|

|

| DOLLY VARDEN SILVER CORPORATION Management's Discussion and Analysis June 30, 2025 |

|

|

| DOLLY VARDEN SILVER CORPORATION Management's Discussion and Analysis June 30, 2025 |

This Management Discussion and Analysis ("MD&A") of Dolly Varden Silver Corporation (the "Company" or "Dolly Varden") is for the six months ended June 30, 2025, and is prepared by management using information available as of August 13, 2025. This MD&A should be read in conjunction with the condensed consolidated interim financial statements of the Company as at June 30, 2025 and for the six months then ended and the audited consolidated financial statements of the Company as at December 31, 2024 and for the year then ended, and the notes thereto, prepared in accordance with IFRS Accounting Standards ("IFRS"), as issued by the International Accounting Standards Board. This MD&A complements and supplements, but does not form part of, the Company's condensed consolidated interim financial statements.

This MD&A contains forward-looking statements. Statements regarding the adequacy of cash resources to carry out the Company's exploration programs or the need for future financing are forward-looking statements. All forward-looking statements, including those not specifically identified herein, are made subject to cautionary language on page 24 in addition to the cautionary notes for US Investors concerning resource estimates on page 24. Readers are advised to refer to the cautionary language when reading any forward-looking statements.

This MD&A is prepared in conformity with National Instrument ("NI") 51-102F1 Continuous Disclosure Obligations. All dollar amounts referred to in this MD&A are expressed in Canadian dollars, except where indicated otherwise.

CORPORATE OVERVIEW

Dolly Varden Silver Corporation was incorporated under the Business Corporations Act (British Columbia) (the "BCBCA") in the province of British Columbia (or "BC") on March 4, 2011. The Company's primary business is the acquisition and exploration of mineral properties in Canada. The Company's common shares are listed for trading on the TSX Venture Exchange ("TSXV") under the symbol "DV", on the NYSE American LLC ("NYSE-A") under the trading symbol "DVS" and on the Frankfurt Exchange under the trading symbol "DVQ". The Company's head office is located at Suite 3123, 595 Burrard Street, Vancouver, British Columbia, Canada, V7X 1J1. The registered address and records office of the Company is located at Suite 1700 Park Place, 666 Burrard Street, Vancouver, British Columbia, Canada, V6C 2X8.

Dolly Varden is a mineral exploration company focused on exploration advancing its 100% owned Kitsault Valley project (or "KV Project"), which includes the Dolly Varden property (or "DV Property") and the Homestake Ridge property located in the Golden Triangle of British Columbia, Canada, 25 kilometres ("km") by road to tide water. The 163-square km KV Project hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge along with the past-producing Dolly Varden and Torbrit silver mines. The KV Project is prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other on-trend, high-grade deposits, such as Eskay Creek and Brucejack.

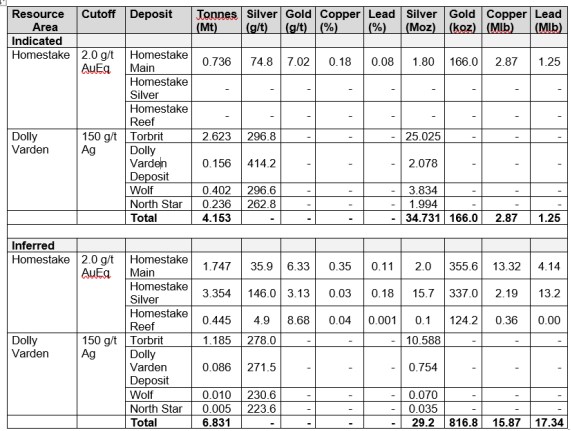

The Company presently has one NI 43-101 Standards of Disclosure for Mineral Projects report, which was signed on March 23, 2023, with an effective date of September 28, 2022, and combines the DV Property and the Homestake Ridge property. The KV Project hosts the silver and gold resources of Dolly Varden and Homestake Ridge with combined resources of 34,731,000 ounces of silver and 165,993 ounces of gold in the Indicated category and 29,277,000 ounces of silver and 816,719 ounces of gold in the Inferred category.

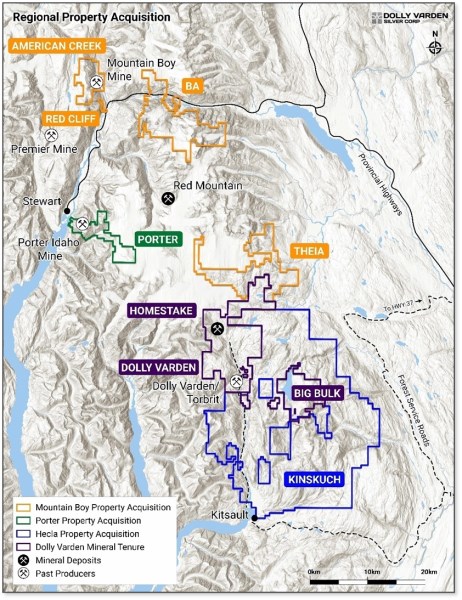

In addition to the KV Project, Dolly Varden has consolidated a land package of six other properties in the same region as the KV Project. These six properties have historically been explored for gold, copper, silver, lead and zinc. Including the KV Project and the recent acquisitions. The Company now holds a combined area of 100,000 hectares within the region.

The Company currently has no producing mines and consequently no revenue or cash flow from operations. The recovery of the amounts comprising exploration and evaluation assets are dependent upon: (1) the ability of the Company to obtain necessary financing to successfully complete the exploration and development of those resources; (2) the confirmation of economically recoverable reserves; and (3) future profitable production or on selling the project. It is the intention of the Company to obtain financing through access to public equity markets, debt and partnerships or joint ventures as sources of funding for its exploration expenditures and to meet ongoing working capital requirements.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

OPERATIONS AND OVERALL PERFORMANCE

Outlook

The 2025 Kitsault Valley Project exploration program is underway and more than half of the drilling complete. The plan includes approximately 55,000 metres of exploration drilling. This work is focused on resource expansion and upgrading at the Wolf Vein and Homestake Silver deposits, as well as follow-up drilling on priority exploration targets at Moose, Red Point, and the mid-valley silver trend. In addition, the Company plans to drill-test the Big Bulk copper-gold porphyry system in 2025. Advanced metallurgical studies and environmental baseline programs are also in progress.

During the second quarter of 2025, the Company acquired the Kinskuch Property, Porter Property, and MTB Projects (all as defined and discussed below) which have significantly expanded the Company's exploration property pipeline heading into 2026. Dolly Varden Silver continues to evaluate additional regional consolidation opportunities aimed at de-risking the portfolio, expanding resources, and making new high-grade silver and gold discoveries.

Note: American Creek, Red Cliff, BA, Theia, Porter and Kinskuch

were acquired in May 2025 and June 2025 in three separate transactions

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Highlights - General

• On June 26, 2025, the Company closed a bought deal financing for aggregate gross proceeds to the Company of $28,755,500 through two offerings. Issued under a prospectus-exempt basis pursuant to the 'listed issuer financing exemption' (the "LIFE Offering"), the Company sold 2,445,500 common shares of the Company at a price of $4.60 per common share for gross proceeds of $ 11,249,300 and also sold 1,128,000 flow-through ("FT") common shares at a price of $6.65 per FT common share for gross proceeds of $7,501,200. Under an additional Private Placement Offering, the Company sold 1,740,000 FT common shares of the Company at a price of $5.75 per FT common share for gross proceeds of $10,005,000. In connection with the closing of the two financings, a finders' fee of $1,437,775 was paid representing 5.0% of the gross proceeds.

• On June 26, 2025, the Company acquired an interest in four properties in British Columbia totalling over 20,000 hectares (collectively, the "MTB Group") from MTB Metals Corp. by issuance of 486,072 common shares of the Company valued at $2,245,653 plus the assumption of an outstanding property payment obligations of $50,000. The Properties include the American Creek Property (consisting of Mountain Boy Property, Silver Crown Property, and Dorothy Property), the Theia Property, the BA Property, and the Red Cliff Property.

• On May 23, 2025, the Company acquired StrikePoint's interest in the Porter Project, located in the Golden Triangle, British Columbia, which has 15 contiguous claims and 46 Crown grants, encompassing an area of approximately 3,192 hectares. The property was acquired for consideration of $1,105,914, which was satisfied by the issuance of 295,699 common shares.

• On May 23, 2025, the Company acquired 100% of Hecla Mining Company's ("Hecla") Kinskuch property in northwest BC's Golden Triangle for consideration of $5,178,018, which was satisfied by Dolly Varden issuing 1,351,963 common shares.

• On April 15, 2025, the Company announced that it received approval to be listed on the NYSE-A and, on April 21, 2025, the common shares began trading on the NYSE-A under the symbol "DVS".

• In April 2025, the Company hired a market maker to support trading and LFG Equities to support general market awareness of the Company.

• Effective April 7, 2025, the Company implemented a 4:1 consolidation of its common shares (the "Consolidation").. The Consolidation acted to reduce the number of issued and outstanding common shares from 318,077,469 on a pre-Consolidation basis to 79,519,464 on a post-Consolidation basis. All share figures and per share figures in this MD&A have been retroactively adjusted to reflect the Consolidation.

• On February 28, 2025, the Company granted 548,500 stock options (2,194,000 pre-consolidation) exercisable at $4.00 ($1.00 pre-consolidation) and 237,244 (949,000 pre-consolidation) restricted share units ("RSUs").

Highlights - Exploration Results

Following is a summary of highlights related to the 2024 exploration program, announced during this fiscal year:

On February 3, 2025, Dolly Varden announced drill results from its 2024 program at the Homestake Silver deposit and exploration drilling at the Homestake Ridge Property in BC's Golden Triangle. Highlights from the Homestake Silver Deposit Area included1:

HR24-431 - step out to north: 21.55 g/t Au and 27 g/t Ag over 8.72 metres, including 47.92 g/t Au and 58 g/t Ag over 3.74 metres and including 91.1 g/t Au and 114 g/t Ag over 0.51 metres.

HR24-433 - step out on new eastern lens: 35.05 g/t Au and 114 g/t Ag over 2.32 metres, including 74.7 g/t Au and 297 g/t Ag over 0.72 metres within 29.50 metres of 3.48 g/t Au and 13 g/t Ag.

HR24-437 - south end infill: 5.54 g/t Au and 97 g/t Ag over 10.20 metres, including 21.34 g/t Au and 384 g/t Ag over 2.40 metres, including 42.10 g/t Au and 1,135 g/t Ag over 0.77 metres.

HR24-438 - south end infill: 4.48 g/t Au and 16 g/t Ag over 14.33 metres, including 29.17 g/t Au and 59 g/t Ag over 1.62 metres.

HR24-439 - step out 170 metre down dip: 1.56 g/t Au and 5 g/t Ag over 28.9 metres, including 9.55 g/t Au and 32 g/t Ag over 0.50 metres and 12.15 g/t Au and 14 g/t Ag over 1.00 metre.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

(1intervals shown are core length; estimated true widths vary depending on intersection angles and range from 55% to 75% of core lengths, further modelling of the new interpretation is needed before true widths can be calculated; Assay results reported are uncapped)

On January 7, 2025, Dolly Varden announced infill, step-out and resource expansion drilling results from the Wolf Vein at the KV Property. Drill hole DV24-421 is a significant 120-meter step-out down the plunge of the high-grade silver zone and intersected 379 grams per tonne ("g/t") Ag, 0.64% Pb and 0.66% Zn over 21.69 metres. Highlights included2:

DV24-421 - 120-meter step-out: 379g/t Ag, 0.64% Pb and 0.66% Zn over 21.69 metres, including 1,804 g/t Ag, 4.36% Pb and 3.10% Zn over 1.67 metres.

DV24-406 - infill: 465 g/t Ag, 0.49% Pb and 0.22% Zn over 7.67 metres, including 1,416 g/t Ag, 1.56% Pb and 0.51% Zn with 0.24 g/t Au over 1.00 metres.

DV24-413 - lower extension: 374g/t Ag, 0.54% Pb and 0.82% Zn over 9.70 metres, including 975 g/t Ag, 0.36% Pb and 2.28% Zn over 2.30 metres. Individual Pb/Zn veins in the footwall to the main Wolf Vein graded 130 g/t Ag, 2.48% Pb, 14.65% Zn over a length of 2.07 metres.

DV24-415 - upper extension: 357 g/t Ag, 0.52% Pb and 0.41% Zn over 9.17 metres, including 2,034 g/t Ag, 3.47% Pb and 0.18% Zn over 1.15 metres.

(2intervals shown are core length. Estimated true widths vary depending on intersection angles and range from 55% to 70% of core lengths, further modelling of the new intersections is needed before true widths can be estimated)

Quality Assurance and Quality Control

The Company adheres to Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Best Practices Guidelines for exploration related activities conducted on all of its properties. Quality Assurance and Quality Control ("QA/QC") procedures are overseen by the qualified person ("QP").

Dolly Varden QA/QC protocols are maintained through the insertion of certified reference material (standards), blanks and field duplicates within the sample stream. Drill core is cut in-half with a diamond saw, with one-half placed in sealed bags and shipped to the laboratory and the other half retained on site. Third party laboratory checks on 5% of the samples are carried out as well. Chain of custody is maintained from the drill to the submittal into the laboratory preparation facility.

Analytical testing was performed by ALS Canada Ltd. in North Vancouver, British Columbia. The entire sample is crushed to 70% minus 2 mm (10 mesh), of which a 500-gram split is pulverized to minus 200 mesh. Multi-element analyses were determined by inductively coupled plasma mass spectrometry (ICP-MS) for 48 elements following a 4-acid digestion process. High-grade silver testing was determined by fire assay with either an atomic absorption or a gravimetric finish, depending on grade range. Au is also determined by fire assay on a 30-gram split with either atomic absorption or gravimetric finish, depending on grade range. Metallic screen assays may be completed on very high-grade samples.

Mineral Properties: KV Project

The KV Project contains the DV Property with silver resources, the Homestake Ridge property with gold, silver, copper and lead resources, and the Big Bulk property, a copper-gold porphyry system. Together the consolidated KV Project creates one large, high-grade precious metals project comprising 16,300 hectares, which is 100% held by Dolly Varden. This provides the Company with economies of scale and exploration upside potential in the silver and gold rich Dolly Varden mining camp, north of Alice Arm, BC, within the regionally important and prolific Stewart Complex in northwestern BC.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Dolly Varden Property

The Dolly Varden property encompasses several historic underground workings, including historic production stopes from the Dolly Varden and Torbrit mines, exploration adits at North Star and Wolf, as well as several other showings and many mineralized prospects. The silver-rich deposits found on the Dolly Varden property are hosted in Jurassic-aged volcanic and sedimentary rocks (Iskut River Formation) of the Hazelton Group. They display textural and mineralogical similarity to mineralization found in the region in subaqueous, gold- and silver-rich, hot spring-type volcanogenic massive sulfide (VMS) and epithermal style deposits, such as the Eskay Creek and Brucejack deposits, respectively. The nearby Big Bulk property hosts porphyry copper-gold style mineralization.

Since acquiring the Dolly Varden property in 2011, fieldwork was dedicated to confirming and expanding the known mineralization near the historic deposits to upgrade into a compliant and current mineral resource estimate ("Current Mineral Resource Estimate") for the Wolf, Dolly Varden, Torbrit and North Star deposits. The Company's work consisted of surface and underground mapping, underground rehabilitation, detailed sampling, data compilation from reliable historic records and over 17,000 metres of core drilling. This data was used to complete an initial mineral resource estimate in 2015.

During the year ended December 31, 2011, the Company purchased the Dolly Varden property, consisting of fee simple titles, mineral claims and mineral tenures in respect of certain lands located in the Kitsault area of BC. The Dolly Varden property is subject to a 2% net smelter return royalty ("NSR") of which one-half (or 1%) of the NSR can be repurchased by the Company for $2,750,000 at any time.

During the year ended December 31, 2020, the Company acquired surface rights and fee simple lands where the exploration camp, offices, logging and sampling facilities are situated. The parcel of land is located at waterfront for shoreline access, has current core storage areas and has related property water rights. The total property package had been previously leased annually by the Company from private owners. The transaction involved a payment of $153,000 in cash and issuance of 192,061 common shares of the Company with a value of $149,808 for a total cost of $302,808.

Homestake Ridge Property

On February 25, 2022, Dolly Varden acquired the Homestake Ridge property. The Homestake Ridge property consists of a 7,500-hectare project area hosting three known deposits that make up the Homestake Ridge portion of the Current Mineral Resource Estimate over the KV Project. Mineralization in the main deposits is interpreted to be structurally controlled epithermal veins and breccia systems within the prospective Jurassic Hazelton, the formation hosting the deposits in the Dolly Varden property area. In addition to epithermal style mineralization, Homestake Ridge also hosts strata bound volcanogenic style mineralization and intrusion related alteration and stock work veining.

Gold mineralization was first discovered at the Homestake Ridge project over 100 years ago with several exploration adits and trenches exposing vein and breccia style mineralization at surface. Mineralization was of significant grade and thickness that the property has been the subject of numerous exploration programs since the 1920s, including prospecting, mapping, soil sampling, exploration drilling and airborne geophysics that have advanced the project and defined the trend of structurally controlled mineralization within the northern continuation of the Jurassic Hazelton formation from the Dolly Varden project. The 15 km of prospective Hazelton formation on the combined Homestake Ridge and Dolly Varden properties has been the focus for historical exploration.

Since 2008, significant diamond drilling at Homestake Ridge has led to definition of a current NI 43-101-compliant mineral resource estimate that is summarized in the Homestake Ridge property section of the Company's current NI 43-101 technical report on the KV Project. The advanced stage project had a preliminary economic analysis completed on it in 2020. The exploration potential along the Homestake Ridge trend was tested with deeper historic drilling near the mineral resource and indicates the mineralization continues to depth and along strike. Recent analysis of historic airborne geophysics data from the Homestake Ridge project has defined exploration targets along trend of Homestake Ridge deposits to the south.

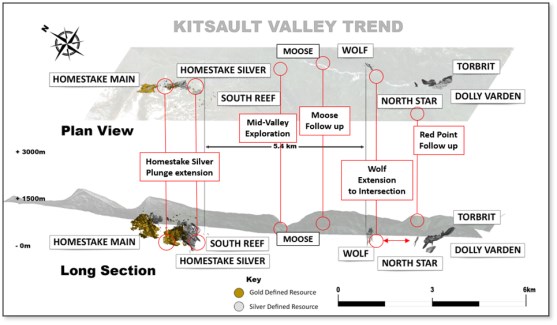

The 5.4 km distance between the deposits at Homestake Ridge and the deposits at Dolly Varden are, in the Company's opinion, prospective for further discovery of silver and gold mineralization, as the area is on a magnetic, stratigraphic and anomalous silver and gold geochemical trend within the Kitsault Valley. Geophysics interpretation has defined several target zones below a sediment cover to test along this trend in future exploration.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Mineral Resource Estimates of KV Project

The KV Project hosts the silver and gold resources of Dolly Varden and Homestake Ridge with combined resources of 34,731,000 ounces of silver and 165,993 ounces of gold in the Indicated category and 27,317,000 ounces of silver and 816,719 ounces of gold in the Inferred category.

Notes:

(1) Mineral resources are not mineral reserves, as they do not have demonstrated economic viability although, as per CIM requirements, the mineral resources reported above have been determined to have demonstrated reasonable prospects for eventual economic extraction.

(2) The mineral resources were estimated in accordance with the CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

(3) The resources reported above are derived from the Technical Report on The Combined Kitsault Valley Project, British Columbia, Canada dated effective September 28, 2022 and authored by Andrew J. Turner, B.Sc., P.Geol., of APEX Geoscience Ltd. The effective date of the report is September 28, 2022.

(4) The cut-off grade for the Homestake claim block mineral resources is 2.0 g/t AuEq, which was determined using average block grade values within the estimation domains and a Au price of $1,300 per troy ounce ("/tr oz"), a Ag price of US$20.00/tr oz and a Cu price of US$2.50/pound, and mill recoveries of 92% for Au, 88% from Ag and 87.5% for Cu, and combined mining, milling, and general and administrative costs of approximately US$109/ton.

(5) The cut-off grade for the Dolly Varden claim block mineral resource is 150 g/t Ag, which was determined using a Ag price of US$20.00/tr oz, a recovery of 90% and combined mining, milling, and general and administrative costs of US$80/ton and was supported by comparison to similar projects.

(6) Sufficient sample density data existed to allow for estimation of block density within the estimation domains of the Homestake Main, Homestake Silver and Homestake Reef zones, which ranged from 2.69 metric ton per cubic metre ("t/m3") to 3.03 t/m3.

(7) Bulk density values ranging from 2.79 t/m3 to 3.10 t/m3 were assigned to individual estimation domains based on available SG measurements for the DV, TB, NS and WF deposits.

(8) Differences may occur in totals due to rounding.

Please refer to the Company's continuous disclosure documents available on SEDAR+ for more detailed technical information regarding the Technical Report on The Combined Kitsault Valley Project, British Columbia, Canada, which is subject to the qualification statements and notes set forth in the final report posted on www.sedarplus.ca.

Preliminary Metallurgical Testing

Results of the first phase of the preliminary metallurgical testing for the Dolly Varden property was released by the Company on May 8, 2019. A silver recovery of 86.9% was obtained from the Torbrit deposit and a silver recovery of 85.6% was obtained from the Dolly Varden deposit, both based on the kinematics curves from bottle roll cyanide leach tests over a period of 96 hours. The tests were performed on drill core composite samples from the Torbrit deposit with a head grade of 290 g/t Ag and the Dolly Varden deposit with a head grade 372 g/t Ag. Metallurgical testing was conducted in the laboratories of Blue Coast Research Ltd., in Parksville, BC. Results of the second phase of the preliminary metallurgical testing were released by the Company on June 20, 2019. Results from flotation metallurgical test work on separate concentrates for Ag-Pb and Zn yielded recoveries of 88% silver, 78% lead and 70% zinc from the Torbrit deposit. For more details concerning the metallurgical test work, please refer to the Company's disclosure documents.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Mineral Properties: Big Bulk Project

Big Bulk Project is located 5 km east of the KV Project and consists of a copper-gold porphyry system that is mapped by the BC Geological survey as being of Texas Creek Intrusive Suite age. It consists of 2,640 hectares in 7 mineral claims covering a copper-gold porphyry and skarn prospect on the southern shores of Kinskuch Lake, approximately 23 km northeast of the village of Kitsault.

The Company has compiled historic data that includes 2009 drilling by Anglo Gold Ashanti ("Anglo") and 2021 drilling by Libero Copper & Gold Corporation ("Libero"). Now that the entire porphyry and associated alteration and mineralization is under one ownership the entire system can be modelled as one to guide exploration in the coming years. Historical exploration was conducted by Teck Resources Limited and Canadian Empire Minerals, and more recent geological interpretations suggest a significant Cu-Au mineralized porphyry system. The area also shows potential for associated epithermal style gold mineralization.

The Hazelton Group in the Kitsault area is the southern limit of a continuous belt of the Stikine Terrane, which has been shown to host large alkalic gold-copper porphyry deposits, of which the Galore Creek, Red Mountain and KSM deposits are examples. The Big Bulk copper-gold porphyry is interpreted to fall into the same age and mineralization category.

On January 9, 2024, the Company issued 275,000 common shares to Libero, valued at $222,750, as consideration for the acquisition by Dolly Varden of an option agreement (the "Option Agreement") from Libero entitling Dolly Varden to earn-in a 100% undivided interest in the Big Bulk Property. In connection with this acquisition, the Company entered into an amended agreement with LCT Holdings Inc., the owner of the southern Big Bulk property and optionor under the Option Agreement. The amended Option Agreement provides that the Company may earn-in a 100% undivided interest in the Big Bulk Property with annual payments over four years ending December 31, 2027, totalling $1,450,000 over the period. The Company may elect to issue common shares instead of cash payments under certain conditions. Since acquisition, the Company also made $200,000 in cumulative property cash payments under the Option Agreement. The value of the property included in exploration and evaluation assets is $422,750.

Mineral Properties: Kinskuch

The Kinskuch Property is contiguous on the east and south of Dolly Varden's Kitsault Valley Project, and through the acquisition Dolly Varden will increase the mineral tenure holdings and triple the total strike length of favorable Jurassic age Hazelton-group volcanic rocks and associated "Red Line" by adding the Illiance trend to the Kitsault Valley trend. Both the Kitsault Valley and the Illiance trends are interpreted to be part of a district scale, sub-basin of the Eskay Rift period. The Illiance trend has seen little modern exploration work, limited to localized diamond drilling by Hecla on the three kilometer long, north-south trending Illy epithermal system.

Also included within the acquisition area is the past producing Esperanza Mine (1910), interpreted as quartz-carbonate veins with similar silver grades to the historic Dolly Varden Mine (1920) hosted in Upper Hazelton sedimentary rocks. The Esperanza Mine is located along the Kitsault Valley access road, two kilometers north of Dolly Varden's camp in Alice Arm, BC.

The southwestern portion of the acquired claims covers Hazelton Group rocks that trend to within seven kilometers of Goliath Resources Limited's recently discovered Surebet Zone gold mineralization.

The area within the Kinskuch Property that trends south of Big Bulk has the potential to host additional gold-copper porphyry systems along the south trend towards the Kitsault molybdenum porphyry deposit, which is being actively advanced by New Moly LLC.

Mineral Properties: Porter

The Porter Project has an upside exploration potential between two shear hosted silver-rich vein systems: the historic Silverado mine and past-producing Prosperity-Porter mines that are separated by a 2,350 meter long unexplored trend. Veins at both sites run at a similar orientation and it is hypothesized that the system may be continuous under the summit of Mount Rainey. The Prosperity Idaho vein system has seen past production, having been mined between 1929 and 1931, producing 27,123 tonnes of direct shipping ore with recovered grades of 2,542 g/t silver (73.8 oz/ton) and 1 g/t gold (yielding approximately 2.2 million ounces of silver). The ore was shipped to the port at Stewart, British Columbia via aerial tramway.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Mineral Properties: American Creek, Theia, BA, Red Cliff

The American Creek Property (3,381 hectares) is centered on the past producing Mountain Boy high-grade silver mine. The BC Government Minfile Report documents small and very high-grade silver production from the 1910s to the 1940s and 2000s, with reported silver grades in mined material ranging from 8,000 to 17,000 g/t silver. Historic exploration drilling previously reported by MTB Metals (see MTB Metals' news release dated March 5, 2019) reported DDH-MB-2006-10 that intersected 5.10 meters of 5,258 g/t silver and DDH-MB-2006-19 that intersected 6.1m of 2,260 g/t silver from vein zones. The system remains open to depth and along strike. The property consolidated a significant land package in the American Creek corridor including the Mountain Boy Property, Silver Crown Property and Dorothy Property. The American Creek Property is host to a variety of targets with several known mineral occurrences, all of which are under explored. The property is road accessible and 20 kilometers from the deep-water port of Stewart, 6 kilometers from the Premier mill and 7 kilometers from Highway 37A. Favorable host stratigraphy, including rocks from the Lower and Upper Hazelton Group host multiple silver, gold and copper occurrences on the property, a number of which are hosted within felsic volcanic rocks with a similar primitive geochemistry to the Eskay Creek mine host rocks.

The Theia Property (8,119 hectares) is an early stage, geologically strategic property that is contiguous with the northern boundary of the Kitsault Valley Project's Homestake Ridge Property. The addition will increase the tenure area around the Kitsault Valley to over 86,000 hectares and increase the strike length of prospective Hazelton Group rock to the north, where receding glaciers have exposed new areas along a mineralized trend. Early stage reconnaissance work by previous explorers has outlined an anomalous silver bearing trend 500 metres long.

The BA Property (10,165 hectares) hosts numerous mineralized showings. Historic drilling of 178 drill holes has outlined a substantial zone of silver-lead-zinc mineralization located 4 kilometers from highway 37A. Several targets with high-grade silver potential include volcanogenic massive sulphide (VMS) / epithermal hot spring deposit containing silver, lead and zinc, and remain to be drill tested. These occurrences are hosted in the same prospective Hazelton Group stratigraphy as on the Kitsault Valley Project. The BA Property is located 30 kilometers northeast of the town of Stewart, BC. Highway 37A passes through the northern portion of the BA Property.

The Red Cliff Property (246 hectares) consists of a number of smaller crown grants covering a past-producing gold and copper mine, of which MTB Metals held a 35% interest in pursuant to the Red Cliff JV Agreement. As described above, Dolly Varden assumed and stepped into MTB Metals' obligations under the Red Cliff JV Agreement as part of the acquisition of the Properties. Located within the American Creek corridor, the Red Cliff Property is approximately 1.0 kilometer south of the American Creek Property.

2025 Exploration Program

The on going drill program for the Kitsault Valley Project was expanded in June 2025, increasing from 35,000 metres to a planned 55,000 metres of diamond drilling building on the success of the 2024 exploration program. Drilling is focus on expanding high-grade mineralization at the Wolf Vein and Homestake Silver deposit and will follow up on promising results from numerous exploration targets, including Red Point and Moose. The program also includes deep drilling at the Big Bulk copper-gold porphyry target. Drilling commenced in mid-May with four rigs and increased to five rigs in July 2025. A combination of infill, step-out and new discovery potential exploration drilling is under way. Fieldwork includes detailed mapping in new areas where surface showings have been outlined in previous seasons.

Exploration targets on both the Homestake Ridge and Dolly Varden properties include targets within the 5.4-km-long area between the southern end of Homestake Silver and Wolf Vein, under the mid-valley sedimentary cap rocks. Additionally, geophysical targets west of the Homestake Main deposit will be tested, within parallel basin bounding structures similar to those hosting the Homestake Main and Homestake Silver deposits.

With the acquisition of the adjacent Kinskuch Project area from Hecla, an initial program of geological mapping and reconnaissance of the prospective Jurassic age Hazelton Group rocks of the under-explored 30-kilometre eastern Illiance trend and western Surbet (Goliath Resources Ltd.) hosting trend are also planned for the 2025 exploration season. Combined with the results of ongoing data compilation, this planned fieldwork may generate new priority drill targets that could be tested later in the 2025 season if timing and budget allow.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Targets for the 2025 Exploration program along Dolly Varden's Kitsault Valley Trend

At the Wolf Vein, drilling will target the extension of the southwesterly plunging, high grade silver corridor along strike and at depth, with the aim to further expand the zone. Directional drilling technology will again be employed to accurately intersect the steeply dipping vein with priority on aggressive step outs from the furthest west step out drill hole from 2024. The step out drilling planned for 2025 will target the intersection of the two main structures interpreted to be the source of Wolf silver mineralization.

Drilling at the Homestake Silver deposit will continue to define and expand the gold- and silver-rich plunge zone interpreted utilizing assay results and structural data from the previous season's drilling. The program will test the projected trend and the down dip extent of the structurally controlled system, which shows strong continuity and upside.

The Red Point target is on the west side of the Kitsault River trending northwest towards the Homestake Ridge deposits 6 kilometres northwest. Red Point is a known broad quartz sericite pyrite alteration zone with high grade gold values within stockwork zones. Reinterpreted downhole structural data highlights high grade structural corridors that will be tested during the 2025 season. Follow-up drilling planned for 2025 will test the extent of the new hypothesis based on drill hole DV24-400 that intersected 21.10 g/t Au over 0.50 m, within a broader zone averaging 0.79 g/t Au over 20.15 metres (from previous release: January 7, 2025) from an intense quartz sericite stockwork.

The Big Bulk area is a large, underexplored Cu-Au porphyry system where copper and gold mineralization in stockwork veining has been intersected by previous operators (Anglo in 2009 and Libero in 2021) along the margin of the associated alteration system. The 2025 program will include deep drilling to test the northeast trending mineralized system based on updated geological interpretation and mapping. The target is prospective for both copper-gold porphyry and skarn-style mineralization, analogous to nearby Red Mountain and KSM deposits.

The Company will also continue to advance metallurgical studies to include Wolf and Homestake Silver deposits characterization.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

REVIEW OF OPERATIONS AND FINANCIAL RESULTS

Results of Operations

For the three months ended June 30, 2025 and 2024

The total comprehensive loss for the three months ended June 30, 2025 was $9,285,139, as compared to $7,220,688 for the same period last year, with the increase of $2,064,451, or 29%, primarily attributed to increases in consulting, administration, marketing, professional fees, Part XII.6 tax, exploration and evaluation expenditures and a lower recovery from flow-through (or "FT") share premium, which was offset by an decrease in share based payment.

Exploration and evaluation expenditures for the three months ended June 30, 2025 were $7,543,387 (2024 - $6,640,091). Exploration and evaluation expenditures for the three months ended June 30, 2025 were $903,296 higher compared to the same period in 2024 due to an earlier start to camp mobilization, a larger planned program and a greater need for geological services, including modeling work.

The general and administrative expenses, which is the operating loss excluding exploration costs, amounted to $2,965,720 for the current year, as compared to $2,477,776 in the previous year. This increase of $487,944 was primarily attributed to an increase in consulting, marketing expenses, administration, professional fees and Part XII.6 tax as well as a lower recovery from FT share premium. The higher costs were offset by a decrease in share-based payments expense.

The estimated Part XII.6 tax is calculated and payable to the Canada Revenue Agency on the Company's flow-through expenditures renounced under the Look-back Rule in the prior year and unspent in the current year multiplied by the prescribed interest rate. The Company recorded Part XII.6 tax expenses of $157,759 compared to an expense recovery of $2,933 in the same period last year. This expense was offset in the same period by a recovery of flow-though share premium of $1,142,183 (2024- $1,630,300). Recovery of flow-through share premium is recognized in proportion to incurred eligible exploration expenditures.

For the six months ended June 30, 2025 and 2024

The total comprehensive loss for the six months ended June 30, 2025 was $11,628,923, as compared to $9,472,447 in the same period last year, with the increase of $2,156,476, or 23%, primarily attributed to increases in filing fees, administration, professional fees, Part XII.6 tax, exploration and evaluation expenditures and a lower recovery from flow-through (or "FT") share premium, which was offset by an decrease in share based payment and increase in interest income.

Exploration and evaluation expenditures for the six months ended June 30, 2025 were $8,230,080 (2024 - $7,276,286). Exploration and evaluation expenditures for the six months ended June 30, 2025 were $953,794 higher compared to the same period in 2024 due to an earlier start to camp mobilization, a larger planned program and a greater need for geological services, including modeling work.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

The general and administrative expenses, which is the operating loss excluding exploration costs, amounted to $4,809,355 for the current year, as compared to $4,239,942 in the previous year. This increase of $569,413 was primarily attributed to an increase in marketing expenses, filing fees, administration, professional fees and Part XII.6 tax as well as a lower recovery from FT share premium. The higher costs were offset by a decrease in share-based payments expense and higher interest revenue.

The estimated Part XII.6 tax is calculated and payable to the Canada Revenue Agency on the Company's flow-through expenditures renounced under the Look-back Rule in the prior year and unspent in the current year multiplied by the prescribed interest rate. The Company recorded Part XII.6 tax expenses of $286,530 compared to an expense recovery of $2,933 in the same period last year. This expense was offset by a recovery of flow-though share premium of $1,201,099 (2022- $1,630,300). Recovery of flow-through share premium is recognized in proportion to incurred eligible exploration expenditures.

Summary of Quarterly Results

The Company had an operating loss of $10.5 million in Q2/25 (Q2/24 - $9.1 million) $2.5 million in Q1/25 (Q1/24-$2.4 million), $2.9 million in Q4/24, (Q4/23 - $4.05 million), and $11.5 million in Q3/24 (Q3/23 -$16.1million). The first half of 2025 and 2024 quarterly spending trend was as expected and is comparable to prior years, where exploration activity is typically highest in the second and third quarters each year. The mobilization for the drilling program started in Q2/25 and Q2/24. The exploration program for 2025 is expected to be $27.5 million and completed by October 2025. General and administrative costs are expected to increase in 2025, as there was additional business development activity and more professional fees required as a result of the NYSE American uplisting in April 2025. Insurance costs, which are expensed as administration costs, are also expected to be continue to be higher from second quarter of 2025 onward.

The Company's drill program typically operates from May to October each year. As such, the exploration related expenses are historically highest during the fiscal quarter ending in September. The exploration costs were lower in 2024 relative to 2023, as the Company drilled 38%, or 19,801 less, metres in 2024 (31,726 metres) relative to 2023 (51,527 metres). The exploration program in 2025 will be larger than in the prior year as four to five drill rigs are in use for the 2025 drill program versus three drills utilized during 2024.

Fluctuations in exploration expenses materially impact the changes to operating losses in all periods, as exploration costs as a percentage of total expenses ranged from 27% to 92% over the last eight quarters. Exploration costs in millions, excluding the benefit of the British Columbia Mineral Exploration Tax Credit ("BC METC"), were: Q3/23 $14.8 million, Q4/23 $2.7 million, Q1/24 $0.8 million, Q2/24 $6.6 million, Q3/24 $9.2 million, Q4/24 $1.3 million, Q1/25 $0.7 million, and Q2/25 $7.5 million.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

The following table summarizes selected quarterly financial information derived from the Company's condensed consolidated interim financial statements for each of the eight most recently completed fiscal quarters:

| As at and for the quarter ended | June 30, 2025 (Q2/25) $ |

March 31, 2025 (Q1/25) $ |

December 31, 2024 (Q4/24) $ |

September 30, 2024 (Q3/24) $ |

||||||||

| Total assets | 134,427,324 | 104,502,073 | 106,253,494 | 110,812,810 | ||||||||

| Exploration and evaluation assets | 80,088,262 | 71,329,535 | 71,329,535 | 71,179,535 | ||||||||

| Equipment | 174,379 | 181,331 | 191,715 | 200,794 | ||||||||

| Working capital | 42,177,779 | 28,580,081 | 30,173,355 | 31,180,698 | ||||||||

| Shareholders' equity | 122,648,420 | 100,249,947 | 101,853,605 | 102,720,027 | ||||||||

| Interest and other income | 239,544 | 315,315 | 746,806 | 243,245 | ||||||||

| Total revenue | - | - | - | - | ||||||||

| Operating loss | (10,509,107 | ) | (2,530,328 | ) | (2,939,025 | ) | (11,500,402 | ) | ||||

| Total loss and comprehensive loss | (9,285,139 | ) | (2,343,784 | ) | (2,192,219 | ) | (8,984,483 | ) | ||||

| Basic and fully diluted loss per share | (0.12 | ) | (0.03 | ) | (0.04 | ) | (0.12 | ) |

| As at and for the quarter ended | June 30, 2024 (Q2/24) $ |

March 31, 2024 (Q1/24) $ |

December 31, 2023 (Q4/23) $ |

September 30, 2023 (Q3/23) $ |

||||||||

| Total assets | 90,919,180 | 95,457,683 | 82,749,756 | 78,249,830 | ||||||||

| Exploration and evaluation assets | 71,179,535 | 71,179,535 | 70,906,785 | 70,906,785 | ||||||||

| Equipment | 212,504 | 212,140 | 216,056 | 229,845 | ||||||||

| Working capital | 13,023,669 | 18,689,456 | 10,663,863 | 4,218,696 | ||||||||

| Shareholders' equity | 84,574,708 | 90,860,131 | 81,945,704 | 75,514,326 | ||||||||

| Interest income | 263,946 | 146,602 | 110,371 | 182,262 | ||||||||

| Total revenue | - | - | - | - | ||||||||

| Operating loss | (9,117,867 | ) | (2,398,362 | ) | (4,053,789 | ) | (16,100,427 | ) | ||||

| Total loss and comprehensive loss | (7,220,688 | ) | (2,251,760 | ) | (3,983,419 | ) | (13,621,266 | ) | ||||

| Basic and fully diluted loss per share | (0.12 | ) | (0.03 | ) | (0.08 | ) | (0.20 | ) |

Liquidity and Capital Resources

The Company has no operations that generate cash flow. The Company's future financial success will depend on its ability to raise capital or through the discovery and development of one or more economic mineral deposits. Discovery and development may take many years, can consume significant resources and is largely based on factors that are beyond the control of the Company and its management. To date, the Company has successfully financed its activities by the issuance of equity securities, consisting of a combination of flow-through and non-flow-through securities. In order to continue funding exploration activities and corporate costs, the Company is reliant on their ongoing ability to raise financing through the sale of equity. This is dependent on positive investor sentiment, which in turn is influenced by a positive climate for the target commodities, the Company's track record, and the experience and caliber of the Company's management. There is no assurance that equity funding will be accessible to the Company at the times and in the amounts required to fund the Company's activities. As at June 30, 2025, the Company had cash, guaranteed investment certificates and investments of $52,504,523 to settle accounts payable and accrued liabilities of $5,245,251, as well as the liability on flow-through share issuances of $6,533,653.

Base Shelf Prospectus

On April 26, 2023, the Company filed and has a receipted final short form base shelf prospectus (the "base shelf prospectus") with the securities commissions in each of the provinces of Canada, except Quebec. The base shelf prospectus expired May 26, 2025.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Use of Proceeds from Past Financings

| Date of Financing | Disclosed Expected Purpose | Actual Use of Proceeds |

Proceeds $ |

Spent to June 30 $ |

Balance $ |

| November 2023 | 60% to be spent on exploration and 40% on other corporate purposes | Details below | 10,000,000 | 8,500,000 | 1,500,000 |

| September 2024 | Expand scope of 2024 drill season, fund 2025 drill season, and other corporate purposes | Details below | 30,450,000 | 13,468,000 | 16,982,000 |

On November 1, 2023, the Company completed the sale of 15,384,616 common shares of the Company to Hecla at a price of $0.65 per common share for gross proceeds of $10,000,000. As at June 30, 2025, approximately $4,500,000 of the proceeds of this sale has been spent on exploration related expenses and $4 million has been spent on general administration.

On September 4, 2024, the Company closed the first tranche of a bought deal financing (the "September 2024 Offering") for gross proceeds of $11,500,000 by issuance of 11,500,000 common shares of the Company at a price of $1.00 per common share. In addition, the Company issued 12,960,000 flow-through common shares at a price of $1.25 per common share with gross proceeds of $16,200,000. In connection with the closing of the first tranche of the offering, a finders' fee of $1,385,000 was paid representing 5% of the gross proceeds. The Company spent $13,468,000 of the net proceeds of this financing as at June 30, 2025.

On September 27, 2024, the Company closed the second and final tranche of the September 2024 Offering for gross proceeds of $4,500,000 from the issuance of 3,600,000 FT common shares at price of $1.25 per FT common share. In connection with the closing of the second and final tranche of the financing, a finders' fee of $225,000 was paid representing 5% of the gross proceeds. The Company has not yet spent any of the net proceeds of this financing as at June 30, 2025.

On June 26, 2025, the Company closed a bought deal financing for aggregate gross proceeds to the Company of $28,755,500 through two offerings. Under the LIFE Offering, the Company sold 2,445,500 common shares of the Company at a price of $4.60 per common share for gross proceeds of $ 11,249,300 and also sold 1,128,000 flow-through ("FT") common shares at a price of $6.65 per FT common share for gross proceeds of $7,501,200. Under the Private Placement Offering, the Company sold 1,740,000 FT common shares of the Company at a price of $5.75 per FT common share for gross proceeds of $10,005,000. In connection with the closing of the two financings, a finders' fee of $1,437,775 was paid representing 5.0% of the gross proceeds. The Company has not yet spent any of the net proceeds of this financing as at June 30, 2025.

As disclosed in the prospectus supplement to the base shelf prospectus dated August 21, 2024, the Company's approximate spending to June 30, 2025 relative to the intended use of the net proceeds from the bought deal financings from September 2024 is as follows:

| Principal Purpose | Estimated Use of Net Proceeds(1) $ |

Spent to June 30, 2025 $ |

Balance $ |

||||||

| Exploration Expenditures - Drilling and related in 2024 for extended program | 2,000,000 | 1,060,000 | 940,000 | (2) | |||||

| Exploration - Camp and other costs in 2024 | 1,500,000 | 340,000 | 1,160,000 | (2) | |||||

| Exploration - Drilling and related in 2025 | 8,600,000 | 5,812,000 | 2,788,000 | ||||||

| Exploration - Camp and geoscience/technical team in 2025 | 6,500,000 | 2,300,000 | 4,200,000 | ||||||

| Exploration - Samples and other costs in 2025 | 2,200,000 | 123,000 | 2,077,000 | ||||||

| General and Administration | 5,000,000 | 3,654,000 | 1,346,000 | ||||||

| Business Development | 500,000 | 179,000 | 321,000 | ||||||

| Sub-total per prospectus supplement | 26,300,000 | 13,468,000 | 12,832,000 | ||||||

| Exploration - Contingency | 2,700,000 | - | 2,700,000 | ||||||

| General and Administration - Unallocated | 1,450,000 | - | 1,450,000 | ||||||

| Total | 30,450,000 | 13,468,000 | 16,982,000 |

(1) Gross proceeds of $32,200,000 were raised for net proceeds of approximately $30,450,000 after deducting finders' fees and transaction costs of approximately $1,750,000. The net proceeds from the over-allotment were allocated to General and Administration - Unallocated and an Exploration - Contingency.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

(2) The exploration program was shorter than expected due to bad weather in late September. The balance of funds originally intended for exploration in 2024 is now planned be spent on exploration in 2025.

Cash and Financial Condition

As of June 30, 2025, the Company had a working capital surplus of $42,177,779 (December 31, 2024 - $30,173,355), which includes the liability on flow-through share issuances of $6,533,653 (December 31, 2024 - $3,478,712). The Company's working capital needs fluctuate based on exploration program requirements, which place variable demands on the Company's resources and timing of expenditures. Demand on capital is expected to increase during summer months, as drilling and exploration activity typically begins in May and ends in October.

During the six months ended June 30, 2025, the Company used $8,455,478 (2024 - $6,010,324) of cash in operating activities. The Company had a loss of $11,628,923 (2024 - $9,472,447) from operations in the quarter. Items not affecting cash totaling $241,416 (2024 - $111,479) were added back to the loss mainly due to share-based payments, restricted share compensation and recovery on flow-through share premium. The Company had changes in non-cash working capital items that adjusted the loss by $2,932,029 (2024 - $3,573,602). The change in cash from operations between periods was most significantly impacted by the higher loss for the year, and a increase of $866,820 in accounts payable and accrued liabilities (2024 - decrease of $437,251) during the six months ended June 30, 2025.

During the six months ended June 30, 2025, the Company acquired equipment for $5,980 (2024 - $20,947) and invested $229,142 (2024 - nil) of cash for property acquisitions.

During the six months ended June 30, 2025, the Company received cash proceeds of $181,018 (2024 - $420,000) from the exercise of 101,163 stock options. There were net cash proceeds of $26,836,506 (2024 - $13,964,375) from issuance of flow-through common shares

Commitments and Contingencies

On May 1, 2024, the Company entered into a lease agreement for the purpose of landing helicopters and parking a maximum of five trucks from May 1, 2024 to April 30, 2026, pursuant to which the Company was obligated to pay basic rent of $25,750 for 2024 and $26,525 for 2025.

In June 2024, the Company also entered into a lease agreement of renting land for two lots in Alice Arm, BC, for a term of three years, pursuant to which the Company is obligated to pay basic rent of $5,000 per annum.

Outstanding Share Data

On April 7, 2025, the Company completed a consolidation of the issued and outstanding shares of the Company at a ratio of four pre-consolidation common shares for one post-consolidation common share. All common share stock option, RSU and per share figures in the MD&A and condensed consolidated interim financial statements have been retroactively adjusted to reflect the share consolidation.

The Company's authorized share capital consists of an unlimited number of common shares. The issued and outstanding securities of the Company are as follows:

| As at | The date of this MD&A | June 30, 2025 | ||||

| Common shares | 87,165,155 | 87,069,881 | ||||

| Restricted share units(1) | 605,636 | 605,636 | ||||

| Stock options(2) | 2,750,501 | 2,845,775 |

(1) Each RSU grants the holder the right to receive one common share per RSU, for a total of 605,636 common shares (June 30, 2025 - 605,636).

(2) Each stock option grants the holder the right to purchase one common share per stock option, for a total of 2,750,501 common shares as of the date hereof (June 30 2025-2,845,775).

Summary of the 2025 share issuances are as follows:

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Transactions with Related Parties

During the six months ended June 30, 2025, and 2024, the Company incurred the following amounts charged by officers and directors (being key management personnel) and companies controlled and/or owned by officers and directors of the Company in addition to the related party transactions disclosed elsewhere in these condensed consolidated interim financial statements:

| June 30, 2025 | June 30, 2024 | |||||

| Directors' fees (1)(2) | $ | 116,000 | $ | 113,400 | ||

| Exploration and evaluation (3,4) | 298,750 | 392,500 | ||||

| Management fees (1)(2) | 547,500 | 702,200 | ||||

| Consulting(5) | 25,000 | - | ||||

| Share-based payments (1)(2) | 947,461 | 1,122,056 | ||||

| Total | $ | 1,934,711 | $ | 2,330,156 |

(1) The Company entered into a consulting service agreement with S2K Capital Corp. and Shawn Khunkhun, Chief Executive Officer and director of the Company. Pursuant to this consulting agreement, Mr. Khunkhun is compensated at a rate of $34,167 (2024 - $30,000) per month effective April 1, 2025. The Company is required to pay an equivalent to 24 months' pay plus an average of any cash performance bonus paid in the previous two completed financial years if the consulting agreement is terminated by either party absent an event of default during the twelve-month period following the date of a change in control of the Company. During the six months ended June 30, 2025, the Company paid a $360,000 bonus related to the year ended December 31, 2024, and made a bonus allowance of $200,000 for amounts expected to be paid in 2026 that relate to the year to end December 31, 2025. If the agreement is terminated for reasons other than event of default, the Company is required to pay a sum equal to 12 months' pay.

(2) The Company entered into a consulting service agreement with Fehr & Associates and Ann Fehr, Chief Financial Officer ("CFO") for full outsourced accounting and corporate secretary services. During the six months ended June 30, 2025, the Company paid $16,667 (2024 - $16,667) per month for CFO services. During the six months ended June 30, 2025, the Company paid a $100,000 bonus related to the year ended December 31, 2024, and made a bonus allowance of $55,000 for amounts estimated to be payable in 2026 that relate to the year to end December 31, 2025. The Company is required to pay an equivalent to 12 months' pay if the consulting agreement is terminated by either party absent an event of default during the twelve-month period following the date of a change in control of the Company.

(3) The Company entered into a consulting service agreement with Robert van Egmond, VP Exploration of the Company. Pursuant to this consulting agreement, Mr. van Egmond is compensated at a rate of $23,333 (2024 - $22,500) per month effective April 1, 2025. During the six months ended June 30, 2025, the Company paid a $135,000 bonus related to the year ended December 31, 2024, and made a bonus allowance of $67,500 for amounts expected to be paid in 2026 that relate to the year to end December 31, 2025. The Company is required to pay the equivalent to 12 months' pay if the consulting agreement is terminated by either party, absent an event of default, during the twelve-month period following the date of a change in control of the Company.

(4) The Company recognized expense of $60,000 (2024 - $120,000) in exploration and evaluation expenses to Linus Geological Ltd., a company controlled by Robert McLeod, a director of the Company.

(5) The Company recognized consulting expenses of $25,000 (2024-nil) to Chelmer Consulting Corp., a company controlled by Darren Devine, a director of the Company.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Other related party transactions are as follows:

- At June 30, 2025, included in accounts payable is $21,453 (December 31, 2024 - $10,640) owed to officers of the Company.

- At June 30, 2025, included in accrued liabilities is $nil (December 31, 2024 - $686,750) accrued to officers and directors of the Company.

- During the six months ended June 30, 2025, $66,215 (2024 - $30,650) in fees were paid to Fehr & Associates, a corporation controlled by the CFO, that were attributable to costs directly associated with office space, accounting services and administration staff used by the Company. Prior to April 1, 2024 these costs were included in CFO related management fees.

- Porter Property acquisition was a related party transaction on account that Shawn Khunkhun, Chief Executive Officer, President and a Director of Dolly Varden is also the Executive Chairman and Director of Strikepoint

- The Kinskuch Property acquisition is a related party transaction as Hecla is considered an insider on account of Hecla owning approximately 13.3% of the outstanding Common Shares.

Financial Instruments

The Company's financial instruments recorded at fair value require disclosure as to how the fair value was determined based on significant levels of input described in the following hierarchy:

– Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities;

– Level 2 - inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly (i.e., as prices) or indirectly (i.e., derived from prices); and

– Level 3 - inputs for the asset or liability that are not based on observable market data (unobservable inputs).

The Company's financial instruments include cash, short-term investments, deposits, accounts payable and accrued liabilities, all of which are measured at amortized cost.

Off-balance Sheet Arrangements

As of the date of this MD&A, the Company does not have any off-balance sheet arrangements.

Proposed Transactions

As of the date of this MD&A, the Company does not have any material proposed transactions.

Disclosure Controls and Procedures

Management, with the participation of the Chief Executive Officer ("CEO") and Chief Financial Officer ("CFO"), assessed the effectiveness of disclosure controls and procedures as of June 30, 2025. Based upon the results of that evaluation, the CEO and CFO concluded that the disclosure controls and procedures were effective to provide reasonable assurance that material information relating to the Company is accumulated and communicated to management to allow timely decisions regarding required disclosure, and that the information disclosed by us in the reports that we file is appropriately recorded, processed, summarized and reported within the time period specified in applicable securities legislation.

Internal Control Over Financial Reporting

The Company's internal control over financial reporting may not prevent or detect all misstatements because of inherent limitations. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial reporting and disclosure. Additionally, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions or deterioration in the degree of compliance with the Company's policies and procedures.

There were no changes to the Company's internal controls over financial reporting during the six months ended June 30, 2025 that have materially affected, or are likely to materially affect, the Company's internal control over financial reporting or disclosure controls and procedures.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Limitations of Controls and Procedures

The CEO and CFO, in consultation with management, believe that any disclosure controls and procedures or internal control over financial reporting, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, they cannot provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been prevented or detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by unauthorized override of the controls.

The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Accordingly, because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

Critical Accounting Estimates

Key assumptions concerning the future and other key sources of estimation uncertainty that have a significant risk of resulting in a material adjustment to the carrying amounts of assets and liabilities include, but are not limited to, the following:

Share-based compensation

The fair value of share-based payments is determined using the Black-Scholes option pricing model. Such option pricing models require the input of subjective assumptions, including the expected price volatility, option life, dividend yield, risk-free rate and estimated forfeitures at the initial grant.

Estimating useful life of equipment

Depreciation of equipment is charged to write-down the value of those assets to their residual value over their respective estimated useful lives. Management is required to assess the useful economic lives and residual values of the assets such that depreciation is charged on a systematic basis to the current carrying amount. The useful lives are estimated having regard to such factors as asset maintenance, rate of technical and commercial obsolescence, and asset usage. The useful lives of key assets are reviewed annually.

Deferred income taxes

Judgment is required in determining whether deferred tax assets are recognized in the condensed consolidated interim statements of financial position. Deferred tax assets, including those arising from unutilized tax losses require management to assess the likelihood that the Company will generate taxable earnings in future periods, in order to utilize recognized deferred tax assets. Estimates of future taxable income are based on forecasted cash flows from operations and the application of existing tax laws in each jurisdiction. To the extent that future cash flows and taxable income differ significantly from estimates, the ability of the Company to realize the net deferred tax assets recorded at the date of the condensed consolidated interim statements of financial position could be impacted.

Accrual of British Columbia Mineral Exploration Tax Credit

The provincial government of BC provides for a refundable tax on net qualified mining exploration expenditures incurred in BC. The credit is calculated as 20% of qualified mining exploration expenses less the amount of any assistance received or receivable. The determination of the expenditures that would qualify as mining exploration expenses was based on previous years' tax filings and subsequent reviews by government auditors. BC METC will be recorded in net income or loss upon cash receipt or when reasonable assurance exists that the tax filings are assessed and the expenditures are qualified as mining exploration expenses.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Significant Accounting Judgments

Significant accounting judgments that management has made in the process of applying accounting policies and that have the most significant effect on the amounts recognized in the consolidated financial statements include, but are not limited to, the following:

Recoverability of the carrying value of the Company's exploration and evaluation assets

Recorded costs of exploration and evaluation assets are not intended to reflect present or future values of these properties. The recorded costs are subject to measurement uncertainty and it is reasonably possible, based on existing knowledge, that a change in future conditions could require a material change in the recognized amount.

Risk Factors

The Company is subject to risks and challenges similar to other companies in a comparable stage of development. These risks include, but are not limited to, continuing losses, dependence on key individuals, and the ability to secure adequate financing to meet minimum capital required to successfully complete its projects and continue as a going concern. These factors should be reviewed carefully.

The following risk factors, in addition to the risks noted above in the Financial Instruments and Liquidity and Capital Resources sections, should be given special consideration when evaluating trends, risks and uncertainties relating to the Company's business.

Exploration, Development and Production Risks

The exploration for and development of minerals involves significant risks, which even a combination of careful evaluation, experience and knowledge of management and key employees and contractors of the Company may not eliminate. Few exploration and evaluation assets that are explored are ultimately developed into producing mines. There can be no guarantee that the estimates of quantities and qualities of minerals disclosed will be economically recoverable. With all mining operations, there is uncertainty and, therefore, risk associated with operating parameters and costs resulting from the scaling up of extraction methods tested in pilot conditions.

Mineral exploration is speculative in nature and there can be no assurance that any minerals discovered will result in the definition of a mineral resource. The Company's operations will be subject to all of the hazards and risks normally encountered in the exploration, development and production of minerals. These include unusual and unexpected geological formations, rock falls, seismic activity, flooding and other conditions involved in the extraction of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although precautions to minimize risk will be taken, operations are subject to hazards that may result in environmental pollution and consequent liability that could have a material adverse impact on the business, operations and financial performance of the Company. Substantial expenditures are required to establish ore reserves through drilling, to develop metallurgical processes to extract the metal from the ore and, in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis.

The economics of developing silver and other exploration and evaluation assets is affected by many factors, including the cost of operations, variations in the grade of ore mined, fluctuations in metal markets, costs of processing equipment, access to qualified personnel and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection. The remoteness and restrictions on access of the Company's exploration and evaluation assets may have an adverse effect on profitability as a result of higher infrastructure costs. There are also physical risks to the exploration personnel working in the terrain in which the Company's exploration and evaluation assets are located, which are subject to poor climate conditions.

The long-term commercial success of the Company depends on its ability to explore, develop and commercially produce minerals from its exploration and evaluation assets and to locate and acquire additional properties worthy of exploration and development for minerals. No assurance can be given that the Company will be able to locate satisfactory properties for acquisition or participation. Moreover, if such acquisitions or participations are identified, the Company may determine that current markets, terms of acquisition and participation or pricing conditions make such acquisitions or participation uneconomic.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Substantial Capital Requirements

Management of the Company anticipates that it may make substantial future capital expenditures for the acquisition, exploration, development and production of its exploration and evaluation assets. As the Company will be at the exploration stage with no revenue being generated from the exploration activities on its exploration and evaluation assets, the Company may have limited ability to raise the capital necessary to undertake or complete future exploration work, including drilling programs.

There can be no assurance that debt or equity financing will be available or sufficient to meet these requirements or for other corporate purposes or, if debt or equity financing is available, that it will be on terms acceptable to the Company. Moreover, future activities may require the Company to alter its capitalization significantly.

The inability of the Company to access sufficient capital for its operations could have a material adverse effect on the Company's financial condition, results of operations or prospects. In particular, failure to obtain such financing on a timely basis could cause the Company to forfeit its interest in its exploration and evaluation assets, miss certain acquisition opportunities and reduce or terminate its operations.

Competition

The mining industry is highly competitive. Many of the Company's competitors for the acquisition, exploration, production and development of exploration and evaluation assets, and for capital to finance such activities, include companies that have greater financial and personnel resources available to them than the Company.

Volatility of Mineral Prices

The market price of any mineral is volatile and is affected by numerous factors that are beyond the Company's control. These include international supply and demand, the level of consumer product demand, international economic trends, currency exchange rate fluctuations, the level of interest rates, rate of inflation, global or regional political events and international events, as well as a range of other market forces. Sustained downward movements in mineral market prices could render less economic, or uneconomic, some or all of the mineral extraction and/or exploration activities to be undertaken by the Company.

Mineral Reserves / Mineral Resources

The Company's exploration and evaluation assets are in the early exploration stage only and, though they contain Current Mineral Resources, as disclosed on page 3 of this MD&A, they do not contain a known body of commercial minerals ("mineral reserves"). Mineral reserves are, in large part, estimates, and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery will be realized. Mineral reserve estimates for exploration and evaluation assets that have not yet commenced production may require revision based on actual production experience.

Market price fluctuations of metals, as well as increased production costs or reduced recovery rates, may render mineral reserves containing relatively lower grades of mineralization uneconomic and may ultimately result in a restatement of reserves. Moreover, short-term operating factors relating to the mineral reserves, such as the need for orderly development of the ore bodies and the processing of new or different mineral grades, may cause a mining operation to be unprofitable in any particular accounting period.

Environmental Risks

All phases of the mining business present environmental risks and hazards and are subject to environmental regulation pursuant to a variety of international conventions and state and municipal laws and regulations. Environmental legislation provides for, among other things, restrictions and prohibitions on spills, releases or emissions of various substances produced in association with mining operations. The legislation also requires that wells and facility sites be operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. Compliance with such legislation can require significant expenditures and a breach may result in the imposition of fines and penalties, some of which may be material. Environmental legislation is evolving in a manner expected to result in stricter standards and enforcement, larger fines and liability, and potentially increased capital expenditures and operating costs. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has the potential to reduce the profitability of operations.

| DOLLY VARDEN SILVER CORPORATION Management’s Discussion and Analysis |

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations and, in particular, environmental laws.

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or production costs or reduction in levels of production at any future-producing exploration and evaluation assets or require abandonment or delays in the development of new mining properties.

Reliance on Key Personnel

The success of the Company will be largely dependent upon the performance of its management and key employees and contractors. In assessing the risk of an investment in the shares of the Company, potential investors should realize that they are relying on the experience, judgment, discretion, integrity and good faith of the proposed management of the Company.

Conflicts of Interest

Certain directors and officers of the Company will be engaged in, and will continue to engage in, other business activities on their own behalf and on behalf of other companies. As a result of these and other activities, such directors and officers of the Company may become subject to conflicts of interest. The BCBCA provides that in the event that a director or senior officer has a material interest in a contract or proposed contract or agreement that is material to the issuer, the director or senior officer must disclose his or her interest in such contract or agreement and a director must refrain from voting on any matter in respect of such contract or agreement, subject to and in accordance with the BCBCA. To the extent that conflicts of interest arise, such conflicts will be resolved in accordance with the provisions of the BCBCA. To the knowledge of management of the Company, as at the date of this MD&A, there are no existing or potential material conflicts of interest between the Company and a director or officer of the Company, except as otherwise disclosed in this MD&A.

Dividends

To date, the Company has not paid any dividends on its outstanding common shares. Any decision to pay dividends on the shares of the Company will be made by the board of directors on the basis of the Company's earnings, financial requirements and other conditions.