| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

The following discussion is management's assessment and analysis of the results of operations, cash flows and financial condition of HIVE Digital Technologies Ltd. ("HIVE", the "Company", "we" or "us") on a consolidated basis for the three months ended June 30, 2025, and should be read in conjunction with the accompanying unaudited condensed interim consolidated financial statements and related notes for the three months ended June 30, 2025.

These documents and additional information regarding the business of the Company are available on the System for Electronic Data Analysis and Retrieval ("SEDAR+") at www.sedarplus.ca, the Electronic Data Gathering, Analysis and Retrieval ("EDGAR") system maintained by the Securities and Exchange Commission (the "SEC") at www.sec.gov/EDGAR and the Company's website at www.hivedigitaltechnologies.com. For the year ended March 31, 2025, the Company transitioned its financial reporting framework from International Financial Reporting Standards ("IFRS") to the generally accepted accounting principles in the United States of America ("US GAAP"). The transitionary date is April 1, 2023 which represents the opening balance sheet for the comparative period. The preparation of financial data is in accordance with US GAAP as issued by the Financial Accounting Standards Board ("FASB") and all figures are reported in United States dollars unless otherwise indicated.

This Management's Discussion & Analysis contains information up to and including August 14, 2025.

BUSINESS OVERVIEW

HIVE Digital Technologies Ltd. is a growth-oriented company listed on the TSX Venture Exchange ("TSXV"), the NASDAQ Capital Markets Exchange ("NASDAQ") and on the Open Market of the Frankfurt Stock Exchange. Our primary business is operating data centers, the computing power of which is used for high performance computing ("HPC") and generating hashrate which is sold to mining pools and then used for the "mining of cryptocurrencies".

HIVE operates "green" energy-powered data center facilities in Canada, Sweden, and Paraguay. Our references to "green" energy are to our energy supply agreements with producers of hydroelectric power in Canada, Sweden and Paraguay, and previously, hosting agreements with suppliers in Iceland where the hosting facilities were powered by hydroelectric or geothermal power. One of our key objectives in locating our facilities where they are is to avoid using energy derived from fossil fuels. Our facilities are connected to local power grids that are controlled by local authorities. As a result, we do not control the sourcing of our power, which may include energy from any source on the grid. However, the close proximity of our facilities to hydroelectric, and previously geothermal, based power generating plants, makes it highly probable that most or all of the energy we use for our data centers originates from those hydroelectric plants, which is the basis for our saying that our operations are "green."

The following table summarizes the operational hashrate of each of the Company's major data centers together with its average operational power consumption and power capacity available to each such data center, as of July 31, 2025.

| Operational | MW | MW Capacity | |||||||

| Sites | Hashrate | Utilized | Available | ||||||

| New Brunswick, Canada owned facility** | 3,096 PH/s | 67.0 MW | 70.0MW | ||||||

| Quebec, Canada leased facility | 1,298 PH/s | 29.5 MW | 34.5 MW | ||||||

| Boden, Sweden leased facility | 1,435 PH/s | 28.5 MW | 32.0 MW | ||||||

| Boden 2, Sweden owned facility | 261 PH/s | 4.5 MW | 6.0 MW | ||||||

| Robertsfors, Sweden leased facility | 69 PH/s | 3.0 MW | 4.0 MW | ||||||

| Notviken, Sweden leased facility | 43 PH/s | 1.0 MW | 1.5 MW | ||||||

| Yguazu, Paraguay owned facility | 8,928 PH/s | 163.0 MW | 200.0 MW | ||||||

| Quebec City, Canada hosted facility * | N/A | 0.7 MW | 0.7 MW | ||||||

| Montreal, Canada hosted facility * | N/A | 1.4 MW | 1.5 MW | ||||||

| Stockholm, Sweden hosted facility * | N/A | 0.8 MW | 0.8 MW MW | ||||||

| Total | 15,130 PH/s | 299.4 MW | 351.0 MW MW |

* Data center used for HPC / AI compute only.

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

** Includes approximately 150 PH/s of BTC equivalent hashrate.

Currently, the majority of our data center power is being utilized by HIVE to generate hashrate which is sold to mining pools who then utilize the hashrate for the mining of Bitcoin. The mining pools acquire the hashrate from HIVE based on an FPPS payout model. We retain our Bitcoin in segregated, secure storage wallets with Fireblocks Inc. ("Fireblocks"), a third-party provider that specializes in secure crypto storage. See "DIGITAL CURRENCY AND RISK MANAGEMENT" below. We have not pledged or staked our Bitcoin assets as collateral against debt or other obligations of any kind. Our Bitcoin is not stored on any exchange. Our Bitcoin is never "staked" for mining purposes (see definition of "Proof-of-Stake" below) or loaned to any third party.

The Company recognizes the majority of its revenue from the provision of hashrate services, where the company generates hashrate and sells said hashrate to mining pools which utilise the hashrate for their purposes while paying out HIVE based on an FPPS (as defined below) payout model for which the Company receives digital currencies and records them at their fair value on the date received. The Company's revenue is being diversified through our expansion into data center operations, which support HPC and artificial intelligence ("AI") based applications.

Change of Name and Diversification of Business

On July 12, 2023, the Company changed its name from HIVE Blockchain Technologies Ltd. to HIVE Digital Technologies Ltd. The change represents HIVE's evolving focus on revenue opportunities made possible by HIVE's large inventory of Nvidia Graphics Processing Unit ("GPU") cards in combination with emerging technologies, including AI, machine learning, advanced data analysis and HPC.

HIVE maintains a strong presence in Bitcoin mining through the generation and sale of its hashrate as a service; however, going forward, HIVE will diversify its business by utilizing its Nvidia GPU-based cards to build HPC clusters with Supermicro and Dell servers, which can provide computational power at a scale particularly useful for AI compute applications. In addition, the Company is branching out into the rental of GPU server clusters via marketplace aggregators and direct contracts and is developing new cloud service offerings. This cloud service is designed to offer to users a selection of options to access computing resources ranging from a virtual instance of a single GPU, to a "bare-metal" server equipped with clusters of multiple GPU servers. The term, "bare metal" refers to instances where a user rents a physical machine from our facility that is not shared with any other tenants. Bare metal servers provide the high-performance capabilities of dedicated hardware combined with the flexibility and scalability of a cloud service. Pricing will be based upon the level of computing power accessed. Marketing for the cloud services is expected to be directed toward institutions, start-ups, small and medium-sized businesses and enterprises as an efficient and cost-effective alternative, which we believe will offer substantial savings in comparison to other major hyperscale cloud service providers.

FINANCIAL SUMMARY

| Three months ended June 30, | ||||||

| (in thousands, except share amounts) | 2025 | 2024 | ||||

| Total revenue | $ | 45,611 | $ | 32,241 | ||

| Net income (loss) | 35,016 | (18,288 | ) | |||

| Gross operating margin (1) | 15,819 | 10,693 | ||||

| Basic income (loss) per share | $ | 0.19 | $ | (0.17 | ) | |

| Digital assets mined - BTC | 406 | 449 | ||||

1 Non-GAAP measure. A reconciliation to its nearest GAAP measures is provided under "Reconciliations of Non-GAAP Financial Performance Measures" below.

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

The Company is a reporting issuer in each of the Provinces and Territories of Canada and under the Securities Exchange Act of 1934 in the United States. The Company's common shares are listed for trading on the TSXV, under the symbol "HIVE.V", as well as on the NASDAQ Capital Markets Exchange under "HIVE" and on the Open Market of the Frankfurt Stock Exchange under the symbol "YO0.F". The Company's head office is located at Suite 128, 7900 Callaghan Road, San Antonio, Texas, 78229, and its registered office is located at Suite 2500, 700 West Georgia Street, Vancouver, BC, V7Y 1B3, Canada.

DEFINED TERMS

| ANDE: | Refers to the Administración Nacional de Electricidad ("ANDE"), Paraguay's state-owned utility responsible for the generation, transmission, and distribution of electricity nationwide. |

| ASIC: | An ASIC (application-specific integrated circuit) is a microchip designed for a special application, such as a particular kind of transmission protocol or a hand-held computer. In the context of digital currency mining ASICs have been designed to solve specific hashing algorithms efficiently, including for Bitcoin mining. |

| Bitcoin or BTC: | Bitcoin refers to the native token of the Bitcoin network which utilizes the SHA-256 algorithm. Bitcoin is a peer-to-peer payment system and the digital currency of the same name which uses open source cryptography to control the creation and transfer of such digital currency. |

| Bitcoin Network: | The network of computers running the software protocol underlying Bitcoin and which network maintains the database of Bitcoin ownership and facilitates the transfer of Bitcoin among parties. |

| Blockchain: | A Blockchain is a generally immutable, decentralized public transaction ledger which records transactions, such as financial transactions in cryptocurrency, in chronological order. Bitcoin and Ethereum are the largest examples of a public blockchain. |

| BuzzMiner: | A Bitcoin mining system developed by HIVE, using the Intel BlockScale ASIC, manufactured by an original design manufacturer ("ODM") which HIVE engaged, using aspects of the Intel Reference Design, with various improvements and optimizations and features implemented by HIVE (and unique to HIVE's BuzzMiner) including custom application programming interface ("API") calls, a software layer, operating modes at different ASIC frequencies, allowing HIVE to mine from 110 Terahash per second ("TH/s") to 130 TH/s at different efficiencies, along with demand response functionality. |

| Fireblocks: | Fireblocks LLC is an enterprise-grade platform delivering a secure infrastructure for moving, storing, and issuing digital assets. |

| FPPS: | FPPS (Full Pay-Per-Share) is a Bitcoin mining reward model where miners receive a fixed payout for each share submitted, covering both block rewards and transaction fees. The mining pool assumes the risk of block variability and pays miners regardless of actual block discovery, offering predictable earnings. |

| GPU: | A GPU or Graphics Processing Unit is a programmable logic chip (processor) specialized for display functions. GPUs have proven to be efficient at solving digital currency hashing algorithm previously and more commonly now used to process machine learning or AI workloads |

| Hashrate: | Hashrate is a measure of mining power whereby the expected revenue from mining is directly proportional to a miner's hashrate normalized by the total hashrate of the network. All Company hashrate metrics that are provided within this report (e.g. EH/s) are from ASIC machines ("BTC only") unless otherwise specified. |

| Hashprice | Hashprice measures the daily revenue Bitcoin miners can expect to earn per unit of computational power and is typically measured in dollars per terahash per second per day ($/TH/s/day). |

| HPC: | High performance computing (HPC) is a business practice that combines computing resources to solve large problems that are too difficult or time-consuming for a single computer to handle. HPC is used in many industries, including business, science, engineering, and academic research and more recently, has been used to support artificial intelligence (AI) applications. |

| Mining: | Mining refers to the provision of computing capacity (or hashing power) to secure a distributed network by creating, verifying, publishing and propagating blocks in the blockchain in exchange for rewards and fees denominated in the native token of that network (i.e. Bitcoin or Ethereum, as applicable) for each block generated. |

| Network Difficulty or Difficulty: |

Network difficulty is a measure of how difficult it is to find a hash below a given target. |

| Proof-of-Stake: | Under proof-of-stake consensus stakers who have sufficiently large coin balances 'staked' on the network update the ledger; stakers are incentivized to protect the network and put forth valid transactions because they are heavily invested in the network's currency. |

| Proof-of-Work: | Under proof-of-work consensus, miners performing computational work on the network update the ledger; miners are incentivized to protect the network and put forth valid transactions because they must invest in hardware and electricity for the opportunity to mine coins on the network. The success of a miner's business relies on the value of the currency remaining above the cost to create a coin. |

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

| SHA-256: | SHA-256 is a cryptographic Hash Algorithm. A cryptographic hash is a kind of 'signature' for a text or a data file. SHA-256 generates an almost-unique 256-bit (32-byte) signature for a text. The most well-known cryptocurrencies that utilize the SHA-256 algorithm are Bitcoin and Bitcoin Cash. |

| Tier 3 Data Center: | A concurrently maintainable facility with multiple active power and cooling paths, allowing for planned maintenance without downtime. It features N+1 redundancy, meaning it has backup components to handle failures or maintenance, and guarantees an uptime of 99.982% (1.6 hours of downtime annually). |

| Valenzuela or HIVE Valenzuela Facility: | 100 MW hydroelectric data center near Valenzuela, Paraguay |

| Yguazú or HIVE Yguazú Facility: | 200-megawatt ("MW") hydroelectric facility located in Yguazú, Paraguay |

OUTLOOK

Operations

The Bitcoin protocol is such that following every 210,000 blocks that are mined, the mining rewards are reduced by 50 percent (a "Halving"). The most recent Halving occurred on April 20, 2024, with the block rewards reduced from 6.25 BTC to 3.125 BTC. To mitigate the effects of a Halving, the Company intends to continue making opportunistic investments to upgrade its ASICs and infrastructure, to improve its fleet efficiency and to maximise hashrate. In addition to our cryptocurrency mining operations, the Company has continued its efforts to expand and diversify its facilities to offer HPC services to companies in the gaming, artificial intelligence and graphics rendering industries.

On January 2, 2024, the Company mutually agreed to the early termination of its service agreement for its facility in Blonduos, Iceland.

On November 1, 2024, the Company executed an early termination of its service agreement for its facility in Keflavik, Iceland. The service agreement was due to expire in May 2025, based on a 3-year term. The ASICs operation in the facility was of an older generation and was approaching the end of their economic life cycle. Instead of upgrading to new generation ASICs, the preferred option was to conclude the service agreement. This marked the end of the Company's operations in Iceland, and simplified the Company's global portfolio. HIVE's operations in Canada, Sweden, and Paraguay provide the Company with a lower $/KWHR operating costs compared to the former Iceland facilities, and investments in new generation ASICs with lower J/TH and thus lower cost of Bitcoin production, which will allow longer economic lifecycles for the ASICs to generate profit margins from mining in data centers on sites that are wholly owned by HIVE.

Between November 10 and November 20, 2024, the Company announced the purchase of a total of 11,500 Canaan Avalon 1566 miners, comprising 6,500 units with a hashrate of 185 terahashes per second ("TH/s") and 5,000 units with a hashrate of 194 TH/s, each with an efficiency of 18.5 joules per terahash ("J/TH"). These miners, which collectively add approximately 2.17 exahashes per second ("EH/s") of capacity, have been fully installed.

On December 3, 2024, the Company announced the purchase of 13,480 S21+ Hydro miners, together with a call option to acquire an additional 13,480 units within one year, for a potential total of 26,960 units representing approximately 8.6 EH/s of capacity. The Company subsequently exercised this option, with approximately 7,420 units shipped to the Yguazú facility and the remaining 6,060 units scheduled for shipment to the Valenzuela facility in September 2025.

In April 2025, the Company purchased 16,560 Bitmain S21+ Antminers with an average hashrate of 216 TH/s, representing approximately 3.57 EH/s of capacity. This purchase also included a call option to acquire an additional 15,000 Bitmain S21+ Hydro miners within one year, which, if exercised, would add approximately 4.78 EH/s, bringing the potential total from this order to 8.36 EH/s.

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

On January 27, 2025, the Company announced its plans to expand its global hash rate capacity to over 25 EH/s. This growth will be driven primarily by the expansion of operations in Paraguay, as well as ongoing upgrades to our existing data centers.

On March 17, 2025, the Company announced it closed the acquisition of the 200-megawatt ("MW") hydroelectric facility located in Yguazú, Paraguay. This facility forms the core of the first two development phases that are expected to support an additional 12.5 EH/s of operating capacity.

Phase 1 of the development, comprising approximately 6 EH/s of capacity, commenced operations in early April 2025 and was fully energized by mid-May 2025.

Phase 2, supporting a further 6.5 EH/s, is currently under construction and on track for completion by August 31, 2025.

A third phase of the Company's expansion into Paraguay is underway at the 100-megawatt site in Valenzuela, Paraguay. This site is expected to contribute the remaining capacity necessary to achieve the 25 EH/s target by American Thanksgiving 2025. The Company expects to improve its overall fleet efficiency to 17.5 J/TH.

These developments are central to HIVE's strategic commitment to fostering scalable, energy-efficient operations in regions that offer low-cost energy advantages. Management believes these advancements will drive significant value for our investors as we continue to optimize our operations and expand our presence in the Bitcoin mining landscape.

High Performance Computing

The Company has continued to develop and expand its HPC business, which draws on the Company's fleet of GPUs in enterprise grade CPU servers, operating in Tier 3 data centers. These GPUs operate with redundancy and are utilized for rental on GPU on-demand marketplaces and term contracts, where end users are typically performing Large Language Model ("LLM") computations, such as modeling, inference and fine-tuning. The Company's fleet of GPUs used for this purpose include the NVIDIA A5000, A6000, H100 and H200 GPUs. Currently the Company has operations in Tier 3 data centers in Montreal, Canada and Stockholm Sweden, where collectively approximately 5,000 GPUs are operating.

Energy Risks in Europe

Ever since Russia invaded Ukraine, there has been a global wake-up call on energy security. Many countries have implemented aggressive tax policies, strategic reserves, and industrial incentives to protect their domestic energy supply. In Europe, the sharp rise in energy prices underscored the vulnerability of unhedged power consumers, particularly in energy-intensive industries. At the same time, the geopolitical energy shock has reinforced the strategic value of data centers, which has surged even further in the wake of the AI super cycle ignited by OpenAI's ChatGPT and NVIDIA's advances in high-performance computing. This combination of energy scarcity and unprecedented demand for AI-driven compute capacity has made stable, low-cost renewable energy a critical competitive advantage in both digital asset mining and AI infrastructure services.

The Company has made best efforts to mitigate its exposure to high or unstable energy prices in Europe. Notwithstanding those efforts, there is no assurance that this risk can be mitigated. With respect to the Company's operations in Sweden, the increased energy prices across Europe resulting from the Russian invasion of Ukraine have been buffered partially by the Company having forward energy agreements for the purchase of electricity. These energy hedging contracts allow HIVE to purchase a fixed quantity of power measured in MW, for a fixed period of time months. As a result, if the index spot price increases, HIVE can rely on a previously agreed upon fixed energy price to continue operations uninterrupted.

Furthermore, HIVE actively monitors the hashrate economics of its operations to determine earnings from digital asset mining measured in dollars per megawatt-hour ("MWHR"). Under certain market conditions, it may be more profitable for HIVE to sell its energy rights back to the grid-since the Company receives the proceeds of energy sold at index spot pricing, while paying the lower fixed price secured under the energy hedged contract-than to mine digital assets. This energy optimization strategy not only protects profitability but also demonstrates HIVE's operational flexibility in a volatile energy environment.

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

Our owned and leased Swedish data centers provide capacity of approximately 44.3 MW of renewable hydroelectric energy, which represents approximately 13% of our total global hydroelectric capacity. These facilities are strategically positioned to benefit from Sweden's robust renewable energy infrastructure and to support both Bitcoin mining and emerging AI workloads. In an era when energy security is increasingly linked to national policy and the compute economy is expanding at historic speed, HIVE's combination of stable renewable power and advanced data center infrastructure positions the Company to thrive across multiple high-growth digital sectors.

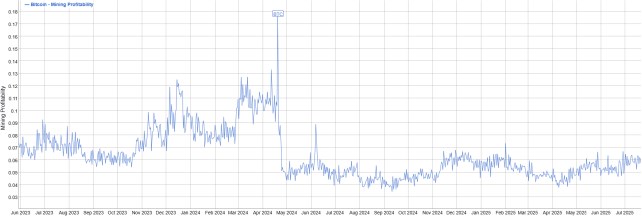

Bitcoin Mining Industry Revenues of U.S. dollars per Day for each 1 Terahash per second of computing power for the 24-month period from June 2023 to June 2025:

Source: bitinfocharts.com

This fiscal quarter hashprice was in the $40 to $60 per PH/s per day range. During this period we saw Bitcoin reach an all time high of $111,000 in May, and Difficulty reached a peak of 127T, however even during the periods of peak Difficulty, hashprice remained above $50 per PH/s per day.

Overall, the average hashprice from April to June 2025 was $51 per PH/s per day, and mining economics this quarter were down approximately 6% from the previous quarter average of $54 per PH/s. Nevertheless, HIVE increased its Gross Mining Margin this quarter to 34%, up from 28% the previous quarter.

The Bitcoin Halving event in April 2024 resulted in a significant decline in hashprice, falling from a range of approximately $100 to $120 per PH/s per day to a range of $40 to $60 per PH/s per day.

Since the quarter end, in July 2025 Bitcoin has risen to a new all-time high of $123,000, and Difficulty has also reached a new all-time high of 129T, and hashprice is back in the $60 per PH/s per day range. So while hashprice is not at pre-halving levels, with the advent of new ASICs with better energy efficiency, Bitcoin miners are able to realize strong $/KWHR revenues. When comparing against electrical operating costs, for example if power is $0.05 per KWHR hour, one would compare the $/KWHR revenue of an ASIC miner to have a correlation to Gross Mining Margin.

Notably, the introduction of next-generation ASIC miners, such as the Bitmain S21+ Antminer, has helped improve mining economics. For example, at a hashprice of $60 per PH/s per day-corresponding to Bitcoin trading at approximately $123,000 and network Difficulty of 129 trillion-an ASIC miner with an efficiency of 16.5 J/TH can generate revenue equivalent to approximately $0.15 per kilowatt-hour. These economics reflect the operating environment as of August 13 2025. Accordingly, the mining margin of an S21+ ASIC doing $0.15 per KWHR revenue, with $0.05 per KWHR operating cost would have a mining margin of approximately 65%.

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

The average monthly Bitcoin market data from April 2025 to June 2025 was as follows:

| April | May | June | Average | |||||||||

| Bitcoin | 2025 | 2025 | 2025 | YTD F2026 | ||||||||

| Average price | $ | 86,068 | $ | 103,315 | $ | 105,737 | $ | 98,373 | ||||

| Average daily difficulty (in trillions) | 121.0 | 120.8 | 126.1 | 122.6 |

Sources: Coinmarketcap.com, Glassnode.com, Blockchain.com

The average monthly Bitcoin market data from April 2024 to March 2025 was as follows:

| April | May | June | July | August | September | ||||||||||||||||

| Bitcoin | 2024 | 2024 | 2024 | 2024 | 2024 | 2024 | |||||||||||||||

| Average price | $ | 66,247 | $ | 65,043 | $ | 66,057 | $ | 62,739 | $ | 60,095 | $ | 60,212 | |||||||||

| Average daily difficulty (in trillions) | 85.7 | 84.8 | 83.8 | 81.3 | 88.9 | 90.9 | |||||||||||||||

| October | November | December | January | February | March | Average | |||||||||||||||

| Bitcoin | 2024 | 2024 | 2024 | 2025 | 2025 | 2025 | YTD F2025 | ||||||||||||||

| Average price | $ | 65,362 | $ | 85,698 | $ | 98,344 | $ | 99,706 | $ | 95,925 | $ | 85,138 | $ | 75,881 | |||||||

| Average daily difficulty (in trillions) | 92.2 | 101.1 | 106.3 | 109.8 | 111.7 | 112.2 | 95.7 | ||||||||||||||

Sources: Coinmarketcap.com, Glassnode.com, Blockchain.com

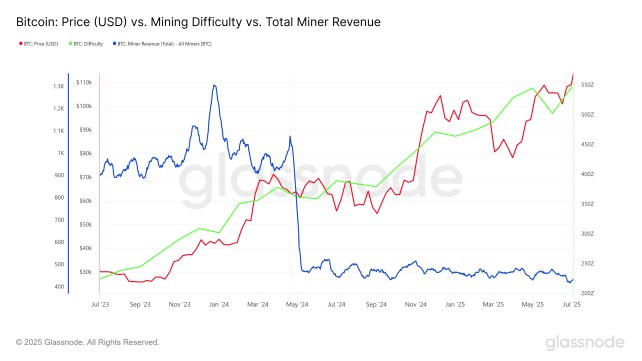

For reference, the following chart shows Bitcoin price vs Bitcoin miners' revenues (in Bitcoin block rewards and transaction fees) vs Difficulty* for the 24-month period from July 2023 to June 2025:

Source: Glassnode.com

The block reward is how new Bitcoin is "minted" or brought into the economy. These rewards, which started at 50 Bitcoin per block at inception of the network in 2009, halve every 210,000 blocks, with the Halving that occurred on May 11, 2020 (the "2020 Halving"), resulting in a reward of 6.25 Bitcoin per block vs 12.5 Bitcoin per block immediately prior to the 2020 Halving. The Halving which reduced the reward to 3.125 Bitcoin per block from 6.25 Bitcoin per block occurred on April 20, 2024. The next Halving currently is projected to occur in April 2028, and will reduce the block reward at that time to 1.5625 Bitcoin per block.

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

As a result of the April 20, 2024 Halving event, the total number of Bitcoins available to miners per day were reduced from 900 to 450 per day.

Industry subject to evolving regulatory and tax landscape

Both the regulatory and tax landscape for digital companies is evolving. The changing regulatory landscape applies to sectors that are based on blockchain, distributed ledgers, technology and the mining, use, sale and holding of tokens, or digital currencies, and the blockchain technology networks that support them.

Ever since Russia's invasion of Ukraine, global energy security concerns have accelerated regulatory scrutiny, with many countries introducing aggressive tax policies and energy-specific levies to protect domestic supply. This geopolitical shift has coincided with the AI super cycle ignited by technology from high-performance computing breakthroughs, significantly increasing the strategic and economic value of data centers worldwide. The new operative term in global policy circles is "sovereign data centers"-facilities that nations view as critical infrastructure to control within their borders, particularly when they power both Bitcoin mining and AI workloads.

In 2025, the United States underwent a massive policy shift in favor of Bitcoin mining and digital asset innovation. Pro-Bitcoin legislation such as the Genius Act and a growing framework for stablecoin adoption have created one of the most favorable policy environments in the world for large-scale blockchain infrastructure. This stands in sharp contrast to Canada and Sweden, which have reacted with more knee-jerk, anti-Bitcoin mining measures in recent years, including restrictive energy allocation policies and increased scrutiny of mining infrastructure. By comparison, U.S. policy is now actively courting Bitcoin miners, positioning the country as a strategic hub for both blockchain and AI compute growth.

Within this mixed regulatory environment, HIVE has demonstrated adaptability. In Canada and Sweden, we have continued to operate despite policy headwinds, while in Paraguay-where we operate large-scale hydro-powered facilities-an unexpected tariff increase on hydroelectricity last summer underscored the risk of sudden policy changes. These examples highlight the dynamic and sometimes unpredictable nature of the Company's operating environment, as well as HIVE's proven ability to manage and adapt to shifting energy and tax landscapes while continuing to execute its growth strategy.

Operating in an emerging industry, the Company must adapt to significant changes in regulatory, tax and industry rules and guidelines and obtain regulatory and tax advice from external global experts. In addition, regulations and the rules, rates, interpretations, and practices related to taxes, including consumption taxes such as value added taxes ("VAT"), are constantly changing.

The Company's headquarters are in San Antonio, Texas, United States, and its registered office is in Vancouver, British Columbia, Canada. As such, the Company is subject to the jurisdiction of the laws of the State of Texas, the Province of British Columbia and the federal laws of each of the United States and Canada. The Company manages its data centers and trading operations from Bermuda in order to simplify tax expectations.

The Company also has assets in Sweden and Paraguay and is subject to changes in political conditions and regulations within these markets. Changes, if any, in policies or shifts in political attitude could adversely affect the Company's operations or profitability. See "Energy Risks in Europe" above.

Operations may be affected in varying degrees by government regulations and decisions with respect to, but not limited to, restrictions on price controls, currency remittance, income and consumption taxes, foreign investment, maintenance of claims, environmental legislation, land use, electricity use and safety. Additionally, cryptocurrency prices are highly volatile, can fluctuate substantially and are affected by numerous factors beyond the Company's control, including hacking, demand, inflation, expectations with respect to the rate of inflation, and global or regional political or economic events.

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

Ongoing and future regulatory or tax changes may alter the nature of an investment in the Company or restrict the use of cryptocurrencies in a manner that adversely affects operations. Governments may curtail or outlaw the acquisition, use, or redemption of cryptocurrencies, or take regulatory action that increases operating costs or imposes additional licensing requirements. Such actions could also extend to restrictions on the acquisition, ownership, holding, selling, or trading of the Company's common shares. In an adverse scenario, these measures could force the Company to liquidate cryptocurrency inventory at unfavorable prices, reducing shareholder value.

The Company's wholly owned subsidiaries located in Sweden (Bikupa Datacenter AB ("Bikupa") and Bikupa Datacenter 2 AB ("Bikupa 2")) received decision notice of assessments ("the decision(s)"), on December 28, 2022, December 21, 2023, December 22, 2023, May 28, 2024, October 14 & 16, 2024, and March 18, 2025 for Bikupa and February 14, 2023, December 21, 2023, June 14, 2024, September 11 & 23, 2024 and March 21, 2025 for Bikupa 2 respectively, from the Swedish Tax Authority in connection with the application of VAT and its ability to recover input VAT against certain equipment and other charges in a total amount of Swedish Krona ("SEK") 607.3 million or approximately $60.4 million. The assessments covered the period December 2020 to July 2024 for Bikupa, and the period April 2021 to July 2024 for Bikupa 2, expressing the intent to reject the recovery of all the VAT for the periods under assessment.

The Company filed a formal appeal in connection with the December 28, 2022 Bikupa decision on February 9, 2023; however, there can be no guarantee that the Company will achieve a favourable outcome in its appeal. A formal appeal for Bikupa 2 in relation to the February 14, 2023 decision was filed on March 10, 2023 by the Company. The Company has engaged an independent legal firm and independent audit firm in Sweden that have expertise in these matters to assist in the appeal process. The Company does not believe that the decisions have merit because in our opinion and those of our independent advisors, the decisions are not compatible with the current applicable law and therefore the amount claimed to be owed by the Company is not probable. According to general principles regarding the placement of the burden of proof, it is up to the Swedish Tax Agency to provide sufficient evidence in support of its decisions. In our opinion, the Swedish Tax Agency has not substantiated their claim. We are not aware of any precedent cases, authoritative literature, or other statements that support the Swedish Tax Agency's position. The cases are currently in the County Administrative Court.

It is not yet known when these disputes will be resolved; the due process following appeals and the court ruling could extend well beyond a year. Furthermore, given that the industry is rapidly developing, there can be no guarantee that changes to the laws or policies of Sweden will not have a negative impact on the Company's tax position with respect to the eligibility of the claimed VAT.

If the Company is unsuccessful in its appeals, the full amount could be payable including other items such as penalties and interest that may continue to accrue. The Company will continue to assess these matters.

In the spring budget of 2023, the Swedish Parliament abolished the reduced energy tax for data centers, effective as of July 1, 2023. As a result of this decision, the Company's cost of energy at its HIVE Sweden facilities has increased by approximately 0.30 SEK per kWh. Prior to the effective date of the abolishment of the energy tax reduction, HIVE's total cost of energy at the HIVE Sweden facilities was approximately 0.30 SEK ($0.03) per kWh. Revenues from HIVE's operations at these facilities typically ranges from 0.80 to 1.00 SEK ($0.07 to $0.09) per kWh. As at July 31, 2025, the HIVE Sweden facilities represent approximately 12% of the Company's global production of Bitcoin per day. Even with this change, we believe that the HIVE Sweden facilities undertook positive actions to reduce the negative impact through the supplemental power pricing arrangement that was entered into in order to fix prices for electricity consumption at attractive prices. The HIVE Sweden facilities have secured between 21 MW and 36 MW at an average price of approximately 0.26 SEK ($0.02) per kWh for the remainder of calendar year 2025, and 8.5 MW at an average price of 0.23 SEK ($0.02) per KWh for the calendar year 2026. The Company has been exploring and will continue to explore strategies for minimizing the impact.

On February 4, 2022, the Canadian Department of Finance released for public comment a set of draft legislative proposals to implement certain tax measures. These tax measures include restricting the ability of cryptocurrency mining companies to claim back the consumption taxes they incur on purchases of goods and services made in Canada and imports into Canada. The Company expects that the restriction on the Company's ability to claim back its consumption taxes, namely the Goods and Services Tax and Harmonized Sales Tax, which apply at combined rates from 5% to 15% on the cost of goods and services, could significantly add to the Company's ongoing operating costs and the costs of its capital expenditures and imports into Canada. The measures obtained royal assent on June 22, 2023. The Company has recorded a provision during the year ended March 31, 2024 in the amount of $4.5 million, for our ability to claim back our consumption taxes. During the year ended March 31, 2025, an additional provision was recognized of $0.3 million and the Company recovered $0.8 million in relation to the provision of $4.5 million and reversed an additional $0.5 million of the same provision as a result of further examination of the sales tax provision amounts. During the period ended June 30, 2025, the Company paid $0.3 million towards the $0.3 million provisioned amount. The Company also received an assessment of $2.3 million for sales tax payable that is included in the provision as a result of a sales tax audit related to periods prior to the acquisition of 9376-9974 Quebec Inc. in 2021, and the recovered amount of $0.8 million has been applied against the sales tax payable. During the period ended June 30, 2025, the Company received sales tax credits totalling $1.4 million that were applied against the assessment of $2.3 million and the Company paid an additional $0.2 million towards this assessment. The Company will continue to work with our consultants and the Canadian authorities in resolving the disputed amounts.

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

TRANSITION TO US GAAP FROM IFRS

Effective for the Fiscal Year ending March 31, 2025, Hive Digital Technologies Ltd. has transitioned its financial reporting framework from IFRS to US GAAP.

This change aligns the Company's accounting policies with the requirements applicable to entities listed or operating primarily in the U.S. market. As a result:

The transition enhances comparability with U.S.-listed peers, aligns with the Company's investor base, and supports future capital market initiatives. Management has implemented appropriate internal controls to ensure accurate and consistent application of the new accounting framework.

HIVE PARAGUAY FACILITIES

The Company announced on July 22, 2024 that it planned to develop its HIVE Valenzuela Facility. The Company has since entered into: (i) an engineering and construction agreement executed on September 26, 2024 between W3X S.A., being a wholly-owned subsidiary of the Company, and Rieder & CIA S.A.C.I., a company organized pursuant to the laws of Paraguay relating to high voltage infrastructure within the local utility's substation, bringing down the power to the HIVE Valenzuela Facility for which the contract value is approximately $3.8 million; and (ii) a purchase order from a hardware supplier for a total of 160 MVA substation components including transformers, miscellaneous electronic parts and components at an aggregate cost of $6.0 million.

On January 24, 2025 the Company entered into a binding letter of intent with Bitfarms Ltd. to acquire the Yguazú 200 MW hydro-powered Bitcoin mining facility in Paraguay which is under development (the "HIVE Yguazú Facility"). The Company's operational capacity in Paraguay will total 300 MW upon completion of this acquisition and will solidify its leadership as one of Latin America's largest Bitcoin mining operators.

The acquisition is valued at $56 million and includes ownership of a 240 MVA substation with 200 MW of capacity as well as all associated land and facilities.

Key terms of the deal include:

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

• $25 million payable at closing, which occurred on March 17, 2025.

• $31 million payable in equal installments over six months following closing.

In addition to this, HIVE assumed $19 million of PPA deposits to ANDE, the Paraguayan utility company, and assumed remaining construction completion costs. As of June 30, 2025, the full PPA deposit was paid to ANDE.

On March 17, 2025, the Company announced it closed the acquisition of the 200-megawatt HIVE Yguazú Facility located in Yguazú, Paraguay.

On April 6, 2025, the Company announced the energization and commencement of operations at its new HIVE Yguazú Facility. This site represents a key component of the Company's multi-phase infrastructure expansion strategy.

Mining capacity in Paraguay will come online in three distinct phases:

• Phase 1 (HIVE Yguazú Facility - Air-Cooled):

Phase 1 includes the deployment of 100 MW of air-cooled ASIC miners. Since energization, the site has been scaling according to plan, and full commissioning is anticipated by June 2025. Upon completion, Phase 1 is expected to contribute approximately 5 EH/s to the Company's total Bitcoin mining capacity. This will bring the Company's total installed capacity to 11.5 EH/s, at an average efficiency of approximately 20 Joules Per Terahash (J/TH). Phase 1 was successfully completed on schedule in June 2025.

• Phase 2 (HIVE Yguazú Facility - Hydro-Cooled):

Phase 2 will add an additional 100 MW of capacity at the HIVE Yguazú Facility. The Company will deploy Bitmain Hydro AntSpace containers equipped with Bitmain S21+ Hydro ASIC miners. Construction is currently progressing on schedule, with energization expected in June 2025 and full capacity anticipated by August 2025. Once complete, Phase 2 is projected to deliver an incremental 6.5 EH/s of hashrate. At this stage, the Company's total installed capacity is expected to reach approximately 18 EH/s, with a projected fleet efficiency of approximately 18.5 J/TH. Phase 2 has been advancing and has reached 4 EH/s in July 2025, and is expected to complete on Schedule before the end of Summer 2025.

• Phase 3 (HIVE Valenzuela Facility - Hydro-Cooled):

The third and final phase involves the addition of 100 MW of hydro-cooled capacity at the Company's Valenzuela Facility, utilizing the same Bitmain Hydro AntSpace and Bitmain S21+ Hydro miner configuration as Phase 2. Energization is scheduled for September 2025, with full deployment expected by the end of calendar 2025. Upon completion, Phase 3 is expected to contribute an additional 6.5 EH/s of hashrate, bringing the Company's total installed mining capacity to approximately 24.5 EH/s. Fleet-wide energy efficiency is expected to improve further to approximately 17.5 J/TH.

See Business Objectives and Milestones section under "USE OF PROCEEDS" for further details on expected facility site costs.

ASSET ACQUISITION

On November 29, 2023, the Company acquired a data center in Sweden ("Boden 2"). In consideration, the Company issued 345,566 common shares of the Company to the vendor, made a cash payment totalling $647 thousand and $500 thousand in holdback common shares payable that are included in accounts payable and accrued liabilities as at March 31, 2025 and the period ended June 30, 2025. The Company also incurred $141 thousand in acquisition costs which were capitalized to the cost of the assets.

The $500 thousand in holdback common shares payable is to be paid at the later of: (i) the six month anniversary of the closing date; and (ii) the date on which any claims made by the Company within six months of the closing date relating to a breach of warranty under the property transfer agreement have been finally settled, and shall be composed of such number of Common Shares equal to $500 thousand less any amount payable by the Vendor to the Company in respect of such claim. As of the date of this report, the holdback common shares have not been paid out.

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

The Company determined that this transaction is an asset acquisition as the assets acquired did not constitute a business as defined by ASC 805. The following table summarizes the consideration transferred, the estimated fair value of the identifiable assets acquired and liabilities assumed as the date of the acquisition:

| in thousands | |||

| Cash paid | $ | 647 | |

| Shares issued | 1,088 | ||

| Holdback payable | 500 | ||

| Acquisition costs | 141 | ||

| Total consideration | $ | 2,376 | |

| Land | $ | 86 | |

| Building | 1,587 | ||

| Equipment | 446 | ||

| VAT receivables | 360 | ||

| Total assets | 2,479 | ||

| Current liabilities | (103 | ) | |

| Net assets acquired | $ | 2,376 |

On January 28, 2025, the Company entered into a binding letter of intent with Backbone Hosting Solutions Inc. ("BHS") and Bitfarms Ltd. ("Bitfarms") to acquire Zunz S.A., which owns a Bitcoin mining data center under construction in Yguazú, Paraguay designed for a total power capacity of up to 200 MW. The acquisition closed on March 17, 2025. In consideration, the Company paid $25 million cash up front and will pay the remaining purchase price of $31 million over six months. The consideration paid also includes transaction costs of $692 thousand and cash advanced by the Company after January 28, 2025. During the period ended June 30, 2025, the Company made three instalment payments on the acquisition loan payable and at June 30, 2025, $15.5 million remained outstanding (March 31, 2025 - $31 million).

The Company determined that this transaction is an asset acquisition as the assets acquired did not constitute a business as defined by ASC 805. The following table summarizes the consideration transferred, the estimated fair value of the identifiable assets acquired and liabilities assumed as the date of the acquisition:

| in thousands | |||

| Cash paid | $ | 25,000 | |

| Acquisition loan payable | 31,000 | ||

| Cash advances | 7,260 | ||

| Acquisition costs | 692 | ||

| Total consideration | 63,952 | ||

| Land | $ | 952 | |

| Equipment | 44 | ||

| Building and leasehold | 57,070 | ||

| Power purchase agreement guarantee | 3,314 | ||

| VAT receivables | 3,126 | ||

| Other | 52 | ||

| Total assets | $ | 64,558 | |

| Deferred tax liability | (606 | ) | |

| Net assets acquired | $ | 63,952 |

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

CONVERTIBLE DEBENTURE

On January 12, 2021, the Company closed its non-brokered private placement of unsecured debentures (the "Debentures"), for aggregate gross proceeds of $15 million with U.S. Global Investors, Inc. ("U.S. Global"). The Executive Chairman of the Company is a director, officer and controlling shareholder of U.S. Global, but the transaction was exempt from the formal valuation and minority approval requirements in Multilateral Instrument 61-10 Protection of Minority Holders in Special Transactions, because the fair market value of the transaction did not exceed 25% of the Company's market capitalization.

The Debentures will mature on the date that is 60 months from the date of issuance, bearing interest at a rate of 8% per annum. The Debentures were issued at par, with each Debenture being redeemable by HIVE at any time, and convertible at the option of the holder into common shares (each, a "Share") in the capital of the Company at a conversion price of C$15.00 per Share. Interest is payable monthly, and principal is payable quarterly. In addition, U.S. Global was issued 5 million common share purchase warrants (the "January 2021 Warrants"). Each five whole January 2021 Warrants entitles U.S. Global to acquire one common Share at an exercise price of C$15.00 per Share for a period of three years from closing. On January 12, 2024, the January 2021 Warrants expired unexercised. The Company has been paying down this debt on a quarterly basis and the total outstanding amount as of the period ended June 30, 2025 is $2.4 million.

AT-THE-MARKET EQUITY PROGRAM

On May 10, 2023, the Company entered into an equity distribution agreement ("May 2023 Equity Distribution Agreement") with Stifel GMP and Canaccord Genuity Corp. Under the May 2023 Equity Distribution Agreement, the Company may, from time to time, sell up to $100 million of common shares in the capital of the Company (the "May 2023 ATM Equity Program"). The May 2023 Equity Distribution Agreement was terminated as of August 16, 2023.

For the year ended March 31, 2024, the Company issued 1,374,700 common shares (the "May 2023 ATM Shares") pursuant to the May 2023 ATM Equity Program for gross proceeds of C$9.0 million ($6.8 million). The May 2023 ATM Shares were sold at prevailing market prices, for an average price per May 2023 ATM Share of C$6.55. Pursuant to the May 2023 Equity Distribution Agreement, a cash commission of $0.2 million on the aggregate gross proceeds raised was paid to the agent in connection with its services under the May 2023 Equity Distribution Agreement. In addition, the Company incurred $162 thousand in fees related to its May 2023 ATM Equity Program.

On August 17, 2023, the Company entered into an equity distribution agreement ("August 2023 Equity Distribution Agreement") with Stifel GMP and Canaccord Genuity Corp. Under the August 2023 Equity Distribution Agreement, the Company may, from time to time, sell up to $90 million of common shares in the capital of the Company (the "August 2023 ATM Equity Program").

For the year ended March 31, 2024, the Company issued 13,612,024 common shares (the "August 2023 ATM Shares") pursuant to the August 2023 ATM Equity Program for gross proceeds of C$71 million ($52.7 million). The August 2023 ATM Shares were sold at prevailing market prices, for an average price per August 2023 ATM Share of C$5.22. Pursuant to the August 2023 Equity Distribution Agreement, a cash commission of $1.6 million on the aggregate gross proceeds raised was paid to the agent in connection with its services under the August 2023 Equity Distribution Agreement. In addition, the Company incurred $316 thousand in fees related to its August 2023 ATM Equity Program.

For the year ended March 31, 2025, the Company issued 12,534,457 common shares (the "August 2023 ATM Shares") pursuant to the August 2023 ATM Equity Program for gross proceeds of C$51.1 million ($37.4 million). The August 2023 ATM shares were sold at prevailing market prices, for an average price per August 2023 ATM Share of C$4.08. Pursuant to the August 2023 Equity Distribution Agreement, a cash commission of $1.1 million on the aggregate gross proceeds raised was paid to the agent in connection with its services under the August 2023 Equity Distribution Agreement. In addition, the Company incurred $2 thousand in fees related to its August 2023 ATM Equity Program. The August 2023 Equity Distribution Agreement was terminated as of July 8, 2024.

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

On October 3, 2024, the Company entered into an equity distribution agreement ("October 2024 Equity Distribution Agreement"). Under the October 2024 Equity Distribution Agreement, the Company may, from time to time, sell up to $200 million of common shares in the capital of the Company (the "October 2024 ATM Equity Program").

For the year ended March 31, 2025, the Company issued 46,573,974 October 2024 ATM Shares pursuant to the October 2024 ATM Equity Program for gross proceeds of $154.9 million. The October 2024 ATM shares were sold at prevailing market prices, for an average price per October 2024 ATM Share of C$4.71. Pursuant to the October 2024 Equity Distribution Agreement, a cash commission of $4 million on the aggregate gross proceeds raised was paid to the agent in connection with its services under the October 2024 Equity Distribution Agreement. In addition, the Company incurred $0.5 million in fees related to its October 2024 ATM Equity Program.

For the period ended June 30, 2025, the Company issued 38,109,822 October 2024 ATM Shares pursuant to the October 2024 ATM Equity Program for gross proceeds of $70 million. The October 2024 ATM shares were sold at prevailing market prices, for an average price per October 2024 ATM Share of $1.84 (C$2.54). Pursuant to the October 2024 Equity Distribution Agreement, a cash commission of $1.8 million on the aggregate gross proceeds raised was paid to the agent in connection with its services under the October 2024 Equity Distribution Agreement. In addition, the Company incurred $145,000 in fees related to its October 2024 ATM Equity Program.

The Company is using the net proceeds from the May 2023 Equity Distribution Agreement, the August 2023 Equity Distribution Agreement and the October 2024 Equity Distribution Agreement for the purchase of data center equipment, strategic investments including building BTC assets on our balance sheet and general working capital. HIVE ended the period ended June 30, 2025, with 435 BTC on its balance sheet.

SPECIAL WARRANT FINANCING

On December 28, 2023, the Company completed a bought-deal financing of 5,750,000 special warrants of the Company (the "2023 Special Warrants") at a price of C$5.00 per 2023 Special Warrant for aggregate gross proceeds to the Company of C$28.8 million (the "2023 Special Warrant Offering"). Each 2023 Special Warrant entitled the holder to receive without payment of additional consideration, one unit of the Company upon exercise consisting of one common share and one-half of common share purchase warrant.

On February 2, 2024, the 2023 Special Warrants were deemed exercised into one unit of the Company comprised of one common share of the Company and one-half of one common share purchase warrant. Each whole warrant entitles the holder thereof to purchase one common share of the Company at an exercise price of C$6.00 per whole warrant until December 28, 2026.

In consideration of services, a cash commission of C$1.7 million, and 345,000 broker warrants were paid to the underwriters of the 2023 Special Warrant Offering. Each broker warrant entitles the holder to acquire one common share of the Company at an exercise price of C$5.00 per broker warrant until December 28, 2026. The broker warrants were valued at $1.28 million using the Black-Scholes option pricing model with the following assumptions: a risk-free interest rate of 3.51%, an expected volatility of 100%, an expected life of 3 years, a forfeiture rate of zero; and an expected dividend of zero. The Company also incurred C$257 thousand in professional and other fees associated with the 2023 Special Warrant financing.

USE OF PROCEEDS

2023 Special Warrants Financing

The Company has used the net proceeds from the 2023 Special Warrants offering to support the growth of its Bitcoin mining footprint. Specifically, the Company used the net proceeds to fund the purchase of 7,000 S21 Antminer ASIC units announced on December 22, 2023 which were expected to expand the Company's Bitcoin mining capacity by 1.4 EH/s. The Company allocated C$19.5 million from the net proceeds to this acquisition, which includes C$0.2 million for supplemental expenses (which includes an update or expansion of power-distribution units to support the 7,000 S21 Antminer ASICs). This resulted in an upgrade at the New Brunswick facility from the existing 38 J/TH miners to new 17 J/TH Bitmain S21 miners, which increased the Company's mining efficiency and improve the break-even cost of mining Bitcoin.

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

The following table sets forth the business objectives by the Company for the amount of proceeds from the Offering allocated to the objective, and an estimated completion date.

| Business Objective | Amount of Gross Proceeds Allocated (CAD) | Estimated Completion Date |

| Purchase of 7,000 S21 Antminer ASIC units | $19.5 million | Completed(1) |

| General Working Capital & Overhead(2) | $7.4 million | N/A |

| TOTAL: | $26.9 million(3) | - |

Note:

(1) As per the Company's press release dated December 22, 2023, the units were to be delivered over the period from January 2024 to June 1, 2024. As of the date of this report, the units have been delivered.

(2) The largest general working capital and overhead expenses for the Company are related to electricity and rent expenses at the Company's various facilities.

(3) Represents net proceeds of C$28.8 million less the Underwriters' Commission of C$1.7 million and estimated total expenses of C$0.2 million.

The total cost of the 7,000 S21 Antminer ASIC units was approximately $24.5 million. Accordingly, in addition to the gross proceeds raised under the offering, the Company paid approximately $10.0 million from the August 2023 ATM Equity Program towards the above-noted business objectives. As of the date of this report, the Company has fully funded the purchase of the 7,000 S21 units and all units have been delivered.

The remaining proceeds from the offering had been allocated for general working capital and overhead costs. As of the date of this report, all of the proceeds from the offering have been spent on the use of proceeds described above.

Prior Use of ATM Proceeds

The Company previously raised aggregate gross proceeds of $3.9 million (C$5.2 million) pursuant to the 2022 ATM Equity Program; $6.8 million (C$9.0 million) pursuant to the May 2023 ATM Equity Program; $90.0 million (C$122.2 million) pursuant to the August 2023 ATM Equity Program; and, as of the date hereof, has raised $277.8 (C$388.4 million) pursuant to the October 2024 ATM Equity Program. The following chart summarizes the proceeds raised pursuant to these offerings, and the amount spent on the Company's various facilities during the time such offerings were active:

| Agreement | Proceeds | Use of Proceeds Per Facility(1) |

| 2022 ATM Equity Program(2) | $3.9 million | Purchase of $5.5 million in data center equipment for New Brunswick Facility. |

| Purchase of $0.7 million in data center equipment for Lachute (Québec) Facility | ||

| Purchase of $26.0 million in data center equipment for Sweden (Boden) Facility | ||

| Purchase of $1.0 million in data center equipment for Iceland Facilities. | ||

| May 2023 ATM Equity Program (3) | $6.8 million | Purchase of $5.2 million in data center equipment for Lachute (Québec) Facility |

| Purchase of $12.9 million in data center equipment for New Brunswick Facility | ||

|

August 2023 ATM Equity Program (4)

|

$90 million |

Purchase of $15.1 million in data center equipment for Lachute (Québec) Facility |

|

Purchase of $24.2 million in data center equipment for Sweden (Boden & Boden 2) Facility |

||

|

Purchase of $25.1 million data center equipment for New Brunswick Facility |

||

|

Purchase of $5.9 million data center equipment for Montreal Facility |

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

| Agreement | Proceeds | Use of Proceeds Per Facility(1) |

| October 2024 ATM Equity Program (5) |

$277.8 million | Purchase of $6.6 million in data center equipment for Sweden (Boden & Boden 2) Facility |

| Purchase of $15.6 million data center equipment for New Brunswick Facility and Montreal Facility | ||

| Purchase of $189.1 million in data center equipment and development costs for Paraguay Facilities | ||

| Purchase of $18.7 million data center equipment for Montreal (HPC) Facility | ||

| Acquisition of Zunz SA from Bitfarms Ltd. and project payments of $53.5 million for Yguazú Paraguay Facility |

Notes:

(1) Note that the use of proceeds per facility is not in exact alignment with the proceeds under the various at-the-market offerings, as the Company funds acquisitions through a number of methods, including private placements and operating revenues.

(2) Proceeds raised through shares distributed at-the-market qualified by a prospectus supplement dated September 2, 2022 to a short form base shelf prospectus dated January 4, 2022.

(3) Proceeds raised through shares distributed at-the-market qualified by a prospectus supplement dated May 3, 2023 to a short form base shelf prospectus dated May 1, 2023.

(4) Proceeds raised through shares distributed at-the-market qualified by an amended and restated prospectus supplement dated August 17, 2023 to a short form base shelf prospectus dated May 1, 2023.

(5) Proceeds raised through shares distributed at-the-market qualified by a prospectus supplement dated October 3, 2024 to a short form base shelf prospectus dated September 11, 2024.

Business Objectives and Milestones

The Company's business objectives are to increase shareholder value and continue its operations as one of the globally diversified publicly traded data center companies with a focus on digital asset mining services and HPC, primarily powered by green energy. The Company's expectations are based on significant assumptions and are subject to significant risks.

The Company intends to use the available funds as set forth above based on budgets and consultations with the Board of Directors of the Company. However, there may be circumstances where, for sound business reasons, a reallocation of the net proceeds may be necessary in order for the Company to achieve its overall business objectives. Management has, and will continue to have, the discretion to modify the allocation of the Company's available funds, including the net proceeds of the offering, if necessary. Investors are cautioned that the actual amount the Company spends in connection with each of the intended uses of the proceeds may vary significantly from the amounts specified above and will depend on a number of factors, including those referred to under "RISK AND UNCERTAINTIES" below.

The following are the milestones set out by the Company as of the date hereof:

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

The Company purchased an additional 248 Nvidia H100 GPUs installed in SuperMicro servers with InfiniBand, and also 504 Nvidia H200 GPUs installed in Super Micro servers with InfiniBand.

The Company currently operates approximately 4,300 Nvidia A-series GPUs (previously 4,650) since the Company found optimal configuration for certain AI application to have 8 GPUs per server for the Nvidia A40, instead of 10 GPUs per server for the A5000 and A4000. Overall, the Company still has 480 Supermicro Servers operating a total of 4,300 GPUs in Tier 3 data centers in Quebec and Stockholm. The Company has found growing demand for the A40 GPU, and thus the majority of the 480 SuperMicro servers now run 8 Nvidia A40 GPUs.

The Company for the three months ended June 30, 2025 realized $4.8 million of revenue from the HPC business.

In total the Company is operating approximately 5,150 Nvidia GPUs as of this report date, primarily comprised of the 344 Nvidia H100 GPU, 504 Nvidia H200 GPUs and approximately 4,300 Nvidia A-series GPUs (A40s and A5000).

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

On May 27th, 2025, the Company announced it had reached $20M ARR target for the HPC business. The Company has realized peak daily revenue of $63,000 from the HPC business, which is approximately $23M ARR.

Since the Company uses a business-to-business model, it does not control the customer engagement and marketing of the marketplace platforms where the GPUs are rented, there can be fluctuations in the demand outside of the Company's control. There are fixed costs associated with operating in a Tier 3 data center, and as such the operating margins can also vary if revenue drops, with certain fixed costs in place.

The Company previously noted it had elected to sell some A-Series GPUs which were not being used for HPC, to realize a positive return on investment from the sales price combined with the operating income of these GPU cards during their lifecycle. Accordingly, the Company has recorded a gain on the sale of equipment for the year ended March 31, 2025, on the sale of these GPU cards which were fully depreciated. The revenue generated from the operation of these GPU cards combined with the proceeds on sale, exceeded the original purchase price, and accordingly represent an accretive investment with a positive return on investment. The Company used these proceeds to purchase next generation Nvidia GPU hardware to expand towards its $20 million annualized revenue target for calendar H1 2025. On December 23, 2024, the Company announced the purchase of a 32 node HGX cluster of Nvidia H100 GPUs (totalling 248 GPUs) with Infiniband, and a 64 node HGX cluster of Nvidia H200 GPUs (totalling 504 GPUs) with Infiniband as well. The 31 node H100 cluster was expected to add approximately $4 million of revenue annually once fully rented to customers, and the H200 cluster is expected to add approximately $9 million of revenue annually once fully rented to customers. Thus, in addition to the previous run-rate revenue of $10 million (prior fiscal quarter of $2.5 million translates to $10 million of annualized HPC revenue), once fully deployed the Company expected HPC annualized revenues of approximately $23 million. Thus, in effect, since peak daily revenues of $63,000 were realized, the $23 million ARR target has been reached. References to annualized revenue and run-rate revenue are considered future-oriented financial information. Readers should be cautioned that this information is used by the Company only for the purpose of evaluating the merit of this line of its business operations and may not be appropriate for other purposes.

2024 Business Objectives and Milestones

The following table sets forth the business objective and milestones contemplated by the short form base shelf prospectus dated September 11, 2024, the progress of achieving these milestones, and a comparison of the actual costs spent against the estimated costs, other than those objective and milestones that the Company has previously announced or disclosed as having been completed or achieved.

| Business Objective / Milestone |

Status | Estimated Costs | Expenditures to Date |

| Review sites for potential expansion opportunities. | Complete. After evaluating both existing and new jurisdictions to diversify operations and mitigate regulatory risk, the Company intends to construct a 100 MW facility in Paraguay. | $56 million for infrastructure; $115 million for ASIC miners(1) | $133.3 million(6) |

| Construct a 100 MW green energy mining facility in Paraguay. | Construction of 100 MW at the Valenzuela Facility is in progress. Energization is scheduled for September 2025, with full deployment expected by the end of calendar 2025. The Company anticipates a break-even period of approximately 750 days (as of June 1, 2025) on infrastructure and equipment investment. | $171 million(1) | $133.3 million(6) |

| Evaluate potential development of an 8 MW data center in Canada. | Ongoing, the Company is evaluating the acquisition and development of a new facility with an estimated cost of C$130 million. No guarantee of proceeding under current terms. | $130 million | nil |

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

| Business Objective / Milestone |

Status | Estimated Costs | Expenditures to Date |

| Upgrade ASIC miner fleet to improve operational efficiency. | Complete. As of March 2025, approximately 3,000 ASIC miners in Sweden with 38 J/TH efficiency or lower have been unplugged and replaced with Canaan Avalon 1566 miners. As of March 2025, 500 38 J/TH efficiency or lower ASICs were upgraded at the HIVE Lachute Facility with Canaan Avalon 1566 miners. As of March 2025, 500 38 J/TH efficiency or lower ASICs were upgraded at the HIVE New Brunswick Facility with Scrypt ASICs. Between January and February 2025, 4,500 additional units at this facility were upgraded to Canaan Avalon 1566 miners. |

$12 million per 10 MW upgrade | $22.2 million |

| Expand HPC operations to increase revenue. | Complete. For the year ended March 31, 2025 the Company realized a revenue of $10.0 million, with its 248 Nvidia H100 GPUs operational in Québec. On May 27th, 2025, the Company announced it had reached $20M ARR target for the HPC business with its installed 504 Nvidia H200 GPUs. The Company has realized peak daily revenue of $63,000 from the HPC business, which is approximately $23M ARR. | $30 million(2) | $36 million |

| Upgrade HIVE Facilities located in Sweden, to Tier 3 HPC data centers. | Ongoing, the Company plans to upgrade the HIVE Facilities located in Sweden | $26.5 million | nil |

| Expand AI-focused GPU computing capacity at the Montreal facility. | Complete. The Company acquired a 64-node NVIDIA H200 GPU cluster, along with InfiniBand and ethernet connections, which has been deployed at the Montreal Facility during the period ended June 30, 2025. | $25.65 million(2) | $25.9 million |

| Increase global hashrate to 12.1 EH/s. | Complete. On July 23, 2025, the Company announced that it had surpassed 13 EH/s. | $171 million. (1) | $133.3 million(6) |

| Review sites for potential expansion opportunities with 40 MW of available power capacity. | Complete. The Company recently acquired a 6MW site in Sweden in fiscal 2024 and signed a 100 MW PPA in Paraguay as announced in July 2024(3). | Revised to $75 million to $85 million(4) | $43.9 million5 |

Notes:

| (1) | The Company estimates that it will cost an aggregate of $171 million to achieve these objectives. |

| (2) | These figures reflect an aggregate of $30 million spent on these objectives, of which approximately $25.65 million has been spent specifically on AI-focused GPU computing capacity at the Montreal Facility. An additional approximately $4.35 million was spent towards expansion of the Company's HPC operations, generally. |

| (3) | Achieved in In March 2025. |

| (4) | These figures reflect an approximate $56 million cost for the construction and infrastructure of the 100 MW HIVE Valenzuela Facility. |

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

| (5) | This objective supersedes the objective disclosed above under the heading 2023 Business Objectives and Milestones. See note 3 to the table above under the heading "2023 Business Objectives and Milestones". |

| (6) | These figures reflect an aggregate of $133.3 million spent on these objectives as a whole. |

2023 Business Objectives and Milestones

The following table sets forth the business objective and milestones contemplated by the amended and restated short form base shelf prospectus dated May 1, 2023, the progress of achieving these milestones, and a comparison of the actual costs spent against the estimated costs, other than those objective and milestones that the Company has previously announced or disclosed as having been completed or achieved.

| Business Objective / Milestone |

Status | Estimated Costs |

Expenditures to Date |

| Upgrade fleet of ASIC Miners to an efficiency of 30 J/TH.(1) | Complete, with more machines purchased than initially budgeted due to attractive deals in the market for low $/TH |

$30 million | Approximately $31 million |

| Review sites for potential expansion opportunities with 40 MW of available power capacity.(3) |

Complete. The Company acquired a 6 MW site in Sweden in fiscal 2024 and signed a 100 MW PPA in Paraguay as announced in July 2024. The Company continues to evaluate further sites and expansion opportunities. | $75 million to $85 million | $43.9 million(2) |

| Expand revenue from HPC line of operations by a factor of 10. | Complete. All equipment required to complete this milestone is installed and operating, and as of the date hereof the Company has expanded the HPC line of operations by a factor of 10 (that is growing from $1 million to $10 million annual run-rate revenue1 ("ARR")). For the year ended March 31, 2025 the Company realized a revenue of $10.0 million, with its new Nvidia H100 cluster operation in Québec. The Company achieved the $10 million ARR target, and still maintains a $20 million ARR target for calendar H1 2025 with future expansions of GPUs for HPC computing. | $5.3 million | $10.8 million |

Notes:

(1) Note that there is considerable overlap between the goals of increasing efficiency, increasing hashrate, and acquiring new miners.

(2) Note that this objective continues into the 2024 Business Objectives and Milestones. See note 5 to the table below under the heading "2024 Business Objectives and Milestones".

(3) This objective has been superseded by the objective disclosed below. See note 3 to the table below under the heading "2024 Business Objectives and Milestones".

1 The Company calculates run-rate revenue on an annual basis by multiplying the revenue realized per week times 52 weeks per year. As context dictates, the Company may calculate run-rate revenue on an annual basis by multiplying the realized revenue per day times 365 days per year, or per quarter times four quarter per year.

| HIVE Digital Technologies Ltd. Management's Discussion and Analysis of Financial Condition and Results of Operations For the period ended June 30, 2025 (Expressed in US Dollars unless otherwise indicated) |

|

CONSOLIDATED RESULTS OF OPERATIONS ON A QUARTERLY BASIS

| Q1 2026 | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 | |||||||||||

| (in thousands) | |||||||||||||||

| Revenue from digital currency mining | $ | 40,797 | $ | 28,148 | $ | 26,687 | $ | 20,765 | $ | 29,636 | |||||

| High performance computing hosting | 4,814 | 3,013 | 2,542 | 1,883 | 2,605 | ||||||||||

| 45,611 | 31,161 | 29,229 | 22,648 | 32,241 | |||||||||||

| Operating and maintenance | (28,983 | ) | (21,787 | ) | (23,465 | ) | (21,903 | ) | (21,004 | ) | |||||

| High performance computing service fees | (809 | ) | (596 | ) | (487 | ) | (345 | ) | (544 | ) | |||||

| Depreciation | (22,011 | ) | (17,967 | ) | (18,050 | ) | (15,379 | ) | (13,094 | ) | |||||

| (6,192 | ) | (9,189 | ) | (12,773 | ) | (14,979 | ) | (2,401 | ) | ||||||

| Gross operating margin | 15,819 | 8,778 | 5,277 | 400 | 10,693 | ||||||||||

| Gross operating margin % (1) | 35% | 28% | 18% | 2% | 33% | ||||||||||

| Gross margin % | (14%) | (29%) | (44%) | (66%) | (7%) | ||||||||||

| Net realized and unrealized gains (losses) on digital currencies (2) | 23,161 | (26,416 | ) | 77,386 | 4,646 | (21,942 | ) | ||||||||

| General and administrative | (5,750 | ) | (5,260 | ) | (4,564 | ) | (3,381 | ) | (3,443 | ) | |||||

| Foreign exchange gain (loss) | 2,872 | (1,046 | ) | (4,695 | ) | 1,786 | (1,152 | ) | |||||||

| Share based compensation | (5,750 | ) | (4,639 | ) | (3,526 | ) | (2,234 | ) | (489 | ) | |||||