What were the Fund costs for the period?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 | Costs paid as a |

| Kingsbarn Tactical Bond ETF | $47 | 0.95%1 |

1 Annualized.

What Factors Influenced Performance?

The Fund underperformed the index due to negative alpha driven by the Fund’s tactical duration positioning. Over this prior six-month period the Fund has generally maintained higher duration exposure than its respective index due to expectations of weaker economic growth and higher inflation expectations. This increased duration exposure reduced the Fund’s performance as long-term yields increased over the reporting period.

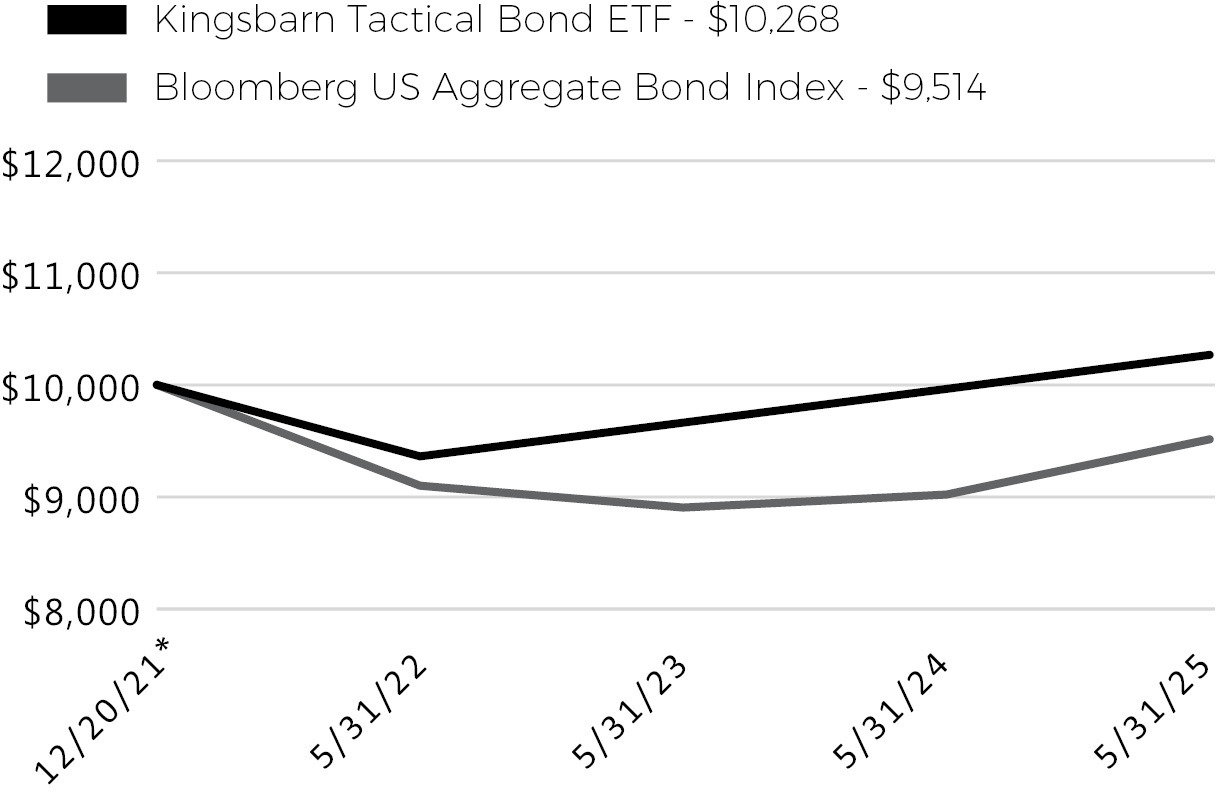

Cumulative Performance

(based on a hypothetical $10,000 investment)

* Inception

Annual Performance

| 1 year | Average Annual | |

| Kingsbarn Tactical Bond ETF | 4.95% | 0.77% |

| Bloomberg US Aggregate Bond Index | 5.46% | -1.44% |

The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Visit www.kingsbarncapital.com/kingsbarn-etf/ for more recent performance information.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

How did the Fund Perform?

The Kingsbarn Tactical Bond ETF (“the Fund”) returned -0.43% for the period of December 1, 2024, to May 31, 2025, vs Bloomberg Aggregate Bond Index which returned 0.77% for the same period. The Fund primarily invests in a diversified portfolio of high-grade fixed-income securities coupled with tactical duration positions which are adjusted monthly and implemented using exchange-traded Treasury futures.

Key Fund Statistics

(as of May 31, 2025)

| Fund Net Assets | $1,169,137 |

| Number of Holdings | 52 |

| Total Advisory Fee | $5,496 |

| Portfolio Turnover Rate | 0.00% |

What did the Fund invest in?

(% of Net Assets as of May 31, 2025)

Sector Breakdown

Top Holdings

| iShares 0-3 Months Treasury Bond ETF | 19.52% |

| iShares MBS ETF | 19.42% |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | 19.36% |

| iShares 7-10 Year Treasury Bond ETF | 19.06% |

| iShares TIPS Bond ETF | 14.68% |

Top Holdings

| iShares 0-3 Months Treasury Bond ETF | 19.52% |

| iShares MBS ETF | 19.42% |

| iShares iBoxx $ Investment Grade Corporate Bond ETF | 19.36% |

| iShares 7-10 Year Treasury Bond ETF | 19.06% |

| iShares TIPS Bond ETF | 14.68% |

| [1] | Annualized. |

| [2] | Excludes derivatives |