No securities regulatory authority or regulator has assessed the merits of these securities or reviewed this document. Any representation to the contrary is an offence. This Offering may not be suitable for you and you should only invest in it if you are willing to risk the loss of your entire investment. In making this investment decision, you should seek the advice of a registered dealer.

These securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any of the securities laws of any state of the United States, and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons except pursuant to an exemption from the registration requirements of the U.S. Securities Act and any applicable securities laws of any state of the United States. This offering document does not constitute an offer to sell, or the solicitation of an offer to buy, any of these securities within the United States or to, or for the account or benefit of, U.S. persons. "United States" and "U.S. person" have the meanings ascribed to them in Regulation S under the U.S. Securities Act.

OFFERING DOCUMENT

UNDER THE LISTED ISSUER FINANCING EXEMPTION

June 9, 2025

DOLLY VARDEN SILVER CORPORATION

(the "Company" or "Dolly Varden")

What are we offering?

|

Securities: |

The Company will issue: (i) common shares of the Company (the "Common Shares") that qualify as "flow-through shares" within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the "Tax Act") that will be issued as part of a charity arrangement (each, a "CFT Share"); and (ii) Common Shares (each, a "HD Share", collectively with the CFT Shares, the "LIFE Securities") under the listed issuer financing exemption under Part 5A of National Instrument 45-106 - Prospectus Exemptions ("NI 45-106") (the "LIFE Offering"). Concurrently with the LIFE Offering, the Company will also issue 1,740,000 Common Shares that qualify as "flow-through shares" within the meaning of subsection 66(15) of the Tax Act (each, a "FT Share", and collectively with the CFT Shares and HD Shares, the "Offered Shares"), pursuant to one or more prospectus exemptions available under applicable securities laws other than the listed issuer financing exemption under Part 5A of NI 45-106 (the "Non-LIFE Offering", together with the LIFE Offering, the "Offering"). |

2

|

Offering Prices: |

$6.65 per CFT Share, $4.60 per HD Share and $5.75 per FT Share. |

|

Offering: |

The Company will issue such number of CFT Shares and HD Shares in combination to raise gross proceeds of $15,000,000 under the LIFE Offering and together with the 1,740,000 FT Shares issuable under the Non-LIFE Offering, will raise aggregate gross proceeds for the Offering of $25,005,000. There is no minimum amount. The Offering is being made pursuant to an underwriting agreement to be entered into between the Company and Research Capital Corporation, as sole bookrunner and co-lead underwriter, and together with Raymond James Ltd., as co-lead underwriter, on behalf of a syndicate of underwriters to be formed, including Haywood Securities Inc. (collectively, the "Underwriters") on or before the Closing Date (as defined below). The Underwriters shall purchase (with the right to arrange for substitute purchasers) from the Company, on a "bought deal" private placement basis, all of the CFT Shares, FT Shares and HD Shares. The Underwriters will endeavor to arrange for substituted purchasers ("Substituted Purchasers") with the effect that such substituted purchasers will be the initial purchasers of some or all of the Offered Shares. To the extent that Substituted Purchasers purchase any Offered Shares, the Underwriters shall not be obligated to purchase the Offered Shares so purchased by such Substituted Purchasers. The Company has granted the Underwriters an option (the "Underwriters' Option"), exercisable in part or in whole at the Underwriters' sole discretion, up to 2 days prior to the Closing Date, to purchase up to an additional 15% the aggregate number of HD Shares, FT Shares, CFT Shares, or any combination thereof sold pursuant to the Offering. |

|

Significant Attributes: |

The Company will use an amount equal to the gross proceeds received by the Company from the sale of the CFT Shares and the FT Shares to incur expenses eligible for qualification as "Canadian exploration expenses" and that qualify as "flow-through mining expenditures" as both terms are defined in the Tax Act (the "Qualifying Expenditures") related to the Company's Kitsault Valley Project and other mineral projects in British Columbia, on or before December 31, 2026, and to renounce all the Qualifying Expenditures in favour of the purchasers or substituted purchasers, as are arranged by the Underwriters, in each case that act at arm's length with the Company at all relevant times, of the CFT Shares and the FT Shares effective December 31, 2025. In the event the Company is unable to renounce Qualifying Expenditures effective on or prior to December 31, 2025 for each CFT Share and FT Share purchased by an arm's length purchaser or substituted purchaser in an aggregate amount not less than the gross proceeds raised from the issue of the CFT Shares and the FT Shares, the Company will indemnify each CFT Share and FT Share purchaser or substituted purchaser for the additional taxes payable by such purchaser or substituted purchaser as a result of the Company's failure to renounce the Qualifying Expenditures as agreed. The Company understands that the CFT Shares may be sold by the Underwriters on a structured flow-through share financing basis whereby the Company will, following the substitution of the purchaser of a CFT Share by the Underwriters, issue the CFT Shares to purchasers or agents acting on behalf of disclosed principals that intend to (i) donate all or a portion of the CFT Shares acquired by such substituted purchasers to a "qualified donee" as defined in the Tax Act as part of a charitable donation arrangement promoted by a third party, (ii) immediately sell the CFT Shares subscribed for to a third party, or (iii) any combination of (i) and (ii), in each case, without further action or involvement by the Company. |

3

|

|

The Company understands that the initial purchasers of any CFT Shares may subsequently choose to sell such CFT Shares (the "Secondary Shares") to purchasers arranged by the Underwriters (the "Re-Offering") at a price of $[4.60] (the "Re-Offer Price"). The Company will not be a party to any such arrangements. The Secondary Shares will not qualify as "flow- through shares" for any subsequent purchaser and consequently the Company will only renounce Qualifying Expenditures to the original purchaser of the CFT Shares. |

|

Standstill: |

The Company will be, subject to certain exceptions, subject to a restriction with respect to the issuance of Common Shares for 90 days after the Closing Date. |

|

Closing Date: |

The Offering is expected to close on or about June 26, 2025, or such other date as may be agreed upon by the Company and the Underwriters (the "Closing Date"). |

|

Exchange: |

The Common Shares are listed on the TSX Venture Exchange ("TSXV") under the symbol "DV", the NYSE American, LLC ("NYSE American") under the symbol "DVS" and on the Frankfurt Stock Exchange under the trading symbol "DVQ". |

|

Last Closing Price: |

The last closing price of the Common Shares on the TSXV, the NYSE American and the Frankfurt Stock Exchange on June 9, 2025, was $4.96, US$3.67 and €3.14, respectively. |

Dolly Varden is conducting a listed issuer financing under section 5A.2 of National Instrument 45-106 - Prospectus Exemptions. In connection with this Offering, the Company represents the following is true:

The Company has active operations and its principal asset is not cash, cash equivalents or its exchange listing;

the Company has filed all periodic and timely disclosure documents that it is required to have filed;

the Company is relying on the exemptions in Coordinated Blanket Order 45-935 Exemptions from Certain Conditions of the Listed Issuer Financing Exemption (the "Order") and is qualified to distribute securities in reliance on the exemptions included in the Order;

the total dollar amount of this Offering, in combination with the dollar amount of all other offerings made under the listed issuer financing exemption in the 12 months immediately before the date of this offering document, will not exceed $50,000,000;

the Company will not close this Offering unless the Company reasonably believes it has raised sufficient funds to meet its business objectives and liquidity requirements for a period of 12 months following the distribution; and

the Company will not allocate the available funds from this Offering to an acquisition that is a significant acquisition or restructuring transaction under securities law or to any other transaction for which the issuer seeks security holder approval.

4

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

This offering document contains "forward-looking statements" or "forward-looking information" within the meaning of applicable Canadian securities legislation. Such statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or its mineral projects, or industry results, to be materially different from any future results, expectations, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified by the use of words such as "may", "would", "could", "will", "intend", "expect", "believe", "plan", "anticipate", "estimate", "scheduled", "forecast", "predict" and other similar terminology, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved although not all forward-looking statements contain such identifying words. These statements reflect the Company's current expectations regarding future events, performance and results based on information currently available and speak only as of the date of this offering document. In making such statements or providing such information, the Company has made assumptions regarding, among other things: (i) the accuracy of the estimation of mineral resources; (ii) that exploration activities and studies will provide results that support anticipated development and extraction activities; (iii) that studies of estimated mine life and production rates at its mineral projects will provide results that support anticipated development and extraction activities; (iv) that the Company will be able to obtain additional financing on satisfactory terms, including financing necessary to advance the development of its projects;

(v) that infrastructure anticipated to be developed or operated by third parties, including electrical generation and transmission capacity, will be developed and/or operated as currently anticipated; (vi) that laws, rules and regulations are fairly and impartially observed and enforced; (vii) that the market prices for gold and silver remain at levels that justify development and/or operation of any mineral project; (viii) general economic conditions; (ix) that labour disputes, surface rights disputes, access to property, flooding, ground instability, fire, failure of plant, equipment or processes to operate as anticipated and other risks of the mining industry will not be encountered; (x) competitive conditions in the mining industry; (xi) title to mineral properties; (xii) changes in laws, rules and regulations applicable to the Company; (xiii) that the Company will be able to obtain, maintain, renew or extend required permits; (xiv) the Company's expectations with respect to the terms of the Offering; (xv) the Company's expectations with respect to the use of proceeds and the use of the available funds following completion of the Offering; (xvi) timing in respect of the Qualifying Expenditures; (xvii) the completion of the Offering and the expected Closing Date; and (xviii) the Company's expectation in respect of the Re-Offering and any sales of Secondary Shares. All other assumptions contained in this offering document constitute forward-looking information.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities, including potentially arbitrary action; the failure of parties to contracts with the Company to perform as agreed; social or labour unrest; changes in commodity prices; effects of pandemics, wars, terrorism or acts of god; unexpected changes in the cost of mining consumables; and the failure of exploration programs or current or future economic studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations. New risks may emerge from time to time and the importance of current factors may change from time to time and it is not possible for the Company to predict all such factors, changes in such factors and to assess in advance the impact of such factor on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward- looking statements contained in this offering document. Further risks, uncertainties and assumptions include, but are not limited to, those applicable to the Company and described in the Company's annual information form for the year ended December 31, 2024, which is available on the Company's profile on the System for Electronic Data Analysis and Retrieval (SEDAR+) at www.sedarplus.ca.

Information concerning the interpretation of drill results also may be considered forward-looking statements, as such information constitutes a prediction of what mineralization might be found to be present if and when a project is actually developed. This offering document also contains references to estimates of mineral resources. The estimation of mineral resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The accuracy of any such estimates of mineral resources is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation (including estimated future production from the Company's mineral projects, including the Kitsault Valley Project, the anticipated tonnages and grades that will be mined and the estimated level of recovery that will be realized), which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral resource estimates may have to be re-estimated based on, among other things: (i) fluctuations in silver, gold or other mineral prices; (ii) results of drilling; (iii) results of metallurgical testing and other studies; (iv) proposed mining operations, including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates; and (vi) the possible failure to receive required permits, approvals and licences.

5

Although the forward-looking statements contained in this offering document are based upon what management of the Company believes are reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. The Company's actual results could differ materially from those anticipated in these forward-looking statements, as a result of, amongst others, those factors noted above. Accordingly, readers should not place undue reliance on forward-looking information. These forward-looking statements are made as of the date of this offering document and are expressly qualified in their entirety by this cautionary statement. Subject to applicable Canadian securities laws, the Company assumes no obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this offering document.

CURRENCY AND MINERAL RESOURCE ESTIMATES

Unless otherwise indicated, all references to "$", "C$" or "dollars" in this offering document refer to Canadian dollars, which is the Company's functional currency. References to "US$" and "€" in this offering document refer to United States dollars and Euros, respectively.

All references to "mineral resources" included in this offering document are calculated in accordance with the standards set by the Canadian Institute of Mining & Metallurgy Definition Standards and disclosed in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). The terms "Mineral Resource", "Measured Mineral Resource", "Indicated Mineral Resource", and "Inferred Mineral Resource" are defined in accordance with the Canadian Institute of Mining & Metallurgy Definition Standards which were incorporated by reference in NI 43-101.

SUMMARY DESCRIPTION OF BUSINESS

What is our business?

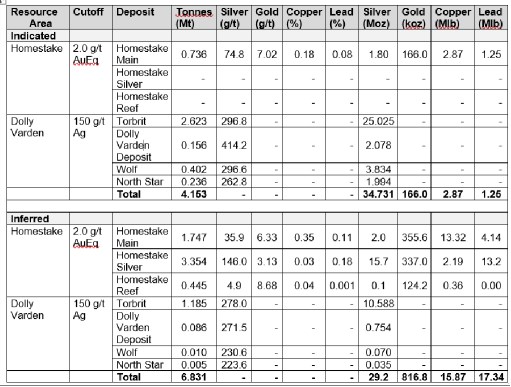

Dolly Varden is a mineral exploration company focused on exploration in the Golden Triangle region of northwestern British Columbia. The Company holds a 100% interest in the Kitsault Valley Project (being the combined Homestake Ridge Project and Dolly Varden Project), among the largest high-grade, undeveloped precious metal assets in Western Canada with a combined mineral resource base of 34.7 million ounces of silver and 166,000 ounces of gold, both in the indicated category, and 29.2 million ounces of silver and 817,000 ounces of gold, both in the inferred category (see the section titled "Scientific and Technical" information below for details regarding the mineral resource base at the Kitsault Valley Project, including tonnes and grade for each category). The Company also holds 100% interest in half of the nearby Big Bulk copper-gold property in addition to an option to own 100% of the southern half of the copper-gold property. The company also retains 100% ownership of the Kinskush property which is contiguous to The Kitsault Valley Project and surrounds the two Big Bulk properties. Outside of the Kitsault Valley, Big Bulk and Kinskuch properties, the Company has 100% interest in the Porter property located 5 kilometers from Stewart, BC. These projects are considered to be highly prospective for hosting high-grade precious metal deposits.

6

At present, the Kitsault Valley Project, the nearby Big Bulk copper-gold property, the Kinskush property and Porter property are all considered exploration stage projects, and consequently have no current operating income, cash flow or revenues. There is no assurance that commercially viable mineral deposits exist on any of the Company's properties.

Recent Developments

On September 4, 2024 and September 27, 2024, the Company closed two tranches of a bought deal public offering of 16,560,000 charity flow-through shares at a price of $1.25 per share for gross proceeds of

$20,700,000 and 11,500,000 common shares at a price of $1.00 per share for gross proceeds of

$11,500,000 respectively (the "September 2024 Offering"). In connection with the September 2024 Offering, the Company entered into an underwriting agreement with Research Capital Corporation, as the sole bookrunner and co-lead underwriter, and together with Haywood Securities Inc. as co-lead underwriters, on behalf of a syndicate of underwriters, including Raymond James Ltd. The September 2024 Offering was conducted prior to the Company's April 7, 2025 4:1 Consolidation (as defined below) and is disclosed on a pre-Consolidation basis.

On September 9, 2024, Dolly Varden announced results from the Wolf Vein high-grade silver plunge expansion directional drilling. Drill hole DV24-416, averaged 654 g/t Ag, 0.47% Pb and 0.57% Zn over 21.48 meters and drill hole DV24-408, averaged 513g/t Ag, 2.95% Pb and 1.82% Zn over 27.19 meters. Highlights included1:

Au, 0.18% Pb and 0.88% Zn over 2.80 meters.

(1Intervals shown are core length. Estimated true widths vary depending on intersection angles and range from 55% to 70% of core lengths, further modelling of the new intersections is needed before true widths can be estimated.)

On November 4, 2024, Dolly Varden announced drilled results from its 2024 program at the Homestake Silver deposit in BC's Golden Triangle. Highlights from the Homestake Silver deposit included2:

13.94 meters, including one breccia vein grading 701 g/t Au and 184 g/t Ag over 0.54 meters.

(2Intervals shown are core length; Estimated true widths vary depending on intersection angles and range from 70% to 85% of core lengths, further modelling of the new interpretation is needed before true widths can be calculated; Assay results reported are uncapped.)

On January 7, 2025, Dolly Varden announced infill, step-out and resource expansion drilling results from the Wolf Vein. Drill hole DV24-421 is a significant 120-meter step-out down the plunge of the high grade silver zone and intersected 379 g/t Ag, 0.64% Pb and 0.66% Zn over 21.69 meters. Highlights included3:

7

(3Intervals shown are core length. Estimated true widths vary depending on intersection angles and range from 55% to 70% of core lengths, further modelling of the new intersections is needed before true widths can be estimated.)

On February 3, 2025, Dolly Varden announced drill results from its 2024 program at the Homestake Silver deposit and exploration drilling at the Homestake Ridge Property in BC's Golden Triangle. Highlights from the Homestake Silver Deposit Area included4:

74.7 g/t Au and 297 g/t Ag over 0.72 meters within 29.50 meters of 3.48 g/t Au and 13 g/t Ag.

1.00 meter as well as silver dominant intercepts including 1.10 g/t Au and 786 g/t Ag over 0.91 meters and 0.31g/t Au and 571 g/t Ag over 0.82 meters.

(4Intervals shown are core length; Estimated true widths vary depending on intersection angles and range from 55% to 75% of core lengths, further modelling of the new interpretation is needed before true widths can be calculated; Assay results reported are uncapped.)

On February 28, 2025, Dolly Varden announced that, pursuant to its stock option plan, it had granted stock options to directors, officers and consultants to purchase an aggregate of 2,194,000 Common Shares. The stock options are exercisable at a price of $1.00 per Common Share with an expiry of February 28, 2030. Dolly Varden also announced on February 28, 2025, it granted an aggregate of 949,000 restricted share units to officers and directors of the Company which vest equally over three years, with the first vesting occurring after one year. Each vested restricted share unit entitles the holder to receive one Common Share. This grant of restricted share units is subject to the Company's restricted share unit plan.

On April 2, 2025, Dolly Varden announced it applied to list its issued and outstanding Common Shares on the NYSE American. Dolly Varden also announced on April 2, 2025, that in connection with the NYSE American listing, it would proceed with a 4:1 consolidation of its common shares (the "Consolidation"). Effective as of April 7, 2025, the Company implemented the Consolidation. The Consolidation acted to reduce the number of issued and outstanding common shares from 318,077,469 on a pre-Consolidation basis to approximately 79,519,464 Common Shares on a post-Consolidation basis.

8

On April 4, 2025, Dolly Varden announced it engaged the services of ICP Securities Inc. to provide automated market making services, including use of its proprietary algorithm, ICP Premium™, in compliance with the policies and guidelines of the TSXV and other applicable legislation.

On April 15, 2025, Dolly Varden further announced that it received approval to be listed on the NYSE American and on April 21, 2025, the Common Shares began trading on the NYSE American under the symbol "DVS".

On April 17, 2025, the Company announced it engaged LFG Equities Corp. ("LFG") to provide strategic advice and digital media and marketing services to the Company. LFG, a Toronto-based company, will provide strategic advice, media buying and distribution, and marketing services through on-line media placements for the Company, including but not limited to newsletters.

On May 5, 2025, Dolly Varden announced it had entered into a definitive agreement to acquire 100% of Hecla Mining Company's ("Hecla Mining") Kinskuch property in northwest BC's Golden Triangle (the "Kinskuch Acquisition") for consideration of $5 million, which was to be satisfied by Dolly Varden issuing 1,351,963 Common Shares to Hecla Mining. Under the Kinskuch Acquisition, Hecla Mining would also retain a 2% net smelter return royalty on the Kinskuch property area (the "Kinskuch NSR"). The Kinskuch NSR includes a 50% buyback right, for $5 million, that will allow Dolly Varden to reduce the royalty to 1% at any time.

On May 7, 2025, the Company announced a 2025 exploration drilling program at its 100% owned Kitsault Valley Project (the "2025 Exploration Drill Program"). The program planned for the Kitsault Valley Project located in the newly emerging southern Eskay Rift sub-basin in northwest BC's Golden Triangle, will consist of a minimum planned 35,000 meters of diamond drilling building on the success of the 2024 program. Drilling will focus on expanding high-grade mineralization at the Wolf and Homestake Silver deposits and will follow up on promising results from numerous exploration targets including Red Point and Moose. The program will also include deep drilling at the Big Bulk copper-gold porphyry target. Drilling commenced in May with four rigs expected to be active throughout the season.

On May 8, 2025, Dolly Varden announced that it had entered into a definitive agreement with Strikepoint Gold Inc. ("Strikepoint") to acquire Strikepoint's interest in the Porter Project, located in the Golden Triangle, British Columbia (the "Porter Acquisition"). Dolly Varden agreed to purchase from Strikepoint all of its interests to the Porter Project for consideration of $1,100,000, which was satisfied by Dolly Varden issuing 295,699 Common Shares to Strikepoint.

On May 15, 2025, the Company announced that it had entered into a definitive agreement with MTB Metals Corp. ("MTB Metals") to acquire MTB Metals' interests in four properties totaling over 20,000 hectares (collectively, the "MTB Properties"), in the Golden Triangle area of British Columbia, being the American Creek Property (consisting of Mountain Boy Property, Silver Crown Property, and Dorothy Property), the Theia Property, the BA Property, and the Red Cliff Property. Dolly Varden has agreed to purchase from MTB Metals all of MTB Metals' interests to the MTB Properties for consideration of up to 500,000 Common Shares at a deemed value of $3.59 per Common Share and a net smelter return royalty of 1.0% on all production from each of the Mountain Boy Property, the BA Property, the Theia Property, and the Silver Crown Property. Dolly Varden will also assume and step into MTB Metals obligations under MTB Metals' option agreement to acquire the Dorothy Property (the "Dorothy Option") and MTB Metals' joint venture agreement with respect to the Red Cliff Property. The number of Common Shares issuable to MTB Metals on closing will be adjusted downwards in order to factor in the outstanding payment obligations under the Dorothy Option, if any. The issuance of the Common Shares and completion of the transaction remains subject to NYSE American approval and other customary conditions, including satisfying the requirements of the TSXV's conditional approval of the transaction, and is currently expected to close late June 2025.

On May 23, 2025, the Company announced it completed the Porter Acquisition.

9

On May 26, 2025, the Company announced it completed the Kinskuch Acquisition.

On May 28, 2025, Dolly Varden announced that the 2025 Exploration Drill Program was underway. Two diamond drills commenced in early May at the Moose Vein and Red Point exploration targets. The four drills are now focused on the Wolf Vein step outs on the southwest side of the deposit where the vein is widening with indications of higher temperature mineralization and alteration. Total meterage of approximately 35,000 meters planned for the 2025 drill program will be split approximately 60:40 between the Dolly Varden Properties to the south, including the Big Bulk copper-gold porphyry, and the Homestake Ridge Property to the north, along the Kitsault Valley trend.

MATERIAL FACTS

As of the date hereof, to the knowledge of the Company, Fury Gold Mines Ltd. ("Fury") owns 11,763,647 Common Shares, representing approximately 14.5% of the issued and outstanding Common Shares. The Company and Fury are parties to an investor rights agreement dated February 25, 2022 (the "Fury IRA"). Pursuant to the Fury IRA, Fury has a right to nominate two persons to the Company's board of directors so long as Fury owns greater than 20% of the outstanding Common Shares. Should Fury own greater than 10%, but less than 20%, of the outstanding Common Shares, Fury shall have the right to appoint one nominee to the Company's board of directors. The Fury IRA also contains certain customary re-sale restrictions, voting and standstill conditions, and participation rights entitling Fury to maintain its percentage ownership of the Company for so long as Fury owns more than 10% of the outstanding Common Shares, all as agreed between the Company and Fury. Pursuant to the Fury IRA, Fury will be entitled to acquire will be entitled to acquire Common Shares in connection with the Offerings at a price of $4.60 per Common Share to maintain its pro rata equity interest in the Company. If Fury exercises its pro rata rights, any Common Shares issued will be in addition to those issued as part of the Offering.

As of the date hereof, to the knowledge of the Company, Hecla Canada Ltd. ("Hecla") owns 11,958,337 Common Shares, representing approximately 14.7% of the issued and outstanding Common Shares. The Company and Hecla are parties to an ancillary rights agreement dated September 4, 2012 (the "Hecla IRA"), which provides Hecla certain rights, including the right to nominate a director to the Company's board of directors, a right of first refusal for any transfer or sale of the Company's mineral properties, and the right to participate in future financings and private placements in order to maintain its pro-rata interest. Pursuant to the Hecla IRA, Hecla will be entitled to acquire will be entitled to acquire Common Shares in connection with the Offerings at a price of $4.60 per Common Share to maintain its pro rata equity interest in the Company. If Hecla exercises its pro rata rights, any Common Shares issued will be in addition to those issued as part of the Offering.

The CFT Shares and HD Shares issuable in connection with the LIFE Offering will not be subject to a statutory hold period. The FT Shares issuable in connection with the Non-LIFE Offering will be subject to a statutory hold period of four months plus one day from the date of issue.

There are no material facts about the LIFE Securities that have not been disclosed in this offering document or in any other document filed by the Company in the 12 months preceding the date of this offering document.

BUSINESS OBJECTIVES AND MILESTONES

What are the business objectives that we expect to accomplish using the available funds?

The Company's objective is to derisk, expand and discover new high-grade silver and gold mineralization for all of its exploration properties so that defined mineral deposits on the project may be considered for further advancement or development. In order to achieve that goal, certain short, medium and long term business objectives must be met. The net proceeds of the Offering are intended to meet the following near and medium term business objectives:

10

| Business Objectives and Milestones | Target Completion |

Projected Cost (in $1,000s) |

||||

| Complete 45,000 metres of exploration drilling at the Kitsault Valley Project ("KV Project") in 2025 (an increase of 10,000 meters over announced plan) | December 2025 | 22,300 | ||||

| Complete 15,000 metres of exploration drilling at KV and other projects in 2026 | December 2026 | 10,000 | ||||

| Complete 3,000 metres of exploration at Big Bulk Property | Summer 2026 | 2,000 | ||||

| Complete analysis and planning work for properties recently acquired | Winter 2025/2026 | 500 | ||||

| Maintenance or existing properties and option payments | 2025 & 2026 | 950 | ||||

| Studies and data analysis for KV Project | Spring 2026 | 600 |

USE OF AVAILABLE FUNDS

What will our available funds be upon the closing of the Offering?

Based on the Company's existing estimated working capital as at May 31, 2025 of approximately $27 million, the Company's expected availability of funds following closing of the Offering (assuming the Underwriter's Option is not exercised) is expected to be approximately $50.5 million.

| Assuming 100% of Offering (in $1,000s) |

||||

| A | Amount to be raised by this Offering: | 25,000 | ||

| B | Selling commissions and fees: | (1,250 | ) | |

| C | Estimated Offering costs: (e.g. listing fees, legal, accounting, auditor) |

(450 | ) | |

| D | Net proceeds of Offering: (D = A - (B + C)) |

23,300 | ||

| E | Working capital as at most recent month end: | 27,000 | ||

| F | Additional sources of funding: | 200 | ||

| G | Total available funds: (G = D + E + F) |

50,500 |

How will we use the available funds?

The Company intends to use the net proceeds from this Offering (assuming the Underwriter's Option is not exercised) to complete the business objections and milestones noted above as follows:

| Intended Use of Available Funds | Assuming 100% of Offering (in $1,000s) |

||

| KV Project exploration 2025 - current program | 17,300 | ||

| KV Project exploration 2025 - expanded program | 5,000 |

11

| Intended Use of Available Funds | Assuming 100% of Offering (in $1,000s) |

||

| KV Project exploration 2026 | 10,000 | ||

| Big Bulk Project exploration 2025 & 2026 | 2,000 | ||

| Studies and data analysis | 1,100 | ||

| Land holding costs to December 2026 | 950 | ||

| General and administrative to December 2026 | 9,500 | ||

| Unallocated working capital | 4,650 | ||

| Total: | 50,500 |

The above noted allocation represents the Company's current intentions with respect to its use of proceeds based on current knowledge, planning and expectations of management of the Company. Although the Company intends to expend the proceeds from this Offering as set forth above, there may be circumstances where, for sound business reasons, a reallocation of funds may be deemed prudent or necessary and may vary materially from that set forth above, as the amounts actually allocated and spent will depend on a number of factors, including the Company's ability to execute on its business plan and financing objectives. The Company has generated negative cash flows from operating activities since inception and anticipates that it will continue to have negative operating cash flow until profitable commercial production at one or more of its properties is achieved. As a result, certain of the net proceeds from this Offering may be used to fund such negative cash flow from operating activities in future periods. See the "Cautionary Statement On Forward-Looking Information" section above.

How have we used the other funds we have raised in the past 12 months?

|

Previous Financing |

Intended Use of Funds |

Use of Funds to |

Variance and Impact on |

|

September 2024 Offering for aggregate gross proceeds of $32,200,000 |

Further exploration, drilling for mineral resource expansion and exploration drilling in the combined Kitsault Valley Project or other eligible Canadian properties of the Company, as well as working capital and general corporate purposes. |

Exploration drilling, mineral resource expansion drilling and de-risk resource drilling in the combined Kitsault Valley Project, as well as for working capital and general corporate purposes. A balance of approximately $23 million remains unspent and is forecasted to be incurred for the same purposes prior to December 31, 2025. |

None. |

12

FEES AND COMMISSIONS

Who are the dealers or finders that we have engaged in connection with this Offering, if any, and what are their fees?

|

Underwriters: |

Research Capital Corporation and Raymond James Ltd, as co-lead underwriters, on behalf of a syndicate of underwriters, including Haywood Securities Inc. |

|

Compensation Type: |

Cash fee. |

|

Cash Fee: |

The Underwriters will receive a cash fee equal to 5.0% of the gross proceeds of the Offering. |

Do the Underwriters have a conflict of interest?

To the knowledge of the Company, it is not a "related issuer" or "connected issuer" of or to any Research Capital Corporation, Raymond James Ltd. or Haywood Securities Inc., as such terms are defined in National Instrument 33-105 - Underwriting Conflicts.

PURCHASERS' RIGHTS

Rights of Action in the Event of a Misrepresentation

If there is a misrepresentation in this offering document, you have a right:

a) to rescind your purchase of the LIFE Securities with the Company, or

b) to damages against the Company and may, in certain jurisdictions, have a statutory right to damages from other persons.

These rights are available to you whether or not you relied on the misrepresentation. However, there are various circumstances that limit your rights. In particular, your rights might be limited if you knew of the misrepresentation when you purchased the LIFE Securities.

If you intend to rely on the rights described in paragraph (a) or (b) above, you must do so within strict time limitations.

You should refer to any applicable provisions of the securities legislation of your province or territory for the particulars of these rights or consult with a legal adviser.

SCIENTIFIC AND TECHNICAL INFORMATION

All scientific and technical information relating to the Kitsault Valley Project contained in this offering document is solely derived from the technical report prepared for the Company entitled "Technical Report On The Combined Kitsault Valley Project, British Columbia, Canada" dated effective September 28, 2022 and authored by Andrew J. Turner and Rachelle Hough (the "Kitsault Valley Technical Report"), each of whom is an independent "Qualified Person" as defined in NI 43-101.

Rob van Egmond, P.Geo., Vice-President Exploration of the Company, has reviewed and approved all other scientific and technical information contained in this offering document. Mr. van Egmond is considered, by virtue of his education, experience and professional association, to be a Qualified Person for the purposes of NI 43-101. Mr. van Egmond is not independent of the Company within the meaning of NI 43-101.

13

Quality Assurance and Quality Control

The Company adheres to Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Best Practices Guidelines for exploration related activities conducted on its property. Quality Assurance and Quality Control ("QA/QC") procedures are overseen by the qualified person ("QP"). Dolly Varden QA/QC protocols are maintained through the insertion of certified reference material (standards), blanks and field duplicates within the sample stream. Drill core is cut in-half with a diamond saw, with one-half placed in sealed bags and shipped to the laboratory and the other half retained on site. Third party laboratory checks on 5% of the samples are carried out as well. Chain of custody is maintained from the drill to the submittal into the laboratory preparation facility.

Analytical testing was performed by ALS Canada Ltd. in North Vancouver, British Columbia. The entire sample is crushed to 70% minus 2 mm (10 mesh), of which a 500-gram split is pulverized to minus 200 mesh. Multi-element analyses were determined by inductively coupled plasma mass spectrometry (ICP- MS) for 48 elements following a 4-acid digestion process. High-grade silver testing was determined by fire assay with either an atomic absorption or a gravimetric finish, depending on grade range. Au is also determined by fire assay on a 30-gram split with either atomic absorption or gravimetric finish, depending on grade range. Metallic screen assays may be completed on very high-grade samples.

Kitsault Valley Project Mineral Resource Estimate

The Kitsault Valley Project resource estimate is derived from the Kitsault Valley Technical Report.

Notes:

(1) Mineral resources are not mineral reserves, as they do not have demonstrated economic viability although, as per CIM requirements, the mineral resources reported above have been determined to have demonstrated reasonable prospects for eventual economic extraction.

(2) The mineral resources were estimated in accordance with the CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

14

(3) The resources reported above are derived from the Technical Report on The Combined Kitsault Valley Project, British Columbia, Canada dated effective September 28, 2022 and authored by Andrew J. Turner, B.Sc., P.Geol., of APEX Geoscience Ltd. The effective date of the report is September 28, 2022.

(4) The cut-off grade for the Homestake claim block mineral resources is 2.0 g/t AuEq, which was determined using average block grade values within the estimation domains and a Au price of $1,300 per troy ounce ("/tr oz"), a Ag price of US$20.00/tr oz and a Cu price of US$2.50/pound, and mill recoveries of 92% for Au, 88% from Ag and 87.5% for Cu, and combined mining, milling, and general and administrative costs of approximately US$109/ton.

(5) The cut-off grade for the Dolly Varden claim block mineral resource is 150 g/t Ag, which was determined using a Ag price of US$20.00/tr oz, a recovery of 90% and combined mining, milling, and general and administrative costs of US$80/ton and was supported by comparison to similar projects.

(6) Sufficient sample density data existed to allow for estimation of block density within the estimation domains of the Homestake Main, Homestake Silver and Homestake Reef zones, which ranged from 2.69 metric ton per cubic metre ("t/m3") to 3.03 t/m3.

(7) Bulk density values ranging from 2.79 t/m3 to 3.10 t/m3 were assigned to individual estimation domains based on available SG measurements for the DV, TB, NS and WF deposits.

(8) Differences may occur in totals due to rounding.

ADDITIONAL INFORMATION

Where can you find more information about us?

The Company's continuous disclosure filings with applicable securities regulatory authorities in the provinces and territories of Canada are available electronically under the Company's profile on the System for Electronic Data Analysis and Retrieval (SEDAR+) at www.sedarplus.ca.

For further information regarding Dolly Varden, visit our website at: https://dollyvardensilver.com/

Investors should read this offering document and consult their own professional advisors to assess the income tax, legal, risk factors and other aspects of their investment of LIFE Securities.

15

CERTIFICATE

Dated: June 9, 2025

This offering document, together with any document filed under Canadian securities legislation on or after June 9, 2024, contains disclosure of all material facts about the securities being distributed and does not contain a misrepresentation.

| DOLLY VARDEN SILVER CORPORATION | |

| (signed) Shawn Khunkhun | (signed) Ann Fehr |

| Shawn Khunkhun Chief Executive Officer and Director |

Ann Fehr Chief Financial Officer |