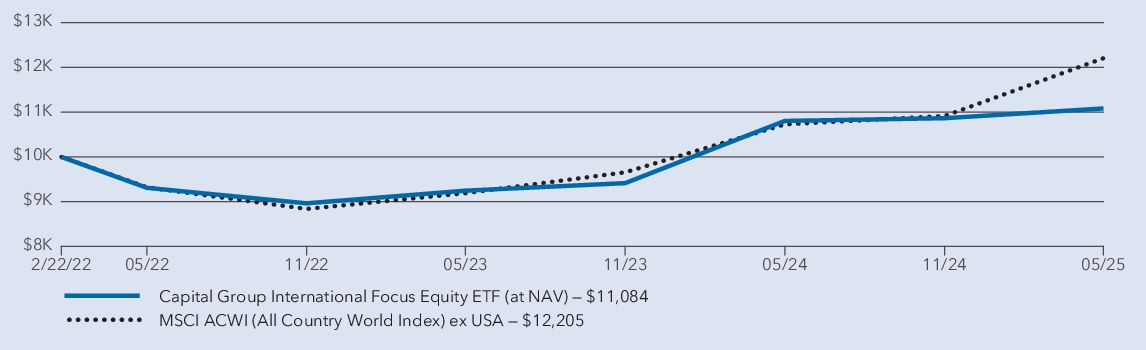

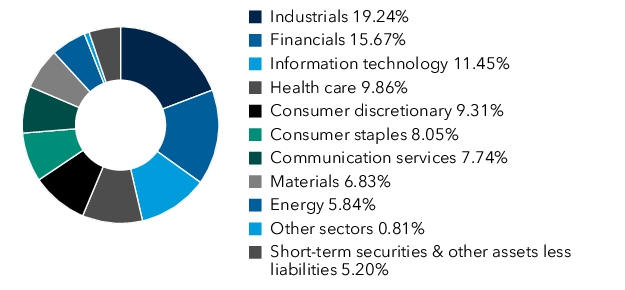

Management's discussion of fund performance The fund's shares gained 2.58% on a net asset value (NAV) basis and 1.99% on a market price basis for the year ended May 31, 2025. These results compare with a 13.75% gain for the MSCI ACWI (All Country World Index) ex USA. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/ETF-returns . What factors influenced results Europe saw moderate growth driven by resilient domestic demand and easing inflation despite trade tensions. Germany’s reform of its fiscal framework is expected to boost the country’s economy with potentially broader positive implications for Europe. The U.K. showed signs of economic recovery amid persistent inflation. Japan's economic growth weakened, dragged down by stagnant private consumption and slowing exports. Among emerging markets, China was aided by government stimulus and increased overall exports, while India’s economy remained resilien t des pite slower growth amid global challenges. Holdings in communication services, financials, consumer staples contributed the most to returns during the fund’s fiscal year. Holdings in information technology, industrials and real estate also contributed to returns. Geographically, holdings of companies based in the U.S., Germany and Singapore were the top three contributors. In terms of detractors, holdings in the health care, materials, utilities and energy sectors had negative returns during the period. Holdings of companies based in the U.K., Denmark and Japan detracted from portfolio returns.

|