| Line Graph [Table Text Block] |

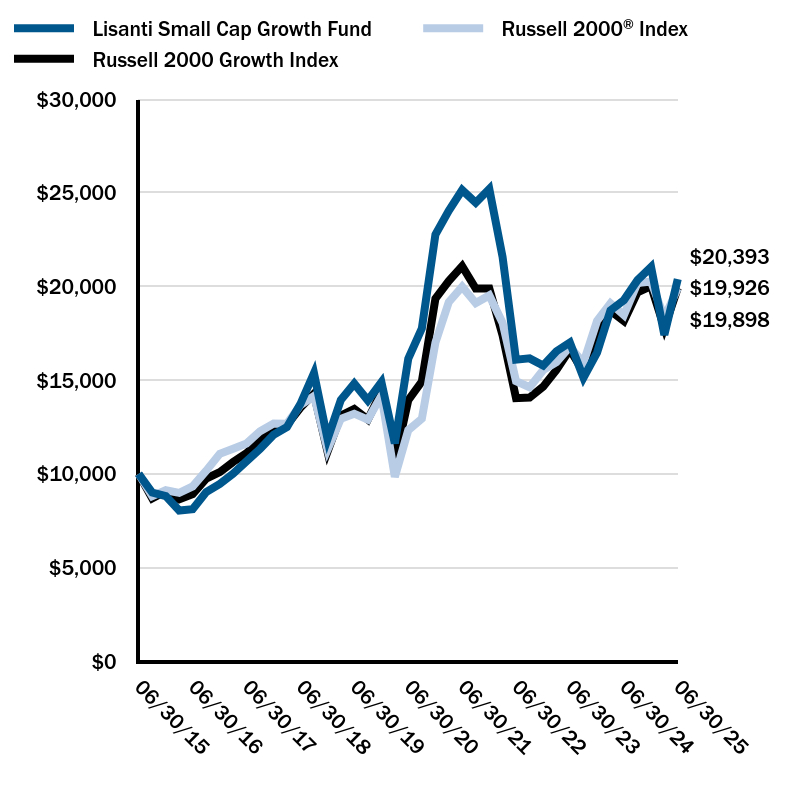

Date | Lisanti Small Cap Growth Fund | Russell 2000® Index | Russell 2000 Growth Index |

|---|

06/30/15 | $10,000 | $10,000 | $10,000 |

|---|

09/30/15 | $9,000 | $8,808 | $8,694 |

|---|

12/31/15 | $8,815 | $9,125 | $9,069 |

|---|

03/31/16 | $8,040 | $8,986 | $8,645 |

|---|

06/30/16 | $8,115 | $9,327 | $8,925 |

|---|

09/30/16 | $9,033 | $10,171 | $9,748 |

|---|

12/31/16 | $9,460 | $11,069 | $10,096 |

|---|

03/31/17 | $10,006 | $11,342 | $10,636 |

|---|

06/30/17 | $10,672 | $11,621 | $11,103 |

|---|

09/30/17 | $11,333 | $12,280 | $11,793 |

|---|

12/31/17 | $12,089 | $12,690 | $12,334 |

|---|

03/31/18 | $12,500 | $12,680 | $12,617 |

|---|

06/30/18 | $13,728 | $13,663 | $13,530 |

|---|

09/30/18 | $15,379 | $14,151 | $14,277 |

|---|

12/31/18 | $11,859 | $11,293 | $11,186 |

|---|

03/31/19 | $13,942 | $12,940 | $13,104 |

|---|

06/30/19 | $14,813 | $13,211 | $13,464 |

|---|

09/30/19 | $13,922 | $12,894 | $12,902 |

|---|

12/31/19 | $14,899 | $14,175 | $14,372 |

|---|

03/31/20 | $11,626 | $9,835 | $10,669 |

|---|

06/30/20 | $16,152 | $12,335 | $13,932 |

|---|

09/30/20 | $17,767 | $12,944 | $14,929 |

|---|

12/31/20 | $22,773 | $17,005 | $19,349 |

|---|

03/31/21 | $24,038 | $19,164 | $20,292 |

|---|

06/30/21 | $25,149 | $19,987 | $21,087 |

|---|

09/30/21 | $24,472 | $19,115 | $19,895 |

|---|

12/31/21 | $25,206 | $19,524 | $19,898 |

|---|

03/31/22 | $21,573 | $18,055 | $17,385 |

|---|

06/30/22 | $16,095 | $14,951 | $14,038 |

|---|

09/30/22 | $16,163 | $14,624 | $14,072 |

|---|

12/31/22 | $15,785 | $15,534 | $14,653 |

|---|

03/31/23 | $16,543 | $15,960 | $15,543 |

|---|

06/30/23 | $17,011 | $16,790 | $16,639 |

|---|

09/30/23 | $15,137 | $15,929 | $15,421 |

|---|

12/31/23 | $16,473 | $18,164 | $17,387 |

|---|

03/31/24 | $18,725 | $19,105 | $18,705 |

|---|

06/30/24 | $19,273 | $18,479 | $18,159 |

|---|

09/30/24 | $20,339 | $20,192 | $19,687 |

|---|

12/31/24 | $21,037 | $20,260 | $20,022 |

|---|

03/31/25 | $17,419 | $18,340 | $17,796 |

|---|

06/30/25 | $20,393 | $19,898 | $19,926 |

|---|

|