Shareholder Report

|

6 Months Ended |

|

Jun. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

BNY Mellon Investment Portfolios

|

|

| Entity Central Index Key |

0001056707

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jun. 30, 2025

|

|

| C000007614 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Technology Growth Portfolio

|

|

| Class Name |

Initial Shares

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about BNY Mellon Investment Portfolios, Technology Growth Portfolio (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.bny.com/investments/us/en/intermediary/products/variable-products.html#funds-table-tabs1. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

|

|

| Additional Information Phone Number |

1-800-373-9387

|

|

| Additional Information Email |

info@bny.com

|

|

| Additional Information Website |

www.bny.com/investments/us/en/intermediary/products/variable-products.html#funds-table-tabs1

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months ? (based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Initial Shares |

$43 |

0.81%* |

|

|

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.81%

|

[1] |

| Net Assets |

$ 164,000,000

|

|

| Holdings Count | Holding |

37

|

|

| Investment Company Portfolio Turnover |

13.89%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (AS OF 6/30/25 )

Fund Size (Millions) |

Number of Holdings |

Portfolio Turnover |

| $164 |

37 |

13.89% |

| Not FDIC Insured. Not Bank-Guaranteed. May Lose Value |

|

|

| Holdings [Text Block] |

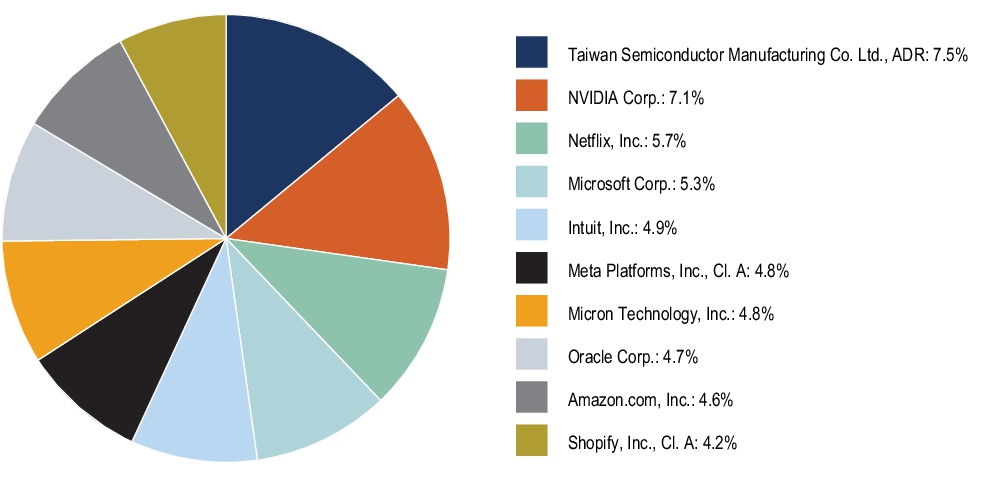

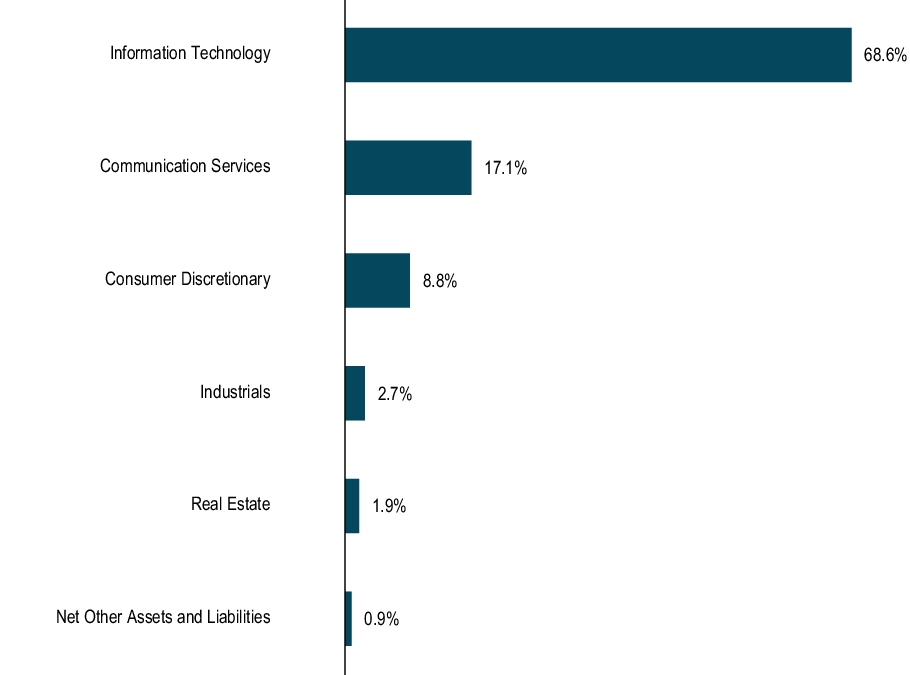

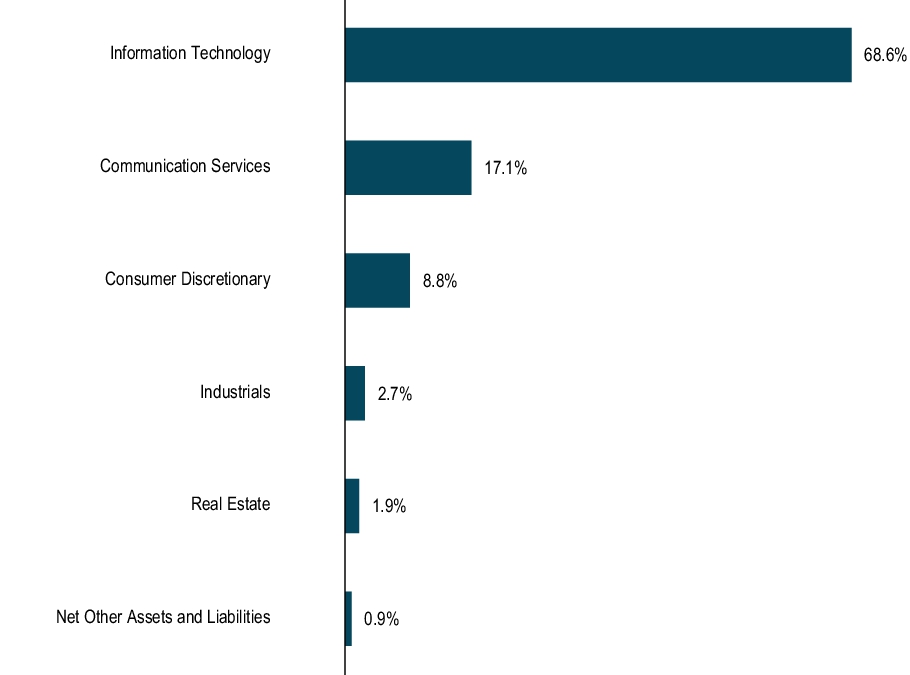

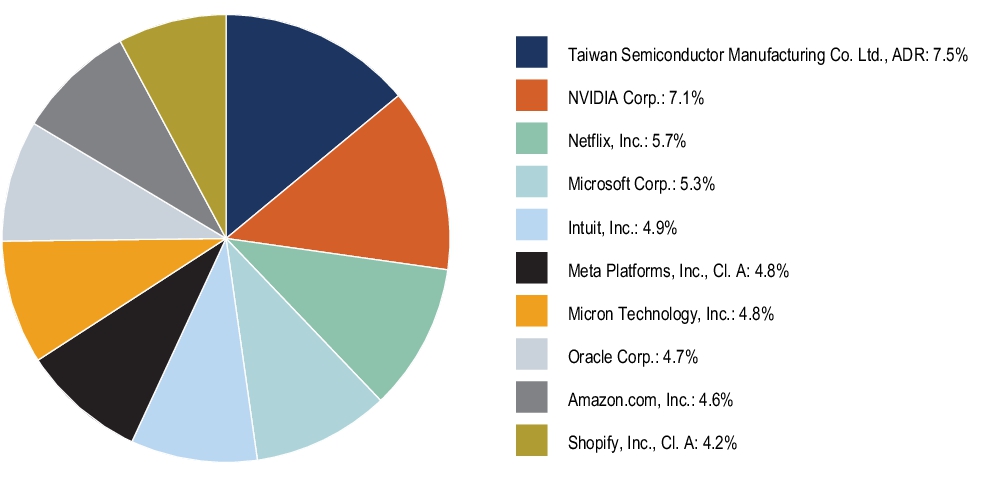

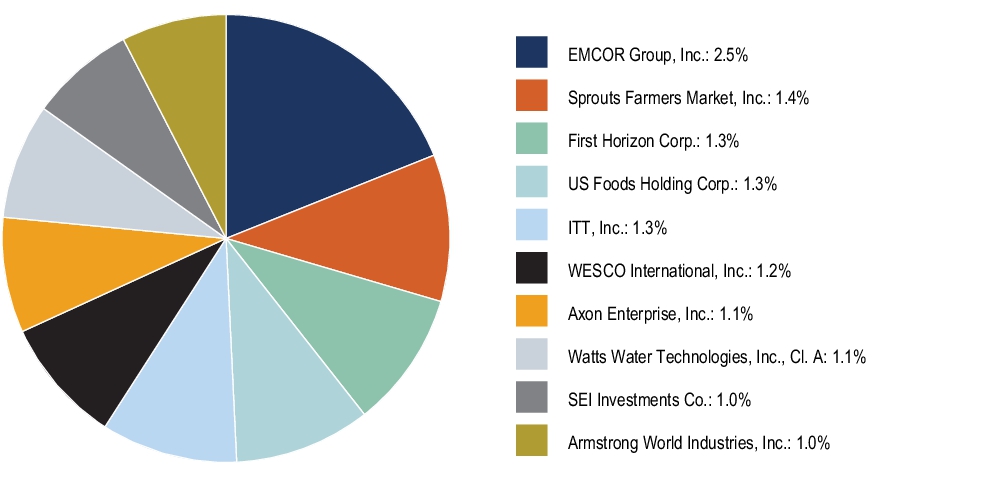

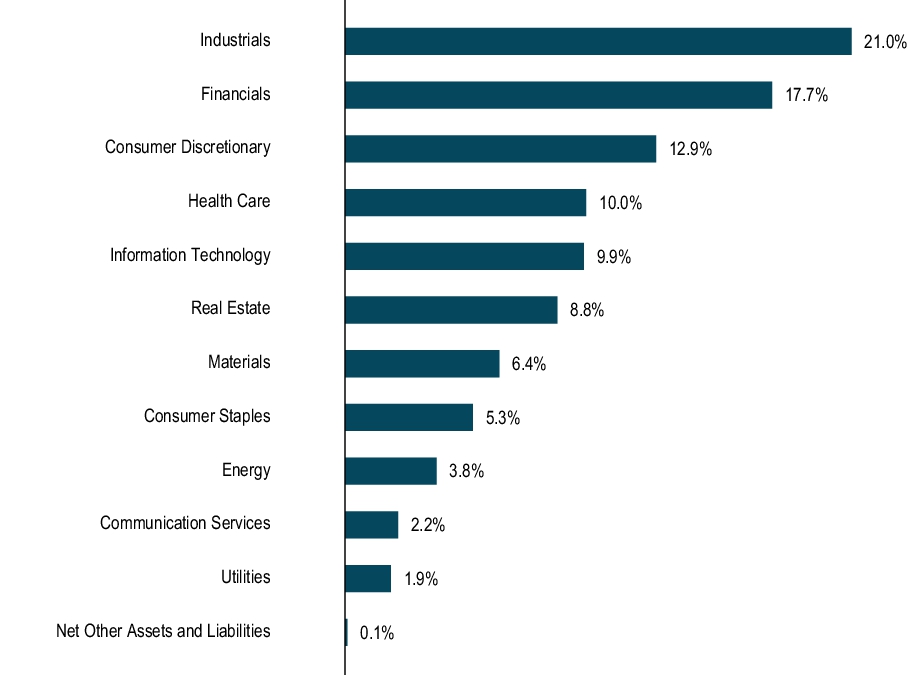

Portfolio Holdings (as of 6/30/25 ) Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any. Sector Allocation (Based on Net Assets)

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

|

|

| C000007615 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Technology Growth Portfolio

|

|

| Class Name |

Service Shares

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about BNY Mellon Investment Portfolios, Technology Growth Portfolio (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.bny.com/investments/us/en/intermediary/products/variable-products.html#funds-table-tabs1. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

|

|

| Additional Information Phone Number |

1-800-373-9387

|

|

| Additional Information Email |

info@bny.com

|

|

| Additional Information Website |

www.bny.com/investments/us/en/intermediary/products/variable-products.html#funds-table-tabs1

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months ? (based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Service Shares |

$56 |

1.06%* |

|

|

| Expenses Paid, Amount |

$ 56

|

|

| Expense Ratio, Percent |

1.06%

|

[2] |

| Net Assets |

$ 164,000,000

|

|

| Holdings Count | Holding |

37

|

|

| Investment Company Portfolio Turnover |

13.89%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (AS OF 6/30/25 )

Fund Size (Millions) |

Number of Holdings |

Portfolio Turnover |

| $164 |

37 |

13.89% |

| Not FDIC Insured. Not Bank-Guaranteed. May Lose Value |

|

|

| Holdings [Text Block] |

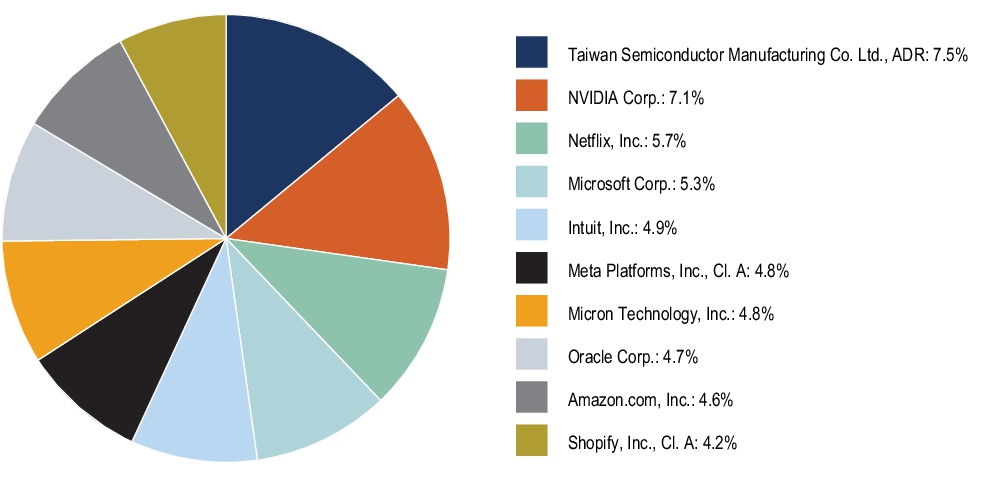

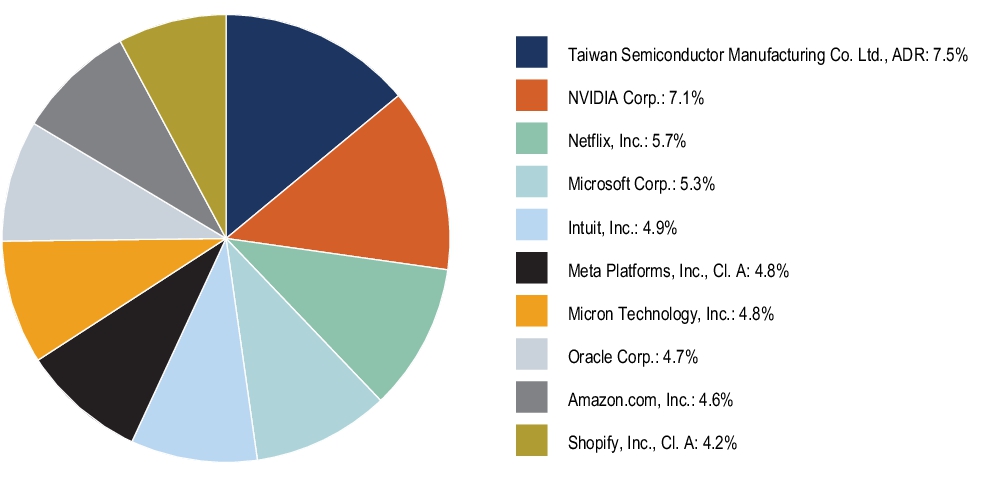

Portfolio Holdings (as of 6/30/25 ) Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any. Sector Allocation (Based on Net Assets)

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

|

|

| C000007611 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MidCap Stock Portfolio

|

|

| Class Name |

Initial Shares

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about BNY Mellon Investment Portfolios, MidCap Stock Portfolio (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.bny.com/investments/us/en/intermediary/products/variable-products.html#funds-table-tabs1. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

|

|

| Additional Information Phone Number |

1-800-373-9387

|

|

| Additional Information Email |

info@bny.com

|

|

| Additional Information Website |

www.bny.com/investments/us/en/intermediary/products/variable-products.html#funds-table-tabs1

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months ? (based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Initial Shares* |

$40 |

0.80%** |

| * |

During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

| ** |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 40

|

[3] |

| Expense Ratio, Percent |

0.80%

|

[3],[4] |

| Net Assets |

$ 154,000,000

|

|

| Holdings Count | Holding |

257

|

|

| Investment Company Portfolio Turnover |

29.98%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (AS OF 6/30/25 )

Fund Size (Millions) |

Number of Holdings |

Portfolio Turnover |

| $154 |

257 |

29.98% |

| Not FDIC Insured. Not Bank-Guaranteed. May Lose Value |

|

|

| Holdings [Text Block] |

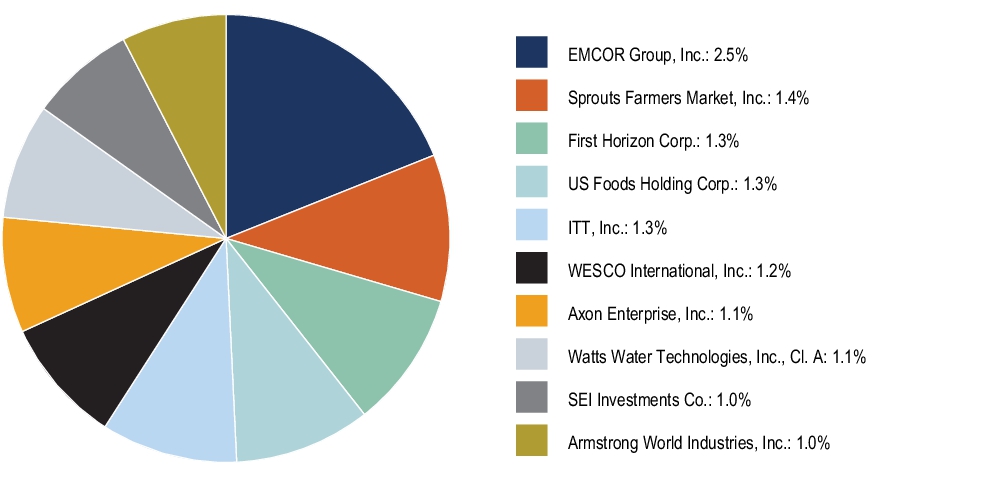

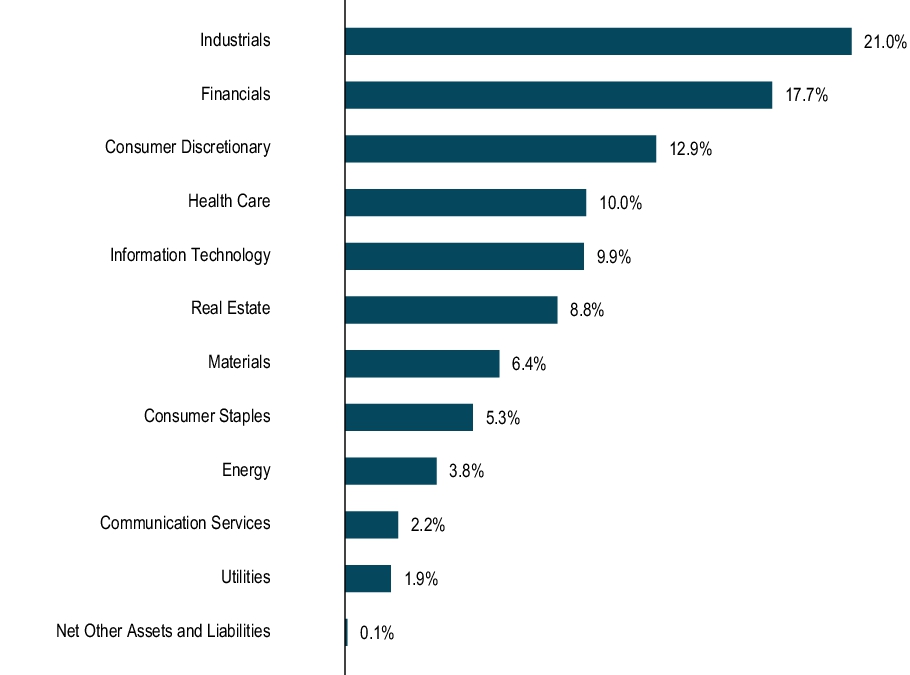

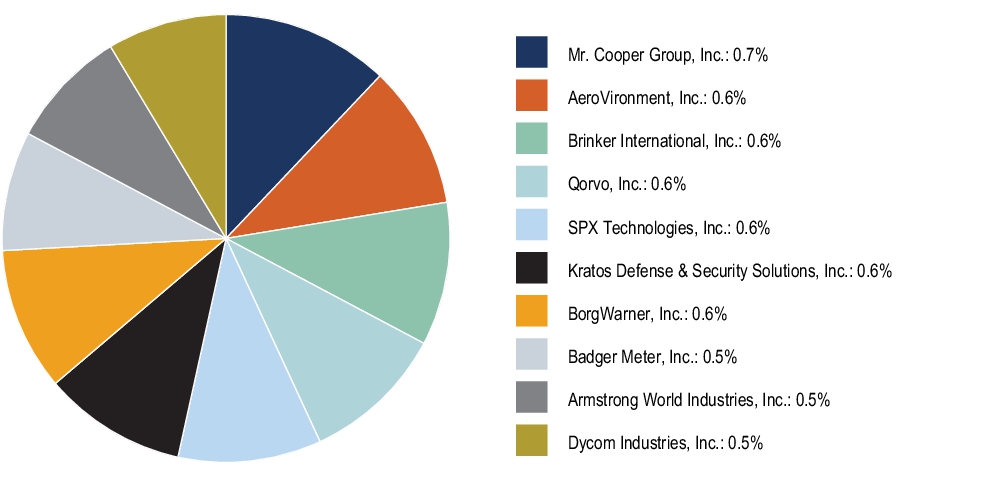

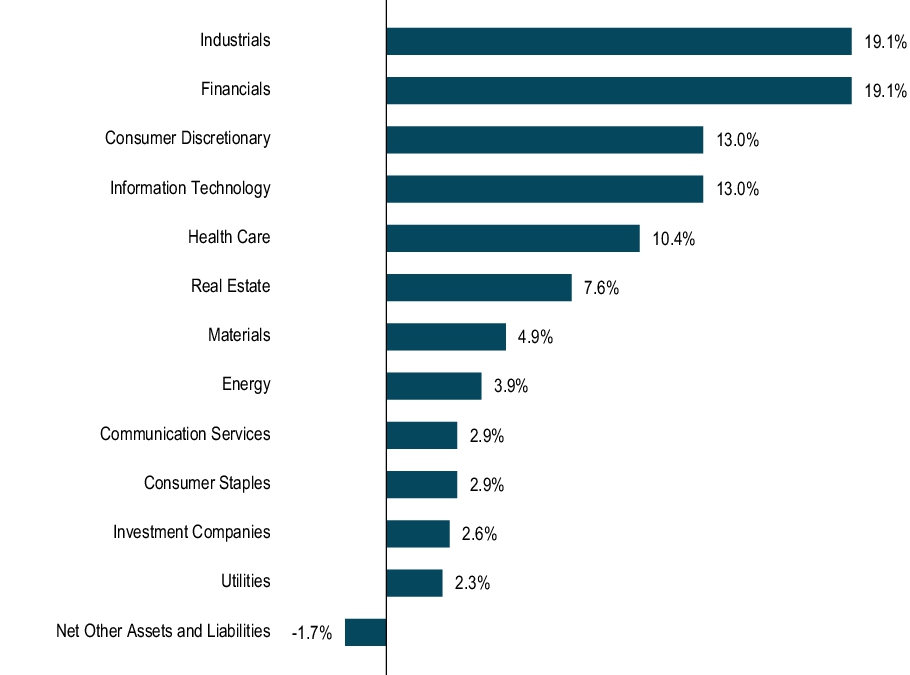

Portfolio Holdings (as of 6/30/25 ) Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any. Sector Allocation (Based on Net Assets)

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

|

|

| C000007612 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

MidCap Stock Portfolio

|

|

| Class Name |

Service Shares

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about BNY Mellon Investment Portfolios, MidCap Stock Portfolio (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.bny.com/investments/us/en/intermediary/products/variable-products.html#funds-table-tabs1. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

|

|

| Additional Information Phone Number |

1-800-373-9387

|

|

| Additional Information Email |

info@bny.com

|

|

| Additional Information Website |

www.bny.com/investments/us/en/intermediary/products/variable-products.html#funds-table-tabs1

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months ? (based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Service Shares* |

$53 |

1.05%** |

| * |

During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

| ** |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 53

|

[5] |

| Expense Ratio, Percent |

1.05%

|

[5],[6] |

| Net Assets |

$ 154,000,000

|

|

| Holdings Count | Holding |

257

|

|

| Investment Company Portfolio Turnover |

29.98%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (AS OF 6/30/25 )

Fund Size (Millions) |

Number of Holdings |

Portfolio Turnover |

| $154 |

257 |

29.98% |

| Not FDIC Insured. Not Bank-Guaranteed. May Lose Value |

|

|

| Holdings [Text Block] |

Portfolio Holdings (as of 6/30/25 ) Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any. Sector Allocation (Based on Net Assets)

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

|

|

| C000007613 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Small Cap Stock Index Portfolio

|

|

| Class Name |

Service Shares

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about BNY Mellon Investment Portfolios, Small Cap Stock Index Portfolio (the “Fund”) for the period of January 1, 2025 to June 30, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.bny.com/investments/us/en/intermediary/products/variable-products.html#funds-table-tabs1. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

|

|

| Additional Information Phone Number |

1-800-373-9387

|

|

| Additional Information Email |

info@bny.com

|

|

| Additional Information Website |

www.bny.com/investments/us/en/intermediary/products/variable-products.html#funds-table-tabs1

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months ? (based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Service Shares* |

$30 |

0.61%** |

| * |

During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. |

| ** |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 30

|

[7] |

| Expense Ratio, Percent |

0.61%

|

[7],[8] |

| Net Assets |

$ 517,000,000

|

|

| Holdings Count | Holding |

608

|

|

| Investment Company Portfolio Turnover |

33.03%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (AS OF 6/30/25 )

Fund Size (Millions) |

Number of Holdings |

Portfolio Turnover |

| $517 |

608 |

33.03% |

| Not FDIC Insured. Not Bank-Guaranteed. May Lose Value |

|

|

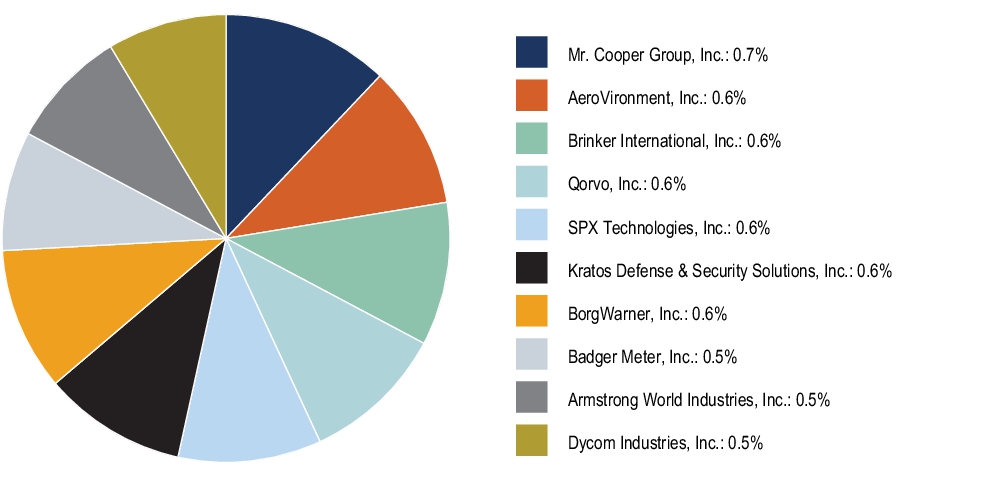

| Holdings [Text Block] |

Portfolio Holdings (as of 6/30/25 ) Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any. Sector Allocation (Based on Net Assets)

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

|

|

|

|