|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$62

|

1.24%

|

|

|

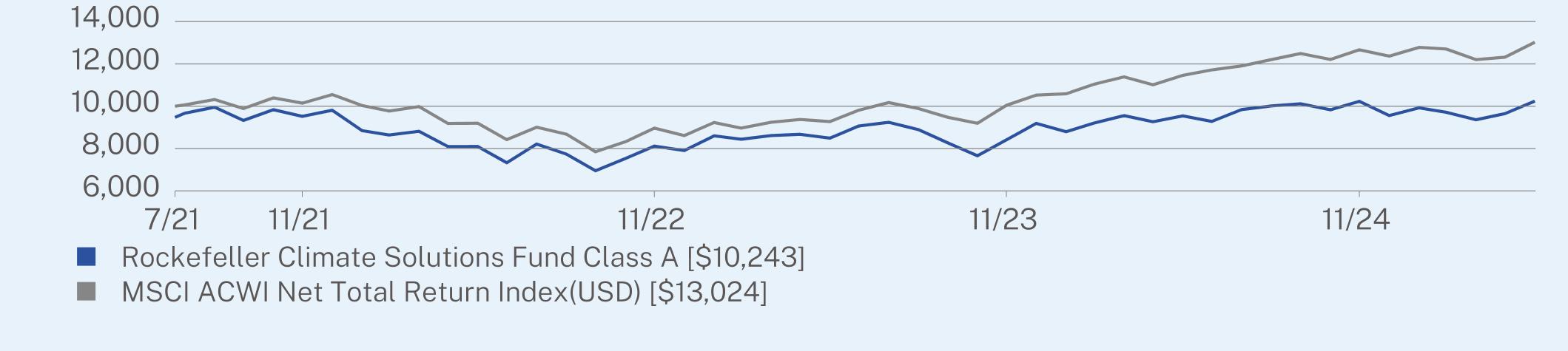

1 Year

|

Since Inception

(07/21/2021) |

|

Class A (without sales charge)

|

7.33

|

2.04

|

|

Class A (with sales charge)

|

1.70

|

0.62

|

|

MSCI ACWI Net Total Return Index (USD)

|

13.65

|

7.08

|

|

Net Assets

|

$87,032,067

|

|

Number of Holdings

|

47

|

|

Portfolio Turnover

|

14%

|

|

Top 10 Issuers

|

(%)

|

|

StoneX Group, Inc.

|

4.4%

|

|

Mueller Industries, Inc.

|

3.9%

|

|

Schneider Electric SE

|

3.6%

|

|

Chubb Ltd.

|

3.5%

|

|

Bureau Veritas SA

|

3.4%

|

|

Limbach Holdings, Inc.

|

3.3%

|

|

Badger Meter, Inc.

|

3.2%

|

|

Cie de Saint-Gobain

|

3.1%

|

|

Trimble, Inc.

|

2.9%

|

|

Veralto Corp.

|

2.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Institutional Class

|

$49

|

0.99%

|

|

|

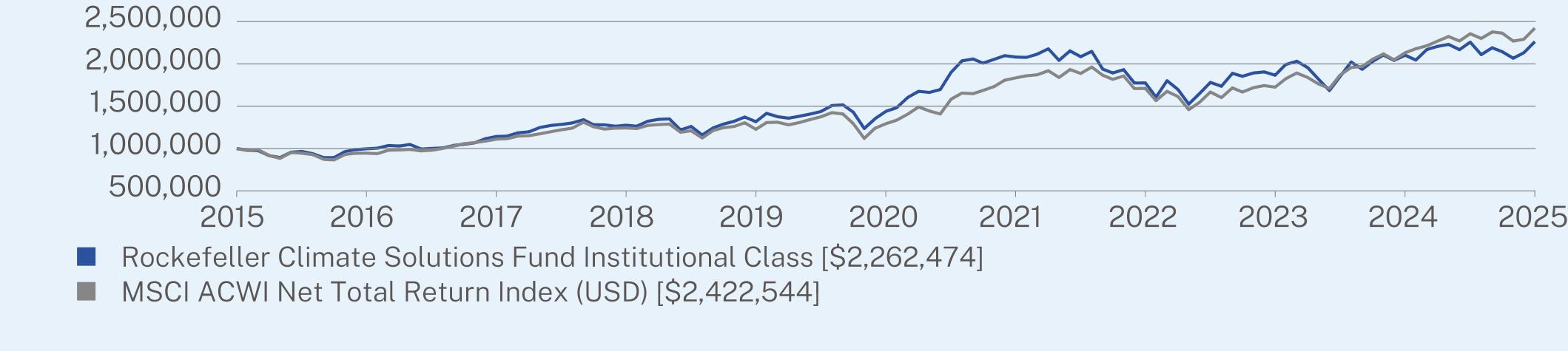

1 Year

|

5 Year

|

10 Year**

|

|

Insitutional Class

|

7.60

|

9.46

|

8.51

|

|

MSCI ACWI Net Total Return Index (USD)

|

13.65

|

13.37

|

9.25

|

|

Net Assets

|

$87,032,067

|

|

Number of Holdings

|

47

|

|

Portfolio Turnover

|

14%

|

|

Top 10 Issuers

|

(%)

|

|

StoneX Group, Inc.

|

4.4%

|

|

Mueller Industries, Inc.

|

3.9%

|

|

Schneider Electric SE

|

3.6%

|

|

Chubb Ltd.

|

3.5%

|

|

Bureau Veritas SA

|

3.4%

|

|

Limbach Holdings, Inc.

|

3.3%

|

|

Badger Meter, Inc.

|

3.2%

|

|

Cie de Saint-Gobain

|

3.1%

|

|

Trimble, Inc.

|

2.9%

|

|

Veralto Corp.

|

2.9%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$62

|

1.30%

|

|

|

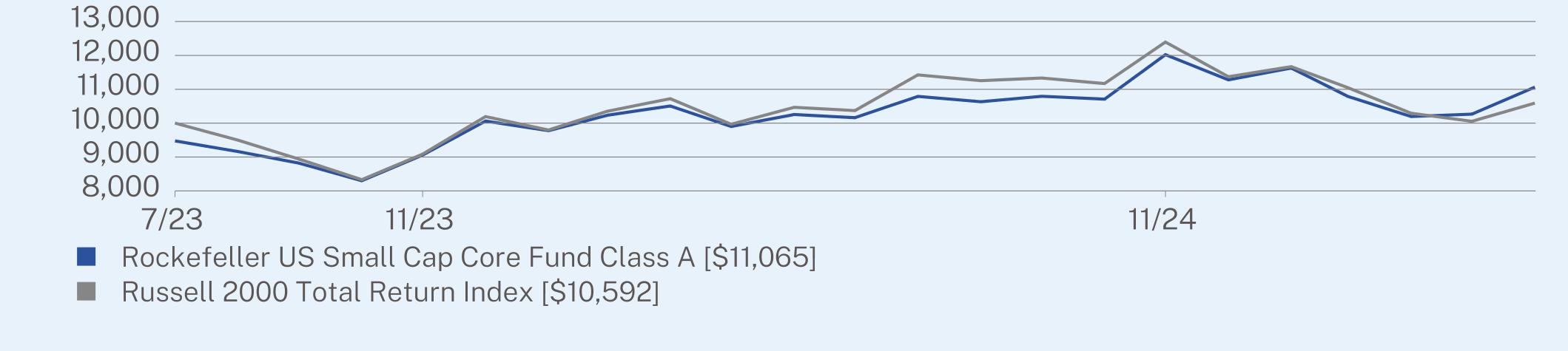

1 Year

|

Since Inception

(07/31/2023) |

|

Class A (without sales charge)

|

7.95

|

8.83

|

|

Class A (with sales charge)

|

2.28

|

5.68

|

|

Russell 2000 Total Return Index

|

1.19

|

3.18

|

|

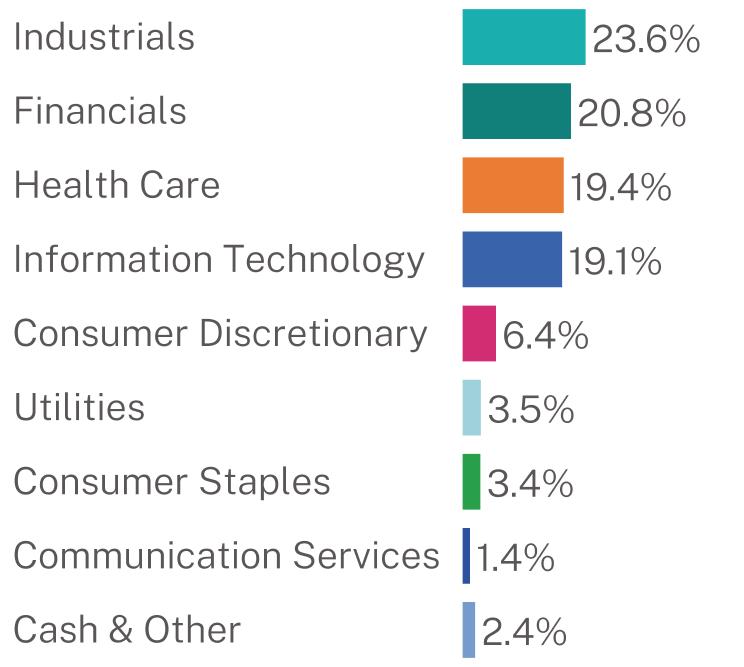

Net Assets

|

$102,608,236

|

|

Number of Holdings

|

42

|

|

Portfolio Turnover

|

40%

|

|

Top 10 Issuers

|

(%)

|

|

Korn Ferry

|

4.3%

|

|

StoneX Group, Inc.

|

4.2%

|

|

Stride, Inc.

|

3.9%

|

|

ONE Gas, Inc.

|

3.5%

|

|

SunOpta, Inc.

|

3.4%

|

|

RadNet, Inc.

|

3.2%

|

|

Limbach Holdings, Inc.

|

3.1%

|

|

LeMaitre Vascular, Inc.

|

3.0%

|

|

ESCO Technologies, Inc.

|

3.0%

|

|

Agilysys, Inc.

|

2.8%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class I

|

$50

|

1.05%

|

|

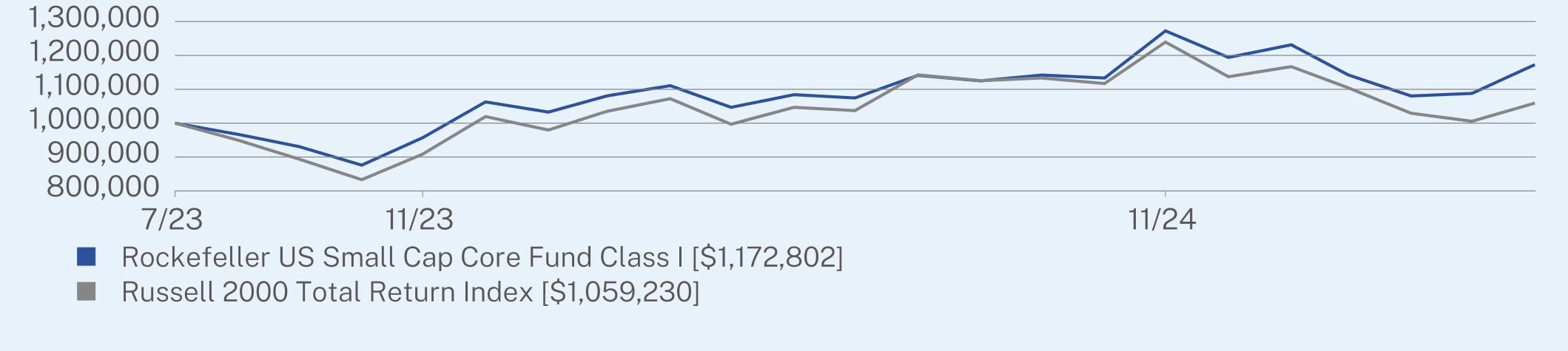

|

1 Year

|

Since Inception

(07/31/2023) |

|

Class I

|

8.25

|

9.09

|

|

Russell 2000 Total Return Index

|

1.19

|

3.18

|

|

Net Assets

|

$102,608,236

|

|

Number of Holdings

|

42

|

|

Portfolio Turnover

|

40%

|

|

Top 10 Issuers

|

(%)

|

|

Korn Ferry

|

4.3%

|

|

StoneX Group, Inc.

|

4.2%

|

|

Stride, Inc.

|

3.9%

|

|

ONE Gas, Inc.

|

3.5%

|

|

SunOpta, Inc.

|

3.4%

|

|

RadNet, Inc.

|

3.2%

|

|

Limbach Holdings, Inc.

|

3.1%

|

|

LeMaitre Vascular, Inc.

|

3.0%

|

|

ESCO Technologies, Inc.

|

3.0%

|

|

Agilysys, Inc.

|

2.8%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|