| What were the Fund’s costs for the last 6 months? | ||

| (based on a hypothetical $10,000 investment) | ||

| Class Name | Cost of a 10k Investment | Cost Paid as a % of a 10k Investment |

| A | $227 | 2.24% |

How has the Fund performed since its inception?

Longboard Fund has underperformed its primary benchmark, the Morningstar Moderate Target Risk Index, and its secondary benchmark, the Russell 2000 Total Return Index, since inception.

Total Return Based on a $10,000 Investment

| The above chart represents the historic performance of a hypothetical $10,000 investment since fund inception (12/9/2015). The results of this chart do not predict the results of future time periods and does not guarantee the same results. The graph and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. |

Morningstar Moderate Target Risk Index: Index representing a balanced portfolio of 60% equities and 40% bonds.

Russell 2000 Total Return Index: A small-cap stock market index of the smallest 2,000 stocks in the Russell 3000 Index.

S&P 500 Index: A stock market index tracking the performance of 500 of the largest companies listed on stock exchanges in the United States.

| Average Annual Total Returns as of 5/31/2025 |

| 1 Year | 5 Years | Since

Inception (12/9/2015) | |

| LONAX (Without Load) | 2.87% | 6.64% | 6.74% |

| LONAX (With Load) | -3.05% | 5.38% | 6.08% |

| S&P 500 Index | 13.52% | 15.94% | 13.83% |

| Russell 2000 Total Return Index | 1.19% | 9.64% | 7.89% |

| Morningstar Moderate Target Risk Index | 10.52% | 7.42% | 7.18% |

| ICE BofA 3-Month U.S. Treasury Bill | 4.79% | 2.72% | 2.06% |

| Longboard

Fund - Class A: LONAX Annual Shareholder Report - May 31, 2025 |

|

| Fund Statistics as of 5/31/2025 | |

| Total Net Assets | $136,756,623 |

| # of Portfolio Holdings | 423 |

| Portfolio Turnover Rate | 61% |

| Advisory Fees Paid | $2,719,413 |

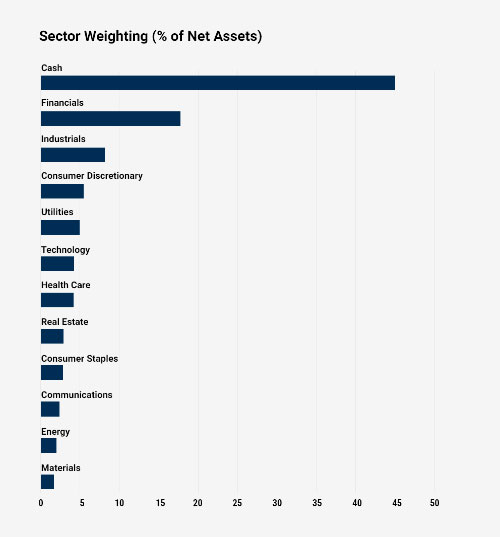

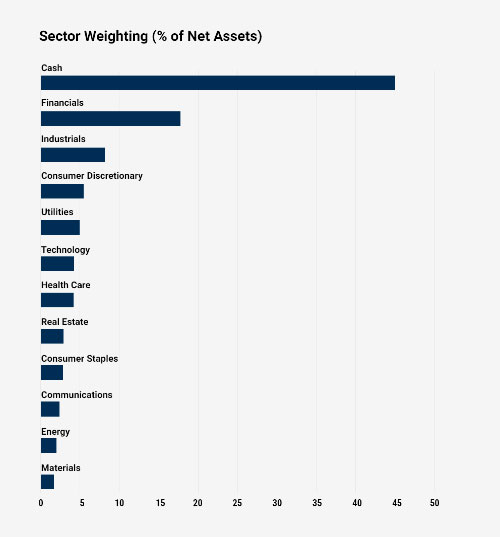

What did the Fund invest in?

Longboard Fund employs a trend-following strategy, maintaining a diversified portfolio of to stocks exhibiting strong upward trends, increasing exposure to market leaders while eliminating positions in underperforming stocks.

| Top 10 Holdings |

| Holding Name | %

of Net Assets |

| Automatic Data Processing, Inc. | 0.3% |

| Boston Scientific Corporation | 0.3% |

| Starwood Property Trust, Inc. | 0.3% |

| Phillips Edison & Company, Inc. | 0.2% |

| Arthur J Gallagher & Company | 0.2% |

| Roper Technologies, Inc. | 0.2% |

| Progressive Corporation (The) | 0.2% |

| Bank of New York Mellon Corporation (The) | 0.2% |

| Box, Inc., Class A | 0.2% |

| TJX Companies, Inc. (The) | 0.2% |

Material Fund Changes

No material changes occurred during the period ended May 31, 2025.

| What were the Fund’s costs for the year? |

| (based on a hypothetical $10,000 investment) |

| Class Name | Cost of a 10k Investment | Cost Paid as a % of a 10k Investment |

| Institutional | $202 | 1.99% |

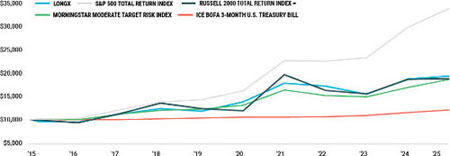

How has the Fund performed since its inception?

Longboard Fund has outperformed its primary benchmark, the Morningstar Moderate Target Risk Index, and its secondary benchmark, the Russell 2000 Total Return Index, since inception.

Total Return Based on a $10,000 Investment

| The above chart represents the historic performance of a hypothetical $10,000 investment since fund inception (3/19/2015). The results of this chart do not predict the results of future time periods and does not guarantee the same results. The graph and table do not reflect the deductions of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares. | ||

Morningstar Moderate Target Risk Index: Index representing a balanced portfolio of 60% equities and 40% bonds.

Russell 2000 Total Return Index: A small-cap stock market index of the smallest 2,000 stocks in the Russell 3000 Index.

S&P 500 Index: A stock market index tracking the performance of 500 of the largest companies listed on stock exchanges in the United States.

| Average Annual Total Returns as of 5/31/2025 |

| 1 Year | 5 Years | 10 Years | |

| LONGX | 3.16% | 6.92% | 7.23% |

| S&P 500 Index | 13.52% | 15.94% | 12.86% |

| Russell 2000 Total Return Index | 1.19% | 9.64% | 6.64% |

| Morningstar Moderate Target Risk Index | 10.52% | 7.42% | 6.34% |

| ICE BofA 3-Month U.S. Treasury Bill | 4.79% | 2.72% | 1.95% |

| Longboard

Fund - Class I: LONGX Annual Shareholder Report - May 31, 2025 |

|

| Fund Statistics as of 5/31/2025 | |

| Total Net Assets | $136,756,623 |

| # of Portfolio Holdings | 423 |

| Portfolio Turnover Rate | 61% |

| Advisory Fees Paid | $2,719,413 |

What did the Fund invest in?

Longboard Fund employs a trend-following strategy, maintaining a diversified portfolio of to stocks exhibiting strong upward trends, increasing exposure to market leaders while eliminating positions in underperforming stocks.

| Top 10 Holdings |

| Holding Name | %

of Net Assets |

| Automatic Data Processing, Inc. | 0.3% |

| Boston Scientific Corporation | 0.3% |

| Starwood Property Trust, Inc. | 0.3% |

| Phillips Edison & Company, Inc. | 0.2% |

| Arthur J Gallagher & Company | 0.2% |

| Roper Technologies, Inc. | 0.2% |

| Progressive Corporation (The) | 0.2% |

| Bank of New York Mellon Corporation (The) | 0.2% |

| Box, Inc., Class A | 0.2% |

| TJX Companies, Inc. (The) | 0.2% |

Material Fund Changes

No material changes occurred during the period ended May 31, 2025.