Exhibit 10.2

Execution Version

THE USE OF THE FOLLOWING NOTATION IN THIS EXHIBIT INDICATES THAT THE CONFIDENTIAL PORTION HAS BEEN OMITTED PURSUANT TO ITEM 601(b)(10)(iv) WHEREBY CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED BECAUSE IT IS BOTH NOT MATERIAL AND WOULD LIKELY CAUSE COMPETITIVE HARM TO THE REGISTRANT IF PUBLICLY DISCLOSED: [***]

EMPLOYMENT AGREEMENT

This Employment Agreement (together with all Annexes and Exhibits hereto, this “Agreement”), entered into effective as of April 16, 2025 (the “Effective Date”), is made by and between David Davis (the “Executive”) and Spirit Aviation Holdings, Inc., a Delaware corporation (together with any of its subsidiaries and Affiliates (as defined below), and any and all successors thereto, the “Company”).

RECITALS

A. The Company and the Executive desire to enter into this Agreement to provide the Company the services of the Executive and to set forth the rights and duties of the parties hereto.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing and of the respective covenants and agreements set forth below, the parties hereto agree as follows:

1.Certain Definitions.

(a) “Action” shall have the meaning set forth in Section 9.

(b) “Affiliate” shall mean, with respect to any Person, any other Person directly or indirectly controlling, controlled by, or under common control with such Person, where “control” shall have the meaning given such term under Rule 405 of the Securities Act of 1933, as amended.

(c) “Agreement” shall have the meaning set forth in the preamble hereto.

(d) “Air Carrier Competitors” shall mean the companies listed on Annex A.

(e) “Annual Base Salary” shall have the meaning set forth in Section 3(a).

(f) “Annual Bonus” shall have the meaning set forth in Section 3(b).

(g) “Board” shall mean the Board of Directors of the Company.

(h) The Company shall have “Cause” to terminate the Executive’s employment pursuant to Section 4(a)(iii) hereunder upon (i) the Executive’s indictment for, conviction of, or plea of guilty or nolo contendere to, any (x) felony, (y) misdemeanor involving moral turpitude, or (z) other crime involving either fraud or a breach of the Executive’s duty of loyalty with respect to the Company or any Affiliates thereof, or any of its suppliers, (ii) the Executive’s failure to perform duties as reasonably directed by the Board (other than as a consequence of Disability) after written notice

thereof and failure to cure within ten (10) business days of receipt of the written notice, (iii) the Executive’s fraud, misappropriation, embezzlement (whether or not in connection with employment), or material misuse of funds or property belonging to the Company or any of its Affiliates, (iv) the Executive’s willful violation of the policies of the Company or any of its subsidiaries of which he is made aware or of which he reasonably should be aware given his role with the Company, or gross negligence in connection with the performance of his duties, after written notice thereof and failure to cure within ten (10) business days of receipt of written notice, (v) the Executive’s use of alcohol that interferes with the performance of the Executive’s duties or use of illegal drugs, if either (A) the Executive fails to obtain treatment within ten (10) business days after receipt of written notice thereof or (B) the Executive obtains treatment and, following the Executive’s return to work, the Executive’s use of alcohol again interferes with the performance of the Executive’s duties or the Executive again uses illegal drugs, (vi) the Executive’s material breach of this Agreement, and failure to cure such breach within ten (10) business days after receipt of written notice, or (vii) the Executive’s breach of the confidentiality or non-disparagement provisions (excluding unintentional breaches that are cured within ten (10) days after the Executive becomes aware of such breaches, to the extent curable, it being agreed that stopping an act which is an unintentional breach and which does not cause material harm to the Company, shall be deemed a cure) or the non-competition and non-solicitation provisions under Sections 6 and 7 of this Agreement; provided, however that Cause shall not exist unless the Company has afforded a reasonable opportunity for the Executive to appear (with counsel) before the Board. If, within thirty (30) days subsequent to the Executive’s termination of employment for any reason other than by the Company for Cause, the Company discovers facts such that the Executive’s termination of employment could have been for Cause, the Executive’s termination of employment will be deemed to have been for Cause for all purposes, and the Executive will be required to disgorge to the Company all amounts received under this Agreement, all equity awards or otherwise that would not have been payable to the Executive had such termination of employment been by the Company for Cause.

(i) “Change of Control” shall mean and include each of the following: (a) a transaction or series of transactions (other than an offering of Common Stock to the general public through a registration statement filed with the Securities and Exchange Commission (the “SEC”)) whereby any Person or “group” (as defined in Section 13(d) of the Exchange Act) (other than the Company, any of its parents or subsidiaries of any of their respective Affiliates, an employee benefit plan maintained by the Company or any of its subsidiaries or a Person that, prior to such transaction, directly or indirectly controls, is controlled by, or is under common control with, the Company) directly or indirectly acquires beneficial ownership (within the meaning of Rule 13d-3 under the Exchange Act) of securities of the Company possessing more than 50% of the total combined voting power of the Company’s securities outstanding immediately after such acquisition; or (b) during any period of two consecutive years, individuals who, at the beginning of such period, constitute the Board together with any new director(s) (other than a director designated by a person who shall have entered into an agreement with the Company to effect a transaction described in clause (a) or clause (c) of this Section 1(i) whose election by the Board or nomination for election by the Company’s stockholders was approved by a vote of at least two-thirds of the directors then still in office who either were directors at the beginning of the two-year period or whose election or nomination for election was previously so approved, cease for any reason to constitute a majority thereof; or (c) the consummation by the Company (whether directly involving the Company or indirectly involving the Company through one or more intermediaries) of (x) a merger, consolidation, reorganization, or business combination of the Company, (y) a sale or other disposition of all or substantially all of the

Company’s assets in any single transaction or series of related transactions to one or more persons or entities that are not, immediately prior to such transaction(s), Affiliates of the Company, or any employee benefit plan of the Company, or (z) the acquisition of assets or stock of another entity, in each case other than a transaction: (i) which results in Persons who were stockholders of the Company immediately prior to the transaction continuing to represent (either by remaining outstanding or by being converted into voting securities of the Company or the Person that, as a result of the transaction, controls, directly or indirectly, the Company or owns, directly or indirectly, all or substantially all of the Company’s assets or otherwise succeeds to the business of the Company (the Company or such Person, the “Successor Entity”)) directly or indirectly, at least fifty percent (50%) of the combined voting power of the Successor Entity’s outstanding voting securities immediately after the transaction, and (ii) after which no Person or group beneficially owns voting securities representing fifty percent (50%) or more of the combined voting power of the Successor Entity; provided, however, that no person or group shall be treated for purposes of this subclause (ii) as beneficially owning fifty percent (50%) or more of combined voting power of the Successor Entity solely as a result of the voting power held in the Company prior to the consummation of the transaction; or (d) the consummation of a liquidation or dissolution of the Company, other than a liquidation or dissolution of the Company into a subsidiary or for the purposes of effecting a corporate restructuring or reorganization as a result of which Persons who were stockholders of the Company immediately prior to such liquidation or dissolution continue to own immediately thereafter, directly or indirectly, more than fifty percent (50%) of the combined voting power entitled to vote generally in the election of directors of the entity that owns, directly or indirectly, substantially all of the assets of the Company following such transaction. In addition, if a Change in Control constitutes a payment event with respect to any Award that provides for the deferral of compensation and is subject to Section 409A of the Code, the transaction or event described in clause (a), (b), (c) or (d) of this Section 1(i) with respect to such Award must also constitute a “change in control event,” as defined in Treasury Regulation §1.409A-3(i)(5) to the extent required by Section 409A. Notwithstanding the foregoing or anything to the contrary herein, any transaction (or series of related transactions) that results in (i) the acquisition of any equity securities of the Company or any assets of the Company (whether by acquisition, merger, consolidation, restructuring, reorganization or otherwise) by (x) the creditors or holders of debt of the Company or any of its subsidiaries (excluding any such holders that are Air Carrier Competitors, other airlines or their respective subsidiaries) or (y) any of the Company's subsidiaries or (ii) any change in the composition of the Board, in each case in connection with the restructuring of the Company pursuant to Chapter 11 of the U.S. Bankruptcy Code (a “Chapter 11 Transaction”) following the date hereof, will not, individually or in the aggregate, be deemed to result in a Change of Control.

(j) “Code” shall mean the Internal Revenue Code of 1986, as amended.

(k) “Common Stock” shall mean the common stock of the Company, par value U.S. $0.0001 per share.

(l) “Date of Termination” shall mean (i) if the Executive’s employment is terminated by his death, the date of his death, (ii) if the Executive’s employment is terminated pursuant to Section 4(a)(ii) – 4(a)(vi), the date specified or otherwise effective pursuant to Section 4(a)(ii) – 4(a)(vi), as applicable or (iii) if Executive’s employment terminates on the Term End Date, the Term End Date.

(m) “Disability” shall mean the Executive’s incapacitation through any illness, injury, accident or condition of either a physical or psychological nature that has resulted in his inability to perform the essential functions of his position, even with reasonable accommodations, for one hundred eighty (180) calendar days during any period of three hundred sixty-five (365) consecutive calendar days, and such incapacity is expected to continue, as determined by an independent medical examination and evaluated in accordance with the standard used under the Company’s long-term disability insurance policy.

(n) “Employment Commencement Date” shall have the meaning set forth in Section 2(b).

(o) “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended from time to time.

(p) “Executive” shall have the meaning set forth in the preamble hereto.

(q) “Good Reason” shall mean, without the Executive’s written consent, (i) a material reduction of Executive’s duties and responsibilities as in effect immediately after the Employment Commencement Date in his capacity as President and Chief Executive Officer of the Company (which, without limitation, shall be deemed to occur if, solely as a result of the occurrence of a Change of Control, the common stock of the Company is no longer listed on a national securities exchange (provided that, notwithstanding anything to the contrary in this Agreement, the Company ceasing to be listed on a national securities exchange in any other circumstance shall not, by itself, constitute or result in “Good Reason”), unless the Executive becomes the President and Chief Executive Officer of the ultimate parent of the Company and such parent’s shares are listed on a national securities exchange (provided that, for the avoidance of doubt, if the Company does not become listed on a national securities exchange following the Employment Commencement Date for any reason, such failure to become so listed shall not, by itself, constitute “Good Reason”)), a change in title or a change that results in the Executive no longer reporting solely and directly to the Board or a failure of the Company to nominate the Executive to serve as a member of the Board, (ii) a reduction in the Executive’s Base Salary (other than as expressly permitted by Section 3(a)) or target annual bonus opportunity, (iii) a failure to pay an Annual Bonus (to the extent earned) in accordance with Section 3(b), (iv) the relocation of the Company’s principal executive offices to a location outside a 25-mile radius of the current location, or (v) any material breach by the Company of any material term or provision of this Agreement or any other written agreement between the Executive and the Company and its Affiliates; provided, however, that the Executive cannot terminate his employment for Good Reason unless the Executive has first provided written notice to the Company of the existence of the circumstances providing grounds for termination for Good Reason within thirty (30) days of becoming aware of the existence of such grounds and the Company has been afforded at least thirty (30) days from the date on which such notice is provided to cure such circumstances and has failed to do so. If the Executive does not terminate his employment for Good Reason within thirty (30) days after the expiration of such cure period, then the Executive will be deemed to have waived the Executive’s right to terminate for Good Reason with respect to such grounds.

(r) “Inventions” shall have the meaning set forth in Section 7(c)(i).

(s) “MIP” shall have the meaning set forth in Section 3(e).

(t) “Notice of Termination” shall have the meaning set forth in Section 4(b).

(u) “Person” shall mean an individual, partnership, corporation, limited liability company, business trust, joint stock company, trust, unincorporated association, joint venture, governmental authority, or other entity of whatever nature.

(v) “Proprietary Rights” shall have the meaning set forth in Section 7(c)(i).

(w) “Term” shall have the meaning set forth in Section 2(b).

2.Employment.

(a) In General. The Company shall employ the Executive, and the Executive shall be employed by the Company under this Agreement, for the period set forth in Section 2(b), in the position set forth in Section 2(c), and upon the other terms and conditions herein provided.

(b) Term of Employment. The term of employment under this Agreement shall be for the period beginning as of May 1, 2025 or such earlier date as the parties may agree (the “Employment Commencement Date”) and ending on the later of (x) the third (3rd) anniversary of the Employment Commencement Date or (y) if a Change of Control is consummated on or prior to the third (3rd) anniversary of the Employment Commencement date, the first (1st) anniversary of the date of consummation of the Change in Control (such date, the “Term End Date”), unless earlier terminated in accordance with Section 4 of this Agreement (the period during which the Executive is so employed under this Agreement, the “Term”).

(c) Position and Duties.

(i) During the Term, the Executive shall serve as President and Chief Executive Officer of the Company, with responsibilities, duties, and authority customary for such position. The Executive shall also serve as an officer of Affiliates of the Company as requested by the Board. During each year of the Term, the Executive will be nominated to serve as a member of the Board, subject to shareholder approval of such nomination, and shall be appointed to serve as a member of the Board effective as of the Employment Commencement Date. The Executive shall not be entitled to any additional compensation for his service as a member of the Board or other positions or titles he may hold with any Affiliate of the Company to the extent he is so appointed, unless he is no longer serving as an employee of the Company, in which case the Executive shall be eligible to receive board compensation and expense reimbursements pursuant to its non-employee director compensation program and Board expense reimbursement policy then-in effect. The Executive shall report solely and directly to the Board. The Executive agrees to observe and comply with the Company’s rules and policies as adopted from time to time by the Company of which he is made aware or of which he reasonably should be aware given his role with the Company. The Executive shall devote his full business time, skill, attention, and best efforts to the performance of his duties hereunder; provided, however, that the Executive shall be entitled to (A) serve on civic, charitable, and religious boards, (B) continue to serve on the board of directors of the company listed on Annex B, (C) subject in each case to approval by the Board, serve on additional corporate boards, and (D) manage the Executive’s personal and family investments, in each case, to the extent that such activities do not interfere with the performance of the Executive’s duties and responsibilities, do not

materially conflict with the business interests of the Company or its Affiliates, and do not violate the applicable restrictions on competition in Section 6 of this Agreement. During the Term, the Executive shall submit to the Board all business, commercial and investment opportunities or offers presented to the Executive or of which the Executive becomes aware which relate to the business of the Company and its Affiliates at any time during the Term, and unless approved by the Board, the Executive shall not accept or pursue, directly or indirectly, any such corporate opportunities on the Executive’s own behalf; provided, however, that the foregoing restrictions on opportunities or offers shall not apply to opportunities or offers presented to the Executive or of which Executive becomes aware, directly as a result of his service as a director of another company with respect to the business of that company, other than with respect to the business of an Air Carrier Competitor.

(ii) The Executive’s employment shall be principally based at the Company’s headquarters in Dania Beach, Florida. The Executive shall perform his duties and responsibilities to the Company at such principal place of employment and at such other location(s) to which the Company may reasonably require the Executive to travel for Company business purposes.

3.Compensation and Related Matters.

(a) Annual Base Salary. During the Term, the Executive shall receive a base salary at a rate of nine hundred fifty thousand dollars ($950,000) per annum, paid in accordance with the customary payroll practices of the Company, subject to annual review by the Board (or a committee of the Board) for possible increase but not decrease, except in the case of a labor-related concessions package, in which case any reduction must be on the same proportionate basis as applicable to all other members of senior management and in no event more than a 20% reduction (the “Annual Base Salary”).

(b) Annual Bonus. During the Term, the Executive shall be eligible to receive a discretionary annual cash bonus with a target amount equal to one hundred twenty-five percent (125%) of the applicable Annual Base Salary and with a maximum amount equal to two hundred fifty percent (250%) of the applicable Annual Base Salary or such higher amount as may be approved by the Board (or a committee of the Board) in its sole discretion (the “Annual Bonus”); provided, however, that the Executive’s Annual Bonus for the 2025 calendar year shall be paid at target and pro-rated (based on the number of days from the Employment Commencement Date through December 31, 2025 divided by 365). The Executive’s actual Annual Bonus for the 2026 and subsequent calendar years, if any, shall be determined on the basis of the Executive’s and/or the Company’s attainment of individual and corporate performance relative to annual objectives established by the Board in consultation with the Executive and communicated to the Executive at the beginning of such year. Each such Annual Bonus shall be payable on such date as is determined by the Board, but in any event within the period required by Section 409A of the Code such that it qualifies as a “short-term deferral” pursuant to Section l.409A-l(b)(4) of the Department of Treasury Regulations (or any successor thereto). No Annual Bonus shall be payable with respect to any calendar year unless the Executive remains continuously employed with the Company through the date of payment, except as otherwise provided herein or in Section 5.

(c) Sign-On Bonus. The Executive shall receive a sign-on bonus in the amount of four million dollars ($4,000,000) which shall be payable in cash in two equal installments, as follows. The first installment of two million dollars ($2,000,000) (the “First Installment”) shall be paid to

Executive on the Employment Commencement Date. The second installment of two million dollars ($2,000,000) (the “Second Installment”) shall be deposited by the Company into an escrow account held by a compensated third-party escrow agent (the “Escrow”) on or promptly following the Employment Commencement Date. The funds in the Escrow shall not be considered property of the Company within the meaning of 11 U.S.C. 541. The Second Installment funds will be released to the Executive on the Company’s next regular payroll date that occurs at least five days following the earliest to occur of: (i) the first anniversary of the Employment Commencement Date (if Executive is employed by the Company on that date); (ii) a Change of Control of the Company; and (iii) the termination of the Executive’s employment under Section 4(a)(iv) or 4(a)(v) (subject to Section 5(d)). If neither of the events described in (ii) or (iii) occurs prior to the first anniversary of the Employment Commencement Date and Executive is no longer employed by the Company on the first anniversary of the Employment Commencement Date, the Second Installment will be released to the Company (and the Executive will have no rights or entitlements with respect thereto). Each of the First Installment and Second Installment (net of taxes incurred by the Executive) will be promptly repaid by the Executive to the Company, on a pro-rated monthly basis, if Executive’s employment is terminated under Section 4(a)(iii) or 4(a)(vi) or Executive materially breaches the Executive’s obligations under Sections 6 or 7 of this Agreement at any time within twelve (12) months of payment or release of that applicable installment. For the avoidance of doubt, the repayment obligation will not apply if Executive’s employment is terminated under Section 4(a)(i), 4(a)(ii), 4(a)(iv) or 4(a)(v). The escrow agent appointed to hold the Escrow shall be mutually agreed by the Company and the Executive acting in good faith (not to be unreasonably, withheld, conditioned or delayed), and the escrow agreement (the “Escrow Agreement”) pursuant to which the Escrow will be held will be in a form to be mutually agreed by the Company and the Executive acting in good faith (not to be unreasonably, withheld, conditioned or delayed), on the one hand, and the escrow agent, on the other hand. The Company will pay the fees and expenses of the escrow agent.

(d) Retention Bonus. The Executive shall be entitled to receive a one-time cash retention bonus in the aggregate amount of $4,000,000 (the “Retention Bonus”) that will vest on the fifth (5th) anniversary of the Employment Commencement Date (the “Retention Date”), subject to the Executive’s continued employment through the Retention Date. The Retention Bonus will be paid in cash within 60 days following the Retention Date. Notwithstanding the foregoing, in the event of the termination of Executive’s employment pursuant to Section 4(a)(iv) or 4(a)(v) prior to the Retention Date, then the Executive shall be entitled to receive the Retention Bonus within 60 days following the applicable Date of Termination, subject to Section 5(d) and subject to the Executive’s continued compliance with the covenants contained in Sections 6 and 7.

(e) Equity Awards.

(i) Effective on the Employment Commencement Date, the Executive shall be granted an inducement award of restricted stock units of the Company representing 1.0% of the Company’s fully-diluted outstanding shares of common stock as of March 12, 2025, pursuant to (x) the terms of the Company’s management equity incentive plan to be adopted by the Board (the “MIP”) and (y) an award agreement that is (A) on a form approved by the Board for other senior executives of the Company (and consistent in all material respects with the form of award agreement previously provided to Executive), (B) in all cases contains terms no less favorable to the Executive than those set forth in Exhibit A attached hereto and (C) does not impose any additional restrictive

covenant obligations on the Executive beyond those set forth in this Agreement (the “Inducement RSU Award”).

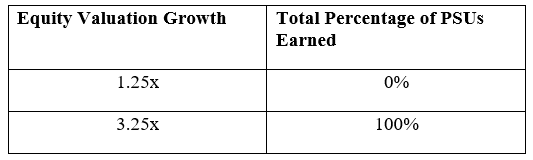

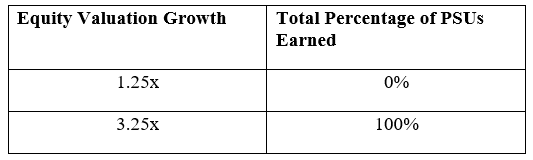

(ii) Effective on the Employment Commencement Date, the Executive shall be granted an initial equity incentive award of the Company representing 2.0% of the Company’s fully-diluted outstanding shares of common stock as of March 12, 2025, which shall be granted 50% in the form of time-based restricted stock units (the “Initial RSU Award”) and 50% in the form of performance-based restricted stock units (the “Initial PSU Award”), pursuant to (x) the terms of the MIP and (y) an award agreement that is (A) on a form approved by the Board for other senior executives of the Company (and consistent in all material respects with the form of award agreement previously provided to Executive), (B) in all cases contains terms no less favorable to the Executive than those set forth in Exhibit A attached hereto and (C) does not impose any additional restrictive covenant obligations on the Executive beyond those set forth in this Agreement.

(iii) During the Term, the Executive will be eligible to receive such additional awards under the MIP as the Board may approve in its sole discretion and containing such terms as determined by the Board, including with respect to any performance conditions applicable to such awards.

(f) Executive Travel Benefits. The Executive and his family members (and, subject to applicable limitations under Company policy, other designees of Executive) shall be entitled to positive-space travel benefits with the Company (or its successor) in accordance with, and subject to, the Company’s (or successor’s) rules and policies for senior executives (“Travel Benefits Policy”). Executive’s travel benefits under this Section 3(f) will become non-forfeitable upon the earliest to occur of (i) the completion by Executive of three years of service with the Company (provided that if the Executive is terminated for Cause, the Executive shall cease to be entitled to the benefits under this Section 3(f)), (ii) the termination of Executive’s employment pursuant to Section 4(a)(ii), 4(a)(iv) or 4(a)(v) (subject to Section 5(d)), or (iii) consummation of a Change of Control and will thereafter be useable by Executive and his family members and other designees for the remainder of Executive’s life, in accordance with, and subject to, the Travel Benefits Policy. In the event of a Change of Control, the Company shall require the successor to assume the Company’s obligations under this Section 3(f) if not otherwise required by the terms of the acquisition agreement.

(g) Benefits. During the Term, the Executive shall be entitled to participate in the employee benefit plans, programs, and arrangements of the Company as may be in effect from time to time, on terms no less favorable than those provided to other senior executives.

(h) Vacation. During the Term, the Executive shall be entitled to vacation in accordance with the Company’s vacation policies, as then in effect. Any vacation shall be taken at a time that does not unreasonably interfere with the Executive’s work and the Company’s operations.

(i) Business Expenses. During the Term, the Company shall reimburse the Executive for all reasonable travel and other business expenses incurred by him in the performance of his duties to the Company, in accordance with the Company’s expense reimbursement policies and procedures.

(j) Moving Expenses. The Company shall reimburse the Executive for reasonable moving expenses incurred in moving his household goods to Florida at any time during the twelve

(12) month period commencing on the Employment Commencement Date, up to a maximum of $50,000 in the aggregate.

4.Termination. Prior to the Term End Date, the Executive’s employment hereunder may be terminated without any breach of this Agreement only under the following circumstances:

(a) Circumstances.

(i) Death. The Executive’s employment hereunder shall terminate upon his death.

(ii) Disability. If the Executive has incurred a Disability, the Company may give the Executive written notice of its intention to terminate the Executive’s employment. In that event, the Executive’s employment with the Company shall terminate effective on the later of the thirtieth (30th) day after receipt of such notice by the Executive and the date specified in such notice, provided that within the thirty (30) day period following receipt of such notice, the Executive shall not have returned to full-time performance of his duties hereunder.

(iii) Termination with Cause. The Company may terminate the Executive’s employment with Cause.

(iv) Termination by the Company without Cause. The Company may terminate the Executive’s employment without Cause. For the avoidance of doubt, the termination of the Term upon the Term End Date shall not be deemed to be a termination without Cause for purposes of this Agreement.

(v) Resignation for Good Reason. The Executive may terminate the Executive’s employment with Good Reason.

(vi) Resignation without Good Reason. The Executive may resign from his employment without Good Reason upon not less than forty-five (45) days’ advance written notice to the Board.

(b) Notice of Termination. Any termination of the Executive’s employment by the Company or by the Executive under this Section 4 (other than termination pursuant to Section 4(a)(i)) shall be communicated by a written notice to the other party hereto (i) indicating the specific termination provision in this Agreement relied upon, (ii) except with respect to a termination pursuant to Section 4(a)(iv) or Section 4(a)(vi), setting forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of the Executive’s employment under the provision so indicated, and (iii) specifying a Date of Termination as provided herein (a “Notice of Termination”). If the Company delivers a Notice of Termination under Section 4(a)(ii), the Date of Termination shall be at least sixty (60) days following the date of such notice; provided, however, that such notice need not specify a Date of Termination, in which case the Date of Termination shall be determined pursuant to Section 4(a)(ii). If the Company delivers a Notice of Termination under Section 4(a)(iii) or 4(a)(iv), the Date of Termination shall be, in the Company’s sole discretion, the date on which the Executive receives such notice or any subsequent date selected by the Company. If the Executive delivers a Notice of Termination under Section 4(a)(vi), the Date of Termination shall be at least forty-five (45) days following the date of such notice; provided,

however, that the Company may, in its sole discretion, accelerate the Date of Termination to any date that occurs following the Company’s receipt of such notice, without changing the characterization of such termination as voluntary, even if such date is prior to the date specified in such notice and without having to pay any compensation or benefits for the balance of such notice period. The failure by the Company to set forth in the Notice of Termination any fact or circumstance that contributes to a showing of Cause shall not waive any right of the Company hereunder or preclude the Company from asserting such fact or circumstance in enforcing the Company’s rights hereunder.

(c) Termination of All Positions. Upon termination of the Executive’s employment for any reason, if requested by the Company, the Executive agrees to resign, as of the Date of Termination or such other date requested by the Company, from all positions and offices that the Executive then holds with the Company and its Affiliates. The Executive agrees to promptly execute such documents as the Company, in its sole discretion, shall reasonably deem necessary to effect such resignations, and in the event that the Executive is unable or unwilling to execute any such document, Executive hereby grants his proxy to any officer of the Company to so execute on his behalf. Notwithstanding anything to the contrary in this Section 4(c), it is understood and agreed that following the termination of his employment for any reason, except in the case of the Executive’s death or termination due to Disability or by the Company for Cause pursuant to Section 4(a)(iii), the Executive will retain his position, if any, as a member of the Board, during which time the Executive shall be subject to all policies of the Company which apply to members of the Board with general applicability, the implementation of which is not intended to disparately treat the Executive in comparison to the other members of the Board, but which policies may prevent Board members from engaging in the type of activity prohibited under Sections 6(a) and (b) of this Agreement.

(d) Suspension of Duties. The Company reserves the right to bar the Executive from the offices of the Company or any of its Affiliates and to require that the Executive refrain from undertaking all or any of the Executive’s duties and contacting clients, colleagues and advisors of the Company or any of its Affiliates (unless otherwise instructed) during all or part of any period of notice of the Executive’s termination of employment. Should the Company exercise this right, all the Executive’s other duties and obligations hereunder, including the Executive’s duties of fidelity and confidentiality to the Company, remain in full force and effect and, during any such period, the Executive shall remain a service provider to the Company and shall not be employed or engaged in any other business. For the avoidance of doubt, the Company shall continue to pay to the Executive his compensation and benefits during any such notice period, until the Date of Termination. The Company properly exercising its rights pursuant to this Section 4(d) shall in no event constitute Good Reason.

5.Company Obligations upon Termination of Employment.

(a) In General Upon termination of the Executive’s employment for any reason, the Executive (or the Executive’s estate) shall be entitled to receive (i) any amount of the Executive’s Annual Base Salary earned through the Date of Termination not theretofore paid, (ii) any Annual Bonus for the year prior to the year in which the Date of Termination occurred, that was earned but not yet paid, (iii) any expenses owed to the Executive under Section 3(i) and 3(j) and Section 27, (iv) any vested amount arising from the Executive’s participation in, or benefits under, any employee benefit plans, programs, or arrangements under Section 3(g) (other than severance plans, programs, or arrangements), which amounts shall be payable in accordance with the terms and conditions of

such employee benefit plans, programs, or arrangements including, where applicable, any death and disability benefits, (iv) any rights to indemnification to the extent required pursuant to the provisions of the Company’s and its subsidiaries’ bylaws, certificate of incorporation or other governing documents or policies, (v) any rights in his capacity as a holder of equity incentive awards under the MIP, subject to and in accordance with the terms of the MIP and the applicable award agreement and (vi) any vested life-time travel benefits pursuant to, and subject to the terms and conditions of, Section 3(f) (collectively, the “Accrued Obligations”). Notwithstanding anything to the contrary, upon a termination of employment pursuant to Section 4(a)(iii) or 4(a)(vi), the Accrued Obligations shall not include the amount set forth in clause (ii) of the preceding sentence.

(b) Termination without Cause by the Company or Resignation by the Executive for Good Reason other than in Connection with a Change of Control. Subject to Section 5(d) and subject to the Executive’s continued compliance with the covenants contained in Sections 6 and 7, if the Company terminates the Executive’s employment without Cause pursuant to Section 4(a)(iv) or the Executive resigns for Good Reason pursuant to Section 4(a)(v), in each case other than during the twelve (12)-month period following a Change of Control, the Company shall, in addition to the Accrued Obligations (which, for the avoidance of doubt, shall not be subject to Section 5(d)), pay to the Executive an amount equal to two (2) times the sum of (i) the Executive’s Annual Base Salary and (ii) the Executive’s target Annual Bonus, which shall be paid in a lump sum on the 60th day following the Date of Termination. In addition, subject to Section 5(d) and subject to the Executive’s continued compliance with the covenants contained in Sections 6 and 7, the Company shall pay the monthly employer contribution costs of continued group health, dental and vision plan insurance coverage for the Executive and his dependents under the plans and programs in which the Executive participated immediately prior to the Date of Termination, or plans and programs maintained by the Company in replacement thereof in which the senior executives of the Company are eligible to participate, for a period of twenty-four (24) months following the Date of Termination. If the payment of any COBRA or health insurance premiums by the Company on behalf of the Executive as described herein would otherwise violate any applicable nondiscrimination rules or cause the reimbursement of claims to be taxable under the Patient Protection and Affordable Care Act of 2010, together with the Health Care and Education Reconciliation Act of 2010 (collectively, the “Act”) or Section 105(h) of the Internal Revenue Code of 1986, as amended (the “Code”), the Company shall in lieu thereof provide to Executive a taxable lump-sum payment in an amount equal to the sum of the monthly (or then remaining) COBRA premiums that the Executive would be required to pay to maintain the Executive’s group health insurance coverage in effect on the Termination Date for the remaining portion of the twenty-four (24) month period described above. For the avoidance of doubt, if the Executive’s employment terminates upon the Term End Date, he shall not be entitled to the payments described in this Section 5(b), other than the Accrued Obligations.

(c) Termination without Cause by the Company or Resignation by the Executive for Good Reason in Connection with a Change of Control. Subject to Section 5(d) and subject to the Executive’s continued compliance with the covenants contained in Sections 6 and 7, if the Company terminates the Executive’s employment without Cause pursuant to Section 4(a)(iv) or the Executive resigns for Good Reason pursuant to Section 4(a)(v), in either case within twelve (12) months following a Change of Control, the Company shall, in addition to the Accrued Obligations (which, for the avoidance of doubt, shall not be subject to Section 5(d)), pay to the Executive an amount equal to three (3) times the sum of (i) the Executive’s Annual Base Salary and (ii) the Executive’s target Annual Bonus, which shall be paid in a lump sum within sixty (60) days of the Date of

Termination. In addition, subject to Section 5(d) and subject to the Executive’s continued compliance with the covenants contained in Sections 6 and 7, the Company shall pay the monthly employer contribution costs of continued group health, dental and vision plan insurance coverage for the Executive and his dependents under the plans and programs in which the Executive participated immediately prior to the Date of Termination, or plans and programs maintained by the Company in replacement thereof in which the senior executives of the Company are eligible to participate, for a period of thirty-six (36) months following the Date of Termination. If the payment of any COBRA or health insurance premiums by the Company on behalf of the Executive as described herein would otherwise violate any applicable nondiscrimination rules or cause the reimbursement of claims to be taxable under the Act or Section 105(h) of the Code, the Company shall in lieu thereof provide to Executive a taxable lump-sum payment in an amount equal to the sum of the monthly (or then remaining) COBRA premiums that the Executive would be required to pay to maintain the Executive’s group health insurance coverage in effect on the Termination Date for the remaining portion of the thirty-six (36) month period described above. For the avoidance of doubt, if the Executive’s employment terminates upon the Term End Date, he shall not be entitled to the payments described in this Section 5(c), other than the Accrued Obligations.

(d) Release. Notwithstanding anything herein to the contrary, the amounts payable to the Executive under Sections 5(b) and 5(c) and such other amounts payable under this Agreement that are expressly made subject to this Section 5(d), other than the Accrued Obligations, shall be contingent upon and subject to the Executive’s (or the Executive’s estate, if applicable) execution and non-revocation of a general waiver and release of claims agreement substantially in the form attached hereto as Exhibit B (the “Release”) (and the expiration of any applicable revocation period), on or prior to the 53rd day following the Date of Termination.

(e) Other Severance Benefits. For the avoidance of doubt, the severance payments set forth in Sections 5(b) and 5(c) and such other payments and benefits expressly set forth in this Agreement (or in award agreements governing the Equity Incentive Awards (as defined in Exhibit A)) that are or become payable on a termination of the Executive’s employment shall be the sole compensation and benefits to be received by the Executive in connection with a termination of employment or service from the Company, and Executive shall otherwise not be eligible to participate in, or receive any payments or benefits under, the Company’s 2017 Executive Severance Plan (or any successor thereto) or any other severance plan, policy, arrangement or agreement of the Company or any of its subsidiaries.

(f) Survival. The expiration or termination of the Term shall not impair the rights or obligations of any party hereto, which shall have accrued prior to such expiration or termination.

6.Non-Competition; Non-Solicitation; Non-Hire.

(a) To the fullest extent permitted by applicable law, the Executive agrees that during the Executive’s service with the Company and for the “Restricted Post-Employment Non-Compete Period” (as defined below) following termination of the Executive’s employment with the Company, the Executive will not, directly or indirectly, engage in, provide services to (whether as a director, officer, employee, agent, representative, partner, security holder, consultant, or otherwise), or have any equity or equity-based interest in, any Air Carrier Competitor, unless such Air Carrier Competitor is a successor to the business of the Company (“Competitive Activity”).

Notwithstanding the foregoing, the Executive shall be permitted to (i) maintain and/or acquire an additional passive stock or equity interest in any such Air Carrier Competitor (or the ultimate parent of any such Air Carrier Competitor); provided that the stock or other equity interest acquired is not more than one percent (1%) of the outstanding interest in such Air Carrier Competitor, and (ii) retain any rights he may have attributable to prior employment with any Air Carrier Competitor or its predecessor. The “Restricted Post-Employment Non-Compete Period” shall mean the duration of the Executive’s continued service, if any, as a member of the Board.

(b) To the fullest extent permitted by applicable law, the Executive agrees that during the Executive’s employment with the Company and for the “Restricted Post-Employment Non-Solicit Period” (as defined below) following the Executive’s cessation of employment with the Company for any reason, the Executive will not, on the Executive’s own behalf or on behalf of another (other than on behalf of a successor to the business of the Company) (i) directly or indirectly solicit, induce or attempt to solicit or induce any officer, director or employee of the Company to terminate their relationship with or leave the employ of the Company, or in any way interfere with the relationship between the Company, on the one hand, and any officer, director or employee thereof, on the other hand, or (ii) directly or indirectly hire (or other similar arrangement) any Person (in any capacity whether as an officer, director, employee or consultant) who is or at any time was an officer, director or employee of the Company until twelve (12) months after such individual’s relationship (whether as an officer, director or employee) with the Company has ended; provided, that it shall not be a violation of this Section 6(b) for a subsequent employer of the Executive to hire a Company employee who is at the “director” level or below, so long as such Company employee responds to generic, non-targeted position advertising and the Executive does not engage in activities prohibited by clause (i) of this Section 6(b) with respect to such Company employee. In addition, the Executive agrees that during the Executive’s employment with the Company, the Executive will not induce or attempt to induce any customer, supplier, prospect, licensee or other business relation of the Company to cease doing business with the Company, or in any way interfere with the relationship between any such customer, supplier, prospect, licensee or business relation, on the one hand, and the Company, on the other hand. The “Restricted Post-Employment Non-Solicit Period” shall mean the twelve (12) month period following the Executive’s termination of employment for any reason (including on or following the Term End Date) or, if longer, the duration of the Executive’s continued service, if any, as a member of the Board; provided, however, that the Restricted Post-Employment Non-Solicit Period shall immediately terminate if the Company breaches any of its applicable payment obligations under Section 5.

(c) In the event that the terms of this Section 6 shall be determined by any court of competent jurisdiction to be unenforceable by reason of its extending for too great a period of time or over too great a geographical area or by reason of its being too extensive in any other respect, it will be interpreted to extend only over the maximum period of time for which it may be enforceable, over the maximum geographical area as to which it may be enforceable, or to the maximum extent in all other respects as to which it may be enforceable, all as determined by such court in such action. The Executive hereby acknowledges that the terms of this Section 6 are reasonable in terms of duration, scope and area restrictions and are necessary to protect the goodwill of the Company. The Executive hereby authorizes the Company to inform any future employer or prospective employer of the existence and terms of Sections 6 and 7 of this Agreement without liability for interference with the Executive’s employment or prospective employment.

(d) The Executive acknowledges that the Company has expended and shall continue to expend substantial amounts of time, money and effort to develop business strategies, employee and customer relationships and goodwill and build an effective organization. The Executive recognizes and acknowledges that he has access to confidential information and trade secrets, and has had or will have material contact with the Company’s customers, suppliers, licensees, representatives, agents, partners, licensors, or business relations, and that the Executive’s services are of special, unique and extraordinary value to the Company and its Affiliates. The Executive acknowledges that the Company has a legitimate business interest and right in protecting its confidential information, business strategies, employee and customer relationships and goodwill, and that the Company would be seriously damaged by the disclosure of confidential information and the loss or deterioration of its business strategies, employee and customer relationships and goodwill. The Executive acknowledges (i) that the business of the Company and its Affiliates is international in scope and without geographical limitation and (ii) notwithstanding the jurisdiction of formation or principal office of the Company and its Affiliates, or the location of any of their respective executives or employees (including, without limitation, the Executive), it is expected that the Company and its Affiliates will have business activities and have valuable business relationships within their respective industries throughout the world. The Executive further acknowledges that although his compliance with the covenants contained in Sections 6 and 7 may prevent the Executive from earning a livelihood in a business similar to the business of the Company, the Executive’s experience and capabilities are such that the Executive has other opportunities to earn a livelihood and adequate means of support for the Executive and the Executive’s dependents. In addition, the Executive agrees and acknowledges that the potential harm to the Company of the non-enforcement of Sections 6 and 7 outweighs any potential harm to the Executive of their enforcement by injunction or otherwise.

7.Nondisclosure of Confidential Information; Nondisparagement; Intellectual Property.

(a) Non-Disclosure of Confidential Information; Return of Property. Except as required in the faithful performance of the Executive’s duties hereunder, as required by law, or in proceedings to enforce or defend his rights under this Agreement or any other written agreement between the Executive, on the one hand, and the Company or any of its Affiliates, on the other hand, Executive agrees that for the period during which he is providing services to the Company and for three years thereafter, the Executive shall maintain in confidence and shall not directly, indirectly or otherwise, use, disseminate, disclose or publish, or use for the Executive’s benefit or the benefit of any Person (other than a successor to the business of the Company), any confidential or proprietary information or trade secrets of the Company, including, without limitation, information with respect to the Company’s operations, processes, products, inventions, business practices, finances, principals, vendors, suppliers, customers, potential customers, marketing methods, costs, prices, contractual relationships, regulatory status, compensation paid to employees or other terms of employment, or deliver to any Person any document, record, notebook, computer program or similar repository of or containing any such confidential or proprietary information or trade secrets. Confidential Information shall not include any information that is generally known to the industry or the public other than as a result of the Executive’s breach of this covenant or any breach of other confidentiality obligations by third parties. Upon the Executive’s termination of employment for any reason, the Executive shall promptly deliver to the Company or destroy all key cards, computer hardware or software, tangible or electronic files, papers, credit cards and other items of any nature which are the property of the Company, as well as all correspondence, drawings, manuals, letters, notes, notebooks,

reports, programs, plans, proposals, financial documents, or any other documents concerning the Company’s customers, business plans, marketing strategies, products or processes); provided, however, that the Executive will be permitted to retain a list of his personal contacts. The Executive may respond to a lawful and valid subpoena or other legal process but shall (if lawful to do so) give the Company the earliest possible notice thereof, shall, as much in advance of the return date as possible, make available to the Company and its counsel the documents and other information sought and, if requested by the Company, shall reasonably assist such counsel in resisting or otherwise responding to such process.

(b) Non-Disparagement. The Executive shall not, at any time during the Term and in perpetuity thereafter, directly or indirectly, knowingly disparage, criticize, or otherwise make derogatory statements regarding the Company and its officers, the members of the Board, and the respective Affiliates of any of the foregoing. At the end of the Term, the Company will instruct its executive officers and members of the Board to not, directly or indirectly, knowingly disparage, criticize, or otherwise make derogatory statements regarding the Executive, at any time (provided that, the foregoing shall not prohibit the executive officers and members of the Board from responding truthfully to inquiries from shareholders or otherwise complying with its disclosure obligations under appliable regulatory or securities law). The foregoing shall not be violated by either party’s truthful responses to legal process or inquiry by a governmental authority or in disputes between the parties to enforce the terms of this Agreement or any other written agreement between the Executive, on the one hand, and the Company or any of its affiliates, on the other hand.

(c) Intellectual Proprietary Rights.

(i) The Executive agrees that the results and proceeds of the Executive’s services for the Company (including, but not limited to, any trade secrets, products, services, processes, know-how, designs, developments, innovations, analyses, drawings, reports, techniques, formulas, methods, developmental or experimental work, improvements, discoveries, inventions, ideas, source and object codes, programs, matters of a literary, musical, dramatic or otherwise creative nature, writings and other works of authorship) resulting from services performed for the Company and any works in progress, whether or not patentable or registrable under copyright or similar statutes, that were made, developed, conceived or reduced to practice or learned by the Executive, either alone or jointly with others (collectively, “Inventions”), shall be works-made-for-hire and the Company (or, if applicable or as directed by the Company) shall be deemed the sole owner throughout the universe of any and all trade secret, patent, copyright and other intellectual property rights (collectively, “Proprietary Rights”) of whatsoever nature therein, whether or not now or hereafter known, existing, contemplated, recognized or developed, with the right to use the same in perpetuity in any manner the Company determines in its sole discretion, without any further payment to the Executive whatsoever. If, for any reason, any of such results and proceeds shall not legally be a work-made-for-hire and/or there are any Proprietary Rights which do not accrue to the Company under the immediately preceding sentence, then the Executive hereby irrevocably assigns and agrees to assign any and all of the Executive’s right, title and interest thereto, including, without limitation, any and all Proprietary Rights of whatsoever nature therein, whether or not now or hereafter known, existing, contemplated, recognized or developed, to the Company (or, if applicable or as directed by the Company, any of its Affiliates), and the Company or such Affiliates shall have the right to use the same in perpetuity throughout the universe in any manner determined by the Company or such Affiliates without any further payment to the Executive whatsoever. As to any

Invention that the Executive is required to assign, the Executive shall promptly and fully disclose to the Company all information known to the Executive concerning such Invention. The Executive hereby waives and quitclaims to the Company any and all claims, of any nature whatsoever, that the Executive now or may hereafter have for infringement of any Proprietary Rights assigned hereunder to the Company. In accordance with applicable law, this Section 7(c) does not apply to any Inventions for which no equipment, supplies, facilities, trade secrets or other Confidential Information of the Company was used and which was developed entirely on the Executive’s own time unless (a) the Invention relates to the Company’s business or the Company’s actual or demonstrably anticipated research or development; or (b) the Invention results from any work performed by the Executive for the Company.

(ii) The Executive agrees that, from time to time, as may be requested by the Company and at the Company’s sole cost and expense, the Executive shall do any and all things that the Company may reasonably deem useful or desirable to establish or document the Company’s exclusive ownership throughout the United States of America or any other country of any and all Proprietary Rights in any such Inventions, including, without limitation, the execution of appropriate copyright and/or patent applications or assignments. To the extent the Executive has any Proprietary Rights in the Inventions that cannot be assigned in the manner described above, the Executive unconditionally and irrevocably waives the enforcement of such Proprietary Rights. This Section 7(c)(ii) is subject to and shall not be deemed to limit, restrict or constitute any waiver by the Company of any Proprietary Rights of ownership to which the Company may be entitled by operation of law by virtue of the Executive’s employment with, or service to, the Company. The Executive further agrees that, from time to time, as may be requested by the Company and at the Company’s sole cost and expense, the Executive shall assist the Company in every proper and lawful way to obtain and from time to time enforce Proprietary Rights relating to Inventions in any and all countries. To this end, the Executive shall execute, verify and deliver such documents and perform such other acts (including appearances as a witness) as the Company may reasonably request for use in applying for, obtaining, perfecting, evidencing, sustaining, and enforcing such Proprietary Rights and the assignment thereof. In addition, the Executive shall, at the Company’s expense, execute, verify, and deliver assignments of such Proprietary Rights to the Company or its designees. The Executive’s obligation to assist the Company with respect to Proprietary Rights relating to such Inventions in any and all countries shall continue beyond the termination of the Executive’s employment with the Company.

(d) Prior Employment Information. The Executive further agrees that the Executive will not improperly use or disclose any confidential information or trade secrets, if any, of any former employers or any other Person to whom the Executive has an obligation of confidentiality, and will not bring onto the premises of the Company or its Affiliates any unpublished documents or any property belonging to any former employer or any other Person to whom the Executive has an obligation of confidentiality unless consented to in writing by the former employer or other Person.

(e) Protected Rights. Notwithstanding anything to the contrary contained in this Agreement, nothing in this Agreement limits the Executive’s ability to communicate directly with and provide information, including documents, not otherwise protected from disclosure by any applicable law or privilege to the SEC or any other federal, state or local governmental agency or commission (“Government Agency”) regarding possible legal violations, without disclosure to the Company. The Company may not retaliate against the Executive for any of these activities, and

nothing in this Agreement or otherwise requires the Executive to waive any monetary award or other payment that the Executive might become entitled to from the SEC or any other Government Agency. Pursuant to Section 7 of the Defend Trade Secrets Act of 2016 (which added 18 U.S.C. § 1833(b)), the Company and the Executive acknowledge and agree that the Executive shall not have criminal or civil liability under any federal or state trade secret law for any disclosure of a trade secret that (A) is made (i) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (B) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. In addition and without limiting the preceding sentence, if the Executive files a lawsuit for retaliation by the Company for reporting a suspected violation of law, the Executive may disclose the trade secret to the Executive’s attorney and may use the trade secret information in the court proceeding, if the Executive (X) files any document containing the trade secret under seal and (Y) does not disclose the trade secret, except pursuant to court order. Nothing in this Agreement or otherwise is intended to conflict with 18 U.S.C. § 1833(b) or create liability for disclosures of trade secrets that are expressly allowed by such Section.

8.Injunctive Relief. The Executive recognizes and acknowledges that a breach of any of the covenants contained in Sections 6 and 7 may cause irreparable damage to the Company and its goodwill, the exact amount of which may be difficult or impossible to ascertain, and that the remedies at law for any such breach may be inadequate. Accordingly, the Executive agrees that in the event of a breach or threatened breach of any of the covenants contained in Sections 6 and 7, in addition to any other remedy that may be available at law or in equity, the Company will be entitled (without the necessity of showing economic loss or other actual damage) to specific performance and injunctive relief (without posting a bond). In the event of any breach or violation by the Executive of any of the covenants contained in Section 6 and 7, the time period of such covenant with respect to the Executive shall, to the fullest extent permitted by law, be tolled until such breach or violation is resolved.

9.Cooperation. The Executive agrees that during and after his employment with the Company, the Executive will assist the Company and its Affiliates in the defense of any claims or potential claims that may be made or threatened to be made against the Company or any of its Affiliates in any action, suit, or proceeding, whether civil, criminal, administrative, investigative, or otherwise (each, an “Action”), and will assist the Company and its Affiliates in the prosecution of any claims that may be made by the Company or any of its Affiliates in any Action, to the extent that such claims may relate to the Executive’s employment or the period of the Executive’s employment by the Company and its Affiliates. The Executive agrees, unless precluded by law, to promptly inform the Company if the Executive is asked to participate (or otherwise become involved) in any such Action. The Executive also agrees, unless precluded by law, to promptly inform the Company if the Executive is asked to assist in any investigation (whether governmental or otherwise) of the Company or any of its Affiliates (or their actions) to the extent that such investigation may relate to the Executive’s employment or the period of the Executive’s employment by the Company, regardless of whether a lawsuit has then been filed against the Company or any of its Affiliates with respect to such investigation. The Company or one of its Affiliates shall reimburse the Executive for all of the Executive’s reasonable out-of-pocket expenses associated with such cooperation following his Date of Termination.

10.Section 409A of the Code.

(a) General. The parties hereto acknowledge and agree that, to the extent applicable, this Agreement shall be interpreted in accordance with, and incorporate the terms and conditions required by, Section 409A of the Code and the Department of Treasury Regulations and other interpretive guidance issued thereunder, including without limitation any such regulations or other guidance that may be issued after the date hereof. Notwithstanding any provision of this Agreement to the contrary, in the event that the Company determines that any amounts payable hereunder will be taxable currently to the Executive under Section 409A(a)(l)(A) of the Code and related Department of Treasury guidance, the Company and the Executive shall cooperate in good faith to (i) adopt such amendments to this Agreement and appropriate policies and procedures, including amendments and policies with retroactive effect, that they mutually determine to be necessary or appropriate to preserve the intended tax treatment of the benefits provided by this Agreement, to preserve the economic benefits of this Agreement, and to avoid less-favorable accounting or tax consequences for the Company, and/or (ii) take such other actions as mutually determined to be necessary or appropriate to exempt the amounts payable hereunder from Section 409A of the Code or to comply with the requirements of Section 409A of the Code and thereby avoid the application of penalty taxes thereunder; provided, however, that this Section 10(a) does not create an obligation on the part of the Company to modify this Agreement and does not guarantee that the amounts payable hereunder will not be subject to interest or penalties under Section 409A, and in no event whatsoever shall the Company or any of its Affiliates be liable for any additional tax, interest, or penalties that may be imposed on the Executive as a result of Section 409A of the Code or any damages for failing to comply with Section 409A of the Code.

(b) Separation from Service Under Section 409A. Notwithstanding any provision to the contrary in this Agreement: (i) no amount that is “nonqualified deferred compensation” subject to Section 409A of the Code shall be payable pursuant to Section 5 unless the termination of the Executive’s employment constitutes a “separation from service” within the meaning of Section l .409A-l(h) of the Department of Treasury Regulations; (ii) if the Executive is deemed at the time of his separation from service to be a “specified employee” for purposes of Section 409A(a)(2)(B)(i) of the Code, to the extent that delayed commencement of any portion of the termination benefits to which the Executive is entitled under this Agreement (after taking into account all exclusions applicable to such termination benefits under Section 409A), including, without limitation, any portion of the additional compensation awarded pursuant to Section 5, is required in order to avoid a prohibited distribution under Section 409A(a)(2)(B)(i) of the Code, such portion of the Executive’s termination benefits shall not be provided to the Executive prior to the earlier of (A) the expiration of the six-month period measured from the date of the Executive’s “separation from service” with the Company (as such term is defined in the Department of Treasury Regulations issued under Section 409A) and (B) the date of the Executive’s death: provided, that upon the earlier of such dates, all payments deferred pursuant to this Section 10(b)(ii) shall be paid to the Executive in a lump sum, and any remaining payments due under this Agreement shall be paid as otherwise provided herein; (iii) the determination of whether the Executive is a “specified employee” for purposes of Section 409A(a)(2)(B)(i) of the Code as of the time of his separation from service shall be made by the Company in accordance with the terms of Section 409A of the Code and applicable guidance thereunder (including, without limitation, Section l.409A-l(i) of the Department of Treasury Regulations and any successor provision thereto); (iv) for purposes of Section 409A of the Code, the Executive’s right to receive installment payments pursuant to Section 5 shall be treated as a right to receive a series of separate and distinct payments; (v) if the sixty (60) day period following the Date of Termination ends in the calendar year following the year that includes the Date of Termination,

then payment of any amount that is conditioned upon the execution of the Release and is subject to Section 409A shall not be paid until the first day of the calendar year following the year that includes the Date of Termination, regardless of when the Release is signed; and (vi) to the extent that any reimbursement of expenses or in-kind benefits constitutes “deferred compensation” under Section 409A, such reimbursement or benefit shall be provided no later than December 31 of the year following the year in which the expense was incurred. The amount of expenses reimbursed in one year shall not affect the amount eligible for reimbursement in any subsequent year. The amount of any in-kind benefits provided in one year shall not affect the amount of in-kind benefits provided in any other year. The right to any benefits or reimbursements or in-kind benefits may not be liquidated or exchanged for any other benefit.

11.Section 280G of the Code.

(a) If there is a change of ownership or effective control or change in the ownership of a substantial portion of the assets of a corporation (within the meaning of Section 280G of the Code) and any payment or benefit (including payments and benefits pursuant to this Agreement) that the Executive would receive from the Company or otherwise (“Transaction Payment”) would (i) constitute a “parachute payment” within the meaning of Section 280G of the Code, and (ii) but for this sentence, be subject to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then the Company shall cause to be determined, before any amounts of the Transaction Payment are paid to the Executive, which of the following two alternative forms of payment would result in the Executive’s receipt, on an after-tax basis, of the greater amount of the Transaction Payment notwithstanding that all or some portion of the Transaction Payment may be subject to the Excise Tax: (x) payment in full of the entire amount of the Transaction Payment (a “Full Payment”), or (y) payment of only a part of the Transaction Payment so that the Executive receives the largest payment possible without the imposition of the Excise Tax (a “Reduced Payment”). For purposes of determining whether to make a Full Payment or a Reduced Payment, the Company shall cause to be taken into account all applicable federal, state and local income and employment taxes and the Excise Tax (all computed at the highest applicable marginal rate, net of the maximum reduction in federal income taxes which could be obtained from a deduction of such state and local taxes). If a Reduced Payment is made, the reduction in payments and/or benefits will occur in the following order: (1) any equity or equity derivatives that are included under Section 280G of the Code at full value rather than accelerated value (with the highest value reduced first); (2) any equity or equity derivatives included under Section 280G of the Code at an accelerated value (and not at full value), with the highest value reduced first (as such values are determined under Treasury Regulation Section 1.280G-1, Q&A 24); (3) cash payments (from latest scheduled to earliest scheduled); and (4) any other non-cash benefits (from latest scheduled to earliest scheduled).

(b) Unless the Executive and the Company otherwise agree in writing, any determination required under this Section 11 shall be made in writing by the Company’s independent public accountants (the “Accountants”), whose determination shall be conclusive and binding upon the Executive and the Company for all purposes. For purposes of making the calculations required by this Section 11, the Accountants may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonable, good faith interpretations concerning the application of Sections 280G and 4999 of the Code. The Accountants shall provide detailed supporting calculations to the Company and the Executive as requested by the Company or the Executive. The Executive and the Company shall furnish to the Accountants such information and documents as the Accountants

may reasonably request in order to make a determination under this Section 11. The Company shall bear all costs the Accountants may reasonably incur in connection with any calculations contemplated by this Section 11(b).

(c) Notwithstanding the foregoing, in the event that no stock of the Company or its Affiliates is readily tradable on an established securities market or otherwise (within the meaning of Section 280G of the Code) at the time of the change in control, the Board may elect to submit to a vote of shareholders for approval the portion of the Transaction Payments that equals and exceeds three times the Executive’s “base amount” (within the meaning of Section 280G of the Code) (the “Excess Parachute Payments”) in accordance with Treas. Reg. §1.280G-1, and the Executive shall cooperate with such vote of shareholders, including the execution of any required documentation subjecting the Executive’s entitlement to all Excess Parachute Payments to such shareholder vote.

(d) The Company and the Executive will reasonably cooperate in good faith (including with the Accountants) to mitigate the amount of any Excise Tax due in connection with a change in the ownership or effective control or change in the ownership of a substantial portion of the assets of the Company (within the meaning of Section 280G of the Code).

12.Assignment and Successors. The Company may assign its rights and obligations under this Agreement to any entity, including any successor to all or substantially all the assets of the Company, by merger or otherwise, and may assign or encumber this Agreement and its rights hereunder as security for indebtedness of the Company and its Affiliates; provided, however, that no such assignment shall release the Company from its obligations hereunder. The Executive may not assign his rights or obligations under this Agreement to any individual or entity except as otherwise set forth in this Section 12. This Agreement shall be binding upon and inure to the benefit of the Company and the Executive and their respective successors, assigns, personnel, legal representatives, executors, administrators, heirs, distributees, devisees, and legatees, as applicable. In the event of the Executive’s death following a termination of his employment, all unpaid amounts otherwise due the Executive (including under Section 5) shall be paid to his estate.

13.Governing Law. This Agreement shall be governed, construed, interpreted, and enforced in accordance with the substantive laws of the State of Delaware, without reference to the principles of conflicts of law of Delaware or any other jurisdiction, and where applicable, the laws of the United States.

14.Validity. The invalidity or unenforceability of any provision or provisions of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement, which shall remain in full force and effect.

15.Notices. Any notice, request, claim, demand, document, and other communication hereunder to any party hereto shall be effective upon receipt (or refusal of receipt) if delivered during normal business hours at the location of the recipient or on the next business day at the location of the recipient if delivered outside such hours and shall be in writing and delivered personally or sent by email or sent by nationally recognized overnight courier, or certified or registered mail, postage prepaid, to the following address (or at any other address as any party hereto shall have specified by notice in writing to the other party hereto):

(a) If to the Company, to it at:

Spirit Aviation Holdings, Inc.

c/o General Counsel

1731 Radiant Drive

Dania Beach, Florida 33004

(b) If to the Executive, at his most recent address on the payroll records of the Company.

16.Counterparts. This Agreement may be executed in several counterparts, each of which shall be deemed to be an original, but all of which together will constitute one and the same Agreement, and shall become effective when one or more counterparts have been signed by each of the parties and delivered to the other parties.

17.Entire Agreement. The terms of this Agreement (together with the Escrow Agreement and the Exhibits and Annexes hereto) are intended by the parties hereto to be the final expression of their agreement with respect to the employment of the Executive by the Company and its Affiliates and to supersede any and all prior confidentiality agreements, offer letters, term sheets and similar agreements, plans, provisions, understandings or arrangements, whether written or oral. The parties hereto further intend that this Agreement shall constitute the complete and exclusive statement of its terms and that no extrinsic evidence whatsoever may be introduced in any judicial, administrative, or other legal proceeding to vary the terms of this Agreement.