Shareholder Report

|

6 Months Ended |

|

May 31, 2025

USD ($)

Holdings

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

Tidal

Trust III

|

| Entity Central Index Key |

0001722388

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

May 31, 2025

|

| NestYield Total Return Guard ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

NestYield Total Return Guard ETF

|

| Class Name |

NestYield Total Return Guard ETF

|

| Trading Symbol |

EGGS

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the NestYield Total Return Guard ETF (the "Fund") for the period December 26, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://nestyield.com/. You can also request this information by contacting us at (855) 879‑5979 or by writing to NestYield Total Return Guard ETF, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701.

|

| Additional Information Phone Number |

(855) 879‑5979

|

| Additional Information Website |

https://nestyield.com/

|

| Expenses [Text Block] |

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

NestYield Total Return Guard ETF | $38 | 0.89% |

|

| Expenses Paid, Amount |

$ 38

|

| Expense Ratio, Percent |

0.89%

|

| Net Assets |

$ 19,817,000

|

| Holdings Count | Holdings |

61

|

| Advisory Fees Paid, Amount |

$ 48,439

|

| Investment Company, Portfolio Turnover |

44.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

| |

|---|

Fund Size (Thousands) | $19,817 | Number of Holdings | 61 | Total Advisory Fee Paid | $48,439 | Portfolio Turnover Rate | 44% |

|

| Holdings [Text Block] |

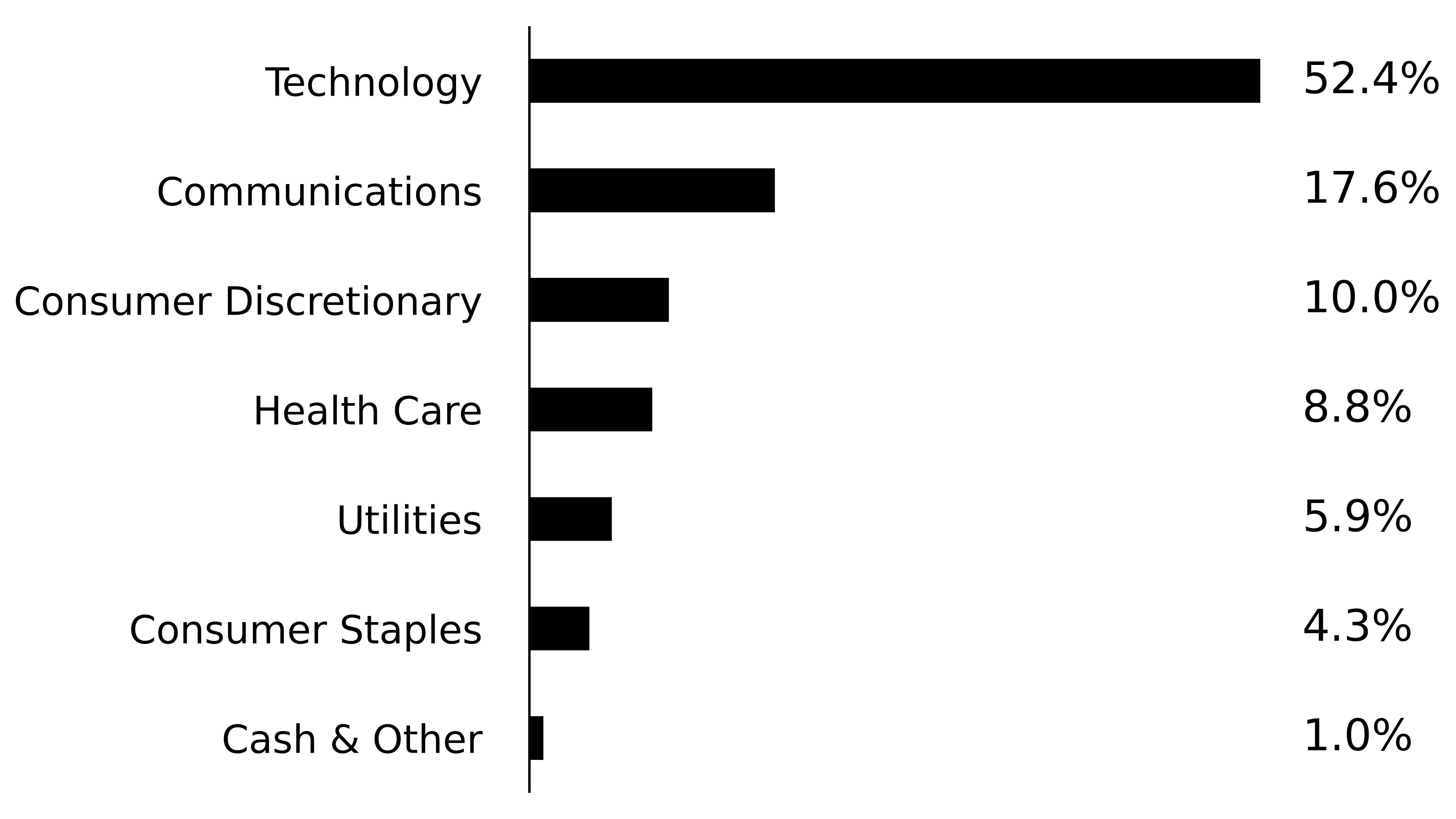

Sector Breakdown

(% of Total Net Assets)

|

| Largest Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025)

Top Ten Holdings | (Percentage of Net Assets) |

|---|

NVIDIA Corp. | 12.6 | Broadcom, Inc. | 12.3 | Eli Lilly & Co. | 6.9 | Tesla, Inc. | 5.6 | Vistra Corp. | 5.5 | Netflix, Inc. | 5.3 | MicroStrategy, Inc. | 5.3 | Microsoft Corp. | 5.0 | Taiwan Semiconductor Manufacturing Co. Ltd. | 4.9 | Meta Platforms, Inc. | 4.6 |

|

| Material Fund Change [Text Block] |

How Has the Fund Changed? There we no material changes during the reporting period.

|

| Accountant Change Statement [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| NestYield Dynamic Income ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

NestYield Dynamic Income ETF

|

| Class Name |

NestYield Dynamic Income ETF

|

| Trading Symbol |

EGGY

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the NestYield Dynamic Income ETF (the "Fund") for the period December 26, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://nestyield.com/. You can also request this information by contacting us at (855) 879‑5979 or by writing to NestYield Dynamic Income ETF, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701.

|

| Additional Information Phone Number |

(855) 879‑5979

|

| Additional Information Website |

https://nestyield.com/

|

| Expenses [Text Block] |

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

NestYield Dynamic Income ETF | $38 | 0.89% |

|

| Expenses Paid, Amount |

$ 38

|

| Expense Ratio, Percent |

0.89%

|

| Net Assets |

$ 22,907,000

|

| Holdings Count | Holdings |

57

|

| Advisory Fees Paid, Amount |

$ 51,053

|

| Investment Company, Portfolio Turnover |

53.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

| |

|---|

Fund Size (Thousands) | $22,907 | Number of Holdings | 57 | Total Advisory Fee Paid | $51,053 | Portfolio Turnover Rate | 53% |

|

| Holdings [Text Block] |

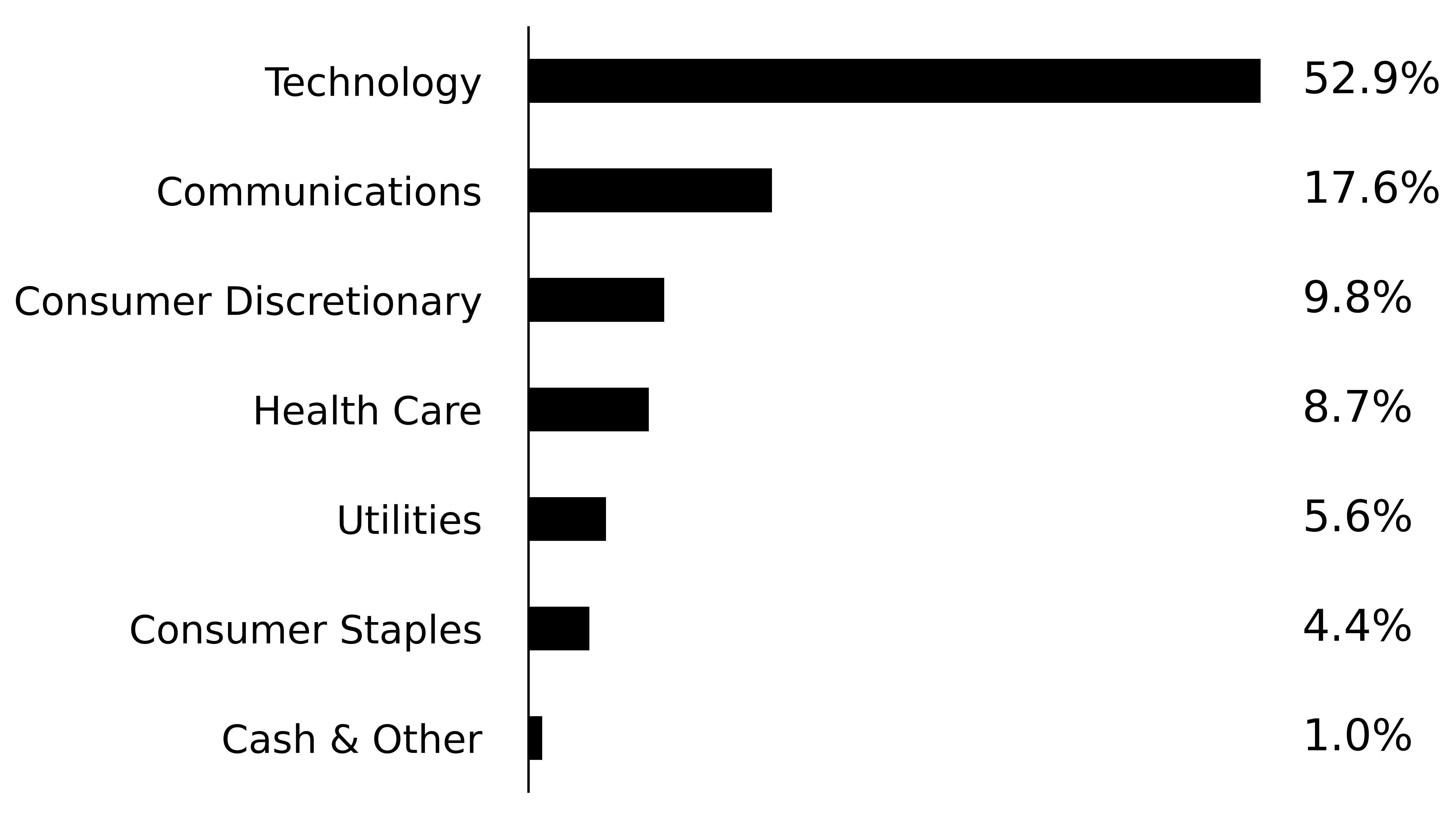

Sector Breakdown

(% of Total Net Assets)

|

| Largest Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025)

Top Ten Holdings | (Percentage of Net Assets) |

|---|

NVIDIA Corp. | 12.7 | Broadcom, Inc. | 12.4 | Eli Lilly & Co. | 7.0 | Vistra Corp. | 5.3 | Tesla, Inc. | 5.3 | Netflix, Inc. | 5.2 | MicroStrategy, Inc. | 5.1 | Microsoft Corp. | 5.0 | Taiwan Semiconductor Manufacturing Co. Ltd. | 5.0 | Meta Platforms, Inc. | 4.7 |

|

| Material Fund Change [Text Block] |

How Has the Fund Changed? There we no material changes during the reporting period.

|

| Accountant Change Statement [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|

| NestYield Visionary ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

NestYield Visionary ETF

|

| Class Name |

NestYield Visionary ETF

|

| Trading Symbol |

EGGQ

|

| Security Exchange Name |

NASDAQ

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the NestYield Visionary ETF (the "Fund") for the period December 27, 2024 to May 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://nestyield.com/. You can also request this information by contacting us at (855) 879-5979 or by writing to NestYield Visionary ETF, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701.

|

| Additional Information Phone Number |

(855) 879-5979

|

| Additional Information Website |

https://nestyield.com/

|

| Expenses [Text Block] |

What were the Fund costs for the period?

(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

NestYield Visionary ETF | $39 | 0.89% |

|

| Expenses Paid, Amount |

$ 39

|

| Expense Ratio, Percent |

0.89%

|

| Net Assets |

$ 32,475,000

|

| Holdings Count | Holdings |

24

|

| Advisory Fees Paid, Amount |

$ 58,970

|

| Investment Company, Portfolio Turnover |

61.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of May 31, 2025)

| |

|---|

Fund Size (Thousands) | $32,475 | Number of Holdings | 24 | Total Advisory Fee Paid | $58,970 | Portfolio Turnover Rate | 61% |

|

| Holdings [Text Block] |

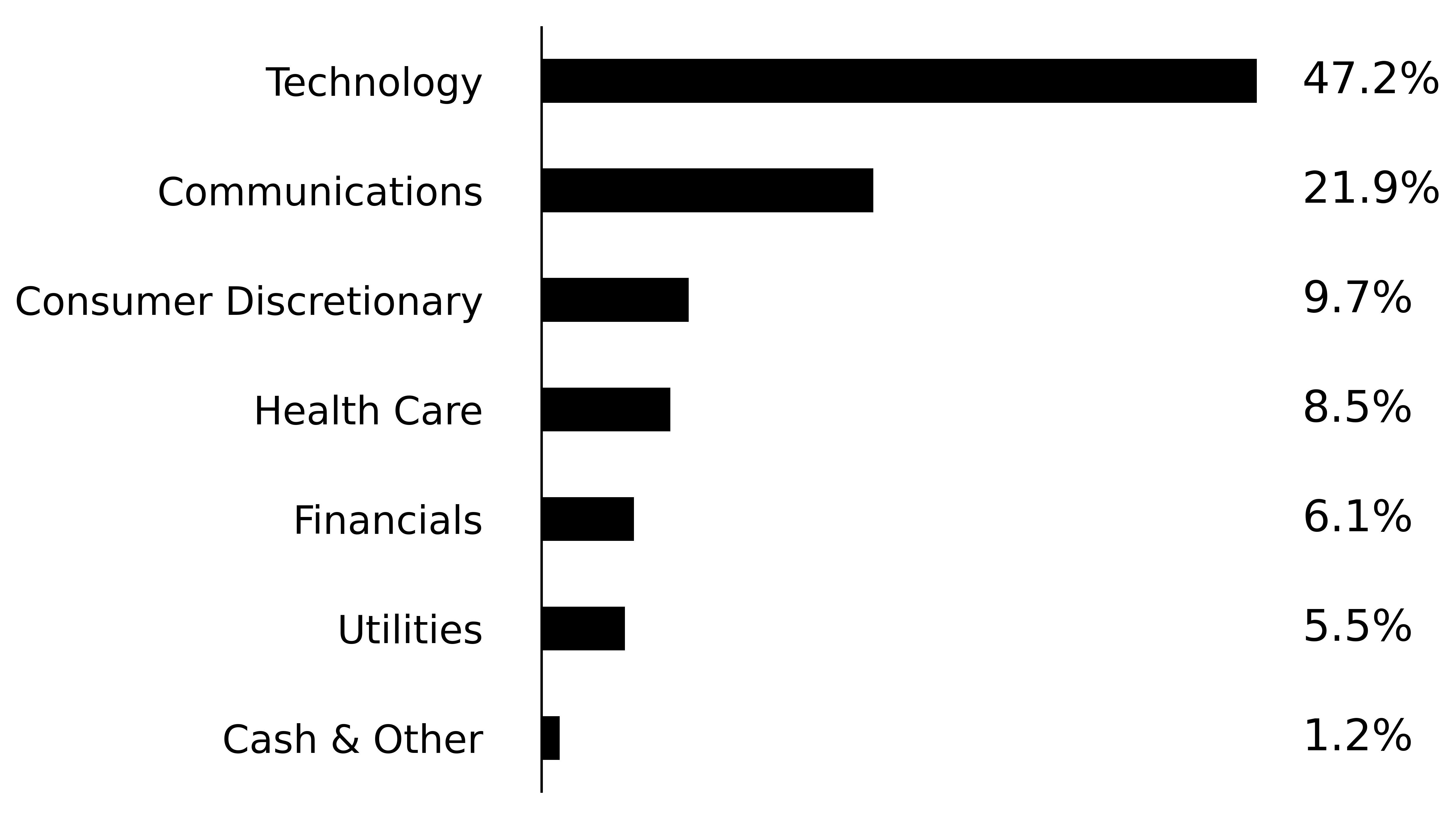

Sector Breakdown

(% of Total Net Assets)

|

| Largest Holdings [Text Block] |

What did the Fund invest in? (as of May 31, 2025)

Top Ten Holdings | (Percentage of Net Assets) |

|---|

NVIDIA Corp. | 12.5 | Broadcom, Inc. | 11.5 | Meta Platforms, Inc. | 7.0 | Eli Lilly & Co. | 6.5 | MicroStrategy, Inc. | 6.0 | Vistra Corp. | 5.5 | Netflix, Inc. | 5.4 | Tesla, Inc. | 5.4 | Microsoft Corp. | 5.0 | Taiwan Semiconductor Manufacturing Co. Ltd. | 4.7 |

|

| Material Fund Change [Text Block] |

How Has the Fund Changed? There we no material changes during the reporting period.

|

| Accountant Change Statement [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with accountants during the reporting period.

|