Shareholder Report

|

12 Months Ended |

|

May 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

SEI INSTITUTIONAL INVESTMENTS TRUST

|

|

| Entity Central Index Key |

0000939934

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

May 31, 2025

|

|

| C000018356 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Large Cap Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

SLCAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Class A Shares of the Large Cap Fund (the "Fund") for the period from June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 1-800-DIAL-SEI.

|

|

| Additional Information Phone Number |

1-800-DIAL-SEI

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Large Cap Fund, Class A Shares | $19 | 0.18% |

|---|

|

|

| Expenses Paid, Amount |

$ 19

|

|

| Expense Ratio, Percent |

0.18%

|

|

| Factors Affecting Performance [Text Block] |

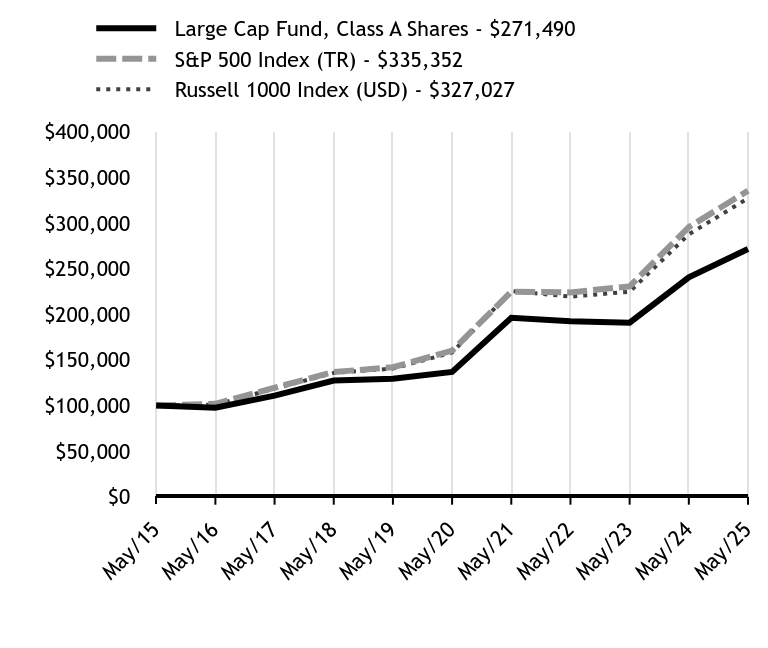

How did the Fund perform in the last year?The Fund underperformed its benchmark, the Russell 1000 Index (USD)—which tracks the performance of 1000 of the largest U.S. equity securities based on market capitalization—for the 12-month period ending May 31, 2025. Fund performance was hampered by its value tilt and preference for companies with consistent free cash flow. This resulted in underweight allocations to several strong-performing stocks within the consumer discretionary sector, particularly within the automobile industry. The Fund’s gains were concentrated in the financials and communication services sectors. Among Fund managers, Cullen Capital Management LLC’s performance lagged the Russell 1000 Index (USD) due to its value style, its dividend orientation, and its underweight allocation to the consumer discretionary sector. LSV Asset Management underperformed due to its value orientation and underweight allocations to growth stocks including those in the information technology and consumer discretionary sectors. Copeland Capital Management, LLC lagged due to its dividend orientation, an underweight to communication services, and security selection within the consumer discretionary sector. Acadian Asset Management LLC’s outperformance was attributable to its momentum orientation, an underweight to the healthcare sector, and favorable security selection within healthcare and communication services. Fred Alger Management, LLC benefited from its momentum orientation and favorable security selection within the information technology sector. During the portion of the year in which Mar Vista Investment Partners, LLC (“Mar Vista”) was a Fund sub-adviser, its performance lagged the benchmark due to the lack of exposure to the automobile industry and security selection within the information technology and industrials sectors. During the portion of the year in which PineStone Asset Management, Inc. (“PineStone”) was a Fund manager, its performance was in line with the benchmark as its favorable security selection within the financials and consumer discretionary sectors was offset by negative security selection within healthcare. |

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

|

| Line Graph [Table Text Block] |

| Large Cap Fund, Class A Shares - $271490 | S&P 500 Index (TR) - $335352 | Russell 1000 Index (USD) - $327027 |

|---|

May/15 | $100000 | $100000 | $100000 |

|---|

May/16 | $97587 | $101716 | $100776 |

|---|

May/17 | $110705 | $119484 | $118388 |

|---|

May/18 | $127315 | $136671 | $135668 |

|---|

May/19 | $129214 | $141841 | $140371 |

|---|

May/20 | $136682 | $160050 | $157970 |

|---|

May/21 | $195993 | $224579 | $225363 |

|---|

May/22 | $192146 | $223907 | $219261 |

|---|

May/23 | $190733 | $230448 | $224627 |

|---|

May/24 | $240418 | $295404 | $287539 |

|---|

May/25 | $271490 | $335352 | $327027 |

|---|

|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

Large Cap Fund, Class A Shares | 12.92% | 14.71% | 10.50% |

|---|

S&P 500 Index (TR) | 13.52% | 15.94% | 12.86% |

|---|

Russell 1000 Index (USD) | 13.73% | 15.66% | 12.58% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares.

|

|

| AssetsNet |

$ 803,516,000

|

|

| Holdings Count | Holding |

391

|

|

| Advisory Fees Paid, Amount |

$ 1,320

|

|

| InvestmentCompanyPortfolioTurnover |

85.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of May 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $803,516 | 391 | $1,320 | 85% |

|---|

|

|

| Holdings [Text Block] |

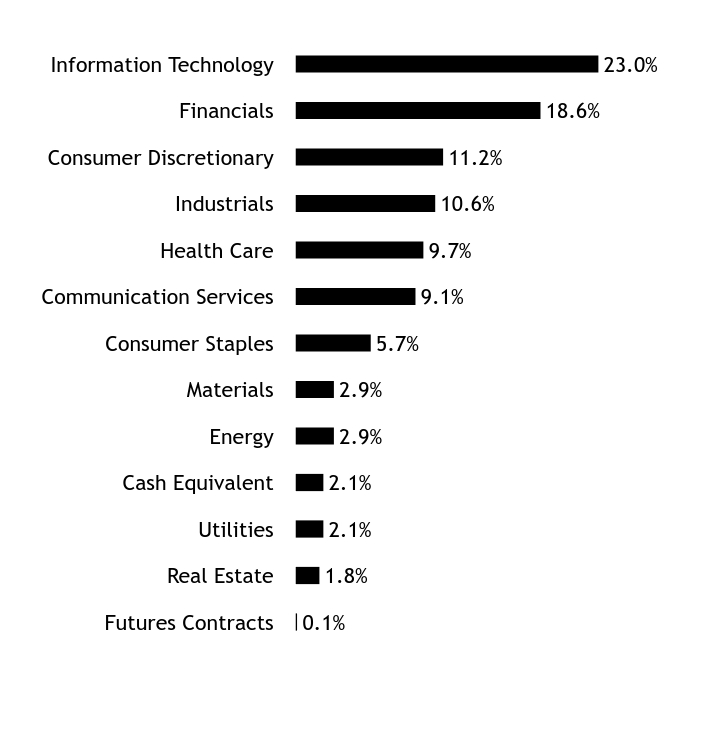

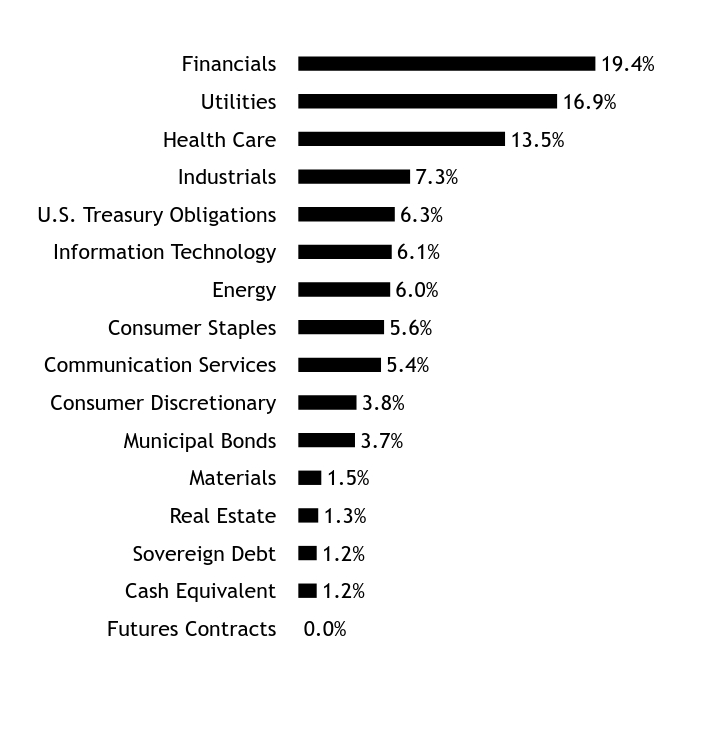

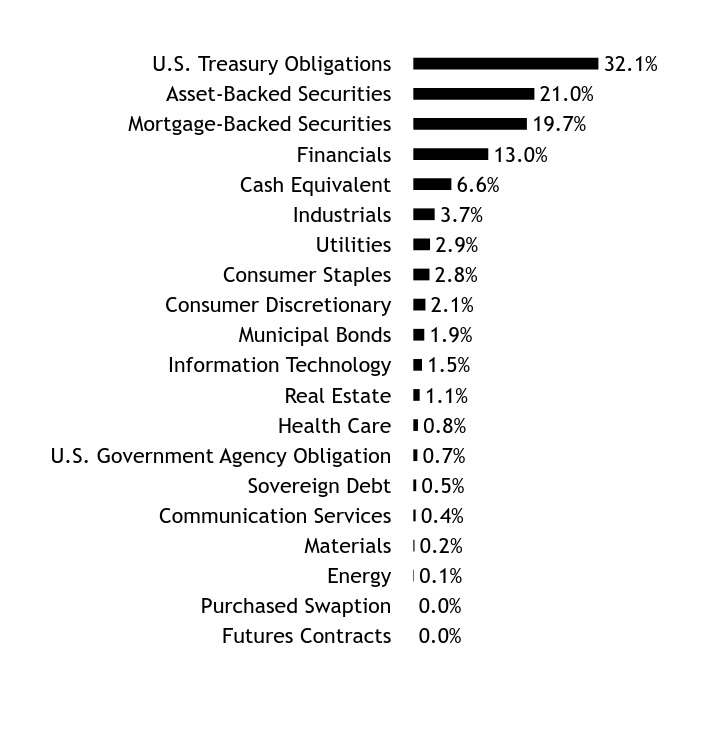

Asset/Sector WeightingsFootnote Reference*Value | Value |

|---|

Futures Contracts | 0.1% | Real Estate | 1.8% | Utilities | 2.1% | Cash Equivalent | 2.1% | Energy | 2.9% | Materials | 2.9% | Consumer Staples | 5.7% | Communication Services | 9.1% | Health Care | 9.7% | Industrials | 10.6% | Consumer Discretionary | 11.2% | Financials | 18.6% | Information Technology | 23.0% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

Microsoft Corp | | | 5.2% | NVIDIA Corp | | | 2.8% | Broadcom Inc | | | 2.1% | Meta Platforms Inc, Cl A | | | 2.0% | Apple Inc | | | 1.9% | Amazon.com Inc | | | 1.9% | Alphabet Inc, Cl A | | | 1.7% | Visa Inc, Cl A | | | 1.4% | Johnson & Johnson | | | 1.3% | JPMorgan Chase & Co | | | 1.3% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| Material Fund Change [Text Block] |

PineStone replaced Mar Vista as a Fund sub-adviser in January 2025. |

|

| C000018358 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Large Cap Disciplined Equity Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

SCPAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Class A Shares of the Large Cap Disciplined Equity Fund (the "Fund") for the period from June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 1-800-DIAL-SEI.

|

|

| Additional Information Phone Number |

1-800-DIAL-SEI

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Large Cap Disciplined Equity Fund, Class A Shares | $19 | 0.18% |

|---|

|

|

| Expenses Paid, Amount |

$ 19

|

|

| Expense Ratio, Percent |

0.18%

|

|

| Factors Affecting Performance [Text Block] |

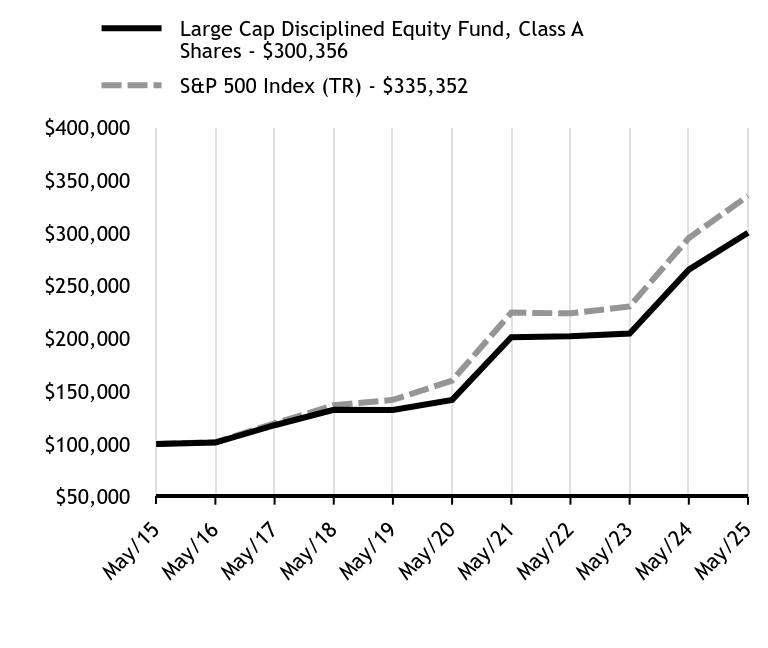

How did the Fund perform in the last year?The Fund modestly underperformed its primary benchmark, the S&P 500 Index (TR)—a capitalization-weighted index consisting of roughly 500 large U.S. companies that are considered representative of the broad U.S. stock market—for the 12-month period ending May 31, 2025. The Fund’s value tilt and underweight allocation to mega-cap technology stocks served as headwinds to performance, particularly in the first half of the reporting period. Fund performance was enhanced by its overweight to the financials sector and favorable stock selection in healthcare, while stock selection in the consumer discretionary sector was a detractor. Among Fund sub-advisers, Acadian Asset Management LLC outperformed the benchmark S&P 500 Index (TR) due to its momentum (in which investors buy stocks that have shown recent price gains and sell stocks that have recently declined) orientation, an underweight allocation to the healthcare sector, and favorable security selection in the healthcare and communication services sectors. Copeland Capital Management, LLC slightly lagged the benchmark due to its dividend growth orientation, underweight to the communication services sector, and unfavorable stock selection in the consumer discretionary sector. These negative effects were partially offset by favorable stock selection in the information technology sector. Mackenzie Investments Corporation slightly underperformed due to its value tilt and unfavorable stock selection in the energy and information technology sectors. These negative effects were partially counterbalanced by favorable stock selection in the consumer staples and healthcare sectors. Brandywine Global Investment Management, LLC lagged the benchmark due to its significant value bias and underweights to the information technology and consumer discretionary sectors. PineStone Asset Management LLC’s (“PineStone”) performance was in line with that of the benchmark as positive security selection in the financials and consumer discretionary sectors was offset by adverse security selection effects in healthcare. |

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

|

| Line Graph [Table Text Block] |

| Large Cap Disciplined Equity Fund, Class A Shares - $300356 | S&P 500 Index (TR) - $335352 |

|---|

May/15 | $100000 | $100000 |

|---|

May/16 | $101340 | $101716 |

|---|

May/17 | $117785 | $119484 |

|---|

May/18 | $132424 | $136671 |

|---|

May/19 | $132236 | $141841 |

|---|

May/20 | $141792 | $160050 |

|---|

May/21 | $201344 | $224579 |

|---|

May/22 | $202120 | $223907 |

|---|

May/23 | $204690 | $230448 |

|---|

May/24 | $265375 | $295404 |

|---|

May/25 | $300356 | $335352 |

|---|

|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

Large Cap Disciplined Equity Fund, Class A Shares | 13.18% | 16.20% | 11.63% |

|---|

S&P 500 Index (TR) | 13.52% | 15.94% | 12.86% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares.

|

|

| AssetsNet |

$ 1,318,047,000

|

|

| Holdings Count | Holding |

333

|

|

| Advisory Fees Paid, Amount |

$ 2,042

|

|

| InvestmentCompanyPortfolioTurnover |

113.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of May 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,318,047 | 333 | $2,042 | 113% |

|---|

|

|

| Holdings [Text Block] |

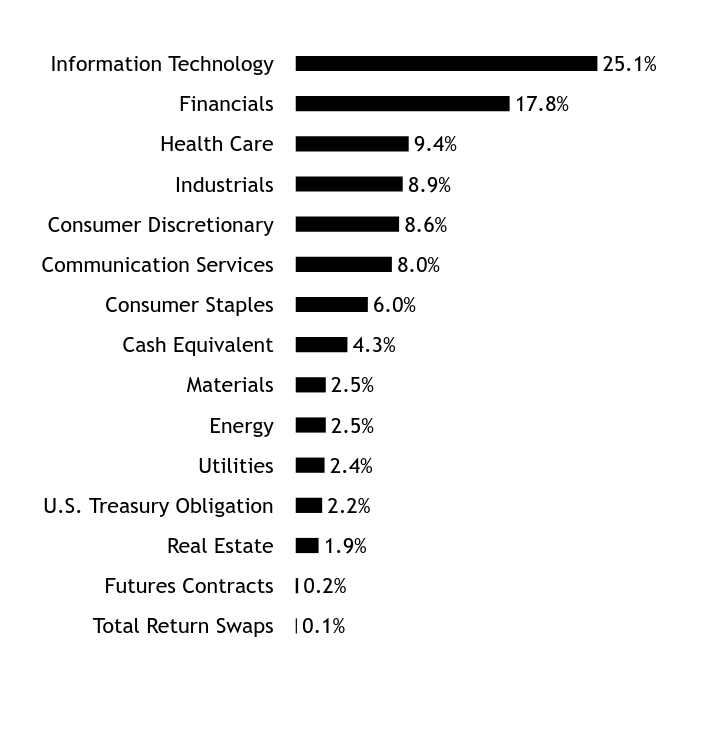

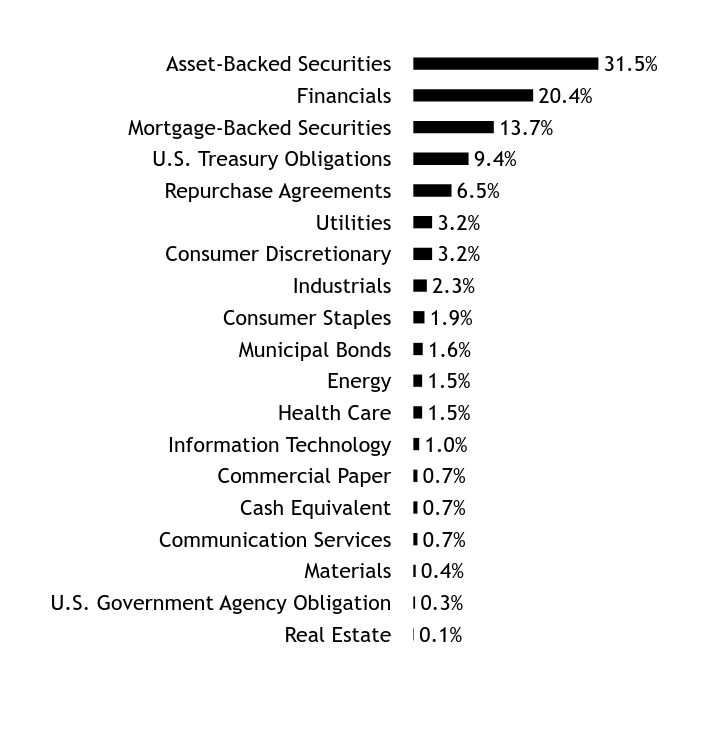

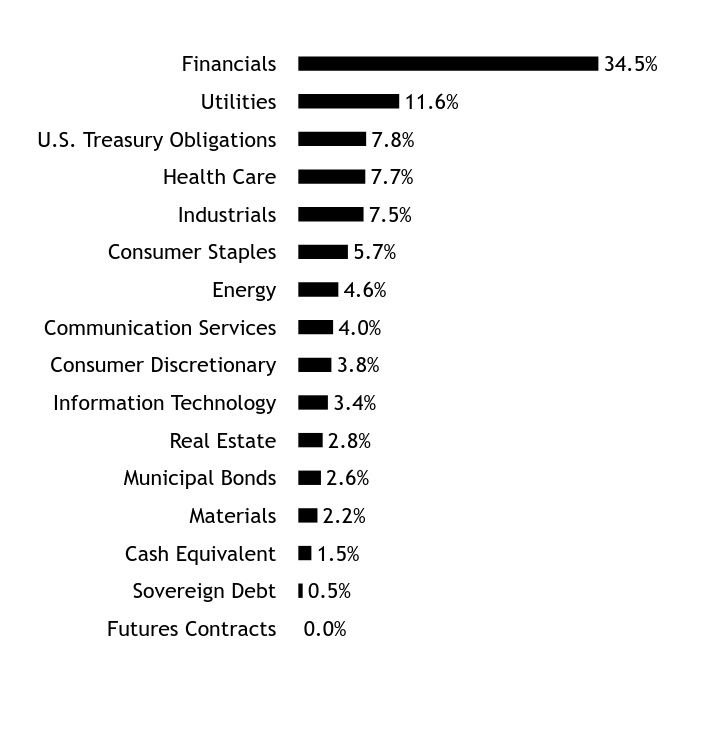

Asset/Sector WeightingsFootnote Reference*Value | Value |

|---|

Total Return Swaps | 0.1% | Futures Contracts | 0.2% | Real Estate | 1.9% | U.S. Treasury Obligation | 2.2% | Utilities | 2.4% | Energy | 2.5% | Materials | 2.5% | Cash Equivalent | 4.3% | Consumer Staples | 6.0% | Communication Services | 8.0% | Consumer Discretionary | 8.6% | Industrials | 8.9% | Health Care | 9.4% | Financials | 17.8% | Information Technology | 25.1% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

Microsoft Corp | | | 5.4% | Apple Inc | | | 4.1% | Meta Platforms Inc, Cl A | | | 2.5% | NVIDIA Corp | | | 2.4% | U.S. Treasury Bill, 4.29%, 8/21/2025 | | | 2.2% | JPMorgan Chase & Co | | | 1.8% | Broadcom Inc | | | 1.7% | Amazon.com Inc | | | 1.6% | Visa Inc, Cl A | | | 1.4% | Alphabet Inc, Cl A | | | 1.4% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| Material Fund Change [Text Block] |

PineStone was hired as a Fund manager in December 2024. |

|

| C000018357 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Large Cap Index Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

LCIAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Class A Shares of the Large Cap Index Fund (the "Fund") for the period from June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 1-800-DIAL-SEI.

|

|

| Additional Information Phone Number |

1-800-DIAL-SEI

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Large Cap Index Fund, Class A Shares | $4 | 0.04% |

|---|

|

|

| Expenses Paid, Amount |

$ 4

|

|

| Expense Ratio, Percent |

0.04%

|

|

| Factors Affecting Performance [Text Block] |

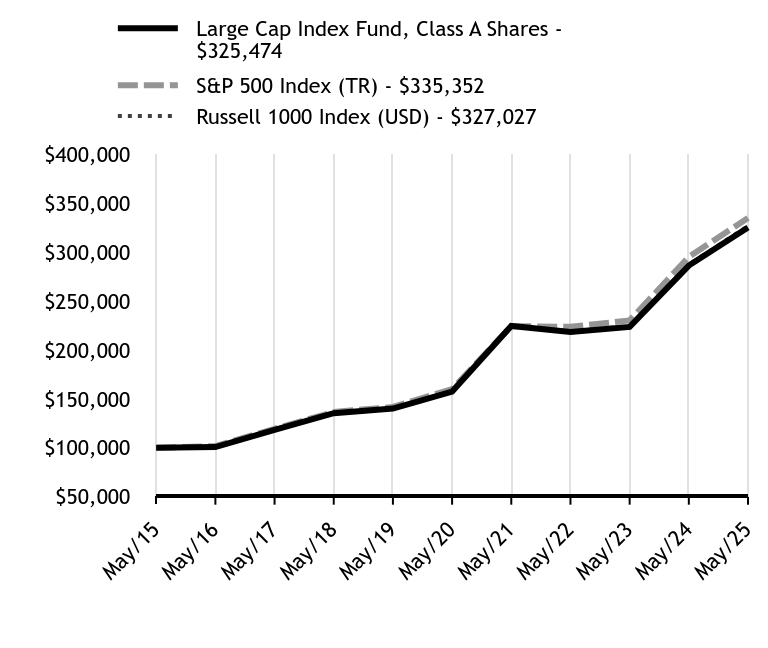

How did the Fund perform in the last year?The Fund’s benchmark, the Russell 1000 Index (USD)—which is used to measure the performance of the U.S. large-cap equity market—returned 13.73% for the 12-month period ending May 31, 2025. During the reporting period, the Fund achieved its objective of tracking the performance of the Russell 1000 Index (USD). |

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

|

| Line Graph [Table Text Block] |

| Large Cap Index Fund, Class A Shares - $325474 | S&P 500 Index (TR) - $335352 | Russell 1000 Index (USD) - $327027 |

|---|

May/15 | $100000 | $100000 | $100000 |

|---|

May/16 | $100760 | $101716 | $100776 |

|---|

May/17 | $118329 | $119484 | $118388 |

|---|

May/18 | $135526 | $136671 | $135668 |

|---|

May/19 | $140175 | $141841 | $140371 |

|---|

May/20 | $157662 | $160050 | $157970 |

|---|

May/21 | $224776 | $224579 | $225363 |

|---|

May/22 | $218618 | $223907 | $219261 |

|---|

May/23 | $223835 | $230448 | $224627 |

|---|

May/24 | $286573 | $295404 | $287539 |

|---|

May/25 | $325474 | $335352 | $327027 |

|---|

|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

Large Cap Index Fund, Class A Shares | 13.57% | 15.60% | 12.53% |

|---|

S&P 500 Index (TR) | 13.52% | 15.94% | 12.86% |

|---|

Russell 1000 Index (USD) | 13.73% | 15.66% | 12.58% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares.

|

|

| AssetsNet |

$ 1,952,244,000

|

|

| Holdings Count | Holding |

1,004

|

|

| Advisory Fees Paid, Amount |

$ 183

|

|

| InvestmentCompanyPortfolioTurnover |

16.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of May 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,952,244 | 1,004 | $183 | 16% |

|---|

|

|

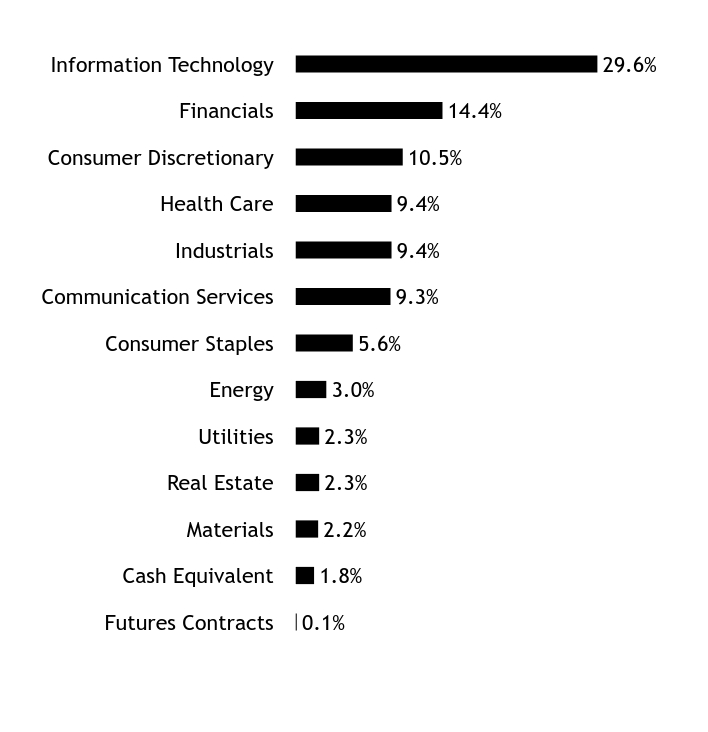

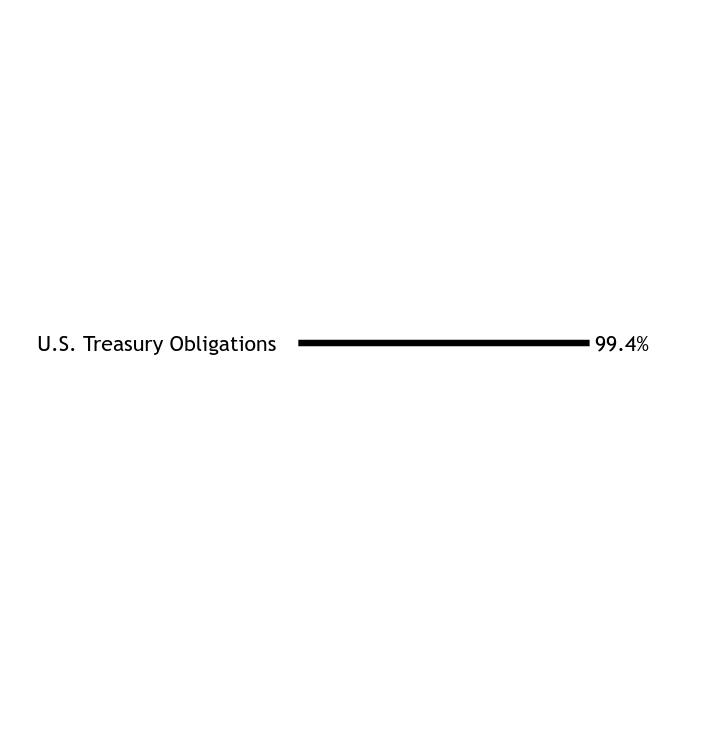

| Holdings [Text Block] |

Asset/Sector WeightingsFootnote Reference*Value | Value |

|---|

Futures Contracts | 0.1% | Cash Equivalent | 1.8% | Materials | 2.2% | Real Estate | 2.3% | Utilities | 2.3% | Energy | 3.0% | Consumer Staples | 5.6% | Communication Services | 9.3% | Industrials | 9.4% | Health Care | 9.4% | Consumer Discretionary | 10.5% | Financials | 14.4% | Information Technology | 29.6% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

Microsoft Corp | | | 6.2% | NVIDIA Corp | | | 5.7% | Apple Inc | | | 5.3% | Amazon.com Inc | | | 3.5% | Meta Platforms Inc, Cl A | | | 2.6% | Broadcom Inc | | | 2.0% | Alphabet Inc, Cl A | | | 1.8% | Tesla Inc | | | 1.7% | Berkshire Hathaway Inc, Cl B | | | 1.7% | Alphabet Inc, Cl C | | | 1.5% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| Material Fund Change [Text Block] |

There were no material fund changes during the reporting period. |

|

| C000134335 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

S&P 500 Index Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

SPINX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Class A Shares of the S&P 500 Index Fund (the "Fund") for the period from June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 1-800-DIAL-SEI.

|

|

| Additional Information Phone Number |

1-800-DIAL-SEI

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

S&P 500 Index Fund, Class A Shares | $5 | 0.05% |

|---|

|

|

| Expenses Paid, Amount |

$ 5

|

|

| Expense Ratio, Percent |

0.05%

|

|

| Factors Affecting Performance [Text Block] |

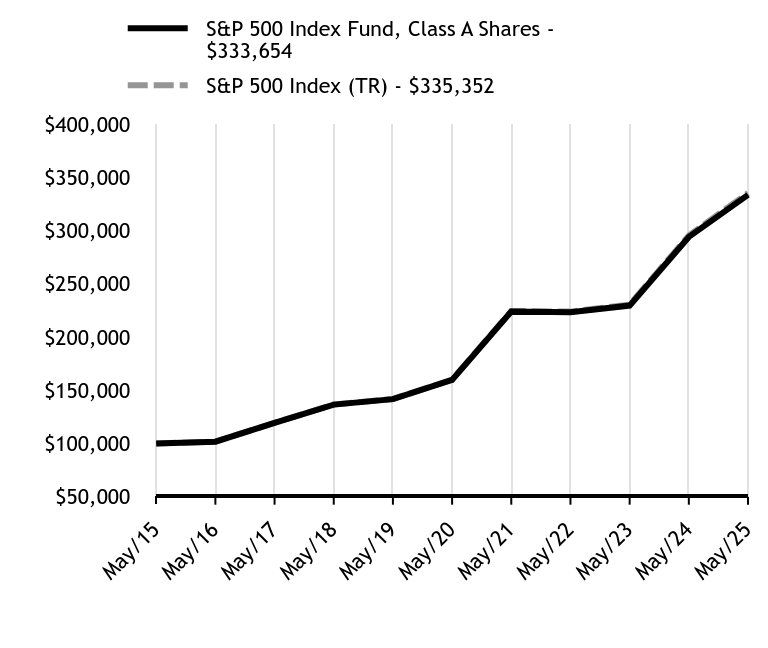

How did the Fund perform in the last year?The S&P 500 Index (TR)—a market-weighted index that tracks the performance of the 500 largest publicly traded U.S. companies and is considered representative of the broad U.S. stock market—returned 13.52% for the 12-month period ending May 31, 2025. During the reporting period, the Fund achieved its objective of tracking the performance of the S&P 500 Index (TR). |

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

|

| Line Graph [Table Text Block] |

| S&P 500 Index Fund, Class A Shares - $333654 | S&P 500 Index (TR) - $335352 |

|---|

May/15 | $100000 | $100000 |

|---|

May/16 | $101663 | $101716 |

|---|

May/17 | $119377 | $119484 |

|---|

May/18 | $136516 | $136671 |

|---|

May/19 | $141658 | $141841 |

|---|

May/20 | $159752 | $160050 |

|---|

May/21 | $224031 | $224579 |

|---|

May/22 | $223291 | $223907 |

|---|

May/23 | $229578 | $230448 |

|---|

May/24 | $294098 | $295404 |

|---|

May/25 | $333654 | $335352 |

|---|

|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

S&P 500 Index Fund, Class A Shares | 13.45% | 15.87% | 12.81% |

|---|

S&P 500 Index (TR) | 13.52% | 15.94% | 12.86% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares.

|

|

| AssetsNet |

$ 4,177,021,000

|

|

| Holdings Count | Holding |

506

|

|

| Advisory Fees Paid, Amount |

$ 427

|

|

| InvestmentCompanyPortfolioTurnover |

5.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of May 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $4,177,021 | 506 | $427 | 5% |

|---|

|

|

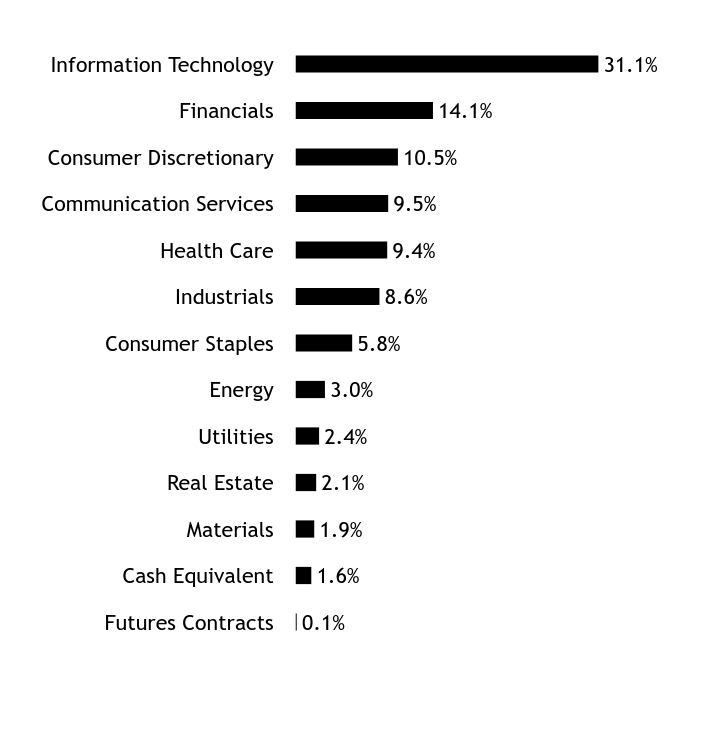

| Holdings [Text Block] |

Asset/Sector WeightingsFootnote Reference*Value | Value |

|---|

Futures Contracts | 0.1% | Cash Equivalent | 1.6% | Materials | 1.9% | Real Estate | 2.1% | Utilities | 2.4% | Energy | 3.0% | Consumer Staples | 5.8% | Industrials | 8.6% | Health Care | 9.4% | Communication Services | 9.5% | Consumer Discretionary | 10.5% | Financials | 14.1% | Information Technology | 31.1% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

Microsoft Corp | | | 6.7% | NVIDIA Corp | | | 6.5% | Apple Inc | | | 5.9% | Amazon.com Inc | | | 3.8% | Meta Platforms Inc, Cl A | | | 2.8% | Broadcom Inc | | | 2.2% | Alphabet Inc, Cl A | | | 2.0% | Tesla Inc | | | 1.9% | Berkshire Hathaway Inc, Cl B | | | 1.8% | Alphabet Inc, Cl C | | | 1.6% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| Material Fund Change [Text Block] |

There were no material fund changes during the reporting period. |

|

| C000109763 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Extended Market Index Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

SMXAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Class A Shares of the Extended Market Index Fund (the "Fund") for the period from June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 1-800-DIAL-SEI.

|

|

| Additional Information Phone Number |

1-800-DIAL-SEI

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Extended Market Index Fund, Class A Shares | $6 | 0.06% |

|---|

|

|

| Expenses Paid, Amount |

$ 6

|

|

| Expense Ratio, Percent |

0.06%

|

|

| Factors Affecting Performance [Text Block] |

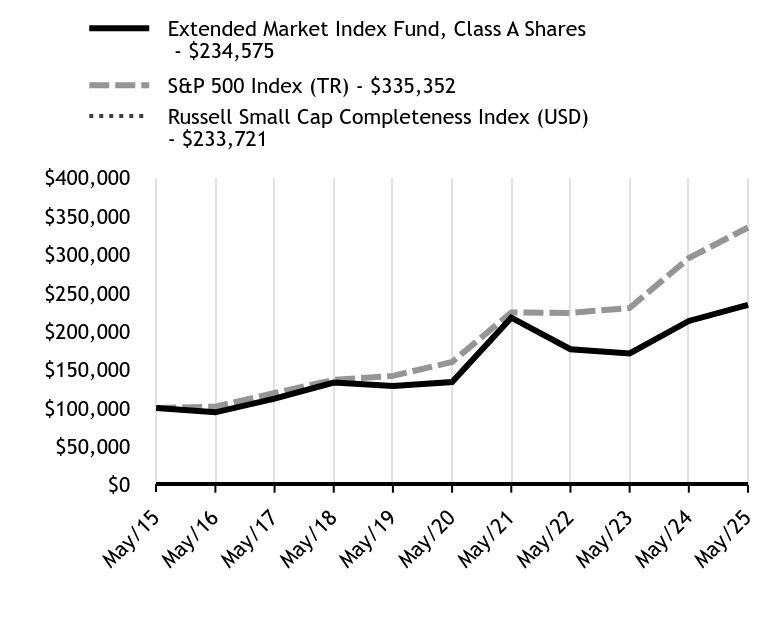

How did the Fund perform in the last year?The Fund modestly underperformed its benchmark, the Russell Small Cap Completeness Index (USD) — which measures the performance of the Russell 3000 Index companies excluding S&P 500 Index constituents — for the 12-month period ending May 31, 2025. The Fund employed equity index futures to provide stock-like performance to a portion of the liquidity reserve account, which contained cash available for fund withdrawals. This weighed on the Fund’s relative performance during the reporting period. |

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

|

| Line Graph [Table Text Block] |

| Extended Market Index Fund, Class A Shares - $234575 | S&P 500 Index (TR) - $335352 | Russell Small Cap Completeness Index (USD) - $233721 |

|---|

May/15 | $100000 | $100000 | $100000 |

|---|

May/16 | $94338 | $101716 | $94235 |

|---|

May/17 | $112287 | $119484 | $112194 |

|---|

May/18 | $133154 | $136671 | $132983 |

|---|

May/19 | $128772 | $141841 | $128435 |

|---|

May/20 | $133775 | $160050 | $133351 |

|---|

May/21 | $217765 | $224579 | $217126 |

|---|

May/22 | $176662 | $223907 | $176006 |

|---|

May/23 | $171173 | $230448 | $170521 |

|---|

May/24 | $213479 | $295404 | $212290 |

|---|

May/25 | $234575 | $335352 | $233721 |

|---|

|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

Extended Market Index Fund, Class A Shares | 9.88% | 11.89% | 8.90% |

|---|

S&P 500 Index (TR) | 13.52% | 15.94% | 12.86% |

|---|

Russell Small Cap Completeness Index (USD) | 10.09% | 11.88% | 8.86% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares.

|

|

| AssetsNet |

$ 1,122,322,000

|

|

| Holdings Count | Holding |

2,227

|

|

| Advisory Fees Paid, Amount |

$ 342

|

|

| InvestmentCompanyPortfolioTurnover |

21.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of May 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,122,322 | 2,227 | $342 | 21% |

|---|

|

|

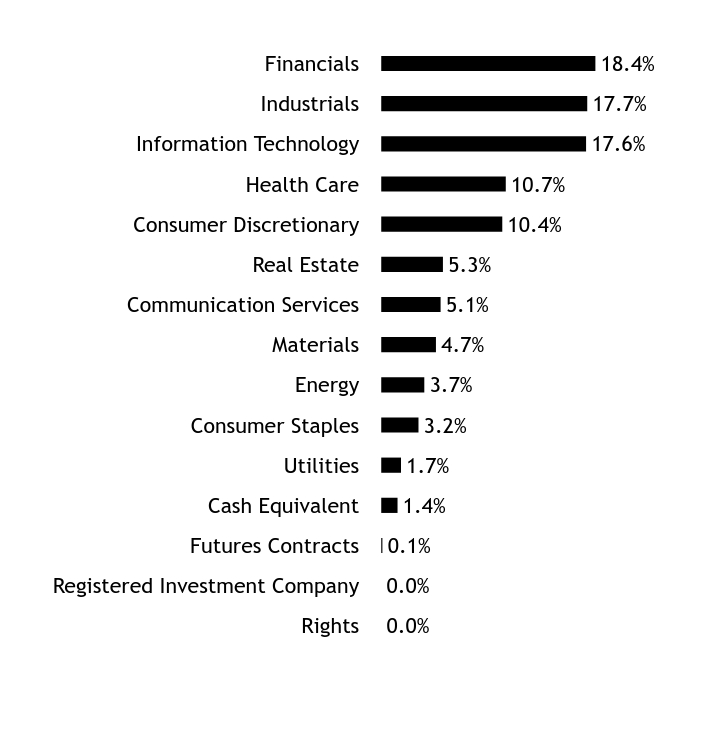

| Holdings [Text Block] |

Asset/Sector WeightingsFootnote Reference*Value | Value |

|---|

Rights | 0.0% | Registered Investment Company | 0.0% | Futures Contracts | 0.1% | Cash Equivalent | 1.4% | Utilities | 1.7% | Consumer Staples | 3.2% | Energy | 3.7% | Materials | 4.7% | Communication Services | 5.1% | Real Estate | 5.3% | Consumer Discretionary | 10.4% | Health Care | 10.7% | Information Technology | 17.6% | Industrials | 17.7% | Financials | 18.4% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

AppLovin Corp, Cl A | | | 1.5% | Spotify Technology SA | | | 1.4% | MicroStrategy Inc, Cl A | | | 1.2% | Snowflake Inc, Cl A | | | 0.9% | CRH PLC | | | 0.9% | Cheniere Energy Inc | | | 0.8% | Marvell Technology Inc | | | 0.7% | Cloudflare Inc, Cl A | | | 0.7% | ROBLOX Corp, Cl A | | | 0.7% | Robinhood Markets Inc, Cl A | | | 0.6% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| Material Fund Change [Text Block] |

There were no material fund changes during the reporting period. |

|

| C000018361 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Small Cap Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

SLPAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Class A Shares of the Small Cap Fund (the "Fund") for the period from June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 1-800-DIAL-SEI.

|

|

| Additional Information Phone Number |

1-800-DIAL-SEI

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Small Cap Fund, Class A Shares | $43 | 0.42% |

|---|

|

|

| Expenses Paid, Amount |

$ 43

|

|

| Expense Ratio, Percent |

0.42%

|

|

| Factors Affecting Performance [Text Block] |

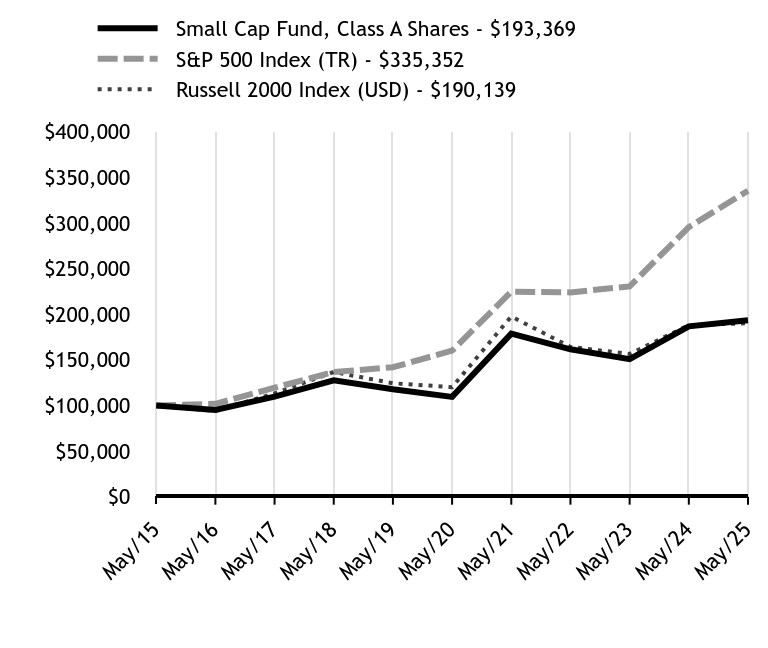

How did the Fund perform in the last year?The Fund outperformed its benchmark, the Russell 2000 Index (USD)—which tracks the performance of the small-cap segment of the U S. equity market—for the 12-month period ending May 31, 2025. Most of the Fund’s outperformance over the reporting period occurred during the volatile market environment in early April 2025. Los Angeles Capital Management LLC (LA Capital) and Martingale Asset Management, L.P. (Martingale) were the top-performing sub-advisers during the period. Martingale’s low volatility-focused strategy benefited as the low volatility factor performed well. LA Capital’s strong performance was attributable mainly to positive stock selection results, especially in the information technology and energy sectors. LSV Asset Management more modestly outperformed versus the benchmark, as the value style did not experience strong performance during the period. Axiom Investors LLC and The Informed Momentum Company LLC (IMC) (fka EAM Investors, LLC) detracted from Fund performance. While these strategies benefited from the positive performance of momentum factor investing (in which investors buy stocks that have shown recent price gains and sell stocks that have recently declined) in 2024, they struggled with the rapid shift in leadership in the first quarter of 2025. At the sector level, Fund performance benefited moderately from active sector positioning. An overweight allocation to the consumer staples and financials sectors, as well as underweights to energy and healthcare, enhanced Fund performance for the reporting period. Overall stock selection had a positive impact on Fund performance, particularly in the healthcare, financials, and energy sectors. Conversely, stock selection in industrials detracted from Fund performance. The Fund’s higher-quality positioning generally provided a tailwind to performance as lower-quality stocks significantly lagged the Russell 2000 Index during the reporting period. Similarly, while the Fund’s bias toward the least-expensive stocks in the Index did not contribute to its outperformance for the period, its bias away from the most-expensive names bolstered performance. An overweight allocation to the momentum factor investing style also contributed positively to Fund performance. |

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

|

| Line Graph [Table Text Block] |

| Small Cap Fund, Class A Shares - $193369 | S&P 500 Index (TR) - $335352 | Russell 2000 Index (USD) - $190139 |

|---|

May/15 | $100000 | $100000 | $100000 |

|---|

May/16 | $95011 | $101716 | $94027 |

|---|

May/17 | $109644 | $119484 | $113172 |

|---|

May/18 | $127521 | $136671 | $136672 |

|---|

May/19 | $117683 | $141841 | $124310 |

|---|

May/20 | $109397 | $160050 | $120036 |

|---|

May/21 | $178732 | $224579 | $197536 |

|---|

May/22 | $161533 | $223907 | $164123 |

|---|

May/23 | $150660 | $230448 | $156443 |

|---|

May/24 | $186706 | $295404 | $187911 |

|---|

May/25 | $193369 | $335352 | $190139 |

|---|

|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

Small Cap Fund, Class A Shares | 3.57% | 12.07% | 6.82% |

|---|

S&P 500 Index (TR) | 13.52% | 15.94% | 12.86% |

|---|

Russell 2000 Index (USD) | 1.19% | 9.64% | 6.64% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares.

|

|

| AssetsNet |

$ 251,278,000

|

|

| Holdings Count | Holding |

851

|

|

| Advisory Fees Paid, Amount |

$ 1,025

|

|

| InvestmentCompanyPortfolioTurnover |

90.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of May 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $251,278 | 851 | $1,025 | 90% |

|---|

|

|

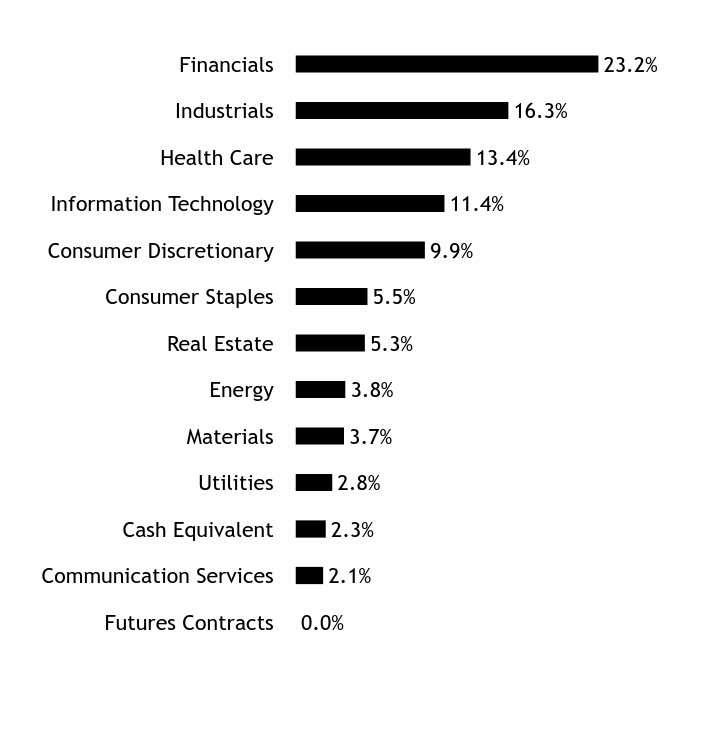

| Holdings [Text Block] |

Asset/Sector WeightingsFootnote Reference*Value | Value |

|---|

Futures Contracts | 0.0% | Communication Services | 2.1% | Cash Equivalent | 2.3% | Utilities | 2.8% | Materials | 3.7% | Energy | 3.8% | Real Estate | 5.3% | Consumer Staples | 5.5% | Consumer Discretionary | 9.9% | Information Technology | 11.4% | Health Care | 13.4% | Industrials | 16.3% | Financials | 23.2% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

National Fuel Gas Co | | | 0.7% | Casella Waste Systems Inc, Cl A | | | 0.6% | CommVault Systems Inc | | | 0.6% | Sprouts Farmers Market Inc | | | 0.5% | Exelixis Inc | | | 0.5% | Ensign Group Inc/The | | | 0.5% | Badger Meter Inc | | | 0.5% | Banco Latinoamericano de Comercio Exterior SA | | | 0.5% | Casey's General Stores Inc | | | 0.5% | Merit Medical Systems Inc | | | 0.5% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| Material Fund Change [Text Block] |

There were no material fund changes during the reporting period. |

|

| C000111997 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Small Cap II Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

SECAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Class A Shares of the Small Cap II Fund (the "Fund") for the period from June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 1-800-DIAL-SEI.

|

|

| Additional Information Phone Number |

1-800-DIAL-SEI

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Small Cap II Fund, Class A Shares | $40 | 0.40% |

|---|

|

|

| Expenses Paid, Amount |

$ 40

|

|

| Expense Ratio, Percent |

0.40%

|

|

| Factors Affecting Performance [Text Block] |

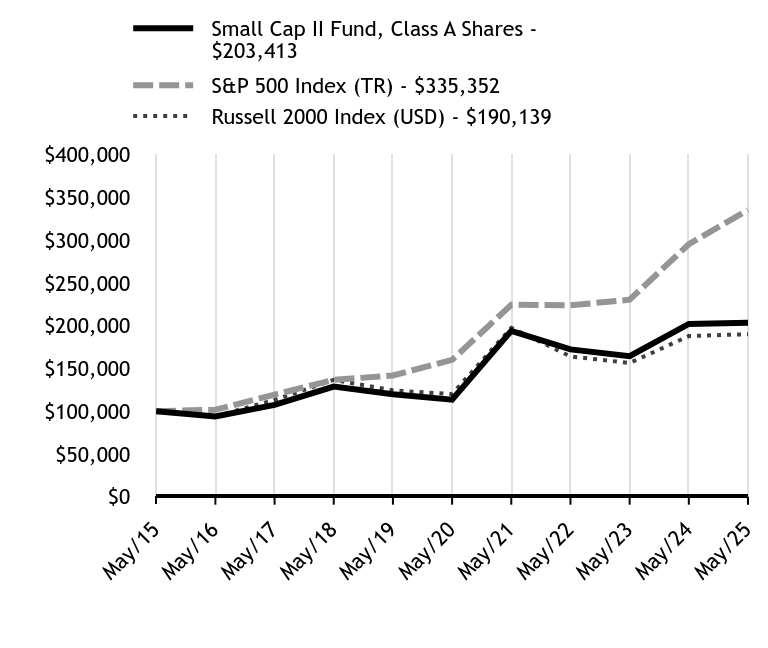

How did the Fund perform in the last year?The Fund underperformed its benchmark, the Russell 2000 Index (USD)—which tracks the performance of the small-cap segment of the U S. equity market—for the 12-month period ending May 31, 2025. The Fund lost ground during the risk-on rally that gripped U.S. small-cap stocks in July 2024. This was partially offset in March and April 2025, as risk-off investor sentiment took hold amid economic uncertainty and announcements of U.S. tariffs. Among the Fund’s sub-advisors, Los Angeles Capital Management LLC benefited from its dynamic approach (in which asset allocations and holdings are actively adjusted based on changing market conditions and trends). Stock selection within the information technology and energy sectors added to Fund performance. Leeward Investments, LLC benefited from its low volatility exposure throughout early 2025. Copeland Capital Management, LLC detracted modestly from Fund performance. The manager struggled notably during the fourth quarter of 2024, amid a positive quarter for more speculative names in the Russell 2000 Index (USD), but rebounded during the volatility in the first several months of 2025. The Informed Momentum Company LLC (IMC) (fka EAM Investors, LLC) weighed on Fund performance to a slightly larger degree, initially benefiting from positive returns for the momentum investing style (in which investors buy stocks that have shown recent price gains and sell stocks that have recently declined) in 2024, but struggling with the shift in market leadership in 2025. Easterly Investment Partners LLC faced value style headwinds and adverse stock selection in the materials and information technology sectors. An overweight allocation to the energy sector hampered Fund performance for the period. This was partially offset by the positive impact of an overweight to financials. Stock selection in materials, information technology, and industrials weighed on Fund performance. This was mostly offset by positive stock selection in energy and financials. At the factor level, the Fund’s bias away from the lowest-quality stocks in the Russell 2000 Index (USD) bolstered performance, but its overweight to the least-expensive stocks in the Index was a detractor. |

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

|

| Line Graph [Table Text Block] |

| Small Cap II Fund, Class A Shares - $203413 | S&P 500 Index (TR) - $335352 | Russell 2000 Index (USD) - $190139 |

|---|

May/15 | $100000 | $100000 | $100000 |

|---|

May/16 | $93935 | $101716 | $94027 |

|---|

May/17 | $107341 | $119484 | $113172 |

|---|

May/18 | $128780 | $136671 | $136672 |

|---|

May/19 | $119790 | $141841 | $124310 |

|---|

May/20 | $113562 | $160050 | $120036 |

|---|

May/21 | $193952 | $224579 | $197536 |

|---|

May/22 | $172354 | $223907 | $164123 |

|---|

May/23 | $164337 | $230448 | $156443 |

|---|

May/24 | $202052 | $295404 | $187911 |

|---|

May/25 | $203413 | $335352 | $190139 |

|---|

|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

Small Cap II Fund, Class A Shares | 0.67% | 12.36% | 7.36% |

|---|

S&P 500 Index (TR) | 13.52% | 15.94% | 12.86% |

|---|

Russell 2000 Index (USD) | 1.19% | 9.64% | 6.64% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares.

|

|

| AssetsNet |

$ 252,161,000

|

|

| Holdings Count | Holding |

572

|

|

| Advisory Fees Paid, Amount |

$ 999

|

|

| InvestmentCompanyPortfolioTurnover |

94.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of May 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $252,161 | 572 | $999 | 94% |

|---|

|

|

| Holdings [Text Block] |

Asset/Sector WeightingsFootnote Reference*Value | Value |

|---|

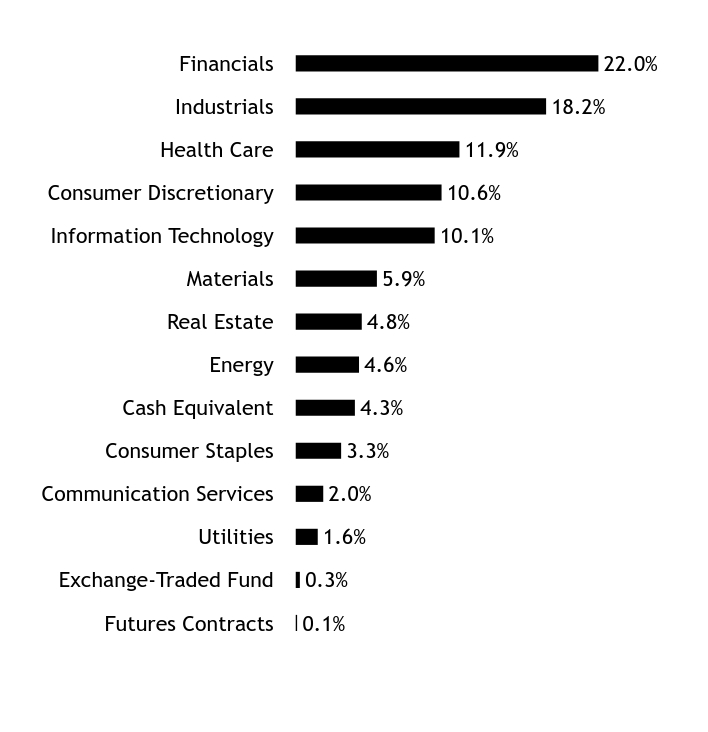

Futures Contracts | 0.1% | Exchange-Traded Fund | 0.3% | Utilities | 1.6% | Communication Services | 2.0% | Consumer Staples | 3.3% | Cash Equivalent | 4.3% | Energy | 4.6% | Real Estate | 4.8% | Materials | 5.9% | Information Technology | 10.1% | Consumer Discretionary | 10.6% | Health Care | 11.9% | Industrials | 18.2% | Financials | 22.0% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

Columbia Banking System Inc | | | 1.1% | Old National Bancorp/IN | | | 1.1% | Encompass Health Corp | | | 1.0% | Delek US Holdings Inc | | | 0.9% | Jackson Financial Inc, Cl A | | | 0.8% | Astec Industries Inc | | | 0.8% | WESCO International Inc | | | 0.7% | Lincoln National Corp | | | 0.7% | FMC Corp | | | 0.7% | Comerica Inc | | | 0.7% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| Material Fund Change [Text Block] |

There were no material fund changes during the reporting period. |

|

| C000018359 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Small/Mid Cap Equity Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

SSMAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Class A Shares of the Small/Mid Cap Equity Fund (the "Fund") for the period from June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 1-800-DIAL-SEI.

|

|

| Additional Information Phone Number |

1-800-DIAL-SEI

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Small/Mid Cap Equity Fund, Class A Shares | $40 | 0.40% |

|---|

|

|

| Expenses Paid, Amount |

$ 40

|

|

| Expense Ratio, Percent |

0.40%

|

|

| Factors Affecting Performance [Text Block] |

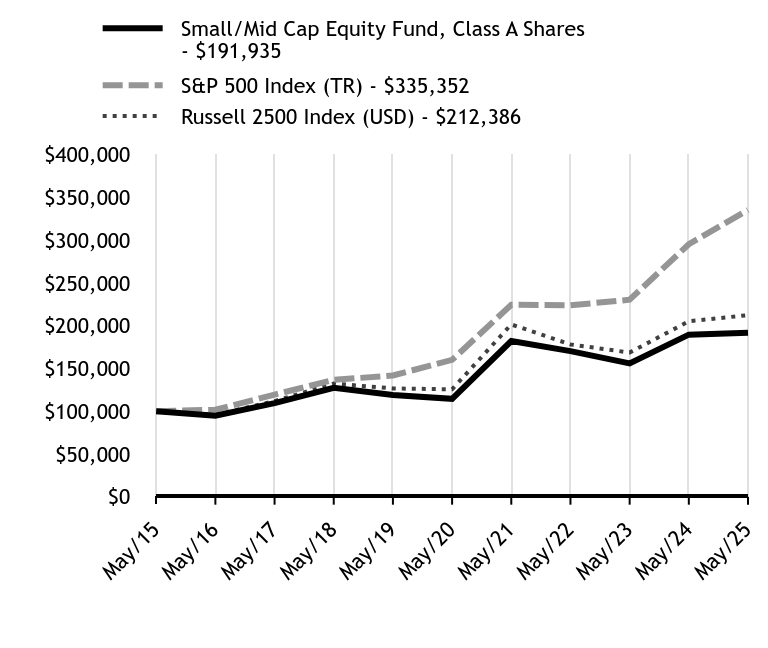

How did the Fund perform in the last year?The Fund underperformed its benchmark, the Russell 2500 Index (USD)—which tracks the performance of the small- to mid-cap segment of the U.S. equity universe, commonly referred to as "smid" cap—for the 12-month period ending May 31, 2025. The Fund declined during the more speculative environment in the fourth quarter of 2024 following the results of the U.S. presidential election in November. The Fund regained this lost ground amid the market volatility of late March and early April 2025, but manager-specific results weighed on performance again at the end of the reporting period in May. Among the Fund’s sub-advisers, Geneva Capital Management LLC benefited from its higher-quality/low-volatility positioning in the first quarter of 2025. The manager also saw an upturn in July 2024, attributable to stock-specific results during a more beta-driven rally (beta is a quantitative measure of the volatility relative to a benchmark) for small-cap stocks. Jackson Creek Investment Advisors LLC slightly outperformed the benchmark Russell 2500 Index for the period, bolstered by its tilt toward the momentum investing style (in which investors buy stocks that have shown recent price gains and sell stocks that have recently declined). Axiom Investors LLC detracted modestly from Fund performance for the reporting period due to style tailwinds in 2024, but struggled with the change in market leadership for the first five months of 2025. LSV Asset Management underperformed more significantly due largely to value style headwinds over the period. Copeland Capital Management, LLC was the largest detractor from Fund performance for the period, attributable mainly to weakness in the fourth quarter of 2024. This was only partially offset by positive performance for the manager’s holdings in low-volatility stocks in the first quarter of 2025. Sector positioning modestly hampered Fund performance for the period due largely to a slight underweight to utilities. Stock selection in consumer discretionary, energy, financials, and information technology detracted from Fund performance. This was partially offset by positive stock selection in healthcare. |

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

|

| Line Graph [Table Text Block] |

| Small/Mid Cap Equity Fund, Class A Shares - $191935 | S&P 500 Index (TR) - $335352 | Russell 2500 Index (USD) - $212386 |

|---|

May/15 | $100000 | $100000 | $100000 |

|---|

May/16 | $94672 | $101716 | $95700 |

|---|

May/17 | $109374 | $119484 | $111848 |

|---|

May/18 | $127437 | $136671 | $132307 |

|---|

May/19 | $119048 | $141841 | $126634 |

|---|

May/20 | $114522 | $160050 | $125619 |

|---|

May/21 | $182052 | $224579 | $201558 |

|---|

May/22 | $170277 | $223907 | $178138 |

|---|

May/23 | $155978 | $230448 | $168633 |

|---|

May/24 | $189591 | $295404 | $205232 |

|---|

May/25 | $191935 | $335352 | $212386 |

|---|

|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

Small/Mid Cap Equity Fund, Class A Shares | 1.24% | 10.88% | 6.74% |

|---|

S&P 500 Index (TR) | 13.52% | 15.94% | 12.86% |

|---|

Russell 2500 Index (USD) | 3.49% | 11.07% | 7.82% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares.

|

|

| AssetsNet |

$ 837,763,000

|

|

| Holdings Count | Holding |

464

|

|

| Advisory Fees Paid, Amount |

$ 3,085

|

|

| InvestmentCompanyPortfolioTurnover |

67.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of May 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $837,763 | 464 | $3,085 | 67% |

|---|

|

|

| Holdings [Text Block] |

Asset/Sector WeightingsFootnote Reference*Value | Value |

|---|

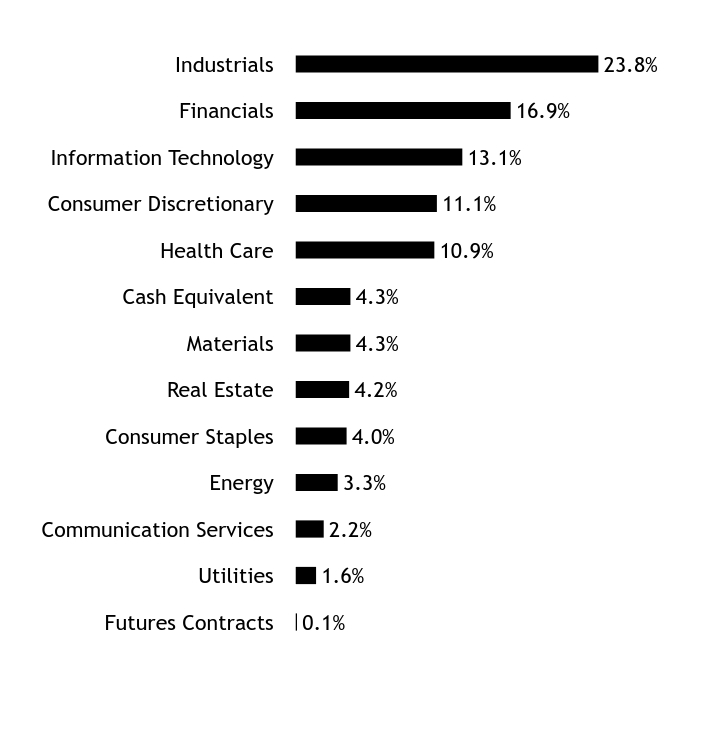

Futures Contracts | 0.1% | Utilities | 1.6% | Communication Services | 2.2% | Energy | 3.3% | Consumer Staples | 4.0% | Real Estate | 4.2% | Materials | 4.3% | Cash Equivalent | 4.3% | Health Care | 10.9% | Consumer Discretionary | 11.1% | Information Technology | 13.1% | Financials | 16.9% | Industrials | 23.8% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

ExlService Holdings Inc | | | 1.0% | Ensign Group Inc/The | | | 1.0% | RBC Bearings Inc | | | 1.0% | Kinsale Capital Group Inc | | | 0.8% | Axon Enterprise Inc | | | 0.7% | Casey's General Stores Inc | | | 0.7% | Matador Resources Co | | | 0.7% | Pool Corp | | | 0.6% | Tyler Technologies Inc | | | 0.6% | Balchem Corp | | | 0.6% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| Material Fund Change [Text Block] |

There were no material fund changes during the reporting period. |

|

| C000198133 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

U.S. Equity Factor Allocation Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

SEHAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Class A Shares of the U.S. Equity Factor Allocation Fund (the "Fund") for the period from June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 1-800-DIAL-SEI.

|

|

| Additional Information Phone Number |

1-800-DIAL-SEI

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

U.S. Equity Factor Allocation Fund, Class A Shares | $2 | 0.02% |

|---|

|

|

| Expenses Paid, Amount |

$ 2

|

|

| Expense Ratio, Percent |

0.02%

|

|

| Factors Affecting Performance [Text Block] |

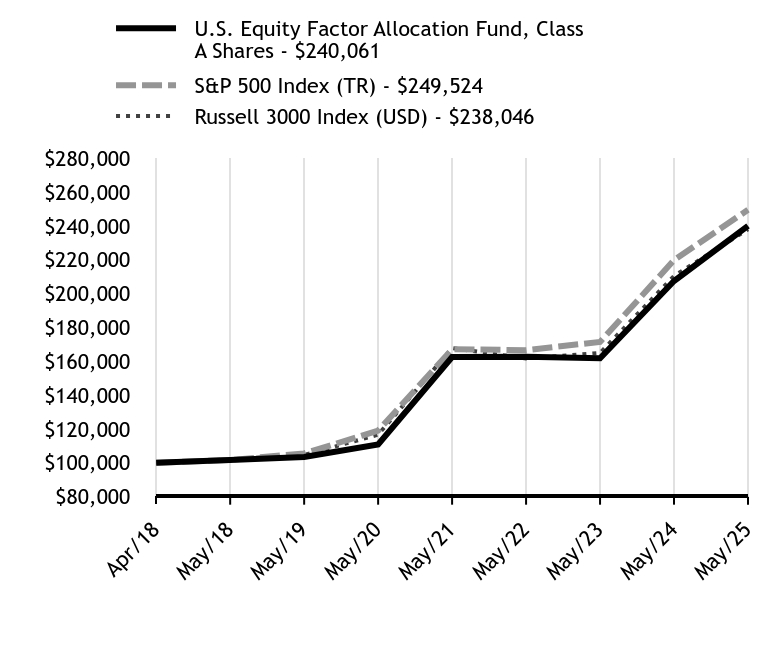

How did the Fund perform in the last year?The Fund outperformed its benchmark, the Russell 3000 Index (USD)—which tracks the performance of the 3,000 largest U.S. companies representing approximately 96% of the investable U.S. equity market— for the 12-month period ending May 31, 2025. Fund performance for the reporting period was bolstered by gains from the momentum strategy, which continued to benefit from the dominance of artificial intelligence (AI)-themed stocks. The strategy benefited from stock selection across multiple sectors, including information technology (with overweight positions in companies such as AppLovin, Guidewire, and Broadcom); consumer staples (overweighting Sprouts Farmers Market, Walmart, and Philip Morris); and healthcare (the lack of exposure to UnitedHealth Group, Merck & Co., and Gilead Sciences). The value and low volatility strategies enhanced Fund performance for the reporting period. The value strategy was bolstered by stock selection in the healthcare sector (especially overweight allocations to Cardinal Health, Merck & Co., and Gilead Sciences), as well as stock selection in the utilities and industrials sectors. The low volatility strategy also benefited from stock selection in the healthcare sector, along with stock selection in the information technology. The Fund’s quality strategy saw virtually flat performance during the reporting period, as investors’ attention shifted toward high-volatility, speculative stocks. In addition to the absence of holdings in strong-performing technology stocks such as Tesla and Broadcom, the was hampered by an underweight position in the financials sector (notably J.P. Morgan, Wells Fargo, and Bank of America), which benefited from a combination of expectations for Trump administration policies and stock-specific corporate earnings guidance. Stock selection in the consumer discretionary and communication services sectors also detracted from the strategy’s performance. This was partially offset by positive stock selection in the healthcare and consumer staples sectors. |

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

|

| Line Graph [Table Text Block] |

| U.S. Equity Factor Allocation Fund, Class A Shares - $240061 | S&P 500 Index (TR) - $249524 | Russell 3000 Index (USD) - $238046 |

|---|

Apr/18 | $100000 | $100000 | $100000 |

|---|

May/18 | $101700 | $101692 | $102083 |

|---|

May/19 | $103470 | $105539 | $104631 |

|---|

May/20 | $110927 | $119088 | $116625 |

|---|

May/21 | $162555 | $167102 | $167837 |

|---|

May/22 | $162724 | $166601 | $161654 |

|---|

May/23 | $161796 | $171469 | $164944 |

|---|

May/24 | $207463 | $219800 | $210440 |

|---|

May/25 | $240061 | $249524 | $238046 |

|---|

|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year | 5 Years | Annualized

Since

Inception |

|---|

U.S. Equity Factor Allocation Fund, Class A Shares | 15.71% | 16.70% | 13.12% |

|---|

S&P 500 Index (TR) | 13.52% | 15.94% | 13.74% |

|---|

Russell 3000 Index (USD) | 13.12% | 15.34% | 12.99% |

|---|

|

|

| Performance Inception Date |

Apr. 26, 2018

|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares.

|

|

| AssetsNet |

$ 2,535,640,000

|

|

| Holdings Count | Holding |

439

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| InvestmentCompanyPortfolioTurnover |

47.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of May 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $2,535,640 | 439 | $- | 47% |

|---|

|

|

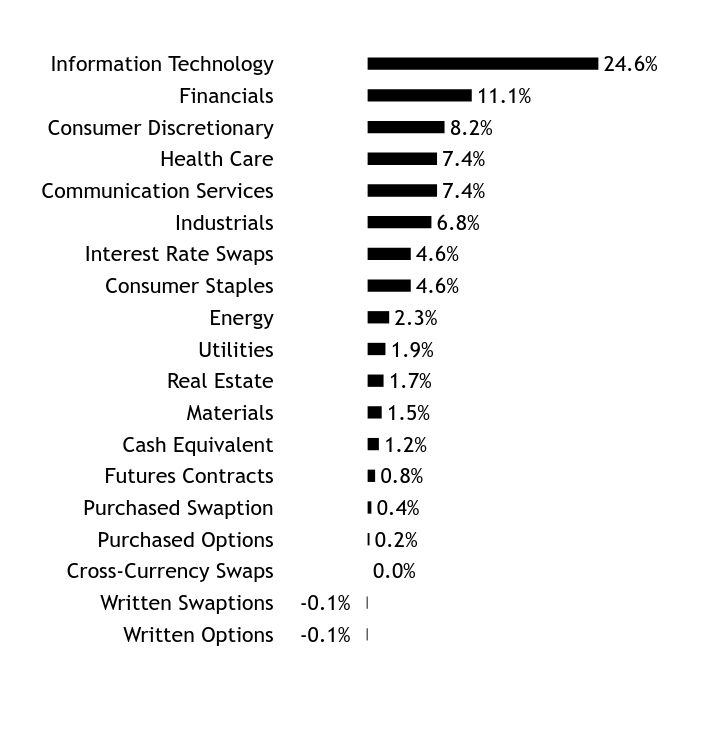

| Holdings [Text Block] |

Asset/Sector WeightingsFootnote Reference*Value | Value |

|---|

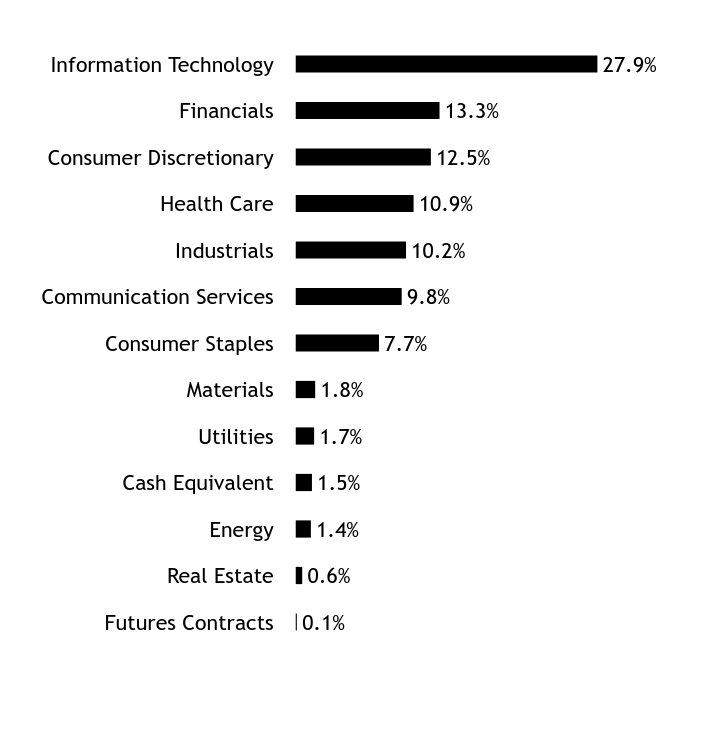

Futures Contracts | 0.1% | Real Estate | 0.6% | Energy | 1.4% | Cash Equivalent | 1.5% | Utilities | 1.7% | Materials | 1.8% | Consumer Staples | 7.7% | Communication Services | 9.8% | Industrials | 10.2% | Health Care | 10.9% | Consumer Discretionary | 12.5% | Financials | 13.3% | Information Technology | 27.9% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

Microsoft Corp | | | 4.9% | Apple Inc | | | 3.9% | NVIDIA Corp | | | 3.6% | Meta Platforms Inc, Cl A | | | 1.9% | Alphabet Inc, Cl A | | | 1.8% | Amazon.com Inc | | | 1.6% | Cisco Systems Inc | | | 1.4% | Visa Inc, Cl A | | | 1.2% | AT&T Inc | | | 1.2% | Philip Morris International Inc | | | 1.1% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| Material Fund Change [Text Block] |

There were no material fund changes during the reporting period. |

|

| C000036888 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

U.S. Managed Volatility Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

SVYAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Class A Shares of the U.S. Managed Volatility Fund (the "Fund") for the period from June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 1-800-DIAL-SEI.

|

|

| Additional Information Phone Number |

1-800-DIAL-SEI

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

U.S. Managed Volatility Fund, Class A Shares | $21 | 0.20% |

|---|

|

|

| Expenses Paid, Amount |

$ 21

|

|

| Expense Ratio, Percent |

0.20%

|

|

| Factors Affecting Performance [Text Block] |

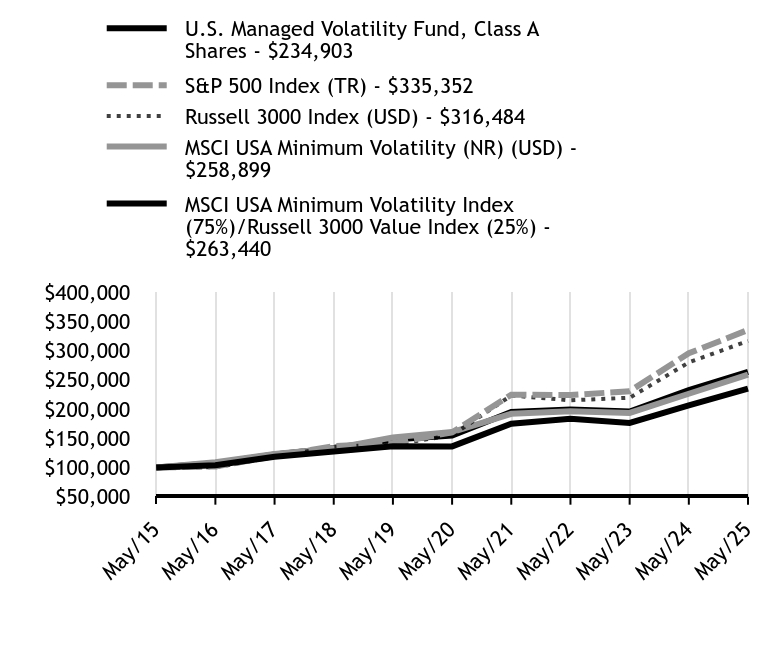

How did the Fund perform in the last year?The Fund modestly outperformed its primary benchmark, the Russell 3000 Index (USD)—which tracks the performance of the 3,000 largest U.S. companies representing approximately 96% of the investable U.S. equity market—for the 12-month period ending May 31, 2025. The Fund underperformed for the first half of the reporting period due to its low-beta exposure (beta is a quantitative measure of the volatility relative to a benchmark) and value exposure. These trends reversed in 2025 due to heightened market volatility amid uncertainty around U.S. tariff policy and concerns around artificial intelligence (AI) capital expenditures. Fund performance benefited from this market rotation due to its low-volatility bias and exposure to value. Overall, the Fund’s alpha source (the investment approach that an active investment manager takes in an effort to generate excess returns relative to a benchmark) exposures delivered mixed results. Positions in low-volatility and value stocks detracted from performance in the first half of the reporting period, but exposure to low-volatility and value stocks in 2025 more than offset the underperformance in 2024. Among the Fund’s sub-advisers, LSV Asset Management outperformed the benchmark Russell 3000 Index (USD) due to favorable stock selection among low-volatility stocks, as well as strong stock selection in the healthcare sector. During the portion of the reporting period in which Allspring Global Investments, LLC (“Allspring”) was a Fund sub-adviser, the manager’s performance modestly outperformed the benchmark due to its low-beta exposure, positions in value stocks, and strong stock selection in the healthcare and information technology sectors. During the brief period in which Acadian Asset Management LLC (“Acadian”) was a sub-adviser, the manager underperformed the benchmark. |

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

|

| Line Graph [Table Text Block] |

| U.S. Managed Volatility Fund, Class A Shares - $234903 | S&P 500 Index (TR) - $335352 | Russell 3000 Index (USD) - $316484 | MSCI USA Minimum Volatility (NR) (USD) - $258899 | MSCI USA Minimum Volatility Index (75%)/Russell 3000 Value Index (25%) - $263440 |

|---|

May/15 | $100000 | $100000 | $100000 | $100000 | $100000 |

|---|

May/16 | $103715 | $101716 | $100223 | $108897 | $107178 |

|---|

May/17 | $118160 | $119484 | $117954 | $122950 | $122326 |

|---|

May/18 | $127384 | $136671 | $135720 | $132679 | $132954 |

|---|

May/19 | $136426 | $141841 | $139107 | $151505 | $147894 |

|---|

May/20 | $136008 | $160050 | $155054 | $160572 | $154442 |

|---|

May/21 | $174913 | $224579 | $223141 | $191829 | $195073 |

|---|

May/22 | $183158 | $223907 | $214920 | $196217 | $199381 |

|---|

May/23 | $176284 | $230448 | $219293 | $193295 | $195650 |

|---|

May/24 | $206199 | $295404 | $279781 | $226119 | $232274 |

|---|

May/25 | $234903 | $335352 | $316484 | $258899 | $263440 |

|---|

|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

U.S. Managed Volatility Fund, Class A Shares | 13.92% | 11.55% | 8.92% |

|---|

S&P 500 Index (TR) | 13.52% | 15.94% | 12.86% |

|---|

Russell 3000 Index (USD) | 13.12% | 15.34% | 12.21% |

|---|

MSCI USA Minimum Volatility (NR) (USD) | 14.50% | 10.03% | 9.98% |

|---|

MSCI USA Minimum Volatility Index (75%)/Russell 3000 Value Index (25%) | 13.42% | 11.27% | 10.17% |

|---|

|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares.

|

|

| AssetsNet |

$ 700,961,000

|

|

| Holdings Count | Holding |

208

|

|

| Advisory Fees Paid, Amount |

$ 1,311

|

|

| InvestmentCompanyPortfolioTurnover |

116.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of May 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $700,961 | 208 | $1,311 | 116% |

|---|

|

|

| Holdings [Text Block] |

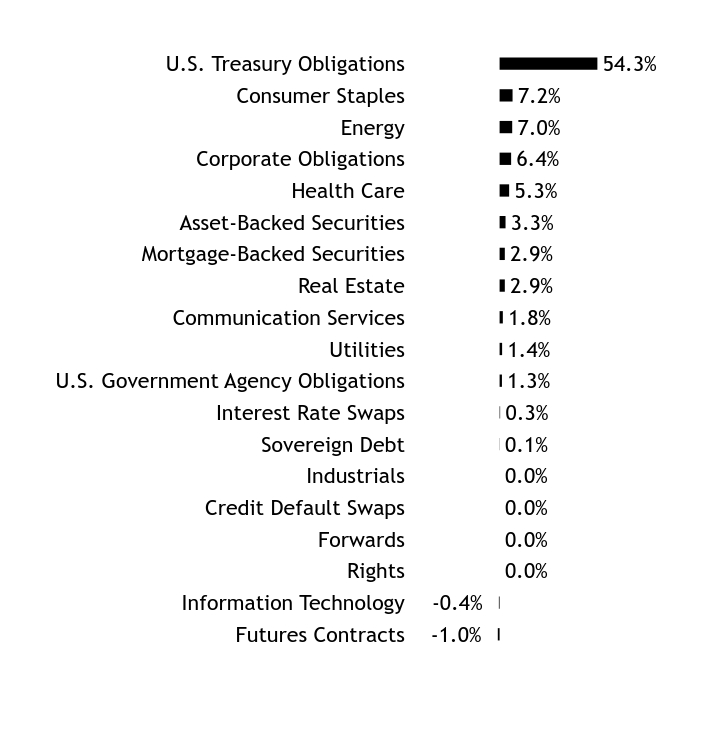

Asset/Sector WeightingsFootnote Reference*Value | Value |

|---|

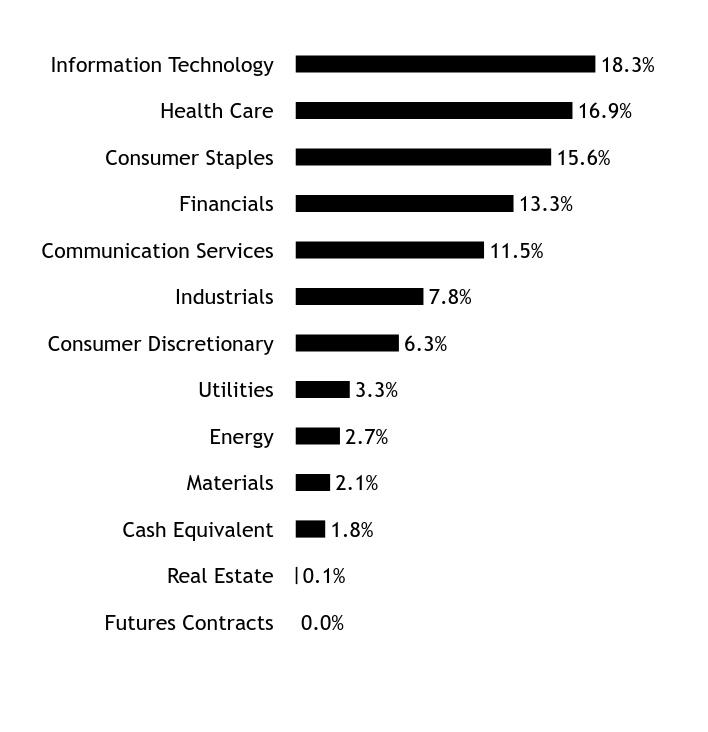

Futures Contracts | 0.0% | Real Estate | 0.1% | Cash Equivalent | 1.8% | Materials | 2.1% | Energy | 2.7% | Utilities | 3.3% | Consumer Discretionary | 6.3% | Industrials | 7.8% | Communication Services | 11.5% | Financials | 13.3% | Consumer Staples | 15.6% | Health Care | 16.9% | Information Technology | 18.3% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

Verizon Communications Inc | | | 2.0% | Cisco Systems Inc | | | 1.9% | AT&T Inc | | | 1.8% | Johnson & Johnson | | | 1.7% | Amdocs Ltd | | | 1.5% | Altria Group Inc | | | 1.4% | Gilead Sciences Inc | | | 1.4% | Comcast Corp, Cl A | | | 1.4% | Bank of New York Mellon Corp/The | | | 1.4% | eBay Inc | | | 1.3% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| Material Fund Change [Text Block] |

In early April 2025, Allspring was terminated as a Fund sub-adviser as the firm discontinued its alternative equity strategies. Acadian was added as a sub-adviser at this time and the assets from Allspring were reallocated to Acadian. In addition, during the reporting period, the Advisory fee for the Fund was reduced. |

|

| C000160603 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Global Managed Volatility Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

SGMAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Class A Shares of the Global Managed Volatility Fund (the "Fund") for the period from June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 1-800-DIAL-SEI.

|

|

| Additional Information Phone Number |

1-800-DIAL-SEI

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Global Managed Volatility Fund, Class A Shares | $27 | 0.25%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.24%. |

|

|

| Expenses Paid, Amount |

$ 27

|

|

| Expense Ratio, Percent |

0.25%

|

[1] |

| Factors Affecting Performance [Text Block] |

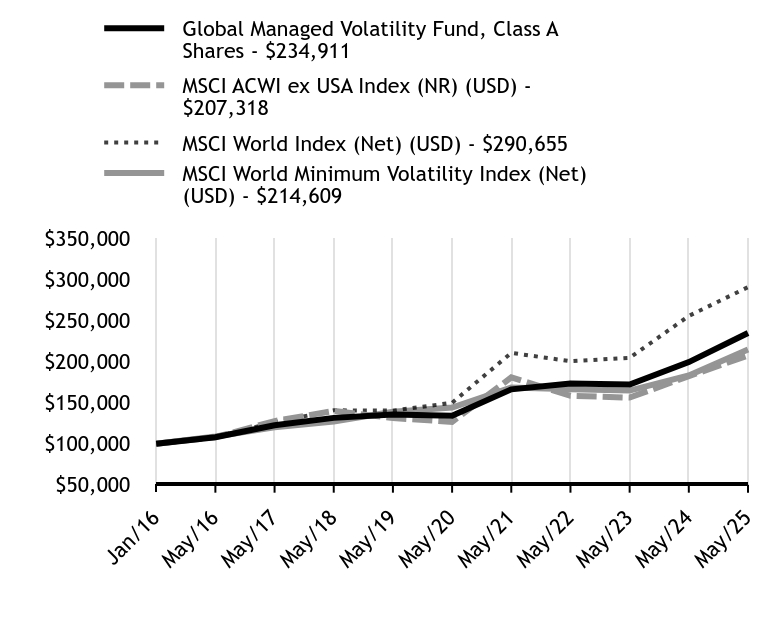

How did the Fund perform in the last year?The Fund outperformed its primary benchmark, the MSCI World Index (Net) (USD), for the 12-month period ending May 31, 2025. The Fund underperformed for the first half of the reporting period due to headwinds to low-volatility, value exposure, and an underweight allocation to the U.S. These trends reversed in 2025 due to heightened market volatility amid uncertainty around U.S. tariff policy and concerns around artificial intelligence (AI) capital expenditures. Fund performance benefited from this market rotation given its low-volatility bias, exposure to value, and underweight to the U.S. Overall, the Fund’s alpha source (the investment approach that an active investment manager takes in an effort to generate excess returns relative to a benchmark) exposures delivered mixed results for the reporting period as positions in low-volatility and value stocks detracted from performance in the first half of the reporting period, but exposure to low-volatility and value stocks in 2025 more than offset the underperformance in 2024. Among the Fund’s sub-advisers, Acadian Asset Management LLC outperformed the benchmark MSCI World Index due to favorable stock selection in the consumer staples, healthcare, and information technology sectors, as well as strong selection among small and mega-cap stocks. LSV Asset Management outperformed the benchmark due to its exposure to value within the low-volatility segment of the market, along with favorable stock selection in the healthcare and consumer staples sectors. During the portion of the reporting period in which Allspring Global Investments (“Allspring”) was a Fund sub-adviser, the manager modestly outperformed the benchmark due to its low-beta exposure (beta is a quantitative measure of the volatility relative to a benchmark) and strong stock selection in the information technology, healthcare, and financials sectors. |

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

|

| Line Graph [Table Text Block] |

| Global Managed Volatility Fund, Class A Shares - $234911 | MSCI ACWI ex USA Index (NR) (USD) - $207318 | MSCI World Index (Net) (USD) - $290655 | MSCI World Minimum Volatility Index (Net) (USD) - $214609 |

|---|

Jan/16 | $100000 | $100000 | $100000 | $100000 |

|---|

May/16 | $107800 | $107857 | $108273 | $108755 |

|---|

May/17 | $122350 | $127533 | $126055 | $119968 |

|---|

May/18 | $131415 | $139868 | $140637 | $126940 |

|---|

May/19 | $135538 | $131112 | $140229 | $138924 |

|---|

May/20 | $134069 | $126611 | $149758 | $143914 |

|---|

May/21 | $166147 | $180770 | $210598 | $168375 |

|---|

May/22 | $173207 | $158342 | $200456 | $166284 |

|---|

May/23 | $172137 | $156117 | $204608 | $164694 |

|---|

May/24 | $199406 | $182256 | $255596 | $183107 |

|---|

May/25 | $234911 | $207318 | $290655 | $214609 |

|---|

|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year | 5 Years | Annualized

Since

Inception |

|---|

Global Managed Volatility Fund, Class A Shares | 17.81% | 11.87% | 9.57% |

|---|

MSCI ACWI ex USA Index (NR) (USD) | 13.75% | 10.37% | 8.12% |

|---|

MSCI World Index (Net) (USD) | 13.72% | 14.18% | 12.11% |

|---|

MSCI World Minimum Volatility Index (Net) (USD) | 17.20% | 8.32% | 8.52% |

|---|

|

|

| Performance Inception Date |

Jan. 29, 2016

|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares.

|

|

| AssetsNet |

$ 2,090,473,000

|

|

| Holdings Count | Holding |

577

|

|

| Advisory Fees Paid, Amount |

$ 4,330

|

|

| InvestmentCompanyPortfolioTurnover |

102.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of May 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $2,090,473 | 577 | $4,330 | 102% |

|---|

|

|

| Holdings [Text Block] |

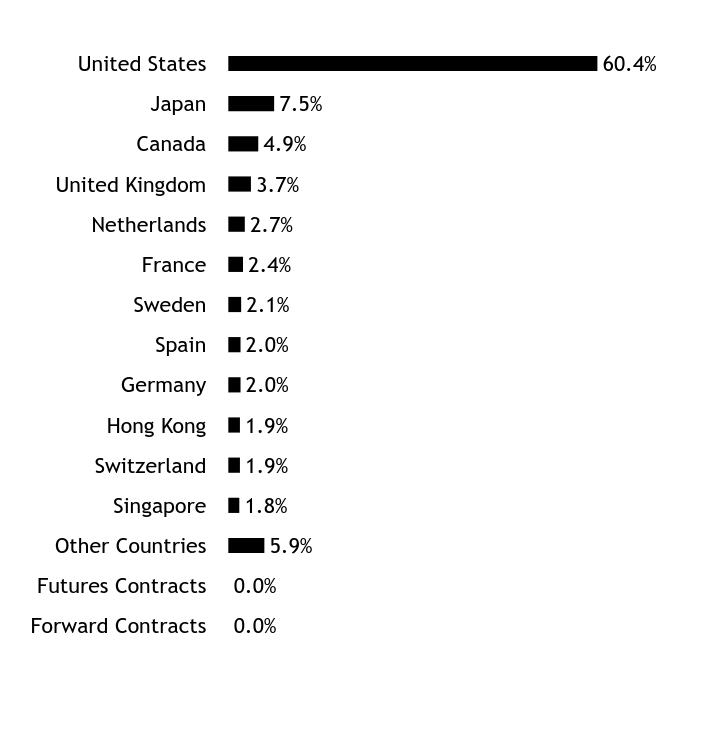

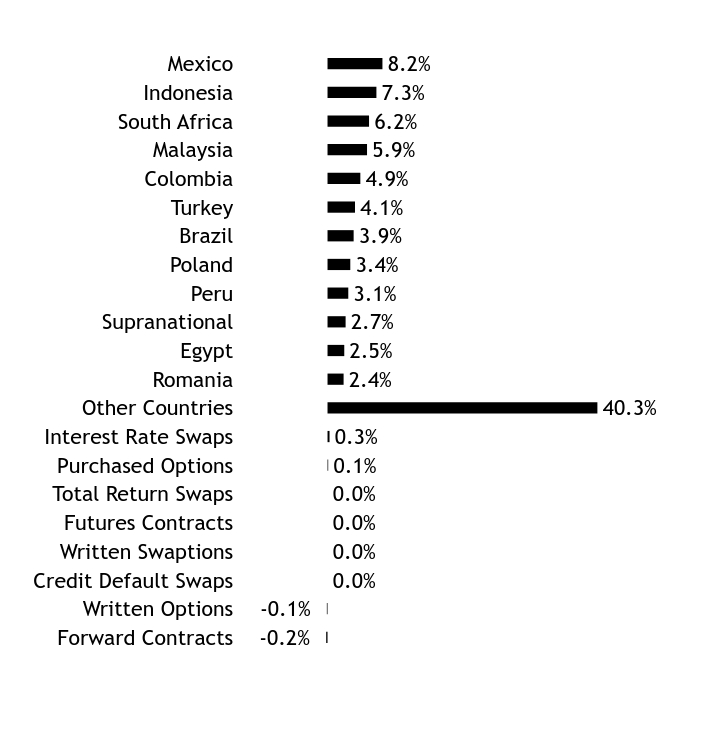

Asset/Country WeightingsFootnote Reference*Value | Value |

|---|

Forward Contracts | 0.0% | Futures Contracts | 0.0% | Other Countries | 5.9% | Singapore | 1.8% | Switzerland | 1.9% | Hong Kong | 1.9% | Germany | 2.0% | Spain | 2.0% | Sweden | 2.1% | France | 2.4% | Netherlands | 2.7% | United Kingdom | 3.7% | Canada | 4.9% | Japan | 7.5% | United States | 60.4% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

Cisco Systems Inc | | | 1.8% | AT&T Inc | | | 1.7% | Verizon Communications Inc | | | 1.7% | Johnson & Johnson | | | 1.3% | Novartis AG | | | 1.3% | Endesa SA | | | 1.2% | Comcast Corp, Cl A | | | 1.2% | Koninklijke Ahold Delhaize NV | | | 1.1% | eBay Inc | | | 1.0% | Imperial Brands PLC | | | 1.0% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| Material Fund Change [Text Block] |

In early April 2025, Allspring was terminated as a Fund sub-adviser as the firm discontinued its alternative equity strategies. The assets were reallocated to the Fund’s existing sub-advisers, Acadian Asset Management LLC and LSV Asset Management. |

|

| C000018354 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

World Equity Ex-US Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

WEUSX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Class A Shares of the World Equity Ex-US Fund (the "Fund") for the period from June 1, 2024 to May 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 1-800-DIAL-SEI. This annual shareholder report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-DIAL-SEI

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

World Equity Ex-US Fund, Class A Shares | $29 | 0.27% |

|---|

|

|

| Expenses Paid, Amount |

$ 29

|

|

| Expense Ratio, Percent |

0.27%

|

|

| Factors Affecting Performance [Text Block] |

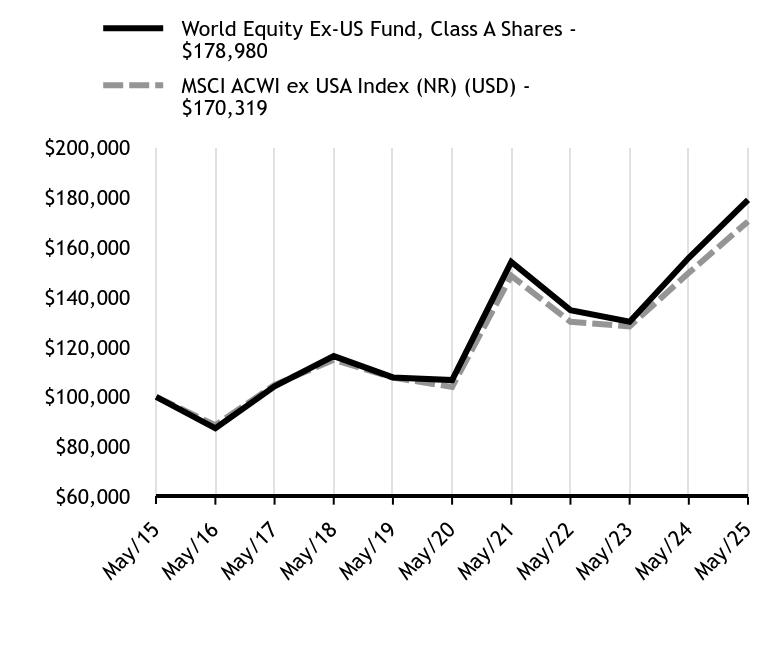

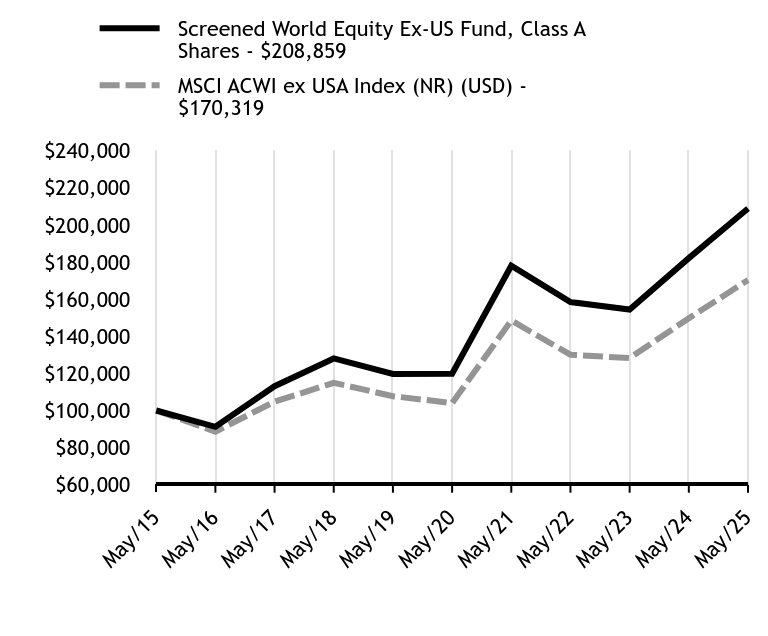

How did the Fund perform in the last year?The Fund outperformed its benchmark, the MSCI ACWI ex USA Index (NR) (USD)—which tracks the performance of both developed-market and emerging market countries, excluding the United States—for the 12-month period ending May 31, 2025. Alpha source exposures (the investment approach that an active investment manager takes in an effort to generate excess returns relative to a benchmark) contributed positively to Fund performance, particularly value and momentum, as both factors performed well despite the broader underperformance of quality stocks. Four out of the Fund’s five sub-advisers outperformed the benchmark MSCI ACWI ex USA Index (NR) (USD) for the reporting period. Lazard Asset Management LLC's (Lazard) 130/30 Momentum strategy benefited from a favorable momentum environment and effective short positioning. Notably, Lazard is the only Fund manager utilizing derivatives, which comprise approximately 50% of its 160% gross exposure. Acadian Asset Management LLC's outperformance was attributable to strong returns from value and momentum exposures. Pzena Investment Management, LLC, a deep value manager, outperformed due primarily to its allocation to European banks. Lazard’s International Quality Growth strategy also outperformed despite the headwinds faced by quality factors overall. Strong stock selection in the technology sector and in numerous equity markets globally contributed significantly to performance. The performance of Brickwood Asset Management LLP (Brickwood), the Fund’s second value manager, lagged the benchmark over the reporting period, attributable to positions in the consumer discretionary and industrials sectors. Finally, Delaware Investments Fund Advisers, a series of Macquarie Investment Management Business Trust underperformed. As a quality manager with a low-volatility bias, both of its core factors lagged in the strong market environment consistent with our expectations. Stock selection, especially in consumer-focused apparel names, weighed further on performance. |

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

|

| Line Graph [Table Text Block] |

| World Equity Ex-US Fund, Class A Shares - $178980 | MSCI ACWI ex USA Index (NR) (USD) - $170319 |

|---|

May/15 | $100000 | $100000 |

|---|

May/16 | $87398 | $88608 |

|---|

May/17 | $104253 | $104772 |

|---|

May/18 | $116346 | $114906 |

|---|

May/19 | $107802 | $107713 |

|---|

May/20 | $106724 | $104015 |

|---|

May/21 | $154088 | $148508 |

|---|

May/22 | $134779 | $130083 |

|---|

May/23 | $130104 | $128255 |

|---|

May/24 | $155749 | $149729 |

|---|

May/25 | $178980 | $170319 |

|---|

|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year | 5 Years | 10 Years |

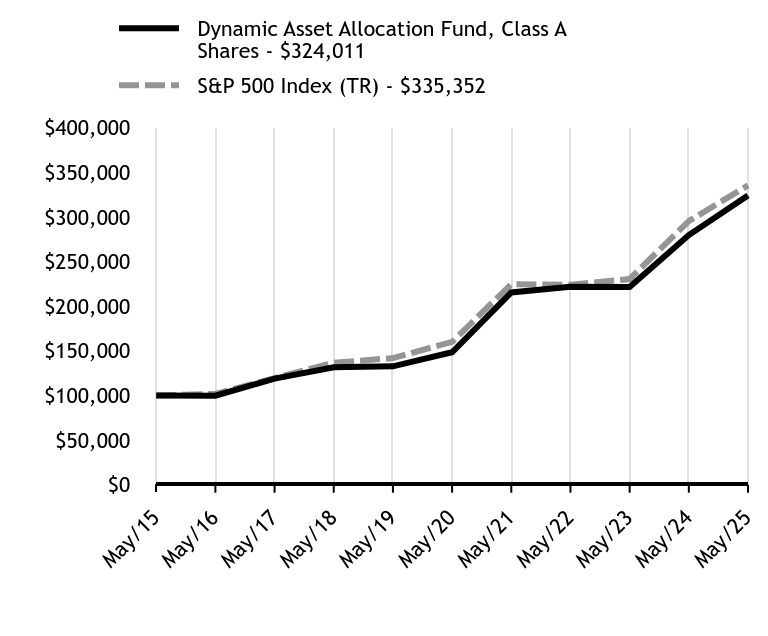

|---|