|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

YCG Enhanced Fund

|

$59

|

1.17%

|

Notable contributors to performance over the six months ended May 31, 2025 were Hermßs, Republic Services, Microsoft, Mastercard, and Intuit.

Notable detractors to performance over the six months ended May 31, 2025 were Copart, Fair Isaac, Apple, L’Oréal, and MSCI.

|

|

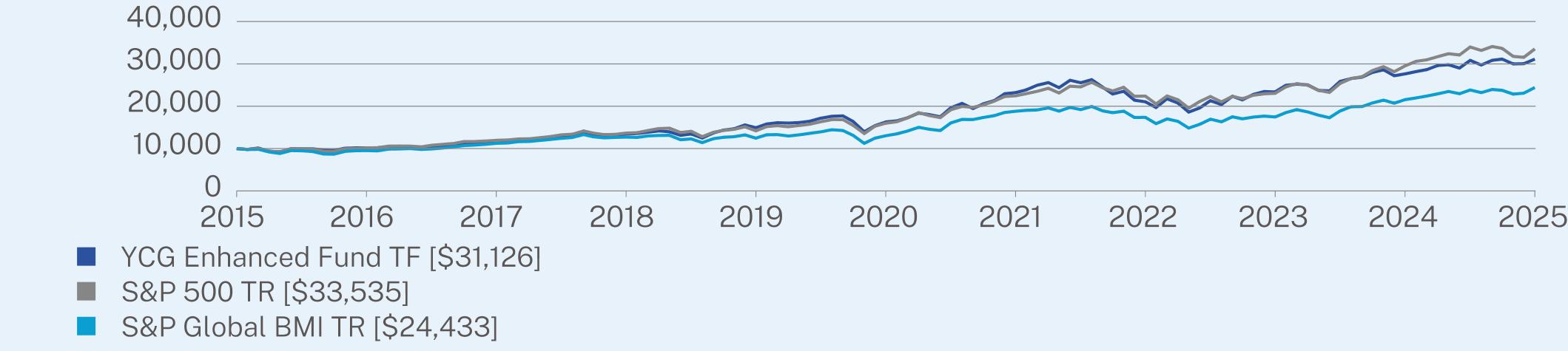

1 Year

|

5 Year

|

10 Year

|

|

TF (without sales charge)

|

12.56

|

13.82

|

12.02

|

|

S&P 500 TR

|

13.52

|

15.94

|

12.86

|

|

S&P Global BMI TR

|

13.32

|

13.37

|

9.34

|

|

Net Assets

|

$589,500,012

|

|

Number of Holdings

|

66

|

|

Portfolio Turnover Rate

|

4%

|

|

Top Sectors

|

(%)**

|

|

Financials

|

33.1%

|

|

Industrials

|

19.2%

|

|

Information Technology

|

17.6%

|

|

Consumer Discretionary

|

12.7%

|

|

Real Estate

|

4.4%

|

|

Consumer Staples

|

2.5%

|

|

Communication Services

|

2.5%

|

|

Materials

|

1.6%

|

|

Cash & Other

|

6.4%

|

|

Top Holdings

|

(%)

|

|

Microsoft Corp.

|

7.6%

|

|

MasterCard, Inc. - Class A

|

6.8%

|

|

Moody’s Corp.

|

6.1%

|

|

Hermes International

|

5.3%

|

|

Amazon.com, Inc.

|

4.4%

|

|

Copart, Inc.

|

4.2%

|

|

Republic Services, Inc.

|

4.0%

|

|

MSCI, Inc.

|

4.0%

|

|

Waste Management, Inc.

|

4.0%

|

|

Marsh & McLennan Cos, Inc.

|

3.9%

|

|

Top Ten Countries

|

(%)

|

|

United States

|

80.5%

|

|

France

|

6.4%

|

|

Ireland

|

4.3%

|

|

Canada

|

4.1%

|

|

Netherlands

|

1.9%

|

|

Cash & Other

|

2.8%

|

| [1] |

|

||

| [2] |

|