Pay Versus Performance

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive compensation actually paid and certain financial performance measures of the company. For further information concerning our pay for performance philosophy and how we align executive compensation with the company’s performance, please review the Compensation Discussion and Analysis beginning on page 44.

The following tables and related disclosures provide information about (i) the total compensation of our principal executive officer (“PEO”) and our non-PEO NEOs (collectively, the “Other NEOs”) as presented in the Summary Compensation Table (“SCT”) on page 56, (ii) the “compensation actually paid” (“CAP”) to our PEO and our Other NEOs, as calculated pursuant to Item 402(v) of Regulation S-K, (iii) certain financial performance measures, and (iv) the relationship of the CAP to those financial performance measures.

| Year | Summary Compensation Table Total for PEO(1) |

Compensation Actually Paid to PEO(2) |

Average Summary Compensation Table Total for Non-PEO NEOs(1) |

Average Compensation Actually Paid to Non-PEO NEOs(2) |

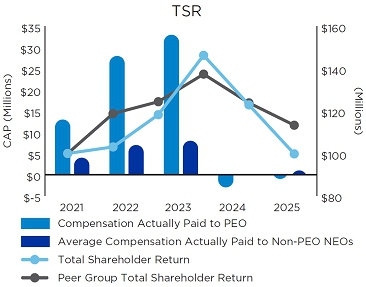

Total Shareholder Return |

Peer Group Total Shareholder Return(3) |

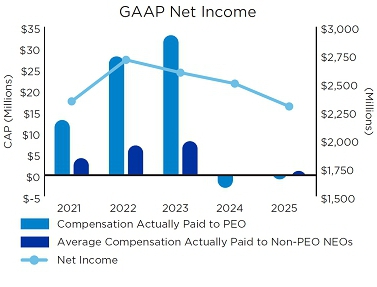

GAAP Net Income (in millions) |

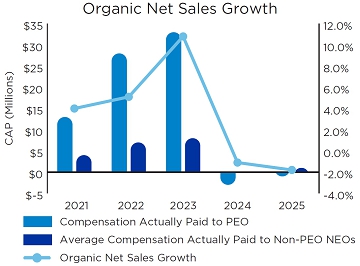

Organic Net Sales Growth(4) | ||||||||||||||||||||||

| 2025 | $ | 12,492,830 | ($ | 751,091 | ) | $ | 4,013,163 | $ | 743,947 | $ | 99.81 | $ | 113.32 | $ | 2,319 | -1.8% | ||||||||||||||

| 2024 | $ | 16,056,114 | ($ | 2,738,708 | ) | $ | 3,836,800 | $ | 402,979 | $ | 122.92 | $ | 123.88 | $ | 2,519 | -1.1% | ||||||||||||||

| 2023 | $ | 16,385,646 | $ | 33,137,997 | $ | 4,607,312 | $ | 7,806,270 | $ | 145.39 | $ | 137.43 | $ | 2,610 | 10.8% | |||||||||||||||

| 2022 | $ | 12,266,195 | $ | 27,692,522 | $ | 3,574,805 | $ | 6,900,889 | $ | 118.28 | $ | 124.42 | $ | 2,735 | 5.1% | |||||||||||||||

| 2021 | $ | 15,572,682 | $ | 12,882,059 | $ | 3,899,324 | $ | 3,540,484 | $ | 103.08 | $ | 118.79 | $ | 2,346 | 4.0% | |||||||||||||||

| (1) | The PEO was Jeffrey L. Harmening for all years in the table. The Other NEOs were Kofi Bruce (all years), Dana McNabb (2024 and 2025), Jonathan Nudi (all years), Jaime Montemayor (all years), Karen Wilson Thissen (2023 and 2024), John Church (2022 and 2021), and Richard Allendorf (2022). |

| (1) | The PEO was Jeffrey L. Harmening for all years in the table. The Other NEOs were Kofi Bruce (all years), Dana McNabb (2024 and 2025), Jonathan Nudi (all years), Jaime Montemayor (all years), Karen Wilson Thissen (2023 and 2024), John Church (2022 and 2021), and Richard Allendorf (2022). |

| (3) | Reflects total shareholder return for the S&P 500 Packaged Foods & Meats Index, which is an industry line peer group reported in the Company’s 2025 Annual Report. Total shareholder return is calculated based on a fixed investment of $100 measured from the market close on the last trading day of fiscal 2020 through and including the end of the fiscal year for each fiscal year reported in the table. |

RECONCILIATION OF SUMMARY COMPENSATION TABLE TOTAL TO COMPENSATION ACTUALLY PAID(a)

| Year | 2025 | |||||||

| PEO | Other NEOs | |||||||

| Summary Compensation Table Total | $ | 12,492,830 | $ | 4,013,163 | ||||

| (Minus): Grant Date Fair Value of Equity Awards Granted in Fiscal Year | ($ | 9,886,297 | ) | ($ | 2,619,958 | ) | ||

| (Minus): Change in Pension Value | ($ | 274,971 | ) | ($ | 178,607 | ) | ||

| Plus: Pension Service Cost and Associated Prior Service Cost | $ | 318,411 | $ | 101,987 | ||||

| Plus: Fair Value at Fiscal Year End of Outstanding and Unvested Equity Awards Granted in the Fiscal Year | $ | 5,353,278 | $ | 1,418,667 | ||||

| Plus/(Minus): Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Fiscal Years | ($ | 8,045,879 | ) | ($ | 1,823,598 | ) | ||

| Plus: Fair Value at Vesting of Equity Awards Granted and Vested in the Fiscal Year | $ | 0 | $ | 0 | ||||

| Plus/(Minus): Change in Fair Value as of the Vesting Date of Equity Awards Granted in Prior Fiscal Years that Vested in the Fiscal Year | ($ | 1,504,771 | ) | ($ | 360,262 | ) | ||

| (Minus): Fair Value as of the Prior Fiscal Year End of Equity Awards Granted in Prior Fiscal Years that Failed to Meet Vesting Conditions in the Fiscal Year | $ | 0 | $ | 0 | ||||

| Plus: Value of Dividends or Other Earnings Paid on Equity Awards Not Otherwise Reflected in Total Compensation | $ | 796,308 | $ | 192,555 | ||||

| Compensation Actually Paid | ($ | 751,091 | ) | $ | 743,947 | |||

| (a) | The fair value of equity awards was determined using methodologies and assumptions developed in a manner substantively consistent with those used to determine the grant date fair value of such awards. For our financial PSUs, we assumed payouts ranging between 32% and 89% for the fiscal 2025 CAP calculations. |

RECONCILIATION OF SUMMARY COMPENSATION TABLE TOTAL TO COMPENSATION ACTUALLY PAID(a)

| Year | 2025 | |||||||

| PEO | Other NEOs | |||||||

| Summary Compensation Table Total | $ | 12,492,830 | $ | 4,013,163 | ||||

| (Minus): Grant Date Fair Value of Equity Awards Granted in Fiscal Year | ($ | 9,886,297 | ) | ($ | 2,619,958 | ) | ||

| (Minus): Change in Pension Value | ($ | 274,971 | ) | ($ | 178,607 | ) | ||

| Plus: Pension Service Cost and Associated Prior Service Cost | $ | 318,411 | $ | 101,987 | ||||

| Plus: Fair Value at Fiscal Year End of Outstanding and Unvested Equity Awards Granted in the Fiscal Year | $ | 5,353,278 | $ | 1,418,667 | ||||

| Plus/(Minus): Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Fiscal Years | ($ | 8,045,879 | ) | ($ | 1,823,598 | ) | ||

| Plus: Fair Value at Vesting of Equity Awards Granted and Vested in the Fiscal Year | $ | 0 | $ | 0 | ||||

| Plus/(Minus): Change in Fair Value as of the Vesting Date of Equity Awards Granted in Prior Fiscal Years that Vested in the Fiscal Year | ($ | 1,504,771 | ) | ($ | 360,262 | ) | ||

| (Minus): Fair Value as of the Prior Fiscal Year End of Equity Awards Granted in Prior Fiscal Years that Failed to Meet Vesting Conditions in the Fiscal Year | $ | 0 | $ | 0 | ||||

| Plus: Value of Dividends or Other Earnings Paid on Equity Awards Not Otherwise Reflected in Total Compensation | $ | 796,308 | $ | 192,555 | ||||

| Compensation Actually Paid | ($ | 751,091 | ) | $ | 743,947 | |||

| (a) | The fair value of equity awards was determined using methodologies and assumptions developed in a manner substantively consistent with those used to determine the grant date fair value of such awards. For our financial PSUs, we assumed payouts ranging between 32% and 89% for the fiscal 2025 CAP calculations. |

Financial Performance Measures

The following table lists the four performance measures that, in our assessment, represent the most important performance measures we used to link compensation actually paid in fiscal 2025 to company performance.

| Organic Net Sales Growth* |

| Adjusted Operating Profit Growth* |

| Cumulative Operating Cash Flow* |

| Relative Total Shareholder Return |

| * | Non-GAAP measure. For more information on the use of non-GAAP measures in the Proxy Statement, and a reconciliation of non-GAAP measures to the most directly comparable GAAP measures, see Appendix A. |

| (4) | Values shown reflect the Organic Net Sales Growth, which is the measure we believe represents the most important financial performance measure not otherwise presented in the table above that we use to link CAP to our NEOs for fiscal 2025 to the company’s performance. |