|

Fund Name

|

Costs of a $10,000 investment*

|

Costs paid as a percentage of a $10,000 investment**

|

|

NEOS Bitcoin High Income ETF

|

$74

|

0.98%

|

|

|

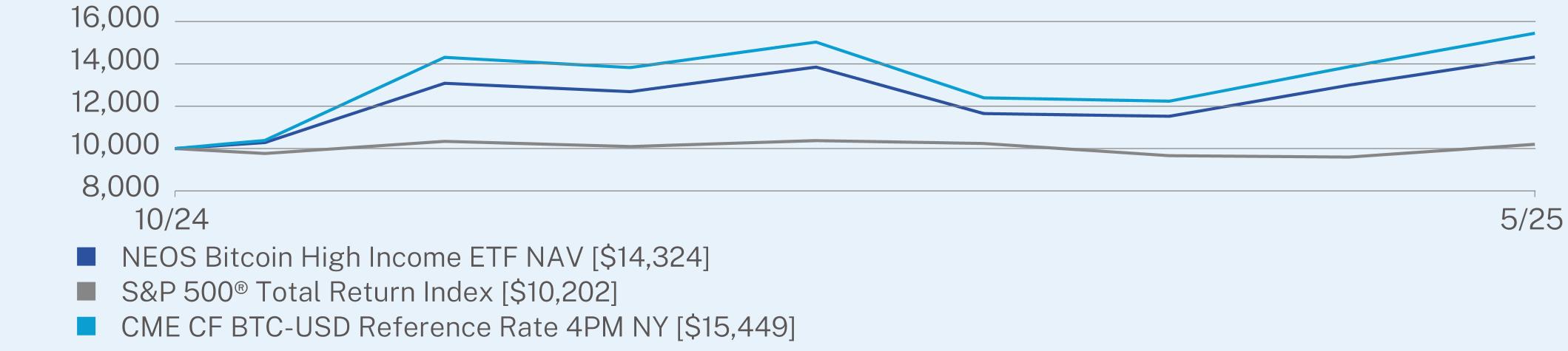

Since Inception

(10/17/2024) |

|

NEOS Bitcoin High Income ETF NAV

|

43.24

|

|

S&P 500® Total Return Index

|

2.02

|

|

CME CF BTC-USD Reference Rate 4PM NY

|

54.49

|

|

Net Assets

|

$246,421,074

|

|

Number of Holdings

|

9

|

|

Net Advisory Fee

|

$530,609

|

|

Portfolio Turnover

|

1%

|

|

30-Day SEC Yield

|

2.10%

|

|

30-Day SEC Yield Unsubsidized

|

2.10%

|

|

Distribution Yield

|

30.25%

|

|

Top 10 Issuers

|

|

|

United States Treasury Bill

|

69.5%

|

|

VanEck Bitcoin ETF

|

23.8%

|

|

Cboe Mini Bitcoin U.S. ETF Index Purchased/Written Options

|

5.9%

|

|

First American Treasury Obligations Fund

|

1.3%

|

|

Northern U.S. Government Select Money Market Fund

|

0.0%*

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

NEOS Enhanced Income 1-3 Month T-Bill ETF

|

$39

|

0.38%

|

|

|

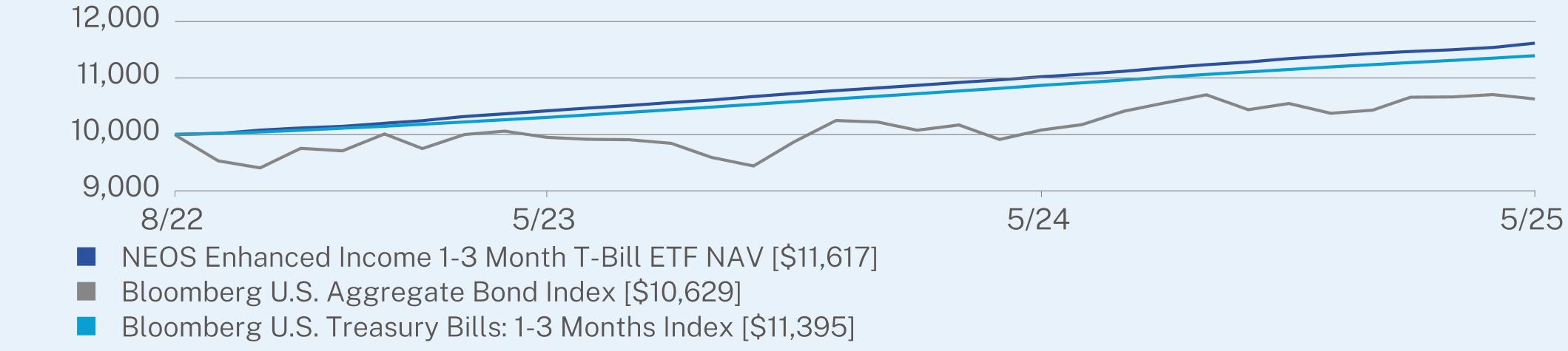

1 Year

|

Since Inception

(08/30/2022) |

|

NEOS Enhanced Income 1-3 Month T-Bill ETF NAV

|

5.39

|

5.59

|

|

Bloomberg U.S. Aggregate Bond Index

|

5.46

|

2.24

|

|

Bloomberg U.S. Treasury Bills: 1-3 Months Index

|

4.83

|

4.86

|

|

Net Assets

|

$504,177,262

|

|

Number of Holdings

|

23

|

|

Net Advisory Fee

|

$1,890,743

|

|

Portfolio Turnover

|

0%

|

|

30-Day SEC Yield

|

3.91%

|

|

30-Day SEC Yield Unsubsidized

|

3.91%

|

|

Distribution Yield

|

5.18%

|

|

Top 10 Issuers

|

|

|

United States Treasury Bill

|

99.1%

|

|

First American Treasury Obligations Fund

|

0.6%

|

|

Northern U.S. Government Select Money Market Fund

|

0.4%

|

|

S&P 500 Index Purchased/Written Options

|

0.0%*

|

|

Fund Name

|

Costs of a $10,000 investment*

|

Costs paid as a percentage of a $10,000 investment**

|

|

NEOS Enhanced Income 20+ Year Treasury Bond ETF

|

$31

|

0.58%

|

|

|

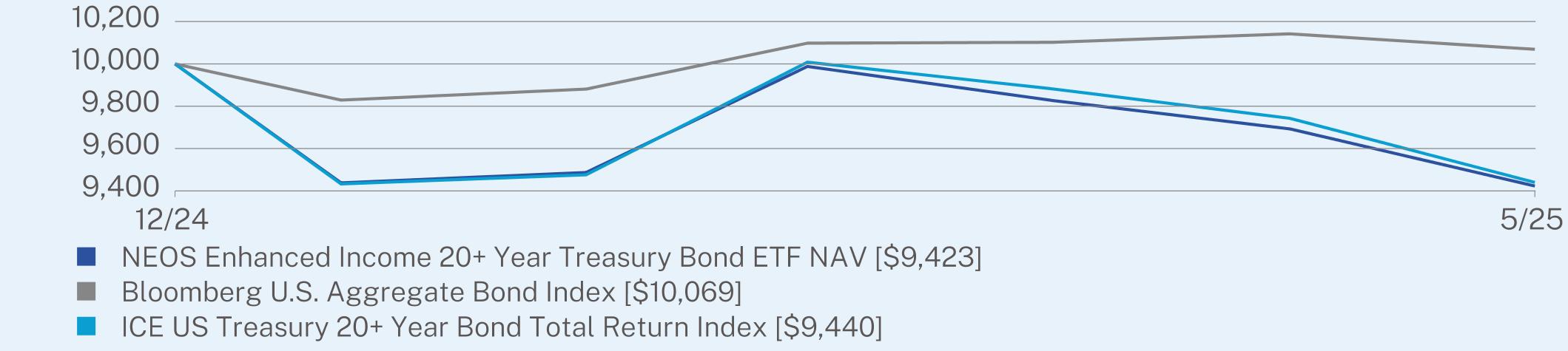

Since Inception

(12/11/2024) |

|

NEOS Enhanced Income 20+ Year Treasury Bond ETF NAV

|

-5.77

|

|

Bloomberg U.S. Aggregate Bond Index

|

0.69

|

|

ICE US Treasury 20+ Year Bond Total Return Index

|

-5.60

|

|

Net Assets

|

$2,738,911

|

|

Number of Holdings

|

9

|

|

Net Advisory Fee

|

$4,839

|

|

Portfolio Turnover

|

0%*

|

|

30-Day SEC Yield

|

4.42%

|

|

30-Day SEC Yield Unsubsidized

|

4.42%

|

|

Distribution Yield

|

6.43%

|

|

Top 10 Issuers

|

|

|

United States Treasury Bond

|

98.0%

|

|

Northern US Government Money Market Fund

|

0.6%

|

|

First American Treasury Obligations Fund

|

0.2%

|

|

S&P 500 Index Purchased/Written Options

|

0.0%*

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

NEOS Enhanced Income Aggregate Bond ETF

|

$57

|

0.55%

|

|

|

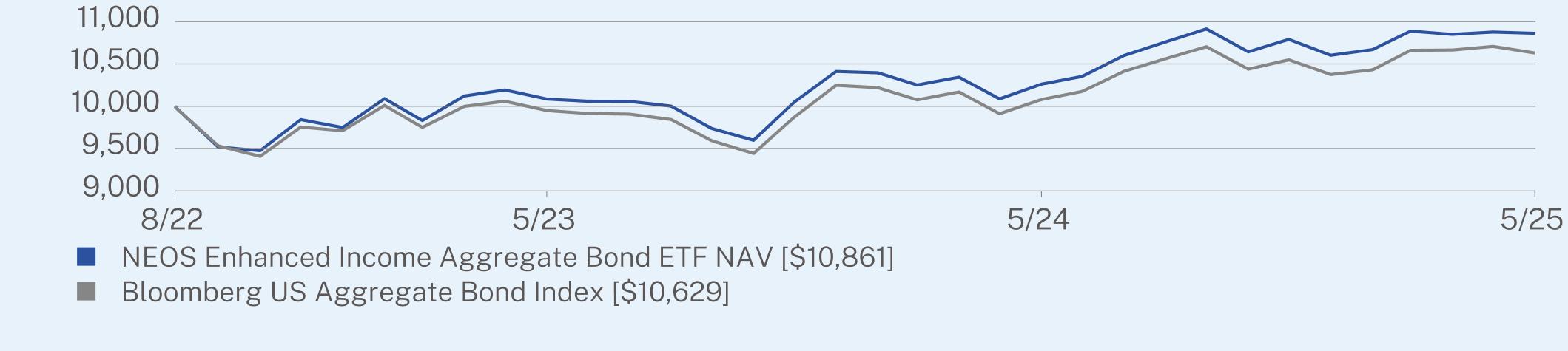

1 Year

|

Since Inception

(08/30/2022) |

|

NEOS Enhanced Income Aggregate Bond ETF NAV

|

5.85

|

3.05

|

|

Bloomberg US Aggregate Bond Index

|

5.46

|

2.24

|

|

Net Assets

|

$86,727,258

|

|

Number of Holdings

|

10

|

|

Net Advisory Fee

|

$278,067

|

|

Portfolio Turnover

|

1%

|

|

30-Day SEC Yield

|

3.27%

|

|

30-Day SEC Yield Unsubsidized

|

3.24%

|

|

Distribution Yield

|

5.72%

|

|

Top 10 Issuers

|

|

|

Vanguard Total Bond Market ETF

|

49.5%

|

|

iShares Core U.S. Aggregate Bond ETF

|

49.5%

|

|

Northern U.S. Government Select Money Market Fund

|

1.0%

|

|

First American Treasury Obligations Fund

|

0.1%

|

|

S&P 500 Index Purchased/Written Options

|

-0.1%

|

|

Fund Name

|

Costs of a $10,000 investment**

|

Costs paid as a percentage of a $10,000 investment*

|

|

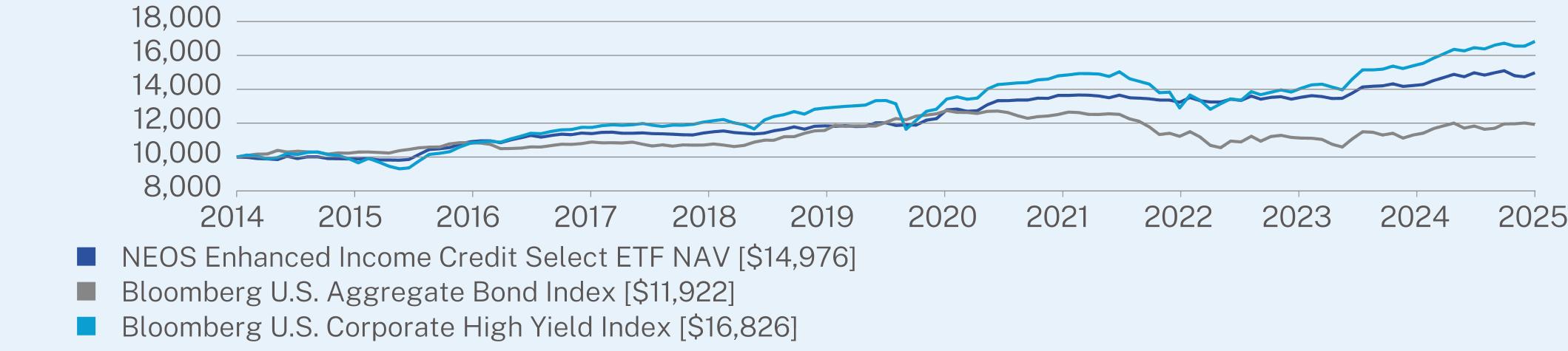

NEOS Enhanced Income Credit Select ETF†

|

$51

|

0.68%

|

|

|

09/01/2024 to 05/31/2025

|

1 Year

|

5 Year

|

10 Year

|

|

NEOS Enhanced Income Credit Select ETF NAV

|

1.89

|

5.27

|

4.22

|

4.11

|

|

Bloomberg U.S. Aggregate Bond Index

|

0.64

|

5.46

|

-0.90

|

1.49

|

|

Bloomberg U.S. Corporate High Yield Index

|

4.52

|

9.32

|

5.79

|

5.03

|

|

Net Assets

|

$139,801,341

|

|

Number of Holdings

|

12

|

|

Net Advisory Fee

|

$602,886

|

|

Portfolio Turnover

|

348%

|

|

30-Day SEC Yield

|

5.51%

|

|

30-Day SEC Yield Unsubsidized

|

5.52%

|

|

Distribution Yield

|

8.51%

|

|

Top 10 Issuers

|

|

|

Xtrackers USD High Yield Corporate Bond ETF

|

32.0%

|

|

iShares Broad USD High Yield Corporate Bond ETF

|

32.0%

|

|

SPDR Portfolio High Yield Bond ETF

|

31.0%

|

|

First American Treasury Obligations Fund

|

2.2%

|

|

United States Treasury Bill

|

1.9%

|

|

Northern US Government Money Market Fund

|

1.0%

|

|

S&P 500 Index Purchased/Written Options

|

-0.1%

|

|

Fund Name

|

Costs of a $10,000 investment**

|

Costs paid as a percentage of a $10,000 investment*

|

|

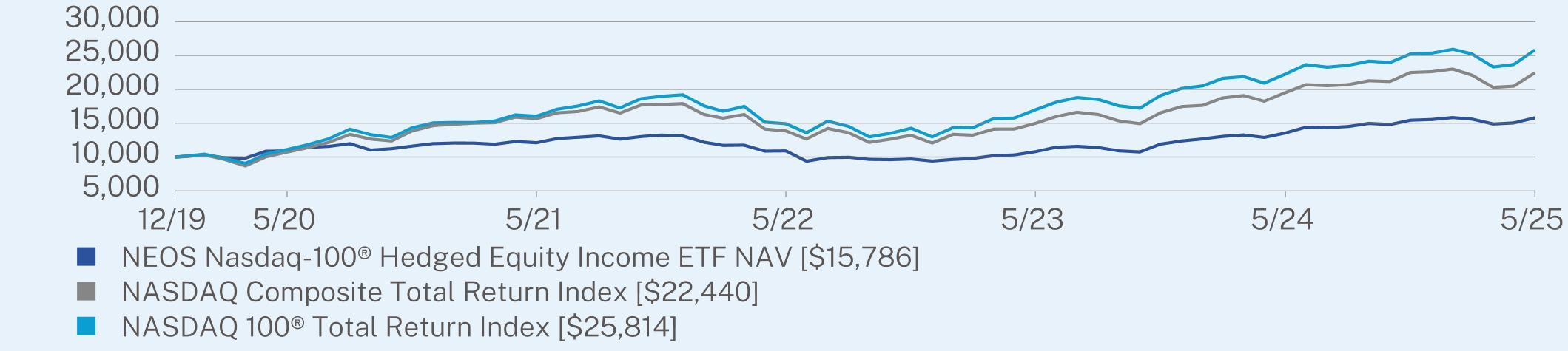

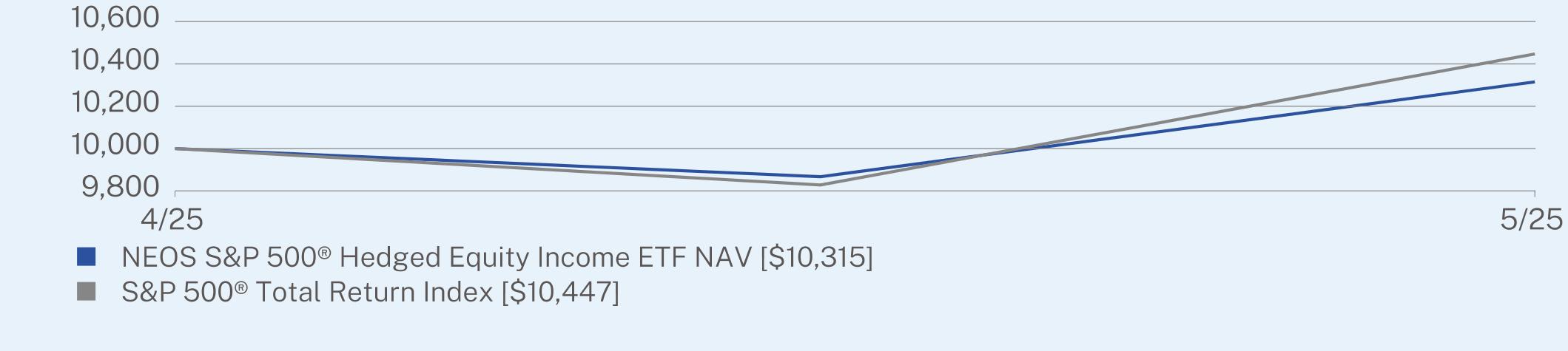

NEOS Nasdaq-100® Hedged Equity Income ETF†

|

$53

|

0.68%

|

|

|

09/01/2024 to 05/31/2025

|

1 Year

|

5 Year

|

Since Inception

(12/20/2019) |

|

NEOS Nasdaq-100® Hedged Equity Income ETF NAV

|

8.84

|

16.48

|

7.65

|

8.74

|

|

NASDAQ Composite Total Return Index

|

8.47

|

15.02

|

15.91

|

15.99

|

|

NASDAQ 100® Total Return Index

|

9.65

|

16.02

|

18.37

|

19.01

|

|

Net Assets

|

$305,930,069

|

|

Number of Holdings

|

105

|

|

Net Advisory Fee

|

$1,621,505

|

|

Portfolio Turnover

|

18%

|

|

30-Day SEC Yield

|

0.16%

|

|

30-Day SEC Yield Unsubsidized

|

0.16%

|

|

Distribution Yield

|

9.74%

|

|

Top 10 Issuers

|

|

|

Microsoft Corp.

|

8.6%

|

|

NVIDIA Corp.

|

8.3%

|

|

Apple, Inc.

|

7.6%

|

|

Alphabet, Inc.

|

5.0%

|

|

Amazon.com, Inc.

|

4.9%

|

|

Broadcom, Inc.

|

4.7%

|

|

Meta Platforms, Inc.

|

3.6%

|

|

Netflix, Inc.

|

3.2%

|

|

Tesla, Inc.

|

3.2%

|

|

Costco Wholesale Corp.

|

2.9%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

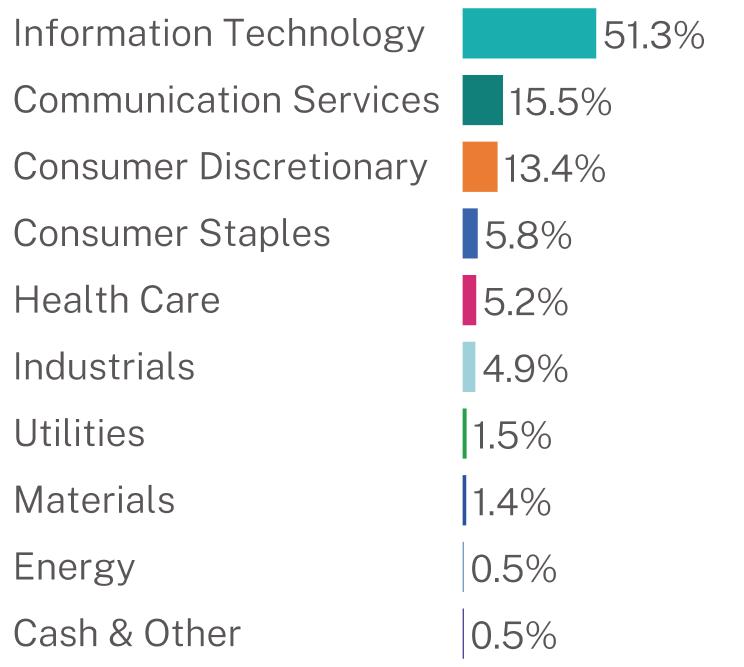

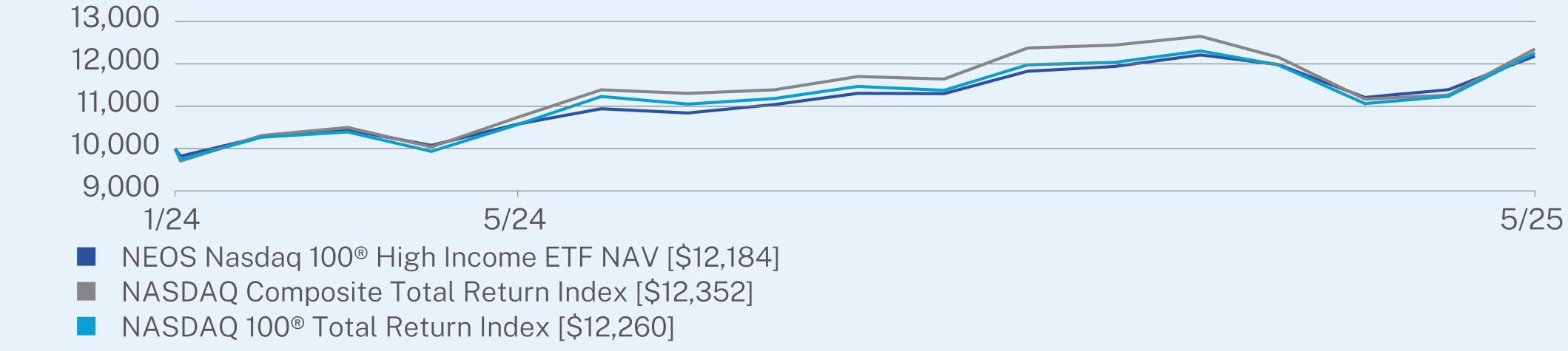

NEOS Nasdaq 100® High Income ETF

|

$73

|

0.68%

|

|

|

1 Year

|

Since Inception

(01/30/2024) |

|

NEOS Nasdaq 100® High Income ETF NAV

|

15.18

|

15.92

|

|

NASDAQ Composite Total Return Index

|

15.02

|

17.11

|

|

NASDAQ 100® Total Return Index

|

16.02

|

16.47

|

|

Net Assets

|

$1,778,335,111

|

|

Number of Holdings

|

104

|

|

Net Advisory Fee

|

$4,980,272

|

|

Portfolio Turnover

|

22%

|

|

30-Day SEC Yield

|

0.17%

|

|

30-Day SEC Yield Unsubsidized

|

0.17%

|

|

Distribution Yield

|

15.35%

|

|

Top 10 Issuers

|

|

|

Microsoft Corp.

|

8.6%

|

|

NVIDIA Corp.

|

8.3%

|

|

Apple, Inc.

|

7.6%

|

|

Alphabet, Inc.

|

4.9%

|

|

Amazon.com, Inc.

|

4.9%

|

|

Broadcom, Inc.

|

4.7%

|

|

Meta Platforms, Inc.

|

3.6%

|

|

Netflix, Inc.

|

3.2%

|

|

Tesla, Inc.

|

3.2%

|

|

Costco Wholesale Corp.

|

2.9%

|

|

Fund Name

|

Costs of a $10,000 investment*

|

Costs paid as a percentage of a $10,000 investment**

|

|

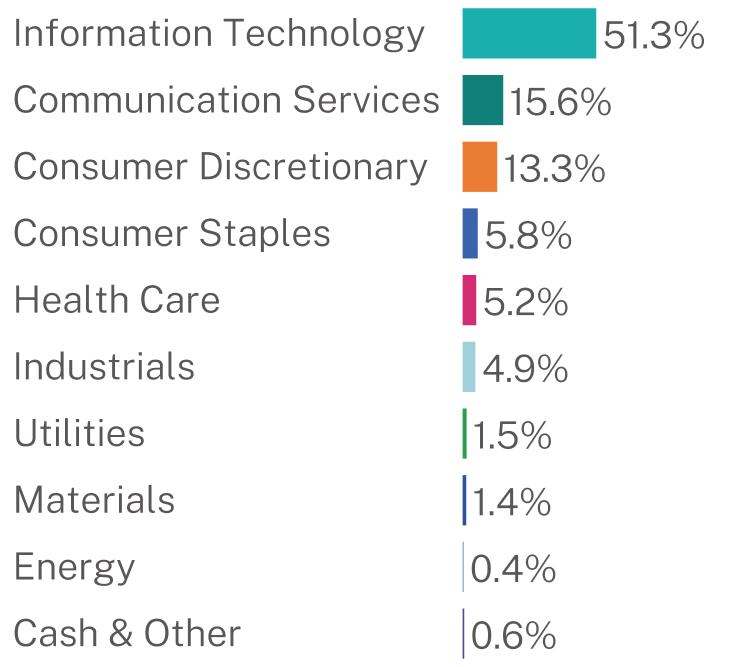

NEOS Real Estate High Income ETF

|

$22

|

0.68%

|

|

|

Since Inception

(01/15/2025) |

|

NEOS Real Estate High Income ETF NAV

|

4.66

|

|

S&P 500® Index

|

1.69

|

|

Dow Jones U.S. Real Estate Capped Index (USD) TR

|

3.97

|

|

Net Assets

|

$48,312,424

|

|

Number of Holdings

|

69

|

|

Net Advisory Fee

|

$63,298

|

|

Portfolio Turnover

|

2%

|

|

30-Day SEC Yield

|

3.22%

|

|

30-Day SEC Yield Unsubsidized

|

3.22%

|

|

Distribution Yield

|

11.84%

|

|

Top 10 Issuers

|

|

|

Prologis, Inc.

|

7.6%

|

|

American Tower Corp.

|

7.6%

|

|

Welltower, Inc.

|

7.0%

|

|

Equinix, Inc.

|

4.7%

|

|

Digital Realty Trust, Inc.

|

4.2%

|

|

Simon Property Group, Inc.

|

3.8%

|

|

Realty Income Corp.

|

3.8%

|

|

Public Storage

|

3.7%

|

|

Crown Castle, Inc.

|

3.4%

|

|

CBRE Group, Inc.

|

2.8%

|

|

Fund Name

|

Costs of a $10,000 investment*

|

Costs paid as a percentage of a $10,000 investment**

|

|

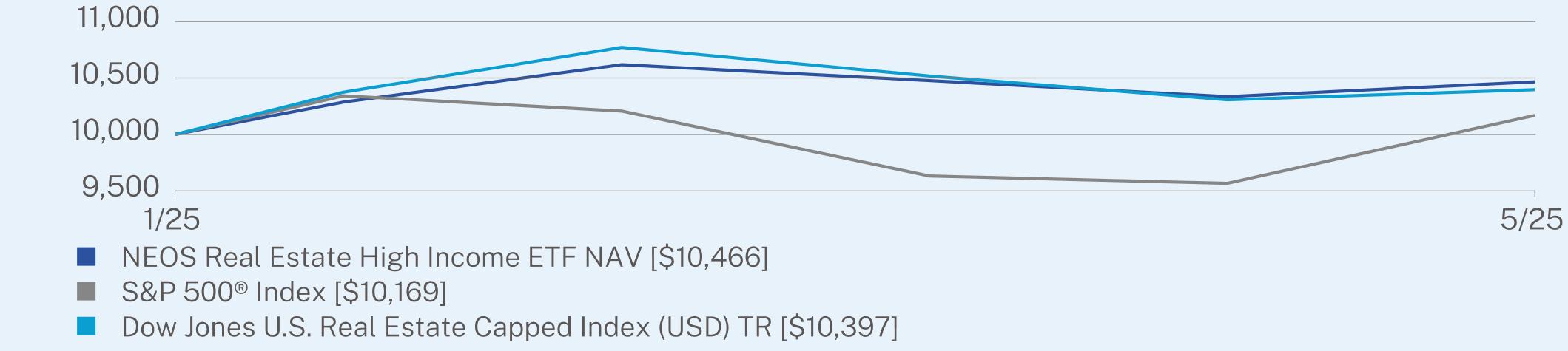

NEOS Russell 2000® High Income ETF

|

$55

|

0.58%

|

|

|

Since Inception

(06/25/2024) |

|

NEOS Russell 2000 High Income ETF NAV

|

2.04

|

|

S&P 500® Index

|

9.86

|

|

Russell 2000 Total Return Index

|

3.04

|

|

Net Assets

|

$177,647,049

|

|

Number of Holdings

|

4

|

|

Net Advisory Fee

|

$572,284

|

|

Portfolio Turnover

|

2%

|

|

30-Day SEC Yield

|

0.90%

|

|

30-Day SEC Yield Unsubsidized

|

0.81%

|

|

Distribution Yield

|

15.22%

|

|

Top 10 Issuers

|

|

|

Vanguard Russell 2000 ETF

|

100.0%

|

|

First American Treasury Obligations Fund

|

0.3%

|

|

Russell 2000 Index Written Options

|

-1.1%

|

|

Fund Name

|

Costs of a $10,000 investment*

|

Costs paid as a percentage of a $10,000 investment**

|

|

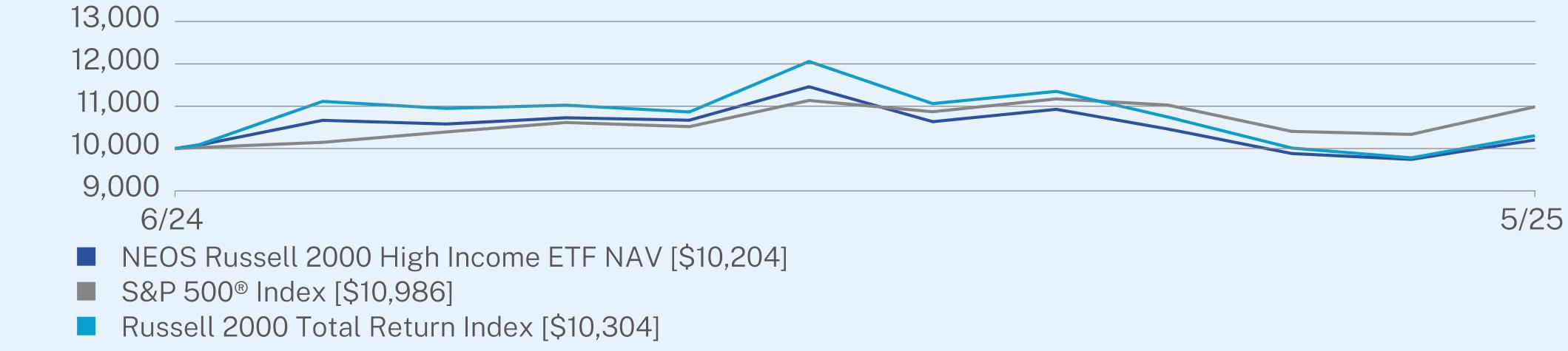

NEOS S&P 500® Hedged Equity Income ETF

|

$11

|

0.68%

|

|

|

Since Inception

(04/03/2025) |

|

NEOS S&P 500® Hedged Equity Income ETF NAV

|

3.15

|

|

S&P 500® Total Return Index

|

4.47

|

|

Net Assets

|

$2,038,503

|

|

Number of Holdings

|

485

|

|

Net Advisory Fee

|

$1,250

|

|

Portfolio Turnover

|

0%*

|

|

30-Day SEC Yield

|

0.75%

|

|

30-Day SEC Yield Unsubsidized

|

0.75%

|

|

Distribution Yield

|

7.94%

|

|

Top 10 Issuers

|

|

|

Microsoft Corp.

|

6.9%

|

|

NVIDIA Corp.

|

6.6%

|

|

Apple, Inc.

|

6.0%

|

|

Amazon.com, Inc.

|

3.9%

|

|

Alphabet, Inc.

|

3.7%

|

|

Meta Platforms, Inc.

|

2.8%

|

|

Broadcom, Inc.

|

2.3%

|

|

Berkshire Hathaway, Inc.

|

1.9%

|

|

Tesla, Inc.

|

1.8%

|

|

JPMorgan Chase & Co.

|

1.5%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

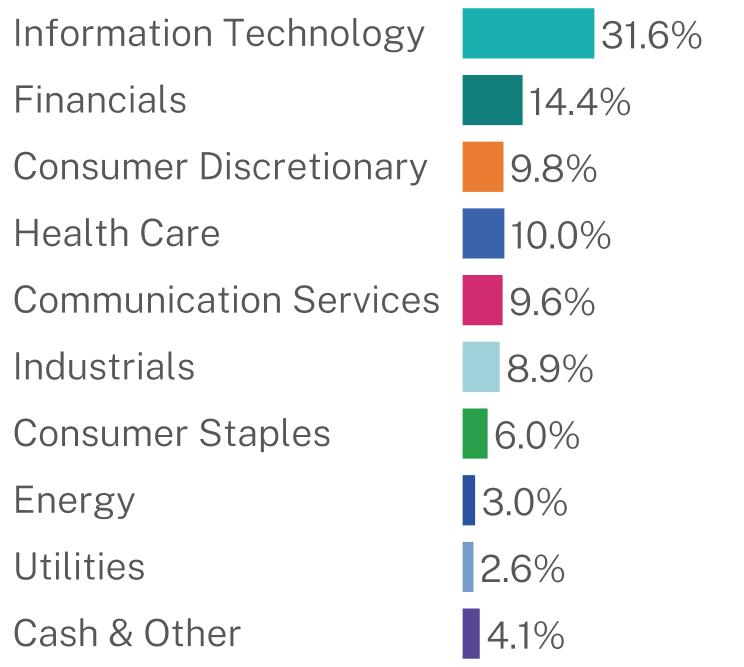

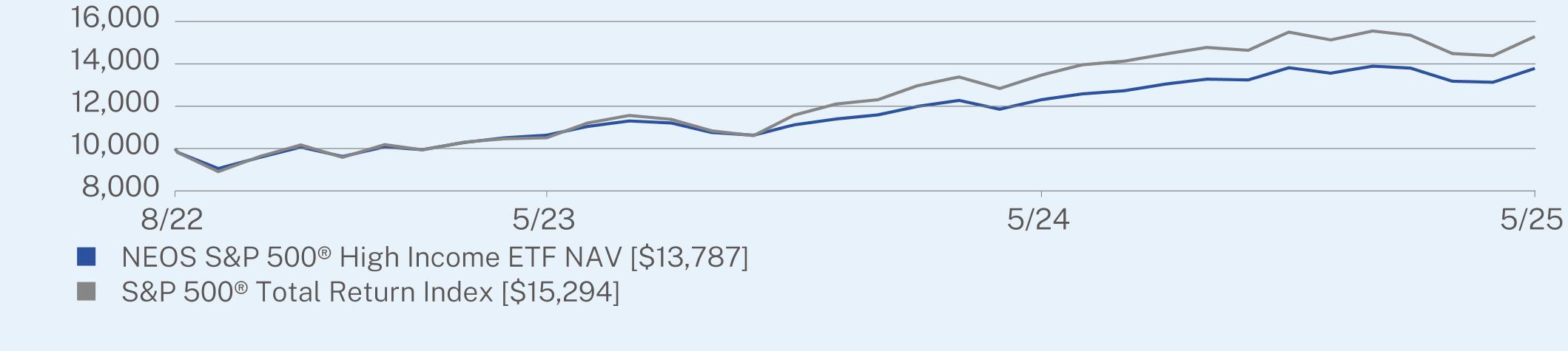

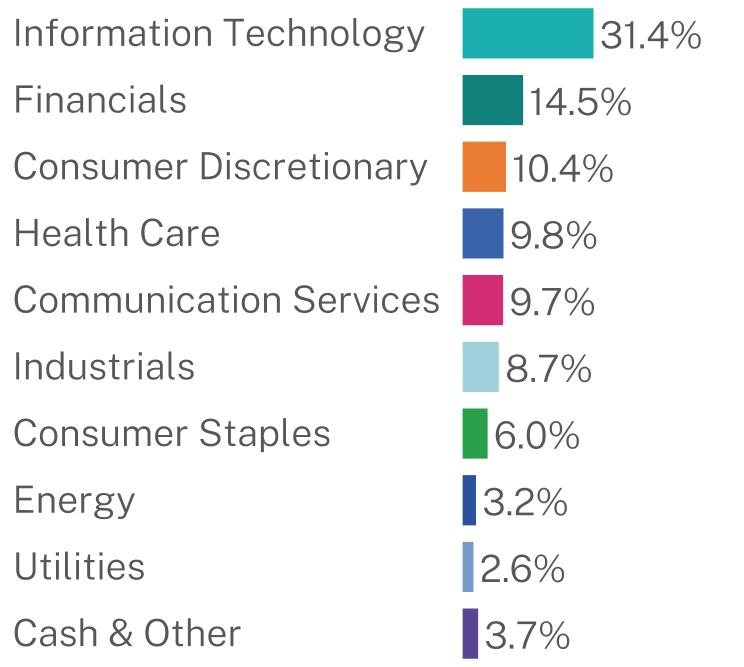

NEOS S&P 500® High Income ETF

|

$72

|

0.68%

|

|

|

1 Year

|

Since Inception

(08/30/2022) |

|

NEOS S&P 500® High Income ETF NAV

|

12.01

|

12.37

|

|

S&P 500® Total Return Index

|

13.52

|

16.69

|

|

Net Assets

|

$3,696,859,069

|

|

Number of Holdings

|

509

|

|

Net Advisory Fee

|

$16,361,817

|

|

Portfolio Turnover

|

2%

|

|

30-Day SEC Yield

|

0.75%

|

|

30-Day SEC Yield Unsubsidized

|

0.75%

|

|

Distribution Yield

|

12.50%

|

|

Top 10 Issuers

|

|

|

Microsoft Corp.

|

6.8%

|

|

NVIDIA Corp.

|

6.6%

|

|

Apple, Inc.

|

6.0%

|

|

Amazon.com, Inc.

|

3.9%

|

|

Alphabet, Inc.

|

3.6%

|

|

Meta Platforms, Inc.

|

2.8%

|

|

Broadcom, Inc.

|

2.2%

|

|

Tesla, Inc.

|

1.9%

|

|

Berkshire Hathaway, Inc.

|

1.9%

|

|

JPMorgan Chase & Co.

|

1.5%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|

||

| [8] |

|

||

| [9] |

|

||

| [10] |

|

||

| [11] |

|

||

| [12] |

|

||

| [13] |

|

||

| [14] |

|

||

| [15] |

|

||

| [16] |

|

||

| [17] |

|

||

| [18] |

|

||

| [19] |

|

||

| [20] |

|

||

| [21] |

|