Exhibit 99.1

OPC ENERGY LTD.

Report of the Board of Directors regarding the Company’s Matters

for the six‑month and three‑month periods ended June 30, 2025

The Board of Directors of OPC Energy Ltd. (hereinafter – “the Company”) is pleased to present herein the Report of the Board of Directors

regarding the activities of the Company and its investee companies (hereinafter together – “the Group”), as at June 30, 2025 and for the six‑month and three‑month periods then ended (the Period of the Report”).

Except for the data reviewed in the Company’s consolidated financial statements as at June 30, 2025 (hereinafter – “the Interim Statements”) that

is included in this report below, the data appearing in the Report of the Board of Directors has not been audited or reviewed by the Company’s auditing CPAs.

This Report of the Board of Directors is submitted on the assumption that the interim reports and all parts of the Company’s

Periodic Report for 2024, which was published on March 12, 2025 (Reference No.: 2025‑01‑016318) (“the Periodic Report for 2024”), are before the reader and references to the Company’s reports include the information presented therein by means of

reference.

1

OPC Energy Ltd.

Report of the Board of Directors

| 1. |

Executive Summary1

|

| Main financial parameters (in millions of shekels) |

|

For the

|

For the

|

|||||||||||||||||||||||||

|

Six Months Ended

|

Three Months Ended

|

|||||||||||||||||||||||||

|

June 30

|

June 30

|

|||||||||||||||||||||||||

|

2025

|

2024

|

%

|

2025

|

2024

|

%

|

|||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||

|

Consolidated

|

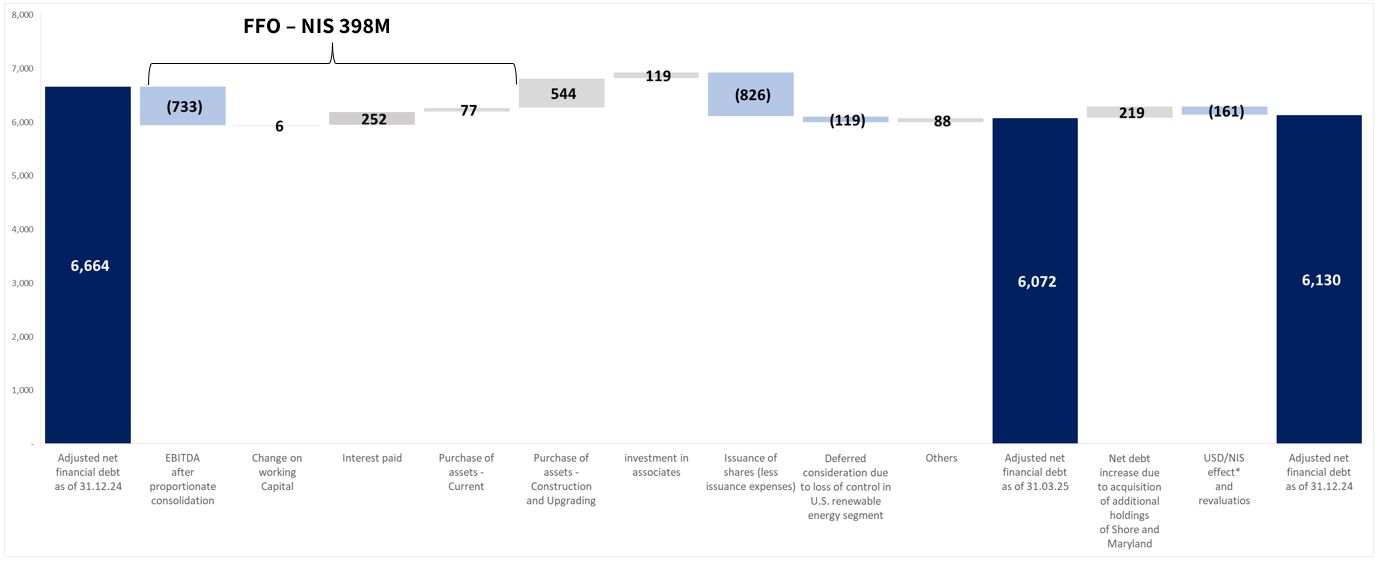

EBITDA after proportionate consolidation

|

733

|

573

|

28

|

%

|

323

|

241

|

34

|

%

|

|||||||||||||||||

|

|

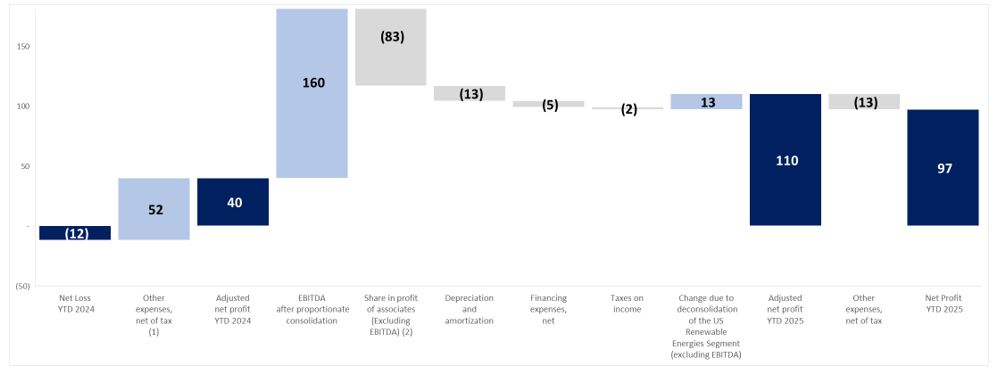

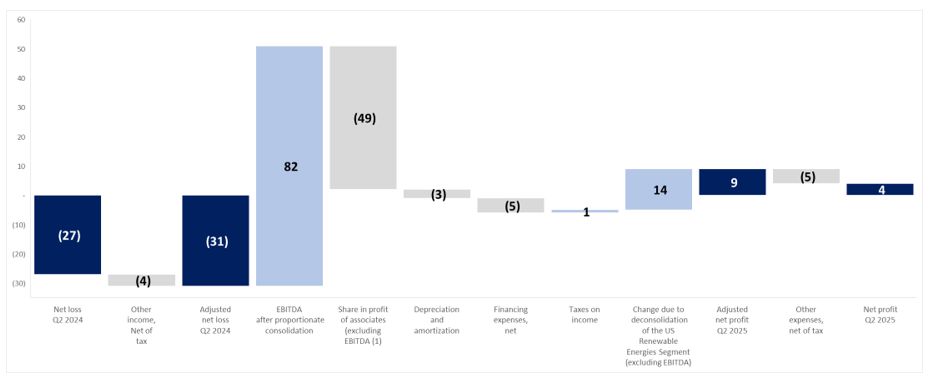

Net income (loss)

|

97

|

(12

|

)

|

908

|

%

|

4

|

(27

|

)

|

115

|

%

|

|||||||||||||||

|

|

Adjusted net income (loss)

|

110

|

40

|

175

|

%

|

9

|

(31

|

)

|

129

|

%

|

||||||||||||||||

|

|

FFO |

398

|

327

|

22

|

%

|

74

|

38

|

95

|

%

|

|||||||||||||||||

|

Israel

|

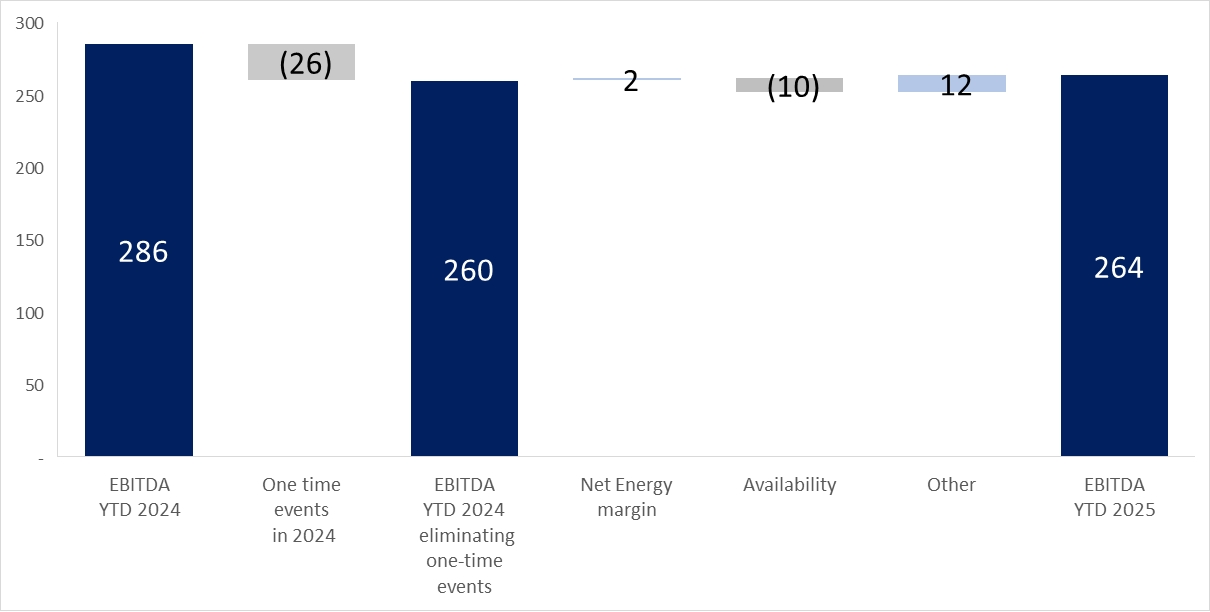

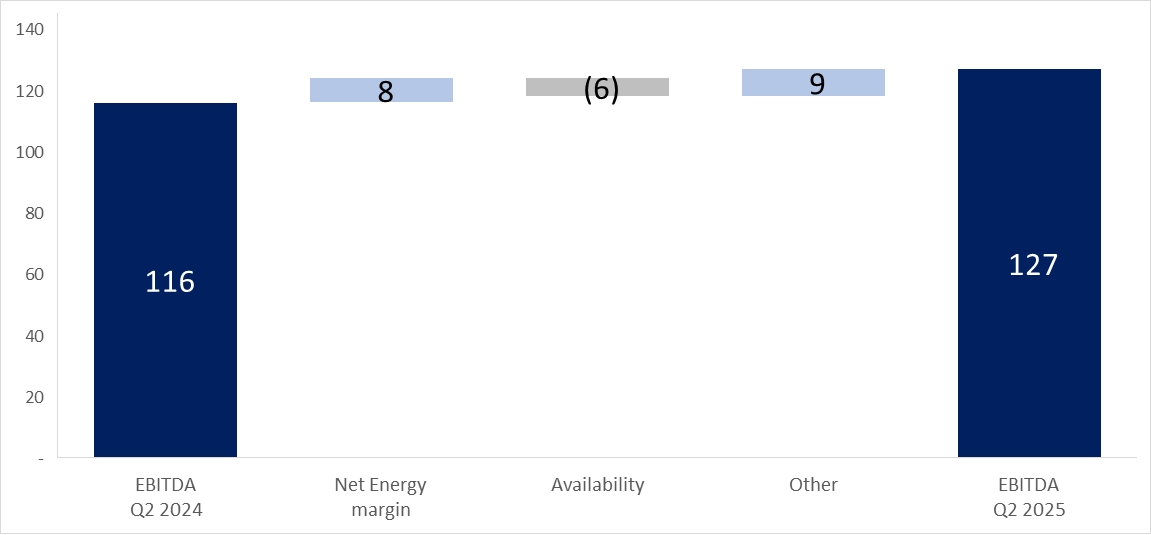

EBITDA

|

264

|

286

|

(8

|

)%

|

127

|

116

|

9

|

%

|

|||||||||||||||||

|

|

FFO |

194

|

238

|

(18

|

)%

|

6

|

9

|

(33

|

)%

|

|||||||||||||||||

|

U.S.

|

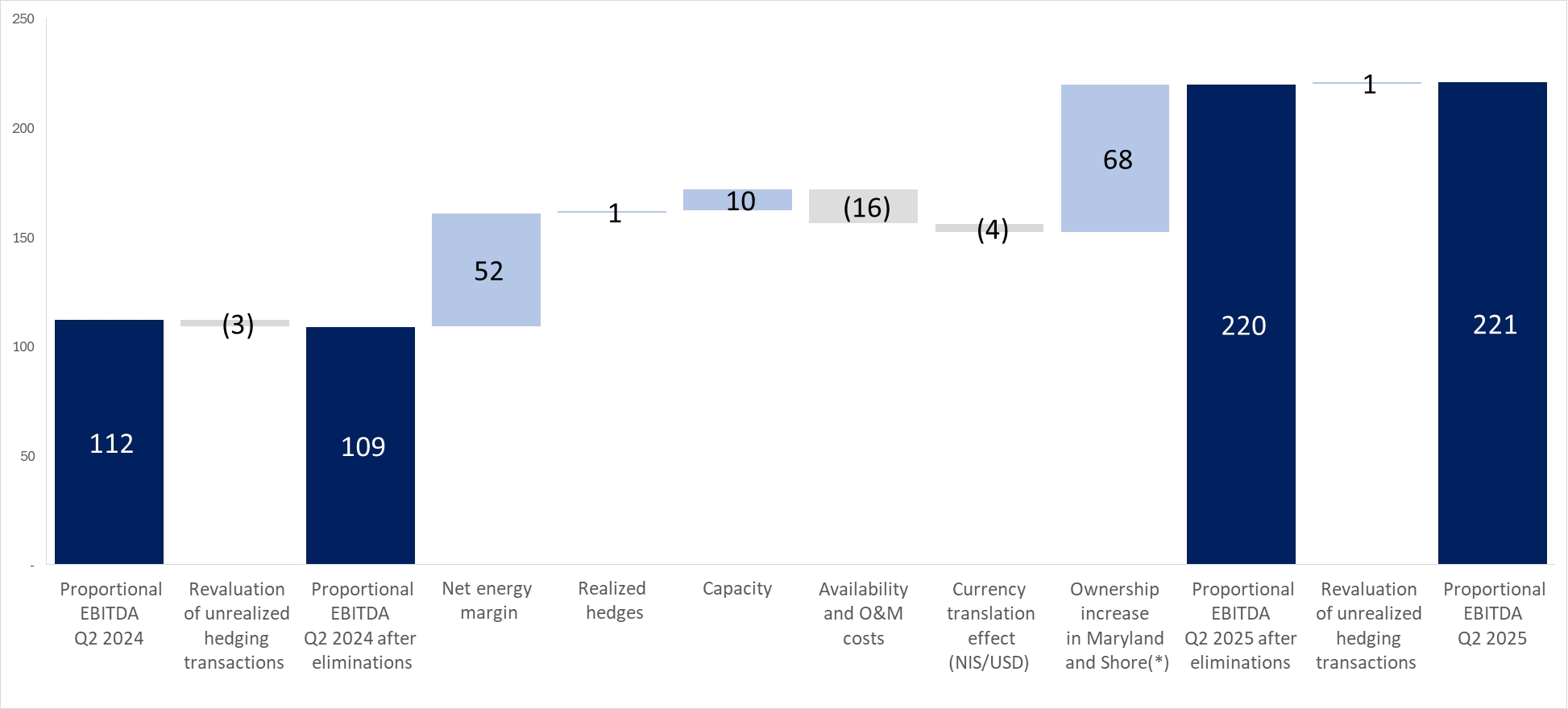

EBITDA after proportionate consolidation |

480

|

295

|

63

|

%

|

201

|

130

|

55

|

%

|

|||||||||||||||||

|

|

FFO

|

242

|

144

|

68

|

%

|

89

|

54

|

65

|

%

|

|||||||||||||||||

|

|

|

|||||||||||||||||||||||||

|

|

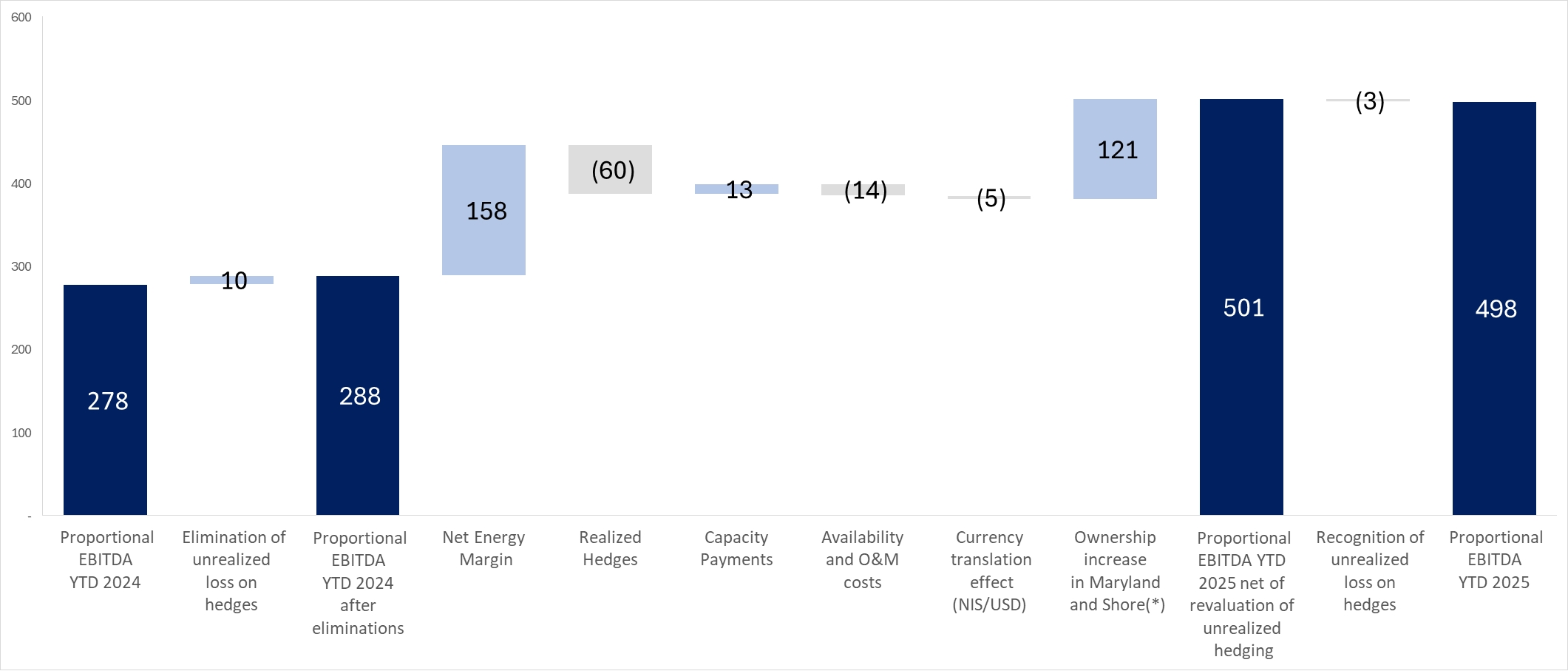

EBITDA after proportionate consolidation – energy transition |

498

|

278

|

79

|

%

|

221

|

112

|

97

|

%

|

|||||||||||||||||

|

|

||||||||||||||||||||||||||

|

|

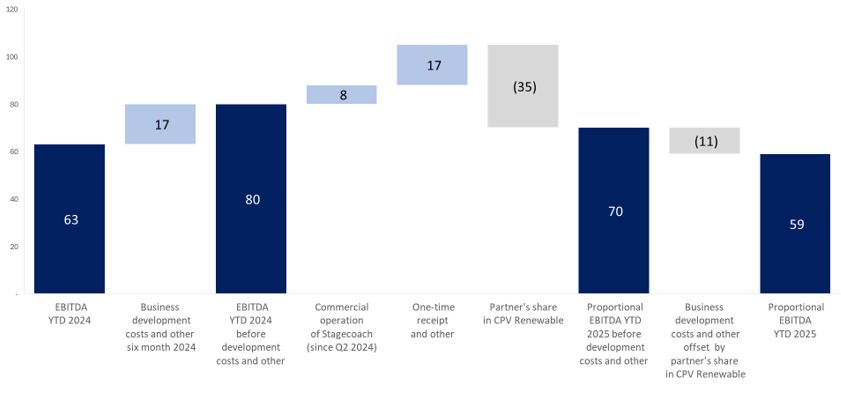

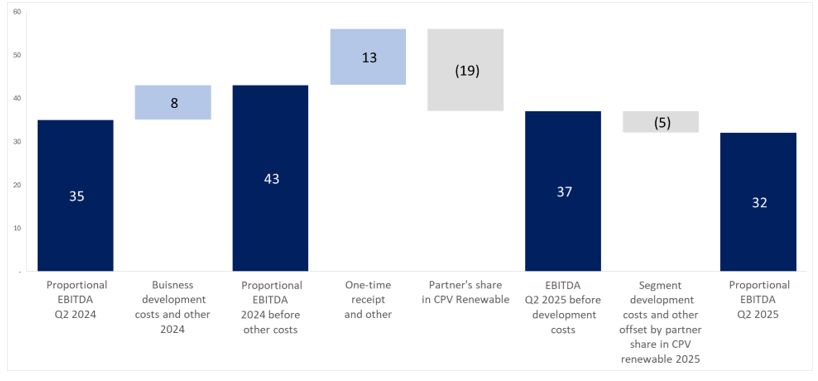

EBITDA after proportionate consolidation – renewable energies |

59

|

63

|

(6

|

)%

|

32

|

35

|

(9

|

)%

|

|||||||||||||||||

| * |

EBITDA, EBITDA after proportionate consolidation, adjusted net income and FFO are not recognized in accordance with IFRS – for definitions and the manner of their calculation – see Sections 4B and

4G below.

|

| 1 |

The Executive Summary below is presented solely for convenience and it is not a substitute for reading the full detail (including with reference to the matters referred to in the

Summary) as stated in this report with all its parts (including warnings relating to “forward‑looking” information as it is defined in the Securities Law, 1968 (“the Securities Law”), definitions or explanations with respect to the indices

for measurement of the results and including the information included by means of reference, as applicable). This Summary includes estimates, plans and assessment of the Company, which constitute “forward‑looking” information regarding which

there is no certainty they will materialize and the readers are directed to the detail presented in this report below.

|

2

OPC Energy Ltd.

Report of the Board of Directors

| 1. |

Executive Summary (Cont.)

|

Main developments in the second quarter and thereafter

| Israel |

Hadera 2 project – on August 10, 2025, as part of an additional discussion regarding National Infrastructures Plan 20B (NIP 20B) the

government of Israel approved construction of a power plant in Hadera. For details – see Section 6A(2) below.

|

|

|

Ramat Beka project – in May 2025, Electricity Authority published a bilateral market regulation for generation and storage

facilities in accordance with which the project is expected to operate. Accordingly, the Company is making technical feasibility studies along with economic optimization with reference to the size of the project, particularly the scope of

the storage therein. For details see Section 6A(2) below.

|

|

Increase in the list of projects under development in the area of renewable energy – in addition to the Ramat Beka project, as at the approval date of the

report the list of projects in the renewable energy area with integrated storage is estimated at a cumulative about 0.4 gigawatts and 1.8 gigawatts per hour. For details see Section 6A(2) below.

|

|

|

Financing in Israel – in July 2025, OPC Israel signed an additional bank financing agreement, in the aggregate amount of about NIS 400 million, on terms

similar to those of the agreements it signed in 2024 and in the beginning of 2025. The company’s share is expected to be used mainly for repayment of its debentures. For details – see Note 6A(1) to the Interim Statements.

|

3

OPC Energy Ltd.

Report of the Board of Directors

| 1. |

Executive Summary (Cont.)

|

Main developments in the second quarter and thereafter (Cont.)

|

U.S.

|

Basin Ranch project in Texas (combined cycle power plant with a capacity of 1.35 gigawatts) advancing toward an investment decision

and start of construction in the second half of 2025 – for financing the share of the CPV Group in the shareholders’ equity required for construction of the project, as at the approval date of the report the Company had completed

issuance of equity, as stated below, and the CPV Group is carrying on advanced negotiations with Bank Leumi for taking out a loan, in the amount of about $300 million. For details – see Section 6B(2) below.

|

|

|

Capacity auctions in the PJM market for the period June 2026 through May 2028 – in April 2025, the FERC approved for PJM minimum

and maximum ceiling (collar) prices for the next two capacity auctions. In July 2025, the results of a capacity auction for the period from June 1, 2026 through May 31, 2027 were published at a price that reflects the price ceiling

determined of $329 for MW/day. For details – see Section 3.3M below.

|

||

|

Approval of the “One Big Beautiful Bill” and change of the tax benefit arrangements in the energy area – for details regarding

the legislation and the estimates of the CPV Group regarding the possible impacts thereof on its business activities, particularly in the area of renewable energy – see Section 3.1C below.

|

||

|

Completion of transaction for increase in the holdings in the Shore power plant in the area of Energy Transition in the U.S.

– in April 2025, acquisition of an additional 20% of the Shore power plant was completed such that as at the approval date of the report CPV’s holding is about 89%. For details – see Note 9C(1) to the Interim Statements.

|

||

|

Oregon project (combined cycle power plant with a capacity of 1.45 gigawatts in the preliminary development stage) - was chosen in May 2025 by PJM for

advancement in an accelerated connection process as part of a RRI (Reliability Resource Initiative). For additional details – see Section 6B(3) below.

|

||

|

Group

headquarters

|

Raising of capital – in June 2025 the Company completed raising of capital in the aggregate scope (gross) of about NIS 850

million (about $245 million). The proceeds of the issuance are earmarked for provision of part of the share of the CPV Group in the shareholders’ equity required for construction of the Basin Ranch project2. For details – see

Section 6B(2) below and Note 6D to the Interim Statements.

|

|

|

Credit rating – in May 2025, Midroog determined an initial rating of A1.il with a stable rating outlook for the Company and its

debentures. In addition, in May 2025 S&P Maalot raised the Company’s credit rating to ilA with a stable rating outlook and the credit rating of its debentures to ilA+. For details – see Section 9C below.

|

For additional developments with respect to the Company’s activities (including potential developments in the Company’s business) and updates

relating to the “Nation as a Lioness” mission – see Sections 10 and 3.1B, respectively.

2 If and to the extent a final decision is made with respect to investment in the project (as at the date of the

report all the preconditions for start of the construction had been fulfilled) and/or for the Company’s needs as will be decided from time to time by the Board of Directors. It is emphasized that use of the issuance

proceeds to provide part of the share of the CPV Group in the shareholders’ equity required for the project, as stated, includes “forward‑looking” information, as it is defined in the Securities Law, which is based on the Company’s estimates as at

the approval date of the report and there is no certainty regarding the realization thereof.

4

OPC Energy Ltd.

Report of the Board of Directors

| 1. |

Executive Summary (Cont.)

|

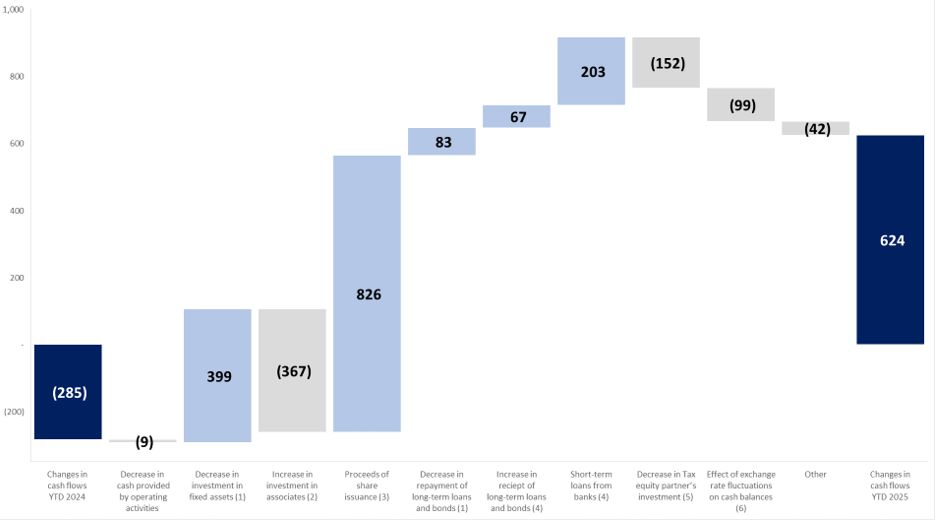

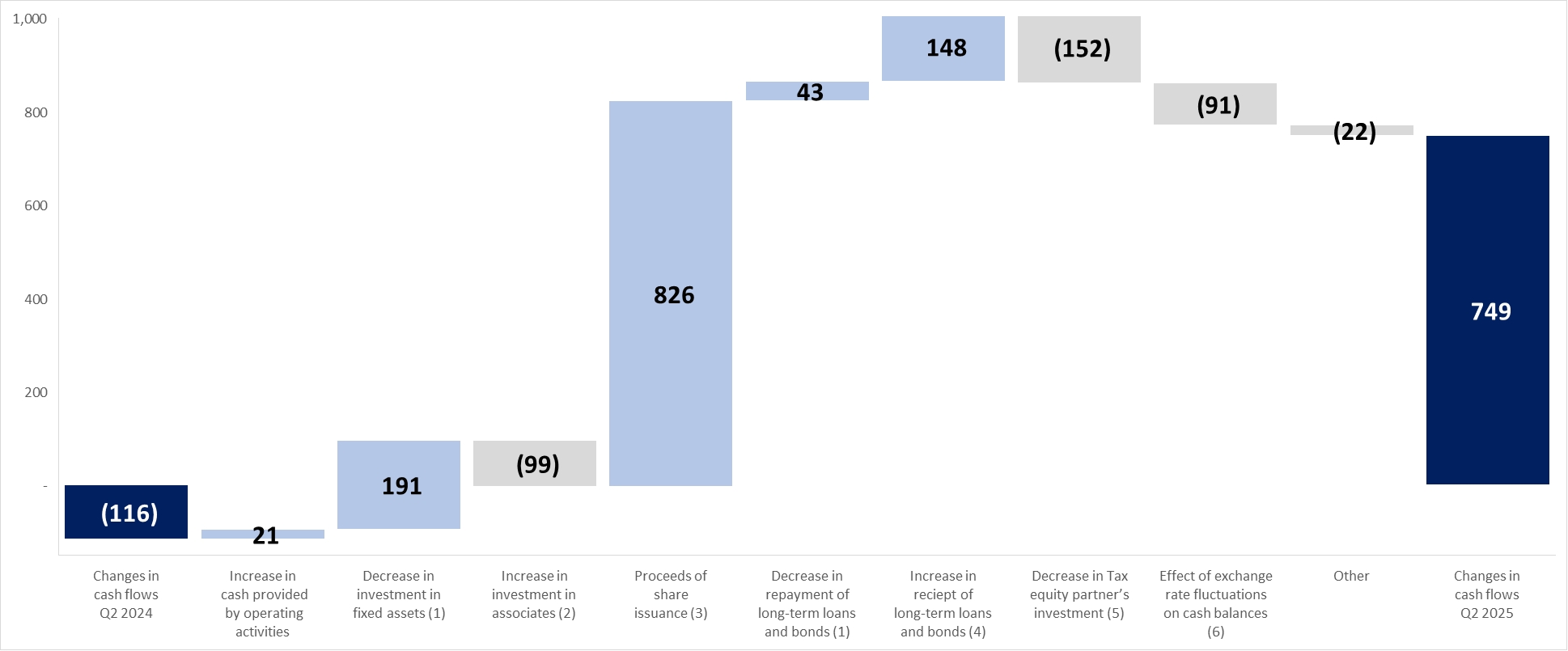

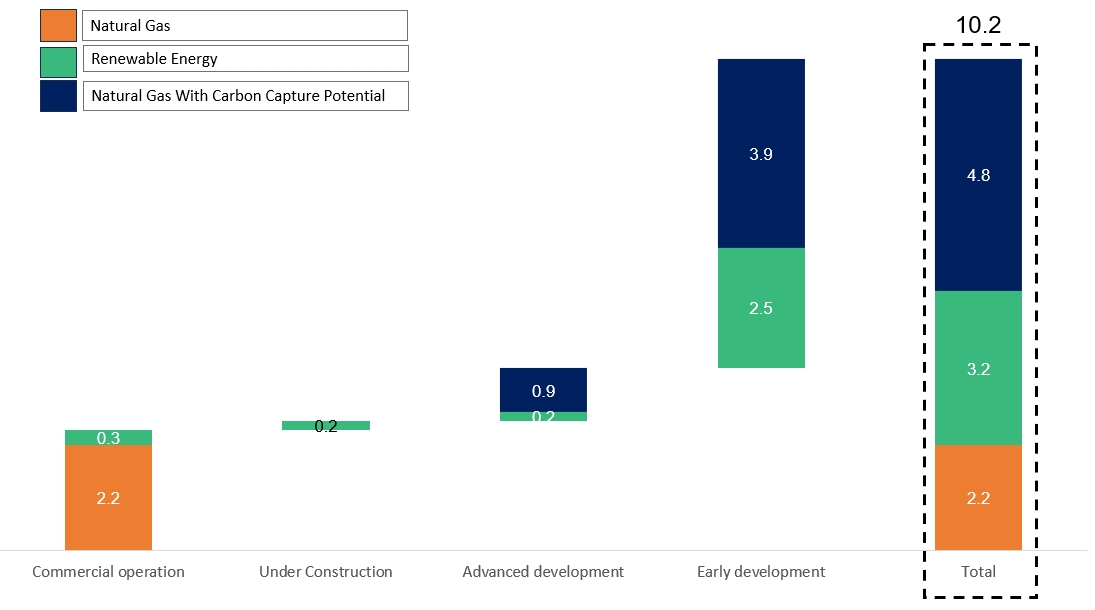

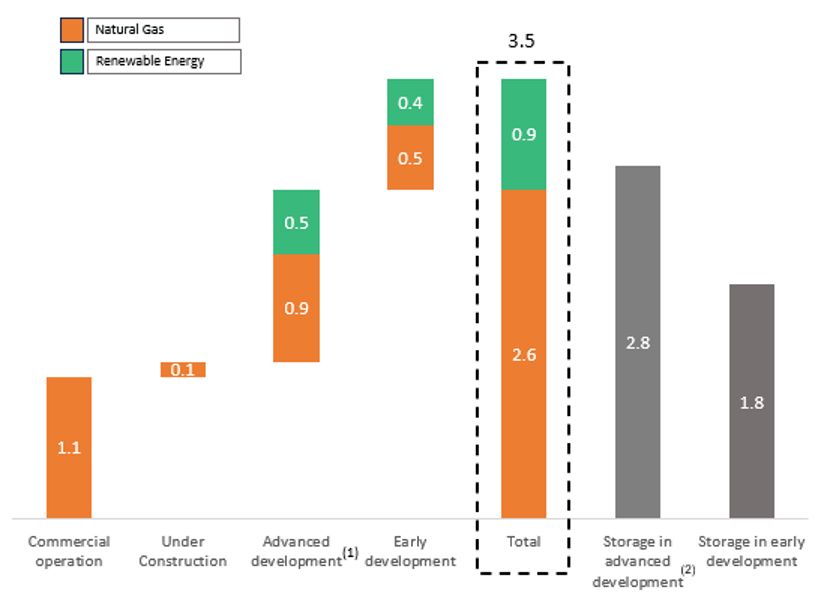

Portfolio of about 13.7 GW and about 4.6 GWh of storage (for details – see Section 6 below)

United States (1)

| (1) |

The projects are presented in accordance with the relative share of the CPV Group in each project.

|

5

OPC Energy Ltd.

Report of the Board of Directors

| 1. |

Executive Summary (Cont.)

|

Portfolio of about 12.8 GW and about 5.5 GWh of storage (for details – see Section 5 below) (Cont.)

Israel (3)

| (1) |

The above chart does not include the Hadera 2 project, with a capacity of 850 megawatts, in light of the Government’s decision to approve the plan. For details – see Section 6A(2)

below and Section 7.3.13.4 of Part A to the Periodic Report for 2024.

|

| (2) |

For additional details regarding a possible increase in the scope of the energy in the Ramat Beka project – see Section 6A(2) below.

|

| (3) |

At this preliminary stage, not including a project covered by an agreement with Migdal, as detailed in Section 6A(2) below.

|

That stated with respect to the development stages, capacities and/or expectations regarding construction of the development projects in Israel and in the

U.S. constitutes “forward‑looking” information as it is defined in the Securities Law, which is based on the Company’s estimates at the approval date of the report and regarding which there is no certainty they will be realized. Ultimately, there

could be changes in the characteristics of the projects and/or delays or changes due to regulatory, operating, commercial factors and/or realization of one or more of the risk factors to which the Company is exposed, as stated in Part A of the

Periodic Report for 2024. Advancement of the development projects (or any one of them) is subject to the discretion of the Company’s competent organs and existence (fulfillment) of additional conditions, as stated in Part A of the Periodic Report

for 2024.

6

OPC Energy Ltd.

Report of the Board of Directors

| 2. |

Brief description of the areas of activity

|

The Company is a public company the securities of which are listed for trade on the Tel Aviv Stock Exchange Ltd.

For details regarding the Group’s activity segments in the Period of the Report – see Part 2 of the Report of the Board of Directors that is

included in the Periodic Report for 2024 (“the Report of the Board of Directors for 2024”) and Note 25 to the annual financial statements.

| 3. |

Main Developments in the Business Environment

|

| 3.1 |

General

|

| A. |

Macro‑economic environment (particularly inflation and interest) – for details regarding the business and macro‑economic environment in which the Group companies operate, significant changes

that occurred in 2024 and the impact thereof on the Group’s activities – see Section 3.1A to the Report of the Board of Directors for 2024.

|

Regarding the interest in Israel, in the interest decisions of Bank of Israel in 2025, the interest rate remained unchanged at

the level of 4.5%. Pursuant to the latest projection published by Bank of Israel, the interest rate is expected to decline to an average of 3.75% in the second quarter of 2026.

Regarding the interest in the U.S., since the beginning of 2025 there have been no additional interest rate reductions. Pursuant

to the latest projection published by the U.S. Federal Reserve Bank, the interest rate is expected to decline to an average in the range of 3.75%–4% during 2025.

Set forth below is data with reference to the currency exchange rate, Consumer Price Index (CPI) in Israel and in the U.S., the

interest rates of Bank of Israel and the interest rates of the Fed in U.S.:

|

Dollar/shekel exchange rate *

|

2025

|

2024

|

Change

|

|||||||||

|

At the end of the previous year

|

3.647

|

3.627

|

0.6

|

%

|

||||||||

|

On June 30

|

3.372

|

3.759

|

(10.3

|

)%

|

||||||||

|

On March 31

|

3.718

|

3.681

|

1.0

|

%

|

||||||||

|

Average January – June

|

3.598

|

3.694

|

(2.6

|

)%

|

||||||||

|

Average April – June

|

3.583

|

3.725

|

(3.8

|

)%

|

||||||||

| * |

The dollar/shekel exchange rate shortly before the approval date of the report (on August 8, 2025) is 3.435.

|

7

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.1 |

General (Cont.)

|

| A. |

(Cont.)

|

|

Israeli

|

U.S.

|

Bank of Israel

|

Federal

|

|||||||||

|

CPI

|

CPI

|

interest rate

|

interest rate

|

|||||||||

|

On August 11, 2025

|

117.3

|

322.6

|

4.5%

|

4.25%–4.50%

|

||||||||

|

On June 30, 2025

|

116.9

|

321.2

|

4.5%

|

4.25%–4.50%

|

||||||||

|

On March 31, 2025

|

115.4

|

319.1

|

4.5%

|

4.25%–4.50%

|

||||||||

|

On December 31, 2024

|

115.1

|

315.5

|

4.5%

|

4.25%–4.50%

|

||||||||

|

On June 30, 2024

|

113.4

|

314.1

|

4.5%

|

5.25%–5.50%

|

||||||||

|

On March 31, 2024

|

111.6

|

310.3

|

4.5%

|

5.25%–5.50%

|

||||||||

|

On December 31, 2023

|

111.3

|

307.1

|

4.75%

|

5.25%–5.50%

|

||||||||

|

Change in the first half of 2025

|

1.6%

|

2.3%

|

0%

|

0%

|

||||||||

|

Change in the first half of 2024

|

1.9%

|

2.3%

|

(0.25%)

|

0%

|

||||||||

|

Change in the second quarter of 2025

|

1.3%

|

1.2%

|

0%

|

0%

|

||||||||

|

Change in the second quarter of 2024

|

1.6%

|

1.3%

|

0%

|

0%

|

For details regarding credit linked to the CPI or to prime – see Section 9B below to the Report of the Board of Directors for

2024, and Note 14B to the annual financial statements. For additional details regarding impacts of the changes in the macro‑economic environment on the results of the Group’s activities – see Section 11 to the Report of the Board of Directors for

2024.

| B. |

Domestic and geopolitical instability in the defense (security) situation in Israel – further to that stated in Section 6.1.1 of Part A of the Periodic Report for 2024, during of the period of

the report, the security instability in Israel increased with a rekindling of the fighting, including calling up of military reserves and missiles from the Yemenite terrorist organizations.

|

Additionally, in June 2025, an additional worsening of the

geopolitical situation started upon the outbreak of widespread military combat between Israel and Iran (“the Nation as a Lioness” mission”), which included airstrikes by Iran, closing of the aviation routes, a general emergency situation on the

Israeli Homefront and a significant rise in the regional tensions. On June 24, 2025, a ceasefire with Iran was declared, which as at the approval date of the report is still in effect. Nonetheless, as at the approval date of the report the combat

situation in Gaza and attacks by terrorist organizations from Yemen are still continuing and the situation in Israel continues to be characterized by significant geopolitical uncertainty.

At the same time, significant uncertainty is ongoing regarding the consequences of the continuing war situation on macro‑economic and financial factors in Israel, including

the Israeli capital market.

8

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.1 |

General (Cont.)

|

| B. |

(Cont.)

|

During the Nation as a Lioness mission the natural gas reservoirs (including Energean's Karish reservoir) were completely shut down and acquisitions of natural gas for the

Group’s power plants were made mainly from the Tamar reservoir (which was shut down for a relatively short time) along with isolated use of diesel oil; there was a certain decrease in the demand for electricity – which was partly temporary against

the background of suspension of the economic activities during the mission and is, in part, still continuing as at the approval date of the report due to physical damage to the generation facilities of a significant industrial customer; and force majeure notifications were received from suppliers and contractors, which mainly relate to the Sorek 2 project, which is under construction.

As at the approval date of the report, the said mission did not have a significant impact on the results of the operations in Israel, and in the Company’s estimation, if

there is no rekindling of the fighting the timetables for the expected resumption of full activities of the said industrial customer will be maintained and the suppliers and contractors from outside of Israel will return and shipments of equipment

for performance of work in Israel will resume. The said mission is not expected to have a material impact on the activities in Israel3.

It is noted that as a group operating in Israel, the said rekindling of the fighting, expansion of the scope of the combat

and/or a worsening of the defense situation in Israel could unfavorably affect its activities, operating results and liquidity, including due to impacts, as stated, on the Group’s suppliers (such as maintenance contractors, gas suppliers and

construction contractors) and significant customers and/or macro‑economic factors and the capital market. The said impacts could apply to both the level of the Company’s projects in Israel (maintenance of the active projects and construction work on

the projects that have not yet started their activities) and the level of the Company’s business activities. For additional details – see Sections 6.1.1 of Part A of the Periodic Report for 2024.

3 The Company’s estimates with respect to the impacts of the Nation as a Lioness

Mission and return to routine activities constitutes “forward‑looking” information as it is defined in the Securities Law, regarding which there is no certainty it will be realized. Ultimately, delays in return to routine activities of suppliers,

equipment shipments and arrival of work teams to Israel (for whatever reason) and return to routine activities of the Company’s customer could have a material negative impact on the Company, cause delays in execution of projects and/or involve

additional costs.

9

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.1 |

General (Cont.)

|

| C. |

Changes in government policies (including with respect to tariffs) and passage of the One Big Beautiful Bill in the U.S. – further to that stated in Section 3.1C of the Report of the Board of

Directors for 2024, the policy changes against the background of entry into office of the Trump administration have created and are continuing to create uncertainty along with opportunities in the energy sector in the U.S.

|

Since his entry into the position in January 2025, President Trump has issued executive orders promoting the production of fossil fuels, including with respect to natural gas

and LNG and laws have been passed and Executive Orders or directives could be issued for reduction of government support in the area of renewable energies, among other things, as detailed below and in Section 8.1.4O of Part A of the Periodic Report

for 2024.

Furthermore, as at the date of the report, President Trump has imposed tariffs (some of which have been updated and are expected

to continue to be updated later on) on import of equipment and raw materials (including, steel and solar panels) into the U.S., and is carrying on negotiations with respect to new trade agreements with foreign countries, in such a manner that at the

present time there is uncertainty regarding the full extent of the impacts of the said orders or new trade agreements on the cost of the equipment for the projects. It is noted that the said update of the Customs’ duty could affect the equipment

costs (both in the areas of renewable‑energy and natural‑gas) and trigger disruptions in the supply chain and, ultimately, lead to an increase in the construction or maintenance costs of projects4.

On July 4, 2025, a comprehensive federal law known as the “One Big Beautiful Bill” (hereinafter in this Section – “the Law”) was

passed into law, which includes, among other things, legislative changes in all that relating to the set of federal tax benefits, which are mainly relevant to the renewable energy activities of the CPV Group in the U.S.

In brief and as relevant, pursuant to the provisions of the Law and the “safe harbor” rules (lenient threshold conditions),

renewable energy projects (sun and wind) will be required to start the construction (as this term will be defined by the U.S. Treasury Department, as detailed below) no later than July 4, 2026 (12 months from the approval date of the Law) and to

complete it no later than the end of 4 years from then or if their construction starts after July 4, 2026 to complete it no later than the end of 2027 – this being in order to comply with the conditions for receipt of the tax benefits (ITC and PTC).

The benefits of entitled projects could range between 30% and 50% of the cost of the project.

In addition, the Law provides new rules for a Foreign Entity of Concern (FEOC), which prevent receipt of tax benefits for

projects that acquire equipment or operate under a financial structure that provides “effective control” to parties in the countries defined in the Law (China, North Korea, Russia and Iran). These restrictions do not apply to projects the

construction of which starts before the end of 2025. The Law restricts the possibility of transferring the credit to a third party (transferability) if the receiving party is considered an FEOC.

| 4 |

That stated in this Section above constitutes “forward‑looking” information, as it is defined in the Securities Law, which is based solely on the Company’s estimates as at the approval date of the report,

which are subject to uncertainty and changes that are not under the Company’s control. The policies (present or additional) of the U.S. government could have a negative impact on advancement and/or benefits with respect to renewable

energy projects (particularly, renewable energies) and the costs of equipment, services and shipping for the projects and power plants in the U.S. In addition, such changes could have macro impacts on the Company’s activity markets.

|

10

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.1 |

General (Cont.)

|

| C. |

(Cont.)

|

Additionally, the Law increased the value of the tax benefit under Section Q45 for re‑use of carbon for purposes of increasing the production of crude oil or another

generation process (“enhanced oil recovery”), from $65 to $85 per ton and left unchanged (at $85 per ton) the tax benefits for carbon dioxide that is separated out (for further details in connection with the benefits under the IRA Law – see

Section 8.10 of Part A of the Periodic Report for 2024).

Also, the Law restores the possibility of deducting as an expense the full cost of the investment in qualifying assets, as they

are defined in the Law, as a depreciation expense in respect of assets acquired or placed into service after January 19, 2025.

Further to that stated above with reference to the entitlement to tax benefits for renewable energies pursuant to the Law, on July 7, 2025, an Executive Order was published

instructing the U.S. Treasury Department to examine and publish within 45 days updated and possibly stricter directives with respect to the definition of “commencement of construction” in all that relating to the Law and application of the safe

harbor rules for projects the start of their construction is expected to take place up to July 4, 2026. As detailed above, such that projects would be considered “under construction” only if construction has already been completed of a significant

part (as it will be defined) of the project and will be subject to stricter conditions.

As at the approval date of the report, the CPV Group is continuing to monitor the changes being advanced by the Trump Administration, including with respect to updated

directives of the U.S. Treasury Department that are expected to be published up to August 18, 2025, and to examine their impacts. For additional details – see Sections 8.1.3.1 and 8.1.4O of Part A of the Periodic Report for 2024.

In the estimation of the CPV Group, as at the approval date of the report: (A) regarding the activities of the CPV Group in

the natural gas area, including future potential for addition of carbon capture, the said directives should have a positive impact on the general sentiment, the business environment and the investment feasibility of the investments, among other

things against the background of the improvement in the tax benefits under Section Q45, as detailed above; (B) regarding the activities of the CPV Group in the renewable energies area, the Law and the said directives are not expected to have a

negative impact on its active projects, its projects under construction and some of its projects in the advanced development stage that should be entitled to tax benefits under the new legislation. Concerning some of the projects in the advanced

development stage and projects in the initial development stage that will not be entitled to tax benefits under the new legislation, in the estimation of the CPV Group as at the approval date

of the report, continuing demand for electricity from renewable energy should support an increase in the electricity prices along with a possible decline in the equipment prices and possible changes in government policies, could fully or partly

compensate for the impact of cancellation of the tax benefits and, thus, reduce the impact of the Law on the economic worthwhileness of the said projects. Nonetheless, there could be delays in the development of projects in such a manner that the

Law could have an unfavorable impact on the projected start dates of the construction5.

| 5 |

That stated above regarding the absence of a negative impact of the new legislation on the list of projects in the advanced development stage, and relating to the demand for renewable energies and an

increase in prices (and scope), a decline in the equipment prices and/or reduction of the impacts of the Law on renewable energy projects, constitutes “forward‑looking” information as it is defined in the Securities Law, which is

based on the estimates of the CPV Group as at the approval date of the report and on an assumption regarding high demand for renewable energies on the part of significant consumers, and regarding which there is no certainty they will

be realized or the manner of their realization. As at the approval date of the report, the manner of the impact of the new legislation on the renewable energy sector in the U.S. has not yet been fully clarified and understood at this

stage. Therefore, as part of the process of internalizing the legislation (including updates, if any, or changes in other regulations) there could be changes in the sector the results of which will be different than the said

estimates, including changes that could have a significant negative impact on the activities, including on projects of the CPV Group in the area. As at the approval date of the report, the estimates described with reference to the

impacts of the legislation on the CPV Group are not final and the CPV Group is continuing to examine these impacts. Accordingly, the said estimates are subject to changes (including due to specific circumstances of the projects on the

list of the awaiting projects of the CPV Group).

|

11

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.2 |

Activities in Israel

|

| D. |

Update of the electricity tariffs – in January 2025, a decision of the Electricity Authority entered into effect regarding update of the tariff for 2025 for consumers of electricity from the

Electric Company. Pursuant to the decision, the weighted‑average generation component was updated to 29.39 agurot per kilowatt hour – a decline of about 2.2% in the weighted‑average generation component with reference to the generation

component in effect at the end of 2024, this being mainly as a result of a decrease in the Electric Company’s generation cost due to a reduction in the use of coal and a forecasted decline in the Electric Company’s natural‑gas price. In

addition, there was a non‑recurring recognition of surplus receipts from sale of the Eshkol power plant, which led to a reduction in the generation component.

|

It is noted that the results of the Group’s activities in Israel are materially impacted by changes in the electricity

generation component tariff, in such a manner that an increase in the electricity generation component has a positive impact on the Group’s results, and vice‑versa6.

Set forth below is data regarding the annual weighted‑average generation component (the prices are denominated in agurot per

kilowatt hours):

|

Period

|

2025

|

2024

|

Change

|

|||||||||

|

January–June average

|

29.39

|

30.12

|

(2.4

|

)%

|

||||||||

|

April–June average

|

29.39

|

30.07

|

(2.2

|

)%

|

||||||||

| E. |

Update of the decision regarding regulation of conventional generation units – further to that stated in Section 7.3.4 of Part A of the Periodic Report for 2024, on March 26,

2025, the Electricity Authority published a decision – “Update of the Decision regarding Regulation of Conventional Generation Units” (“the Decision”). As part of the Decision, the Electricity Authority increased the quota to four

additional generation units and extended the validity of the decision up to the end of June 2027. The availability tariff determined runs from 3.05 agurot to 3.31 agurot based on the date of the financial closing. In addition, an incentive

of 0.5 agurot was provided for the first unit that reaches a financial closing – this being only for units located in the northern part of Gush Dan (central Israel), as well as an incentive of 0.75% of the availability tariff for every

month of acceleration of the commercial operation prior to December 31, 2029. It is noted that the Company is taking action such that the Hadera 2 project will operate (subject to its construction and completion) under this regulation, as

detailed in Section 6A(2) below.

|

| 6 |

That stated regarding the impact of changes in the generation component on the Company’s results, is subject to changes, among other things, as a result of determination of the periodic

generation component and/or the manner of its application between the hourly demand hours’ brackets, operational factors and/or existence of one or more of the risk factors to which the Company is exposed, as stated in Section 19.2 of Part A

of the Periodic Report for 2024. For additional details regarding the generation component – see section 7.2.3 of Part A of the Periodic Report for 2024.

|

12

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.2 |

Activities in Israel (Cont.)

|

| F. |

Regulation for undertakings in transactions for sale of availability in high‑voltage solar generation facilities with integrated storage – further to the hearing described in Section 7.3.5 of

Part A of the Periodic Report for 2024, on May 20, 2025, the Electricity Authority published a decision regarding a bilateral regulation for generation and storage facilities connected to or integrated in the transmission network. The

regulation will apply from January 1, 2026 to renewable energy generation facilities with integrated storage (it was provided that the facility must with a storage capacity to installed generation capacity ratio that does not exceed 7), which

will receive tariff approval up to June 1, 2027 or for a quota of up to 2,000 megawatts.

|

Pursuant to the decision, the possibility was given to renewable energy generation facilities including integrate storage to sign availability transactions with virtual

suppliers. The capacity transaction will give the supplier the right to acquire energy every hour at the half‑hour “SMP” market price up to the amount of the capacity certificate the supplier acquired from the generator. The availability stated in

the capacity certificate will be determined in accordance with the adjustment coefficient (capacity credit). The adjustment coefficient for a renewable energy facility with integrated storage of 4 and 5 hours of unloading, will receive tariff

approval as part of the initial quota of the regulation at the rate of 60% and 67%, respectively, up to 2036. A storage facility, as stated, will operate in the energy market based on the central loading method. A generator, except for an

independent storage generator that does not allocate all the capacity stated in its capacity certificate will be entitled to request from the System Operator to receive a capacity tariff of NIS 0.0175 divided by the adjustment coefficient provided

to the generator, unlinked, in respect of the capacity not allocated the supplier, provided the generator will not be able to allocate this capacity to a private supplier during 12 months. It is noted that the Ramat Beka project, which is in the

advanced development stage, is expected to operate under this regulation (subject to its completion and operation). As part of the decision, the Electricity Authority also provided a quota for independent storage facilities and facilities for

restoration of waste.

| G. |

Hearing regarding integration of existing private conventional generators connected to the transmission network in the bilateral market regulation – on June 26, 2025, the Electricity Authority

published a hearing that proposes regulating the rules for integration of existing private conventional generators that are connected to the transmission network, as part of the bilateral regulation that was determined as part of Decision

71101 (a decision regarding a bilateral regulation for generation and storage facilities connected to or integrated in the transmission network, as detailed in Section F. above). The hearing provides that the regulation will apply to

generators that own conventional generation units for which an availability tariff has been provided based on the tariffs table 6.5 1–A, and that are not permitted to designate capacity or to sell energy to a private supplier or to a yard

consumer based on the tariffs table 6.5 1–B (power plants that were sold as part of the reform of Israel Electric Company and the Etgal and Zomet power plants that were constructed under Regulation 914).

|

Pursuant to the hearing, the relevant generators will be given the right to issue availability certificates, in a scope that

will not deviate from 92% of the plant’s capacity, to suppliers that will acquire energy for their customers from the System Operator at SMP prices without capacity payments – this being up to December 31, 2029, and after this date the Electricity

Authority will adjust the coefficient in accordance with the situation in the market. During the next two years, 4–8 competitive processes are expected to be held in the scope of 2,000–3,000 megawatts, where in every process a uniform transition

tariff will be determined that will be paid by all the generators to the System Operator, for every kilowatt that will be transferred to the regulation.

13

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.2 |

Activities in Israel (Cont.)

|

| G. |

(Cont.)

|

As part of every competitive process, the Electricity Authority will determine a minimum transition tariff that will not be

published to the public, which will be determined prior to the date of submission of the bids. In addition, it will be possible to submit bids for a capacity of not less than 50 megawatts and the total capacity that will be allotted to any one player

may not exceed half of the quota.

Generators will be able to return to the original regulation at the end of 12 months from the date of transfer of the capacity,

subject to advance notice of 30 days. The Electricity Authority might determine that a generator that returned capacity to its original arrangement starting from January 1, 2030, will be entitled to availability payments that are lower than its

original availability payments.

Subject to a final decision, the Regulation is expected to enter into effect in January 2026 after completion of the first

competitive process having a scope of 350 megawatts.

It is noted that the Zomet power plant, which operates under Regulation 914 (as detailed in Sections 7.3.3.2 and 7.13 of Part A

of the Periodic Report for 2024) is permitted to operate under this Regulation (to the extent it is finally recorded in a decision and subject to final regulations), where based on the hearing, Zomet’s original capacity tariff will remain unchanged.

It is emphasized, that as at the approval date of the report, the aforementioned proposed regulation is not final and is subject

to changes and completion of the decision processes in respect thereto. As at the approval date of the report, depending on the final arrangements that will be determined, if determined, Zomet will examine its possibilities under the said Regulation.

In the Company’s estimation, as at the approval date of the report, the above‑mentioned hearing (if recorded in a decision and

subject to the final arrangements) could have a positive impact on Zomet in a case where it chooses to operate under this Regulation, since an operating format is involved that does not exist in the present Regulation applicable to Zomet, as stated7.

Nonetheless, the planned competitive processes in a significant scope, as stated above, are expected to increase the competition in the supply sector for the Company in the area of its activities.

7 The Company’s estimates with reference to the impact of the hearing is “forward‑looking”

information as it is defined in the Securities Law, which is based on the Company’s initial estimates regarding the arrangements included in the hearing, the realization of which is uncertain. Ultimately, the impacts could be different, among other

things, as a result of the market conditions, results of competitive processes, regulatory changes/factors that impact the electricity market and/or the final arrangements that will be determined, to the extent they actually enter into effect, which

are not dependent on the Company. It is also clarified that a decision has not yet been made regarding the transition of Zomet to an operating format under the Regulation, as stated, which is subject to, among other things, examination of the final

conditions of the arrangement (should it actually enter into effect), the market conditions and the Company’s decision based on its discretion.

14

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.2 |

Activities in Israel (Cont.)

|

| H. |

Decision regarding determination of the value of the land of the Eshkol site – assessment of the Electricity Authority – as part of the decision, it was determined that the value of the land

of the Eshkol site that will be recognized by Israel Electric Company in the framework of sale of the site will be NIS 1,740 million. As part of update of the electricity tariff for 2025, the amount of NIS 508 million was recognized by the

Electricity Authority. Recognition of the rest of the amount, totaling NIS 1,232 million, plus interest and linkage differences, will be spread out by Israel Electric Company in the framework of the updated tariff over the next 3 years.

|

| I. |

Hearing for examination of alternatives regarding the manner and scope of preserving Units 1–4 on the Orot Rabin site – based on the principles of the energy policies from 2021, it was determined that Units 1–4 in the Orot Rabin

power plant will be preserved up to the end of 2025 in order to maintain the reliability and uninterrupted supply of the electricity in times of emergency. The Minister of Energy and Infrastructures (“the Minister of Energy”) requested to

examine the continued preservation and activity of the coal‑powered units in a case of a lack of natural gas. The Electricity Authority examined two preservation formats – cold and hot – and compared between them and a closing down

alternative, while analyzing costs, benefits and risks. It was found that even though the operating and environmental costs are higher, hot preservation permits a quicker response in times of emergency and saves up to NIS 4 billion per day

in avoidance of power outages. Therefore, the Electricity Authority decided to preserve the units in the not preservation format starting from January 1, 2026 and for a period of three years only, while advancing additional back‑up

solutions for the energy sector in anticipation of closing down the units at the end of the period.

|

| J. |

Continued increase of activities in the market for supply to household customers and small businesses – further to that stated in Section 7.6.5 of Part A of the Periodic Report for 2024, as part of diversification of the mix of

the customers of OPC Israel and further to the undertaking with Partner Communications Ltd. in 2024, in the period of the report an agreement was signed with an additional large retail company.

|

For additional details regarding developments of the Group’s activities in Israel – see Section 6 below.

15

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S.

|

| K. |

Electricity and natural gas prices

|

The results of the activities of the CPV Group are impacted to a significant extent by the electricity

prices in effect in the areas in which the Group’s power plants operate. The main factors impacting the electricity prices are demand for electricity, available generation capacity (supply) and the natural gas price in the area in which the power

plant operates.

With respect to the “energy transition” activity, in general, the natural gas price is significant in

determination of the price of the electricity in most of the regions in which the power plants of the CPV Group operate that are powered by natural gas. For the most part, in the existing production mix, over time, to the extent the natural‑gas

prices are higher, the marginal energy prices will also be higher, and will have a positive impact on the energy margins of the CPV Group due to the high efficiency of the power plants it owns compared with other power plants operating in the

relevant activity markets (the impact could be different between the projects taking into account their characteristics and the area (region) in which they are located)8.

Electricity prices

The following table summarizes the average electricity prices in each of the regions in which the power

plants in the area of energy transition activities of the CPV Group are active (the prices are denominated in dollars per megawatt hour)*:

|

For the

|

For the

|

|||||||||||||||||||||||

|

Six Months Ended

|

Three Months Ended

|

|||||||||||||||||||||||

|

Region

|

June 30

|

June 30

|

||||||||||||||||||||||

|

(Power Plant)

|

2025

|

2024

|

Change

|

2025

|

2024

|

Change

|

||||||||||||||||||

|

PJM West (Shore, Maryland)

|

48.09

|

31.72

|

52

|

%

|

42.35

|

30.83

|

37

|

%

|

||||||||||||||||

|

New York Zone G (Valley)

|

64.75

|

34.43

|

88

|

%

|

40.93

|

28.64

|

43

|

%

|

||||||||||||||||

|

Mass Hub (Towantic)

|

71.56

|

36.60

|

96

|

%

|

40.01

|

29.28

|

37

|

%

|

||||||||||||||||

|

PJM AEP Dayton (Fairview)

|

44.22

|

29.10

|

52

|

%

|

40.58

|

28.63

|

42

|

%

|

||||||||||||||||

|

PJM ComEd (Three Rivers)

|

33.16

|

24.29

|

37

|

%

|

31.10

|

22.42

|

39

|

%

|

||||||||||||||||

|

ERCOT West Hub (Basin Ranch)**

|

31.42

|

30.88

|

2

|

%

|

31.60

|

31.23

|

1

|

%

|

||||||||||||||||

| * |

Based on Day‑Ahead prices as published by the relevant ISO.

|

| ** |

As at the approval date of the report, a final investment decision with respect to the Basin Ranch project had not yet been made and its construction had not yet started.

|

It is noted that the actual electricity prices of the power plants of the CPV Group could be higher or

lower than the regional price shown in the above table due to the existence of a Power Basis (the difference between the power plant’s specific electricity price and the regional price). The Power Basis is a function of transmission constraints,

local cost of electricity generation, local demand for electricity, losses in the transmission lines and additional factors. For details regarding the Power Basis – see Section 3.3K of the Report of the Board of Directors for 2024.

| 8 |

That stated constitutes merely a general estimate that could be subject to changes due to projects characteristics or factors and events that are not under the control of the CPV Group.

|

16

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| K. |

Electricity and natural gas prices (Cont.)

|

Electricity prices (Cont.)

In the period of the report and in the second quarter of 2025, there was a significant increase in the

electricity prices compared with the corresponding periods last year, which in the estimation of the CPV Group derives mainly from an increase in the natural‑gas prices against the background lower‑than‑average temperatures in the first quarter of

2025 along with higher‑than‑average temperatures in the second quarter of 2025 in the areas in which the power plants of the CPV Group are located.

Natural gas prices

Set forth below are the average natural gas prices in each of the main markets in which the power plants of

the CPV Group operate (the prices are denominated in dollars per MMBtu)*:

|

For the six months ended

|

For the three months ended

|

|||||||||||||||||||||||

|

Region

|

June 30

|

June 30

|

||||||||||||||||||||||

|

(Power Plant)

|

2025

|

2024

|

Change

|

2025

|

2024

|

Change

|

||||||||||||||||||

|

Texas Eastern M‑3 (Shore, Valley – 70%)

|

4.43

|

2.21

|

101

|

%

|

2.47

|

1.53

|

61

|

%

|

||||||||||||||||

|

Transco Zone 5 North (Maryland)

|

4.37

|

2.94

|

49

|

%

|

2.62

|

2.27

|

15

|

%

|

||||||||||||||||

|

Dominion South Pt (Valley – 30%)

|

3.02

|

1.66

|

82

|

%

|

2.32

|

1.45

|

60

|

%

|

||||||||||||||||

|

Algonquin City Gate (Towantic)

|

7.32

|

2.97

|

147

|

%

|

2.86

|

1.68

|

70

|

%

|

||||||||||||||||

|

Texas Eastern M‑2 (Fairview)**

|

3.08

|

1.72

|

79

|

%

|

2.35

|

1.42

|

66

|

%

|

||||||||||||||||

|

Chicago City Gate (Three Rivers)

|

3.43

|

2.25

|

52

|

%

|

2.86

|

1.65

|

73

|

%

|

||||||||||||||||

|

Waha (Basin Ranch)***

|

1.42

|

0.28

|

407

|

%

|

1.02

|

(0.59

|

)

|

273

|

%

|

|||||||||||||||

| * |

Source: The Day‑Ahead prices at gas Midpoints as reported in Platt’s Gas Daily. It is clarified that the actual gas prices of the power plants of the CPV Group could be significantly different.

|

| ** |

Commencing from the third quarter of 2025, Fairview will start acquiring natural gas that is priced based on the Texas Eastern M‑3 transmission region. For additional details – see Appendix A below.

|

| *** |

As at the approval date of the report, a final investment decision with respect to the Basin Ranch project had not yet been made and its construction had not yet started.

|

In the estimation of the CPV Group, the significant increase in the natural gas prices in the period of the

report and in the second quarter of 2025, compared with the corresponding periods last year, is mainly due to the weather conditions described above, which led to a significant rise in demand for natural gas and an increase in the price in the

regions in which the power plants of the CPV Group operate.

Regarding the distribution region for natural gas in Waha Texas, which is expected to serve as the supply

source for the Basin Ranch project, is characterized by variable levels of production of natural gas as a function of the desired levels of production of the crude oil by the producers, which are impacted by the competitive environment in the fuel

market (the natural gas constitutes a by‑product), and transmission and transport limitations of natural gas from the region.

17

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| K. |

Electricity and natural gas prices (Cont.)

|

Natural gas prices (Cont.)

The corresponding periods last year were characterized by a significant surplus supply of natural gas

against the background of the scope of the fuel production and transport limitations as stated (which were resolved in part in the period of the report due to operation of a new natural gas pipeline in the region), and low price‑levels compared with

the other power plants of the CPV Group respectively. Therefore, the rate of increase of the natural gas prices in the period of the report and in the second quarter of 2025 compared with the corresponding periods last year, when measured against the

other power plants of the CPV Group, is unusually high.

Electricity margin in the operating markets of the CPV Group (Spark Spread)

Spark Spread is the difference between the price of the electricity in the relevant area (zone) and the

price of the natural gas used for generation of the electricity in the relevant area (zone) (it is clarified that RGGI is not included in calculation of the Spark Spread but rather in the energy margin as detailed in Section 4F below).

The Spark Spread is calculated based on the following formula:

Spark Spread ($/MWh) = price of the electricity ($/MWh) – [the gas price ($/MMBtu) x thermal conversion

ratio (heat rate) (MMBtu/MWh)]

Set forth below are the average Spark Spread margins for each of the main markets in which the power plants

of the CPV Group are operating (the prices are denominated in dollars per megawatt/hour)*:

|

For the

|

For the

|

|||||||||||||||||||||||

|

Six Months Ended

|

Three Months Ended

|

|||||||||||||||||||||||

|

June 30

|

June 30

|

|||||||||||||||||||||||

|

Power Plant9

|

2025

|

2024

|

Change

|

2025

|

2024

|

Change

|

||||||||||||||||||

|

Shore

|

17.52

|

16.47

|

6

|

%

|

25.31

|

20.27

|

25

|

%

|

||||||||||||||||

|

Maryland

|

17.94

|

11.43

|

57

|

%

|

24.27

|

15.17

|

60

|

%

|

||||||||||||||||

|

Valley

|

37.10

|

20.32

|

83

|

%

|

24.20

|

18.25

|

33

|

%

|

||||||||||||||||

|

Towantic

|

23.98

|

17.30

|

39

|

%

|

21.42

|

18.36

|

17

|

%

|

||||||||||||||||

|

Fairview

|

24.20

|

17.92

|

35

|

%

|

25.31

|

19.40

|

30

|

%

|

||||||||||||||||

|

Three Rivers

|

10.87

|

9.67

|

12

|

%

|

12.51

|

11.70

|

7

|

%

|

||||||||||||||||

|

Basin Ranch**

|

22.19

|

29.06

|

(24

|

)%

|

24.97

|

35.07

|

(29

|

)%

|

||||||||||||||||

| * |

Based on electricity prices as shown in the above table, with assuming a thermal conversion ratio (heat rate) of 6.9 MMBtu/MWh for Maryland, Shore and Valley, and a thermal conversion ratio of 6.5

MMBtu/MWh for Three Rivers, Fairview, Towantic and Basin Ranch. It is clarified that the actual energy margins of the power plants of the CPV Group could be significantly different due to, among other things, the existence of Power Basis and

a different breakdown in the scope of the electricity sold in the peak and off‑peak hours in CPV’s power plants and that shown above (which was calculated in the above table based on the assumption of generation in all the hours of the

24‑hour period).

|

| ** |

As at the approval date of the report, a final investment decision with respect to the Basin Ranch project had not yet been made and its construction had not yet started.

|

9 For additional details regarding the energy

margin of the CPV Group – see Section 4F below.

18

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| K. |

Electricity and natural gas prices (Cont.)

|

Electricity margin in the operating markets of the CPV Group (Spark Spread) (Cont.)

In the period of the report and in the second quarter of 2025, there was a significant increase in the

electricity margins (Spark Spread) in all the active power plants of the CPV Group, compared with the corresponding periods last year, stemming mainly from a relative advantage of the said power plants compared with the market – both the natural gas

prices relative to the gas indices on which the electricity prices are based in the activity markets, as well as the heat rate coefficient and their high efficiency compared with the market (that is, to the extent the gas prices are higher the

marginal energy prices will also be higher and will favorably impact the electricity margins of the CPV Group’s power plants).

Regarding the electricity margins in the ERCOT market, they were different than the said trend of

increases, due to the fact that the pricing of the electricity in the ERCOT West Hub region does not depend directly on the pricing of the natural gas in the WAHA region, which was significantly impacted, as stated above, by the surplus supply and

natural‑gas transmission restrictions in the corresponding periods last year, which contributed to the low price levels of the natural gas in WAHA in 2024.

It is noted that the hedging plans of the electricity margins in the power plants of the CPV Group that are

powered by natural gas is intended to reduce the fluctuations of the CPV Group’s electricity margin resulting from changes in the natural gas and electricity prices in the energy market. For details regarding hedging agreements of the electricity

margin with respect to the active power plants of the CPV Group – see Section 4F below. Regarding the Netback gas agreements and agreements for sale of electricity at a fixed price for hedging a significant part of the capacity of the Basin Ranch

power plant – see Section 6B(2), below).

For details regarding a forecast of the EOX company of electricity and natural gas prices up to the end of

2025 and for 2026–2027 – see Appendix A below.

19

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| L. |

Tax on carbon emissions (RGGI)

|

Regional Greenhouse Gas Initiative (RGGI) is a joint effort of the states of Connecticut, Delaware, Maine,

Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island and Vermont to determine quotas and to reduce the emissions of carbon dioxide from the energy sector. The RGGI regulation requires the power plants running on fossil fuels to

hold, through public tenders or commerce in a secondary market, gas‑emission quotas for purposes of offsetting emissions of carbon dioxide for every facility. Pursuant to the RGGI regulation, an independent market supervisor provides supervision of

the tenders for gas‑emission quotas, as well as activities in the secondary market, in order to assure the integrity of and confidence in the market. The RGGI regulation applies to 4 of the 6 power plants of the CPV Group in the Energy Transition

segment: Maryland, Shore, Valley and Towantic. With respect to the legal proceeding underway in Pennsylvania (the location of the Fairview power plant) in connection with application of RGGI and the possible significance of the matter – see

Section 8.1.4B of Part A of the Periodic Report for 2024.

Set forth below is a summary of the prices of the gas‑emission quotas (carbon emission tax) from the RGGI tenders. In general,

the tenders take place four times a year, in March, June, September and December.

|

Average for the

|

Average for the

|

|||||||||||||||||||||||

|

Six Months Ended

|

Three Months Ended

|

|||||||||||||||||||||||

|

June 30

|

June 30

|

|||||||||||||||||||||||

|

2025

|

2024

|

Change

|

2025

|

2024

|

Change

|

|||||||||||||||||||

|

Price of carbon emission tax in the RGGI

|

||||||||||||||||||||||||

|

tenders ($ per short ton / 2,000 pounds)*

|

19.91

|

15.44

|

29

|

%

|

19.76

|

16.00

|

24

|

%

|

||||||||||||||||

|

Cost of the carbon emission tax (in terms

|

||||||||||||||||||||||||

|

of gas cost) ($ per MMBtu)**

|

1.19

|

0.92

|

29

|

%

|

1.18

|

0.95

|

24

|

%

|

||||||||||||||||

| * |

The prices of the carbon emissions tax are presented under the assumption that the price of the tender that is held prior to a certain quarter represents the price of the carbon emissions tax for the

subsequent quarter. For example, the tender held in December 2024 will represent the price for the first quarter of 2025. It is noted that the actual price of the carbon emissions tax could be different than the tender prices as a result of

transactions made in the secondary market.

|

| ** |

The cost of the carbon emissions tax (in terms of gas cost) is calculated under the assumption of emissions of carbon dioxide with a reference (ratio) of 119 lbs./MMBtu. It is noted that the actual

carbon dioxide emissions ratio varies between the different power plants, and in the estimation of the CPV Group a ratio of 119 lbs./MMBtu is a representative ratio for power plants running on natural gas.

|

In the period of the report and in the second quarter of 2025 compared with the corresponding periods last year, there was a

significant increase in prices of the carbon emissions tax, which in the estimation of the CPV Group was mostly impacted by an increase in demand of institutional entities for purposes of commercial and hedging activities, and release of all the gas

emission quotas from the cost containment reserve in the first quarter of 2024.

It is noted that release of quotas with respect to emission of gas from a reservoir that acted to moderate costs in the first

quarter of 2025 did not have a significant impact on prices of carbon emissions in the tender that was held in June 2025.

20

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| M. |

Capacity revenues

|

Capacity is a component that is paid by regulatory bodies that manage demand and loads (system operators)

to electricity generators, with respect to their ability to generate energy at the required times for purposes of reliability of the system. This revenue component is an additional component, separate and apart from the component based on the energy

prices (which is paid in respect of sale of the electricity). Definition of the capacity component, as stated, including entitlement to revenue for seeing to availability of the electricity, including provisions regarding bonus or penalty payments,

are governed by the tariffs determined by the ISO of every market. Accordingly, NY‑ISO, PJM and ISO‑NE publish mandatory public auctions for determination of the capacity tariffs. It is noted that, in the nature of things, an increase in the capacity

prices favorably impacts CPV’s results, and vice‑versa. The extent of the impact on the overall results changes as a function of the energy margins, which is the most significant component of the gross profit (margin for generation of the electricity

and the sale thereof) – this being taking into account that the weight of the capacity component is usually lower than the weight of the energy margin component. In the ERCOT market (in Texas) there is no mechanism for capacity payments to power

plants compared with the NYISO, PJM and ISO‑NE markets. For additional details regarding ERCOT – see Section N. below.

PJM market

In the PJM market, the capacity payments vary between the market’s sub‑regions, as a function of local supply and demand and

transmission capabilities.

Set forth below are the capacity tariffs in the sub‑regions that are relevant to the CPV Group’s power plants and in the general

market (the prices are denominated in dollars per megawatt per day).

|

Sub-Region

|

CPV Plants10

|

2026/2027

|

2025/2026

|

2024/2025

|

2023/2024

|

|

PJM RTO

|

329.17

|

269.92

|

28.92

|

34.13

|

|

|

PJM COMED

|

Three Rivers

|

329.17

|

269.92

|

28.92

|

34.13

|

|

PJM MAAC

|

Fairview, Maryland, Maple Hill

|

329.17

|

269.92

|

49.49

|

49.49

|

|

PJM EMAAC

|

Shore

|

329.17

|

269.92

|

54.95

|

49.49

|

Source: PJM

10 The Three Rivers power plant, which commenced commercial operation in July 2023, is entitled to

capacity payments, from this date.

21

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| M. |

Capacity revenues (Cont.)

|

Results of capacity auctions in the PJM market for the period from June 2025 through May 2027

In July 2024, PJM published the results of auctions on capacity prices for the period from June 2025 through May 2026.

The significant increase in the capacity tariff in the auction, as shown in the above table, relates to, among other things, the

forecast of an increase in demand, an increase in the reserves required and a decline in the total supply as a result of requirements and a change in the manner of calculating capacities and load capability of the generation sources by PJM. The

change in the manner of calculating availability capacities of the power plants caused a decrease in the availability capacity that is provided for sale in most of the power plants operating in the PJM market. The impact of the said change on the

natural‑gas power plants, including those of the CPV Group operating in the energy transition area, is a decline in the availability capacity provided for sale from about 96% to about 79%.

In the estimation of the CPV Group, as a result of the increase in the capacity tariff, the addition to its revenues from

capacity from all its power plants, as at the approval date of the report, in the PJM market for the period from June 2025 through May 2026 compared with the period from June 2024 through May 2025 is estimated at about $98 million11.

In September 2024, complaints were filed with the FERC in order to make certain changes in the upcoming capacity auctions in the

PJM market. In response, PJM proposed a postponement of the auction that was originally scheduled for December 2024 by about six months in order to permit the making of changes to the rules of the auctions.

In February 2025, the FERC approved proposals of PJM for changes in the framework of the capacity market, which are aimed at

reducing the pricing fluctuations between the auctions. The amendments include: (A) continued use of gas turbines as a representative index for the demand curve; (B) inclusion of RMR (reliability must run) units – the planned sources for scrap remain

for purposes of assurance of reliability in the auctions in the capacity market as an alternative source of supply; (C) determination of a uniform penalty rate for inferior performances for all the generation sources; (D) increase of the flexibility

regarding submission of bids; and (E) cancellation of the automatic exemptions from the bid requirement for certain types of sources.

In April 2025, FERC approved determination of maximum and minimum price ceilings (collar) of $329 per MW/day and $177 per

MW/day, respectively, for the next two capacity auctions, subject to minor adjustments.

| 11 |

That stated in this Section regarding the estimation of the CPV Group constitutes “forward‑looking” information as it is defined in the Securities Law, with respect to which there

is no certainty it will materialize. Ultimately, the revenues of the CPV Group from availability could be different (even significantly) as a result of, among other things, regulatory changes (including appeal or other processes in the PJM

market or relating to other authorities), operating factors, changes in the business environment and/or existence of one or more of the risk factors the CPV Group is exposed to.

|

22

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| M. |

Capacity revenues (Cont.)

|

Results of capacity auctions in the PJM market for the period from June 2025 through May 2027

(Cont.)

In July 2025, PJM published the results of capacity price offers for the period June 2026 and up to May 2027 where the price was

determined based on the maximum price of $329.17 per MW/day, which reflects an increase of about 22% compared with the capacity price in the prior auction for the 2025/2026 period. According to PJM’s publications, the theoretical price derived from

the results of the tender, with no maximum ceiling, which as stated was set in the tender, would have been $388.57 per megawatt/day. In addition, the capacity coefficient for the power plants was updated, resulting in a reduction in the available

capacity provided for sale by the CPV Group’s natural gas-fired power plants – from approximately 79% to around 74%.

In the estimation of the CPV Group, as a result of the increase in the capacity tariff, the addition to its

capacity revenues from all the power plants it holds as at the approval date of the report in the PJM market for the period from June 2026 and up to May 2027, compared with the period from June 2025 up to May 2026, is estimated at about $18 million.

Subject to additional changes in timetables, if any, as at the approval date of the report, the next capacity auction of PJM for

the 2027/2028 capacity year is planned for December 2025.

NYISO market

Similar to the PJM market, in the NYISO market capacity payments are made in the framework of a central mechanism for

acquisition of capacity. In the NYISO market, there are a number of submarkets, wherein there could be various capacity demands as a function of local supply and demand and transmission capability. NYISO makes seasonal auctions every spring for the

upcoming summer (the months of May through October) and in the fall for the upcoming winter (the months of November through April). In addition, there are supplemental monthly auctions for the balance of the capacity not sold in the seasonal

auctions. The power plants are permitted to assure the capacity tariffs in the seasonal auction, the monthly auction or through bilateral sales.

Set forth below are the capacity prices determined in the seasonal auctions in the NYISO market (the prices are denominated in

dollars per megawatt per day):

|

Sub-Area

|

CPV

Plants

|

Summer

2025

|

Winter 2024/2025

|

Summer

2024

|

|

NYISO

Rest of the Market

|

–

|

153.26

|

66.30

|

168.91

|

|

Lower Hudson Valley

|

Valley

|

153.26

|

66.30

|

168.91

|

Source: NYISO – the Company’s processing in order to convert from dollars for kilowatt per month to dollars for megawatt per

day.

It is noted that the Valley power plant is located in Area G (Lower Hudson Valley) and the actual capacity prices for the Valley

power plants are impacted by the seasonal auctions, the monthly auctions and the SPOT prices, with variable capacity prices every month, as well as bilateral agreements with energy suppliers in the market.

23

OPC Energy Ltd.

Report of the Board of Directors

| 3. |

Main Developments in the Business Environment (Cont.)

|

| 3.3 |

Activities in the U.S. (Cont.)

|

| M. |

Capacity revenues (Cont.)

|

ISO‑NE market