DECEMBER 2024 EUROPEAN INVESTMENT BANK GROUP RISK MANAGEMENT DISCLOSURE REPORT

DECEMBER 2024 EUROPEAN INVESTMENT BANK GROUP RISK MANAGEMENT DISCLOSURE REPORT

December 2024 European Investment Bank Group Risk Management Disclosure Report ©

European Investment Bank, 2025. All rights reserved. All questions on rights and licensing should be addressed to publications@eib.org. European Investment Bank 98 -100, boulevard Konrad Adenauer L-2950 Luxembourg For further information on the EIB’s

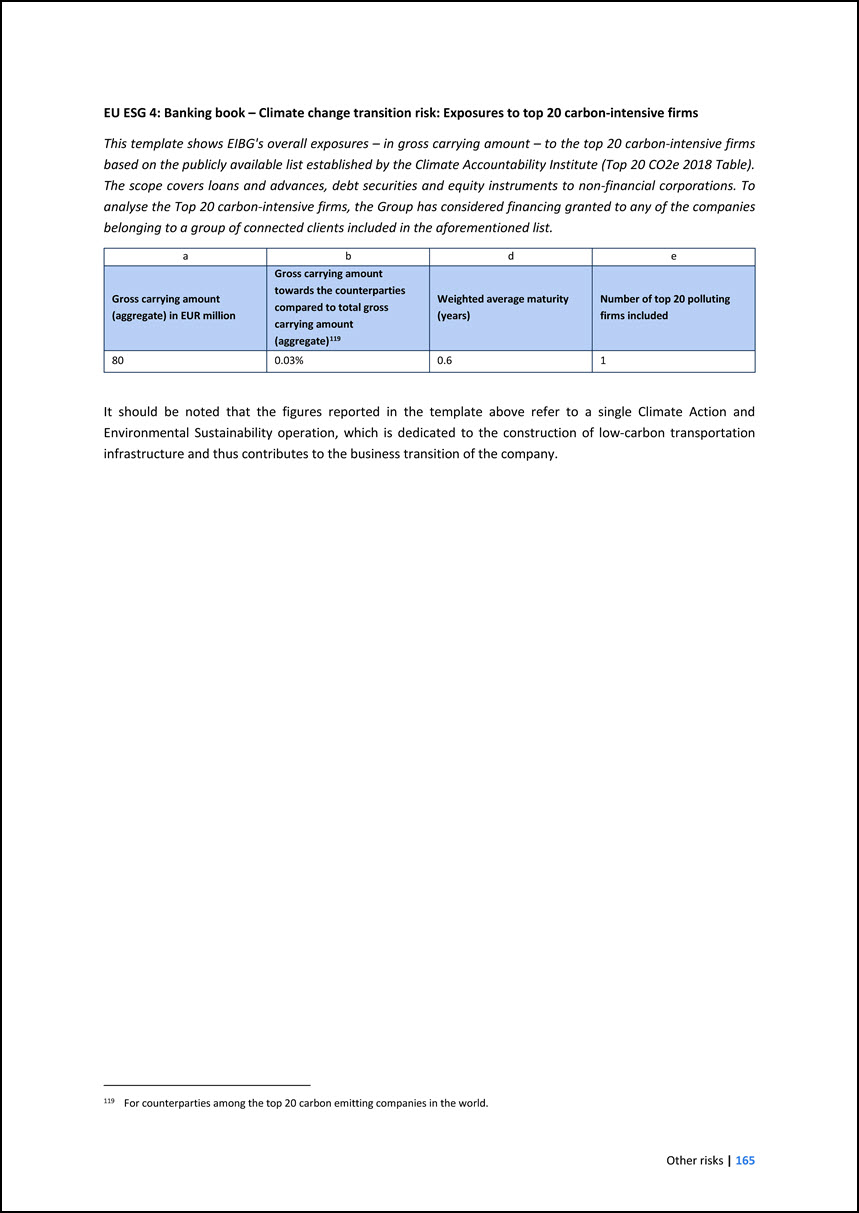

activities, please consult our website, www.eib.org. You can also contact our Info Desk, info@eib.org. Get our e-newsletter at www.eib.org/sign-up. For further information on the European Investment Fund’s activities, please consult our website,

www.eif.org. Disclaimer: The information presented in this report has not been subject to external audit. Published by the European Investment Bank. Printed on FSC®

Paper.

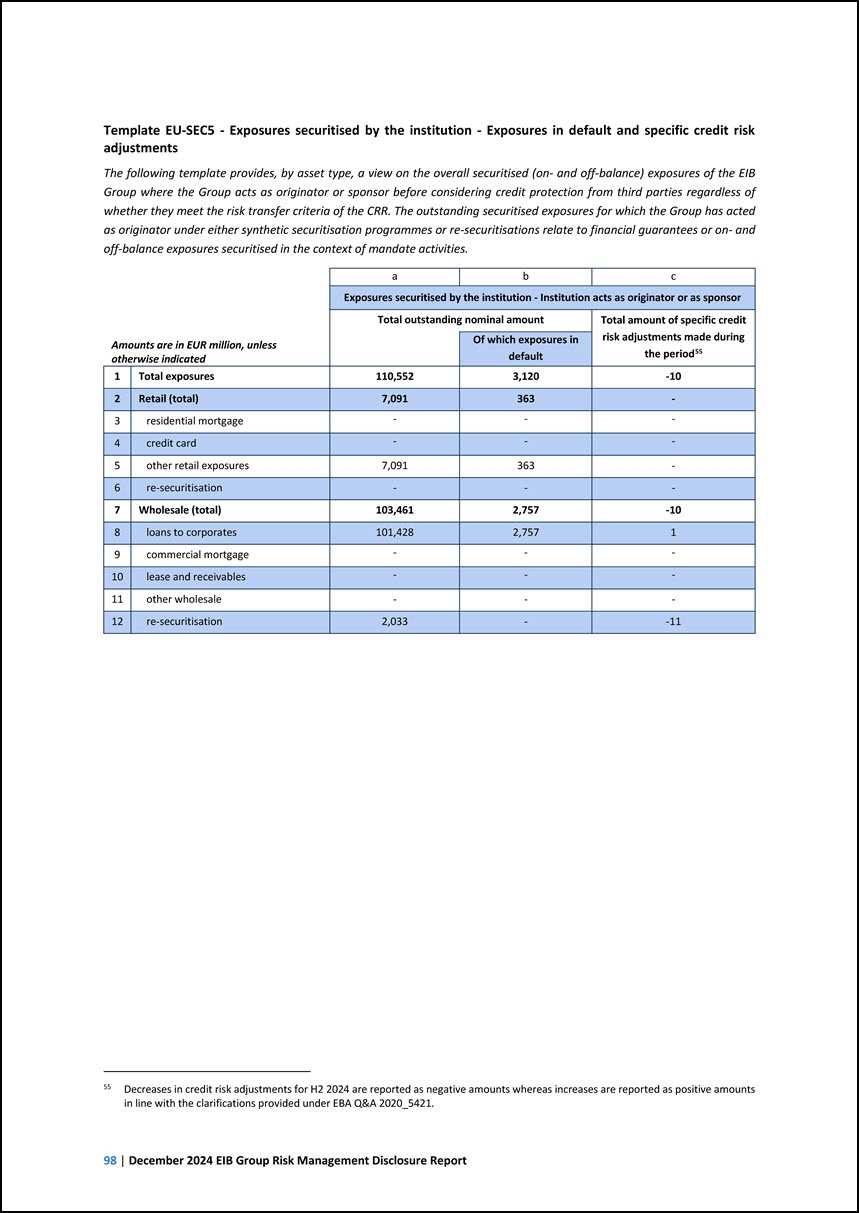

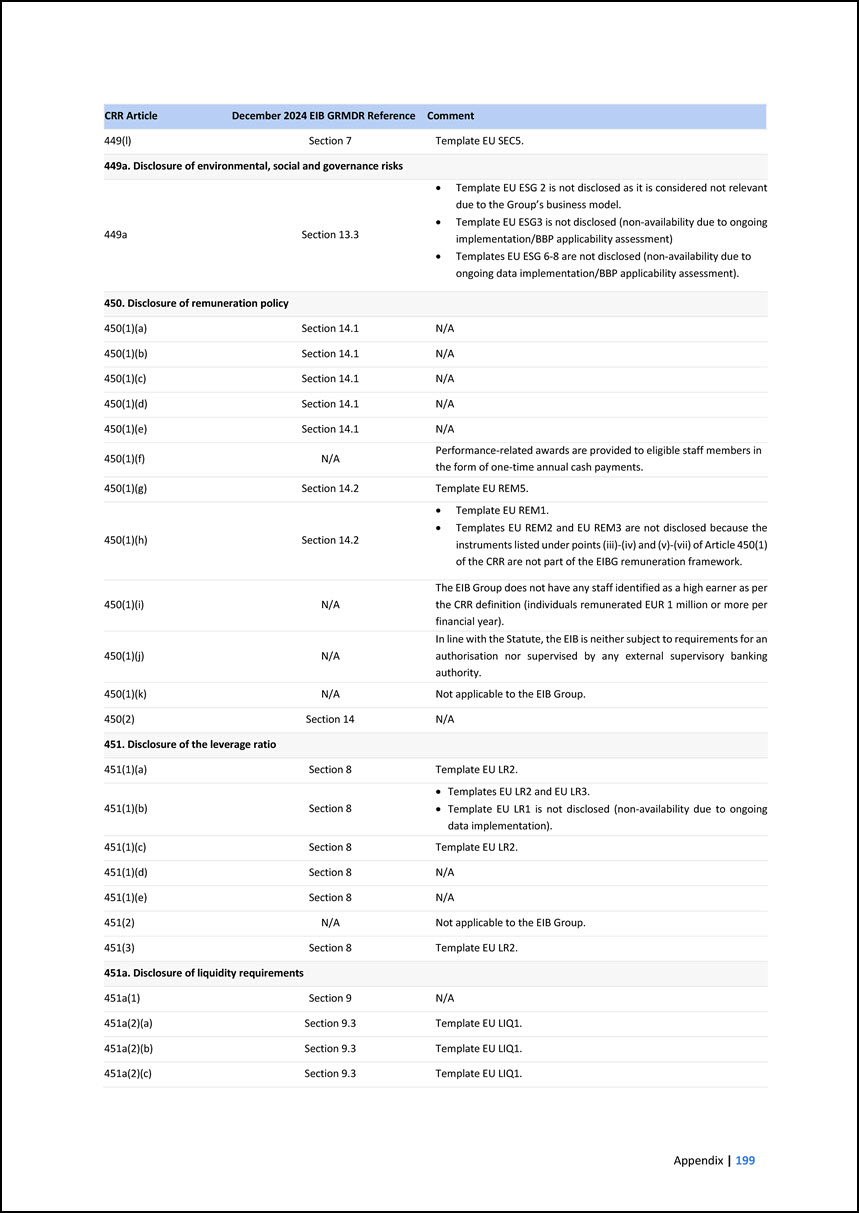

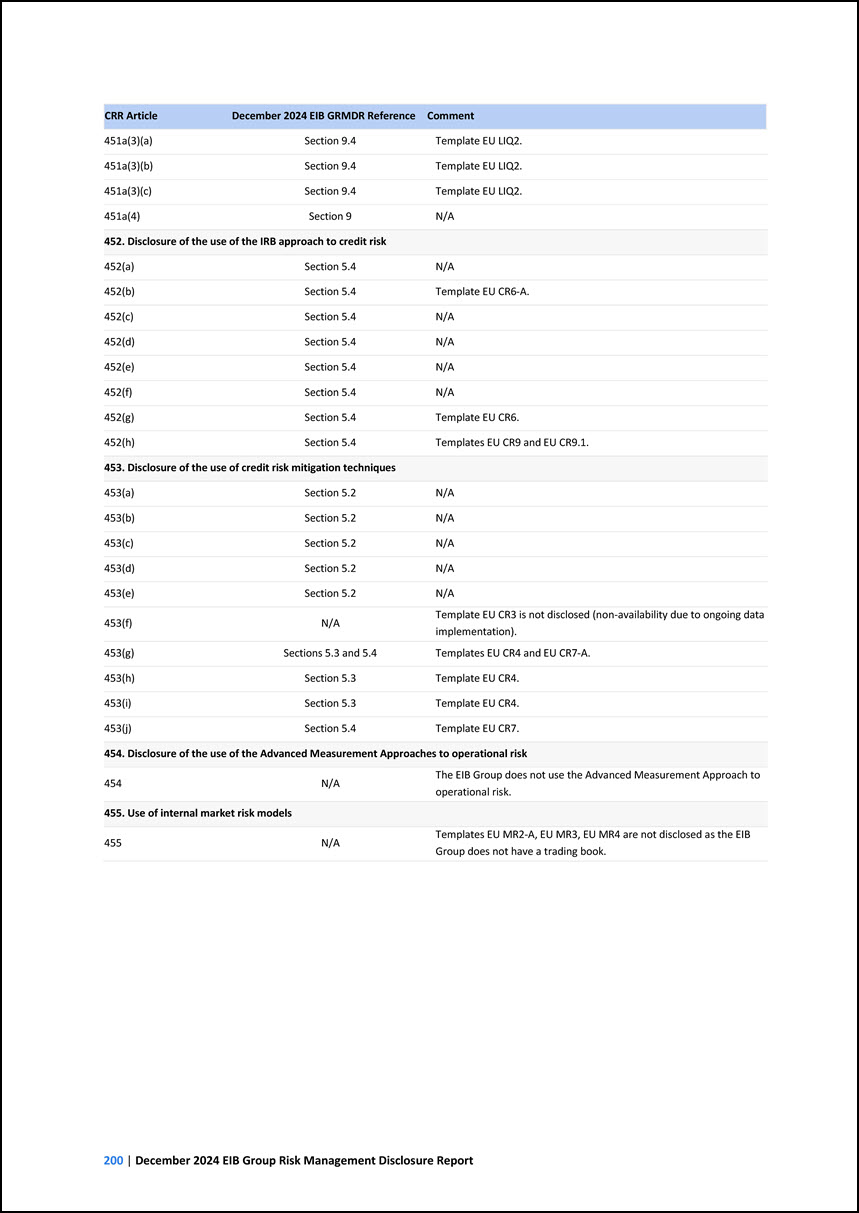

TABLE OF CONTENTS 1 INTRODUCTION 1 1.1 Executive summary 2 1.2 Key risk metrics 5 2 BASIS OF PREPARATION 9 2.1 Scope of consolidation 9 2.2 Reconciliation with

financial statements 9 2.3 Disclosure criteria 10 2.4 Frequency, extent and means of disclosures 12 2.5 Disclosure policy 13 2.6 Approval process 13 3 GOVERNANCE AND RISK MANAGEMENT 14 3.1 Risk management structure and organisation 14 3.2 Risk

management framework 16 3.3 Corporate governance 21 4 CAPITAL ADEQUACY AND RISK-WEIGHTED EXPOSURE AMOUNTS 25 4.1 Capital requirements 25 4.2 Own funds 30 5 CREDIT RISK 39 5.1 Internal framework for credit risk management 39 5.2 Credit risk

mitigation 52 5.3 Use of the standardised approach 53 5.4 Use of the Internal Ratings Based approach 56 5.5 Equity risk 80 6 COUNTERPARTY CREDIT RISK 82 7 SECURITISATION 90 8 LEVERAGE RATIO 99 9 LIQUIDITY RISK 104 9.1 Internal framework for

liquidity risk management 104 9.2 Internal Liquidity Adequacy Assessment Process (ILAAP) 106 9.3 Liquidity coverage ratio (LCR) 107

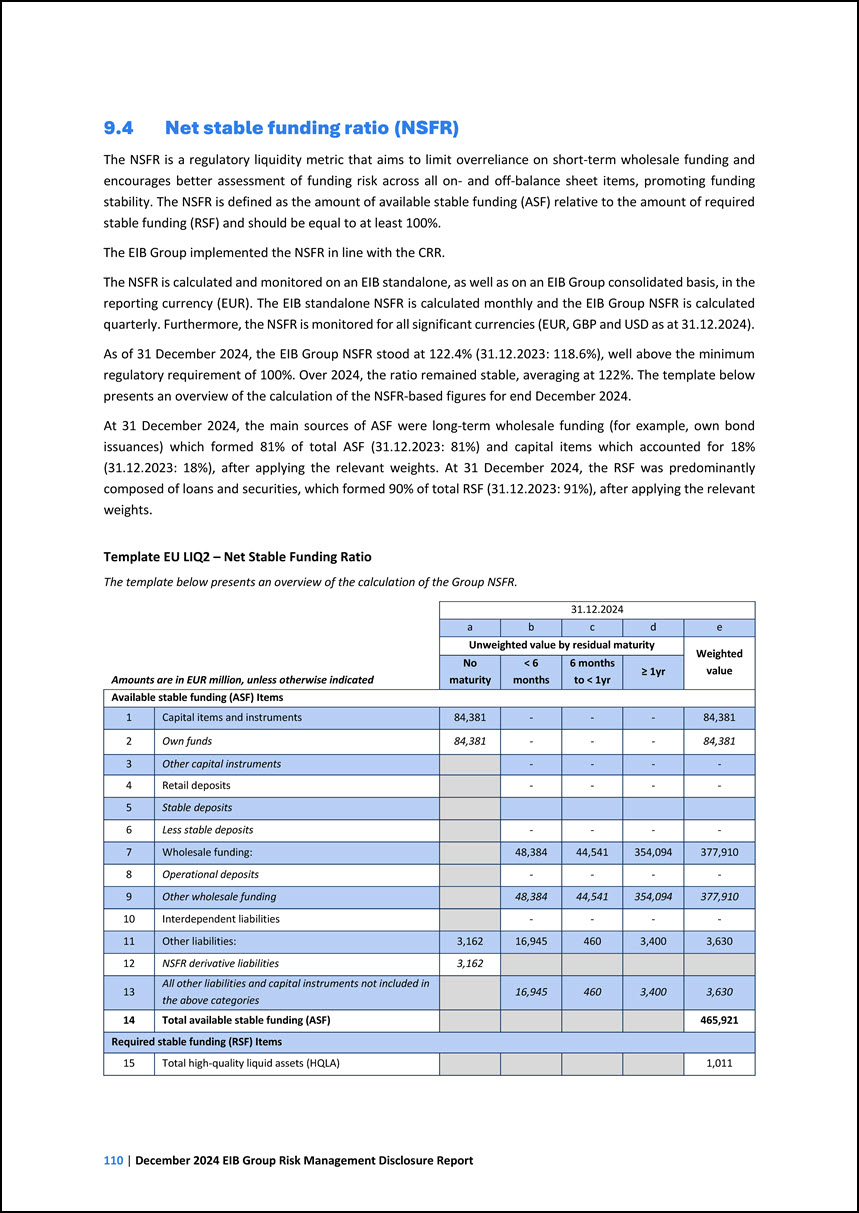

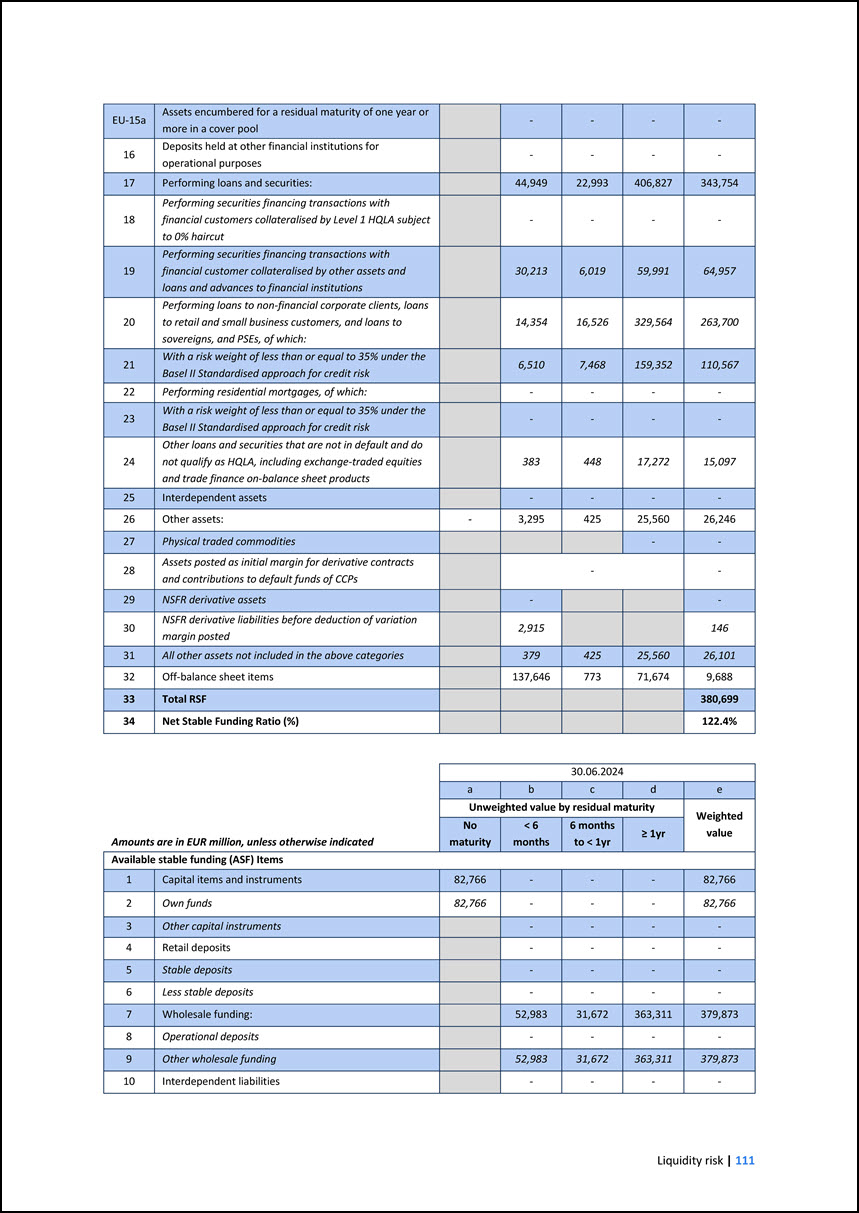

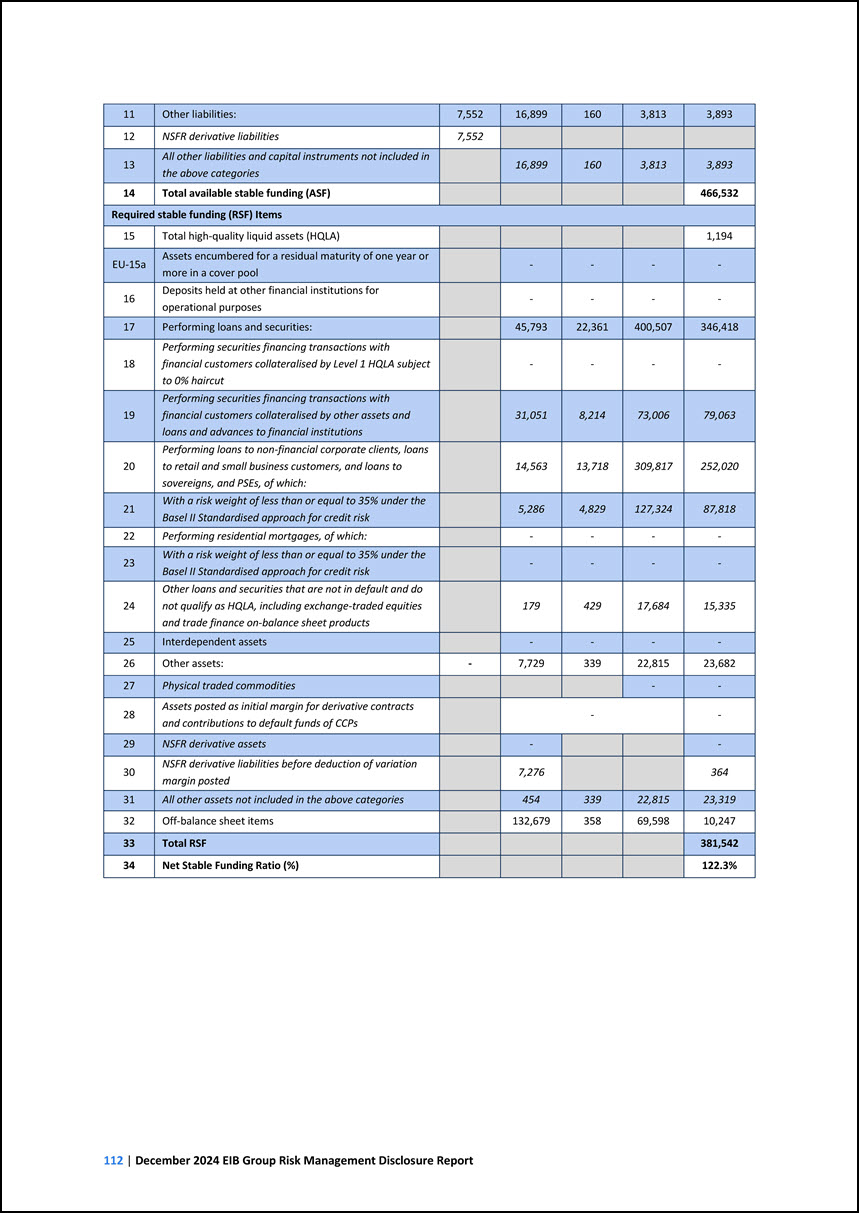

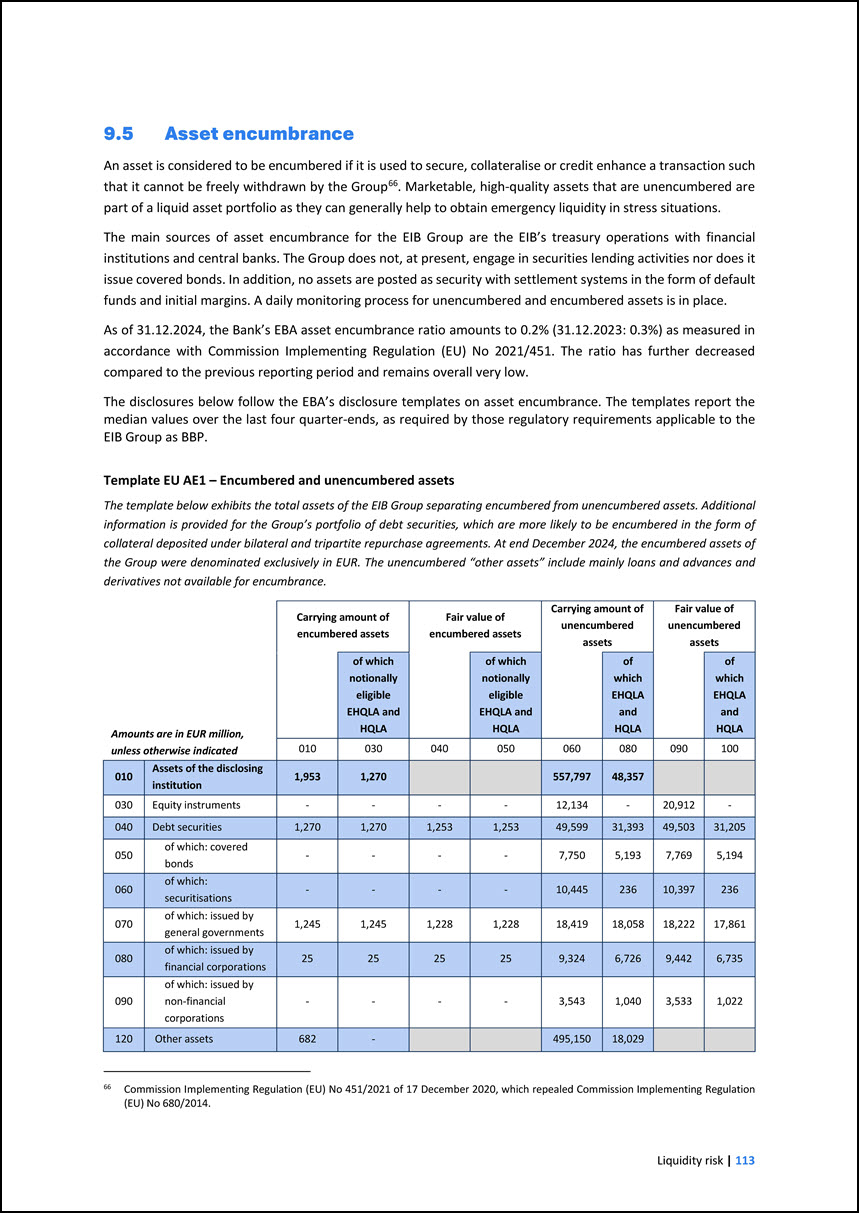

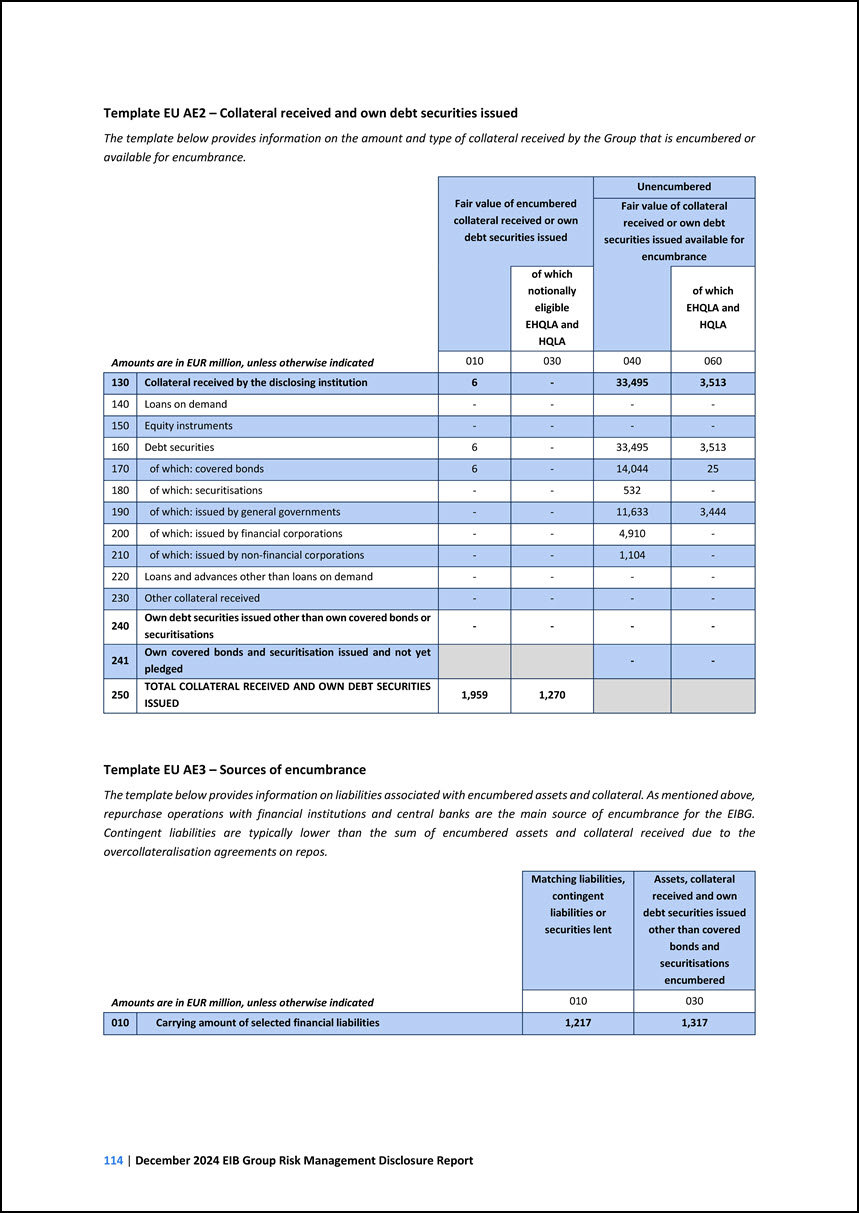

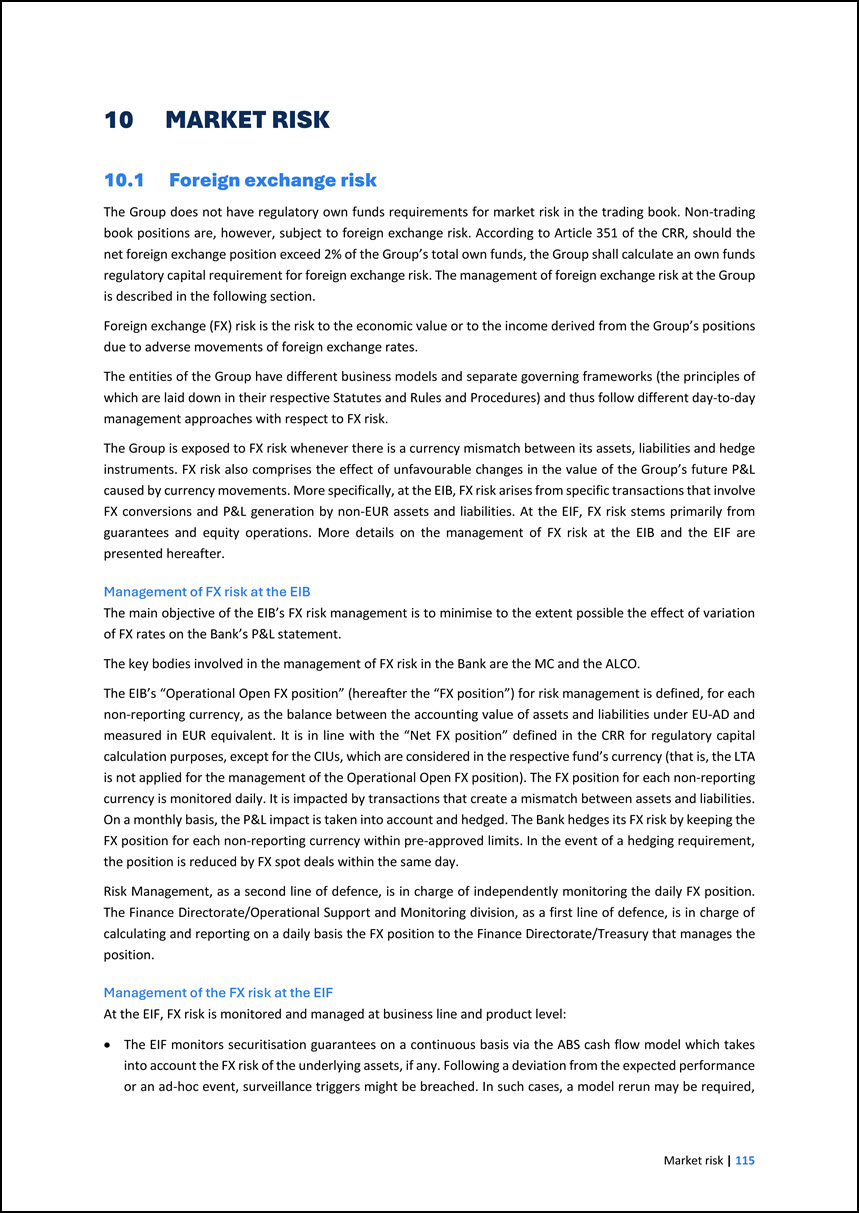

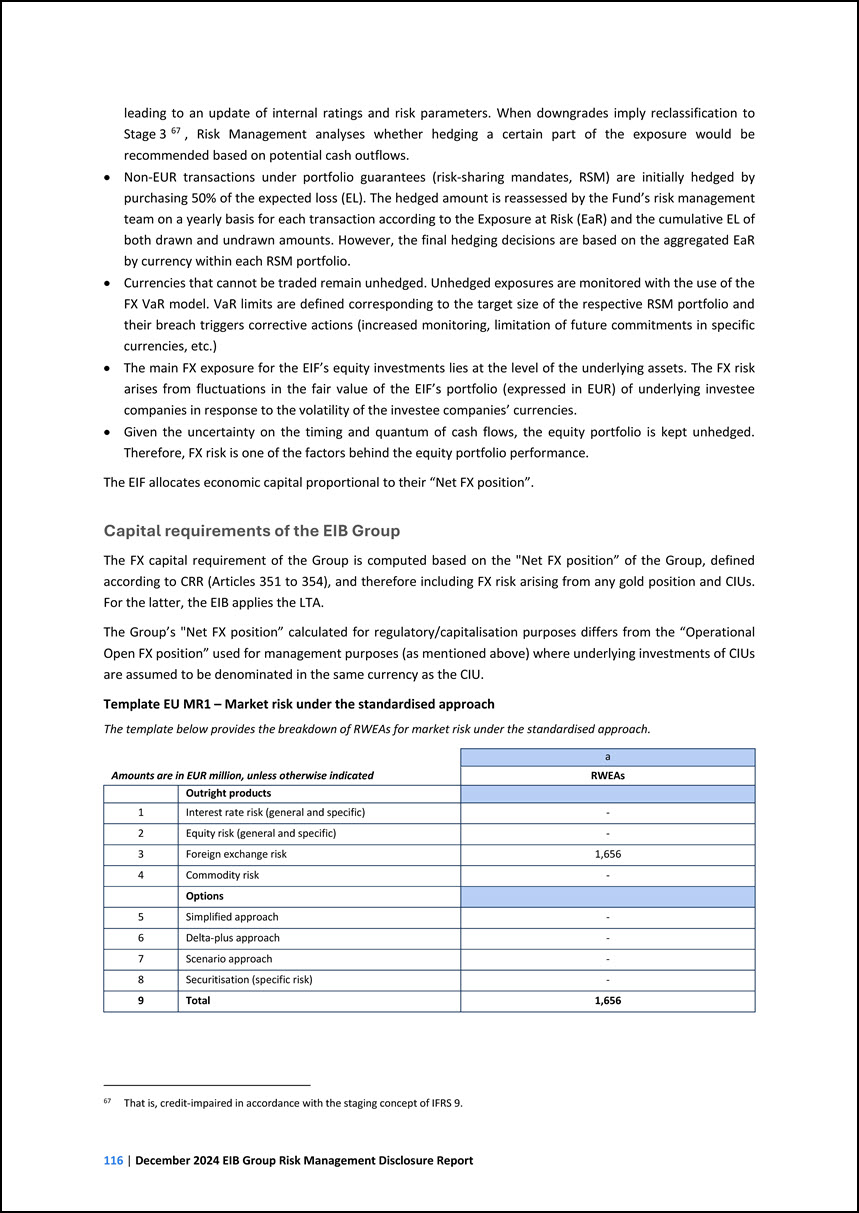

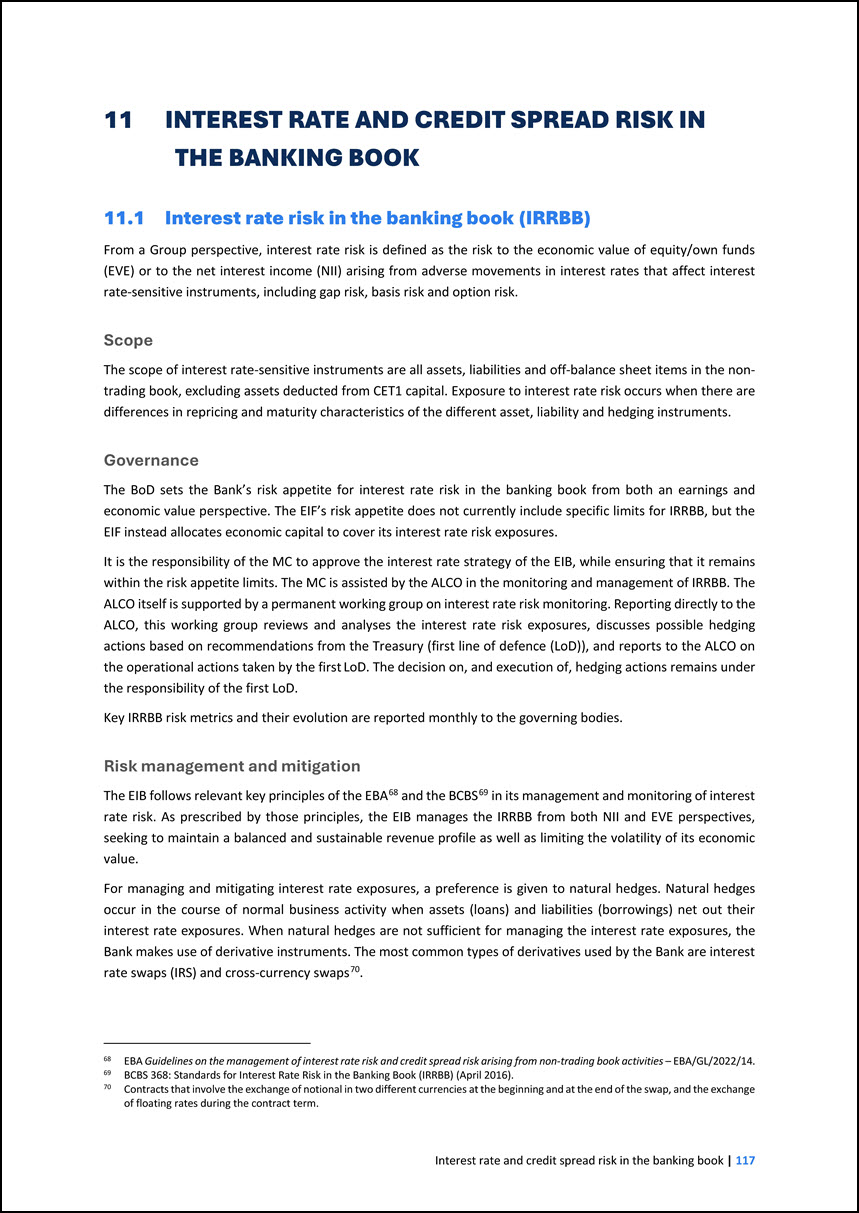

9.4 Net stable funding ratio (NSFR) 110 9.5 Asset encumbrance 113 10 MARKET RISK 115 10.1 Foreign exchange risk 115 11 INTEREST RATE AND CREDIT SPREAD RISK IN THE

BANKING BOOK 117 11.1 Interest rate risk in the banking book (IRRBB) 117 11.2 Credit spread risk in the banking book (CSRBB) 123 12 OPERATIONAL RISK 124 13 OTHER RISKS 136 13.1 Pension and health insurance risks 136 13.2 Reputational and strategic

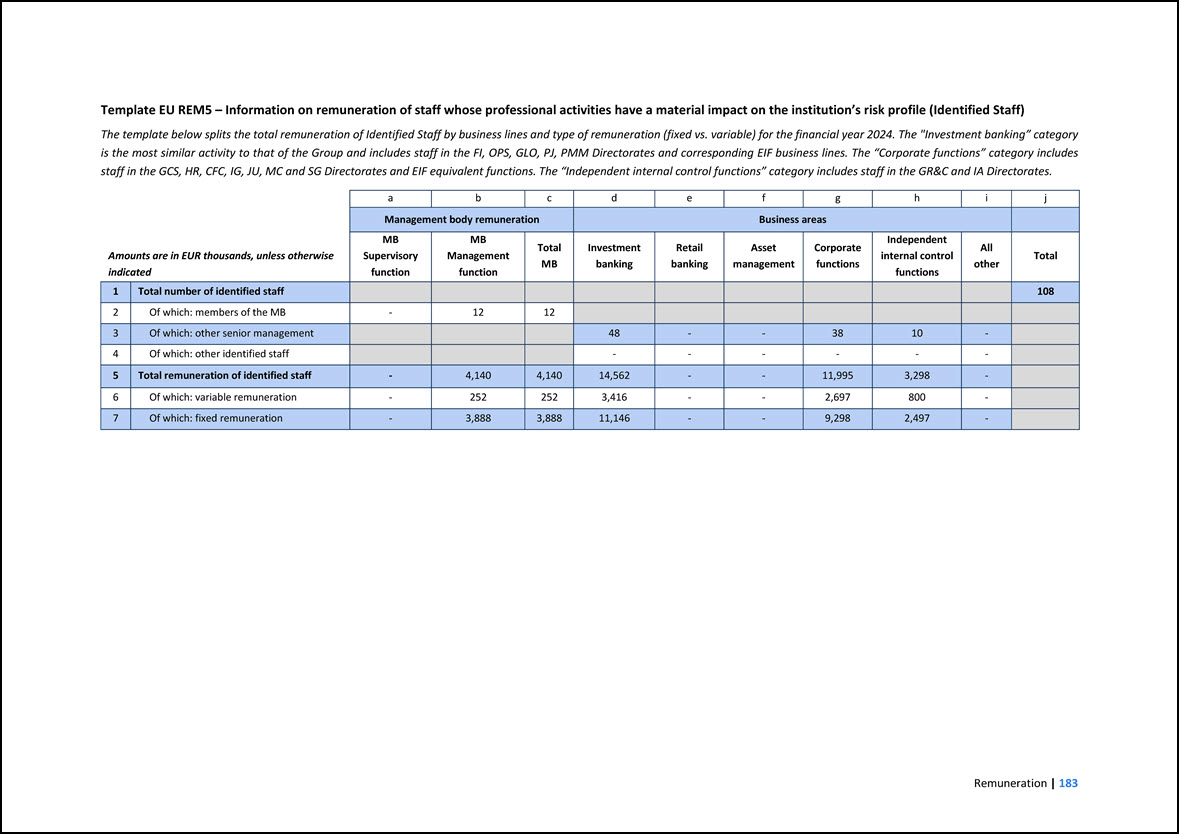

risks 137 13.3 Environmental, social and governance risks 137 14 REMUNERATION 178 14.1 EIB Group annual self-assessment 178 14.2 EIB Group remuneration data 181 15 APPENDIX 185 15.1 Appendix I – Overview of the EIB Group 185 15.2 Appendix II –

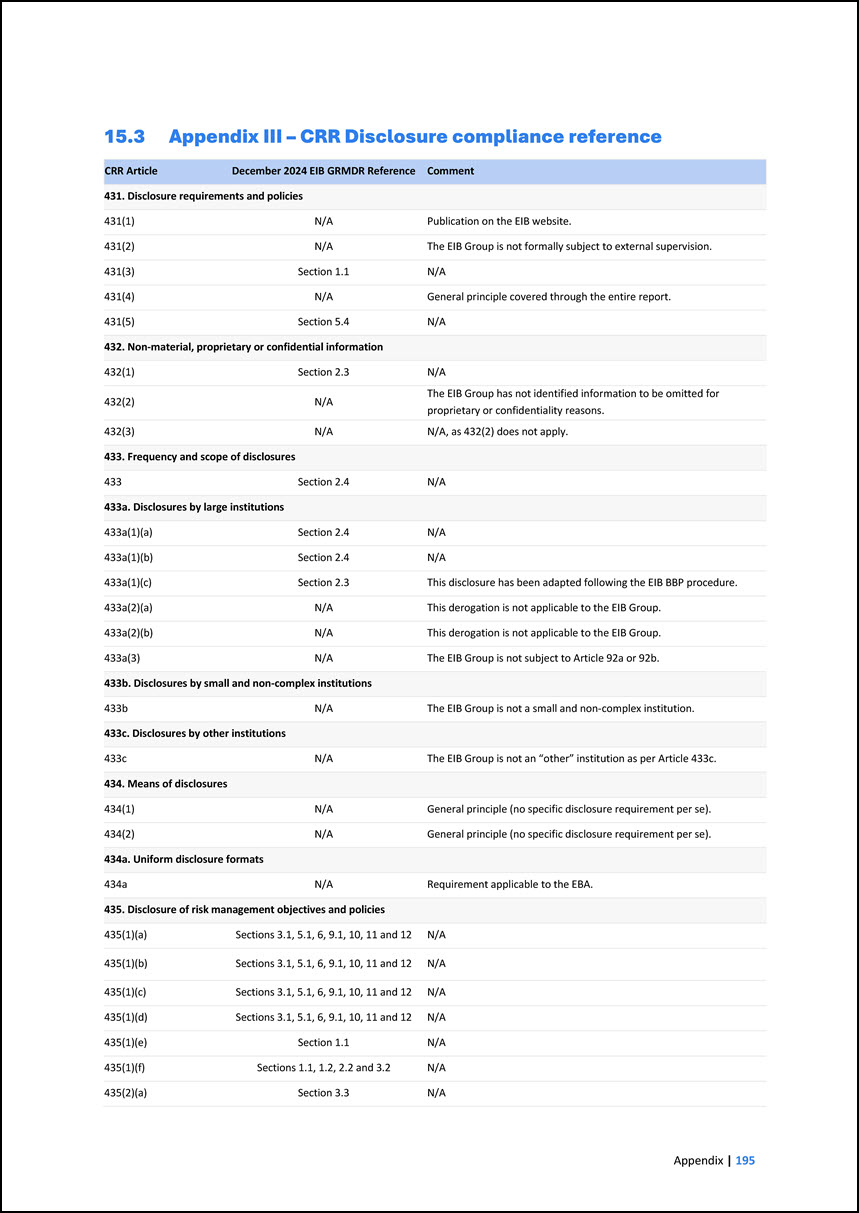

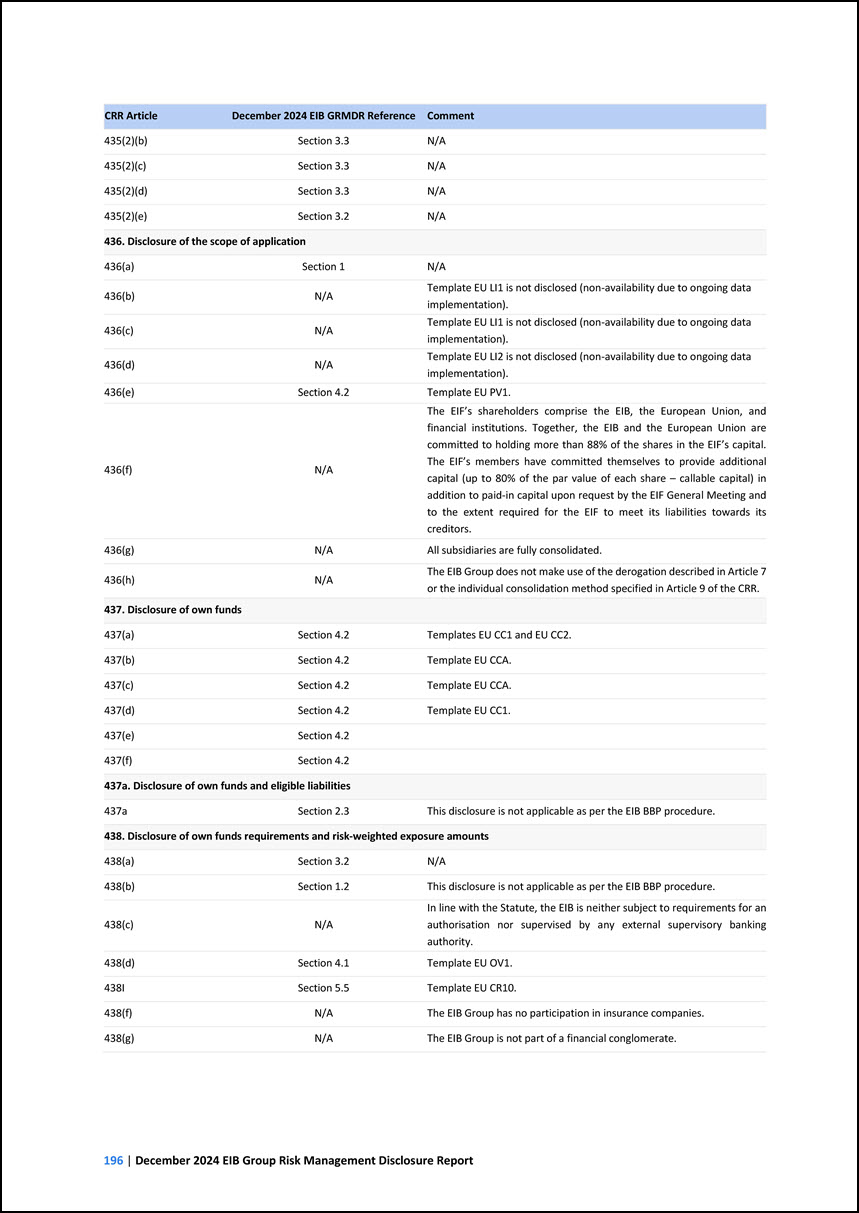

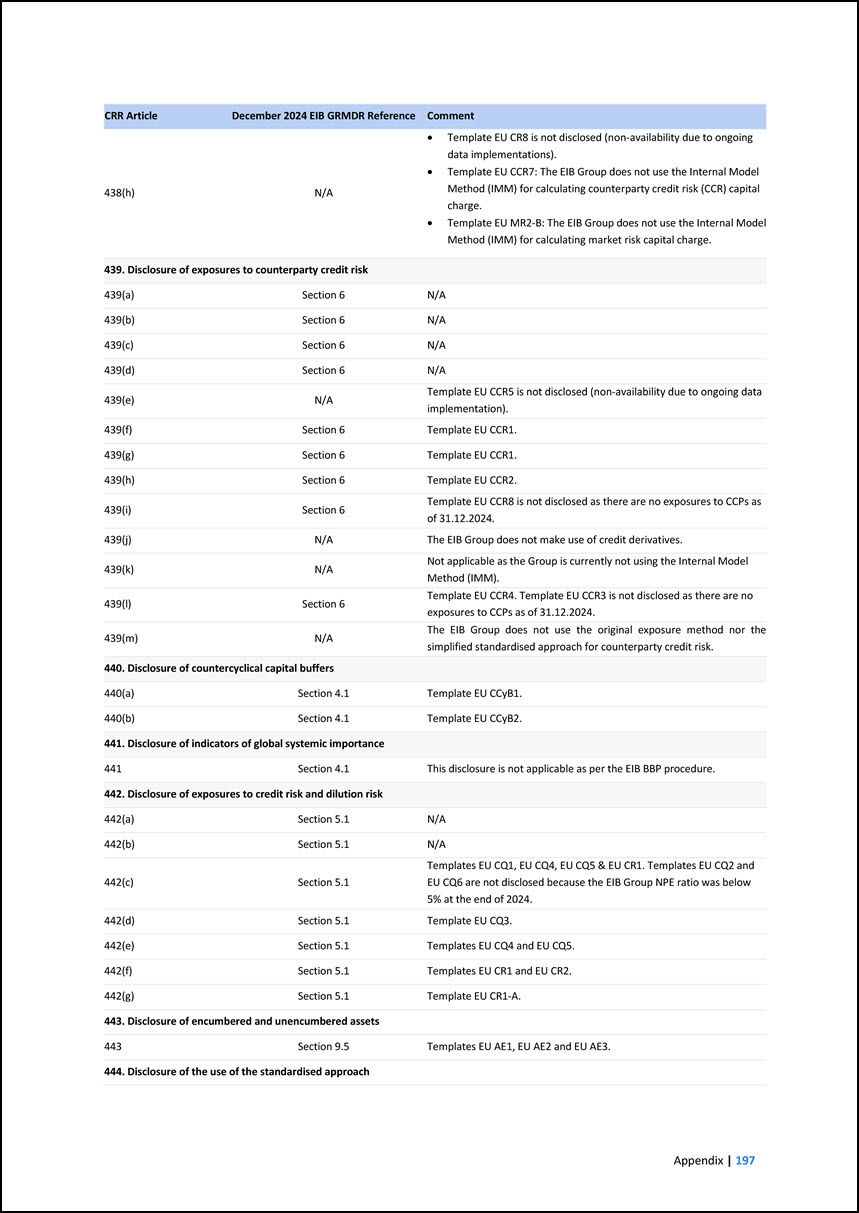

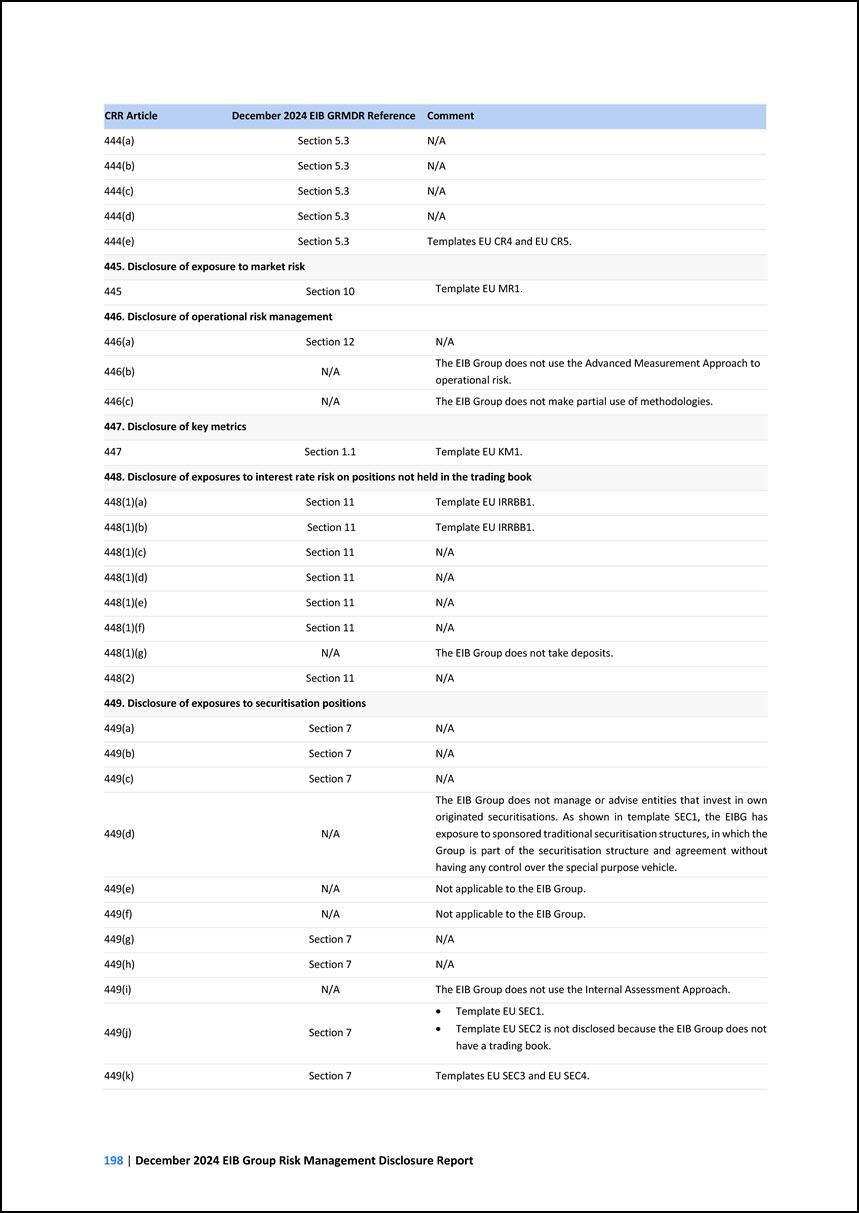

Abbreviations 188 15.3 Appendix III – CRR Disclosure compliance reference 195 -

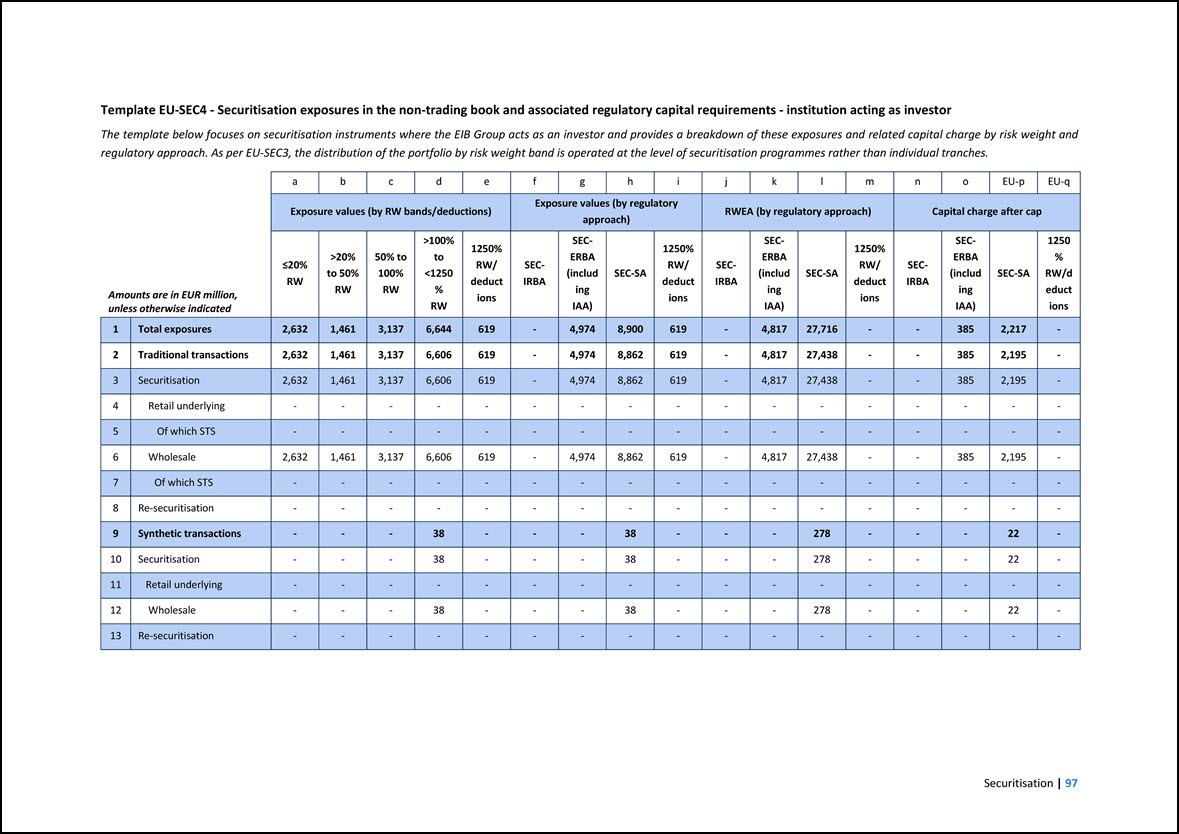

1 INTRODUCTION The EIB Group (the ‘EIBG’ or the ‘Group’’) does not fall within the scope of application of the European Union (EU)’s legislation applicable to credit

institutions, in particular the Capital Requirements Directive and Regulation (Directive 2013/36/EU or ‘CRD’, Regulation 575/2013 or ‘CRR’, as amended from time to time). The EIB, therefore, is not legally obliged to meet the requirements of the

above-mentioned Directive and Regulation. However, reflecting its statutory duty to conform with best banking practice (BBP), the EIB aims to apply both at individual and consolidated level relevant EU banking legislative acts and guidelines, to the

extent determined by its competent governing bodies and in line with the BBP Guiding Principles approved, as further described in Section 2.3 below. Following on from the above, the December 2024 EIB’s Group Risk Management Disclosure Report

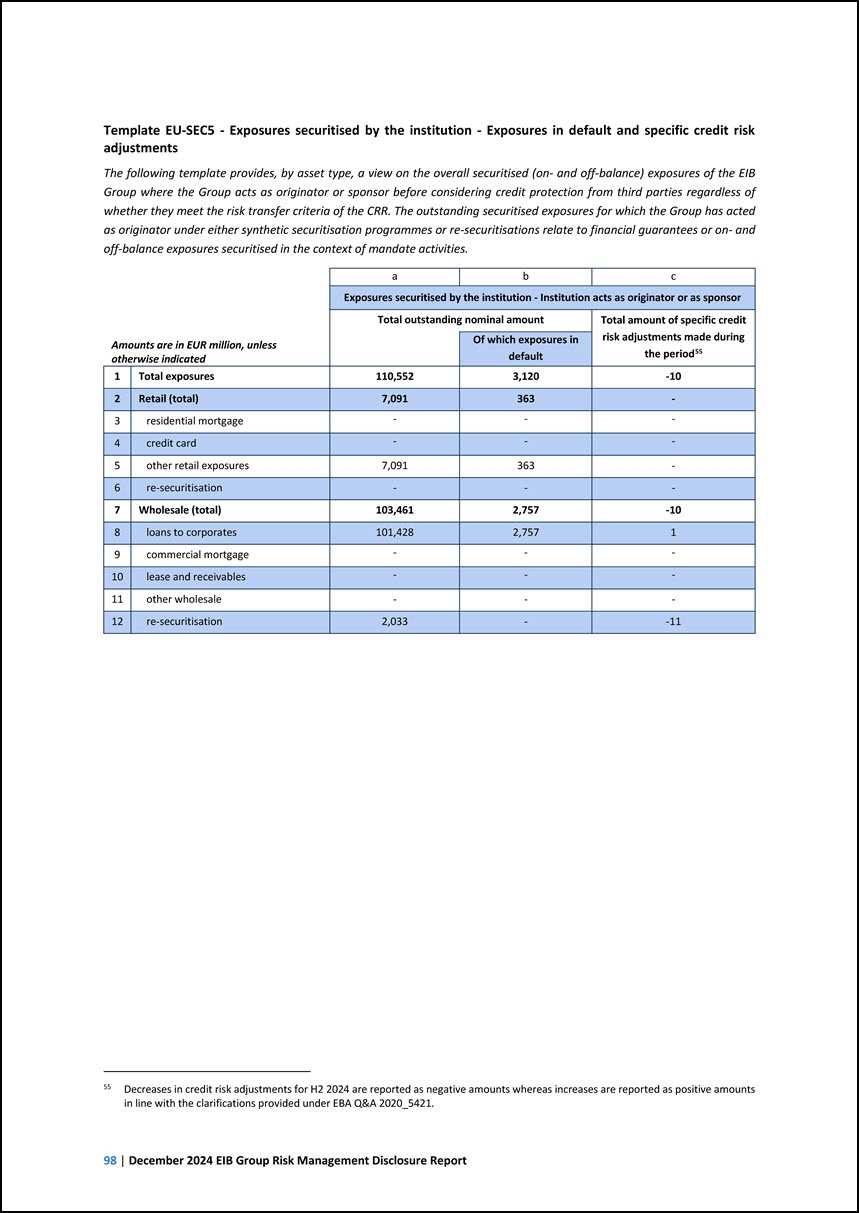

(‘GRMDR’ or the ‘Report’) has been prepared in line with the prudential disclosure requirements as set out in Articles 431 to 455 of Part Eight of CRR seek to increase the efficiency of banks’ disclosures and reinforce market discipline through a

comprehensive framework with consistent and comparable Pillar III disclosures1 and the related technical standards, guidelines and opinions of the European Banking Authority (‘EBA’), deemed applicable to the EIB as BBP. These disclosure requirements

and the corresponding European Commission Implementing Regulation2 3. 1 Part Eight (Articles 431 to 455) of Regulation (EU) No 575/2013 of the European Parliament and of the Council, of 26 June 2013 (CRR), as subsequently amended, notably by

Regulation (EU) 2019/876 of the European Parliament and of the Council, of 20 May 2019. 2 (i) Commission Implementing Regulation 2021/637 of 15 March 2021 laying down implementing technical standards with regard to public disclosures by institutions

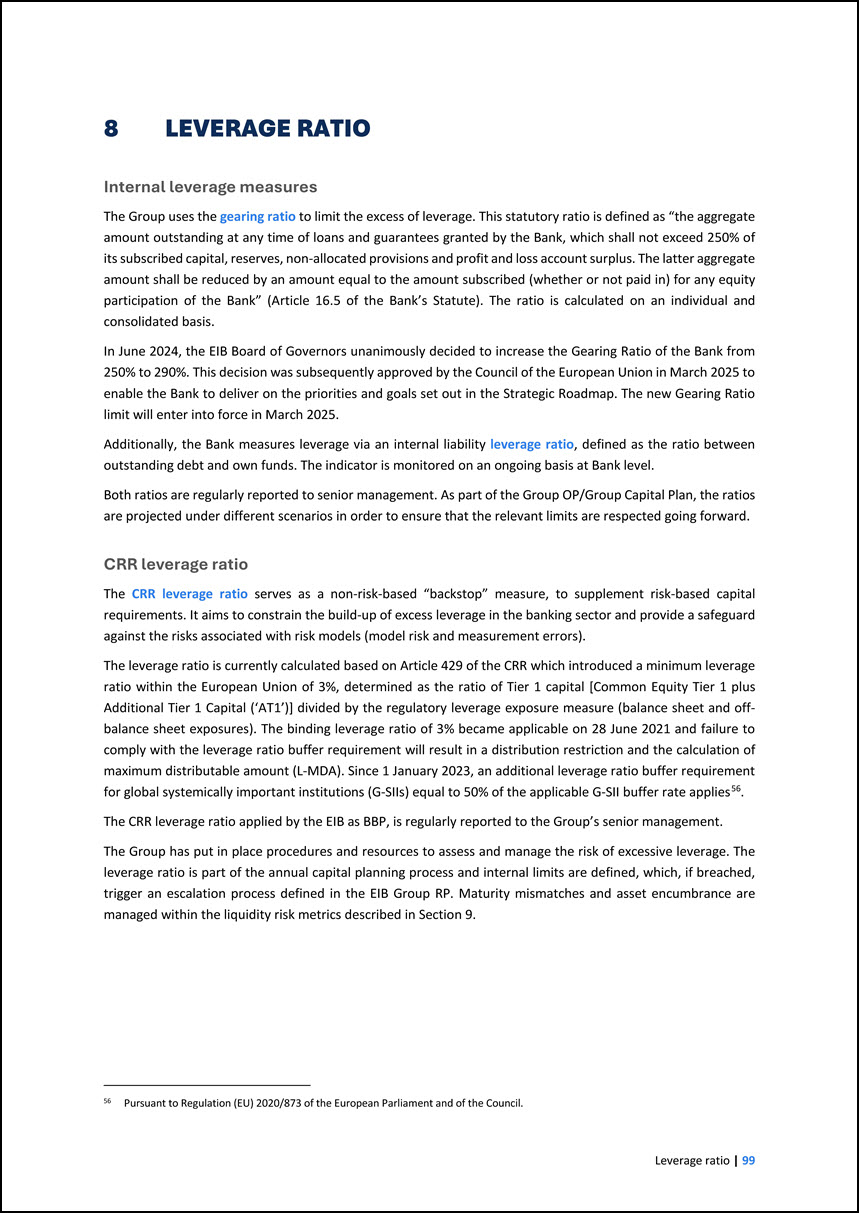

of the information referred to in Titles II and III of Part Eight of Regulation (EU) No 575/2013 of the European Parliament and of the Council and repealing Commission Implementing Regulation (EU) No 1423/2013, Commission Delegated Regulation (EU)

2015/1555, Commission Implementing Regulation (EU) 2016/200 and Commission Delegated Regulation (EU) 2017/2295 (based on EBA/ITS/2020/04), as amended by Commission Implementing Regulations (EU) 2021/1018 of 22 June 2021, (EU) 2022/631 of 13 April

2022, and (EU) 2022/2453 of 30 November 2022. (ii) Commission Implementing Regulation (EU) 2022/631 of 13 April 2022 amending the implementing technical standards laid down in the Implementing Regulation (EU) 2021/637 as regards the disclosure of

exposures to interest rate risk on positions not held in the trading book (based on EBA/ITS/2021/07); and (iii) Commission Implementing Regulation (EU) 2022/2453 of 30 November 2022 amending the implementing technical standards laid down in

Implementing Regulation (EU) 2021/637 as regards the disclosure of environmental, social and governance risks (based on EBA/ITS/2022/01), also jointly referred to in the current report as “EBA ITS”. 3 The disclosure report in the context of the

Basel Framework is also referred to as “Pillar III”, representing the third Basel pillar based on market discipline. Further, in this edition of the Report, disclosures reflect the non-applicability as BBP or non-availability of certain templates,

as described in Section 2.3 below. Accordingly, the EIB Group’s disclosures are not fully comparable with those published by EU credit institutions, financial holding companies and mixed financial holding companies, directly within the subjective

scope of CRD/CRR, owing that to the EIB’s status as an EU body pursuant to the Treaty on the Functioning of the European Union. The EIBG consists of the European Investment Bank (the ‘EIB’ or the ‘Bank’) and the European Investment Fund (the ‘EIF’

or the ‘Fund’). For a more detailed overview of the Group entities please refer to Section 15. Appendix (Appendix I – Overview of the EIB Group). The information provided in this report is unaudited. Due to rounding, numbers presented throughout

this document may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures. For the purpose of the certifications foreseen in Articles 435(1)(e) and 431(3) of the CRR, applicable to the EIB on an

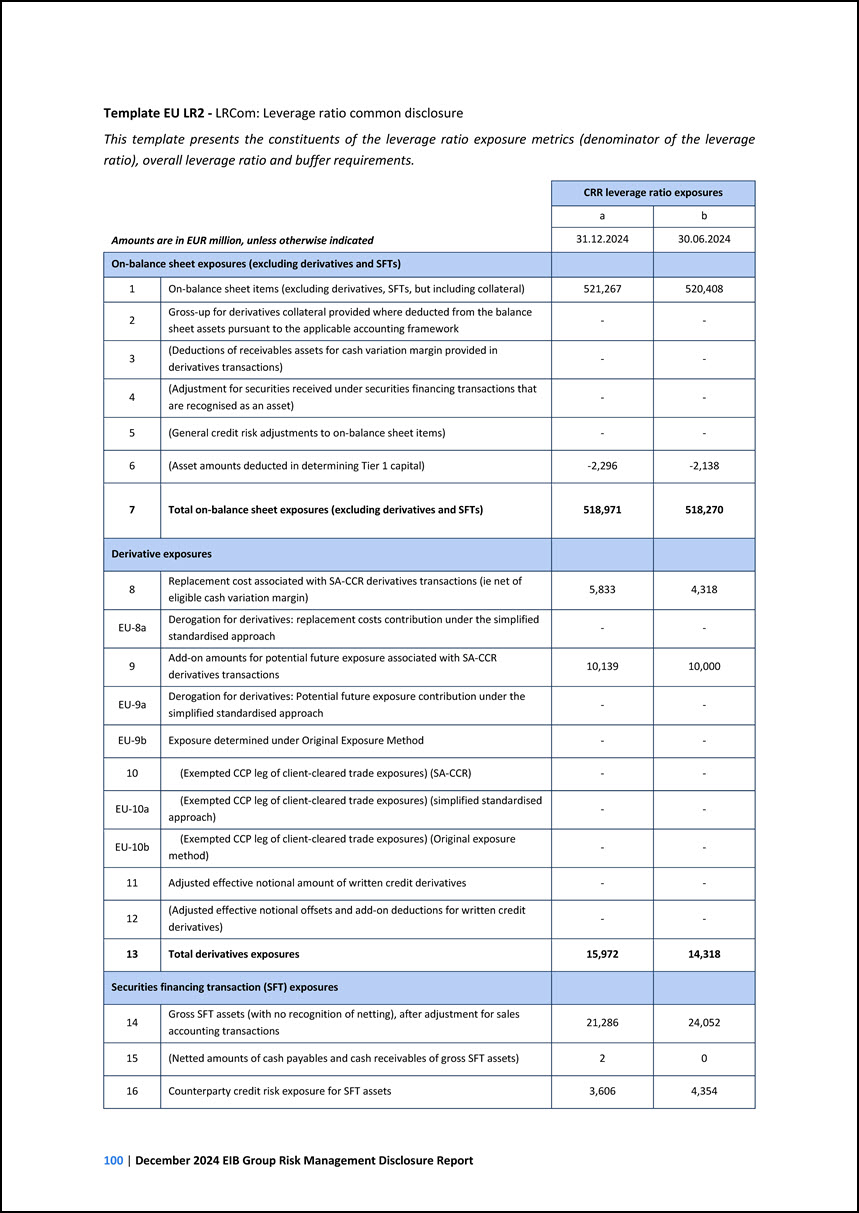

individual and consolidated basis as BBP, the EIB President confirms that the EIB’s risk management systems are adequate with regard to the institution's profile and strategy and that the disclosures in this report have been prepared in accordance

with the EIB’s policies, internal processes, systems and controls.

The format and headings of most of the quantitative disclosures presented in this report are consistent with the relevant European Commission Implementing Regulation

as referred to in this report with some adaptations on the basis of the BBP Guiding Principles, to reflect compatibility with the EIB’s statutory framework. Reference to the respective regulatory templates is provided in the disclosure’s respective

headings. 1.1 Executive summary Business strategy and overall risk profile The 2024-2027 Strategic Roadmap outlines the eight key priorities and programmes that contribute in closing Europe’s investment gap. The Strategic Roadmap allows the EIB

Group to maintain its very high policy relevance. In order for the EIB to keep a strong capital position, the roadmap foresees the maintenance of an appropriate volume of mandates and guarantees from the EU budget. Financing amounts and programming

of the Group’s activities, including the business mix and the level of higher- risk activities, are subject to the annual Group operational planning process. The EIB Group Operational Plan 2025-2027 (“Group Operational Plan”) defines business

targets for 2025 and orientations for 2026 and 2027. It summarises the key priorities and activities to deliver the EIB Group’s strategy for the next three years. It also proposes financing targets using the EIB Group's own and third-party

resources. The approach to determining annual operational targets and orientations takes into account the Group’s objective of maintaining a robust credit standing, the long-term nature of its lending business and the granularity of its portfolio.

The Strategic Roadmap sets a clear focus for the Group’s priorities until 2027. To implement these, the EIB Group’s public policy goals (PPG) framework, including two transversal objectives and four primary goals, continues to serve as a core

planning and eligibility tool for the Group Operational Plan. In March 2025, the EIB Board of Directors approved the creation of an additional horizontal PPG for Security and Defence. The EIB Group remains very vigilant to ensure that activity levels

are both financially sustainable and aligned with the Group’s business model. The Group Operational Plan is deemed financially sustainable over the long term. The EIB Group manages credit, market and liquidity risk in line with its risk appetite and

public mission. By pursuing a prudent financial policy, the Bank seeks to generate financial resources organically to support its growth in the long term. The risk appetite is the level of risk that the Group is willing and, in line with the EIB

statutory framework, able to incur in pursuing its activities in the context of its public mission and objectives. Key to this is the Group’s capacity to provide attractive long-term financing to serve EU objectives across all EU Member States (and

beyond in partner countries). A primary pillar of the Group’s business model is the Bank’s high credit standing and its status as prime issuer in the capital markets underpinned by the long-term AAA issuer rating from the major credit rating

agencies. The Group’s risk appetite, as well as the processes and activities performed by the Group to manage its risk appetite, are formalised in the Group Risk Appetite Framework (‘RAF’) approved by the Board of Directors (BoD). The Group RAF

covers the major financial risks and non-financial risks categories. It helps to embed a healthy organisational risk culture within the Group through the implementation and monitoring of measurable risk appetite metrics, which are subject to risk

limits and (where applicable) cascaded further down within the Group entities. Short and longer-term capital needs of the Group are closely monitored. The EIB Group’s capital position is projected to remain solid over the planning horizon.

The EIB Group Risk Appetite Statement 2024 as included in Section 3.2., together with the Group RAF Policy 2024, were approved by the EIB Board of Directors on 20 June

2024. For a full overview of the key business developments of the Bank’s and the Fund’s activities over the last financial year, please refer to, respectively, the Overview of the EIB Financial Report and the EIF’s Annual Report. For a full overview

on financial and business planning of the EIB Group, please refer to the latest EIB Group Operational Plan, available on the EIB website. EIB Global The EIB’s development finance role has moved forward and intensified in recent years through the

establishment of EIB Global whose goal is to increase the impact of the EIB’s activities outside the European Union aligned with the European Union’s priorities. EIB Global is an internal organisational unit within the EIB, operating under the

Bank’s legal framework. It brings together EIB development staff under a dedicated management team. EIB Global has a specific capital allocation provided annually by the EIB Board of Directors under the Group Operational Plan, and benefits from a

dedicated Board Advisory Group involving European development stakeholders. It has flexibility to establish its own policies and strategies and develop its own products. EIB Global nonetheless operates fully within EIB Group-wide policies on areas

such as risk management, as determined by the EIB Board of Directors. As part of its operating model, EIB Global maintains a strong local presence on the ground through a network of external representations located in partner countries where local

presence has the greatest impact by bringing the Bank closer to its clients. Most of EIB Global’s outstanding portfolio is covered by guarantees from the European Union in the form of either comprehensive guarantees, political risk guarantees or

other guarantees from the EU Member States. Under the current EU long-term budget (Multiannual Financial Framework), EIB Global’s business implementation relies on a mix of EU guarantees under NDICI-Global Europe and third-party funds, allowing to

de-risk the EIB portfolio. These guarantees are complemented by lending from EIB Global’s own risk facilities. EIB support for Ukraine Since 2014, the Bank has stopped its lending activities in Russia, consistent with the overall objectives of EU

common foreign and security policy, including applicable sanctions. Moreover, the Bank has compliance controls and procedures in place, including a dedicated Sanctions Compliance Programme, aiming to ensure that its activities, including those that

may involve Russia, comply with all applicable sanctions. Since the start of Russia’s invasion in 2022 and with the support of the European Commission, the EIB has provided EUR 2 billion in emergency relief and project support to Ukraine. In 2024,

the EIB Group was selected as one of the main implementing partners of the Ukraine Investment Framework (part of the EU’s Ukraine Facility), comprising guarantees and grants for European and other development finance institutions. At least EUR 2

billion in guarantees for public sector operations are foreseen to be allocated to the EIB, with first signatures expected to take place in 2025. Additional funding for existing programmes in support of SMEs in Ukraine have been awarded to the EIB

Group. In 2024, the EU for Ukraine (EU4U) Initiative, approved by the EIB’s Board of Directors in 2023, was implemented. This included the setting-up of the EU4U Fund, a trust fund providing guarantees for EIB Global lending, impact finance

investments and grants (such as investment grants or interest rate subsidies) with additional operations signed and approved during 2024.

At the same time, the EIB set up the EU4U Advisory Programme, a EUR 100 million technical assistance package from the EIB’s own resources to support Ukraine and

Moldova. The EU4U Fund will enable continued lending to Ukraine and will serve as a temporary bridge solution until longer-term EU measures become available. In 2024 the EU4U Advisory Programme approved and allocated EUR 41 million for technical

assistance. The EIB remains committed to supporting the recovery and reconstruction of Ukraine by financing new critical economic and social infrastructure as needed, as soon as conditions permit it. As detailed in the Overview of the EIB Financial

Report, the EIB’s disbursed exposure in Ukraine is predominantly covered by EU Comprehensive Guarantees and EU Political Risk Guarantees under the EU External Lending Mandate. A summary of the EIB’s exposure in Russia, Belarus, Israel and Palestine4

is provided in the Overview of the EIB Financial Report 2024. 4 This designation shall not be construed as recognition of a State of Palestine and is without prejudice to the individual positions of the Member States on this issue. Quality of the

EIB loan portfolio The overall asset quality of the EIB’s loan portfolio is deemed stable in 2024. Preserving the quality of the Bank’s loan portfolio is enabled mainly by a comprehensive due diligence process, adequate lending structures and

security, and standard protective clauses included in loan agreements. In addition, the Bank has established a loan portfolio monitoring framework allowing for timely risk management decisions. Credit enhancements are largely in the form of

portfolio guarantees from EU sovereigns, the EU budget, investment-grade banks and corporates and high-quality financial collateral and assignments of rights or pledges at transaction level. Climate and sustainability In 2020, the EIB Group

developed the EIB Group Climate Bank Roadmap (CBR) 2021-2025 to put its new climate, environmental and social goals into action. Under the CBR, the EIB Group aims to build on its past successes and solidify its role as the climate bank, in alignment

with the Strategic Roadmap which sets a clear focus for the Groups priorities until 2027. It contains three commitments: (i) aligning all new operations with the principles and goals of the Paris Agreement for addressing climate change, (ii)

gradually increasing EIB annual financing dedicated to climate action and environmental sustainability to exceed 50% of total financing by 2025 and beyond, and (iii) supporting EUR 1 trillion of investment in climate action and environmental

sustainability from 2021-2030. The Strategic Roadmap published in 2024 recognises supporting climate action as the top strategic priority of our time and in addition to the EIB’s support for REPowerEU+, identifies two new flagship programmes: a

water programme in support of the blue economy and an energy efficiency programme for small and medium-sized enterprises (SMEs). The EIBG upholds transparency and accountability by proactively publishing information about its projects and

activities, engaging regularly with a broad spectrum of stakeholders and providing diverse reporting on its climate implementation on the EIB website. The EIB Group also reports annually on progress in implementing its 2021- 2025 Climate Bank

Roadmap. All reports are available on a dedicated page on the Bank’s website. Additional information on the EIB Group’s climate and sustainability actions may be found in section 13.3 of this report.

Group Operational Plan The 2025-2027 Group Operational Plan was approved by the EIB’s BoD in December 2024 in line with the Statutes and Rules of Procedures of the

Bank. It summarises the major financing activities to deliver the Group’s Strategic Roadmap for the period. The financing programme for the EIB Group activities of the EIB and the EIF has been defined to optimise additionality and impact whilst

ensuring the Group maintains an extremely solid financial performance with strong profitability and long-term sustainability. To maximise its impact in mobilising private investment and addressing market failures, the EIB Group will continue to

increase its risk appetite, while maintaining its very strong financing capacity. Adequate provision and efficient use of mandates and guarantees is indispensable to ensure the maintenance of current investment volumes and higher risk-taking, while

safeguarding the EIB’s top credit rating. This overall increase in risk-taking ambition will also reinforce support for the innovation, digital and human capital PPGs in the coming years. These smaller high-risk projects, which are also important

considering the tightening financing conditions for young and innovative firms, require significant additional origination and delivery efforts but are expected to be highly impactful. Further details on the Group Operational Plan approved are

available on the EIB website. EIB’s and EIF’s credit ratings The Bank’s high credit rating is a core feature of the business model and facilitates broad and deep investor support, even in times of turbulence. The EIB retains a ‘AAA’ rating with a

‘Stable’ outlook from the three major credit rating agencies (Fitch, Moody’s and S&P). The rating continues to be supported by the Bank’s central EU policy role, the high credit quality of the loan portfolio, robust liquidity, access to European

Central Bank refinancing facilities and strong risk management framework. The EIF’s AAA rating and stable outlook were also affirmed by the three major credit rating agencies. The agencies recognise the EIF’s exceptional capitalisation, robust

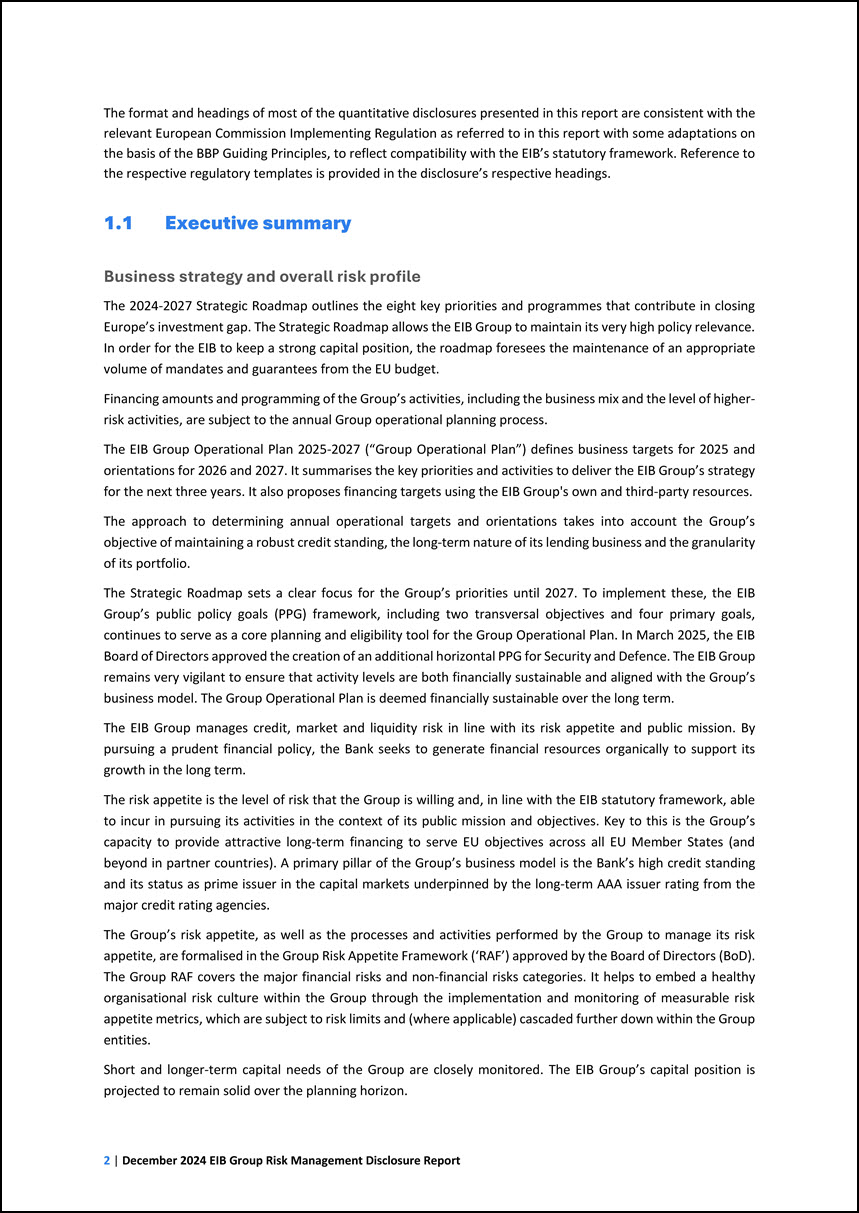

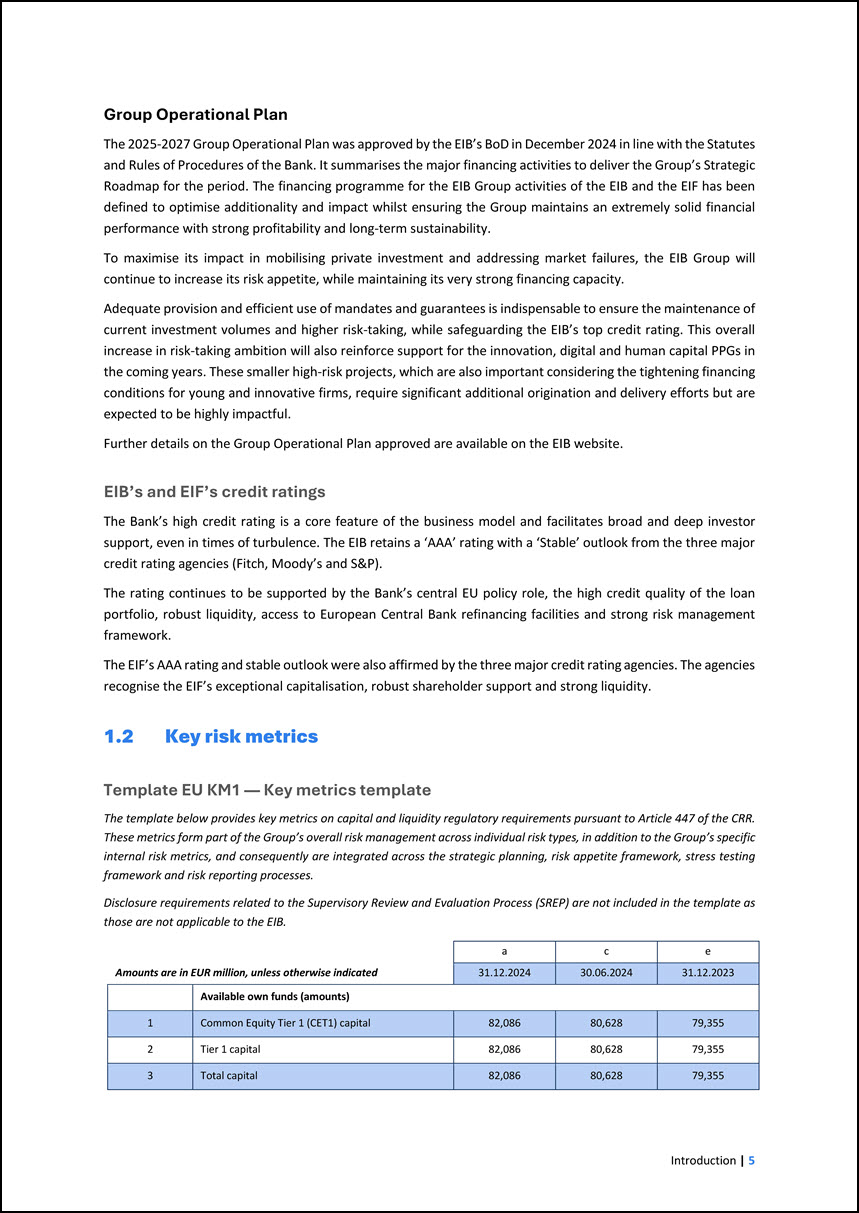

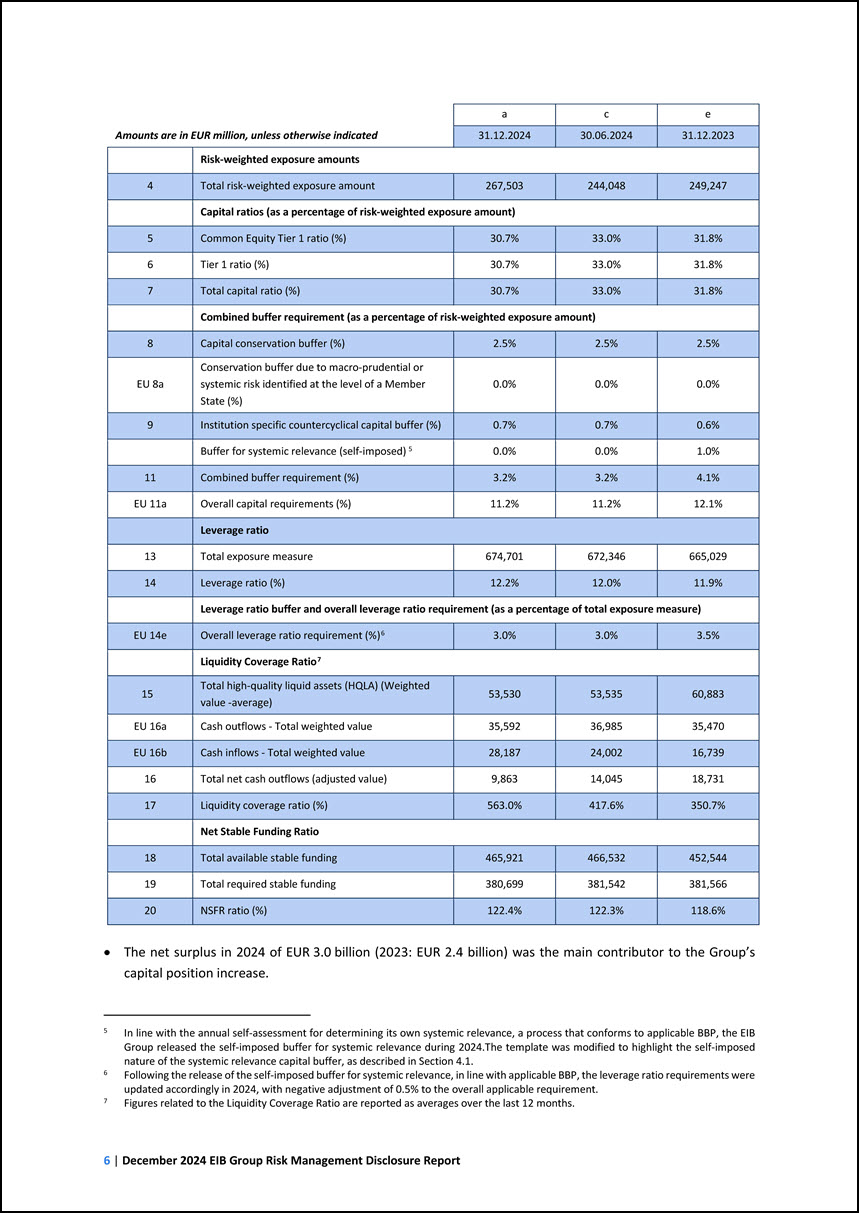

shareholder support and strong liquidity. 1.2 Key risk metrics Template EU KM1 — Key metrics template The template below provides key metrics on capital and liquidity regulatory requirements pursuant to Article 447 of the CRR. These metrics form

part of the Group’s overall risk management across individual risk types, in addition to the Group’s specific internal risk metrics, and consequently are integrated across the strategic planning, risk appetite framework, stress testing framework and

risk reporting processes. Disclosure requirements related to the Supervisory Review and Evaluation Process (SREP) are not included in the template as those are not applicable to the EIB. Amounts are in EUR million, unless otherwise indicated a c

e 31.12.2024 30.06.2024 31.12.2023 Available own funds (amounts) 1 Common Equity Tier 1 (CET1) capital 82,086 80,628 79,355 2 Tier 1 capital 82,086 80,628 79,355 3 Total capital 82,086 80,628 79,355

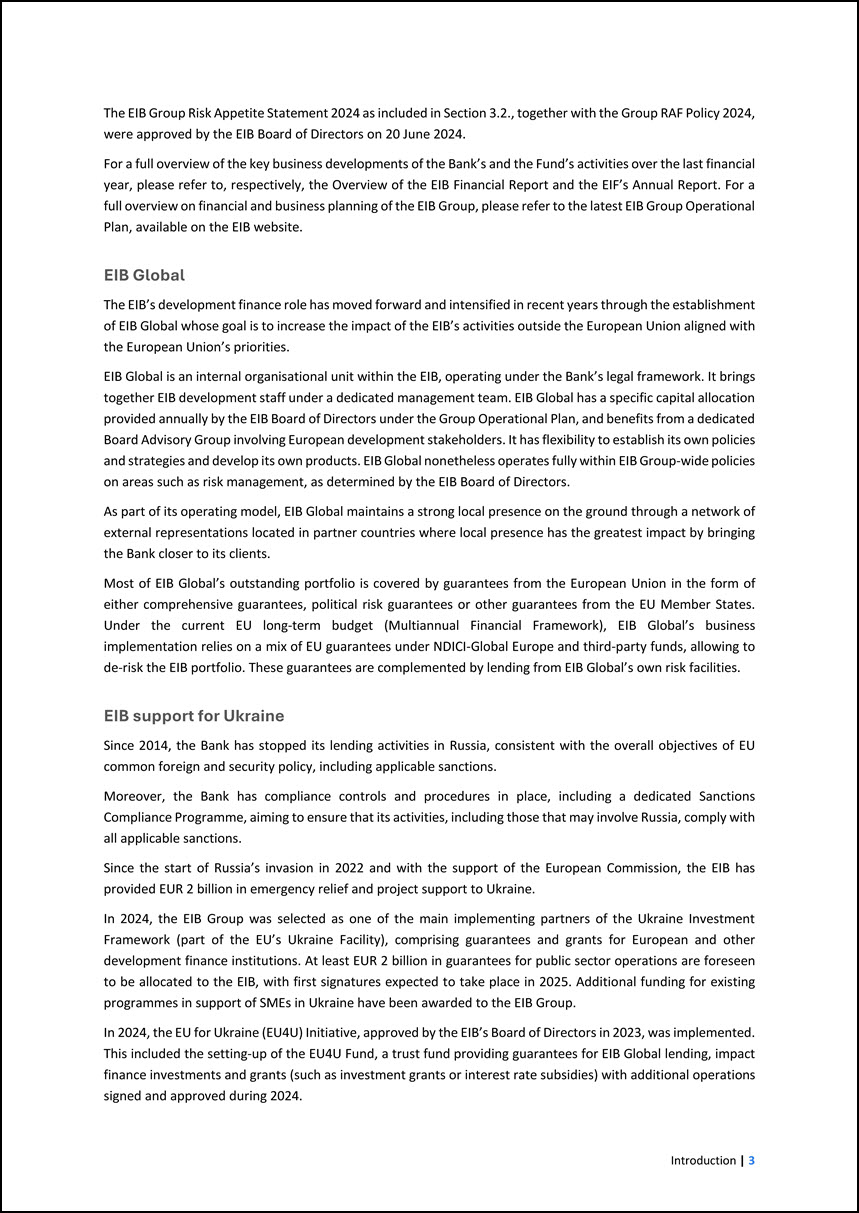

Amounts are in EUR million, unless otherwise indicated a c e 31.12.2024 30.06.2024 31.12.2023 Risk-weighted exposure amounts 4 Total risk-weighted exposure

amount 267,503 244,048 249,247 Capital ratios (as a percentage of risk-weighted exposure amount) 5 Common Equity Tier 1 ratio (%) 30.7% 33.0% 31.8% 6 Tier 1 ratio (%) 30.7% 33.0% 31.8% 7 Total capital ratio (%) 30.7% 33.0% 31.8%

Combined buffer requirement (as a percentage of risk-weighted exposure amount) 8 Capital conservation buffer (%) 2.5% 2.5% 2.5% EU 8a Conservation buffer due to macro-prudential or systemic risk identified at the level of a Member State (%)

0.0% 0.0% 0.0% 9 Institution specific countercyclical capital buffer (%) 0.7% 0.7% 0.6% Buffer for systemic relevance (self-imposed) 5 0.0% 0.0% 1.0% 11 Combined buffer requirement (%) 3.2% 3.2% 4.1% EU 11a Overall capital

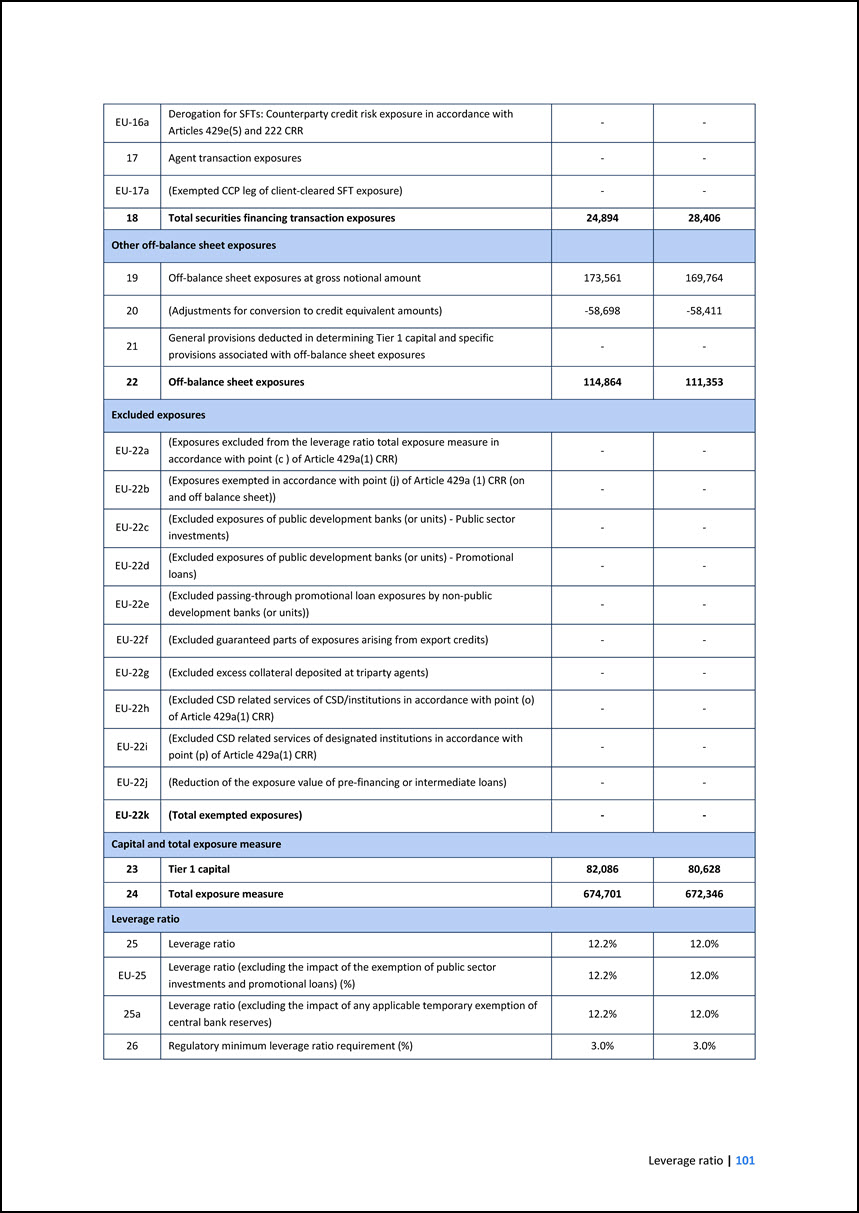

requirements (%) 11.2% 11.2% 12.1% Leverage ratio 13 Total exposure measure 674,701 672,346 665,029 14 Leverage ratio (%) 12.2% 12.0% 11.9% Leverage ratio buffer and overall leverage ratio requirement (as a percentage of total

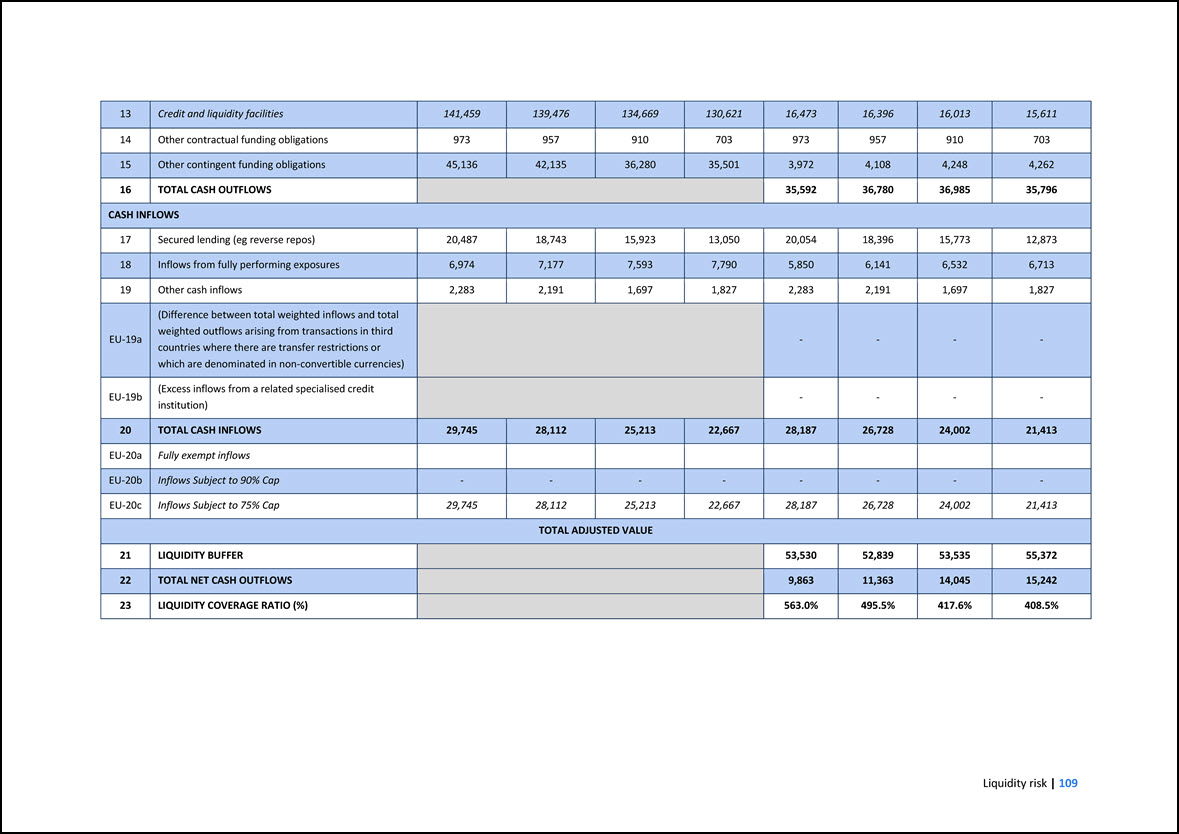

exposure measure) EU 14e Overall leverage ratio requirement (%)6 3.0% 3.0% 3.5% Liquidity Coverage Ratio7 15 Total high-quality liquid assets (HQLA) (Weighted value -average) 53,530 53,535 60,883 EU 16a Cash outflows - Total weighted

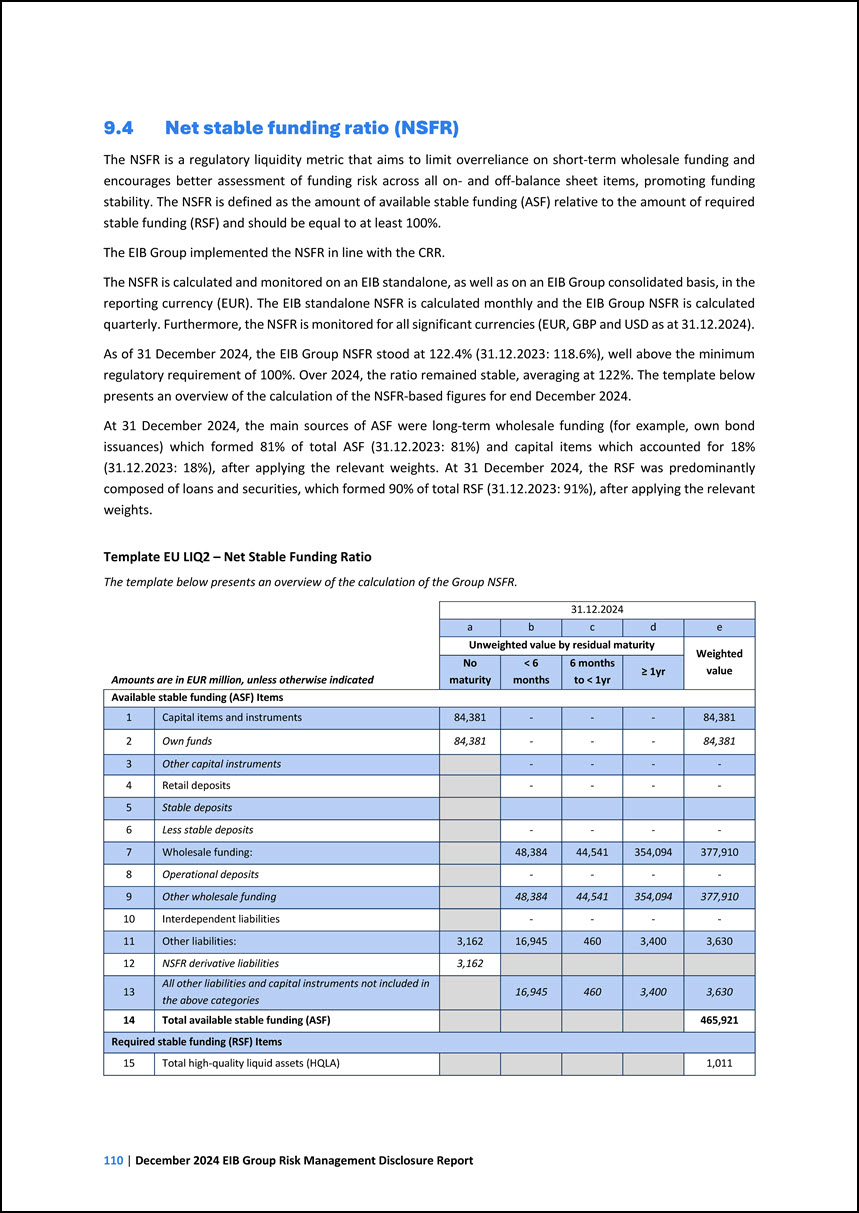

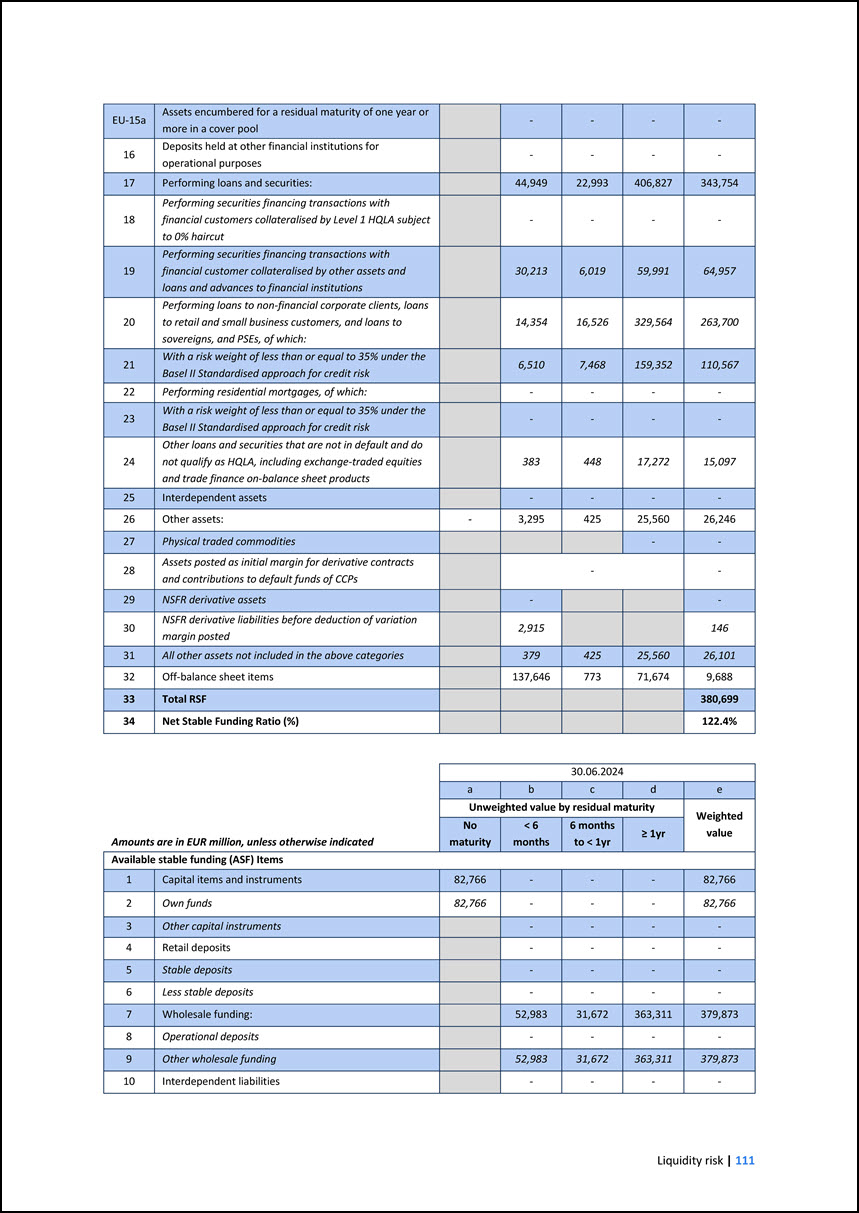

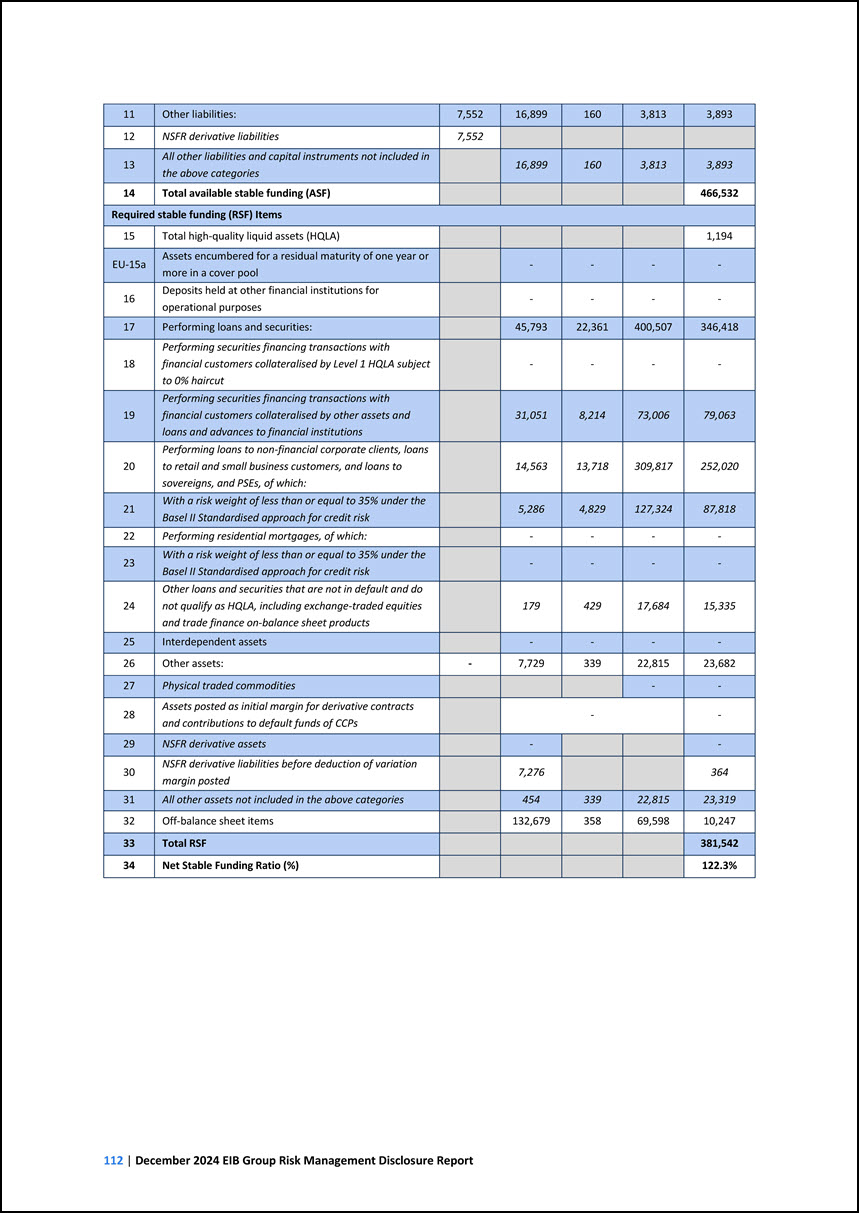

value 35,592 36,985 35,470 EU 16b Cash inflows - Total weighted value 28,187 24,002 16,739 16 Total net cash outflows (adjusted value) 9,863 14,045 18,731 17 Liquidity coverage ratio (%) 563.0% 417.6% 350.7% Net Stable Funding

Ratio 18 Total available stable funding 465,921 466,532 452,544 19 Total required stable funding 380,699 381,542 381,566 20 NSFR ratio (%) 122.4% 122.3% 118.6% 5 In line with the annual self-assessment for determining its own

systemic relevance, a process that conforms to applicable BBP, the EIB Group released the self-imposed buffer for systemic relevance during 2024.The template was modified to highlight the self-imposed nature of the systemic relevance capital buffer,

as described in Section 4.1. 6 Following the release of the self-imposed buffer for systemic relevance, in line with applicable BBP, the leverage ratio requirements were updated accordingly in 2024, with negative adjustment of 0.5% to the overall

applicable requirement. 7 Figures related to the Liquidity Coverage Ratio are reported as averages over the last 12 months. • The net surplus in 2024 of EUR 3.0 billion (2023: EUR 2.4 billion) was the main contributor to the Group’s capital

position increase.

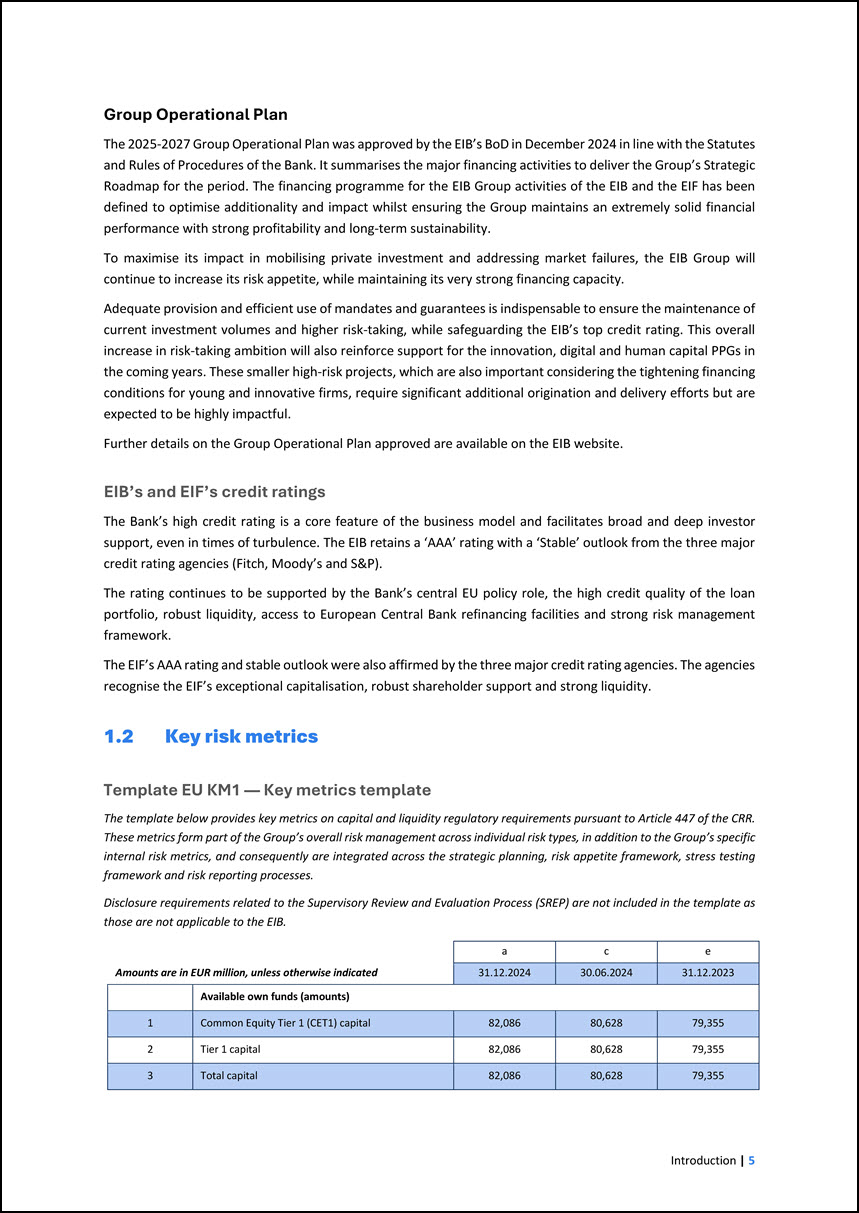

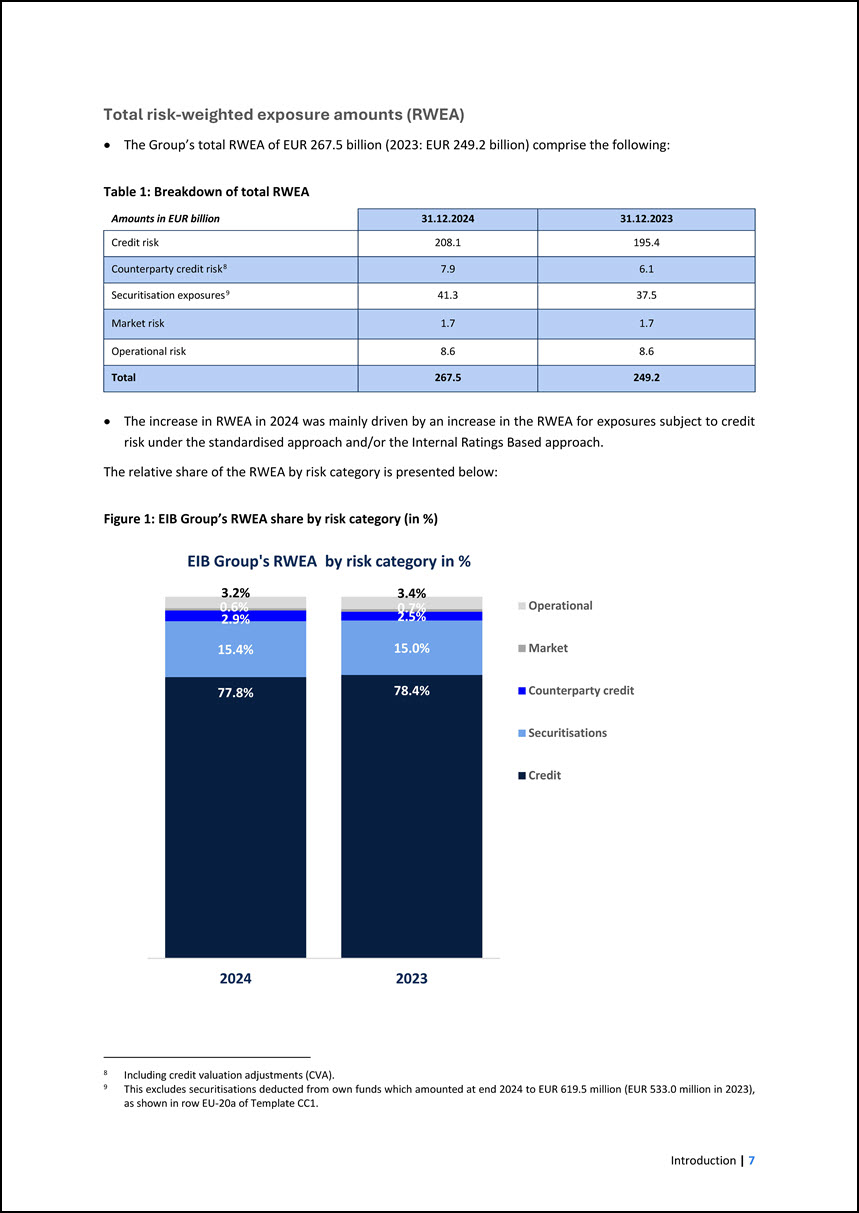

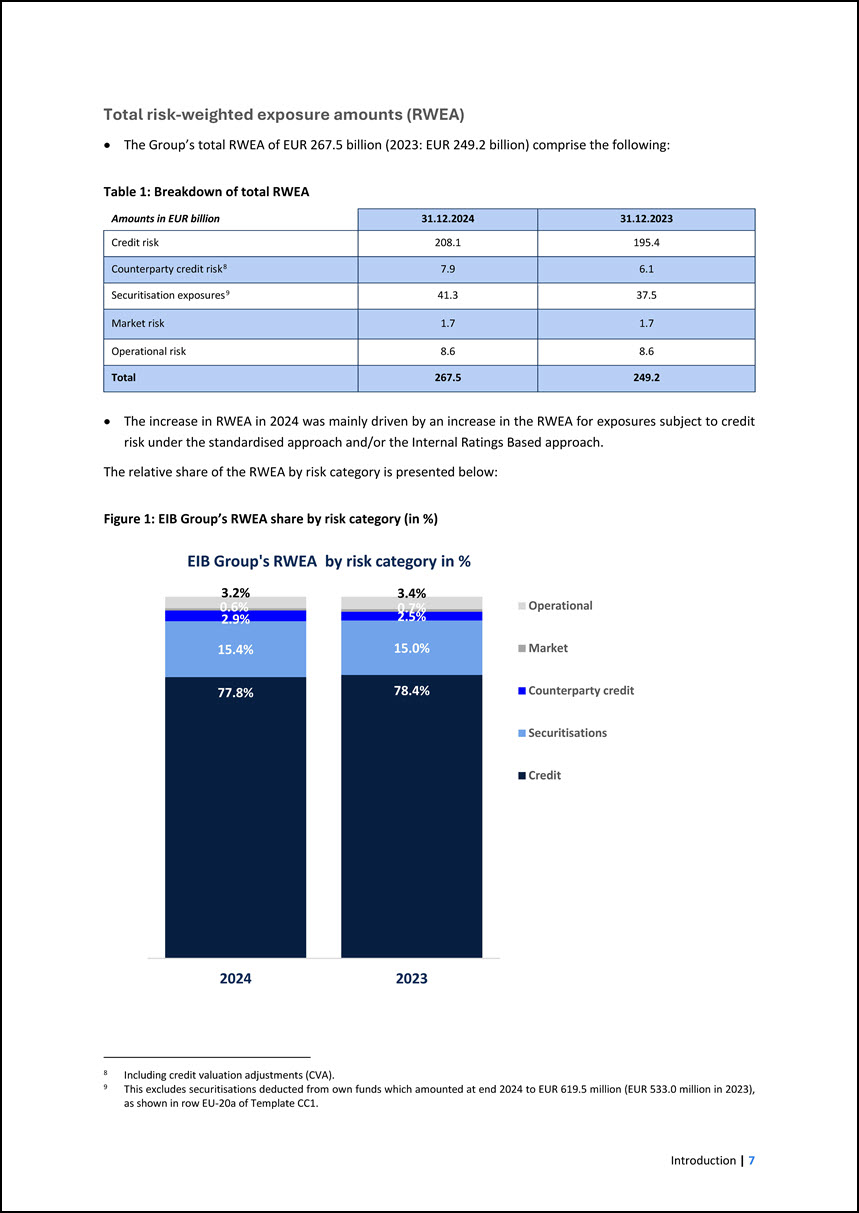

0.6% 2.9% 15.4% 0.7%2.5% 15.0% 78.4%77.8% Total risk-weighted exposure amounts (RWEA) •The Group’s total RWEA of EUR267.5billion(2023: EUR 249.2billion) comprise the

following: Table1: Breakdown oftotalRWEA Amounts in EUR billion31.12.202431.12.2023Credit risk208.1195.4Counterparty credit risk87.96.1Securitisation exposures941.337.5Market risk1.71.7Operationalrisk8.68.6Total267.5249.2 •Theincrease inRWEAin2024

wasmainly driven byanincrease in the RWEA forexposures subject tocreditriskunder the standardised approach and/orthe Internal Ratings Basedapproach. The relative share of the RWEAby risk categoryispresented below: Figure1: EIB Group’s RWEA share by

risk category (in %) EIB Group'sRWEAbyriskcategoryin % 3.2%3.4% OperationalMarketCounterparty creditSecuritisationsCredit 20242023 8Including credit valuation adjustments (CVA). 9This excludes securitisations deducted from own funds which amounted at

end 2024toEUR 619.5million(EUR 533.0millionin 2023), as shown in row EU-20a ofTemplate CC1. Introduction| 7

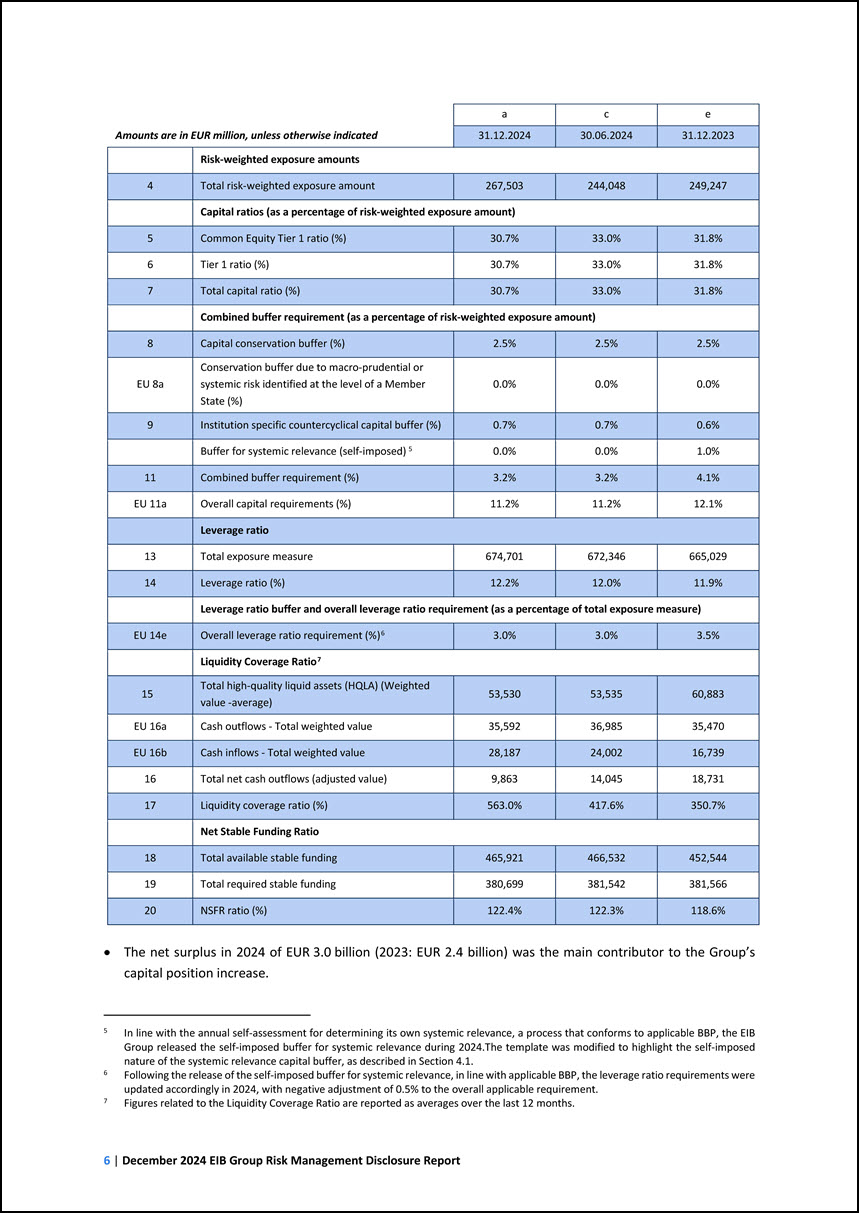

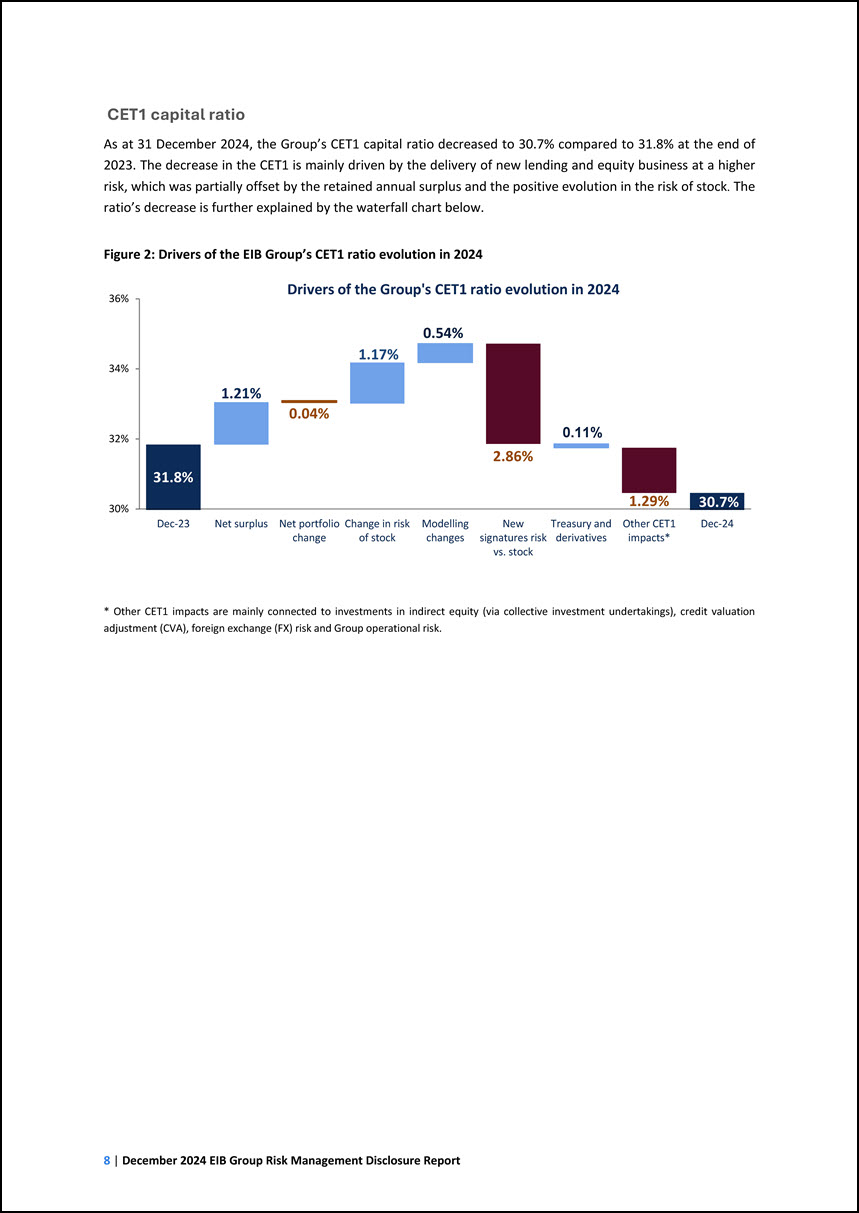

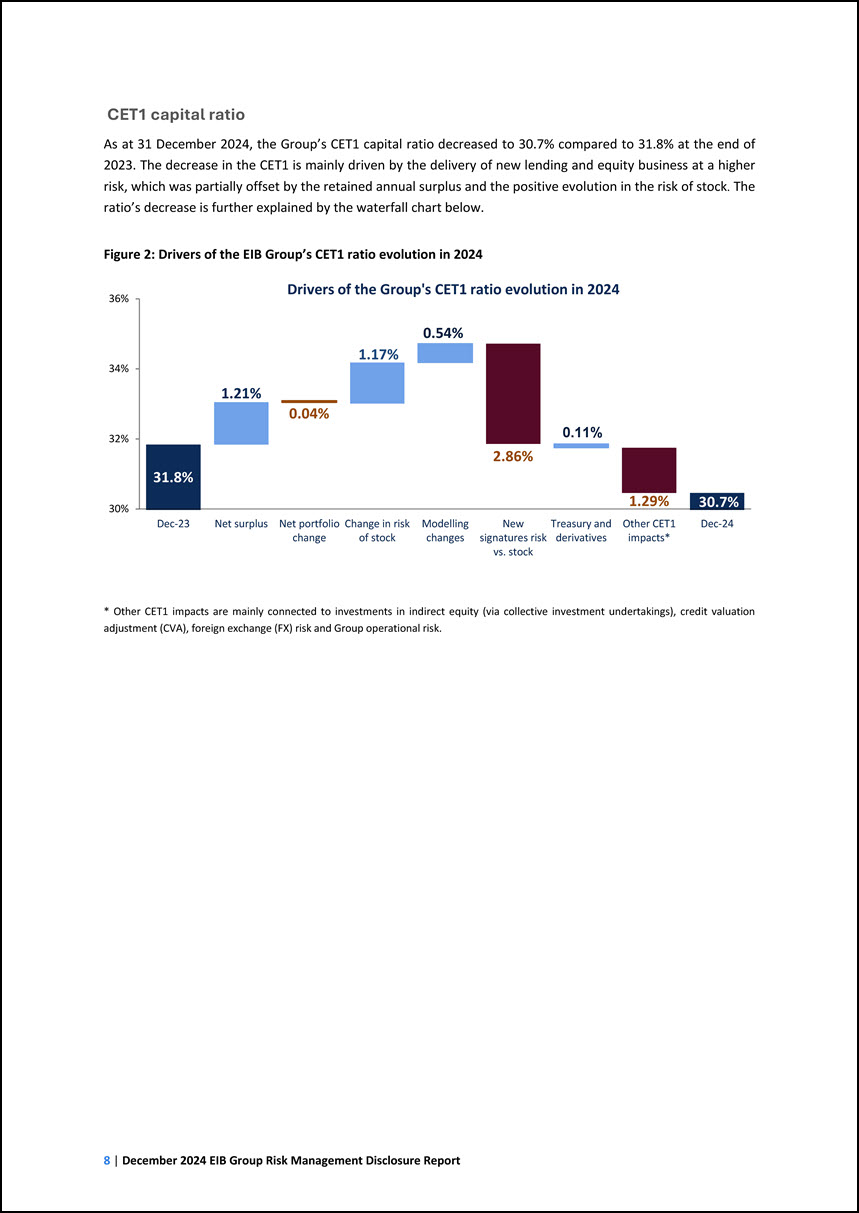

CET1 capital ratio As at 31 December2024, the Group’s CET1 capitalratio decreasedto 30.7%compared to 31.8%at the endof 2023. The decrease in the CET1 ismainly driven

by the delivery ofnew lending and equity business at a higherrisk,which was partiallyoffsetby the retained annual surplusand the positive evolution in the risk of stock.Theratio’sdecreaseisfurtherexplainedbythewaterfallchartbelow. Figure2: Drivers of

the EIB Group’s CET1 ratio evolution in2024 Driversof the Group's CET1 ratioevolutionin 2024 36% 0.54% 1.17% 34% 1.21% 0.04% 0.11% 32% 31.8% 2.86% 1.29% 30% 30.7% Dec-23Net surplusNet portfolioChange in riskModellingNewTreasury andOther

CET1Dec-24changeof stockchangessignatures riskderivativesimpacts* vs. stock * Other CET1 impactsare mainly connected to investments in indirect equity(viacollective investment undertakings), credit valuationadjustment (CVA),foreign exchange (FX)risk

and Groupoperational risk. 8|December 2024 EIB GroupRisk Management DisclosureReport

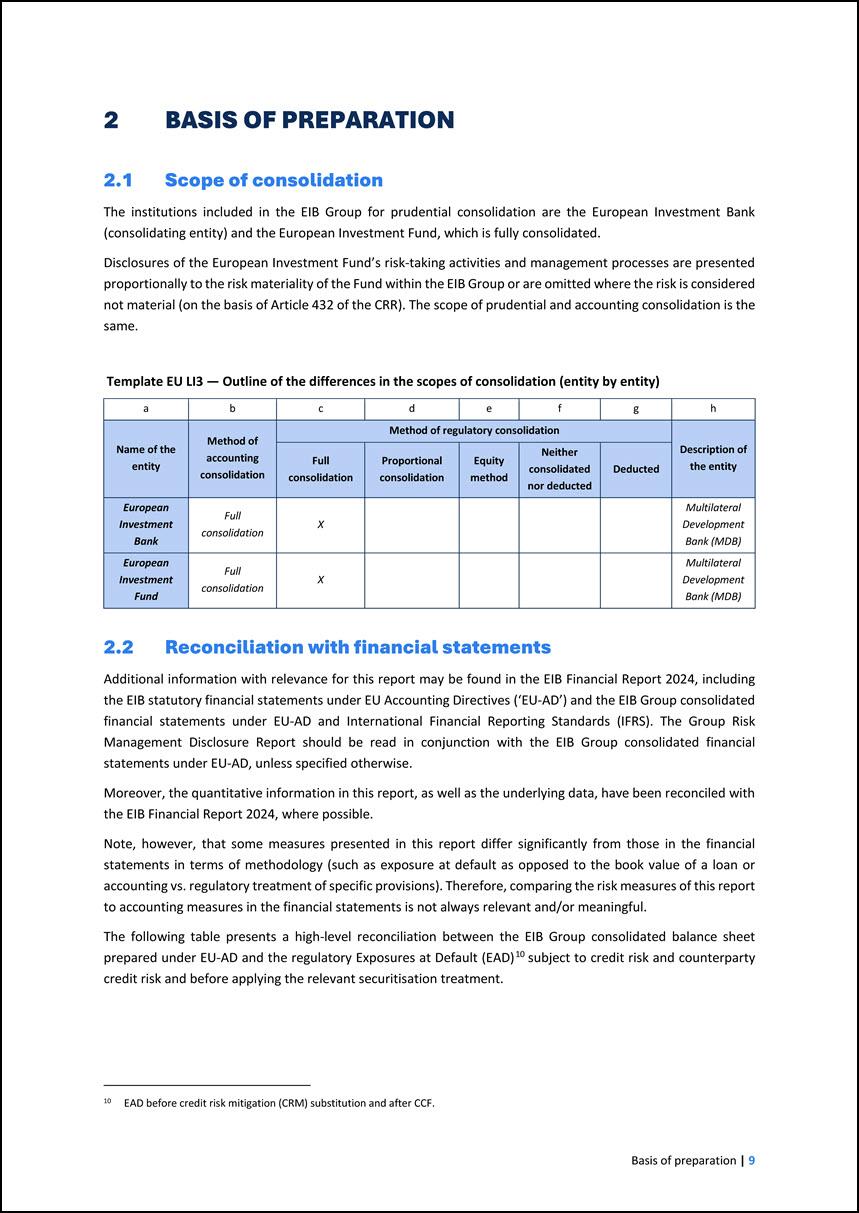

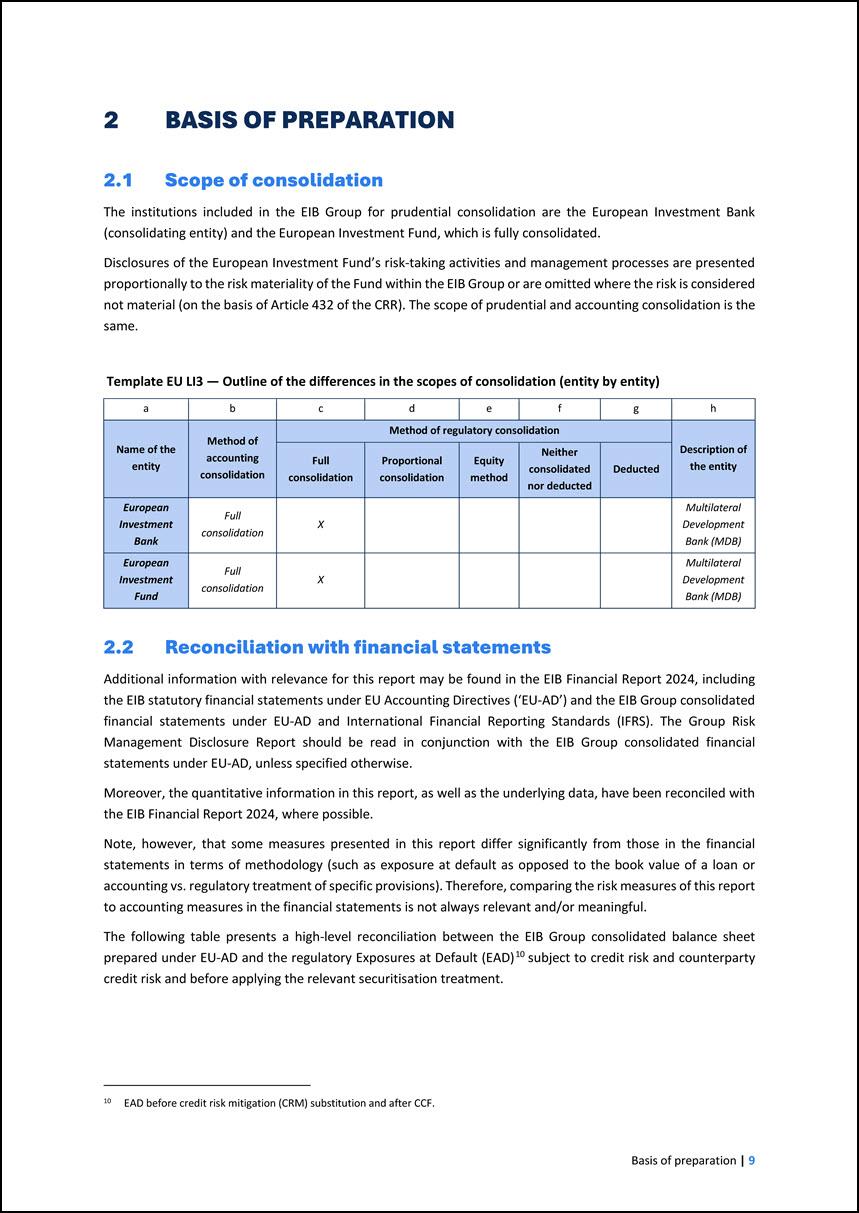

2 BASIS OF PREPARATION 2.1 Scope of consolidation The institutions included in the EIB Group for prudential consolidation are the European Investment Bank

(consolidating entity) and the European Investment Fund, which is fully consolidated. Disclosures of the European Investment Fund’s risk-taking activities and management processes are presented proportionally to the risk materiality of the Fund

within the EIB Group or are omitted where the risk is considered not material (on the basis of Article 432 of the CRR). The scope of prudential and accounting consolidation is the same. Template EU LI3 — Outline of the differences in the scopes of

consolidation (entity by entity) a b c d e f g h Name of the entity Method of accounting consolidation Method of regulatory consolidation Description of the entity Full consolidation Proportional consolidation Equity method Neither

consolidated nor deducted Deducted European Investment Bank Full consolidation X Multilateral Development Bank (MDB) European Investment Fund Full consolidation X Multilateral Development Bank (MDB) 2.2 Reconciliation with

financial statements Additional information with relevance for this report may be found in the EIB Financial Report 2024, including the EIB statutory financial statements under EU Accounting Directives (‘EU-AD’) and the EIB Group consolidated

financial statements under EU-AD and International Financial Reporting Standards (IFRS). The Group Risk Management Disclosure Report should be read in conjunction with the EIB Group consolidated financial statements under EU-AD, unless specified

otherwise. Moreover, the quantitative information in this report, as well as the underlying data, have been reconciled with the EIB Financial Report 2024, where possible. Note, however, that some measures presented in this report differ

significantly from those in the financial statements in terms of methodology (such as exposure at default as opposed to the book value of a loan or accounting vs. regulatory treatment of specific provisions). Therefore, comparing the risk measures of

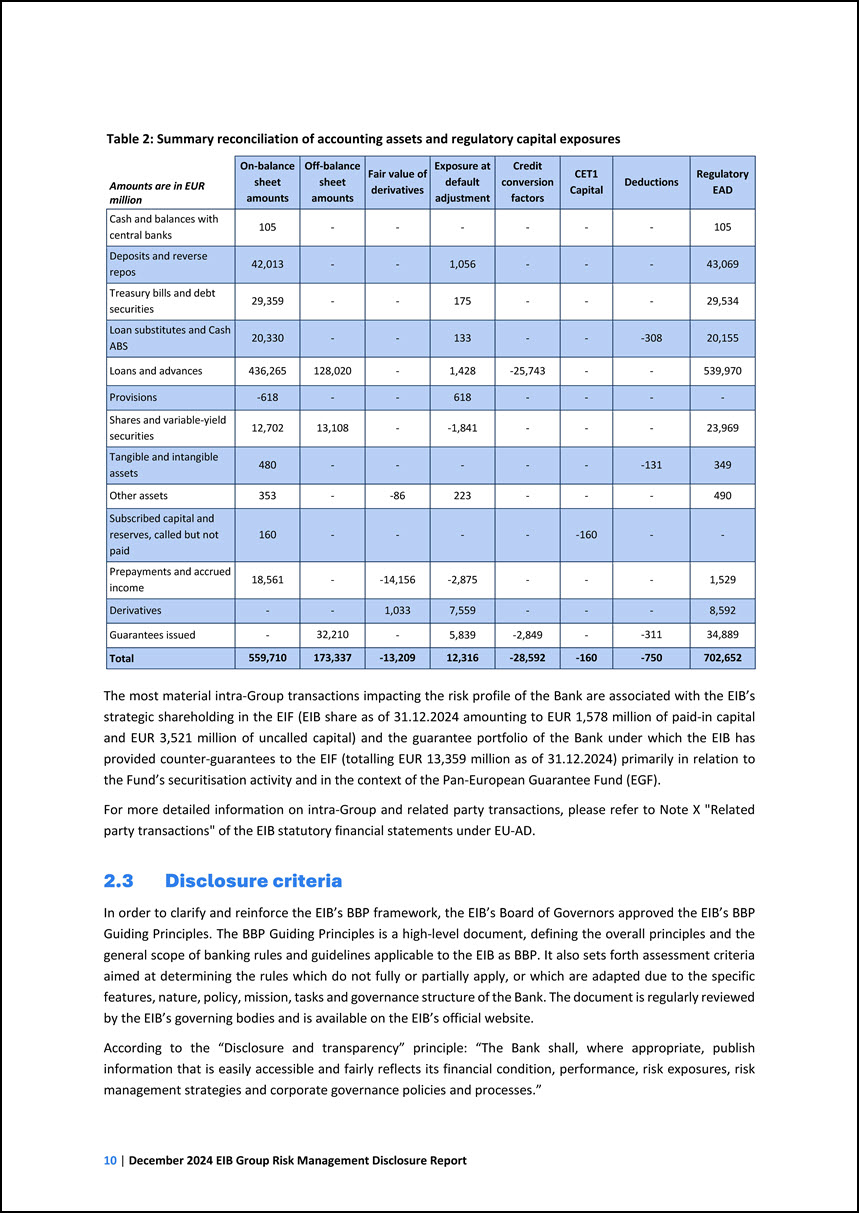

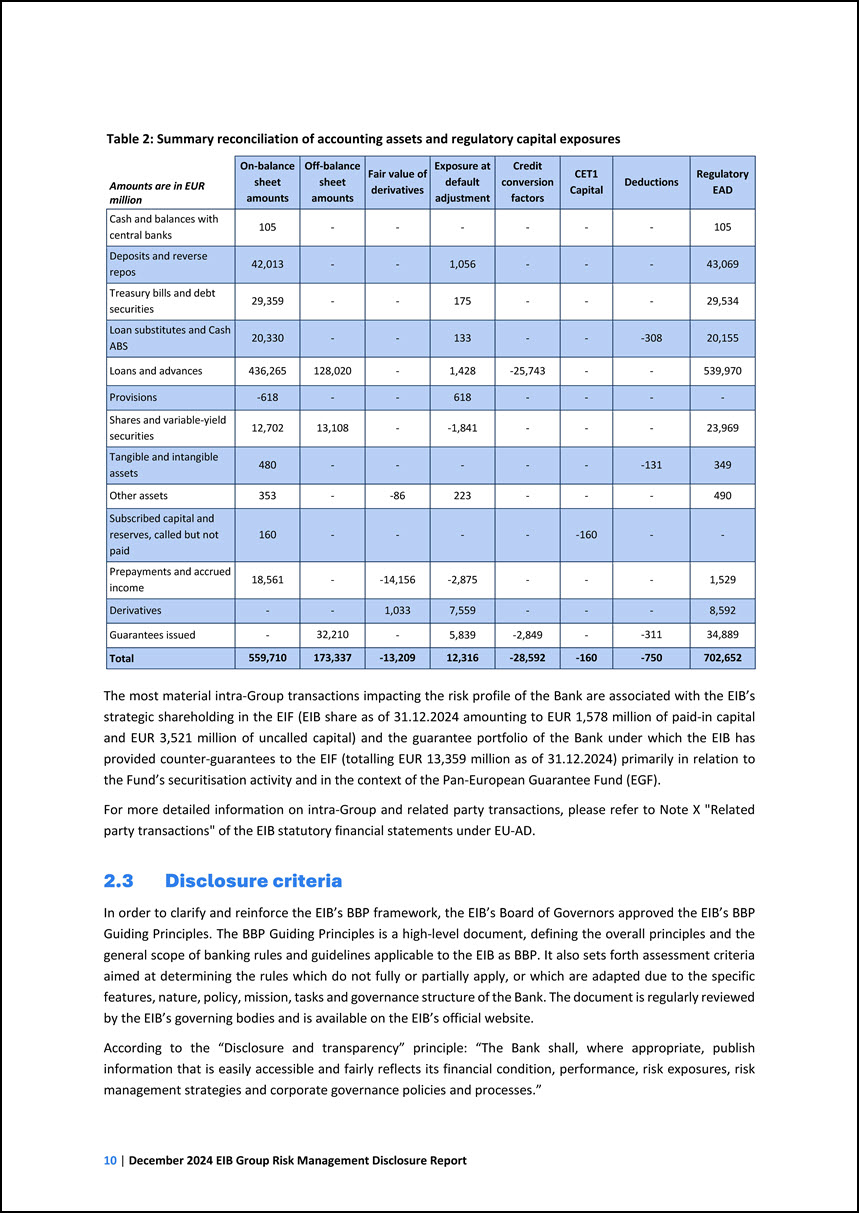

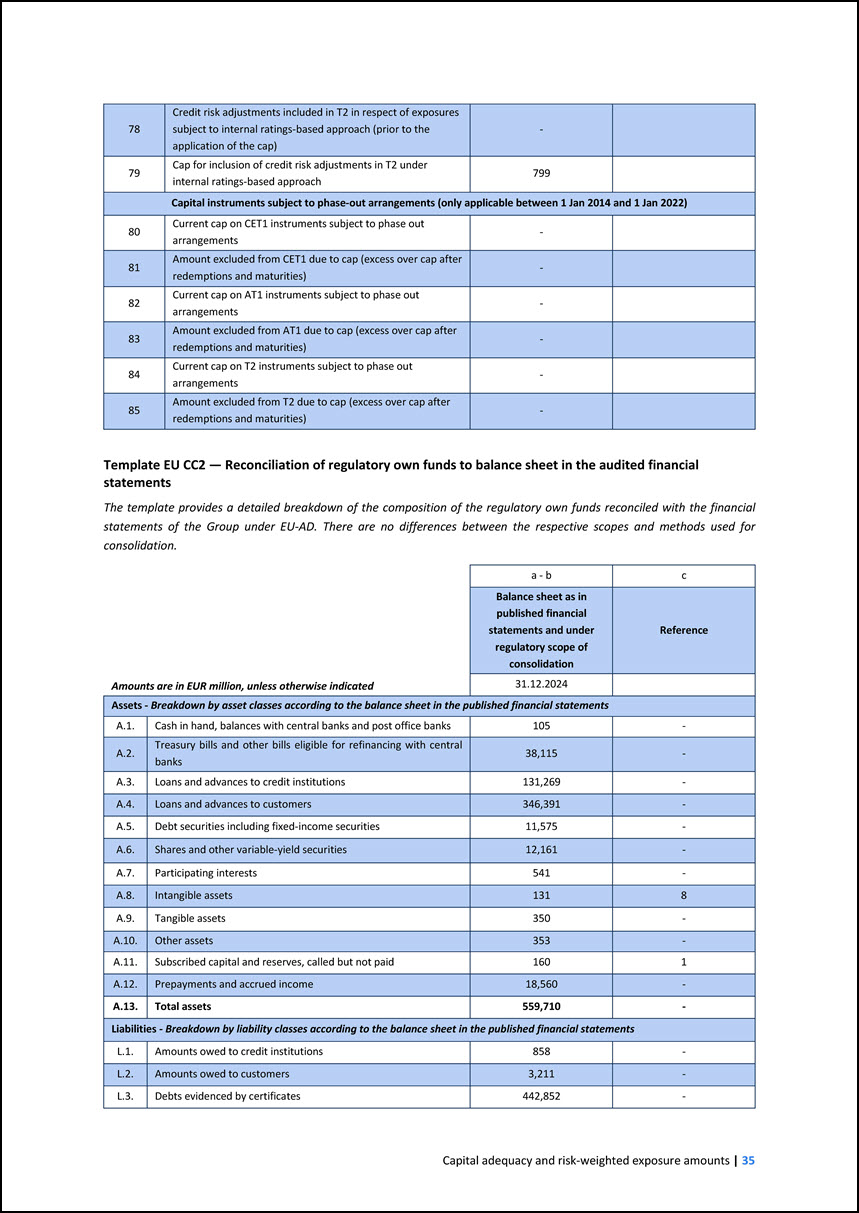

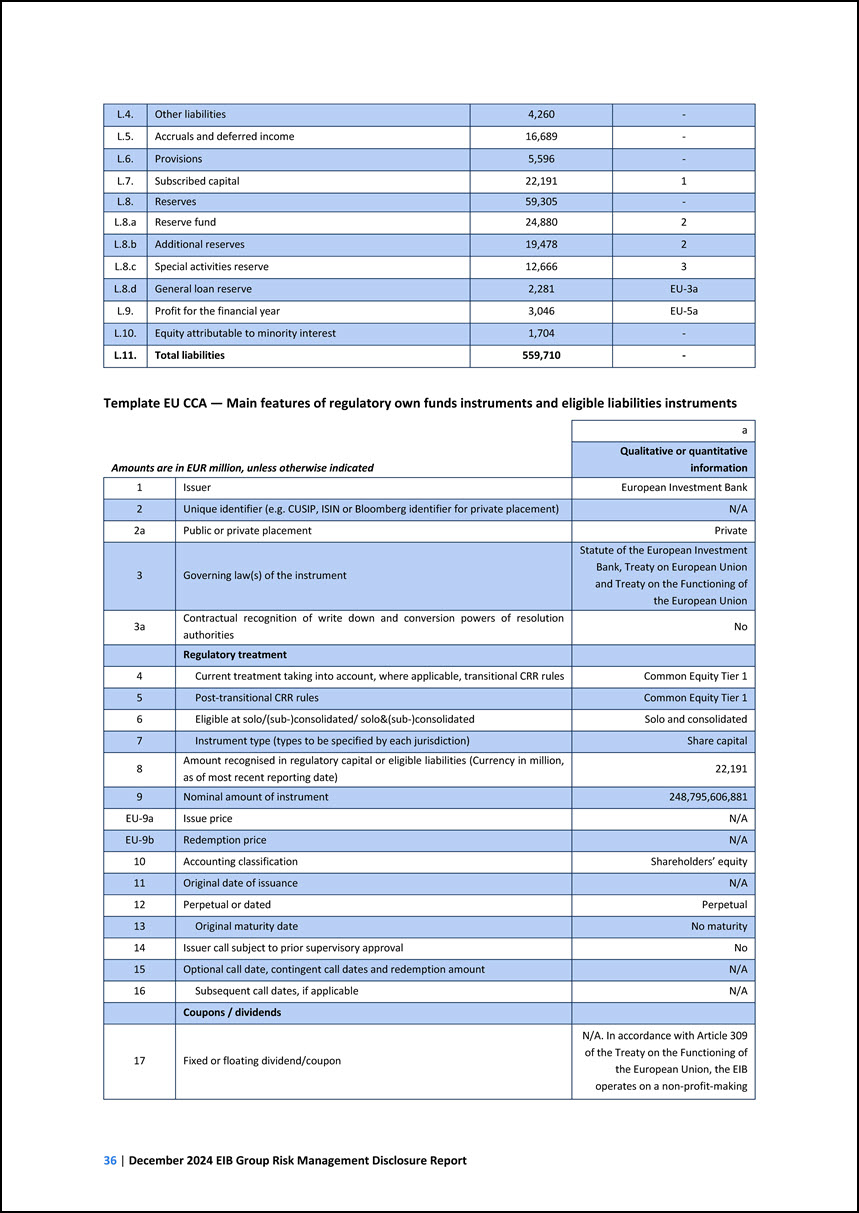

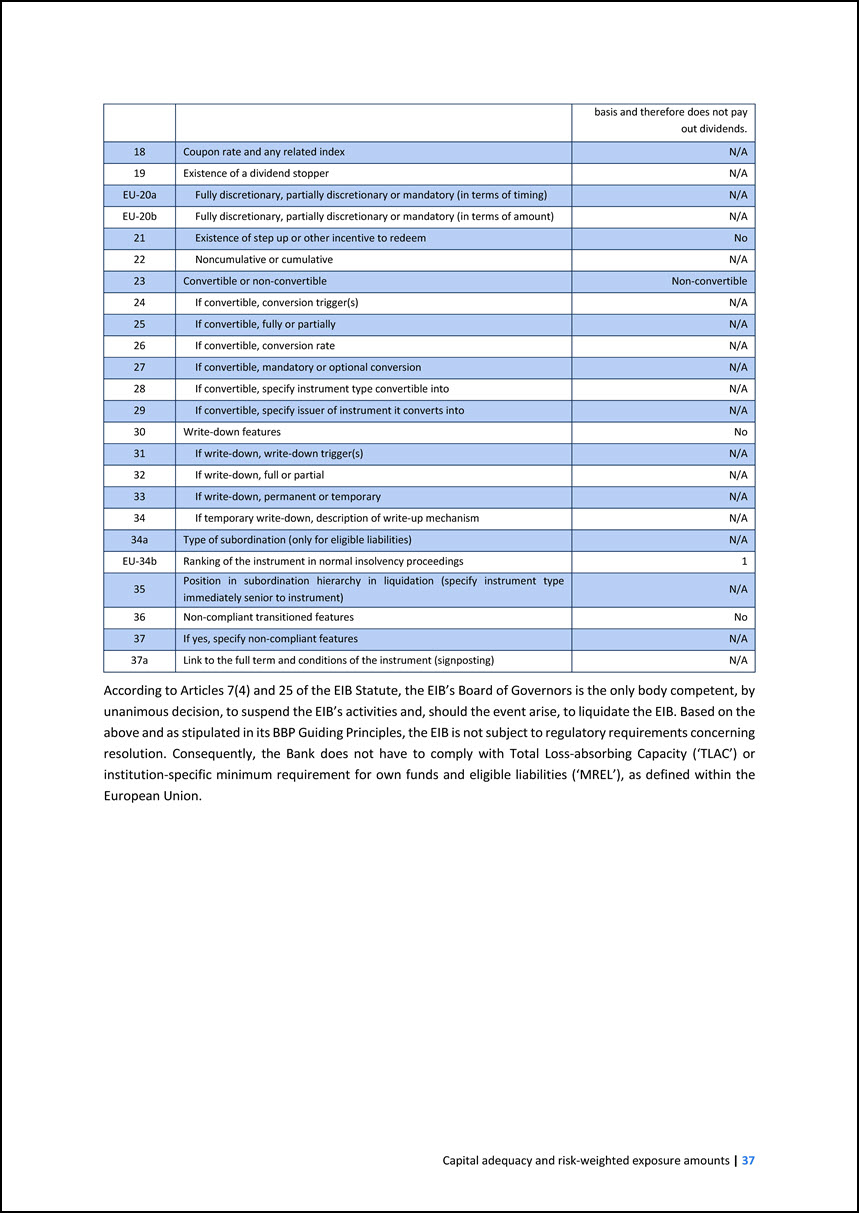

this report to accounting measures in the financial statements is not always relevant and/or meaningful. The following table presents a high-level reconciliation between the EIB Group consolidated balance sheet prepared under EU-AD and the

regulatory Exposures at Default (EAD)10 subject to credit risk and counterparty credit risk and before applying the relevant securitisation treatment. 10 EAD before credit risk mitigation (CRM) substitution and after CCF.

Table 2: Summary reconciliation of accounting assets and regulatory capital exposures Amounts are in EUR million On-balance sheet amounts Off-balance sheet amounts

Fair value of derivatives Exposure at default adjustment Credit conversion factors CET1 Capital Deductions Regulatory EAD Cash and balances with central banks 105 - - - - - - 105 Deposits and reverse repos 42,013 - - 1,056 - -

- 43,069 Treasury bills and debt securities 29,359 - - 175 - - - 29,534 Loan substitutes and Cash ABS 20,330 - - 133 - - -308 20,155 Loans and advances 436,265 128,020 - 1,428 -25,743 - - 539,970 Provisions -618 - -

618 - - - - Shares and variable-yield securities 12,702 13,108 - -1,841 - - - 23,969 Tangible and intangible assets 480 - - - - - -131 349 Other assets 353 - -86 223 - - - 490 Subscribed capital and reserves, called

but not paid 160 - - - - -160 - - Prepayments and accrued income 18,561 - -14,156 -2,875 - - - 1,529 Derivatives - - 1,033 7,559 - - - 8,592 Guarantees issued - 32,210 - 5,839 -2,849 - -311 34,889 Total 559,710

173,337 -13,209 12,316 -28,592 -160 -750 702,652 The most material intra-Group transactions impacting the risk profile of the Bank are associated with the EIB’s strategic shareholding in the EIF (EIB share as of 31.12.2024 amounting to EUR

1,578 million of paid-in capital and EUR 3,521 million of uncalled capital) and the guarantee portfolio of the Bank under which the EIB has provided counter-guarantees to the EIF (totalling EUR 13,359 million as of 31.12.2024) primarily in relation

to the Fund’s securitisation activity and in the context of the Pan-European Guarantee Fund (EGF). For more detailed information on intra-Group and related party transactions, please refer to Note X "Related party transactions" of the EIB statutory

financial statements under EU-AD. 2.3 Disclosure criteria In order to clarify and reinforce the EIB’s BBP framework, the EIB’s Board of Governors approved the EIB’s BBP Guiding Principles. The BBP Guiding Principles is a high-level document,

defining the overall principles and the general scope of banking rules and guidelines applicable to the EIB as BBP. It also sets forth assessment criteria aimed at determining the rules which do not fully or partially apply, or which are adapted due

to the specific features, nature, policy, mission, tasks and governance structure of the Bank. The document is regularly reviewed by the EIB’s governing bodies and is available on the EIB’s official website. According to the “Disclosure and

transparency” principle: “The Bank shall, where appropriate, publish information that is easily accessible and fairly reflects its financial condition, performance, risk exposures, risk management strategies and corporate governance policies and

processes.”

In applying the BBP Guiding Principles, the Bank shall implement and follow EU legislative acts and guidelines applicable for commercial banks except for those rules,

or parts of them, which are adapted or which the Bank does not fully or partially apply, based on the internal assessment mentioned above. The Bank may also determine the implementation date from which it shall follow such rules. When the Bank

follows adapted rules or does not apply certain provisions, where appropriate, mitigating measures in line with the Bank’s public policy nature and mission are enacted. Adaptations and exemptions follow a strict internal assessment procedure and are

approved by the EIB’s BoD, following consultation with the EIB’s Audit Committee. The EIB shall apply the BBP Guiding Principles on an individual basis. In addition, the EIB, as a majority shareholder of the EIF and within the powers provided to the

majority shareholder by the EIF statutory framework, shall: • seek to ensure that certain quantitative prudential requirements are met on a consolidated basis; • seek to ensure that the EIF implements sound internal policies, procedures and

practices required for compliance with certain qualitative prudential and non-prudential requirements on a consolidated basis consistently and in an adequately integrated manner with the EIB. Disclosures with regard to the EIB’s fully consolidated

subsidiary, the EIF, are subject to the proportionality of the EIF’s risk in the context of the Group and may be omitted on the grounds of immateriality, as appropriate. The EIB Group has not identified information to be omitted for proprietary or

confidentiality reasons. The GRMDR has been prepared in compliance with the prudential disclosure requirements, as described above in Section 1. The implementation of the full extent of disclosures compatible with the EIB’s specificities is enhanced

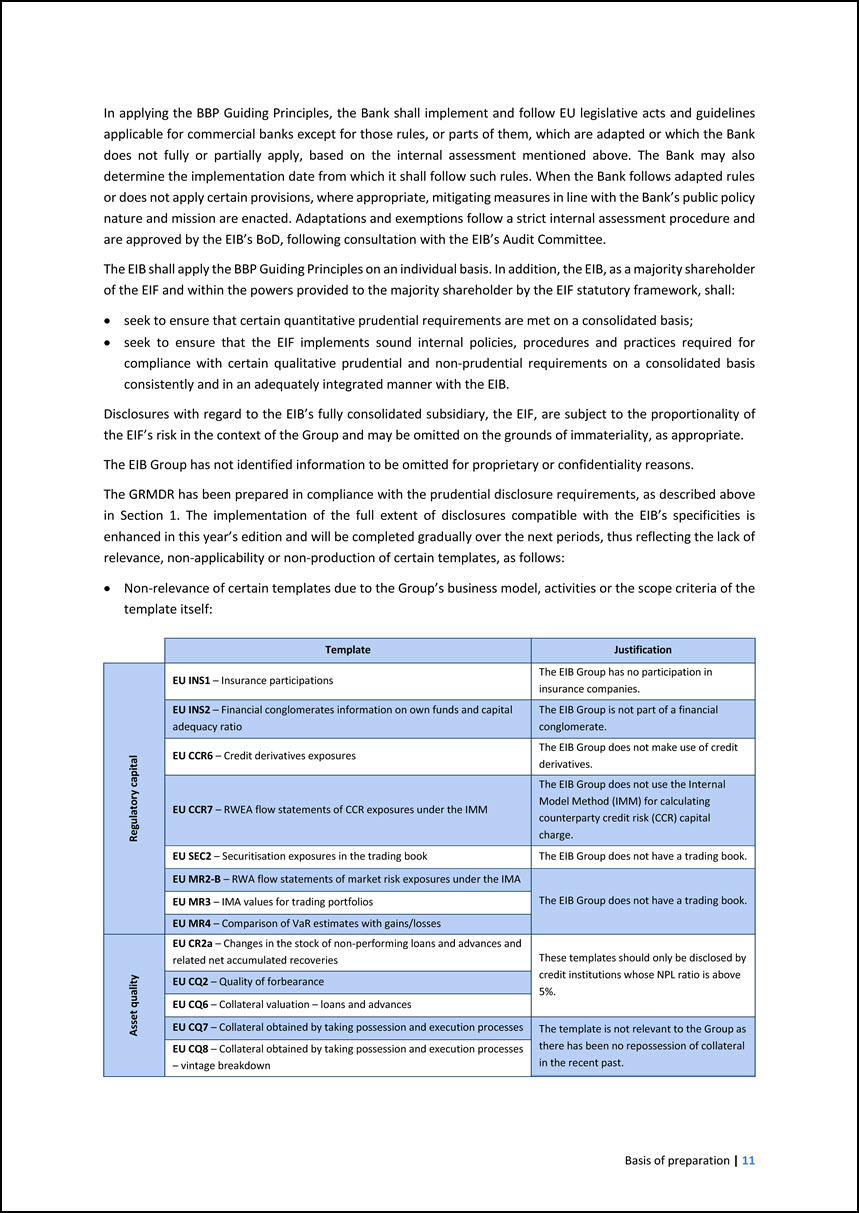

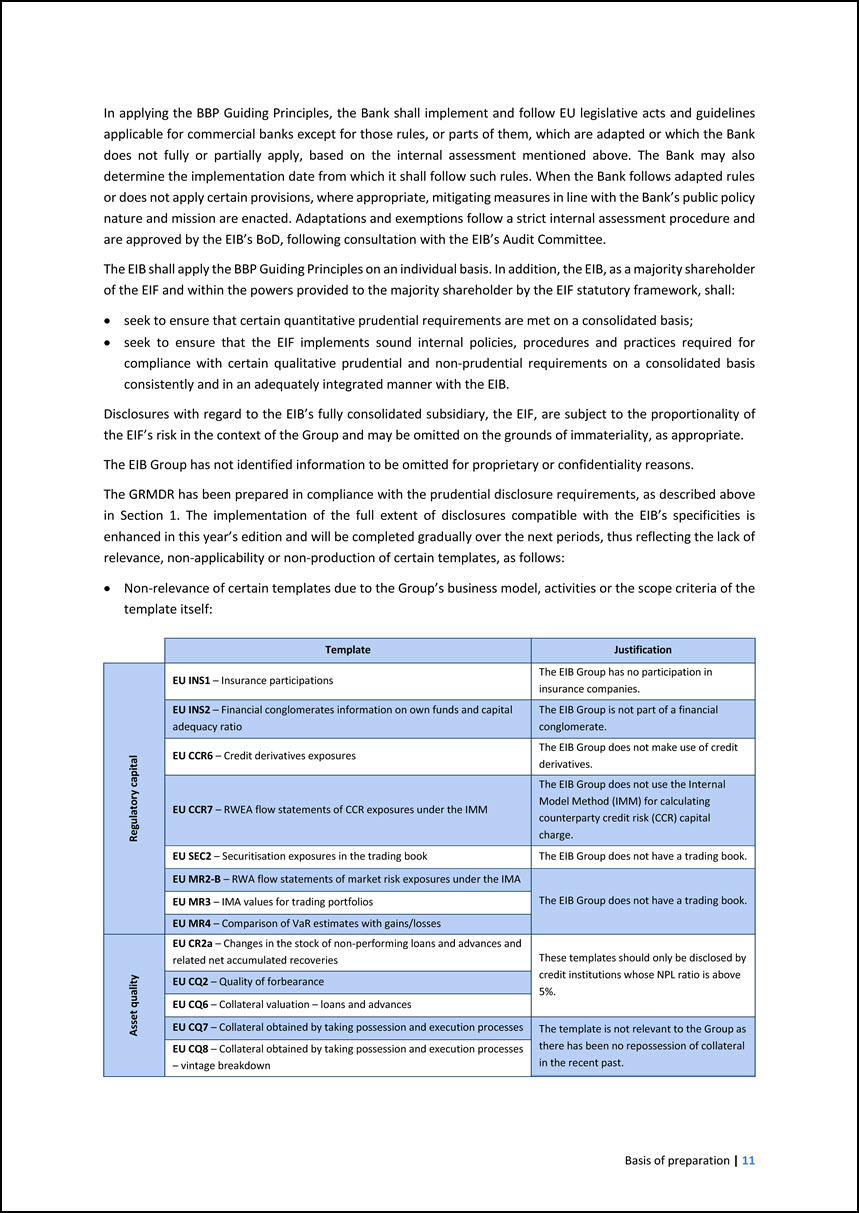

in this year’s edition and will be completed gradually over the next periods, thus reflecting the lack of relevance, non-applicability or non-production of certain templates, as follows: • Non-relevance of certain templates due to the Group’s

business model, activities or the scope criteria of the template itself: Template Justification Regulatory capital EU INS1 – Insurance participations The EIB Group has no participation in insurance companies. EU INS2 – Financial conglomerates

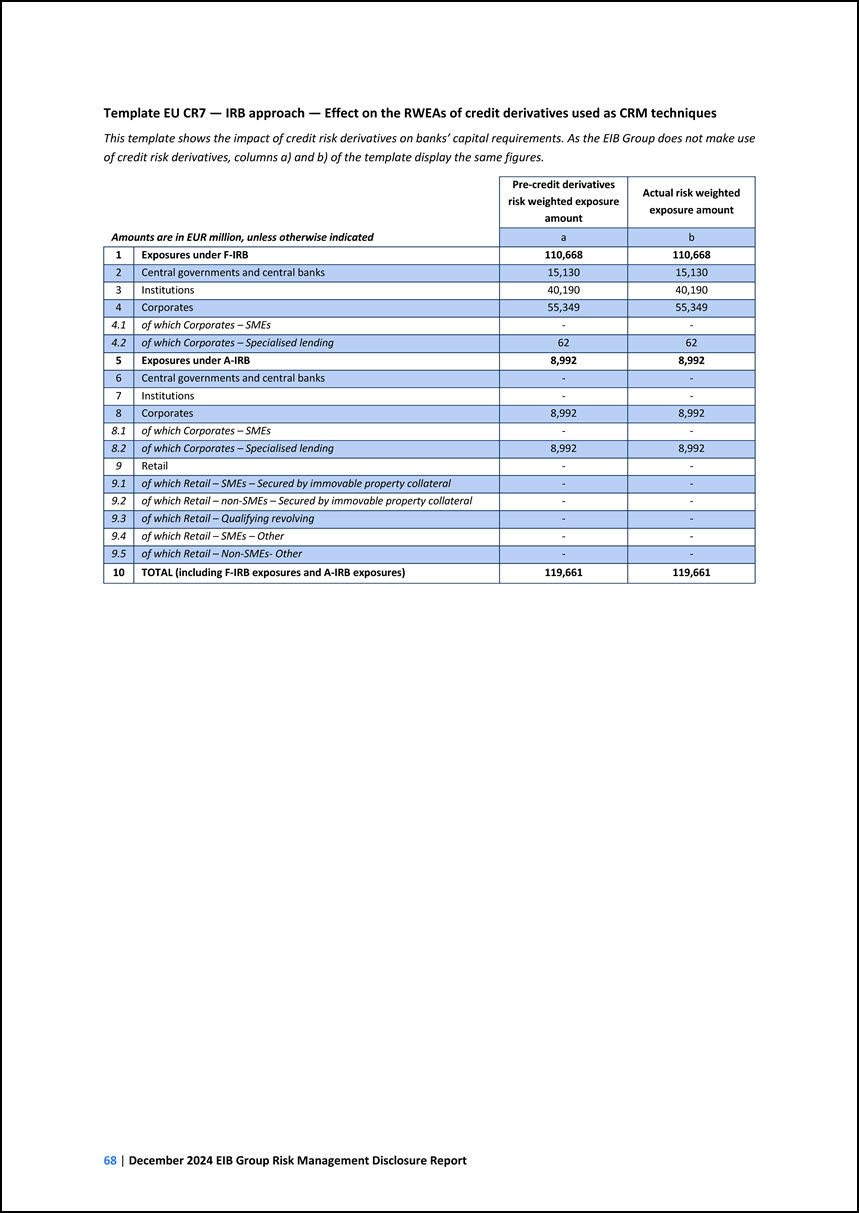

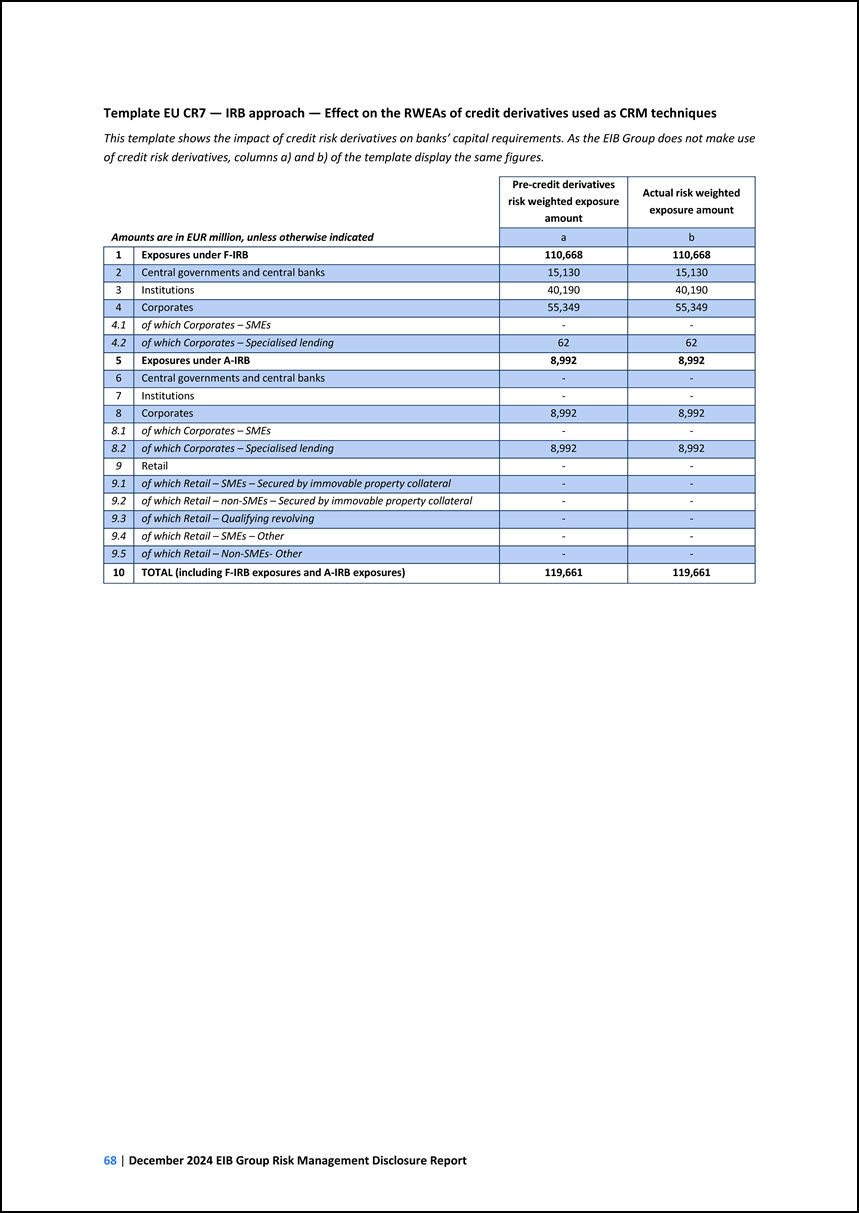

information on own funds and capital adequacy ratio The EIB Group is not part of a financial conglomerate. EU CCR6 – Credit derivatives exposures The EIB Group does not make use of credit derivatives. EU CCR7 – RWEA flow statements of CCR

exposures under the IMM The EIB Group does not use the Internal Model Method (IMM) for calculating counterparty credit risk (CCR) capital charge. EU SEC2 – Securitisation exposures in the trading book The EIB Group does not have a trading book.

EU MR2-B – RWA flow statements of market risk exposures under the IMA The EIB Group does not have a trading book. EU MR3 – IMA values for trading portfolios EU MR4 – Comparison of VaR estimates with gains/losses Asset quality EU CR2a – Changes

in the stock of non-performing loans and advances and related net accumulated recoveries These templates should only be disclosed by credit institutions whose NPL ratio is above 5%. EU CQ2 – Quality of forbearance EU CQ6 – Collateral valuation –

loans and advances EU CQ7 – Collateral obtained by taking possession and execution processes The template is not relevant to the Group as there has been no repossession of collateral in the recent past. EU CQ8 – Collateral obtained by taking

possession and execution processes – vintage breakdown

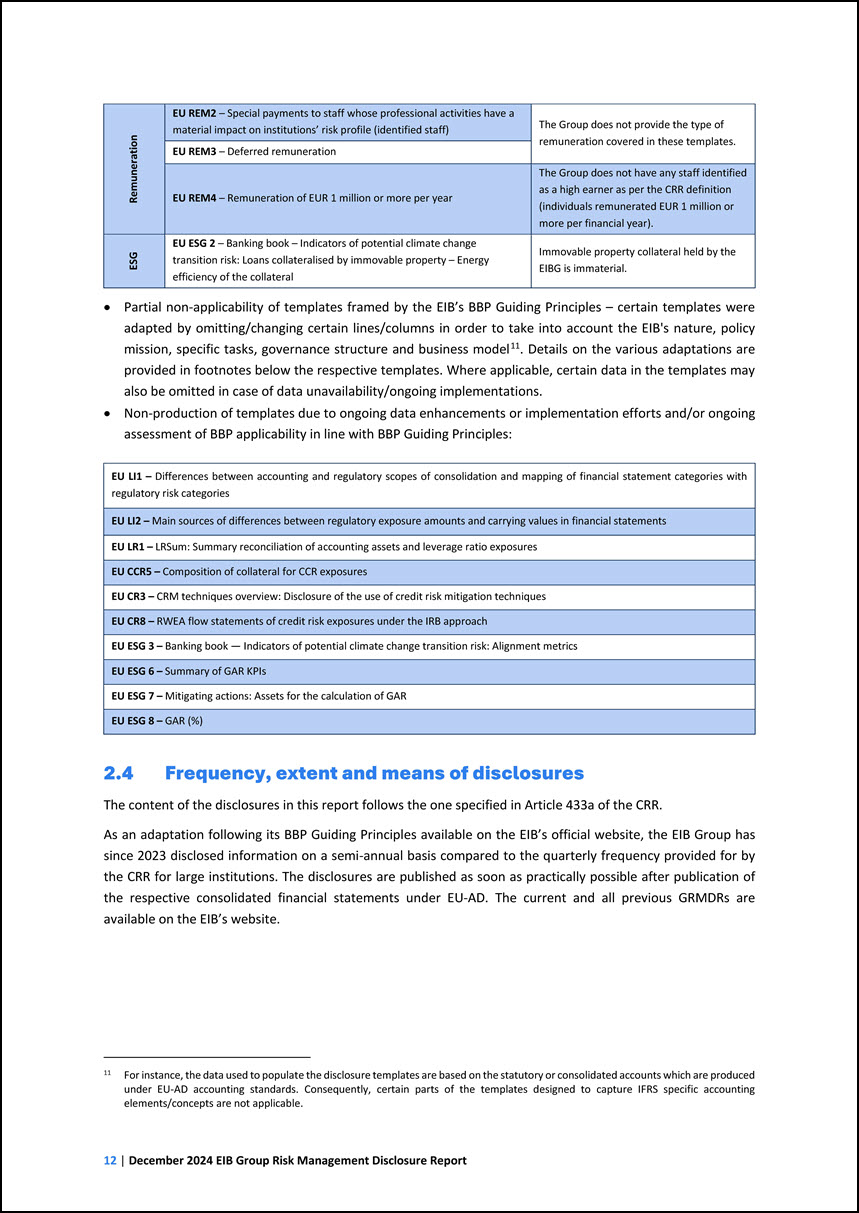

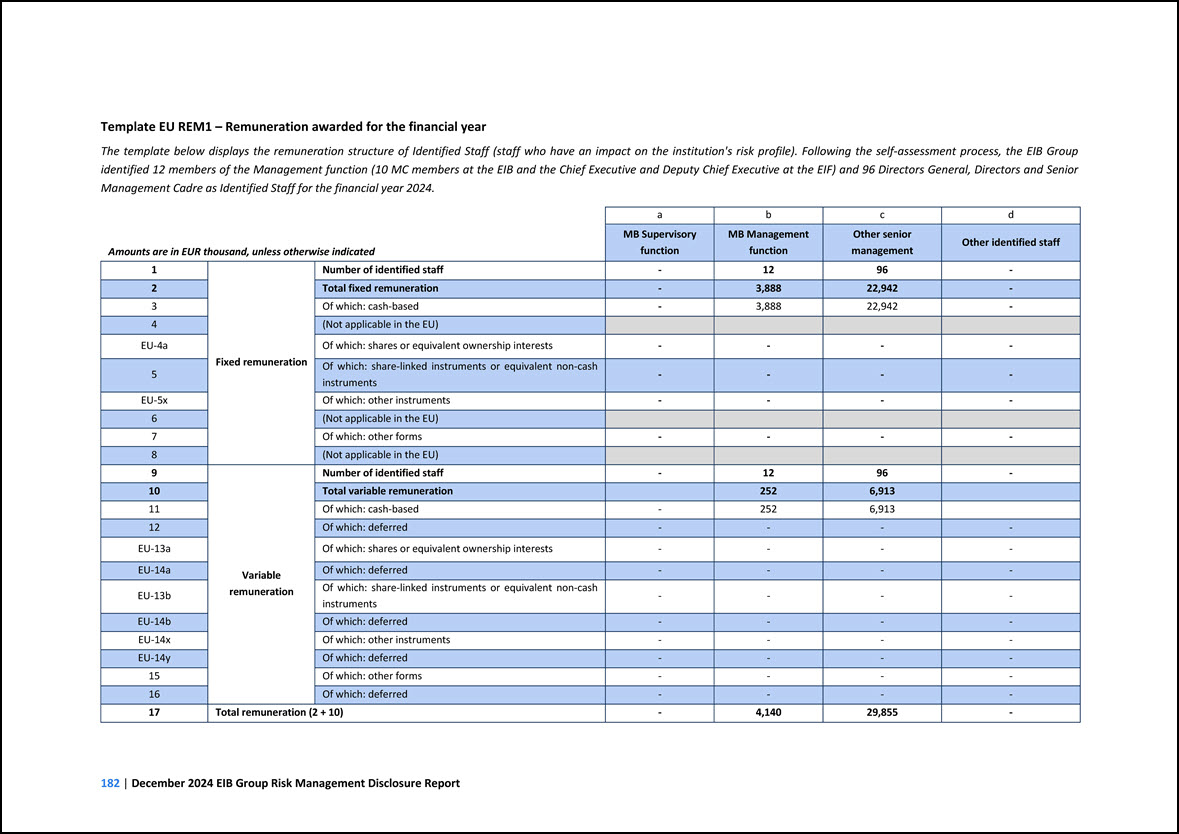

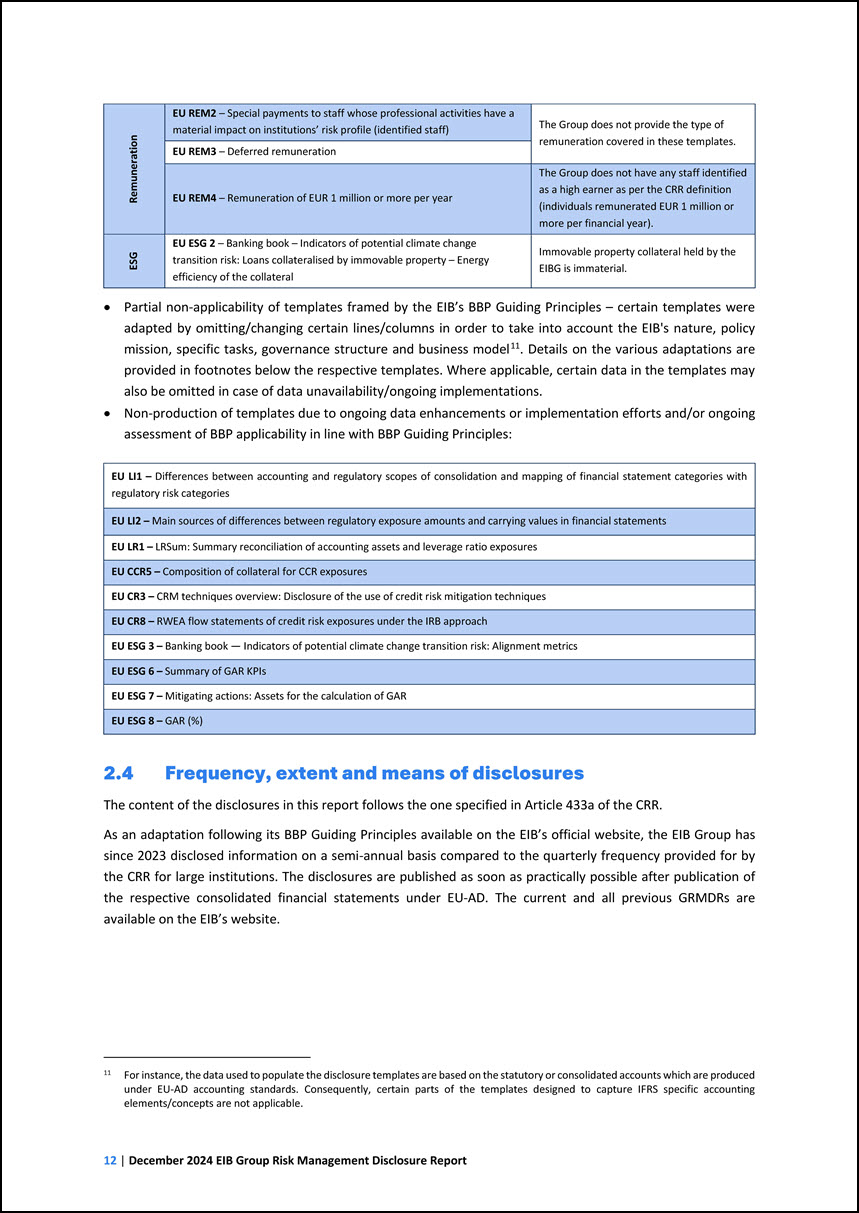

Remuneration EU REM2 – Special payments to staff whose professional activities have a material impact on institutions’ risk profile (identified staff) The Group does

not provide the type of remuneration covered in these templates. EU REM3 – Deferred remuneration EU REM4 – Remuneration of EUR 1 million or more per year The Group does not have any staff identified as a high earner as per the CRR definition

(individuals remunerated EUR 1 million or more per financial year). ESG EU ESG 2 – Banking book – Indicators of potential climate change transition risk: Loans collateralised by immovable property – Energy efficiency of the collateral Immovable

property collateral held by the EIBG is immaterial. • Partial non-applicability of templates framed by the EIB’s BBP Guiding Principles – certain templates were adapted by omitting/changing certain lines/columns in order to take into account the

EIB's nature, policy mission, specific tasks, governance structure and business model11. Details on the various adaptations are provided in footnotes below the respective templates. Where applicable, certain data in the templates may also be omitted

in case of data unavailability/ongoing implementations. • Non-production of templates due to ongoing data enhancements or implementation efforts and/or ongoing assessment of BBP applicability in line with BBP Guiding Principles: 11 For instance, the

data used to populate the disclosure templates are based on the statutory or consolidated accounts which are produced under EU-AD accounting standards. Consequently, certain parts of the templates designed to capture IFRS specific accounting

elements/concepts are not applicable. EU LI1 – Differences between accounting and regulatory scopes of consolidation and mapping of financial statement categories with regulatory risk categories EU LI2 – Main sources of differences between

regulatory exposure amounts and carrying values in financial statements EU LR1 – LRSum: Summary reconciliation of accounting assets and leverage ratio exposures EU CCR5 – Composition of collateral for CCR exposures EU CR3 – CRM techniques

overview: Disclosure of the use of credit risk mitigation techniques EU CR8 – RWEA flow statements of credit risk exposures under the IRB approach EU ESG 3 – Banking book — Indicators of potential climate change transition risk: Alignment metrics

EU ESG 6 – Summary of GAR KPIs EU ESG 7 – Mitigating actions: Assets for the calculation of GAR EU ESG 8 – GAR (%) 2.4 Frequency, extent and means of disclosures The content of the disclosures in this report follows the one specified in Article

433a of the CRR. As an adaptation following its BBP Guiding Principles available on the EIB’s official website, the EIB Group has since 2023 disclosed information on a semi-annual basis compared to the quarterly frequency provided for by the CRR for

large institutions. The disclosures are published as soon as practically possible after publication of the respective consolidated financial statements under EU-AD. The current and all previous GRMDRs are available on the EIB’s website.

2.5 Disclosure policy The GRMD Report is prepared in accordance with the applicable disclosure policy disciplining the EIB Group’s approach for applying risk

management best practice public disclosure requirements, as applicable to the EIB Group, the approval process and governance of preparation of disclosure. 2.6 Approval process This report and its external publication have been approved by the EIB

BoD on the basis of a proposal by the EIB’s Management Committee (‘MC’) and upon the recommendation of the EIB Board Committee on Risk Policy (hereinafter ‘RPC’ or ‘Risk Policy Committee’). In parallel to the EIB BoD, the report is also distributed

for information and discussion to the EIB’s Audit Committee (‘AC’). Any AC recommendations thereon are taken into account for the next reporting iteration. The general approval process of this report entails thorough consultation with the EIF and

the participation of its representatives in the main steps of the process, notably in the discussions and approvals at the level of the EIB’s governing bodies.

3 GOVERNANCE AND RISK MANAGEMENT This chapter provides an overview of the EIB Group’s risk governance structure, outlining the key roles and responsibilities

regarding risk-taking and oversight in the Group, as well as its key governance arrangements. 3.1 Risk management structure and organisation Both the EIB and the EIF have established their risk management functions responsible for risk management

on an institutional level and in respect of financial and non-financial risks. Each EIB Group entity has defined specific risk management policies, procedures and controls in line with the Group Risk Management Charter (‘GRMC’) and any applicable

Group risk management policies, described below. Group Risk Management Charter and Framework The GRMC codifies the sound principles-based approach to risk management to ensure that Group risks are managed in an effective and consistent manner and

defines the Group Risk Management Framework (‘GRMF’). The GRMF, extending across all relevant business lines of the EIB Group, aims to fully recognise the economic substance of all EIB Group risk exposures and to enable the Group to make fully

informed decisions on risk-taking. The GRMC sets out the key principles of the GRMF aimed at ensuring that all Group risks are overseen and managed in an effective and consistent manner. The GRMC applies on an individual basis and on a consolidated

basis, which means the situation as if the EIB formed together with its subsidiaries (entities controlled by the EIB) a single entity (“on a consolidated basis”). The procedural and organisational aspects are implemented by GRMC implementing

provisions, approved by the EIB and the EIF. The following principles, as defined by the GRMC, are the fundamentals of the Group Risk Management Framework and shall be adhered to at all times: • Risk culture: The Group promotes a sound risk culture

in the performance of its activities. • Best banking practice: The Group operates in adherence to the best banking practice applicable to it. • Risk appetite framework: Risk awareness and sustainability of the business model of the Group are

supported by the application of the Group Risk Appetite Framework (Group RAF). • Risk management policies, procedures, risk limits and controls: The EIB as the parent entity sets and oversees risk management policies, procedures, risk limits and

controls related to Group risks and commensurate with the entities’ respective statutes and activities, in compliance with the principles of the Charter. • Proactive, adaptive and ongoing risk management: Each institution continuously identifies,

assesses, measures, monitors, mitigates and reports risks inherent to its activities. • Capital and liquidity adequacy: Strategic decision-making shall be supported by a comprehensive and forward-looking view of the Group’s capital and liquidity

resources in relation to its risk profile and operating environment. • Information exchange, risk reporting and data aggregation: Appropriate arrangements shall be in place to enable the exchange and aggregation of information and data across the

Group for the purposes of sound and effective risk management.

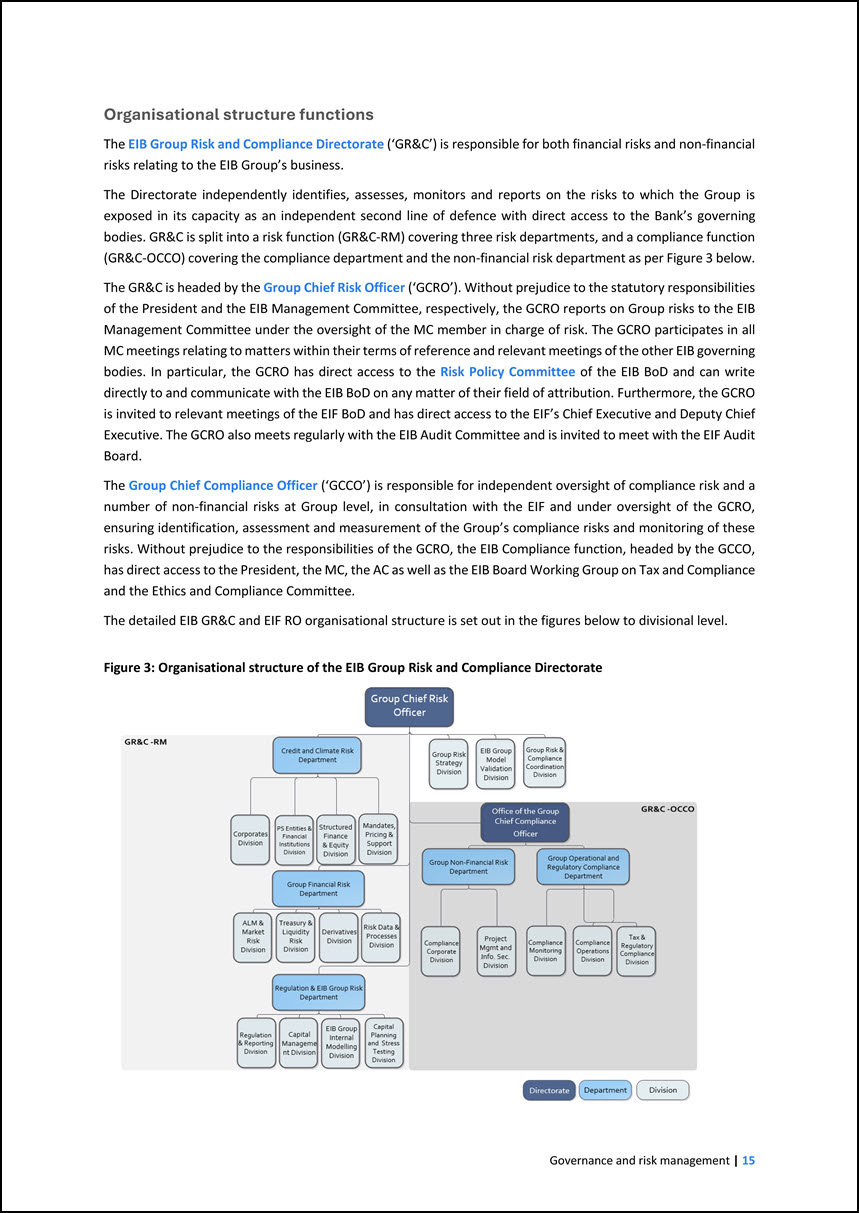

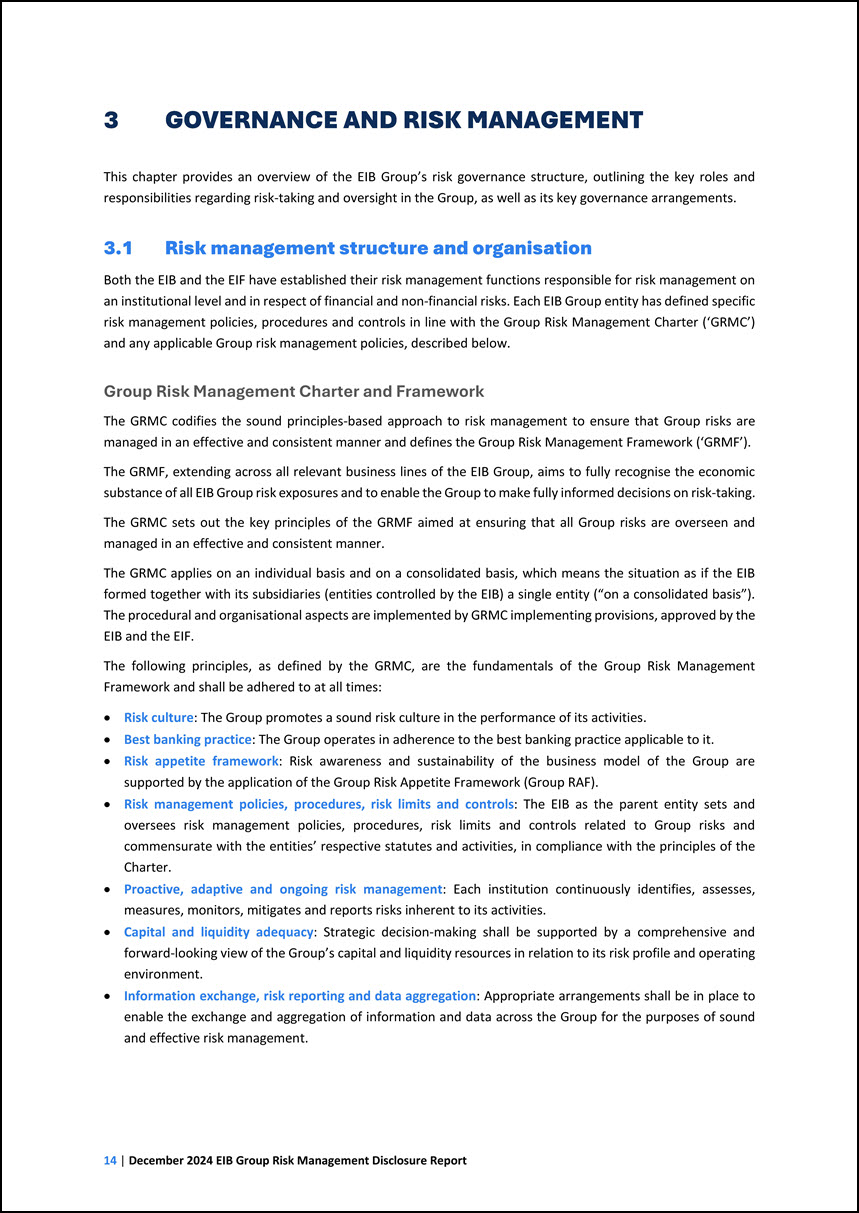

Organisational structure functions The EIB Group Risk and Compliance Directorate (‘GR&C’) is responsible for both financial risks and non-financial risks relating

to the EIB Group’s business. The Directorate independently identifies, assesses, monitors and reports on the risks to which the Group is exposed in its capacity as an independent second line of defence with direct access to the Bank’s governing

bodies. GR&C is split into a risk function (GR&C-RM) covering three risk departments, and a compliance function (GR&C-OCCO) covering the compliance department and the non-financial risk department as per Figure 3 below. The GR&C is

headed by the Group Chief Risk Officer (‘GCRO’). Without prejudice to the statutory responsibilities of the President and the EIB Management Committee, respectively, the GCRO reports on Group risks to the EIB Management Committee under the oversight

of the MC member in charge of risk. The GCRO participates in all MC meetings relating to matters within their terms of reference and relevant meetings of the other EIB governing bodies. In particular, the GCRO has direct access to the Risk Policy

Committee of the EIB BoD and can write directly to and communicate with the EIB BoD on any matter of their field of attribution. Furthermore, the GCRO is invited to relevant meetings of the EIF BoD and has direct access to the EIF’s Chief Executive

and Deputy Chief Executive. The GCRO also meets regularly with the EIB Audit Committee and is invited to meet with the EIF Audit Board. The Group Chief Compliance Officer (‘GCCO’) is responsible for independent oversight of compliance risk and a

number of non-financial risks at Group level, in consultation with the EIF and under oversight of the GCRO, ensuring identification, assessment and measurement of the Group’s compliance risks and monitoring of these risks. Without prejudice to the

responsibilities of the GCRO, the EIB Compliance function, headed by the GCCO, has direct access to the President, the MC, the AC as well as the EIB Board Working Group on Tax and Compliance and the Ethics and Compliance Committee. The detailed EIB

GR&C and EIF RO organisational structure is set out in the figures below to divisional level. Figure 3: Organisational structure of the EIB Group Risk and Compliance Directorate A screenshot of a computer screen

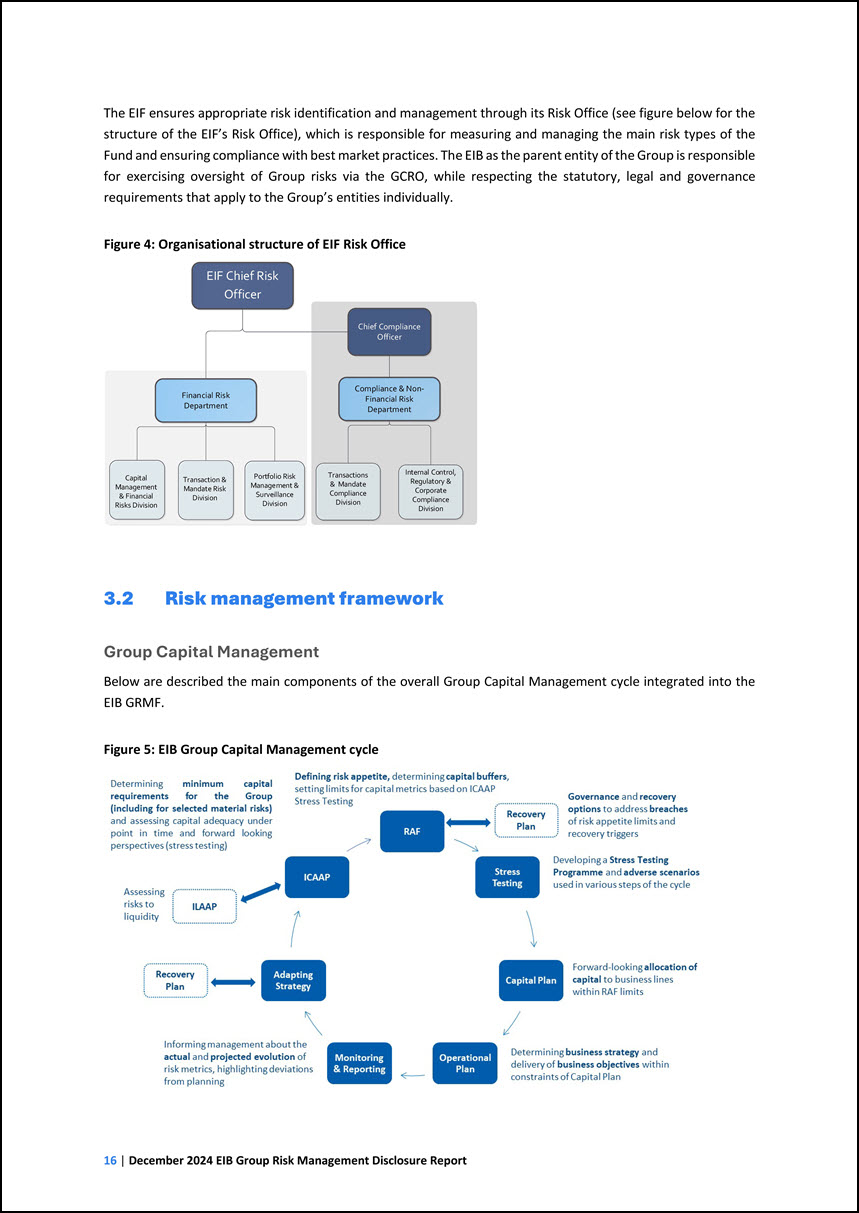

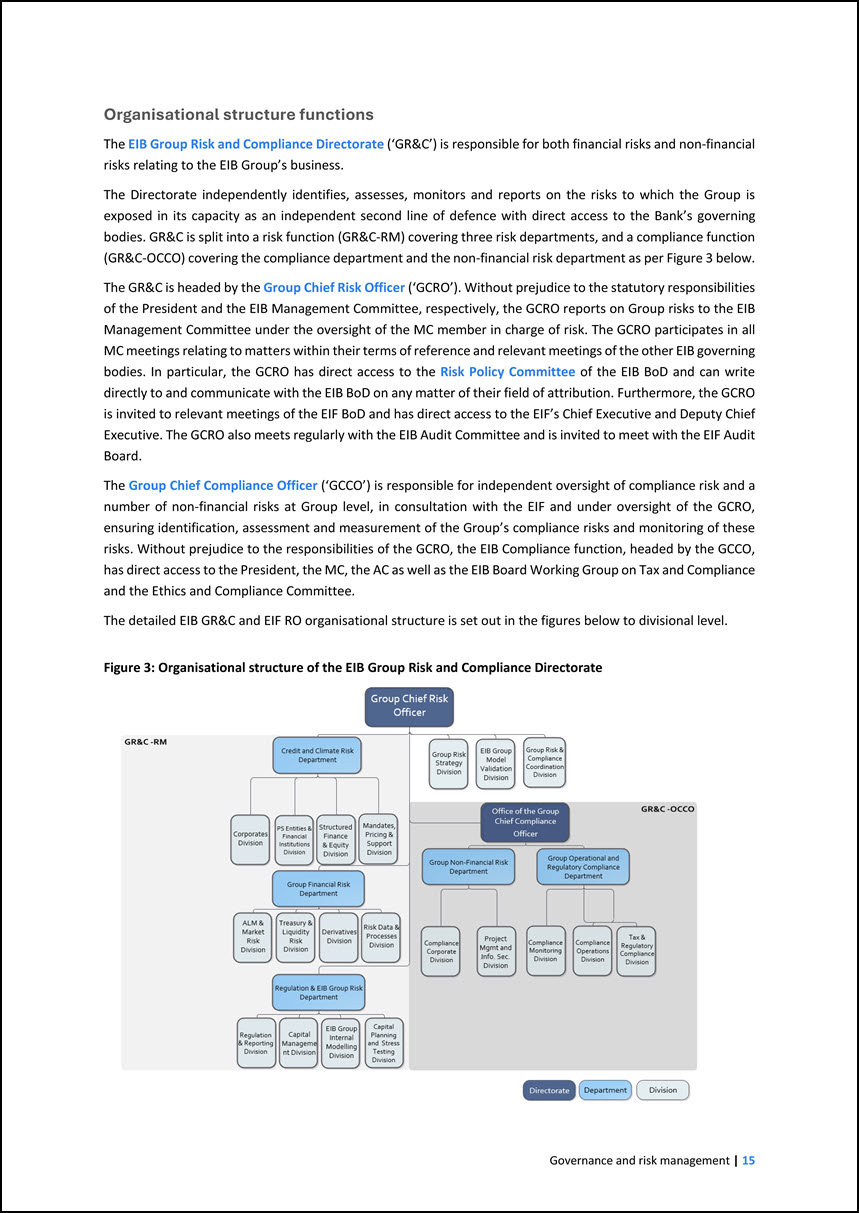

The EIF ensures appropriate risk identification and management through its Risk Office (see figure below for the structure of the EIF’s Risk Office), which is

responsible for measuring and managing the main risk types of the Fund and ensuring compliance with best market practices. The EIB as the parent entity of the Group is responsible for exercising oversight of Group risks via the GCRO, while respecting

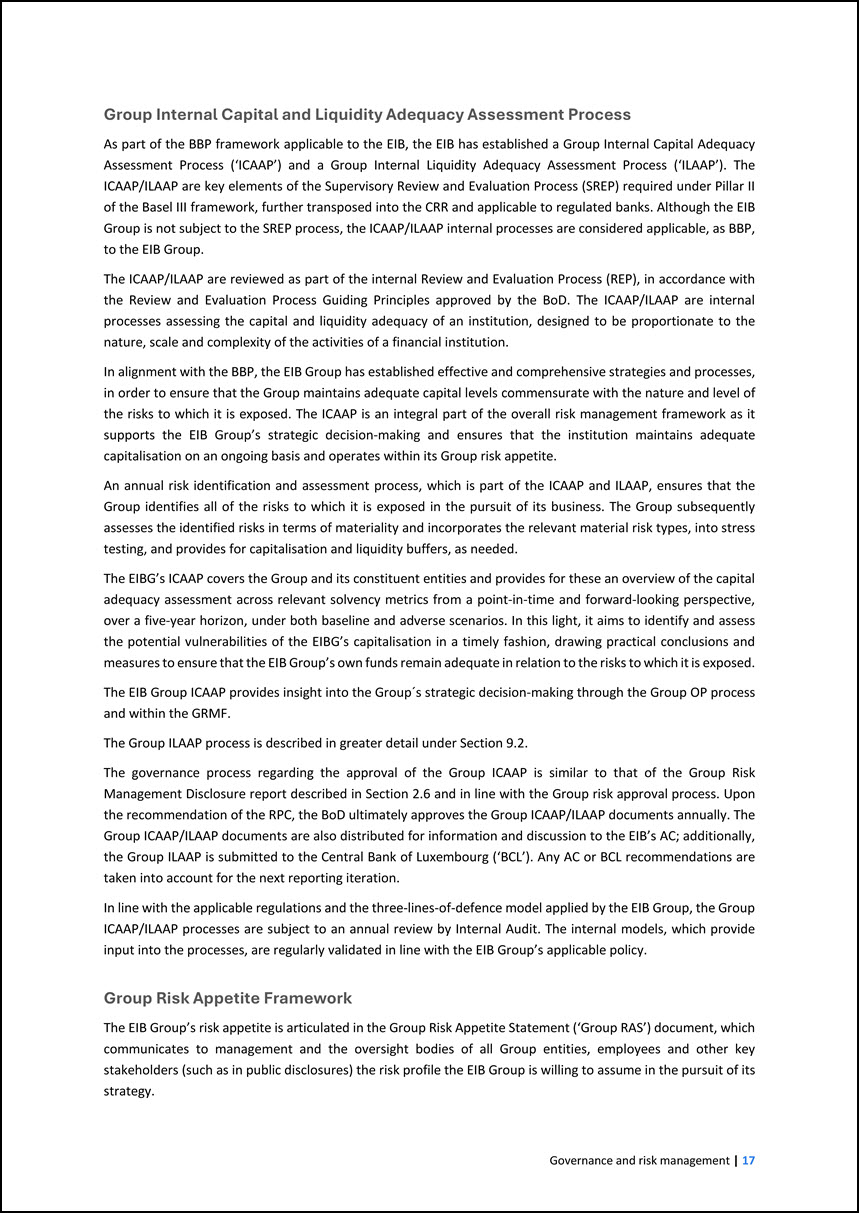

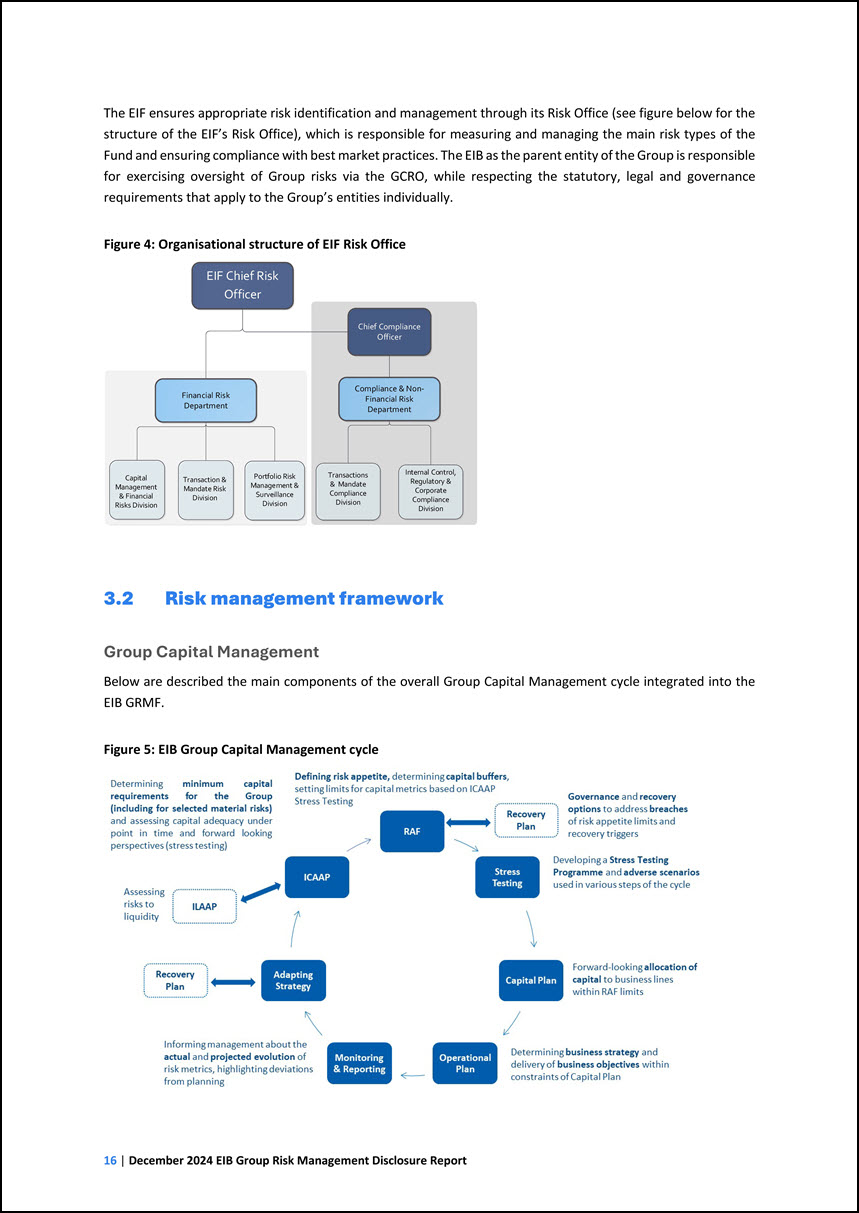

the statutory, legal and governance requirements that apply to the Group’s entities individually. Figure 4: Organisational structure of EIF Risk Office 3.2 Risk management framework Group Capital Management Below are described the main

components of the overall Group Capital Management cycle integrated into the EIB GRMF. Figure 5: EIB Group Capital Management cycle EIF Chief Risk OfficerTransaction & Mandate Risk DivisionFinancial Risk Department Chief Compliance

OfficerCompliance & Non- Financial Risk Department Capital Management& Financial Risks DivisionPortfolio Risk Management & Surveillance DivisionTransactions & Mandate Compliance DivisionInternal Control, Regulatory & Corporate

Compliance Division

Group Internal Capital and Liquidity Adequacy Assessment Process As part of the BBP framework applicable to the EIB, the EIB has established a Group Internal Capital

Adequacy Assessment Process (‘ICAAP’) and a Group Internal Liquidity Adequacy Assessment Process (‘ILAAP’). The ICAAP/ILAAP are key elements of the Supervisory Review and Evaluation Process (SREP) required under Pillar II of the Basel III framework,

further transposed into the CRR and applicable to regulated banks. Although the EIB Group is not subject to the SREP process, the ICAAP/ILAAP internal processes are considered applicable, as BBP, to the EIB Group. The ICAAP/ILAAP are reviewed as

part of the internal Review and Evaluation Process (REP), in accordance with the Review and Evaluation Process Guiding Principles approved by the BoD. The ICAAP/ILAAP are internal processes assessing the capital and liquidity adequacy of an

institution, designed to be proportionate to the nature, scale and complexity of the activities of a financial institution. In alignment with the BBP, the EIB Group has established effective and comprehensive strategies and processes, in order to

ensure that the Group maintains adequate capital levels commensurate with the nature and level of the risks to which it is exposed. The ICAAP is an integral part of the overall risk management framework as it supports the EIB Group’s strategic

decision-making and ensures that the institution maintains adequate capitalisation on an ongoing basis and operates within its Group risk appetite. An annual risk identification and assessment process, which is part of the ICAAP and ILAAP, ensures

that the Group identifies all of the risks to which it is exposed in the pursuit of its business. The Group subsequently assesses the identified risks in terms of materiality and incorporates the relevant material risk types, into stress testing, and

provides for capitalisation and liquidity buffers, as needed. The EIBG’s ICAAP covers the Group and its constituent entities and provides for these an overview of the capital adequacy assessment across relevant solvency metrics from a point-in-time

and forward-looking perspective, over a five-year horizon, under both baseline and adverse scenarios. In this light, it aims to identify and assess the potential vulnerabilities of the EIBG’s capitalisation in a timely fashion, drawing practical

conclusions and measures to ensure that the EIB Group’s own funds remain adequate in relation to the risks to which it is exposed. The EIB Group ICAAP provides insight into the Group´s strategic decision-making through the Group OP process and

within the GRMF. The Group ILAAP process is described in greater detail under Section 9.2. The governance process regarding the approval of the Group ICAAP is similar to that of the Group Risk Management Disclosure report described in Section 2.6

and in line with the Group risk approval process. Upon the recommendation of the RPC, the BoD ultimately approves the Group ICAAP/ILAAP documents annually. The Group ICAAP/ILAAP documents are also distributed for information and discussion to the

EIB’s AC; additionally, the Group ILAAP is submitted to the Central Bank of Luxembourg (‘BCL’). Any AC or BCL recommendations are taken into account for the next reporting iteration. In line with the applicable regulations and the

three-lines-of-defence model applied by the EIB Group, the Group ICAAP/ILAAP processes are subject to an annual review by Internal Audit. The internal models, which provide input into the processes, are regularly validated in line with the EIB

Group’s applicable policy. Group Risk Appetite Framework The EIB Group’s risk appetite is articulated in the Group Risk Appetite Statement (‘Group RAS’) document, which communicates to management and the oversight bodies of all Group entities,

employees and other key stakeholders (such as in public disclosures) the risk profile the EIB Group is willing to assume in the pursuit of its strategy.

The main building blocks through which the Group RAS is derived and embedded are listed below: • Stakeholders’ expectations and public mission; • Strategy and

business models of the Group entities; • Risk Identification process; • Risk Appetite Statement. The Group’s risk appetite setting process starts by identifying its main stakeholders and their respective expectations. Subsequently, the process

entails the assessment of the Group entities’ long-term policy objectives and business models in conjunction with the identification and assessment of the main risk categories to which the Group is exposed, which subsequently is articulated into the

Group RAS and the related risk metrics. The core of the Group’s business model is to provide financing at attractive terms to promote the attainment of the European Union’s policy objectives to which the Group entities play an integral and essential

role. The EIB mainly funds itself through the capital markets at relatively attractive terms and it passes on its attractive funding cost to clients by offering debt and equity-type financing either directly or via intermediated channels. The EIF

finances its activities out of its capital base and through third-party mandates and cooperation schemes with public and private counterparts, including the EIB and the European Union, represented by the European Commission (EC). The Group

originates business either (a) at its own risk; (b) through a risk-sharing mechanism by which a third party (such as the European Commission, Member States) provides credit enhancement to the Bank and/or to the EIF; or (c) on behalf of third parties

at their own risk. Exposures to the Member States benefit from the EIB’s Preferred Creditor Status (‘PCS’) based on international law practice and the EIB’s statutory framework12. 12 Except for exposures in the form of debt instruments with

collective action clauses. Furthermore, the EIB Group mobilises additional funds from other parties (private investors, European Commission, Member States) to maximise the financing impact within the scope of the EU policy goals. In this catalysing

role, the Group thereby creates a multiplier effect. In order to provide financing on attractive terms, the Group needs to maintain broad access to attractive funding from the capital markets by preserving the EIB’s AAA rating13, which is mainly a

function of its capital resources14, available liquidity, risk management practices and shareholders’ support. Consequently, for risk appetite purposes, the Group operates in such a way as to retain its AAA rating. 13 To some extent the preservation

of the AAA rating is subject to external parties’ (credit rating agencies’) judgment, hence not entirely under the Group’s control. 14 Commonly measured by credit rating agencies with respect to the consolidated risk position. The Group RAS

integrates all the elements described above by stating the level of appetite for the Group by each risk category and by translating these statements into risk metrics and related limits that constitute the Group RAF. Quantitative limits are set for

both financial risks and non-financial risk categories. Group Risk Appetite Statement15 15 The Group RAS 2024 and Group RAF Policy 2024 were approved by the BoD on 20 June 2024. The EIB Group is committed to retaining its long-term AAA rating,

which is a primary pillar of its business model. To this end, the EIB Group has implemented a strong risk management framework supported by a multitude of statutory, regulatory and internally developed risk appetite metrics.

As a public financial institution, the Group does not focus on making profits from speculative exposures to risks. As a consequence, the Group does not consider its

treasury or funding activities as profit-maximising centres and does not engage in speculative operations. The EIB Group is focused on the stability of earnings and preservation of the economic value of own funds in order to ensure the

sustainability and self-financing of its growth in the long term. The EIB Group monitors and manages its ability to fulfil this dual objective through related risk appetite metrics. The EIB Group is committed to maintaining its business model and

strategy whilst ensuring a robust operating environment with regard to operational, strategic, climate and reputational risks through a strong internal control framework supported by risk appetite metrics capturing a broad range of risks. The EIB

Group is committed to doing business in an ethical and fair way with zero tolerance for fraud, money laundering and financing of terrorism and from being used, intentionally or unintentionally, for criminal activities. The EIB Group aligns with best

practice anti-money laundering and combating the financing of terrorism standards, promoting high ethical and professional behaviour in the financial sector. For this purpose, the Group promotes a strong compliance and risk culture and manages

conduct and compliance risks through an appropriate internal control framework and specific risk appetite metrics. The EIB Group takes concrete actions to counter the rapid growth in ICT (Information and Communications Technology), information

security and cyber risks and the increasing severity and impacts that these risks pose to the Group’s business operation and to its reputation towards stakeholders, clients and employees. The EIB Group is committed to preserving the reputation of

the Group amongst its stakeholders in line with the highest standards and is monitoring risk appetite metrics related both to external and internal developments, such as media coverage and staff engagement and well-being. The EIB Group is committed

to supporting the Paris Agreement in order to limit the impact of climate change and related environmental, economic and social systemic risks. As the climate bank and a leader in climate- related financing, the EIB Group aims to adapt its processes

and risk management framework to address the financial and non-financial risks induced by climate change and incorporate climate and environmental risk- related considerations into the ongoing management of operations and business priorities. Group

Stress Testing Framework As part of the Group Stress Testing Framework, the EIB Group develops a Stress Testing Programme on an annual basis, which identifies the list of stress and sensitivity tests to be performed over a year, by the Group or by

each Group entity, and which is approved by the MC and the Chief Executive of the EIF for its relevant parts. Group Recovery Planning The Group Recovery Plan (‘Group RP’) describes how the EIB Group would identify and manage actual and potential

crises threatening the Group’s capital adequacy and/or liquidity position. The Group RP covers the recovery stage for both capital adequacy and liquidity risk indicators and the contingency stage for capital adequacy indicators. The contingency stage

for liquidity risk indicators is covered by the Group Contingency Funding Plan (‘Group CFP’), while reference is made to the latter also at the recovery stage for liquidity risk indicators. The Group RP complements the Group RAF as it elaborates on a

range of contingency and recovery options and actions in response to breaches of risk appetite limits/recovery triggers, in order to avoid exceeding the Group’s risk capacity.

Group Capital Sustainability Policy The Group Capital Sustainability Policy (‘GCSP’) aims to ensure that the Group’s business strategy and Operational Plan remain

sustainable from a capital perspective, as in that the Group’s and the Group Entities’ capital risk metrics remain within their risk appetite limits over the planning horizon. The Group Capital Plan (’GCP’) enacts the key objectives of the Group

Capital Sustainability Policy, by determining the maximum available capital headroom and allocating the capital to be deployed through the Group Operational Plan. The GCP ensures that capital is used efficiently to support the Group’s mission and the

delivery and implementation of the Group entities’ business plans, while safeguarding the Bank’s AAA rating and retaining flexibility to respond to market downturns and new EU policy initiatives. Group Risk Reporting The GCRO is responsible for

overseeing internal risk reporting to the MC, the BoD, the RPC and the AC. Several risk reporting processes are in place within the EIB Group to support managerial decisions with a focus on the various risks and limit monitoring. Based on the

function, risk monitored, audience and purpose, reports may have a customised level of detail and be produced with frequencies ranging from daily to quarterly as needed. Two overarching EIB Group Risk Reports provides to senior management the

overview of the Group‘s financial and non-financial risks respectively, including regular monitoring of Group and entity-level RAF metrics. Quarterly and monthly versions of these reports provide different levels of detail to management and support

managerial decision-making for the governing bodies of the EIB (MC and BoD). The reports are also provided to and discussed at the RPC and AC on a regular basis. The EIB Group aims at applying BCBS (Basel Committee on Banking Supervision) 239

principles in its risk reporting activity.

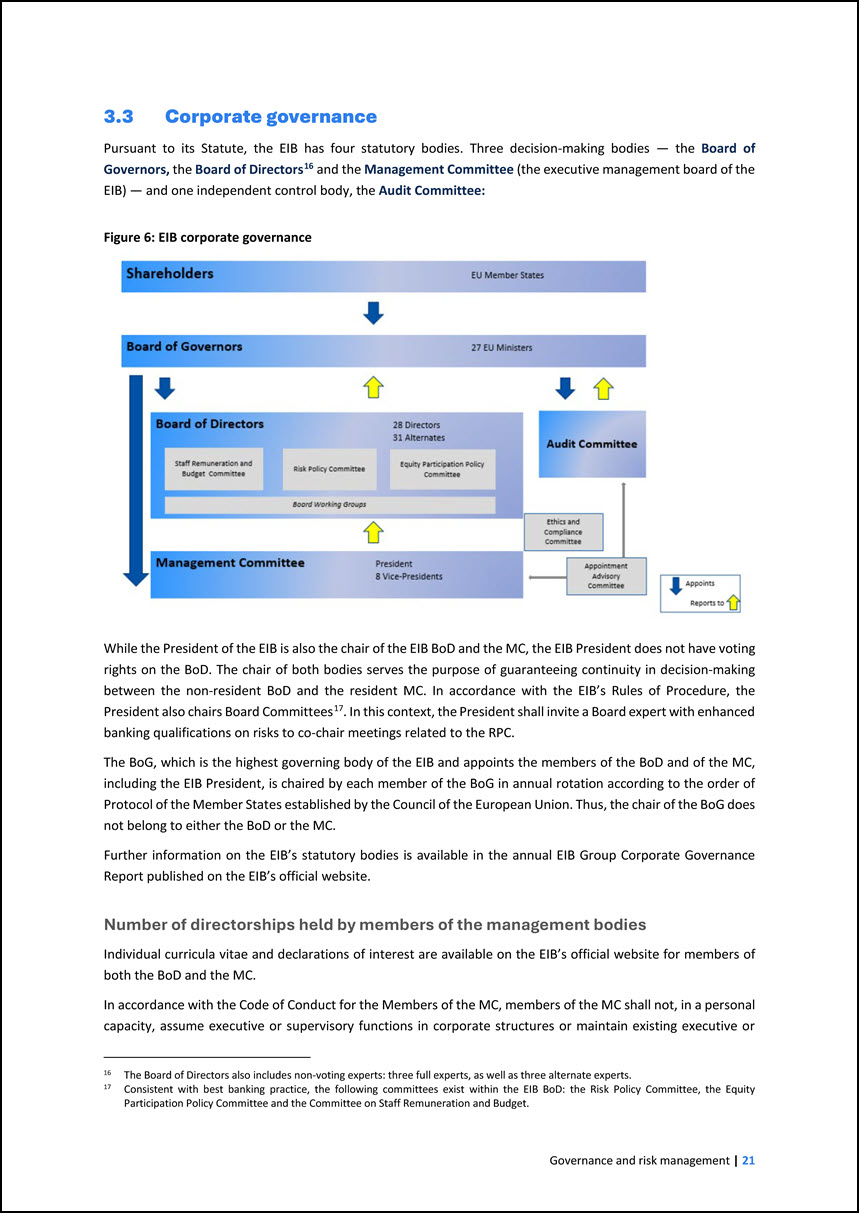

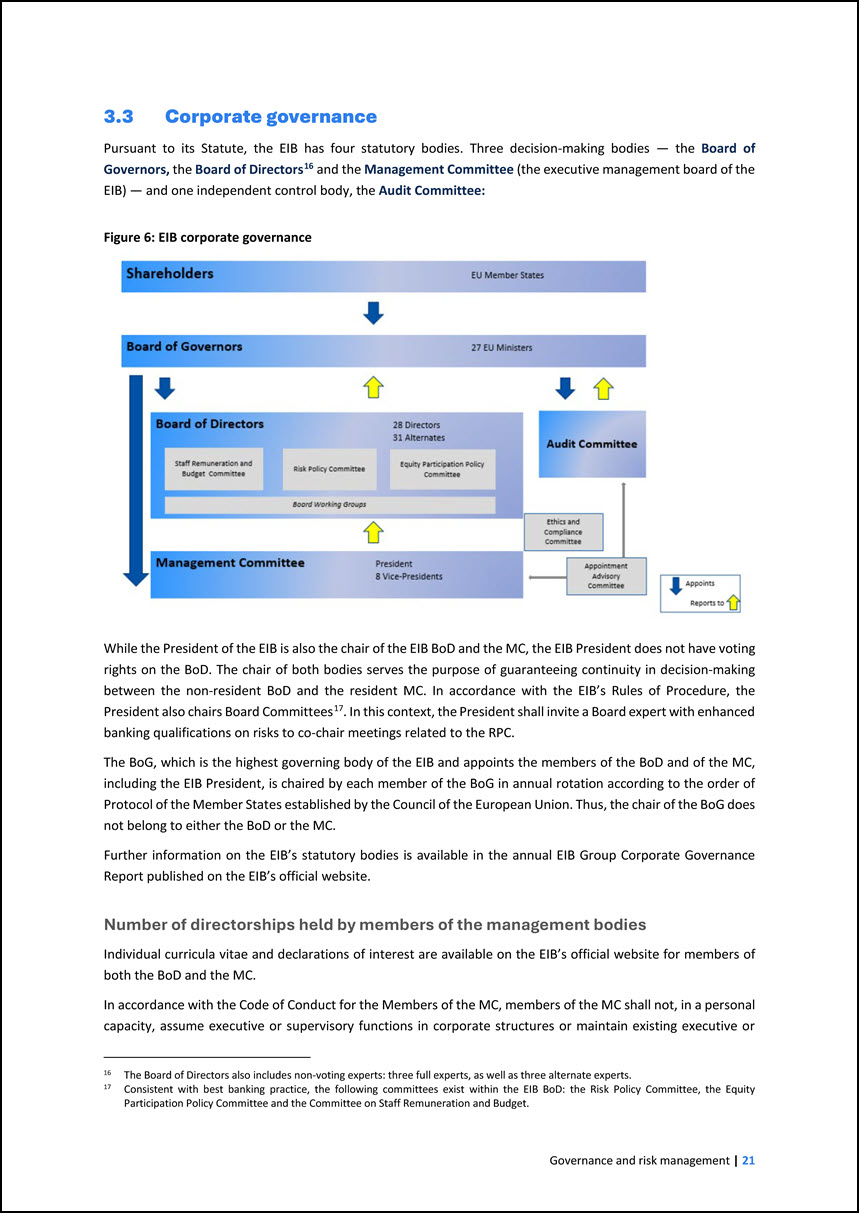

3.3 Corporate governance Pursuant to its Statute, the EIB has four statutory bodies. Three decision-making bodies — the Board of Governors, the Board of DirectorsEIB)

— and one independent control body, the Audit Committee: 16 and the Management Committee (the executive management board of the 16 The Board of Directors also includes non-voting experts: three full experts, as well as three alternate experts.

Figure 6: EIB corporate governance While the President of the EIB is also the chair of the EIB BoD and the MC, the EIB President does not have voting rights on the BoD. The chair of both bodies serves the purpose of guaranteeing continuity in

decision-making between the non-resident BoD and the resident MC. In accordance with the EIB’s Rules of Procedure, the President also chairs Board Committeesbanking qualifications on risks to co-chair meetings related to the RPC. 17. In this context,

the President shall invite a Board expert with enhanced 17 Consistent with best banking practice, the following committees exist within the EIB BoD: the Risk Policy Committee, the Equity Participation Policy Committee and the Committee on Staff

Remuneration and Budget. The BoG, which is the highest governing body of the EIB and appoints the members of the BoD and of the MC, including the EIB President, is chaired by each member of the BoG in annual rotation according to the order of

Protocol of the Member States established by the Council of the European Union. Thus, the chair of the BoG does not belong to either the BoD or the MC. Further information on the EIB’s statutory bodies is available in the annual EIB Group Corporate

Governance Report published on the EIB’s official website. Number of directorships held by members of the management bodies Individual curricula vitae and declarations of interest are available on the EIB’s official website for members of both the

BoD and the MC. In accordance with the Code of Conduct for the Members of the MC, members of the MC shall not, in a personal capacity, assume executive or supervisory functions in corporate structures or maintain existing executive or

supervisory functions when joining the Bank. This prohibition does not apply when the executive or supervisory function is performed at the request of the Bank and is

connected to the Bank’s work. In accordance with their respective Codes of Conduct, members of both the MC and of the BoD shall disclose to the Ethics and Compliance Committee (ECC) any official or professional position they hold at the time of

their appointment, as well as any subsequent changes thereto. Information regarding the recruitment policy for the selection of members of the management bodies and their actual knowledge, skills and expertise The Appointment Advisory Committee,

pursuant to Articles 23.a.2 and 27.8 of the Rules of Procedure of the EIB, shall give an opinion on candidates' suitability to perform the duties of a member of the EIB MC and those of a full member or observer of the EIB’s AC, before the Board of

Governors makes the statutory appointment. In the context of the assessment of the collective knowledge and expertise of the MC pursuant to the Operating Rules of the Appointment Advisory Committee, the Committee shall consult the President of the

Bank for nominations to the MC on any potential specific need within the MC, at the time of appointment. The Secretary General shall inform the nominating Member State of any such specific need within the MC, at the time of a vacancy. In accordance

with the Statute of the Bank, the EIB’s Board of Directors consists of 28 directors and 31 alternate directors who shall be chosen from persons whose independence and competence are beyond doubt and appointed by the BoG for a collective five-year

mandate that is renewable. To broaden its professional expertise, the BoD has made use of the possibility of co-opting non-voting experts (three full experts as well as three alternate experts). The end of their mandate coincides with that of the

entire BoD. In accordance with Article 23.a, first paragraph, of the Rules of Procedure of the Bank, the members of the MC shall be persons of independence and competence and have experience in financial, banking and/or EU matters. They shall at all

times be of sound integrity and enjoy high reputation, and possess sufficient knowledge, skills and expertise to perform their duties. Information on the knowledge, skills and expertise of members of the EIB management bodies is available in their

individual curricula vitae on the EIB’s website. Information on diversity18 policies with regard to the members of the management bodies 18 Reflecting the EIB statutory framework, the process and rules relating to the nomination and appointment of

the members of the EIB governance bodies are not all based on the same suitability requirements applicable to commercial banks, namely the diversity requirements in the CRD and in the joint European Securities and Markets Authority (ESMA) and

European Banking Authority (EBA) Guidelines on the assessment of the suitability of members of the management body and key function holders; hence, no diversity policy as such is in place in that regard. In accordance with the Rules of Procedure of

the Bank, the overall composition of the BoD and of the MC shall aim to reflect an adequately broad range of expertise as well as gender diversity. Gender diversity in the BoD is reported in Annex 2 to the annual EIB Group Corporate Governance

Report available on the EIB’s website.

Risk Policy Committee Within the BoD, the Risk Policy Committee (RPC) is the EIB’s risk committee, composed of nine members of the BoD19. Its role is to discuss and

advise the BoD on the Bank’s risk policies, including those policies that are relevant for aspects of the EIB Group regarding risk appetite, tolerance and strategy. The RPC provides non-binding opinions and/or recommendations to the BoD so as to

facilitate the decision-making process of the BoD. 19 Members are nominated by the Member States or groups of Member States that nominate alternate Directors as specified under Article 9(2) of the Statute. Nominations shall be effective upon

recording of receipt by the chair of the Board. More specifically, the Committee advises the BoD on the EIB’s policies regarding overall risk appetite, tolerance and strategy by reviewing the EIB Group Risk Management Framework with respect to

credit, market and liquidity risks. It provides opinions and makes recommendations to the BoD as to whether the policies related to identification, assessment and management of risks are appropriate to the Bank's risk profile. Furthermore, it

discusses policies associated with all risks relevant to the EIB Group. The Committee advises the BoD on risk policies by reviewing and providing opinions and/or recommendations to the BoD on the following high-level risk policy documents upon

proposal from the Bank: • Group Risk Management Charter; • Group Capital Sustainability Policy; • Group Risk Appetite Framework; • Group Internal Capital Adequacy Assessment Process (‘ICAAP’); • Group Internal Liquidity Adequacy Assessment Process

(‘ILAAP’); • Group Contingency Funding Plan; • Group Recovery Plan; • Group Stress Testing Framework. The Committee also reviews and discusses: • The Group Capital Plan, and recommends the capital allocation as part of the Operational Plan; • The

EIB Group Risk Reports on a quarterly basis; • The annual report prepared by the Bank on the implemented restructurings of existing operations; • The main changes to the Credit Risk Guidelines (CRGs) and Financial Risk Guidelines (FRGs), as approved

from time to time by the MC of the Bank; • Any written contributions submitted to it by the GCRO, in accordance with Article 11.3 of the Rules of Procedure. Further details on the RPC Terms of Reference are available on the EIB’s website. In 2024,

the RPC met seven times. Three lines of defence The EIB Group’s internal control functions and risk management systems are consistent with the three-lines-of- defence model. As a first line of defence, the business units are responsible, within

their respective areas, for managing risks within the established set of limits and boundaries. Amongst other functions, the second line of defence includes the respective Risk Management and Compliance functions as well as IT resources. The Chief

Financial Controller Directorate as a second line of defence function is responsible for the maintenance, development and oversight of the internal control framework. The second line of defence also includes functions in the EIB's Projects

Directorate and the Legal Directorate.

The third line of defence is ensured by the Internal Audit function, which provides an independent review of the risk management practices and internal control

framework and reports to the AC or to the EIF's Audit Board, as relevant. At both the EIB and the EIF, the segregation of duties is supported by the fact that internal control functions are separate functions, each having direct access to the

relevant executive body (President/MC for the EIB, Chief Executive for the EIF) and to the BoD. Furthermore, the Audit Committee has an internal and specific review and evaluation process (the “EIB REP”) in place. This process has been framed by the

EIB’s Review and Evaluation Guiding Principles, available on the Bank’s website, which were complemented by implementing rules and a methodology specific to the EIB Group. Globally, this framework is based on the EBA’s Guidelines on the Supervisory

Review and Evaluation Process, while considering the EIB’s specific nature, policy mission, tasks and governance structure. The EIB REP supports the AC in its role to ensure that the Bank conforms with applicable BBP.

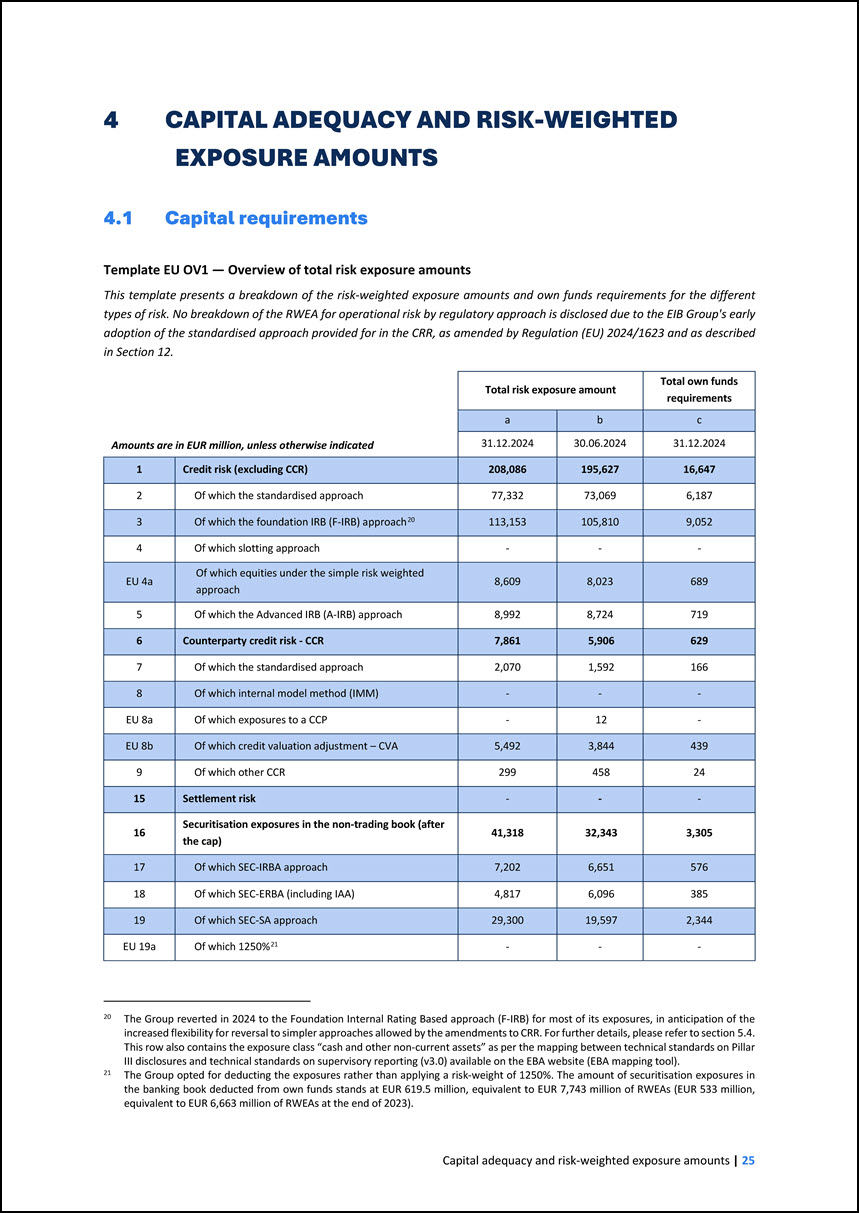

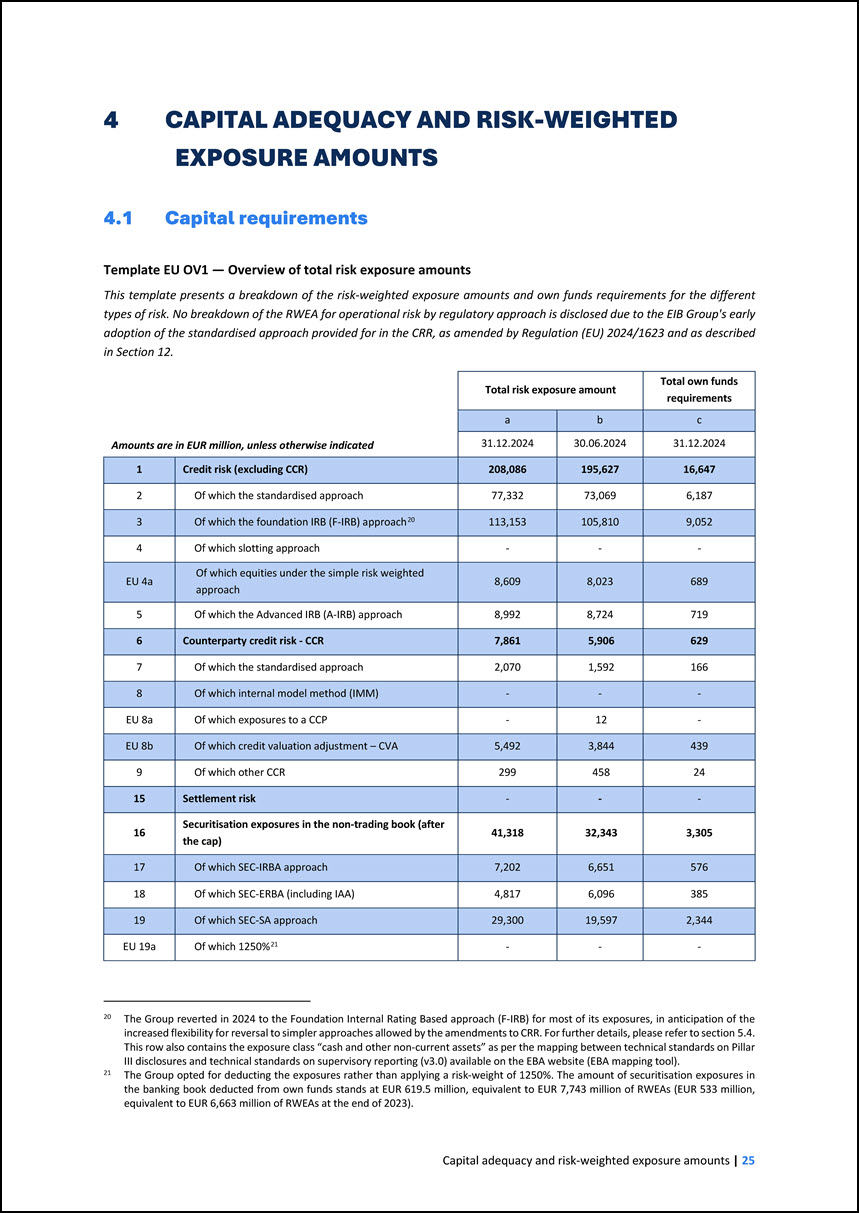

4 CAPITAL ADEQUACY AND RISK-WEIGHTED EXPOSURE AMOUNTS 4.1 Capital requirements Template EU OV1 — Overview of total risk exposure amounts This template presents a

breakdown of the risk-weighted exposure amounts and own funds requirements for the different types of risk. No breakdown of the RWEA for operational risk by regulatory approach is disclosed due to the EIB Group's early adoption of the standardised

approach provided for in the CRR, as amended by Regulation (EU) 2024/1623 and as described in Section 12. Amounts are in EUR million, unless otherwise indicated Total risk exposure amount Total own funds requirements a b c 31.12.2024

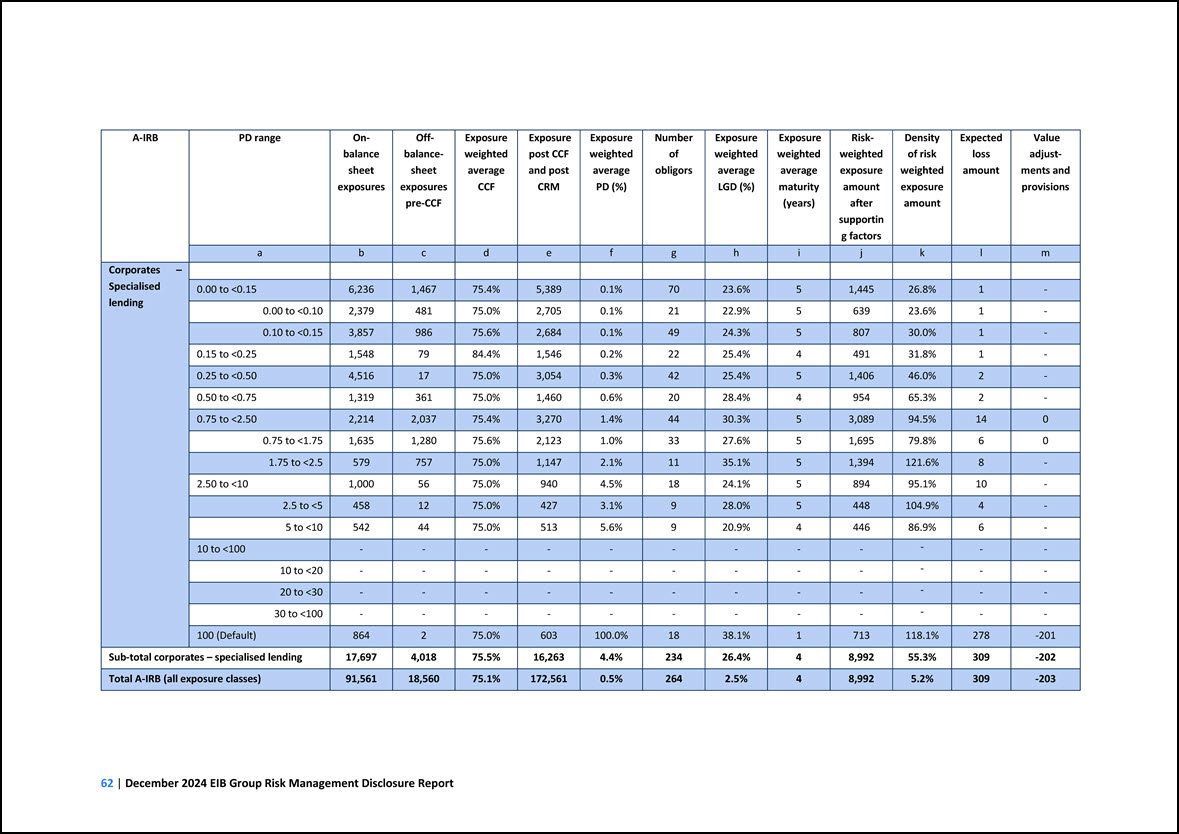

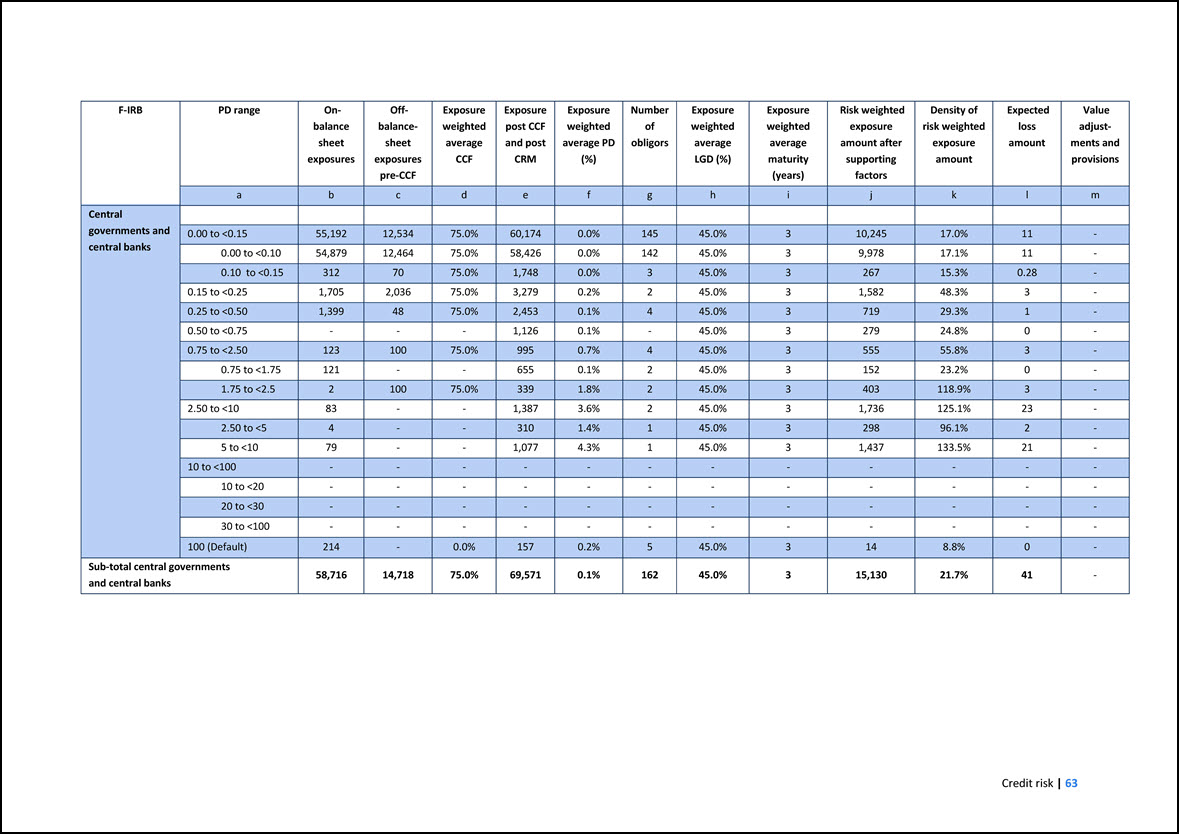

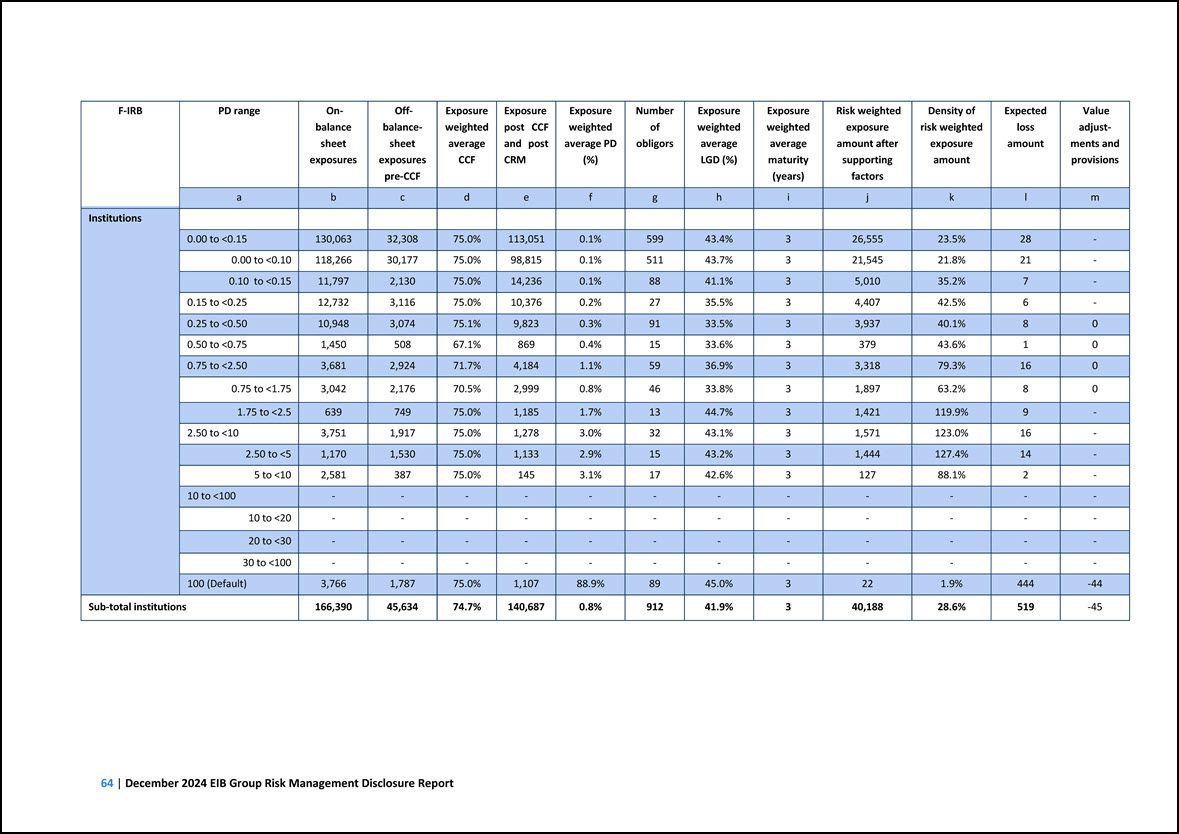

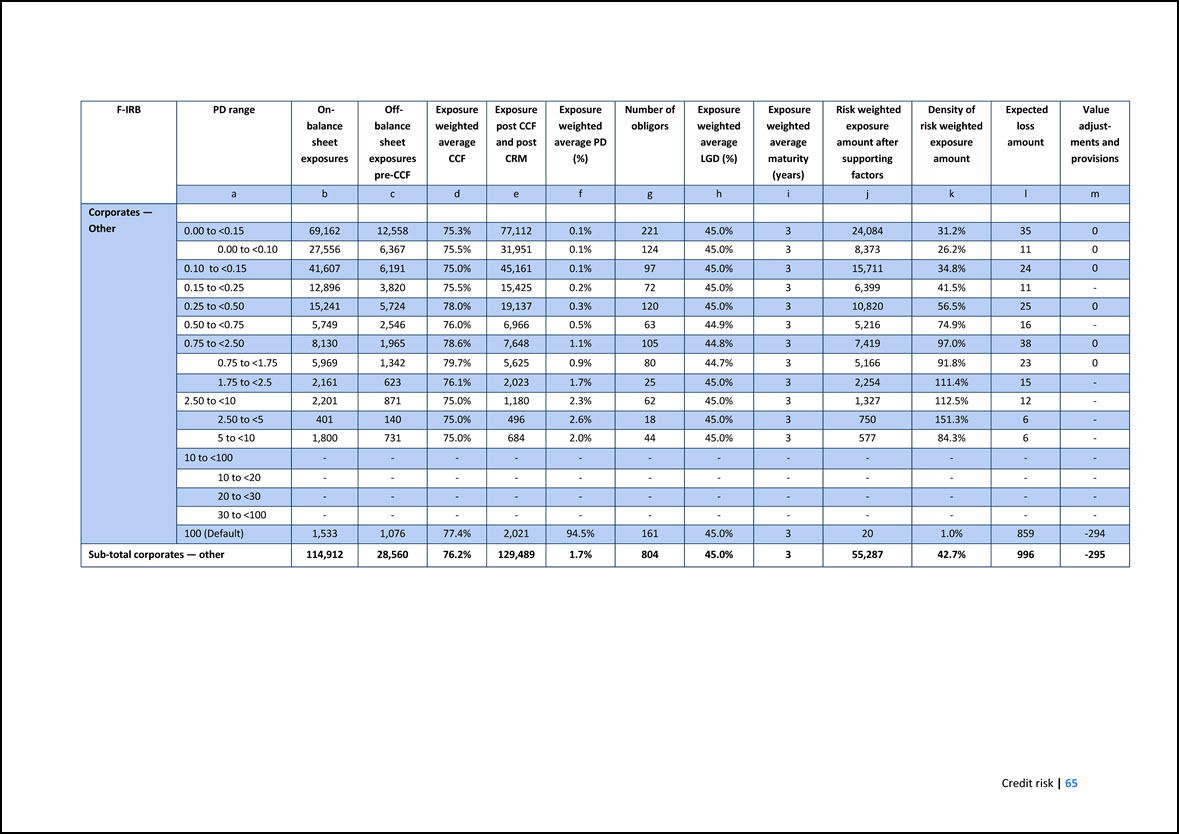

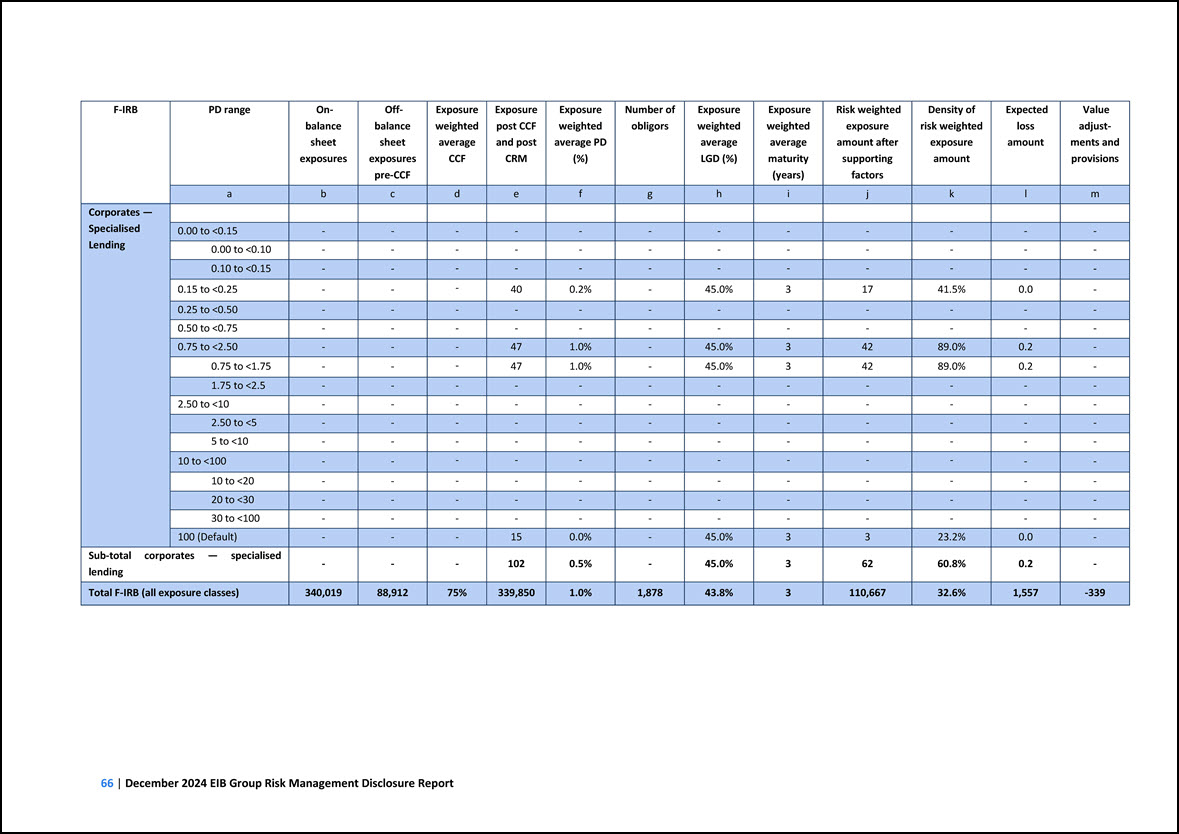

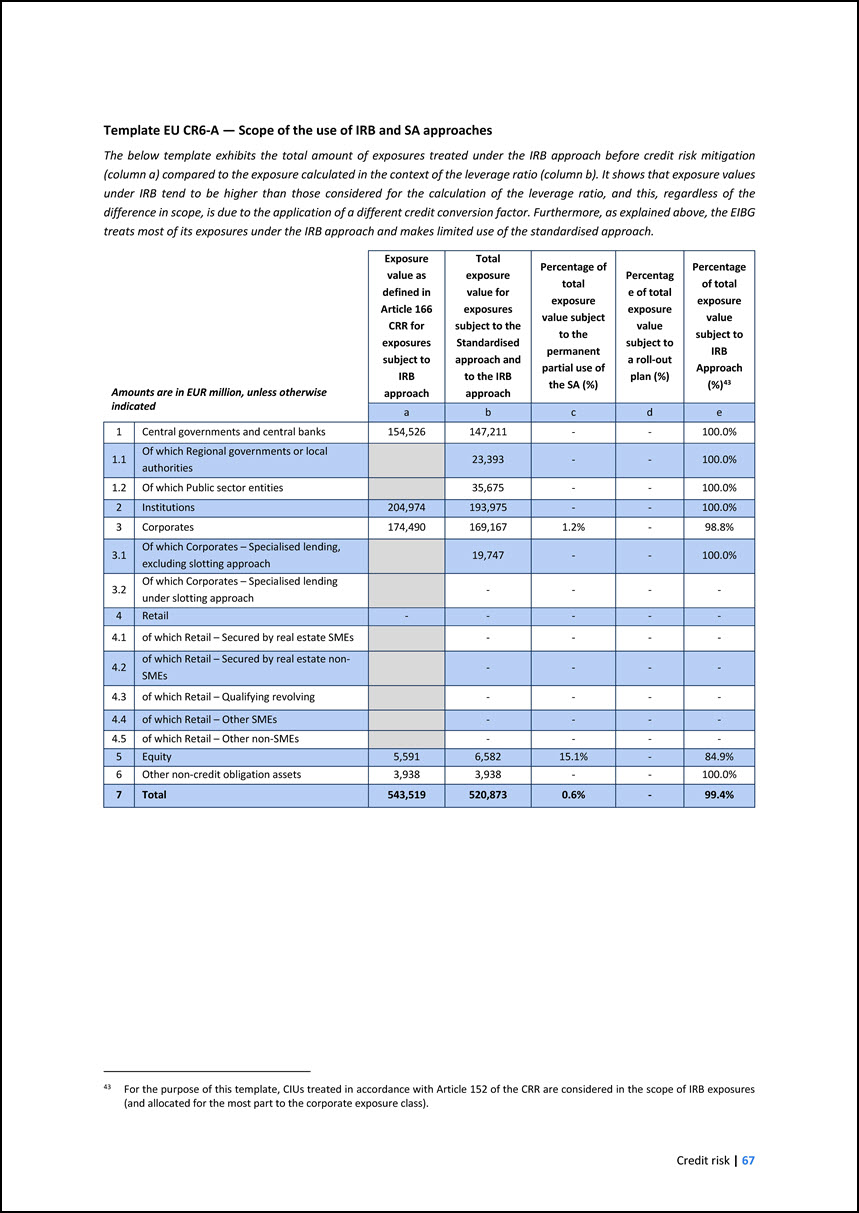

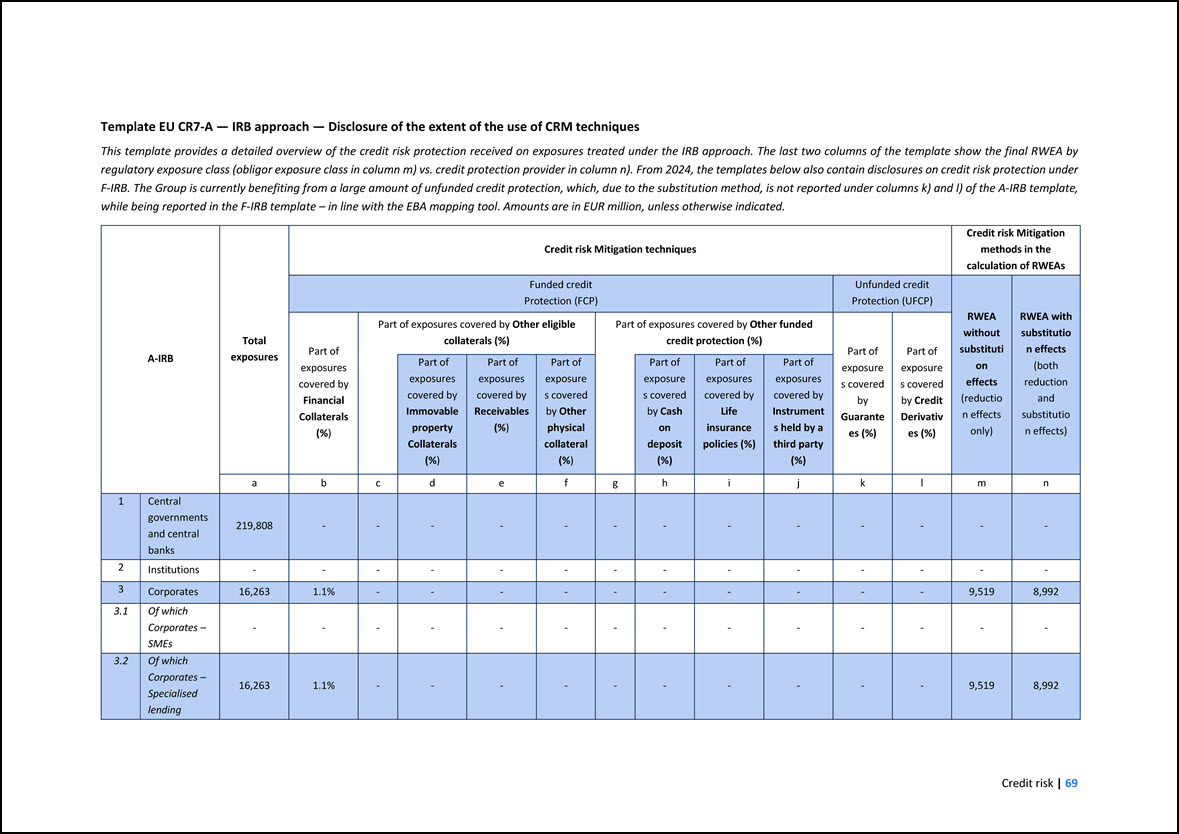

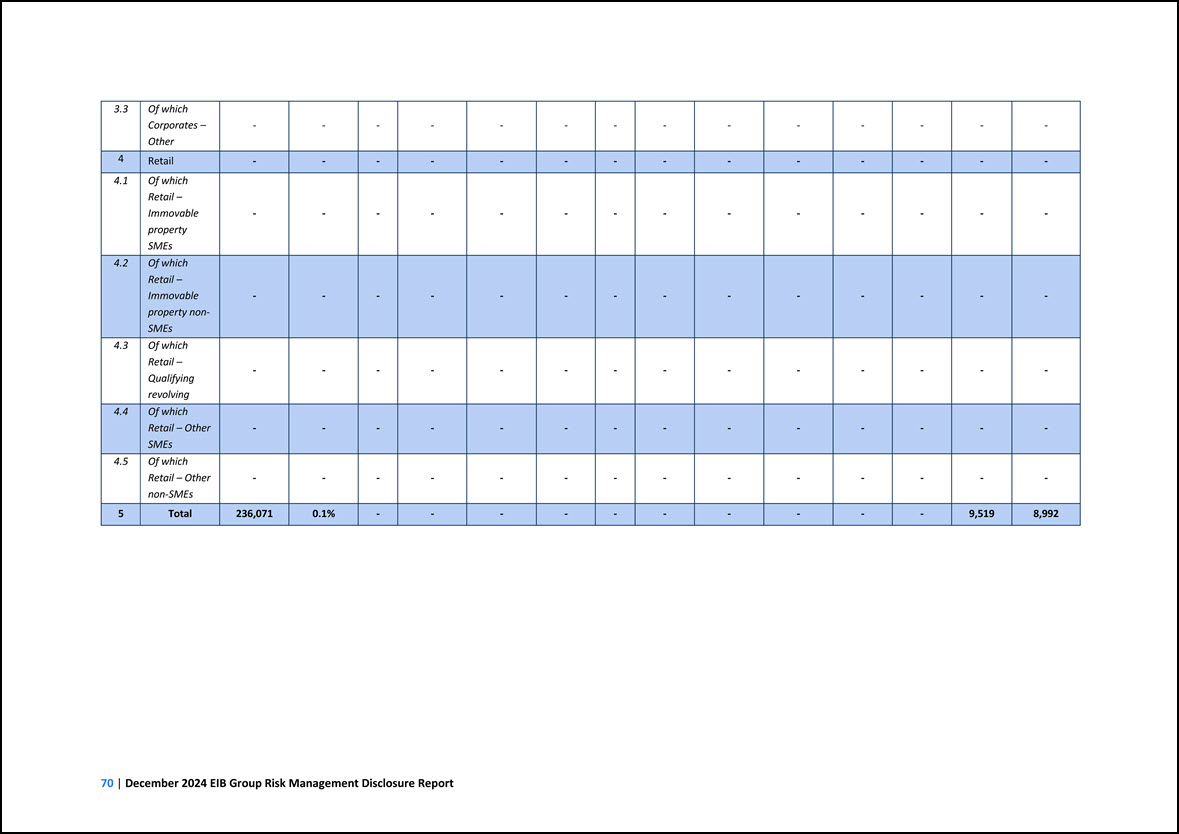

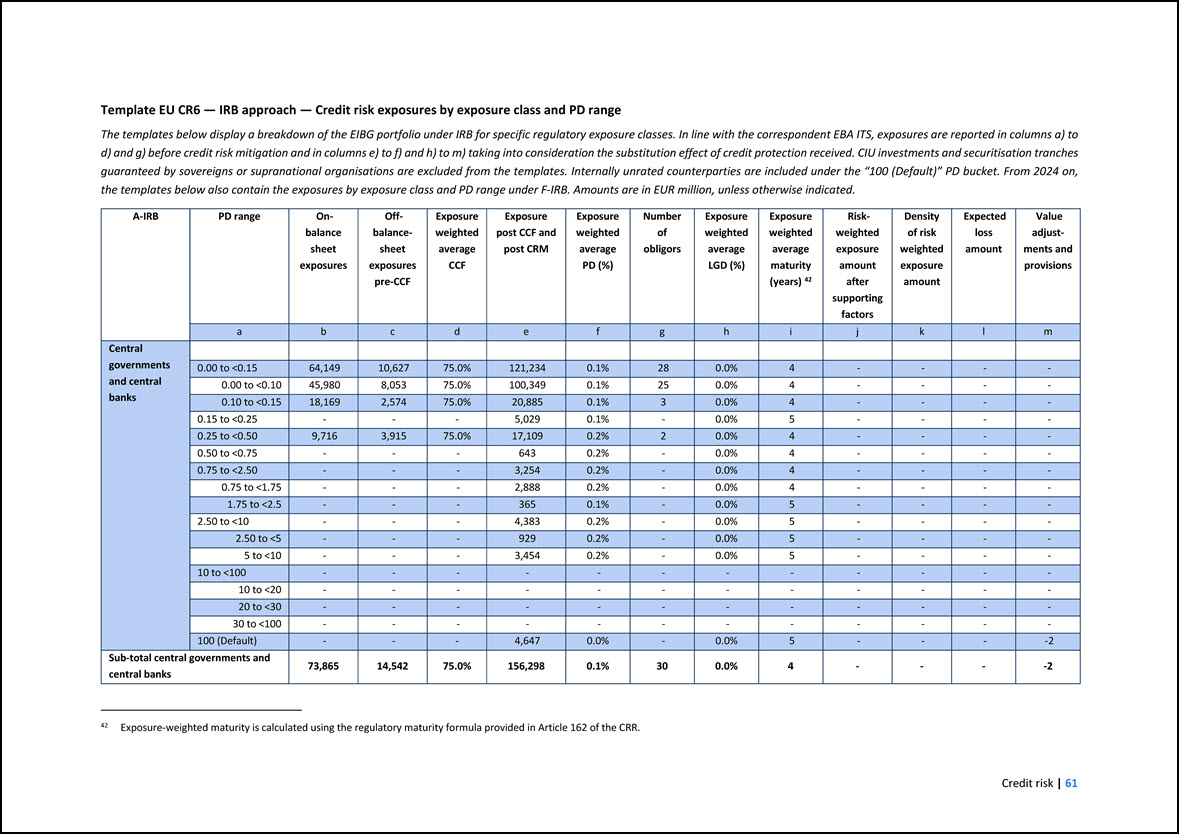

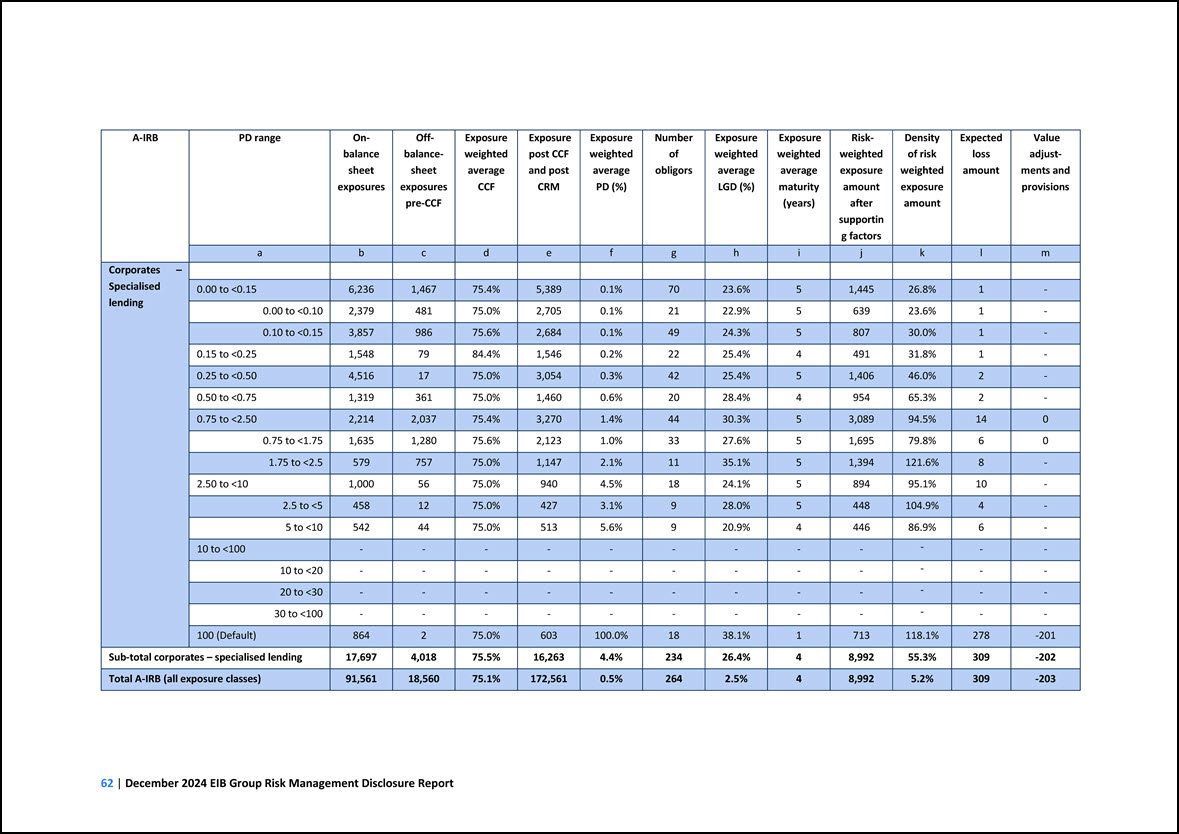

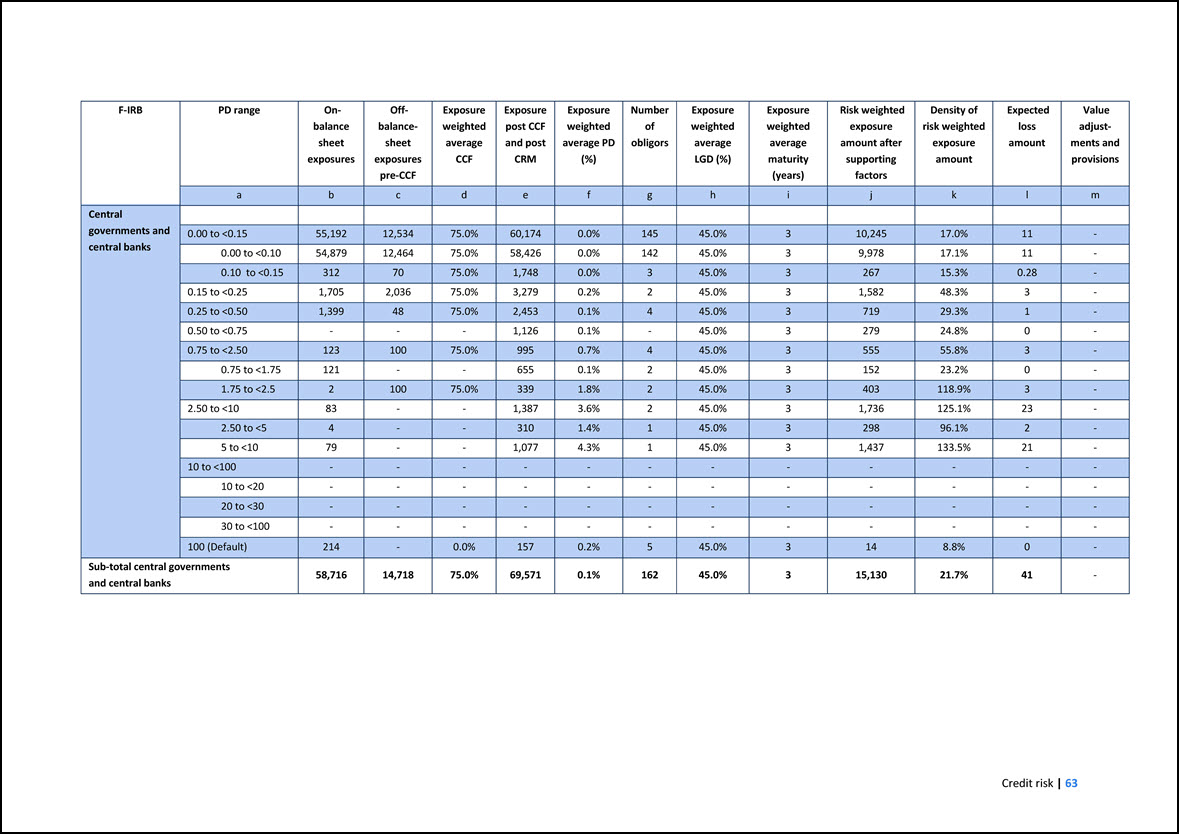

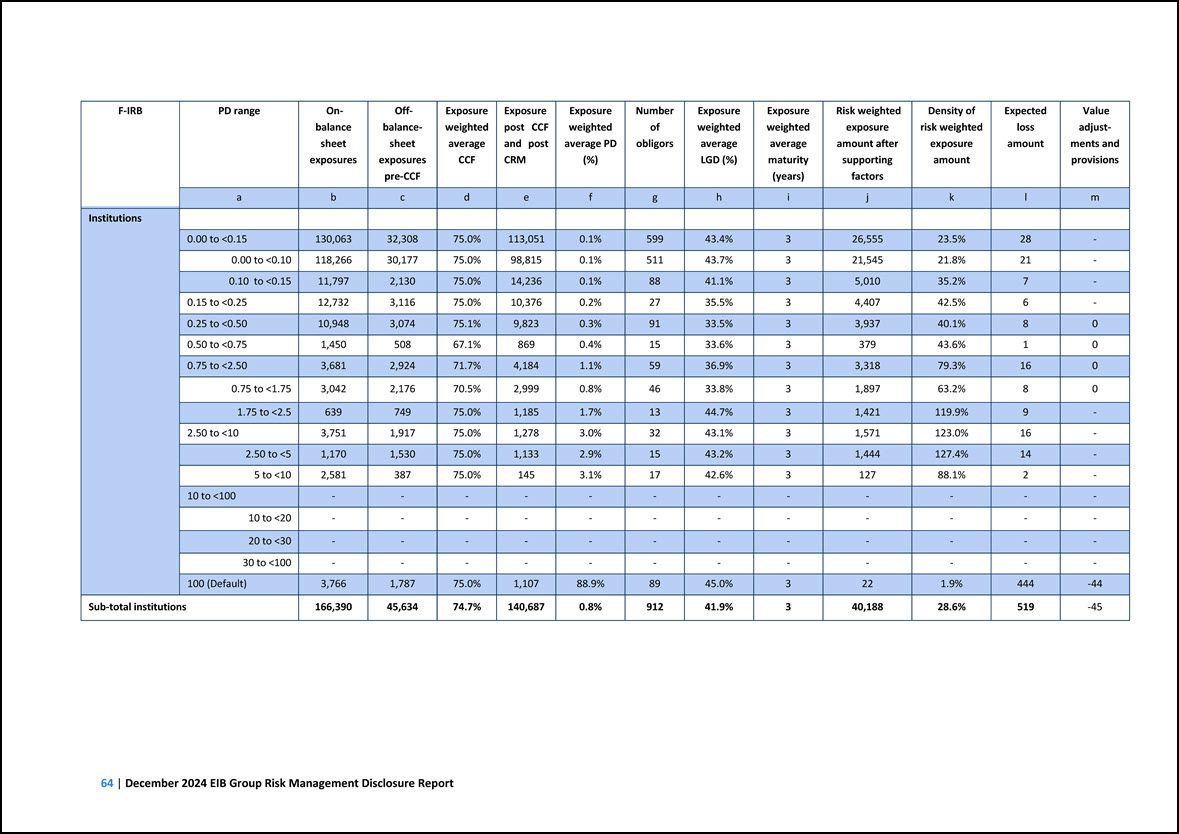

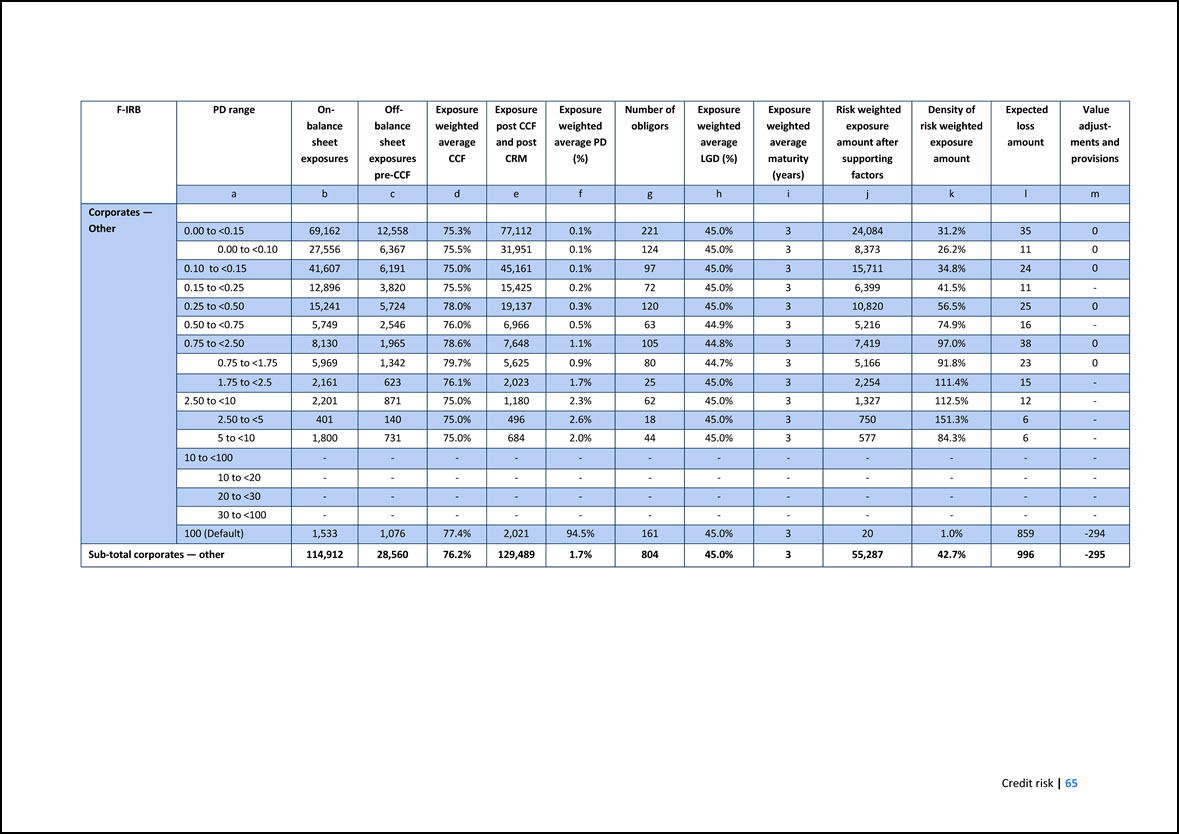

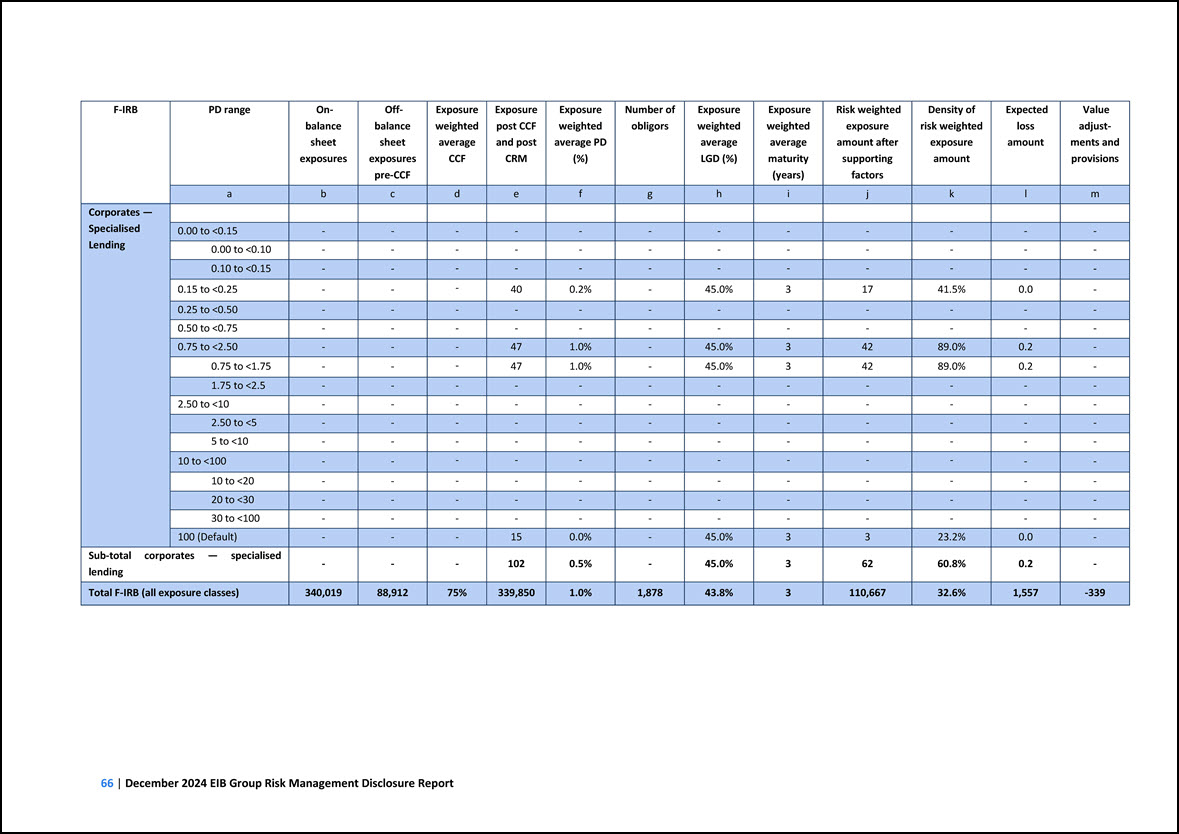

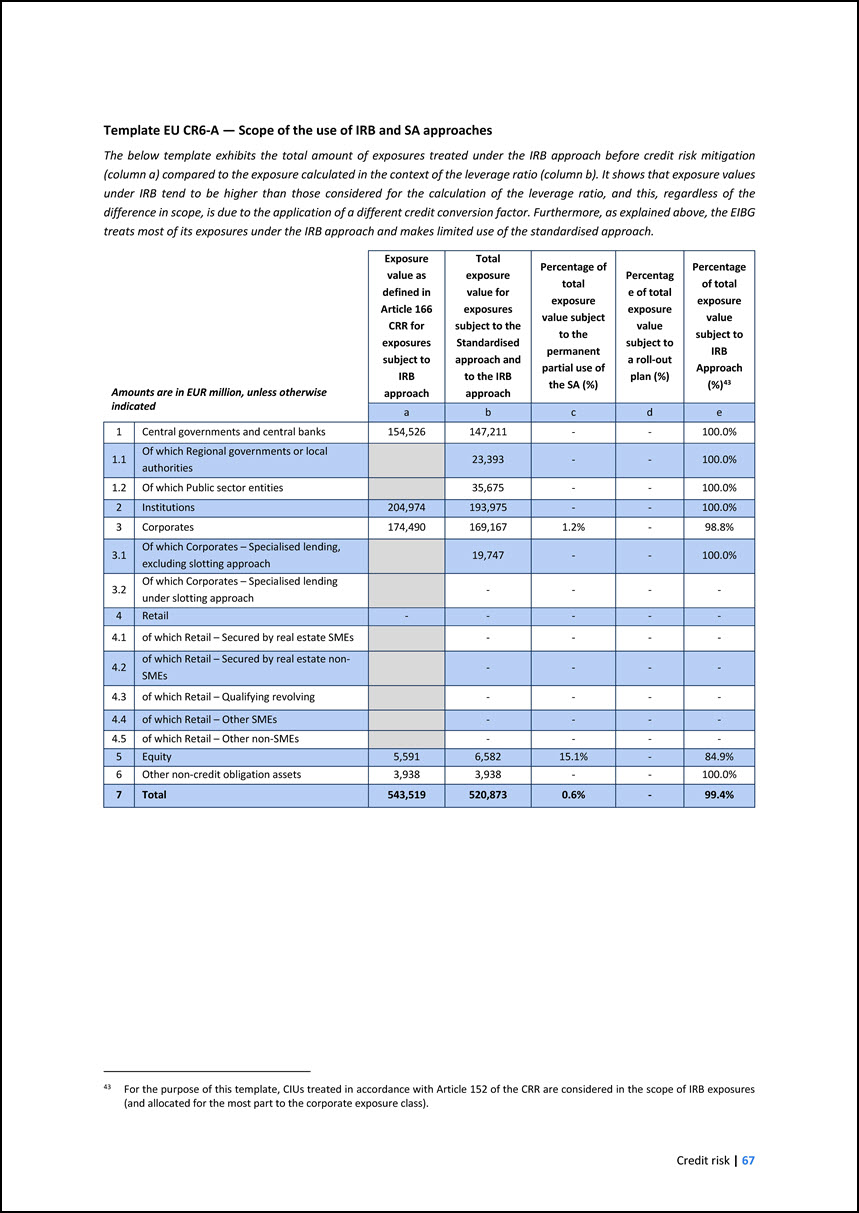

30.06.2024 31.12.2024 1 Credit risk (excluding CCR) 208,086 195,627 16,647 2 Of which the standardised approach 77,332 73,069 6,187 3 Of which the foundation IRB (F-IRB) approach20 113,153 105,810 9,052 4 Of which slotting approach

- - - EU 4a Of which equities under the simple risk weighted approach 8,609 8,023 689 5 Of which the Advanced IRB (A-IRB) approach 8,992 8,724 719 6 Counterparty credit risk - CCR 7,861 5,906 629 7 Of which the standardised

approach 2,070 1,592 166 8 Of which internal model method (IMM) - - - EU 8a Of which exposures to a CCP - 12 - EU 8b Of which credit valuation adjustment – CVA 5,492 3,844 439 9 Of which other CCR 299 458 24 15 Settlement

risk - - - 16 Securitisation exposures in the non-trading book (after the cap) 41,318 32,343 3,305 17 Of which SEC-IRBA approach 7,202 6,651 576 18 Of which SEC-ERBA (including IAA) 4,817 6,096 385 19 Of which SEC-SA approach

29,300 19,597 2,344 EU 19a Of which 1250%21 - - - 20 The Group reverted in 2024 to the Foundation Internal Rating Based approach (F-IRB) for most of its exposures, in anticipation of the increased flexibility for reversal to simpler

approaches allowed by the amendments to CRR. For further details, please refer to section 5.4. This row also contains the exposure class “cash and other non-current assets” as per the mapping between technical standards on Pillar III disclosures and

technical standards on supervisory reporting (v3.0) available on the EBA website (EBA mapping tool). 21 The Group opted for deducting the exposures rather than applying a risk-weight of 1250%. The amount of securitisation exposures in the banking

book deducted from own funds stands at EUR 619.5 million, equivalent to EUR 7,743 million of RWEAs (EUR 533 million, equivalent to EUR 6,663 million of RWEAs at the end of 2023).

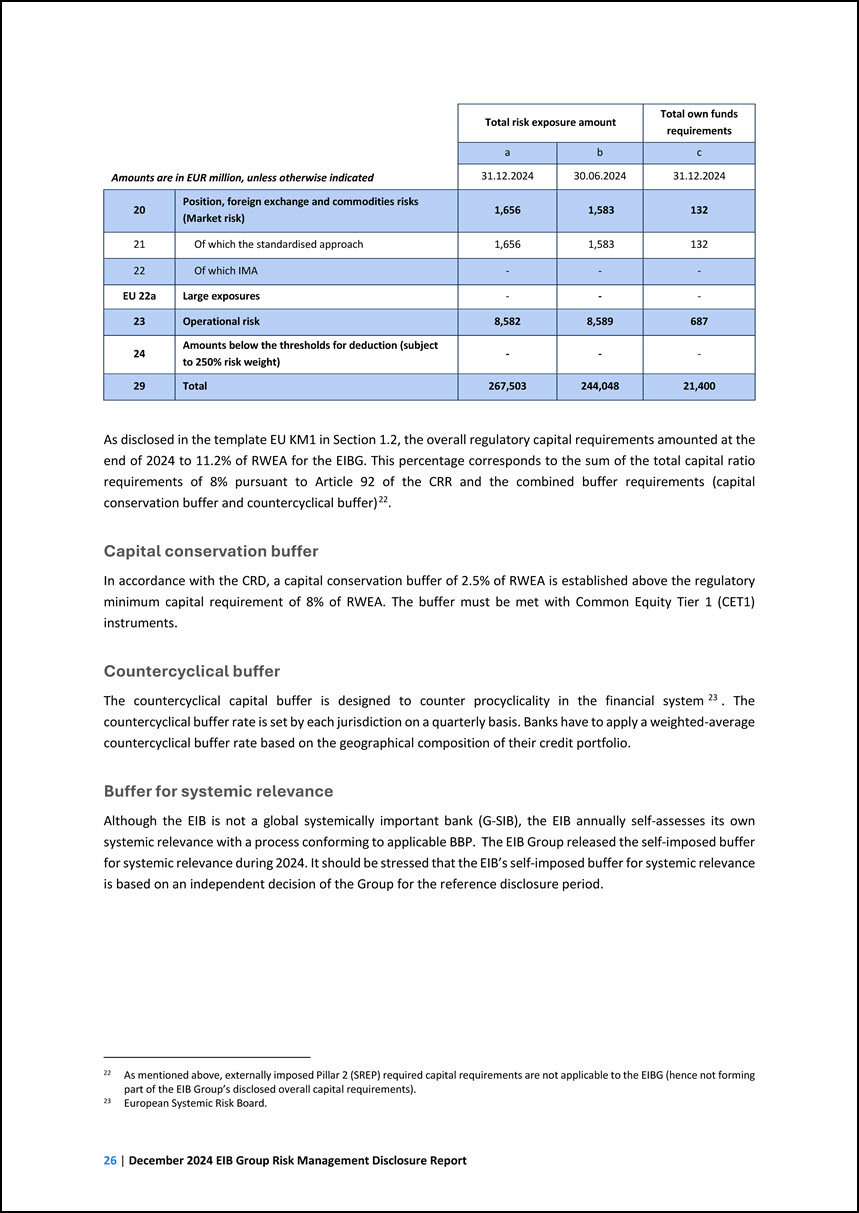

Amounts are in EUR million, unless otherwise indicated Total risk exposure amount Total own funds requirements a b c 31.12.2024 30.06.2024 31.12.2024 20

Position, foreign exchange and commodities risks (Market risk) 1,656 1,583 132 21 Of which the standardised approach 1,656 1,583 132 22 Of which IMA - - - EU 22a Large exposures - - - 23 Operational risk 8,582 8,589 687 24

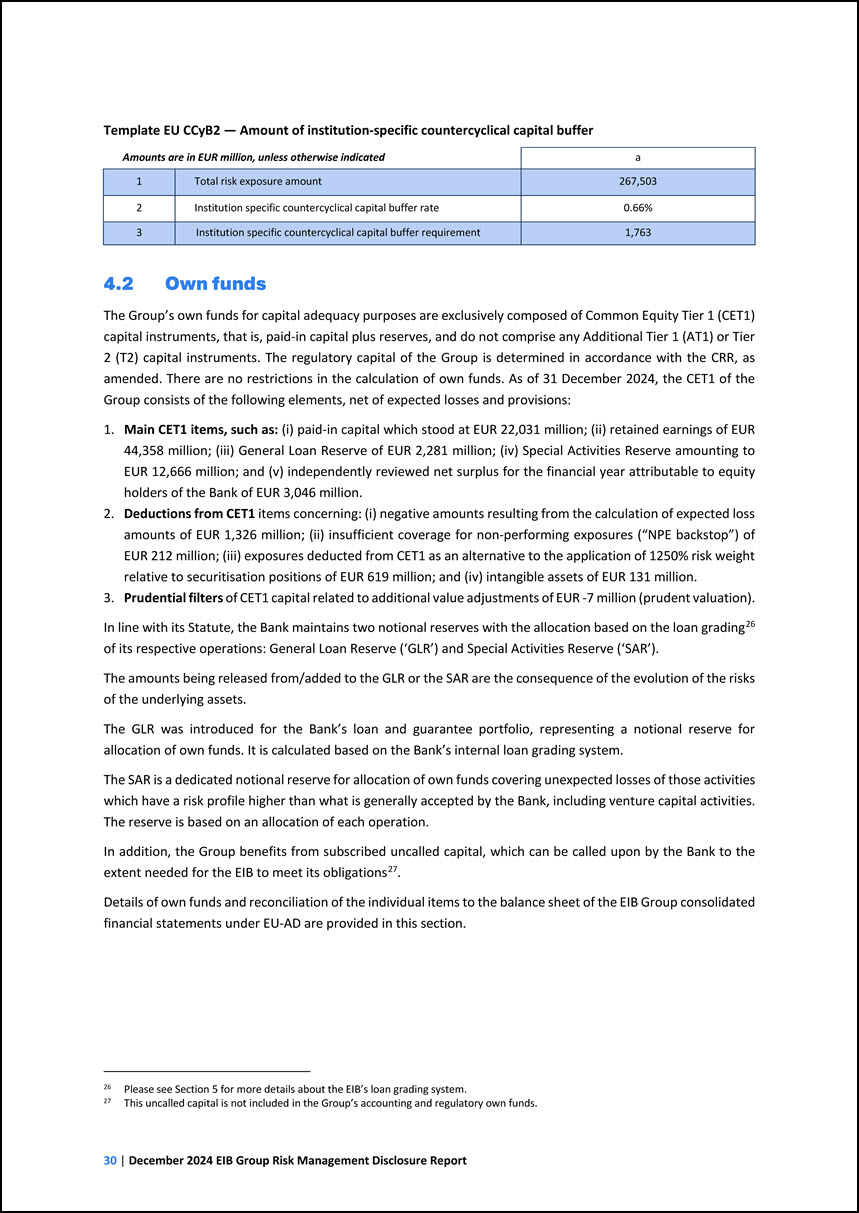

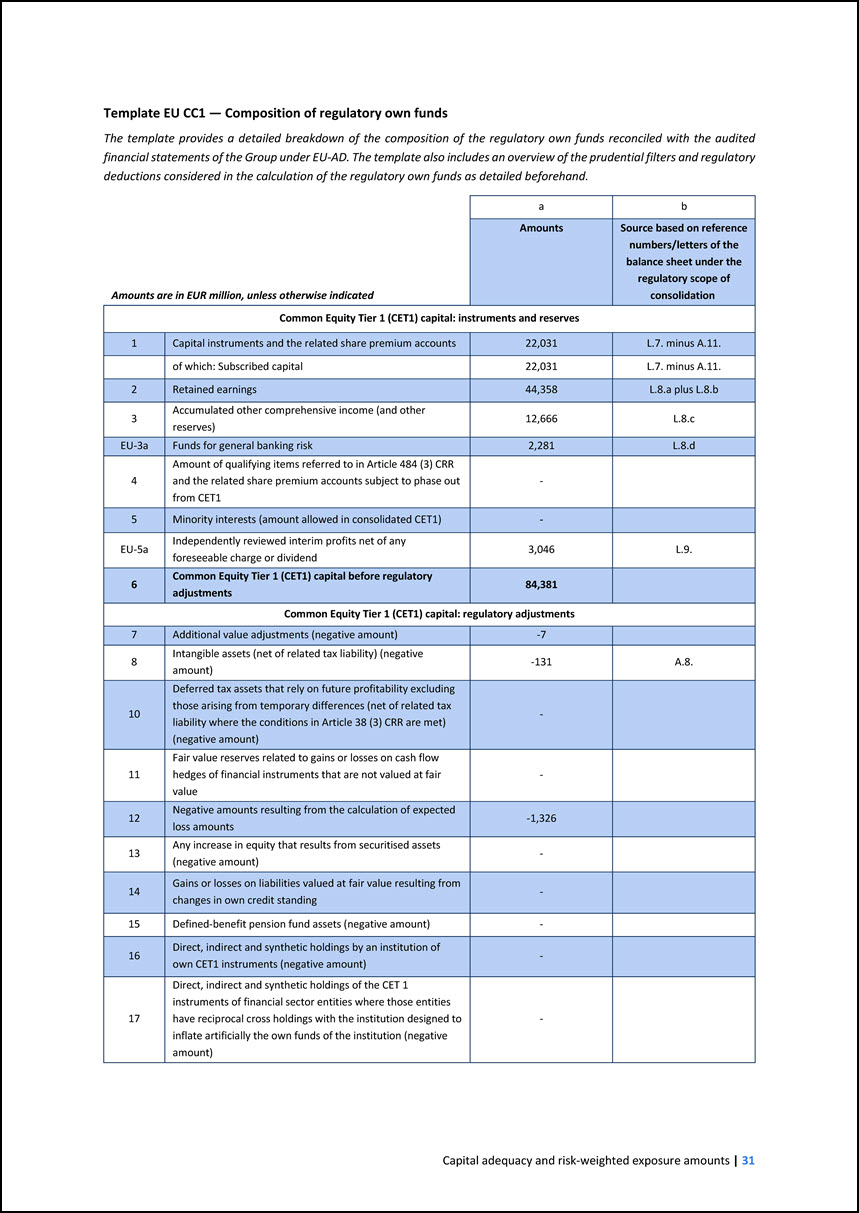

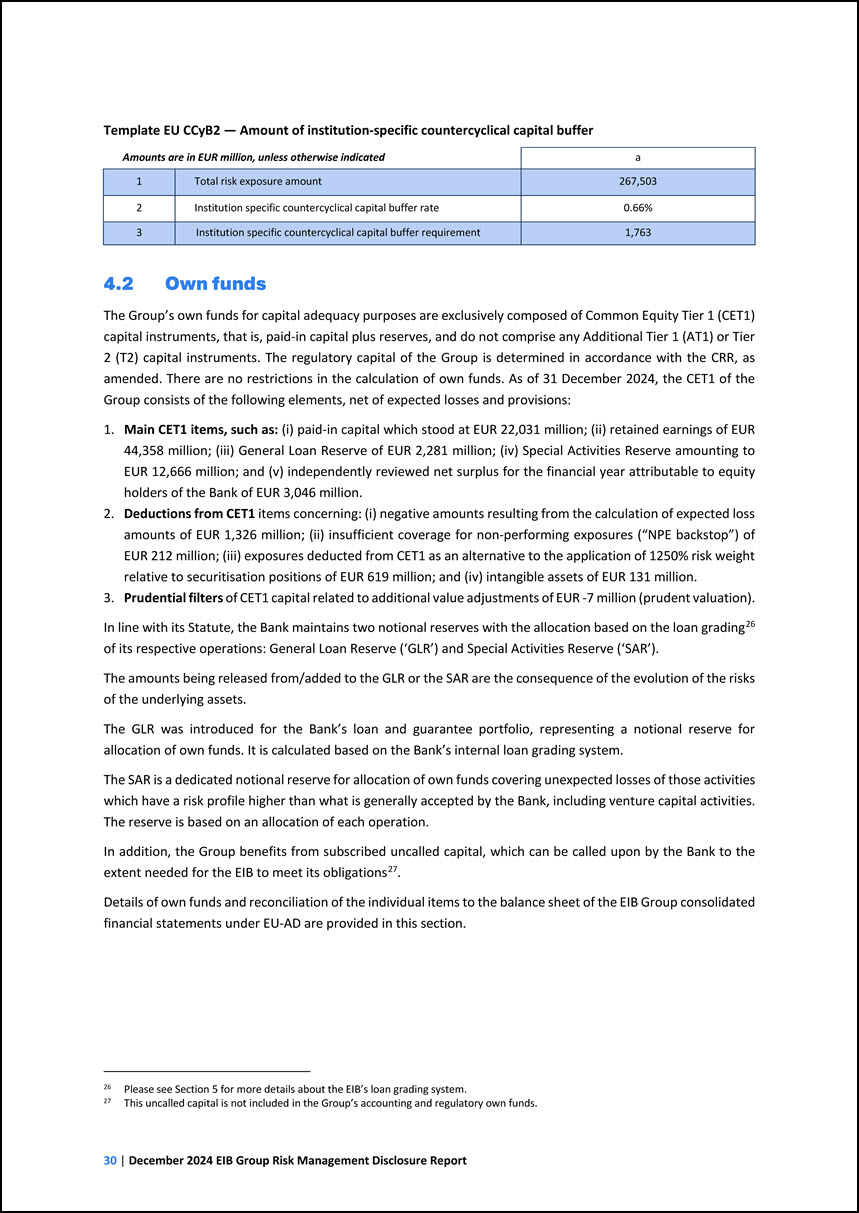

Amounts below the thresholds for deduction (subject to 250% risk weight) - - - 29 Total 267,503 244,048 21,400 As disclosed in the template EU KM1 in Section 1.2, the overall regulatory capital requirements amounted at the end of 2024 to

11.2% of RWEA for the EIBG. This percentage corresponds to the sum of the total capital ratio requirements of 8% pursuant to Article 92 of the CRR and the combined buffer requirements (capital conservation buffer and countercyclical buffer)22. 22 As

mentioned above, externally imposed Pillar 2 (SREP) required capital requirements are not applicable to the EIBG (hence not forming part of the EIB Group’s disclosed overall capital requirements). Capital conservation buffer In accordance with the

CRD, a capital conservation buffer of 2.5% of RWEA is established above the regulatory minimum capital requirement of 8% of RWEA. The buffer must be met with Common Equity Tier 1 (CET1) instruments. Countercyclical buffer The countercyclical

capital buffer is designed to counter procyclicality in the financial system23. The countercyclical buffer rate is set by each jurisdiction on a quarterly basis. Banks have to apply a weighted-average countercyclical buffer rate based on the

geographical composition of their credit portfolio. 23 European Systemic Risk Board. Buffer for systemic relevance Although the EIB is not a global systemically important bank (G-SIB), the EIB annually self-assesses its own systemic relevance with

a process conforming to applicable BBP. The EIB Group released the self-imposed buffer for systemic relevance during 2024. It should be stressed that the EIB’s self-imposed buffer for systemic relevance is based on an independent decision of the

Group for the reference disclosure period.

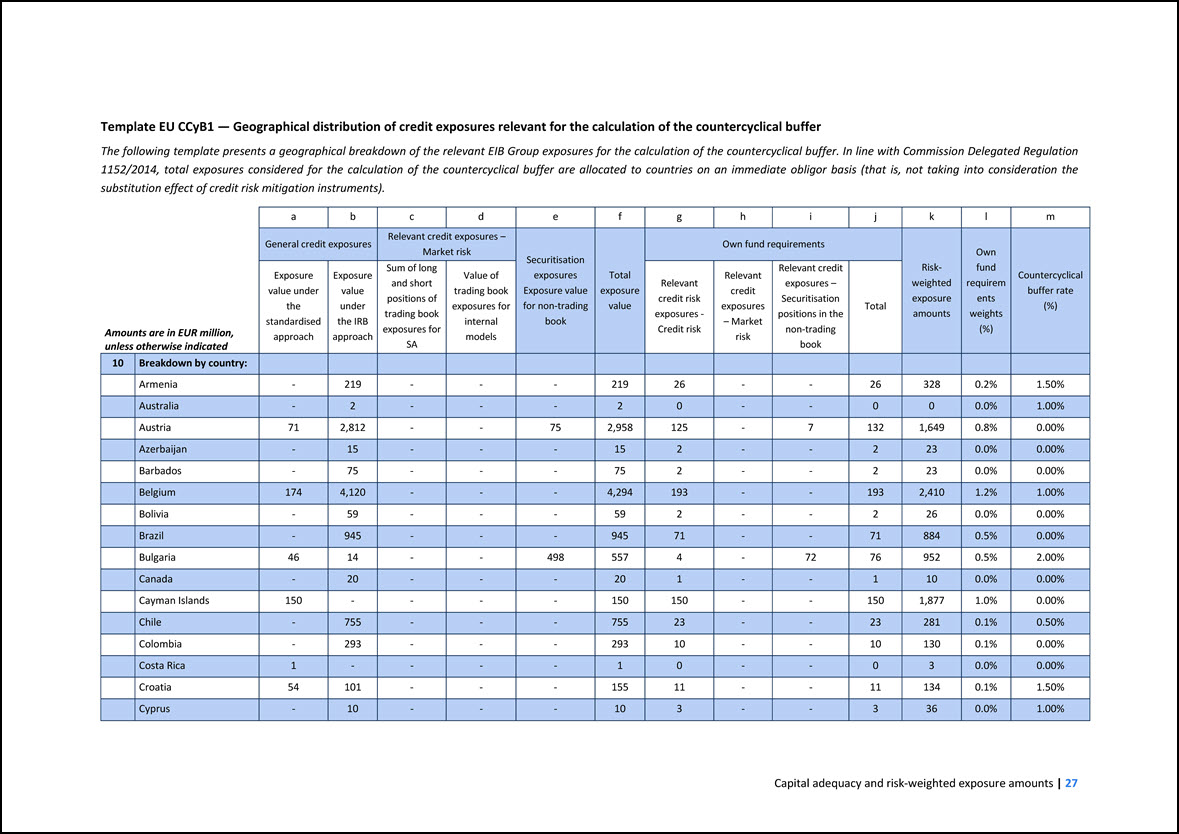

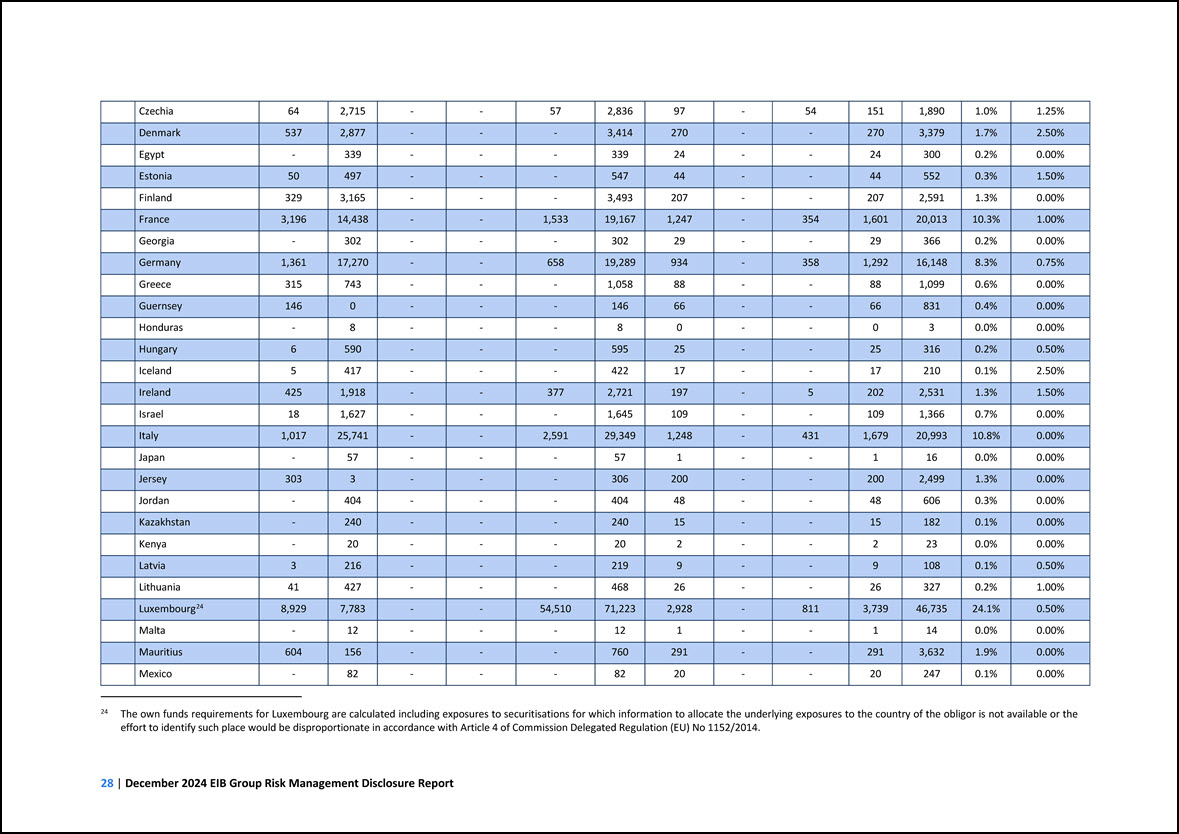

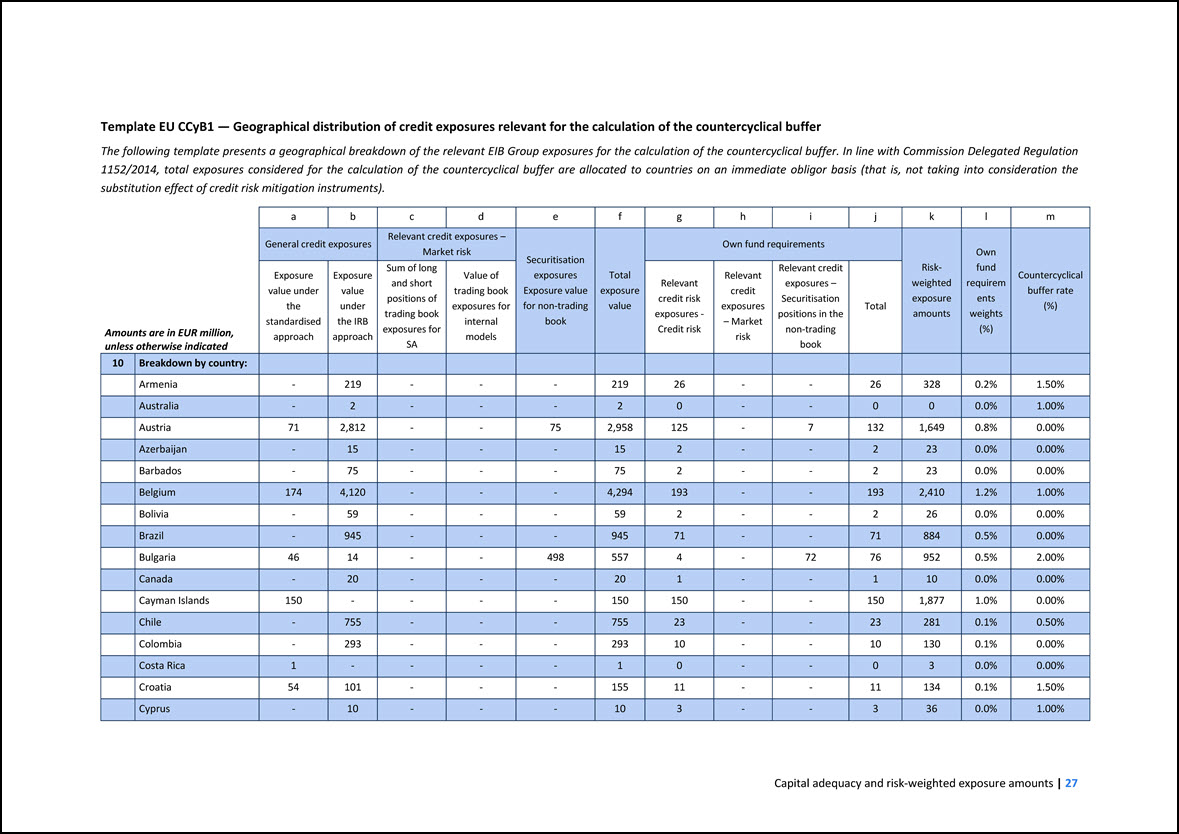

Template EU CCyB1 — Geographical distribution of credit exposures relevant for the calculation of the countercyclical buffer The following template presents a

geographical breakdown of the relevant EIB Group exposures for the calculation of the countercyclical buffer. In line with Commission Delegated Regulation 1152/2014, total exposures considered for the calculation of the countercyclical buffer are

allocated to countries on an immediate obligor basis (that is, not taking into consideration the substitution effect of credit risk mitigation instruments). Amounts are in EUR million, unless otherwise indicated a b c d e f g h i j k l

m General credit exposures Relevant credit exposures – Market risk Securitisation exposures Exposure value for non-trading book Total exposure value Own fund requirements Risk- weighted exposure amounts Own fund requirements weights (%)

Countercyclical buffer rate (%) Exposure value under the standardised approach Exposure value under the IRB approach Sum of long and short positions of trading book exposures for SA Value of trading book exposures for internal models Relevant

credit risk exposures - Credit risk Relevant credit exposures – Market risk Relevant credit exposures – Securitisation positions in the non-trading book Total 10 Breakdown by country: Armenia - 219 - - - 219 26 -

- 26 328 0.2% 1.50% Australia - 2 - - - 2 0 - - 0 0 0.0% 1.00% Austria 71 2,812 - - 75 2,958 125 - 7 132 1,649 0.8% 0.00% Azerbaijan - 15 - - - 15 2 - - 2 23 0.0% 0.00% Barbados - 75 - - - 75

2 - - 2 23 0.0% 0.00% Belgium 174 4,120 - - - 4,294 193 - - 193 2,410 1.2% 1.00% Bolivia - 59 - - - 59 2 - - 2 26 0.0% 0.00% Brazil - 945 - - - 945 71 - - 71 884 0.5% 0.00% Bulgaria 46 14 - -

498 557 4 - 72 76 952 0.5% 2.00% Canada - 20 - - - 20 1 - - 1 10 0.0% 0.00% Cayman Islands 150 - - - - 150 150 - - 150 1,877 1.0% 0.00% Chile - 755 - - - 755 23 - - 23 281 0.1% 0.50% Colombia -

293 - - - 293 10 - - 10 130 0.1% 0.00% Costa Rica 1 - - - - 1 0 - - 0 3 0.0% 0.00% Croatia 54 101 - - - 155 11 - - 11 134 0.1% 1.50% Cyprus - 10 - - - 10 3 - - 3 36 0.0% 1.00%

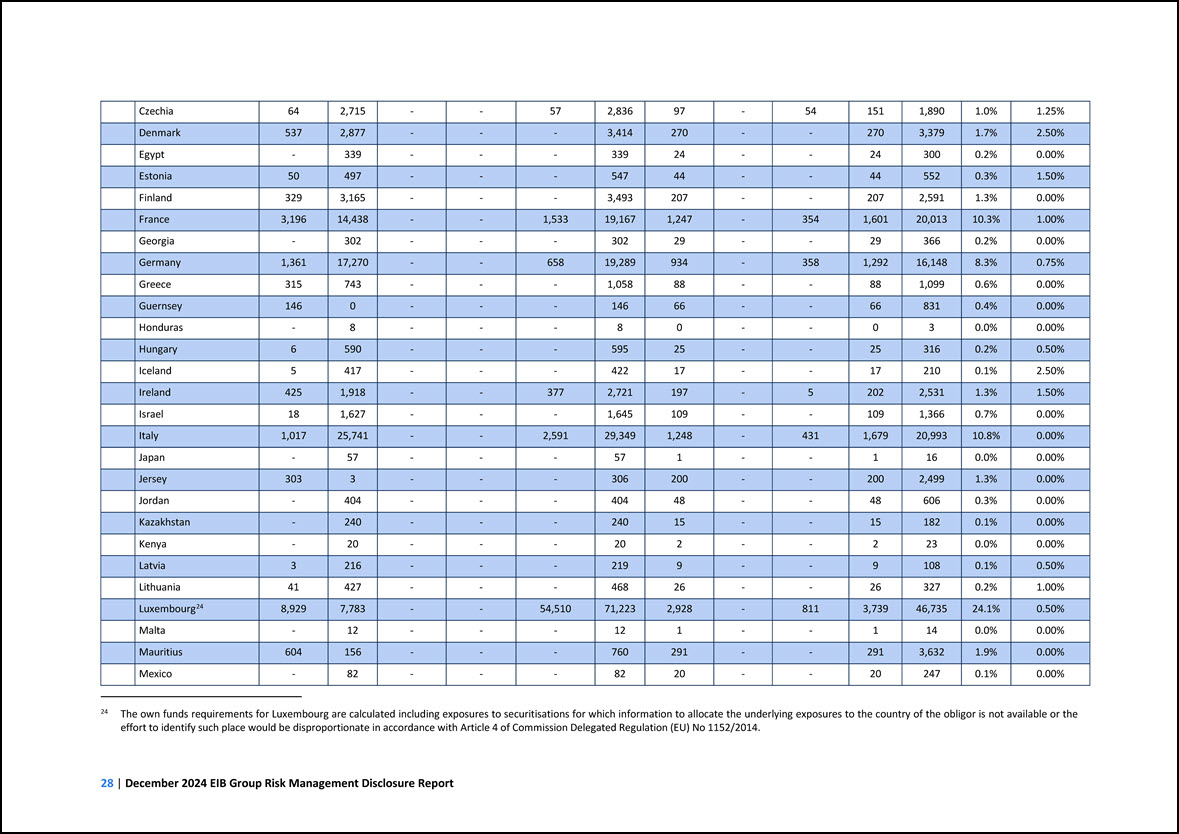

Czechia 64 2,715 - - 57 2,836 97 - 54 151 1,890 1.0% 1.25% Denmark 537 2,877 - - - 3,414 270 - - 270 3,379 1.7% 2.50% Egypt - 339 -

- - 339 24 - - 24 300 0.2% 0.00% Estonia 50 497 - - - 547 44 - - 44 552 0.3% 1.50% Finland 329 3,165 - - - 3,493 207 - - 207 2,591 1.3% 0.00% France 3,196 14,438 - - 1,533 19,167 1,247 - 354 1,601

20,013 10.3% 1.00% Georgia - 302 - - - 302 29 - - 29 366 0.2% 0.00% Germany 1,361 17,270 - - 658 19,289 934 - 358 1,292 16,148 8.3% 0.75% Greece 315 743 - - - 1,058 88 - - 88 1,099 0.6% 0.00% Guernsey

146 0 - - - 146 66 - - 66 831 0.4% 0.00% Honduras - 8 - - - 8 0 - - 0 3 0.0% 0.00% Hungary 6 590 - - - 595 25 - - 25 316 0.2% 0.50% Iceland 5 417 - - - 422 17 - - 17 210 0.1% 2.50% Ireland

425 1,918 - - 377 2,721 197 - 5 202 2,531 1.3% 1.50% Israel 18 1,627 - - - 1,645 109 - - 109 1,366 0.7% 0.00% Italy 1,017 25,741 - - 2,591 29,349 1,248 - 431 1,679 20,993 10.8% 0.00% Japan - 57 - - -

57 1 - - 1 16 0.0% 0.00% Jersey 303 3 - - - 306 200 - - 200 2,499 1.3% 0.00% Jordan - 404 - - - 404 48 - - 48 606 0.3% 0.00% Kazakhstan - 240 - - - 240 15 - - 15 182 0.1% 0.00% Kenya - 20 - -

- 20 2 - - 2 23 0.0% 0.00% Latvia 3 216 - - - 219 9 - - 9 108 0.1% 0.50% Lithuania 41 427 - - - 468 26 - - 26 327 0.2% 1.00% Luxembourg 24 8,929 7,783 - - 54,510 71,223 2,928 - 811 3,739 46,735

24.1% 0.50% Malta - 12 - - - 12 1 - - 1 14 0.0% 0.00% Mauritius 604 156 - - - 760 291 - - 291 3,632 1.9% 0.00% Mexico - 82 - - - 82 20 - - 20 247 0.1% 0.00% 24 The own funds requirements for Luxembourg

are calculated including exposures to securitisations for which information to allocate the underlying exposures to the country of the obligor is not available or the effort to identify such place would be disproportionate in accordance with Article

4 of Commission Delegated Regulation (EU) No 1152/2014.

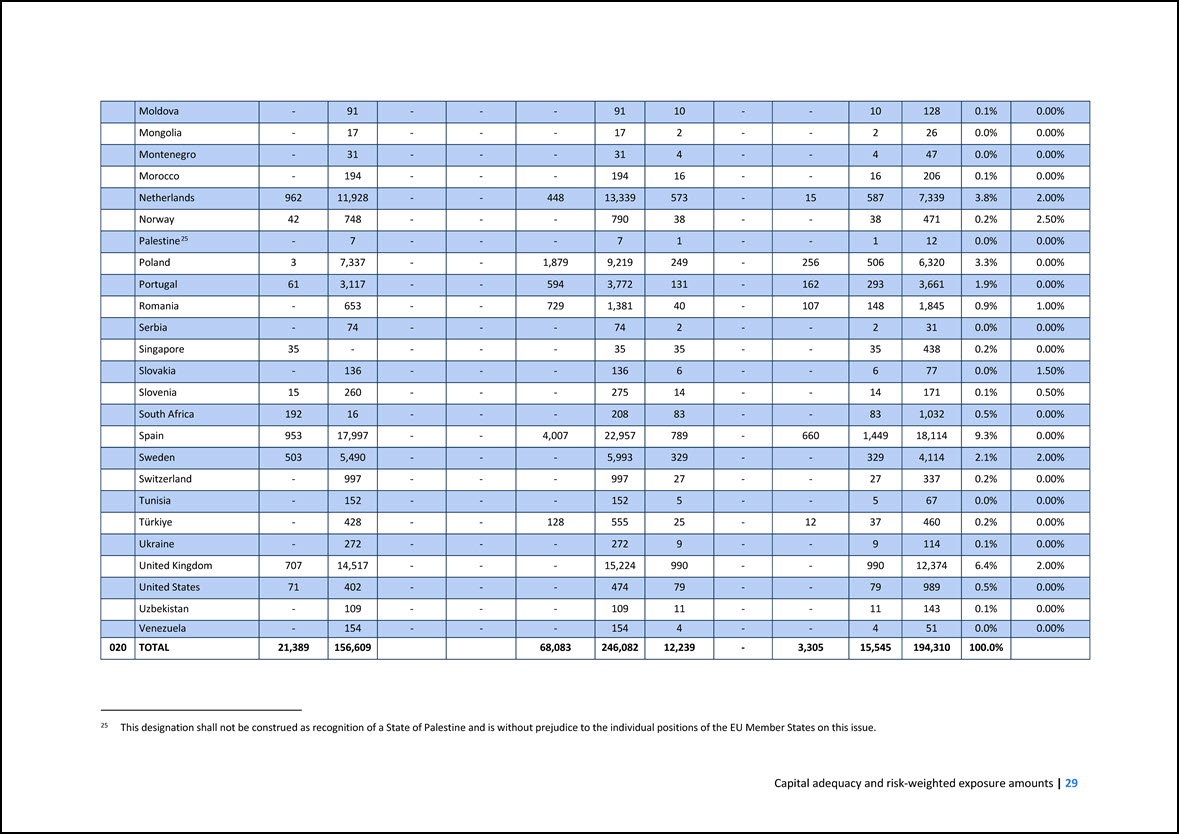

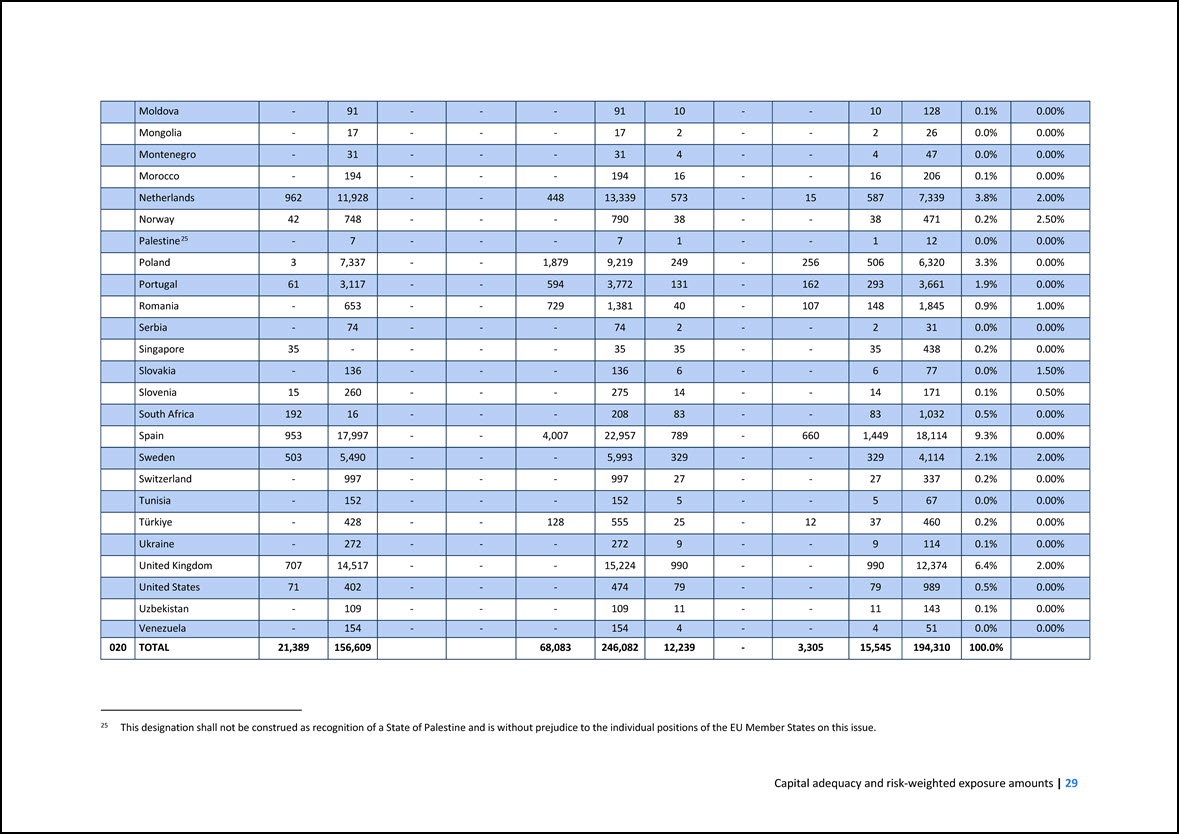

Moldova - 91 - - - 91 10 - - 10 128 0.1% 0.00% Mongolia - 17 - - - 17 2 - - 2 26 0.0% 0.00% Montenegro - 31 - - - 31 4 - - 4

47 0.0% 0.00% Morocco - 194 - - - 194 16 - - 16 206 0.1% 0.00% Netherlands 962 11,928 - - 448 13,339 573 - 15 587 7,339 3.8% 2.00% Norway 42 748 - - - 790 38 - - 38 471 0.2% 2.50% Palestine 25 - 7

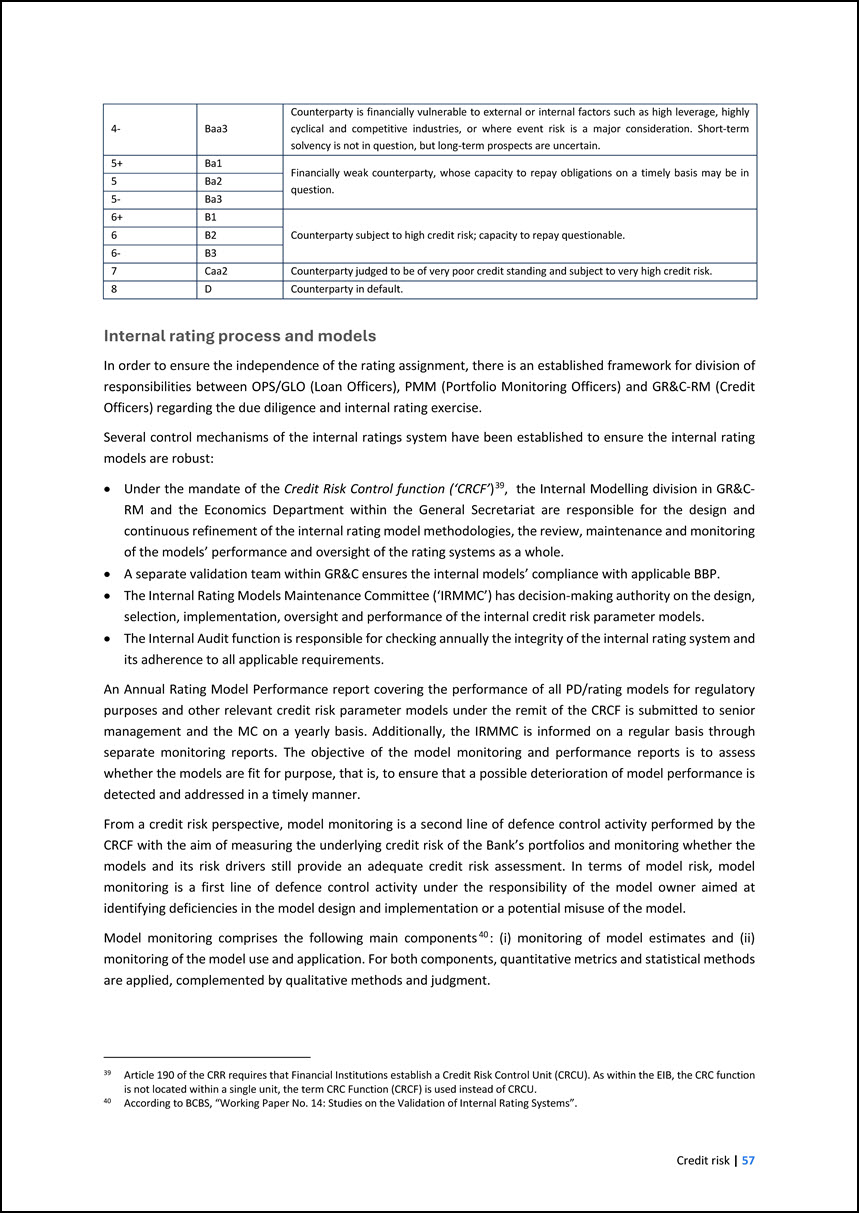

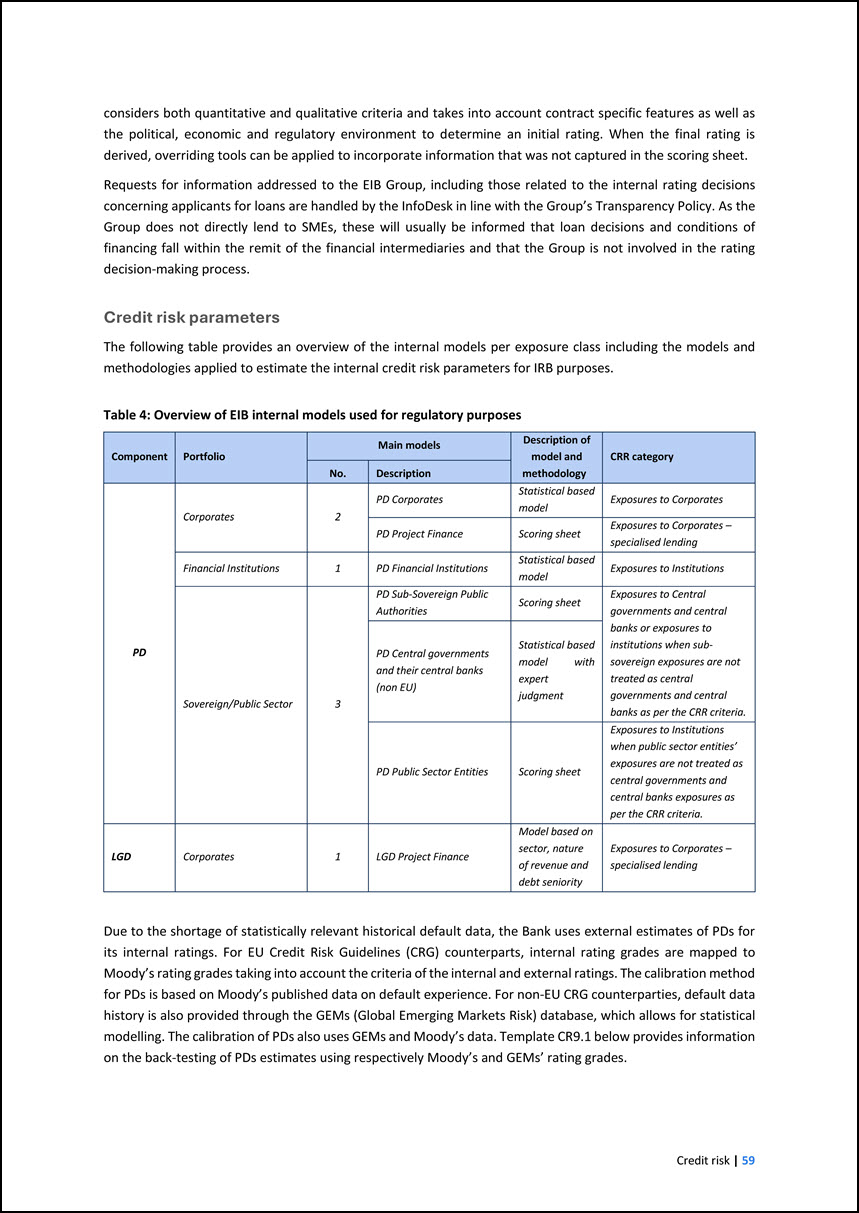

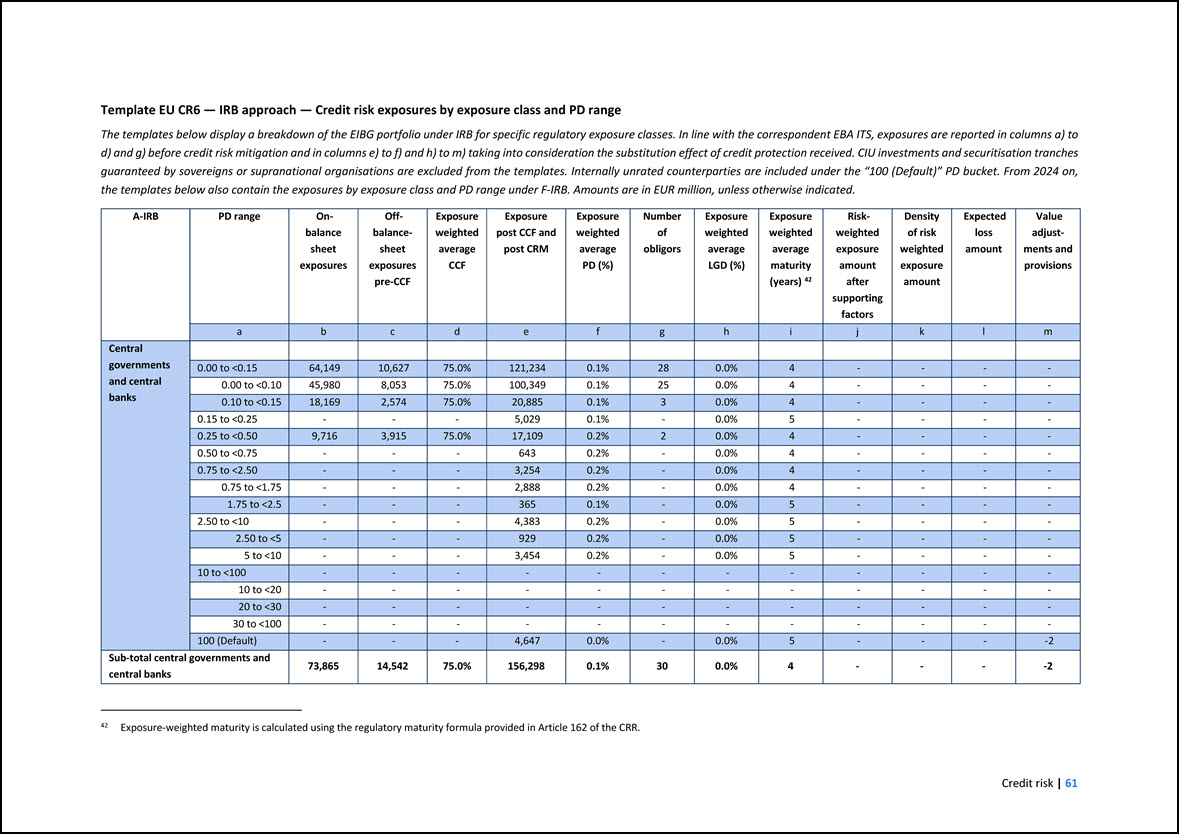

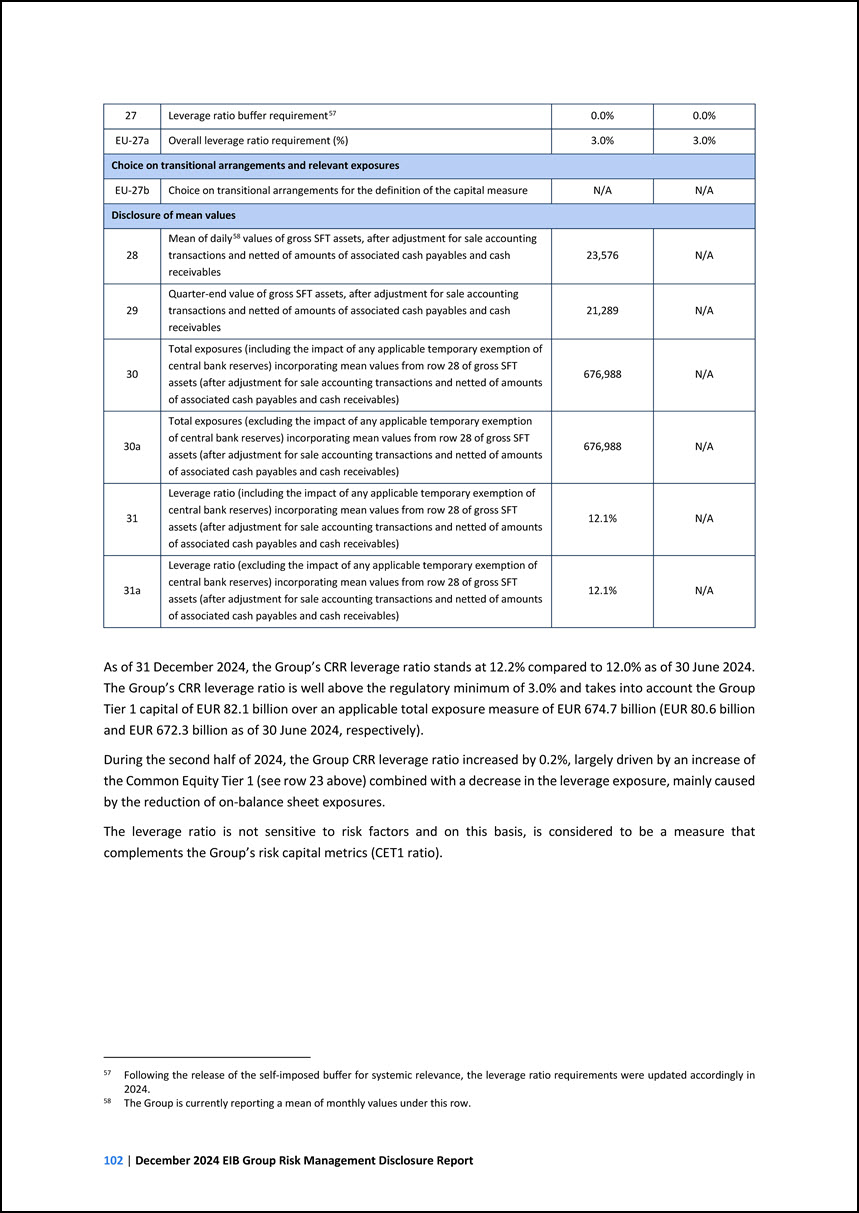

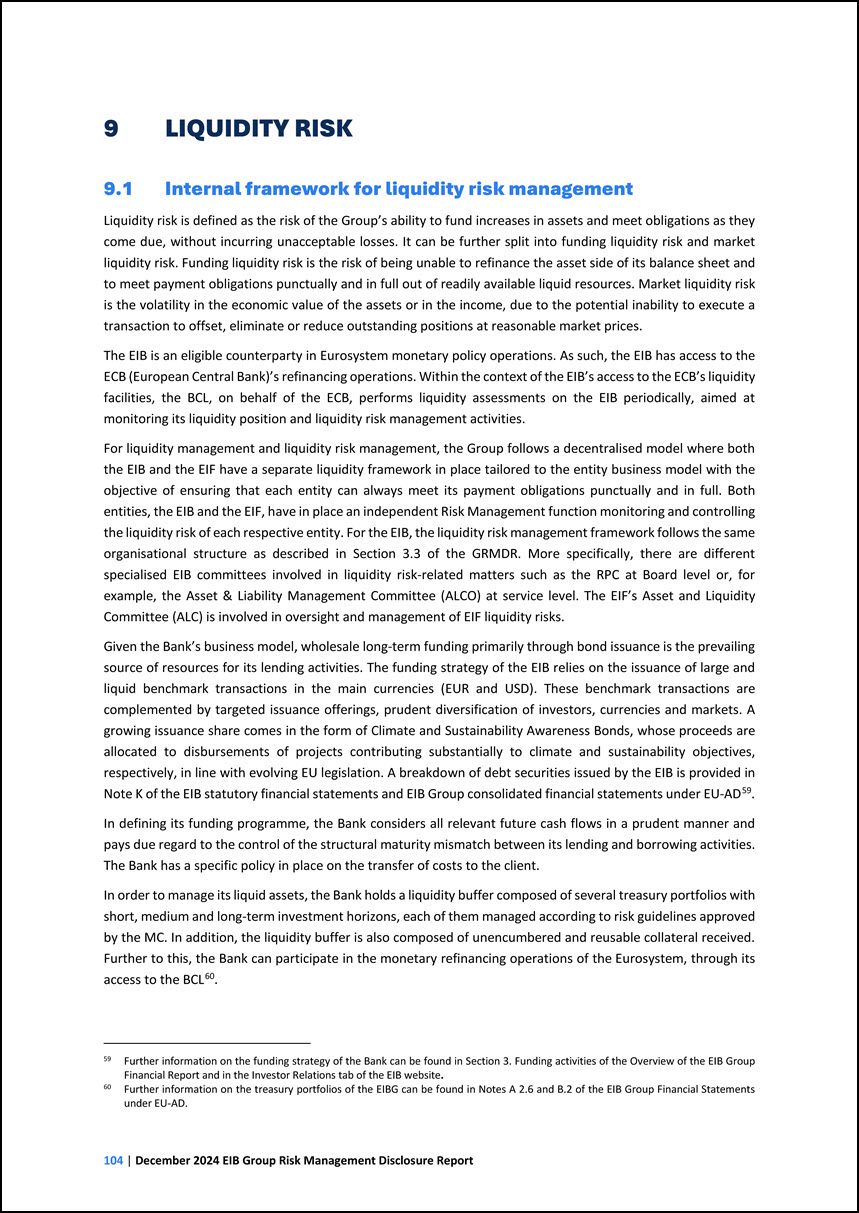

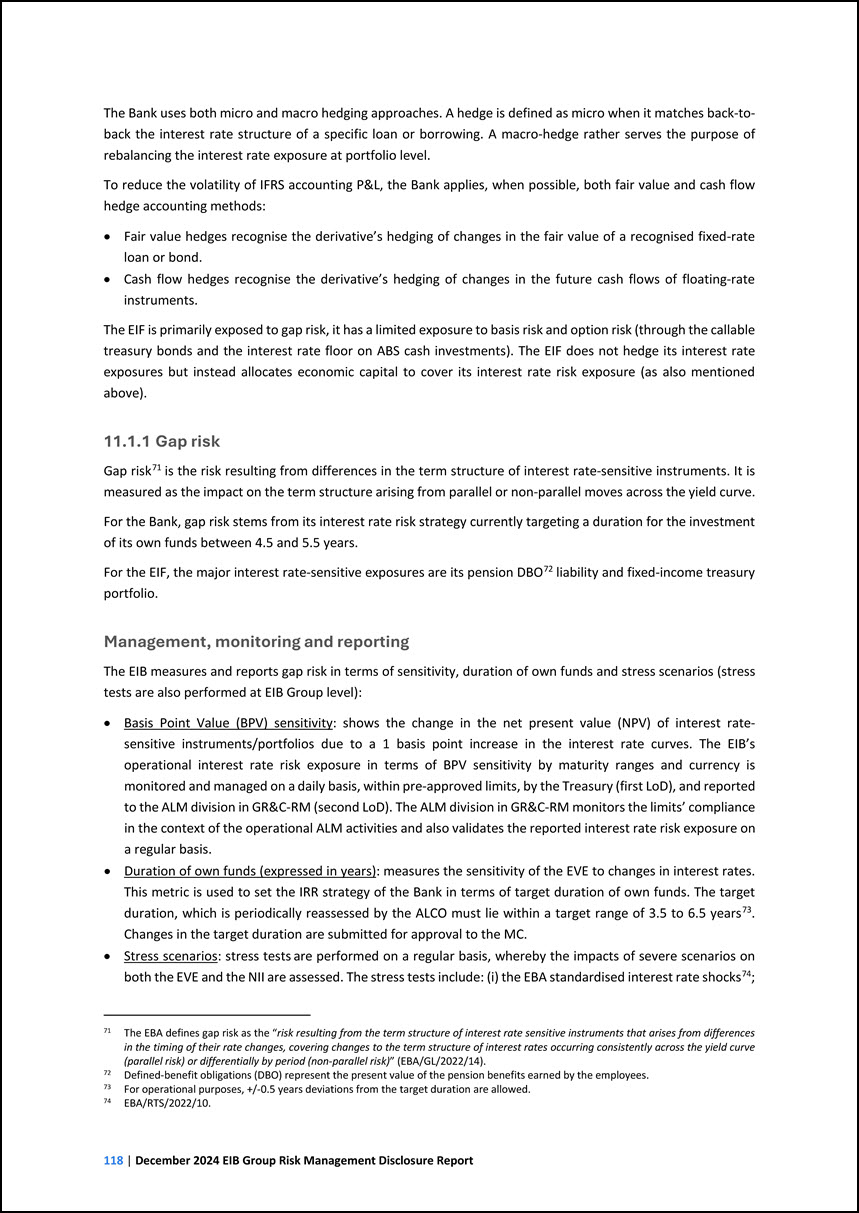

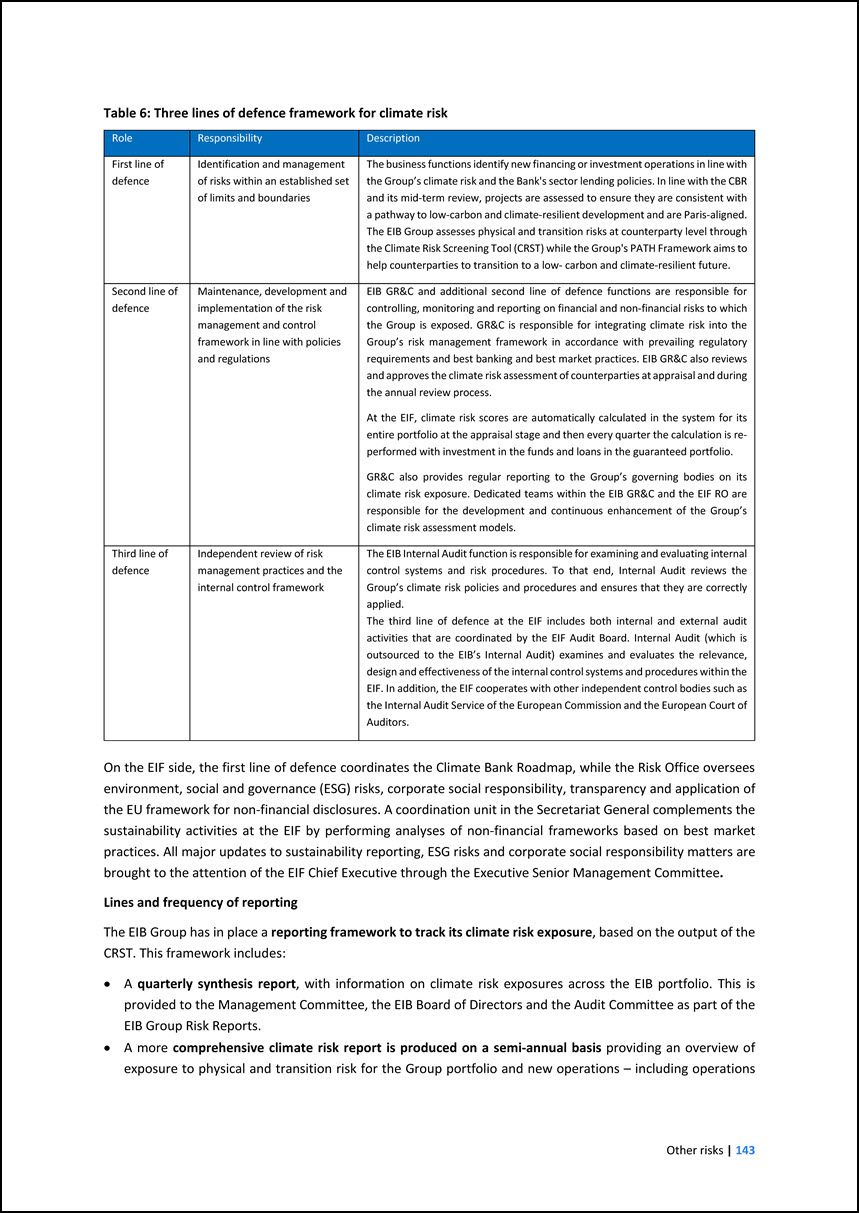

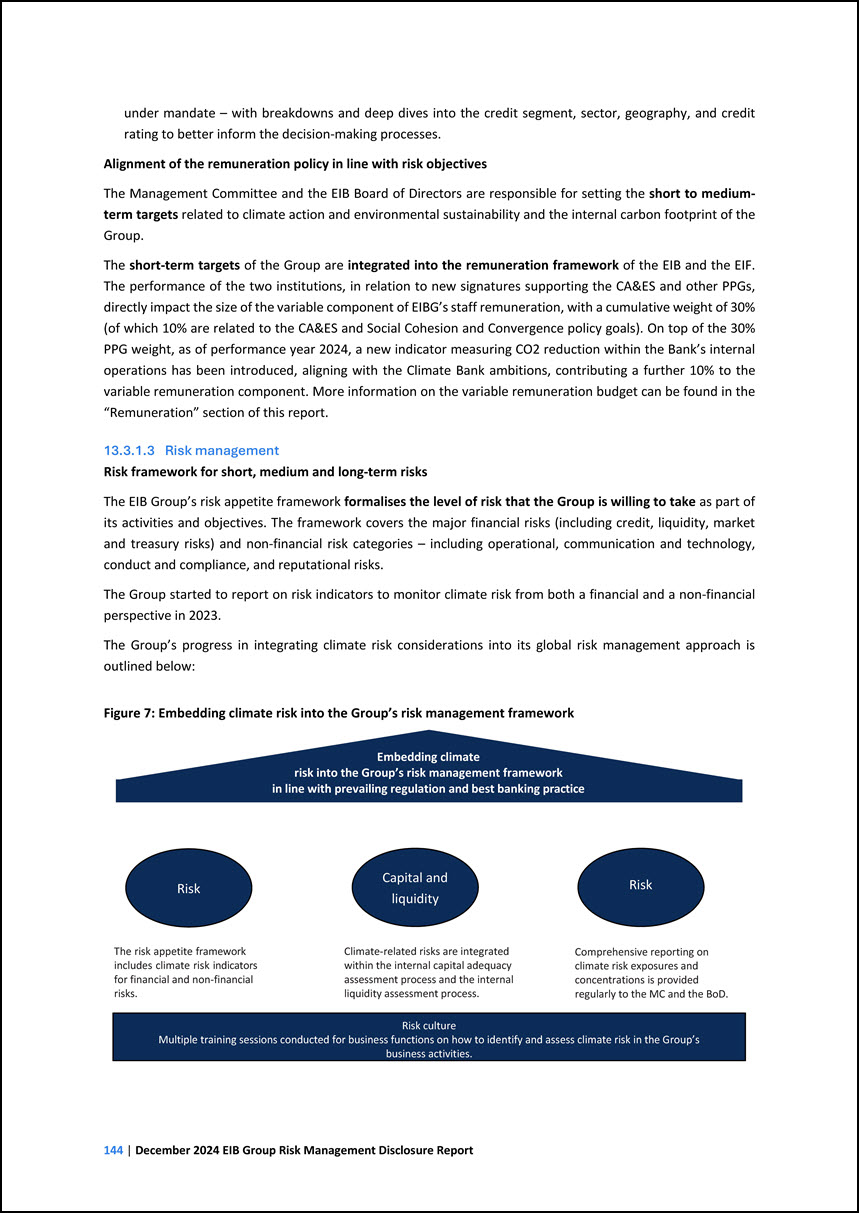

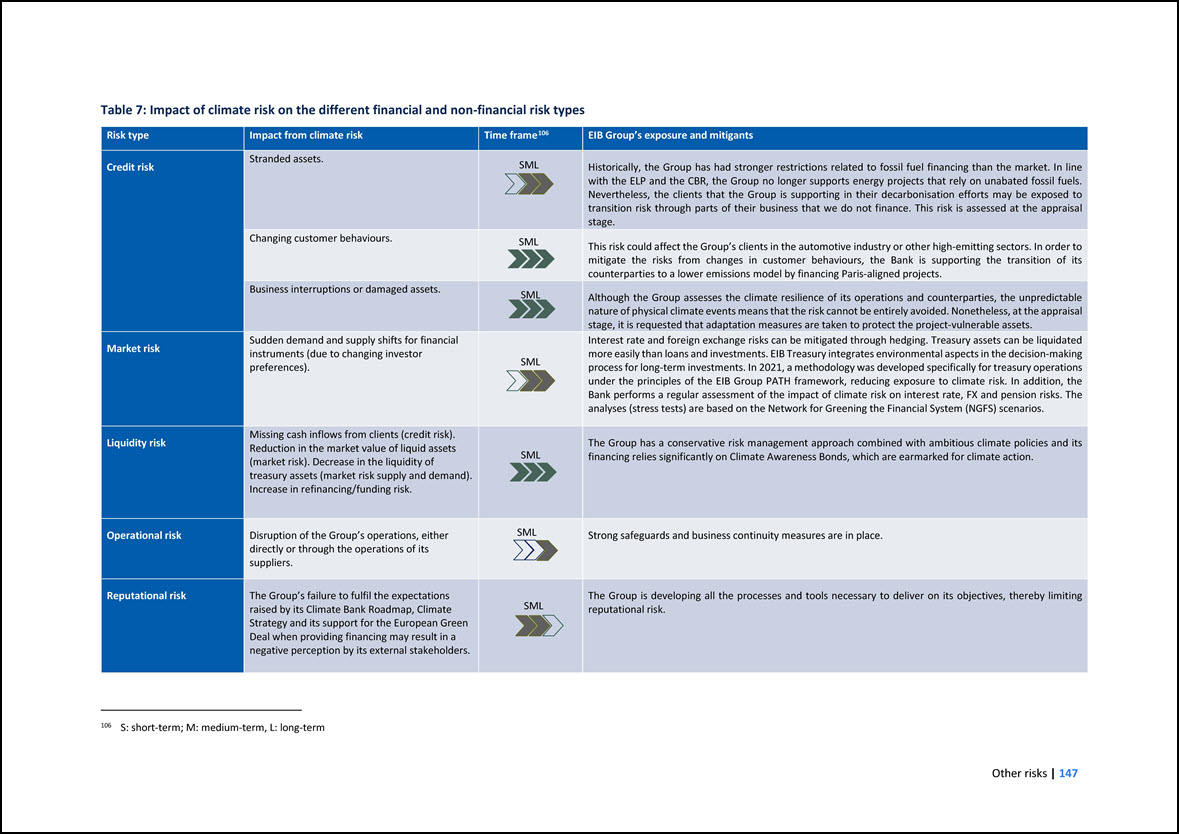

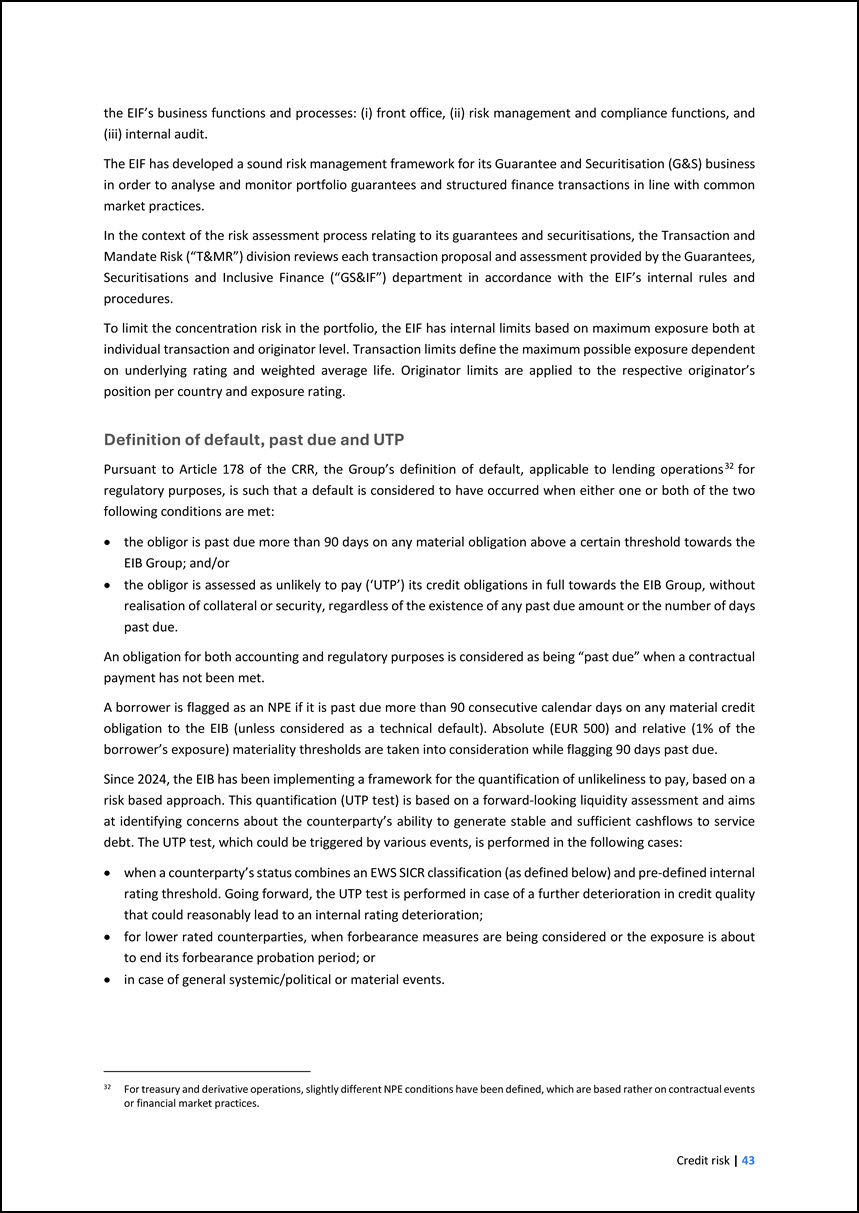

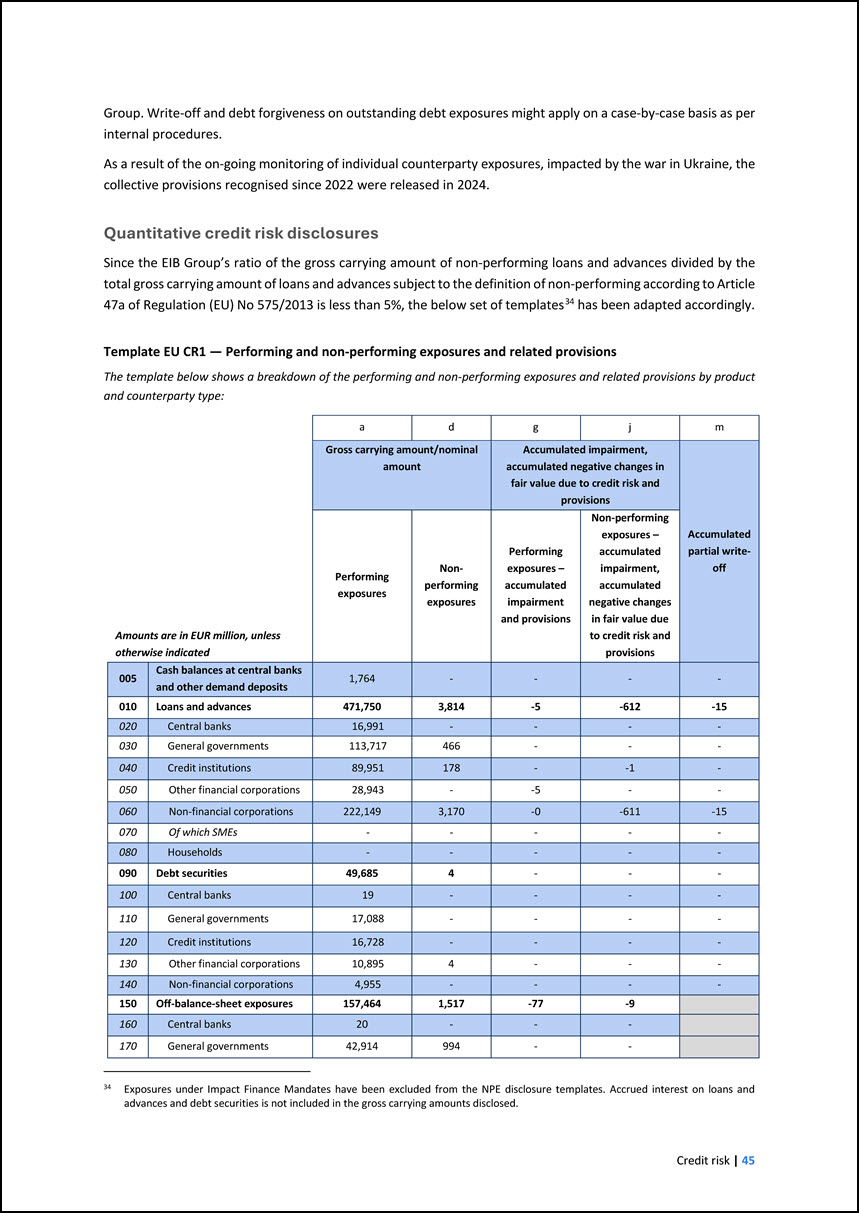

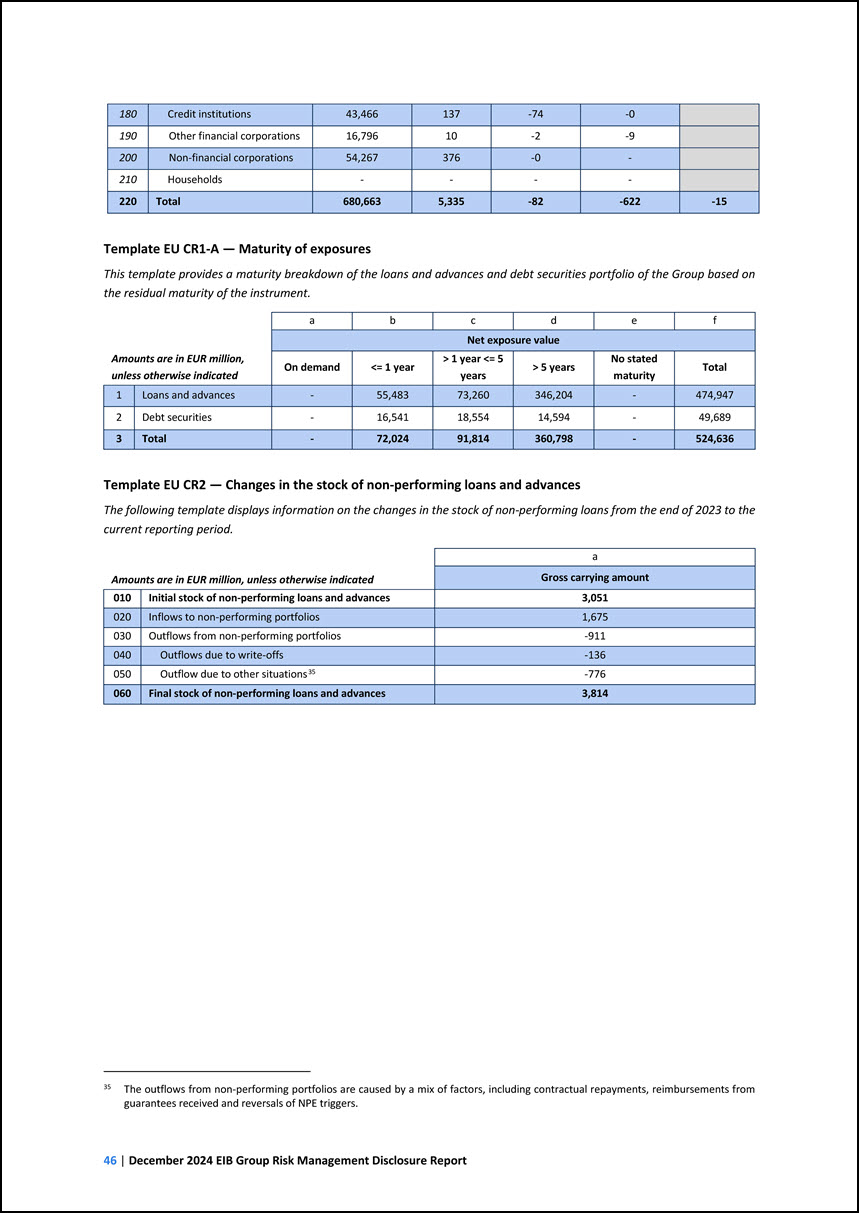

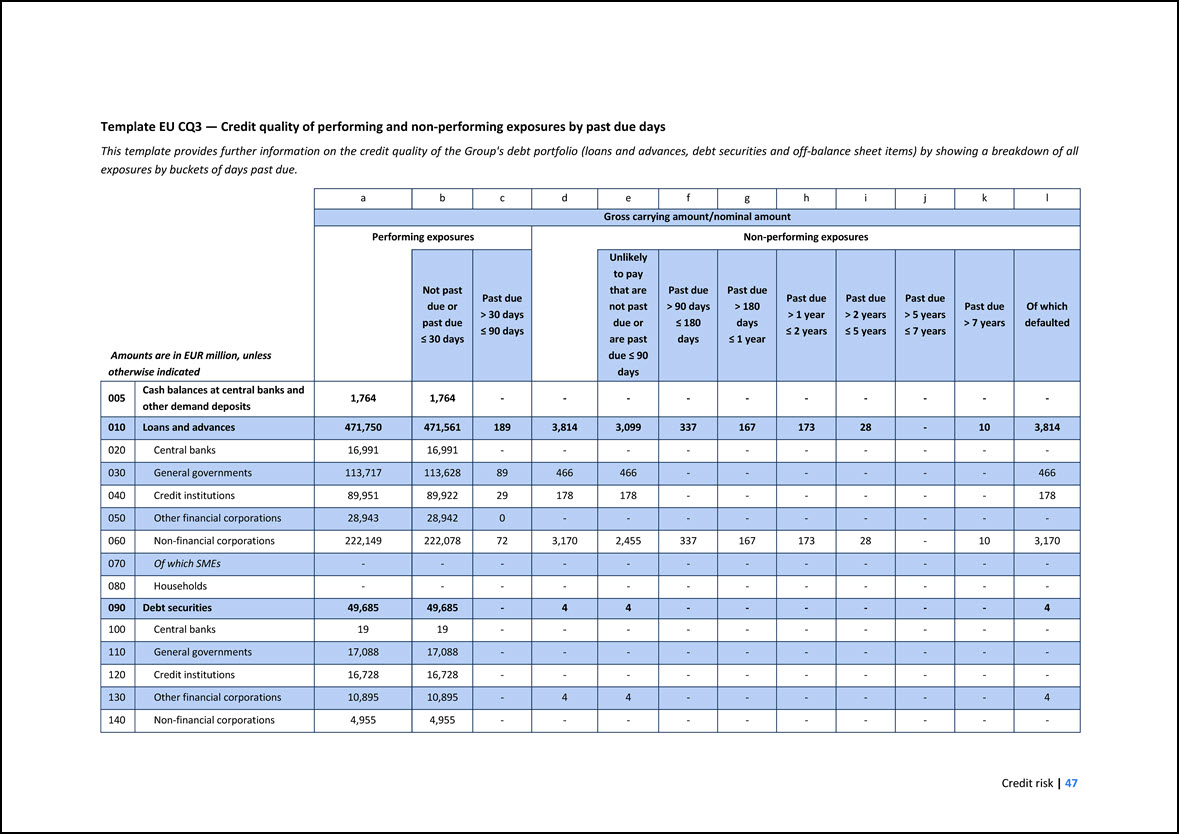

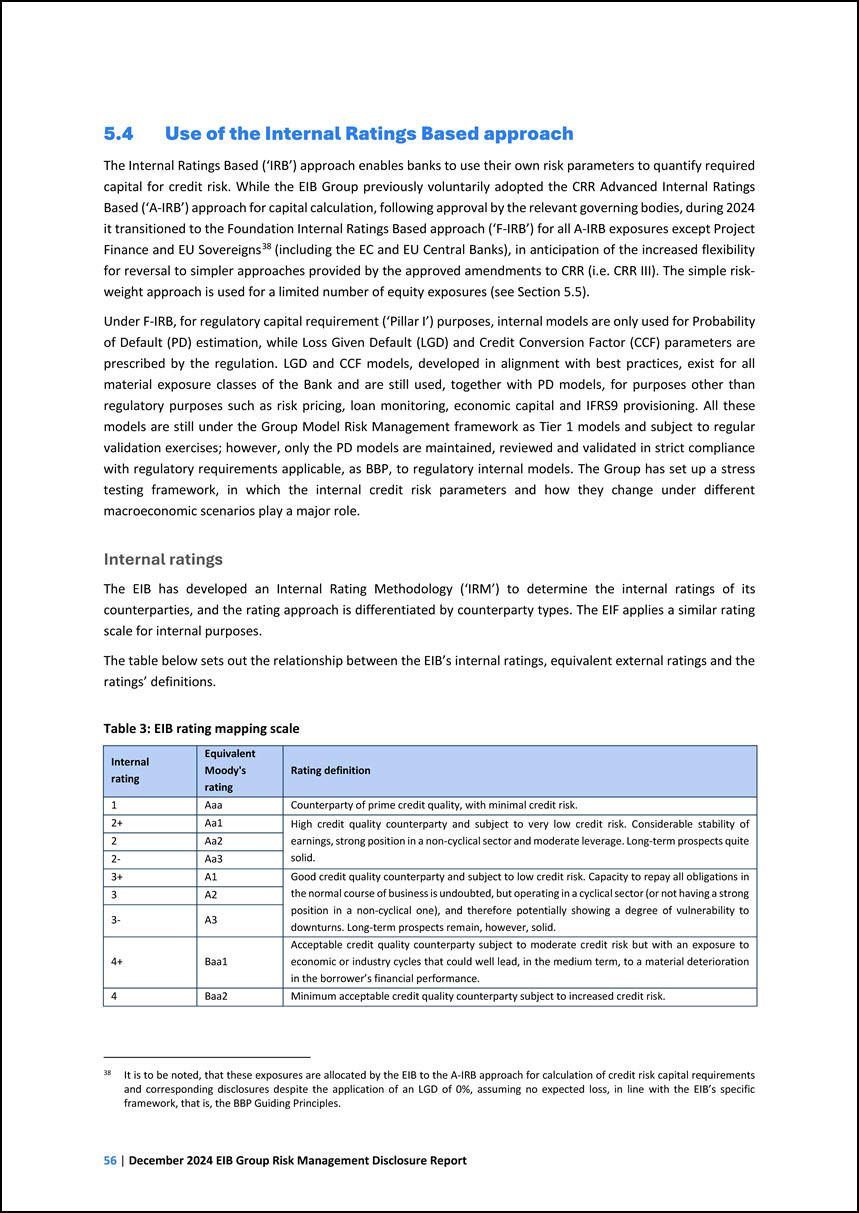

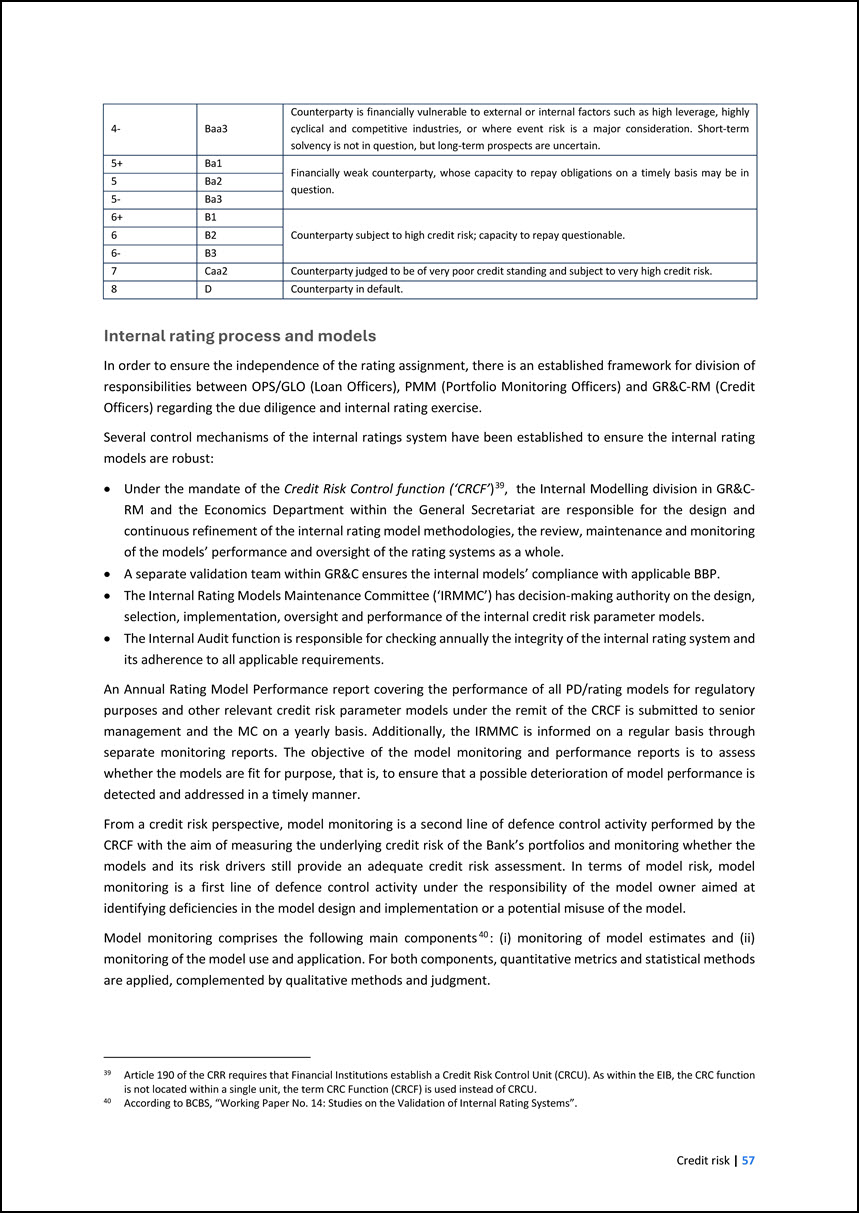

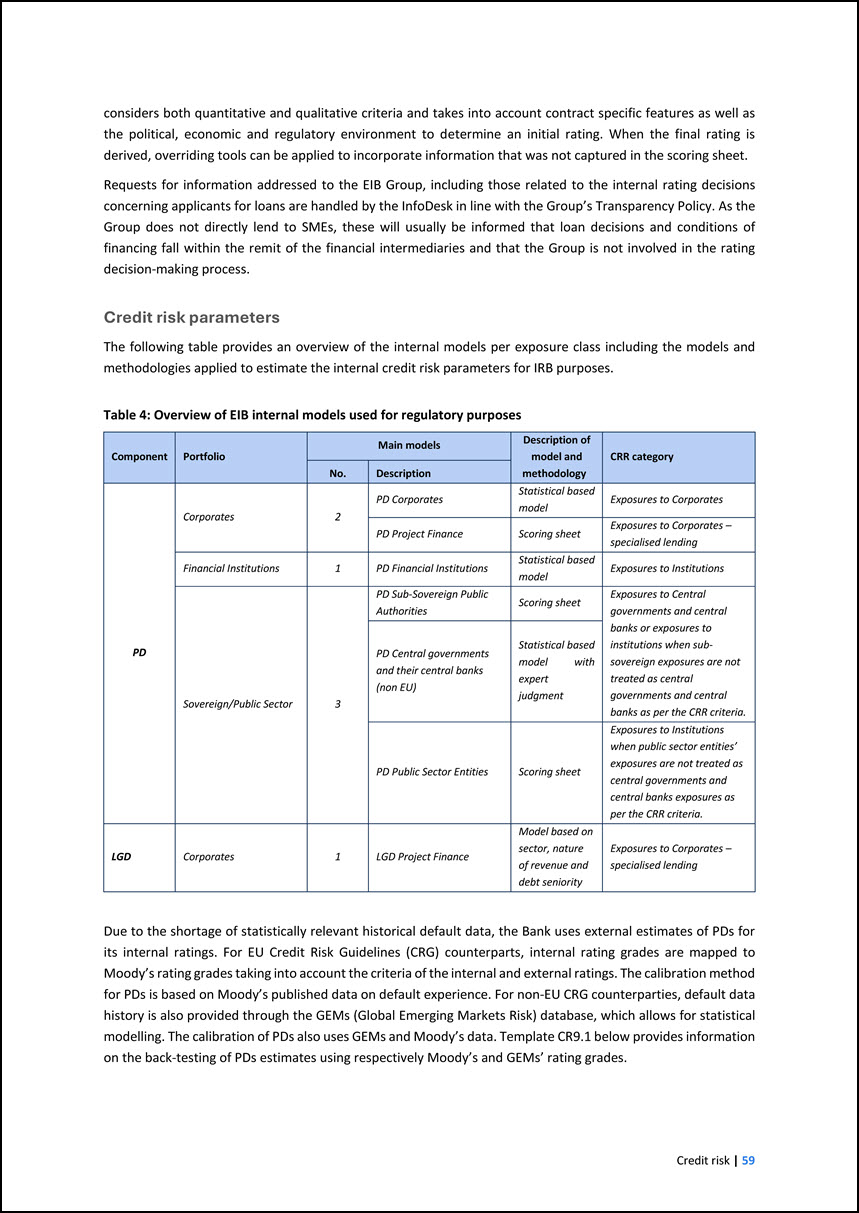

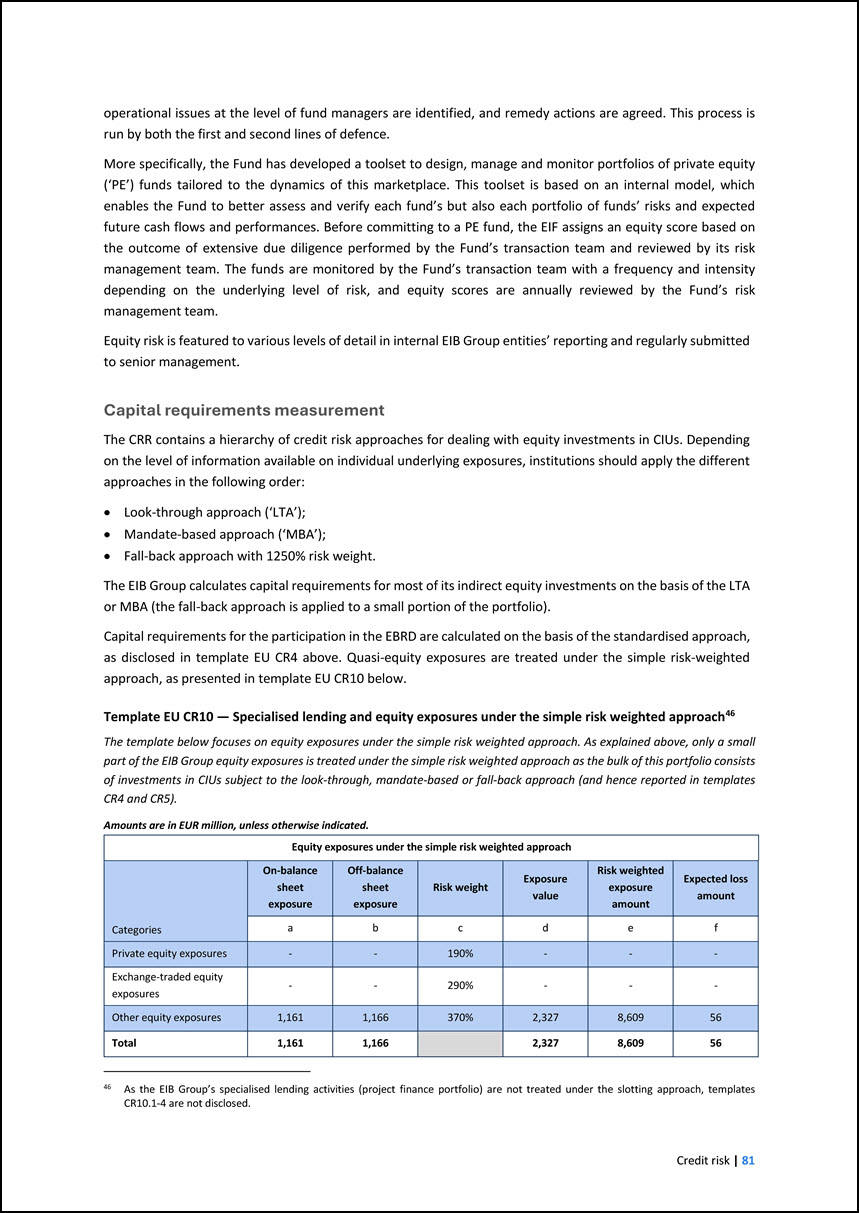

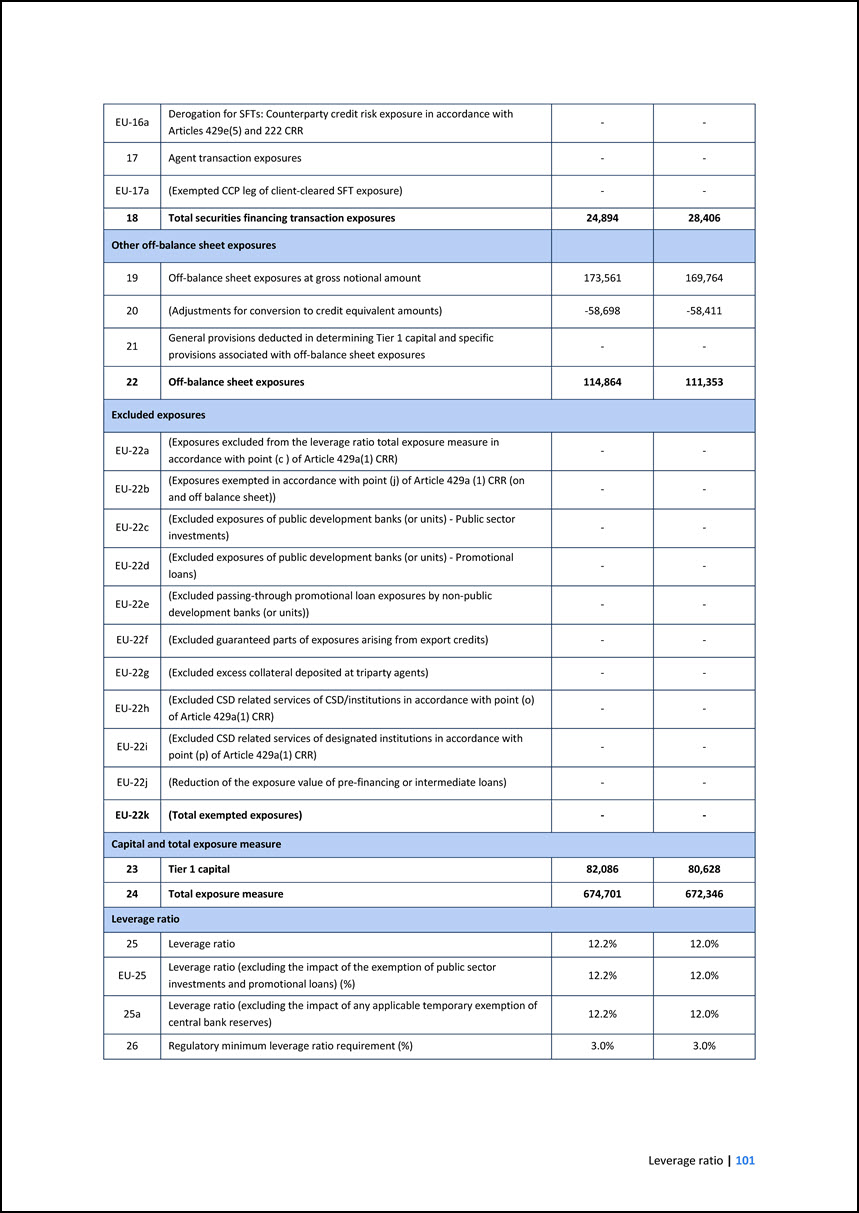

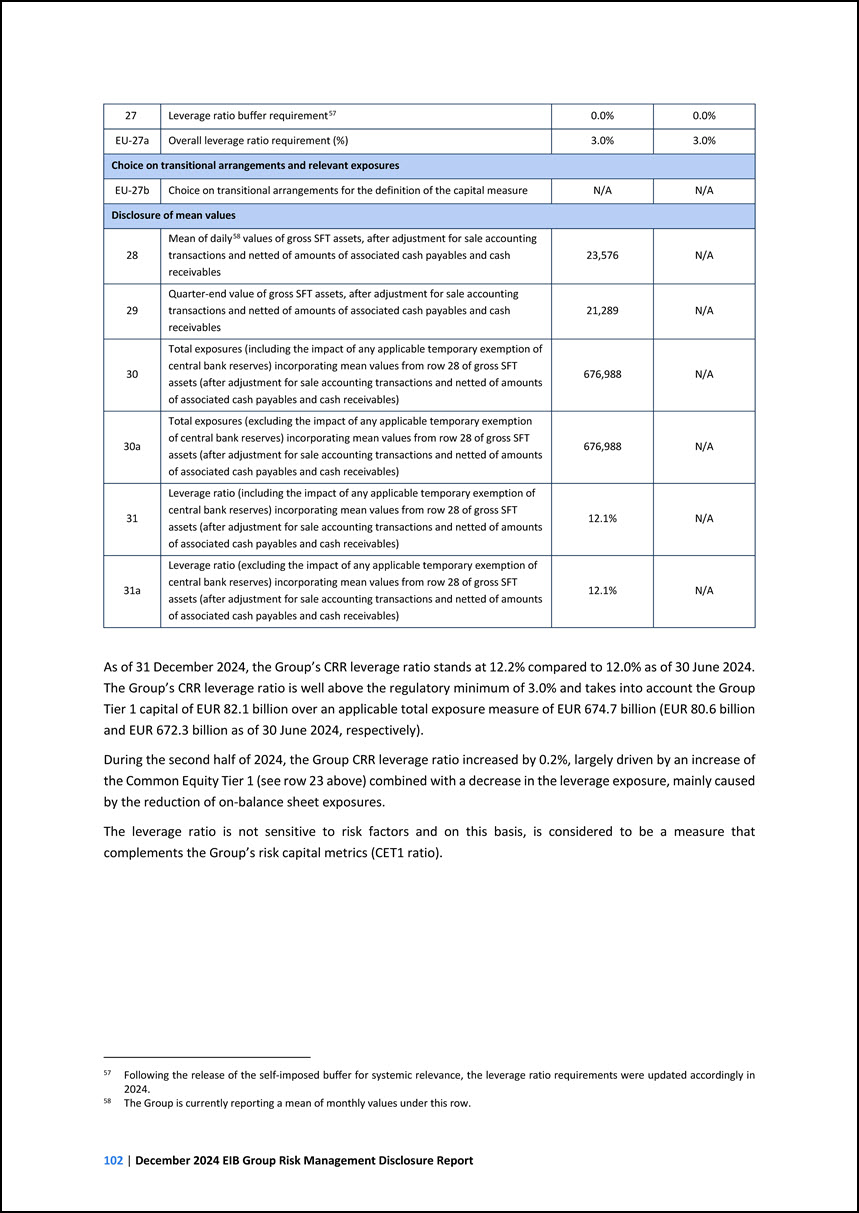

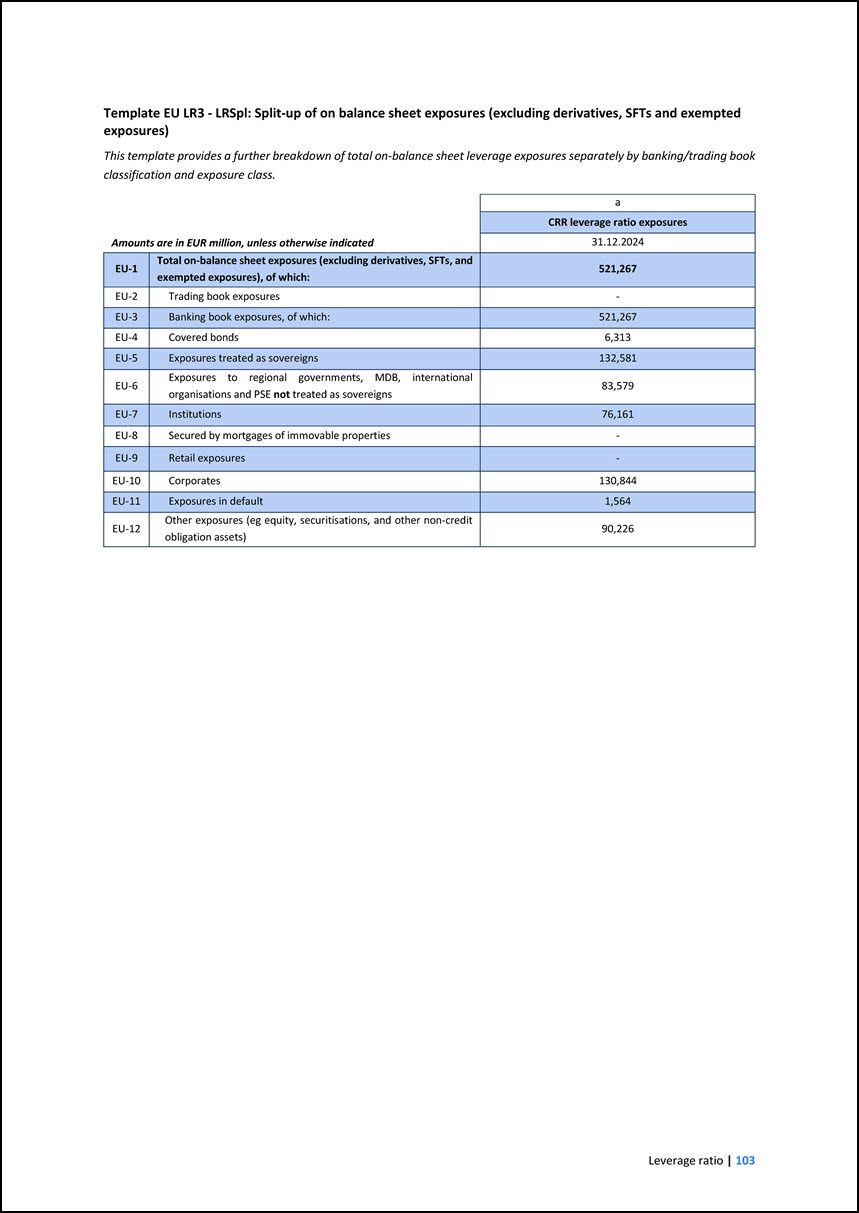

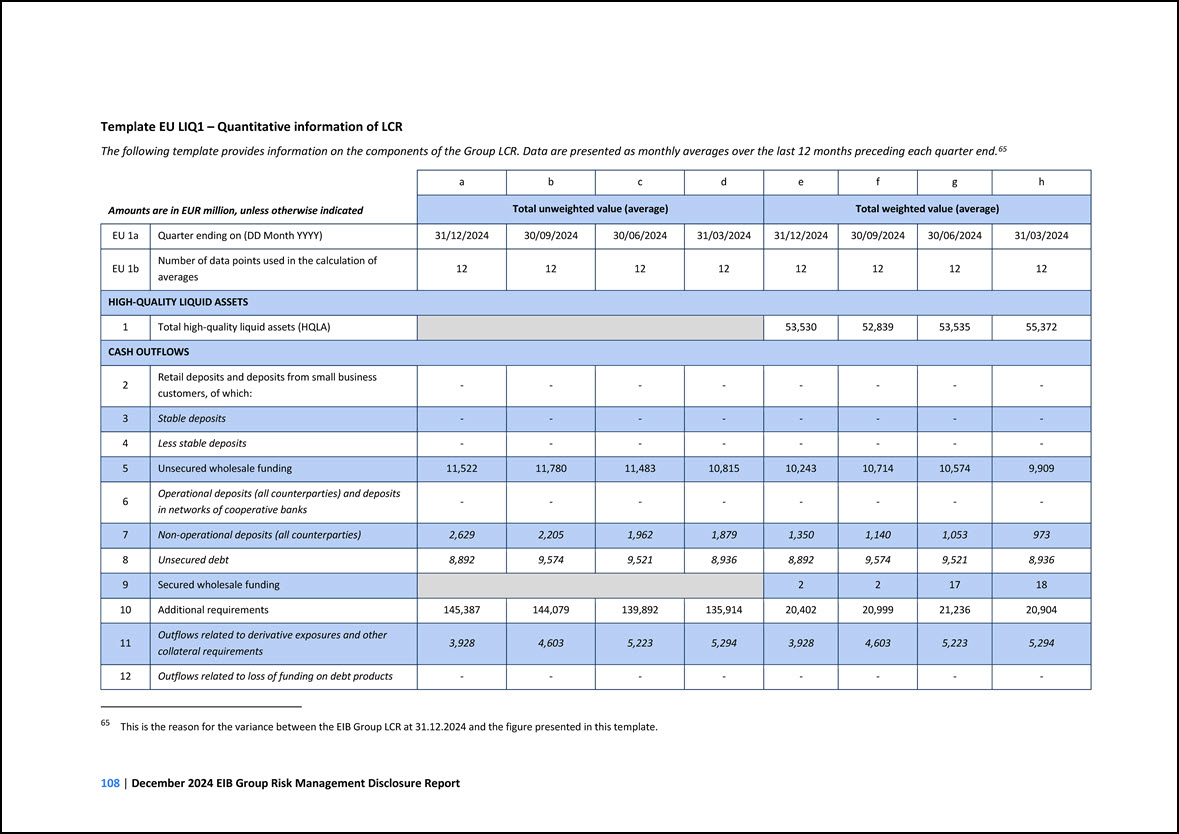

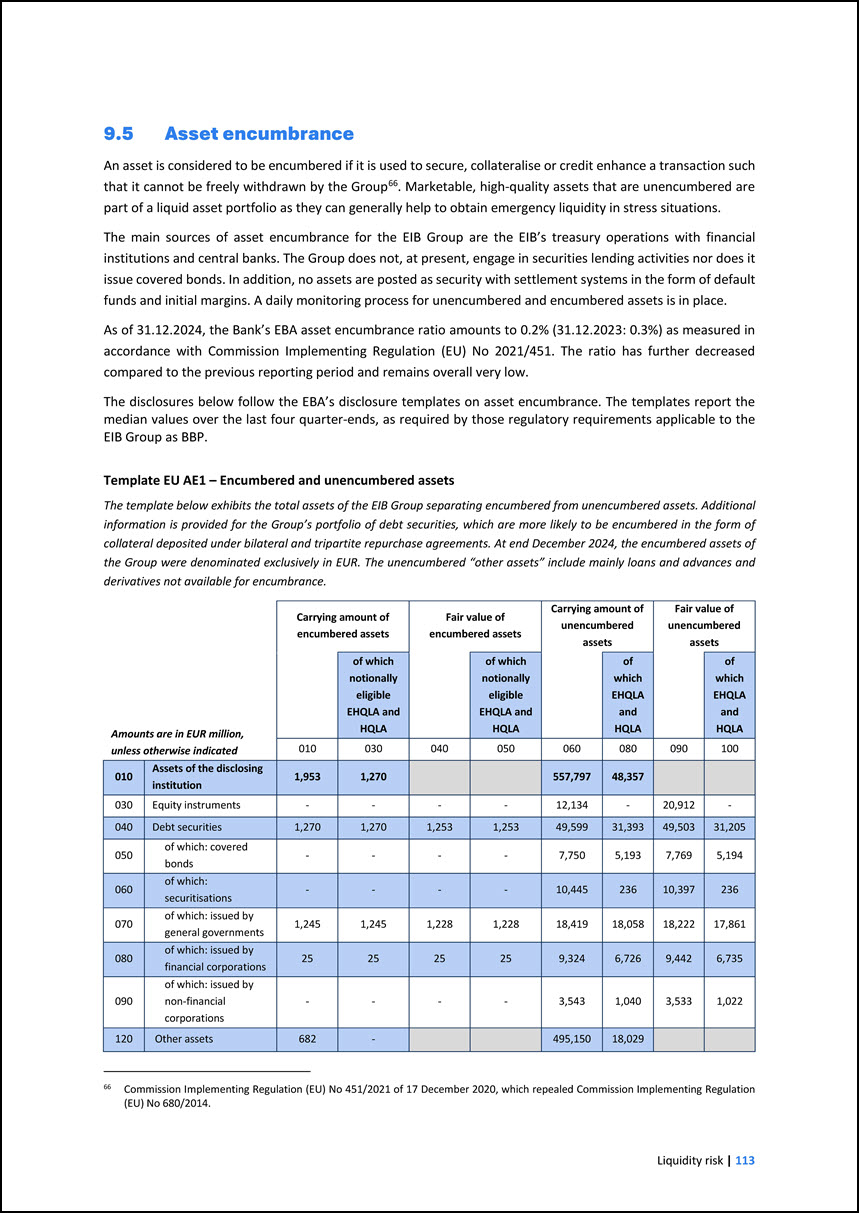

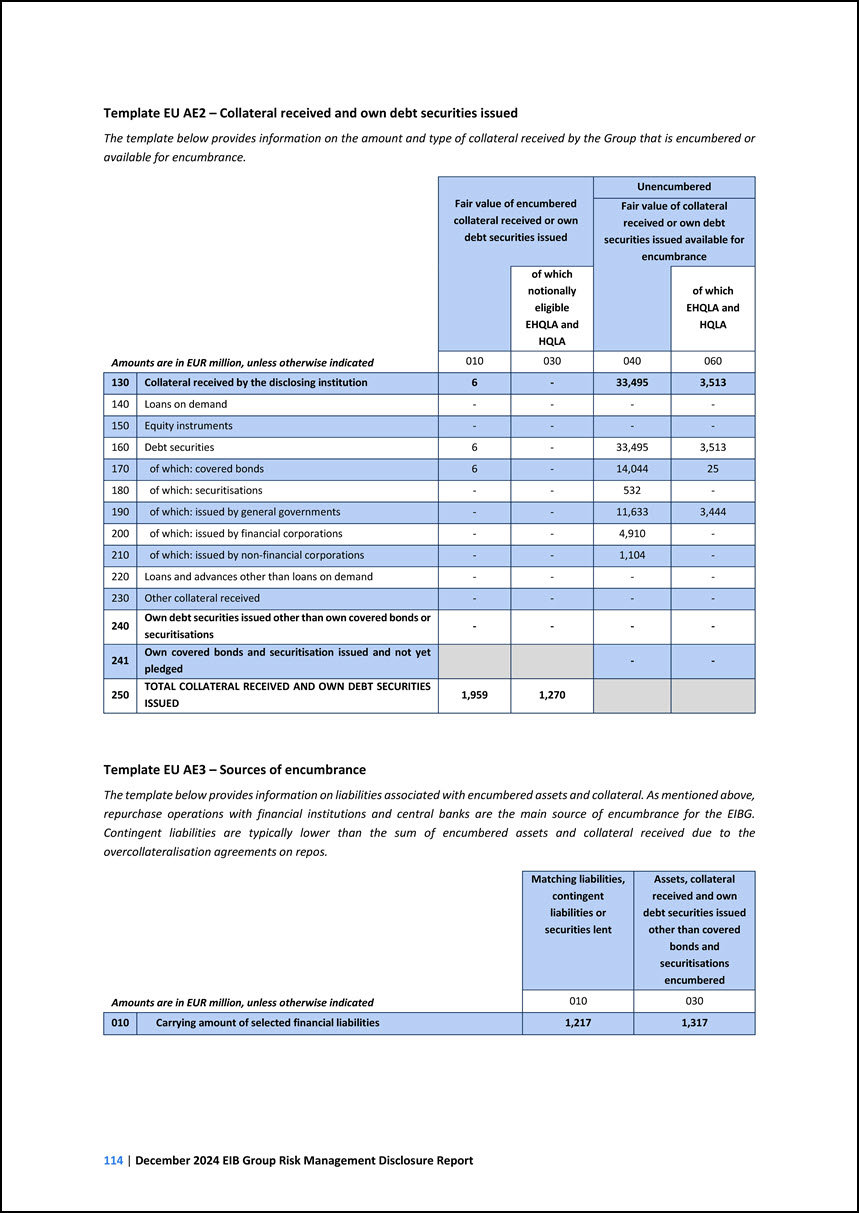

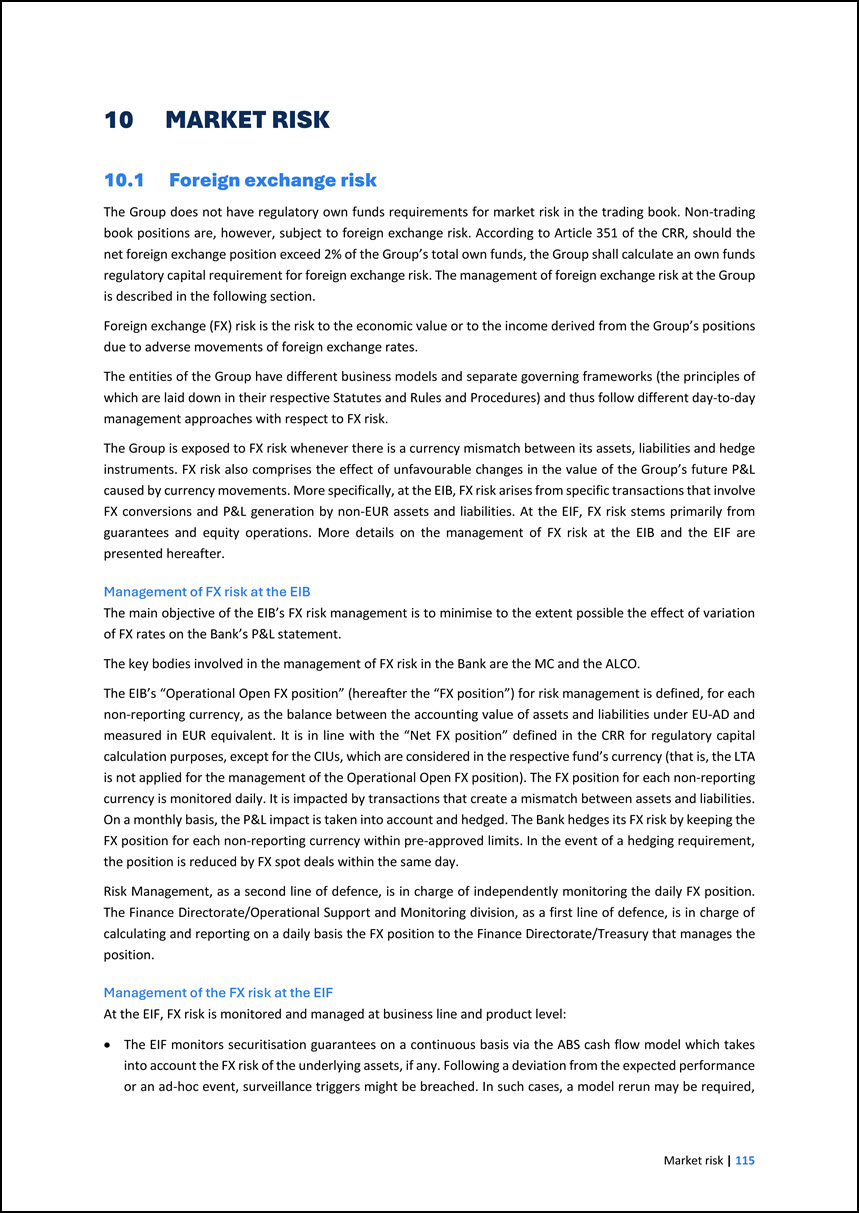

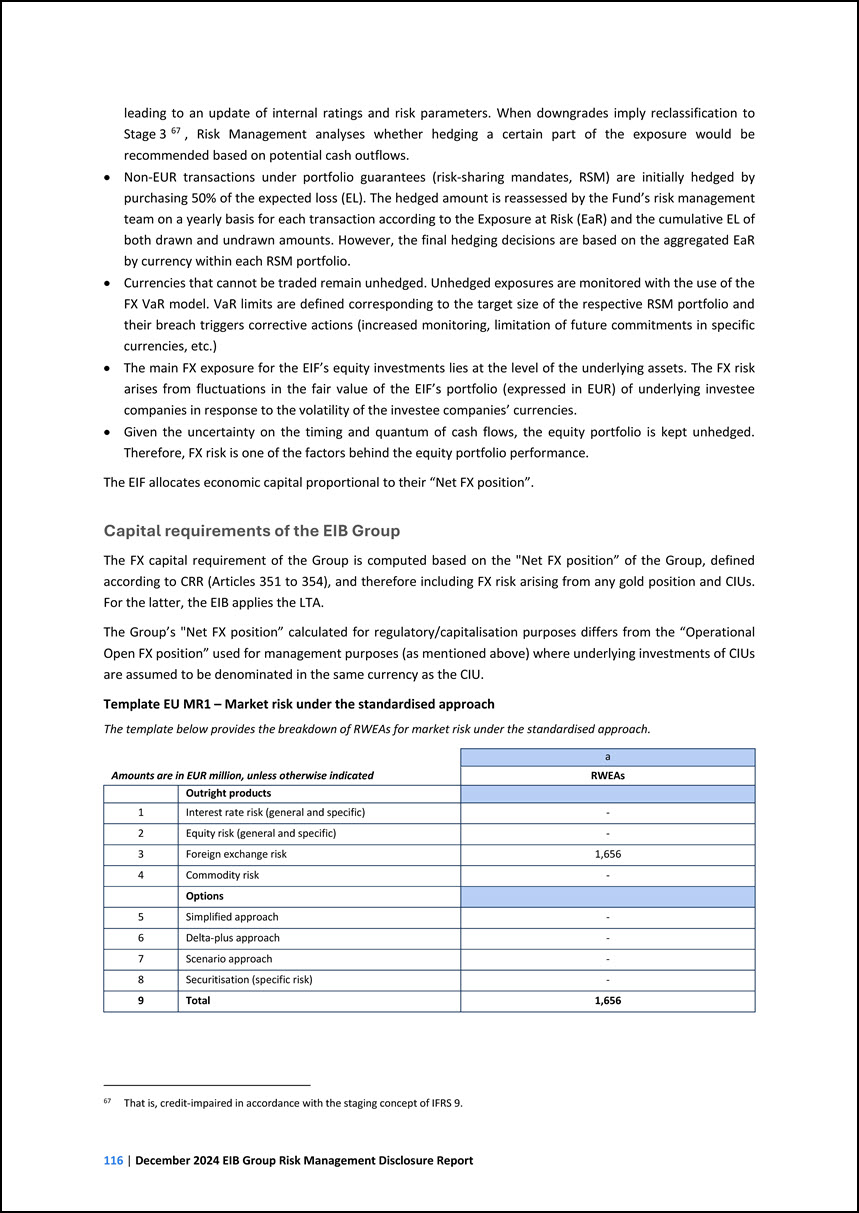

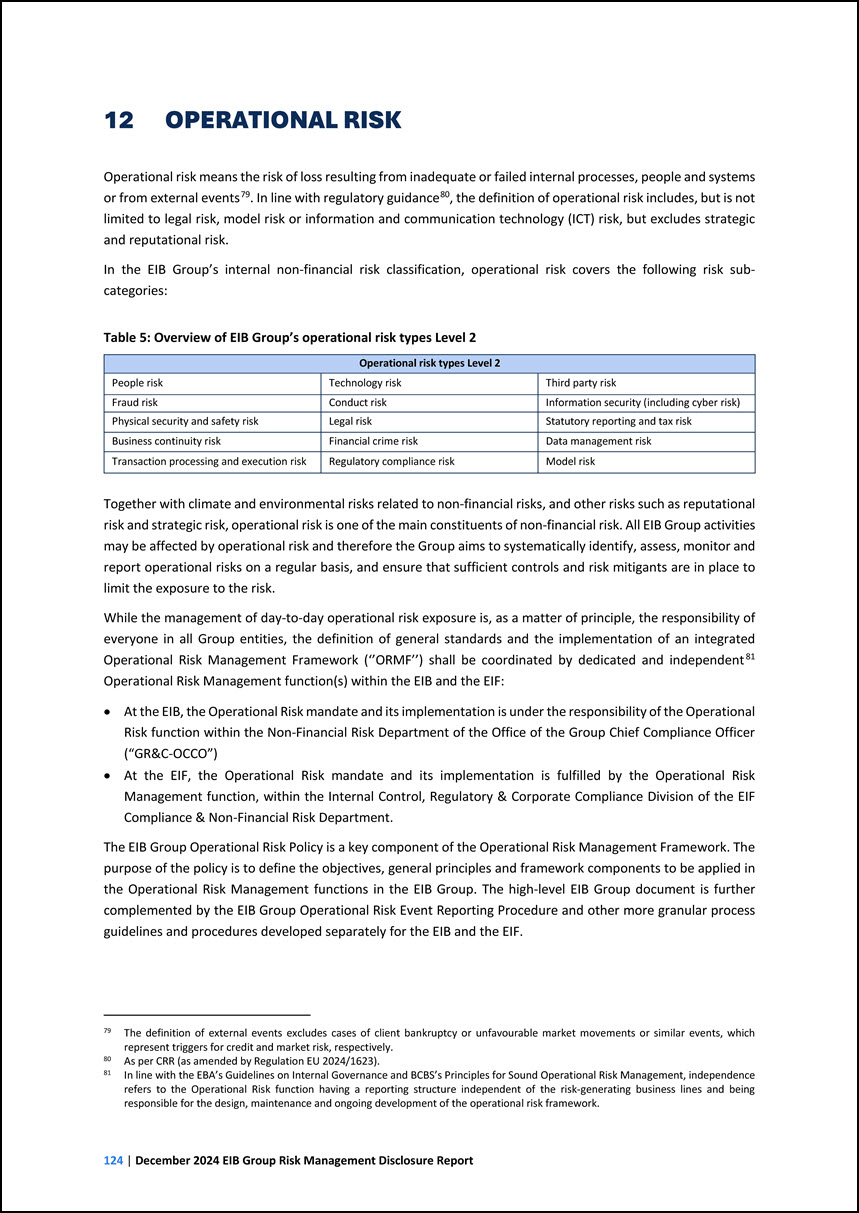

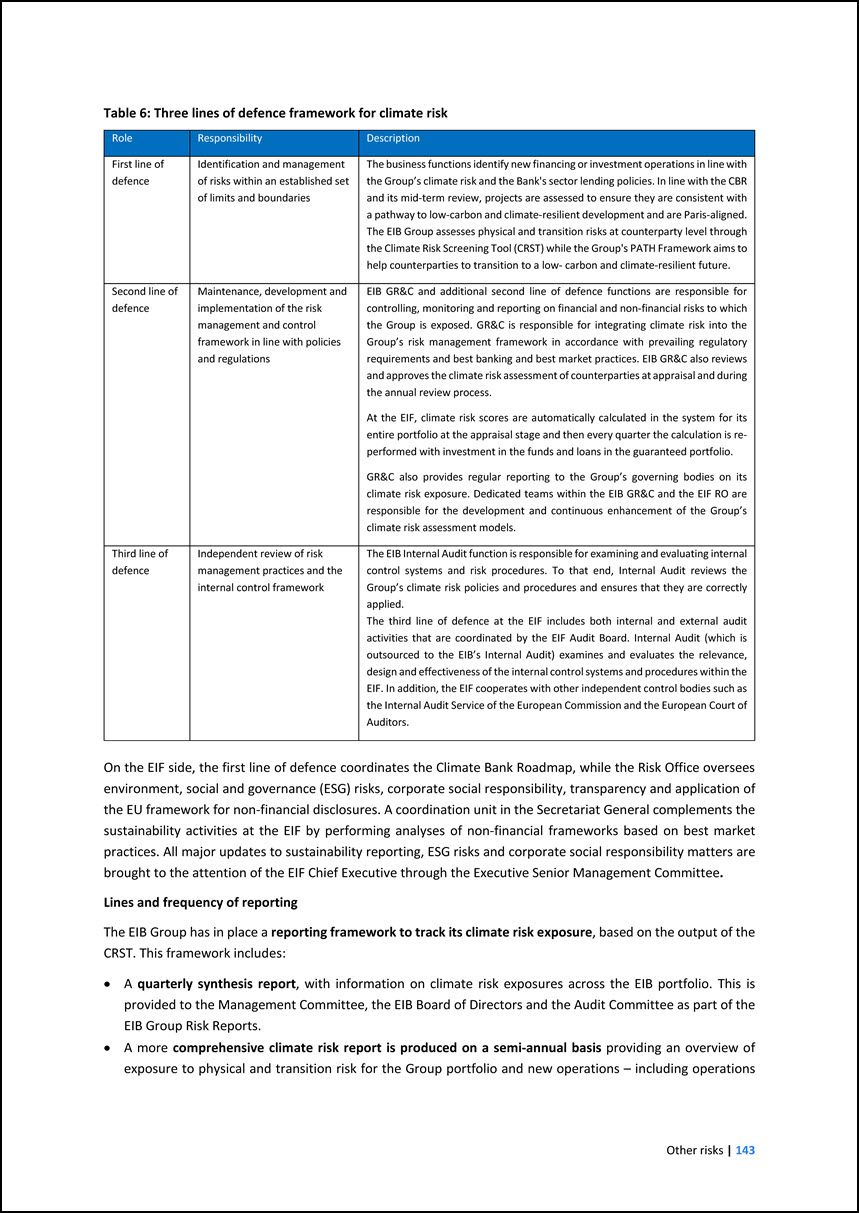

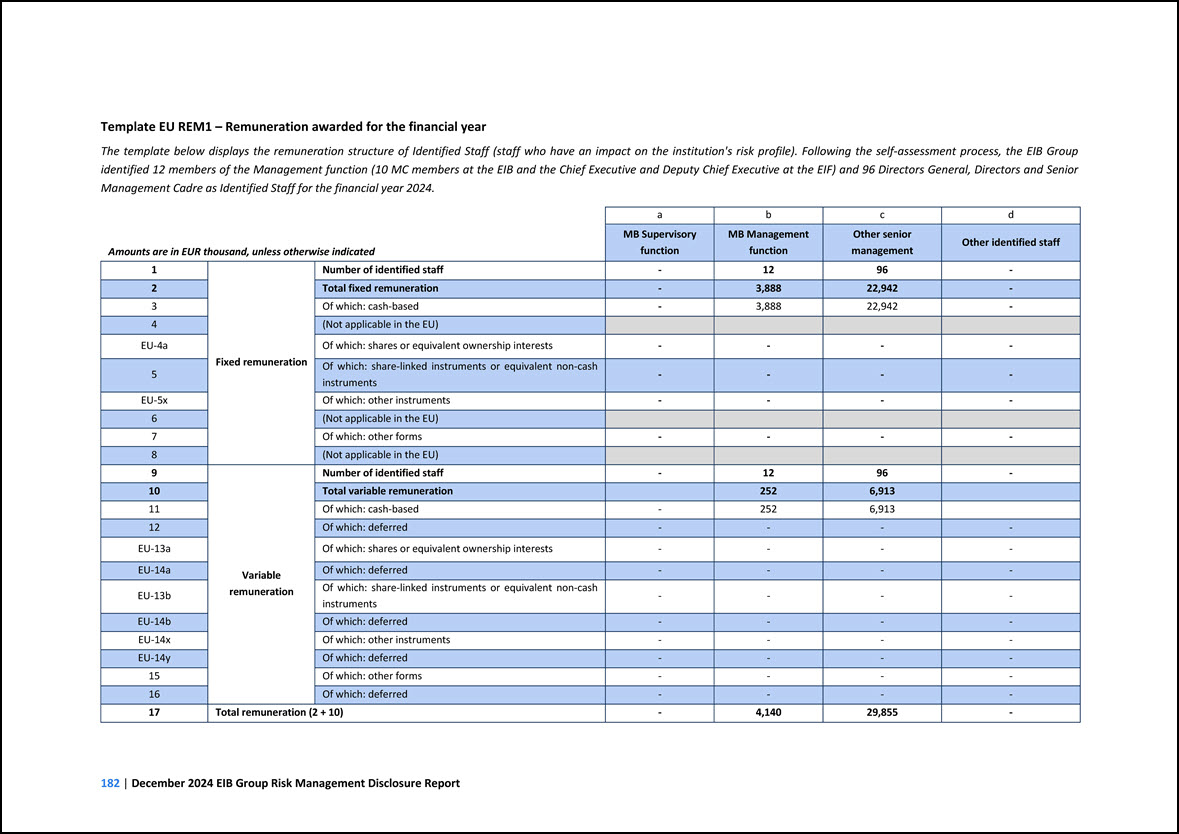

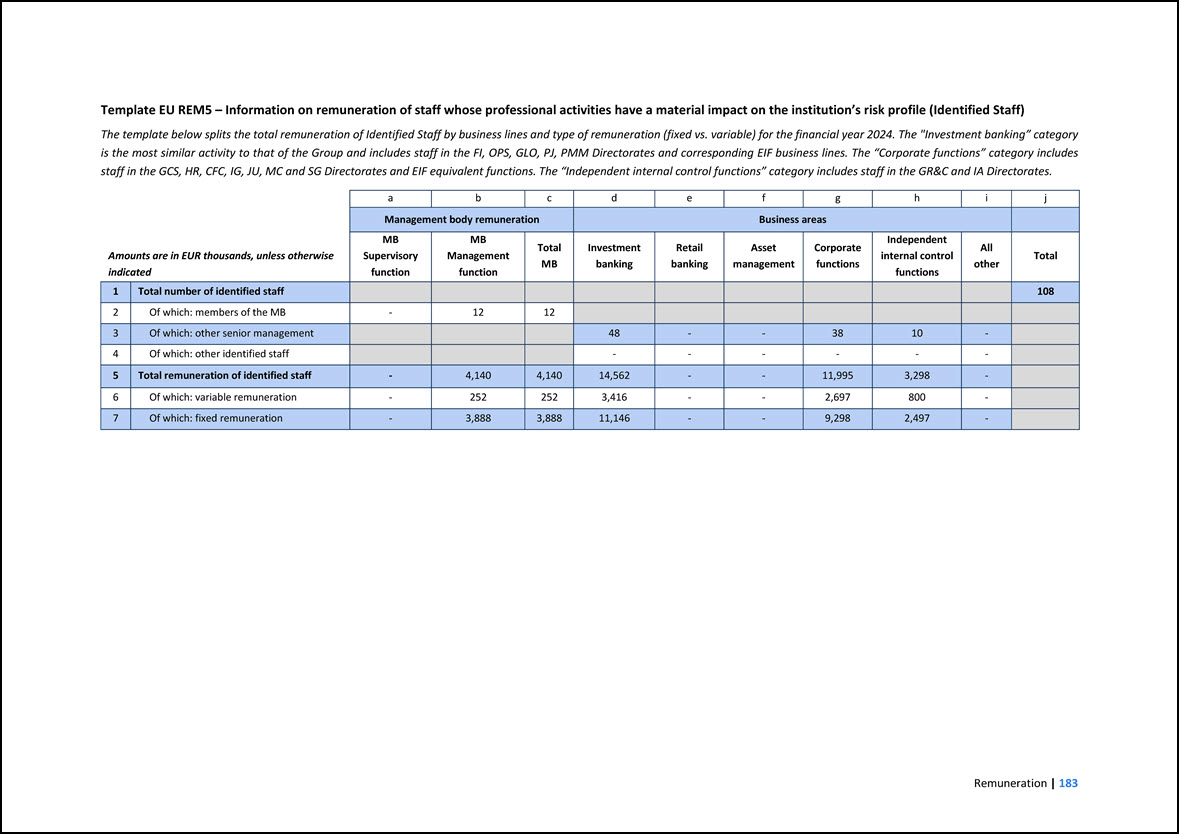

- - - 7 1 - - 1 12 0.0% 0.00% Poland 3 7,337 - - 1,879 9,219 249 - 256 506 6,320 3.3% 0.00% Portugal 61 3,117 - - 594 3,772 131 - 162 293 3,661 1.9% 0.00% Romania - 653 - - 729 1,381 40 - 107 148