Demand for U.S. industrial space largely remained resilient in the face of higher tariffs and increased economic uncertainty. Overall net absorption exceeded expectations with a total of 29.6 million square feet (“MSF”) in Q2 2025, on par with the 30.3 MSF registered in the first quarter. While growth has moderated, absorption remains steady and continues to show variation across markets, building sizes, and building classes. 13 markets reported more than 1 MSF of positive absorption for the quarter, led by Dallas/Ft. Worth (+6.8 MSF), Houston (+3.4 MSF), and Greenville (+2.7 MSF). New leasing activity finished the first half of the year with almost 309 MSF of deals, marginally outpacing last year’s midyear total of 307.9 MSF. Lease decisions are delayed 3–12 months in two-thirds of markets, but this may lead to pent-up demand once trade uncertainty eases. The overall vacancy rate continued to edge upwards, increasing by 20 basis points (bps) in the second quarter. However, vacancy remains just 10 bps higher than the long-term 15-year pre-pandemic historical average. The South and the Midwest regions saw their vacancy rates hold relatively firm quarter-over-quarter (QOQ), ticking higher by just 10 bps. Small warehouses under 100,000 SF remain especially tight with a 4.4% vacancy rate. New completions fell to just 71.5 MSF, the lowest point since Q1 2019 (68.6 MSF) amid the shrinking under-construction pipeline. The pipeline has dissipated to its lowest level (268.6 MSF) since the close of 2017 and should continue to shrink throughout increased economic uncertainty, higher borrowing costs, and elevated vacancy rates. Annual average asking rent growth decelerated to 2.6% in Q2. Rent growth is expected to decelerate, dipping below 2% by late 2025. As market conditions improve and supply and demand rebalance in late 2026, rent growth is projected to rebound toward the historical 3–4% range. Meanwhile, warehouse and logistics pricing continue to reflect size-based segmentation, with smaller product commanding a 31% premium over spaces greater than 100,000 SF. A potential surge of manufacturing activity, due to onshoring, could also help spur leasing and build-to-suit construction. Also, as trade agreements are reached, industrial leasing is predicted to increase as some large corporate occupiers re-enter the marketplace and long- term decision making accelerates. - Sector commentary & data sourced from Cushman & Wakefield U.S. National Industrial Q2 2025 Marketbeat Q2 2025 Quarterly Operations Summary INVESTMENT DASHBOARD TOTAL REVENUE* Q2 Actual** $9.4MM Trailing 12 Months** $20.7MM Q2 Gain On Sale $1.2MM OCCUPANCY Q2 In-Service*** 100% LEASING ACTIVITY Q2 Actual No Leasing/ 100% Occupied ACQUISITIONS Closed one acquisition totaling $25.5MM adding 243,984 SF of Class A industrial product to the SIP IV portfolio. Crosstown Logistics Center located in St. Louis, closed on 06/30/25. Built in 2022 and 100% leased to a diversified mix of regional and national tenants, the asset is one of the few modern industrial offerings in a submarket where developable industrial land is virtually nonexistent. Sealy Industrial Partners lV, L.P. A Sealy & Company sponsored investment. Broker-Dealer Inquiries: Sealy Investment Securities, LLC 888.SEALY90 or 888.732.5990 SalesSupport@SealyInvestmentSecurities.com EVENTS & ANNOUNCEMENTS Distributions The general partner declared and completed the regular quarterly distribution for the second quarter of 2025, marking the 12th consecutive regular quarterly distribution by Sealy Industrial Partners IV, L.P. (“SIP IV” or “the Partnership”) since inception. Capital SIP IV continued to see success in the market. From inception through the end of Q2 2025, $384MM of capital has been raised for SIP IV including $7.6 million from the distribution reinvestment plan. Dispositions Closed the sale of the fully leased 55,500 SF industrial building in the Lake Charles, LA market which was leased to two regional oil and gas tenants. The property was sold for $8.25MM at a 6.72% exit cap rate in June 2025. Net proceeds of $7.9MM were successfully recycled via 1031 exchange into the recent SIP IV acquisition of Crosstown Logistics Center in St. Louis, MO. The disposition resulted in an unlevered internal rate of return of 8.6% and unlevered equity multiple of 1.24x, or roughly $1.2MM in gain on sale. Pipeline The Sponsor evaluated 56 pipeline opportunities totaling 11.5MM SF with an underwritten value of just under $1.6B in Q2 of 2025. Financing The general partner and KeyBank agreed to extend the current $100MM Credit Facility to the end of September 2026 from the original maturity of September 2025. Management Committee Update In light of the unfortunate passing of Management Committee member Mr. John Dienes, Mr. George Kirchwey has been appointed to the Committee effective immediately to uphold our commitment to strong governance and strategic leadership. INDUSTRIAL MARKET FUNDAMENTALS REMAIN REASONABLY HEALTHY * Unaudited ** Excludes gain on sale of real estate assets *** A property is in service unless: (i) occupancy is be- low 75% at acquisition or expected within two years, or (ii) redevelopment costs exceed 20% of acqui- sition cost within 24 months. It returns to service at 90% occupancy or 12 months after move-out. Investor Inquiries: For more information on Sealy Industrial Partners IV, please contact your financial professional. Sealy Investment Securities, LLC is the managing broker-dealer of Sealy & Company sponsored offerings and a member of FINRA and SIPC. Exhibit 99.1

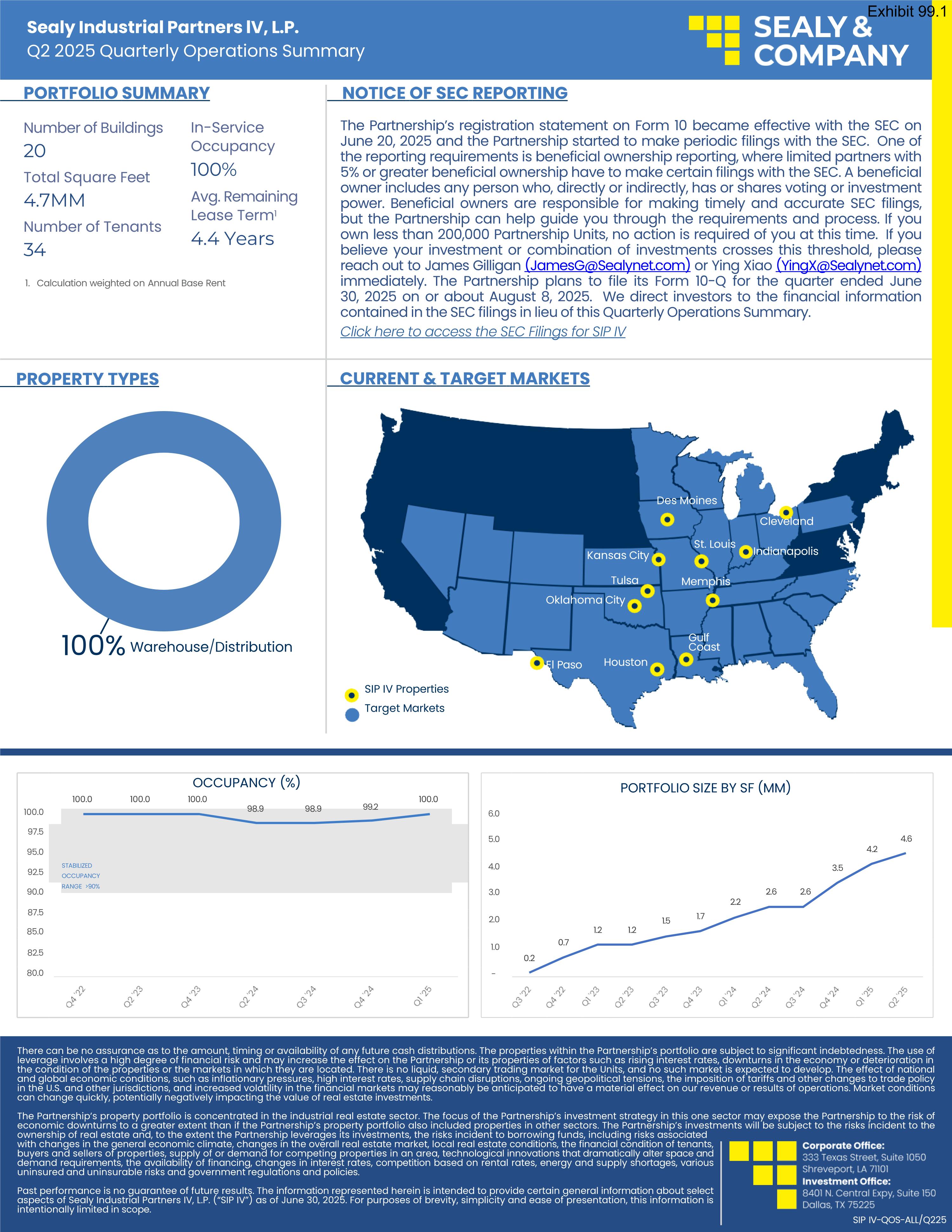

Sealy Industrial Partners lV, L.P. Q2 2025 Quarterly Operations Summary Number of Buildings 20 Total Square Feet 4.7MM Number of Tenants 34 In-Service Occupancy 100% Avg. Remaining Lease Term1 4.4 Years PORTFOLIO SUMMARY 100% Warehouse/Distribution PROPERTY TYPES 100.0 OCCUPANCY (%) 100.0 100.0 100.0 100.0 98.9 98.9 99.2 6.0 PORTFOLIO SIZE BY SF (MM) 97.5 5.0 4.6 95.0 4.2 92.5 STABILIZED OCCUPANCY 4.0 3.5 90.0 RANGE >90% 3.0 2.6 2.6 2.2 87.5 2.0 1.5 1.7 85.0 1.2 1.2 82.5 1.0 0.2 0.7 80.0 - 1. Calculation weighted on Annual Base Rent CURRENT & TARGET MARKETS SIP IV Properties Target Markets Gulf Coast Memphis Kansas City Tulsa Oklahoma City Houston Des Moines Cleveland St. Louis NOTICE OF SEC REPORTING The Partnership’s registration statement on Form 10 became effective with the SEC on June 20, 2025 and the Partnership started to make periodic filings with the SEC. One of the reporting requirements is beneficial ownership reporting, where limited partners with 5% or greater beneficial ownership have to make certain filings with the SEC. A beneficial owner includes any person who, directly or indirectly, has or shares voting or investment power. Beneficial owners are responsible for making timely and accurate SEC filings, but the Partnership can help guide you through the requirements and process. If you own less than 200,000 Partnership Units, no action is required of you at this time. If you believe your investment or combination of investments crosses this threshold, please reach out to James Gilligan (JamesG@Sealynet.com) or Ying Xiao (YingX@Sealynet.com) immediately. The Partnership plans to file its Form 10-Q for the quarter ended June 30, 2025 on or about August 8, 2025. We direct investors to the financial information contained in the SEC filings in lieu of this Quarterly Operations Summary. Click here to access the SEC Filings for SIP IV Indianapolis El Paso There can be no assurance as to the amount, timing or availability of any future cash distributions. The properties within the Partnership’s portfolio are subject to significant indebtedness. The use of leverage involves a high degree of financial risk and may increase the effect on the Partnership or its properties of factors such as rising interest rates, downturns in the economy or deterioration in the condition of the properties or the markets in which they are located. There is no liquid, secondary trading market for the Units, and no such market is expected to develop. The effect of national and global economic conditions, such as inflationary pressures, high interest rates, supply chain disruptions, ongoing geopolitical tensions, the imposition of tariffs and other changes to trade policy in the U.S. and other jurisdictions, and increased volatility in the financial markets may reasonably be anticipated to have a material effect on our revenue or results of operations. Market conditions can change quickly, potentially negatively impacting the value of real estate investments. The Partnership’s property portfolio is concentrated in the industrial real estate sector. The focus of the Partnership’s investment strategy in this one sector may expose the Partnership to the risk of economic downturns to a greater extent than if the Partnership’s property portfolio also included properties in other sectors. The Partnership’s investments will be subject to the risks incident to the ownership of real estate and, to the extent the Partnership leverages its investments, the risks incident to borrowing funds, including risks associated with changes in the general economic climate, changes in the overall real estate market, local real estate conditions, the financial condition of tenants, buyers and sellers of properties, supply of or demand for competing properties in an area, technological innovations that dramatically alter space and demand requirements, the availability of financing, changes in interest rates, competition based on rental rates, energy and supply shortages, various uninsured and uninsurable risks and government regulations and policies. Past performance is no guarantee of future results. The information represented herein is intended to provide certain general information about select aspects of Sealy Industrial Partners IV, L.P. (“SIP IV”) as of June 30, 2025. For purposes of brevity, simplicity and ease of presentation, this information is intentionally limited in scope. SIP IV-QOS-ALL/Q225 Exhibit 99.1