![]()

Report to Shareholders

Quarter Ended June 30, 2025

Recent Highlights

KSM Field Program Progresses with Data Collection for Feasibility and Completion of BC Hydro Switching Station

KSM 2025 project activities continue to focus on green power development and distribution, foundational infrastructure, site environmental compliance, and data collection to support the next project phase - a bankable feasibility study. These work programs are being shaped in part by our discussions with prospective partners.

Power

In Q2 2025, British Columbia Hydro and Power Authority (BC Hydro) continued the multi-year construction of the Treaty Creek Terminal (TCT) station. The earthworks and infrastructure contractor are focused on pile foundations and utility installation within the control building. Contracting with the transmission line partner advanced through Q2. These activities are the second phase of construction under the Facilities Agreement signed between Seabridge and BC Hydro covering the design and construction of the TCT facility, regional system upgrades, and infrastructure that tie KSM into the Northwest Transmission Line. BC Hydro's Indigenous partner for onsite work is the Treaty Creek Limited Partnership, the 50/50 partnership of the Nisga'a Growth Corporation and the Tahltan Nation Development Corporation fostered by Seabridge. BC Hydro reports that construction costs are aligned with previous forecasts and delivery remains on schedule for an In-Service date of Q4 2026.

Site design and construction

Now that KSM has achieved its substantial start designation, the project focus is to expedite both preparatory works required for the bankable feasibility study as well as accelerating designs of critical-path portions of the early construction schedule to shovel-ready status. In Q2, subsurface characterization drilling contracts were awarded and drill crews mobilized to the site. The primary focus is on geotechnical data collection for site infrastructure including tunnels, dams, pit slopes and civil structures in the mine, processing and tailings areas for use in the bankable feasibility study. Key consultants supervising these data collection programs and the overall field program continue on plan. Value engineering remains centered on enhancing project revenue, optimizing construction timelines, reducing costs, and promoting sustainability.

Engineering of Issued-for-Construction design packages continued to advance for the Saddle Portal Support Earthworks, Mitchell Valley Portal Access Roads, Coulter Creek Access Road and Construction Camps, North Treaty Access Road, and Camp 9 Support Earthworks. The Issued-for-Construction design package was completed for the Upper Treaty Creek Access Road. In addition to maintaining the site in a safe and environmentally compliant manner, the mostly Indigenous KSM Site Services team completed the installation of the Camp 11 potable water system and installed Seabridge owned generators as part of phase 2 of the power consolidation program.

Approximately 75% of 2025 field contract awards through Q2 have been made to First Nation affiliated companies.

HSE compliance

KSM site personnel continue to demonstrate a high commitment to health and safety and environmental compliance. Year over year, the project continues to exceed historical average performance in leading and lagging indicators. In Q2, no recordable injuries were experienced.

Partnership discussions continue to advance toward 2025 announcement

KSM Partnership discussions continue to progress with suitable candidates. Follow-up site visits have either already been completed or will take place this field season. Seabridge considers the process is on course for an announcement of a partnership arrangement prior to year end with a company that has the technical, financial and social wherewithal to advance KSM towards a construction/production decision.

Snip North drilling intersects 729m of 0.48 gpt Au and 0.16% Cu including 254m of 0.77 gpt Au and 0.31% Cu.

Results from the first three holes drilled this summer at the Snip North target have confirmed a copper-gold porphyry deposit of unusual size and consistency. These holes are part of a 12,000 meter drill program designed to offset and extend intense potassic alteration and associated mineralization discovered in 2024. Each of the first three holes succeeded in expanding the mineralized footprint of Snip North with wide intersections of copper and gold grades. The 2025 drill program at Snip North is designed to achieve a density of pierce points needed for a maiden resource from a mineralized zone that so far measures approximately 1,700x600x600 meters, with the aim of announcing a resource estimation for Snip North early next year.

Results from the first three holes drilled this season are as follows:

| Hole ID | Length (m) |

From (m) |

To (m) | Interval (m) |

Au g/t | Cu % | Ag g/t | Mo ppm |

|

| SN-25-25 | 817.7 | 62.5 | 791.6 | 729.1 | 0.48 | 0.16 | 1.2 | 108 | |

| including | 250.5 | 699.0 | 448.5 | 0.63 | 0.23 | 1.4 | 148 | ||

| including | 445.0 | 699.0 | 254.0 | 0.77 | 0.31 | 1.6 | 169 | ||

| SN-25-26 | 659.2 | 75.2 | 416.0 | 340.8 | 0.51 | 0.11 | 1.2 | 73 | |

| including | 257.0 | 303.0 | 46.0 | 0.86 | 0.25 | 1.8 | 220 | ||

| SN-25-27 | 864.7 | 3.4 | 271.0 | 267.6 | 0.44 | 0.15 | 1.2 | 94 | |

| including | 52.0 | 113.5 | 61.5 | 0.48 | 0.20 | 1.3 | 99 |

NOTE: True thickness of these intervals is not known; additional drilling results and geological modeling are required to establish each interval's true width. Assays are contracted through ALS Global, an ISO accredited laboratory from their facility in Langley, BC. Sample precision in all Seabridge exploration drilling is provided by the systematic insertion of blind certified geochemical standards, blanks and duplicate samples consistent with industry standards.

2024 Sustainability Report

In June, Seabridge released its 2024 Sustainability Report, underscoring the Company's ongoing commitment to safety, diversity and inclusion, environmental stewardship, Indigenous engagement and community investment. The full report is here.

Looking ahead, Seabridge remains dedicated to advancing sustainable exploration and development practices and creating lasting value for its stakeholders. We continue to assess and address our climate and nature-related risks and opportunities, aiming to be a trusted and valued member of the communities in which we operate.

Court Date Set to Hear Petitions Challenging KSM's Substantially Started Designation. One of the 3 Petitioners Withdraws from Proceedings

In May, Seabridge filed its responses in the BC Supreme Court to two petitions challenging the Environmental Assessment Office's ("EAO") decision granting Seabridge Gold's KSM project Substantially Started ("SS") Designation. The July 29, 2024, SS decision by the EAO made the project's Environmental Assessment Certificate no longer subject to expiry.

The first petition filed against KSM's SS designation was filed by the Tsetsaut Skii km Lax Ha ("TSKLH"). The 2nd petition was filed jointly by Skeena Wild Conservation Trust and the Southeast Alaska Indigenous Transboundary Commission ("SEITC"). Seabridge has been informed that SEITC is withdrawing its participation in the 2nd petition.

Seabridge's responses further strengthen and broaden the responses that had been filed by the BC Government in late April 2025 detailing the extent of our engagement with the petitioners in support of our SS application and the previously granted Provincial, Federal, and Nisga'a environmental approvals. Seabridge's extensive engagement with the TSKLH and the funding support we have provided to the TSKLH (one of the petitioners) was initiated in 2007 and has continued to be available ever since, including during the period of review of our application for an SS determination. The TSKLH have been included in all reviews of Seabridge's regulatory applications and participated to the extent they deemed warranted, with our funding support, contrary to their assertions. Seabridge's responses also support BC's position on why granting the SS Designation was not unreasonable. The Petitions, the Responses from Seabridge and the BC Government and our related news releases can be found here.

A court hearing has been scheduled for September 22 to October 1, 2025.

B.C. Chief Gold Commissioner Rejects Tudor's application challenging KSM's Tunnel Status

Tudor Gold has filed a Notice of Appeal in the British Columbia Supreme Court against the Chief Gold Commissioner of British Columbia (the "CGC") and Seabridge which appeals a decision of the CGC rejecting an application brought by Tudor that seeks to rescind the legal mechanism which prioritizes Seabridge's rights to use land passing through Tudor's claims for the KSM Project's Mitchell Treaty Tunnels ("MTT"). Tudor previously had applied for a decision from the CGC that KSM's conditional mineral reserve (the "CMR") in respect of the MTT should not apply to Tudor or, in the alternative, that the CMR be cancelled. The CGC rejected Tudor's application. The CGC's decision can be found here.

Seabridge's CMR requires that "a free miner must not obstruct, endanger or interfere with, or allow any other person to obstruct, endanger or interfere with, the construction, operation or maintenance of" the MTT. Tudor is a free miner. Tudor is, among other things, arguing that Seabridge's Licence of Occupation for the MTT gives it a competing claim to minerals in Tudor's claims and therefore must be adjudicated by the CGC. Seabridge does not claim any rights to the minerals in Tudor's Treaty Creek Project, whether under its Licence of Occupation or otherwise. Accordingly, Seabridge considers the CGC's decision to reject Tudor's application to be correct.

After Tudor's initial submission to the CGC on January 28, 2025, followed by four additional submissions through April 17, 2025 raising every argument Tudor could devise, the CGC concluded that she did not have the jurisdiction to make the decisions requested by Tudor. Tudor now appears to be trying to obtain a court decision that the CMR does not apply to it. Seabridge believes Tudor's appeal will be dismissed.

2025 Drill Program Underway at 3 Aces

In Q2, Seabridge began a fully funded $5 million exploration program at 3 Aces, using VLF geophysics and base of till sampling to find extensions of mineralized structures in the Central Core Area. The program targets mineralization similar to the Spades and Hearts zones, focusing on the intersection of feeder structures with key geological contacts. Subsequent mapping and sampling based on these surveys have identified multiple targets, and a 2,500m diamond drilling program has been initiated to assess three primary areas.

The Gold Market: The Tables Turn

Please note that the information contained in this section expresses the views and opinions of Seabridge Gold management and is not intended as investment advice. Seabridge is not licensed as an investment advisor.

"People, including economists and financial experts, didn't realize that the most important thing in the 20th century was not World War I, World War II, or the disintegration of the USSR, but rather the August 15, 1971, disconnection between the U.S. dollar and gold." Dr. Yao Yudong, Vice Chair, People's Bank of China

Most of us do not understand how important gold once was in the global financial system. Until 1909, a rapidly expanding international trading system was dependent on gold backed Bills of Exchange for settlement. Anticipating the world war to come, European countries suspended the gold standard in 1909 in order to debt finance an arms race. After the war and its inflationary consequences, the developed world was not able to fully regain the traditional gold standard for long. Trade faltered and finally collapsed as the Great Depression unfolded, leading to another world war.

As WW2 was ending, agreement was reached at Bretton Woods to launch a new gold exchange system based on the dollar. More than half of the world's currencies had disappeared and the US held an enormous 22,000 tonnes of gold. To return to price stability, the gold price was fixed at $35 per oz, the price prior to the war.

This new arrangement lasted only until 1971 when the US stopped exchanging gold for dollars. There was simply not enough gold at $35 per oz to redeem the flood of dollars being created by the US government and Federal Reserve. The US could have kept the principle of a gold exchange and allowed the gold price to rise but the administration feared the dollar would lose its status to gold. From that moment, the unbacked dollar supported an exploding credit market that grew 10 times faster than the US economy, expanding an extraordinary 226 times from 1971 to 2024.

With gold out of the system, US Treasuries became the only financial market deep enough to cycle huge US trade imbalances. As a result, Treasuries became the preferred central bank asset, a huge benefit to the US which effectively had its trade deficits financed. It finally took six years of zero interest rates and QE following the Global Financial Crisis to stop UST accumulation in its tracks, killing this 'exorbitant privilege'. In 2014, central banks started to sell USTs for gold.

Bloomberg analysts calculate that the gold market now has equivalent volume and liquidity to Treasuries and lower volatility! With $3.8 trillion in Treasuries still on hand, foreign central bank gold purchases have much further to go.

The US also had the world's only neutral trade settlement currency. This advantage has finally been weakened by the US dollar's increasing use as a geopolitical weapon. The last straw was the 2022 imposition of sanctions on Russia and its trading partners. BRICS started using gold for final settlement, replacing the USD.

The transition to a new global financial system is accelerating. To support the dollar as the pre-eminent trade currency and to find more buyers for the hugely disproportionate and growing Treasury market, the Trump administration is gambling on stable coins. The Genius Act and related legislation have regularized the rules around stable coins to give the USD a further edge in transaction settlement and deepen the UST market. Stable coins are typically backed by short term USTs to keep their one-to-one relationship to the dollar.

Curiously, Tether Holdings SA, the world's largest stable coin issuer, has quietly established its own vault in Switzerland and acquired 80 tons of gold reserves valued at around $8 Billion, totaling about 5% of its assets. The company says it plans to expand these reserves, claiming gold is logically "safer" than national currencies.

China is moving swiftly in the other direction, taking over global gold market trading volumes and pricing via the Shanghai Gold Exchange with fully backed futures and physical ETFs. China is also strongly encouraging its citizens to save in physical gold. However, its biggest initiative has just begun: the SGE is shifting vault capabilities offshore to internationalize the yuan by providing it with gold backing. Chinese importers will buy product in yuan and offer net settlement in gold, avoiding the dollar.

As America goes digital, China goes physical, in effect creating a new Bretton Woods system.

Who will win? China and the other BRICS have a huge net positive annual trade balance while the digital USD trading block taking shape from US tariff policy has huge corresponding deficits. We think the gold block will therefore outperform the digital USD. In any case, gold is back at the heart of the global financial system, money once again and, in our view, going much higher.

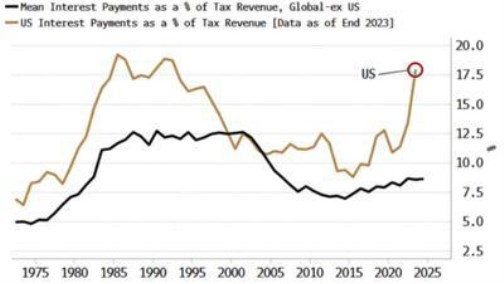

"The US fiscal and debt situation IS among the worst in the world, and among the most acute (what interest expense as a % of receipts denotes.)" Luke Gromen

Financial Results

During the three-months ended June 30, 2025, Seabridge posted a net profit of $12.3 million ($0.12 per share) compared to a net profit of $45.2 million ($0.51 per share) for the same period in 2024. Lower net profit during the current period compared to the same period in 2024 was primarily related to the remeasurement of the secured note liabilities. For details on the accounting treatment of the secured note liabilities, please refer to Note 9 of the Company's June 30, 2025 financial statements. During the second quarter, Seabridge invested $21.1 million in mineral interests, property and equipment at its projects compared to $12.6 million invested in the second quarter of 2024. At June 30, 2024, net working capital was $103.1 million compared to $37.8 million at December 31, 2024.

On Behalf of the Board of Directors,

![]()

Rudi P. Fronk

Chairman and Chief Executive Officer

August 13, 2025