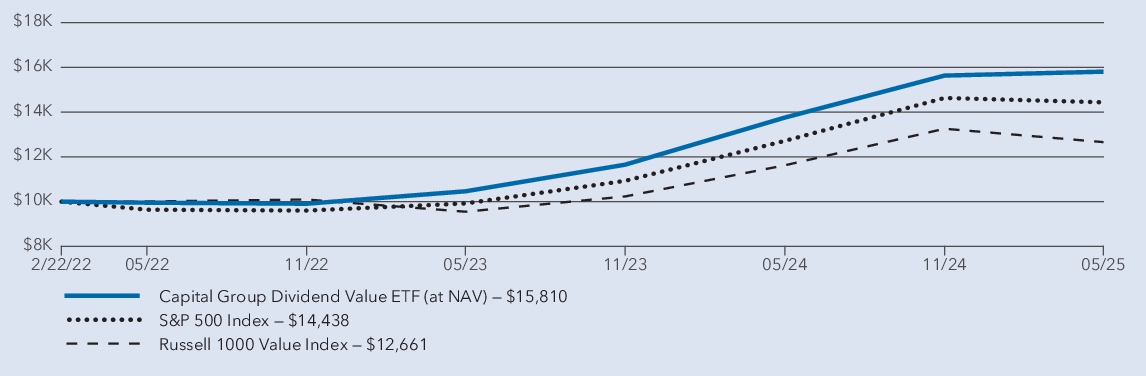

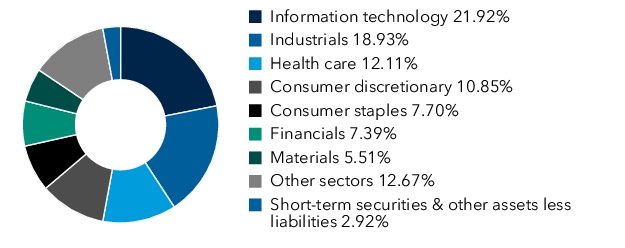

Management's discussion of fund performance The fund's shares gained 14.91% on a net asset value (NAV) basis and 14.77% on a market price basis for the year ended May 31, 2025. These results compare with a 13.52% gain for the S&P 500 Index. For information on returns for additional periods, including the fund lifetime, please refer to capitalgroup.com/ETF-returns . What factors influenced results U.S. equity markets delivered strong returns, rebounding from early 2025 volatility on the back of a late-stage rally in the technology sector. The financials and consumer discretionary sectors led the gains, supported by shifting interest rates and a pickup in consumer spending. Overall, during the fund's fiscal year the U.S. economy maintained steady growth, despite witnessing a contraction in the first quarter of 2025 amid rising tariff tensions. As inflation moderated, the Federal Reserve implemented three rate cuts in 2024 to stimulate the economy and improve consumer sentiment. Within the fund, most sectors added positive returns to the overall portfolio, with information technology, industrial and consumer staples companies contributing the most. Likewise, holdings in financials and communication services saw returns above those of the overall portfolio. Consumer discretionary and energy shares were also positive, though below the portfolio’s total return. In terms of detractors, holdings in the materials, utilities and health care sectors posted negative returns during the period.

|