| ASX RELEASE Westpac Banking Corporation Level 18, 275 Kent Street Sydney, NSW, 2000 14 August 2025 WESTPAC 3Q25 UPDATE Following is Westpac’s 3Q25 update for the three months ended 30 June 2025. For further information: Hayden Cooper Justin McCarthy Group Head of Media Relations General Manager, Investor Relations and Corporate & Business Development 0402 393 619 0422 800 321 This document has been authorised for release by Tim Hartin, Company Secretary. |

| ASX ANNOUNCEMENT I WESTPAC 3Q25 UPDATE ASX ANNOUNCEMENT 3Q25 UPDATE 14 AUGUST 2025 HIGHLIGHTS $1.9bn Unaudited statutory net profit up 14% on 1H25 average $1.9bn Unaudited net profit ex Notable Items up 8% on 1H25 average 12.3% CET1 capital ratio above target operating range of 11.0% to 11.5% "This quarter we delivered a sound financial result, while executing on our strategy and priorities. We grew strongly in business and institutional banking, while focusing on returns in Consumer and improving customer experience. Customer service and access were enhanced with new branches in Coomera on the Gold Coast and the Darwin business banking centre, along with an additional five co-located branches and investment in front line bankers. To further strengthen customer security we are piloting AI technology to enhance real-time scam detection, helping bankers respond quickly to protect customers. The resilience of both households and businesses has been aided by the reduction in interest rates and the moderation of inflation. This is reflected in lower levels of customer stress. It should also underpin a recovery in private sector activity and support lending growth. Our transformation agenda, which includes UNITE, BizEdge and Westpac One, is focused on simplifying our operating environment across products, processes and systems, and accelerating innovation. The UNITE operating model was enhanced with activities centralised under the Chief Transformation Officer. This led to further planning and the allocation of additional resources to complete the Discovery phase of the program. We are committed to supporting improvement in Australia’s productivity, recently making a submission to the Government's upcoming Economic Reform Roundtable. Three key policy priorities for Westpac are increasing housing supply, investing in the regions and accelerating the energy transition. Our strong financial foundations provide us with the stability and capacity to support our people, customers, shareholders and the broader economy." Anthony Miller – Chief Executive Officer |

| ASX ANNOUNCEMENT I WESTPAC 3Q25 UPDATE Performance overview • Unaudited statutory net profit was $1.9 billion. • Notable Items, related to economic hedges of term funding, provided a slight benefit. • Excluding Notable Items, net profit increased 8% to $1.9 billion and pre-provision profit rose 6% with revenue increasing 4% and expenses rising 3%. • Impairment charges were 5 basis points of average gross loans. • Capital, funding and liquidity remain comfortably above regulatory minimums. Operating trends excluding Notable Items1 Net interest income increased 4%, largely due to the increase in Net Interest Margin (NIM). The NIM of 1.99% comprised: • Core NIM of 1.85%, up 5 basis points. The increase was driven by: – Liquids, 3 basis points higher, reflecting reductions in liquid and trading assets; – Deposits, 1 basis point higher. Proactive margin management and the continuing benefit of higher earnings on hedged deposits more than offset a mix shift towards lower margin savings accounts and competition for term deposits; and – Loans, 1 basis point higher. Higher spreads on mortgage lending in New Zealand provided a benefit while Australian mortgage margins were stable. A mix shift towards higher margin business lending was offset by narrower spreads due to competition. • Treasury and Markets contribution of 14 basis points, up from 12 basis points, reflecting favourable interest rate positioning in a more volatile market environment. Continued operating momentum drove customer deposit growth of $10 billion and gross loan growth of $16 billion. This includes Australian housing loan growth, excluding RAMS, of 1%, business loan growth of 5% and institutional loan growth of 2%. Non-interest income rose 6%, supported by stronger Markets revenue. Expenses were up 3%, reflecting wage and salary growth, investment in bankers and the planned increase in UNITE investment. We are pursuing targeted productivity initiatives through our Fit for Growth program to constrain cost growth. The financial resilience of our customers is reflected in improved credit quality metrics across all segments. Impairment charges were low at 5 basis points of average gross loans. Financial strength The CET1 capital ratio was 12.3% as at 30 June 2025, above the target operating range of 11.0% to 11.5%. The modest rise in CET1 reflects earnings in the quarter and a reduction in IRRBB2 RWA more than offsetting the 1H25 dividend payment and lending growth. The proforma CET1 capital ratio was 12.0% assuming completion of the remaining on market share buyback. The Group has completed 71%3 of the previously announced $3.5 billion on market share buyback. The quarterly average liquidity coverage ratio of 134% and net stable funding ratio of 114% remain above regulatory minimums. We have issued $27 billion in long-term wholesale funding for the financial year to date, completing our 2025 funding plan. Credit impairment provisions were $5.1 billion as at 30 June 2025, $1.9 billion above expected losses of the base case economic scenario. The ratio of CAP to credit RWA was little changed at 1.25%. Refer to the 3Q25 Investor Discussion Pack slides for further details. |

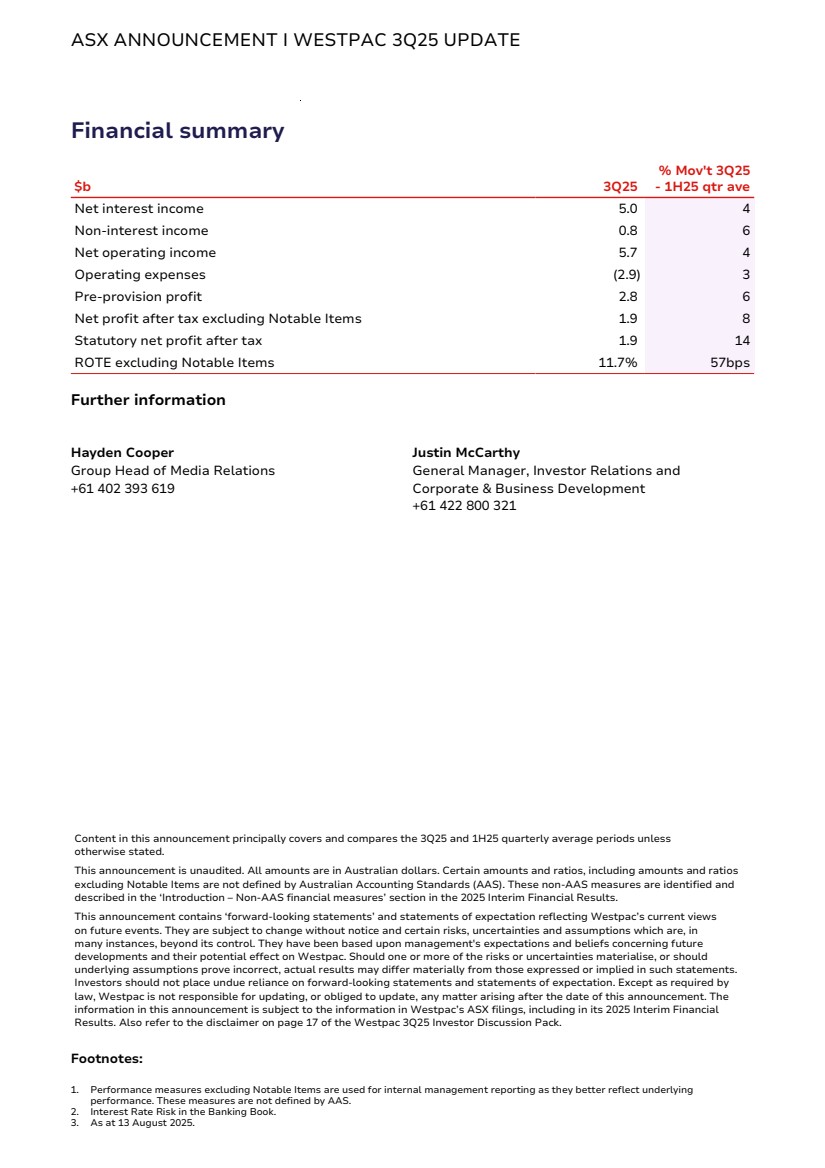

| ASX ANNOUNCEMENT I WESTPAC 3Q25 UPDATE Financial summary $b 3Q25 % Mov't 3Q25 - 1H25 qtr ave Net interest income 5.0 4 Non-interest income 0.8 6 Net operating income 5.7 4 Operating expenses (2.9) 3 Pre-provision profit 2.8 6 Net profit after tax excluding Notable Items 1.9 8 Statutory net profit after tax 1.9 14 ROTE excluding Notable Items 11.7% 57bps Further information Hayden Cooper Justin McCarthy Group Head of Media Relations +61 402 393 619 General Manager, Investor Relations and Corporate & Business Development +61 422 800 321 Content in this announcement principally covers and compares the 3Q25 and 1H25 quarterly average periods unless otherwise stated. This announcement is unaudited. All amounts are in Australian dollars. Certain amounts and ratios, including amounts and ratios excluding Notable Items are not defined by Australian Accounting Standards (AAS). These non-AAS measures are identified and described in the ‘Introduction – Non-AAS financial measures’ section in the 2025 Interim Financial Results. This announcement contains ‘forward-looking statements’ and statements of expectation reflecting Westpac’s current views on future events. They are subject to change without notice and certain risks, uncertainties and assumptions which are, in many instances, beyond its control. They have been based upon management's expectations and beliefs concerning future developments and their potential effect on Westpac. Should one or more of the risks or uncertainties materialise, or should underlying assumptions prove incorrect, actual results may differ materially from those expressed or implied in such statements. Investors should not place undue reliance on forward-looking statements and statements of expectation. Except as required by law, Westpac is not responsible for updating, or obliged to update, any matter arising after the date of this announcement. The information in this announcement is subject to the information in Westpac’s ASX filings, including in its 2025 Interim Financial Results. Also refer to the disclaimer on page 17 of the Westpac 3Q25 Investor Discussion Pack. Footnotes: 1. Performance measures excluding Notable Items are used for internal management reporting as they better reflect underlying performance. These measures are not defined by AAS. 2. Interest Rate Risk in the Banking Book. 3. As at 13 August 2025. |