile services, as well as overall cost optimization. It is believed that these strategic priorities will support the path to operational profitability. In 2024, asset-backed securities may be used as a funding source for the Company's operations. It is anticipated that this will provide the Company with an additional source of cash to finance its operations. In addition to monitoring financing opportunities, the Company continues to focus on improving overall operating performance and liquidity by evaluating different options available to the Company, restructuring plans or strategic options related to strategic assets, and closely monitoring inventory turnover levels to ensure optimal inventory levels at all times. The optimal personnel levels required to continue operations are dynamically reviewed, and necessary actions are taken as needed within this scope. |

| 12 5.5. Information regarding the dividend distribution policy, and if no dividend is to be distributed, the reason for this and the proposed use of undistributed profits The provisions of Article 519 of the Turkish Commercial Code apply to the statutory reserves to be set aside by the Company. The amount that the Company is required to pay or set aside, such as general expenses and various amortization expenses, and taxes that the Company is required to pay, are deducted from the income determined at the end of the accounting period. The remaining amount, after deducting any losses from previous years, if any, from the net profit for the period shown in the annual balance sheet, is distributed in accordance with the following order and principles: General Legal Reserve a) From the net period profit calculated in this manner, 5% is set aside as general legal reserve each year until it reaches 20% (twenty percent) of the paid-in capital, in accordance with Article 519 of the Turkish Commercial Code. First Profit Distribution b) From the remaining amount, after adding any donations made during the year, the first profit distribution is allocated in accordance with the Company’s profit distribution policy and in compliance with the Turkish Commercial Code. After the above deductions are made, the General Assembly has the right to decide on the distribution of the profit share among the members of the Board of Directors, the Company’s employees, and persons other than shareholders. Second Profit Distribution c) The General Assembly may decide to distribute the remaining portion of the net period profit, after deducting the amounts specified in paragraphs (a) and (b), either partially or entirely as a second dividend, or to set it aside as a reserve fund in accordance with Article 521 of the Turkish Commercial Code at its discretion. General Legal Reserve d) After deducting 5% of the profit to be distributed to shareholders and other persons entitled to participate in profits, 10% of the remaining amount is added to the general statutory reserve fund in accordance with the second paragraph of Article 519 of the Turkish Commercial Code. Unless the statutory reserves required under the Turkish Commercial Code and the profit share allocated to shareholders in the articles of association or the profit distribution policy have been set aside; no decision may be made to allocate additional reserves, transfer profits to the next year, distribute profits to members of the board of directors, company employees, or persons other than shareholders, nor may profits be distributed to such persons unless the profit share determined for shareholders has been paid in cash. The profit share shall be distributed equally among all existing shares as of the distribution date, without considering the issuance and acquisition dates of such shares. Taking into account the company's financial situation, initiatives, and investments, the amount to be distributed from this profit and how it will be distributed shall be decided by the general assembly. The method and timing of the distribution of the profit decided to be distributed shall be determined by the general assembly upon the proposal of the board of directors. The profit distribution decision made by the general meeting in accordance with the provisions of theArticles of Association cannot be revoked. As of December 31, 2024, there is no distributable profit for the period in accordance with the financial statements prepared in accordance with the Turkish Commercial Code, therefore, no profit distribution proposal has been submitted to the general assembly. |

| 13 6. RISKS AND THE MANAGEMENT BODY’S ASSESSMENT 6.1. Information regarding the risk management policies the Company will implement against anticipated risks, if any The Group has adopted a risk management approach that aims to systematically assess various risks, primarily strategic, operational, financial, and legal risks. The Risk Committee, which operates under the Board of Directors, is responsible for monitoring the early detection of risks, prioritizing them within the framework of corporate risk appetite, and determining appropriate actions. The risk management process is carried out in line with the Company's objectives and strategies and is based on analyzing risks according to their probability and impact, determining preventive and mitigating measures, and implementing them in coordination with the relevant units. The Risk Committee regularly reviews priority risks, primarily financial and operational risks, and monitors the actions taken by management and provides necessary guidance. Additionally, periodic meetings and reporting mechanisms have been established to monitor new risks that may arise due to regulatory changes or sudden shifts in market conditions. 6.2. Information regarding the activities and reports of the risk identification and management committee, if established The Risk Committee, consisting of three members of the Board of Directors, two of whom are independent members, was established in 2021 to be responsible for this matter. The Risk Committee Charter contains detailed information about the responsibilities and working principles of the Risk Committee members. The Risk Committee is responsible for the early detection of risks that threaten the Company's existence, development, and continuity. It reviews the Company's risk management policies at least once a year. As of the date of publication of this Activity Report, the name of this committee has been changed to the Early Risk Detection Committee, effective January 1, 2025. 6.3. Forward-looking risks related to sales, efficiency, revenue generation capacity, profitability, debt-to-equity ratio, and similar matters Inflationary price increases affecting inventory costs, personnel costs, transportation costs, and other operating expenses have increased the Company's cash requirements. Additionally, the high inflation environment in Türkiye may result in a decrease in customer demand, thereby leading to a decline in Gross Sales Volume compared to targets, and may necessitate offering higher customer discounts to stimulate demand in response to any slowdown in demand, which could result in lower Gross Profit. As a result, additional financing may be required from sources outside of operations to meet working capital needs. It may be possible to evaluate inorganic growth opportunities to expand operations. Such acquisitions may result in additional cash requirements and financing. Due to the transfer of credit risk associated with the "Buy Now, Pay Later" solution, expanding financial services may expose the Company to increased risk, which could impact the value of financial assets. If the "Buy Now, Pay Later" solution and the planned consumer finance product are preferred to be financed through bank loans, additional financing costs may arise. Additionally, financial guarantees may occasionally need to be provided to third parties, and letters of guarantee are obtained from suppliers in connection with such obligations. Such off-balance sheet commitments may also lead to an increase in financing expenses. |

| 14 In connection with assessing the ability to continue as a going concern, including the competitive environment and customer demand, the ability to postpone or cancel uncommitted investment expenditures and reduce advertising expenditures, as well as the ability to mitigate the effects of an inflationary environment that could increase operating expenses and costs and reduce profitability; factors that could significantly affect the assessment are as follows: (i) In an inflationary environment, suppliers and product vendors may demand shorter payment terms, which could result in a lower negative net working capital position, and (ii) any regulatory changes that limit operational capabilities, resulting in lower Gross Sales Volume production, could also result in a lower negative net working capital position. Long-term cash requirements are expected to arise primarily from capital expenditures and working capital requirements necessary to improve profitability and commercial growth. Given the dynamic nature of the market in which the Company operates, changing market regulations, fluctuations in capital markets, the current state of the business, a high inflation environment, exchange rate volatility, supply chain challenges arising from the COVID-19 pandemic, and the impact of the uncertainty created by the war between Russia and Ukraine on commercial operations; the ability to fully meet long-term capital requirements and long-term liquidity needs may develop differently than expected and may be adversely affected. The current economic environment and market conditions may limit the ability to borrow, in terms of the amounts or acceptable terms that may be necessary to support funding needs or cash flows, albeit to a limited extent. Additional debt will result in an increase in financial expenses. In addition to pursuing alternative financing opportunities, different options, plans or alternatives related to strategic business lines may be evaluated and necessary changes implemented. In addition, efforts have been focused on improving overall operational performance and liquidity by enhancing inventory management and renegotiating more favorable payment terms with suppliers. Optimal staffing levels required to maintain operations are dynamically reviewed, and necessary actions are taken as needed. 7. OTHER MATTERS There are no significant events that occurred after the end of the fiscal year that could affect the rights of shareholders, creditors, and other relevant parties and organizations. 8. CONCLUSION OF THE AFFILIATION REPORT Our Company has not engaged in any commercial transactions with the Controlling Company or any company directly or indirectly affiliated with the Controlling Company, nor has it undertaken any legal transactions for the benefit of the Controlling Company or any company affiliated with it at the direction of the Controlling Company. No measures have been taken or avoided, and no loss has been incurred by the Controlling Company in this context. |