Exhibit 99.2

MANAGEMENT

DISCUSSION & ANALYSIS

For the six-month period ended June 30, 2025

Exhibit 99.2

MANAGEMENT

DISCUSSION & ANALYSIS

For the six-month period ended June 30, 2025

This Management Discussion and Analysis (“MD&A”) dated August 14, 2025, has been prepared according to Regulation 51-102 of the continuous disclosure requirements and approved by the Board of Directors of Nouveau Monde Graphite Inc. (the “Company” or “NMG”).

This MD&A should be read in conjunction with the Company’s condensed consolidated interim unaudited financial statements for the six-month period ended June 30, 2025, and the consolidated audited financial statements for the years ended December 31, 2024, and December 31, 2023, and related notes. The Company’s consolidated financial statements have been prepared in accordance with the International Financial Reporting Standards (“IFRS Accounting Standards”), as published by the International Accounting Standards Board (“IASB”). All monetary amounts included in this MD&A are expressed in thousands of Canadian dollars (“CAD”), the Company’s reporting and functional currency, unless otherwise noted.

This MD&A report is for the six-month period ended June 30, 2025, with additional information up to August 14, 2025.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This MD&A contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities legislation (collectively, “forward-looking statements”), including, but not limited to, statements relating to future events or future financial or operating performance of the Company and reflect management’s expectations and assumptions regarding the Company’s growth, results, performance and business prospects and opportunities. Such forward-looking statements reflect management’s current beliefs and are based on information currently available to it. In some cases, forward-looking statements can be identified by words such as “aim”, “anticipate”, “aspire”, “attempt”, “believe”, “budget”, “could”, “estimate”, “expect”, “forecast”, “intend”, “may”, “mission”, “plan”, “potential”, “predict”, “progress”, “outlook”, “schedule”, “should”, “study”, “target”, “will”, “would” or the negative of these terms or other similar expressions concerning matters that are not historical facts. In particular, statements regarding the intended construction and commissioning of the Matawinie Mine Project (as defined herein), and the Bécancour Battery Material Plant Project (as defined herein), the intended development of the Matawinie Mine property, the intended development of the Uatnan Mining Project (as defined herein), the intended execution strategy of the Company’s projected development of the Matawinie Mine Project and the Bécancour Battery Material Plant Project, including the possibility of sequencing financing stages, product development efforts, including the ability to obtain sufficient financing for the development of the Matawinie Mine Project and the Bécancour Battery Material Plant Project on favorable terms for the Company, including the completion of the financing and the FID (as defined herein), the Company’s development activities and production plans, including the operation of the shaping demonstration plant, the purification demonstration plant, the coating demonstration plant and the concentrator demonstration plant, the ability to achieve the Company’s environmental, social and governance (“ESG”) initiatives, the execution of agreements with First Nations, communities and key stakeholders on favorable terms for the Company, the Company’s ability to provide high-performing and reliable advanced materials while promoting sustainability and supply chain traceability, including the Company’s green and sustainable lithium-ion active anode material initiatives, the Company’s ability to establish a local, carbon-neutral, and traceable turnkey supply of graphite-based advanced materials for the Western World, the Company’s electrification strategy and its intended results, market trends, the consumers demand for components in lithium-ion batteries for EVs (as defined herein) and energy storage solutions, the Company’s competitive advantages, macroeconomic conditions, the impact of applicable laws and regulations, the current geopolitical conditions, the results of the integrated feasibility study, preliminary economic assessment for the Uatnan Mining Project and any other feasibility study and preliminary economic assessments and any information as to future plans, performance and outlook for the Company are or involve forward looking-statements.

Management Discussion and Analysis | 3 |

Forward-looking statements are based on reasonable assumptions that have been made by the Company as at the date of such statements and are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements, including but not limited to, general business and economic conditions, the actual results of current development, engineering and planning activities, access to capital and future prices of graphite, mining development activities inherent risks, the speculative nature of mining development, changes in mineral production performance, the uncertainty of processing the Company’s technology on a commercial basis, development and production timetables, competition and market risks; pricing pressures, other risks of the mining industry and the geopolitical conditions, and additional engineering and other analysis is required to fully assess their impact, the fact that certain of the initiatives described in this MD&A, are still in the early stages and may not materialize, business continuity and crisis management, political instability and international conflicts; and such other assumptions and factors as set out herein and in this MD&A, and additionally, such other factors discussed in the section entitled “Risk Factors” in the Company’s most recent annual information form, which is available under the Company’s profile on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov).

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that may cause results not to be as anticipated, estimated, or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and are cautioned that the list of risks, uncertainties, assumptions and other factors are not exhaustive. The Company does not undertake to update or revise any forward-looking statements that are included in this MD&A, whether as a result of new information, future events, or otherwise, except in accordance with applicable securities laws. Additional information regarding the Company can be found in the most recent annual information form, which is available under the Company’s profile on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov).

TECHNICAL INFORMATION AND CAUTIONARY NOTE TO U.S. INVESTORS

Scientific and technical information in this MD&A has been reviewed and approved by Eric Desaulniers, geo, President and CEO for NMG, a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). Further information about the Matawinie Mine Project and the Bécancour Battery Material Plant Project, including a description of key assumptions, parameters, methods, and risks, is available in a technical report following NI 43-101 rules and guidelines, titled “NI 43-101 Updated Technical Feasibility Study Report for the Matawinie Mine and Bécancour Battery Material Plant Integrated Graphite Projects”, effective March 25, 2025, and available on SEDAR+ and EDGAR (the “Updated Feasibility Study”). Further information about the Uatnan Mining Project, including a description of key assumptions, parameters, methods, and risks, is available in a technical report following NI 43-101 rules and guidelines, titled “NI 43-101 Technical Report – PEA Report for the Uatnan Mining Project”, effective January 10, 2023, and available on SEDAR+ and EDGAR (the “2023 PEA”).

Disclosure regarding Mineral Reserve and Mineral Resource estimates included herein were prepared in accordance with NI 43-101 and applicable mining terms are as defined in accordance with the CIM Definition Standards on Mineral Resources and Reserves adopted by the Canadian Institute of Mining, Metallurgy and Petroleum Council (the “CIM Definition Standards”), as required by NI 43-101. Unless otherwise indicated, all reserve and resource estimates included in this MD&A have been prepared in accordance with the CIM Definition Standards, as required by NI 43-101.

NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs from the disclosure requirements of the United States Securities and Exchange Commission (the “SEC”) applicable to U.S. companies.

Management Discussion and Analysis | 4 |

Accordingly, information contained herein may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC reporting and disclosure requirements.

Market and industry data presented throughout this MD&A was obtained from third-party sources and industry reports, publications, websites, and other publicly available information, as well as industry and other data prepared by the Company or on behalf of the Company based on its knowledge of the markets in which the Company operates, including but not limited to information provided by suppliers, partners, customers, and other industry participants.

The Company believes that the market and economic data presented throughout this MD&A is accurate as of the date of publication and, with respect to data prepared by the Company or on behalf of the Company, that estimates and assumptions are currently appropriate and reasonable, but there can be no assurance as to the accuracy or completeness thereof. The accuracy and completeness of the market and economic data presented throughout this MD&A are not guaranteed and the Company does not make any representation as to the accuracy of such data and the Company does not undertake to update or revise such data. Actual outcomes may vary materially from those forecasted in such reports or publications, and the potential for material variations can be expected to increase as the length of the forecasted period increases. Although the Company believes it to be reliable as of the date of publication, the Company has not independently verified any of the data from third-party sources referred to in this MD&A, analyzed or verified the underlying studies or surveys relied upon or referred to by such sources, or ascertained the underlying market, economic and other assumptions relied upon by such sources. Market and economic data are subject to variations and cannot be verified due to limits on the availability and reliability of data inputs, the voluntary nature of the data-gathering process and other limitations and uncertainties inherent in any statistical survey.

The Company was established on December 31, 2012, under the Canada Business Corporations Act. NMG’s registered office is located at 481 Brassard Street, Saint-Michel-des-Saints, Québec, Canada, J0K 3B0.

The Company’s shares are listed under the symbol NMG on the New York Stock Exchange (“NYSE”) and NOU on the Toronto Stock Exchange (“TSX”).

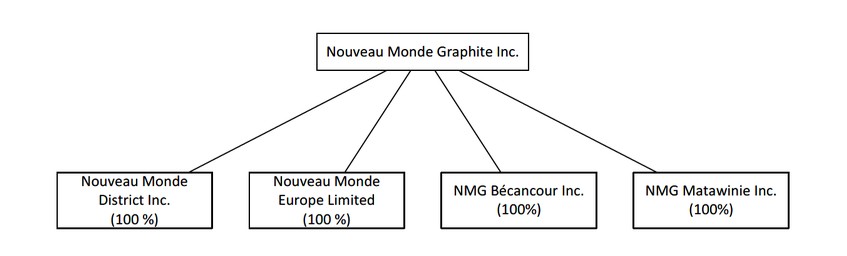

In view of FID, the Company incorporated NMG Matawinie Inc. and NMG Bécancour Inc. on June 20, 2025. The Corporation now has four subsidiaries (with equity ownership indicated below) namely:

The Company’s consolidated financial statements have been prepared using accounting principles applicable to a going concern, which contemplates the realization of assets and settlement of liabilities in the normal course of business as they

Management Discussion and Analysis | 5 |

come due. In assessing whether the going concern assumption is appropriate, management considers all available information about the future, which is at least, but not limited to, the next twelve months.

Management believes that without additional funding, the Company does not have sufficient liquidity to pursue its planned expenditures. These circumstances indicate the existence of material uncertainties that cast substantial doubt upon the Company’s ability to continue as a going concern and, accordingly, the appropriateness of the use of IFRS Accounting Standards applicable to a going concern.

The Company’s ability to continue future operations and fund its development and acquisition activities is dependent on management’s ability to secure additional financing, which may be completed in a number of ways including, but not limited to, the issuance of debt or equity instruments, expenditure reductions, or a combination of strategic partnerships, joint venture arrangements, project debt finance, offtake financing, royalty financing and other capital markets alternatives. While management has been successful in securing financing in the past, there can be no assurance it will be able to do so in the future or that these sources of funding or initiatives will be available for the Company or that they will be available on terms which are acceptable to the Company.

Although management has taken steps to verify the ownership rights in mining properties in which the Company holds an interest in accordance with industry standards for the current stage of exploration of such properties, these procedures do not guarantee the title property for the Company. The title may be subject to unregistered prior agreements and may not comply with regulatory requirements.

NMG is an integrated company developing responsible mining and advanced processing operations to supply the global economy with carbon-neutral graphite concentrate and active anode material to power electric vehicles (“EV”) and renewable energy storage systems. The Company is developing a fully integrated ore-to-battery-material source of graphite-based active anode material in Québec, Canada. With recognized ESG standards and structuring partnerships with anchor customers, NMG is set to become a strategic supplier to the world’s leading lithium-ion battery and EV manufacturers, providing advanced materials while promoting sustainability and supply chain traceability.

Vision | Drive the transition to a decarbonized and just future through sustainable graphite-based solutions. |

Mission | Provide the greenest advanced graphite materials with a carbon-neutral footprint for a sustainable world. |

Values | Caring, responsibility, openness, integrity, and entrepreneurial spirit. |

Based in Québec, Canada, the Company’s activities are focused on the planned Matawinie graphite mine and concentrator (the “Matawinie Mine”) and the planned commercial value-added graphite products transformation plant (the “Bécancour Battery Material Plant”), both of which are progressing concurrently towards FID in view of commercial operations. NMG is also planning the development of the Uatnan mining project (the “Uatnan Mining Project”) as a subsequent expansion phase. Underpinning these projects are NMG’s Matawinie and Lac Guéret graphite deposits and clean hydroelectricity powering its operations. The Company is developing what is projected to be North America’s one of the first and largest fully integrated natural graphite production.

Management Discussion and Analysis | 6 |

| » | Active work to align engineering, construction, and procurement preparation with project financing activities to reach FID and launch construction of the Phase-2 Matawinie Mine. |

| » | Focus on advancing engineering of the Phase-2 Bécancour Battery Material Plant with the support of specialized Asian firms and partnering facilities for large-scale testing, in view of reaching FID. |

| » | Continued engagement with customers, potential lenders, and targeted institutional equity investors to advance project financing requirements and reach FID on the Phase-2 Matawinie Mine and the Phase-2 Bécancour Battery Material Plant, subject to their respective technical, commercial and financing parameters. |

| » | Preliminary results of the U.S. Department of Commerce’s investigation of Chinese active anode material bring combined duties on graphite-based materials of up to 160%, thus improving the competitiveness of North American producers. |

| » | EV adoption remains strong globally (+28%), while energy storage emerges as the next major growth driver, pushed by rising AI/data center power demand. |

| » | Twelve-month rolling total recordable injury frequency rate (“TRIFR”) of 2.82 at the Company’s facilities (severity rate at 2.82) and 0 for contractors onsite; and no major environmental incidents. |

| » | Period-end cash position of $73,462. |

Striving to establish a local, carbon-neutral, and traceable turnkey supply of graphite for the Western World, the Company is advancing an integrated business operation, from responsible mining to advanced processing. NMG is marketing its future production of graphite concentrate and active anode material to serve in lithium-ion batteries for EVs, energy storage solutions, and consumer technology applications, as well as niche applications in traditional, specialized, and defense industries.

The Company is carrying out a phased development plan for its Matawinie Mine and Bécancour Battery Material Plant (respectively, with the applicable demonstration plants (Phase 1), the “Matawinie Mine Project” and “Bécancour Battery Material Plant Project” (Phase 2)) to derisk its projects and advance towards FID in view of commercial operations. To support growth and meet customers’ demand beyond its Phase 2, the Company is planning the development of the Uatnan Mining Project targeted as NMG’s Phase-3 expansion.

Management Discussion and Analysis | 7 |

Matawinie Mine Project | ||

To support the development of the commercial operations of the Matawinie Mine (“Phase-2 Matawinie Mine”), NMG has optimized its processes, products, and operational practices using its Phase-1 Demonstration Plant. The Company is advancing detailed engineering, construction planning, and procurement activities, as well as the project financing structure with the various financial stakeholders engaged in the project to reach FID and launch construction of the Phase-2 Matawinie Mine. A positive FID is dependent on the financing structure in light of the Updated Feasibility Study, updated financial model, the conclusions of the due diligence processes and negotiations with the various financial stakeholders, including bankable offtake agreements and project-related agreements with customers. | ||

Phase 1 – Matawinie Mine Demonstration Plant | ||

| Concentrator Demonstration Plant | In operation to support product sampling and qualification to customers’ specifications. |

Phase 2 – Matawinie Mine | Mining decree obtained. Some groundworks completed; shovel-ready in preparation for launch of construction upon a positive FID. Completion and issuance of the Updated Feasibility Study reflecting advancement in engineering, technological development, and project optimizations. Detailed engineering, construction planning, and procurement strategy advancing in parallel to project financing. | |

Management Discussion and Analysis | 8 |

Bécancour Battery Material Plant Project | ||

To support the development of the Bécancour Battery Material Plant (“Phase-2 Bécancour Battery Material Plant”), NMG continues to optimize its processes, products, and operational practices to align with the technical requirements of its Anchor Customers – Panasonic Energy and General Motors (“GM”) (Panasonic Energy and GM collectively, the “Anchor Customers”) – using its Phase-1 Demonstration Plant and third-party facilities; refine environmental performance and operational parameters of the chemical purification technology; advance engineering; and progress with the project financing activities with the various financial stakeholders to reach FID and launch construction of the Phase-2 Bécancour Battery Material Plant. A positive FID is dependent on the financing structure in light of the Updated Feasibility Study, updated financial model, refined technical development, the conclusions of the due diligence processes and negotiations with the various financial stakeholders, including bankable offtake agreements and project-related agreements with customers. | ||

Phase 1 – Battery Material Demonstration Plants | ||

| Shaping Demonstration Plant | In operation to support product sampling and qualification to customers’ specifications. |

| Purification Demonstration Plant | Decommissioning of facility on-going in light of technology change. |

| Coating Demonstration Plant | In operation to support product sampling and qualification to customers’ specifications. |

Phase 2 – Bécancour Battery Material Plant | Completion and issuance of the Updated Feasibility Study. Continuing advancement in engineering, technological development, and project optimizations. | |

Uatnan Mining Project | ||

To support the advancement of the Uatnan Mining Project, NMG plans to continue engaging with the Innu First Nation of Pessamit to establish a collaboration model in view of advancing a feasibility study along with an environmental and social impact assessment. Additional funding will be required to support this development. The Company also aims at formalizing commercial engagement for this contemplated production. The development of the project leading to governmental authorizations is dependent on positive studies results, successful public consultation and First Nation engagement, favorable market demand, and commercial interest. | ||

Phase 3 – Uatnan Mining Project | Preliminary economic assessment (“2023 PEA”) completed; detailed work plan for subsequent studies ready for deployment. Assessment of potential sites for processing plants initiated. | |

Management Discussion and Analysis | 9 |

NMG is advancing the development of its Matawinie graphite property, in which the Company owns a 100% interest, to produce about 106,000 tonnes per annum (“tpa”) of graphite concentrate over the 25-year life of mine.

Phase-1 Matawinie Mine Demonstration Plant

Since 2018, the Company has been operating a concentrator demonstration plant to qualify the Company’s graphite products, improve processes ahead of commercial operations, train employees, and test innovative technologies of tailings management and site restoration.

During the period, NMG has initiated work for key environmental infrastructure at the demonstration mining site in view of additional flake production at the Phase-1 Demonstration Plant.

Following the issuance of the Updated Technical Feasibility Study Report for the Matawinie Mine and Bécancour Battery Material Plant Integrated Graphite Projects (the “Updated Feasibility Study”), NMG is pursuing the development of the Phase-2 Matawinie Mine in preparation for FID. Detailed engineering, negotiation of contracts with key suppliers, preparation of call for tenders for construction, value engineering, electrification planning, and schedule optimization are ongoing to advance the project. Upon a positive FID, the Matawinie Mine could be built and enter commercial production in less than three years.

BÉCANCOUR BATTERY MATERIAL PLANT PROJECT

The Bécancour Battery Material Plant is planned to become NMG’s advanced processing platform, expected to be located in the heart of Québec’s “battery valley” and within an established industrial park equipped with key industrial infrastructure as well as hydroelectricity, an international port, railway, and expressway.

Phase-1 Battery Material Demonstration Plants

The Company is producing active anode material samples at its Phase-1 Battery Material Demonstration Plant and third-party facilities to support commercial engagement, inform Phase-2 engineering, qualify vendors, and refine operational parameters. Testing is paired with comprehensive statistical analysis to develop products based on each manufacturer’s battery specifications.

Upon the completion of testing protocols at the Phase-1 Purification Demonstration Plant, NMG is progressing well with the decommissioning of this facility in light of the technology change and as the industrial space lease nears its end. Management anticipates the closure of this facility to be completed in Q3-2025.

| » | The Company leverages third-party facilities to purify its sample production, using the chemical process that has been selected for the Phase-2 operations. |

Phase-2 Bécancour Battery Material Plant

Following the issuance of the Updated Feasibility Study, NMG is actively focusing on advancing engineering to optimize processing technologies and refine environmental, operational, and financial parameters, in view of reaching FID.

| » | Engineering is being supported by specialized Asian firms with expertise in the graphite and anode material industry. |

| » | Large-scale testing and sample production are being planned at partnering facilities to inform engineering and commercialization efforts. |

Management Discussion and Analysis | 10 |

The Uatnan Mining Project is located in the Côte-Nord administrative region, Québec, Canada, approximately 220 km as the crow flies, north northwest of the closest community, the city of Baie-Comeau. It is accessible by paved and Class-1 forestry roads.

Leveraging the wholly-owned Lac Guéret Property, NMG, is planning the Uatnan Mining Project with a focus on battery material feedstock, with a targeted production of approximately 500,000 tpa of graphite concentrate over a 24-year life of mine, based on the Preliminary Economic Assessment published in 2023 in accordance with NI 43-101.

NMG is actively engaged with the Innu First Nation of Pessamit to define a shared development vision for the Uatnan Mining Project in view of the project’s next steps, namely the preparation of a feasibility study and an environmental and social impact assessment.

Focusing on the EV and energy storage systems market segments, NMG is aligning its business plan and associated commercial strategy to cater to battery material supply chains, with a focus on the North American market. The integrated material flowsheet developed for the Company’s Phase 2 is designed to maximize the production of high-value active anode material destined to the battery market segments while reserving jumbo and large high-purity flake graphite for specialty markets, with some flexibility in the allocation of volumes.

Early commercial engagement for the Uatnan Mining Project is oriented toward battery material supply chains for the Western World and/or emerging markets.

The Company is working with its Anchor Customers toward bankable offtake agreements to bring NMG’s Phase-2 Matawinie Mine and Phase-2 Bécancour Battery Material Plant to FID. The Company's agreements with its Anchor Customers contain conditions precedent which require the Company to have made a positive decision with respect to FID and entered into certain other project-related agreements by certain fixed dates, failing which the Anchor Customers may terminate their agreements with the Company. While those dates have been exceeded, the Company and its Anchor Customers are working collaboratively toward FID and are in discussions to update the project timeline, including for the satisfaction of these conditions precedent. The offtakes are also contingent on finalizing the product qualification process and commercial plant validation upon commissioning.

In addition, the Company is actively engaged with other tier-1 potential customers interested in signing offtake agreement(s) for NMG’s Phase-2 production accompanied by strategic investments. The Company’s Phase-1 operations support technical marketing and product qualification efforts with said manufacturers.

Prices for natural graphite and active anode materials remain relatively flat (Benchmark Mineral Intelligence, July 2025) regardless of movements in the battery and EV value chain and/or geopolitics.

The global EV momentum remains strong despite some policy headwinds in North America. Over nine million EVs were sold worldwide in the first half of 2025, a 28% year-to-date increase that saw significant growth in China (+32%) and Europe (+26%), while the North American EV market slowed to just 3% growth (Rho Motion, July 2025). According to the International Energy Agency, global EV sales are on track to exceed 20 million in 2025.

Management Discussion and Analysis | 11 |

| » | The UK government introduced an EV subsidy package running until 2029 to accelerate adoption. |

| » | In contrast, the U.S. EV tax credit is set to end on September 30, 2025, following the signing of the One Big Beautiful Bill Act, which also adds an annual EV registration fee—likely impacting U.S. demand further. |

| » | GM, NMG’s Anchor Customer, emerged as the #2 EV manufacturer in the U.S. behind Tesla, with EV sales up 104% in H1 2025. In Canada, GM secured the #1 place in Canadian EV sales, posting a 38% year-over-year increase (GM, July 2025). |

Energy storage is experiencing record growth with global grid-scale deployments increasing by over 50% in H1 2025 (Rho Motion, July 2025), fueled by new renewable energy capacity, AI-driven electricity demand and grid resilience infrastructure.

| » | Rho Motion tracked 14 gigascale projects (>1 GWh) entering operation in 2025 so far, and over 300 such projects are scheduled for completion before 2027. |

| » | The International Energy Agency forecasts a 180% increase in global data center electricity demand by 2030, bolstering the need for large-scale storage. |

| » | GM announced a partnership with Redwood Materials to supply batteries for data centers, marking AI infrastructure as a second major growth market for lithium-ion batteries beyond EVs (GM, July 2025). |

The global pipeline of battery production remains robust at 9,275 GWh (Benchmark, July 2025). New capacity is coming online, namely Panasonic Energy’s, NMG’s Anchor Customer, De Soto plant inaugurated in July 2025. The Kansas factory is set to boost Panasonic Energy’s U.S.-based production capacity to approximately 73 GWh and help meet the demand from automotive customers expanding their EV production (Panasonic Energy, July 2025). Panasonic Energy is targeting a 50% local supply chain integration and full production by year-end, while diversifying its EV client base across established OEMs and start-ups (Bloomberg, July 2025).

Resetting American policies on clean technology and strategic sectors, the newly adopted American One Big Beautiful Bill Act tightens domestic content rules for battery manufacturing and imposes new limits to exclude China and other foreign entities of concern from critical mineral supply chains. The legislation also eliminates and/or phases out incentives in a number of sectors but preserves battery storage tax credits. It also allocates US$2.0 billion for the National Defense Stockpile to acquire strategic and critical minerals, and US$5.0 billion to the Department of Defense’s Industrial Base Fund for investments in critical mineral supply chains (U.S. Congress; SFA Oxford, July 2025).

Moreover, the U.S. Department of Commerce announced preliminary affirmative determinations as part of its antidumping and countervailing duties investigation of active anode material from China (International Trade Administration, July 2025). Combined tariffs on Chinese graphite-based active anode material bring effective duties to 160%, thus improving the competitiveness of North American producers (Benchmark Mineral Intelligence, July 2025). Final duties determination is expected in December 2025.

Members of the North Atlantic Treaty Organization (“NATO”), a political and military alliance of countries from Europe and North America, adopted a new Defense Investment Pledge of 5% of GDP by 2035, including 1.5% for defense-adjacent infrastructure such as critical minerals development. NATO lists graphite among 12 essential minerals for defense technology (NATO, July 2025). Investments in Canadian critical minerals not only strengthen NATO readiness but also reduce reliance on Chinese-controlled supply chains.

Management notes that current trade and geopolitical dynamics—marked by rising tariffs, shifting alliances, and growing resource nationalism—are injecting significant uncertainty into global supply chains and investment planning. EV adoption remains strong globally but is encountering policy headwinds in North America, while energy storage emerges as the next major growth driver, fueled by rising AI and data center power demand. Geopolitical fragmentation and reconfiguration of global trade flows are reshaping alliances and leading to volatility in investment and operational planning, with firms

Management Discussion and Analysis | 12 |

delaying or altering strategies amid uncertainty. Together, these shifts may reshape market demand, investment flows and supply chain strategies across the Western World (World Economic Forum, June 2025).

NMG published its annual ESG Report to present its governance of material topics, disclose its performance, and highlight sustainability milestones and targets on May 15, 2025. The 2024 ESG Report is available on NMG’s website.

For the twelve-month rolling period ended June 30, 2025, NMG reported a total recordable injury frequency rate of 2.82 and severity rate of 2.82 at the Company’s facilities, and 0 at contractors’ worksites. There were no environmental incidents during this period.

The Company has consulted and continues to actively engage with First Nations, communities and key stakeholders as it develops its projects.

The Company operates in an industry that contains various risks and uncertainties. The Company's contracts with its Anchor Customers contain conditions precedent which require the Company to have made a positive decision with respect to FID and entered into certain other project-related agreements by certain fixed dates, failing which the Anchor Customers may terminate their contracts with the Company. Those dates have exceeded. The termination of either of those contracts would have a material adverse impact on the Company’s business, ability to obtain additional financing, financial performance and operations.

For a more comprehensive discussion of these inherent risks, see “Risk Factors”’ in the Company’s most recent annual information form on the Company’s profile on SEDAR+ and on EDGAR.

Following the issuance of the Updated Feasibility Study, NMG has entered the financing stage for its Phase-2 Matawinie Mine and Phase-2 Bécancour Battery Material Plant, subject to their respective technical, commercial and financing parameters. The Company is exploring various financing and commercial scenarios to lessen risk exposure in light of current geopolitical conditions, including the possibility of sequencing financing stages.

Hence, the Company is engaged with its Anchor Customers, potential lenders, and targeted institutional equity investors with a view to advancing project financing requirements. Meetings, site visits, and different due diligence workstreams are ongoing.

| » | NMG is assisted by Société Générale as the debt advisor and BMO Capital Markets as the strategic equity advisor. |

| » | To date, the Company has received letters of interest concerning the debt financing structure for over US$1 billion toward the Company’s Phase-2 Matawinie Mine and Bécancour Battery Material Plant. Targeted capital providers include various governmental bodies, public institutions, and export credit agencies, namely Export Development Canada and Canada Infrastructure Bank. |

| » | The financing structure at FID is set to include an equity participation from key investors, including the Company’s Anchor Customers. |

| » | Although management believes that FID will occur, no assurance can be given that those expressions of interest will be converted into a positive FID. |

Management Discussion and Analysis | 13 |

During the three-month period ended June 30, 2025, the Company recorded a net loss of $21,016 (net loss of $11,082 in 2024), a basic and diluted loss per share of $0.14 (basic and diluted loss per share of $0.10 in 2024).

Description |

| Q2-2025 |

| Q1-2025 |

| Q4-2024 |

| Q3-2024 |

| | (note a) | | (note b) | | (note c) | | (note d) |

|

| $ |

| $ |

| $ |

| $ |

Net loss | | 21,016 | | 12,442 | | 21,904 | | 8,062 |

Basic loss per share | | 0.14 | | 0.08 | | 0.19 | | 0.07 |

Diluted loss per share | | 0.14 | | 0.08 | | 0.19 | | 0.07 |

Description |

| Q2-2024 |

| Q1-2024 |

| Q4-2023 |

| Q3-2023 |

| | $ | | $ | | $ | | $ |

Net loss | | 11,082 | | 32,237 | | 16,575 | | 15,526 |

Basic loss per share | | 0.10 | | 0.43 | | 0.27 | | 0.26 |

Diluted loss per share | | 0.10 | | 0.43 | | 0.27 | | 0.26 |

| a) | The net loss in Q2-2025 increased by $9,934 compared to Q2-2024, mainly due to the fair value revaluation of the derivative warrant liabilities, which resulted in a gain of $14,611 in 2024 compared to a loss in 2025. Additionally, the increase can be explained by increased activities in connection with technical audits and due diligence processes for potential lenders. These impacts were partially offset by a $7,548 loss recognized in 2024 from the settlement of convertible notes with Mitsui and Pallinghurst, as well as lower share-based compensation expense in 2025 due to a revised assumption related to performance-based stock options granted to key employees, combined with the decrease in options granted to consultants. |

| b) | The net loss in Q1-2025 decreased by $19,795 compared to Q1-2024, mainly due to a non-cash expense of $18,638 recorded in the Q1-2024 consolidated statement of loss and comprehensive loss related to the acquisition of the Lac Guéret Property combined with lower interest expenses on the convertible note due to having only the Investissement Québec note of USD$12,500 remaining. This decrease was partially offset by the increased engineering activities in connection with the Updated Feasibility Study, published on March 31, 2025, and higher share-based compensation expenses due to options granted to key employees in April 2024 that vest upon a positive FID. |

| c) | The net loss in Q4-2024 increased by $5,329 compared to Q4-2023 mainly due to a loss of $5,919 related to the fair value revaluation of the derivative warrant liability and increased engineering activities in connection with the Updated Feasibility Study deliverable, which was published on March 31, 2025. |

| d) | The net loss in Q3-2024 decreased by $7,464 compared to Q3-2023 mainly due to a $10,254 gain from the fair value revaluation of the derivative warrant liability and a reduction in interest expenses following the settlement of the convertible notes with Mitsui and Pallinghurst on May 2, 2024. This was partially offset by increased vesting expenses for stock options and higher engineering costs related to the ongoing Updated Feasibility Study for the Phase-2 projects. |

Management Discussion and Analysis | 14 |

Description | | June 30, 2025 | | December 31, 2024 |

| | $ | | $ |

Total assets (a) |

| 174,804 |

| 204,100 |

Mine under construction included in Property, plant and equipment (b) | | 71,544 | | 62,479 |

Bécancour Battery Material Plant under construction included in Property, plant and equipment | | 1,218 | | 1,175 |

Non-current liabilities |

| 3,292 |

| 3,467 |

a) | The decrease of $29,296 in total assets between June 30, 2025, and December 31, 2024, is mainly explained by a decrease of $32,834 in Cash and cash equivalents. No additional financing was received in 2025, as the previous financing was completed in December 2024 with Canada Growth Fund and Investissement Québec. The decrease is therefore explained by a monthly cash expenditure rate of approximately $5,201. This is partially offset by a $5,624 increase in property, plant, and equipment due to investments and continued progress on the development of the Phase-2 Matawinie Mine. |

b) | The increase of $9,065 in the Mine under construction between June 30, 2025, and December 31, 2024, is related to costs incurred for the Phase-2 Matawinie Mine, which have been capitalized under property, plant, and equipment. These costs are primarily associated with continued progression of the detailed engineering for both the concentrator and the mining infrastructures ($5,404), long-lead equipment deposit for the electrical substation ($377), borrowing costs ($1,122), wages and benefits ($898), and a deposit for the engineering and construction of the electrical powerline with Hydro-Québec ($1,250). |

SECOND QUARTER AND HALF YEAR RESULTS

|

| For the three-month periods ended | | For the six-month periods ended | ||||

Description | | June 30, 2025 | | June 30, 2024 | | June 30, 2025 | | June 30, 2024 |

|

| $ |

| $ |

| $ |

| $ |

Wages and benefits (a) | | 1,242 | | 1,023 | | 2,387 | | 2,073 |

Share-based compensation (b) | | 55 | | 385 | | 585 | | 524 |

Consulting fees | | 20 | | 22 | | 59 | | 43 |

Materials, consumables, and supplies | | 121 | | 185 | | 339 | | 336 |

Maintenance and subcontracting | | 125 | | 176 | | 213 | | 288 |

Utilities | | 93 | | 91 | | 185 | | 180 |

Depreciation and amortization | | 61 | | 65 | | 121 | | 128 |

Other | | 79 | | 68 | | 146 | | 110 |

Uatnan Mining Project - Exploration and evaluation expenses (c) | | 4 | | 7 | | 14 | | 18,654 |

Grants | | (37) | | (9) | | (42) | | (26) |

Tax credits | | (119) | | (170) | | (213) | | (244) |

Mining projects expenses | | 1,644 | | 1,843 | | 3,794 | | 22,066 |

Management Discussion and Analysis | 15 |

BATTERY MATERIAL PLANT PROJECT EXPENSES

|

| For the three-month periods ended | | For the six-month periods ended | ||||

Description | | June 30, 2025 | | June 30, 2024 | | June 30, 2025 | | June 30, 2024 |

|

| $ |

| $ |

| $ |

| $ |

Wages and benefits | | 1,253 | | 1,414 | | 2,643 | | 2,684 |

Share-based compensation | | 67 | | 211 | | 337 | | 270 |

Engineering (a) | | 3,898 | | 3,743 | | 8,972 | | 6,362 |

Consulting fees | | 248 | | 243 | | 456 | | 400 |

Materials, consumables, and supplies (b) | | 193 | | 525 | | 661 | | 1,191 |

Maintenance and subcontracting (c) | | 714 | | 477 | | 872 | | 1,139 |

Utilities | | 9 | | 91 | | 139 | | 279 |

Depreciation and amortization (d) | | 2,248 | | 2,401 | | 4,345 | | 4,896 |

Other | | 104 | | 85 | | 185 | | 140 |

Grants | | (154) | | (134) | | (404) | | (257) |

Tax credits (e) | | 70 | | (105) | | 70 | | (339) |

Battery Material Plant project expenses | | 8,650 | | 8,951 | | 18,276 | | 16,765 |

| b) | The decrease of $332 and $530 in materials, consumables, and supplies expenses for the three and six-month periods ended June 30, 2025, respectively, is mainly due to the decrease in operational activities at the Purification Demonstration Plant. This reduction is aligned with the start of the decommissioning of the facility, which began in Q2-2025, and is expected to be completed in Q3-2025. |

| c) | The increase of $237 in maintenance and subcontracting expenses for the three-month period ended June 30, 2025, is mainly due to a provision recorded for the remaining costs associated with the decommissioning of the Purification Demonstration Plant, as the Company has an obligation to restore the rented facility to its original condition. |

| d) | The decrease of $551 for the six-month period ended June 30, 2025, is mainly due to the end of the depreciation useful life of production equipment at the Purification Demonstration Plant. |

| e) | The decrease of $409 in tax credits for the six-month period ended June 30, 2025, is due to the Company reaching the maximum limit of eligible expenditures for the Critical and Strategic Mineral Development provincial tax credit in the 2024 fiscal period, combined with adjustments resulting from tax assessments received for prior years. |

Management Discussion and Analysis | 16 |

GENERAL AND ADMINISTRATIVE EXPENSES

|

| For the three-month periods ended | | For the six-month periods ended | ||||

Description | | June 30, 2025 | | June 30, 2024 | | June 30, 2025 | | June 30, 2024 |

|

| $ |

| $ |

| $ |

| $ |

Wages and benefits | | 1,956 | | 1,767 | | 3,810 | | 3,630 |

Share-based compensation (a) | | (7) | | 1,992 | | 2,073 | | 2,649 |

Professional fees (b) | | 1,180 | | 673 | | 1,711 | | 2,108 |

Consulting fees (c) | | 1,176 | | 425 | | 1,826 | | 889 |

Travelling, representation and convention | | 352 | | 332 | | 554 | | 452 |

Office and administration (d) | | 1,335 | | 1,383 | | 2,583 | | 2,925 |

Stock exchange, authorities, and communication | | 183 | | 199 | | 434 | | 283 |

Depreciation and amortization | | 36 | | 59 | | 72 | | 120 |

Other financial fees | | 60 | | 5 | | 64 | | 8 |

Grants | | — | | — | | — | | (46) |

General and administrative expenses | | 6,271 | | 6,835 | | 13,127 | | 13,018 |

a) | The decrease of $1,999 and $576 in share-based compensation expenses for the three and six-month periods ended June 30, 2025, respectively, is mainly due to a revised assumption related to performance-based stock options granted to key employees in April 2024, combined with the decrease in options granted to consultants. |

b) | The increase in professional fees of $507 for the three-month period ended June 30, 2025, is mostly due to higher legal costs associated with progression on the project financing structure, partially offset by legal fees in 2024 in connection with the private placement with Mitsui and Pallinghurst, completed in May 2024. |

c) | The increase of $751 and $937 in consulting fees for the three and six-month periods ended June 30, 2025, respectively, is mostly due to increased activities in connection with technical audits and due diligence processes in connection with the project financing. |

d) | The decrease in office and administration fees of $342 for the six-month period ended June 30, 2025, is mainly due to lower Director & Officer insurance fees. |

The $6,790 increase in financial costs for the six-month period ended June 30, 2025, is mainly due to the fair value revaluation of derivative warrant liabilities, which resulted in a gain of $20,565 in 2024 compared to a loss in 2025. This increase was partially offset by lower interest and accretion expenses on the convertible notes, following the surrender and cancellation of the notes by Mitsui and Pallinghurst as part of the private placement completed on May 2, 2024. Additional offsets include a $7,548 loss on settlement of convertible notes recorded in 2024, as well as a foreign exchange gain in 2025 compared to a loss during the same period in 2024.

As at June 30, 2025, the difference between the Company’s current assets and current liabilities was $33,068, including $73,462 in cash and cash equivalents.

Liquidity risk is the risk that the Company encounters difficulty in meeting obligations associated with financial liabilities that are settled by delivering cash or another financial asset.

The Company manages its liquidity risk by using budgets that enable it to determine the amounts required to fund its exploration, evaluation, and development expenditure programs. The Company’s liquidity and operating results may be

Management Discussion and Analysis | 17 |

adversely affected if the Company’s access to the capital markets or other alternative forms of financing is hindered, whether because of a downturn in stock market conditions generally or related to matters specific to the Company. The Company has historically generated cash flow primarily from its financing activities.

As at June 30, 2025, all of the Company’s short-term liabilities totalling $47,161 ($46,976 as at December 31, 2024) have contractual maturities of less than one year, except for the Derivative warrants liabilities, which are recorded in short-term liabilities due to their conversion features. The Company regularly evaluates its cash position to ensure preservation and security of capital as well as maintenance of liquidity.

| | | | | | | | As at June 30, 2025 | ||||

| | Carrying | | Contractual | | Remainder of | | Year | | Year | | 2028 and |

| | amount | | cash flows | | the year | | 2026 | | 2027 | | Onward |

| | $ | | $ | | $ | | $ | | $ | | $ |

Accounts payable and other | | 14,257 | | 14,257 | | 14,257 | | — | | — | | — |

Lease liabilities |

| 1,416 |

| 1,623 |

| 187 |

| 376 | | 279 | | 781 |

Borrowings |

| 891 |

| 975 |

| 150 |

| 300 | | 300 | | 225 |

Convertible Notes – Host[i] |

| 16,308 |

| 17,053 |

| 17,053 |

| — | | — | | — |

[i]The Convertible Notes are translated at the spot rate as of June 30, 2025.

For the six-month period ended June 30, 2025, the Company had an average monthly cash expenditure rate of approximately $5,201, including additions to property, plant and equipment, deposits to suppliers and all operating expenses. This expenditure rate can be adjusted to preserve liquidity. The Company anticipates it will continue to have negative cash flows from operating activities in future periods at least until commercial production is achieved. Significant additional financing will be needed to bring the Matawinie Mine and the Bécancour Battery Material Plant to commercial production.

| For the six-month periods ended | ||

Cash flows provided by (used in) | June 30, 2025 | | June 30, 2024 |

| $ | | $ |

Operating activities before the net change in working capital items | (26,156) |

| (23,013) |

Net change in working capital items | 810 |

| (488) |

Operating activities | (25,346) |

| (23,501) |

Investing activities | (5,860) |

| (3,784) |

Financing activities | (1,187) |

| 64,830 |

Effect of exchange rate changes on cash and cash equivalents | (441) |

| (1) |

Increase (decrease) in cash and cash equivalents | (32,834) |

| 37,544 |

For the six-month period ended June 30, 2025, cash outflows from operating activities totaled $25,346, while cash outflows totaled $23,501 for the same period in 2024. When excluding non-cash items, the cash outflows relating to operating activities were higher, as described in the above sections, partially offset by a positive variance in the net change in working capital items of $1,298.

For the six-month period ended June 30, 2025, cash used in investing activities totaled $5,860 whereas for the same period in 2024, investing activities totaled $3,784. The variance is mainly due to continued progress and investments in property, plant, and equipment for the Phase-2 Matawinie Mine in 2025, partially offset by a higher balance of outstanding payables for property, plant, and equipment, due to timing of vendor payments.

Management Discussion and Analysis | 18 |

For the six-month period ended June 30, 2025, the Company had a net outflow of $1,187 related to financing, compared to a net cash inflow of $64,830 for the same period in 2024. The variance is mainly due to the closing of the private placement with GM and Panasonic for gross proceeds of $67,870 in 2024.

The Company considers its directors and officers to be key management personnel. Transactions with key management personnel are set out as follows:

| | For the three-month periods ended | | For the six-month periods ended | ||||

| | June 30, 2025 | | June 30, 2024 | | June 30, 2025 | | June 30, 2024 |

|

| $ |

| $ | | $ |

| $ |

Key management compensation |

|

|

|

| |

|

|

|

Wages and short-term benefits |

| 545 |

| 570 | | 890 |

| 1,120 |

Share-based payments |

| (172) |

| 1,419 | | 1,923 |

| 1,856 |

Board fees |

| 240 |

| 224 | | 470 |

| 447 |

OFF-BALANCE SHEET TRANSACTIONS

There are no off-balance sheet transactions.

CRITICAL ACCOUNTING ESTIMATES, NEW ACCOUNTING POLICIES, JUDGEMENTS AND ASSUMPTIONS

Refer to note 3 and 4 in the condensed consolidated interim unaudited financial statements for the three and six-month periods ended June 30, 2025, and notes 3, 4, and 5 in the Company’s audited consolidated financial statements for the year ended December 31, 2024.

FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

Refer to note 16 in the condensed consolidated interim unaudited financial statements for the three and six-month periods ended June 30, 2025.

CONTRACTUAL OBLIGATIONS AND COMMITMENTS

Refer to note 17 in the condensed consolidated interim unaudited financial statements for the three and six-month periods ended June 30, 2025.

|

| As at August 14, 2025 |

Common shares | | 152,400,705 |

Options |

| 9,055,750 |

Warrants |

| 83,432,538 |

Warrants - Convertible Notes |

| 2,500,000 |

Convertible Notes |

| 2,500,000 |

Other reserves - settlement of interests on Convertible Notes |

| 1,534,532 |

Fully diluted |

| 251,423,525 |

Management Discussion and Analysis | 19 |

SUBSEQUENT EVENTS TO June 30, 2025

There are no subsequent events to report.

DISCLOSURE CONTROLS AND PROCEDURES AND INTERNAL CONTROLS OVER FINANCIAL REPORTING

Disclosure Controls and Procedures

The Chief Executive Officer ("CEO") and Chief Financial Officer ("CFO") of the Company have designed, or caused to be designed, disclosure controls and procedures ("DC&P") under their supervision, to provide reasonable assurance that material information pertaining to the Company is promptly communicated to Management, particularly during the period in which the filings are being prepared. These procedures ensure that information required to be disclosed by the Company in its annual filings, interim filings or other reports filed or submitted by the Company under securities legislation is recorded, processed, summarized and reported within the time periods specified in securities legislation.

Internal Controls over Financial Reporting

Internal controls over financial reporting (“ICFR”) are designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with IFRS Accounting Standards. Management is also responsible for the design of the Company's internal controls over financial reporting in order to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS Accounting Standards.

There have been no changes in the Company's ICFR that occurred during the period beginning on January 1, 2025, and ending on June 30, 2025, which have materially affected or are reasonably likely to materially affect the company’s ICFR. The CEO and CFO have signed form 52‐109F2, Certification of Interim Filings, which can be found on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

Because of their inherent limitations, internal controls over financial reporting can provide only reasonable, and not absolute, assurance with respect to the reliability of the financial reporting and financial statements preparation. Accordingly, management, including the CEO and CFO, does not expect that the internal controls over financial reporting of the Company will prevent or detect all errors and all frauds. Furthermore, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. The control framework used to evaluate the effectiveness of the design and operation of the Company's internal controls over financial reporting is the 2013 Internal Control – Integrated Framework published by the Committee of Sponsoring Organizations of the Treadway Commission.

ADDITIONAL INFORMATION AND CONTINUOUS DISCLOSURE

Additional information on the Company is available through regular filings of press releases, financial statements, and the most recent annual information form on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov). These documents and other information about NMG may also be found on our website at www.nmg.com.

August 14, 2025

/s/ Eric Desaulniers |

| /s/ Charles-Olivier Tarte |

Eric Desaulniers, géo., M.Sc. | | Charles-Olivier Tarte, CPA |

President and Chief Executive Officer | | Chief Financial Officer |

Management Discussion and Analysis | 20 |