8. Commitments and Contingencies

Legal Claims

The Company may be subject to legal claims and actions from time to time as part of its business activities. As of June 30, 2025 and December 31, 2024, the Company was not subject to any threatened or pending lawsuits, legal claims or legal proceedings.

Principal Commitments

Clinical Trial Agreements

At June 30, 2025, the Company’s remaining financial contractual commitments pursuant to clinical trial agreements and clinical trial monitoring agreements not yet incurred, as described below, aggregated $524,000, including clinical trial agreements of $293,000 and clinical trial monitoring agreements of $231,000, which, based on current estimates, are currently scheduled to be incurred through approximately December 31, 2027. The Company’s ability to conduct and fund these contractual commitments is subject to the timely availability of sufficient capital to fund such expenditures, as well as any changes in the allocation or reallocation of such funds to the Company’s current or future clinical trial programs. The Company expects that the full amount of these expenditures will be incurred only if such clinical trial programs are conducted as originally designed and their respective enrollments and duration are not modified or reduced. Clinical trial programs, such as the types that the Company is engaged in, can be highly variable and can frequently involve a series of changes and modifications over time as clinical data is obtained and analyzed, and is frequently modified, suspended or terminated, in part based on receipt or lack of receipt of an indication of clinical benefit or activity, before the clinical trial endpoint is reached. Accordingly, such contractual commitments as discussed herein should be considered as estimates only based on current clinical assumptions and conditions and are typically subject to significant modifications and revisions over time.

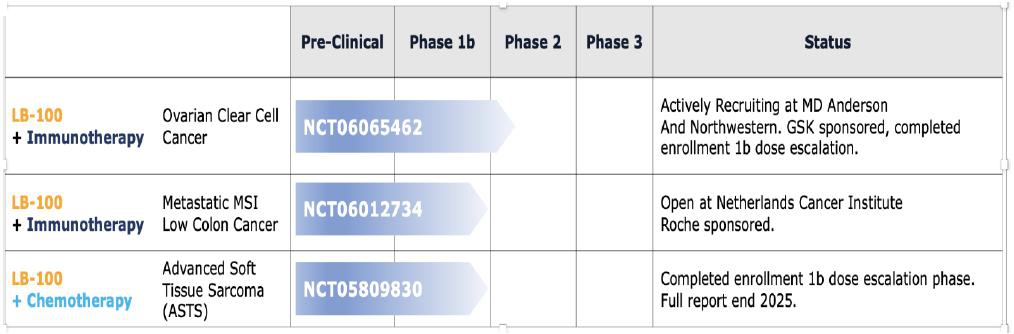

The following is a summary of the Company’s ongoing active contractual clinical trials described below as of June 30, 2025:

| Description of Clinical Trial | Institution | Start Date | Projected End Date | Planned Number of Patients in Trial | Study Objective | Clinical Update | Expected Date of Preliminary Efficacy Signal | NCT No. | Remaining Financial Contractual Commitment | |||||||||||||||||||||||||||

| LB-100 combined with dostarlimab in ovarian clear cell carcinoma (Phase 1b/2) | MD Anderson | January 2024 | December 2027 | 21 | Determine the OS of patients with recurrent ovarian clear cell carcinoma | 16 patients entered | December 2026 | NCT06065462 | $ | -0- (1 ) | ||||||||||||||||||||||||||

| LB-100 combined with atezolizumab in microsatellite stable metastatic colorectal cancer (Phase 1b) | Netherlands Cancer Institute (NKI) | August 2024 | December 2026 | 37 | Determine RP2D with atezolizumab | First patient entered August 2024, in total two patients entered | June 2026 | NCT06012734 | -0- (1 ) | |||||||||||||||||||||||||||

| LB-100 combined with doxorubicin in advanced soft tissue sarcoma (Phase 1b) | GEIS | June 2023 | Recruitment completed September 2024 | 14 | Determine MTD and RP2D | Fourteen patients entered | December 2025 | NCT05809830 | 293,000 | |||||||||||||||||||||||||||

| Total | $ | 293,000 | ||||||||||||||||||||||||||||||||||

| (1) | The Company has no financial contractual commitments associated with these clinical trials at June 30, 2025. |

Netherlands Cancer Institute. Effective June 10, 2024, the Company entered into a Clinical Trial Agreement with the Netherlands Cancer Institute (“NKI”) (see Note 5) to conduct a Phase 1b clinical trial of the Company’s protein phosphatase inhibitor, LB-100, combined with atezolizumab, a PD-L1 inhibitor, the proprietary molecule of F. Hoffman-La Roche Ltd. (“Roche”), for patients with microsatellite stable metastatic colorectal cancer. Under the agreement, the Company will provide its lead compound, LB-100, and under a separate agreement between NKI and Roche, Roche will provide atezolizumab and financial support for the clinical trial. The Company has no obligation to and will not provide any reimbursement of clinical trial costs. Pursuant to the agreement and the protocol set forth in the agreement, the clinical trial will be conducted by NKI at NKI’s site in Amsterdam by principal investigator Neeltje Steeghs, MD, PhD, and NKI will be responsible for the recruitment of patients. The agreement provides for the protection of the respective intellectual property rights of each of the Company, NKI and Roche.

This Phase 1b clinical trial will evaluate safety, optimal dose and preliminary efficacy of LB-100 combined with atezolizumab for the treatment of patients with metastatic microsatellite stable colorectal cancer. Immunotherapy using monoclonal antibodies like atezolizumab can enhance the body’s immune response against cancer and hinder tumor growth and spread. LB-100 has been found to improve the effectiveness of anticancer drugs in killing cancer cells by inhibiting a protein called PP2A on cell surfaces. Blocking PP2A increases stress signals in tumor cells expressing the PP2A protein. Accordingly, combining atezolizumab with LB-100 may enhance treatment efficacy for metastatic colorectal cancer, as cancer cells with heightened stress signals are more vulnerable to immunotherapy.

This study comprises a dose escalation phase and a dose expansion phase. The objective of the dose escalation phase is to determine the recommended Phase 2 dose (RP2D) of LB-100 when combined with the standard dosage of atezolizumab. The dose expansion phase will further investigate the preliminary efficacy, safety, tolerability, and pharmacokinetics/dynamics of the LB-100 and atezolizumab combination. The clinical trial opened in August 2024 with the enrollment of the first patient. A total of two patients have been enrolled to date. Patient accrual is expected to take up to 24 months, with a maximum of 37 patients with advanced colorectal cancer to be enrolled in this study.

The principal investigator of the colorectal study testing LB-100 in combination with atezolizumab is currently investigating two Serious Adverse Events (“SAEs”) observed in the clinical trial. The Investigational Review Board (IRB) of NKI has requested additional information with respect to these SAEs and the study has been paused for enrollment until the IRB’s questions have been satisfactorily addressed (see “Specific Risks Associated with the Company’s Business Activities - Serious Adverse Events” below for additional information).

The Company has no financial contractual commitment associated with this clinical trial.

City of Hope. Effective January 18, 2021, the Company executed a Clinical Research Support Agreement (the “Agreement”) with the City of Hope National Medical Center, an NCI-designated comprehensive cancer center, and City of Hope Medical Foundation (collectively, “City of Hope”), to carry out a Phase 1b clinical trial of LB-100, the Company’s first-in-class protein phosphatase inhibitor, combined with an FDA-approved standard regimen for treatment of untreated extensive-stage disease small cell lung cancer (“ED-SCLC”). LB-100 was given in combination with carboplatin, etoposide and atezolizumab, an FDA-approved standard of care regimen, to previously untreated ED-SCLC patients. The LB-100 dose was to be escalated with the standard fixed doses of the 3-drug regimen to reach a recommended Phase 2 dose (“RP2D”). Patient entry was to be expanded so that a total of 12 patients would be evaluable at the RP2D to determine the safety of the LB-100 combination and to look for potential therapeutic activity as assessed by objective response rate, duration of overall response, progression-free survival, and overall survival.

The clinical trial was initiated on March 9, 2021, with patient accrual expected to take approximately two years to complete. Because patient accrual was slower than expected, effective March 6, 2023, the Company and City of Hope added the Sarah Cannon Research Institute (“SCRI”), Nashville, Tennessee, to the ongoing Phase 1b clinical trial. The Company and City of Hope continued efforts to increase patient accrual by adding additional sites and by modifying the protocol to increase the number of patients eligible for the clinical trial. The impact of these efforts to increase patient accrual and to decrease time to completion was evaluated in subsequent quarters.

After evaluating patient accrual through June 30, 2024, the Company and City of Hope agreed to close the clinical trial. Pursuant to the terms of the Agreement, the Company provided notice to City of Hope of the Company’s intent to terminate the Agreement effective as of July 8, 2024. Upon closure, the Company incurred a prorated charge of $207,004 for the cost of patients enrolled to date, which is included in accounts payable and accrued expenses at June 30, 2025 and December 31, 2024.

During the three months ended June 30, 2025 and 2024, the Company incurred costs of $0 and $78,015, respectively, pursuant to this Agreement. During the six months ended June 30, 2025 and 2024, the Company incurred costs of $0 and $78,015, respectively, pursuant to this Agreement. As of June 30, 2025, total costs of $732,532 had been incurred pursuant to this Agreement.

GEIS. Effective July 31, 2019, the Company entered into a Collaboration Agreement for an Investigator-Initiated Clinical Trial with the Spanish Sarcoma Group (Grupo Español de Investigación en Sarcomas or “GEIS”), Madrid, Spain, to carry out a study entitled “Randomized phase I/II trial of LB-100 plus doxorubicin vs. doxorubicin alone in first line of advanced soft tissue sarcoma”. The purpose of this clinical trial is to obtain information with respect to the efficacy and safety of LB-100 combined with doxorubicin in soft tissue sarcomas. Doxorubicin is the global standard for initial treatment of advanced soft tissue sarcomas (“ASTS”). Doxorubicin alone has been the mainstay of first line treatment of ASTS for over 40 years, with little improvement in survival from adding cytotoxic compounds to or substituting other cytotoxic compounds for doxorubicin. In animal models, LB-100 has consistently enhanced the anti-tumor activity of doxorubicin without apparent increases in toxicity.

GEIS has a network of referral centers in Spain and across Europe that have an impressive track record of efficiently conducting innovative studies in ASTS. The Company agreed to provide GEIS with a supply of LB-100 to be utilized in the conduct of this clinical trial, as well as to provide funding for the clinical trial. The goal is to enter approximately 150 to 170 patients in this clinical trial over a period of two to four years. The Phase 1 portion of the study began in the quarter ended June 30, 2023 to determine the recommended Phase 2 dose of the combination of doxorubicin and LB-100. As advanced sarcoma is a very aggressive disease, the design of the Phase 2 portion of the study assumes a median progression-free survival (“PFS”), no evidence of disease progression or death from any cause, of 4.5 months in the doxorubicin arm and an alternative median PFS of 7.5 months in the doxorubicin plus LB-100 arm to demonstrate a statistically significant decrease in relative risk of progression or death by adding LB-100. There is a planned interim analysis of the primary endpoint when approximately 50% of the 102 events required for final analysis is reached.

The Company had previously expected that this clinical trial would commence during the quarter ended June 30, 2020. However, during July 2020, the Spanish regulatory authority advised the Company that although it had approved the scientific and ethical basis of the protocol, it required that the Company manufacture new inventory of LB-100 under current Spanish pharmaceutical manufacturing standards. These standards were adopted subsequent to the production of the Company’s existing LB-100 inventory.

In order to manufacture a new inventory supply of LB-100 for the GEIS clinical trial, the Company engaged a number of vendors to carry out the multiple tasks needed to make and gain approval of a new clinical product for investigational study in Spain. These tasks included the synthesis under good manufacturing practice (GMP) of the active pharmaceutical ingredient (API), with documentation of each of the steps involved by an independent auditor. The API was then transferred to a vendor that prepares the clinical drug product, also under GMP conditions documented by an independent auditor. The clinical drug product was then sent to a vendor to test for purity and sterility, provide appropriate labels, store the drug, and distribute the drug to the clinical centers for use in the clinical trials. A formal application documenting all steps taken to prepare the clinical drug product for clinical use was submitted to the appropriate regulatory authorities for review and approval before being used in a clinical trial.

As of June 30, 2025, this program to provide new inventory of the clinical drug product for the Spanish Sarcoma Group study, and potentially for subsequent multiple trials within the European Union, had cost approximately $1,144,000.

On October 13, 2022, the Company announced that the Spanish Agency for Medicines and Health Products (Agencia Española de Medicamentos y Productos Sanitarios or “AEMPS”) had authorized a Phase 1b/randomized Phase 2 study of LB-100, the Company’s lead clinical compound, plus doxorubicin, versus doxorubicin alone, the global standard for initial treatment of ASTS. Consequently, this clinical trial commenced during the quarter ended June 30, 2023 and is expected to be completed and a report prepared by December 31, 2026. In April 2023, GEIS completed its first site initiation visit in preparation for the clinical trial at Fundación Jiménez Díaz University Hospital (Madrid). Up to 170 patents will be entered into the clinical trial. The recruitment for the Phase 1b portion of the protocol was extended with two patients and was completed during the quarter ended September 30, 2024. The Company expects to have data on toxicity and preliminary efficacy from this portion of the clinical trial during the quarter ending December 31, 2025.

Given the focus on the combination of LB-100 with immunotherapy in ovarian clear cell carcinoma and colorectal cancer and the availability of capital resources, the Company entered into Amendment No. 1 to the Collaboration Agreement effective March 11, 2025 that relieved the Company of the financial obligation to support the randomized Phase 2 portion of the clinical trial contemplated in the Collaboration Agreement of approximately $3,095,000. As a result, it is uncertain as to whether the Phase 2 portion of this clinical trial will proceed.

The Company’s agreement with GEIS provided for various payments based on achieving specific milestones over the term of the agreement. During the three months ended June 30, 2025 and 2024, the Company did not incur any costs pursuant to this agreement. During the six months ended June 30, 2025 and 2024, the Company did not incur any costs pursuant to this agreement. Through June 30, 2025, the Company has incurred charges of $685,107 for work done under this agreement through the fourth milestone.

The Company’s aggregate commitment pursuant to this agreement, less amounts previously paid to date, totaled approximately $293,000 for the Phase 1b portion of this clinical trial as of June 30, 2025, which is scheduled to be incurred through December 31, 2025. As the work is being conducted in Europe and is paid for in Euros, final costs are subject to foreign currency fluctuations between the United States Dollar and the Euro. Such fluctuations are recorded in the consolidated statements of operations as foreign currency gain or loss, as appropriate, and have not been significant.

MD Anderson Cancer Center Clinical Trial. On September 20, 2023, the Company announced an investigator-initiated Phase 1b/2 collaborative clinical trial to assess whether adding LB-100 to a human programmed death receptor-1 (“PD-1”) blocking antibody of GSK plc (“GSK”), dostarlimab-gxly, may enhance the effectiveness of immunotherapy in the treatment of ovarian clear cell carcinoma (“OCCC”). The study objective is to determine the overall survival (“OS”) of patients with OCCC. The clinical trial is being sponsored by The University of Texas MD Anderson Cancer Center (“MD Anderson”) and is being conducted at The University of Texas - MD Anderson Cancer Center. The Company is providing LB-100 and GSK is providing dostarlimab-gxly and financial support for the clinical trial. On January 29, 2024, the Company announced the entry of the first patient into this clinical trial. The Company currently expects that this clinical trial will be completed by December 31, 2027.

On February 25, 2025, the Company announced that it has added the Robert H. Lurie Comprehensive Cancer Center (Lurie Cancer Center) of Northwestern University as a second site in a clinical trial combining the Company’s proprietary compound LB-100 with GSK’s dostarlimab to treat ovarian clear cell cancer. Patient recruitment is underway, and the first patient has been dosed.

Clinical Trial Monitoring Agreements

MD Anderson Cancer Center Clinical Trial. On May 15, 2024, the Company signed a letter of intent with Theradex to monitor the MD Andersen investigator-initiated Phase 1b/2 collaborative clinical trial to assess whether adding LB-100 to a human programmed death receptor-1 (“PD-1”) blocking antibody of GSK plc (“GSK”), dostarlimab-gxly, may enhance the effectiveness of immunotherapy in the treatment of ovarian clear cell carcinoma (“OCCC”). On August 19, 2024, the Company signed a work order agreement with Theradex to monitor the MD Anderson clinical trial. The study oversight is expected to be completed by January 31, 2027.

Costs under this letter of intent and related work order agreement are estimated to be approximately $95,000. During the three months ended June 30, 2025 and 2024, the Company incurred costs of $4,614 and $8,228 pursuant to this letter of intent and subsequent work order. During the six months ended June 30, 2025 and 2024, the Company incurred costs of $11,892 and $8,228 pursuant to this letter of intent and subsequent work order. As of June 30, 2025, total costs of $38,655 have been incurred pursuant to this letter of intent and subsequent work order.

The Company’s aggregate commitment pursuant to this letter of intent, less amounts previously paid to date, totaled approximately $57,000 as of June 30, 2025, which is expected to be incurred through December 31, 2027.

City of Hope. On February 5, 2021, the Company signed a new work order agreement with Theradex to monitor the City of Hope investigator-initiated clinical trial in small cell lung cancer in accordance with FDA requirements for oversight by the sponsoring party. Costs under this work order agreement were estimated to be approximately $335,000. During the three months ended June 30, 2025 and 2024, the Company incurred costs of $0 and $4,500, respectively, pursuant to this work order. During the six months ended June 30, 2025 and 2024, the Company incurred costs of $0 and $9,000, respectively, pursuant to this work order. As of June 30, 2025, total costs of $87,823 had been incurred pursuant to this work order agreement.

As a result of the closure of the Agreement with City of Hope effective July 8, 2024 (see “Clinical Trial Agreements – City of Hope” above), the work order agreement with Theradex to monitor this clinical trial was concurrently terminated, although nominal oversight trailing costs subsequent to July 8, 2024 are expected to be incurred relating to the closure of this study.

GEIS. On June 22, 2023, the Company finalized a work order agreement with Theradex, to monitor the GEIS investigator-initiated clinical Phase I/II randomized trial of LB-100 plus doxorubicin vs. doxorubicin alone in first line of advanced soft tissue sarcoma. The study oversight is expected to be completed by December 31, 2026.

Costs under this work order agreement are estimated to be approximately $153,000, with such payments expected to be allocated approximately 72% to Theradex for services and approximately 28% for payments for pass-through software costs. During the three months ended June 30, 2025 and 2024, the Company incurred costs of $3,750 and $7,203, respectively, pursuant to this work order. During the six months ended June 30, 2025 and 2024, the Company incurred costs of $7,622 and $12,732, respectively, pursuant to this work order. As of June 30, 2025, total costs of $57,077 have been incurred pursuant to this work order agreement.

The Company’s aggregate commitment pursuant to this clinical trial monitoring agreement, less amounts previously paid to date, totaled approximately $95,000 as of June 30, 2025, which is expected to be incurred through December 31, 2026.

Netherlands Cancer Institute. On August 27, 2024, the Company finalized a work order agreement with Theradex, to monitor the NKI Phase 1b clinical trial of LB-100 combined with atezolizumab, a PD-L1 inhibitor, for patients with microsatellite stable metastatic colorectal cancer. The study oversight was expected to be completed by May 31, 2027.

Costs under this work order agreement were estimated to be approximately $106,380, with such payments expected to be allocated approximately 47% to Theradex for services and approximately 53% for payments for pass-through software costs. During three months and six months ended June 30, 2025, the Company incurred costs of $4,500 and $9,000, respectively, pursuant to this work order. As of June 30, 2025, total costs of $29,191 have been incurred pursuant to this work order agreement.

The Company’s aggregate commitment pursuant to this clinical trial monitoring agreement, less amounts previously paid to date, totaled approximately $79,000 as of June 30, 2025, which was expected to be incurred through May 31, 2027.

The Company was recently notified that the preparations for this clinical trial were suspended and the clinical trial is not expected commence. Accordingly, the Company expects that this agreement will be terminated and the Company will have no further financial commitment or cost.

Patent and License Agreements

National Institute of Health. Effective February 23, 2024, the Company entered into a Patent License Agreement (the “License Agreement”) with the National Institute of Neurological Disorders and Stroke (“NINDS”) and the National Cancer Institute (“NCI”), each an institute or center of the National Institute of Health (“NIH”). Pursuant to the License Agreement, the Company has licensed on an exclusive basis the NIH’s intellectual property rights claimed for a Cooperative Research and Development Agreement (“CRADA”) subject invention co-developed with the Company, and the licensed field of use, which focuses on promoting anti-cancer activity alone, or in combination with standard anti-cancer drugs. The scope of this clinical research extends to checkpoint inhibitors, immunotherapy, and radiation for the treatment of cancer. The License Agreement is effective, and shall extend, on a licensed product, licensed process, and country basis, until the expiration of the last-to-expire valid claim of the jointly owned licensed patent rights in each such country in the licensed territory, estimated at twenty years, unless sooner terminated.

The License Agreement contemplates that the Company will seek to work with pharmaceutical companies and clinical trial sites (including comprehensive cancer centers) to initiate clinical trials within timeframes that will meet certain benchmarks. Data from the clinical trials will be the subject of various regulatory filings for marketing approval in applicable countries in the licensed territories. Subject to the receipt of marketing approval, the Company would be expected to commercialize the licensed products in markets where regulatory approval has been obtained.

The Company is obligated to pay the NIH a non-creditable, non-refundable license issue royalty of $50,000 and a first minimum annual royalty within sixty days from the effective date of the Agreement. The first minimum annual royalty of $25,643 was prorated from the effective date of the License Agreement to the next subsequent January 1. Thereafter, the minimum annual royalty of $30,000 is due each January 1 and may be credited against any earned royalties due for sales made in that year. The license issue royalty of $50,000 and the first minimum annual royalty of $25,643 were paid in April 2024. The second minimum annual royalty for 2025 of $30,000 was paid in December 2024 and was included in other prepaid expenses in the consolidated balance sheet at December 31, 2024.

The Company is obligated to pay the NIH, on a country-by-country basis, earned royalties of 2% on net sales of each royalty-bearing product and process, subject to reduction by 50% under certain circumstances relating to royalties paid by the Company to third parties, but not less than 1%. The Company’s obligation to pay earned royalties under the License Agreement commences on the date of the first commercial sale of a royalty-bearing product or process and expires on the date on which the last valid claim of the licensed product or licensed process expires in such country.

The Company is obligated to pay the NIH benchmark royalties, on a one-time basis, within sixty days from the first achievement of each such benchmark. The License Agreement defines four such benchmarks, which the Company is required to pursue based on “commercially reasonable efforts” as defined in the License Agreement, with deadlines of October 1, 2024, 2027, 2029 and 2031, each with a different specified benchmark payment amount payable within thirty days of achieving such benchmark. The October 1, 2024 benchmark of $100,000 was defined as the dosing of the first patient with a licensed product in a Phase 2 clinical study of such licensed product in the licensed fields of use. The Company had not commenced a Phase 2 clinical study as of June 30, 2025. The total of all such benchmark payments is $1,225,000.

The Company is obligated to provide annual reports to the NIH on its progress toward the development and commercialization of products under the licensed patents. These reports, due within sixty days following the end of each calendar year, must include updates on research and development activities, regulatory submissions, manufacturing efforts, sublicensing, and sales initiatives. If any deviations from the established commercial development plan or agreed-upon benchmarks occur, the Company is obligated to provide explanation and may amend the commercial development plan and the benchmarks, which, subject to certain conditions, the NIH shall not unreasonably withhold, condition, or delay approval of any request of the Company to amend the commercial development plan and/or the benchmarks and to extend the time periods of the benchmarks.

The Company is obligated to pay the NIH sublicensing royalties of 5% on sublicensing revenue received for granting each sublicense within sixty days of receipt of such sublicensing revenue.

During the three months ended June 30, 2025 and 2024, the Company incurred costs of $7,397 and $7,455, respectively, in connection with its obligations under the License Agreement. During the six months ended June 30, 2025 and 2024, the Company incurred costs of $14,794 and $60,569, respectively, in connection with its obligations under the License Agreement. Such costs when incurred have been included in general and administrative costs in the Company’s consolidated statement of operations. As of June 30, 2025, total costs of $90,438 have been incurred pursuant to this agreement. The Company’s aggregate commitment pursuant to this agreement, less amounts previously paid to date, totaled approximately $1,765,000 as of June 30, 2025, which is expected to be incurred over approximately the next twenty years.

Other Significant Agreements and Contracts

NDA Consulting Corp. On December 24, 2013, the Company entered into a consulting agreement with NDA Consulting Corp. for consultation and advice in the field of oncology research and drug development. As part of the consulting agreement, NDA also agreed to have its president, Dr. Daniel D. Von Hoff, M.D., serve on the Company’s Scientific Advisory Committee during the term of such consulting agreement. The term of the consulting agreement was for one year and provided for a quarterly cash fee of $4,000. The consulting agreement had been automatically renewed for additional one-year terms on its anniversary date, most recently on December 24, 2023, but was subsequently terminated by mutual agreement effective September 30, 2024. Consulting and advisory fees charged to operations pursuant to this consulting agreement were $4,000 and $8,000 for the three months and six months ended June 30, 2024, respectively.

BioPharmaWorks. Effective September 14, 2015, the Company entered into a Collaboration Agreement with BioPharmaWorks, pursuant to which the Company engaged BioPharmaWorks to perform certain services for the Company. Those services included, among other things, assisting the Company to commercialize its products and strengthen its patent portfolio; identifying large pharmaceutical companies with a potential interest in the Company’s product pipeline; assisting in preparing technical presentations concerning the Company’s products; consultation in drug discovery and development; and identifying providers and overseeing tasks relating to clinical development of new compounds.

BioPharmaWorks was founded in 2015 by former Pfizer scientists with extensive multi-disciplinary research and development and drug development experience. The Collaboration Agreement was for an initial term of two years and automatically renews for subsequent annual periods unless terminated by a party not less than 60 days prior to the expiration of the applicable period. In connection with the Collaboration Agreement, the Company agreed to pay BioPharmaWorks a monthly fee of $10,000, subject to the right of the Company to pay a negotiated hourly rate in lieu of the monthly fee. Effective March 1, 2024, the compensation payable under the Collaboration Agreement was converted to an hourly rate structure.

The Company recorded charges to operations pursuant to this Collaboration Agreement of $10,800 and $7,200 during the three months ended June 30, 2025 and 2024, respectively, which were included in research and development costs in the consolidated statements of operations. The Company recorded charges to operations pursuant to this Collaboration Agreement of $24,800 and $27,200 during the six months ended June 30, 2025 and 2024, respectively, which were included in research and development costs in the consolidated statements of operations.

Netherlands Cancer Institute. On October 8, 2021, the Company entered into a Development Collaboration Agreement with the Netherlands Cancer Institute, Amsterdam (“NKI”) (see Note 5), one of the world’s leading comprehensive cancer centers, and Oncode Institute, Utrecht, a major independent cancer research center, for a term of three years. The Development Collaboration Agreement was subsequently modified by Amendment No. 1 thereto.

The Development Collaboration Agreement is a preclinical study intended to identify the most promising drugs to be combined with LB-100, and potentially LB-100 analogues, to be used to treat a range of cancers, as well as to identify the specific molecular mechanisms underlying the identified combinations. The Company agreed to fund the preclinical study, at an approximate cost of 391,000 Euros and provide a sufficient supply of LB-100 to conduct the preclinical study.

On October 3, 2023, the Company entered into Amendment No. 2 to the Development Collaboration Agreement with NKI, which provides for additional research activities, extends the termination date of the Development Collaboration Agreement by two years to October 8, 2026, and added 500,000 Euros to the operating budget being funded by the Company.

On October 4, 2024, the Company entered into Amendment No. 3 to the Development Collaboration Agreement with NKI, which suspended Amendment No. 2 and provided for a new study term of one year commencing upon the dosing of the first patient in the trial at a project cost of 100,000 Euros.

During the three months ended June 30, 2025 and 2024, the Company incurred charges of $0 and $67,119, respectively, with respect to this agreement, which amounts are included in research and development costs in the Company’s consolidated statements of operations. During the six months ended June 30, 2025 and 2024, the Company incurred charges of $0 and $134,084, respectively, with respect to this agreement, which amounts are included in research and development costs in the Company’s consolidated statements of operations. As of June 30, 2025, total costs of $695,918 have been incurred pursuant to this agreement.

The Company was recently notified that the preparations for this clinical trial were suspended and the clinical trial is not expected commence. Accordingly, the Company expects that this agreement will be terminated and the Company will have no further financial commitment or cost.

MRI Global. As amended, the Company has contracted with MRI Global for stability analysis, storage and distribution of LB-100 for clinical trials in the United States. During the three months ended June 30, 2025 and 2024, the Company incurred costs of $6,765 and $5,976, respectively, pursuant to this contract. During the six months ended June 30, 2025 and 2024, the Company incurred costs of $34,857 and $9,870, respectively, pursuant to this contract. As of June 30, 2025, total costs of $375,379 have been incurred pursuant to this contract.

The Company’s aggregate commitment pursuant to this contract, less amounts previously paid to date, totaled approximately $90,000 as of June 30, 2025.

Specific Risks Associated with the Company’s Business Activities

Serious Adverse Events

The Company’s lead drug candidate, LB-100, is currently undergoing various clinical trials, and there is a risk that one or more of these trials could be placed on hold by regulatory authorities due to serious adverse events (SAEs) related to the Company’s drug candidate or to another company’s drug used in combination in one of the Company’s clinical trials. It is possible that the SAEs could be attributable to the Company’s drug candidate and could include, but not be limited to, unexpected severe side effects, treatment-related deaths, or long-term health complications. A dose given could result in non-tolerable adverse events defined as dose-limiting toxicity (DLT). When two DLTs occur at the same dose-level that dose-level is considered too high and unsafe. Further treatment is only allowed at lower dose-levels that have previously been found safe.

If an SAE or a pattern of SAEs is observed during the course of a clinical trial involving the Company’s drug candidate, the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), or other regulatory authorities may issue a clinical hold, requiring the Company to pause or discontinue further enrollment and dosing in the Company’s clinical trial. It is also possible that the clinical trial could be terminated. Any of these actions could delay or halt the development of the Company’s drug candidate, increase development costs, and negatively impact the Company’s ability to ultimately achieve regulatory approval. Additionally, if an SAE is confirmed to be drug-related, the Company may be required to conduct additional studies, modify the study design, or abandon further development of the drug candidate altogether, which could materially impact the Company’s business, financial condition, and prospects.

The occurrence of an SAE and any resulting clinical hold could also harm the Company’s reputation with patients, physicians, health institutions, and investors, diminish the Company’s ability to attract clinical trial participants, and damage the Company’s ability to interest investors and obtain financing in the future. There can be no assurances that the Company will not experience such SAEs in the future or that any related clinical hold will be lifted in a timely manner, or at all.

The principal investigator of the colorectal study testing LB-100 in combination with atezolizumab (Roche PD-L1 inhibitor) is currently investigating two SAEs observed in the clinical trial that was launched in August 2024. The Institutional Review Board (the “IRB”) of the Netherlands Cancer Institute (“NKI”) has put the colorectal cancer study on hold. The adverse reactions that developed in the two patients were dyspnea (shortness of breath) due to lung toxicity possibly or probably related to the combination of LB-100 and atezolizumab in one patient and fever and aphasia possibly or probably related to the combination of LB-100 and atezolizumab in the second patient. The patient who developed lung toxicity deceased due to the combination of lung metastases of colorectal cancer and dyspnea. The patient with fever and aphasia fully recovered from the adverse events with supportive medication.

Given the identified adverse events in the two patients in the clinical trial, the IRB requested from the principal investigator of the study at the NKI information as to whether the adverse events could have been caused by the combination of LB-100 and atezolizumab and information about the mode of action of the combination of LB-100 and atezolizumab. The principal investigator prepared a response to the IRB detailing the safety experience with LB-100 given alone and in combination with other cancer drugs, especially doxorubicin and dostarlimab. Doxorubicin is a well-known chemotherapy, and dostarlimab is a well-known immunotherapy of which the mode of action is closely related to that of atezolizumab.

The reported adverse events in the colorectal cancer study have not been seen in any other patients thus far treated with LB-100 alone or in combination with other cancer drugs. Through early July 2025, the Company has been informed that a total of 82 patients had received or were receiving experimental treatment with LB-100.

In May 2025, the Company updated the safety overview of LB-100 and delivered the updated version 5.0 of the Investigator’s Brochure (the “IB”), which contains all of the relevant preclinical, clinical and pharmacologic data with respect to the study of the LB-100 clinical compound in humans, to the investigators of all ongoing clinical trials. The investigators of the study in colorectal cancer (NCT06012734) submitted a detailed response to the IRB, including the updated IB. The Company is currently awaiting the outcome of the IRB review.

Other Business Risks

Covid-19 Virus. The global outbreak of the novel coronavirus (Covid-19) in early 2020 led to disruptions in general economic activities throughout the world as businesses and governments implemented broad actions to mitigate this public health crisis. Although the Covid-19 outbreak has subsided, the extent to which the coronavirus or any other pandemics may reappear and impact the Company’s clinical trial programs and capital raising efforts in the future is uncertain and cannot be predicted.

Inflation and Interest Rate Risk. The Company does not believe that inflation or increasing interest rates have had a material effect on its operations to date, other than their impact on the general economy. However, there is a risk that the Company’s operating costs could become subject to inflationary and interest rate pressures in the future, which would have the effect of increasing the Company’s operating costs, and which would put additional stress on the Company’s working capital resources.

Supply Chain Issues. The Company does not currently expect that supply chain issues will have a significant impact on its business activities, including its ongoing clinical trials.

Potential Recession. There have been some indications that the United States economy may be at risk of entering a recessionary period. Although it does not appear likely at this time, an economic recession could impact the general business environment and the capital markets, which could, in turn, affect the Company.

Geopolitical Risk. The geopolitical landscape poses inherent risks that could significantly impact the operations and financial performance of the Company. In the event of a military conflict, supply chain disruptions, geopolitical uncertainties, and economic repercussions may adversely affect the Company’s ability to conduct research, develop, test and manufacture products, and distribute them globally. This could lead to delays in product development, interruptions in the supply of critical materials, and delays in clinical trials, thereby impeding the Company’s clinical development and commercialization plans. Furthermore, the impact of a conflict on global financial markets may result in increased volatility and uncertainty in the capital markets, thereby affecting the valuation of the Company’s publicly-traded shares. Investor confidence, market sentiment, and access to capital could all be negatively influenced. Such geopolitical risks are outside the control of the Company, and the actual effects on the Company’s business, financial condition and results of operations may differ from current estimates.

Cybersecurity Risks. The Company has established policies and processes for assessing, identifying and managing material risk from cybersecurity threats, and has integrated these processes into its overall risk management systems and processes. The Company routinely assesses material risks from cybersecurity threats, including any potential unauthorized occurrence on or conducted through its information and email systems that may result in adverse effects on the confidentiality, integrity, or availability of the Company’s information and email systems or any information residing therein. The Company conducts periodic risk assessments to identify cybersecurity threats, as well as assessments in the event of a material change in the Company’s business practices that may affect information systems that are vulnerable to such cybersecurity threats. These risk assessments include identification of reasonably foreseeable internal and external risks, the likelihood and potential damage that could result from such risks, and the sufficiency of existing policies, procedures, systems and safeguards in place to manage such risks. The Company has not encountered any cybersecurity challenges to date that have materially impaired its operations or financial condition.

The Company is continuing to monitor these matters and will adjust its current business and financing plans as more information becomes available.