Western Union August 11, 2025

Western Union 2 Forward-Looking Statements Safe Harbor Compliance Statement for

Forward-Looking Statements This presentation contains certain statements that are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance and involve

certain risks, uncertainties, and assumptions that are difficult to predict. Actual outcomes and results may differ materially from those expressed in, or implied by, our forward-looking statements. Words such as “expects,” “intends,”

“targets,” “anticipates,” “believes,” “estimates,” “guides,” “provides guidance,” “provides outlook,” “projects,” “designed to,” and other similar expressions or future or conditional verbs such as “may,” “will,” “should,” “would,” “could,” and

“might” are intended to identify such forward-looking statements. Readers of this press release of The Western Union Company (the “Company,” “Western Union,” “we,” “our,” or “us”) should not rely solely on the forward-looking statements and

should consider all uncertainties and risks discussed in the Risk Factors section of our Annual Report on Form 10-K for the year ended December 31, 2024 and in our subsequent filings with the Securities and Exchange Commission. The statements

are only as of the date they are made, and the Company undertakes no obligation to update any forward-looking statement. Possible events or factors that could cause results or performance to differ materially from those expressed in our

forward-looking statements include the following: changes in economic conditions, trade disruptions, or significantly slower growth or declines in the money transfer, payment service, and other markets in which we operate; interruptions in

migration patterns or other events, such as public health emergencies, any changes arising as a result of policy changes in the United States and/or other key markets, civil unrest, war, terrorism, natural disasters, or non-performance by our

banks, lenders, insurers, or other financial services providers; failure to compete effectively in the money transfer and payment service industry, including among other things, with respect to digital, mobile and internet-based services, card

associations, and card-based payment providers, and with digital currencies, including cryptocurrencies; geopolitical tensions, political conditions and related actions, including trade restrictions, tariffs, and government sanctions;

deterioration in customer confidence in our business; failure to maintain our agent network and business relationships; our ability to adopt new technology; the failure to realize anticipated financial benefits from mergers, acquisitions and

divestitures; decisions to change our business mix; exposure to foreign exchange rates; changes in tax laws, or their interpretation, and unfavorable resolution of tax contingencies; cybersecurity incidents involving any of our systems or those

of our vendors or other third parties; cessation of or defects in various services provided to us by third-party vendors; our ability to realize the anticipated benefits from restructuring-related initiatives; our ability to attract and retain

qualified key employees; failure to manage credit and fraud risks presented by our agents, clients, and consumers; adverse rating actions by credit rating agencies; our ability to protect our intellectual property rights, and to defend

ourselves against potential intellectual property infringement claims; material changes in the market value or liquidity of securities that we hold; restrictions imposed by our debt obligations; liabilities or loss of business resulting from a

failure by us, our agents, or their subagents to comply with laws and regulations and regulatory or judicial interpretations thereof; increased costs or loss of business due to regulatory initiatives and changes in laws, regulations, and

industry practices and standards; developments resulting from governmental investigations and consent agreements with, or investigations or enforcement actions by, regulators and other government authorities; liabilities resulting from

litigation; failure to comply with regulations and evolving industry standards regarding data privacy; failure to comply with consumer protection laws; effects of unclaimed property laws or their interpretation or the enforcement thereof;

failure to comply with working capital requirements; changes in accounting standards, rules and interpretations; and other unanticipated events and management’s ability to identify and manage these and other risks. Important factors that could

cause Western Union’s or Intermex’s or the combined company’s actual results to differ materially from the results referred to in the forward-looking statements Western Union makes in this release include: the possibility that the conditions to

the consummation of the proposed acquisition of Intermex (the “Proposed Acquisition”) will not be satisfied on the terms or timeline expected, or at all; failure to obtain, or delays in obtaining, or adverse conditions related to obtaining

stockholder or regulatory approvals sought in connection with the Proposed Acquisition; dependence on key agents and the potential effects of network disruption; the possibility that Western Union may be unable to achieve expected benefits,

synergies and operating efficiencies in connection with the Proposed Acquisition; and failure to retain key management of Western Union or Intermex. Additional Information and Where to Find It This communication relates to a proposed

acquisition (the “Transaction”) of International Money Express, Inc. (“Intermex”) by The Western Union Company (“Western Union”). In connection with the proposed transaction between Intermex and Western Union, Intermex will file with the

Securities and Exchange Commission (the “SEC”) a proxy statement (the “Proxy Statement”), the definitive version of which will be sent or provided to Intermex stockholders. Intermex may also file other documents with the SEC regarding the

proposed transaction. This document is not a substitute for the Proxy Statement or any other document which Intermex may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS

THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED

MATTERS. Investors and security holders may obtain free copies of the Proxy Statement (when it is available) and other documents that are filed with the SEC or will be filed with the SEC by Intermex (when they become available) through the

website maintained by the SEC at http://www.sec.gov or from Intermex at its website, www.Intermexonline.com. Participants in the Solicitation Intermex, and certain of its directors and executive officers may be deemed to be participants in

the solicitation of proxies from the stockholders of Intermex in connection with the Transaction under the rules of the SEC. Information about the interests of the directors and executive officers of Intermex and other persons who may be deemed

to be participants in the solicitation of stockholders of Intermex in connection with the Transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the Proxy Statement related

to the Transaction, which will be filed with the SEC. Additional information about Intermex, the directors and executive officers of Intermex and their ownership of Intermex common stock can also be found in its Annual Report on Form 10-K for

the year ended December 31, 2024, as filed with the SEC on February 27, 2025, and its definitive proxy statement, as amended, as filed with the SEC on May 12, 2025, and other documents subsequently filed by Intermex with the SEC. Free copies of

these documents may be obtained as described above. To the extent holdings of Intermex securities by its directors or executive officers have changed since the amounts set forth in such documents, such changes have been or will be reflected on

Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Additional information regarding the identity of potential participants, and their direct or indirect interests, by

security holdings or otherwise, will be included in the Proxy Statement relating to the proposed transaction when it is filed with the SEC.

Western Union Devin McGranahan President & CEO 3

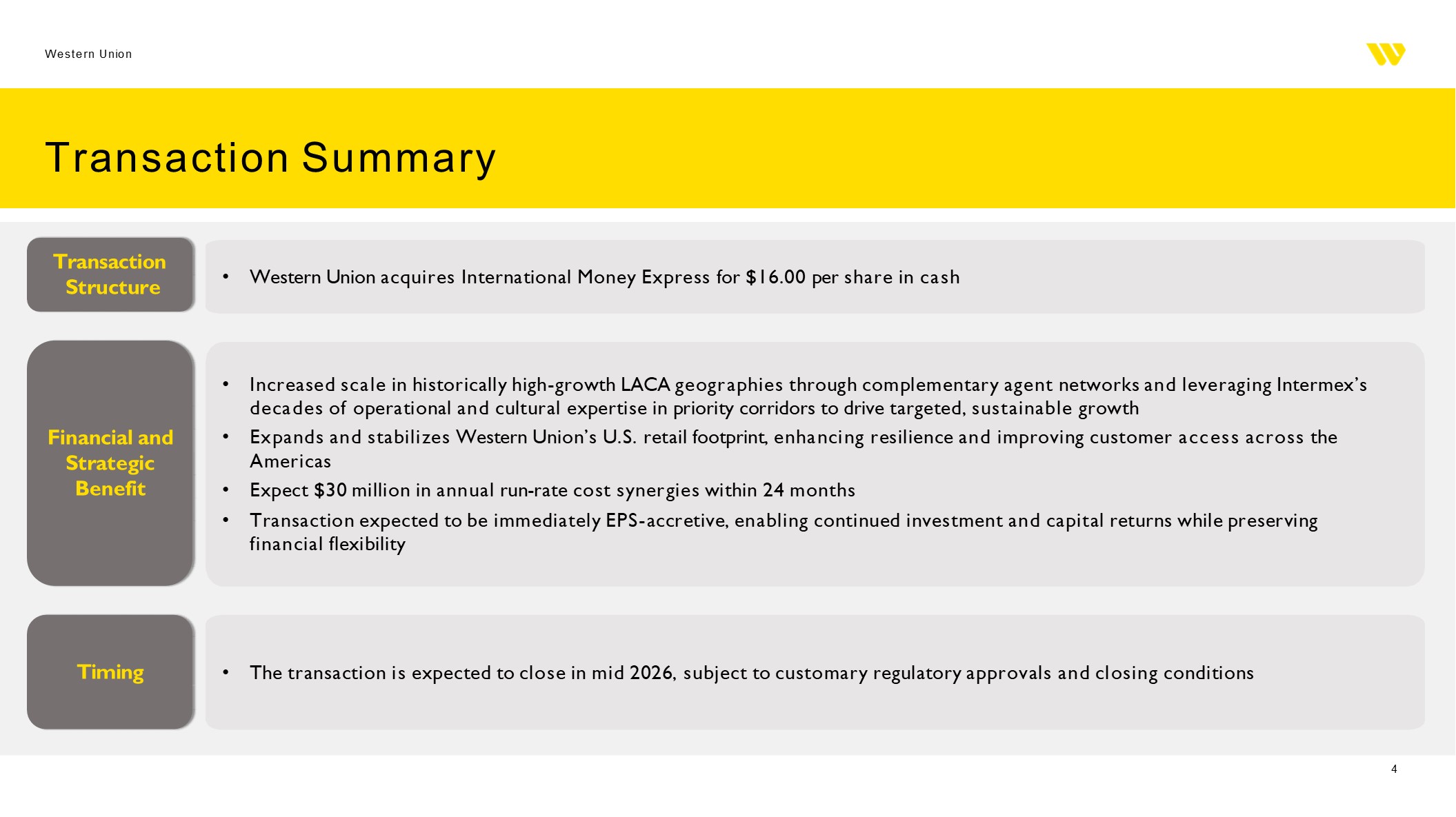

Western Union Transaction Summary Western Union acquires International Money

Express for $16.00 per share in cash Increased scale in historically high-growth LACA geographies through complementary agent networks and leveraging Intermex’s decades of operational and cultural expertise in priority corridors to drive

targeted, sustainable growth Expands and stabilizes Western Union’s U.S. retail footprint, enhancing resilience and improving customer access across the Americas Expect $30 million in annual run-rate cost synergies within 24

months Transaction expected to be immediately EPS-accretive, enabling continued investment and capital returns while preserving financial flexibility The transaction is expected to close in mid 2026, subject to customary regulatory approvals

and closing conditions Transaction Structure Financial and Strategic Benefit Timing 3

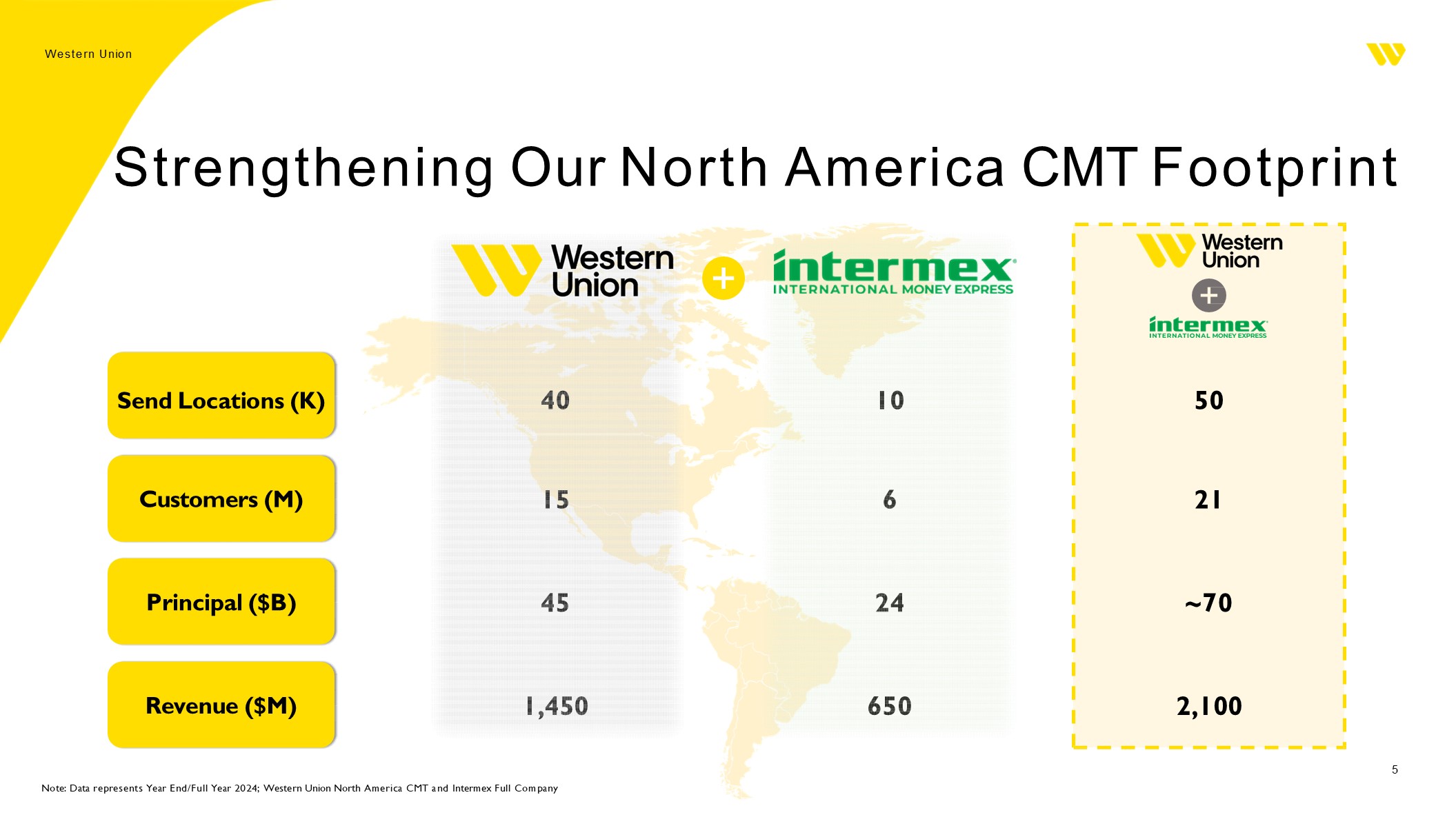

Western Union Strengthening Our North America CMT Footprint Send Locations

(K) 40 10 50 Customers (M) 15 6 21 Principal ($B) 45 24 ~70 Revenue ($M) 1,450 650 2,100 5 Note: Data represents Year End/Full Year 2024; Western Union North America CMT and Intermex Full Company

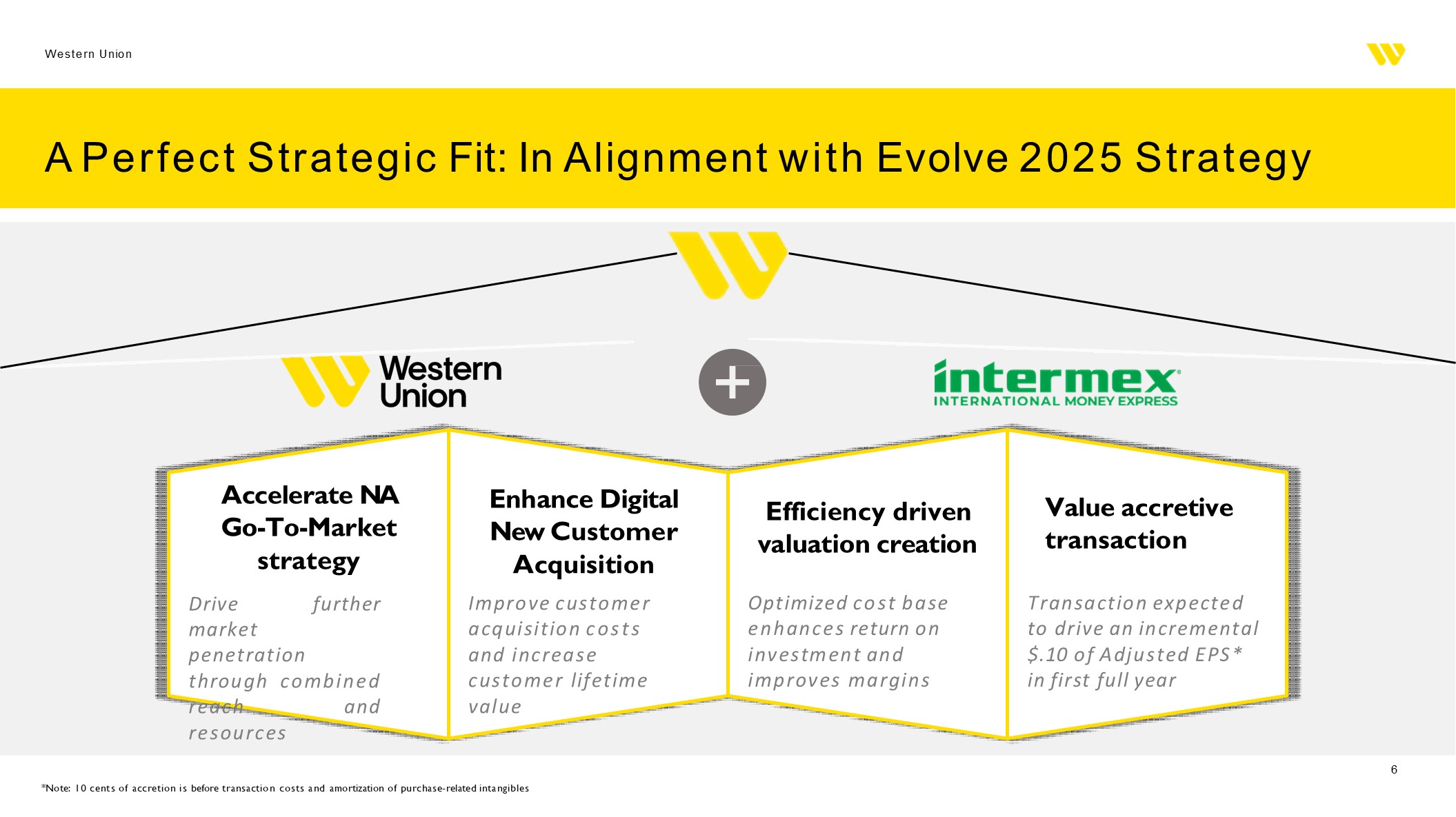

Western Union 6 A Perfect Strategic Fit: In Alignment with Evolve 2025

Strategy Accelerate NA Go-To-Market strategy Drive further market penetration through combined reach and resources Enhance Digital New Customer Acquisition Improve customer acquisition costs and increase customer lifetime value Optimized

cost base enhances return on investment and improves margins Efficiency driven valuation creation Transaction expected to drive an incremental $.10 of Adjusted EPS* in first full year *Note: 10 cents of accretion is before transaction costs

and amortization of purchase-related intangibles Value accretive transaction

Western Union Robust Free Cash Flow Generation and Strong Credit Profile $30

million in cost savings within 24 months No material impact to Capital Allocation Strategy Strengthens long term Free Cash Conversion 8 Disciplined Capital Allocation Strategy

Western Union Questions and Answers 8