Shareholder Report

|

6 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

First Trust Exchange-Traded Fund VIII

|

|

| Entity Central Index Key |

0001667919

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

May 31, 2025

|

|

| C000243906 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Active Global Quality Income ETF

|

|

| Class Name |

First Trust Active Global Quality Income ETF

|

|

| Trading Symbol |

AGQI

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the First Trust Active Global Quality Income ETF (the “Fund”) for the period of December 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/AGQI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/AGQI

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Active Global Quality Income ETF |

$23 |

0.44%(1) (2) |

|

(1) |

Annualized. |

|

(2) |

This ratio reflects tax expense paid by the Fund and a payment received from insurance related to extraordinary legal fees paid by the Fund during the fiscal year ended November 30, 2024 and the fiscal period ended November 30, 2023. If the tax payment had not been made and the insurance payment had not been received, the ratio would have been 0.85%. |

|

|

| Expenses Paid, Amount |

$ 23

|

|

| Expense Ratio, Percent |

0.44%

|

[1],[2] |

| Extraordinary Expenses Footnote [Text Block] |

This ratio reflects tax expense paid by the Fund and a payment received from insurance related to extraordinary legal fees paid by the Fund during the fiscal year ended November 30, 2024 and the fiscal period ended November 30, 2023. If the tax payment had not been made and the insurance payment had not been received, the ratio would have been 0.85%.

|

|

| Expenses Excluding Extraordinary Expenses, Percent |

0.85%

|

|

| Net Assets |

$ 55,241,347

|

|

| Holdings Count | Holding |

33

|

|

| Investment Company Portfolio Turnover |

37.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of May 31, 2025)

| Fund net assets |

$55,241,347 |

| Total number of portfolio holdings |

33 |

| Portfolio turnover rate |

37% |

|

|

| Holdings [Text Block] |

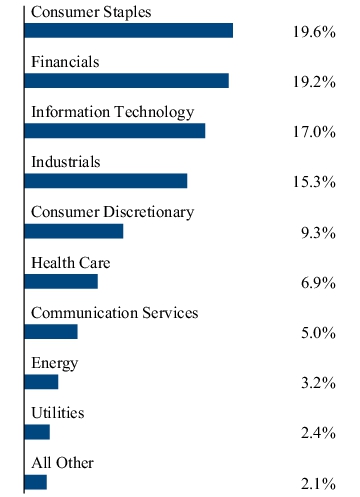

WHAT DID THE FUND INVEST IN? (As of May 31, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

5.0% |

| Microsoft Corp. |

4.7% |

| BAE Systems PLC |

4.5% |

| RELX PLC |

4.4% |

| Nordea Bank Abp |

4.0% |

| Coca-Cola (The) Co. |

4.0% |

| Carlsberg A/S, Class B |

3.8% |

| nVent Electric PLC |

3.7% |

| Procter & Gamble (The) Co. |

3.6% |

| Unilever PLC |

3.6% | Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Taiwan Semiconductor Manufacturing Co., Ltd. |

5.0% |

| Microsoft Corp. |

4.7% |

| BAE Systems PLC |

4.5% |

| RELX PLC |

4.4% |

| Nordea Bank Abp |

4.0% |

| Coca-Cola (The) Co. |

4.0% |

| Carlsberg A/S, Class B |

3.8% |

| nVent Electric PLC |

3.7% |

| Procter & Gamble (The) Co. |

3.6% |

| Unilever PLC |

3.6% |

|

|

| C000247844 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

FT Energy Income Partners Enhanced Income ETF

|

|

| Class Name |

FT Energy Income Partners Enhanced Income ETF

|

|

| Trading Symbol |

EIPI

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the FT Energy Income Partners Enhanced Income ETF (the “Fund”) for the period of December 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/EIPI. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/EIPI

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| FT Energy Income Partners Enhanced Income ETF |

$56 |

1.14%(1) (2) |

|

(1) |

Annualized. |

|

(2) |

Includes tax expense. If the tax expense was not included, the expense ratio would have been 1.10%. |

|

|

| Expenses Paid, Amount |

$ 56

|

|

| Expense Ratio, Percent |

1.14%

|

[3],[4] |

| Net Assets |

$ 902,506,252

|

|

| Holdings Count | Holding |

111

|

|

| Investment Company Portfolio Turnover |

64.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of May 31, 2025)

| Fund net assets |

$902,506,252 |

| Total number of portfolio holdings |

111 |

| Portfolio turnover rate |

64% |

|

|

| Holdings [Text Block] |

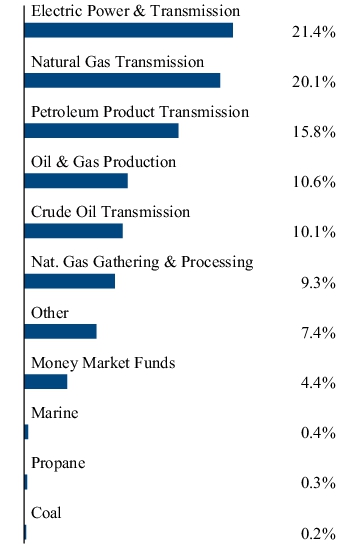

WHAT DID THE FUND INVEST IN? (As of May 31, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Enterprise Products Partners, L.P. |

7.7% |

| Energy Transfer, L.P. |

6.7% |

| MPLX, L.P. |

4.6% |

| ONEOK, Inc. |

4.5% |

| Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio - Institutional Class |

4.4% |

| Kinder Morgan, Inc. |

3.9% |

| Williams (The) Cos., Inc. |

3.8% |

| TotalEnergies SE, ADR |

3.4% |

| Shell PLC, ADR |

3.0% |

| Exxon Mobil Corp. |

2.7% | Industry Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Enterprise Products Partners, L.P. |

7.7% |

| Energy Transfer, L.P. |

6.7% |

| MPLX, L.P. |

4.6% |

| ONEOK, Inc. |

4.5% |

| Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio - Institutional Class |

4.4% |

| Kinder Morgan, Inc. |

3.9% |

| Williams (The) Cos., Inc. |

3.8% |

| TotalEnergies SE, ADR |

3.4% |

| Shell PLC, ADR |

3.0% |

| Exxon Mobil Corp. |

2.7% |

|

|

|

|