Exhibit 99.2

|

H1 2025

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

As of June 30, 2025, and for the six-month period then ended

Special note regarding forward-looking statements

Certain information included herein may be deemed to be “forward-looking statements”. Forward-looking statements are often characterized by the use of

forward-looking terminology such as “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible,” or the negative of these

terms or similar expressions, but are not the only way these statements are identified.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe

may affect our business, financial condition and results of operations. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be

materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to:

| • |

our ability to effectively manage the scope and complexity of our business following years of rapid growth and our ability to maintain profitability;

|

| • |

foreign currency exchange rate fluctuations;

|

| • |

the fact that we continue to derive a majority of revenues from monday work management;

|

| • |

fluctuations in operating results;

|

| • |

real or perceived errors, failures, vulnerabilities or bugs in our platform, products, or third-party applications offered on our app marketplace or interruptions or performance problems in the technology or

infrastructure underlying our platform;

|

| • |

risks related to artificial intelligence (“AI”) or machine learning (“ML”);

|

| • |

our ability to attract customers, grow our retention rates and expand usage within organizations, including cross selling and upselling;

|

| • |

risks related to our subscription-based business model;

|

| • |

our sales efforts may require considerable time and expense and the use of differing sales strategies

and may extend our sales cycles;

|

| • |

changes in sizes or types of business that purchase our platform and products;

|

| • |

our ability to offer high-quality customer support and consistent sales strategies;

|

| • |

maintenance of corporate culture;

|

| • |

risks related to international operations and compliance with laws and regulations applicable to our global operations;

|

| • |

risks related to acquisitions, strategic investments, partnerships, or alliances;

|

|

H1 2025

|

| • |

risks associated with environmental and social responsibility and climate change;

|

| • |

our dependence on key employees and ability to attract and retain highly skilled employees;

|

| • |

our ability to raise additional capital or generate cash flows necessary to grow our business;

|

| • |

uncertain global economic conditions and inflation;

|

| • |

changes and competition in the market and software categories in which we participate;

|

| • |

our ability to introduce new products, features, integrations, capabilities, and enhancements;

|

| • |

the ability of our platform to interoperate with a variety of software applications;

|

| • |

our reliance on third-party application stores to distribute our mobile application;

|

| • |

our successful strategic relationships with, and our dependence on third parties;

|

| • |

our reliance on traditional web search engines to direct traffic to our website;

|

| • |

interruption or delays in service from third parties or our inability to plan and manage interruptions;

|

| • |

risks related to security disruptions, unauthorized system access;

|

| • |

evolving privacy protection and data security laws, regulations, industry standards, policies, contractual obligations, and cross-border data transfer or localization restrictions;

|

| • |

new legislation and regulatory obligations regulating AI;

|

| • |

changes in tax law and regulations or if we were to be classified as a passive foreign investment company;

|

| • |

our ability to maintain, protect or enforce our intellectual property rights or risks related to

intellectual property infringement claims;

|

| • |

risks related to our use of open-source software;

|

| • |

risks related to our founder share that provides certain veto rights

|

| • |

risks related to our status as a foreign private issuer incorporated and located in Israel, including risks related to the ongoing war between Israel and Hamas and escalations thereof;

|

| • |

our expectation not to pay dividends for the foreseeable future;

|

| • |

risks related to our Digital Lift Initiative and the monday.com Foundation; and

|

| • |

risks related to legal and regulatory matters.

|

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. The estimates and forward-looking statements contained

herein speak only as of the date thereof. Except as required by applicable law, we undertake no obligation to publicly update or revise any estimates or forward-looking statements whether as a result of new information, future events or otherwise,

or to reflect the occurrence of unanticipated events.

|

H1 2025

|

The foregoing list is intended to identify only certain of the principal factors that could cause actual results to differ. For a more detailed description of the risks and

uncertainties affecting our company, reference is made to our Annual Report on Form 20-F for the year ended December 31, 2024, which was filed with the Securities and Exchange Commission, or the SEC, on March 17, 2025 (hereafter: “Annual Report”),

and the other risk factors discussed from time to time by our company in reports filed or furnished to the SEC.

Introduction

Unless indicated otherwise by the context, all references in this report to “monday.com,” “we,” “us” or “our” are to monday.com Ltd. When the following terms and abbreviations

appear in the text of this report, they have the meanings indicated below:

| • |

“dollars” or “$” means United States dollars; and

|

| • |

“NIS” means New Israeli Shekels.

|

You should read the following discussion and analysis in conjunction with our unaudited condensed consolidated financial statements for the six months ended June 30, 2025 and

notes thereto, and together with our audited consolidated financial statements for the year ended December 31, 2024 and notes thereto filed with the SEC as part of our Annual Report.

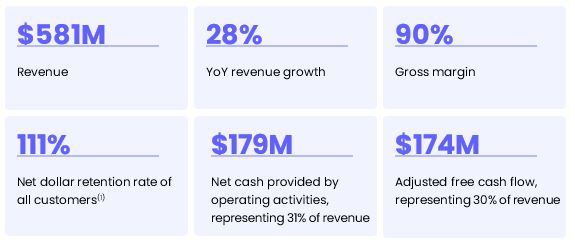

monday.com H1-25 overview in numbers

$581M Revenue 28% YoY revenue growth 90% Gross margin 111% Net dollar retention rate of all customers(1) $179M Net cash provided

by operating activities, representing 31% of revenue $174M Adjusted free cash flow, representing 30% of revenue Net cash provided by operating activities, representing 31% of revenue

(1) For a definition

of Net Dollar Retention Rate see “Key Business Metrics” below.

|

H1 2025

|

Growth at scale

We have experienced rapid growth since we launched our product in 2014.

| • |

Revenue: Our revenue was $581.3 million and $453.0 million for

the six months ended June 30, 2025, and June 30, 2024, respectively.

|

| • |

Year over Year Revenue Growth: Our revenue growth was 28% and

34% for the six months ended June 30, 2025, and June 30, 2024, respectively.

|

| • |

Net Income: Our net income was $29.0 million and $21.4 million

for the six months ended June 30, 2025, and June 30, 2024, respectively.

|

| • |

Net Cash Provided by Operating Activities: Our net cash

provided by operating activities was $178.8 million and $147.7 million for the six months ended June 30, 2025, and June 30, 2024, respectively.

|

| • |

Adjusted free Cash Flow: Our adjusted free cash flow was

$173.6 million and $140.7 million for the six months ended June 30, 2025, and June 30, 2024, respectively.

|

Key Business Metrics

We believe that our growth and financial performance are dependent upon many factors, including the key factors described below.

A Large and Diversified Customer Base

We are focused on expanding within our existing customers by increasing the number of users within the organization, upgrading to higher tiers and by offering additional products with new features, such as AI-powered risk insights, AI-powered portfolio report, managed templates and resource planning capabilities. Our operating results and growth opportunities depend, in part, on our ability

to attract new customers and expand relationships with existing customers. We believe we have significant greenfield opportunities among addressable customers worldwide and we will continue to invest in our research and development to differentiate

our platform and products from competitive products and services. We will also continue to invest in our sales and marketing to help us take advantage of this opportunity. To this extent, we are making significant investments in our sales and

marketing efforts, including investment and expansion of our CRO teams.

We define “customer” to mean a unique web domain-based account that is on a paid subscription plan, which could include an organization, educational or government institution, or distinct

business unit of an organization. We are not reliant on any specific customer, as no single customer accounts for more than 1% of our revenues, and our top 100 customers accounted for less than 10% of our revenues for the six months ended June 30,

2025, and 2024.

We see a significant opportunity to continue to add customers as we further develop our sales and marketing efforts and scale our platform and existing products, as well as add new products.

|

H1 2025

|

Consistent Growth of Enterprise Customers

Our ability to successfully move upmarket is demonstrated by the consistent growth in the number of our enterprise customers. We grew the number of enterprise customers, which we define as

customers with more than $50,000 in Annual Recurring Revenue (“ARR”) (defined below), on our platform by 36% from 2,713 customers as of June 30, 2024, to 3,702 customers as of June 30, 2025. The ARR from such enterprise customers grew by 44% from

June 30, 2024, to June 30, 2025, outpacing our overall ARR growth. As of June 30, 2025 and June 30, 2024, such enterprise customers accounted for 38% and 33% of our ARR, respectively.

Customers with more than $100,000 in ARR grew by 46% during the 12 months ended June 30, 2025, from 1,009 customers as of June 30, 2024, to 1,472 customers as of June 30, 2025. The ARR from

such enterprise customers grew by 51% from June 30, 2024, to June 30, 2025. As of June 30, 2025 and June 30, 2024, such enterprise customers accounted for 26% and 21% of our ARR, respectively.

We distinguish customers with more than 10 users from our broader customer base. We grew the number of such customers on our platform by 8% from 57,203 customers as of June 30, 2024, to 61,803

as of June 30, 2025. The ARR from such customers grew by 29% from June 30, 2024 to June 30, 2025. As of June 30, 2025 and June 30, 2024, such customers accounted for 80% and 78% of our ARR, respectively.

“Annual Recurring Revenue” or “ARR” is defined to mean, as of the measurement date, the annualized value of our customer subscriptions plans assuming that any contract that expires during the next 12 months is

renewed on its existing terms.

We believe ARR illustrates the improvements we have made to our products to increase the value we deliver to our customers over time. We expect the percentage of ARR attributable to customers

with more than 10 users to remain at similar levels.

Net Dollar Retention Rate

We expect to derive a significant portion of our revenue growth from expansion within our customer base, where we have an opportunity to expand adoption of our products across teams, departments, and organizations.

We believe that our dollar-based net retention rate (“Net Dollar Retention Rate”) underscores the significant opportunity to further expand within our existing customer base, particularly among those with high annual revenue.

We calculate Net Dollar Retention Rate as of a period end by starting with the ARR from customers as of the 12 months prior to such period end (“Prior Period ARR”). We then calculate the ARR

from these customers as of the current period end (“Current Period ARR”). The calculation of Current Period ARR includes any upsells, contraction and attrition. We then divide the total Current Period ARR by the total Prior Period ARR to arrive at

the Net Dollar Retention Rate.

For the trailing 12-month calculation, we take a weighted average of this calculation of our quarterly Net Dollar Retention Rate for the four quarters ending with the most recent quarter. Our

Net Dollar Retention Rate may fluctuate due to a number of factors, including the level of penetration within our customer base, expansion of products and features and our ability to retain our customers.

|

H1 2025

|

Our Net Dollar Retention Rate for all of our customers was 111% and 110% for the three months ended June 30, 2025 and June 30, 2024, respectively. Net Dollar Retention Rate for Customers with

more than $50,000 in ARR was 116% and 114% for the three months ended June 30, 2025 and June 30, 2024, respectively. Net Dollar Retention Rate for Customers with more than $100,000 in ARR was 117% and 114% for the three months ended June 30, 2025

and June 30, 2024, respectively. In addition, our Net Dollar Retention Rate for customers with more than 10 users was 115% and 114% for the three months ended June 30, 2025 and June 30, 2024, respectively.

A. Operating Results

Components of Results of Operations

The following briefly describes the components of revenue and expenses as presented in our consolidated statements of operations.

Revenue

We derive revenue mainly from monthly or annual subscription agreements with our customers for access to our cloud-based Work OS products. Our customers do not have the ability to take

possession of our software.

Cost of Revenue

Cost of revenue consists of merchant and credit card processing fees, hosting fees, amortization of capitalized software development costs, subcontractor costs, salaries and related expenses,

share-based compensation, software license fees, and allocated overhead costs.

Gross Profit and Gross Margin

Gross profit, or revenue less cost of revenues, and gross margin, or gross profit as a percentage of revenue, has been, and will continue to be, affected by various factors, including the

timing of our acquisition of new customers, renewals of and follow-on sales to existing customers, costs associated with operating our cloud-based products, and the extent to which we expand our operations and customer support organizations. We

expect our gross margin to remain relatively consistent over the long term.

Operating Expenses

Our operating expenses consist of research and development, sales and marketing, and general and administrative expenses. Sales and marketing expenses are the most significant component of our

operating expenses and consist of marketing and advertising expenses and commission paid to our partners. In addition, personnel-related expenses are a substantial component of our operating expenses and consist of salaries, benefits, and

share-based compensation expenses. Operating expenses also include an allocation of overhead costs for facilities and shared IT-related expenses, including depreciation expenses.

|

H1 2025

|

Research and Development Expenses

Research and development expenses include salaries and related expenses, share-based compensation, subcontractor costs and allocated overhead costs.

As we continue to focus our research and development efforts on enhancing our Work OS and existing products, as well as building new products, we expect our research and development expenses

to increase in absolute dollar amounts and remain at approximately the same level as a percentage of revenue. We foresee that such investment in research and development will contribute to our long-term growth

but will also negatively impact our short-term profitability.

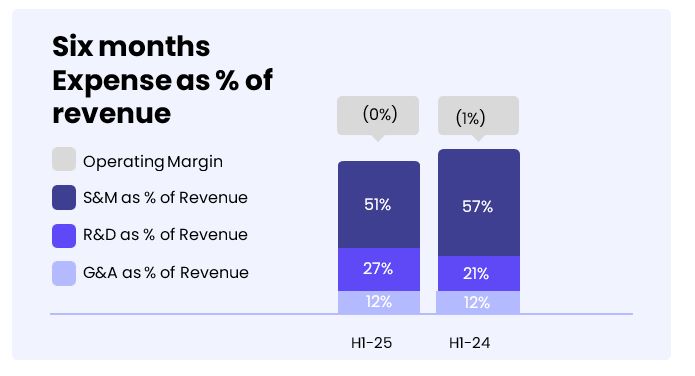

For the six months ended June 30, 2025, and June 30, 2024, our research and development expenses as a percentage of revenue were approximately 27% and 21%, respectively.

Sales and Marketing Expenses

Sales and marketing expenses consist primarily of compensation expenses for our employees, including share-based compensation, online and offline marketing and advertising expenses, channel

partners’ commissions and allocated overhead costs.

Our channel partners' commissions as a percentage of revenue were approximately 2% and 5% for the six months ended June 30, 2025, and June 30, 2024 (see also Note 2N to our 2024 consolidated

financial statements for the accounting policy for contract costs). For the six months ended June 30, 2025, and June 30, 2024, our sales and marketing expenses as a percentage of revenue were approximately 51% and 57%, respectively.

We expect our sales and marketing expenses will increase in absolute dollar amounts, as we plan to expand our sales and marketing efforts globally, through personnel, online and offline

marketing efforts and brand awareness. In the long term, as our business scales through customer expansion and market awareness, we anticipate that sales and marketing expenses as a percentage of total revenue will continue to decline.

General and Administrative Expenses

General and administrative expenses consist of salaries and related expenses, share-based compensation, professional service fees and allocated overhead costs.

We expect our general and administrative expenses to increase in absolute dollars as we continue to grow and expand our operations and operate as a public company. In the long term, we expect

that general and administrative expenses as a percent of total revenue will remain at approximately the same level. For both the six months ended June 30, 2025 and June 30, 2024, our general and administrative expenses as a percentage of revenue

were approximately 12%.

Financial Income, Net

Financial income, net, consists primarily of interest generated by our money market funds and marketable securities, amortization of discount on marketable securities and foreign exchange

gains and losses, offset by bank charges and interest expenses.

|

H1 2025

|

Income Tax Expenses

Income tax expenses consist primarily of income tax related to foreign jurisdictions in which we conduct business. We maintain a full valuation allowance on deferred tax assets because we have

concluded that it is not more likely than not that the deferred tax assets will be realized.

Comparison of Period-to-Period Results of Operations

The following tables set forth the consolidated statements of operations in U.S. dollars and as a percentage of revenue for the period presented.

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(in thousands)

|

||||||||

|

Revenue

|

$

|

581,264

|

$

|

453,019

|

||||

|

Cost of revenue (1)

|

59,978

|

47,217

|

||||||

|

Gross profit

|

521,286

|

405,802

|

||||||

|

Operating Expenses:

|

||||||||

|

Research and development (1)

|

156,424

|

94,868

|

||||||

|

Sales and marketing (1)

|

294,310

|

259,612

|

||||||

|

General and administrative (1)

|

72,307

|

54,550

|

||||||

|

Total operating expenses

|

523,041

|

409,030

|

||||||

|

Operating loss

|

(1,755

|

)

|

(3,228

|

)

|

||||

|

Financial income, net

|

31,749

|

27,689

|

||||||

|

Income before income taxes

|

29,994

|

24,461

|

||||||

|

Income tax expenses

|

(996

|

)

|

(3,068

|

)

|

||||

|

Net income

|

$

|

28,998

|

$

|

21,393

|

||||

(1) Includes

share-based compensation expense as follows:

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(in thousands)

|

||||||||

|

Cost of revenue

|

$

|

3,406

|

$

|

3,116

|

||||

|

Research and development

|

43,347

|

23,193

|

||||||

|

Sales and marketing

|

19,205

|

18,068

|

||||||

|

General and administrative

|

21,645

|

18,789

|

||||||

|

Total share-based compensation

|

$

|

87,603

|

$

|

63,166

|

||||

|

H1 2025

|

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

Revenue

|

100

|

%

|

100

|

%

|

||||

|

Cost of revenue

|

10

|

10

|

||||||

|

Gross profit

|

90

|

90

|

||||||

|

Operating Expenses:

|

||||||||

|

Research and development

|

27

|

21

|

||||||

|

Sales and marketing

|

51

|

57

|

||||||

|

General and administrative

|

12

|

12

|

||||||

|

Total operating expenses

|

90

|

90

|

||||||

|

Operating loss

|

(-

|

)

|

(1

|

)

|

||||

|

Financial income, net

|

5

|

6

|

||||||

|

Income before income taxes

|

5

|

5

|

||||||

|

Income tax expenses

|

(-

|

)

|

(1

|

)

|

||||

|

Net income

|

5

|

%

|

5

|

%

|

||||

Comparison of the Six Months Ended June 30, 2025 and 2024

Revenue

|

Six months ended June 30,

|

||||||||||||||||

|

2025

|

2024

|

Change

|

%

|

|||||||||||||

|

(in thousands)

|

||||||||||||||||

|

Revenue

|

$

|

581,264

|

$

|

453,019

|

$

|

128,245

|

28

|

%

|

||||||||

Revenue was $581.3 million for the six months ended June 30, 2025, an increase of $128.2 million, or 28%, compared to $453.0 million for the six months ended June 30, 2024. This increase was

driven primarily by the addition of new customers and revenues generated from our existing customers expanding their use of our products, as reflected by our dollar-based net retention rate of 111% as of June 30, 2025.

Cost of Revenue and Gross Profit

|

Six months ended June 30,

|

||||||||||||||||

|

2025

|

2024

|

Change

|

% change

|

|||||||||||||

|

(in thousands)

|

||||||||||||||||

|

Cost of revenue

|

$

|

59,978

|

$

|

47,217

|

$

|

12,761

|

27

|

%

|

||||||||

|

Gross profit

|

90

|

%

|

90

|

%

|

||||||||||||

Cost of revenue was $60.0 million for the six months ended June 30, 2025, an increase of $12.8 million, or 27%, compared to $47.2 million for the six months ended June 30, 2024. This increase

is directly related to the growth and scale of our business and was primarily driven by an increase of $3.7 million in salaries and related expenses, an increase of $3.3 million in hosting expenses, an increase of $2.3 million in third-party

consulting costs, an increase of $1.4 million in processing fees, an increase of $0.8 million in software and subscriptions costs, an increase in allocated overhead costs of $0.7 million as a result of increased overall costs to support our

business growth and related infrastructure and an increase of $0.3 million in share-based compensation expenses.

|

H1 2025

|

Operating Expenses

|

Six months ended June 30,

|

||||||||||||||||

|

2025

|

2024

|

Change

|

%

|

|||||||||||||

|

(in thousands)

|

||||||||||||||||

|

Research and development

|

$

|

156,424

|

$

|

94,868

|

$

|

61,556

|

65

|

%

|

||||||||

|

Sales and marketing

|

294,310

|

259,612

|

34,698

|

13

|

%

|

|||||||||||

|

General and administrative

|

72,307

|

54,550

|

17,757

|

33

|

%

|

|||||||||||

|

Total operating expenses

|

$

|

523,041

|

$

|

409,030

|

$

|

114,011

|

28

|

%

|

||||||||

Research and Development Expenses

Research and development expenses were $156.4 million for the six months ended June 30, 2025, an increase of $61.6 million, or 65%, compared to $94.9 million for the six months ended June 30,

2024. This increase is directly related to the growth and scale of our business and was primarily driven by an increase of $31.5 million in salaries and related expenses, an increase of $20.2 million in share-based compensation expenses, due to an

increase in the number of employees, an increase of $7.7 million in allocated overhead costs as a result of increased overall costs to support our business growth and related infrastructure, an increase of $1.1 million in software costs, and a $1.0

million increase in hosting costs, partially offset by a decrease of $0.8 million in third-party consulting costs.

Sales and Marketing Expenses

Sales and marketing expenses were $294.3 million for the six months ended June 30, 2025, an increase of $34.7 million, or 13%, compared to $259.6 million for the six months ended June 30,

2024. This increase is directly related to the growth and scale of our business and was primarily driven by an increase of $33.7 million in salaries and related expenses, an increase of $1.1 million in share-based compensation expenses, due to an

increase in the number of employees, an increase of $5.4 million in allocated overhead costs to support our business growth and related infrastructure, an increase of $2.4 million in courses and conferences expenses, an increase of $1.7 million in

online marketing campaigns, branding and costs associated with global events, an increase of $1.5 million in software costs, and an increase of $0.4 million in recruitment expenses, partially offset by a decrease of $13.1 million in partners

commissions.

General and Administrative Expenses

General and administrative expenses were $72.3 million for the six months ended June 30, 2025, an increase of $17.8 million, or 33%, compared to $54.6 million for the six months ended June 30,

2024. This increase is directly related to the growth and scale of our business and was primarily driven by an increase of $11.5 million in salaries and related expenses, an increase of $2.9 million in share-based compensation expenses due to an

increase in the number of employees, an increase of $8.5 million in rent and related expenses mainly due to our global office expansion, an increase of $1.2 million in welfare, an increase of $1.5 million in software expenses, an increase of $1.0

million in depreciation, and an increase of $0.7 million in legal fees, partially offset by a decrease of $13.8 million in overhead allocation.

|

H1 2025

|

Financial Income, Net

|

Six months ended June 30,

|

||||||||||||||||

|

2025

|

2024

|

Change

|

%

|

|||||||||||||

|

(in thousands)

|

||||||||||||||||

|

Financial income, net

|

$

|

31,749

|

$

|

27,689

|

$

|

4,060

|

15

|

%

|

||||||||

Financial income, net, was $31.7 million for the six months ended June 30, 2025, an increase of $4.1 million or 15%, compared to income of $27.7 million for the six months ended June 30, 2024.

This increase was partially driven by global macroeconomic trends, such as higher interest rates on our money market funds and marketable securities of $2.2 million.

Income Tax Expenses

|

Six months ended June 30,

|

||||||||||||||||

|

2025

|

2024

|

Change

|

%

|

|||||||||||||

|

(in thousands)

|

||||||||||||||||

|

Income tax expenses

|

$

|

996

|

$

|

3,068

|

$

|

(2,072

|

)

|

(68

|

)%

|

|||||||

Income tax expenses were $1.0 million for the six months ended June 30, 2025, a decrease of $2.1 million, or 68%, compared to $3.1 million for the six months ended June 30, 2024. The decrease

was primarily driven by tax benefits related to share-based compensation.

Non-GAAP Financial Measures

We regularly review several financial measures, including non-GAAP operating income and adjusted free cash flow, to evaluate our business, measure our performance, identify trends in our

business, prepare financial forecasts and make strategic decisions. We believe these non-GAAP financial measures are useful in evaluating our performance in addition to our financial results prepared in accordance with GAAP. You should read these

non-GAAP measures in conjunction with our unaudited condensed consolidated financial statements for the six months ended June 30, 2025, and notes thereto, and together with our audited consolidated financial statements for the year ended December

31, 2024, included in our Annual Report.

Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as substitutes for financial information presented under GAAP. For example, other

companies in our industry may calculate these non-GAAP financial measures differently or may use other measures to evaluate their performance. Investors are encouraged to review the reconciliations of these non-GAAP financial measures to their most

directly comparable GAAP financial measures and to not rely on any single financial measure to evaluate our business.

|

H1 2025

|

The following table sets forth our non-GAAP operating income and adjusted free cash flow for the six months ended June 30, 2025, and June 30, 2024:

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(in thousands)

|

||||||||

|

Non-GAAP operating income

|

$

|

85,848

|

$

|

59,938

|

||||

|

Adjusted free cash flow

|

$

|

173,625

|

$

|

140,715

|

||||

Non-GAAP Operating income

We define non-GAAP operating income as GAAP operating loss, adjusted for certain non-cash items, such as share-based compensation expenses. We exclude these items because these are non-cash

expenses, which we do not consider indicative of performance. In addition, management uses non-GAAP operating income to evaluate our financial performance and for planning and forecasting purposes. Non-GAAP operating income should not be considered

as an alternative to GAAP operating loss or net income as an indicator of operating performance. The following table provides a reconciliation of non-GAAP operating income to GAAP operating loss for the periods indicated:

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(in thousands)

|

||||||||

|

Operating loss

|

$

|

(1,755

|

)

|

$

|

(3,228

|

)

|

||

|

Share-based compensation expenses

|

87,603

|

63,166

|

||||||

|

Non-GAAP operating income

|

$

|

85,848

|

$

|

59,938

|

||||

Adjusted Free Cash Flow

We define adjusted free cash flow as net cash provided by operating activities less cash used for purchases of property and equipment and capitalized software development costs, plus costs associated with the built-out and expansion of our corporate headquarters.

|

H1 2025

|

We believe that adjusted free cash flow is a useful indicator of liquidity that provides information to management and investors, even if negative, about the amount of cash used in our

operations and for investments in property and equipment and capitalized software development costs. However, we caution that adjusted free cash flow does not reflect our future contractual commitments and the total increase or decrease of our cash

balance for a given period. The following table provides a reconciliation of net cash provided by operating activities to adjusted free cash flow for the periods indicated:

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(in thousands)

|

||||||||

|

Net cash provided by operating activities

|

$

|

178,807

|

$

|

147,749

|

||||

|

Purchase of property and equipment

|

(9,571

|

)

|

(5,964

|

)

|

||||

|

Capitalized software development costs

|

(1,703

|

)

|

(1,070

|

)

|

||||

|

Purchase of property and equipment related to build-out and expansion of our corporate headquarters

|

6,092

|

-

|

||||||

|

Adjusted free cash flow

|

$

|

173,625

|

$

|

140,715

|

||||

B. Liquidity and Capital Resources

As of June 30, 2025, we had $1,590.5 million in cash and cash equivalents and $60.1 million in short-term investments consisting of marketable securities. In the six months ended June 30,

2025, we generated net cash provided by operating activities, and we have also generated net cash provided by operating activities each year since our initial public offering in June 2021.

Excluding capital raises, our principal sources of funds are from our deferred revenue, which is included in the liabilities section of our consolidated balance sheet. Deferred revenue

consists of payments received in advance of revenue recognition, excluding amounts subject to right of return, and is recognized as revenue recognition criteria are met. We generally invoice our customers in advance of services being provided. The

majority of our deferred revenue is expected to be recognized as revenue during the succeeding 12-month period, provided all other revenue recognition criteria have been met. As of June 30, 2025, and December 31, 2024, we had deferred revenue of

$405.1 million and $342.6 million, respectively. We have generated losses from our operations as reflected in our accumulated deficit of $523.0 million and $552.0 million as of June 30, 2025, and December 31, 2024, respectively. Our future capital

requirements will depend on many factors, including revenue growth and costs incurred to support customer usage and growth in our customer base, increased research and development expenses to support the growth of our business and related

infrastructure, and general and administrative expenses to support being a publicly traded company.

We assess our liquidity primarily through our cash on hand as well as the projected timing of billings under contract with our paying customers and related collection cycles. We believe that

our current cash and cash equivalents will be sufficient to meet our working capital and capital expenditure requirements for at least the next 12 months and for the foreseeable future.

|

H1 2025

|

Cash Flows

The following table presents the summary consolidated cash flow information for the periods presented:

|

Six months ended June 30,

|

||||||||

|

2025

|

2024

|

|||||||

|

(in thousands)

|

||||||||

|

Net cash provided by operating activities

|

$

|

178,807

|

$

|

147,749

|

||||

|

Net cash used in investing activities

|

$

|

(21,323

|

)

|

$

|

(7,034

|

)

|

||

|

Net cash provided by financing activities

|

$

|

21,429

|

$

|

33,399

|

||||

Operating Activities

Cash provided by operating activities for the six months ended June 30, 2025, of $178.8 million was primarily related to our net income of $29.0 million, adjusted for non-cash charges of $94.1

million and net cash inflows of $55.7 million resulting from changes in our operating assets and liabilities. Non-cash charges primarily consisted of share-based compensation, depreciation and amortization of property and equipment and amortization

of discount and accretion of discount on our marketable securities. The main drivers of the changes in operating assets and liabilities were a $62.5 million increase in deferred revenue, resulting primarily from increased billings for

subscriptions, a $24.1 million increase in accrued expenses and other liabilities, and a $6.2 million increase in accounts payable primarily driven by payments timing differences. These amounts were partially offset by a $26.8 million increase in

prepaid expenses and other assets, primarily associated with the revaluation of a foreign currency hedging asset and a $10.4 million increase in accounts receivables, net.

Cash provided by operating activities for the six months ended June 30, 2024 of $147.7 million was primarily related to our net income of $21.4 million, adjusted for non-cash charges of $68.6

million and net cash inflows of $57.7 million resulting from changes in our operating assets and liabilities. Non-cash charges primarily consisted of share-based compensation and depreciation and amortization of property and equipment. The main

drivers of the changes in operating assets and liabilities were a $50.2 million increase in deferred revenue, resulting primarily from increased billings for subscriptions, a $2.7 million increase in accrued expenses and other liabilities, and a

$21.7 million increase in accounts payable primarily driven by payments timing differences. These amounts were partially offset by a $15.2 million increase in prepaid expenses and other assets and a $1.7 million increase in accounts receivables,

net.

Investing Activities

Cash used in investing activities during the six months ended June 30, 2025, was $21.3 million, primarily as a result of purchases of marketable securities in the amount of $10 million and

$11.3 million of purchases of property and equipment and capitalized software development costs.

Cash used in investing activities during the six months ended June 30, 2024 was $7.0 million, as a result of purchases of property and equipment and capitalized software development costs.

|

H1 2025

|

Financing Activities

Cash provided by financing activities for the six months ended June 30, 2025, was $21.4 million and was primarily as a result of proceeds of $26.5 million from exercise of share options and

purchases under the employee share purchase plan, partially offset by repayments of $5.1 million relating to exercises of share options and RSUs, net.

Cash provided by financing activities for the six months ended June 30, 2024 was $33.4 million and was primarily as a result of proceeds of $19.3 million from exercise of share options and

purchases under the employee share purchase plan and a receipt of tax advance in the amount of $14.1 million relating to exercises of share options and RSUs, net.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements, as defined by applicable regulations of the SEC, that are reasonably likely to have a current or future material effect on our financial

condition, results of operations, liquidity, capital expenditures or capital resources.

C. Research and development, patents and licenses, etc.

A comprehensive discussion of our research and development, patents and licenses, etc., is included in “Part 1 - Who We Are” and “Part 4 - Operating and Financial Review and Prospects -

Operating Results” sections in our Annual Report.

D. Trend information

Other than as disclosed above and in our Annual Report, we are not aware of any trends, uncertainties, demands, commitments or events since June 30, 2025, that are reasonably likely to have a

material adverse effect on our net revenue, income, profitability, liquidity or capital resources, or that caused the disclosed financial information to be not necessarily indicative of future operating results or financial condition.

E. Critical Accounting Estimates

We describe our significant accounting policies more fully in Note 2 to our unaudited condensed consolidated financial statements for the six months ended June 30, 2025. There have been no

material changes to our critical accounting policies since we filed our Annual Report. Please see “Part 4. Operating and Financial Review and Prospects – E. Critical Accounting Estimates” section in our Annual Report.

F. Quantitative and Qualitative Disclosures About Market Risk

We are exposed to market risk in the ordinary course of our business. Market risk represents the risk of loss that may impact our financial position due to adverse changes in financial market

prices and rates. Our market risk exposure is primarily a result of foreign currency exchange rates and interest rates, which are discussed in detail below.

|

H1 2025

|

Foreign Currency Risk

The U.S. dollar is our functional currency. The majority of our revenue was denominated in U.S. dollars for the six months ended June 30, 2025, and June 30, 2024; however certain expenses

comprising our cost of revenue and operating expenses were denominated in NIS, mainly payroll and rent.

This foreign currency exposure gives rise to market risk associated with exchange rate movements of the U.S. dollar against the NIS. Furthermore, we anticipate that a material portion of our

expenses will continue to be denominated in NIS.

A decrease of 5% in the U.S. dollar to NIS exchange rate would have increased our cost of revenue and operating expenses by approximately 1% during each of the six months ended June 30, 2025,

and June 30, 2024. If the NIS fluctuates significantly against the U.S. dollar, it may have a negative impact on our results of operations.

To reduce the impact of foreign exchange risks associated with forecasted future cash flows and the volatility in our Consolidated Statements of Operations, we have established a hedging

program as further described in Note 2 to our audited consolidated financial statements included in our Annual Report. Foreign currency contracts are generally utilized in this hedging program. Our foreign currency contracts are short-term in

duration. We do not enter into derivative instruments for trading or speculative purposes.

We account for our derivative instruments as either assets or liabilities and carry them at fair value in the Consolidated Balance Sheets. The accounting for changes in the fair value of the

derivative depends on the intended use of the derivative and the resulting designation. Our hedging program reduces but does not eliminate the impact of currency exchange rate movements.

Our derivatives expose us to credit risk to the extent that the counterparties may be unable to meet the terms of the agreement. We seek to mitigate such risk by limiting our counterparties to

major financial institutions and by spreading the risk across a number of major financial institutions. However, failure of one or more of these financial institutions is possible and could result in incurred losses.

As of June 30, 2025, the notional amount of our outstanding foreign exchange contracts was $274.3 million, all of which met the requirements of hedge accounting.

The table below provides information regarding our derivative instruments held in order to limit the exposure to exchange rate fluctuation as of June 30, 2025 (in thousands of dollars):

|

Derivatives designated as hedging instruments:

|

Maturity in 2025-2026

|

|||

|

Foreign exchange contracts:

|

||||

|

NIS

|

$

|

274,259

|

||

|

Total

|

$

|

274,259

|

||

Interest Rate Risk

We believe that we have no significant exposure to interest rate risk, as we have no long-term loans. However, our future interest income may fall short of expectations due to changes in

market interest rates.