EXHIBIT A

FORM OF PROXY

A-1

A-2

Exhibit 99.1

TUNGRAY TECHNOLOGIES INC

(incorporated in the Cayman Islands)

(NASDAQ: TRSG)

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN THAT the annual general meeting of shareholders (the “Meeting”) of Tungray Technologies Inc (the “Company”) will be held on September 20, 2025, at 9:00 a.m. Singapore time (September 19, 2025, at 9:00 p.m., U.S. Eastern time) at #02-01, 31 Mandai Estate, Innovation Place Tower 4, Singapore 729933, and virtually via teleconference, for which you must register in advance at: https://forms.cloud.microsoft/r/n9UUNQGknZ, or any adjournment thereof, for the purpose of passing the following ordinary resolutions:

(i) to re-elect each of the five directors named in this notice to shareholders (the “Proxy Statement”) to hold office until the next annual general meeting of shareholders and until his/her respective successor is elected and duly qualified;

(ii) to approve the appointment of Guangdong Prouden CPAs GP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025; and

(iii) to approve the Tungray Technologies Inc 2025 Equity Incentive Plan.

The Board of Directors has fixed the close of business on August 6, 2025 as the record date (the “Record Date”) for determining the shareholders entitled to receive notice of and to vote at the Meeting or any adjournment thereof. Only holders of Class A or Class B ordinary shares of the Company on the Record Date are entitled to receive notice of and to vote at the Meeting or any adjournment thereof.

Shareholders may obtain a copy of the proxy materials, including the Company’s 2025 annual report, from the Company’s website at https://tungray.uscubixtech.com/investor/financial-reports.html or by submitting a request to the investor relations contact, Mr. Bill Zuma, ICR Inc., at tungray@icrinc.com.

By Order of the Board of Directors,

|

|

/s/ Wanjun Yao |

|

Wanjun Yao |

|

Chairman of the Board of Directors |

|

August 12, 2025

1

TUNGRAY TECHNOLOGIES INC

ANNUAL GENERAL MEETING OF SHAREHOLDERS

September 20, 2025

9:00 a.m., Singapore Time

PROXY STATEMENT

The board of directors (the “Board”) of Tungray Technologies Inc (the “Company”) is soliciting proxies for the annual general meeting of shareholders (the “Meeting”) of the Company to be held on September 20, 2025, at 9:00 a.m. Singapore Time (September 19, 2025, at 9:00 p.m., U.S. Eastern time) at #02-01, 31 Mandai Estate, Innovation Place Tower 4, Singapore 729933 and virtually via teleconference, for which you must register in advance at: https://forms.cloud.microsoft/r/n9UUNQGknZ, or any adjournment thereof.

Only holders of the Class A ordinary shares of the Company (the “Class A ordinary shares”) or Class B ordinary shares of the Company (the “Class B ordinary shares,” together with Class A ordinary shares, the “ordinary shares”) of record at the close of business on August 6, 2025 (the “Record Date”) are entitled to attend and vote at the Meeting or at any adjournment thereof. The shareholders entitled to vote and present in person or by proxy or (in the case of a shareholder being a corporate entity) by its duly authorized representative throughout the Meeting shall form a quorum. Each Class A ordinary share that you own in your name entitles you to one vote on the applicable proposals, while each Class B ordinary share that you own in your name entitles you to twenty (20) votes on the applicable proposals.

Any shareholder entitled to attend and vote at the Meeting is entitled to appoint a proxy to attend and vote on such shareholder’s behalf. A proxy need not be a shareholder of the Company.

PROPOSALS TO BE VOTED ON

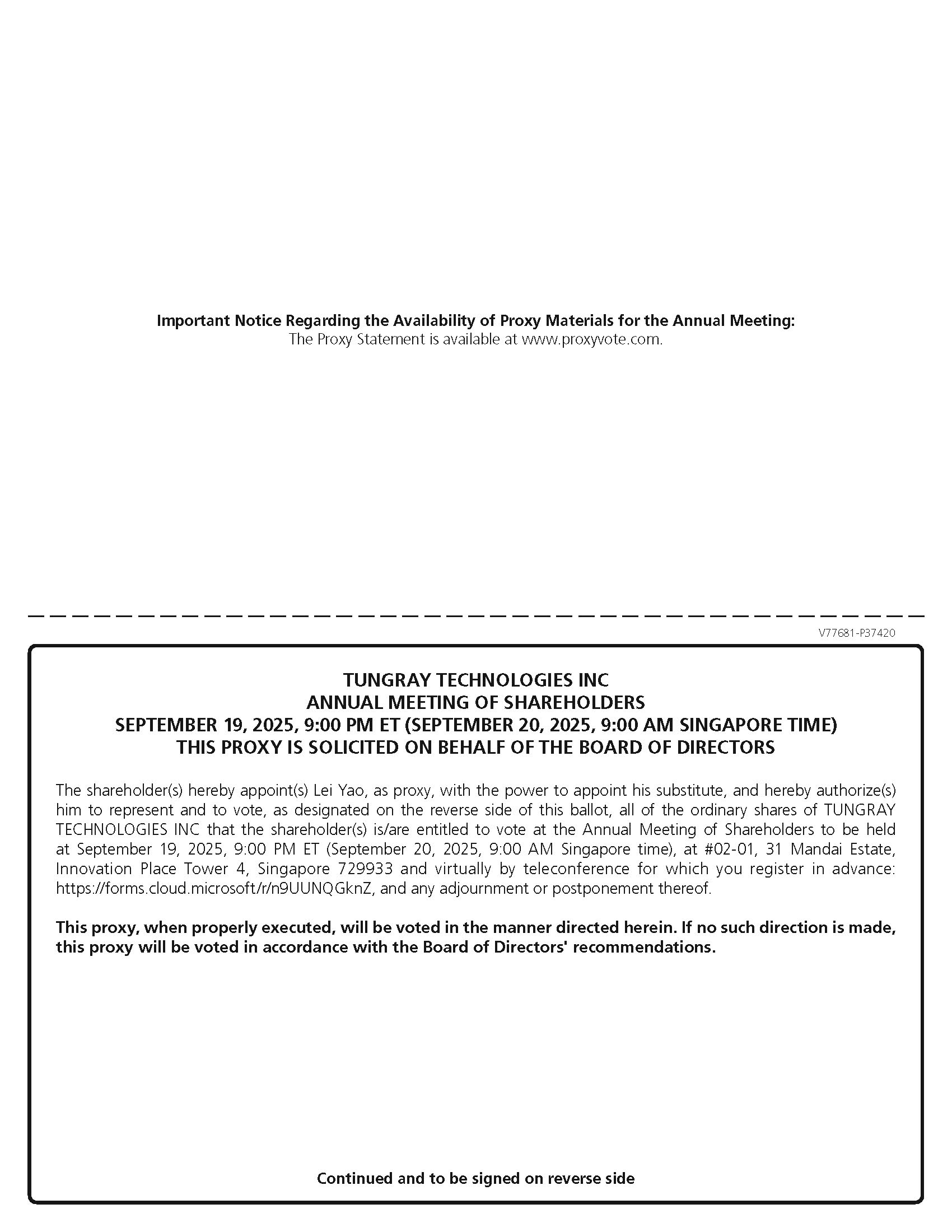

At the Meeting, ordinary resolutions will be proposed as follows:

(i)to re-elect each of the five directors named in this notice to shareholders (the “Proxy Statement”) to hold office until the next annual general meeting of shareholders and until his/her respective successor is elected and duly qualified;

(ii)to approve the appointment of Guangdong Prouden CPAs GP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025; and

(ii)to approve the Tungray Technologies Inc 2025 Equity Incentive Plan.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” ALL OF THE NOMINEES LISTED IN PROPOSAL NO. 1, “FOR” THE PROPOSAL NO. 2, AND “FOR” THE PROPOSAL NO. 3.

VOTING PROCEDURE FOR HOLDERS OF ORDINARY SHARES

Shareholders entitled to vote at the Meeting may do so either in person or by proxy. Those shareholders who are unable to attend the Meeting are requested to read, complete, sign, date, and return the attached proxy card in accordance with the instructions set out therein.

2

ANNUAL REPORT TO SHAREHOLDERS

Pursuant to NASDAQ’s Marketplace Rules, which permit companies to make available their annual report to shareholders on or through the company’s website, the Company posts its annual reports on the Company’s website. The annual report for the year ended December 31, 2024 (the “2024 Annual Report”) has been filed with the U.S. Securities and Exchange Commission on May 14, 2025. The Company adopted this practice to avoid the considerable expense associated with mailing physical copies of such report to record holders. You may obtain a copy of our 2024 Annual Report by visiting the “Annual Results” heading under the “Financial Report” section of the Company’s website at https://tungray.uscubixtech.com/investor/financial-reports.html. If you want to receive a paper or email copy of the Company’s 2024 Annual Report, you must request one. There is no charge to you for requesting a copy. Please make your request for a copy to the Investor Relations contact, Mr. Bill Zuma, ICR Inc., at tungray@icrinc.com.

3

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

Certain of our shareholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Shareholder of Record/Registered Shareholders

If, on the Record Date, your shares were registered directly in your name with our transfer agent, Transhare Corporation, you are a “Shareholder of Record” who may vote at the Meeting, and we are sending these proxy materials directly to you. As a Shareholder of Record, you have the right to direct the voting of your shares by returning the enclosed proxy card to us or to vote in person at the Meeting. Whether or not you plan to attend the Meeting, please complete, date and sign the enclosed proxy card to ensure that your vote is counted.

Beneficial Owner

If, on the Record Date, your shares were held in an account at a brokerage firm or at a bank or other nominee holder, you are considered a beneficial owner of shares held “in street name,” and these proxy materials are being forwarded to you by your broker or nominee. As a beneficial owner, you have the right to direct your broker on how to vote your shares and to attend the Meeting. However, since you are not a Shareholder of Record, you may not vote these shares in person at the Meeting unless you receive a valid proxy from your brokerage firm, bank or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage firm, bank or other nominee holder.

How do I vote?

If you were a Shareholder of Record of the Company’s ordinary shares on the Record Date, you may vote in person at the Meeting or by submitting a proxy. Each Class A ordinary share that you own in your name entitles you to one vote on the applicable proposals, while each Class B ordinary share that you own in your name entitles you to twenty (20) votes on the applicable proposals.

(1) You may submit your proxy by mail. You may submit your proxy by mail by completing, signing and dating your proxy card and returning it in the enclosed, postage-paid and addressed envelope. If we receive your proxy card by mail prior to September 19, 2025 and if you mark your voting instructions on the proxy card, your shares will be voted:

•as you instruct, and

•according to the best judgment of the proxies if a proposal comes up for a vote at this Meeting that is not on the proxy card.

We encourage you to examine your proxy card closely to make sure you are voting all of your shares in the Company.

If you return a signed card, but do not provide voting instructions, your shares will be voted:

•FOR each nominee for director;

•FOR the approval of appointment of Guangdong Prouden CPAs GP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025;

•FOR the approval of the Tungray Technologies Inc 2025 Equity Incentive Plan; and

4

•According to the best judgment of your proxy if a proposal comes up for a vote at the Meeting that is not on the proxy card.

(2) You may vote in person at the Meeting. We will provide written ballots to any Shareholder of Record who wants to vote at the Meeting.

If I plan on attending the Meeting, should I return my proxy card?

Yes. Whether or not you plan to attend the Meeting, after carefully reading and considering the information contained in this proxy statement, please complete and sign your proxy card. Then return the proxy card in the pre-addressed, postage-paid envelope provided herewith as soon as possible so your shares may be represented at the Meeting.

May I change my mind after I return my proxy?

Yes. You may revoke your proxy and change your vote at any time before the polls close at this Meeting. You may do this by:

•sending a written notice to the Chief Financial Officer of the Company at the Company’s executive offices stating that you would like to revoke your proxy of a particular date;

•signing another proxy card with a later date and returning it to the Chief Financial Officer before the polls close at this Meeting; or

•attending this Meeting and voting in person.

What does it mean if I receive more than one proxy card?

You may have multiple accounts at the transfer agent and/or with brokerage firms. Please sign and return all proxy cards to ensure that all of your shares are voted.

What happens if I do not indicate how to vote my proxy?

Signed and dated proxies received by the Company without an indication of how the shareholder desires to vote on a proposal will be voted in favor of each director and proposal presented to the shareholders.

Will my shares be voted if I do not sign and return my proxy card?

If you do not sign and return your proxy card, your shares will not be voted unless you vote in person at this Meeting.

How many votes are required to re-elect the Director Nominees as directors of the Company?

The re-election of each nominee for director requires the affirmative vote of a simple majority of such shareholders as, being entitled to do so, vote in person or by proxy at the Meeting.

How many votes are required to approve the appointment of Guangdong Prouden CPAs GP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025?

The proposal to approve the appointment of Guangdong Prouden CPAs GP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025 requires the affirmative vote of a simple majority of such shareholders as, being entitled to do so, vote in person or by proxy at the Meeting.

5

How many votes are required to approve the Tungray Technologies Inc 2025 Equity Incentive Plan?

The proposal to approve the Tungray Technologies Inc 2025 Equity Incentive Plan requires the affirmative vote of a simple majority of such shareholders as, being entitled to do so, vote in person or by proxy at the Meeting.

Is my vote kept confidential?

Proxies, ballots and voting tabulations identifying shareholders are kept confidential and will not be disclosed, except as may be necessary to meet legal requirements.

Where do I find the voting results of this Meeting?

We will announce voting results at this Meeting and also file a Current Report on Form 6-K with the Securities and Exchange Commission (the “SEC”) reporting the voting results.

Who can help answer my questions?

You can contact Mr. Bill Zuma, ICR Inc., at tungray@icrinc.com, or by sending a letter to the offices of the Company at #02-01, 31 Mandai Estate, Innovation Place Tower 4, Singapore 729933, with any questions about proposals described in this proxy statement or how to execute your vote.

6

PROPOSAL NO. 1

RE-ELECTION OF DIRECTORS

The nominees listed below (the “Director Nominees”) have been nominated by the Nominating and Corporate Governance Committee and approved by our Board to stand for re-election as directors of the Company. Unless such authority is withheld, proxies will be voted for the re-election of the persons named below, each of whom has been designated as a nominee. If, for any reason not presently known, any person is not available to serve as a director, another person who may be nominated will be voted for in the discretion of the proxies.

Director Nominees

The Director Nominees recommended by the Board are as follows:

Name |

| Age |

| Position(s) |

Wanjun Yao |

| 60 |

| Chairman, Chief Executive Officer and Director |

Jingan Tang |

| 47 |

| Director |

Kevin D. Vassily |

| 58 |

| Independent Director |

David Ping Li |

| 60 |

| Independent Director |

Weston Twigg |

| 51 |

| Independent Director |

Mr. Wanjun Yao, Chairman, Chief Executive Officer and Director. As our founder, Mr. Yao currently serves as the Chairman of our Board of Directors and Chief Executive Officer of our Company. Starting his career in Shandong Province, Eastern China, in the late 1980s, Mr. Yao rose through the ranks at various food processing businesses before moving to Singapore in 1997. In 1997,, Mr. Yao founded Tungray Singapore Pte. Ltd (“Tungray Singapore”), providing automation solutions for manufacturing businesses. Starting as a one-person shop, Mr. Yao expanded his business into a conglomerate with subsidiaries in China and Singapore and businesses spanning across manufacturing solutions, welding, motor production, etc., including founding Qingdao Tongri Electric Machines Co., Ltd., one of Mr. Yao’s first China-based businesses in 2002, Tungray Industrial Automation (Shenzhen) Co., Ltd. (“Tungray Industrial”) in 2010, and Qingdao Tungray Intelligent Co., Ltd. in 2017, among others. Mr. Yao graduated with a bachelor’s degree in mechanics from Zhengzhou Institute of Food Sciences (now Henan University of Technology) in 1988 and finished EMBA programs in Peking University President Class in 2014.

Mr. Jingan Tang, Director. Mr. Tang has served as a director of the Company since February 1, 2023. Mr. Tang has served as the Vice Chair of the Board of Directors of Tungray Industrial since May 2010, and as its CEO since its formation in May 2010, and has served as CEO of Tongsheng Intelligent Equipment (Shenzhen) Co., Ltd. since its formation in October 2021 and as the CEO and director of Tongsheng Intelligence Technology Development (Shenzhen) Co., Ltd. since its formation in August 2022. In these roles, Mr. Tang played a major part in establishing our Shenzhen-based manufacturing base for our ETO-focused business and continues to supervise the various ETO-focused business lines of our Shenzhen-based subsidiaries. Mr. Tang started his career with one of our Singapore subsidiaries, first joining Tung Resource Pte. Ltd. in August 2004. He graduated from Singapore Institute of Management in 2002 with a diploma in Business and Management.

Mr. Kevin D. Vassily, Independent Director. Mr. Vassily has been serving as the independent director of the Company since March 28, 2024. Mr. Vassily has extensive working experience as a senior management team member serving private and public companies. Mr. Vassily has been a member of the board of directors of Aimfinity Investment Corp. I since March 2023, Thunder Power Holdings, Inc. (Nasdaq: AIEV), a Taiwanese electronic vehicle developer, since June 2024, and Denali Capital Acquisition Corp. (Nasdaq: DECA), a SPAC, since April 2022. From June 2022 to June 2024, he served

7

as a director of Feutune Light Acquisition Corporation, a Nasdaq-listed SPAC, until its business combination. In January 2021, he was appointed Chief Financial Officer, and in March 2021, became a member of the board of directors of iPower Inc. (Nasdaq: IPW), an online hydroponic equipment retailer and supplier. Prior to joining iPower, from 2019 to January 2021, Mr. Vassily served as Vice President of Market Development for Facteus, Inc., a financial analytics company focused on the Asset Management industry. From March 2019 through Janurary 2020, he served as an advisor at Woodseer Global, a financial technology firm providing global dividend forecasts. From October 2018 through its acquisition in March 2020, Mr. Vassily served as an advisor at Go Capture (which was acquired by Deloitte China in 2020), where he was responsible for providing strategic, business development, and product development advisory services for the company’s emerging “Data as a Service” platform. Since February 2020, Mr. Vassily has served as a director of Zhongchao Inc. (Nasdaq: ZCMD), a provider of healthcare information, education and training services to healthcare professionals and the public in China. Since July 2018, Mr. Vassily has also served as an advisor at Prometheus Fund, a Shanghai-based merchant bank/private equity firm focused on the “green” economy. From April 2015 through May 2018, Mr. Vassily served as an associate director of research at Keybanc Capital Markets Inc. From June 2010 to April 2015, he served as the director of research at Pacific Epoch, LLC (a wholly-owned subsidiary of Pacific Crest Securities LLC). From May 2007 to May 2010, he served as the Asia Technology business development representative and as a senior analyst at Pacific Crest Securities. From July 2003 to September 2006, he served as senior research analyst in the semiconductor technology group at Susquehanna International Group, LLP. From September 2001 to June 2003, Mr. Vassily served as the vice president and senior research analyst for semiconductor capital equipment at Thomas Weisel Partners Group, Inc. Mr. Vassily began his career on Wall Street in August 1998, as a research associate covering the semiconductor industry at Lehman Brothers. He holds a B.A. in liberal arts from Denison University and an M.B.A. from the Tuck School of Business at Dartmouth College.

Mr. David Ping Li, Independent Director. Mr. Li has been serving as the independent director of the Company since March 28, 2024. Mr. Li has more than 25 years of experience in the finance and investment industries. Mr. Li is vice president of Finance at Perfect Storm founded by Justin Lin who directed films and TV series including the global franchise film Fast and Furious sequels and TV series since January 2023. He was vice president of Finance and co-founder at Anthem & Song Pictures from February 2015 and vice president of International Finance at AGBO Films LLC (part-time from June 2020 to July 2022), both co-founded by the Russo brothers, who directed Avengers: Infinity War, Avengers: End Game, Captain America: The Winter Soldier and Captain America: Civil War. Mr. Li was a director of Feutune Light Acquisition Corp., a SPAC listed on Nasdaq, from June 2022 until its business combination in June 2024. From January 2012 to December 2014, Mr. Li was managing director of Strategic Investment, Open Innovation at Koninklijke Phillips N.V. (NYSE: PHG), a global electronics company. From November 2008 to December 2011, Mr. Li was investment director at Intel Capital, the investment division of Intel Corporation with focus on investments in the technology, media, and telecom sector. From January 2004 to October 2008, Mr. Li served as managing director at ChinaVest Inc., a venture capital firm responsible for identifying, evaluating and executing investments to achieve financial returns. From February 2002 to July 2003, Mr. Li served as Chief Financial Officer of Great Wall Technology Co. Ltd., a publicly traded diversified technology company. Mr. Li was senior associate in the Investment Banking Division of Donaldson, Lufkin & Jenrette (acquired by Credit Suisse First Boston) from September 1998 to December 2001. From November 2008 to October 2019, Mr. Li served as independent director and chairman of the audit committee of Highpower International, Inc., a lithium battery company listed on Nasdaq (Nasdaq: HPJ). Mr. Li graduated from Peking University with a Bachelor of Arts degree in Biochemistry. He received a master’s degree in molecular biology from Columbia University and an MBA in finance from the Wharton School of University of Pennsylvania.

8

Mr. Weston Twigg, Independent Director. Mr. Twigg has been serving as the independent director of the Company since March 28, 2024. In October 2023, he co-founded Good Distillations Co., where he acts as CEO. Prior to this, Mr. Twigg was an independent director and audit committee chair for TradeUP Acquisition Corp., a special purpose acquisition company listed on Nasdaq, from July 2021 to September 2023. Mr. Twigg served as Chief Financial Officer of Inno Holdings Inc., a building technology company, from January 2023 to July 2023. Mr. Twigg was previously a Managing Director and Equity Research Analyst leading the Industry 4.0 Software and Systems research practice at Piper Sandler, from July 2021 to September 2022. Before joining Piper Sandler, he was a Managing Director and Equity Research Analyst leading the semiconductor equity research group at KeyBanc Capital Markets from 2014 to 2021. Before joining KeyBanc Capital Markets, Mr. Twigg was an Associate Equity Analyst from 2005 to 2007, Senior Equity Analyst from 2007 to 2012, and Principal from 2012 to 2014 at Pacific Crest Securities until Pacific Crest Securities was acquired by KeyBanc Capital Markets in September 2014. Prior to joining Pacific Crest Securities, Mr. Twigg worked in the semiconductor industry as a senior engineer at Intel from 2000 to 2005, and before that, as a process engineer at Samsung from 1998 to 2000. Mr. Twigg received his MBA from the Michael G. Foster School of Business, University of Washington, his Master of Science in Chemical Engineering from Michigan State University, and his Bachelor of Arts in Chemistry from Albion College. Mr. Twigg has been recognized as one of the Top Ten Stock Pickers in the U.S. by Financial Times and StarMine, and has been a winner in The Wall Street Journal’s “Best on the Street” survey multiple times, including taking the top spot in 2011. In 2008, he was voted “Best Up-and-Coming Analyst” by Institutional Investor, and he has been regularly named in that publication’s All-American Research Team.

Duties of Directors

Under Cayman Islands law, all of our directors owe fiduciary duties to the Company, including a duty of loyalty, a duty to act honestly and a duty to act in what they consider in good faith to be in our best interests. Our directors must also exercise their powers only for a proper purpose. Our directors also owe our company a duty to act with skill and care. It was previously considered that a director need not exhibit in the performance of his or her duties a greater degree of skill than may reasonably be expected from a person of his or her knowledge and experience. However, English and Commonwealth courts have moved towards an objective standard with regard to the required skill and care and these authorities are likely to be followed in the Cayman Islands. In fulfilling their duty of care to us, our directors must ensure compliance with our memorandum and articles of association, as amended from time to time. The Company has the right to seek damages if a duty owed by any of our directors is breached. In certain limited exceptional circumstances, a shareholder may have the right to seek damages in our name if a duty owed by our directors is breached.

Terms of Directors and Executive Officers

Each of the Company’s directors holds office for the term, if any, fixed by the resolution of shareholders or the resolution of directors appointing him, or until his earlier death, resignation or removal. If no term is fixed on the appointment of a director, the director serves indefinitely until his earlier death, resignation or removal. The office of director shall be vacated if the director (a) becomes bankrupt or makes any arrangement or composition with his creditors; (b) dies or is found to be or becomes of unsound mind; (c) resigns his office by notice in writing to the Company; (d) without special leave of absence from the Board, is absent from meetings of the Board for three consecutive meetings and the Board resolves that his office be vacated; or (e) is removed from office pursuant to any other provision of the Articles of Association of the Company.

9

All of the Company’s executive officers are appointed by and serve at the discretion of the Company’s Board.

Qualification

There is currently no shareholding qualification for directors.

Committees of the Board of Directors

The Company has established three committees under the Board: An audit committee, a compensation committee and a nominating and corporate governance committee. Even though the Company is exempted from corporate governance standards because it is a foreign private issuer, the Company has voluntarily adopted a charter for each of the three committees. Each committee’s members and functions are described below.

Audit Committee

The Audit Committee is responsible for, among other matters:

·appointing the independent auditors and pre-approving all auditing and non-auditing services permitted to be performed by the independent auditors;

·reviewing with the independent auditors any audit problems or difficulties and management’s response;

·discussing the annual audited financial statements with management and the independent auditors;

·reviewing the adequacy and effectiveness of our accounting and internal control policies and procedures and any steps taken to monitor and control major financial risk exposures;

·reviewing and approving all proposed related party transactions;

·meeting separately and periodically with management and the independent auditors; and

·monitoring compliance with our code of business conduct and ethics, including reviewing the adequacy and effectiveness of our procedures to ensure proper compliance.

Our Audit Committee consists of Kevin D. Vassily, David Ping Li and Weston Twigg, with Kevin D. Vassily serving as chair of the Audit Committee. Our board has affirmatively determined that each of the members of the Audit Committee meets the definition of “independent director” for purposes of serving on an Audit Committee under Rule 10A-3 of the Exchange Act and Nasdaq rules. In addition, our board has determined that Kevin D. Vassily qualifies as an “audit committee financial expert” as such term is currently defined in Item 407(d)(5) of Regulation S-K and meets the financial sophistication requirements of the Nasdaq rules.

10

Compensation Committee

The Compensation Committee is responsible for, among other matters:

·reviewing and approving to the board with respect to the total compensation package for our most senior executive officers;

·approving reviewing and recommending to the board with respect to the compensation of our directors; and overseeing the total compensation package for our executives other than the most senior executive officers;

·reviewing periodically and approving any long-term incentive compensation or equity plans, if any;

·selecting compensation consultants, legal counsel or other advisors after taking into consideration all factors relevant to that person’s independence from management; and

·programs or similar arrangements, annual bonuses, employee pension and welfare benefit plans.

Our Compensation Committee consists of Kevin D. Vassily, David Ping Li and Weston Twigg, with David Ping Li serving as chair of the Compensation Committee. Our board has affirmatively determined that each of the members of the Compensation Committee meets the definition of “independent director” for purposes of serving on Compensation Committee under Nasdaq rules.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for, among other matters:

·identifying and recommending nominees for election or re-election to our board of directors or for appointments to fill any vacancy;

·reviewing annually with our board of directors its current composition in light of the characteristics of independence, age, skills, experience and availability of service to us;

·identifying and recommending to our board the directors to serve as members of committees;

·advising the board periodically with respect to significant developments in the law and practice of corporate governance as well as our compliance with applicable laws and regulations, and making recommendations to our board of directors on all matters of corporate governance and on any corrective action to be taken; and

·monitoring compliance with our code of business conduct and ethics, including reviewing the adequacy and effectiveness of our procedures to ensure proper compliance.

Our Nominating and Corporate Governance Committee consists of Kevin D. Vassily, David Ping Li and Weston Twigg, with Weston Twigg serving as chair of the Nominating and Corporate Governance Committee. Our board has affirmatively determined that each of the members of the Nominating and

11

Corporate Governance Committee meets the definition of “independent director” for purposes of serving on a Nominating and Corporate Governance Committee under Nasdaq rules.

Code of Business Conduct and Ethics

Our board has adopted a code of business conduct and ethics that applies to our directors, officers and employees.

Insider Trading Policy

The Board has adopted an Insider Trading Policy (the “Insider Trading Policy”) that sets forth restrictions and procedures regarding trading by insiders in the securities of the Company. The Board reviews the Insider Trading Policy at least annually and makes updates as necessary.

Clawback Policy

The Board has adopted an Executive Compensation Recovery Policy (the “Clawback Policy”) providing for the recovery of certain incentive-based compensation from current and former executive officers of the Company in the event the Company is required to restate any of its financial statements filed with the SEC under the Exchange Act in order to correct an error that is material to the previously-issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period. Adoption of the Clawback Policy was mandated by new Nasdaq listing standards introduced pursuant to Exchange Act Rule 10D-1. The Clawback Policy is in addition to Section 304 of the Sarbanes-Oxley Act of 2002 which permits the SEC to order the disgorgement of bonuses and incentive-based compensation earned by a registrant issuer’s chief executive officer and chief financial officer in the year following the filing of any financial statement that the issuer is required to restate because of misconduct, and the reimbursement of those funds to the issuer.

Compensation of Executive Officers

We entered into an employment agreement with each of our executive officers on March 29, 2023, except that we entered into an employment agreement with Ms. Qian, our CFO, on September 1, 2024. The term of each of our executive officers’ employment will be automatically renewed unless terminated by either party by giving 30-day advance notice. We may terminate the employment for cause, at any time, for certain acts of the executive officer, including but not limited to the commitments of any serious or persistent breach or non-observance of the terms and conditions of the employment, conviction of a criminal offense, willful disobedience of a lawful order, fraud or dishonesty, receipt of bribery, or severe neglect of his or her duties. Each executive officer has agreed to hold, both during and after the employment agreement expires, in strict confidence and not to use or disclose to any person, corporation or other entity without written consent, any confidential information. In addition, each executive officer has agreed to be bound by non-competition and non-solicitation restrictions during the term of his or her employment and for one year following termination of the employment.

In addition to the above-mentioned employment agreements, Lei Yao entered into an employment agreement on July 1, 2022 with Tungray Singapore, one of our wholly owned subsidiaries. Pursuant to such employment agreement, Mr. Yao agreed to provide services as Chief Technology Officer to Tungray Singapore or any of the affiliated companies.

12

For the year ended December 31, 2024, we paid an aggregate of $566,732 in cash to our executive officers. For the year ended December 31, 2023, we paid an aggregate of $309,852 in cash to our executive officers. We have not set aside or accrued any amount to provide pension, retirement or other similar benefits to our directors and executive officers.

Our subsidiaries in PRC are required by law to make contributions equal to certain percentages of each employee’s salary for his or her medical insurance, maternity insurance, workplace injury insurance, unemployment insurance, pension benefits and housing provident fund.

Compensation of Directors

For the fiscal year ended December 31, 2024, we paid an aggregate of $30,000 in cash to our directors, payable in equal instalments monthly. For the fiscal year ended December 31, 2023, we did not compensate our directors.

We have agreed to pay each of the independent directors an annual cash compensation in the amount of $20,000, payable in equal instalments monthly, and annual equity compensation of 6,000 Class A ordinary shares payable yearly since the effectiveness of the registration statement in connection with our initial public offering on March 28, 2024.

13

OWNERSHIP OF THE COMPANY’S SECURITIES

The following tables set forth certain information with respect to the beneficial ownership of our Class A ordinary shares (including Class A ordinary shares issuable upon the conversion of outstanding Class B ordinary shares) for:

●each shareholder known by us to be the beneficial owner of more than 5% of our outstanding Class A ordinary shares or Class B ordinary shares;

●each of our directors;

●each of our named executive officers; and

●all of our directors and executive officers as a group.

The beneficial ownership of our Class A ordinary shares is determined in accordance with the rules of the SEC and generally includes any shares over which a person exercises sole or shared voting or investment power, and includes the Class A ordinary shares issuable upon the conversion of the outstanding Class B Ordinary Shares, share options, warrants and any other securities that are exercisable within 60 days of the date hereof. Class A ordinary shares issuable pursuant to exercise of convertible securities are deemed outstanding for computing the percentage of the person holding such convertible securities but are not outstanding for computing the percentage of any other person. As of the date hereof, there were 67,674 Class A ordinary shares issuable pursuant to warrants exercisable within 60 days thereof, and none of the shareholders listed in the table below holds any warrants.

The percentage of beneficial ownership owned is based on 11,793,485 Class A ordinary shares and 4,560,000 Class B ordinary shares outstanding as of the date hereof. Except where otherwise indicated, we believe, based on information furnished to us by such owners, that the beneficial owners listed below have sole investment and voting power with respect to such shares. Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o #02-01, 31 Mandai Estate, Innovation Place Tower 4, Singapore 729933.

14

Name and Address of Beneficial Owner |

| Class A Ordinary Shares |

| Class B Ordinary shares | ||||

|

|

|

| % of Voting |

|

|

| % of Total Voting |

|

| Shares |

| Power* |

| Shares |

| Power* |

Directors and Named Executive Officers |

|

|

|

|

|

|

|

|

Wanjun Yao (1) (7) |

| 4,092,000 |

| 3.97% |

| 4,560,000 |

| 88.55% |

Lei Yao |

| — |

| — |

| — |

| — |

Nina Qian |

| — |

| — |

| — |

| — |

Jingan Tang (2) |

| 2,520,000 |

| 2.45% |

| — |

| — |

Kevin D. Vassily |

| — |

| — |

| — |

| — |

David Ping Li |

| — |

| — |

| — |

| — |

Weston Twigg |

| — |

| — |

| — |

| — |

All executive officers and directors as a group (8 persons) |

| 6,658,150 |

| 6.47% |

| 4,560,000 |

| 88.55% |

5% Shareholders |

|

|

|

|

|

|

|

|

Pegasus Technologies Holding Ltd. (1) |

| 690,000 |

| 0.67% |

| — |

| — |

Pegasus Automation Global Ltd. (1) |

| 720,000 |

| 0.70% |

| — |

| — |

Enolios Ltd. (1) |

| 2,250,000 |

| 2.18% |

| — |

| — |

Pegasus Automation Ltd. (1) |

| — |

| — |

| 4,560,000 |

| 88.55% |

YuChang Global Ltd. (2) |

| 738,000 |

| 0.72% |

| — |

| — |

ChangYuan International Ltd. (2) |

| 1,782,000 |

| 1.73% |

| — |

| — |

UXY Technology Ltd. (3) |

| 1,539,000 |

| 1.49% |

| — |

| — |

WG5 Group Ltd. (4) |

| 999,000 |

| 0.97% |

| — |

| — |

HuiTec. Ltd. (5) |

| 540,000 |

| 0.52% |

| — |

| — |

Aurora International |

| 432,000 |

| 0.42% |

| — |

| — |

*Represents the voting power with respect to all of our Class A ordinary shares and Class B ordinary shares, voting as a single class. According to our amended memorandum and articles of association, holders of Class A ordinary shares are entitled to one vote per share on all matters subject to the vote at general meetings of our company, and holders of Class B ordinary shares are entitled to 20 votes per share on all matters subject to the vote at general meetings of our company.

†Less than 1%.

(1)Includes (i) 690,000 Class A ordinary shares held by Pegasus Technologies Holding Ltd.; (ii) 720,000 Class A ordinary shares held by Pegasus Automation Global Ltd.; (iii) 2,250,000 Class A ordinary shares held by Enolios Ltd. (“Enolios”); and (iv) 4,560,000 Class B ordinary shares held by Pegasus Automation Ltd. All four holding companies are limited liability companies incorporated under the British Virgin Islands laws and controlled by Mr. Wanjun Yao. The person having voting, dispositive or investment powers four entities is Mr. Yao.

(2)Includes (i) 1,782,000 Class A ordinary shares held by ChangYuan International Ltd.; and (ii) 738,000 Class A ordinary shares held by YuChang Global Ltd., both of which are limited liability companies incorporated under the British Virgin Islands laws and wholly-owned by Mr. Jingan Tang. The person having voting, dispositive or investment powers over these two entities is Mr. Jingan Tang.

(3)UXY Technology Ltd is a limited liability company incorporated under the British Virgin Islands laws and wholly-owned by Mr. Demin Han. The address of UXY Technology Ltd is Craigmuir Chambers, Road Town, Tortola, VG 1110, British Virgin Islands. The person having voting, dispositive or investment powers over UXY Technology Ltd is Mr. Han.

15

(4)WG5 Group Ltd. is a limited liability company incorporated under the British Virgin Islands laws and wholly-owned by Mr. Mingxing Gao. The address of WG5 Group Ltd. is Craigmuir Chambers, Road Town, Tortola, VG 1110, British Virgin Islands. The person having voting, dispositive or investment powers over WG5 Group Ltd. is Mr. Gao.

(5)HuiTec. Ltd. is a limited liability company incorporated under the British Virgin Islands laws and wholly-owned by Mr. Gang Wang. The address of HuiTec. Ltd. is Craigmuir Chambers, Road Town, Tortola, VG 1110, British Virgin Islands. The person having voting, dispositive or investment powers over HuiTec. Ltd.is Mr. Wang.

(6)Aurora International Development Ltd. is a limited liability company incorporated under the British Virgin Islands laws and wholly-owned by Ms. Liling Du. The address of Aurora International Development Ltd. is Craigmuir Chambers, Road Town, Tortola, VG 1110, British Virgin Islands. The person having voting, dispositive or investment powers over HuiTec. Ltd.is Ms. Du.

(7)Ms. Liling Du is the wife of Mr. Wanjun Yao, the Chairman, CEO and director of the Company. As spouses, Mr. Yao may be deemed to share the voting, dispositive or investment powers over Aurora International Development Ltd.

The Company is not aware of any arrangement that may, at a subsequent date, result in a change of control of the Company.

To our knowledge, no other shareholder beneficially owns more than 5% of our shares. Our company is not owned or controlled directly or indirectly by any government or by any corporation or by any other natural or legal person severally or jointly.

16

CERTAIN RELATIONS AND RELATED PARTY TRANSACTIONS

A related party is generally defined as (i) any person and or their immediate family hold 10% or more of the company’s securities (ii) the Company’s management and or their immediate family, (iii) someone that directly or indirectly controls, is controlled by or is under common control with the Company, or (iv) anyone who can significantly influence the financial and operating decisions of the Company.

During the last three years and up to the date of the filing of the Annual Report on Form 20-Ffon May 14, 2025, we have engaged in the following transactions with our related parties. Wanjun Yao, our Chief Executive Officer, is the major shareholder in our financial statements.

The table below sets forth the major related parties which has balances or transactions during the years presented and their relationships with the Company:

Name of related parties | Relationship with the Company |

FDT (Qingdao) Intellectual Technology Co., Ltd | Common control under major shareholder |

Tungray (Kunshan) Industrial Automation Co., Ltd | Common control under major shareholder |

Tungray (Kunshan) Robot Intelligent Technology Co., Ltd | Common control under major shareholder |

Qingdao Tungray Technology Development Co., Ltd. | Common control under major shareholder |

Shanghai Tongrui Investment Management Co., Ltd. | Common control under major shareholder |

Hefei CAS Dihuge Automation Co. Ltd | 10.27% ownership interest investee |

Kunshan Tungray Intelligent Technology Co., Ltd. | Common control under major shareholder |

Qingdao Tungray Biology Technology Co., Ltd. | Common control under major shareholder |

Shanghai Tongrui Industrial Automation Equipment Co., Ltd | Common control under major shareholder |

Wanjun Yao | Major shareholder/Chairman, Chief Executive Officer and Director |

Jingan Tang | Director/Senior Manager of Tungray Industrial Automation (Shenzhen) Co., Ltd., a subsidiary |

Liling Du | CFO of Tungray Singapore |

Gang Wang | Shareholder of Tungray Singapore and Tung Resource Pte. Ltd., a subsidiary |

Demin Han | Director of Tung Resource Pte. Ltd., a subsidiary |

Lei Yao | Chief Technology Officer |

Mingxing Gao | Director of Tungray Singapore |

Hui Tang | Senior management of Qingdao Tungray Intelligent Technology Co., Ltd., a subsidiary |

Tungmoon Investment Co., Ltd. | Common control under major shareholder |

17

Related party balances

Account Receivable – related parties

Name of Related Party |

| As of December 31, 2024 |

| As of December 31, 2023 |

| As of December 31, 2022 |

|

|

|

|

|

|

|

FDT (Qingdao) Intellectual Technology Co., Ltd |

| $30,092 |

| $19,372 |

| $67,031 |

Tungray (Kunshan) Industrial Automation Co., Ltd |

| 210,811 |

| 202,679 |

| 7,626 |

Tungray (Kunshan) Robot Intelligent Technology Co., Ltd |

| 51,444 |

| 52,889 |

| 30,086 |

Kunshan Tungray Intelligent Technology Co., Ltd. |

| 35,209 |

| 44,649 |

| - |

Total |

| $327,556 |

| $319,589 |

| $104,743 |

Account payable, related parties

Name of Related Party |

| As of December 31, 2024 |

| As of December 31, 2023 |

| As of December 31, 2022 |

|

|

|

|

|

|

|

FDT (Qingdao) Intellectual Technology Co., Ltd. |

| $13,700 |

| $365,665 |

| $- |

Qingdao Tungray Technology Development Co., Ltd. |

| 8,841 |

| 26,061 |

| - |

Shanghai Tongrui Industrial Automation Equipment Co., Ltd |

| 31,510 |

| 32,395 |

| 33,347 |

Shanghai Tongrui Investment Management Co., Ltd. |

| - |

| 54,661 |

| 56,267 |

Kunshan Tungray Intelligent Technology Co., Ltd. |

| 6,346 |

| - |

| - |

Hefei CAS Dihuge Automation Co., Ltd. |

| 19,591 |

| 20,141 |

| 20,733 |

Total |

| $79,988 |

| $498,923 |

| $110,347 |

18

Other receivables – related parties

Other receivables – related parties are those nontrade receivables arising from transactions between the Company and certain related parties, such as advances made by the Company on behalf of related parties, and advance to related parties. These balances are unsecured and non-interest bearing. Current receivables are due on demand.

|

| As of December 31, 2024 |

| As of December 31, 2023 |

| As of December 31, 2022 |

Qingdao Tungray Biology Technology Co., Ltd. |

| $44,377 |

| $23,816 |

| $- |

FDT (Qingdao) Intellectual Technology Co., Ltd |

| 227,242 |

| - |

| 3,345 |

Du Liling |

| 48,828 |

| - |

| - |

Hui Tang |

| - |

| - |

| 13,348 |

Tungmoon Investment Co., Ltd. |

| - |

| - |

| 7,134 |

Total |

| $320,447 |

| $23,816 |

| $23,827 |

Other payable– related parties

Other payables – related parties are those nontrade payables arising from transactions between the Company and certain related parties, such as advances made by the related party on behalf of the Company, dividend payables and related accrued interest payable on the advances. These balances are unsecured and non-interest bearing. Current payables are due on demand.

Name of Related Party |

| As of December 31, 2024 |

| As of December 31, 2023 |

| As of December 31, 2022 |

FDT (Qingdao) Intellectual Technology Co., Ltd |

| $39,323 |

| $- |

| $- |

Tungray (Kunshan) Industrial Automation Co., Ltd. |

| - |

| 41,853 |

| - |

Qingdao Tungray Technology Development Co., Ltd. |

| 18,438 |

| - |

| - |

Shanghai Tongrui Investment Management Co., Ltd |

| - |

| - |

| 1,160 |

Jingan Tang |

| 280,692 |

| 277,607 |

| 691,792 |

Liling Du |

| - |

| 38,216 |

| 96,475 |

Gang Wang |

| - |

| 54,005 |

| 188,525 |

Demin Han |

| - |

| 156,455 |

| 538,014 |

Lei Yao |

| - |

| 2,893 |

| - |

Mingxing Gao |

| - |

| 99,837 |

| 349,566 |

Total |

| $338,453 |

| $670,866 |

| $1,865,532 |

19

Prepayment-related parties

Name of Related Party |

| As of December 31, 2024 |

| As of December 31, 2023 |

| As of December 31, 2022 |

|

|

|

|

|

|

|

Shanghai Tongrui Investment Management Co., Ltd. |

| $20,254 |

| $- |

| $- |

FDT (Qingdao) Intellectual Technology Co., Ltd |

| 776,878 |

| - |

| - |

Tungray (Kunshan) Robot Intelligent Technology Co., Ltd |

| 14,286 |

| - |

| - |

Qingdao Tungray Technology Development Co., Ltd. |

| 53,497 |

| 55,000 |

| 48,115 |

Tungray (Kunshan) Industrial Automation Co., Ltd. |

| 3,003,903 |

| 993,745 |

| - |

Provision of doubtful accounts |

| (53,497) |

| - |

| - |

Total |

| $3,815,321 |

| $1,048,745 |

| $48,115 |

Movements of provision of doubtful accounts of prepayments-related parties are as follows:

|

| For the Years Ended December 31, | ||||

|

| 2024 |

| 2023 |

| 2022 |

|

|

|

|

|

|

|

Beginning balance |

| $- |

| $- |

| $- |

Addition (recovery) |

| 54,267 |

| - |

| - |

Exchange rate effect |

| (770) |

| - |

| - |

Ending balance |

| $53,497 |

| $- |

| $- |

Operating lease liabilities- related parties

The Company entered into three lease agreements as a lessee under which it leased three operation buildings for 5-7 years from two related parties. The Company accounts for the leases in accordance with Financial Accounting Standards Board (FASB) Account Standards Codification (ASC) 842. The Company’s underlying building properties were classified as operating leases, and the related lease liabilities were recorded under operating lease liabilities – related parties.

Name of Related Party |

| As of December 31, 2024 |

| As of December 31, 2023 |

| As of December 31, 2022 |

|

|

|

|

|

|

|

Tungray (Qingdao) Technology Development Co., Ltd |

| $201,296 |

| $244,112 |

| $206,789 |

Jingan Tang |

| 158,007 |

| 218,432 |

| 356,390 |

Total |

| 359,303 |

| 462,544 |

| 563,179 |

Current portion of operating lease liabilities - related parties |

| (168,551) |

| (123,094) |

| (73,166) |

Noncurrent portion of operating lease liabilities - related parties |

| $190,752 |

| $339,450 |

| $490,013 |

20

Related party transactions

Revenue from related parties

|

|

|

| For the Years Ended December 31, | ||||

Name of Related Party |

| Nature |

| 2024 |

| 2023 |

| 2022 |

Tungray (Kunshan) Industrial Automation Co., Ltd. |

| Sales of products |

| $8,581 |

| $231,209 |

| $- |

Tungray (Kunshan) Robot Intelligent Technology Co., Ltd. |

| Sales of products |

| - |

| 26,245 |

| - |

FDT (Qingdao) Intellectual Technology Co., Ltd. |

| Sales of products |

| 30,761 |

| 4,602 |

| 66,096 |

Kunshan Tungray Intelligent Technology Co., Ltd. |

| Sales of products |

| - |

| 57,490 |

| - |

Kunshan Tongri Intelligent Manufacturing Technology Research Institute Co., Ltd |

| Sales of products |

| - |

| - |

| 1,093 |

Total |

|

|

| $39,342 |

| $319,546 |

| $67,189 |

Purchase from related parties

|

|

|

| For the Years Ended December 31, | ||||

Name of Related Party |

| Nature |

| 2024 |

| 2023 |

| 2022 |

FDT (Qingdao) Intellectual Technology Co., Ltd. |

| Products and services purchase |

| $12,298 |

| $961,525 |

| $41,566 |

Tungray (Kunshan) Industrial Automation Co., Ltd. |

| Products and services purchase |

| 12,993 |

| - |

| - |

Total |

|

|

| $25,291 |

| $961,525 |

| $41,566 |

Non-operating income- related parties

|

|

|

| For the Years Ended December 31, | ||||

Name of Related Party |

| Nature |

| 2024 |

| 2023 |

| 2022 |

Qingdao Tungray Biology Technology Co., Ltd |

| Lease income |

| $19,762 |

| $19,126 |

| $25,129 |

Rental expenses- related parties

|

|

|

| For the Years Ended December 31, | ||||

Name of Related Party |

| Nature |

| 2024 |

| 2023 |

| 2022 |

Qingdao Tungray Technology Development Co., Ltd |

| Lease expense |

| $59,963 |

| $66,476 |

| $51,219 |

Jingan Tang |

| Lease expense |

| 71,255 |

| 72,411 |

| 63,841 |

Total |

|

|

| $131,218 |

| $138,887 |

| $115,060 |

21

Policies and Procedures for Related Party Transactions

Our board of directors has established an audit committee which is tasked with review and approval of all related party transactions.

Vote Required and Board Recommendation

If a quorum is present, the affirmative vote of a simple majority of the votes of the holders of ordinary shares present in person or represented by proxy and entitled to vote at the Meeting will be required to re-elect all of the Director Nominees.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 1, THE RE-ELECTION TO THE BOARD OF DIRECTORS OF ALL OF THE NOMINEES.

22

PROPOSAL NO. 2

On June 9, 2025, the Audit Committee dismissed Marcum Asia CPAs LLP and appointed Guangdong Prouden CPAs GP as its independent registered public accounting firm, effective on the same day for the fiscal year ending December 31, 2025 (the “Change of Auditor”). The Change of Auditor was made after careful consideration and evaluation process by the Company and the Audit Committee. The Company’s decision to make the Change of Auditor was not the result of any disagreement between the Company and Marcum Asia CPAs LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure.

We are asking our shareholders to ratify the selection of Guangdong Prouden CPAs GP as our independent registered public accounting firm. In the event our shareholders fail to ratify the appointment, the Audit Committee may reconsider this appointment.

We have been advised by Guangdong Prouden CPAs GP that neither the firm nor any of its associates had any relationship during the last fiscal year with our company other than the usual relationship that exists between independent registered public accountant firms and their clients. Representatives of Guangdong Prouden CPAs GP are not expected to attend the Meeting in person and therefore are not expected to be available to respond to any questions.

Principal Accountant Fees and Services

The following table sets forth the aggregate fees by categories specified below in connection with certain professional services rendered by Marcum Asia CPAs LLP, the independent auditor of the Company prior to the Change of Auditor on June 9, 2025, for the periods indicated.

|

| December 31, |

| December 31, | ||

|

| USD |

| USD | ||

Audit Fees |

| $ | 418,250 |

| $ | 376,397 |

Audit Fees — This category includes the audit of our annual financial statements, review of interim financial statements and services that are normally provided by the independent registered public accounting firm in connection with engagements for those years and services that are normally provided by our independent registered public accounting firm in connection with statutory audits and SEC regulatory filings or engagements.

Policies and Procedures Relating to Approval of Services by Our Independent Registered Public Accountants

The Audit Committee is solely responsible for the approval in advance of all audit and permitted non-audit services to be provided by our independent registered public accounting firms (including the fees and other terms thereof), subject to the de minimus exceptions for non-audit services provided by Section 10A(i)(1)(B) of the Exchange Act, which services are subsequently approved by the Audit Committee prior to the completion of the audit. None of the fees listed above are for services rendered pursuant to such de minimus exceptions.

23

The Audit Committee of our Board has established its pre-approval policies and procedures, pursuant to which the Audit Committee approved the audit services to be provided by Guangdong Prouden CPAs GP for the fiscal year ending December 31, 2025. The full Audit Committee approves proposed services, and fee estimates for these services. One or more independent directors serving on the Audit Committee may be delegated by the full Audit Committee to pre-approve any audit and non-audit services. Any such delegation shall be presented to the full Audit Committee at its next scheduled meeting.

Vote Required

If a quorum is present, the affirmative vote of a simple majority of the votes of the holders of ordinary shares present in person or represented by proxy and entitled to vote at the Meeting will be required to approve the appointment of Guangdong Prouden CPAs GP.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 2, THE APPOINTMENT OF GUANGDONG PROUDEN CPAS GP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM AS DESCRIBED IN THIS PROPOSAL 2.

24

PROPOSAL NO. 3

The Board has approved the Tungray Technologies Inc 2025 Equity Incentive Plan (the “2025 Plan”), subject to shareholder approval. Our employees, officers, directors, and consultants are eligible to be granted share options (including incentive share options), restricted share awards, restricted share unit awards, share appreciate rights, performance units and performance shares (each, an “Award”) under the 2025 Plan. The 2025 Plan is expected to be administered by the Compensation Committee, which has all the power to administer the 2025 Plan according to its terms, including the power to grant Awards, determine who may be granted Awards and the types and amounts of Awards to be granted, prescribe Award agreements, and establish programs for granting Awards. Awards may be made under the 2025 Plan for up to 1,180,000 Class A ordinary shares. No awards have been granted under the 2025 Plan as of today.

The purpose of the 2025 Plan is to recognize contributions made to our company and its affiliates by such individuals and to provide them with additional incentive to achieve the objectives of our Company. The following is a summary of the 2025 Plan and is qualified by the full text of the 2025 Plan.

Administration. The 2025 Plan will be administered by the Compensation Committee of the Board (we refer to body administering the 2025 Plan as the “Committee”).

Number of Class A Ordinary Shares. The number of Class A ordinary shares that may be issued under the 2025 Plan is 1,180,000. Shares issuable under the 2025 Plan may be authorized but unissued shares or treasury shares. If there is a lapse, forfeiture, expiration, termination or cancellation of any award made under the 2025 Plan for any reason, the shares subject to the award will again be available for issuance. Any shares subject to an award that are delivered to us by a participant, or withheld by us on behalf of a participant, as payment for an award or payment of withholding taxes due in connection with an award will not again be available for issuance, and all such shares will count toward the number of shares issued under the 2025 Plan. The number of Class A ordinary shares issuable under the 2025 Plan is subject to adjustment, in the event of any dividend, share split, combination or exchange of Shares, amalgamation, arrangement or consolidation, spin-off, recapitalization or other distribution (other than normal cash dividends) of Company assets to its shareholders, or any other change affecting the Class A ordinary shares or the share price of an ordinary share. In each case, the Committee has the discretion to make adjustments it deems necessary to preserve the intended benefits under the 2025 Plan. No award granted under the 2025 Plan may be transferred, except by will, the laws of descent and distribution.

Eligibility. All employees (including officers), directors, and consultants of the Company and its subsidiaries are eligible to receive awards under the 2025 Plan.

Awards to Participants. The Plan provides for discretionary awards of, among others, share options (including incentive share options), restricted share awards, restricted share unit awards, share appreciate rights, performance units and performance shares to participants. Each Award made under the 2025 Plan will be evidenced by a written award agreement specifying the terms and conditions of the Award as determined by the Committee in its sole discretion, consistent with the terms of the 2025 Plan.

Share Options. The Committee has the discretion to grant non-qualified share options to participants or incentive share options to employees of the Company or its affiliates, and to set the terms and conditions applicable to the options, including the type of option, the exercise price, the number of shares subject to the option and the vesting schedule; each option will expire upon such date as set forth in the award agreement, but shall in no case expire later than ten years from the date of grant and no dividend equivalents may be paid with respect to share options. The exercise price of any share option granted to any ten-percent holders of the total combined voting power of all classes of shares of the Company or any parent or subsidiary of the Company may not be less than 110% of fair market value on the date of grant and such option may not be exercisable for more than five years from the date of grant.

25

Restricted Share Awards. The Committee has the discretion to grant share awards to participants. Class A ordinary shares may be granted for appropriate consideration as determined by the Board. The number of shares awarded to each participant, and the restrictions, terms and conditions of the Award, will be at the discretion of the Committee. A participant will be a shareholder with respect to the shares awarded to him or her and will have the rights of a shareholder with respect to the shares, including the right to vote the shares and receive dividends on the shares, only once the restrictions and vesting conditions are lifted.

Restricted Share Unit Awards. The Committee may, in its discretion, grant share unit awards to any participant. Each share unit subject to the Award shall entitle the participant to receive, on the date or the occurrence of an event (including the attainment of performance goals) as described in the share unit award agreement, a share or cash equal to the fair market value of a share on the date of such event as provided in the share unit award agreement.

Share Appreciation Rights or SAR. The Committee may grant SARs to participants. Upon exercise, an SAR entitles the participant to receive from the Company the number of shares having an aggregate fair market value equal to the excess of the fair market value of one share as of the date on which the SAR is exercised over the exercise price, multiplied by the number of shares with respect to which the SAR is being exercised. The Committee, in its discretion, shall be entitled to cause the Company to elect to settle any part or all of its obligations arising out of the exercise of an SAR by the payment of cash in lieu of all or part of the shares it would otherwise be obligated to deliver in an amount equal to the fair market value of such shares on the date of exercise. The terms and conditions of any such Award shall be determined at the time of grant.

Performance Share and Performance Unit Awards. The Committee may, in its discretion, grant performance share or share unit awards to any participant. Performance shares may be granted for appropriate consideration as determined by the Board, subject to the attainment of performance goals as described in the performance share award agreement. Each performance share unit subject to the Award shall entitle the participant to receive, on the date or the occurrence of the attainment of performance goals as described in the performance share unit award agreement, a share or cash equal to the fair market value of a Share on the date of such event as provided in the share unit award agreement.

Amendment and Termination of the Equity Incentive Plan. The Compensation Committee or the Board may, at any time terminate, and from time to time may amend or modify the 2025 Plan; provided, however, that no amendment or modification may become effective without approval of the amendment or modification by the shareholders of the Company if shareholder approval is required to enable the 2025 Plan to satisfy any applicable statutory or regulatory requirements. No amendment, modification or termination of the 2025 Plan shall in any manner adversely affect any awards theretofore granted under the 2025 Plan without the consent of the holders or the permitted transferee(s) of such Awards, subject always to applicable laws. No Awards may be granted or awarded during any period of suspension or after termination of the 2025 Plan.

Duration of the Plan. The 2025 Plan shall terminate the tenth anniversary of the effective date of the 2025 Plan unless earlier terminated. Awards outstanding at the time of the 2025 Plan’s termination may continue to be exercised in accordance with their terms and shall continue to be governed by and interpreted consistent with the terms of the 2025 Plan.

26

Vote Required and Board Recommendation

The affirmative vote of the holders of a majority of the ordinary shares present in person or represented by proxy and entitled to vote at the Meeting is required for approval of this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 3, THE TUNGRAY TECHNOLOGIES INC 2025 EQUITY INCENTIVE PLAN AS DESCRIBED IN THIS PROPOSAL 3.

27

OTHER MATTERS

The Board is not aware of any other matters to be submitted to the Meeting. If any other matters properly come before the Meeting, it is the intention of the persons named in the enclosed form of proxy to vote the shares they represent as the Board may recommend.

|

| By order of the Board of Directors |

August 12, 2025 |

| /s/ Wanjun Yao |

|

| Wanjun Yao |

|

| Chairman of the Board of Directors |

28

EXHIBIT A

FORM OF PROXY

A-1

A-2

EXHIBIT B

TUNGRAY TECHNOLOGIES INC

2025 EQUITY INCENTIVE PLAN

1. Purposes of the Plan. Tungray Technologies Inc, a Cayman Islands company (the “Company”) hereby establishes the Tungray Technologies Inc 2025 Equity Incentive Plan (the “Plan”). The purpose of the Plan is to promote the long-term success of the Company and the creation of shareholder value by (a) encouraging Employees, Directors and Consultants to focus on the Company’s performance, (b) encouraging the attraction and retention of Employees, Directors and Consultants with exceptional qualifications, and (c) providing incentives that align the interests of Employees, Directors and Consultants with those of the shareholder of the Company. The Plan permits the grant of Incentive Share Options, Nonstatutory Share Options, Restricted Shares, Restricted Share Units, Share Appreciation Rights, Performance Units, and Performance Shares as the Administrator may determine.

2. Definitions. The following definitions will apply to the terms in the Plan:

“Administrator” means the Board or any of its Committees as will be administering the Plan, in accordance with Section 4.

“Affiliate” means any corporation, partnership, limited liability company, limited liability partnership, business trust, or other entity or person controlling, controlled by or under common control of the Company, as determined by the Administrator in its sole discretion.

“Applicable Laws” means the legal requirements relating to the Plan and the Awards under applicable provisions of the corporate, securities, tax and other laws, rules, regulations and government order, and the rules of any applicable stock exchange, of any jurisdiction applicable to Awards granted to residents therein.

“Award” means, individually or collectively, a grant under the Plan of Options, SARs, Restricted Shares, Restricted Share Units, Performance Units, and Performance Shares.

“Award Agreement” means the written or electronic agreement setting forth the terms and provisions applicable to each Award granted under the Plan. The Award Agreement is subject to the terms and conditions of the Plan.

“Board” means the Board of Directors of the Company, as constituted from time to time.

“Cause” means, with respect to a Participant, unless in the case of a particular Award, the particular Award Agreement states otherwise, (a) the Company or the relevant Subsidiary, having “cause,” “just cause” or term of similar meaning or import, to terminate a Participant’s employment or service, as defined in any employment, consulting or services agreement with the Participant in effect at the time of such termination, or (b) in the absence of any such employment, consulting or services agreement (or the absence of any definition of “cause,” “just cause” or term of similar meaning or import contained therein), the following events or conditions, as determined by the Administrator in its sole discretion:

| (i) | any commission of an act of theft, embezzlement, fraud, dishonesty, ethical breach or other similar acts, or commission of a criminal offense; |

| (ii) | any material breach of any agreement or understanding between the Participant and the Company or the relevant Subsidiary including, without limitation, any applicable intellectual property and/or invention assignment, employment, non-competition, confidentiality or other similar agreement or the Company’s or the relevant Subsidiary’s code of conduct or other workplace rules; |

B-1

| (iii) | any material misrepresentation or omission of any material fact in connection with the Participant’s employment with the Company or the relevant Subsidiary or service as a Service Provider; |

| (iv) | any material failure to perform the customary duties as an Employee or Director, to obey the reasonable directions of a supervisor or to abide by the policies or codes of conduct of the Company or the relevant Subsidiary or to satisfy the requirements or working standards of the Company or the relevant Subsidiary during any applicable probationary employment period; or |

| (v) | any conduct that is materially adverse to the name, reputation or interests of the Company or any Subsidiary. |

“Change in Control” means the occurrence of any of the following events:

| (i) | Any transaction as a result of which any person is the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company representing at least 50% of the total voting power represented by the Company’s then outstanding voting securities. For purposes of this subsection (i), the term “person” shall have the same meaning as when used in sections 13(d) and 14(d) of the Exchange Act but shall exclude (A) a trustee or other fiduciary holding securities under an employee benefit plan of the Company or of a Parent or Subsidiary, and (B) a corporation owned directly or indirectly by the shareholders of the Company in substantially the same proportions as their ownership of the shares of the Company. For purposes of this subsection (i), the acquisition of additional shares by any one person, who is considered to own more than fifty percent (50%) of the total voting power of the securities of the Company will not be considered an additional Change in Control; |

| (ii) | A change in the composition of the Board occurring within a two-year period, as a result of which fewer than a majority of the directors are Incumbent Directors. “Incumbent Directors” means directors who either (A) are Directors as of the effective date of the Plan, or (B) are elected, or nominated for election, to the Board with the affirmative votes of at least a majority of the Directors at the time of such election or nomination (except where such election or nomination is in connection with an actual or threatened proxy contest relating to the election of directors to the Company); or |

| (iii) | The consummation of the sale, transfer or other disposition by the Company of all or substantially all of the Company’s assets, except with respect to a sale, transfer or other disposition of assets to a Parent, Subsidiary, or Affiliate; |

| (iv) | The consummation of a merger or consolidation of the Company with or into another entity or any other corporate reorganization, if persons who were not shareholders of the Company immediately prior to such merger, consolidation or other reorganization own immediately after such merger, consolidation or other reorganization 50% or more of the voting power of the outstanding securities of each of (i) the continuing or surviving entity and, (ii) any direct or indirect Parent corporation of such continuing or surviving entity. |

For avoidance of doubt, a transaction will not constitute a Change in Control if: (i) its sole purpose is to change the jurisdiction of the Company’s incorporation, or (ii) its sole purpose is to create a holding company that will be owned in substantially the same proportions by the persons who held the Company’s securities immediately before such transaction. The foregoing notwithstanding, if the Award constitutes non-qualified deferred compensation under Section 409A of the Code, in no event shall a Change in Control be deemed to have occurred unless such change shall satisfy the definition of a change in control under Section 409A of the Code.

B-2

“Code” means the Internal Revenue Code of 1986, as amended. Any reference in the Plan to a section of the Code will be a reference to any successor or amended section of the Code.

“Committee” means a committee appointed by the Board that consists of one or more Board members or other individuals satisfying all Applicable Laws. As of the Effective Date, and until otherwise determined by the Board, the Compensation Committee of the Board will serve as the Committee.

“Company” means Tungray Technologies Inc, a Cayman Islands company, or any successor thereto. For purposes of the Plan, the term “Company” shall include any present or future Parent and Subsidiary.

“Consultant” means any person, including an advisor, but who is not an Employee or an Director, engaged by the Company or any Subsidiary of the Company to render services to such entity if: (i) such person renders bona fide services to the Company or any Subsidiary; (ii) the services rendered by such person are not in connection with the offer or sale of securities in a capital-raising transaction and do not directly or indirectly promote or maintain a market for the Company’s securities; and (iii) such person is a natural person who has contracted directly with the Company or any Subsidiary to render such services.

“Director” means a member of the Board or any board of directors (or similar governing authority) of any Subsidiary, including a non-employee Director.

“Disability” unless otherwise defined in an Award Agreement, means that the Participant qualifies to receive long-term disability payments under the Company’s or any Subsidiary’s long-term disability insurance program, as it may be amended from time to time, to which the Participant provides services regardless of whether the Participant is covered by such policy. If the Company or a Subsidiary to which the Participant provides service does not have a long-term disability plan in place, “Disability” means that a Participant is unable to carry out the responsibilities and functions of the position held by the Participant by reason of any medically determinable physical or mental impairment for a period of not less than ninety (90) consecutive days. A Participant will not be considered to have incurred a Disability unless he or she furnishes proof of such impairment sufficient to satisfy the Administrator in its discretion.

“Employee” means any natural person employed by the Company or any Subsidiary of the Company. Neither service as a Director nor payment of a director’s fee by the Company will be sufficient to constitute “employment” by the Company.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Exercise Price” in the case of an Option, means the amount for which one Share may be purchased upon exercise of such Option, as specified in the applicable Option Award Agreement. “Exercise Price,” in the case of a SAR, means an amount, as specified in the applicable SAR Agreement, which is subtracted from the Fair Market Value of one Share in determining the amount payable upon exercise of such SAR.

“Fair Market Value” means, as of any date, the value of Shares determined as follows: