P10 Reports Second Quarter 2025 Earnings Results

Record Organic Fundraising and Deployments of over $1.9 Billion in Gross New Fee-Paying AUM

Fee-Paying AUM grew 21% year over year

Closed acquisition of Qualitas Funds, Bringing Platform-Wide Fee-Paying AUM to $28.9 Billion

DALLAS, August 7, 2025 (GLOBE NEWSWIRE) - P10, Inc. (NYSE: PX) (the “Company”), a leading private markets solutions provider, today reported financial results for the second quarter ended June 30, 2025.

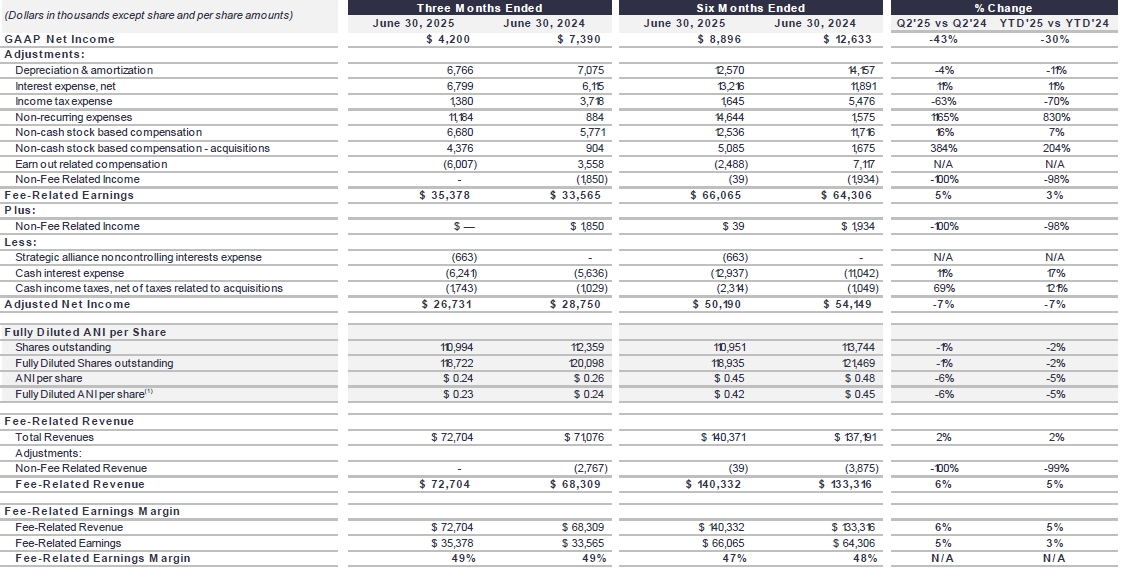

Second Quarter 2025 Financial Highlights

A presentation of the quarterly financials may be accessed here and is available on the Company’s website.

“P10 executed across our strategic initiatives, including capital formation, global expansion, and cross-platform collaboration in the second quarter,” said Luke Sarsfield, P10 Chairman and Chief Executive Officer. “Our strategies raised and deployed $1.9 billion in organic gross fee-paying assets. When combined with the $1 billion in fee-paying AUM from the Qualitas Funds transaction and moderate FX tailwinds, our gross fee-paying AUM increased by nearly $3 billion in the quarter. Our momentum is powered by our focus on the middle and lower-middle market, where we see long-term structural advantages that will drive demand for our leading access-constrained solutions.”

Stock Repurchase Program

In the second quarter, the Company repurchased 2,501,083 shares at an average price of $10.49 per share. The repurchase activity left approximately $2.3 million available under the share repurchase authorization at the end of the second quarter. The P10 Board of Directors authorized an additional $25 million for the repurchase plan.

Declaration of Dividend

The Board of Directors of the Company has declared a quarterly cash dividend of $0.0375 per share on Class A and Class B common stock, payable on September 19, 2025, to the holders of record as of the close of business on August 29, 2025.

Conference Call Details