Exhibit 99.1

News Release |

|

Resolute Holdings Reports Second Quarter 2025 Results

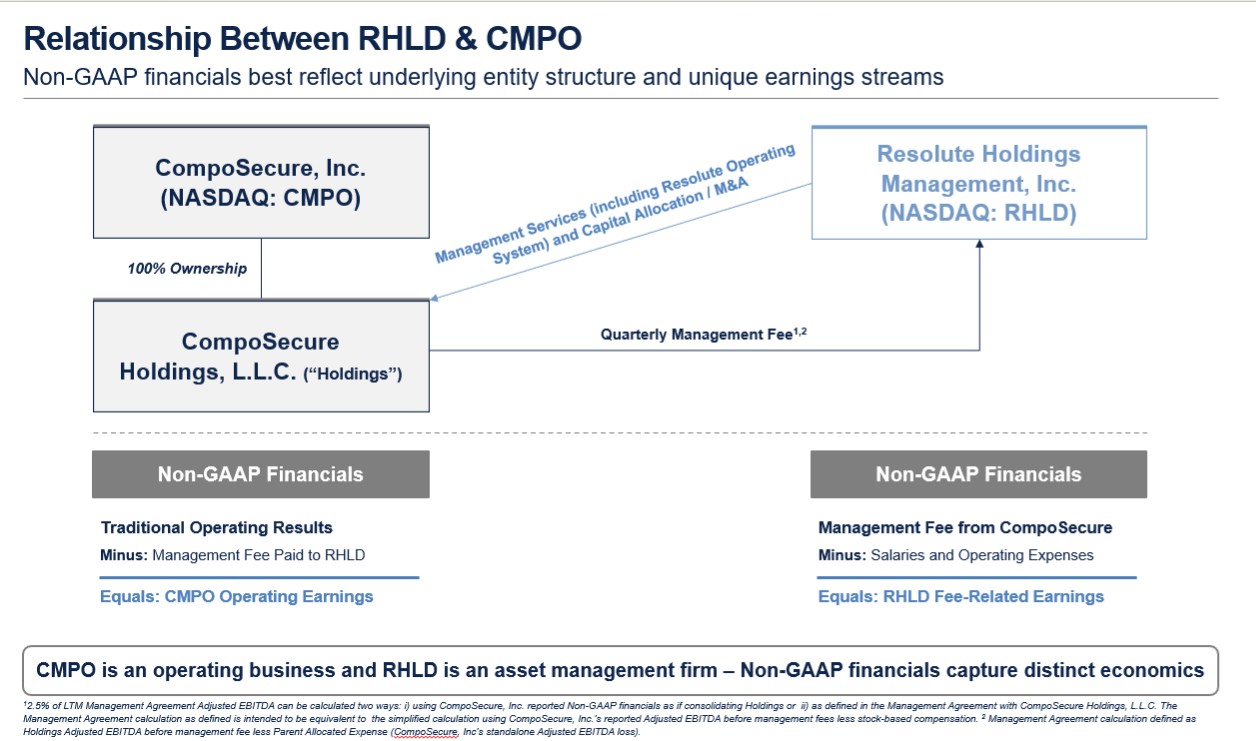

NEW YORK, NY, August 7, 2025 (GLOBE NEWSWIRE) – Resolute Holdings Management, Inc. (“Resolute Holdings”) (Nasdaq: RHLD), an operating management company responsible for providing management services to CompoSecure Holdings, L.L.C. (“CompoSecure Holdings”), a wholly owned subsidiary of CompoSecure, Inc. (“CompoSecure”) (Nasdaq: CMPO), today reported financial results for its fiscal second quarter ending June 30, 2025. Resolute Holdings reported second quarter earnings per share attributable to common stockholders of ($0.07) and Non-GAAP Fee-Related Earnings per share of $0.08.

“I am pleased with our performance in the second quarter. We are seeing strong early results from the implementation of the operating system at CompoSecure, and our activity levels evaluating new acquisition opportunities remain high. Our platform combines proven operating capabilities with a permanent capital base, which we believe positions us as a differentiated buyer and long-term owner of market leading businesses. We reiterate our expectation for limited profitability for the full year” said Tom Knott, Resolute Holdings’ Chief Executive Officer.

Dave Cote, Resolute Holdings’ Executive Chairman added “I remain pleased with the progress we are making to improve operations, drive organic growth, and build a high-performance culture at CompoSecure. While still early in the process, I believe the second quarter’s performance is a good indicator of what’s possible. We are committed to making the necessary investments in the business to ensure it can reach its full potential over time. Beyond the specific operating system work at CompoSecure, Tom and I remain focused diligently evaluating the growing list of acquisition opportunities we are seeing against our core investment criteria.”

As a result of the spin-off from CompoSecure and execution of the Management Agreement with CompoSecure Holdings, Resolute Holdings is required to consolidate the financial results of CompoSecure Holdings in accordance with U.S. GAAP. This presentation of financial results does not represent the underlying economics or the positive attributes of Resolute Holdings’ standalone business model, which consist of recurring, long-duration management fees and a relatively fixed expense base. The results of the Resolute Holdings standalone business and associated Non-GAAP Fee-Related Earnings calculation are included below to provide a clear picture of the economic performance of the business directly attributable to shareholders of RHLD. This release includes such results presented in accordance with U.S. GAAP, as well as certain Non-GAAP measures, including Fee-Related Earnings. See “Use of Non-GAAP Financial Measures” below.

Resolute Holdings Segment Financial Information (GAAP); Fee-Related Earnings and Fee-Related Earnings Per Share (Non-GAAP) ($ in thousands except per share figures)

| | Three months | | | Six months | |

| | ended | | | ended | |

| | June 30, 2025 | | | June 30, 2025 | |

Management fees | | $ | 3,419 | | | 4,548 |

Selling, general and administrative expenses | | | 3,804 | | | 7,730 |

Income from operations | | | (385) | | | (3,182) |

Total other income (expense) | | | 73 | | | 72 |

Income (loss) before income taxes | | | (312) | | | (3,110) |

Income tax (expense) | | | (299) | | | (867) |

Net income (loss) | | | (611) | | | (3,977) |

Net income (loss) attributable to non-controlling interest | | | — | | | — |

Net income (loss) attributable to common stockholders | | | (611) | | | (3,977) |

Net income (loss) per share attributable to common stockholders - diluted | | $ | (0.07) | | | (0.47) |

| | | | | | |

Adjustments to reconcile Fee-Related Earnings to net income (loss) attributable to common stockholders: | | | | | | |

Add: Equity-based compensation at CompoSecure (1) | | | 1,310 | | | 2,458 |

Add: Pro forma management fees from Jan 1, 2025 to Feb 27, 2025 (2) | | | — | | | 2,046 |

Add: Spin-Off costs (3) | | | — | | | 290 |

Net tax impact of adjustments (4) | | | — | | | (724) |

Fee-Related Earnings | | | 699 | | | 93 |

Fee-Related Earnings per share - diluted | | $ | 0.08 | | | 0.01 |

| (1) | Equity-based compensation required to be reported by Resolute Holdings related to awards issued under the CompoSecure Equity Plan. Equity granted under the CompoSecure Equity Plan relates to CompoSecure Class A common stock and has no impact on Resolute Holdings’ common stock outstanding. |

| (2) | Incremental management fees as if the CompoSecure Management Agreement was executed on January 1, 2025. |

| (3) | One-time costs associated with the Spin-Off from CompoSecure. |

| (4) | Tax-effect of adjustments at a 31% effective tax rate. Only applied to those adjustments that would impact Resolute Holdings’ taxes. Equity-based compensation expense under the CompoSecure Equity Plan is expensed for tax purposes at CompoSecure and not Resolute Holdings. |

1