September 30, 2024 Second Quarter 2025 Results Earnings Presentation Second Line of Title

Important Disclosures IMPORTANT NOTICES The inclusion of references to P10, Inc. (“P10” or the “Company”) in this presentation is for information purposes only as the holding company of various subsidiaries. P10 does not offer investment advisory services and this presentation is neither an offer of any investment products nor an offer of advisory services by P10. By accepting this presentation, you acknowledge that P10 is not offering investment advisory services. All investment advisory services referenced in this presentation are provided by subsidiaries of P10 which are registered as investment advisers with the U.S. Securities and Exchange Commission (“SEC”). Accordingly, this presentation may be considered marketing materials, in which event it would be marketing materials of each registered investment adviser subsidiary only. To the extent you have any questions regarding this presentation, please direct them to the applicable subsidiary. Registration as an investment adviser does not imply any level of skill or training. This presentation does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other investment product. Any securities described herein have not been recommended by any U.S. federal or state or non-U.S. securities commission or regulatory authority, including the SEC. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this document. Any representation to the contrary is a criminal offense. Nothing herein is intended to provide tax, legal or investment advice. Cautionary Statement Regarding Forward-Looking Information Some of the statements in this presentation may constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Words such as "will, " "expect, " "believe, " "estimate, " "continue, " "anticipate, " "intend, ” "plan “ and similar expressions are intended to identify these forward-looking statements. Forward-looking statements discuss management's current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. The inclusion of any forward-looking information in this presentation should not be regarded as a representation that the future plans, estimates or expectations contemplated will be achieved. Forward-looking statements are based on our historical performance and reflect management’s current plans, estimates and expectations and are inherently uncertain. All forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors that may cause actual results to be materially different, including risks relating to: global and domestic market and business conditions; our successful execution of business and growth strategies; and regulatory factors relevant to our business; changes in our tax status; our ability to maintain our fee structure; our ability to attract and retain key employees; our ability to manage our obligations under our debt agreements; our ability to make acquisitions and successfully integrate the businesses we acquire; assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy, the timing and amount of any share repurchases; and our ability to manage the effects of events outside of our control. The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks that we face, you should refer to the “Risk Factors” included in our annual report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 28, 2025, and in our subsequent reports filed from time to time with the SEC. The forward-looking statements included in this presentation are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information or future events, except as otherwise required by law. Cautionary Statement Regarding Financial and Operating Projections All financial and operating projections, forecasts or estimates about or relating to the Company included in this document, including statements regarding pro-forma valuation and ownership, have been prepared based on various estimates, assumptions and hypothetical scenarios. Forecasts and projections of financial performance, valuation and operating results are, by nature, speculative and based in part on anticipating and assuming future events (and the effects of future events) that are impossible to predict with certainty and no representation of any kind is made with respect thereto. The Company’s future results and achievements will depend on a number of factors, including the accuracy and reasonableness of the assumptions underlying any forecasted information as well as on significant transaction, business, economic, competitive, regulatory, technological and other uncertainties, contingencies and developments that in many cases will be beyond the Company’s control. Accordingly, all projections or forecasts (and estimates based on such projections or forecasts) contained herein should not be viewed as an assessment, prediction or representation as to future results and interested parties should not rely, and will not be deemed to have relied, on any such projections or forecasts. Actual results may differ substantially and could be materially worse than any projection, forecast or scenario set forth in this document. The Company expressly disclaims any obligation to update or revise any of the projections, forecasts, models or scenarios contained herein to reflect any change in the Company’s expectations with regard thereto or any changes in events, conditions or circumstances on which any such statement is based. Fee-Paying Assets Under Management, or FPAUM FPAUM reflects the assets from which we earn management and advisory fees. Our vehicles typically earn management and advisory fees based on committed capital, and in certain cases, net invested capital, depending on the fee terms. Management and advisory fees based on committed capital are not affected by market appreciation or depreciation. Use of Non-GAAP Financial Measures by P10, Inc. In addition to the Company’s financial results determined in accordance with U.S. GAAP, the Company provides non-GAAP measures that it determines to be useful in evaluating its operating performance and liquidity, including, without limitation, Fee-Related Revenue (“FRR”), Fee-Related Earnings (“FRE”), Fee-Related Earnings Margin, Adjusted Net Income (“ANI”), Fully Diluted ANI per share, FPAUM, and AUM. These non-GAAP measures should not be considered as alternatives to net income as a measure of financial performance or cash flows from operations as measures of liquidity, or any other performance measure derived in accordance with GAAP. A reconciliation of such non-GAAP measures to their most directly comparable GAAP measure is included later in this presentation. The Company believes the presentation of these non-GAAP measures provide useful additional information to investors because it provides better comparability of ongoing operating performance to prior periods. It is reasonable to expect that one or more excluded items will occur in future periods, but the amounts recognized can vary significantly from period to period. These non-GAAP measures should not be considered substitutes for net income or cash flows from operating, investing, or financing activities. You are encouraged to evaluate each adjustment to non-GAAP financial measures and the reasons management considers it appropriate for supplemental analysis. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

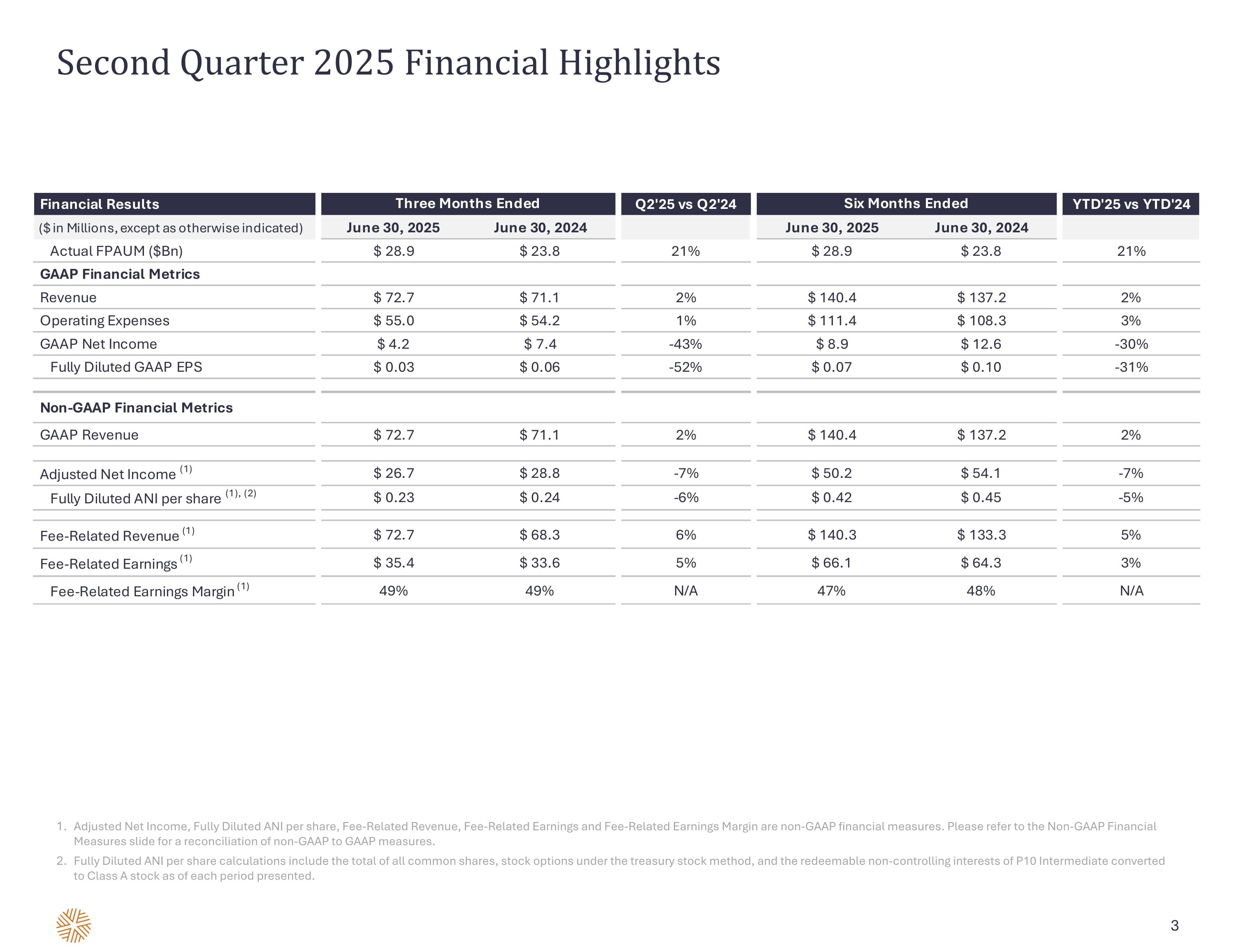

Second Quarter 2025 Financial Highlights Adjusted Net Income, Fully Diluted ANI per share, Fee-Related Revenue, Fee-Related Earnings and Fee-Related Earnings Margin are non-GAAP financial measures. Please refer to the Non-GAAP Financial Measures slide for a reconciliation of non-GAAP to GAAP measures. Fully Diluted ANI per share calculations include the total of all common shares, stock options under the treasury stock method, and the redeemable non-controlling interests of P10 Intermediate converted to Class A stock as of each period presented.

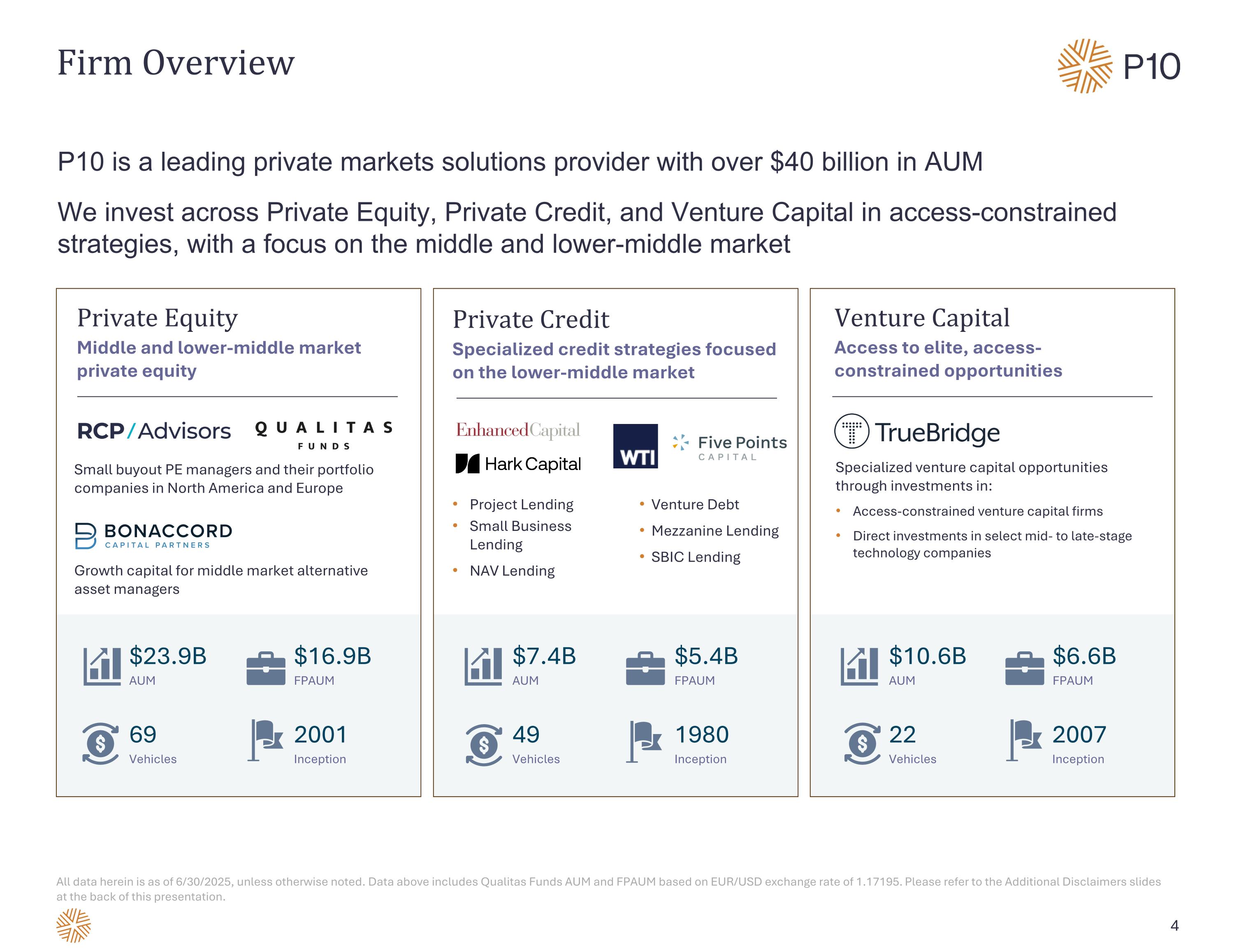

Firm Overview P10 is a leading private markets solutions provider with over $40 billion in AUM We invest across Private Equity, Private Credit, and Venture Capital in access-constrained strategies, with a focus on the middle and lower-middle market Private Equity Middle and lower-middle market private equity Small buyout PE managers and their portfolio companies in North America and Europe Growth capital for middle market alternative asset managers $23.9B AUM 69 Vehicles 2001 Inception $16.9B FPAUM Private Credit Specialized credit strategies focused on the lower-middle market Project Lending Small Business Lending NAV Lending Venture Debt Mezzanine Lending SBIC Lending 49 Vehicles $7.4B AUM 1980 Inception $5.4B FPAUM Venture Capital Access to elite, access-constrained opportunities Specialized venture capital opportunities through investments in: Access-constrained venture capital firms Direct investments in select mid- to late-stage technology companies 22 Vehicles $10.6B AUM 2007 Inception $6.6B FPAUM All data herein is as of 6/30/2025, unless otherwise noted. Data above includes Qualitas Funds AUM and FPAUM based on EUR/USD exchange rate of 1.17195. Please refer to the Additional Disclaimers slides at the back of this presentation.

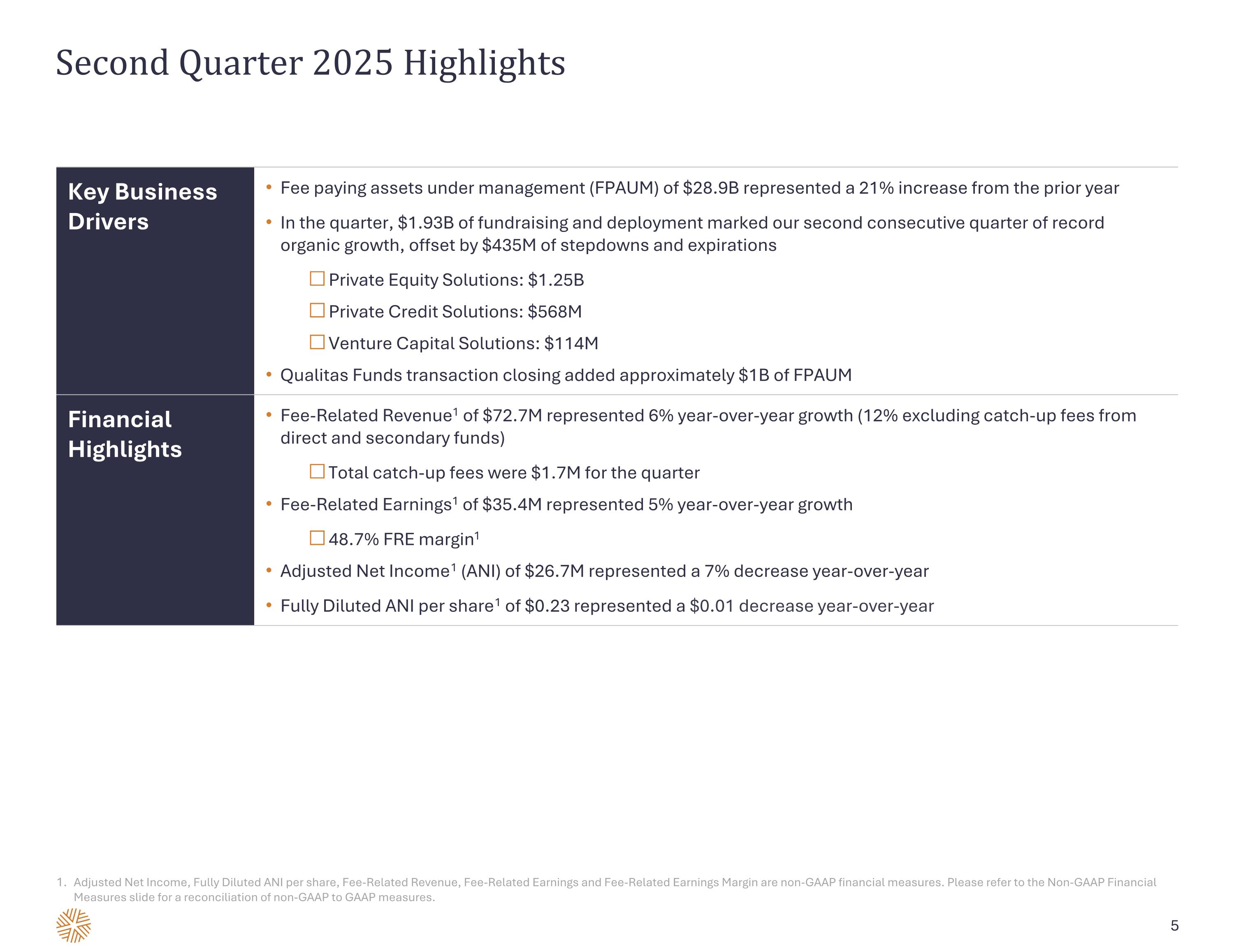

Second Quarter 2025 Highlights Key Business Drivers Fee paying assets under management (FPAUM) of $28.9B represented a 21% increase from the prior year In the quarter, $1.93B of fundraising and deployment marked our second consecutive quarter of record organic growth, offset by $435M of stepdowns and expirations Private Equity Solutions: $1.25B Private Credit Solutions: $568M Venture Capital Solutions: $114M Qualitas Funds transaction closing added approximately $1B of FPAUM Financial Highlights Fee-Related Revenue1 of $72.7M represented 6% year-over-year growth (12% excluding catch-up fees from direct and secondary funds) Total catch-up fees were $1.7M for the quarter Fee-Related Earnings1 of $35.4M represented 5% year-over-year growth 48.7% FRE margin1 Adjusted Net Income1 (ANI) of $26.7M represented a 7% decrease year-over-year Fully Diluted ANI per share1 of $0.23 represented a $0.01 decrease year-over-year Adjusted Net Income, Fully Diluted ANI per share, Fee-Related Revenue, Fee-Related Earnings and Fee-Related Earnings Margin are non-GAAP financial measures. Please refer to the Non-GAAP Financial Measures slide for a reconciliation of non-GAAP to GAAP measures.

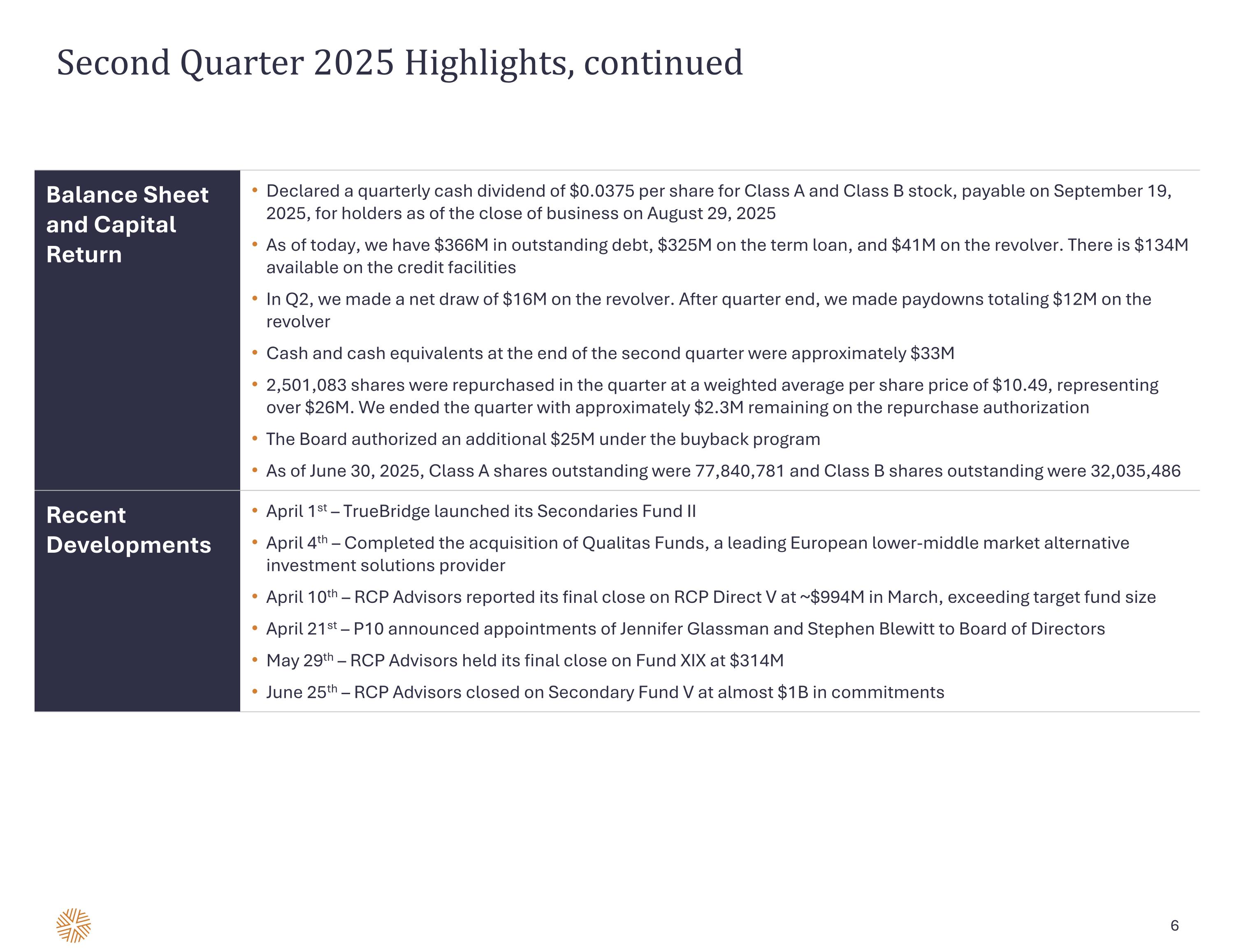

Second Quarter 2025 Highlights, continued Balance Sheet and Capital Return Declared a quarterly cash dividend of $0.0375 per share for Class A and Class B stock, payable on September 19, 2025, for holders as of the close of business on August 29, 2025 As of today, we have $366M in outstanding debt, $325M on the term loan, and $41M on the revolver. There is $134M available on the credit facilities In Q2, we made a net draw of $16M on the revolver. After quarter end, we made paydowns totaling $12M on the revolver Cash and cash equivalents at the end of the second quarter were approximately $33M 2,501,083 shares were repurchased in the quarter at a weighted average per share price of $10.49, representing over $26M. We ended the quarter with approximately $2.3M remaining on the repurchase authorization The Board authorized an additional $25M under the buyback program As of June 30, 2025, Class A shares outstanding were 77,840,781 and Class B shares outstanding were 32,035,486 Recent Developments April 1st – TrueBridge launched its Secondaries Fund II April 4th – Completed the acquisition of Qualitas Funds, a leading European lower-middle market alternative investment solutions provider April 10th – RCP Advisors reported its final close on RCP Direct V at ~$994M in March, exceeding target fund size April 21st – P10 announced appointments of Jennifer Glassman and Stephen Blewitt to Board of Directors May 29th – RCP Advisors held its final close on Fund XIX at $314M June 25th – RCP Advisors closed on Secondary Fund V at almost $1B in commitments

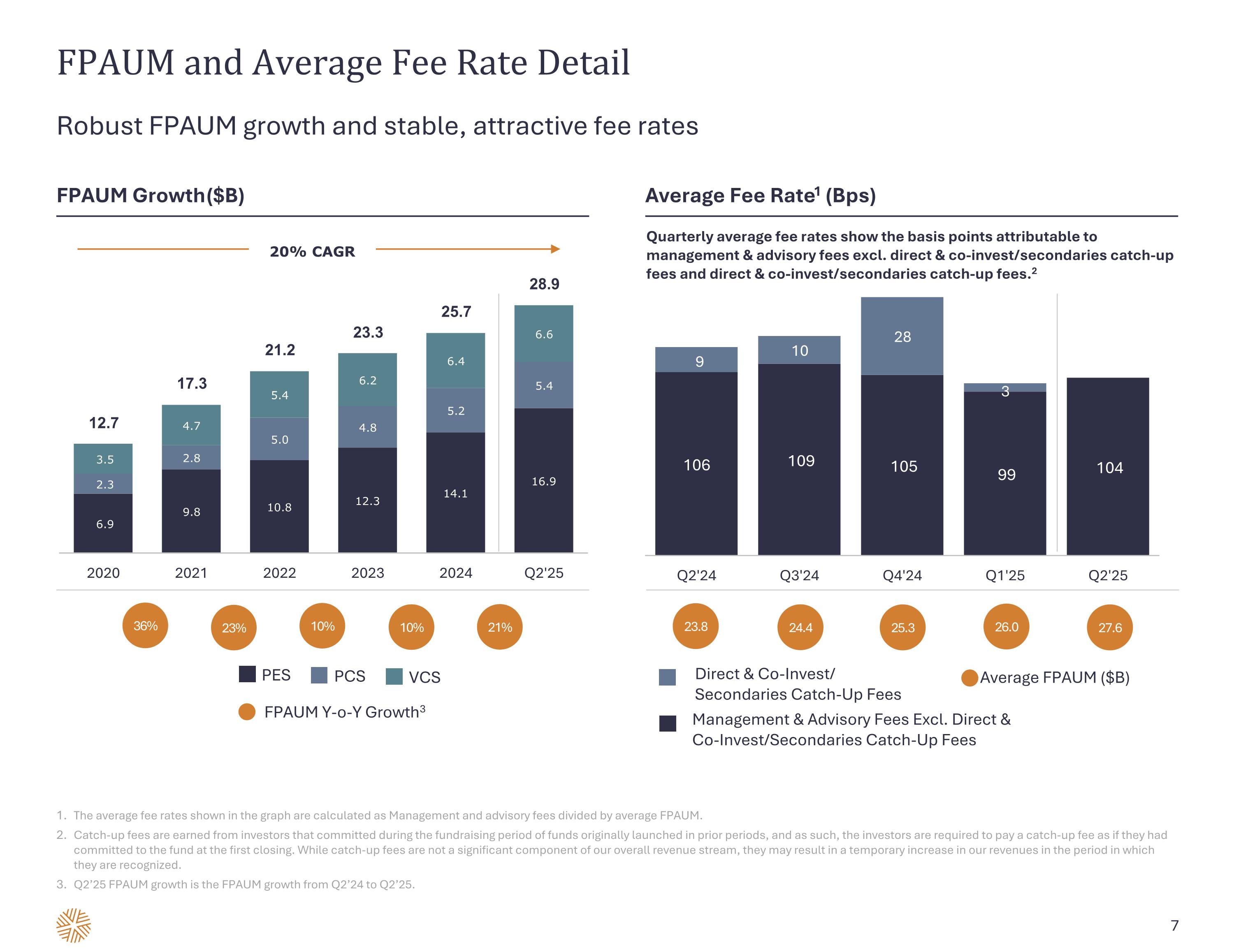

FPAUM and Average Fee Rate Detail Robust FPAUM growth and stable, attractive fee rates The average fee rates shown in the graph are calculated as Management and advisory fees divided by average FPAUM. Catch-up fees are earned from investors that committed during the fundraising period of funds originally launched in prior periods, and as such, the investors are required to pay a catch-up fee as if they had committed to the fund at the first closing. While catch-up fees are not a significant component of our overall revenue stream, they may result in a temporary increase in our revenues in the period in which they are recognized. Q2’25 FPAUM growth is the FPAUM growth from Q2’24 to Q2’25. FPAUM Growth ($B) 36% 23% 10% FPAUM Y-o-Y Growth3 Average Fee Rate1 (Bps) Quarterly average fee rates show the basis points attributable to management & advisory fees excl. direct & co-invest/secondaries catch-up fees and direct & co-invest/secondaries catch-up fees.2 Management & Advisory Fees Excl. Direct & Co-Invest/Secondaries Catch-Up Fees 23.8 24.4 25.3 20% CAGR Direct & Co-Invest/ Secondaries Catch-Up Fees Average FPAUM ($B) PES PCS VCS 10% 26.0 27.6 21%

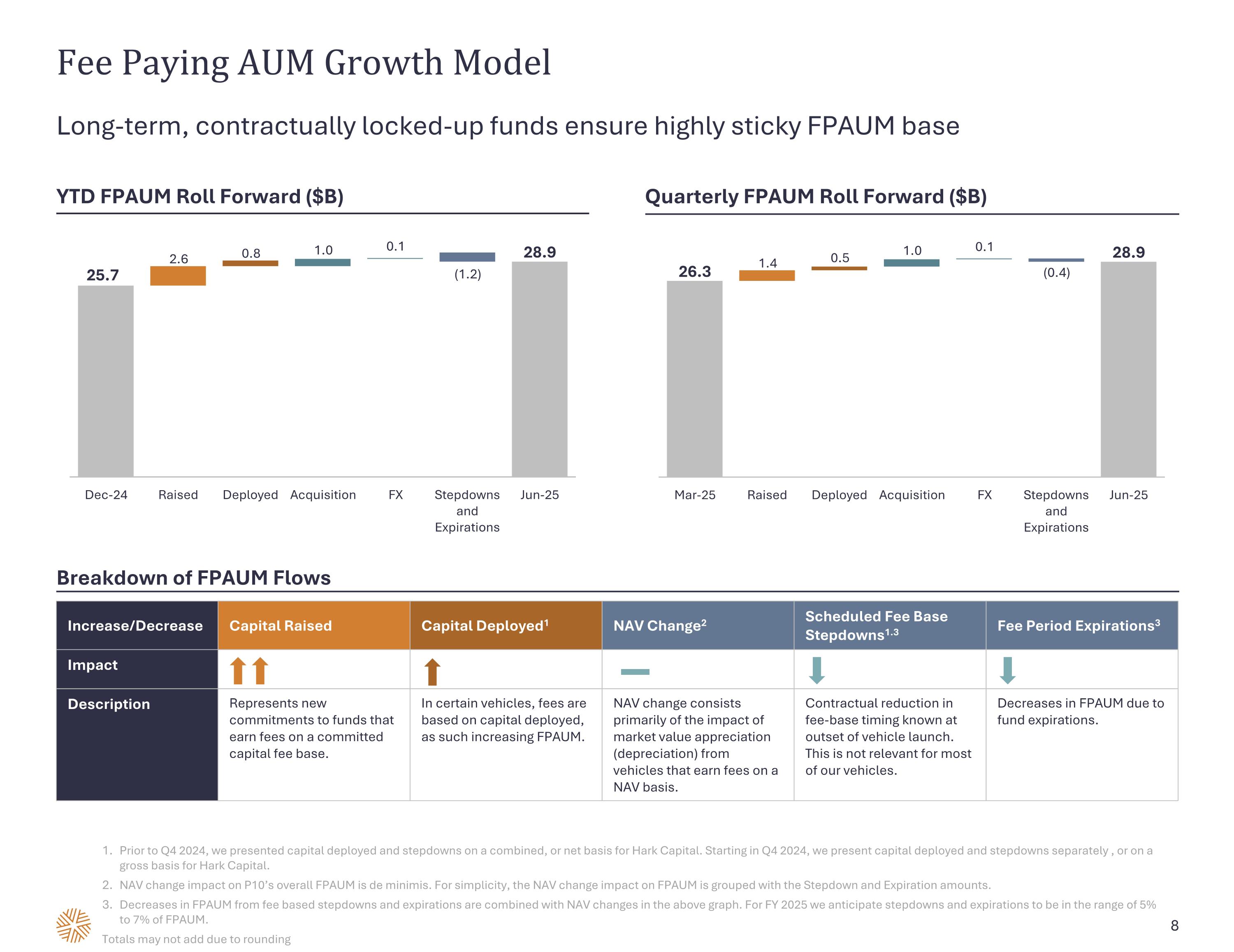

Increase/Decrease Capital Raised Capital Deployed1 NAV Change2 Scheduled Fee Base Stepdowns1.3 Fee Period Expirations3 Impact Description Represents new commitments to funds that earn fees on a committed capital fee base. In certain vehicles, fees are based on capital deployed, as such increasing FPAUM. NAV change consists primarily of the impact of market value appreciation (depreciation) from vehicles that earn fees on a NAV basis. Contractual reduction in fee-base timing known at outset of vehicle launch. This is not relevant for most of our vehicles. Decreases in FPAUM due to fund expirations. Fee Paying AUM Growth Model Long-term, contractually locked-up funds ensure highly sticky FPAUM base Prior to Q4 2024, we presented capital deployed and stepdowns on a combined, or net basis for Hark Capital. Starting in Q4 2024, we present capital deployed and stepdowns separately , or on a gross basis for Hark Capital. NAV change impact on P10’s overall FPAUM is de minimis. For simplicity, the NAV change impact on FPAUM is grouped with the Stepdown and Expiration amounts. Decreases in FPAUM from fee based stepdowns and expirations are combined with NAV changes in the above graph. For FY 2025 we anticipate stepdowns and expirations to be in the range of 5% to 7% of FPAUM. Totals may not add due to rounding YTD FPAUM Roll Forward ($B) Quarterly FPAUM Roll Forward ($B) Breakdown of FPAUM Flows

Financial Details

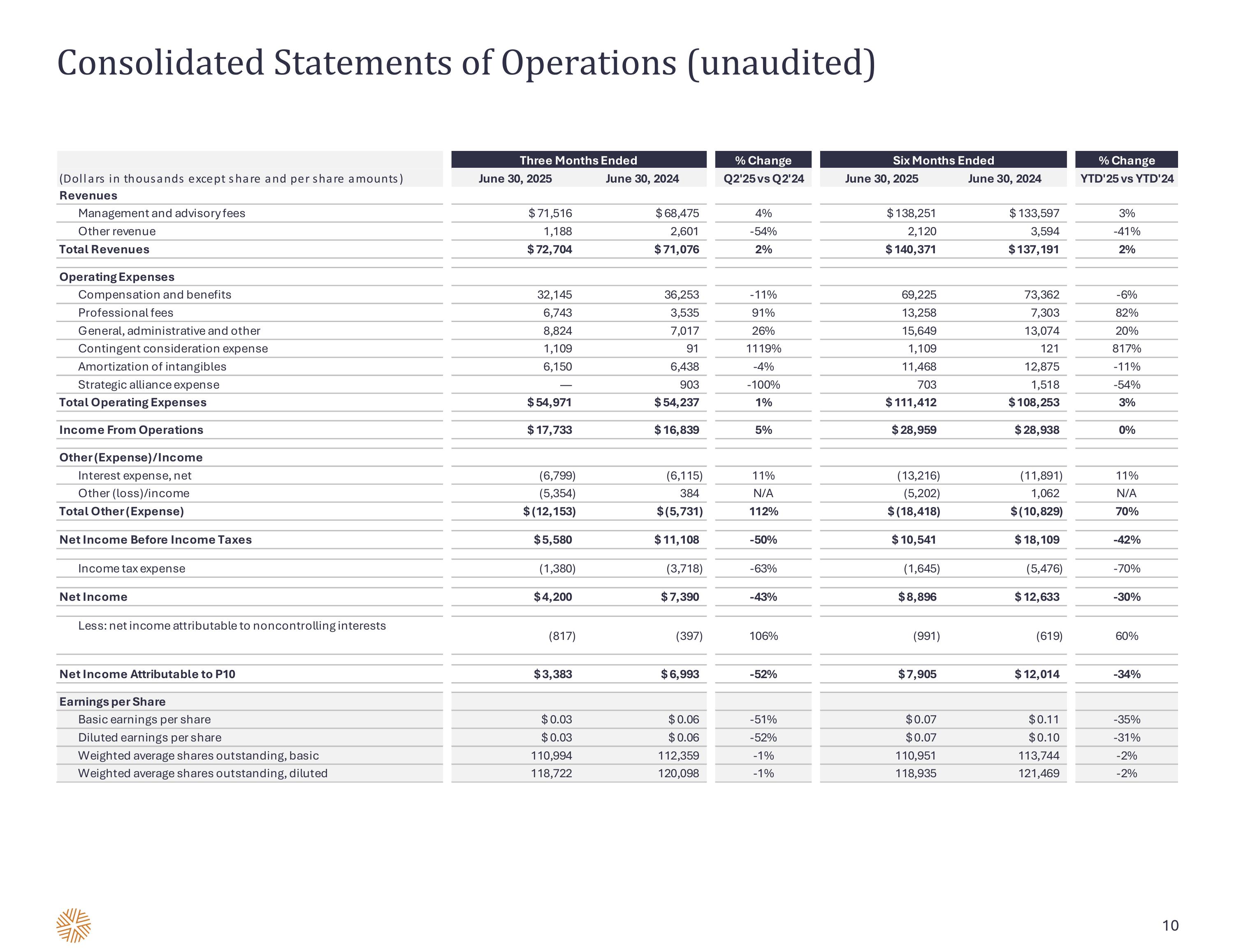

Consolidated Statements of Operations (unaudited)

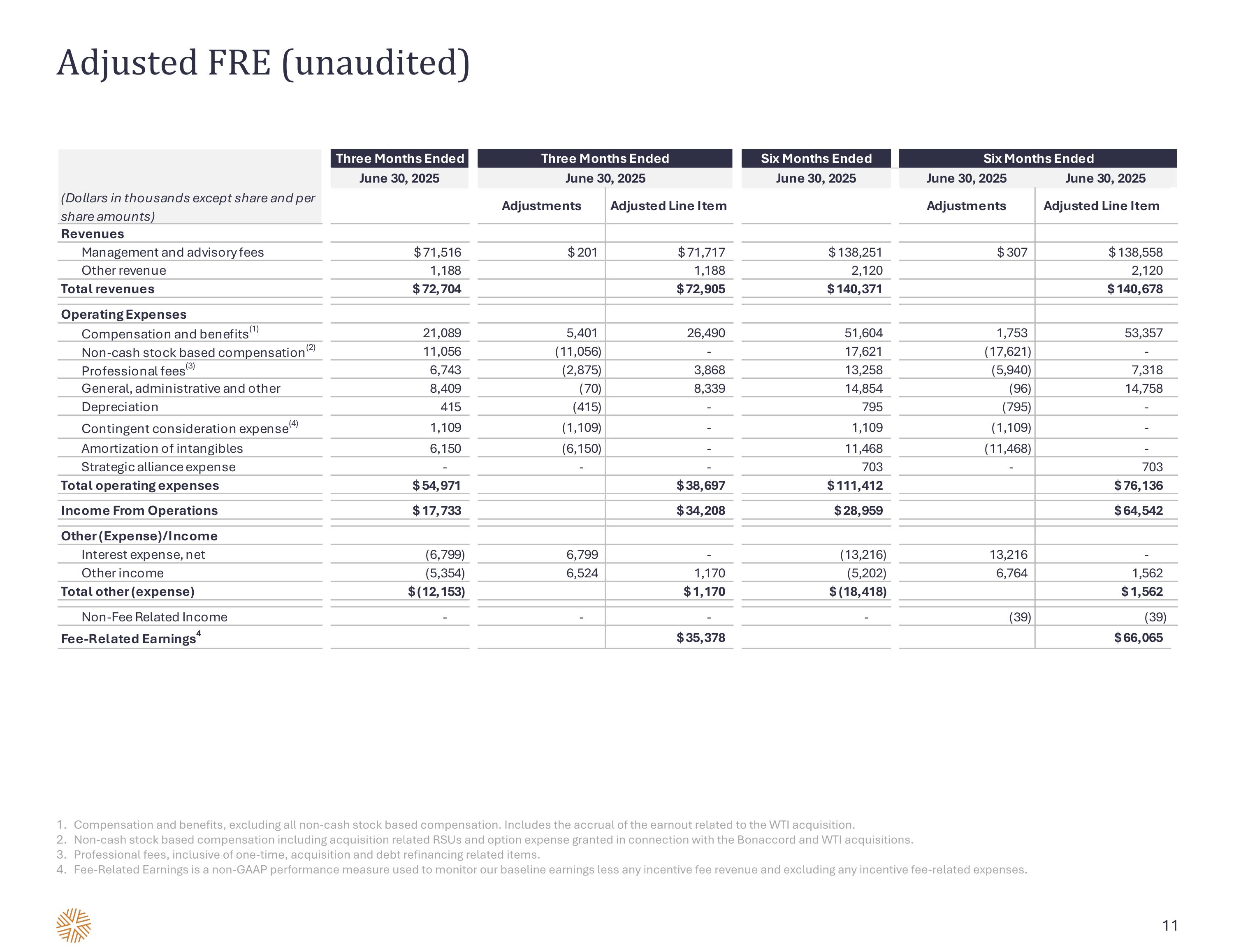

Adjusted FRE (unaudited) Compensation and benefits, excluding all non-cash stock based compensation. Includes the accrual of the earnout related to the WTI acquisition. Non-cash stock based compensation including acquisition related RSUs and option expense granted in connection with the Bonaccord and WTI acquisitions. Professional fees, inclusive of one-time, acquisition and debt refinancing related items. Fee-Related Earnings is a non-GAAP performance measure used to monitor our baseline earnings less any incentive fee revenue and excluding any incentive fee-related expenses.

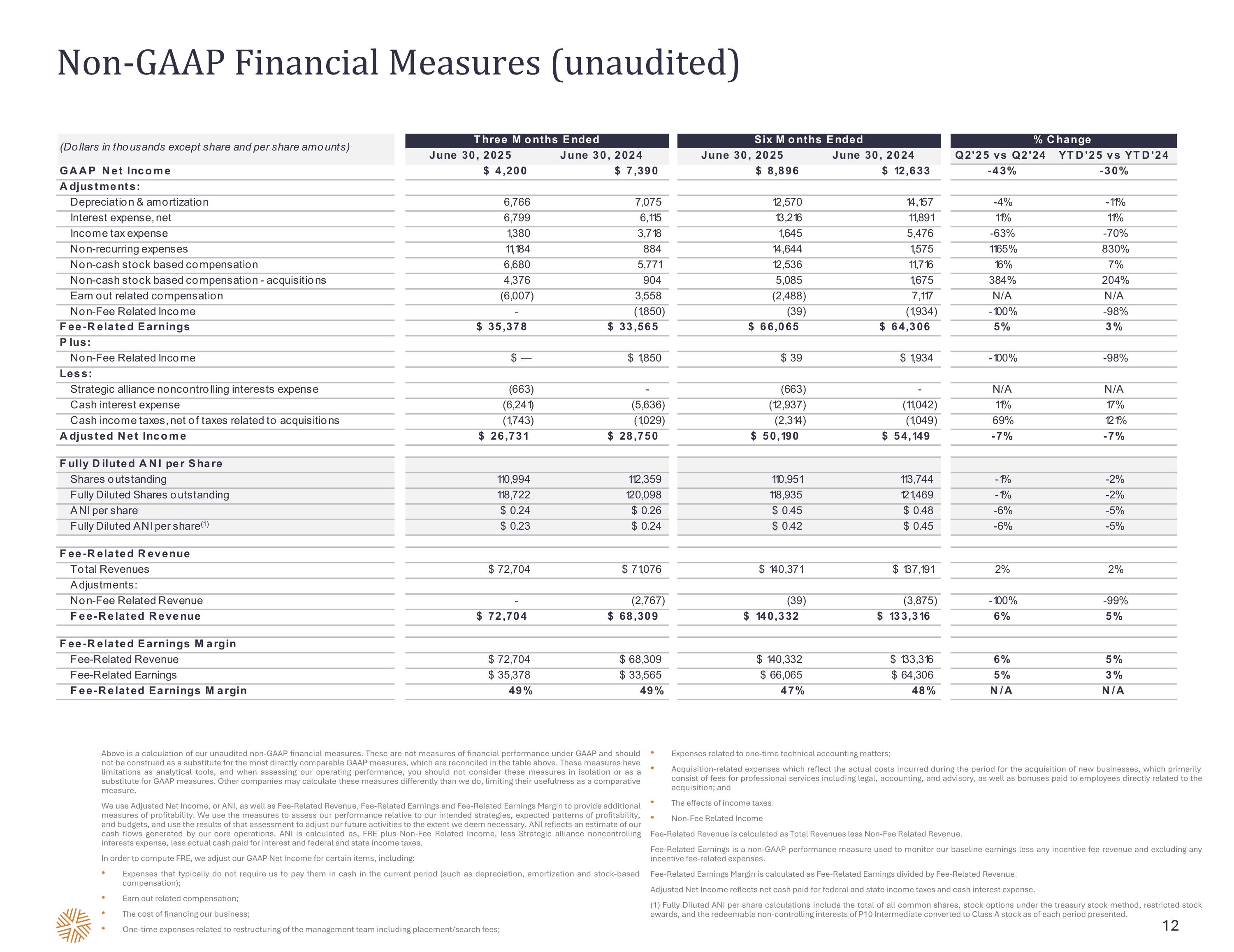

Non-GAAP Financial Measures (unaudited) Above is a calculation of our unaudited non-GAAP financial measures. These are not measures of financial performance under GAAP and should not be construed as a substitute for the most directly comparable GAAP measures, which are reconciled in the table above. These measures have limitations as analytical tools, and when assessing our operating performance, you should not consider these measures in isolation or as a substitute for GAAP measures. Other companies may calculate these measures differently than we do, limiting their usefulness as a comparative measure. We use Adjusted Net Income, or ANI, as well as Fee-Related Revenue, Fee-Related Earnings and Fee-Related Earnings Margin to provide additional measures of profitability. We use the measures to assess our performance relative to our intended strategies, expected patterns of profitability, and budgets, and use the results of that assessment to adjust our future activities to the extent we deem necessary. ANI reflects an estimate of our cash flows generated by our core operations. ANI is calculated as, FRE plus Non-Fee Related Income, less Strategic alliance noncontrolling interests expense, less actual cash paid for interest and federal and state income taxes. In order to compute FRE, we adjust our GAAP Net Income for certain items, including: Expenses that typically do not require us to pay them in cash in the current period (such as depreciation, amortization and stock-based compensation); Earn out related compensation; The cost of financing our business; One-time expenses related to restructuring of the management team including placement/search fees; Expenses related to one-time technical accounting matters; Acquisition-related expenses which reflect the actual costs incurred during the period for the acquisition of new businesses, which primarily consist of fees for professional services including legal, accounting, and advisory, as well as bonuses paid to employees directly related to the acquisition; and The effects of income taxes. Non-Fee Related Income Fee-Related Revenue is calculated as Total Revenues less Non-Fee Related Revenue. Fee-Related Earnings is a non-GAAP performance measure used to monitor our baseline earnings less any incentive fee revenue and excluding any incentive fee-related expenses. Fee-Related Earnings Margin is calculated as Fee-Related Earnings divided by Fee-Related Revenue. Adjusted Net Income reflects net cash paid for federal and state income taxes and cash interest expense. (1) Fully Diluted ANI per share calculations include the total of all common shares, stock options under the treasury stock method, restricted stock awards, and the redeemable non-controlling interests of P10 Intermediate converted to Class A stock as of each period presented.

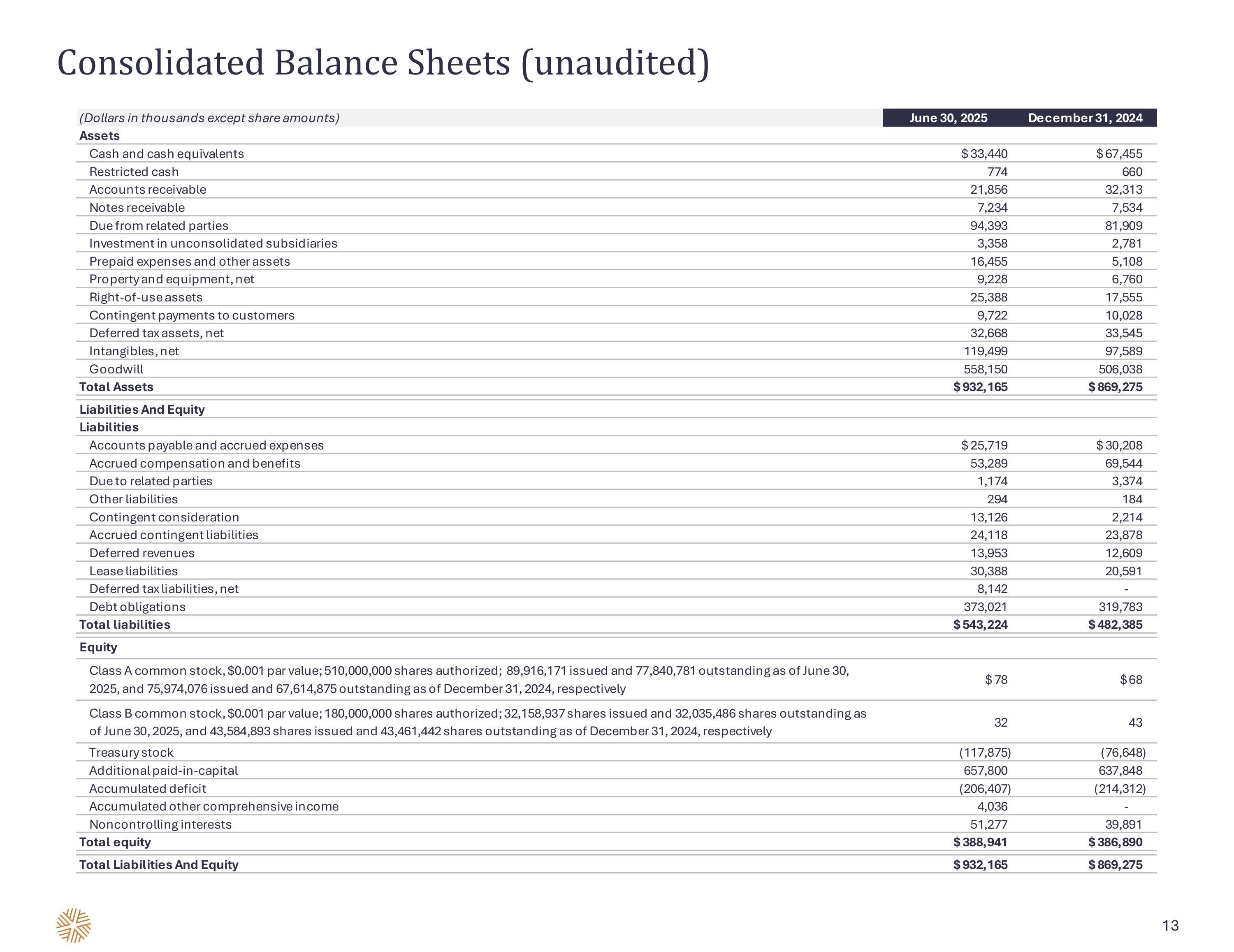

Consolidated Balance Sheets (unaudited)

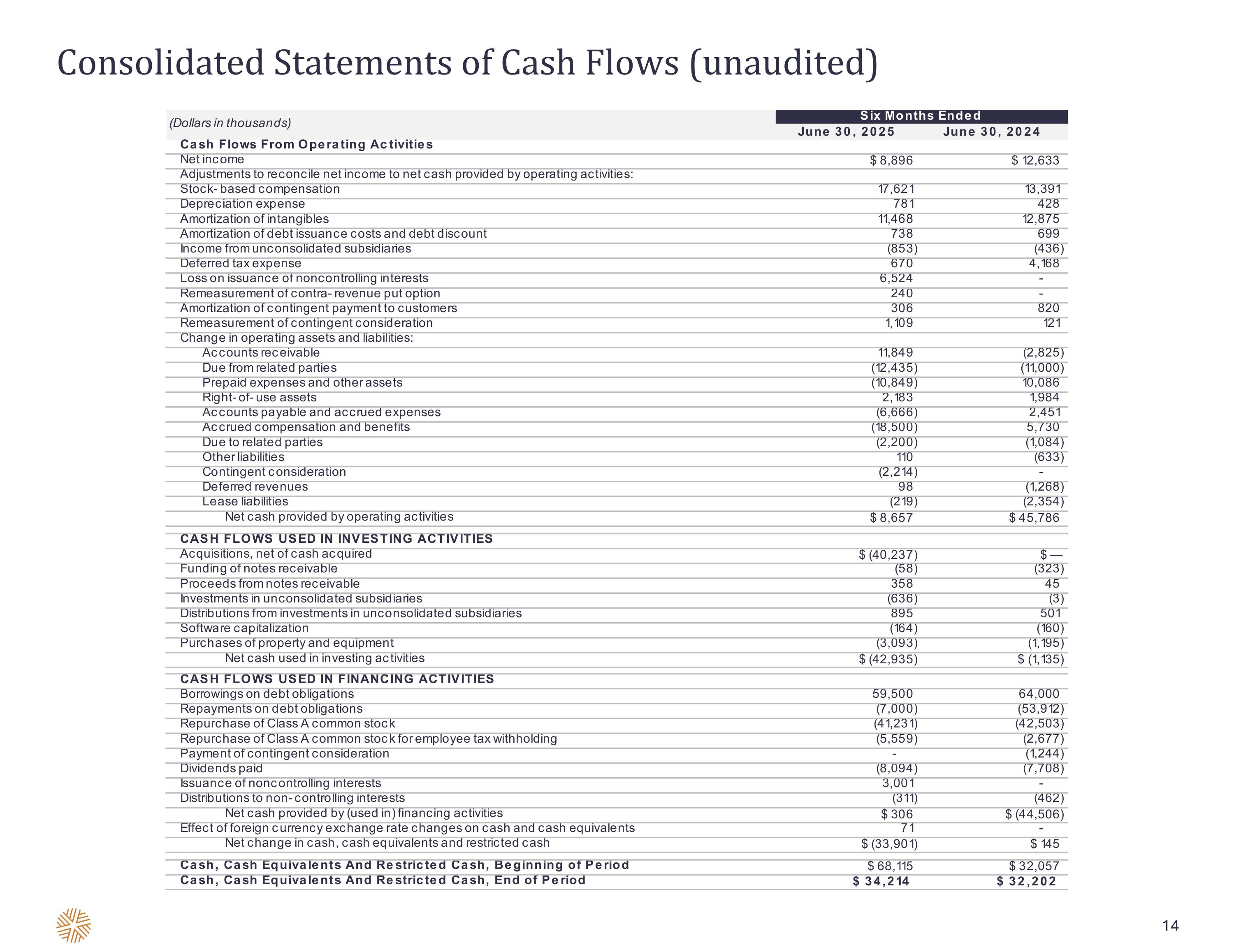

Consolidated Statements of Cash Flows (unaudited)

Supplemental Materials - Structural Advantages of the Middle and Lower-Middle Market

Structural Advantages of the Middle and Lower-Middle Market We believe there are important long-term structural advantages to the middle and lower-middle market that reduce volatility in returns and ultimately fundraising – P10’s “all-weather strategies” Past performance does not predict, and is not a guarantee of, future results. Any reference to returns or outperformance is based on historical observations and does not guarantee future performance. Certain statements herein may be considered forward looking and are subject to risks and uncertainties; actual results may differ materially. See ‘Forward Looking Statements’ disclosure for additional information. Attractive competitive dynamics in a large addressable market Valuations structurally lower Meaningfully less utilization of financial leverage Opportunities to create value and drive growth combined with multiple expansion have historically driven outperformance (1) (2) (3) (4) Historically leading to better overall returns and greater potential for outperformance (5)

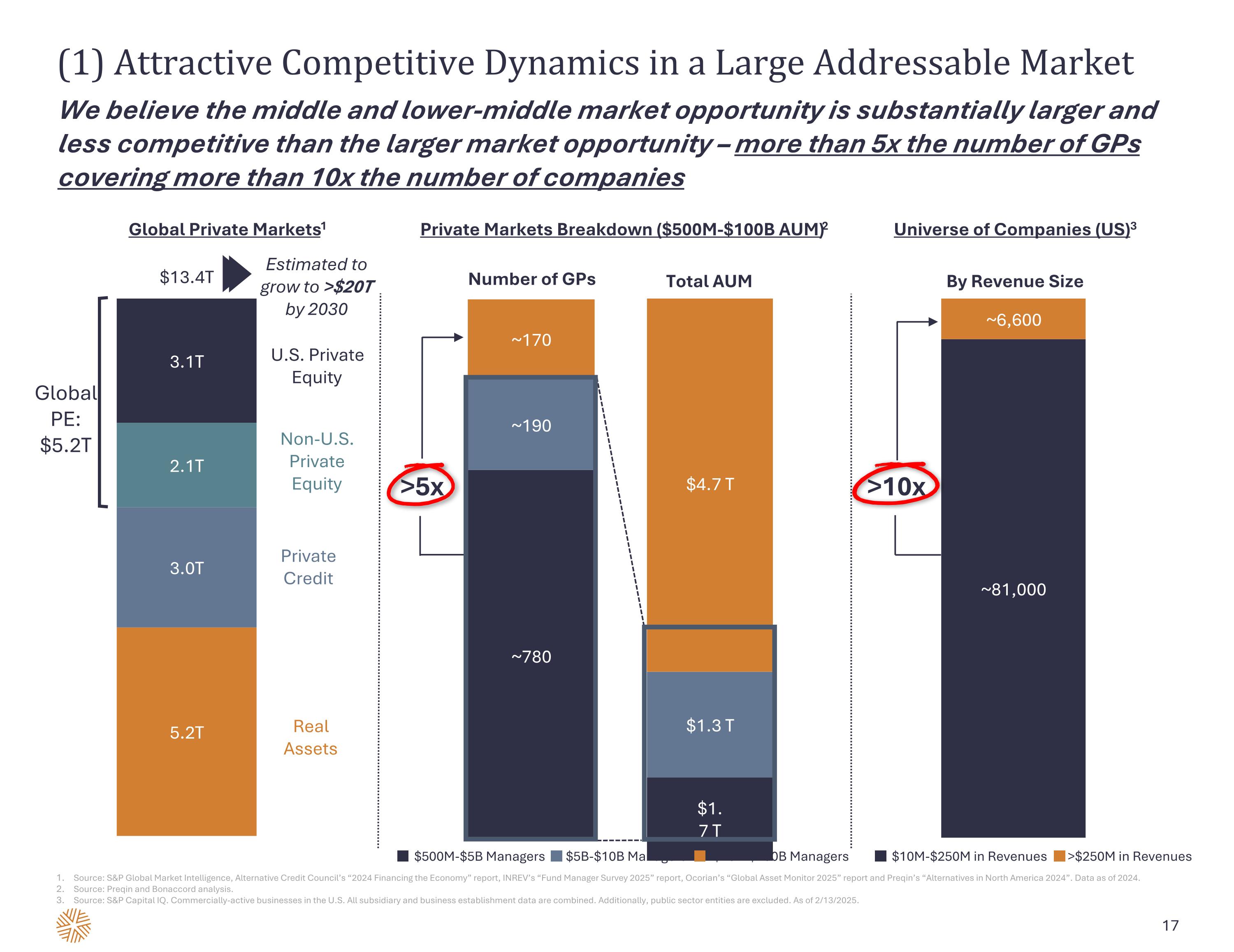

(1) Attractive Competitive Dynamics in a Large Addressable Market We believe the middle and lower-middle market opportunity is substantially larger and less competitive than the larger market opportunity – more than 5x the number of GPs covering more than 10x the number of companies Private Markets Breakdown ($500M-$100B AUM)2 Real Assets Private Credit Non-U.S. Private Equity $13.4T U.S. Private Equity Global PE: $5.2T Global Private Markets1 Estimated to grow to >$20T by 2030 Number of GPs Total AUM $5B-$10B Managers $500M-$5B Managers $10B-$100B Managers Universe of Companies (US)3 >$250M in Revenues $10M-$250M in Revenues By Revenue Size Source: S&P Global Market Intelligence, Alternative Credit Council’s “2024 Financing the Economy” report, INREV’s “Fund Manager Survey 2025” report, Ocorian’s “Global Asset Monitor 2025” report and Preqin’s “Alternatives in North America 2024”. Data as of 2024. Source: Preqin and Bonaccord analysis. Source: S&P Capital IQ. Commercially-active businesses in the U.S. All subsidiary and business establishment data are combined. Additionally, public sector entities are excluded. As of 2/13/2025. >5x >10x

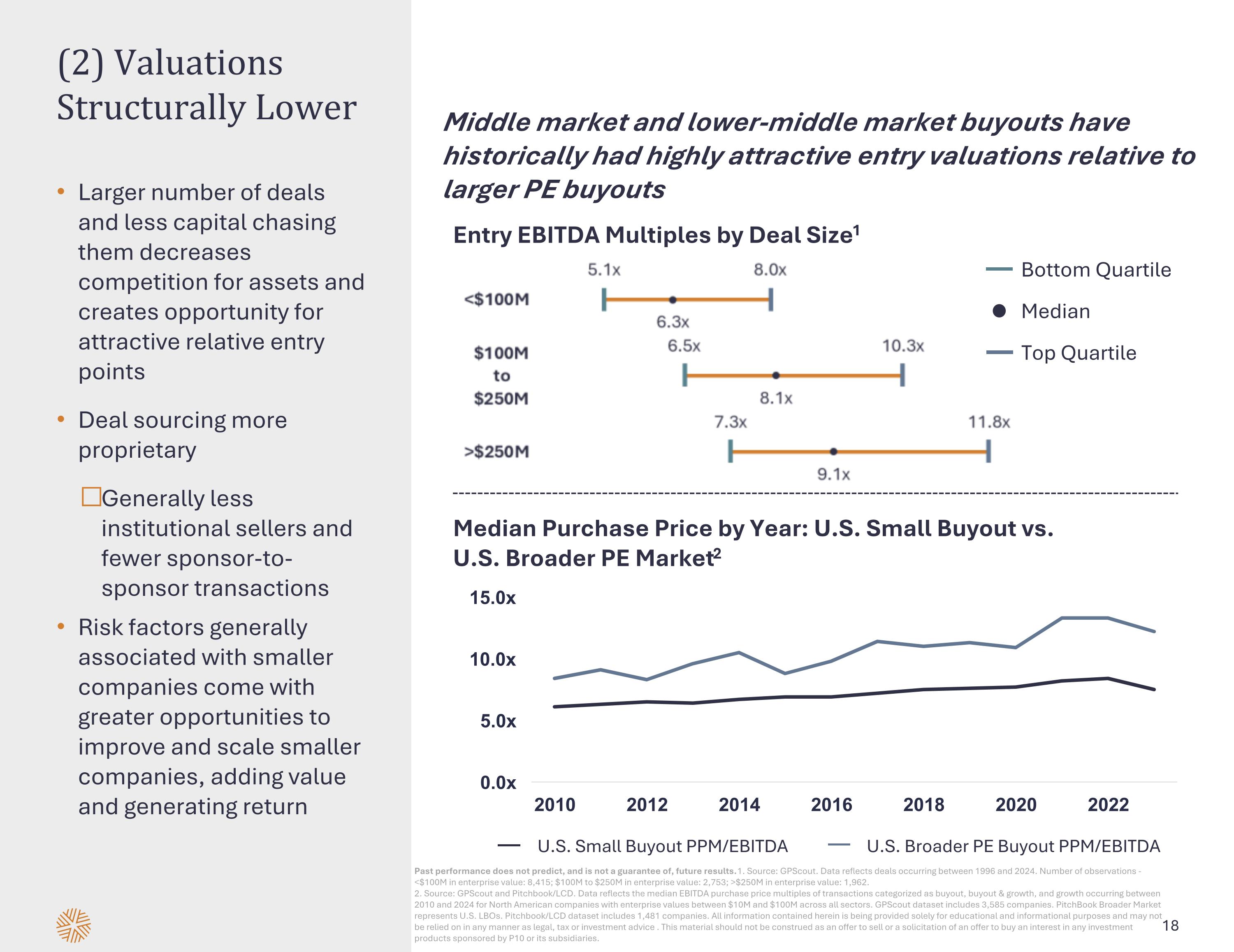

(2) Valuations Structurally Lower Larger number of deals and less capital chasing them decreases competition for assets and creates opportunity for attractive relative entry points Deal sourcing more proprietary Generally less institutional sellers and fewer sponsor-to-sponsor transactions Risk factors generally associated with smaller companies come with greater opportunities to improve and scale smaller companies, adding value and generating return Past performance does not predict, and is not a guarantee of, future results. 1. Source: GPScout. Data reflects deals occurring between 1996 and 2024. Number of observations - <$100M in enterprise value: 8,415; $100M to $250M in enterprise value: 2,753; >$250M in enterprise value: 1,962. 2. Source: GPScout and Pitchbook/LCD. Data reflects the median EBITDA purchase price multiples of transactions categorized as buyout, buyout & growth, and growth occurring between 2010 and 2024 for North American companies with enterprise values between $10M and $100M across all sectors. GPScout dataset includes 3,585 companies. PitchBook Broader Market represents U.S. LBOs. Pitchbook/LCD dataset includes 1,481 companies. All information contained herein is being provided solely for educational and informational purposes and may not be relied on in any manner as legal, tax or investment advice . This material should not be construed as an offer to sell or a solicitation of an offer to buy an interest in any investment products sponsored by P10 or its subsidiaries. U.S. Small Buyout PPM/EBITDA U.S. Broader PE Buyout PPM/EBITDA Entry EBITDA Multiples by Deal Size1 Median Purchase Price by Year: U.S. Small Buyout vs. U.S. Broader PE Market2 Bottom Quartile Top Quartile Median Middle market and lower-middle market buyouts have historically had highly attractive entry valuations relative to larger PE buyouts

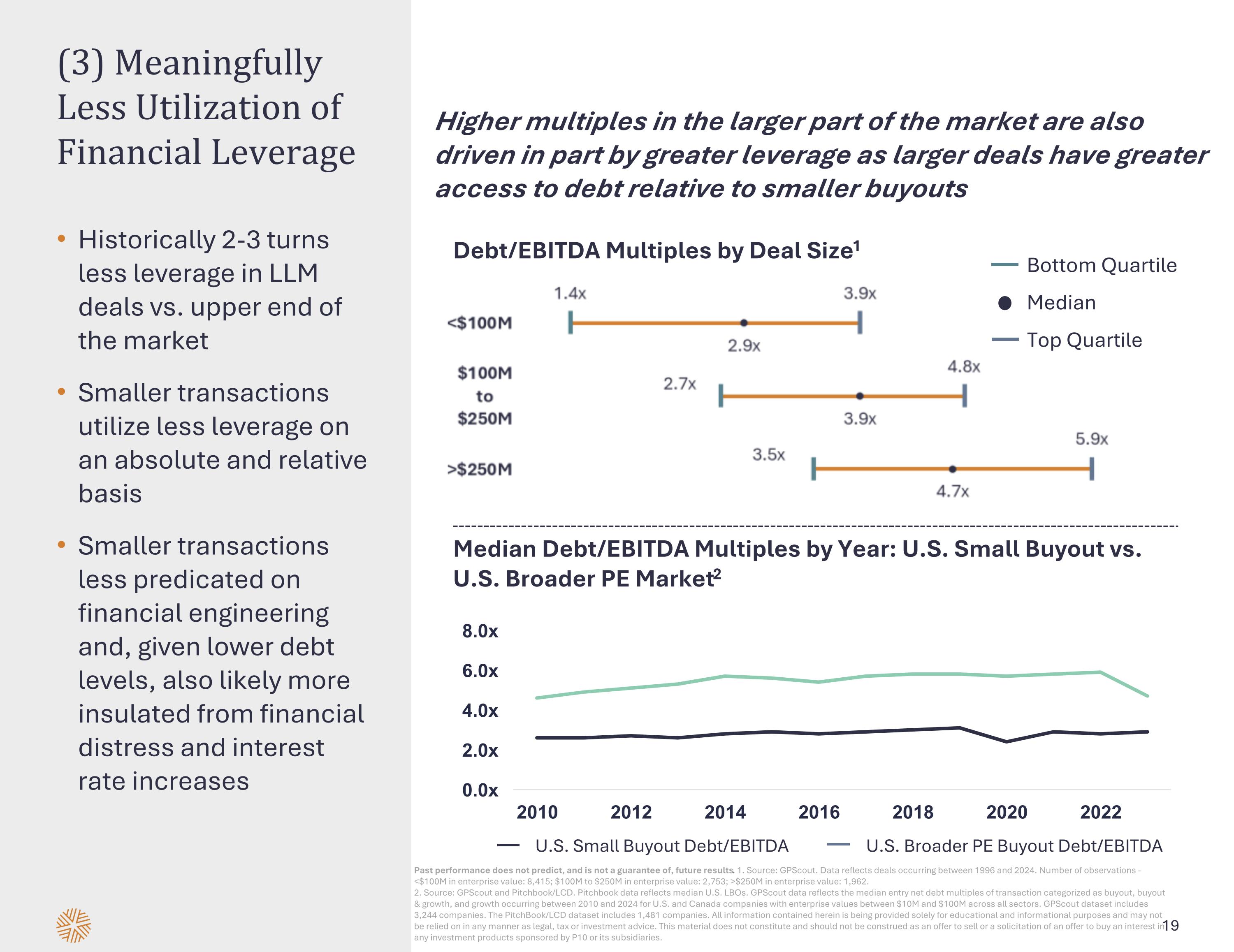

(3) Meaningfully Less Utilization of Financial Leverage Historically 2-3 turns less leverage in LLM deals vs. upper end of the market Smaller transactions utilize less leverage on an absolute and relative basis Smaller transactions less predicated on financial engineering and, given lower debt levels, also likely more insulated from financial distress and interest rate increases Past performance does not predict, and is not a guarantee of, future results. 1. Source: GPScout. Data reflects deals occurring between 1996 and 2024. Number of observations - <$100M in enterprise value: 8,415; $100M to $250M in enterprise value: 2,753; >$250M in enterprise value: 1,962. 2. Source: GPScout and Pitchbook/LCD. Pitchbook data reflects median U.S. LBOs. GPScout data reflects the median entry net debt multiples of transaction categorized as buyout, buyout & growth, and growth occurring between 2010 and 2024 for U.S. and Canada companies with enterprise values between $10M and $100M across all sectors. GPScout dataset includes 3,244 companies. The PitchBook/LCD dataset includes 1,481 companies. All information contained herein is being provided solely for educational and informational purposes and may not be relied on in any manner as legal, tax or investment advice. This material does not constitute and should not be construed as an offer to sell or a solicitation of an offer to buy an interest in any investment products sponsored by P10 or its subsidiaries. Higher multiples in the larger part of the market are also driven in part by greater leverage as larger deals have greater access to debt relative to smaller buyouts Bottom Quartile Top Quartile Median Debt/EBITDA Multiples by Deal Size1 Median Debt/EBITDA Multiples by Year: U.S. Small Buyout vs. U.S. Broader PE Market2 U.S. Small Buyout Debt/EBITDA U.S. Broader PE Buyout Debt/EBITDA

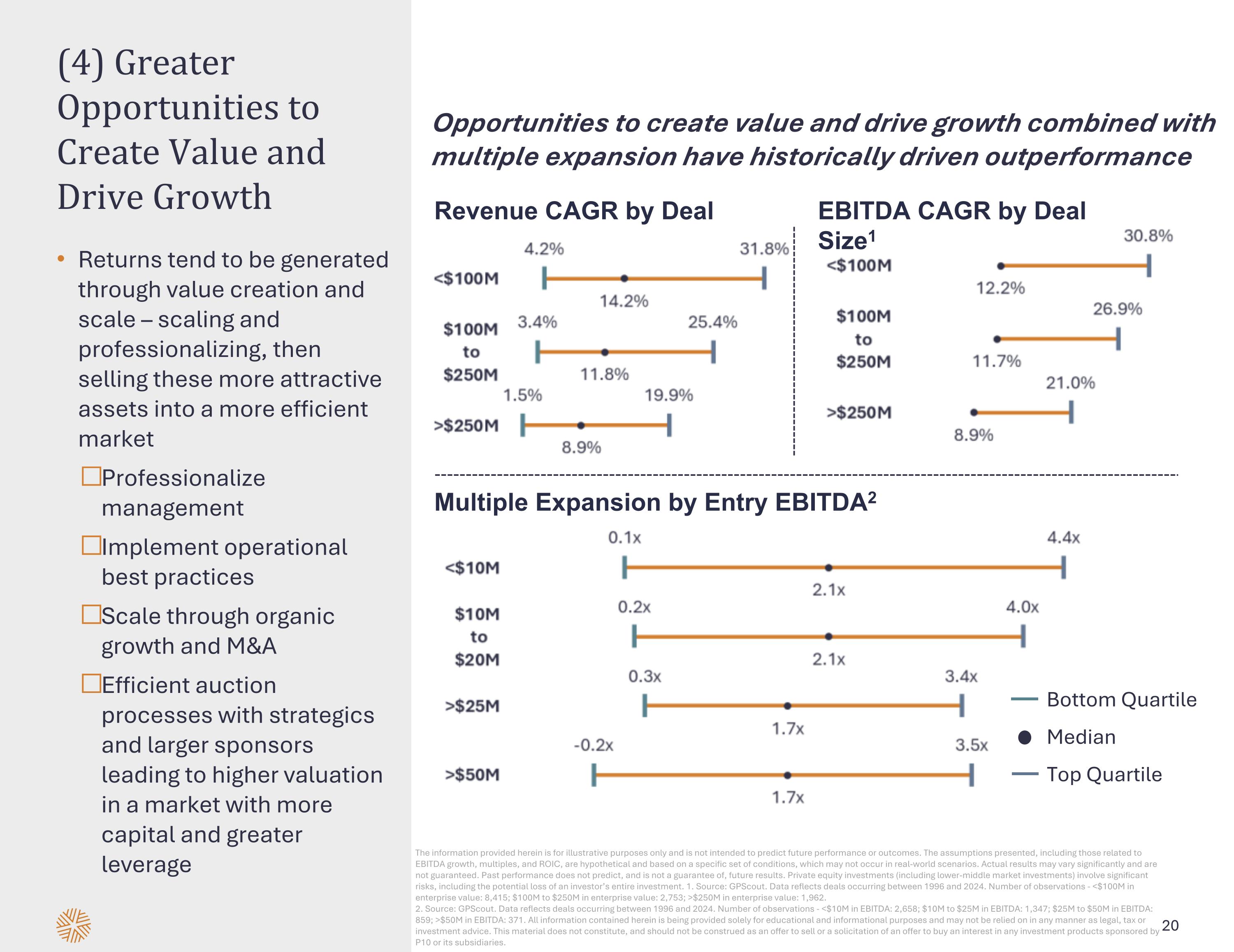

Opportunities to create value and drive growth combined with multiple expansion have historically driven outperformance (4) Greater Opportunities to Create Value and Drive Growth Returns tend to be generated through value creation and scale – scaling and professionalizing, then selling these more attractive assets into a more efficient market Professionalize management Implement operational best practices Scale through organic growth and M&A Efficient auction processes with strategics and larger sponsors leading to higher valuation in a market with more capital and greater leverage The information provided herein is for illustrative purposes only and is not intended to predict future performance or outcomes. The assumptions presented, including those related to EBITDA growth, multiples, and ROIC, are hypothetical and based on a specific set of conditions, which may not occur in real-world scenarios. Actual results may vary significantly and are not guaranteed. Past performance does not predict, and is not a guarantee of, future results. Private equity investments (including lower-middle market investments) involve significant risks, including the potential loss of an investor’s entire investment. 1. Source: GPScout. Data reflects deals occurring between 1996 and 2024. Number of observations - <$100M in enterprise value: 8,415; $100M to $250M in enterprise value: 2,753; >$250M in enterprise value: 1,962. 2. Source: GPScout. Data reflects deals occurring between 1996 and 2024. Number of observations - <$10M in EBITDA: 2,658; $10M to $25M in EBITDA: 1,347; $25M to $50M in EBITDA: 859; >$50M in EBITDA: 371. All information contained herein is being provided solely for educational and informational purposes and may not be relied on in any manner as legal, tax or investment advice. This material does not constitute, and should not be construed as an offer to sell or a solicitation of an offer to buy an interest in any investment products sponsored by P10 or its subsidiaries. Revenue CAGR by Deal Size1 EBITDA CAGR by Deal Size1 Multiple Expansion by Entry EBITDA2 Bottom Quartile Top Quartile Median

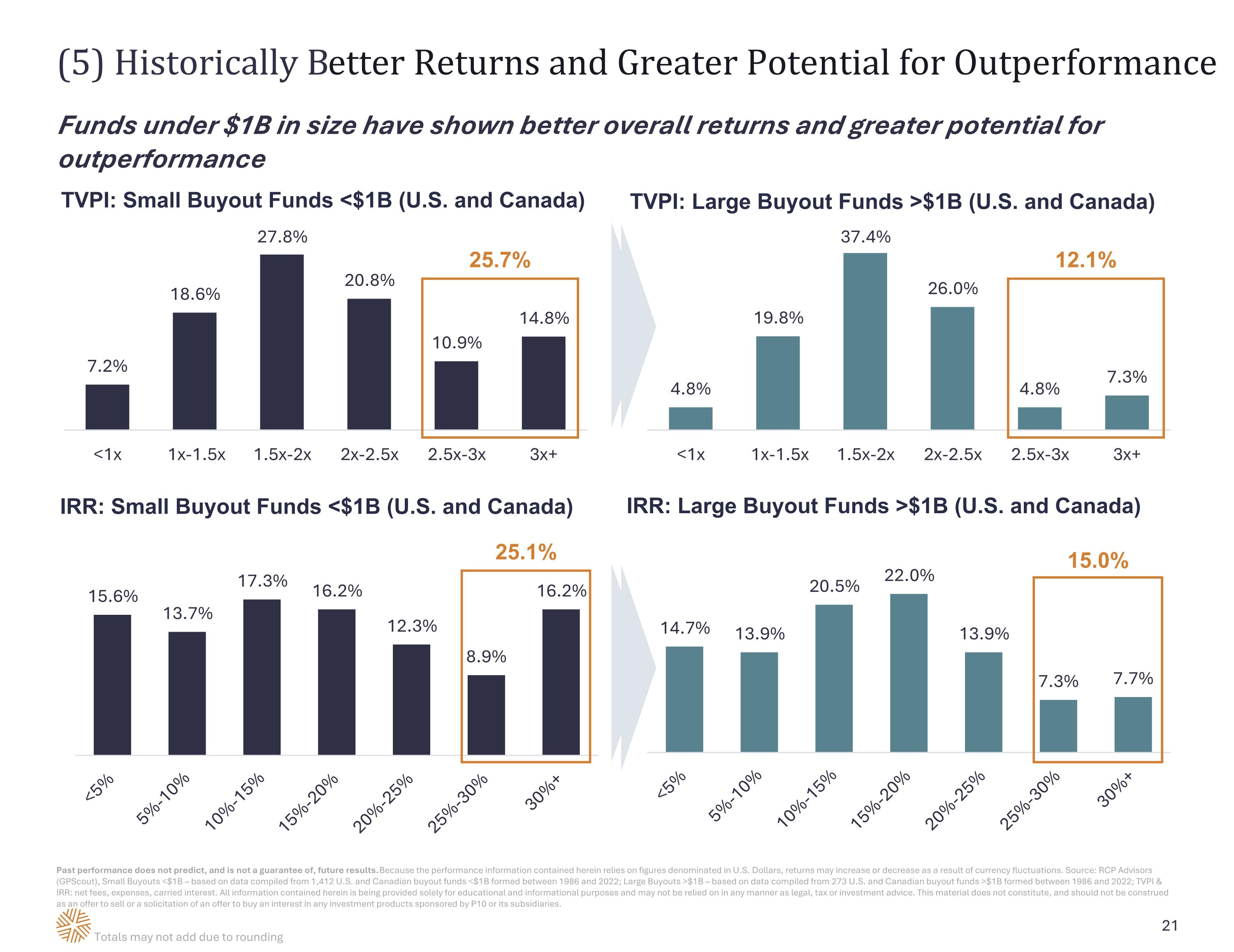

(5) Historically Better Returns and Greater Potential for Outperformance Past performance does not predict, and is not a guarantee of, future results. Because the performance information contained herein relies on figures denominated in U.S. Dollars, returns may increase or decrease as a result of currency fluctuations. Source: RCP Advisors (GPScout), Small Buyouts <$1B – based on data compiled from 1,412 U.S. and Canadian buyout funds <$1B formed between 1986 and 2022; Large Buyouts >$1B – based on data compiled from 273 U.S. and Canadian buyout funds >$1B formed between 1986 and 2022; TVPI & IRR: net fees, expenses, carried interest. All information contained herein is being provided solely for educational and informational purposes and may not be relied on in any manner as legal, tax or investment advice. This material does not constitute, and should not be construed as an offer to sell or a solicitation of an offer to buy an interest in any investment products sponsored by P10 or its subsidiaries. TVPI: Small Buyout Funds <$1B (U.S. and Canada) IRR: Small Buyout Funds <$1B (U.S. and Canada) TVPI: Large Buyout Funds >$1B (U.S. and Canada) IRR: Large Buyout Funds >$1B (U.S. and Canada) 25.7% 12.1% 15.0% 25.1% Funds under $1B in size have shown better overall returns and greater potential for outperformance Totals may not add due to rounding

Appendix

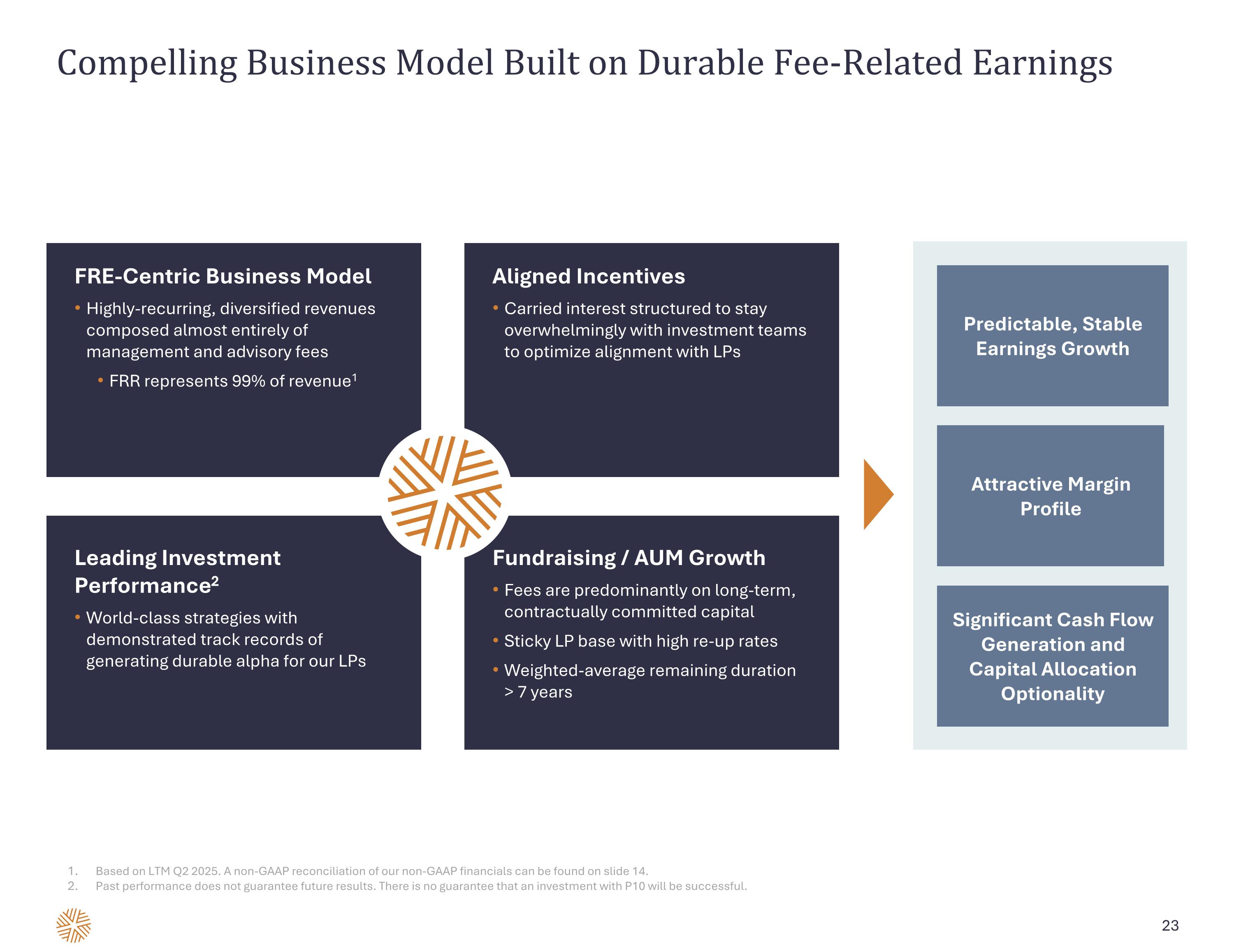

FRE-Centric Business Model Highly-recurring, diversified revenues composed almost entirely of management and advisory fees FRR represents 99% of revenue1 Aligned Incentives Carried interest structured to stay overwhelmingly with investment teams to optimize alignment with LPs Leading Investment Performance2 World-class strategies with demonstrated track records of generating durable alpha for our LPs Fundraising / AUM Growth Fees are predominantly on long-term, contractually committed capital Sticky LP base with high re-up rates Weighted-average remaining duration > 7 years Predictable, Stable Earnings Growth Attractive Margin Profile Significant Cash Flow Generation and Capital Allocation Optionality Compelling Business Model Built on Durable Fee-Related Earnings Based on LTM Q2 2025. A non-GAAP reconciliation of our non-GAAP financials can be found on slide 14. Past performance does not guarantee future results. There is no guarantee that an investment with P10 will be successful.

Capital availability / opportunity imbalance creates attractive competitive dynamic Importance of proprietary data continuously guiding disciplined investment processes Valuations structurally lower Meaningfully less utilization of financial leverage Sourcing more proprietary Opportunities to create value and drive growth Strategies investing in specialized and/or fragmented markets, with a particular focus on the attractive middle and lower-middle market segment Focused Investment Strategies with Leadership in Attractive MM/LMM Investment Strategy Focus People and Culture Data Driving Differentiated Insights Investing Prowess Partner of Choice for LPs Long History of Success 24

Attractive Private Markets Ecosystem Robust Foundation for a Range of Levers to Drive Organic and Inorganic Growth Leader in attractive MM/LMM, underpinned by data and insights Large and diverse global client base World-class private markets strategies with long track records of alpha generation1 Compelling business model built on durable FRE Well-Positioned to Utilize Variety of Levers to Drive Growth Past performance does not guarantee future results. There is no guarantee that an investment with P10 will be successful.

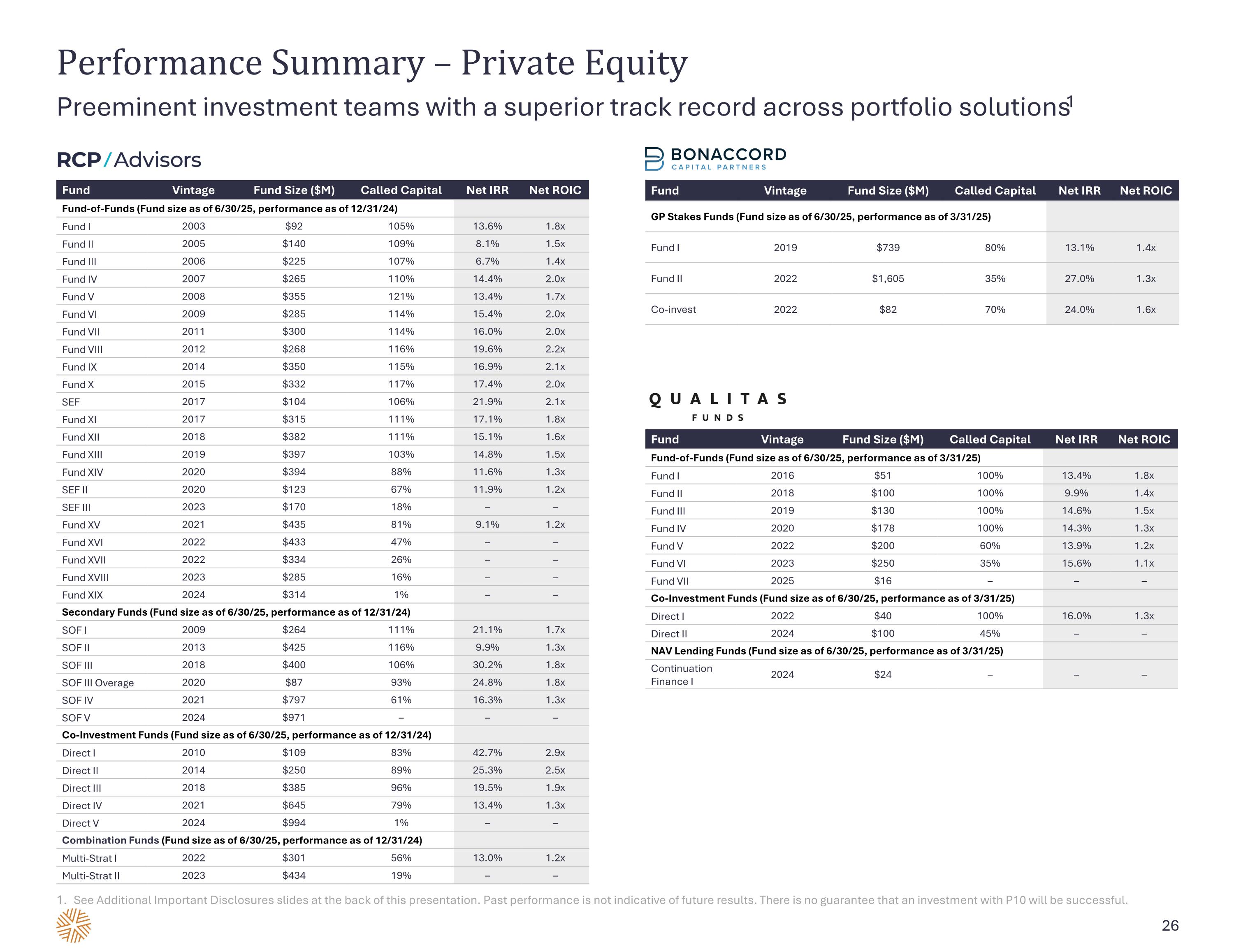

Performance Summary – Private Equity Preeminent investment teams with a superior track record across portfolio solutions1 See Additional Important Disclosures slides at the back of this presentation. Past performance is not indicative of future results. There is no guarantee that an investment with P10 will be successful. Fund Vintage Fund Size ($M) Called Capital Net IRR Net ROIC Fund-of-Funds (Fund size as of 6/30/25, performance as of 12/31/24) Fund I 2003 $92 105% 13.6% 1.8x Fund II 2005 $140 109% 8.1% 1.5x Fund III 2006 $225 107% 6.7% 1.4x Fund IV 2007 $265 110% 14.4% 2.0x Fund V 2008 $355 121% 13.4% 1.7x Fund VI 2009 $285 114% 15.4% 2.0x Fund VII 2011 $300 114% 16.0% 2.0x Fund VIII 2012 $268 116% 19.6% 2.2x Fund IX 2014 $350 115% 16.9% 2.1x Fund X 2015 $332 117% 17.4% 2.0x SEF 2017 $104 106% 21.9% 2.1x Fund XI 2017 $315 111% 17.1% 1.8x Fund XII 2018 $382 111% 15.1% 1.6x Fund XIII 2019 $397 103% 14.8% 1.5x Fund XIV 2020 $394 88% 11.6% 1.3x SEF II 2020 $123 67% 11.9% 1.2x SEF III 2023 $170 18% – – Fund XV 2021 $435 81% 9.1% 1.2x Fund XVI 2022 $433 47% – – Fund XVII 2022 $334 26% – – Fund XVIII 2023 $285 16% – – Fund XIX 2024 $314 1% – – Secondary Funds (Fund size as of 6/30/25, performance as of 12/31/24) SOF I 2009 $264 111% 21.1% 1.7x SOF II 2013 $425 116% 9.9% 1.3x SOF III 2018 $400 106% 30.2% 1.8x SOF III Overage 2020 $87 93% 24.8% 1.8x SOF IV 2021 $797 61% 16.3% 1.3x SOF V 2024 $971 – – – Co-Investment Funds (Fund size as of 6/30/25, performance as of 12/31/24) Direct I 2010 $109 83% 42.7% 2.9x Direct II 2014 $250 89% 25.3% 2.5x Direct III 2018 $385 96% 19.5% 1.9x Direct IV 2021 $645 79% 13.4% 1.3x Direct V 2024 $994 1% – – Combination Funds (Fund size as of 6/30/25, performance as of 12/31/24) Multi-Strat I 2022 $301 56% 13.0% 1.2x Multi-Strat II 2023 $434 19% – – Fund Vintage Fund Size ($M) Called Capital Net IRR Net ROIC GP Stakes Funds (Fund size as of 6/30/25, performance as of 3/31/25) Fund I 2019 $739 80% 13.1% 1.4x Fund II 2022 $1,605 35% 27.0% 1.3x Co-invest 2022 $82 70% 24.0% 1.6x Fund Vintage Fund Size ($M) Called Capital Net IRR Net ROIC Fund-of-Funds (Fund size as of 6/30/25, performance as of 3/31/25) Fund I 2016 $51 100% 13.4% 1.8x Fund II 2018 $100 100% 9.9% 1.4x Fund III 2019 $130 100% 14.6% 1.5x Fund IV 2020 $178 100% 14.3% 1.3x Fund V 2022 $200 60% 13.9% 1.2x Fund VI 2023 $250 35% 15.6% 1.1x Fund VII 2025 $16 – – – Co-Investment Funds (Fund size as of 6/30/25, performance as of 3/31/25) Direct I 2022 $40 100% 16.0% 1.3x Direct II 2024 $100 45% – – NAV Lending Funds (Fund size as of 6/30/25, performance as of 3/31/25) Continuation Finance I 2024 $24 – – –

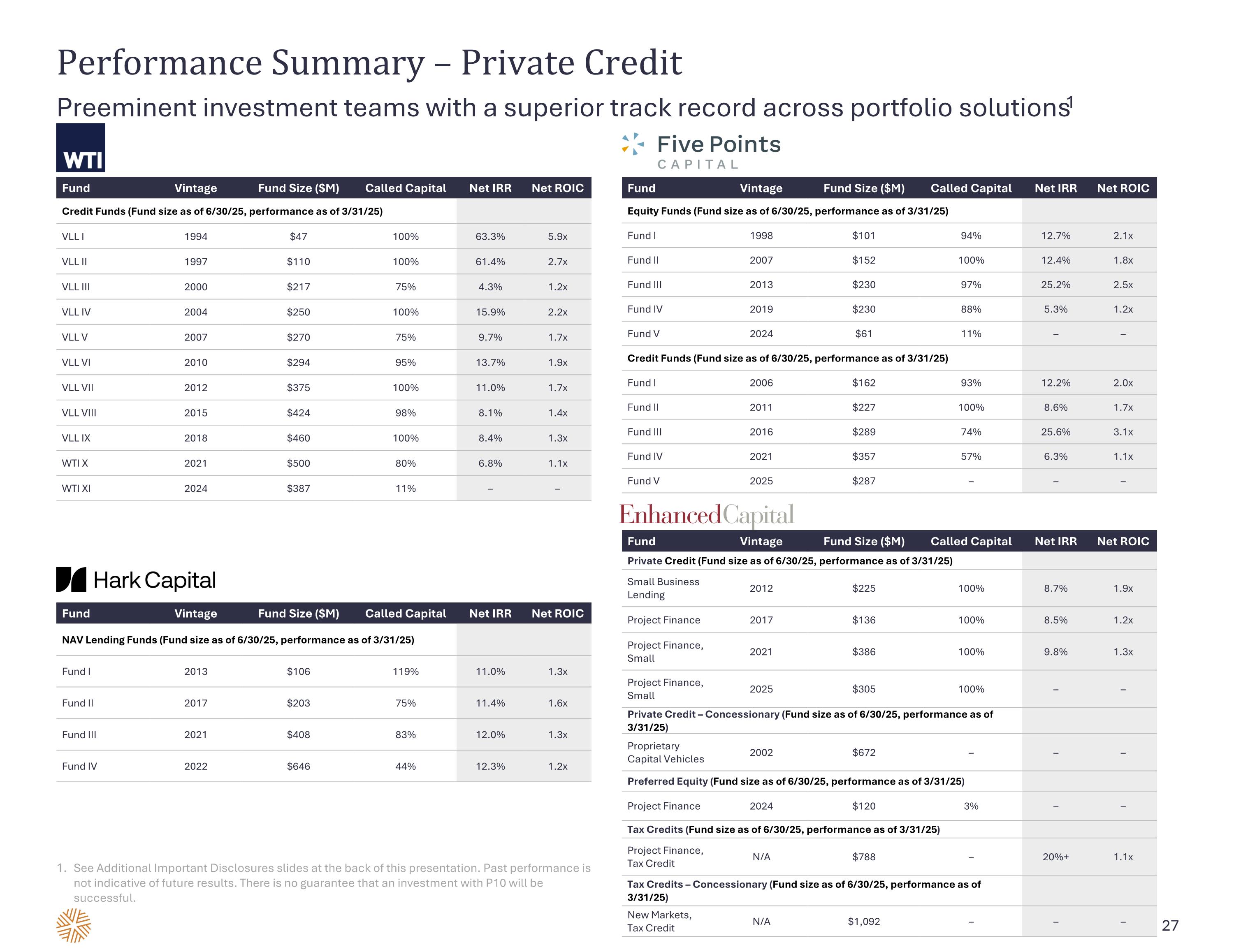

Performance Summary – Private Credit Preeminent investment teams with a superior track record across portfolio solutions1 Fund Vintage Fund Size ($M) Called Capital Net IRR Net ROIC NAV Lending Funds (Fund size as of 6/30/25, performance as of 3/31/25) Fund I 2013 $106 119% 11.0% 1.3x Fund II 2017 $203 75% 11.4% 1.6x Fund III 2021 $408 83% 12.0% 1.3x Fund IV 2022 $646 44% 12.3% 1.2x Fund Vintage Fund Size ($M) Called Capital Net IRR Net ROIC Credit Funds (Fund size as of 6/30/25, performance as of 3/31/25) VLL I 1994 $47 100% 63.3% 5.9x VLL II 1997 $110 100% 61.4% 2.7x VLL III 2000 $217 75% 4.3% 1.2x VLL IV 2004 $250 100% 15.9% 2.2x VLL V 2007 $270 75% 9.7% 1.7x VLL VI 2010 $294 95% 13.7% 1.9x VLL VII 2012 $375 100% 11.0% 1.7x VLL VIII 2015 $424 98% 8.1% 1.4x VLL IX 2018 $460 100% 8.4% 1.3x WTI X 2021 $500 80% 6.8% 1.1x WTI XI 2024 $387 11% – – Fund Vintage Fund Size ($M) Called Capital Net IRR Net ROIC Equity Funds (Fund size as of 6/30/25, performance as of 3/31/25) Fund I 1998 $101 94% 12.7% 2.1x Fund II 2007 $152 100% 12.4% 1.8x Fund III 2013 $230 97% 25.2% 2.5x Fund IV 2019 $230 88% 5.3% 1.2x Fund V 2024 $61 11% – – Credit Funds (Fund size as of 6/30/25, performance as of 3/31/25) Fund I 2006 $162 93% 12.2% 2.0x Fund II 2011 $227 100% 8.6% 1.7x Fund III 2016 $289 74% 25.6% 3.1x Fund IV 2021 $357 57% 6.3% 1.1x Fund V 2025 $287 – – – Fund Vintage Fund Size ($M) Called Capital Net IRR Net ROIC Private Credit (Fund size as of 6/30/25, performance as of 3/31/25) Small Business Lending 2012 $225 100% 8.7% 1.9x Project Finance 2017 $136 100% 8.5% 1.2x Project Finance, Small 2021 $386 100% 9.8% 1.3x Project Finance, Small 2025 $305 100% – – Private Credit – Concessionary (Fund size as of 6/30/25, performance as of 3/31/25) Proprietary Capital Vehicles 2002 $672 – – – Preferred Equity (Fund size as of 6/30/25, performance as of 3/31/25) Project Finance 2024 $120 3% – – Tax Credits (Fund size as of 6/30/25, performance as of 3/31/25) Project Finance, Tax Credit N/A $788 – 20%+ 1.1x Tax Credits – Concessionary (Fund size as of 6/30/25, performance as of 3/31/25) New Markets, Tax Credit N/A $1,092 – – – See Additional Important Disclosures slides at the back of this presentation. Past performance is not indicative of future results. There is no guarantee that an investment with P10 will be successful.

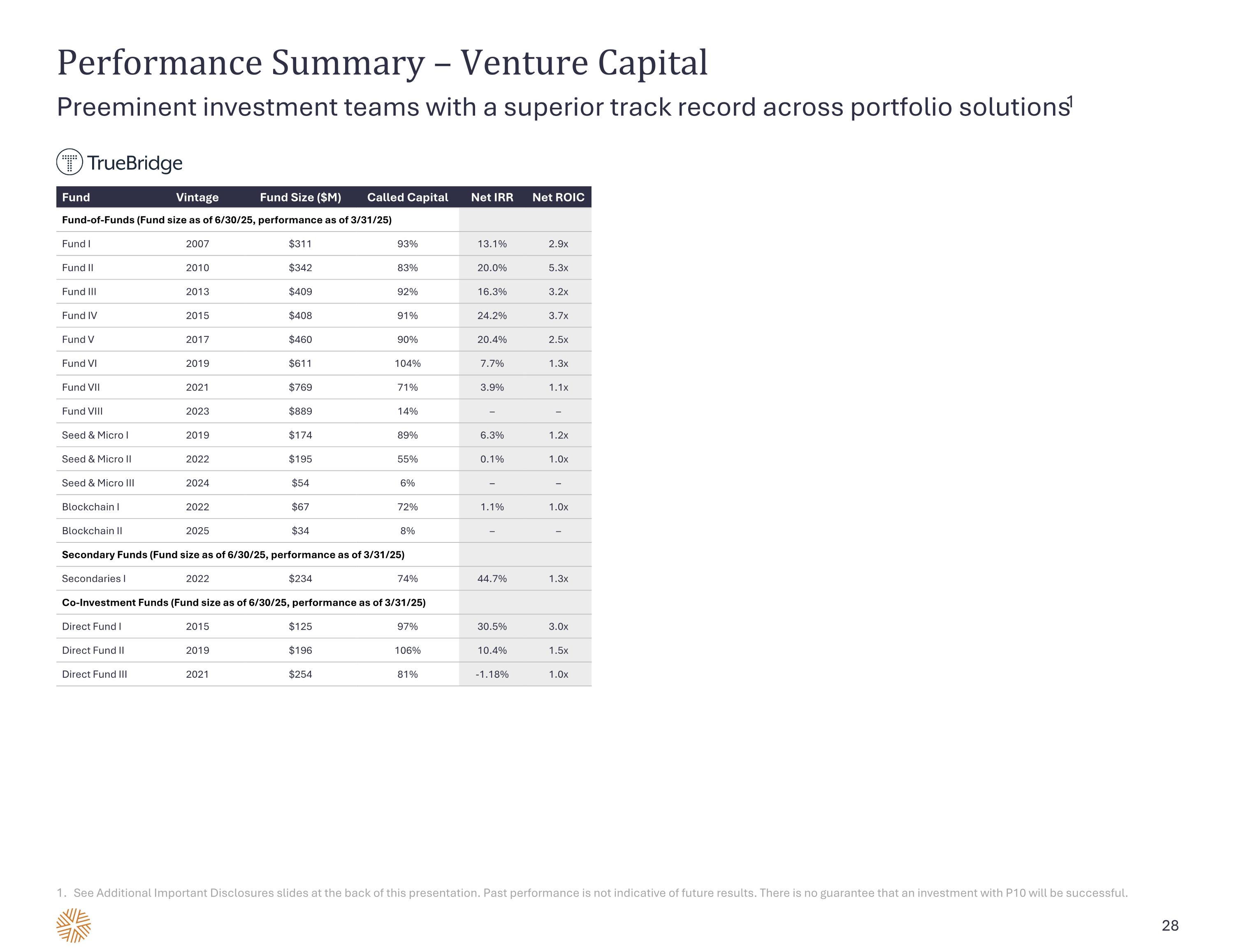

Performance Summary – Venture Capital Preeminent investment teams with a superior track record across portfolio solutions1 Fund Vintage Fund Size ($M) Called Capital Net IRR Net ROIC Fund-of-Funds (Fund size as of 6/30/25, performance as of 3/31/25) Fund I 2007 $311 93% 13.1% 2.9x Fund II 2010 $342 83% 20.0% 5.3x Fund III 2013 $409 92% 16.3% 3.2x Fund IV 2015 $408 91% 24.2% 3.7x Fund V 2017 $460 90% 20.4% 2.5x Fund VI 2019 $611 104% 7.7% 1.3x Fund VII 2021 $769 71% 3.9% 1.1x Fund VIII 2023 $889 14% – – Seed & Micro I 2019 $174 89% 6.3% 1.2x Seed & Micro II 2022 $195 55% 0.1% 1.0x Seed & Micro III 2024 $54 6% – – Blockchain I 2022 $67 72% 1.1% 1.0x Blockchain II 2025 $34 8% – – Secondary Funds (Fund size as of 6/30/25, performance as of 3/31/25) Secondaries I 2022 $234 74% 44.7% 1.3x Co-Investment Funds (Fund size as of 6/30/25, performance as of 3/31/25) Direct Fund I 2015 $125 97% 30.5% 3.0x Direct Fund II 2019 $196 106% 10.4% 1.5x Direct Fund III 2021 $254 81% -1.18% 1.0x See Additional Important Disclosures slides at the back of this presentation. Past performance is not indicative of future results. There is no guarantee that an investment with P10 will be successful.

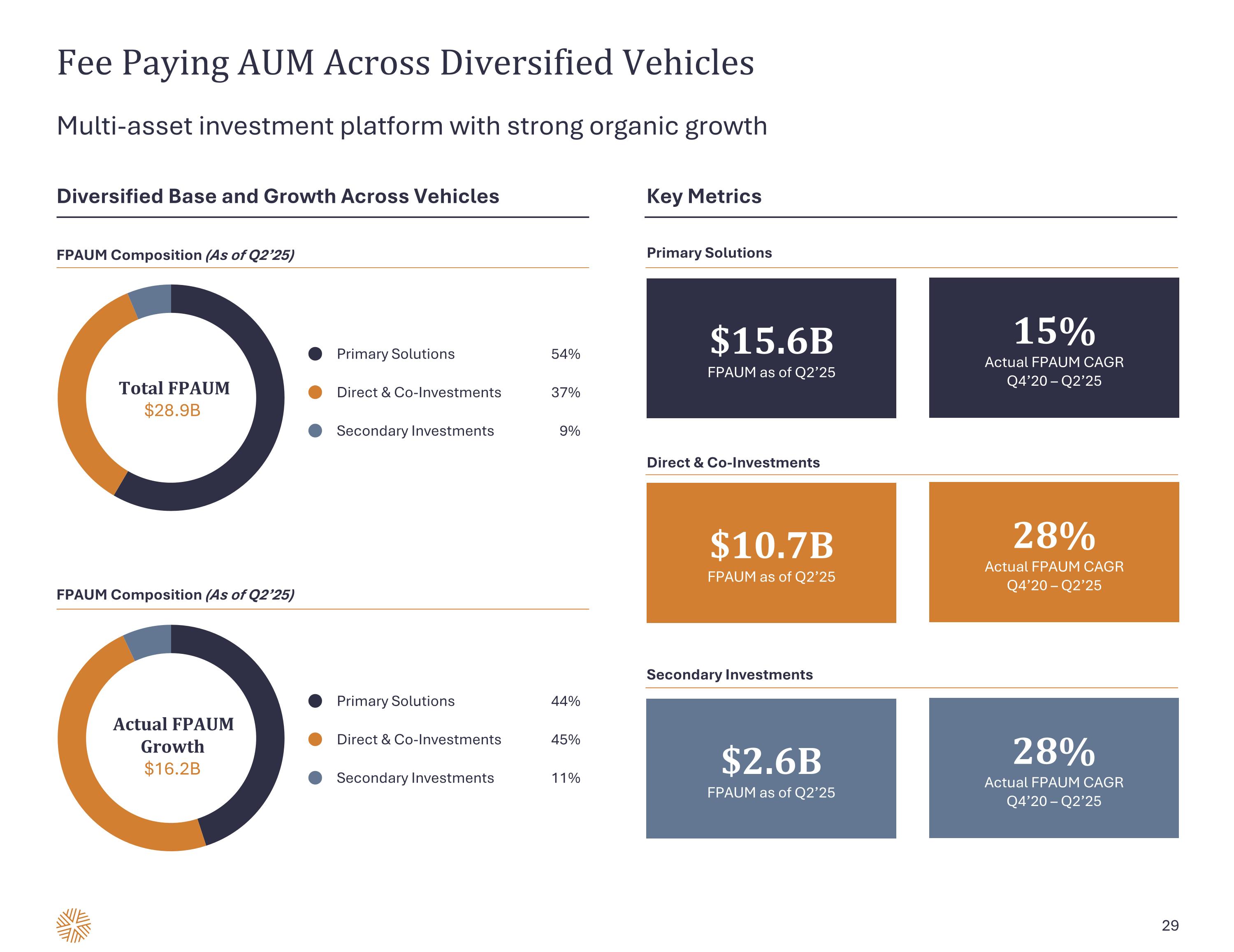

Fee Paying AUM Across Diversified Vehicles Multi-asset investment platform with strong organic growth Diversified Base and Growth Across Vehicles Key Metrics FPAUM Composition (As of Q2’25) FPAUM Composition (As of Q2’25) ● Primary Solutions 44% ● Direct & Co-Investments 45% ● Secondary Investments 11% ● Primary Solutions 54% ● Direct & Co-Investments 37% ● Secondary Investments 9% Primary Solutions Direct & Co-Investments Secondary Investments $15.6B FPAUM as of Q2’25 15% Actual FPAUM CAGR Q4’20 – Q2’25 $10.7B FPAUM as of Q2’25 28% Actual FPAUM CAGR Q4’20 – Q2’25 $2.6B FPAUM as of Q2’25 28% Actual FPAUM CAGR Q4’20 – Q2’25 Total FPAUM $28.9B Actual FPAUM Growth $16.2B

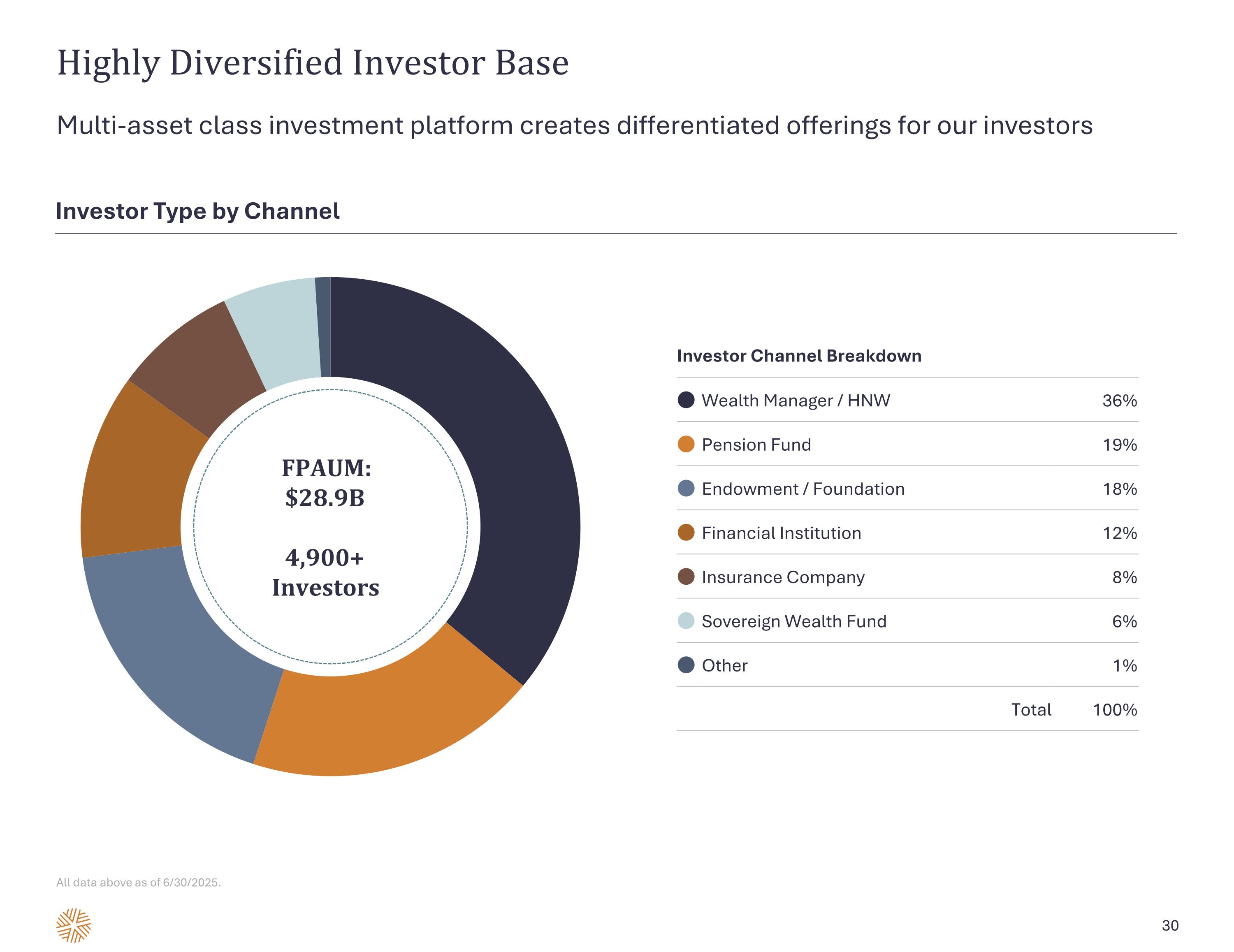

Highly Diversified Investor Base All data above as of 6/30/2025. Investor Type by Channel FPAUM: $28.9B 4,900+ Investors Investor Channel Breakdown ● Wealth Manager / HNW 36% ● Pension Fund 19% ● Endowment / Foundation 18% ● Financial Institution 12% ● Insurance Company 8% ● Sovereign Wealth Fund 6% ● Other 1% Total 100% Multi-asset class investment platform creates differentiated offerings for our investors

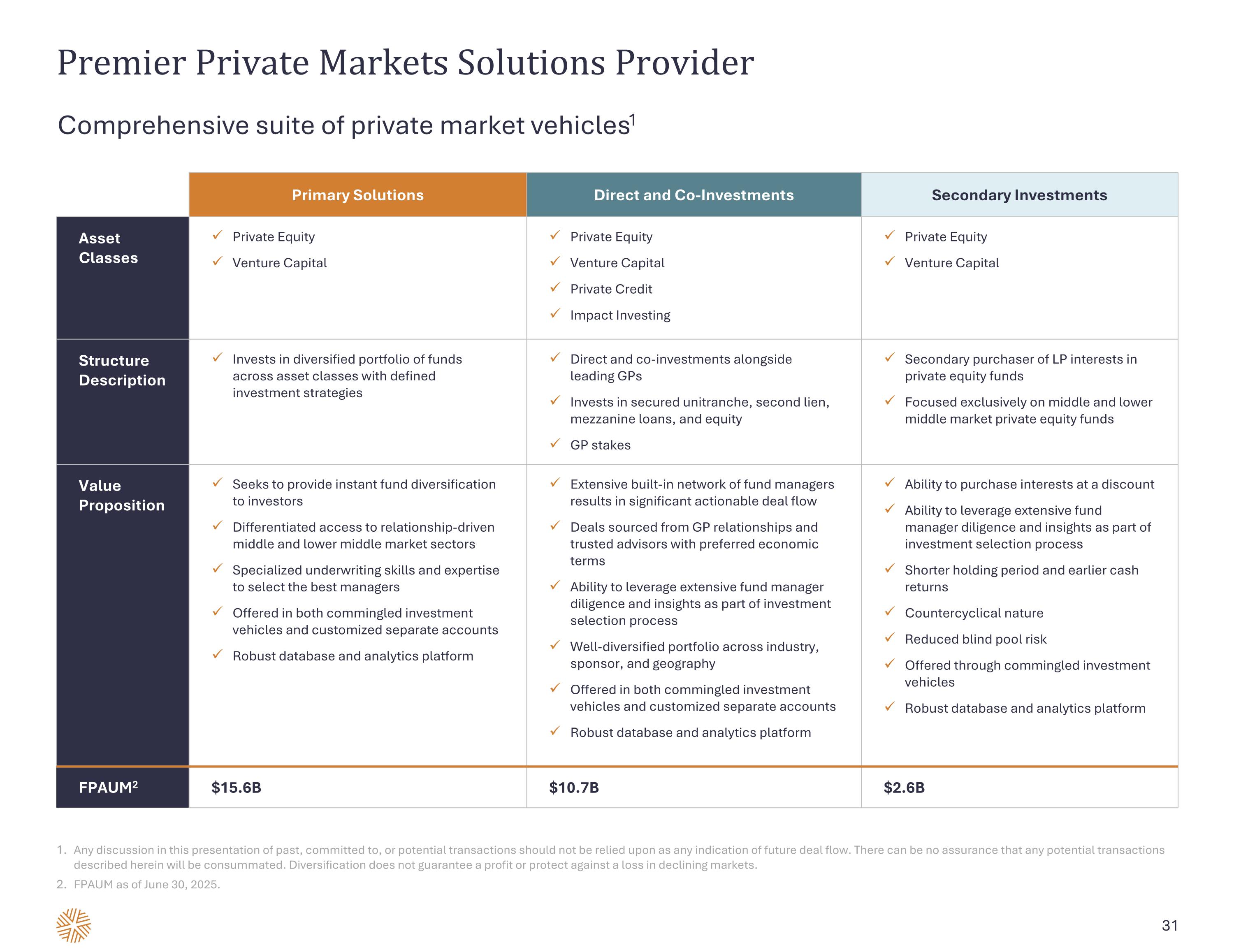

Premier Private Markets Solutions Provider Comprehensive suite of private market vehicles1 Any discussion in this presentation of past, committed to, or potential transactions should not be relied upon as any indication of future deal flow. There can be no assurance that any potential transactions described herein will be consummated. Diversification does not guarantee a profit or protect against a loss in declining markets. FPAUM as of June 30, 2025. Primary Solutions Direct and Co-Investments Secondary Investments Asset Classes Private Equity Venture Capital Private Equity Venture Capital Private Credit Impact Investing Private Equity Venture Capital Structure Description Invests in diversified portfolio of funds across asset classes with defined investment strategies Direct and co-investments alongside leading GPs Invests in secured unitranche, second lien, mezzanine loans, and equity GP stakes Secondary purchaser of LP interests in private equity funds Focused exclusively on middle and lower middle market private equity funds Value Proposition Seeks to provide instant fund diversification to investors Differentiated access to relationship-driven middle and lower middle market sectors Specialized underwriting skills and expertise to select the best managers Offered in both commingled investment vehicles and customized separate accounts Robust database and analytics platform Extensive built-in network of fund managers results in significant actionable deal flow Deals sourced from GP relationships and trusted advisors with preferred economic terms Ability to leverage extensive fund manager diligence and insights as part of investment selection process Well-diversified portfolio across industry, sponsor, and geography Offered in both commingled investment vehicles and customized separate accounts Robust database and analytics platform Ability to purchase interests at a discount Ability to leverage extensive fund manager diligence and insights as part of investment selection process Shorter holding period and earlier cash returns Countercyclical nature Reduced blind pool risk Offered through commingled investment vehicles Robust database and analytics platform FPAUM2 $15.6B $10.7B $2.6B

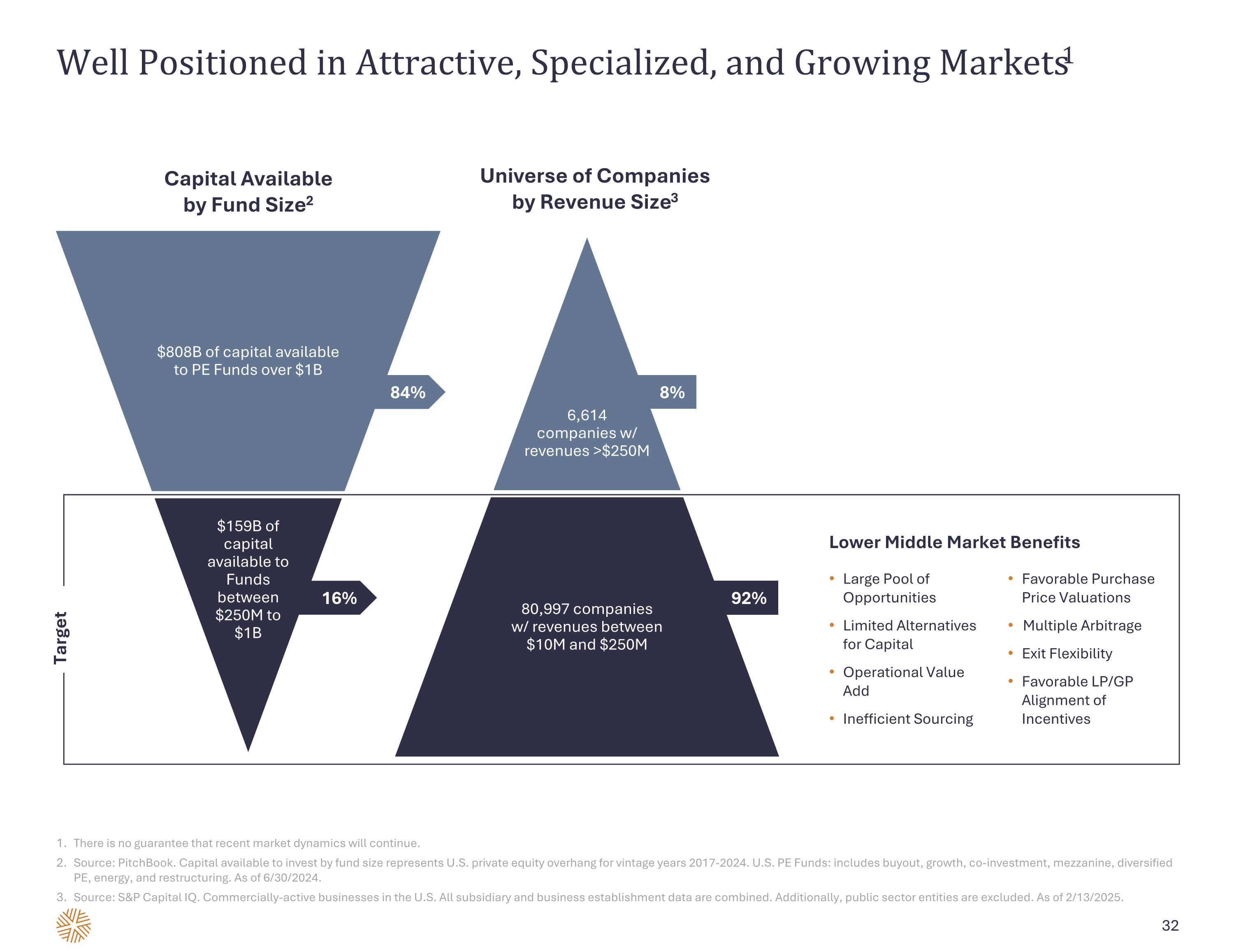

Well Positioned in Attractive, Specialized, and Growing Markets1 There is no guarantee that recent market dynamics will continue. Source: PitchBook. Capital available to invest by fund size represents U.S. private equity overhang for vintage years 2017-2024. U.S. PE Funds: includes buyout, growth, co-investment, mezzanine, diversified PE, energy, and restructuring. As of 6/30/2024. Source: S&P Capital IQ. Commercially-active businesses in the U.S. All subsidiary and business establishment data are combined. Additionally, public sector entities are excluded. As of 2/13/2025. Capital Available by Fund Size2 Universe of Companies by Revenue Size3 6,614 companies w/ revenues >$250M 80,997 companies w/ revenues between $10M and $250M $808B of capital available to PE Funds over $1B $159B of capital available to Funds between $250M to $1B 8% 92% 84% 16% Large Pool of Opportunities Limited Alternatives for Capital Operational Value Add Inefficient Sourcing Favorable Purchase Price Valuations Multiple Arbitrage Exit Flexibility Favorable LP/GP Alignment of Incentives Lower Middle Market Benefits Target

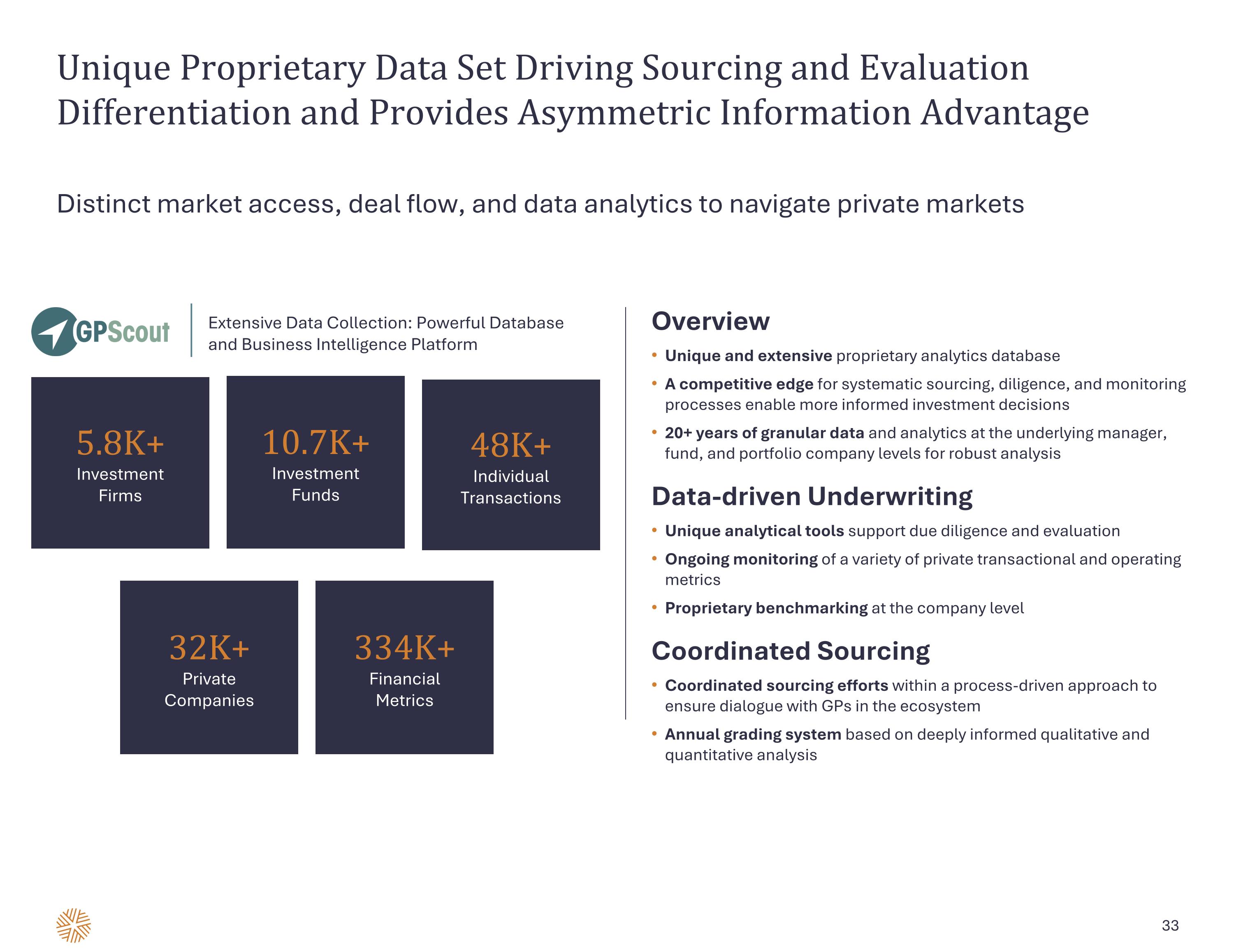

Unique Proprietary Data Set Driving Sourcing and Evaluation Differentiation and Provides Asymmetric Information Advantage Distinct market access, deal flow, and data analytics to navigate private markets Overview Unique and extensive proprietary analytics database A competitive edge for systematic sourcing, diligence, and monitoring processes enable more informed investment decisions 20+ years of granular data and analytics at the underlying manager, fund, and portfolio company levels for robust analysis Data-driven Underwriting Unique analytical tools support due diligence and evaluation Ongoing monitoring of a variety of private transactional and operating metrics Proprietary benchmarking at the company level Coordinated Sourcing Coordinated sourcing efforts within a process-driven approach to ensure dialogue with GPs in the ecosystem Annual grading system based on deeply informed qualitative and quantitative analysis Extensive Data Collection: Powerful Database and Business Intelligence Platform 5.8K+ Investment Firms 10.7K+ Investment Funds 48K+ Individual Transactions 32K+ Private Companies 334K+ Financial Metrics

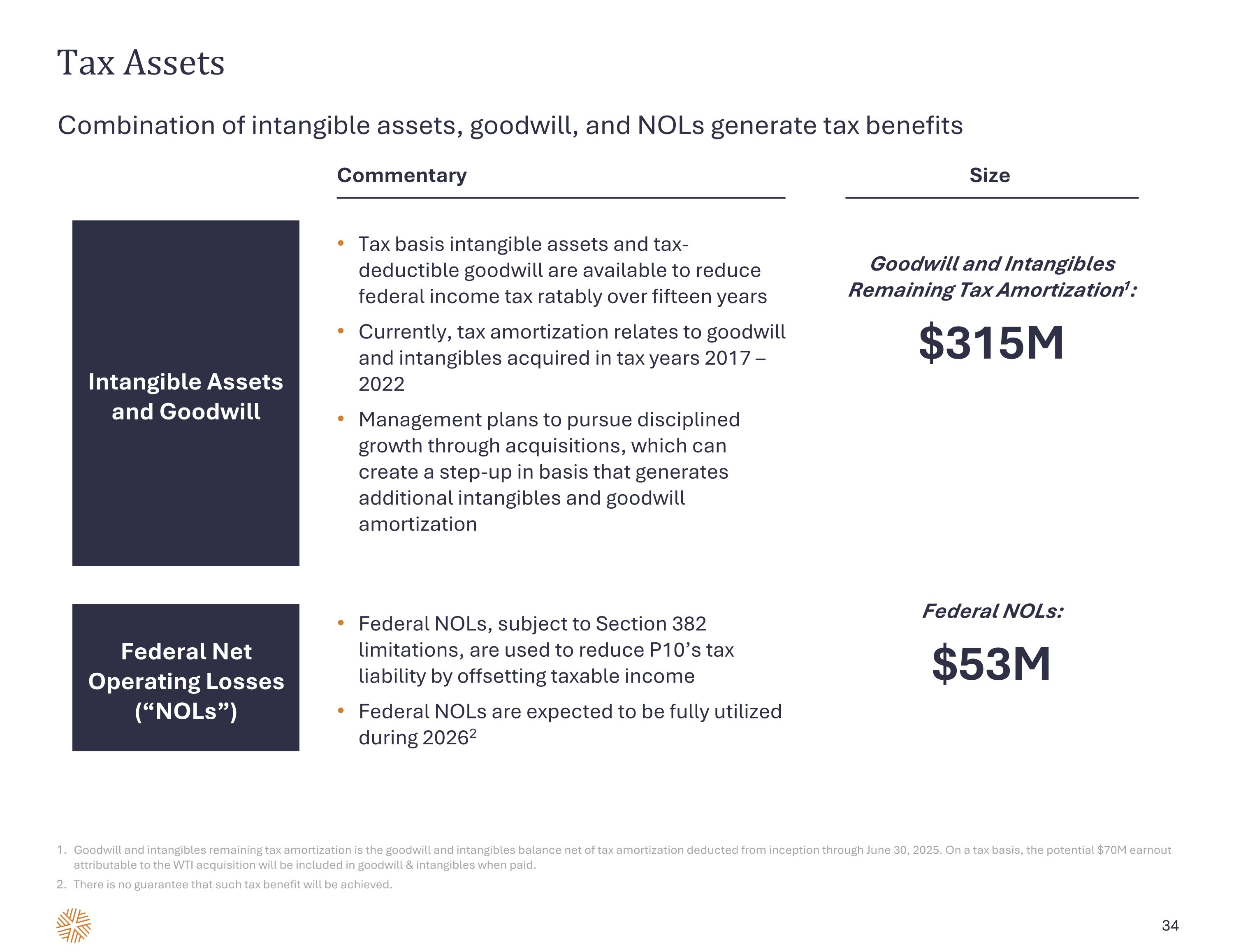

Tax Assets Combination of intangible assets, goodwill, and NOLs generate tax benefits Intangible Assets and Goodwill Tax basis intangible assets and tax-deductible goodwill are available to reduce federal income tax ratably over fifteen years Currently, tax amortization relates to goodwill and intangibles acquired in tax years 2017 – 2022 Management plans to pursue disciplined growth through acquisitions, which can create a step-up in basis that generates additional intangibles and goodwill amortization Commentary Goodwill and Intangibles Remaining Tax Amortization1: $315M Size Federal Net Operating Losses (“NOLs”) Federal NOLs, subject to Section 382 limitations, are used to reduce P10’s tax liability by offsetting taxable income Federal NOLs are expected to be fully utilized during 20262 Goodwill and intangibles remaining tax amortization is the goodwill and intangibles balance net of tax amortization deducted from inception through June 30, 2025. On a tax basis, the potential $70M earnout attributable to the WTI acquisition will be included in goodwill & intangibles when paid. There is no guarantee that such tax benefit will be achieved. Federal NOLs: $53M

Notes

Key Terms & Supplemental Information Below is a description of our unaudited non-GAAP financial measures. These are not measures of financial performance under GAAP and should not be construed as a substitute for the most directly comparable GAAP measures. These measures have limitations as analytical tools, and when assessing our operating performance, you should not consider these measures in isolation or as a substitute for GAAP measures. Other companies may calculate these measures differently than we do, limiting their usefulness as a comparative measure. Fee Paying Assets Under Management (FPAUM) FPAUM reflects the assets from which we earn management and advisory fees. Our vehicles typically earn management and advisory fees based on committed capital, and in certain cases, net invested capital, depending on the fee terms. Management and advisory fees based on committed capital are not affected by market appreciation or depreciation. Assets Under Management (AUM) AUM reflects the assets that we manage, and is calculated as the sum of: (i) net asset value (“NAV”) of our clients’ and funds’ underlying investments as of the most recently available date; (ii) drawn and undrawn debt (excluding capital call lines); (iii) uncalled capital commitments (net of deferred purchase price and not in excess of total capital commitments, as applicable) as of the NAV record date; (iv) incremental commitments raised since NAV record date. In situations where NAV data is not available, such as with certain advisory relationships, we use FPAUM. Adjusted Net Income (ANI) We use Adjusted Net Income, or ANI, to provide additional measures of profitability. We use the measures to assess our performance relative to our intended strategies, expected patterns of profitability, and budget and use the results of that assessment to adjust our future activities to the extent we deem necessary. ANI reflects an estimate of our cash flows generated by our core operations. ANI is calculated as FRE, plus Non-Fee Related Income, less Strategic alliance noncontrolling interests expense, less actual cash paid for interest and federal and state income taxes. Fully Diluted ANI per share Fully Diluted ANI per share is a calculation that assumes all the Company’s securities were converted into shares, not just shares that are currently outstanding. Fee-Related Revenue Fee-Related Revenue is calculated as Total Revenues less Non-Fee Related Revenue. Fee-Related Earnings Fee-Related Earnings is a non-GAAP performance measure used to monitor our baseline earnings less any incentive fee revenue and excluding any incentive fee-related expenses. Fee-Related Earnings Margin Fee-Related Earnings Margin is calculated as Fee-Related Earnings divided by Fee-Related Revenue. Net IRR Refers to Internal Rate of Return net of fees, carried interest and expenses charged by both the underlying fund managers and each of our solutions. Net ROIC Refers to return on invested capital net of fees and expenses charged by both the underlying fund managers and each of our solutions. Fund Size Refers to the total amount of capital committed by investors and, when applicable, the U.S. Small Business Administration to each fund disclosed. Called Capital Refers to the amount of capital provided from investors, expressed as a percent of the total fund size. A Refers to “actual” and indicates a number that is unadjusted. Supplemental Share Information Class A shares (CUSIP # 69376K106) trade on the NYSE under the symbol “PX” and have one vote per share. Class B shares (CUSIP # 69376K205) are not tradeable in the open market and have ten votes per share. The Class B shares are convertible at any time at the option of the holder into Class A shares on a one-for-one basis, irrespective of whether or not the holder is planning to sell shares at that time. Please refer to our amended and restated certificate of incorporation for a full description of the Class A and Class B shares.

Additional Disclaimers Performance Disclaimer The historical performance of our investments should not be considered as indicative of the future results of our investments or our operations or any returns expected on an investment in our Class A common stock. In considering the performance information contained in this prospectus, prospective Class A common stockholders should be aware that past performance of our specialized investment vehicles or the investments that we recommend to our investors is not necessarily indicative of future results or of the performance of our Class A common stock. An investment in our Class A common stock is not an investment in any of our specialized investment vehicles. In addition, the historical and potential future returns of specialized investment vehicles that we manage are not directly linked to returns on our Class A common stock. Therefore, you should not conclude that continued positive performance of our specialized investment vehicles or the investments that we recommend to our investors will necessarily result in positive returns on an investment in our Class A common stock. However, poor performance of our specialized investment vehicles could cause a decline in our ability to raise additional funds and could therefore have a negative effect on our performance and on returns on an investment in our Class A common stock. The historical performance of our funds should not be considered indicative of the future performance of these funds or of any future funds we may raise, in part because: market conditions and investment opportunities during previous periods may have been significantly more favorable for generating positive performance than those we may experience in the future; the performance of our funds is generally calculated on the basis of net asset value of the funds’ investments, including unrealized gains, which may never be realized; our historical returns derive largely from the performance of our earlier funds, whereas future fund returns will depend increasingly on the performance of our newer funds or funds not yet formed; our newly established funds typically generate lower returns during the period that they initially deploy their capital; changes in the global tax and regulatory environment may affect both the investment preferences of our investors and the financing strategies employed by businesses in which particular funds invest, which may reduce the overall capital available for investment and the availability of suitable investments, thereby reducing our investment returns in the future; in recent years, there has been increased competition for investment opportunities resulting from the increased amount of capital invested in private markets alternatives and high liquidity in debt markets, which may cause an increase in cost and reduction in the availability of suitable investments, thereby reducing our investment returns in the future; and the performance of particular funds also will be affected by risks of the industries and businesses in which they invest. Enhanced Capital Performance Disclosures: Past performance is not indicative of future results. All investments bear the risk of loss. Risks include non-payment of loans by borrowers and recapture of tax credits due to lack of following program compliance rules. Investments in tax credits are not securities investments and returns shown do not reflect a return achieved on investment securities. Small Business Lending Net Reflects limited partner returns after allocation of management fees, general fund expenses, investment expenses, income earned on cash and cash equivalents, any carried interest to the general partner, and any other fees and expenses. Limited partners’ IRRs may vary based on the dates of their admittance to the Fund. There can be no assurance that unrealized investments will be realized at the valuations used to calculate the IRRs contained herein and additional fund expenses and investment related expenses to be incurred during the remainder of the Fund’s term remain unknown and, therefore, are not factored into the calculations. Any anticipated Carried Interest reduces the net returns of unrealized investments. Calculations used herein which incorporate estimations of the net unrealized value of remaining investments represent valuation estimates made by the general partner using the most recent valuation data provided by the portfolio companies. Such estimates are subject to numerous variables which change over time and therefore amounts actually realized in the future will vary (in some cases materially) from the estimated net unrealized values used in connection with calculations referenced herein. Past performance is not a guarantee of future results, and there can be no assurance that any fund will achieve comparable results. Please note the Fund utilizes a subscription-based credit facility to bridge capital calls. Accordingly, many of the Fund's underlying investments may have been initially funded using a subscription line of credit. For purposes of the fund-level Net IRR calculations contained herein, the use of a subscription line of credit increases the IRR (in situations where the IRR is positive), as the IRR calculation takes into account the amount of time capital is outstanding and is based upon the capital call due date, rather than the date the Fund made the underlying investment with borrowed funds. Accordingly, the related delay of capital calls will increase the fund-level Net IRR reflected herein (in some cases, materially). All investments bear the risk of loss. Risks include non-payment of loans by borrowers. Past performance is not indicative of future results. Project Finance Net Reflects returns after allocation of fees and carry. Fee structure includes 50% split of origination fee, and 12.5% carried interest above 7% hurdle with an 100% carry catch up. Excludes fund-level professional fees as these loans and participations were not within a fund structure with professional fees to offset the gross returns. An investor’s return will be reduced by the fees and expenses incurred by their account or the private fund in which they invest. Scope of performance only includes loans and participations that Enhanced has sourced on behalf of its relationship with two entities since 10/19/2018, inception of the arrangement. This includes sourcing and participation relationships that did not involve Enhanced providing investment advice or any investment advisory services and as such were not part of Enhanced’s registered investment adviser business at the time the transactions were consummated. These relationships are included in the track record, however, as the subject transactions are representative of transactions that Enhanced would recommend to investment advisory clients. Actual returns may differ materially. All investments bear the risk of loss. Risks include non-payment of loans by borrowers. Past performance is not indicative of future results.

Additional Disclaimers Enhanced Capital Performance Disclosures (continued): Project Finance, Small Business Lending Net Reflects Client returns after allocation of management fees, interest expense, and any incentive fees. Client equity owners’ IRRs will vary based on the dates of their share purchases in the Client and the Client’s separate business operating results not comprised within this investment advisory relationship. 1.5% management fee paid on capital deployed, and 15% carried interest above 7% hurdle with a 100% incentive fee catch up. The unrealized component of the returns is based on the 12/31/24 fair value of the investment and assumes liquidation at that FMV on 01/01/25. There can be no assurance that unrealized investments will be realized at the valuations used to calculate the IRRs contained herein and additional investment related expenses to be incurred during the remainder of the investment advisory relationship remain unknown and, therefore, are not factored into the calculations. Any anticipated incentive fee reduces the net returns of unrealized investments. Calculations used herein which incorporate estimations of the net unrealized value of remaining investments represent valuation estimates made by the investment manager using the most recent valuation data provided by the portfolio investments. Such estimates are subject to numerous variables which change over time and therefore amounts actually realized in the future will vary (in some cases materially) from the estimated net unrealized values used in connection with calculations referenced herein. One year investment returns assume an investor invested in the vehicle at NAV on 12/31/23 and the investment was realized on 12/31/24 utilizing the same calculations as noted above. Past performance is not a guarantee of future results, and there can be no assurance that any investment account will achieve comparable results. Excludes fund-level professional fees as these investments are not held within a fund structure with professional fees to offset the gross returns. An investor’s return will be reduced by the fees and expenses incurred by their account or the private fund in which they invest. Performance includes closing fees which are realized in full at investment inception resulting in early investment return metrics in excess of the expected yield to maturity. These returns regress toward the expected yield to maturity over the full duration of the investment. Actual returns may differ materially. Loan performance only includes impact investments in which Enhanced has sourced to Project Finance, Small Business Lending vehicle since September 2021, inception of the advisory agreement. All investments bear the risk of loss. Risks include non-payment of loans by borrowers. Past performance is not indicative of future results. Proprietary Capital Vehicles represent Enhanced’s proprietary asset portfolios and are not available to third party investors. As a result, no performance results were achieved by any investor. Details on individual proprietary asset pool performance can be provided upon request. Project Finance Preferred Equity Performance information is not included in the performance tables contained herein; Enhanced believes that the results are not yet meaningful due to the early stage of the client lifecycle. Enhanced Capital Performance Disclosures (continued): Project Finance – Tax Credit Investments returns include the pooling of Historic Tax Credit and Renewable Energy Tax Credit transactions. Historic Tax Credit deals with a 1-year credit assume a 0% Management Fee and a 30% Profit Share. Historic Tax Credit deals with a 5-year credit assume a 0.5% Management Fee and a 20% Profit Share. IRRs for Historic Tax Credit transactions are not recorded as the credits trade at a discount to par. The IRRs reflected only represent Renewable Energy Tax Credit transactions and are the product of a very short hold period. Investments in tax credits are not securities investments and returns shown do not reflect a return achieved on investment securities. All investments bear the risk of loss. Risks include recapture due to lack of following program compliance rules. Excludes fund-level professional fees as these tax credit transactions were not within a fund structure with professional fees to offset the gross returns. An investor’s return will be reduced by the fees and expenses incurred by their account or the private fund in which they invest. Past performance is not indicative of future results. Actual returns may differ materially. Tax Credits shown herein represent Low-Income Housing Tax Credits and New Markets Tax Credits which Enhanced does not to non-bank investors. Tax credit purchasers generally participate in these programs for non-economic reasons such as Community Reinvestment Act credit, and therefore an investor return is not targeted. Details on individual tax credit transactions can be provided upon request. Investments in tax credits are not securities investments and returns shown do not reflect a return achieved on investment securities. All investments bear the risk of loss. Risks include recapture of tax credits due to lack of following program compliance rules.

Disclaimers RCP Advisors Performance Disclosures: Past performance does not predict, and is not a guarantee of, future results. The historical returns of RCP Advisors are not necessarily indicative of the future performance of a Fund and there can be no assurance that the returns described herein or comparable returns will be achieved by any Fund. RCP’s investment strategy is subject to significant risks and there is no guarantee that any RCP Fund will achieve comparable results as any prior investments or prior investment funds of RCP. The performance information presented reflects 3/31/25 cash flows with 3/31/25 underlying investment valuations unless stated otherwise. Performance metrics are preliminary, estimated and subject to change. Performance information for RCP’s later vintage-year funds is not included in the performance tables contained herein; RCP believes that the results are not yet meaningful, and analysis of later vintage fund data may be irrelevant. Funds that are fully liquidated (Fund I, Fund II, Fund III, Fund IV, Fund V, SOF I, and Direct I). Funds that are currently investing (SEF III, Multi-Strategy Fund II, Fund XIX, SOF V, and Direct V). Net Performance Metrics (Highest Fee Rate). Net ROIC, Net D/PI, and Net IRR reflects the return of a “representative investor” in a particular Fund that: (i) is in good standing; (ii) where more than one investment vehicle is established to accommodate investors with different tax and/or regulatory requirements, invested in such Fund via the Delaware “onshore” vehicle; (iii) subscribed at the earliest closing in which unaffiliated LPs paying the highest level of fees and expenses (including, without limitation, management fees, carried interest and, in the case of certain earlier vintage RCP Funds, “due diligence fees,” if applicable) chargeable to an investor in such Fund were admitted; (iv) is not affiliated with the Fund’s general partner; and (v) is/was not excused or excluded from any underlying investments made by such Fund. Certain limited partners, who have met specific requirements, may have different preferred returns, as well as different carry percentages. In addition, the General Partner of each Fund may agree to reduce the management fees for certain limited partners in accordance with the applicable Fund’s Partnership Agreement. The actual performance returns of each investor may vary and are dependent upon the specific preferred return hurdles, management fees, and carried interest expense charged to such investor and the timing of capital transactions for such investor. RCP Fund Performance Data – Selection Criteria. The performance tables herein are intended to illustrate the past performance of RCP’s commingled (i) funds-of-funds and dedicated secondary funds which are at least 50% funded (in the aggregate) at the underlying investment level and (ii) dedicated co-investment funds which have called at least 50% of capital commitments at the RCP Fund level; accordingly, certain other investment vehicles (including discretionary and non-discretionary separate accounts) which RCP has sponsored, advised, or sub-advised have been excluded. Unlike the commingled RCP Funds, separate accounts (a) tailor their investment objectives to the specific needs of the separate account client (as set forth in an investment advisory agreement or other governing document) and/or (b) are subject to different terms and fees (which are individually negotiated) than those of the commingled RCP Funds. The actual performance returns of each investor may vary (in some cases, materially) and are dependent on a number of factors including, but not limited to, (a) the timing of an investor’s capital contributions, including as a result of a later subscription date and lower preferred return, (b) differences in fees or expenses allocable to certain investors as a result of taxes or other considerations, (c) the fact that certain investors may have negotiated reduced, waived or otherwise modified management fee and/or carried interest rates with the Fund’s general partner, and (d) the excuse or exclusion of an investor from one or more of such Fund’s investments. Accordingly, the actual performance of an individual investor may differ from the returns presented herein. In addition, because RCP typically utilizes a subscription-based credit facility to bridge capital calls for its commingled Funds, many investments have been initially funded using a subscription line of credit. For purposes of the fund-level Net IRR calculation, the use of a subscription line of credit increases the IRR (in situations where the IRR is positive), as the IRR calculation takes into account the amount of time capital is outstanding and is based upon the capital call due date, rather than the date the relevant Fund made the underlying investment with borrowed funds. Accordingly, the related delay of capital calls will increase the fund-level Net IRR reflected herein (in some cases, materially). Furthermore, the fund-level Net IRR and Net ROIC calculations used herein measure the actual value of realized investments and estimated fair value of unrealized investments (as reported to RCP by the general partners of the underlying investments). There can be no assurance that unrealized investments will be realized at the valuations used to calculate the Net IRRs and Net ROICs contained herein, and additional fund expenses and investment related expenses to be incurred during the remainder of a particular Fund’s term remain unknown and, therefore, are not factored into the Net IRR and Net ROIC calculations. Any anticipated carried interest reduces the net returns of unrealized investments. Calculations used herein which incorporate estimations of the net “unrealized value” of remaining investments represent valuation estimates made by RCP using the most recent valuation data provided by the general partners of the underlying investments. Such estimates are subject to numerous variables which change over time and therefore amounts actually realized in the future will vary (in some cases materially) from the estimated net “unrealized values” used in connection with calculations referenced herein.

Disclaimers RCP Advisors Performance Disclosures (Continued): RCP Small and Emerging Fund. Because RCP’s inaugural “small and emerging manager” fund (which was structured using two distinct parallel investment vehicles – RCP Small and Emerging Fund, LP (“SEF (Main)”) and RCP Small and Emerging Parallel Fund, LP (“RCP SEF Parallel”) – only accepted commitments from two unaffiliated (anchor) investors, the performance returns of SEF (Main) and RCP SEF Parallel contained herein reflect fee/carry rates not typically associated with RCP’s commingled funds (specifically, unaffiliated investors in such vehicles pay 0% management fees and 10% carried interest). The SEF (Main) and RCP SEF Parallel returns would be reduced by the effect of typical management fees charged to investors in RCP’s commingled funds. Emerging Managers are defined as young and small private equity managers raising institutional capital for their first or second North American small buyout-focused fund including firms early in their existence; transition groups which have spun out of larger firms; fundless sponsors; and in the case of SEF (Main) & SEF II, managers raising funds of $250 million or less in size. Performance information for RCP SEF Parallel is not included in the performance tables contained herein. As of 3/31/25, RCP SEF Parallel has a Net IRR of 21.2%, Net ROIC of 2.1x, and Net DPI of 0.9x. Direct Fund Performance. With limited exceptions, Direct Funds generally do not pay third-party management fees since the Direct Funds invest directly (or indirectly through special purpose vehicles) in equity investments and not in other private equity funds. The Direct Fund returns would be reduced by the effect of typical third-party management fees charged to RCP’s commingled primary and secondary funds. With respect to Direct IV and Direct V only, an investor who contemporaneously made (or agreed to make) aggregate capital commitments to one or more RCP primary funds and/or secondary funds in an amount no less than two (2) times the amount of such investor’s commitment to Direct IV or Direct V (as applicable), was eligible to be designated as a “Platform Limited Partner” and thus pay discounted management fees and carried interest in connection with its investment in Direct IV or Direct V (as applicable). The Direct IV and/or Direct V returns (as applicable) of a non-Platform Limited Partner would be lower than the returns of a Platform LP due to the effect of higher fees/carried interest charged to such non-Platform LP. Realized vs. Unrealized Investments. The fund-level Net IRR and Net ROIC calculations used herein measure the actual value of realized investments and estimated fair value of unrealized investments (as reported to RCP by the general partners of the underlying investments), which involves significant elements of subjective judgment and analysis. There can be no assurance that unrealized investments will be realized at the valuations used to calculate the Net IRRs and Net ROICs contained herein, and additional fund expenses and investment related expenses to be incurred during the remainder of a particular Fund’s term remain unknown and, therefore, are not factored into the Net IRR and Net ROIC calculations. Any anticipated carried interest reduces the net returns of unrealized investments. Calculations used herein which incorporate estimations of the net “unrealized value” of remaining investments represent valuation estimates made by RCP using the most recent valuation data provided by the general partners of the underlying investments. Such estimates are subject to numerous variables which change over time and therefore amounts actually realized in the future will vary (in some cases materially) from the estimated net “unrealized values” used in connection with calculations referenced herein. RCP Advisors Performance Disclosures (Continued): Effects of Leverage on IRRs. Because RCP typically utilizes a subscription-based credit facility to bridge capital calls for its commingled Funds, many investments have been initially funded using a subscription line of credit. For purposes of the fund-level Net-Net IRR calculation, the use of a subscription line of credit increases the IRR (in situations where the IRR is positive), as the IRR calculation takes into account the amount of time capital is outstanding and is based upon the capital call due date, rather than the date the relevant Fund made the underlying investment with borrowed funds. Accordingly, the related delay of capital calls will increase the fund-level Net IRR reflected herein (in some cases, materially).

Disclaimers Hark Performance Disclosures: ROIC: Represents the return on invested capital. ROIC is calculated by dividing the sum of distributions plus total partners’ capital by capital contributed. Total partners’ capital balance is the book assets (fair value of unrealized investments plus cash on hand and miscellaneous assets) less the liabilities at the measurement date. IRR: Represents the internal rate of return of the Fund. IRR is a time-weighted average expressed as a percentage. The IRR of an investment is the discount rate at which the net present value of costs (negative cash flows) of the investment equals the net present value of the benefits (positive cash flows) of the investment, including the current value of unrealized investments. Effects of Leverage on IRRs. Please note the Fund utilizes a subscription-based credit facility to bridge capital calls. Accordingly, many of the Fund's underlying investments may have been initially funded using a subscription line of credit. For purposes of the fund-level Net IRR calculations contained herein, the use of a subscription line of credit increases the IRR (in situations where the IRR is positive), as the IRR calculation takes into account the amount of time capital is outstanding and is based upon the capital call due date, rather than the date the Fund made the underlying investment with borrowed funds. Accordingly, the related delay of capital calls will increase the fund-level Net IRR reflected herein (in some cases, materially). Net ROIC, Net D/PI, and Net IRR: Reflects limited partner returns after allocation of management fees, general fund expenses, investment expenses, income earned on cash and cash equivalents, any carried interest to the general partner, and any other fees and expenses. Not all limited partners pay the same management fee or carried interest. Furthermore, limited partners’ IRRs may vary based on the dates of their admittance to the Fund. There can be no assurance that unrealized investments will be realized at the valuations used to calculate the ROICs and IRRs contained herein and additional fund expenses and investment related expenses to be incurred during the remainder of the Fund’s term remain unknown and, therefore, are not factored into the calculations. Any anticipated Carried Interest reduces the net returns of unrealized investments. Calculations used herein which incorporate estimations of the net “unrealized value” of remaining investments represent valuation estimates made by RCP using the most recent valuation data provided by the general partners of the underlying funds. Such estimates are subject to numerous variables which change over time and therefore amounts actually realized in the future will vary (in some cases materially) from the estimated net “unrealized values” used in connection with calculations referenced herein. Past performance is not a guarantee of future results, and there can be no assurance that any fund will achieve comparable results. Bonaccord Performance Disclosures: Net Performance for BCP II, which excludes performance of BCP II-C, is determined assuming a limited partner is subject to a 2.0% management fee during the investment period and a 1.5% management fee thereafter, 17.5% carry, and an 8.0% preferred return. Certain investors are subject to lower management fee rates and/or carried interest, and accordingly will experience higher net returns. Full-Fee Net Performance for BCP Co-Investment is determined assuming a limited partner is subject to a 1.0% management fee during the investment period and a 0.75% management fee thereafter, 10.0% carry, and an 8.0% preferred return. Certain investors were subject to lower management fee rates and/or carried interest, and accordingly experienced higher net returns. Effects of Leverage on IRRs. Please note the Fund utilizes a subscription-based credit facility to bridge capital calls. Accordingly, many of the Fund's underlying investments may have been initially funded using a subscription line of credit. For purposes of the fund-level Net IRR calculations contained herein, the use of a subscription line of credit increases the IRR (in situations where the IRR is positive), as the IRR calculation takes into account the amount of time capital is outstanding and is based upon the capital call due date, rather than the date the Fund made the underlying investment with borrowed funds. Accordingly, the related delay of capital calls will increase the fund-level Net IRR reflected herein (in some cases, materially). Bonaccord values its investments at estimated fair value as determined in good faith by Bonaccord. Valuations involve a significant degree of judgment. Due to the generally illiquid nature of the securities held, fair values determined Bonaccord may not reflect the prices that actually would be received when such investments are realized. The actual realized returns on unrealized investments will depend on, among other factors, future operating results and cash flows, future fundraising, the performance of the investment funds now existing or subsequently launched by the relevant sponsors, any related transaction costs, market conditions at the time of disposition and manner of disposition of investments, all of which could differ from the assumptions on which the valuations used in the performance data contained herein are based. Thus, the return for each such investment calculated after its complete realization most likely will vary from the return shown for that investment in this presentation. Similarly, the return for BCP I calculated after the complete realization of all of its investments most likely will vary from the return shown herein in the aggregate.