Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

VALIC Co I

|

|

| Entity Central Index Key |

0000719423

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

May 31, 2025

|

|

| C000021763 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Asset Allocation

|

|

| Class Name |

Asset Allocation

|

|

| Trading Symbol |

VCAAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the VALIC Company I Asset Allocation Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Fund costs for the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Asset Allocation Fund* |

$68 |

0.65% |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies (“Variable Contracts”) that invest in the Fund.

|

|

|

| Expenses Paid, Amount |

$ 68

|

[1] |

| Expense Ratio, Percent |

0.65%

|

[1] |

| Factors Affecting Performance [Text Block] |

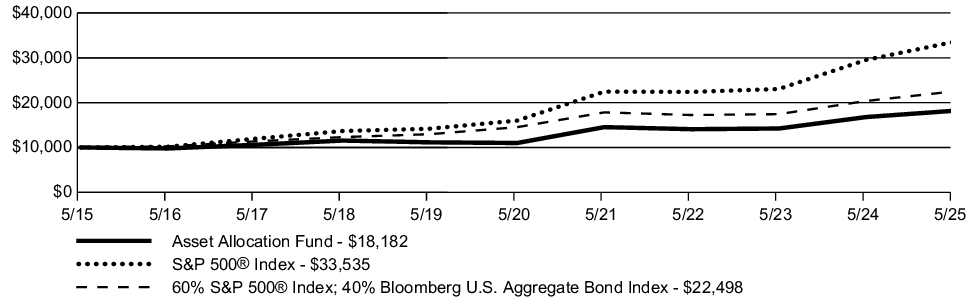

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund posted a return of 8.30% for the year ended May 31,2025, compared to 13.52% for the S&P 500® Index (a broad-based securities market index) and 10.40% for the Blended Index (the "Performance Index") comprised of 60% S&P 500® Index; 40% Bloomberg U.S. Aggregate Bond Index. Over the period, U.S. large-cap equities outperformed small-cap equities. The U.S. Treasury curve bull steepened. The two-year U.S. Treasury yield decreased by 98 bps to 3.90%, the five-year yield decreased by 55 bps ending at 3.96%, the ten-year yield decreased by 10 bps to 4.40%, and the thirty-year yield increased by 28 bps to 4.93%.

The following is a summary of the top contributors and detractors that impacted the Fund's performance during the year relative to the Performance Index.

TOP PERFORMANCE CONTRIBUTORS

For the equity segment of the fund | Allocations in the following sectors: consumer discretionary; industrials; consumer staples. Security selection in the following sectors: financials; energy; industrials. Position weightings: Howmet Aerospace, Inc.; Wells Fargo & Co.; Merck & Co., Inc.

For the fixed income segment of the fund | Allocations in the following sectors: Treasuries; agency mortgage-backed securities; non-agency mortgage-backed securities. Security selection in the following sectors: corporate credit; asset-backed securities; collateralized mortgage-backed securities

TOP PERFORMANCE DETRACTORS

For the equity segment of the fund | Allocations in the following sectors: energy; cash; communication services. Security selection in the following sectors: information technology; consumer discretionary; health care. Position Weightings: Regeneron Pharmaceuticals, Inc.; NXP Semiconductors NV; Tesla, Inc.

For the fixed income segment of the fund | Allocations in the following sectors: corporate credit. Security selection in the following sectors: none

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund ’s past performance is not a good predictor of how the Fund will perform in the future.

|

|

| Line Graph [Table Text Block] |

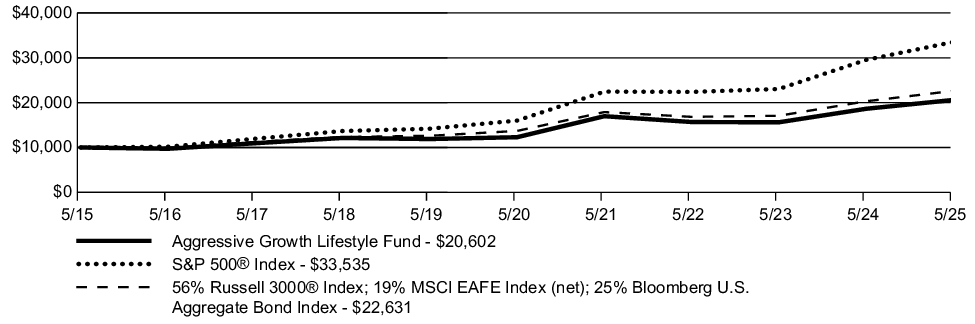

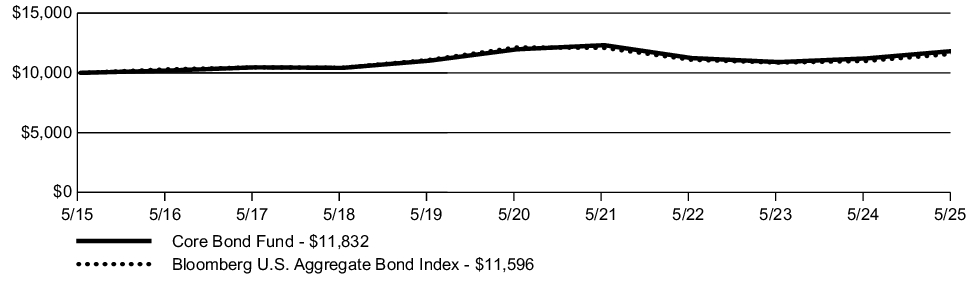

Fund Performance

The following graph compares a $10,000 initial investment in the Fund to the index(es) listed below for the last 10 fiscal years of the Fund.

GROWTH OF $10,000

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Year |

10 Year |

| Asset Allocation Fund |

8.30% |

10.58% |

6.16% |

| S&P 500® Index |

13.52% |

15.94% |

12.86% |

| 60% S&P 500® Index; 40% Bloomberg U.S. Aggregate Bond Index |

10.40% |

9.14% |

8.45% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit my.valic.com/ARO/FundPerformance/Index.aspx for the most recent performance information.

|

|

| Net Assets |

$ 145,000,000

|

|

| Holdings Count | Holding |

607

|

|

| Advisory Fees Paid, Amount |

$ 700,000

|

|

| Investment Company Portfolio Turnover |

35.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$145M |

| Total number of portfolio holdings |

607 |

| Total net advisory fee paid |

$0.7M |

| Portfolio turnover rate during the reporting period |

35% |

|

|

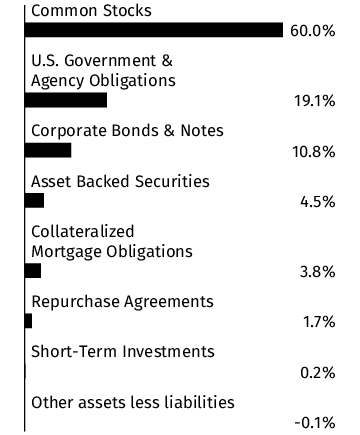

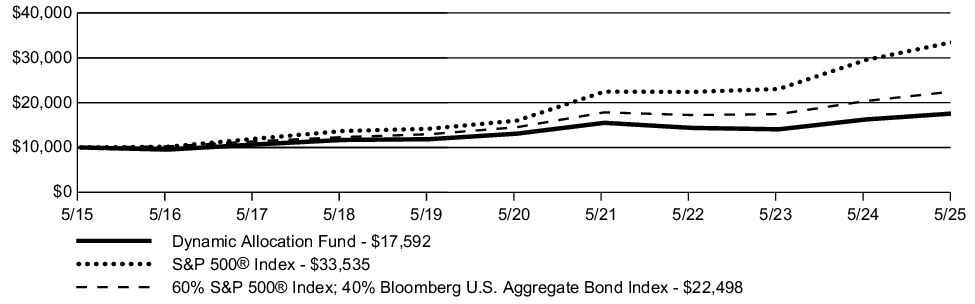

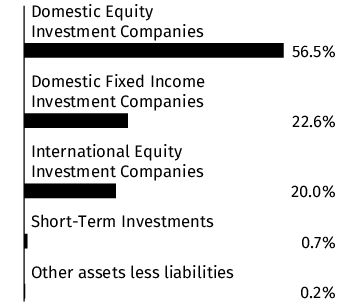

| Holdings [Text Block] |

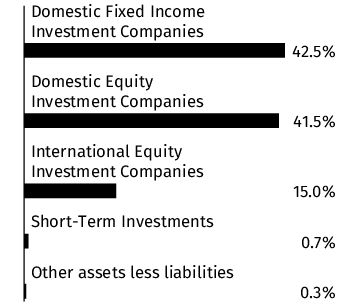

Graphical Representation of Holdings

The information below represents the composition of the Fund's net assets as of the end of the period.

Top Industries*

| U.S. Government & Agency Obligations |

19.1% |

| Semiconductors |

7.6% |

| Software |

7.5% |

| Internet |

6.9% |

| Banks |

6.4% |

| Diversified Financial Services |

5.3% |

| Retail |

4.6% |

| Electric |

4.1% |

| Computers |

3.9% |

| Collateralized Mortgage Obligations |

3.8% |

| Other Asset Backed Securities |

2.8% |

| Building Materials |

2.7% |

| Healthcare-Products |

2.4% |

| Insurance |

2.4% |

| Aerospace/Defense |

2.2% |

Portfolio Composition

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Material Fund Change [Text Block] |

Material Fund Changes

There were no material fund changes during the period.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000021764 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Equities Index

|

|

| Class Name |

International Equities Index

|

|

| Trading Symbol |

VCIEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the VALIC Company I International Equities Index Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Fund costs for the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| International Equities Index Fund* |

$45 |

0.42% |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies (“Variable Contracts”) that invest in the Fund.

|

|

|

| Expenses Paid, Amount |

$ 45

|

[2] |

| Expense Ratio, Percent |

0.42%

|

[2] |

| Factors Affecting Performance [Text Block] |

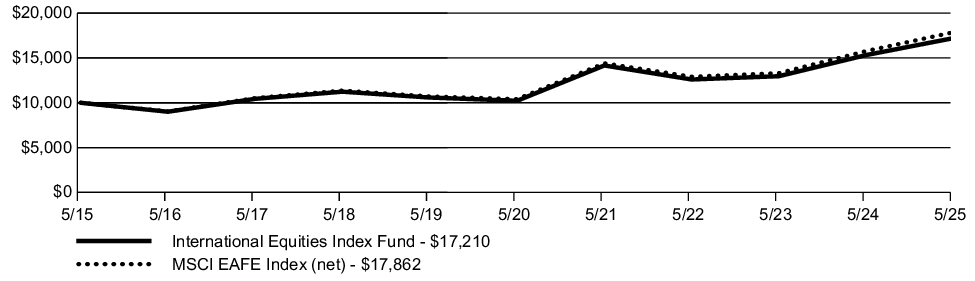

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund is managed to seek to track the performance of the Index. The Subadviser may endeavor to track the Index by purchasing every stock included in the Index, in the same proportions; or, in the alternative, the Subadviser may invest in a sampling of Index stocks by utilizing a statistical technique known as "optimization".

The Fund posted a return of 12.32% for the year ended May 31, 2025, compared to a return of 13.33% for the MSCI EAFE Index (net) (a broad-based securities market & Performance Index). Over the period, international equity markets outperformed U.S. equities, according to the MSCI® family of indices. Developed markets outside the U.S. slightly outperformed emerging markets.

The following is a summary of the top contributors and detractors that impacted the Fund's performance during the year.

TOP PERFORMANCE CONTRIBUTORS

BlackRock Investment Management, LLC - see Material Fund Changes for the time period covered | Allocations in the following sectors: financials; industrials; information technology. Position weightings: ASML Holding NV; Mitsubishi UFJ Financial Group, Inc.; Rheinmetall AG. Exposure to the following countries: Japan; United Kingdom; Germany

SunAmerica Asset Management, LLC - see Material Fund Changes for the time period covered | Allocations in the following sectors: financials; industrials; communication services. Position weightings: SAP SE; HSBC Holdings PLC; Sony Group Corp. Exposure to the following countries: Germany; United Kingdom; Japan

TOP PERFORMANCE DETRACTORS

BlackRock Investment Management, LLC - see Material Fund Changes for the time period covered | Allocations in the following sectors: health care. Position weightings: Allianz SE; Sanofi SA; Alcon AG. Exposure to the following countries: New Zealand

SunAmerica Asset Management, LLC - see Material Fund Changes for the time period covered | Allocations in the following sectors: health care; materials; energy. Position weightings: Novo Nordisk A/S, Class B; ASML Holding NV; LVMH Moet Hennessy Louis Vuitton SE. Exposure to the following countries: Denmark; Netherlands; Portugal

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund ’s past performance is not a good predictor of how the Fund will perform in the future.

|

|

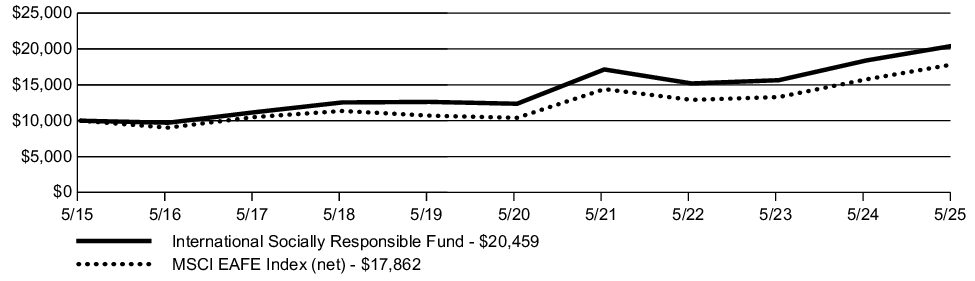

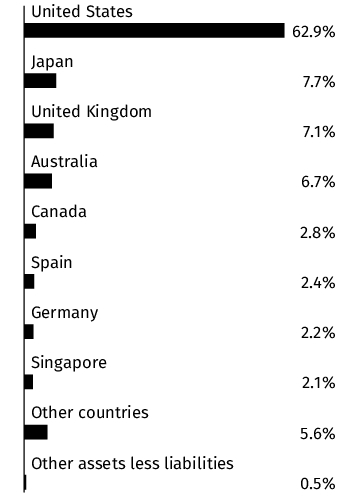

| Line Graph [Table Text Block] |

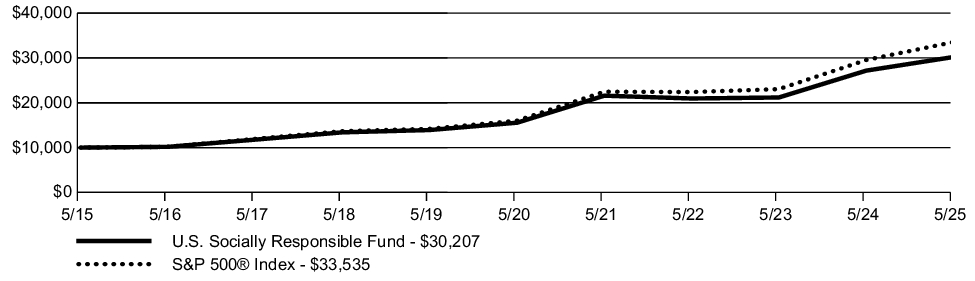

Fund Performance

The following graph compares a $10,000 initial investment in the Fund to the index(es) listed below for the last 10 fiscal years of the Fund.

GROWTH OF $10,000

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Year |

10 Year |

| International Equities Index Fund |

12.32% |

10.98% |

5.58% |

| MSCI EAFE Index (net) |

13.33% |

11.42% |

5.97% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Apr. 30, 2025

|

|

| Updated Performance Information Location [Text Block] |

Visit my.valic.com/ARO/FundPerformance/Index.aspx for the most recent performance information.

|

|

| Net Assets |

$ 1,707,000,000

|

|

| Holdings Count | Holding |

698

|

|

| Advisory Fees Paid, Amount |

$ 4,900,000

|

|

| Investment Company Portfolio Turnover |

12.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$1,707M |

| Total number of portfolio holdings |

698 |

| Total net advisory fee paid |

$4.9M |

| Portfolio turnover rate during the reporting period |

12% |

|

|

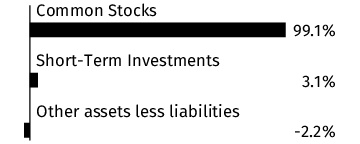

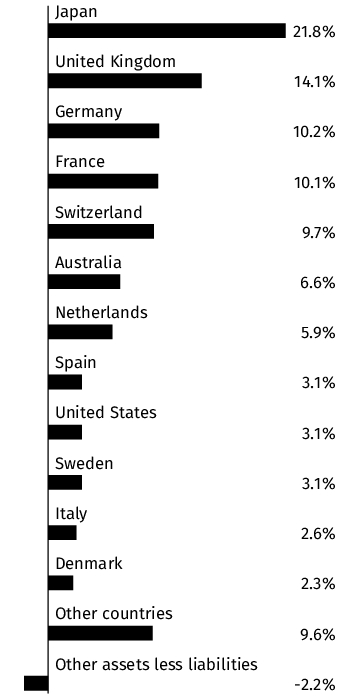

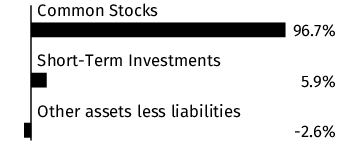

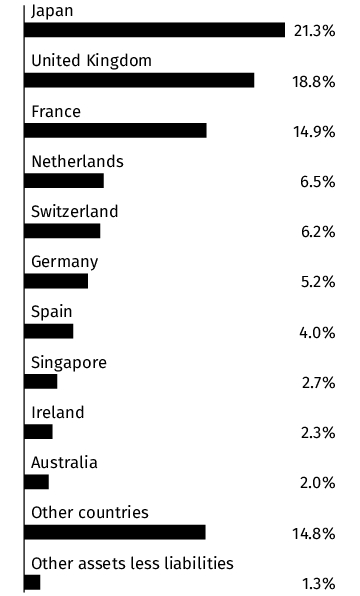

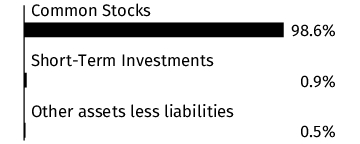

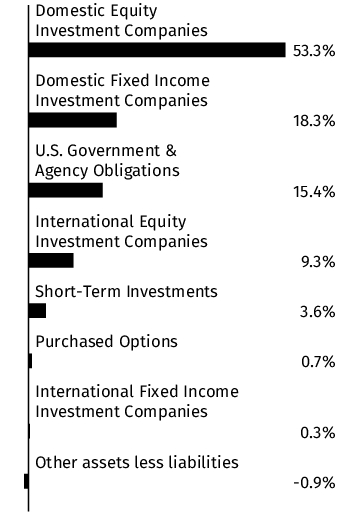

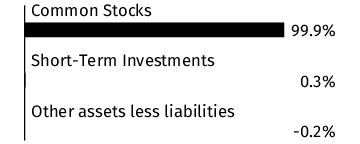

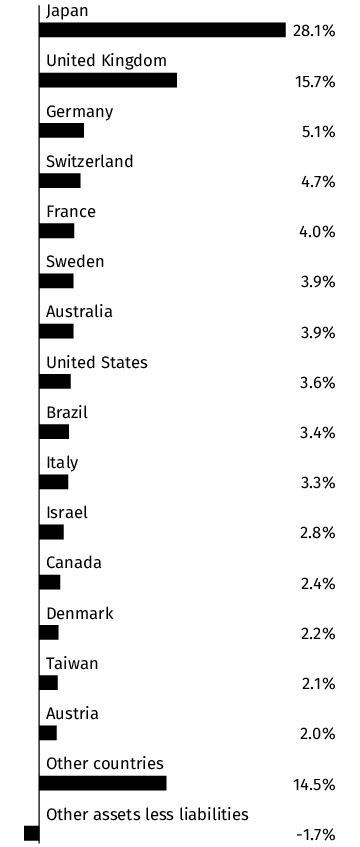

| Holdings [Text Block] |

Graphical Representation of Holdings

The information below represents the composition of the Fund's net assets as of the end of the period.

Top Industries*

| Banks |

14.5% |

| Pharmaceuticals |

7.9% |

| Insurance |

6.2% |

| Food |

3.5% |

| Aerospace/Defense |

3.4% |

| Telecommunications |

3.2% |

| Oil & Gas |

3.2% |

| Short-Term Investments |

3.1% |

| Semiconductors |

3.0% |

| Electric |

2.7% |

| Commercial Services |

2.7% |

| Software |

2.7% |

| Auto Manufacturers |

2.6% |

| Chemicals |

2.4% |

| Retail |

2.3% |

Portfolio Composition

Country

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Material Fund Change [Text Block] |

Material Fund Changes

This is a summary of certain changes to the Fund since the beginning of the period. Effective April 30, 2025, BlackRock Investment Management, LLC was appointed as subadviser to the Fund, replacing the existing subadvisor, SunAmerica Asset Management, LLC. Additionally, changes to the Fund’s investment strategies and techniques were adjusted to match the investment processes and techniques used by the subadviser. As a result of these changes, derivatives risk was added as a principal risk. Additionally, effective September 28, 2024, Japan exposure risk was added as a principal risk of the Fund. For more comprehensive information, you may review the Fund’s next prospectus, which we expect to be available by September 30, 2025 at www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds or upon special request at 1-800-448-2542 or by sending an e-mail request to Forms.Request@valic.com.

|

|

| Material Fund Change Strategies [Text Block] |

Additionally, changes to the Fund’s investment strategies and techniques were adjusted to match the investment processes and techniques used by the subadviser.

|

|

| Material Fund Change Risks Change [Text Block] |

As a result of these changes, derivatives risk was added as a principal risk. Additionally, effective September 28, 2024, Japan exposure risk was added as a principal risk of the Fund.

|

|

| Material Fund Change Adviser [Text Block] |

Effective April 30, 2025, BlackRock Investment Management, LLC was appointed as subadviser to the Fund, replacing the existing subadvisor, SunAmerica Asset Management, LLC.

|

|

| Summary of Change Legend [Text Block] |

For more comprehensive information, you may review the Fund’s next prospectus, which we expect to be available by September 30, 2025 at www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds or upon special request at 1-800-448-2542 or by sending an e-mail request to Forms.Request@valic.com.

|

|

| Updated Prospectus Phone Number |

1-800-448-2542

|

|

| Updated Prospectus Email Address |

Forms.Request@valic.com

|

|

| Updated Prospectus Web Address |

www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000021765 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Government Bond

|

|

| Class Name |

International Government Bond

|

|

| Trading Symbol |

VCIFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the VALIC Company I International Government Bond Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Fund costs for the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| International Government Bond Fund* |

$87 |

0.84% |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies (“Variable Contracts”) that invest in the Fund.

|

|

|

| Expenses Paid, Amount |

$ 87

|

[3] |

| Expense Ratio, Percent |

0.84%

|

[3] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund posted a return of 6.04% for the year ended May 31, 2025, compared to 6.06% for the Bloomberg Global Aggregate Index (USD hedged) (a broad-based securities market index) and 6.96% for the Blended Index (the "Performance Index") comprised of 70% FTSE WGBI Index (unhedged); 30% JPMorgan EMBI Global Diversified Index. Global bonds delivered positive total returns over the past twelve months, despite volatility in global bond yields. Hard currency emerging market bonds outperformed, delivering higher carry throughout the year.

The following is a summary of the top contributors and detractors that impacted the Fund's performance during the year relative to the Performance Index.

TOP PERFORMANCE CONTRIBUTORS

In aggregate | yield curve positioning; foreign currency exposure

Exposure to the following countries | Pakistan; Senegal; France

TOP PERFORMANCE DETRACTORS

In aggregate | country allocations

Exposure to the following countries | lack of exposure to Ukraine; United States; lack of exposure to Lebanon

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund ’s past performance is not a good predictor of how the Fund will perform in the future.

|

|

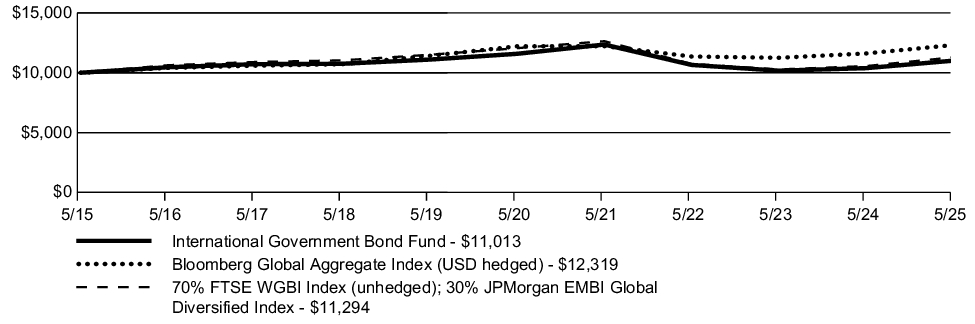

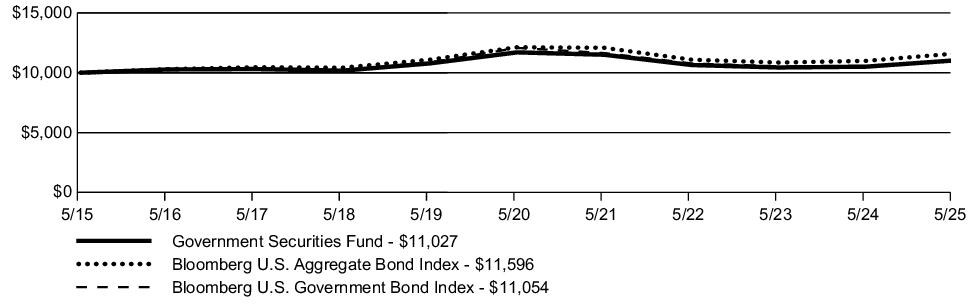

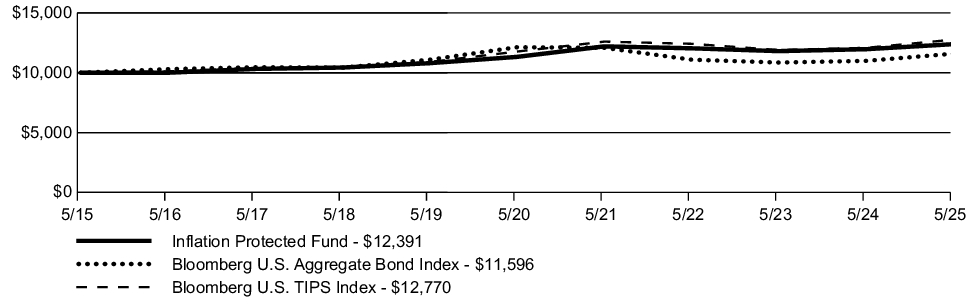

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares a $10,000 initial investment in the Fund to the index(es) listed below for the last 10 fiscal years of the Fund.

GROWTH OF $10,000

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Year |

10 Year |

| International Government Bond Fund |

6.04% |

(1.01)% |

0.97% |

| Bloomberg Global Aggregate Index (USD hedged) |

6.06% |

0.17% |

2.11% |

| 70% FTSE WGBI Index (unhedged); 30% JPMorgan EMBI Global Diversified Index |

6.96% |

(1.30)% |

1.22% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Sep. 30, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit my.valic.com/ARO/FundPerformance/Index.aspx for the most recent performance information.

|

|

| Net Assets |

$ 55,000,000

|

|

| Holdings Count | Holding |

144

|

|

| Advisory Fees Paid, Amount |

$ 300,000

|

|

| Investment Company Portfolio Turnover |

108.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$55M |

| Total number of portfolio holdings |

144 |

| Total net advisory fee paid |

$0.3M |

| Portfolio turnover rate during the reporting period |

108% |

|

|

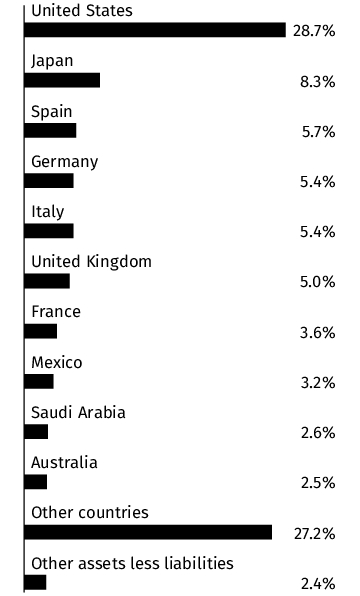

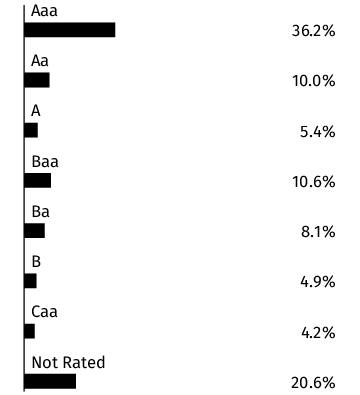

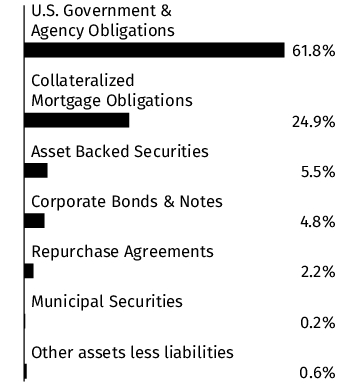

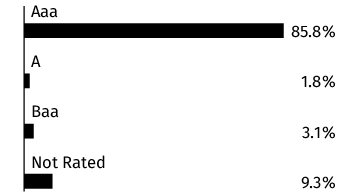

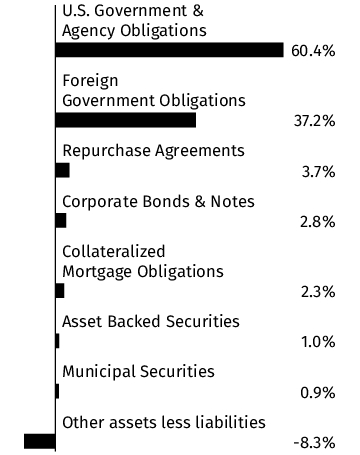

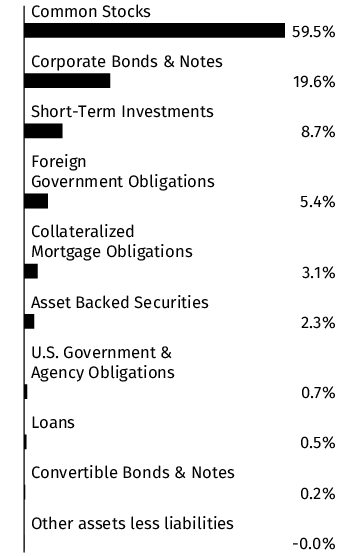

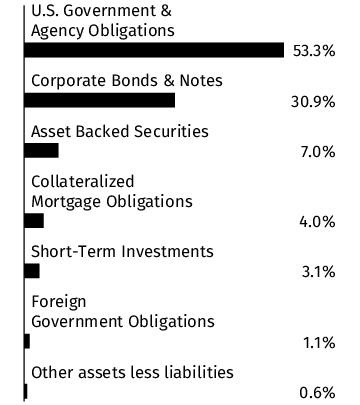

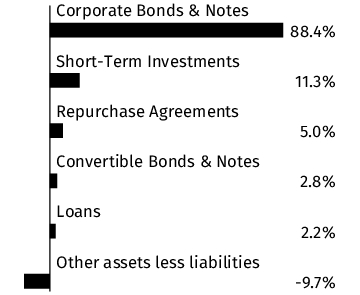

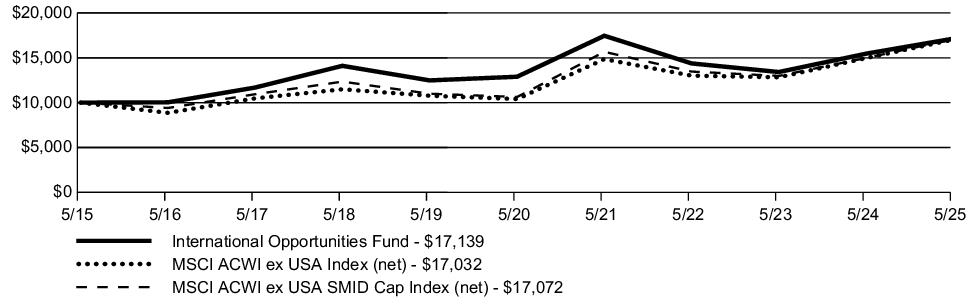

| Holdings [Text Block] |

Graphical Representation of Holdings

The information below represents the composition of the Fund as of the end of the period.

Top Industries*

(% of net assets)

| Foreign Government Obligations |

64.7% |

| U.S. Government & Agency Obligations |

28.3% |

| Oil & Gas |

1.1% |

| Electric |

0.9% |

| Chemicals |

0.8% |

| Investment Companies |

0.5% |

| Telecommunications |

0.5% |

| Commercial Services |

0.4% |

| Distribution/Wholesale |

0.4% |

Country

(% of net assets)

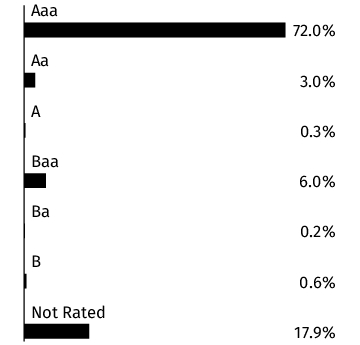

Credit Quality **

(% of total debt issues)

* Percentages exclude derivatives (other than purchased options), if any.

** Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Quality Explanation [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings.

|

|

| Material Fund Change [Text Block] |

Material Fund Changes

This is a summary of certain changes to the Fund since the beginning of the period. Effective September 30, 2024, the Fund entered into a contractual advisory fee waiver to lower the advisory fee rate payable by the Fund to VALIC to 0.48% of the Fund’s average daily net assets on the first $250 million, 0.43% of the Fund’s average daily net assets on the next $250 million, 0.38% of the Fund’s average daily net assets on the next $500 million, and 0.33% of the Fund’s average daily net assets over $1 billion. For more comprehensive information, you may review the Fund’s next prospectus, which we expect to be available by September 30, 2025 at www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds or upon special request at 1-800-448-2542 or by sending an e-mail request to Forms.Request@valic.com.

|

|

| Material Fund Change Expenses [Text Block] |

Effective September 30, 2024, the Fund entered into a contractual advisory fee waiver to lower the advisory fee rate payable by the Fund to VALIC to 0.48% of the Fund’s average daily net assets on the first $250 million, 0.43% of the Fund’s average daily net assets on the next $250 million, 0.38% of the Fund’s average daily net assets on the next $500 million, and 0.33% of the Fund’s average daily net assets over $1 billion.

|

|

| Summary of Change Legend [Text Block] |

For more comprehensive information, you may review the Fund’s next prospectus, which we expect to be available by September 30, 2025 at www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds or upon special request at 1-800-448-2542 or by sending an e-mail request to Forms.Request@valic.com.

|

|

| Updated Prospectus Phone Number |

1-800-448-2542

|

|

| Updated Prospectus Email Address |

Forms.Request@valic.com

|

|

| Updated Prospectus Web Address |

www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000021766 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Growth

|

|

| Class Name |

International Growth

|

|

| Trading Symbol |

VCINX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the VALIC Company I International Growth Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Fund costs for the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| International Growth Fund* |

$92 |

0.84% |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies (“Variable Contracts”) that invest in the Fund.

|

|

|

| Expenses Paid, Amount |

$ 92

|

[4] |

| Expense Ratio, Percent |

0.84%

|

[4] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund posted a return of 18.44% for the year ended May 31, 2025, compared to a return of 13.75% for the MSCI ACWI ex USA Index (net) (a broad-based securities market & Performance Index). International equities advanced, despite heightened volatility amid increased macroeconomic uncertainty during the 12-month period ending May 31, 2025.

The following is a summary of the top contributors and detractors that impacted the Fund's performance during the year relative to the Performance Index.

TOP PERFORMANCE CONTRIBUTORS

In aggregate | sector allocations; position weightings

Allocations in the following sectors | lack of allocation in energy; lack of allocation in materials; health care

Security selection in the following sectors | communication services; industrials; information technology

Position weightings | Spotify Technology SA; DSV A/S; Shopify, Inc., Class A

Exposure to the following countries | Sweden; Denmark; Canada

TOP PERFORMANCE DETRACTORS

In aggregate | country allocations

Allocations in the following sectors | consumer discretionary; financials; cash

Security selection in the following sectors | financials; health care; consumer staples

Position weightings | ASML Holding NV; LVMH Moet Hennessy Louis Vuitton SE; Evolution AB

Exposure to the following countries | Italy; Germany; France

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund ’s past performance is not a good predictor of how the Fund will perform in the future.

|

|

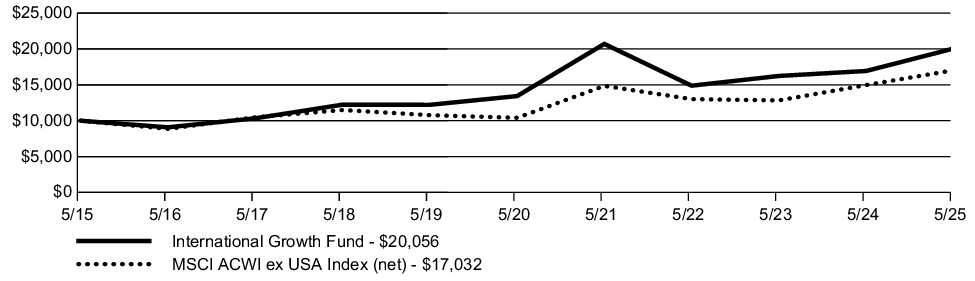

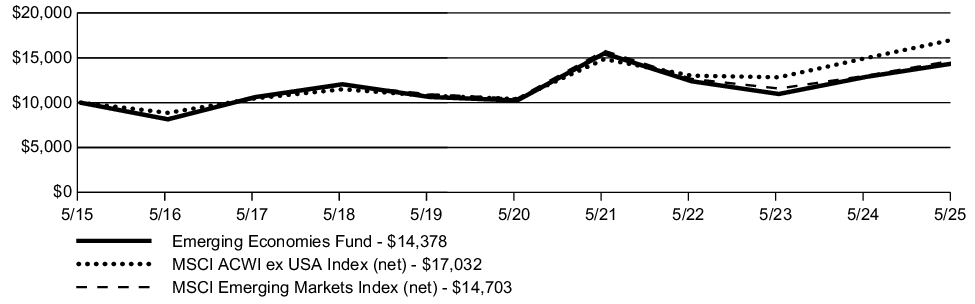

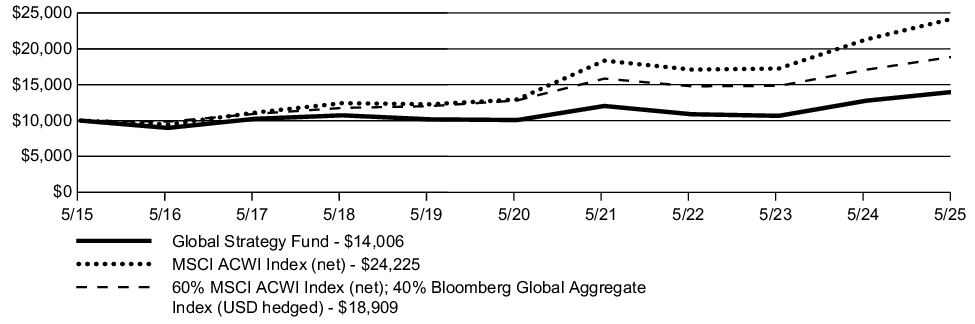

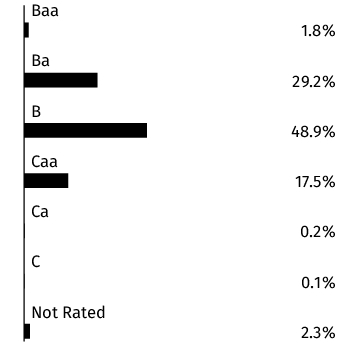

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares a $10,000 initial investment in the Fund to the index(es) listed below for the last 10 fiscal years of the Fund.

GROWTH OF $10,000

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Year |

10 Year |

| International Growth Fund |

18.44% |

8.35% |

7.21% |

| MSCI ACWI ex USA Index (net) |

13.75% |

10.37% |

5.47% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Sep. 30, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit my.valic.com/ARO/FundPerformance/Index.aspx for the most recent performance information.

|

|

| Net Assets |

$ 381,000,000

|

|

| Holdings Count | Holding |

31

|

|

| Advisory Fees Paid, Amount |

$ 2,600,000

|

|

| Investment Company Portfolio Turnover |

17.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$381M |

| Total number of portfolio holdings |

31 |

| Total net advisory fee paid |

$2.6M |

| Portfolio turnover rate during the reporting period |

17% |

|

|

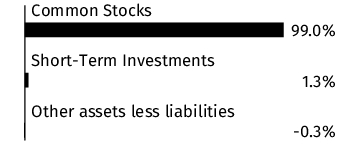

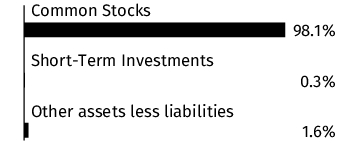

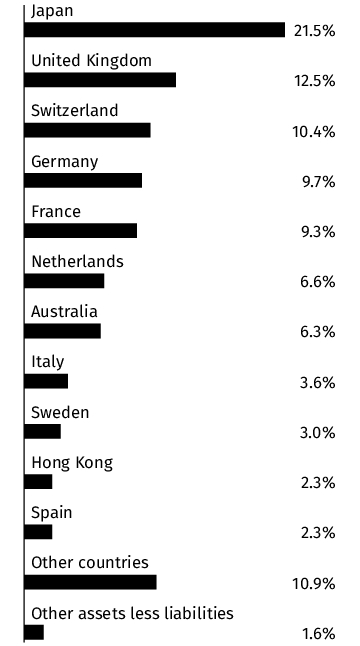

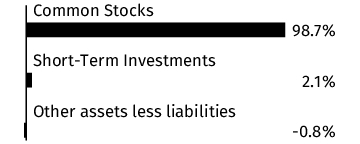

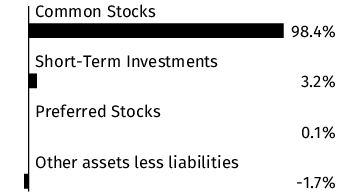

| Holdings [Text Block] |

Graphical Representation of Holdings

The information below represents the composition of the Fund's net assets as of the end of the period.

Top Industries*

| Internet |

15.9% |

| Apparel |

13.4% |

| Transportation |

11.8% |

| Retail |

8.9% |

| Semiconductors |

8.5% |

| Banks |

8.4% |

| Electrical Components & Equipment |

4.7% |

| Healthcare-Products |

4.2% |

| Cosmetics/Personal Care |

4.1% |

| Machinery-Diversified |

3.8% |

| Diversified Financial Services |

3.2% |

| Insurance |

2.7% |

| Media |

2.4% |

| Private Equity |

2.2% |

| Commercial Services |

1.8% |

Portfolio Composition

Country

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Material Fund Change [Text Block] |

Material Fund Changes

This is a summary of certain changes to the Fund since the beginning of the period. Effective September 30, 2024, the Fund clarified that its subadvisor, Morgan Stanley Investment Management Inc., may delegate certain of its investment advisory services to Morgan Stanley Investment Management Company, an affiliated investment adviser. Additionally, effective September 30, 2024, the contractual advisory fee waiver was amended to lower the advisory fee rate payable by the Fund to VALIC to 0.69% of the Fund’s average daily net assets on the first $250 million, 0.64% of the Fund’s average daily net assets on the next $250 million, 0.59% of the Fund’s average daily net assets on the next $500 million and 0.54% of the Fund’s average daily net assets over $1 billion. For more comprehensive information, you may review the Fund’s next prospectus, which we expect to be available by September 30, 2025 at www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds or upon special request at 1-800-448-2542 or by sending an e-mail request to Forms.Request@valic.com.

|

|

| Material Fund Change Expenses [Text Block] |

Additionally, effective September 30, 2024, the contractual advisory fee waiver was amended to lower the advisory fee rate payable by the Fund to VALIC to 0.69% of the Fund’s average daily net assets on the first $250 million, 0.64% of the Fund’s average daily net assets on the next $250 million, 0.59% of the Fund’s average daily net assets on the next $500 million and 0.54% of the Fund’s average daily net assets over $1 billion.

|

|

| Material Fund Change Adviser [Text Block] |

Effective September 30, 2024, the Fund clarified that its subadvisor, Morgan Stanley Investment Management Inc., may delegate certain of its investment advisory services to Morgan Stanley Investment Management Company, an affiliated investment adviser.

|

|

| Summary of Change Legend [Text Block] |

For more comprehensive information, you may review the Fund’s next prospectus, which we expect to be available by September 30, 2025 at www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds or upon special request at 1-800-448-2542 or by sending an e-mail request to Forms.Request@valic.com.

|

|

| Updated Prospectus Phone Number |

1-800-448-2542

|

|

| Updated Prospectus Email Address |

Forms.Request@valic.com

|

|

| Updated Prospectus Web Address |

www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000021768 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Large Capital Growth

|

|

| Class Name |

Large Capital Growth

|

|

| Trading Symbol |

VLCGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the VALIC Company I Large Capital Growth Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Fund costs for the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Large Capital Growth Fund* |

$74 |

0.72% |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies (“Variable Contracts”) that invest in the Fund.

|

|

|

| Expenses Paid, Amount |

$ 74

|

[5] |

| Expense Ratio, Percent |

0.72%

|

[5] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund posted a return of 6.55% for the year ended May 31, 2025, compared to a return of 13.52% for the S&P 500® Index (a broad-based securities market index) and 17.62% for the Russell 1000® Growth Index (the "Performance Index"). Over the period, U.S. large-cap equities outperformed mid- and small-cap equities, according to the Russell® family of indices. Growth-oriented stocks outperformed value stocks across the market-cap spectrum.

The following is a summary of the top contributors and detractors that impacted the Fund's performance during the year relative to the Performance Index.

TOP PERFORMANCE CONTRIBUTORS

Allocations in the following sectors | utilities; financials; industrials

Security selection in the following sectors | financials; materials

Position weightings | Apple, Inc.; lack of a position in Eli Lilly & Co.; Alphabet, Inc., Class A

TOP PERFORMANCE DETRACTORS

In aggregate | position weightings

Allocations in the following sectors | health care; consumer discretionary; consumer staples

Security selection in the following sectors | consumer discretionary; consumer staples; industrials

Position weightings | lack of a position in Broadcom, Inc.; lack of a position in Tesla, Inc.; ICON PLC

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund ’s past performance is not a good predictor of how the Fund will perform in the future.

|

|

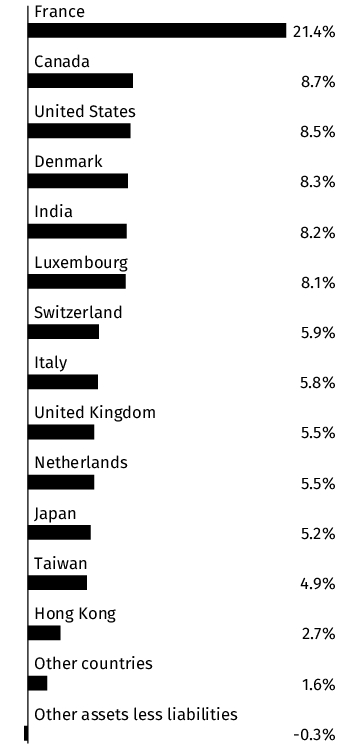

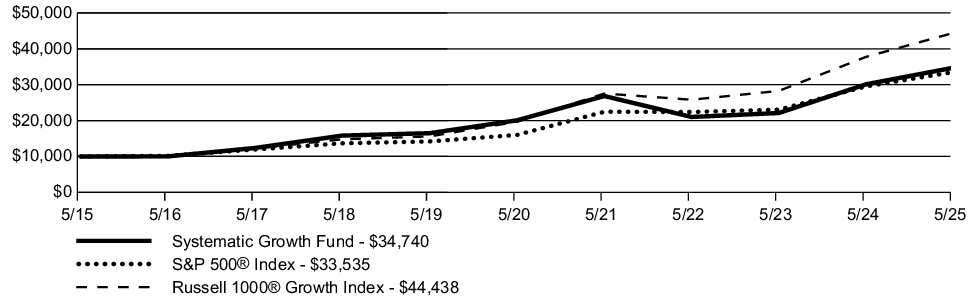

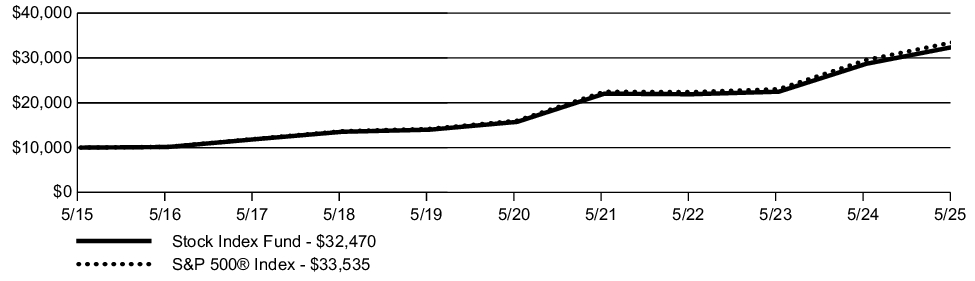

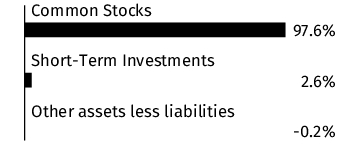

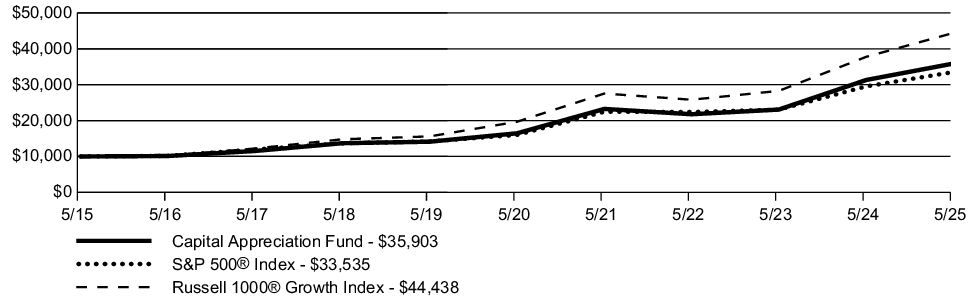

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares a $10,000 initial investment in the Fund to the index(es) listed below for the last 10 fiscal years of the Fund.

GROWTH OF $10,000

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Year |

10 Year |

| Large Capital Growth Fund |

6.55% |

12.89% |

12.75% |

| S&P 500® Index |

13.52% |

15.94% |

12.86% |

| Russell 1000® Growth Index |

17.62% |

17.69% |

16.08% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Sep. 30, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit my.valic.com/ARO/FundPerformance/Index.aspx for the most recent performance information.

|

|

| Net Assets |

$ 587,000,000

|

|

| Holdings Count | Holding |

57

|

|

| Advisory Fees Paid, Amount |

$ 3,800,000

|

|

| Investment Company Portfolio Turnover |

18.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$587M |

| Total number of portfolio holdings |

57 |

| Total net advisory fee paid |

$3.8M |

| Portfolio turnover rate during the reporting period |

18% |

|

|

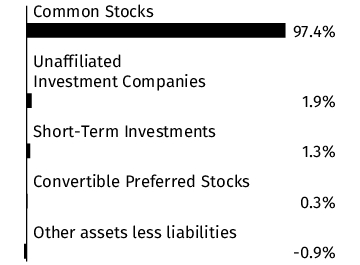

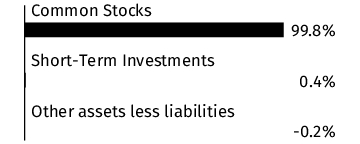

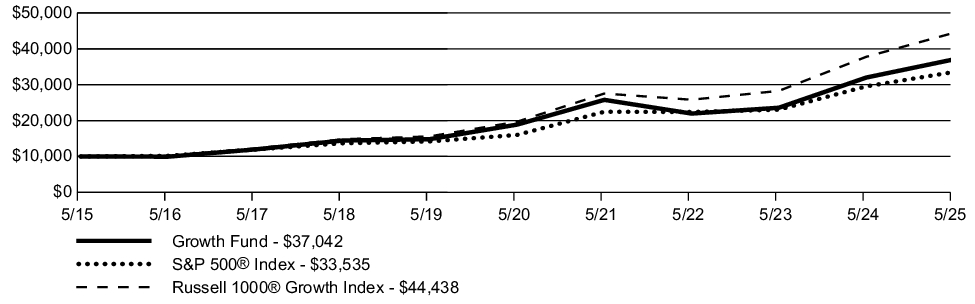

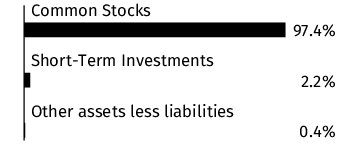

| Holdings [Text Block] |

Graphical Representation of Holdings

The information below represents the composition of the Fund's net assets as of the end of the period.

Top Industries*

| Software |

18.6% |

| Diversified Financial Services |

9.0% |

| Semiconductors |

8.6% |

| Computers |

8.6% |

| Healthcare-Products |

7.6% |

| Electronics |

6.7% |

| Internet |

4.0% |

| Insurance |

3.7% |

| Commercial Services |

3.7% |

| Electrical Components & Equipment |

3.0% |

| Retail |

2.9% |

| Household Products/Wares |

2.3% |

| Electric |

2.1% |

| Cosmetics/Personal Care |

2.1% |

| REITS |

2.0% |

Portfolio Composition

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Material Fund Change [Text Block] |

Material Fund Changes

This is a summary of certain changes to the Fund since the beginning of the period. Effective September 30, 2024, the Fund entered into a contractual advisory fee waiver to lower the advisory fee rate payable by the Fund to VALIC to 0.59% of the Fund’s average daily net assets on the first $750 million, and 0.54% of the Fund’s average daily net assets over $750 million. For more comprehensive information, you may review the Fund’s next prospectus, which we expect to be available by September 30, 2025 at www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds or upon special request at 1-800-448-2542 or by sending an e-mail request to Forms.Request@valic.com.

|

|

| Material Fund Change Expenses [Text Block] |

Effective September 30, 2024, the Fund entered into a contractual advisory fee waiver to lower the advisory fee rate payable by the Fund to VALIC to 0.59% of the Fund’s average daily net assets on the first $750 million, and 0.54% of the Fund’s average daily net assets over $750 million.

|

|

| Summary of Change Legend [Text Block] |

For more comprehensive information, you may review the Fund’s next prospectus, which we expect to be available by September 30, 2025 at www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds or upon special request at 1-800-448-2542 or by sending an e-mail request to Forms.Request@valic.com.

|

|

| Updated Prospectus Phone Number |

1-800-448-2542

|

|

| Updated Prospectus Email Address |

Forms.Request@valic.com

|

|

| Updated Prospectus Web Address |

www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000021769 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Mid Cap Index

|

|

| Class Name |

Mid Cap Index

|

|

| Trading Symbol |

VMIDX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the VALIC Company I Mid Cap Index Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Fund costs for the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Mid Cap Index Fund* |

$36 |

0.36% |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies (“Variable Contracts”) that invest in the Fund.

|

|

|

| Expenses Paid, Amount |

$ 36

|

[6] |

| Expense Ratio, Percent |

0.36%

|

[6] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund is managed to seek to track the performance of the Index. The Subadviser may endeavor to track the Index by purchasing every stock included in the Index, in the same proportions; or, in the alternative, the Subadviser may invest in a sampling of Index stocks by utilizing a statistical technique known as "optimization".

The Fund posted a return of 1.60% for the year ended May 31, 2025, compared to a return of 13.12% for the Russell 3000® Index (a broad-based securities market index) and 2.17% for the S&P MidCap 400® Index (the "Performance Index"). Over the period, U.S. large-cap equities outperformed mid- and small-cap equities, according to the Russell® family of indices. Growth-oriented stocks outperformed value stocks across the market-cap spectrum.

The following is a summary of the top contributors and detractors that impacted the Fund's performance during the year.

TOP PERFORMANCE CONTRIBUTORS

BlackRock Investment Management, LLC - see Material Fund Changes for the time period covered | Allocations in the following sectors: industrials; consumer discretionary; financials. Position weightings: Duolingo, Inc. Class A; Hims & Hers Health, Inc.; Interactive Brokers Group, Inc., Class A

SunAmerica Asset Management, LLC - see Material Fund Changes for the time period covered | Allocations in the following sectors: finance; utilities; business services. Position weightings: Texas Pacific Land Corp.; Sprouts Farmers Market, Inc.; Duolingo, Inc., Class A

TOP PERFORMANCE DETRACTORS

BlackRock Investment Management, LLC - see Material Fund Changes for the time period covered | Allocations in the following sectors: none. Position weightings: Okta, Inc.; Sarepta Therapeutics, Inc.; Fidelity National Financial, Inc.

SunAmerica Asset Management, LLC - see Material Fund Changes for the time period covered | Allocations in the following sectors: consumer cyclicals; energy; industrials. Position weightings: Celsius Holdings, Inc.; e.l.f. Beauty, Inc.; Avantor, Inc.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund ’s past performance is not a good predictor of how the Fund will perform in the future.

|

|

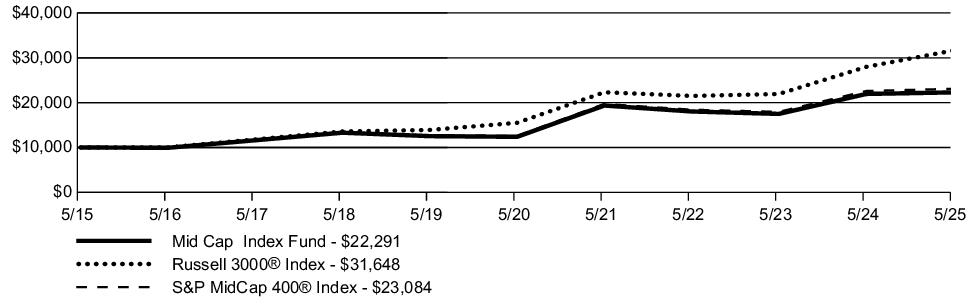

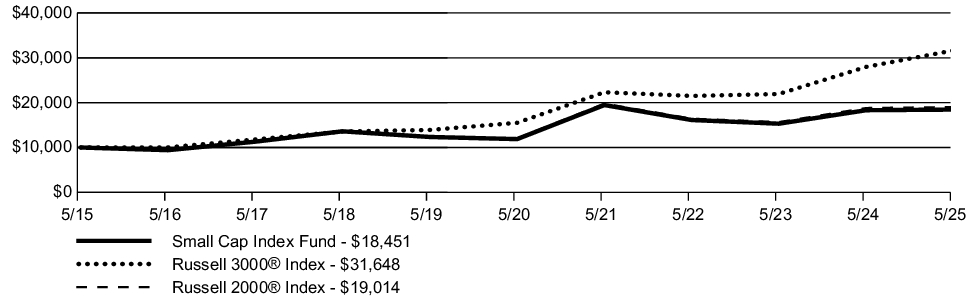

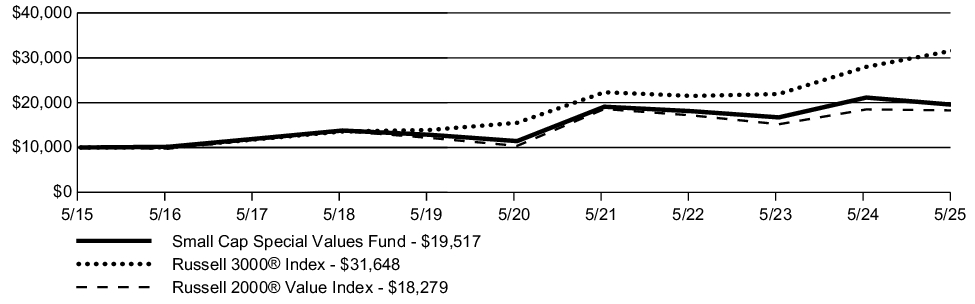

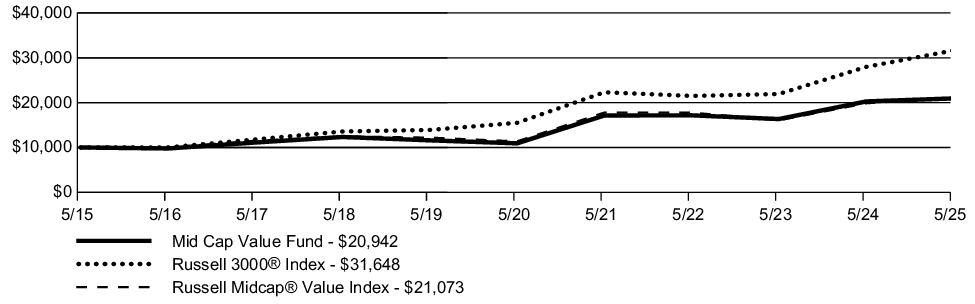

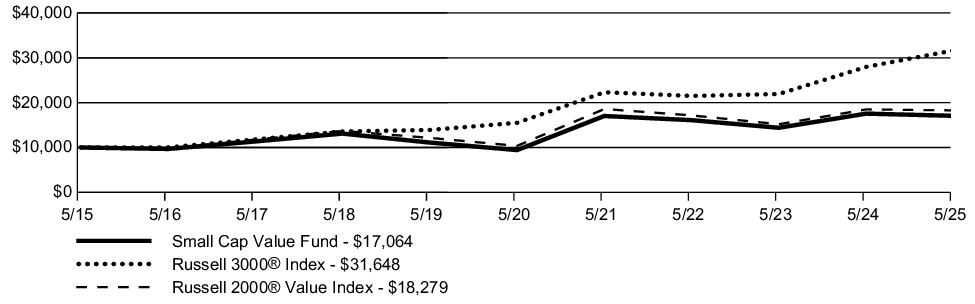

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares a $10,000 initial investment in the Fund to the index(es) listed below for the last 10 fiscal years of the Fund.

GROWTH OF $10,000

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Year |

10 Year |

| Mid Cap Index Fund |

1.60% |

12.49% |

8.35% |

| Russell 3000® Index |

13.12% |

15.34% |

12.21% |

| S&P MidCap 400® Index |

2.17% |

12.93% |

8.73% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Apr. 30, 2025

|

|

| Updated Performance Information Location [Text Block] |

Visit my.valic.com/ARO/FundPerformance/Index.aspx for the most recent performance information.

|

|

| Net Assets |

$ 2,550,000,000

|

|

| Holdings Count | Holding |

404

|

|

| Advisory Fees Paid, Amount |

$ 7,400,000

|

|

| Investment Company Portfolio Turnover |

18.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$2,550M |

| Total number of portfolio holdings |

404 |

| Total net advisory fee paid |

$7.4M |

| Portfolio turnover rate during the reporting period |

18% |

|

|

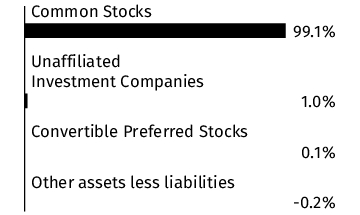

| Holdings [Text Block] |

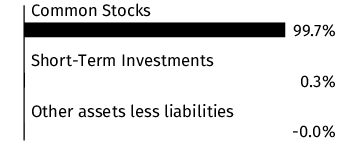

Graphical Representation of Holdings

The information below represents the composition of the Fund's net assets as of the end of the period.

Top Industries*

| REITS |

7.2% |

| Banks |

6.2% |

| Retail |

6.2% |

| Insurance |

5.2% |

| Software |

4.4% |

| Diversified Financial Services |

3.8% |

| Commercial Services |

3.7% |

| Computers |

3.6% |

| Machinery-Diversified |

3.4% |

| Electronics |

3.1% |

| Engineering & Construction |

2.9% |

| Food |

2.9% |

| Oil & Gas |

2.7% |

| Biotechnology |

2.6% |

| Healthcare-Services |

2.4% |

Portfolio Composition

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Material Fund Change [Text Block] |

Material Fund Changes

This is a summary of certain changes to the Fund since the beginning of the period. Effective April 30, 2025, BlackRock Investment Management, LLC was appointed as subadviser to the Fund, replacing the existing subadvisor, SunAmerica Asset Management, LLC. Additionally, changes to the Fund’s investment strategies and techniques were adjusted to match the investment processes and techniques used by the subadviser. As a result of these changes, derivatives risk was added as a principal risk. Additionally, effective September 30, 2024, the Fund entered into a contractual advisory fee waiver to lower the advisory fee rate payable by the Fund to VALIC to 0.34% of the Fund’s average daily net assets on the first $500 million, 0.24% of the Fund’s average daily net assets on the next $2.5 billion, 0.19% of the Fund’s average daily net assets on the next $2 billion, and 0.14% of the Fund’s average daily net assets over $5 billion. For more comprehensive information, you may review the Fund’s next prospectus, which we expect to be available by September 30, 2025 at www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds or upon special request at 1-800-448-2542 or by sending an e-mail request to Forms.Request@valic.com.

|

|

| Material Fund Change Expenses [Text Block] |

Additionally, effective September 30, 2024, the Fund entered into a contractual advisory fee waiver to lower the advisory fee rate payable by the Fund to VALIC to 0.34% of the Fund’s average daily net assets on the first $500 million, 0.24% of the Fund’s average daily net assets on the next $2.5 billion, 0.19% of the Fund’s average daily net assets on the next $2 billion, and 0.14% of the Fund’s average daily net assets over $5 billion.

|

|

| Material Fund Change Strategies [Text Block] |

Additionally, changes to the Fund’s investment strategies and techniques were adjusted to match the investment processes and techniques used by the subadviser.

|

|

| Material Fund Change Risks Change [Text Block] |

As a result of these changes, derivatives risk was added as a principal risk.

|

|

| Material Fund Change Adviser [Text Block] |

Effective April 30, 2025, BlackRock Investment Management, LLC was appointed as subadviser to the Fund, replacing the existing subadvisor, SunAmerica Asset Management, LLC.

|

|

| Summary of Change Legend [Text Block] |

For more comprehensive information, you may review the Fund’s next prospectus, which we expect to be available by September 30, 2025 at www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds or upon special request at 1-800-448-2542 or by sending an e-mail request to Forms.Request@valic.com.

|

|

| Updated Prospectus Phone Number |

1-800-448-2542

|

|

| Updated Prospectus Email Address |

Forms.Request@valic.com

|

|

| Updated Prospectus Web Address |

www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000021770 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Mid Cap Strategic Growth

|

|

| Class Name |

Mid Cap Strategic Growth

|

|

| Trading Symbol |

VMSGX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the VALIC Company I Mid Cap Strategic Growth Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Fund costs for the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Mid Cap Strategic Growth Fund* |

$79 |

0.74% |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies (“Variable Contracts”) that invest in the Fund.

|

|

|

| Expenses Paid, Amount |

$ 79

|

[7] |

| Expense Ratio, Percent |

0.74%

|

[7] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund posted a return of 13.34% for the year ended May 31, 2025, compared to a return of 13.12% for the Russell 3000® Index (a broad-based securities market index) and 23.23% for the Russell Midcap® Growth Index (the "Performance Index"). The U.S. equity market delivered positive returns for the 12-month period ended May 31, 2025. TheU.S. economy continued to grow, supported by relatively low unemployment. The equity market advance was narrow, however, with investors favoring mostly large-cap growth stocks with exposure to artificial intelligence (AI) in the second half of 2024. Moderating inflation led the Federal Reserve to cut rates three times in the second half of 2024, but policymakers signaled they would be slow to cut rates in 2025 given persistent inflation risks.

The following is a summary, by subadviser, of the top contributors and detractors that impacted their portion of the Fund's performance during the year relative to the Performance Index.

TOP PERFORMANCE CONTRIBUTORS

Janus Henderson Investors US LLC | In aggregate: sector allocations. Allocations in the following sectors: utilities; consumer discretionary; consumer staples. Security selection in the following sectors: consumer discretionary; materials; cash. Position weightings: lack of position in Super Micro Computer, Inc.; lack of position in Dexcom, Inc.; lack of position in Deckers Outdoor Corp.

Voya Investment Management Co. LLC | Allocations in the following sectors: consumer discretionary; real estate; industrials. Security selection in the following sectors: information technology; financials; materials. Position weightings: lack of position in Super Micro Computer, Inc.; AppLovin Corp., Class A; Interactive Brokers Group Inc., Class A

TOP PERFORMANCE DETRACTORS

Janus Henderson Investors US LLC | In aggregate: position weightings. Allocations in the following sectors: health care; cash; real estate. Security selection in the following sectors: information technology; industrials; health care. Position weightings: lack of position in Palantir Technologies, Inc., Class A; Teleflex, Inc.; ON Semiconductor Corp.

Voya Investment Management Co. LLC | In aggregate: position weightings; sector allocations. Allocations in the following sectors: materials; health care; cash. Security selection in the following sectors: industrials; energy; consumer discretionary. Position weightings: lack of position in Axon Enterprise, Inc.; CACI International, Inc., Class A; lack of position in ROBLOX Corp., Class A

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund ’s past performance is not a good predictor of how the Fund will perform in the future.

|

|

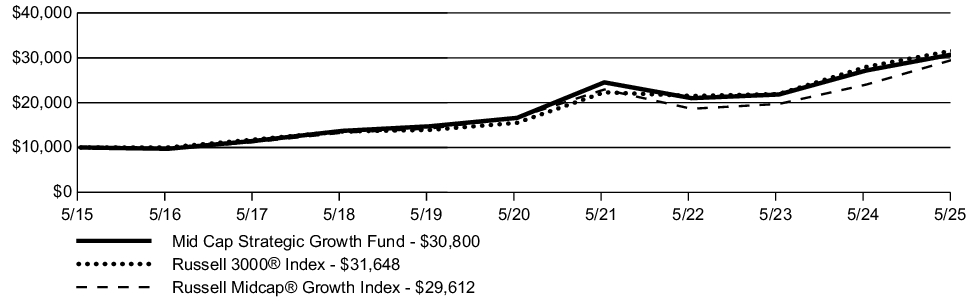

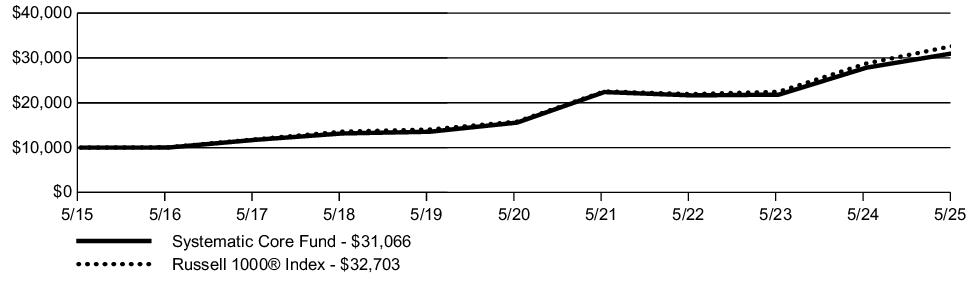

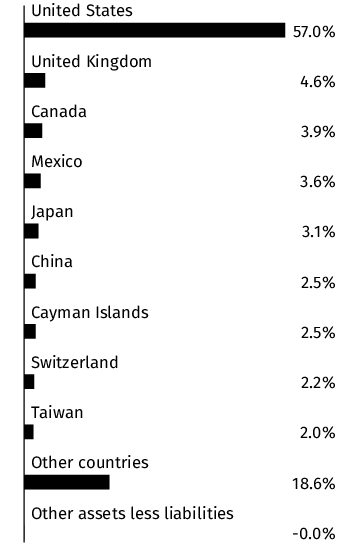

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares a $10,000 initial investment in the Fund to the index(es) listed below for the last 10 fiscal years of the Fund.

GROWTH OF $10,000

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Year |

10 Year |

| Mid Cap Strategic Growth Fund |

13.34% |

13.15% |

11.91% |

| Russell 3000® Index |

13.12% |

15.34% |

12.21% |

| Russell Midcap® Growth Index |

23.23% |

12.22% |

11.47% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit my.valic.com/ARO/FundPerformance/Index.aspx for the most recent performance information.

|

|

| Net Assets |

$ 1,190,000,000

|

|

| Holdings Count | Holding |

145

|

|

| Advisory Fees Paid, Amount |

$ 6,700,000

|

|

| Investment Company Portfolio Turnover |

52.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$1,190M |

| Total number of portfolio holdings |

145 |

| Total net advisory fee paid |

$6.7M |

| Portfolio turnover rate during the reporting period |

52% |

|

|

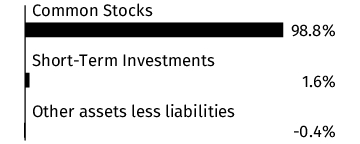

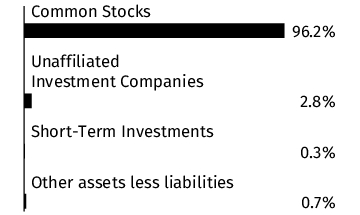

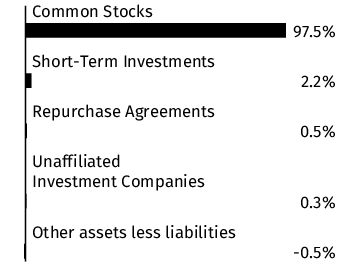

| Holdings [Text Block] |

Graphical Representation of Holdings

The information below represents the composition of the Fund's net assets as of the end of the period.

Top Industries*

| Software |

19.5% |

| Healthcare-Products |

8.6% |

| Diversified Financial Services |

6.0% |

| Retail |

5.9% |

| Computers |

4.0% |

| Insurance |

4.0% |

| Commercial Services |

3.8% |

| Internet |

3.7% |

| Aerospace/Defense |

3.6% |

| Semiconductors |

3.4% |

| Electric |

3.0% |

| Electronics |

3.0% |

| Entertainment |

2.9% |

| Short-Term Investments |

2.2% |

| Pipelines |

2.0% |

Portfolio Composition

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Material Fund Change [Text Block] |

Material Fund Changes

There were no material fund changes during the period.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000021772 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Nasdaq-100® Index

|

|

| Class Name |

Nasdaq-100® Index

|

|

| Trading Symbol |

VCNIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the VALIC Company I Nasdaq-100® Index Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Fund costs for the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Nasdaq-100® Index Fund* |

$45 |

0.42% |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies (“Variable Contracts”) that invest in the Fund.

|

|

|

| Expenses Paid, Amount |

$ 45

|

[8] |

| Expense Ratio, Percent |

0.42%

|

[8] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund is managed to seek to track the performance of the Index. The Subadviser may endeavor to track the Index by purchasing every stock included in the Index, in the same proportions; or, in the alternative, the Subadviser may invest in a sampling of Index stocks by utilizing a statistical technique known as "optimization".

The Fund posted a return of 15.41% for the year ended May 31, 2025, compared to a return of 13.52% for the S&P 500® Index (a broad-based securities market index) and 16.02% for the Nasdaq-100® Index (the "Performance Index"). Over the period, U.S. large-cap equities outperformed mid- and small-cap equities, according to the Russell® family of indices. Growth-oriented stocks outperformed value stocks across the market-cap spectrum.

The following is a summary of the top contributors and detractors that impacted the Fund's performance during the year.

TOP PERFORMANCE CONTRIBUTORS

BlackRock Investment Management, LLC - see Material Fund Changes for the time period covered | Allocations in the following sectors: information technology; consumer discretionary; communication services. Position weightings: Microsoft Corp.; NVIDIA Corp.; Broadcom, Inc.

SunAmerica Asset Management, LLC - see Material Fund Changes for the time period covered | Allocations in the following sectors: technology; consumer cyclicals; business services. Position weightings: Broadcom, Inc.; Tesla, Inc.; Netflix, Inc.

TOP PERFORMANCE DETRACTORS

BlackRock Investment Management, LLC - see Material Fund Changes for the time period covered | Allocations in the following sectors: real estate. Position weightings: Apple, Inc.; Vertex Pharmaceuticals, Inc.; Regeneron Pharmaceuticals, Inc.

SunAmerica Asset Management, LLC - see Material Fund Changes for the time period covered | Allocations in the following sectors: healthcare; energy; industrials. Position weightings: Advanced Micro Devices, Inc.; QUALCOMM, Inc.; Intel Corp.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund ’s past performance is not a good predictor of how the Fund will perform in the future.

|

|

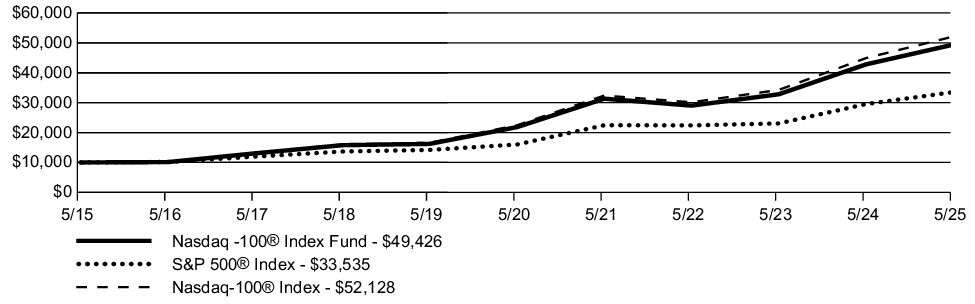

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares a $10,000 initial investment in the Fund to the index(es) listed below for the last 10 fiscal years of the Fund.

GROWTH OF $10,000

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Year |

10 Year |

| Nasdaq-100® Index Fund |

15.41% |

17.75% |

17.33% |

| S&P 500® Index |

13.52% |

15.94% |

12.86% |

| Nasdaq-100® Index |

16.02% |

18.37% |

17.96% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Apr. 30, 2025

|

|

| Updated Performance Information Location [Text Block] |

Visit my.valic.com/ARO/FundPerformance/Index.aspx for the most recent performance information.

|

|

| Net Assets |

$ 1,018,000,000

|

|

| Holdings Count | Holding |

105

|

|

| Advisory Fees Paid, Amount |

$ 3,000,000.0

|

|

| Investment Company Portfolio Turnover |

10.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$1,018M |

| Total number of portfolio holdings |

105 |

| Total net advisory fee paid |

$3.0M |

| Portfolio turnover rate during the reporting period |

10% |

|

|

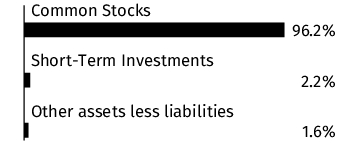

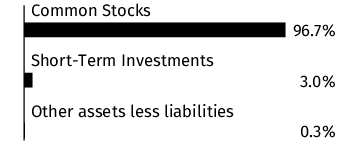

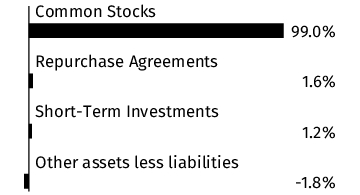

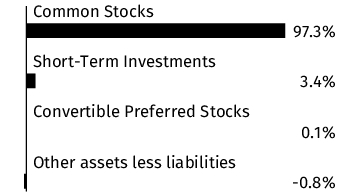

| Holdings [Text Block] |

Graphical Representation of Holdings

The information below represents the composition of the Fund's net assets as of the end of the period.

Top Industries*

| Internet |

22.1% |

| Semiconductors |

21.6% |

| Software |

17.6% |

| Computers |

9.3% |

| Retail |

4.4% |

| Auto Manufacturers |

3.5% |

| Telecommunications |

3.3% |

| Biotechnology |

3.0% |

| Commercial Services |

2.1% |

| Beverages |

2.0% |

| Healthcare-Products |

1.7% |

| Electric |

1.5% |

| Chemicals |

1.4% |

| Media |

1.3% |

| Electronics |

0.9% |

Portfolio Composition

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Material Fund Change [Text Block] |

Material Fund Changes

This is a summary of certain changes to the Fund since the beginning of the period. Effective April 30, 2025, BlackRock Investment Management, LLC was appointed as subadviser to the Fund, replacing the existing subadvisor, SunAmerica Asset Management, LLC. Additionally, changes to the Fund’s investment strategies and techniques were adjusted to match the investment processes and techniques used by the subadviser. For more comprehensive information, you may review the Fund’s next prospectus, which we expect to be available by September 30, 2025 at www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds or upon special request at 1-800-448-2542 or by sending an e-mail request to Forms.Request@valic.com.

|

|

| Material Fund Change Strategies [Text Block] |

Additionally, changes to the Fund’s investment strategies and techniques were adjusted to match the investment processes and techniques used by the subadviser.

|

|

| Material Fund Change Adviser [Text Block] |

Effective April 30, 2025, BlackRock Investment Management, LLC was appointed as subadviser to the Fund, replacing the existing subadvisor, SunAmerica Asset Management, LLC.

|

|

| Summary of Change Legend [Text Block] |

For more comprehensive information, you may review the Fund’s next prospectus, which we expect to be available by September 30, 2025 at www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds or upon special request at 1-800-448-2542 or by sending an e-mail request to Forms.Request@valic.com.

|

|

| Updated Prospectus Phone Number |

1-800-448-2542

|

|

| Updated Prospectus Email Address |

Forms.Request@valic.com

|

|

| Updated Prospectus Web Address |

www.corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000021773 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Science & Technology

|

|

| Class Name |

Science & Technology

|

|

| Trading Symbol |

VCSTX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the VALIC Company I Science & Technology Fund (the “Fund”) for the period of June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/rs/prospectus-and-reports/annuities#underlyingfunds

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Fund costs for the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Science & Technology Fund* |

$97 |

0.90% |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies (“Variable Contracts”) that invest in the Fund.

|

|

|

| Expenses Paid, Amount |

$ 97

|

[9] |

| Expense Ratio, Percent |

0.90%

|

[9] |

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

The Fund posted a return of 16.20% for the year ended May 31, 2025, compared to 13.52% for the S&P 500® Index (a broad-based securities market index) and 16.50% for the S&P North American Technology Sector Index (the "Performance Index"). Over the annual period, global equity markets have provided strong results across broad indices. Technology stocks were higher thanks to favorable underlying fundamentals and earnings growth.

The following is a summary, by subadviser, of the top contributors and detractors that impacted their portion of the Fund's performance during the year relative to the Performance Index.

TOP PERFORMANCE CONTRIBUTORS

BlackRock Investment Management, LLC | In aggregate: position weightings. Allocations in the following industries: entertainment; automobiles; financial services. Security selection in the following industries: semiconductors & semiconductor equipment; entertainment; technology hardware, storage & peripherals. Position weightings: Spotify Technology SA; Alphabet, Inc., Class A; QUALCOMM, Inc.

Voya Investment Management Co. LLC | In aggregate: position weightings. Allocations in the following industries: entertainment; capital markets; technology hardware storage & peripherals. Security selection in the following industries: software; entertainment; semiconductors & semiconductor equipment. Position weightings: Palantir Technologies, Inc., Class A; Cloudflare, Inc., Class A; Netflix, Inc.

Wellington Management Company, LLP - see Material Fund Changes for the time period covered | Allocations in the following industries: semiconductors & semiconductor equipment; professional services; ground transportation. Security selection in the following industries: electronic equipment, instruments & components; technology hardware, storage & peripherals; semiconductors & semiconductor equipment. Position weightings: lack of position in QUALCOMM, Inc.; lack of position in Intel Corp.; Chroma ATE, Inc.

TOP PERFORMANCE DETRACTORS

BlackRock Investment Management, LLC | In aggregate: industry allocations. Allocations in the following industries: IT services; semiconductors & semiconductor equipment; electrical equipment. Security selection in the following industries: software; IT services; communications equipment. Position weightings: lack of a position in Palantir Technologies, Inc., Class A; ASML Holding NV; Meta Platforms, Inc., Class A

Voya Investment Management Co. LLC | Allocations in the following industries: IT services; communication equipment; broadline retail. Security selection in the following industries: interactive media & services; technology hardware storage & peripherals; communication equipment. Position weightings: Alphabet, Inc., Class C; KraneShares CSI China Internet ETF; MicroStrategy, Inc., Class A

Wellington Management Company, LLP - see Material Fund Changes for the time period covered | Allocations in the following industries: technology hardware, storage & peripherals; IT services; electronic equipment, instruments & components. Security selection in the following industries: software; IT services . Position weightings: Broadcom, Inc.; Apple, Inc.; lack of position in Oracle Corp.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund ’s past performance is not a good predictor of how the Fund will perform in the future.

|

|

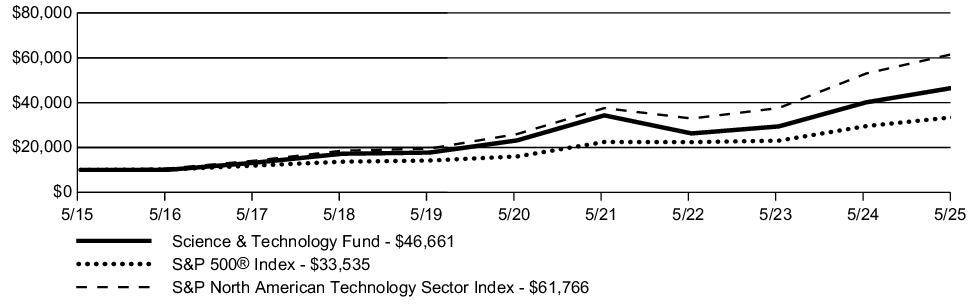

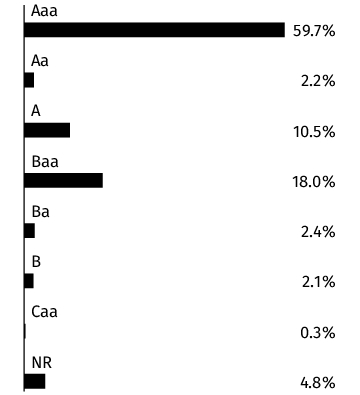

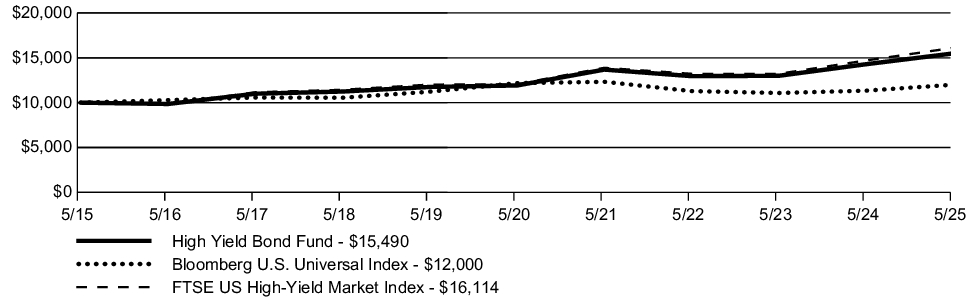

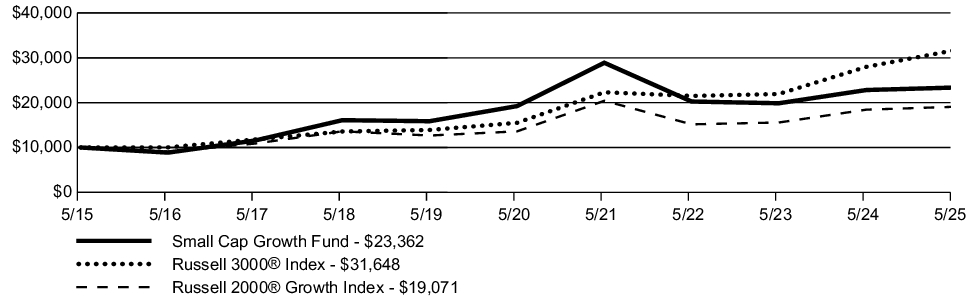

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares a $10,000 initial investment in the Fund to the index(es) listed below for the last 10 fiscal years of the Fund.

GROWTH OF $10,000

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Year |

10 Year |

| Science & Technology Fund |

16.20% |

15.03% |

16.65% |

| S&P 500® Index |

13.52% |

15.94% |

12.86% |

| S&P North American Technology Sector Index |

16.50% |

18.91% |

19.97% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Material Change Date |

Sep. 30, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit my.valic.com/ARO/FundPerformance/Index.aspx for the most recent performance information.

|

|

| Net Assets |

$ 2,778,000,000

|

|

| Holdings Count | Holding |

103

|

|

| Advisory Fees Paid, Amount |

$ 22,600,000

|

|

| Investment Company Portfolio Turnover |

67.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$2,778M |

| Total number of portfolio holdings |

103 |

| Total net advisory fee paid |

$22.6M |

| Portfolio turnover rate during the reporting period |

67% |

|

|

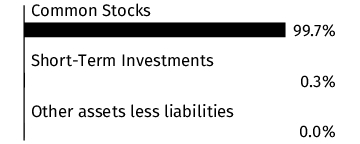

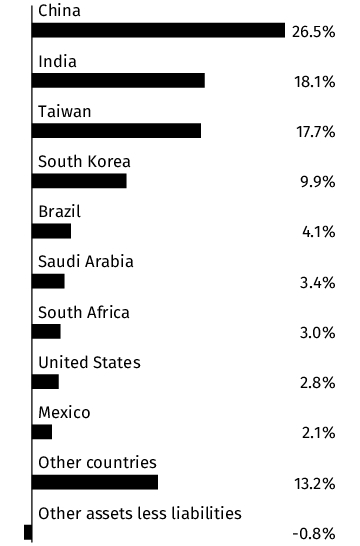

| Holdings [Text Block] |

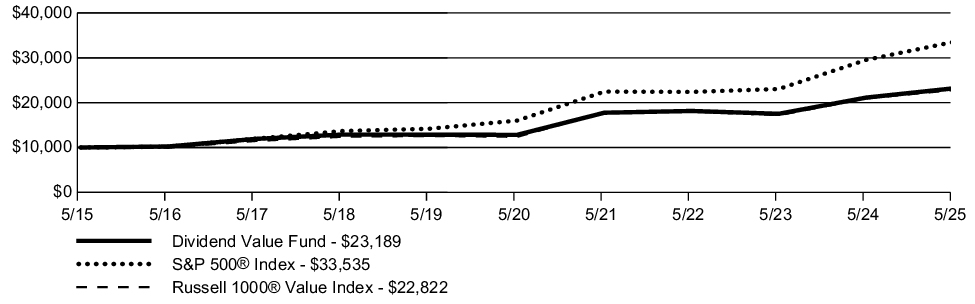

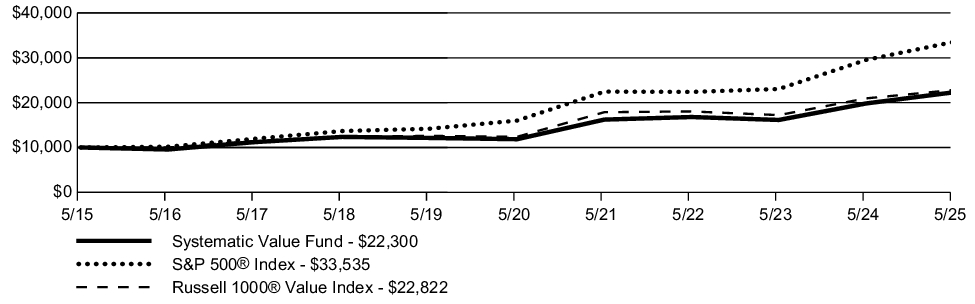

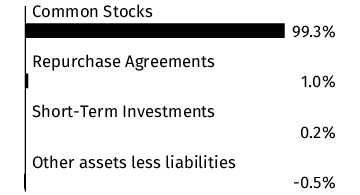

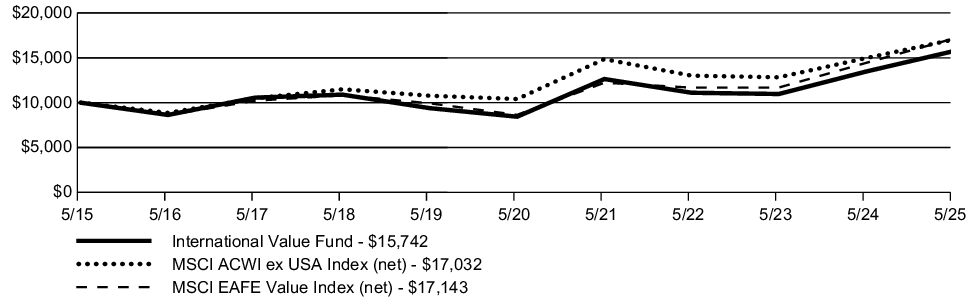

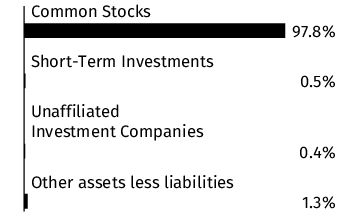

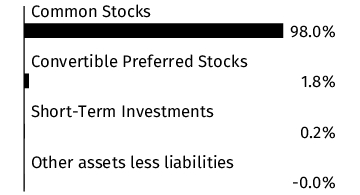

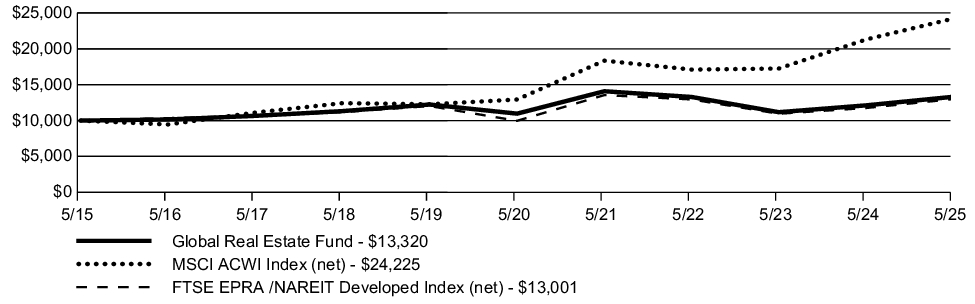

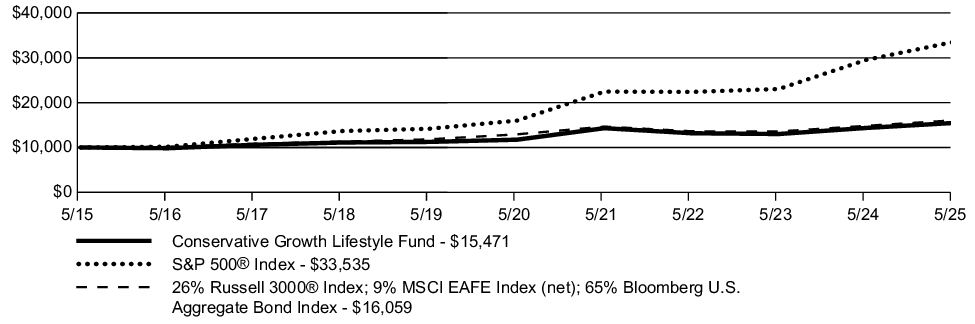

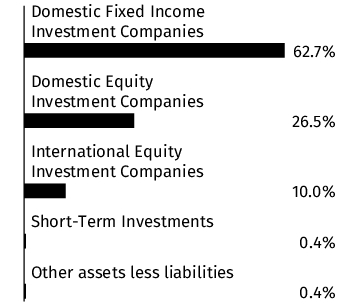

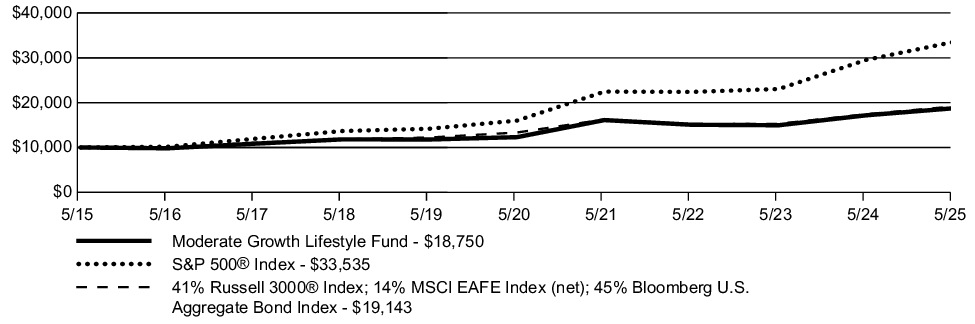

Graphical Representation of Holdings