Exhibit 99.1

A New Era in Brain Disorder Treatment Corporate Presentation Nasdaq/TASE: BWAY August 2025

Disclaimer Safe Harbor and Non - GAAP/IFRS Financial Measures This presentation does not constitute an offer or invitation to sell or issue, or any solicitation of an offer to subscribe for or acquire any of the Company’s securities or to participate in any investment in the Company . This presentation shall not constitute advertising or misconstrued as being commercial and/or promotional in nature . No representation or warranty is made to the accuracy or completeness of this presentation . You must make your own investigation and assessment of the matters contained herein . In particular, no representation or warranty is given, and the Company has no responsibility, as to the achievement or reasonableness of any forecasts, estimates, or statements as to prospects contained or referred to in this presentation . This presentation contains information that includes or is based on forward - looking statements within the meaning of the federal securities law . These statements are not guarantees of future performance, are based on current expectations of future events and are subject to various risks and uncertainties that could cause our actual activities, timing or results to differ materially from those expressed or implied in such statements . Such factors include, but are not limited to : continued business impact from the COVID - 19 global pandemic ; weakening of economic conditions that could adversely affect the level of demand for our products ; pricing pressures generally ; difficulties or delays in manufacturing ; legislative and regulatory actions ; changes in reimbursement level from third - party payors ; product liability claims ; the impact of federal legislation to reform the United States healthcare system ; changes in financial markets ; changes in the competitive environment ; failure to gain sufficient market adoption of our products ; regulatory actions or delays ; and our ability to realize anticipated operational and manufacturing efficiencies . Additional information concerning these and other factors, including the Risk Factors set forth therein, is contained in our filings with the U . S . Securities and Exchange Commission . The forward - looking statements in this presentation are made based upon our current expectations . If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward - looking statements . You should not place undue reliance on forward - looking statements as a prediction of actual results . In addition, the presentation contains certain data and information that we obtained from various government and private publications . Statistical data in these publications also include projections based on a number of assumptions . If any one or more of the assumptions underlying the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions . You should not place undue reliance on these forward - looking statements . All forward - looking statements included in this presentation are made only as of the date of this presentation . We assume no obligation to update any written or oral forward - looking statement made by us or on our behalf as a result of new information, future events or other factors . Certain non - GAAP/IFRS financial measures are included in this presentation, which are designed to complement the financial information presented in accordance with IFRS, because management believes such measures are useful to investors . For example, we believe that Adjusted EBITDA, a non - IFRS measure, is useful in evaluating our operating performance, because (a) it is widely used by investors and securities analysts to measure a company’s operating performance without regard one - time items (such as restructuring and litigation expenses), that can vary substantially from company to company ; and (b) management uses Adjusted EBITDA in conjunction with IFRS financial measures for planning purposes, including the preparation of our annual operating budget, as a measure of operating performance . These non - GAAP/IFRS financial measures should be considered only as supplemental to, and not superior to, financial measures provided in accordance with IFRS . Other companies may calculate similarly titled non - GAAP/IFRS financial measures differently than the Company . Corporate Presentation May 2025 2

BrainsWay (BWAY) at a Glance Advancing Neuroscience to Improve Health and Transform Lives x BrainsWay is a fast - growing global leader in advanced noninvasive neurostimulation treatments for mental health disorders x First and only TMS company to obtain 4 FDA - cleared indications (MDD, OCD, Anxious Depression, Smoking Addiction) x Transition to a recurring revenue model through rentals and pay - per - use agreements, providing predictable and sustainable cash flow x Backlog and remaining performance obligations $62 million x Broad reimbursement among commercial and governmental payors x Global presence in key markets including the U.S., Canada, Asia, India, and Europe x Proven, differentiated noninvasive neurostimulation platform technology x Strong balance sheet with ~$78 million in cash and no debt x NASDAQ: BWAY; MC: $2 3 0M 3 Corporate Presentation August 2025

Strategic Partnership with Valor Equity Partners Valor’s Support Strengthens Our Position as a Leader in the TMS Industry ▪ Closed $ 20 M equity financing with Valor, a top - tier U . S . tech investor ▪ Expertise in High - Growth Companies ▪ Invest in innovation ▪ Scaling growth ▪ Access to best practices 4

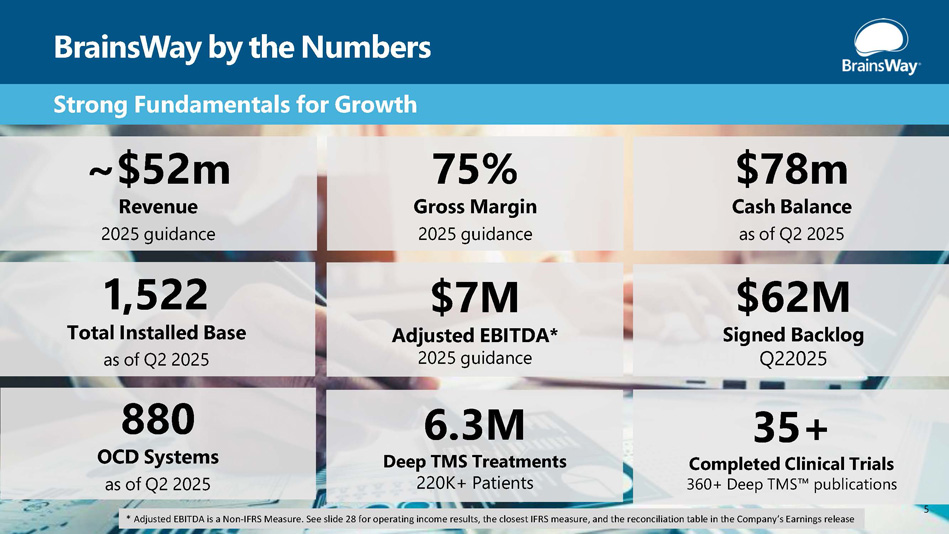

BrainsWay by the Numbers Strong Fundamentals for Growth ~$52m Revenue 2025 guidance $78m Cash Balance as of Q2 2025 1,522 Total Installed Base as of Q2 2025 75% Gross Margin 2025 guidance $7M Adjusted EBITDA* 2025 guidance $62M Signed Backlog Q22025 880 OCD Systems as of Q2 2025 6.3M Deep TMS Treatments 220K+ Patients 35+ Completed Clinical Trials 360+ Deep TMS publications 5 * Adjusted EBITDA is a Non - IFRS Measure. See slide 28 for operating income results, the closest IFRS measure, and the reconciliation table in the Company’s Earnings release

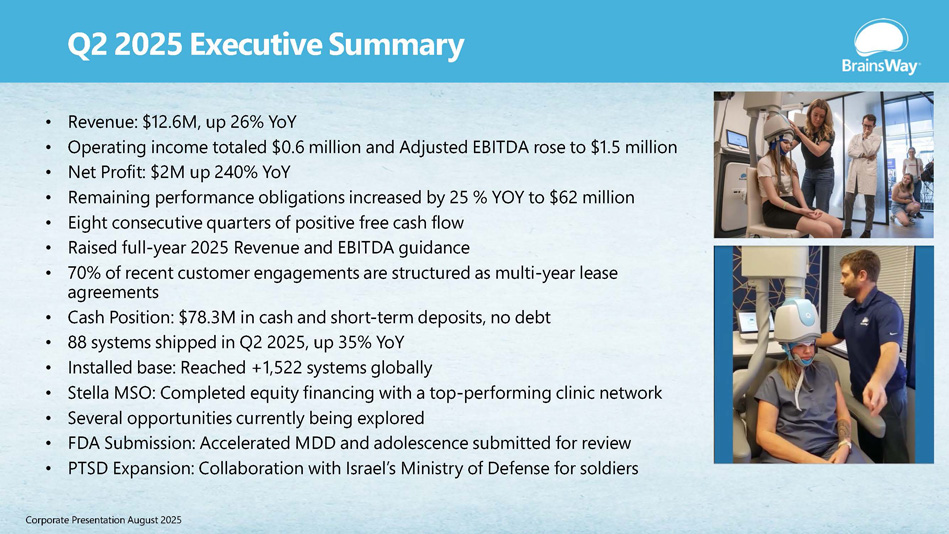

Q2 2025 Executive Summary • Revenue: $12.6M, up 26% YoY • Operating income totaled $0.6 million and Adjusted EBITDA rose to $1.5 million • Net Profit: $2M up 240% YoY • Remaining performance obligations increased by 25 % YOY to $62 million • Eight consecutive quarters of positive free cash flow • Raised full - year 2025 Revenue and EBITDA guidance • 70% of recent customer engagements are structured as multi - year lease agreements • Cash Position: $78.3M in cash and short - term deposits, no debt • 88 systems shipped in Q2 2025, up 35% YoY • Installed base: Reached +1,522 systems globally • Stella MSO: Completed equity financing with a top - performing clinic network • Several opportunities currently being explored • FDA Submission: Accelerated MDD and adolescence submitted for review • PTSD Expansion: Collaboration with Israel’s Ministry of Defense for soldiers Corporate Presentation August 2025

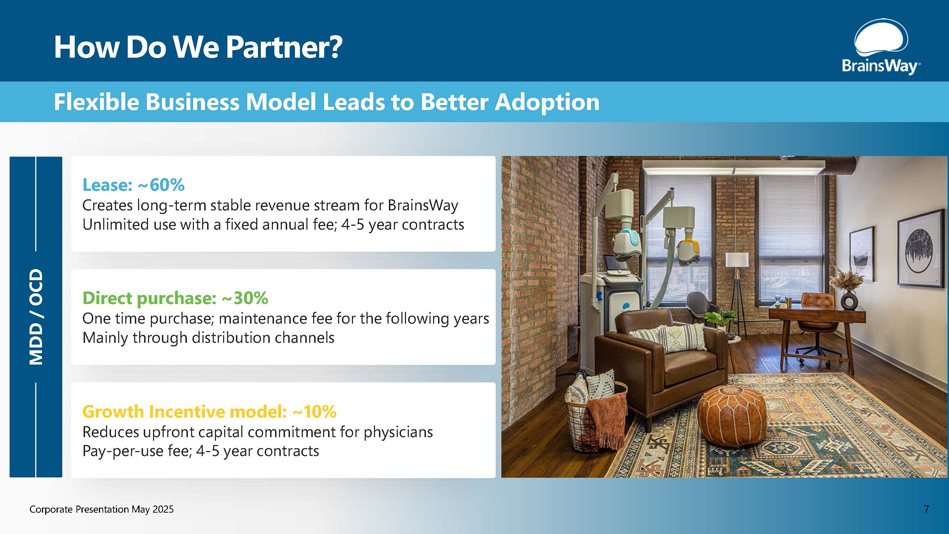

MDD / OCD Lease: ~60% Creates long - term stable revenue stream for BrainsWay Unlimited use with a fixed annual fee; 4 - 5 year contracts Direct purchase: ~30% One time purchase; maintenance fee for the following years Mainly through distribution channels Growth Incentive model: ~10% Reduces upfront capital commitment for physicians Pay - per - use fee; 4 - 5 year contracts Flexible Business Model Leads to Better Adoption Corporate Presentation May 2025 7 How Do We Partner?

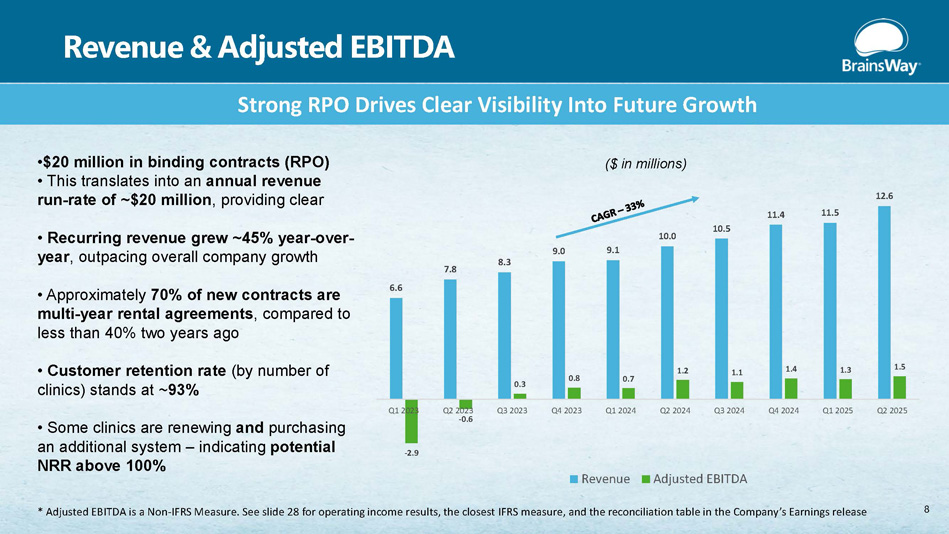

Revenue & Adjusted EBITDA • $20 million in binding contracts (RPO) • This translates into an annual revenue run - rate of ~$20 million , providing clear • Recurring revenue grew ~45% year - over - year , outpacing overall company growth • Approximately 70% of new contracts are multi - year rental agreements , compared to less than 40% two years ago • Customer retention rate (by number of clinics) stands at ~ 93% • Some clinics are renewing and purchasing an additional system – indicating potential NRR above 100% Strong RPO Drives Clear Visibility Into Future Growth 6.6 7.8 8.3 9.0 9.1 10.0 10.5 11.4 11.5 12.6 - 2.9 - 0.6 0.3 0.8 0.7 1.2 1.1 1.4 1.3 1.5 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025 ($ in millions) Revenue Adjusted EBITDA 8 * Adjusted EBITDA is a Non - IFRS Measure. See slide 28 for operating income results, the closest IFRS measure, and the reconciliation table in the Company’s Earnings release

200+ Mental Health Clinics Identified Strategic Equity Investments in Mental Health Providers New Strategy to Accelerate Company Growth Highly Profitable Deals No Added OPEX Each Deal Can Potentially Add 10 - 15 Clinics Anually Strategic Initiative Led by Valor Fund Corporate Presentation August 2025

5$M minority investment in Stella - a leading U.S. - based interventional psychiatry platform Structured as a preferred, compounding equity stake Joint business planning and strategic growth support About Stella 20+ clinics across the U.S. and Israel 30,000+ patients treated to date Known for clinical excellence, operational strength, and innovative care delivery Strategic Partnership with Stella Corporate Presentation August 2025

Superior Science, Evidence, and Support Drive Growth 2025 – Pivotal Year for BrainsWay Clinical Research* Sales & Support Initiatives Technology Innovation • Launch Insights Cloud • Introduce TMS 360 • Development of next - gen Deep TMS system • AI - driven personalization tool to optimize treatment protocols • Home use device • Adolescent MDD • Accelerated Deep TMS • Alcohol trial launch • PTSD data collection for label expansion • Launch of clinical trials combining Deep TMS with psychedelic therapies • Strategic partnerships with mental health networks & addiction centers • OCD expansion • Practice Development Program Corporate Presentation August 2025 11 *Not FDA - cleared

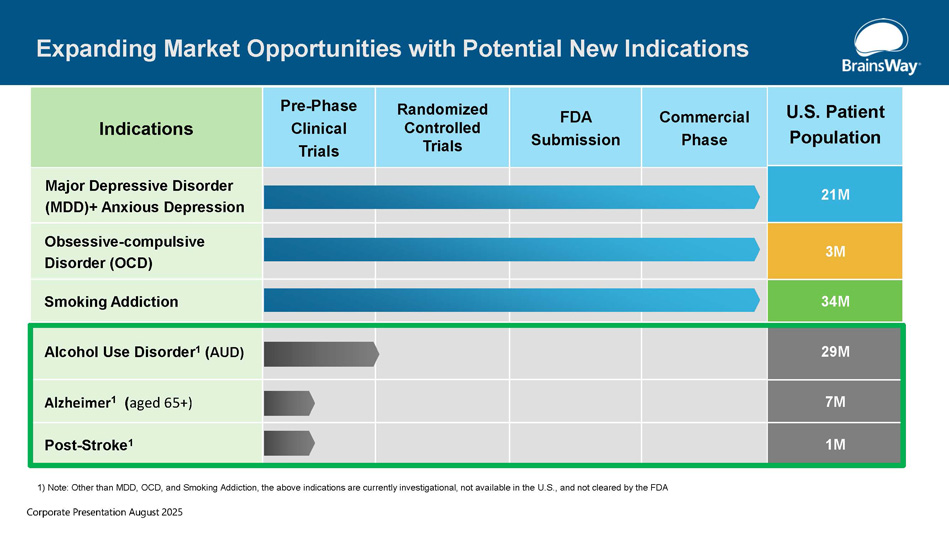

U.S. Patient Population Commercial Phase FDA Submission Randomized Controlled Trials Pre - Phase Clinical Trials Indications 21M Major Depressive Disorder (MDD)+ Anxious Depression 3M Obsessive - compulsive Disorder (OCD) 34M Smoking Addiction 29M Alcohol Use Disorder 1 ( AUD) 7M Alzheimer 1 ( aged 65+) 1M Post - Stroke 1 Expanding Market Opportunities with Potential New Indications 1) Note: Other than MDD, OCD, and Smoking Addiction, the above indications are currently investigational, not available in the U.S., and not cleared by the FDA Corporate Presentation August 2025

BrainsWay in Use Corporate Presentation April 2025 Academic Institutions and Private Clinics Worldwide Use BrainsWay Technology Leveraged in Clinical Trials By Major Academic Centers of Excellence 6.3M+ Deep TMS sessions 220K+ Patients successfully treated across 47 US States and 6 Continents Corporate Presentation August 2025

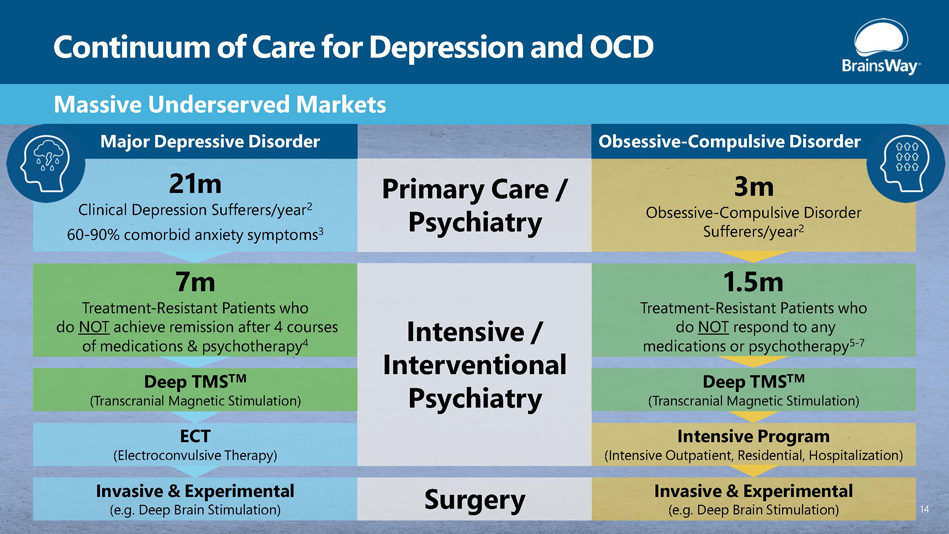

Continuum of Care for Depression and OCD Massive Underserved Markets Primary Care / Psychiatry 21m Clinical Depression Sufferers/year 2 60 - 90% comorbid anxiety symptoms 3 7m Treatment - Resistant Patients who do NOT achieve remission after 4 courses of medications & psychotherapy 4 3m Obsessive - Compulsive Disorder Sufferers/year 2 1.5m Treatment - Resistant Patients who do NOT respond to any medications or psychotherapy 5 - 7 Intensive / Interventional Psychiatry Invasive & Experimental (e.g. Deep Brain Stimulation) ECT (Electroconvulsive Therapy) Deep TMS TM (Transcranial Magnetic Stimulation) Invasive & Experimental (e.g. Deep Brain Stimulation) Intensive Program (Intensive Outpatient, Residential, Hospitalization) Deep TMS TM (Transcranial Magnetic Stimulation) Major Depressive Disorder Obsessive - Compulsive Disorder 14 Surgery

Transcranial Magnetic Stimulation (TMS) Established Technology with Demonstrated Safety and Efficacy Comprehensively Studied Over 25,000 published papers on TMS 8 How Does it Work? 1. An electromagnetic coil is placed over the scalp 2. A fast current is produced in the coil 3. Electromagnetic field is induced in the brain 4. Rapidly changing electric field in the brain, leading to axonal depolarization and action potentials 5. 2.5 times deeper than Standard TMS 6. Deeper and broader stimulation leads to activation of more neurons. 15 Corporate Presentation August 2025

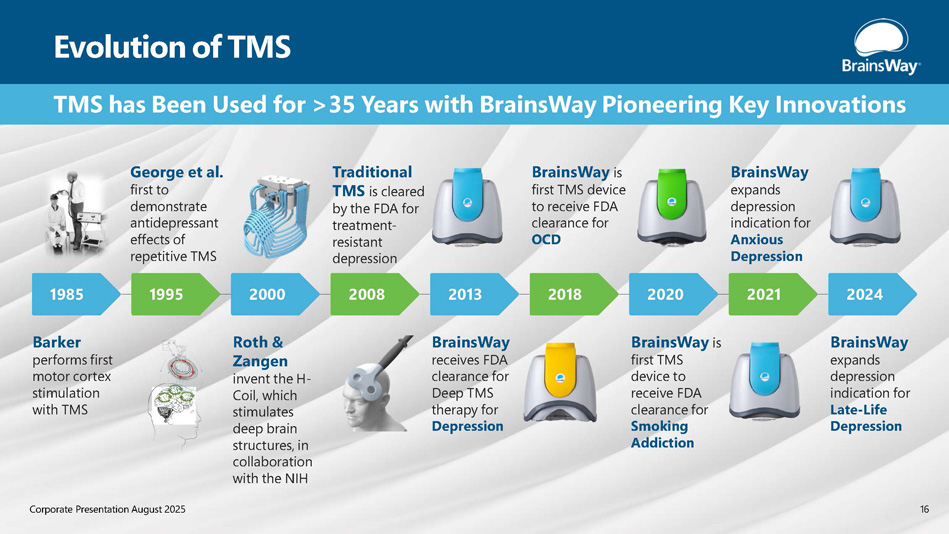

TMS has Been Used for >35 Years with BrainsWay Pioneering Key Innovations Evolution of TMS 1985 George et al. first to demonstrate antidepressant effects of repetitive TMS Barker performs first motor cortex stimulation with TMS Roth & Zangen invent the H - Coil, which stimulates deep brain structures, in collaboration with the NIH BrainsWay receives FDA clearance for Deep TMS therapy for Depression BrainsWay is first TMS device to receive FDA clearance for OCD BrainsWay is first TMS device to receive FDA clearance for Smoking Addiction BrainsWay expands depression indication for Late - Life Depression BrainsWay expands depression indication for Anxious Depression 1995 2000 Traditional TMS is cleared by the FDA for treatment - resistant depression 2008 2013 2018 2020 2021 2024 16 Corporate Presentation August 2025

BrainsWay Delivers Proven Records Deep TMS Therapy Has Significant Appeal to Providers and Patients Strong Reimbursement Easy to Administer ~3 to 20 Minute Sessions Well - Tolerated by Patients No Anesthesia Required Noninvasive Technology 17 Corporate Presentation August 2025

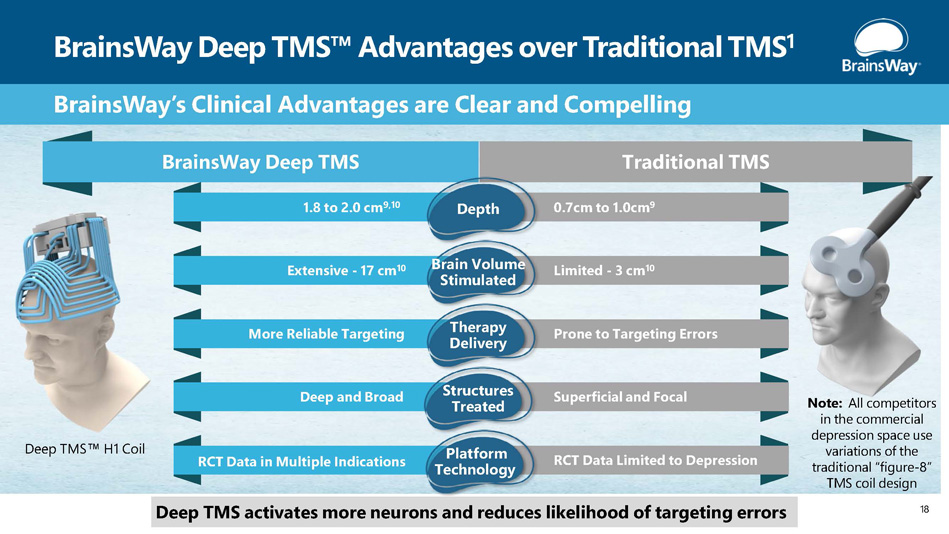

BrainsWay Deep TMS Advantages over Traditional TMS 1 Deep TMS H1 Coil BrainsWay’s Clinical Advantages are Clear and Compelling BrainsWay Deep TMS Traditional TMS 1.8 to 2.0 cm 9,10 0.7cm to 1.0cm 9 Depth Extensive - 17 cm 10 Limited - 3 cm 10 Brain Volume Stimulated More Reliable Targeting Prone to Targeting Errors Therapy Delivery Deep and Broad Superficial and Focal Structures Treated RCT Data in Multiple Indications RCT Data Limited to Depression Platform Technology Deep TMS activates more neurons and reduces likelihood of targeting errors Note: All competitors in the commercial depression space use variations of the traditional “figure - 8” TMS coil design 18

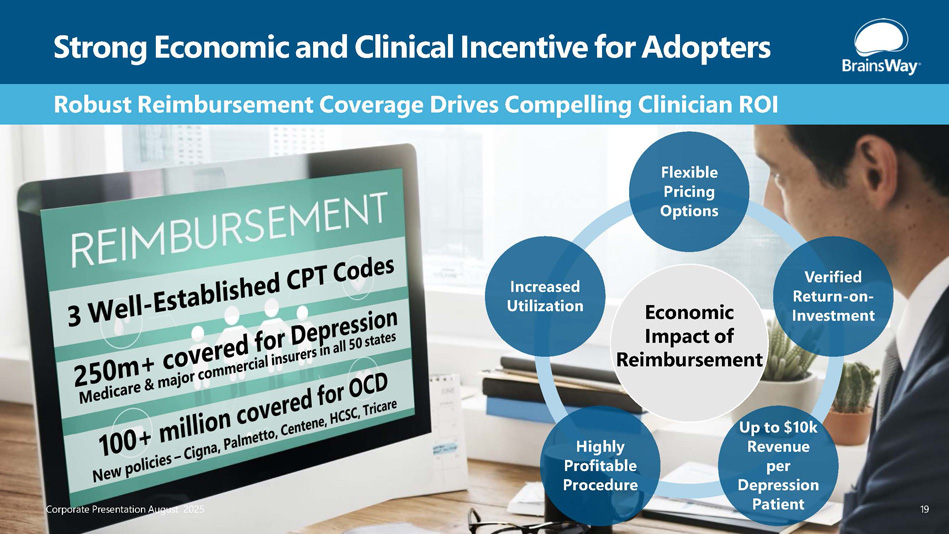

Robust Reimbursement Coverage Drives Compelling Clinician ROI Strong Economic and Clinical Incentive for Adopters Flexible Pricing Options Verified Return - on - Investment Up to $10k Revenue per Depression Patient Highly Profitable Procedure Increased Utilization Economic Impact of Reimbursement Corporate Presentation August 2025 19

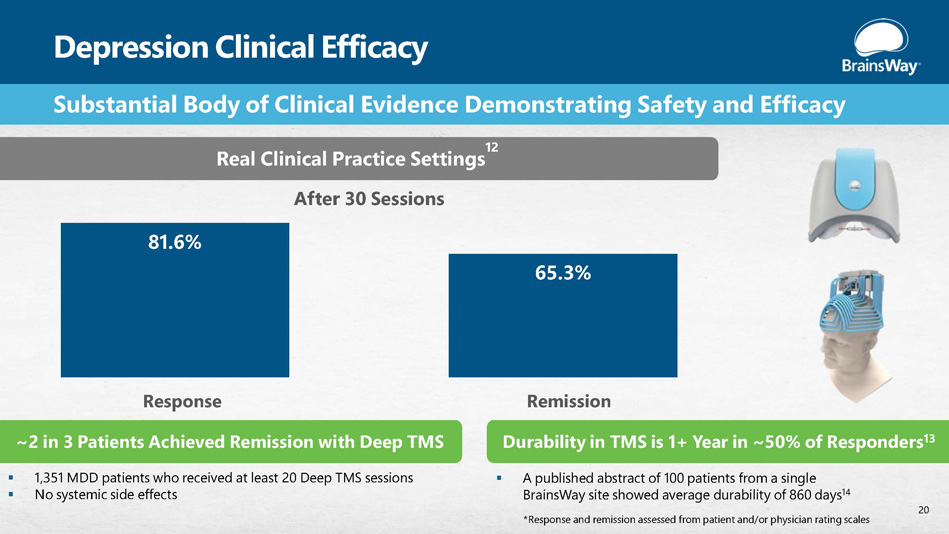

Depression Clinical Efficacy 81.6% 65.3% Substantial Body of Clinical Evidence Demonstrating Safety and Efficacy Real Clinical Practice Settings 12 After 30 Sessions Response ~2 in 3 Patients Achieved Remission with Deep TMS ▪ 1,351 MDD patients who received at least 20 Deep TMS sessions ▪ No systemic side effects Remission Durability in TMS is 1+ Year in ~50% of Responders 13 ▪ A published abstract of 100 patients from a single BrainsWay site showed average durability of 860 days 14 20 *Response and remission assessed from patient and/or physician rating scales

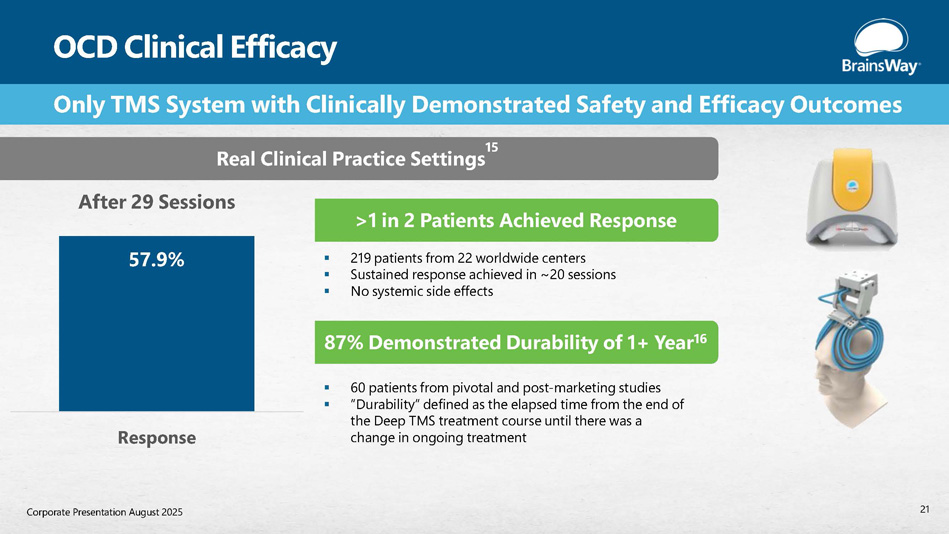

OCD Clinical Efficacy >1 in 2 Patients Achieved Response ▪ 219 patients from 22 worldwide centers ▪ Sustained response achieved in ~20 sessions ▪ No systemic side effects 57.9% Response Only TMS System with Clinically Demonstrated Safety and Efficacy Outcomes Real Clinical Practice Settings 15 After 29 Sessions ▪ 60 patients from pivotal and post - marketing studies ▪ ”Durability” defined as the elapsed time from the end of the Deep TMS treatment course until there was a change in ongoing treatment 21 Corporate Presentation August 2025 87% Demonstrated Durability of 1+ Year 16

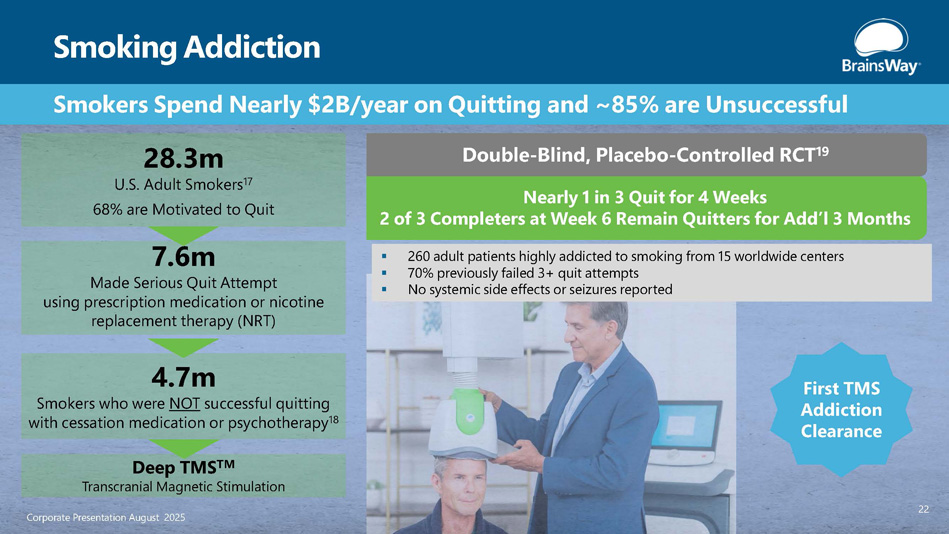

Smoking Addiction Smokers Spend Nearly $2B/year on Quitting and ~85% are Unsuccessful 28.3m U.S. Adult Smokers 17 68% are Motivated to Quit 4.7m Smokers who were NOT successful quitting with cessation medication or psychotherapy 18 Deep TMS TM Transcranial Magnetic Stimulation 7.6m Made Serious Quit Attempt using prescription medication or nicotine replacement therapy (NRT) First TMS Addiction Clearance ▪ 260 adult patients highly addicted to smoking from 15 worldwide centers ▪ 70% previously failed 3+ quit attempts ▪ No systemic side effects or seizures reported Double - Blind, Placebo - Controlled RCT 19 Nearly 1 in 3 Quit for 4 Weeks 2 of 3 Completers at Week 6 Remain Quitters for Add’l 3 Months 22 Corporate Presentation August 2025

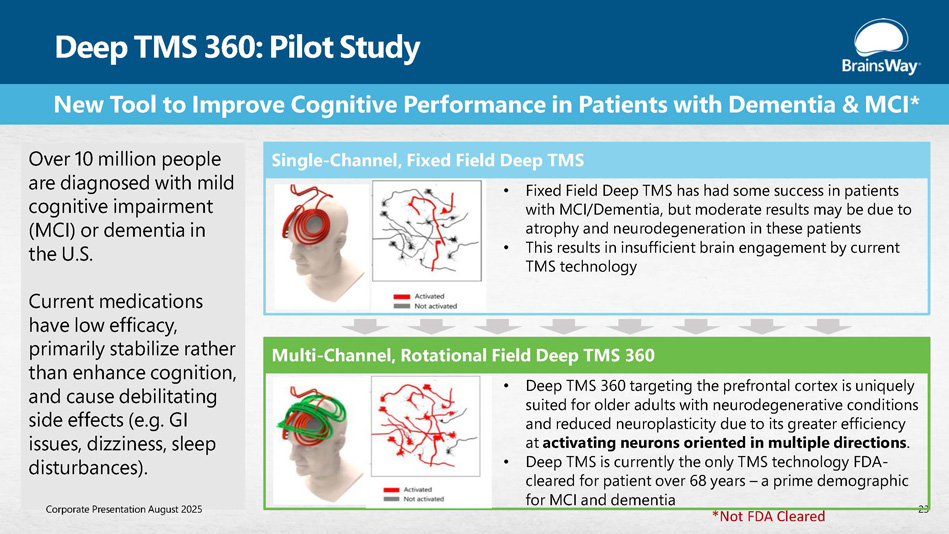

New Tool to Improve Cognitive Performance in Patients with Dementia & MCI* Deep TMS 360: Pilot Study 23 Single - Channel, Fixed Field Deep TMS Multi - Channel, Rotational Field Deep TMS 360 • Fixed Field Deep TMS has had some success in patients with MCI/Dementia, but moderate results may be due to atrophy and neurodegeneration in these patients • This results in insufficient brain engagement by current TMS technology • Deep TMS 360 targeting the prefrontal cortex is uniquely suited for older adults with neurodegenerative conditions and reduced neuroplasticity due to its greater efficiency at activating neurons oriented in multiple directions . • Deep TMS is currently the only TMS technology FDA - cleared for patient over 68 years – a prime demographic for MCI and dementia Over 10 million people are diagnosed with mild cognitive impairment (MCI) or dementia in the U.S. Current medications have low efficacy, primarily stabilize rather than enhance cognition, and cause debilitating side effects (e.g. GI issues, dizziness, sleep disturbances). Corporate Presentation August 2025 *Not FDA Cleared

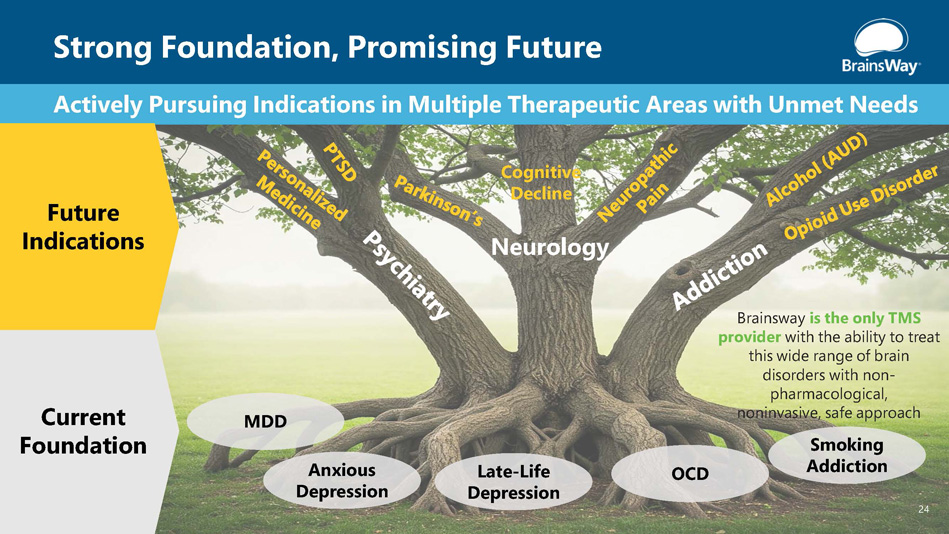

Strong Foundation, Promising Future 24 MDD Anxious Depression Late - Life Depression OCD Neurology Actively Pursuing Indications in Multiple Therapeutic Areas with Unmet Needs Cognitive Decline Current Foundation Future Indications Brainsway is the only TMS provider with the ability to treat this wide range of brain disorders with non - pharmacological, noninvasive, safe approach Smoking Addiction

Support Program Proven to Increase Device Utilization, Leading to Repeat Sales Practice Development Program 25 Clinical Knowledge & Treatment Mastery • The Deep TMS System • Major Depressive Disorder Treatment • Obsessive - Compulsive Disorder Treatment • Smoking Addiction Treatment • Patient Treatment Management Operational & Financial Excellence • Site Preparation • Patient Flow • Practice Administration • Preparing to Accept Insurance • Prequalification with Insurance • Navigating Billing Patient Acquisition & Retention • Marketing Strategy • Internal Patient Generation • Referral Network Building • Direct - to - Patient Marketing Each Quarter, >50 Practice Sites Enrolled in the Practice Development Program Experience a Badge Promotion , Indicating at Least 250 Additional Treatments Completed

New Territories Europe 37m Depression Patients Existing Partnership India 57m Depression Patients Existing Partnership China 71m Depression Patients Existing Partnership Japan 6m Depression Patients Cleared for Sale Existing Partnership Australia 1.3m Depression Patients Cleared for Sale Geographic Expansion into Japan, Europe, and Other Asian Countries International Markets are Long - Term Growth Opportunities Japan: Secured reimbursement & signed exclusive multi - year distribution deal. Canada: Entered market with an exclusive multi - year agreement, including minimum annual purchase commitments. Israel: Expanded Deep TMS access to 21 new centers. Military & PTSD Treatment: Secured reimbursement & ongoing collaboration with Israel’s Ministry of Defense. East Asia: Significant international deals strengthening our global footprint. 26 Corporate Presentation August 2025

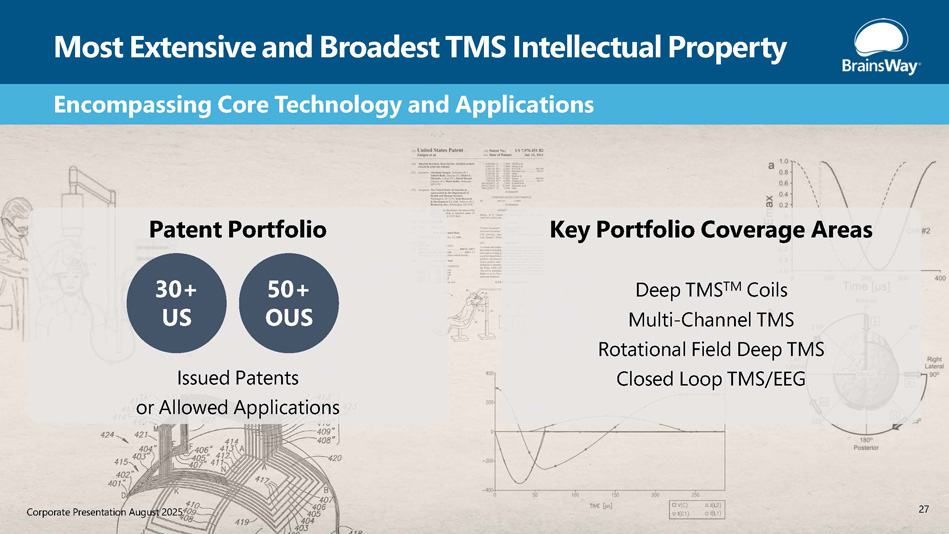

Most Extensive and Broadest TMS Intellectual Property Encompassing Core Technology and Applications Key Portfolio Coverage Areas Deep TMS TM Coils Multi - Channel TMS Rotational Field Deep TMS Closed Loop TMS/EEG Patent Portfolio Issued Patents or Allowed Applications 30+ US 50+ OUS 27 Corporate Presentation August 2025

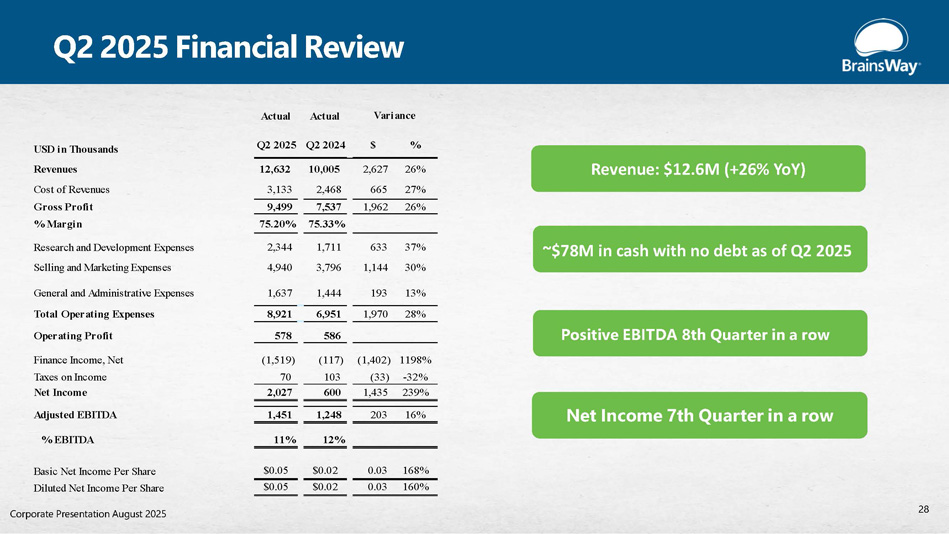

Q2 2025 Financial Review Positive EBITDA 8th Quarter in a row Net Income 7th Quarter in a row ~$78M in cash with no debt as of Q2 2025 Revenue: $12.6M (+26% YoY) Actual Actual Q2 2025 Q2 2024 $ % USD in Thousands Revenues 12,632 10,005 2,627 26% 27% 665 2,468 3,133 Cost of Revenues 26% 1,962 7,537 9,499 Gross Profit 75.33% 75.20% % Margin 37% 633 1,711 2,344 Research and Development Expenses 30% 1,144 3,796 4,940 Selling and Marketing Expenses 13% 193 1,444 1,637 General and Administrative Expenses 28% 1,970 6,951 8,921 Total Operating Expenses 586 578 Operating Profit 1198% (1,402) (117) (1,519) Finance Income, Net - 32% (33) 103 70 Taxes on Income 239% 1,435 600 2,027 Net Income 16% 203 1,248 1,451 Adjusted EBITDA % EBITDA 11% 12% 168% 0.03 $0.02 $0.05 Basic Net Income Per Share 160% 0.03 $0.02 $0.05 Diluted Net Income Per Share Variance 28 Corporate Presentation August 2025

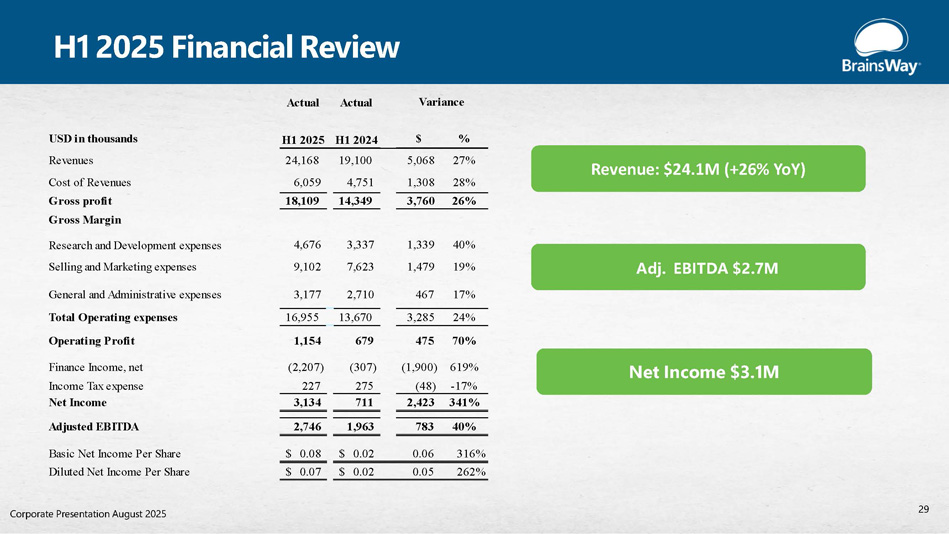

H1 2025 Financial Review Adj. EBITDA $2.7M Net Income $3.1M Revenue: $24.1M (+26% YoY) 29 Corporate Presentation August 2025 Actual Actual % $ H1 2024 H1 2025 USD in thousands 27% 5,068 19,100 24,168 Revenues 28% 1,308 4,751 6,059 Cost of Revenues 26% 3,760 14,349 18,109 Gross profit Gross Margin 40% 1,339 3,337 4,676 Research and Development expenses 19% 1,479 7,623 9,102 Selling and Marketing expenses 17% 467 2,710 3,177 General and Administrative expenses 24% 3,285 13,670 16,955 Total Operating expenses 70% 475 679 1,154 Operating Profit 619% (1,900) (307) (2,207) Finance Income, net - 17% (48) 275 227 Income Tax expense 341% 2,423 711 3,134 Net Income 40% 783 1,963 2,746 Adjusted EBITDA 316% 0.06 $ 0.02 $ 0.08 Basic Net Income Per Share 262% 0.05 $ 0.02 $ 0.07 Diluted Net Income Per Share Variance

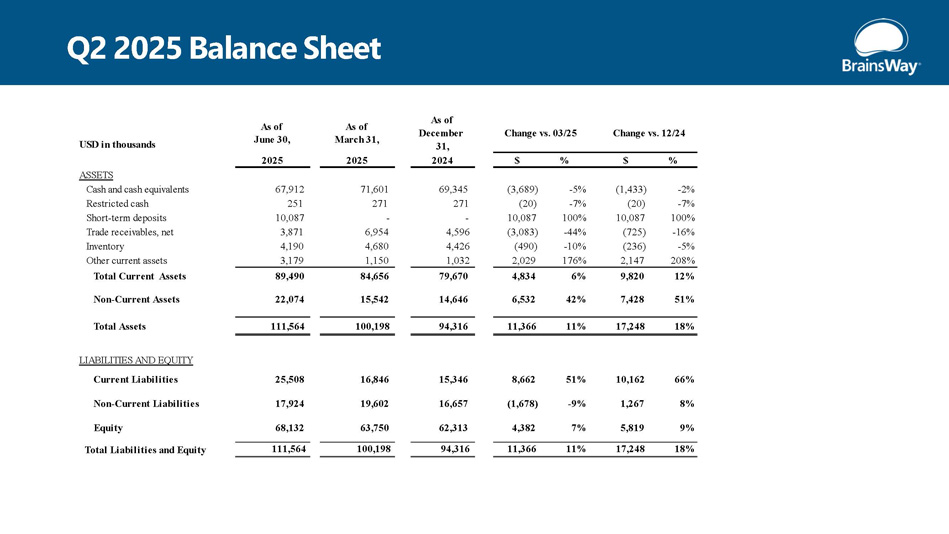

Change vs. 03/25 Change vs. 12/24 As of December 31, As of March 31, As of June 30, USD in thousands % $ % $ 2024 2025 2025 ASSETS - 2% (1,433) - 5% (3,689) 69,345 71,601 67,912 Cash and cash equivalents - 7% (20) - 7% (20) 271 271 251 Restricted cash 100% 10,087 100% 10,087 - - 10,087 Short - term deposits - 16% (725) - 44% (3,083) 4,596 6,954 3,871 Trade receivables, net - 5% (236) - 10% (490) 4,426 4,680 4,190 Inventory 208% 2,147 176% 2,029 1,032 1,150 3,179 Other current assets 12% 9,820 6% 4,834 79,670 84,656 89,490 Total Current Assets 51% 7,428 42% 6,532 14,646 15,542 22,074 Non - Current Assets 18% 17,248 11% 11,366 94,316 100,198 111,564 Total Assets LIABILITIES AND EQUITY 66% 10,162 51% 8,662 15,346 16,846 25,508 Current Liabilities 8% 1,267 - 9% (1,678) 16,657 19,602 17,924 Non - Current Liabilities 9% 5,819 7% 4,382 62,313 63,750 68,132 Equity 18% 17,248 11% 11,366 94,316 100,198 111,564 Total Liabilities and Equity Q2 2025 Balance Sheet

BrainsWay Investment Highlights Advancing Neuroscience to Improve Health and Transform Lives x Leading neuromodulation company with proven breakthrough technology x Large underserved markets x Strong momentum across our core market and successful execution of our growth strategy x 70% of recent customer engagements are structured as multi - year lease agreements x Major U.S. Expansion: Partnering with large mental health networks to integrate Deep TMS x Remaining performance obligations increased by 25 % YOY to $62 million x Business model encouraging utilization and guaranteeing revenue generation x Pursuing 4 new indications x Experienced management team 31

BrainsWay Leadership Team Successful, Experienced Medical Device Professionals Ido Marom Chief Financial Officer 20+ Years Finance Hadar Levy Chief Executive Officer 25 + Years Med Device Moria Ben Soussan Vice President - R&D 15+ Years Med Device Dev Yuval Gimshi Vice President – Int’l Sales 15+ Years Med Device Sales Dr. Richard Bermudes Chief Medical Officer 15+ Years TMS Leadership Dr. Gilead Moiseyev Chief Technology Officer 20+ Years Med Device Dev Dor Hagai Dr. Colleen Hanlon Ross Mitchell Vice President – Operations Vice President - Medical Affairs Vice President - Marketing 10+ Years Supply Chain & Ops 15+ Years Brain Stim Research 12+ Years Healthcare Mkting Michael Cohen Vice President - US Sales 15+ Years Med Device Sales Corporate Presentation May 2025

Thank you! 33 Investor Contact: Ido Marom Chief Financial Officer Ido.Marom@BrainsWay.com

References 1. BrainsWay Data on File 2. The National Institute of Mental Health: nimh.nih.gov 3. Kessler RC, et al. Comorbidity of DSM - III - R major depressive disorder in the general population: results from the US National Comorbidity Survey Br J Psychiatry Suppl. 1996 4. Trivedi MH et al. STAR*D Study Team (2006), Evaluation of outcomes with citalopram for depression using measurement - based care in STAR*D: implications for clinical practice. Am J Psychiatry. 2006 Jan; 163(1):28 - 40. 5. Greist JH. The comparative effectiveness of treatments for obsessive - compulsive disorder. Bull Menninger Clin. 1998;62(4, suppl 1A):A65 – A81 6. Marks I. Behavior therapy for obsessive - compulsive disorder: a decade of progress. Can J Psychiatry. 1997;42:1021 – 1027 7. Ballenger JC. Current treatments of the anxiety disorders in adults. Biol Psychiatry. 1999;46: 1579 – 1594 8. Lawson McLean A. Publication trends in transcranial magnetic stimulation: a 30 - year panorama. Brain Stimul. 2019 May - Jun;12(3): 619 - 627 9. BrainsWay Data on File ; Depth, measured in phantom head, is from cortical surface toward brain center for which E - field >= 100 V/m for calibrated stimulator output . If measuring from scalp surface, an additional 1 . 5 cm should be added ; See also, Guadagnin, V . , et . al . , 2016 . Deep Transcranial Magnetic Stimulation : Modeling of Different Coil Configurations . 63 , 1543 – 1550 . 10. Fiocchi, S . , et . al . , 2016 . Modelling of the Electric Field Distribution in Deep Transcranial Magnetic Stimulation . 2016 11. Company estimates, references 3.4M adult MDD patients with insurance coverage and assumes 33 sessions per patient with an average session price of $70; Oppenheimer Research Report, 08/24/2020 12. Tendler, A, et al. Deep TMS H1 Coil treatment for depression: Results from a large post marketing data analysis. Psychiatry Research. Vol 324, June 2023, 115179 13. Senova S, et al. Durability of antidepressant response to repetitive transcranial magnetic stimulation: Systematic review and meta - analysis. Brain Stimulation 12 (2019) 119e128 14. Gersner R, et al. What is the durability of Deep TMS for Major Depressive Disorder. Brain Stimulation 13 (2020) 1842 - 1862 15. Roth Y, et al. Real - world efficacy of deep TMS for obsessive - compulsive disorder: Post - marketing data collected from twenty - two clinical sites. J Psychiatr Res. 2020 Nov 4;S0022 - 3956(20)31065 - 7 16. Harmelech T et al. Long - term outcomes of a course of deep TMS for treatment - resistant OCD. Brain Stimulation 15 (2022) 226e228 17. h ttps://www.cdc.gov/tobacco/data_statistics/fact_sheets/cessation/smoking - cessation - fast - facts/index.html. Data as of 2018 for U.S. adults. 18. EY Parthenon Analysis 2018 h ttps://www.smokefreeworld.org/sites/default/files/ey - p_smoking_cessation_landscape_analysis_key_findings.pdf 19. Zangen A et al. Repetitive transcranial magnetic stimulation for smoking cessation: a pivotal multicenter double - blind randomized controlled trial. World Psychiatry. 2021 Oct;20(3):397 - 404 20. https://worldpopulationreview.com/country - rankings/depression - rates - by - country Corporate Presentation March 2025 34