Management's Discussion and Analysis (“MD&A”)

Quarterly Report on the Second Quarter of 2025

This portion of the Quarterly Report provides management’s discussion and analysis (“MD&A”) of the financial condition and results of operations, to enable a reader to assess material changes in financial condition and results of operations as at, and for the three and six month periods ended June 30, 2025, in comparison to the corresponding prior-year periods. The MD&A is intended to help the reader understand Barrick Mining Corporation (formerly Barrick Gold Corporation) (“Barrick”, “we”, “our”, the “Company” or the “Group”), our operations, financial performance as well as our present and future business environment. This MD&A, which has been prepared as of August 8, 2025, is intended to supplement and complement the condensed unaudited interim consolidated financial statements and notes thereto, prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board applicable to the preparation of interim financial statements, under International Accounting Standard 34, Interim Financial Reporting, for the three and six month periods ended June 30, 2025 (collectively, the “Financial Statements”), which are included in this Quarterly Report on pages 64 to 68. You are encouraged to review the Financial Statements in conjunction with your review of this MD&A. This MD&A should be read in conjunction with both the annual audited

consolidated financial statements for the two years ended December 31, 2024, the related annual MD&A included in the 2024 Annual Report, and the most recent Form 40–F/Annual Information Form on file with the U.S. Securities and Exchange Commission (“SEC”) and Canadian provincial securities regulatory authorities. These documents and additional information relating to the Company are available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov. Certain notes to the Financial Statements are specifically referred to in this MD&A and such notes are incorporated by reference herein. All dollar amounts in this MD&A are in millions of United States dollars (“$” or “US$”), unless otherwise specified.

For the purposes of preparing our MD&A, we consider the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of our shares; (ii) there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision; or (iii) it would significantly alter the total mix of information available to investors. We evaluate materiality with reference to all relevant circumstances, including potential market sensitivity.

Abbreviations

|

|

|

|

|

|

|

|

| AISC |

All-in Sustaining Costs |

| ARK |

Agbarabo-Rhino-Kombokolo |

|

|

|

|

|

|

|

|

| BNL |

Barrick Niugini Limited |

|

|

|

|

|

|

| CCV |

Critical Control Verifications |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COS |

Cost of Sales |

|

|

| DRC |

Democratic Republic of Congo |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| G&A |

General and administrative |

|

|

| GHG |

Greenhouse Gas |

|

|

| GoT |

Government of Tanzania |

|

|

|

|

| IASB |

International Accounting Standards Board |

| ICMM |

International Council on Mining and Metals |

| ICSID |

International Centre for the Settlement of Investment Disputes |

| IFRS |

IFRS Accounting Standards as issued by the International Accounting Standards Board |

|

|

|

|

|

|

|

|

|

|

|

|

| KCD |

Karagba, Chauffeur and Durba |

|

|

|

|

|

|

|

|

|

|

| Ktpa |

Thousand tonnes per annum |

| Lb |

Pound |

| LME |

London Metal Exchange |

| LTI |

Lost Time Injury |

|

|

|

|

|

|

| LTIFR |

Lost Time Injury Frequency Rate |

|

|

|

|

|

|

|

|

|

|

| Mtpa |

Million tonnes per annum |

|

|

| MW |

Megawatt |

|

|

| NGM |

Nevada Gold Mines |

|

|

| OECD |

Organisation for Economic Co-operation and Development |

| Oz |

Ounce |

|

|

|

|

|

|

| PJL |

Porgera Jersey Limited |

| PNG |

Papua New Guinea |

|

|

| Randgold |

Randgold Resources Limited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SOKIMO |

Société Minière de Kilo-Moto SARL |

| TCC |

Total Cash Costs |

| TRIFR |

Total Recordable Injury Frequency Rate |

|

|

| TSF |

Tailings Storage Facilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| UN SDG |

United Nations Sustainable Development Goals |

| VAT |

Value-Added Tax |

|

|

| WGC |

World Gold Council |

| WTI |

West Texas Intermediate |

| YTD |

Year to date June 30 |

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2025 |

1 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Cautionary Statement on Forward-Looking Information

Certain information contained or incorporated by reference in this MD&A, including any information as to our strategy, projects, plans or future financial or operating performance, constitutes “forward-looking statements”. All statements, other than statements of historical fact, are forward-looking statements. The words “believe”, “expect”, “anticipated”, “aim”, “strategy”, “ramp up”, “target”, “plan”, “opportunities”, “guidance”, “forecast”, “outlook”, “project”, “develop”, “progress”, “continue”, “temporary”, “committed”, “estimate”, “potential”, “prospective”, “future”, “focus”, “ongoing”, “following”, “subject to”, “scheduled”, “may”, “will”, “can”, “could”, “would”, “should” and similar expressions identify forward-looking statements. In particular, this MD&A contains forward-looking statements including, without limitation, with respect to: Barrick’s forward-looking production and cost guidance, including our ability to meet our 2025 guidance; anticipated production growth from Barrick’s organic project pipeline and reserve replacement; estimates of future cost of sales per ounce for gold and per pound for copper, total cash costs per ounce and C1 cash costs per pound, and all-in sustaining costs per ounce/pound; cash flow forecasts; projected capital, operating and exploration expenditures; the share buyback program and performance dividend policy; mine life and production rates; anticipated benefits from the sale of the Donlin Gold project; anticipated timing for development of the Goldrush Project; our plans, timelines, and expected completion and benefits of our growth projects, including the Goldrush Project, Fourmile, Ren, Pueblo Viejo Expansion project, Veladero Phase 8 Leach Pad, Reko Diq, solar power project at Kibali, and the Lumwana Super Pit Expansion; anticipated production at Goldrush, Ren, Reko Diq and Lumwana; timing for first production from the Lumwana Super Pit Expansion; capital expenditures related to upgrades and ongoing management initiatives; Barrick’s global exploration strategy and planned exploration activities; Barrick’s copper strategy; the status of negotiations with the Government of Mali in respect of ongoing disputes regarding the Loulo-Gounkoto Complex, including the outcome of dispute resolution through arbitration; the resumption of operations and the temporary nature of the provisional administration and transfer of operational control to an external administrator at Loulo-Gounkoto; our pipeline of high confidence projects at or near existing operations; our ability to identify new Tier One assets and the potential for existing assets to attain Tier One status, including Fourmile; the incorporation of Fourmile into the NGM joint venture at fair market value; potential mineralization and metal or mineral recoveries; our ability to convert resources into reserves and future reserve replacement; asset sales, joint ventures and partnerships; Barrick’s strategy, plans, targets and goals in respect of sustainability issues, including climate change, greenhouse gas (“GHG”) emissions reduction targets, safety performance, community development, and responsible water use; and expectations regarding future price assumptions, financial performance and other outlook or guidance.

Forward-looking statements are necessarily based upon a number of estimates and assumptions including material estimates and assumptions related to the factors set forth below that, while considered reasonable by the Company as at the date of this MD&A in light of

management’s experience and perception of current conditions and expected developments, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information. Such factors include, but are not limited to: fluctuations in the spot and forward price of gold, copper or certain other commodities (such as silver, diesel fuel, natural gas and electricity); risks associated with projects in the early stages of evaluation and for which additional engineering and other analysis is required; risks related to the possibility that future exploration results will not be consistent with the Company’s expectations, that quantities or grades of reserves will be diminished, and that resources may not be converted to reserves; risks associated with the fact that certain of the initiatives described in this MD&A are still in the early stages and may not materialize; changes in mineral production performance, exploitation and exploration successes; risks that exploration data may be incomplete and considerable additional work may be required to complete further evaluation, including but not limited to drilling, engineering and socioeconomic studies and investment; the speculative nature of mineral exploration and development; lack of certainty with respect to foreign legal systems, corruption and other factors that are inconsistent with the rule of law; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices, including the expropriation or nationalization of property and political or economic developments in Canada, the United States, Mali or other countries in which Barrick does or may carry on business in the future; risks relating to political instability in certain of the jurisdictions in which Barrick operates; timing of receipt of, or failure to comply with, necessary permits and approvals; non-renewal of key licenses by governmental authorities; failure to comply with environmental and health and safety laws and regulations; increased costs and physical and transition risks related to climate change, including extreme weather events, resource shortages, emerging policies and increased regulations relating to related to GHG emission levels, energy efficiency and reporting of risks; the Company's ability to achieve its sustainability goals, including its climate-related goals and GHG emissions reduction targets, in particular its ability to achieve its Scope 3 emissions targets which require reliance on entities within Barrick's value chain, but outside of the Company's direct control, to achieve such targets within the specified time frames; contests over title to properties, particularly title to undeveloped properties, or over access to water, power and other required infrastructure; the liability associated with risks and hazards in the mining industry, and the ability to maintain insurance to cover such losses; damage to the Company’s reputation due to the actual or perceived occurrence of any number of events, including negative publicity with respect to the Company’s handling of environmental matters or dealings with community groups, whether true or not; risks related to operations near communities that may regard Barrick’s operations as being detrimental to them; litigation and legal and administrative proceedings; operating or technical

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2025 |

2 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

difficulties in connection with mining or development activities, including geotechnical challenges, tailings dam and storage facilities failures, and disruptions in the maintenance or provision of required infrastructure and information technology systems; increased costs, delays, suspensions and technical challenges associated with the construction of capital projects; risks associated with working with partners in jointly controlled assets; risks related to disruption of supply routes which may cause delays in construction and mining activities, including disruptions in the supply of key mining inputs due to the invasion of Ukraine by Russia and conflicts in the Middle East; risk of loss due to acts of war, terrorism, sabotage and civil disturbances; risks associated with artisanal and illegal mining; risks associated with Barrick’s infrastructure, information technology systems and the implementation of Barrick’s technological initiatives, including risks related to cybersecurity incidents, including those caused by computer viruses, malware, ransomware and other cyberattacks, or similar information technology system failures, delays and/or disruptions; the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; the impact of inflation, including global inflationary pressures driven by ongoing global supply chain disruptions, global energy cost increases following the invasion of Ukraine by Russia and country-specific political and economic factors in Argentina; adverse changes in our credit ratings; fluctuations in the currency markets; changes in U.S. dollar interest rates; changes in U.S. trade, tariff and other controls on imports and exports, tax, immigration or other policies that may impact relations with foreign countries, result in retaliatory policies, lead to increased costs for raw materials and components, or impact Barrick’s existing operations and material growth projects; risks arising from holding derivative instruments (such as credit risk, market liquidity risk and mark-to-market risk); risks related to the demands placed on the Company’s management, the ability of management to implement its business strategy and enhanced political risk in certain

jurisdictions; uncertainty whether some or all of Barrick’s targeted investments and projects will meet the Company’s capital allocation objectives and internal hurdle rate; whether benefits expected from recent transactions are realized; business opportunities that may be presented to, or pursued by, the Company; our ability to successfully integrate acquisitions or complete divestitures; risks related to competition in the mining industry; employee relations including loss of key employees; availability and increased costs associated with mining inputs and labor; risks associated with diseases, epidemics and pandemics; risks related to the failure of internal controls; and risks related to the impairment of the Company’s goodwill and assets.

In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion, copper cathode or gold or copper concentrate losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks).

Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this MD&A are qualified by these cautionary statements. Specific reference is made to the most recent Form 40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities for a more detailed discussion of some of the factors underlying forward-looking statements and the risks that may affect Barrick’s ability to achieve the expectations set forth in the forward-looking statements contained in this MD&A. We disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2025 |

3 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Use of Non-GAAP Financial Measures

We use the following non-GAAP financial measures and ratios in our MD&A:

■"adjusted net earnings"

■"free cash flow"

■"EBITDA"

■"adjusted EBITDA"

■"attributable EBITDA"

■“attributable EBITDA margin”

■“net leverage”

■"minesite sustaining capital expenditures"

■"project capital expenditures"

■"TCC/oz"

■"C1 cash costs/lb"

■"AISC per oz/lb" and

■"realized price per oz/lb"

For a detailed description of each of the non-GAAP financial measures used in this MD&A and a detailed reconciliation to the most directly comparable measure under IFRS, please refer to the Non-GAAP Financial Measures section of this MD&A on pages 44 to 59. Each non-GAAP financial measure has been annotated with a reference to an endnote on page 60. The non-GAAP financial measures set out in this MD&A are intended to provide additional information to investors and do not have any standardized meaning under IFRS, and therefore may not be comparable to other issuers, and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Index

|

|

|

|

|

|

|

|

|

|

Overview |

|

|

|

|

|

Financial and Operating Highlights |

|

|

Key Business Developments |

|

|

Sustainability |

|

|

Outlook |

|

|

|

|

|

|

|

Operating Performance |

|

|

|

|

|

Nevada Gold Mines |

|

|

Carlin |

|

|

Cortez |

|

|

Turquoise Ridge |

|

|

|

|

|

Pueblo Viejo |

|

|

|

|

|

Kibali |

|

|

|

|

|

|

|

|

North Mara |

|

|

Bulyanhulu |

|

|

Other Mines - Gold |

|

|

Lumwana |

|

|

Other Mines - Copper |

|

|

|

|

Growth Projects |

|

|

|

|

Exploration and Mineral Resource Management |

|

|

|

|

Review of Financial Results |

|

|

|

|

|

Revenue |

|

|

Production Costs |

|

|

|

|

|

General and Administrative Expenses |

|

|

Exploration, Evaluation and Project Expenses |

|

|

Finance Costs, Net |

|

|

Additional Statement of Income Items |

|

|

Income Tax Expense |

|

|

|

|

Financial Condition Review |

|

|

|

|

|

Balance Sheet Review |

|

|

|

|

|

Financial Position and Liquidity |

|

|

Summary of Cash Inflow (Outflow) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies |

|

|

|

|

Review of Quarterly Results |

|

|

|

|

Internal Control over Financial Reporting and

Disclosure Controls and Procedures |

|

|

|

|

IFRS Critical Accounting Policies and Accounting Estimates |

|

|

|

|

Non-GAAP Financial Measures |

|

|

|

|

Technical Information |

|

|

|

|

Endnotes |

|

|

|

|

Financial Statements |

|

|

|

|

Notes to Consolidated Financial Statements |

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2025 |

4 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Overview

Financial and Operating Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

For the six months ended |

| |

6/30/25 |

3/31/25 |

% Change |

|

6/30/24 |

% Change |

|

6/30/25 |

6/30/24 |

% Change |

Financial Results ($ millions) |

|

|

|

|

|

|

|

|

|

|

| Revenues |

3,681 |

3,130 |

18 |

% |

|

3,162 |

16 |

% |

|

6,811 |

5,909 |

15 |

% |

| Cost of sales |

1,878 |

1,785 |

5 |

% |

|

1,979 |

(5) |

% |

|

3,663 |

3,915 |

(6) |

% |

Net earningsa |

811 |

474 |

71 |

% |

|

370 |

119 |

% |

|

1,285 |

665 |

93 |

% |

Adjusted net earningsb |

800 |

603 |

33 |

% |

|

557 |

44 |

% |

|

1,403 |

890 |

58 |

% |

Attributable EBITDAb |

1,690 |

1,361 |

24 |

% |

|

1,289 |

31 |

% |

|

3,051 |

2,196 |

39 |

% |

Attributable EBITDA marginb |

55 |

% |

51 |

% |

8 |

% |

|

48 |

% |

15 |

% |

|

53 |

% |

45 |

% |

18 |

% |

Minesite sustaining capital expendituresb,c |

479 |

564 |

(15) |

% |

|

631 |

(24) |

% |

|

1,043 |

1,181 |

(12) |

% |

Project capital expendituresb,c |

439 |

269 |

63 |

% |

|

176 |

149 |

% |

|

708 |

341 |

108 |

% |

Total consolidated capital expendituresc,d |

934 |

837 |

12 |

% |

|

819 |

14 |

% |

|

1,771 |

1,547 |

14 |

% |

Total attributable capital expenditurese |

717 |

631 |

14 |

% |

|

694 |

3 |

% |

|

1,348 |

1,266 |

6 |

% |

| Net cash provided by operating activities |

1,329 |

1,212 |

10 |

% |

|

1,159 |

15 |

% |

|

2,541 |

1,919 |

32 |

% |

Net cash provided by operating activities marginf |

36 |

% |

39 |

% |

(8) |

% |

|

37 |

% |

(3) |

% |

|

37 |

% |

32 |

% |

16 |

% |

Free cash flowb |

395 |

375 |

5 |

% |

|

340 |

16 |

% |

|

770 |

372 |

107 |

% |

| Net earnings per share (basic and diluted) |

0.47 |

0.27 |

74 |

% |

|

0.21 |

124 |

% |

|

0.75 |

0.38 |

97 |

% |

Adjusted net earnings (basic)b per share |

0.47 |

0.35 |

34 |

% |

|

0.32 |

47 |

% |

|

0.82 |

0.51 |

61 |

% |

| Weighted average diluted common shares (millions of shares) |

1,716 |

1,725 |

(1) |

% |

|

1,755 |

(2) |

% |

|

1,721 |

1,755 |

(2) |

% |

| Operating Results |

|

|

|

|

|

|

|

|

|

|

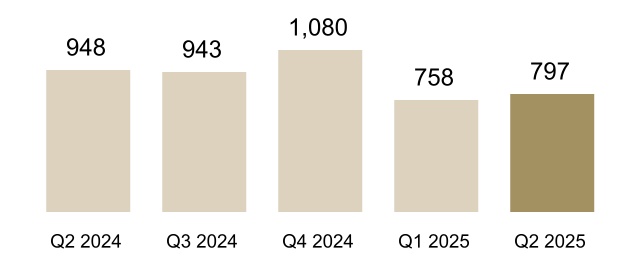

Gold production (thousands of ounces)g |

797 |

758 |

5 |

% |

|

948 |

(16) |

% |

|

1,555 |

1,888 |

(18) |

% |

Gold sold (thousands of ounces)g |

770 |

751 |

3 |

% |

|

956 |

(19) |

% |

|

1,521 |

1,866 |

(18) |

% |

| Market gold price ($/oz) |

3,280 |

2,860 |

15 |

% |

|

2,338 |

40 |

% |

|

3,067 |

2,203 |

39 |

% |

Realized gold priceb,g ($/oz) |

3,295 |

2,898 |

14 |

% |

|

2,344 |

41 |

% |

|

3,099 |

2,213 |

40 |

% |

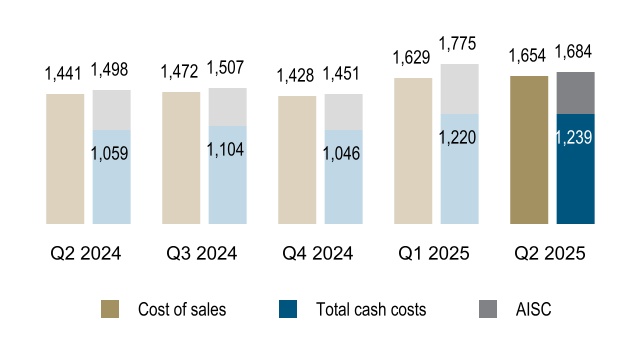

Gold COS (Barrick’s share)g,h ($/oz) |

1,654 |

1,629 |

2 |

% |

|

1,441 |

15 |

% |

|

1,641 |

1,433 |

15 |

% |

Gold TCCb,g ($/oz) |

1,239 |

1,220 |

2 |

% |

|

1,059 |

17 |

% |

|

1,229 |

1,055 |

16 |

% |

Gold AISCb,g ($/oz) |

1,684 |

1,775 |

(5) |

% |

|

1,498 |

12 |

% |

|

1,728 |

1,489 |

16 |

% |

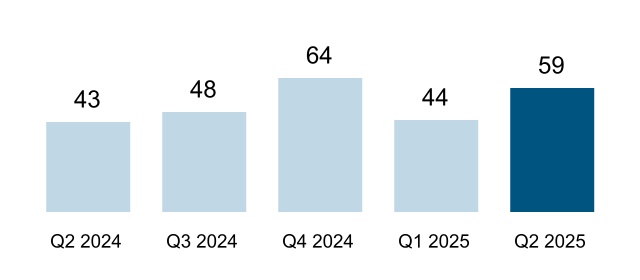

Copper production (thousands of tonnes)g |

59 |

44 |

34 |

% |

|

43 |

37 |

% |

|

103 |

83 |

24 |

% |

Copper sold (thousands of tonnes)g |

54 |

51 |

6 |

% |

|

42 |

29 |

% |

|

105 |

81 |

30 |

% |

| Market copper price ($/lb) |

4.32 |

4.24 |

2 |

% |

|

4.42 |

(2) |

% |

|

4.28 |

4.12 |

4 |

% |

Realized copper priceb,g ($/lb) |

4.36 |

4.51 |

(3) |

% |

|

4.53 |

(4) |

% |

|

4.43 |

4.21 |

5 |

% |

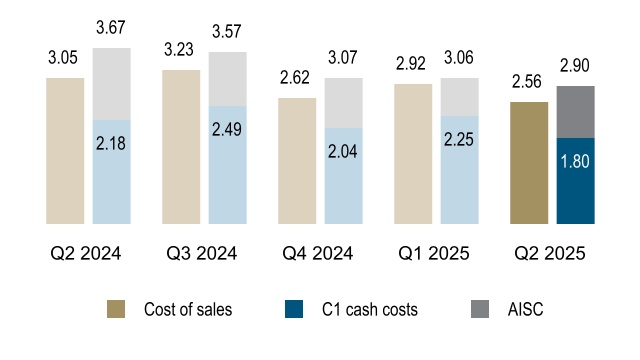

Copper COS (Barrick’s share)g,i ($/lb) |

2.56 |

2.92 |

(12) |

% |

|

3.05 |

(16) |

% |

|

2.74 |

3.12 |

(12) |

% |

Copper C1 cash costsb,g ($/lb) |

1.80 |

2.25 |

(20) |

% |

|

2.18 |

(17) |

% |

|

2.02 |

2.28 |

(11) |

% |

Copper AISCb,g ($/lb) |

2.90 |

3.06 |

(5) |

% |

|

3.67 |

(21) |

% |

|

2.98 |

3.64 |

(18) |

% |

|

|

|

|

|

|

|

|

|

|

|

| |

As at 6/30/25 |

As at 3/31/25 |

% Change |

|

As at 6/30/24 |

% Change |

|

|

|

|

Financial Position ($ millions) |

|

|

|

|

|

|

|

|

|

|

| Debt (current and long-term) |

4,729 |

4,727 |

0 |

% |

|

4,724 |

0 |

% |

|

|

|

|

| Cash and equivalents |

4,802 |

4,104 |

17 |

% |

|

4,036 |

19 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Debt, net of cash |

(73) |

623 |

(112) |

% |

|

688 |

(111) |

% |

|

|

|

|

a.Net earnings represents net earnings attributable to the equity holders of the Company.

b.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 44 to 59 of this MD&A.

c.Amounts presented on a consolidated cash basis. Project capital expenditures are not included in our calculation of AISC.

d.Total consolidated capital expenditures also includes capitalized interest of $16 million and $20 million for Q2 2025 and YTD 2025, respectively (Q1 2025: $4 million; Q2 2024: $12 million; YTD 2024: $25 million).

e.These amounts are presented on the same basis as our guidance.

f.Represents net cash provided by operating activities divided by revenue.

g.On an attributable basis.

h.Gold COS/oz is calculated as cost of sales across our gold operations (excluding sites in closure or care and maintenance) divided by ounces sold (both on an attributable basis using Barrick's ownership share).

i.Copper COS/lb is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick's ownership share).

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2025 |

5 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

|

|

|

|

|

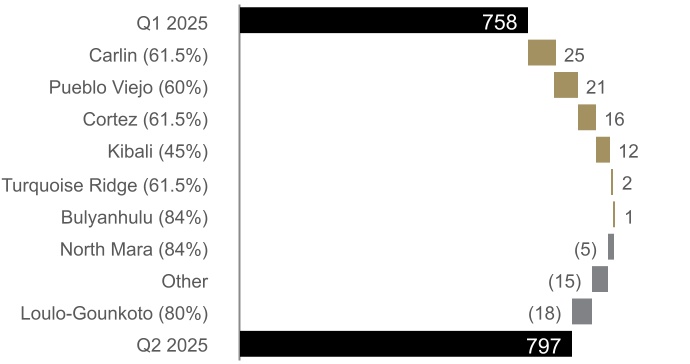

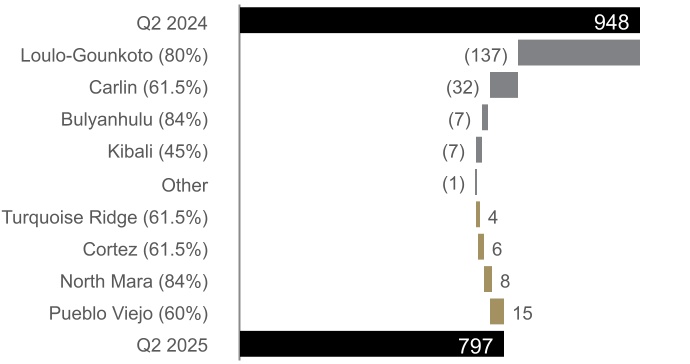

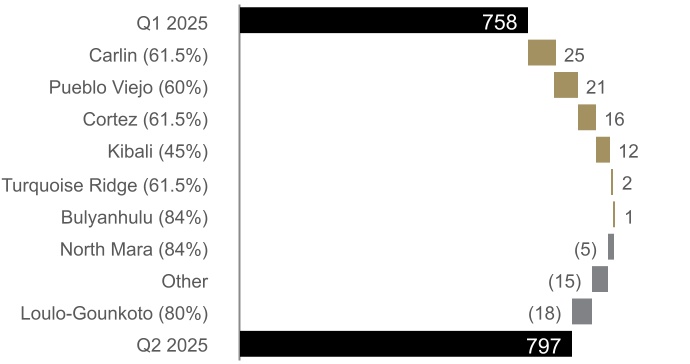

GOLD PRODUCTIONa (thousands of ounces) |

COPPER PRODUCTIONa (thousands of tonnes) |

|

|

|

|

|

|

GOLD COST OF SALESb, TOTAL CASH COSTSc, |

COPPER COST OF SALESb, C1 CASH COSTSc, |

AND ALL-IN SUSTAINING COSTSc ($ per ounce) |

AND ALL-IN SUSTAINING COSTSc ($ per pound) |

|

|

|

|

|

|

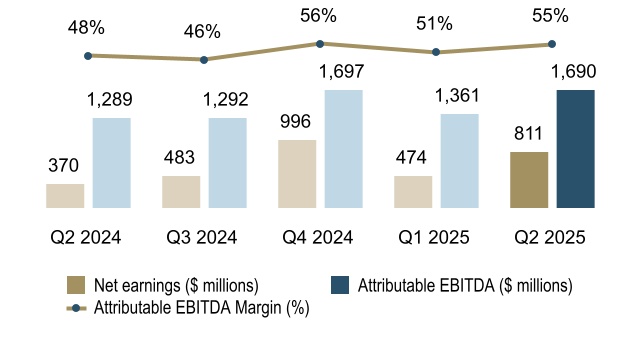

NET EARNINGS, ATTRIBUTABLE EBITDAc |

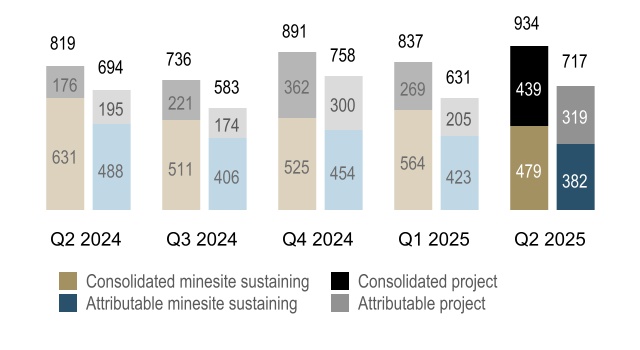

CAPITAL EXPENDITURESc,d

|

AND ATTRIBUTABLE EBITDA MARGINc |

($ millions) |

|

|

|

|

|

|

|

|

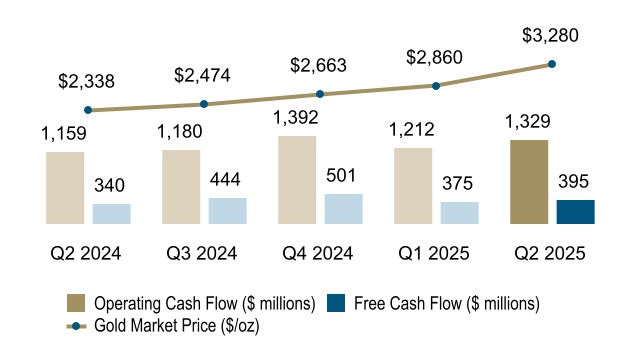

OPERATING CASH FLOW AND FREE CASH FLOWc |

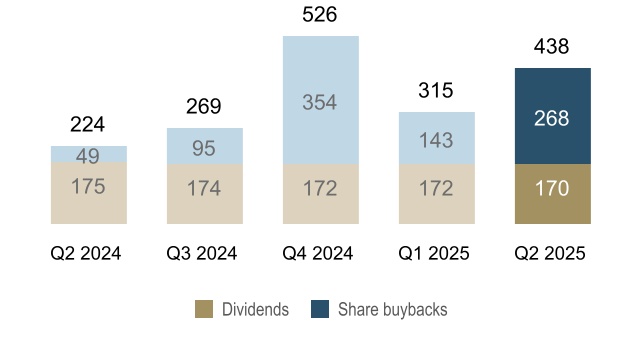

RETURNS TO SHAREHOLDERSe ($ millions) |

a.On an attributable basis.

b.Gold COS/oz is calculated as cost of sales across our gold operations (excluding sites in closure or care and maintenance) divided by ounces sold (both on an attributable basis using Barrick's ownership share). Copper COS/lb is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick's ownership share). Refer to endnote 2 for further details.

c.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 44 to 59 of this MD&A.

d.Capital expenditures also includes capitalized interest.

e.Dividends declared are inclusive of performance dividends.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2025 |

6 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Factors affecting net earnings and adjusted net earnings1 - Q2 2025 versus Q1 2025

The higher realized gold price1 was the primary driver of our Q2 2025 results performance relative to Q1 2025. Although unit costs were marginally higher due to the positive correlation between royalties and higher prices, almost all of the benefit of the higher price was delivered to the bottom line.

Net earnings and adjusted net earnings1 attributable to equity holders of Barrick ("net earnings") for Q2 2025 were $811 million and $800 million, respectively, compared to $474 million and $603 million, respectively in Q1 2025. The primary drivers of the increase were higher realized gold prices1, increased gold sales volumes, and lower copper COS/lb2. This was partially offset by higher gold COS/oz2.

After adjusting for items that are not indicative of future operating earnings, adjusted net earnings1 of $800 million for Q2 2025 was $197 million higher than Q1 2025. Q2 2025 realized gold prices1 were 14% higher when compared to Q1 2025. The increase in gold sales volumes was mainly as a result of planned shutdowns at Carlin, Pueblo Viejo and Kibali that occurred in the prior quarter. Copper COS/lb2 was lower compared to Q1 2025, primarily driven by lower unit costs at Lumwana due to the impact of higher grades processed and higher capitalised waste stripping. Higher gold COS/oz2 was mainly driven by higher costs at Cortez due to higher tonnes shipped and processed at Carlin and increased processing costs at the Gold Quarry roaster due to the planned shutdown, combined with changes in the sales mix across the portfolio.

Factors affecting net earnings and adjusted net earnings1 - Q2 2025 versus Q2 2024

Net earnings and adjusted net earnings1 for Q2 2025 were $811 million and $800 million, respectively, compared to $370 million and $557 million, respectively in Q2 2024. The primary drivers of the increase were higher realized gold prices1 and lower copper COS/lb2, partially offset by lower gold sales volumes and higher gold COS/oz2. Q2 2025 realized gold prices1 were 41% higher when compared to Q2 2024. Lower copper COS/lb2 resulted from higher grades processed driving greater fixed cost dilution at Lumwana. The decrease in gold sales volume was primarily as a result of the temporary suspension of operations at Loulo-Gounkoto, which was subsequently placed under a temporary provisional administration on June 16, 2025. This was combined with lower production at Carlin resulting from the planned shutdown at the Gold Quarry roaster. The increase in gold COS/oz2 was mainly due to the impact of less fixed cost dilution driven by lower throughput and to a lesser extent lower grades processed at a number of operations, combined with higher royalties (impact approximately $25/oz) associated with the higher realized gold price1.

Factors affecting net earnings and adjusted net earnings1 - YTD 2025 versus YTD 2024

Net earnings and adjusted net earnings1 for YTD 2025 were $1,285 million and $1,403 million, respectively, up from $665 million and $890 million in YTD 2024. The primary drivers of the increase were higher realized gold prices1 and lower copper COS/lb2, partially offset by lower gold sales volumes, and higher gold COS/oz2. YTD 2025 realized gold prices1 were 40% higher when compared to YTD 2024 while the decrease in copper COS/lb2 was mainly due to higher grades processed at Lumwana. The lower gold sales volume was primarily driven by the temporary suspension of operations at Loulo-Gounkoto, which was subsequently placed under a temporary provisional administration on June 16, 2025. This was combined with lower production at Carlin as a result of a decrease in underground tonnes mined, lower grades mined and lower recoveries at the autoclave. The increase in gold COS/oz2 compared to YTD 2024 was primarily due to the impact of less fixed cost dilution driven by lower throughput and to a lesser extent lower grades processed at a number of operations, combined with higher royalties (impact approximately $30/oz) associated with the higher realized gold price1.

Significant adjusting items for both Q2 2025 and YTD 2025 include:

■acquisition/disposition losses of $289 million for both Q2 2025 and YTD 2025, mainly relating to the $1,035 million net loss on the deconsolidation of Loulo-Gounkoto following the change of control after it was placed under a temporary provisional administration on June 16, 2025 (refer to page 8 for further details), partially offset by the recognition of our investment in Loulo-Gounkoto. This was offset by a gain of $745 million on the sale of our 50% interest in the Donlin Gold project; and ■other expense adjustments of $44 million and $217 million, respectively, which mainly related to reduced operations costs at Loulo-Gounkoto prior to June 16, 2025. YTD 2025 was further impacted by the signing of agreements to settle legacy legal matters in the Philippines related to Placer Dome Inc. (refer to note 17 of the Financial Statements for further details).

Refer to page 45 for a full list of reconciling items between net earnings and adjusted net earnings1 for the current and previous periods.

1Numerical annotations throughout the text of this document refer to the endnotes found starting on page 60.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2025 |

7 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Factors affecting Operating Cash Flow and Free Cash Flow1 - Q2 2025 versus Q1 2025

The cash flow outcomes for Q2 2025 reflect the strong earnings delivery and would have been even higher if not for a temporary working capital increase as discussed below. The second quarter is typically our lowest from a cash generation perspective given the timing of our largest tax payments coincides with the semi-annual coupon payments on our public market debt in the second quarter. Our two key growth projects remain on track and at current copper prices, the Lumwana expansion is self funding. We also accelerated our share buy back program with $268 million for the quarter bringing the total over the last 12 months to $860 million. Finally, we ended the quarter in a net cash position resulting in the payment of a performance dividend in relation to the second quarter, further enhancing our returns to shareholders.

In Q2 2025, we generated $1,329 million in operating cash flow, compared to $1,212 million in Q1 2025. The increase of $117 million was primarily due to higher realized gold prices, increased gold sales volumes, and lower copper C1 cash costs/lb1. This was partially offset by higher gold TCC/oz1. Operating cash flow was further impacted by a favorable movement in working capital, mainly in accounts payable and inventory, partially offset by an unfavorable movement in accounts receivable. The increase in accounts receivable mainly relates to our mines in Tanzania and Zambia where sales occurred at the end of the quarter with the receipt of the cash early in Q3. These results were also impacted by an increase in cash taxes paid and higher interest paid as a result of the timing of semi-annual interest payments on our bonds, which primarily occur in the second and fourth quarters.

In Q2 2025, we recorded free cash flow1 of $395 million, compared to $375 million in Q1 2025, mainly reflecting operating cash flows as explained above partially offset by higher capital expenditures. In Q2 2025, capital expenditures on a cash basis were $934 million compared to $837 million in Q1 2025, as discussed on page 40.

Factors affecting Operating Cash Flow and Free Cash Flow1 - Q2 2025 versus Q2 2024

In Q2 2025, we generated $1,329 million in operating cash flow, compared to $1,159 million in Q2 2024. The increase of $170 million was primarily due to higher realized gold prices1 and lower copper C1 cash costs/lb1. This was partially offset by lower gold sales volumes and higher gold TCC/oz1. These results were partially offset by higher cash taxes paid and an unfavorable movement in working capital, mainly in accounts receivable, partially offset by a favorable movement in other current liabilities. The increase in accounts receivable mainly relates to our mines in Tanzania and Zambia where sales were delayed to the end of the quarter with the receipt of the cash occurring early in Q3.

In Q2 2025, we generated free cash flow1 of $395 million compared to $340 million in Q2 2024. The increase primarily reflects higher operating cash flows as explained above, partially offset by higher capital expenditures. In Q2 2025, capital expenditures on a cash basis were $934 million compared to $819 million in the second quarter of 2024, as discussed on page 41.

Factors affecting Operating Cash Flow and Free Cash Flow1 - YTD 2025 versus YTD 2024

For YTD 2025, we generated $2,541 million in operating cash flow, compared to $1,919 million in YTD 2024. The increase of $622 million was primarily due to higher realized gold prices1, and lower C1 cash costs/lb1, partially offset by lower gold sales volumes and higher TCC/oz1. This was combined with an unfavorable change in working capital mainly in accounts receivable, partially offset by a favorable movement in other current liabilities and accounts payable. The increase in accounts receivable mainly relates to our mines in Tanzania and Zambia where sales were delayed to the end of the quarter with the receipt of the cash occurring early in Q3. These impacts were partially offset by higher cash taxes paid.

For YTD 2025, we generated free cash flow1 of $770 million compared to $372 million in YTD 2024. The increase of $398 million primarily reflects higher operating cash flows as explained above, partially offset by higher capital expenditures. In YTD 2025, capital expenditures on a cash basis were $1,771 million compared to $1,547 million in YTD 2024, as discussed on page 41.

Key Business Developments

Loulo-Gounkoto Mining Conventions Dispute

The Company and the Government of Mali have been engaged in an ongoing dispute in connection with the existing mining conventions of Société des Mines de Loulo SA (“Somilo”) and Société des Mines de Gounkoto (“Gounkoto”) (together, the “Conventions”).

On December 18, 2024, after multiple good faith attempts to resolve the dispute, Somilo and Gounkoto submitted a request for arbitration to ICSID in accordance with the provisions of their respective Conventions. On January 14, 2025, due to the restrictions imposed by the Government of Mali on gold shipments, the Company announced that the Loulo-Gounkoto complex would temporarily suspend operations.

On June 16, 2025, the Bamako Commercial Tribunal placed Loulo-Gounkoto under a temporary provisional administration. While Barrick retains its 80% legal ownership of the mine, operational control has been transferred to an external administrator. As a result of this loss of control event, the assets, liabilities and non-controlling interest of Loulo-Gounkoto were deconsolidated and derecognized and a retained investment was recognized at fair value.

For more information, refer to notes 16 and 17 of the Financial Statements.

Donlin Sale

On April 22, 2025, Barrick announced it had entered into an agreement to sell its 50% interest in the Donlin Gold project located in Alaska, USA to affiliates of Paulson Advisers LLC and NOVAGOLD Resources Inc. (“NOVAGOLD”) for total cash consideration of $1 billion. In addition, Barrick has granted NOVAGOLD an option to purchase the outstanding debt owed to Barrick (value of $160 million as at June 30, 2025 and presented in Other Assets) in connection with the Donlin Gold project for $90 million if purchased prior to closing (which was not exercised), or for $100 million if purchased within 18 months from closing, when the option expires. If that option is not exercised, the debt will remain outstanding, substantially in accordance with its existing terms which would largely defer repayment to the

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2025 |

8 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

commencement of production.

The transaction closed on June 3, 2025 and we recognized a gain on sale of $745 million in Q2 2025. In addition, NOVAGOLD retains the option to purchase the outstanding debt for $100 million within 18 months from closing.

Alturas Sale

On August 8, 2025, Barrick announced that it has reached an agreement to sell the Alturas Project in Chile to a subsidiary of Boroo Pte Ltd (Singapore) (“Boroo”) for an up-front cash payment of $50 million. In addition, Barrick will be granted a 0.5% net smelter return royalty on gold and silver produced from the Project, which will terminate once 2 million ounces of gold and gold-equivalent have been produced. Boroo may repurchase the royalty within four years from closing for $10 million. The transaction is expected to be completed within Q3 2025 subject to customary closing conditions being satisfied.

Name and Ticker Change

At the Company’s Annual and Special Meeting of Shareholders on May 6, 2025, Barrick's shareholders approved the change of the Company's corporate name from Barrick Gold Corporation to Barrick Mining Corporation, which was made effective on that date. In addition, as of May 9, 2025, Barrick’s ticker on the New York Stock Exchange changed to “B” from “GOLD”, better reflecting Barrick’s current business and our mission to achieve sustainable and profitable gold and copper growth. Barrick’s ticker on the TSX will remain unchanged.

Board of Directors Changes

Also at the Company’s Annual and Special Meeting of Shareholders on May 6, 2025, two new independent directors were elected to the Board of Directors: Ben van Beurden and Pekka Vauramo. They replace Christopher Coleman and Andrew Quinn who have retired from the Board.

At the August 8, 2025 meeting, the Board of Directors appointed Ben van Beurden as Lead Director, succeeding Brett Harvey who continues to serve on the Board as an independent director. Mr. van Beurden, former CEO of Shell, brings nearly four decades of global leadership in the energy and natural resource sectors.

Share Buyback Program

At the February 11, 2025 meeting, the Board of Directors authorized a new share buyback program for the purchase of up to $1 billion of Barrick’s outstanding common shares over the next 12 months. Barrick repurchased $268 million of shares in Q2 2025 and $143 million of shares in Q1 2025, bringing the YTD 2025 to $411 million purchased under this share buyback program.

The actual number of common shares that may be purchased, and the timing of any such purchases, will be determined by Barrick based on a number of factors, including the Company’s financial performance, the availability of cash flows, and the consideration of other uses of cash, including capital investment opportunities, returns to shareholders, and debt reduction.

The repurchase program does not obligate the Company to acquire any particular number of common shares, and the repurchase program may be suspended or discontinued at any time at the Company’s discretion.

Sustainability

Sustainability, including our license to operate, is entrenched in our DNA: our sustainability strategy is our business plan. Please refer to page 13 of our fourth quarter and full year 2024 MD&A for a full description of governance, strategy, risk management and targets. Key updates for 2025 are summarized below:

We reiterate our steadfast dedication to the health and safety of our employees and contractors, their families, and the communities in which we operate, encapsulating our safety vision of "Every person going home safe and healthy every day." The ongoing efforts of our "Journey to Zero" initiative continues to make significant strides.

The tracking and reporting on leading indicators continues at all sites, with a key focus on completing our CCVs before tasks and implementing corrective actions where identified. These serve as proactive measures, quantifying prevention efforts and anticipating incidents before they occur.

During the quarter, we undertook over 36,000 CCVs across the group. The group recorded a TRIFR3 of 0.57 during the quarter, a 18% improvement from the previous quarter, and an LTIFR3 of 0.08.

Barrick continues to roll out its climate risk assessments, the Barrick Biodiversity Residual Impact Assessment tool, and development of community based socio-economic metrics aligned to the UN SDGs across all sites, as published in our annual Sustainability Report for 2024. The report included the forecasting of Barrick’s GHG emissions in line with its expansion projects and increased production outlook towards the end of the decade, along with associated revised GHG targets.

During Q2 2025, the Group's total Scope 1 and 2 (location-based) GHG emissions were 1,815 kt CO2-e. Absolute emissions are trending in line with 2024, however emissions have increased on a relative basis compared to 2024 as 2024 emissions included the continued operation of Loulo-Gounkoto.

Following its disclosure of all extreme and very high consequence classified TSFs in August 2023, Barrick disclosed its remaining TSFs as per the Global Industry Standard on Tailings Management. Notably, Barrick has brought a total of 13 TSFs into Safe Closure designation. The TSF disclosures are available on Barrick’s website and are not incorporated by reference into, and are not a part of, this MD&A.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

|

6/30/2025a |

3/31/2025a |

6/30/24 |

|

|

LTIFR3 |

0.08 |

0.10 |

0.16 |

|

|

TRIFR3 |

0.57 |

0.71 |

0.84 |

|

|

| Community Development Spend ($ millions) |

15 |

15 |

10 |

|

|

Class 14 Environmental Incidents |

0 |

0 |

0 |

|

|

GHG Scope 1 and 2 emissions (kt CO2-e) (location based) |

1,815 |

1,890 |

1,730 |

|

|

| Water Recycling and Reuse Rate |

83 |

% |

82 |

% |

85 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a.Data presented is provisional data and is subject to change as a result of external assurance during annual reporting.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2025 |

9 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Full Year 2025 Outlook

As a result of the temporary suspension of operations at Loulo-Gounkoto in January, Loulo-Gounkoto was excluded from our 2025 production guidance at the time it was issued in February (refer to page 8 for more information). The following commentary is therefore exclusive of Loulo-Gounkoto. We continue to expect our 2025 gold production to be in the range of 3.15 to 3.50 million ounces. We expect Pueblo Viejo, Turquoise Ridge, Porgera and Kibali to deliver higher year-over-year performances, together with stable delivery across Carlin and Cortez. At Veladero and Phoenix, we expect 2025 production to be lower than 2024.

Across the four quarters of 2025, as previously indicated the Company’s gold production is expected to be the lowest in Q1 and highest in Q4 due to the timing of shutdowns, the Goldrush ramp-up and mine sequencing across the NGM sites, the 35 day shutdown for de-bottlenecking work needed at Pueblo Viejo in Q1 as previously disclosed, and grade variability at Kibali driven by the mine plan. This trend is partially offset by Veladero and North Mara where production is slightly weighted to the first half of the year. This is expected to result in an approximately 46% / 54% split of the Company’s total gold production between the first half and second half of the year, respectively.

Our 2025 gold cost guidance remains unchanged, including COS/oz2 of $1,460 to $1,560, TCC/oz1 of $1,050 to $1,130 and AISC/oz1 of $1,460 to $1,560 (all based on a gold price assumption of $2,400/oz). We have previously disclosed a sensitivity of $5/oz on our 2025 gold cost guidance metrics for every $100/oz change in the gold price which is driven by higher royalties. On the basis of this sensitivity, and given that the gold price has averaged closer to $3,000/oz for the first six months of the 2025 year, the above mentioned cost guidance ranges would increase by $30/oz if this average holds for the remainder of the year. Aside from this impact, we are on track to achieve our 2025 gold cost guidance metrics.

We expect 2025 copper production to be in the range of 200 to 230 thousand tonnes. As previously indicated, production is expected to be more evenly spread over the last three quarters with Q1 being the lowest quarter of the year mainly driven by grade at Lumwana as per the mine plan. We are on track to achieve our copper cost guidance metrics for 2025, which are based on a LME copper price assumption of $4.00/lb. We have previously disclosed a sensitivity of $0.01/lb on our 2025 copper cost guidance metrics for every $0.25/lb change in the copper price which is driven by higher royalties. On the basis of this sensitivity, if for example the copper price were to average $4.75/lb for the year, the copper all-in sustaining cost1 guidance range would increase by $0.03/lb (note royalties are excluded from C1 cash costs1).

Further detail on our 2025 company guidance is provided below and on the next page, inclusive of the key assumptions that were used as the basis for this guidance as released on February 11, 2025 and as qualified by the comments above.

|

|

|

|

|

|

Company Guidance ($ millions, except per oz/lb data) |

2025

Estimate |

| Gold production (millions of ounces) |

3.15 - 3.50 |

| Gold cost metrics |

|

| COS - gold ($/oz) |

1,460 - 1,560 |

TCC ($/oz)a |

1,050 - 1,130 |

| Depreciation ($/oz) |

370 - 400 |

AISC ($/oz)a |

1,460 - 1,560 |

| Copper production (thousands of tonnes) |

200 - 230 |

| Copper cost metrics |

|

| COS - copper ($/lb) |

2.50 - 2.80 |

C1 cash costs ($/lb)a |

1.80 - 2.10 |

| Depreciation ($/lb) |

0.75 - 0.85 |

AISC ($/lb)a |

2.80 - 3.10 |

| Exploration and project expenses |

330 - 370 |

| Exploration and evaluation |

220 - 240 |

| Project expenses |

110 - 130 |

| General and administrative expenses |

~160 |

| Corporate administration |

~120 |

Share-based compensationb |

~40 |

|

|

| Other expense |

70 - 90 |

| Finance costs, net |

270 - 310 |

| Attributable capital expenditures: |

|

Attributable minesite sustaininga |

1,400 - 1,650 |

Attributable projecta |

1,700 - 1,950 |

| Total attributable capital expenditures |

3,100 - 3,600 |

Effective income tax ratec |

26% - 30% |

| Key assumptions (used for guidance) |

| Gold Price ($/oz) |

2,400 |

|

| Copper Price ($/lb) |

4.00 |

|

| Oil Price (WTI) ($/barrel) |

80 |

|

| AUD Exchange Rate (AUD:USD) |

0.75 |

|

| ARS Exchange Rate (USD:ARS) |

1,000 |

|

| CAD Exchange Rate (USD:CAD) |

1.30 |

|

| CLP Exchange Rate (USD:CLP) |

900 |

|

| EUR Exchange Rate (EUR:USD) |

1.10 |

|

|

|

a.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 44 to 59 of this MD&A.

b.Based on a one-month trailing average ending December 31, 2024 of US$16.39 per share.

c.Based on key assumptions included in this table.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2025 |

10 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Operating Division Guidance

Our 2025 forecast gold and copper production, COSa, TCCb, AISCb, and C1 cash costsb ranges by operating division were originally released on February 12, 2025 as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Division |

2025 forecast attributable production (koz) |

2025 forecast COSa ($/oz) |

2025 forecast TCCb ($/oz) |

2025 forecast AISCb ($/oz) |

| Gold |

|

|

|

|

| Carlin (61.5%) |

705 - 785 |

1,470 - 1,570 |

1,140 - 1,220 |

1,630 - 1,730 |

Cortez (61.5%)c |

420 - 470 |

1,420 - 1,520 |

1,050 - 1,130 |

1,370 - 1,470 |

Turquoise Ridge (61.5%) |

310 - 345 |

1,370 - 1,470 |

1,000 - 1,080 |

1,260 - 1,360 |

| Phoenix (61.5%) |

85 - 105 |

2,070 - 2,170 |

890 - 970 |

1,240 - 1,340 |

|

|

|

|

|

Nevada Gold Mines (61.5%) |

1,540 - 1,700 |

1,470 - 1,570 |

1,070 - 1,150 |

1,460 - 1,560 |

Hemlo |

140 - 160 |

1,500 - 1,600 |

1,200 - 1,280 |

1,600 - 1,700 |

| North America |

1,680 - 1,860 |

1,470 - 1,570 |

1,080 - 1,160 |

1,480 - 1,580 |

|

|

|

|

|

Pueblo Viejo (60%) |

370 - 410 |

1,540 - 1,640 |

910 - 990 |

1,280 - 1,380 |

Veladero (50%) |

190 - 220 |

1,390 - 1,490 |

890 - 970 |

1,570 - 1,670 |

| Porgera (24.5%) |

70 - 95 |

1,510 - 1,610 |

1,210 - 1,290 |

1,770 - 1,870 |

|

|

|

|

|

| Latin America & Asia Pacific |

630 - 730 |

1,490 - 1,590 |

940 - 1,020 |

1,430 - 1,530 |

|

|

|

|

|

Loulo-Gounkoto (80%)d |

— |

— |

— |

— |

Kibali (45%) |

310 - 340 |

1,280 - 1,380 |

940 - 1,020 |

1,130 - 1,230 |

| North Mara (84%) |

230 - 260 |

1,370 - 1,470 |

1,020 - 1,100 |

1,400 - 1,500 |

| Bulyanhulu (84%) |

150 - 180 |

1,470 - 1,570 |

1,010 - 1,090 |

1,540 - 1,640 |

| Tongon (89.7%) |

110 - 140 |

1,790 - 1,890 |

1,570 - 1,650 |

1,660 - 1,760 |

|

|

|

|

|

| Africa & Middle East |

820 - 910 |

1,420 - 1,520 |

1,060 - 1,140 |

1,360 - 1,460 |

|

|

|

|

|

Total Attributable to Barricke,f,g |

3,150 - 3,500 |

1,460 - 1,560 |

1,050 - 1,130 |

1,460 - 1,560 |

|

|

|

|

|

| |

2025 forecast attributable production (kt) |

2025 forecast COSa ($/lb) |

2025 forecast C1 cash costsb ($/lb) |

2025 forecast AISCb ($/lb) |

| Copper |

|

|

|

|

| Lumwana |

125 - 155 |

2.30 - 2.60 |

1.60 - 1.90 |

2.80 - 3.10 |

| Zaldívar (50%) |

40 - 45 |

3.60 - 3.90 |

2.70 - 3.00 |

3.50 - 3.80 |

| Jabal Sayid (50%) |

25 - 35 |

2.00 - 2.30 |

1.60 - 1.90 |

1.80 - 2.10 |

Total Copperg |

200 - 230 |

2.50 - 2.80 |

1.80 - 2.10 |

2.80 - 3.10 |

a.Gold COS/oz is calculated as cost of sales across our gold operations (excluding sites in closure or care and maintenance) divided by ounces sold (both on an attributable basis using Barrick's ownership share). Copper COS/lb is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis using Barrick's ownership share).

b.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 44 to 59 of this MD&A.

c.Includes Goldrush.

d.As a result of the temporary suspension of operations at Loulo-Gounkoto in January, Loulo-Gounkoto was excluded from our 2025 production guidance at the time it was issued in February (refer to page 8 for more information). e.TCC/oz and AISC/oz include costs allocated to non-operating sites.

f.Operating division guidance ranges reflect expectations at each individual operating division and may not add up to the company-wide guidance range total.

g.Includes corporate administration costs.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2025 |

11 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Operating Performance

Our presentation of reportable operating segments consists of eight gold mines (Carlin, Cortez, Turquoise Ridge, Pueblo Viejo, Loulo-Gounkoto, Kibali, North Mara and Bulyanhulu) and one copper mine (Lumwana). Starting with this MD&A, the discussion on Loulo-Gounkoto is being presented in the “Other Mines - Gold” section as no operating or per ounce data is provided as a result of the temporary suspension of operations starting January 14, 2025, and subsequent loss of control on June 16, 2025.

The remaining operating segments, including our remaining gold and copper mines, have been grouped into an “Other Mines” category and will not be reported on individually. Segment performance is evaluated based on a number of measures including operating income before tax, production levels and unit production costs. Certain costs are managed on a consolidated basis and are therefore not reflected in segment income.

Nevada Gold Mines (61.5%)a, Nevada, USA

Summary of Operating and Financial Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

For the six months ended |

| |

6/30/25 |

3/31/25 |

% Change |

|

6/30/24 |

% Change |

|

6/30/25 |

6/30/24 |

% Change |

| Total tonnes mined (000s) |

37,304 |

36,961 |

1 |

% |

|

41,810 |

(11) |

% |

|

74,265 |

81,492 |

(9) |

% |

| Open pit ore |

3,988 |

3,974 |

0 |

% |

|

4,915 |

(19) |

% |

|

7,962 |

10,111 |

(21) |

% |

| Open pit waste |

31,724 |

31,534 |

1 |

% |

|

35,431 |

(10) |

% |

|

63,258 |

68,439 |

(8) |

% |

| Underground |

1,592 |

1,453 |

10 |

% |

|

1,464 |

9 |

% |

|

3,045 |

2,942 |

4 |

% |

| Average grade (grams/tonne) |

|

|

|

|

|

|

|

|

|

|

| Open pit mined |

0.96 |

0.98 |

(2) |

% |

|

0.90 |

7 |

% |

|

0.97 |

0.91 |

7 |

% |

| Underground mined |

8.16 |

7.62 |

7 |

% |

|

8.61 |

(5) |

% |

|

7.91 |

8.45 |

(6) |

% |

| Processed |

2.97 |

2.51 |

18 |

% |

|

2.63 |

13 |

% |

|

2.73 |

2.57 |

6 |

% |

| Ore tonnes processed (000s) |

5,941 |

6,143 |

(3) |

% |

|

6,446 |

(8) |

% |

|

12,084 |

13,225 |

(9) |

% |

| Oxide mill |

1,847 |

1,880 |

(2) |

% |

|

2,177 |

(15) |

% |

|

3,727 |

4,290 |

(13) |

% |

| Roaster |

1,362 |

1,126 |

21 |

% |

|

1,301 |

5 |

% |

|

2,488 |

2,695 |

(8) |

% |

| Autoclave |

929 |

1,098 |

(15) |

% |

|

1,167 |

(20) |

% |

|

2,027 |

2,234 |

(9) |

% |

| Heap leach |

1,803 |

2,039 |

(12) |

% |

|

1,801 |

0 |

% |

|

3,842 |

4,006 |

(4) |

% |

| Recovery rate |

82 |

% |

82 |

% |

0 |

% |

|

83 |

% |

(1) |

% |

|

82 |

% |

83 |

% |

(1) |

% |

| Oxide Mill |

79 |

% |

77 |

% |

3 |

% |

|

78 |

% |

1 |

% |

|

78 |

% |

79 |

% |

(1) |

% |

| Roaster |

86 |

% |

85 |

% |

1 |

% |

|

86 |

% |

0 |

% |

|

85 |

% |

85 |

% |

0 |

% |

| Autoclave |

77 |

% |

81 |

% |

(5) |

% |

|

80 |

% |

(4) |

% |

|

79 |

% |

80 |

% |

(1) |

% |

| Gold produced (000s oz) |

381 |

342 |

11 |

% |

|

401 |

(5) |

% |

|

723 |

821 |

(12) |

% |

| Oxide mill |

77 |

72 |

7 |

% |

|

72 |

7 |

% |

|

149 |

157 |

(5) |

% |

| Roaster |

212 |

172 |

23 |

% |

|

216 |

(2) |

% |

|

384 |

424 |

(9) |

% |

| Autoclave |

82 |

86 |

(5) |

% |

|

91 |

(10) |

% |

|

168 |

179 |

(6) |

% |

| Heap leach |

10 |

12 |

(17) |

% |

|

22 |

(55) |

% |

|

22 |

61 |

(64) |

% |

| Gold sold (000s oz) |

376 |

345 |

9 |

% |

|

400 |

(6) |

% |

|

721 |

824 |

(13) |

% |

| Revenue ($ millions) |

1,272 |

1,030 |

23 |

% |

|

967 |

32 |

% |

|

2,302 |

1,884 |

22 |

% |

| Cost of sales ($ millions) |

637 |

570 |

12 |

% |

|

592 |

8 |

% |

|

1,207 |

1,204 |

0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income ($ millions) |

624 |

453 |

38 |

% |

|

363 |

72 |

% |

|

1,077 |

659 |

63 |

% |

EBITDA ($ millions)b,c |

742 |

566 |

31 |

% |

|

484 |

53 |

% |

|

1,308 |

912 |

43 |

% |

EBITDA margind |

58 |

% |

55 |

% |

5 |

% |

|

50 |

% |

16 |

% |

|

57 |

% |

48 |

% |

19 |

% |

Capital expenditures ($ millions)e |

201 |

257 |

(22) |

% |

|

234 |

(14) |

% |

|

458 |

454 |

1 |

% |

Minesite sustainingb |

151 |

209 |

(28) |

% |

|

199 |

(24) |

% |

|

360 |

383 |

(6) |

% |

Projectb |

48 |

48 |

0 |

% |

|

34 |

41 |

% |

|

96 |

68 |

41 |

% |

| COS ($/oz) |

1,685 |

1,643 |

3 |

% |

|

1,464 |

15 |

% |

|

1,665 |

1,447 |

15 |

% |

TCC ($/oz)b |

1,319 |

1,269 |

4 |

% |

|

1,104 |

19 |

% |

|

1,295 |

1,092 |

19 |

% |

AISC ($/oz)b |

1,749 |

1,899 |

(8) |

% |

|

1,636 |

7 |

% |

|

1,821 |

1,585 |

15 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a.Barrick is the operator of NGM and owns 61.5%, with Newmont Corporation owning the remaining 38.5%. NGM is accounted for as a subsidiary with a 38.5% non-controlling interest. These results represent our 61.5% interest in Carlin, Cortez, Turquoise Ridge and Phoenix.

b.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 44 to 59 of this MD&A.

c.EBITDA represents income less depreciation. Depreciation expense is $118 million and $231 million for Q2 2025 and YTD 2025, respectively (Q1 2025: $113 million, Q2 2024: $121 million, YTD 2024: $253 million).

d.Represents EBITDA divided by revenue.

e.Includes capitalized interest.

NGM includes Carlin, Cortez, Turquoise Ridge, Phoenix and non-mine site related activity such as the TS Solar Project. Barrick is the operator of the joint venture and owns 61.5%, with Newmont owning the remaining 38.5%. Refer to pages 13 to 18 and 27 for a detailed discussion of each minesite's results.

|

|

|

|

|

|

|

|

|

BARRICK SECOND QUARTER 2025 |

12 |

MANAGEMENT'S DISCUSSION AND ANALYSIS |

Carlin (61.5%), Nevada, USA

Summary of Operating and Financial Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

For the six months ended |

| |

6/30/25 |

3/31/25 |

% Change |

|

6/30/24 |

% Change |

|

6/30/25 |

6/30/24 |

% Change |

| Total tonnes mined (000s) |

16,042 |

16,710 |

(4) |

% |

|

17,282 |

(7) |

% |

|

32,752 |

31,310 |

5 |

% |

| Open pit ore |

378 |

128 |

195 |

% |

|

627 |

(40) |

% |

|

506 |

1,217 |

(58) |

% |

| Open pit waste |

14,814 |

15,786 |

(6) |

% |

|

15,801 |

(6) |

% |

|

30,600 |

28,393 |

8 |

% |

| Underground |

850 |

796 |

7 |

% |

|

854 |

0 |

% |

|

1,646 |

1,700 |

(3) |

% |

| Average grade (grams/tonne) |

|

|

|

|

|

|

|

|

|

|

| Open pit mined |

1.38 |

1.30 |

6 |

% |

|

1.67 |

(17) |

% |

|

1.36 |

1.80 |

(24) |

% |

| Underground mined |

7.28 |

7.27 |

0 |

% |

|

7.92 |

(8) |

% |

|

7.27 |

7.72 |

(6) |

% |

| Processed |

4.50 |

3.97 |

13 |

% |

|

4.19 |

7 |

% |

|

4.24 |

4.11 |

3 |

% |

| Ore tonnes processed (000s) |

1,432 |

1,377 |

4 |

% |

|

1,739 |

(18) |

% |

|

2,809 |

3,608 |

(22) |

% |

|

|

|

|

|

|

|

|

|

|

|

| Roasters |

1,049 |

860 |

22 |

% |

|

1,131 |

(7) |

% |

|

1,909 |

2,351 |

(19) |

% |

| Autoclave |

305 |

499 |

(39) |

% |

|

608 |

(50) |

% |

|

804 |

1,257 |

(36) |

% |

| Heap leach |

78 |

18 |

333 |

% |

|

0 |

100 |

% |

|

96 |

0 |

100 |

% |

| Recovery rate |

81 |

% |

81 |

% |

0 |

% |

|

82 |

% |

(1) |

% |

|

81 |

% |

82 |

% |

(1) |

% |

| Roasters |

85 |

% |

84 |

% |

1 |

% |

|

85 |

% |

0 |

% |

|

84 |

% |

84 |

% |

0 |

% |

| Autoclave |

43 |

% |

67 |

% |

(36) |

% |

|

68 |

% |

(37) |

% |

|

56 |

% |

70 |

% |

(20) |

% |

| Gold produced (000s oz) |

170 |

145 |

17 |

% |

|

202 |

(16) |

% |

|

315 |

407 |

(23) |

% |

|

|

|

|

|

|

|

|

|

|

|

| Roasters |

157 |

125 |

26 |

% |

|

173 |

(9) |

% |

|

282 |

342 |

(18) |

% |

| Autoclave |

10 |

16 |

(38) |

% |

|

23 |

(57) |

% |

|

26 |

53 |

(51) |

% |

| Heap leach |

3 |

4 |

(25) |

% |

|

6 |

(50) |

% |

|

7 |

12 |

(42) |

% |

| Gold sold (000s oz) |

166 |

142 |

17 |

% |

|

202 |

(18) |

% |

|

308 |

409 |

(25) |

% |

| Revenue ($ millions) |

552 |

417 |

32 |

% |

|

474 |

16 |

% |

|

969 |

912 |

6 |

% |

| Cost of sales ($ millions) |

264 |

246 |

7 |

% |

|

283 |

(7) |

% |

|

510 |

571 |

(11) |

% |

| Income ($ millions) |

285 |

168 |

70 |

% |

|

187 |

52 |

% |

|

453 |

334 |

36 |

% |

EBITDA ($ millions)a,b |

327 |

206 |

59 |

% |

|

236 |

39 |

% |

|

533 |

434 |

23 |

% |

EBITDA marginc |

59 |

% |

49 |

% |

20 |

% |

|

50 |

% |

18 |

% |

|

55 |

% |

48 |

% |

15 |

% |

Capital expenditures ($ millions)d |

98 |

174 |

(44) |

% |

|

135 |

(27) |

% |

|

272 |

255 |

7 |

% |

Minesite sustaininga |

78 |

156 |

(50) |

% |

|

130 |

(40) |

% |

|

234 |

243 |

(4) |

% |

Projecta |

18 |

18 |

0 |

% |

|

5 |

260 |

% |

|

36 |

12 |

200 |

% |

| COS ($/oz) |

1,589 |

1,720 |

(8) |

% |

|

1,390 |

14 |

% |

|

1,649 |

1,380 |

19 |

% |

TCC ($/oz)a |

1,330 |

1,459 |

(9) |

% |

|

1,145 |

16 |

% |

|

1,390 |

1,136 |

22 |

% |

AISC ($/oz)a |

1,826 |

2,570 |

(29) |

% |

|

1,805 |

1 |

% |

|

2,169 |

1,745 |

24 |

% |

|

|

|

|

|

|

|

|

|

|

|

a.Further information on these non-GAAP financial measures, including detailed reconciliations, is included on pages 44 to 59 of this MD&A.

b.EBITDA represents income less depreciation. Depreciation expense is $42 million and $80 million for Q2 2025 and YTD 2025, respectively (Q1 2025: $38 million, Q2 2024: $49 million, YTD 2024: $100 million).

c.Represents EBITDA divided by revenue.

d.Includes capitalized interest.

Safety and Environment

|

|

|

|

|

|

|

|

|

|

|

| For the three months ended |

|

|

6/30/25 |

3/31/25 |

|

|

| LTI |

0 |

0 |

|

|

LTIFR3 |

0.00 |

0.00 |

|

|

TRIFR3 |

0.80 |

1.66 |

|

|

Class 14 environmental incidents |

0 |

0 |

|

|

Financial Results