Management’s Discussion and Analysis |

This Management’s Discussion and Analysis (“MD&A”) of financial position and results of operations of Franco-Nevada Corporation (“Franco-Nevada”, the “Company”, “we” or “our”) has been prepared based upon information available to Franco-Nevada as at August 8, 2025 and should be read in conjunction with Franco-Nevada’s unaudited condensed consolidated interim financial statements and related notes as at and for the three and six months ended June 30, 2025 and 2024 (the “financial statements”). The financial statements and this MD&A are presented in U.S. dollars and the financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IASB”) (“IFRS Accounting Standards”) applicable to the presentation of condensed interim financial statements, including IAS 34 Interim Financial Reporting.

Readers are cautioned that this MD&A contains forward-looking statements and that actual events may vary from management’s expectations. Readers are encouraged to read the “Cautionary Statement on Forward-Looking Information” at the end of this MD&A and to consult Franco-Nevada’s financial statements which are available on our website at www.franco-nevada.com, on SEDAR+ at www.sedarplus.com and on Form 6-K furnished to the United States Securities and Exchange Commission (“SEC”) on EDGAR at www.sec.gov. Additional information related to Franco-Nevada, including our Annual Information Form and Form 40-F, are available on SEDAR+ at www.sedarplus.com and on EDGAR at www.sec.gov, respectively. These documents contain descriptions of certain of Franco-Nevada’s producing and advanced royalty and stream assets, as well as a description of risk factors affecting the Company. For additional information, please see our website at www.franco-nevada.com.

Abbreviations Used in this Report |

The following abbreviations may be used throughout this MD&A:

Abbreviated Definitions | | | | | | ||

Periods under review | | Measurement | | Interest types | |||

"Q4" | The three-month period ended December 31 | | "GEO" | Gold equivalent ounce | | "NSR" | Net smelter return royalty |

"Q3" | The three-month period ended September 30 | | "PGM" | Platinum group metals | | "GR" | Gross royalty |

"Q2" | The three-month period ended June 30 | | "NGL" | Natural gas liquids | | "ORR" | Overriding royalty |

"Q1" | The three-month period ended March 31 | | "oz" | Ounce | | "GORR" | Gross overriding royalty |

"H2" | The six-month period ended December 31 | | "oz Au" | Ounce of gold | | "FH" | Freehold or lessor royalty |

"H1" | The six-month period ended June 30 | | "oz Ag" | Ounce of silver | | "GMR" | Gross margin royalty |

| | | "oz Pt" | Ounce of platinum | | "NPI" | Net profits interest |

| | | "oz Pd" | Ounce of palladium | | "NRI" | Net royalty interest |

Places and currencies | | | "62% Fe" | 62% Fe iron ore fines, dry metric | | "WI" | Working interest |

"U.S." | United States | | | tonnes CFR China | | | |

"$" or "USD" | United States dollars | | "LBMA" | London Bullion Market Association | | | |

"C$" or "CAD" | Canadian dollars | | "bbl" | Barrel | | | |

"R$" or "BRL" | Brazilian reais | | "mcf" | Thousand cubic feet | | | |

"A$" or "AUD" | Australian dollars | | "WTI" | West Texas Intermediate | | | |

| | | | | | | |

For definitions of the various types of agreements, please refer to our most recent Annual Information Form filed on SEDAR+ at www.sedarplus.com or our Form 40-F filed on EDGAR at www.sec.gov.

Franco-Nevada is the leading gold-focused royalty and streaming company with the most diversified portfolio of cash-flow producing royalties and streams by commodity, geography, operator, revenue type and stage of project.

Our Portfolio (at August 8, 2025) | ||||||||

|

| Precious Metals |

| Other Mining | | Energy |

| TOTAL |

Producing | | 50 | | 14 | | 56 | | 120 |

Advanced | | 32 | | 7 | | — | | 39 |

Exploration | | 161 | | 85 | | 27 | | 273 |

TOTAL | | 243 | | 106 | | 83 | | 432 |

Our shares are listed on the Toronto and New York stock exchanges under the symbol FNV. An investment in our shares is expected to provide investors with yield and exposure to commodity price and exploration optionality while limiting exposure to cost inflation and other operating risks.

Second Quarter 2025 Management’s Discussion and Analysis | 3 |

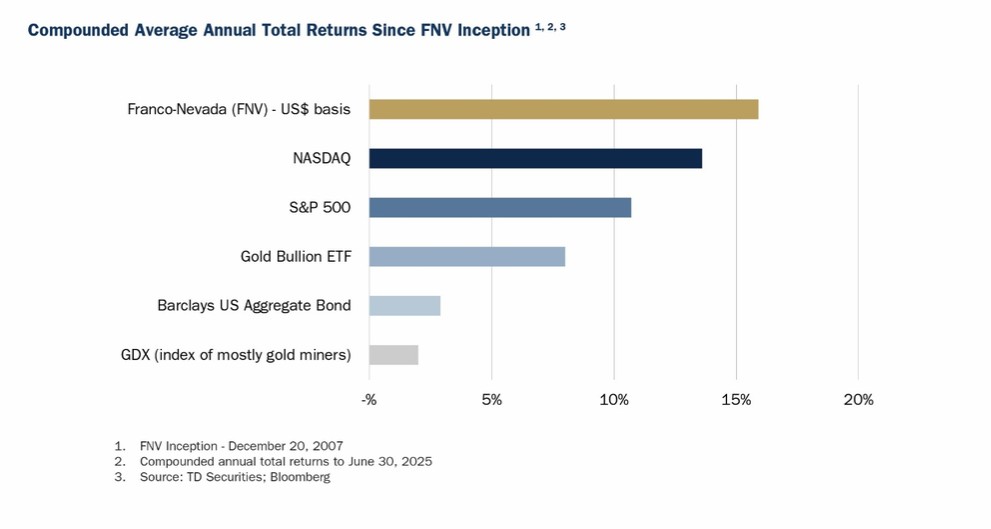

We believe that combining lower risk gold investments with a strong balance sheet, progressively growing dividends and exposure to exploration optionality is the right mix to appeal to investors seeking to hedge market instability. Since our Initial Public Offering over 17 years ago, we have increased our dividend annually and our share price has outperformed the gold price and all relevant gold equity benchmarks. Creating successful long-term partnerships with operators is a core objective. The alignment and the natural flexibility of royalty and stream financing has made it an attractive source of capital for the cyclical resource sector. We also work to be a positive force in all our communities, providing a safe and diverse workplace, promoting responsible mining and contributing to build community support for the operations in which we invest.

Our revenue is generated from various forms of agreements, ranging from net smelter return royalties, streams, profit-based royalty interests, net royalty interests, working interests and other types of arrangements. We do not operate mines, develop projects or conduct exploration. Franco-Nevada has a free cash flow generating business with no additional capital requirements other than the initial commitment, and management is focused on managing and growing its portfolio of royalties and streams. We recognize the cyclical nature of the industry and have a long-term investment outlook. We maintain a strong balance sheet to minimize financial risk and to provide capital to the industry when it is otherwise scarce.

The advantages of this business model are:

| ● | Exposure to commodity price optionality; |

| ● | A perpetual discovery option over large areas of geologically prospective lands; |

| ● | No additional capital requirements other than the initial commitment; |

| ● | Limited exposure to cost inflation; |

| ● | A free cash-flow business with limited cash calls; |

| ● | A high-margin business that can generate cash through the entire commodity cycle; |

| ● | A scalable and diversified business in which a large number of assets can be managed with a small stable overhead; and |

| ● | Management that focuses on forward-looking growth opportunities rather than operational or development issues. |

Our short-term financial results are primarily tied to the price of commodities and the amount of production from our portfolio of assets. Our attributable production has typically been supplemented by acquisitions of new assets. Over the longer term, our results are impacted by the amount of exploration and development capital available to operators to expand or extend our producing assets or to progress our advanced and exploration assets into production.

The focus of our business is to create exposure to gold and precious metal resource optionality. This principally involves investments in gold mines and providing capital to copper and other base metal mines to obtain exposure to by-product gold, silver and platinum group metals production. We also invest in other metals and energy to expose our shareholders to additional resource optionality. In H1 2025, 84.3% of our revenue was earned from mining assets, of which 80.6% was earned from precious metals.

A strength of our business model is that our margins are not generally impacted when producer costs increase. The majority of our interests are royalty and streams with payments/deliveries that are based on production levels with no adjustments for the operator’s operating costs. In H1 2025, these interests accounted for 91.7% of our revenue. We also have WI, NPI, NRI and GMR royalties which are based on the margin or profit of the underlying operations.

Second Quarter 2025 Management’s Discussion and Analysis | 4 |

Selected Financial Information

(in millions, except Average Gold Price, GEOs sold, Net GEOs sold, | | | For the three months ended |

| | For the six months ended | | ||||||||||

Adjusted EBITDA Margin, Adjusted Net Income Margin, | | | June 30, | | | June 30, | | ||||||||||

per GEO amounts and per share amounts) |

|

| 2025 |

| | 2024 |

|

| 2025 |

|

| 2024 | | ||||

| | | | | | | | | | | | | | | | | |

Statistical Measures | | | | | | | | | | | | | | | | | |

Average Gold Price | | | $ | 3,279 | | | $ | 2,338 | | | $ | 3,071 | | | $ | 2,205 | |

GEOs sold(1) | | |

| 112,093 | | |

| 110,264 | | |

| 238,678 | | |

| 233,161 | |

Net GEOs sold(1) | | | | 101,876 | | | | 97,817 | | | | 215,014 | | | | 204,498 | |

| | | | | | | | | | | | | | | | | |

Statement of Comprehensive Income | | | | | | | | | | | | | | | | | |

Revenue | | | $ | 369.4 | | | $ | 260.1 | | | $ | 737.8 | | | $ | 516.9 | |

Costs of sales | | |

| 33.5 | | |

| 29.1 | | |

| 72.0 | | |

| 62.7 | |

Depletion and depreciation | | |

| 64.0 | | |

| 52.9 | | |

| 132.4 | | |

| 111.1 | |

Operating income | | |

| 305.8 | | |

| 169.0 | | |

| 559.3 | | |

| 327.2 | |

Net income | | |

| 247.1 | | |

| 79.5 | | |

| 456.9 | | |

| 224.0 | |

Basic earnings per share | | | $ | 1.28 | | | $ | 0.41 | | | $ | 2.37 | | | $ | 1.17 | |

Diluted earnings per share | | | $ | 1.28 | | | $ | 0.41 | | | $ | 2.37 | | | $ | 1.16 | |

| | | | | | | | | | | | | | | | | |

Dividends declared per share | | | $ | 0.38 | | | $ | 0.36 | | | $ | 0.76 | | | $ | 0.72 | |

Dividends declared (including DRIP) | | | $ | 72.9 | | | $ | 69.6 | | | $ | 146.3 | | | $ | 139.0 | |

Weighted average shares outstanding | | |

| 192.7 | | |

| 192.3 | | |

| 192.6 | | |

| 192.2 | |

| | | | | | | | | | | | | | | | | |

Non-GAAP Measures | | | | | | | | | | | | | | | | | |

Cash Costs(2) | | | $ | 33.5 | | | $ | 29.1 | | | $ | 72.0 | | | $ | 62.7 | |

Cash Costs(2) per GEO sold | | | $ | 299 | | | $ | 264 | | | $ | 302 | | | $ | 269 | |

Adjusted EBITDA(2) | | | $ | 365.7 | | | $ | 221.9 | | | $ | 687.6 | | | $ | 438.0 | |

Adjusted EBITDA(2) per share | | | $ | 1.90 | | | $ | 1.15 | | | $ | 3.57 | | | $ | 2.28 | |

Adjusted EBITDA Margin(2) | | |

| 99.0 | % | |

| 85.3 | % | |

| 93.2 | % | |

| 84.7 | % |

Adjusted Net Income(2) | | | $ | 238.5 | | | $ | 144.9 | | | $ | 444.0 | | | $ | 280.8 | |

Adjusted Net Income(2) per share | | | $ | 1.24 | | | $ | 0.75 | | | $ | 2.31 | | | $ | 1.46 | |

Adjusted Net Income Margin(2) | | | | 64.6 | % | | | 55.7 | % | | | 60.2 | % | | | 54.3 | % |

| | | | | | | | | | | | | | | | | |

Statement of Cash Flows | | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | | | $ | 430.3 | | | $ | 194.3 | | | $ | 719.2 | | | $ | 372.9 | |

Net cash used in investing activities | | | $ | (1,338.1) | | | $ | (36.7) | | | $ | (1,889.1) | | | $ | (227.2) | |

Net cash used in financing activities | | | $ | (66.1) | | | $ | (59.2) | | | $ | (132.9) | | | $ | (117.3) | |

| | | As at | | | As at | | | ||

| | | June 30, | | | December 31, | | | ||

(expressed in millions) |

|

| 2025 |

|

| 2024 |

|

| ||

Statement of Financial Position | | | | | | | | | | |

Cash and cash equivalents | | | $ | 160.3 | | | $ | 1,451.3 | | |

Total assets | | |

| 7,020.6 | | |

| 6,330.4 | | |

Deferred income tax liabilities | | | | 311.6 | | | | 238.0 | | |

Total shareholders’ equity | | | | 6,602.0 | | | | 5,996.6 | | |

Available capital(3) | | | | 1,111.9 | | | | 2,433.6 | | |

| 1 | Refer to the “Gold Equivalent Ounces and Net Gold Equivalent Ounces” section of this MD&A for more information on our methodology for calculating GEOs sold and Net GEOs sold. Net GEOs sold are GEOs sold, net of direct operating costs, including for our stream GEOs, the associated ongoing cost per ounce. |

| 2 | Cash Costs, Cash Costs per GEO sold, Adjusted EBITDA, Adjusted EBITDA per share, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Net Income per share and Adjusted Net Income Margin are non-GAAP financial measures with no standardized meaning under IFRS Accounting Standards and might not be comparable to similar financial measures disclosed by other issuers. Refer to the “Non-GAAP Financial Measures” section of this MD&A for more information on each non-GAAP financial measure. |

| 3 | Available capital comprises our cash and cash equivalents and the amount available to borrow under our $1.0 billion revolving credit facility (the “Corporate Revolver”) as referenced in the “Credit Facility” section of this MD&A. |

Second Quarter 2025 Management’s Discussion and Analysis | 5 |

Financial Update – Q2 2025 compared to Q2 2024

| ● | $369.4 million in revenue (a new record), +42.0% from $260.1 million in Q2 2024; |

| ● | 112,093 GEOs sold, +1.7% from 110,264 GEOs in Q2 2024; |

| ● | 101,876 Net GEOs sold, +4.1% from 97,817 Net GEOs in Q2 2024; |

| ● | Cash Costs of $299 per GEO sold, compared to $264 per GEO sold in Q2 2024; |

| ● | $365.7 million, or $1.90 per share, of Adjusted EBITDA (new records), +64.8% and 65.2%, respectively, from $221.9 million, or $1.15 per share, in Q2 2024; |

| ● | 99.0% in Adjusted EBITDA Margin (a new record), compared to 85.3% in Q2 2024; |

| ● | $247.1 million, or $1.28 per share, in net income (new records), +210.8% and +212.2%, respectively, from $79.5 million, or $0.41 per share, in Q2 2024; |

| ● | $238.5 million, or $1.24 per share, in Adjusted Net Income (new records), +64.6% and +65.3%, respectively, from $144.9 million, or $0.75 per share, in Q2 2024; |

| ● | 64.6% in Adjusted Net Income Margin (a new record), compared to 55.7% in Q2 2024; |

| ● | $430.3 million in net cash provided by operating activities (a new record), +121.5% from $194.3 million in Q2 2024; |

| ● | $160.3 million in cash and cash equivalents as at June 30, 2025 (December 31, 2024 – $1,451.3 million); |

| ● | $1.1 billion in available capital as at June 30, 2025 (December 31, 2024 – $2.4 billion). |

Financial Update – H1 2025 compared to H1 2024

| ● | $737.8 million in revenue (a new record), +42.7% from $516.9 million in H1 2024; |

| ● | 238,678 GEOs sold, +2.4% from 233,161 GEOs in H1 2024; |

| ● | 215,014 Net GEOs sold, +5.1% from 204,498 GEOs in H1 2024; |

| ● | Cash Costs of $302 per GEO sold, compared to $269 per GEO sold; |

| ● | $687.6 million, or $3.57 per share, in Adjusted EBITDA (new records), +57.0% and +56.6%, respectively; |

| ● | 93.2% in Adjusted EBITDA Margin (a new record), compared to 84.7%; |

| ● | $456.9 million, or $2.37 per share, in net income (new records), +104.0% and +102.6%, respectively; |

| ● | $444.0 million, or $2.31 per share, in Adjusted Net Income (new records), +58.1% and +58.2%, respectively; |

| ● | 60.2% in Adjusted Net Income Margin (a new record), compared to 54.3%; |

| ● | $719.2 million in net cash provided by operating activities (a new record), +92.9% compared to prior year. |

Corporate Developments

Subsequent to June 30, 2025

Acquisition of Royalty on AngloGold Ashanti plc’s Arthur Gold Project – Nevada, U.S.

Subsequent to quarter-end, on July 23, 2025, we acquired, through a wholly-owned subsidiary, 1.0% NSR (of an existing 1.5% NSR) on AngloGold Ashanti plc’s (“AngloGold”) Arthur Gold Project (previously the Expanded Silicon Project) from Altius Minerals Corporation (“Altius”) for $250.0 million in cash, plus a contingent cash payment of $25.0 million. The contingent cash consideration is payable dependent upon the final award outcome of an ongoing arbitration process between Altius and AngloGold that confirms that the full extent of the royalty beyond the base area of interest is substantially consistent with that of Altius’ interpretation of a partial award of the arbitration tribunal, as disclosed by Altius in its news release dated January 10, 2025.

Pre-construction Funding of Cascabel Stream – Ecuador

Subsequent to quarter-end, on July 17, 2025, our wholly-owned subsidiary, Franco-Nevada (Barbados) Corporation (“FNBC”), funded the second of three equal-sized payments in the amount of $23.3 million to SolGold plc (“SolGold”) for pre-construction activities of the Cascabel project. FNBC acquired the Cascabel stream from SolGold in July 2024 with Osisko Gold Royalties Ltd.’s subsidiary, Osisko Bermuda Limited (“Osisko”), on a 70%/30% basis. Subject to the achievement of certain conditions, FNBC will provide a total of $525.0 million and Osisko a total of $225.0 million for a total combined funding of $750.0 million.

Acquisition of Additional Royalty on Gold Quarry Mine – Nevada, U.S.

Subsequent to quarter-end, on July 11, 2025, through a wholly-owned subsidiary, we acquired from a third party an additional 1.62% NSR on Nevada Gold Mines LLC’s Gold Quarry mine for $10.5 million plus a $1.0 million contingent payment. As a result, Franco-Nevada now holds a combined 8.91% NSR based on production with an annual minimum payment amount tied to Mineral Reserves and stockpiles attributed to the royalty property. The contingent consideration is payable dependent upon the annual minimum payment.

Second Quarter 2025 Management’s Discussion and Analysis | 6 |

For the six months ended June 30, 2025

Acquisition of Royalty on Côté Gold Mine – Ontario, Canada

On June 24, 2025, we acquired an existing royalty on the Côté Gold Mine in Ontario from a private third party for total cash consideration of $1,050.0 million. The royalty consists of a 7.5% gross margin royalty on the Côté Gold Mine. Royalty deductions include cash operating costs and exclude all capital, exploration, depreciation and other non-cash costs. The Côté Gold Mine is operated through an unincorporated joint venture by IAMGOLD Corporation (“IAMGOLD”) and is owned by IAMGOLD (70%) and Sumitomo Metal Mining Co. Ltd. (“Sumitomo”) (30%). IAMGOLD and Sumitomo hold an option, exercisable at their discretion, to buy down up to 50% of the royalty at Franco-Nevada’s attributable cost in two equal tranches of 25%. The cost to repurchase the tranches are as follows: (i) the initial 25% buydown option for an internal rate of return equal to the Secured Overnight Financing Rate (“SOFR”) plus 1.10%, exercisable within two years of closing, and (ii) the additional 25% buydown option cost for an internal rate of return equal to 10%, following exercise of the initial option, exercisable within three years of closing. Both 25% options are subject to a minimum such that the exercise price shall be the greater of the calculated value or 25% of Franco-Nevada’s Royalty purchase price ($262.5 million).

Financing Package with Discovery Silver Corp. on the Porcupine Complex – Ontario, Canada

On April 15, 2025, we completed a comprehensive financing transaction with Discovery Silver Corp. (“Discovery”) to support its acquisition of the Porcupine Complex located near Timmins, Ontario, from Newmont Corporation. The financing package includes: i) a 4.25% NSR, consisting of two tranches, for $300.0 million, on production from the Porcupine Complex, ii) a $100.0 million senior secured term loan (the “Discovery Term Loan”), and iii) $48.6 million (C$70.9 million) of equity participation. The financing package, totaling $448.6 million, provided Discovery with proceeds to acquire and fund a planned capital program for the Porcupine Complex.

Porcupine Royalty

The royalty on the Porcupine Complex consists of two tranches: (i) a 2.25% NSR in perpetuity on all minerals produced, and (ii) a 2.00% NSR on all minerals produced until the earlier of royalty payments on the tranche equivalent to 72,000 gold ounces or a cash payment equal to a pre-tax annual internal rate of return of 12% in reference to a $100.0 million attributable purchase price.

Discovery Term Loan

The Discovery Term Loan is a $100.0 million, 7-year term loan with an availability period of 2 years from closing. The loan will bear interest at a rate of 3-Month Secured Overnight Financing Rate (“3-Month SOFR”) +4.50% per annum. Amortization will begin after year 5 at 5% per quarter, with no restrictions on prepayment. The loan provides for an upfront fee equal to 2% on any principal drawn, a standby fee of 100 basis points per annum on undrawn funds, and the issuance by Discovery of 3,900,000 common share purchase warrants with an exercise price of C$0.95 per common share and an expiry date of April 15, 2028.

Discovery Common Shares

As part of Discovery’s public offering of subscription receipts of approximately $169.5 million (C$247.5 million) which closed on February 3, 2025, we purchased 78,833,333 subscription receipts at a price of C$0.90 per subscription receipt for an aggregate purchase price of $48.6 million (C$70.9 million). Upon closing of the acquisition of the Porcupine Complex by Discovery, the subscription receipts were automatically exchanged for common shares of Discovery. Franco-Nevada has agreed to a two-year lock-up period ending on April 15, 2027.

Acquisition of Precious Metals Stream on Sibanye Stillwater Limited’s Western Limb Mining Operations – South Africa

On February 28, 2025, our wholly-owned subsidiary, Franco-Nevada (Barbados) Corporation (“FNBC”) completed the acquisition of a precious metals stream (the “Western Limb Mining Operations Stream”) with reference to specific production from Sibanye Stillwater Limited’s (“Sibanye-Stillwater”) Marikana, Rustenburg and Kroondal mining operations (the “Stream Area”) in South Africa for a purchase price of $500.0 million. The Western Limb Mining Operations Stream is primarily comprised of a gold component for the life of mine (“LOM”) and a platinum component for approximately 25 years.

Key terms:

| ● | Gold stream deliveries to FNBC are initially based off the platinum, palladium, rhodium and gold (“4E PGM”) production from the Stream Area, according to the following schedule: |

| o | Gold ounces equal to 1.1% of 4E PGM ounces contained in concentrate until delivery of 87,500 ounces of gold, then |

| o | Gold ounces equal to 0.75% of 4E PGM ounces contained in concentrate until total delivery of 237,000 ounces of gold, then |

| o | 80% of gold contained in concentrate for the remaining LOM. |

| ● | Platinum stream deliveries to FNBC are based on platinum production from the Western Limb Mining Operations Stream Area, according to the following schedule: |

| o | 1.0% of platinum contained in concentrate until the delivery of 48,000 ounces of platinum, then |

| o | Step-up to 2.1% of platinum contained in concentrate until total delivery of 294,000 ounces of platinum, then |

| o | No further platinum deliveries. |

Second Quarter 2025 Management’s Discussion and Analysis | 7 |

Other terms include:

| ● | Gold and platinum ounces delivered will be subject to an ongoing payment of 5% of spot prices respectively to Sibanye-Stillwater. In the case of gold, the ongoing payment will increase to 10% following the delivery of 237,000 ounces of gold to FNBC. |

| ● | Effective start date of the Western Limb Mining Operations Stream is September 1, 2024. First deliveries related to production from September 1, 2024 to December 31, 2024 were received in March 2025. |

Pandora Royalty – South Africa

On February 28, 2025, Franco-Nevada and Sibanye-Stillwater converted Franco-Nevada’s 5% net profit interest on the Pandora property to a 1% net smelter return royalty. Sibanye-Stillwater’s Pandora property forms a portion of its Marikana operations and includes the currently operating E3 decline.

Acquisition of Royalty on Hayasa Metals Inc.’s Urasar Project – Armenia

On January 21, 2025, we acquired a 0.625% NSR covering all minerals produced from Hayasa Metals Inc.’s (“Hayasa”) Urasar gold-copper project in northern Armenia for $0.55 million, pursuant to a joint acquisition agreement with EMX Royalty Corporation (“EMX”).

Acquisition of Mineral Rights with Continental Resources, Inc. – U.S.

Through a wholly-owned subsidiary, we have a strategic relationship with Continental Resources, Inc. (“Continental”) to acquire, through a jointly-owned entity (the “Royalty Acquisition Venture”), royalty rights within Continental’s areas of operation. Franco-Nevada recorded contributions to the Royalty Acquisition Venture of $2.8 million in Q2 2025 (Q2 2024 and H1 2024 – $5.3 million and $19.1 million, respectively). As at June 30, 2025, Franco-Nevada has remaining commitments of up to $41.9 million.

Credit Facility

As at June 30, 2025, there were no amounts drawn from our $1.0 billion unsecured revolving term credit facility (the “Corporate Revolver”). Subsequent to June 30, 2025, on July 22, 2025, we drew down $175.0 million from the Corporate Revolver to finance part of the acquisition of the royalty on the Arthur Gold Project, as referenced above.

There are also four standby letters of credit issued against the Corporate Revolver in relation to the audit by the CRA, totaling $48.4 million (C$66.0 million), as referenced in the “Contingencies” section of this MD&A. These standby letters of credit reduce the available balance under the Corporate Revolver.

As at the date of this MD&A, the available balance on our Corporate Revolver is $776.6 million.

Dividends

In Q2 2025, we declared a quarterly dividend of $0.38 per share, compared to the dividend of $0.36 per share in Q2 2024. During the quarter, we paid total dividends of $72.9 million, of which $67.0 million was paid in cash and $5.9 million was settled in common shares under our Dividend Reinvestment Plan (the “DRIP”).

In H1 2025, we paid total dividends of $146.3 million, of which $137.2 million was paid in cash and $9.1 million was settled in common shares under our DRIP.

Portfolio Updates

Additional updates related to our portfolio of assets are available in our News Release issued on August 11, 2025 available on SEDAR+ at www.sedarplus.com and EDGAR at www.sec.gov.

Cobre Panama remains on preservation and safe management (“P&SM”) with production halted since November 2023. First Quantum Minerals Ltd. (“First Quantum”) has been working with the Government of Panama (the “GOP”) and the Ministry of Commerce and Industry (the “MICI”) to implement a plan that would allow for the execution of environmental and asset integrity measures during the P&SM phase of Cobre Panama (the “P&SM Plan”).

On January 6, 2025, Panama’s Ministry of Environment (“MiAMBIENTE”) released the draft terms of reference for the environmental audit of the Cobre Panama mine. A public consultation process on the terms of reference concluded on February 7, 2025. The overall timeline and final scope for the proposed environmental audit are pending finalization and announcement by MiAMBIENTE. Separately, an independent audit of the copper concentrate stored on site was completed by the GOP in December 2024, which confirmed the quantities of copper concentrate stored at the facilities.

On January 12, 2025, the Minister of Environment and the Minister of Public Security conducted a site visit of Cobre Panama. During the visit, the ministers toured the mine as well as the process, port and power plant facilities to inspect the upkeep of the mine and the status of surrounding communities and the environment. The visit also enabled the ministers to inspect and approve the export of 7,960 tons of ammonium nitrate stored at the mine’s Punta Rincón port. Export of the ammonium nitrate commenced by road in January 2025.

Second Quarter 2025 Management’s Discussion and Analysis | 8 |

On May 30, 2025, the GOP, through the MICI, approved and formally instructed the execution of the P&SM Plan by means of MICI Resolution No. 45. The implementation of the P&SM Plan is now underway and will allow for integral preservation and safe management activities and the associated environmental measures at site, which will be funded through the sale of 121,000 dry metric tonnes of copper concentrate that has been approved by the GOP for export. Exports of the copper concentrate commenced in June 2025 and were completed by the end of July 2025.

The execution of the P&SM Plan also provides for the import of fuel and restart of Cobre Panama’s thermoelectric power plant. First Quantum has commenced pre-commissioning inspections of the power plant and the mobilization of specialists to site. The power plant is currently anticipated to restart in the fourth quarter of 2025 following completion of re-commissioning activities.

Franco-Nevada expects to receive over approximately 10,000 GEOs (over 9,000 ounces of gold and 105,000 ounces of silver) in reference to the shipped copper concentrate. The deliveries, some of which have already been received subsequent to quarter-end, are largely expected in Q3 2025. As a result of the approval of the P&SM Plan and the expected stream deliveries, we recorded a partial impairment reversal of $4.1 million in Q2 2025. This carrying value will subsequently be depleted when the ounces are sold.

Arbitration Proceedings

On March 31, 2025, First Quantum announced it had agreed to discontinue its International Chamber of Commerce arbitration proceedings and has also agreed to suspend its Canada-Panama Free Trade Agreement arbitration.

On June 18, 2025, Franco-Nevada agreed to suspend its arbitration proceeding against the GOP. Franco-Nevada reiterates its hope for a resolution with the State of Panama providing the best outcome for the Panamanian people and all parties involved.

Fatality at Antamina

Teck Resources Limited reported that a fatality occurred at the Antamina mine on April 22, 2025. Production at Antamina was shutdown for approximately one week while an investigation was ongoing. Operations ramped up to return to full production in June 2025. While annual production guidance provided by Teck remains unchanged, Franco-Nevada expects deliveries of silver ounces in Q3 2025 to be lower than initially anticipated.

Nameplate Capacity Achieved at Côté

In June 2025, IAMGOLD announced that the Côté mine achieved nameplate throughput after operating at 36,000 tonnes per day on average over thirty consecutive days.

Nameplate Capacity Achieved at Tocantinzinho

G Mining Ventures Corp. announced that its Tocantinzinho mine reached nameplate capacity of 12,890 tonnes per day in July 2025. During Q2 2025, mill performance improved following the installation of new steel liners in April 2025.

Revised Guidance at Greenstone

In June 2025, Equinox Gold announced that it was reducing its 2025 guidance for the Greenstone mine to between 220,000 and 260,000 gold ounces, from 300,000 to 350,000 gold ounces previously, due to slower than planned ramp-up.

Salares Norte Royalty Buy-Back

In May 2025, Gold Fields Limited exercised its option to buy back 1% of Franco-Nevada’s 2% NSR on Salares Norte, after having paid $6.0 million in cumulative royalty payments.

Second Quarter 2025 Management’s Discussion and Analysis | 9 |

The following contains forward-looking statements. For a description of material factors that could cause our actual results to differ materially from the forward-looking statements below, please see the “Cautionary Statement on Forward-Looking Information” section at the end of this MD&A and the “Risk Factors” section of our most recent Annual Information Form filed with the Canadian securities regulatory authorities on www.sedarplus.com and our most recent Form 40-F filed with the SEC on www.sec.gov. The 2025 guidance is based on assumptions including the forecasted state of operations from our assets based on the public statements and other disclosures by the third-party owners and operators of the underlying properties and our assessment thereof.

We present our guidance in reference to GEO sales. For streams, our guidance reflects GEOs that have been delivered from the operators of our assets and that we have subsequently sold. Our GEO deliveries may differ from operators’ production based on timing of deliveries and due to recovery and payability factors. Our GEO sales may differ from GEO deliveries based on the timing of the sales. For royalties, GEO guidance reflects the timing of royalty payments or accruals.

Our 2025 guidance is based on the following assumed commodity prices for the remainder of 2025: $3,250/oz Au, $37/oz Ag, $1,300/oz Pt, $1,150/oz Pd, $90/tonne Fe 62% CFR China, $65/bbl WTI oil and $3.00/mcf Henry Hub natural gas.

We earned record revenue in H1 2025, benefiting from record gold prices and contributions from recently acquired or producing Precious Metal assets. We expect an increase in GEO sales for the latter part of 2025, as we anticipate an increase in deliveries from Antapaccay, a first full quarter of contributions from Porcupine and Côté, and initial contributions from Vale’s Southeastern System. In addition, we expect approximately 10,000 GEOs from Cobre Panama in connection to the sale of concentrate that had remained on site when production was suspended in November 2023.

We remain on track to meet our previously announced 2025 GEO sales guidance notwithstanding the impact of the outperformance of gold prices on the conversion of non-gold revenues into GEOs. For reference, a $100 increase in the price of gold from our initial assumption of $2,800/oz results in a decrease of approximately 4,750 GEOs, with all other commodity prices and production levels held constant.

|

|

| 2025 Guidance |

|

| H1 2025 Actual |

|

Precious Metal GEO sales | | | 385,000 to 425,000 GEOs | | | 193,072 GEOs | |

Total GEO sales | | | 465,000 to 525,000 GEOs | | | 238,678 GEOs | |

| 1 | We expect our streams to contribute between 255,000 and 285,000 of our GEO sales for 2025. For H1 2025, we sold 123,304 GEOs from our streams. |

| 2 | Our guidance does not reflect any incremental revenue from additional contributions we may make to the Royalty Acquisition Venture with Continental as part of our remaining commitment of $41.9 million. |

Interest revenue: On April 15, 2025, we received a prepayment of $10.0 million from EMX in connection with the term loan of $35.0 million advanced in 2024. Interest revenue from our loans receivable in 2025 is expected to be between $8.0 million and $10.0 million.

Depletion: We expect to be at the higher end of our previously stated depletion and depreciation expense estimate of $265.0 million to $295.0 million due to the addition of Côté and the increase in precious metal prices. In H1 2025, depletion expense was $132.4 million.

Income tax: We expect our annual effective tax rate to be between 19% and 22%.

Capital commitments: As of June 30, 2025, our remaining capital commitment to the Royalty Acquisition Venture with Continental was $41.9 million, of which between $10.0 million and $20.0 million is expected to be deployed in 2025. Subsequent to the quarter, on July 17, 2025, we funded the second of three pre-construction payments for the Cascabel stream. We anticipate making the third pre-construction payment of $23.3 million in late 2025. In addition, refer to the “Commitments” section of this MD&A for further details on our other commitments.

The prices of gold and other precious metals are the largest factors in determining profitability and cash flow from operations for Franco-Nevada. The price of gold can be volatile and is affected by macroeconomic and industry factors that are beyond our control. Major influences on the gold price include interest rates, fiscal and monetary stimulus, inflation expectations, currency exchange rate fluctuations including the relative strength of the U.S. dollar and supply and demand for gold.

Commodity price volatility also impacts the number of GEOs when reflecting revenue from non-gold commodities as GEOs. Silver, platinum, palladium, iron ore, other mining commodities and oil and gas are reflected as GEOs by dividing associated revenue, which includes settlement adjustments, by the relevant gold price. The price used in the computation of GEOs earned from a particular asset varies depending on the royalty or stream agreement, which may refer to the market price realized by the operator, or the average price for the month, quarter, or year in which the commodity was produced or sold. Refer to the commodity price tables on pages 12 and 17 of this MD&A for further details.

Gold prices reached record highs during the first half of 2025 reflecting strong safe haven demand and increasing concerns of a global recession due to escalating tariffs and trade wars. During this same time period, oil prices fell due to tariff-related volatility, higher OPEC+ production, and U.S. energy policies. Natural gas prices on average remained relatively flat during the period.

Second Quarter 2025 Management’s Discussion and Analysis | 10 |

The following table details revenue for the three and six months ended June 30, 2025 and 2024:

| | | | | For the three months ended | | | For the six months ended |

| ||||||||||

(expressed in millions) | | Interest and % | | | June 30, | | | June 30, |

| ||||||||||

Property |

| (Gold unless otherwise indicated) |

| | 2025 |

| | 2024 |

| | 2025 |

| | 2024 |

| ||||

PRECIOUS METALS | | | | | | | | | | | | | | | | | | | |

South America | | | | | | | | | | | | | | | | | | | |

Candelaria |

| Stream 68% Gold & Silver | | | $ | 55.0 | | | $ | 37.6 | | | $ | 110.9 | | | $ | 68.1 | |

Antapaccay |

| Stream (indexed) Gold & Silver | | | | 18.8 | | | | 20.0 | | | | 47.4 | | | | 61.2 | |

Antamina |

| Stream 22.5% Silver | | |

| 23.3 | | |

| 12.7 | | |

| 44.6 | | |

| 26.0 | |

Tocantinzinho | | Stream 12.5% | | | | 14.8 | | | | — | | | | 29.7 | | | | — | |

Condestable | | Stream Gold & Silver, Fixed through 2025 | | | | 10.1 | | | | 14.1 | | | | 19.2 | | | | 14.1 | |

Yanacocha | | NSR 1.8% | | | | 7.9 | | | | — | | | | 13.2 | | | | — | |

Salares Norte | | NSR 1% | | | | 1.2 | | | | 0.0 | | | | 4.3 | | | | 0.0 | |

Other | | | | | | 2.4 | | | | 1.8 | | | | 3.7 | | | | 3.3 | |

Central America & Mexico | | | | | | | | | | | | | | | | | | | |

Guadalupe-Palmarejo |

| Stream 50% | | | $ | 43.1 | | | $ | 16.5 | | | $ | 79.4 | | | $ | 40.9 | |

Cobre Panama |

| Stream (indexed) Gold & Silver | | | | — | | | | 0.1 | | | | — | | | | 0.1 | |

Canada | | | | | | | | | | | | | | | | | | | |

Detour Lake |

| NSR 2% | | | $ | 10.4 | | | $ | 6.8 | | | $ | 20.1 | | | $ | 13.6 | |

Hemlo |

| NSR 3%, NPI 50% | | |

| 11.4 | | |

| 4.3 | | |

| 29.1 | | |

| 9.1 | |

Porcupine Complex | | NSR 4.25% | | | | 6.6 | | | | — | | | | 6.6 | | | | — | |

Musselwhite | | NPI 5% | | | | 7.7 | | | | 1.1 | | | | 8.6 | | | | 1.8 | |

Kirkland Lake (Macassa) |

| NSR 1.5-5.5%, NPI 20% | | |

| 3.8 | | |

| 2.3 | | |

| 7.3 | | |

| 4.4 | |

Greenstone | | NSR 3% | | | | 4.9 | | | | 0.9 | | | | 7.8 | | | | 0.9 | |

Sudbury |

| Stream 50% PGM & Gold | | | | 2.7 | | | | 3.5 | | | | 5.9 | | | | 6.5 | |

Brucejack |

| NSR 1.2% | | | | 1.9 | | | | 1.6 | | | | 3.5 | | | | 2.0 | |

Magino | | NSR 3% | | | | 1.5 | | | | 1.4 | | | | 3.4 | | | | 2.5 | |

Côté | | GMR 7.5% | | | | 1.4 | | | | — | | | | 1.4 | | | | — | |

Other | | | | |

| 2.3 | | |

| 2.2 | | |

| 4.5 | | |

| 4.6 | |

United States | | | | | | | | | | | | | | | | | | | |

Goldstrike |

| NSR 2-4%, NPI 2.4-6% | | | $ | 5.9 | | | $ | 6.6 | | | $ | 8.2 | | | $ | 10.6 | |

Bald Mountain |

| NSR/GR 0.875-5% | | |

| 3.8 | | |

| 3.6 | | |

| 9.1 | | |

| 8.4 | |

Stillwater |

| NSR 5% PGM | | |

| 3.3 | | | | 5.3 | | | | 5.9 | | | | 11.3 | |

Marigold |

| NSR 1.75-5%, GR 0.5-4% | | |

| 2.5 | | |

| 0.9 | | |

| 4.2 | | |

| 2.0 | |

Gold Quarry |

| NSR 7.29% | | |

| 0.1 | | |

| 0.6 | | |

| 0.3 | | |

| 0.8 | |

Other | | | | |

| 6.2 | | |

| 2.5 | | |

| 10.1 | | |

| 4.8 | |

Rest of World | | | | | | | | | | | | | | | | | | | |

Western Limb Mining Operations |

| Stream Gold (indexed) & 1% Platinum | | | $ | 10.6 | | | $ | — | | | $ | 30.4 | | | $ | — | |

Subika (Ahafo) |

| NSR 2% | | |

| 13.9 | | |

| 7.7 | | | | 26.0 | | | | 16.6 | |

Tasiast |

| NSR 2% | | |

| 6.8 | | |

| 7.4 | | | | 14.4 | | | | 13.9 | |

Sabodala |

| Stream 6%, Fixed to 105,750 oz | | |

| 7.7 | | |

| 5.5 | | |

| 14.6 | | |

| 10.4 | |

Duketon |

| NSR 2% | | |

| 1.6 | | |

| 2.2 | | |

| 4.1 | | |

| 5.2 | |

MWS |

| Stream 25% | | | | — | | | | 17.9 | | | | — | | | | 32.8 | |

Other | | | | |

| 10.4 | | |

| 5.9 | | |

| 16.8 | | |

| 11.1 | |

| | | | | $ | 304.0 | | | $ | 193.0 | | | $ | 594.7 | | | $ | 387.0 | |

DIVERSIFIED | | | | | | | | | | | | | | | | | | | |

Vale | | Various Royalty Rates | | | $ | 5.8 | | | $ | 6.9 | | | $ | 16.0 | | | $ | 19.6 | |

LIORC | | GORR 0.7% Iron Ore, IOC Equity 1.5%(1) | | | | 1.4 | | | | 5.1 | | | | 3.6 | | | | 7.2 | |

Other mining assets | | | | |

| 3.0 | | |

| 1.7 | | |

| 7.4 | | |

| 4.7 | |

United States (Energy) | | | | | | | | | | | | | | | | | | | |

Marcellus | | GORR 1% | | | $ | 7.3 | | | $ | 5.7 | | | $ | 16.2 | | | $ | 12.9 | |

Haynesville | | Various Royalty Rates | | | | 8.0 | | | | 5.1 | | | | 14.3 | | | | 11.4 | |

SCOOP/STACK | | Various Royalty Rates | | | | 9.9 | | | | 8.4 | | | | 22.9 | | | | 16.0 | |

Permian Basin | | Various Royalty Rates | | | | 13.2 | | | | 12.0 | | | | 26.7 | | | | 19.0 | |

Other | | | | |

| 0.1 | | |

| 0.1 | | |

| 0.2 | | |

| 0.2 | |

Canada (Energy) | | | | | | | | | | | | | | | | | | | |

Weyburn |

| NRI 11.71%, ORR 0.44%, WI 2.56% | | | $ | 8.9 | | | $ | 13.1 | | | $ | 19.5 | | | $ | 23.4 | |

Orion | | GORR 4% | | | | 3.2 | | | | 4.0 | | | | 6.3 | | | | 7.2 | |

Other | | | | |

| 1.9 | | |

| 2.5 | | |

| 4.4 | | |

| 4.6 | |

| | | | | $ | 62.7 | | | $ | 64.6 | | | $ | 137.5 | | | $ | 126.2 | |

Revenue from royalty, stream and working interests | | | $ | 366.7 | | | $ | 257.6 | | | $ | 732.2 | | | $ | 513.2 | | ||

Interest revenue and other interest income | | | $ | 2.7 | | | $ | 2.5 | | | $ | 5.6 | | | $ | 3.7 | | ||

Total revenue | | | | | $ | 369.4 | | | $ | 260.1 | | | $ | 737.8 | | | $ | 516.9 | |

| 1 | Includes interest attributable to Franco-Nevada’s 9.9% equity ownership of Labrador Iron Ore Royalty Corporation. |

Second Quarter 2025 Management’s Discussion and Analysis | 11 |

Review of Quarterly Financial Performance

The prices of precious metals, iron ore, and oil and gas and production from our assets are the largest factors in determining our profitability and cash flow from operations. The following table summarizes average commodity prices and average exchange rates during the periods presented.

| | | | | | | | | | | |||

Quarterly average prices and rates |

| |

|

| Q2 2025 |

|

| Q2 2024 |

| Variance | |||

Gold(1) |

| ($/oz) | | | $ | 3,279 | | | $ | 2,338 | | 40.2 | % |

Silver(1) |

| ($/oz) | | |

| 33.64 | | |

| 28.86 | | 16.6 | % |

Platinum(1) |

| ($/oz) | | |

| 1,073 | | |

| 981 | | 9.4 | % |

Palladium(1) |

| ($/oz) | | |

| 990 | | |

| 972 | | 1.9 | % |

Iron Ore Fines 62% Fe CFR China | | ($/tonne) | | | | 98 | | | | 110 | | (10.9) | % |

| | | | | | | | | | | | | |

Edmonton Light |

| (C$/bbl) | | |

| 85.81 | | |

| 105.97 | | (19.0) | % |

West Texas Intermediate | | ($/bbl) | | | | 63.74 | | | | 80.57 | | (20.9) | % |

Henry Hub | | ($/mcf) | | | | 3.51 | | | | 2.34 | | 50.0 | % |

| | | | | | | | | | | | | |

CAD/USD exchange rate(2) | | | | |

| 0.7226 | | |

| 0.7308 | | (1.1) | % |

| 1 | Based on LBMA PM Fix for gold, platinum and palladium. Based on LBMA Fix for silver. |

| 2 | Based on Bank of Canada daily rates. |

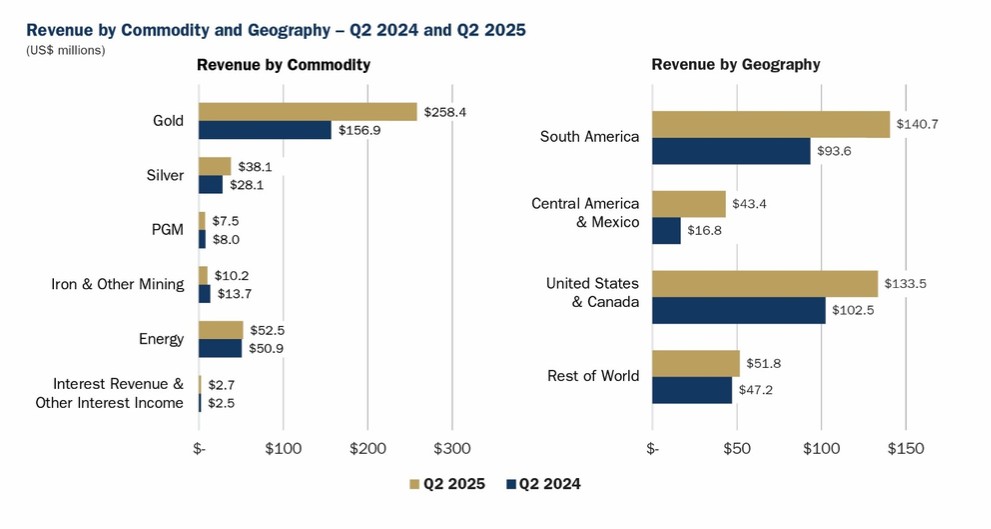

Revenue and GEOs

Revenue and GEO sales by commodity, geographical location and type of interest for the three months ended June 30, 2025 and 2024 were as follows:

| | | Gold Equivalent Ounces(1) | | | Revenue (in millions) |

| |||||||||||||

For the three months ended June 30, |

|

| 2025 |

|

| 2024 |

| Variance |

|

| 2025 |

|

| 2024 |

| Variance |

| |||

Commodity | | | | | | | | | | | | | | | | | | | | |

Gold |

| | 78,738 | | | 66,999 |

| 11,739 | | | $ | 258.4 | | | $ | 156.9 | | $ | 101.5 | |

Silver |

| | 11,520 | | | 12,001 |

| (481) | | |

| 38.1 | | |

| 28.1 | |

| 10.0 | |

PGM |

| | 2,191 | | | 3,350 |

| (1,159) | | |

| 7.5 | | |

| 8.0 | |

| (0.5) | |

Precious Metals | | | 92,449 | | | 82,350 | | 10,099 | | | $ | 304.0 | | | $ | 193.0 | | $ | 111.0 | |

Iron ore(2) |

| | 2,197 | | | 5,155 |

| (2,958) | | | $ | 7.2 | | | $ | 12.0 | | $ | (4.8) | |

Other mining assets | | | 900 | | | 659 | | 241 | | | | 3.0 | | | | 1.7 | | | 1.3 | |

Oil | | | 10,337 | | | 16,463 | | (6,126) | | | | 30.6 | | | | 35.9 | | | (5.3) | |

Gas | | | 4,243 | | | 4,009 | | 234 | | | | 16.9 | | | | 10.8 | | | 6.1 | |

NGL | | | 1,967 | | | 1,628 | | 339 | | | | 5.0 | | | | 4.2 | | | 0.8 | |

Diversified | | | 19,644 | | | 27,914 | | (8,270) | | | $ | 62.7 | | | $ | 64.6 | | $ | (1.9) | |

Revenue from royalty, stream and working interests | | | 112,093 | | | 110,264 | | 1,829 | | | $ | 366.7 | | | $ | 257.6 | | $ | 109.1 | |

Interest revenue and other interest income | | | — | | | — | | — | | | $ | 2.7 | | | $ | 2.5 | | $ | 0.2 | |

|

| | 112,093 |

| | 110,264 |

| 1,829 | | | $ | 369.4 | | | $ | 260.1 | | $ | 109.3 | |

| | | | | | | | | | | | | | | | | | | | |

Geography | | | | | | | | | | | | | | | | | | | | |

South America |

| | 42,429 |

| | 40,125 |

| 2,304 | | | $ | 140.7 | | | $ | 93.6 | | $ | 47.1 | |

Central America & Mexico | | | 13,064 | | | 7,166 | | 5,898 | | | | 43.4 | | | | 16.8 | | | 26.6 | |

United States |

| | 18,990 |

| | 22,227 |

| (3,237) | | | | 60.8 | | | | 51.2 | | | 9.6 | |

Canada(2) |

| | 21,659 |

| | 20,662 |

| 997 | | |

| 72.7 | | |

| 51.3 | |

| 21.4 | |

Rest of World |

| | 15,951 |

| | 20,084 |

| (4,133) | | |

| 51.8 | | |

| 47.2 | |

| 4.6 | |

|

| | 112,093 |

| | 110,264 |

| 1,829 | | | $ | 369.4 | | | $ | 260.1 | | $ | 109.3 | |

| | | | | | | | | | | | | | | | | | | | |

Type | | | | | | | | | | | | | | | | | | | | |

Revenue-based royalties |

| | 43,662 |

| | 43,486 |

| 176 | | | $ | 142.0 | | | $ | 101.2 | | $ | 40.8 | |

Streams |

| | 56,004 |

| | 54,664 |

| 1,340 | | |

| 186.2 | | |

| 127.8 | |

| 58.4 | |

Profit-based royalties |

| | 9,235 |

| | 7,702 |

| 1,533 | | |

| 28.1 | | |

| 17.9 | |

| 10.2 | |

Interest revenue and other(2) |

| | 3,192 |

| | 4,412 |

| (1,220) | | |

| 13.1 | | |

| 13.2 | |

| (0.1) | |

|

| | 112,093 |

| | 110,264 |

| 1,829 | | | $ | 369.4 | | | $ | 260.1 | | $ | 109.3 | |

| 1 | Refer to the “Gold Equivalent Ounces and Net Gold Equivalent Ounces” section of this MD&A for more information on our methodology for calculating GEOs. |

| 2 | Includes interest attributable to Franco-Nevada’s 9.9% equity ownership of Labrador Iron Ore Royalty Corporation. |

Second Quarter 2025 Management’s Discussion and Analysis | 12 |

We recognized $369.4 million in revenue in Q2 2025, up 42.0% from Q2 2024, reflecting record gold prices during the quarter, and contributions from Precious Metal assets which were acquired or commenced production in the past year. Revenue from our Diversified assets was slightly lower than in Q2 2024, as the impact of lower commodity prices more than offset the sustained level of production from our assets. Revenue also includes interest revenue of $2.7 million related to our loans receivable.

In Q2 2025, we earned 82.3% of our revenue from Precious Metals, compared to 74.2% in Q2 2024. Geographically, 86.0% of our revenue was derived from the Americas in Q2 2025, compared to 81.8% in Q2 2024.

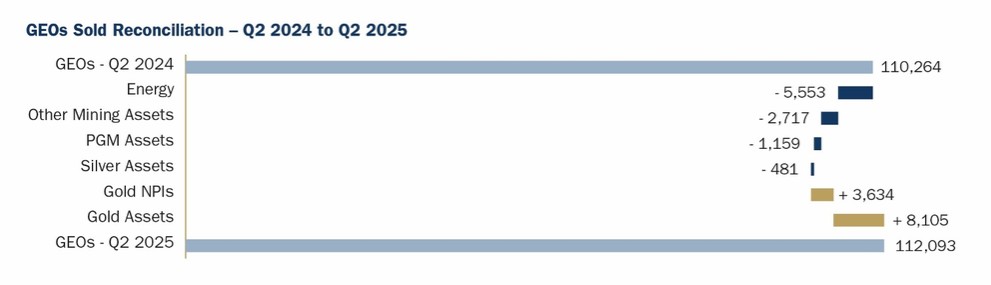

We sold 112,093 GEOs in Q2 2025, up 1.7% compared to 110,264 GEOs in Q2 2024. A comparison of our sources of GEOs in Q2 2025 to Q2 2024 is shown below:

Second Quarter 2025 Management’s Discussion and Analysis | 13 |

Precious Metals

Our Precious Metal assets contributed 92,449 GEOs in Q2 2025, up 12.3% compared to 82,350 GEOs in Q2 2024, primarily due to the following:

| ● | Guadalupe-Palmarejo – We received and sold 12,986 GEOs from Guadalupe-Palmarejo, compared to 7,020 GEOs in Q2 2024, reflecting higher production from Palmarejo and a greater proportion of production being mined from stream ground. |

| ● | Tocantinzinho – We received and sold 4,500 GEOs from Tocantinzinho in Q2 2025. There were no GEOs sold in the comparative period as production at the mine commenced in July 2024. During the quarter, mill performance improved following the installation of new steel liners in April 2025 and the mine reached nameplate capacity of 12,890 tonnes per day. |

| ● | Western Limb Mining Operations – We received and sold 3,246 GEOs from our recently acquired gold and platinum stream on Western Limb Mining Operations. |

| ● | Yanacocha – We earned 2,412 GEOs in Q2 2025 from our recently acquired royalty on the Yanacocha mine. Newmont reported strong production at the mine from the use of patented injection leaching technology. |

| ● | Musselwhite – We earned 2,820 GEOs from our NPI on Musselwhite, compared to 425 GEOs in Q2 2024. Orla Mining Limited acquired the Musselwhite mine from Newmont Corporation in March 2025. |

The above increases were partly offset by the following:

| ● | MWS – There were no GEO deliveries from MWS as our stream reached its cumulative cap of 312,500 gold ounces in Q4 2024. In the prior year quarter, MWS had delivered 7,650 GEOs. |

| ● | Condestable – We received and sold 2,979 GEOs from our Condestable stream in Q2 2025, compared to 6,149 GEOs in Q2 2024. The prior year period included the sale of GEOs related to Q1 2024 which had been received late in that quarter. Our Condestable stream provides for fixed deliveries until the end of 2025. |

| ● | Antapaccay – We received sold 5,630 GEOs from our Antapaccay stream in Q2 2025, compared to 8,596 GEOs in Q2 2024, due to a delay in shipments. We expect a stronger Q3, having already received significant deliveries in July 2025. Glencore anticipates H2 production at Antapaccay to benefit from higher grades. |

Diversified

Our Diversified assets, primarily comprising our Iron Ore and Energy interests, generated $62.7 million in revenue, 2.9% lower than in Q2 2024. While production at our Energy and Iron Ore assets was generally higher than in Q2 2024, the impact was more than offset by lower realized prices. When converted to GEOs, Diversified assets contributed 19,644 GEOs, 29.6% lower than in Q2 2024 due to higher gold prices used in the conversion of non-gold revenue to GEOs.

Iron Ore and Other Mining

Our Iron Ore and Other Mining assets generated $10.2 million in Q2 2025, slightly lower than $13.7 million in Q2 2024.

| ● | Vale Royalty – We recorded $5.8 million in revenue from our Vale Royalty in Q2 2025 compared to $6.9 million in Q2 2024. Production from the Northern System benefited from record output at S11D and lower shipping cost deductions, offset by lower estimated iron ore prices. Attributable sales from our Vale royalty are expected to increase in 2025, reflecting contributions from the Southeastern System once the cumulative sales threshold of 1.7 billion tonnes of iron ore is reached in the latter part of 2025. |

| ● | LIORC – Labrador Iron Ore Royalty Corporation (“LIORC”) contributed $1.4 million in revenue in Q2 2025, compared to $5.1 million in Q2 2024. LIORC declared a cash dividend of C$0.30 per common share in the current period, compared to C$1.10 in Q2 2024. Production from IOC increased compared to the prior year period with a Q2 record for material moved. The impact of higher production was offset by lower average realized prices. |

Energy

Our Energy interests contributed $52.5 million in revenue in Q2 2025, 3.1% higher than $50.9 million in Q2 2024.

| ● | U.S. – Revenue from our U.S. Energy interests increased to $38.5 million in Q2 2025, compared to $31.3 million in Q2 2024. We benefited from an increase in volumes in the Permian Basin, which more than offset lower realized prices. |

| ● | Canada – Revenue from our Canadian Energy interests was $14.0 million in Q2 2025, compared to $19.6 million in the prior year quarter. The decrease in revenue is primarily attributable to our Weyburn NRI which is paid net of costs and therefore more heavily impacted by a lower oil price. |

Second Quarter 2025 Management’s Discussion and Analysis | 14 |

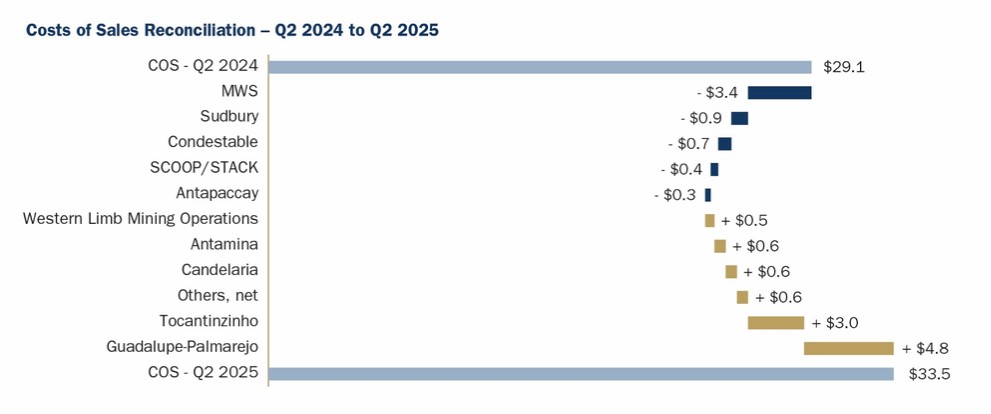

Costs of Sales

The following table provides a breakdown of costs of sales, excluding depletion and depreciation, incurred in the periods presented:

| | | For the three months ended June 30, |

| ||||||||

(expressed in millions) |

|

| 2025 |

|

| 2024 |

| Variance |

| |||

Costs of stream sales | | | $ | 30.3 | | | $ | 25.9 | | $ | 4.4 | |

Mineral production taxes | | |

| 0.8 | | |

| 0.7 | |

| 0.1 | |

Mining costs of sales | | | $ | 31.1 | | | $ | 26.6 | | $ | 4.5 | |

Energy costs of sales | | |

| 2.4 | | |

| 2.5 | |

| (0.1) | |

| | | $ | 33.5 | | | $ | 29.1 | | $ | 4.4 | |

Costs of sales related to our streams increased compared to Q2 2024, reflecting the increase in stream GEOs and higher costs per ounce for streams where the ongoing purchase price varies as a function of spot prices. Costs of sales related to our Energy assets, which include royalties payable and production taxes which vary based on revenue, was relatively consistent with the prior year period. Cost of sales may also vary due to property taxes which are reassessed from time to time. Costs of sales incurred in Q2 2025 compared to Q2 2024 are shown below:

Second Quarter 2025 Management’s Discussion and Analysis | 15 |

Depletion and Depreciation

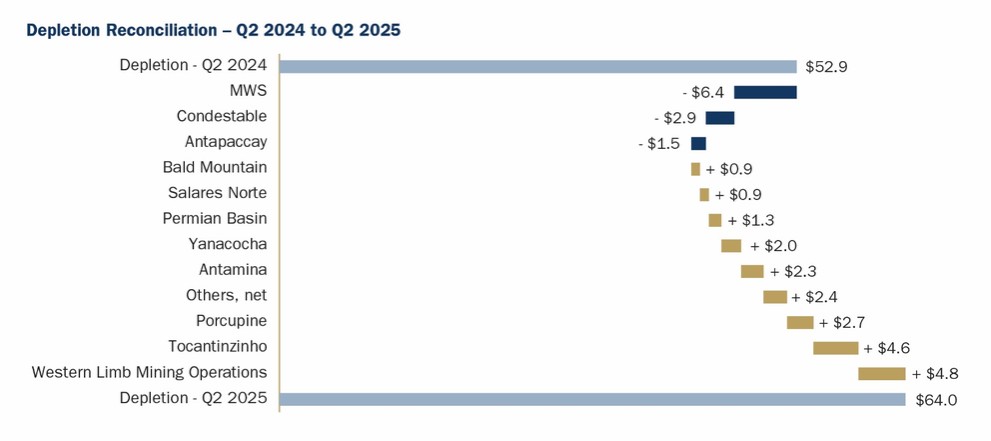

Depletion and depreciation expense totaled $64.0 million in Q2 2025, compared to $52.9 million in Q2 2024. Depletion expense incurred in Q2 2025 compared to Q2 2024 is shown below:

Gain on Sale of Gold and Silver Bullion

Certain of our royalties are settled in-kind with gold and silver bullion rather than cash payments. During Q2 2025, we liquidated a significant portion of our holdings in anticipation of our acquisition of the Côté royalty in June 2025. We sold 44,484 gold ounces with an average carrying value of $104.9 million for proceeds of $147.1 million, and recognized a corresponding gain of $42.2 million. At June 30, 2025, we hold 2,469 ounces of gold and 11,616 ounces of silver at a cost of $6.3 million and $0.3 million, respectively.

Income Taxes

Income tax expense was $68.6 million in Q2 2025, a decrease compared to $95.3 million in Q2 2024. Income taxes in Q2 2024 were higher due to the enactment of an increase of the Barbados corporate tax rate to 9% and the introduction of a qualified domestic minimum top-up tax, which topped up the Barbados effective tax rate payable by an entity subject to the OECD’s Pillar Two global minimum tax initiative, from 9% to 15%. While the tax measures were effective January 1, 2024, the remeasurement of the opening deferred tax liability of $49.1 million and the retroactive impact pertaining to income earned in Q1 2024 of $9.9 million were recognized in Q2 2024.

Net Income and Adjusted Net Income

Net income for Q2 2025 was $247.1 million, or $1.28 per share, compared to $79.5 million, or $0.41 per share, in Q2 2024. The increase is primarily attributable to higher revenue and a gain of $42.2 million from the sale of gold and silver bullion, partly offset by higher costs of sales and depletion expense. The prior year period also included the retroactive application of tax measures enacted in relation to the OECD’s GMT initiative pertaining to income earned in Q1 2024.

Adjusted Net Income for the same period was $238.5 million, or $1.24 per share, compared to $144.9 million, or $0.75 per share, in Q2 2024. Please refer to the “Non-GAAP Financial Measures” section of this MD&A for further details on the computation of Adjusted Net Income.

Second Quarter 2025 Management’s Discussion and Analysis | 16 |

Review of Year-to-Date Financial Performance

The following table summarizes average commodity prices and average exchange rates during the periods presented.

| | | | | | | | | | | |||

Average prices and rates |

| |

|

| H1 2025 |

|

| H1 2024 |

| Variance | | ||

Gold(1) |

| ($/oz) | | | $ | 3,071 | | | $ | 2,205 |

| 39.3 | % |

Silver(1) |

| ($/oz) | | |

| 32.77 | | |

| 26.11 |

| 25.5 | % |

Platinum(1) |

| ($/oz) | | |

| 1,021 | | |

| 945 |

| 8.0 | % |

Palladium(1) |

| ($/oz) | | |

| 976 | | |

| 975 |

| 0.1 | % |

Iron Ore Fines 62% Fe CFR China | | ($/tonne) | | | | 101 | | | | 118 | | (14.4) | % |

| | | | | | | | | | | | | |

Edmonton Light |

| (C$/bbl) | | | | 90.40 | | |

| 100.71 |

| (10.2) | % |

West Texas Intermediate | | ($/bbl) | | | | 67.58 | | | | 78.77 | | (14.2) | % |

Henry Hub | | ($/mcf) | | | | 3.69 | | | | 2.22 | | 66.2 | % |

| | | | | | | | | | | | | |

CAD/USD exchange rate(2) | | | | |

| 0.7098 | | |

| 0.7361 |

| (3.6) | % |

| 1 | Based on LBMA PM Fix for gold, platinum and palladium. Based on LBMA Fix for silver. |

| 2 | Based on Bank of Canada daily rates. |

Revenue and GEOs

Revenue and GEO sales by commodity, geographical location and type of interest for the six months ended June 30, 2025 and 2024 were as follows:

| | | Gold Equivalent Ounces(1) | | | Revenue (in millions) |

| |||||||||||||

For the six months ended June 30, |

|

| 2025 |

|

| 2024 |

| Variance |

|

| 2025 |

|

| 2024 |

| Variance |

| |||

| | | | | | | | | | | | | | | | | | | | |

Commodity | | | | | | | | | | | | | | | | | | | | |

Gold |

| | 164,261 | | | 144,561 |

| 19,700 | | | $ | 504.2 | | | $ | 317.8 | | $ | 186.4 | |

Silver |

| | 24,011 | | | 23,689 |

| 322 | | |

| 75.2 | | |

| 53.0 | |

| 22.2 | |

PGM |

| | 4,800 | | | 7,118 |

| (2,318) | | |

| 15.3 | | |

| 16.2 | |

| (0.9) | |

Precious Metals | | | 193,072 | | | 175,368 | | 17,704 | | | $ | 594.7 | | | $ | 387.0 | | $ | 207.7 | |

Iron ore(2) |

| | 6,085 | | | 12,456 |

| (6,371) | | | $ | 19.6 | | | $ | 26.8 | | $ | (7.2) | |

Other mining assets | | | 2,457 | | | 2,155 | | 302 | | | | 7.4 | | | | 4.7 | | | 2.7 | |

Oil | | | 23,830 | | | 30,347 | | (6,517) | | | | 65.5 | | | | 62.1 | | | 3.4 | |

Gas | | | 8,742 | | | 8,874 | | (132) | | | | 34.3 | | | | 23.1 | | | 11.2 | |

NGL | | | 4,492 | | | 3,961 | | 531 | | | | 10.7 | | | | 9.5 | | | 1.2 | |

Diversified | | | 45,606 | | | 57,793 | | (12,187) | | | $ | 137.5 | | | $ | 126.2 | | $ | 11.3 | |

Revenue from royalty, stream and working interests | | | 238,678 | | | 233,161 | | 5,517 | | | $ | 732.2 | | | $ | 513.2 | | $ | 219.0 | |

Interest revenue and other interest income | | | — | | | — | | — | | | $ | 5.6 | | | $ | 3.7 | | $ | 1.9 | |

|

| | 238,678 |

| | 233,161 |

| 5,517 | | | $ | 737.8 | | | $ | 516.9 | | $ | 220.9 | |

| | | | | | | | | | | | | | | | | | | | |

Geography | | | | | | | | | | | | | | | | | | | | |

South America |

| | 94,405 |

| | 88,464 |

| 5,941 | | | $ | 292.2 | | | $ | 194.4 | | $ | 97.8 | |

Central America & Mexico |

| | 25,594 | | | 19,031 |

| 6,563 | | | | 79.9 | | | | 41.6 | | | 38.3 | |

United States |

| | 39,624 |

| | 44,828 |

| (5,204) | | | | 119.0 | | | | 98.0 | | | 21.0 | |

Canada(2) |

| | 43,436 |

| | 39,344 |

| 4,092 | | |

| 137.6 | | |

| 91.5 | |

| 46.1 | |

Rest of World |

| | 35,619 |

| | 41,494 |

| (5,875) | | |

| 109.1 | | |

| 91.4 | |

| 17.7 | |

|

| | 238,678 |

| | 233,161 |

| 5,517 | | | $ | 737.8 | | | $ | 516.9 | | $ | 220.9 | |

| | | | | | | | | | | | | | | | | | | | |

Type | | | | | | | | | | | | | | | | | | | | |

Revenue-based royalties |

| | 90,810 |

| | 91,435 |

| (625) | | | $ | 277.0 | | | $ | 199.7 | | $ | 77.3 | |

Streams |

| | 123,304 |

| | 117,721 |

| 5,583 | | |

| 382.1 | | |

| 260.0 | |

| 122.1 | |

Profit-based royalties |

| | 18,345 |

| | 14,422 |

| 3,923 | | |

| 53.8 | | |

| 31.9 | |

| 21.9 | |

Interest revenue and other(2) |

| | 6,219 |

| | 9,583 |

| (3,364) | | |

| 24.9 | | |

| 25.3 | |

| (0.4) | |

|

| | 238,678 |

| | 233,161 |

| 5,517 | | | $ | 737.8 | | | $ | 516.9 | | $ | 220.9 | |

| 1 | Refer to the “Gold Equivalent Ounces and Net Gold Equivalent Ounces” section of this MD&A for more information on our methodology for calculating GEOs. |

| 2 | Includes interest attributable to Franco-Nevada’s 9.9% equity ownership of Labrador Iron Ore Royalty Corporation. |

Second Quarter 2025 Management’s Discussion and Analysis | 17 |

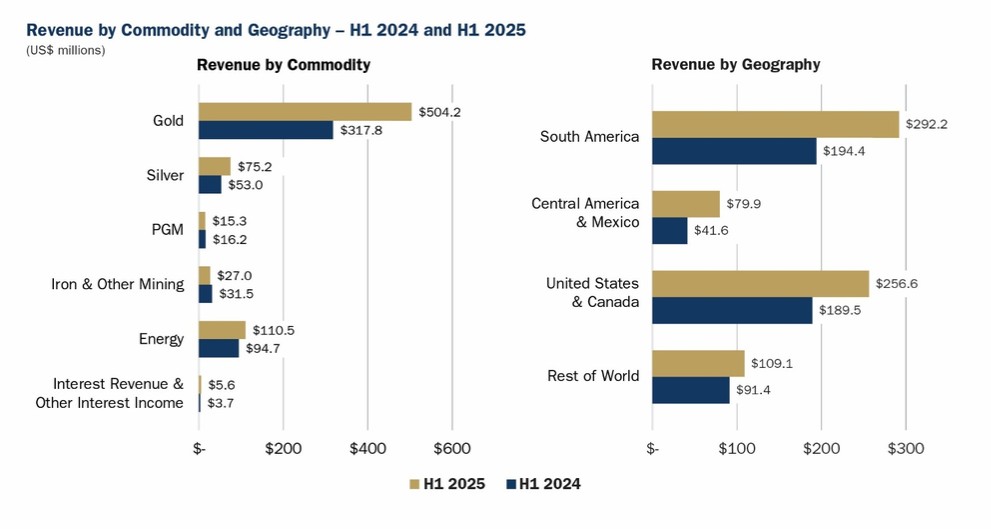

We recognized $737.8 million in revenue in H1 2025, up 42.7% from H1 2024. Revenue in the current period benefited from higher precious metal prices and higher realized revenue from our Energy assets. Revenue also includes interest revenue and other interest income of $5.6 million related to our loans receivable.

We earned 80.6% of our H1 2025 revenue from Precious Metal assets, compared to 74.9% in H1 2024. Geographically, we remain heavily invested in the Americas, with 85.2% of revenue in H1 2025, compared to 82.3% in H1 2024.

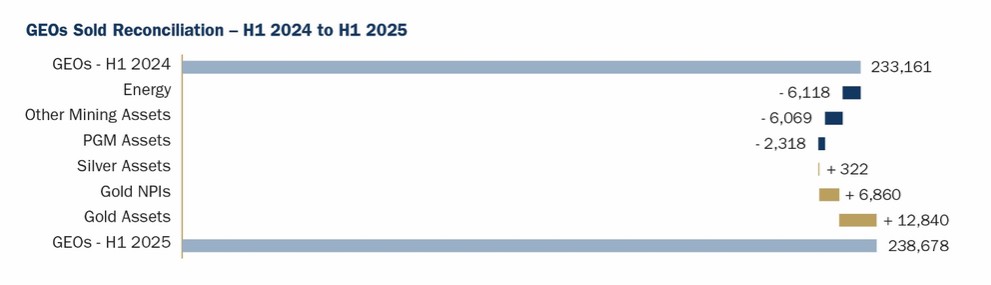

We sold 238,678 GEOs in H1 2025, a 2.4% increase compared to 233,161 GEOs in H1 2024. The conversion of revenue from our non-gold assets into GEOs was impacted by the outperformance of gold prices relative to other commodities. A comparison of our sources of GEOs in H1 2025 to H1 2024 is shown below:

Second Quarter 2025 Management’s Discussion and Analysis | 18 |

Precious Metals

Our Precious Metal assets contributed 193,072 GEOs in H1 2025, up 10.1% from 175,368 GEOs in H1 2024, primarily due to the following:

| ● | Western Limb Mining Operations – We received and sold 9,786 GEOs from our recently acquired gold and platinum stream on Western Limb Mining Operations. The stream had an effective date of September 1, 2024. |

| ● | Hemlo – We earned 9,908 GEOs in H1 2025 compared to 4,159 GEOs in H1 2024 as the NPI benefited from higher gold prices and increased production from royalty ground. Royalties from the NPI may vary significantly depending on the proportion of production sourced from royalty ground and attributable costs. |

| ● | Guadalupe-Palmarejo – We received and sold 25,434 GEOs from Guadalupe-Palmarejo, of which 2,216 GEOs were received in Q4 2024 and remained in inventory at December 31, 2024, compared to 18,710 GEOs in H1 2024. The current period also benefited from higher production from Palmarejo and a greater proportion of production being mined from stream ground. |

| ● | Tocantinzinho – We received and sold 9,662 GEOs from Tocantinzinho in H1 2025, of which 667 GEOs were received in Q4 2024 and remained in inventory at December 31, 2024. There were no GEOs sold in the comparative period as production at the mine commenced in July 2024. |

| ● | Candelaria – We received and sold 36,320 GEOs from our Candelaria stream, of which 3,333 GEOs were received in Q4 2024 and remained in inventory at December 31, 2024, compared to 30,661 GEOs sold in H1 2024. Production in H1 2025 benefited from increased throughput due to softer ore feed and higher ball mill runtime due to rescheduled maintenance in the quarter. Production is expected to continue at similar levels through H2 2025. |

The above increases were partly offset by the following factors:

| ● | MWS – There were no GEO deliveries from MWS as our stream reached its cumulative cap of 312,500 gold ounces in Q4 2024. In the prior year period, MWS had delivered 14,836 GEOs. |

| ● | Antapaccay – We received and sold 15,662 GEOs from our Antapaccay stream in H1 2025, compared to 28,466 GEOs in H1 2024, reflecting a delay in the timing of shipments. |

Diversified

Our Diversified assets, primarily comprising our Iron Ore and Energy interests, generated $137.5 million in revenue in H1 2025, an increase of 9.0% compared to $126.2 million in H1 2024. When converted to GEOs, Diversified assets contributed 45,606 GEOs in H1 2025, down 21.1% compared to H1 2024, almost entirely due to changes in gold prices used in the conversion of non-gold revenue into GEOs.

Iron Ore and Other Mining

Our Iron Ore and Other Mining assets generated $19.6 million in H1 2025, compared to $26.8 million in H1 2024.

| ● | Vale Royalty – Revenue from Vale was $16.0 million in H1 2025 compared to $19.6 million in H1 2024, reflecting higher iron ore sales in H1 2024, partly offset by lower iron ore prices. |

| ● | LIORC – LIORC contributed $3.6 million in revenue in H1 2025 compared to $7.2 million in H1 2024. |

| ● | Caserones – Revenue from our effective NSR on the Caserones mine was $3.2 million in H1 2025 compared to $2.1 million in H1 2024. |

Energy

Our Energy interests contributed $110.5 million in revenue in H1 2025, compared to $94.7 million in H1 2024.

| ● | U.S. – Revenue from our U.S. Energy interests increased to $80.3 million in H1 2025, compared to $59.5 million in H1 2024. We benefited from an increase in realized gas prices, strong performance from our royalties in the Permian Basin and additional volumes from our royalty venture with Continental in the SCOOP/STACK. |

| ● | Canada – Revenue from our Canadian Energy interests decreased to $30.2 million in H1 2025, compared to $35.2 million in H1 2024. The decrease in revenue is primarily attributable to our Weyburn NRI which is paid net of costs and therefore more heavily impacted by a lower oil price. |

Second Quarter 2025 Management’s Discussion and Analysis | 19 |

Costs of Sales

The following table provides a breakdown of costs of sales, excluding depletion and depreciation, incurred in the periods presented:

| | | For the six months ended June 30, |

| ||||||||

(expressed in millions) |

|

| 2025 |

|

| 2024 |

| Variance |

| |||

Costs of stream sales | | | $ | 63.7 | | | $ | 56.0 | | $ | 7.7 | |

Mineral production taxes | | |

| 1.4 | | |

| 1.2 | |

| 0.2 | |

Mining costs of sales | | | $ | 65.1 | | | $ | 57.2 | | $ | 7.9 | |

Energy costs of sales | | |

| 6.9 | | |

| 5.5 | |

| 1.4 | |

| | | $ | 72.0 | | | $ | 62.7 | | $ | 9.3 | |

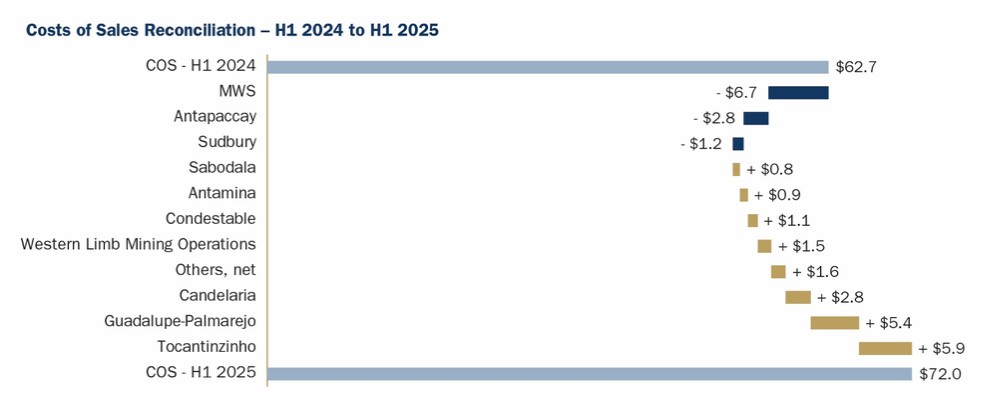

Costs of sales related to our streams in H1 2025 increased relative to H1 2024, reflecting the increase in stream GEOs and higher costs per ounce for streams where the ongoing purchase price varies as a function of spot prices. Costs of sales related to our Energy assets include royalties payable and production taxes which vary based on revenue, and property taxes which may be reassessed from time to time. Costs of sales incurred in H1 2025 compared to H1 2024 are shown below:

Second Quarter 2025 Management’s Discussion and Analysis | 20 |

Depletion and Depreciation

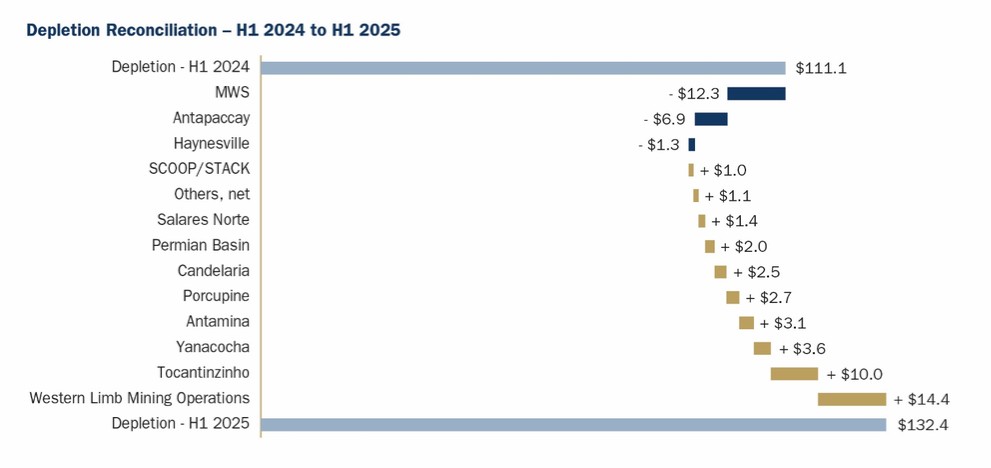

Depletion and depreciation expense totaled $132.4 million in H1 2025 compared to $111.1 million in H1 2024, reflecting the increase in GEOs sold in the current period. Depletion expense incurred in H1 2025 compared to H1 2024 is shown below:

Gain on Sale of Gold and Silver Bullion

Certain of our royalties are settled with payments in-kind in the form of gold and silver bullion rather than cash. In H1 2025, we sold 54,984 gold ounces with an average carrying value of $128.0 million for proceeds of $177.3 million, and recognized a corresponding gain of $49.3 million. At June 30, 2025, we hold 2,469 ounces of gold and 11,616 ounces of silver at a cost of $6.3 million and $0.3 million, respectively.

Income Taxes

Income tax expense was $128.4 million in H1 2025, compared to $122.8 million in H1 2024, reflecting higher net income before taxes earned in the current period. The H1 2024 period also included a deferred tax expense of approximately $49.1 million in relation to the remeasurement of our deferred tax liability due to the changes in the Barbados tax rate enacted in Q2 2024.

Net Income and Adjusted Net Income

Net income in H1 2025 was $456.9 million, or $2.37 per share, compared $224.0 million, or $1.17 per share in H1 2024. The increase is primarily attributable to higher revenue and a gain of $49.3 million from the sale of gold and silver bullion, partly offset by higher costs of sales, depletion and income tax expense.

Adjusted Net Income was $444.0 million, or $2.31 per share, compared to $280.8 million, or $1.46 per share, in H1 2024. Please refer to the “Non-GAAP Financial Measures” section of this MD&A for further details on the computation of Adjusted Net Income.

Second Quarter 2025 Management’s Discussion and Analysis | 21 |

Cobre Panama

First Quantum has been working with the GOP and the MICI to implement the P&SM Plan. On May 30, 2025, the GOP, through the MICI, approved and formally instructed the execution of the P&SM Plan, including the shipment of 121 thousand dry metric tonnes of copper concentrate that had been stored at site since operations were suspended in November 2023. Exports of the copper concentrate commenced in June 2025.

We determined that this was an indicator of a partial reversal of the impairment we recorded in 2023 and recorded a partial impairment reversal of $4.1 million in relation to the gold and silver ounces we expect in Q3 2025 as a result of the sale of copper concentrate. We continue to assess our Cobre Panama stream for further indicators of impairment reversals.

General and Administrative, Share-Based Compensation Expenses and Cobre Panama Arbitration Expenses

The following table provides a breakdown of general and administrative (“G&A”) expenses, share-based compensation (“SBC”) expenses and Cobre Panama arbitration expenses incurred for the periods presented:

| | | For the three months ended June 30, |

| | For the six months ended June 30, |

| ||||||||||||||||

(expressed in millions) |

|

| 2025 |

|

| 2024 |

| Variance |

|

| 2025 |

|

| 2024 |

| Variance |

| ||||||

Salaries and benefits | | | $ | 3.0 | | | $ | 2.5 | | $ | 0.5 | | | $ | 7.6 | | | $ | 5.0 | | $ | 2.6 | |

Professional fees | | |

| 1.3 | | |

| 2.3 | |

| (1.0) | | |

| 2.8 | | |

| 3.7 | |

| (0.9) | |

Community contributions | | | | 0.1 | | | | 0.3 | | | (0.2) | | | | 0.5 | | | | 0.4 | | | 0.1 | |

Board of Directors' costs | | | | 0.1 | | | | 0.1 | | | — | | | | 0.2 | | | | 0.2 | | | — | |

Office expenses | | | | 0.2 | | | | 0.1 | | | 0.1 | | | | 0.8 | | | | 0.4 | | | 0.4 | |

Insurance costs | | | | 0.2 | | | | 0.3 | | | (0.1) | | | | 0.4 | | | | 0.5 | | | (0.1) | |

Other expenses | | |

| 0.8 | | |

| 2.0 | |

| (1.2) | | |

| 2.1 | | |

| 1.6 | |

| 0.5 | |

General and administrative expenses | | | $ | 5.7 | | | $ | 7.6 | | $ | (1.9) | | | $ | 14.4 | | | $ | 11.8 | | $ | 2.6 | |

Share-based compensation expenses | | |

| 2.8 | | |

| 1.8 | |

| 1.0 | | |

| 8.5 | | |

| 4.6 | |

| 3.9 | |

Cobre Panama arbitration expenses | | | | 3.9 | | | | 0.8 | | | 3.1 | | | | 4.6 | | | | 2.3 | | | 2.3 | |

| | | $ | 12.4 | | | $ | 10.2 | | $ | 2.2 | | | $ | 27.5 | | | $ | 18.7 | | $ | 8.8 | |

G&A (including Cobre Panama arbitration expenses and SBC expenses) represented 3.7% of revenue in H1 2025, up from 3.6% in H1 2024. The increase was primarily due to expenses we incurred in relation to our Cobre Panama arbitration prior to its suspension in late June 2025, an increase in salaries and SBC expenses, and higher community contributions.

SBC expenses include expenses related to equity-settled stock options, restricted share units (“RSUs”) and deferred share units (“DSUs”), as well as the mark-to-market gain or loss related to the DSUs which are fair valued based on the Company’s share price. Community contributions relate to the environmental and social initiatives we contribute to for the benefit of the communities where we operate, or own assets. G&A expenses also include business development expenses, which vary based on the level of business development related activities in the period and the timing of the closing of transactions.

Foreign Exchange Gain (Loss) and Other Income (Expenses)

The following table provides a list of foreign exchange and other income/expenses incurred for the periods presented:

| | | For the three months ended June 30, |

| | For the six months ended June 30, |

| ||||||||||||||||

(expressed in millions) |

|

| 2025 |

|

| 2024 |

| Variance |

|

| 2025 |

|

| 2024 |

| Variance |

| ||||||

Foreign exchange gain (loss) | | | $ | (1.4) | | | $ | (7.3) | | $ | 5.9 | | | $ | 4.4 | | | $ | (8.4) | | $ | 12.8 | |

Gain (loss) on derivative financial instruments | | |

| 5.7 | | |

| (2.4) | |

| 8.1 | | | | 5.6 | | | | (3.0) | | | 8.6 | |

Other expenses | | |

| (0.2) | | |

| (0.1) | |

| (0.1) | | |

| (0.2) | | |

| — | |

| (0.2) | |

| | | $ | 4.1 | | | $ | (9.8) | | $ | 13.9 | | | $ | 9.8 | | | $ | (11.4) | | $ | 21.2 | |

The foreign exchange gain of $4.4 million recognized in H1 2025 is largely related to our cash and account receivable balances held in Brazilian Reais received from our Vale royalty, which strengthened relative to the U.S. dollar in the year-to-date period. Under IFRS Accounting Standards, all foreign exchange gains or losses related to monetary assets and liabilities held in a currency other than the functional currency are recorded in net income as opposed to other comprehensive income (loss). The parent company’s functional currency is the Canadian dollar, while the functional currency of certain subsidiaries is the U.S. dollar.

The gain (loss) on derivative instruments includes the mark-to-market of financial instruments that are designed at Fair Value Through Profit and Loss, such as warrants and other derivative instruments the Company holds.

Second Quarter 2025 Management’s Discussion and Analysis | 22 |

Finance Income and Finance Expenses

The following table provides a breakdown of finance income and expenses incurred for the periods presented:

| | | For the three months ended June 30, | | | For the six months ended June 30, |

| ||||||||||||||||

(expressed in millions) |

|

| 2025 |

|

| 2024 |

| Variance |

|

| 2025 |

|

| 2024 |

| Variance |

| ||||||

Finance income |

| | | |

| | | |

| | | | | | | | | | | | | | |

Interest | | | $ | 6.6 | | | $ | 16.2 | | $ | (9.6) | | | $ | 17.7 | | | $ | 32.2 | | $ | (14.5) | |

| | | $ | 6.6 | | | $ | 16.2 | | $ | (9.6) | | | $ | 17.7 | | | $ | 32.2 | | $ | (14.5) | |

Finance expenses |

| | | |

| | | |

| | | | | | | | | | | | | | |

Standby charges | | | $ | 0.6 | | | $ | 0.5 | | $ | 0.1 | | | $ | 1.2 | | | $ | 1.0 | | $ | 0.2 | |

Amortization of debt issue costs | | |

| 0.1 | | |

| 0.1 | | | — | | |

| 0.2 | | |

| 0.2 | |

| — | |

Accretion of lease liabilities | | |

| 0.1 | | |

| — | |

| 0.1 | | |

| 0.1 | | |

| — | |

| 0.1 | |

| | | $ | 0.8 | | | $ | 0.6 | | $ | 0.2 | | | $ | 1.5 | | | $ | 1.2 | | $ | 0.3 | |

Finance income is earned on our cash and cash equivalents. The decrease in finance income in H1 2025 is due to a decrease in yields and cash and cash equivalents balances held compared to Q1 2024.