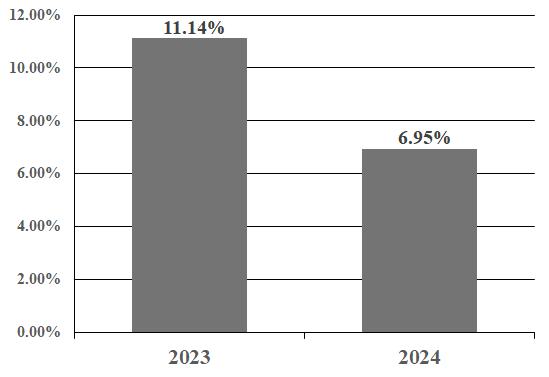

The following performance information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance. The bar chart shows the annual returns for the Fund from year-to-year. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compare with the Index, and two broad measures of market performance. Prior to October 17, 2024, the composition and calculation of the Global Index adhered to a different methodology than the current methodology. The Fund’s past performance, before and after taxes, does not necessarily indicate how it will perform in the future. Updated performance information is available on the Fund’s website at www.aztlanetfs.com.

During the period of time shown in the bar chart, the Fund’s highest quarterly return was 14.76% for the quarter ended September 30, 2024 and the lowest quarterly return was -5.96% for the quarter ended September 30, 2023.

The Fund’s calendar year-to-date return as of June 30, 2025 was -0.19%.

| 1 Year | Since Inception (August 17, 2022) | ||

| Return Before Taxes | 6.95% | 6.91% | |

| Return After Taxes on Distributions | 6.38% | 6.66% | |

| Return After Taxes on Distributions and Sale of Fund Shares | 4.34% | 5.28% | |

| Solactive Aztlan Global Developed Markets SMID Cap Index (reflects no deduction for fees, expenses, or taxes) | 9.85% | 9.29% | |

| S&P 500 Total Return Index (reflects no deduction for fees, expenses, or taxes) | 25.02% | 16.19% | |

| MSCI World SMID Cap Index (reflects no deduction for fees, expenses, or taxes) | 10.08% | 7.99% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Shares through tax-deferred or other tax-advantaged arrangements such as an individual retirement account (“IRA”).

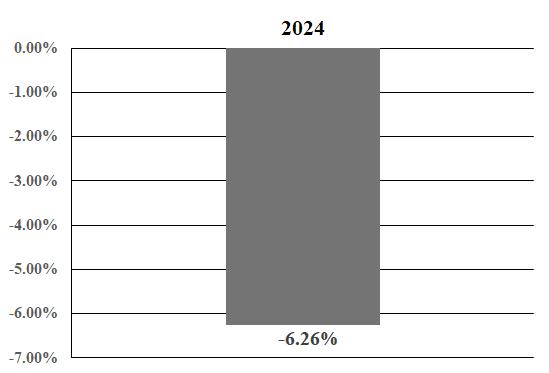

The following performance information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance. The bar chart shows the annual returns for the Fund. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compare with the Index and a broad measure of market performance. Prior to August 18, 2025, the composition and calculation of the Nearshoring Index adhered to a different methodology than the current methodology. The Fund’s past performance, before and after taxes, does not necessarily indicate how it will perform in the future. Updated performance information is available on the Fund’s website at www.aztlanetfs.com.

During the period of time shown in the bar chart, the Fund’s highest quarterly return was 10.13% for the quarter ended September 30, 2024 and the lowest quarterly return was -8.93% for the quarter ended December 30, 2024.

The Fund’s calendar year-to-date return as of June 30, 2025 was -1.56%.

| 1 Year | Since Inception (November 29, 2023) | ||

| Return Before Taxes | -6.26% | 3.06% | |

| Return After Taxes on Distributions | -6.46% | 2.82% | |

| Return After Taxes on Distributions and Sale of Fund Shares | -3.56% | 2.33% | |

| Aztlan North America Nearshoring Price Return Index (reflects no deduction for fees, expenses, or taxes) | -4.89% | 4.57% | |

| S&P 500 Total Return Index (reflects no deduction for fees, expenses, or taxes) | 25.02% | 28.39% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Shares through tax-deferred or other tax-advantaged arrangements such as an individual retirement account (“IRA”). In certain cases, the figures representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.