2025 Second Quarter Investor Presentation NASDAQ: FMAO

Forward Looking Statement Statements contained in any portion of the Company’s annual meeting may be forward-looking statements, as that term is defined in the private securities litigation reform act of 1995. Forward-looking statements may be identified by the use of such words as “intend,” “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” and “potential.” Such forward-looking statements are based on current expectations but may differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time. Other factors which could have a material adverse effect on the operations of the Company and its subsidiaries which include, but are not limited to, changes in interest rates, general economic conditions, legislative and regulator changes, monetary and fiscal polices of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board, the quality and composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the bank’s market area, changes in relevant accounting principles and guidelines and other factors over which management has no control. The forward-looking statements are made as of the date of this meeting, and the Company assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements. NASDAQ: FMAO Slide 2

Community vested to help people realize their best lives. VISION We nurture lasting relationships. MISSION NASDAQ: FMAO Slide 3

About F&M Farmers & Merchants Bancorp, Inc. is the holding company of F&M Bank, a local independent community bank that has been serving its communities since 1897 Top 100 Farm Lending Bank and Top 200 Publicly Traded Community Bank, according to American Banker Twice named Top 50 Social Media Banks by ICBA Longstanding history of strong asset quality, robust net income growth, and 30 consecutive years of higher annual dividends 2019 – 2024 Highlights Total assets grew at a 15.9% CAGR Net income grew at an 7.1% CAGR Four successful acquisitions NASDAQ: FMAO Slide 4

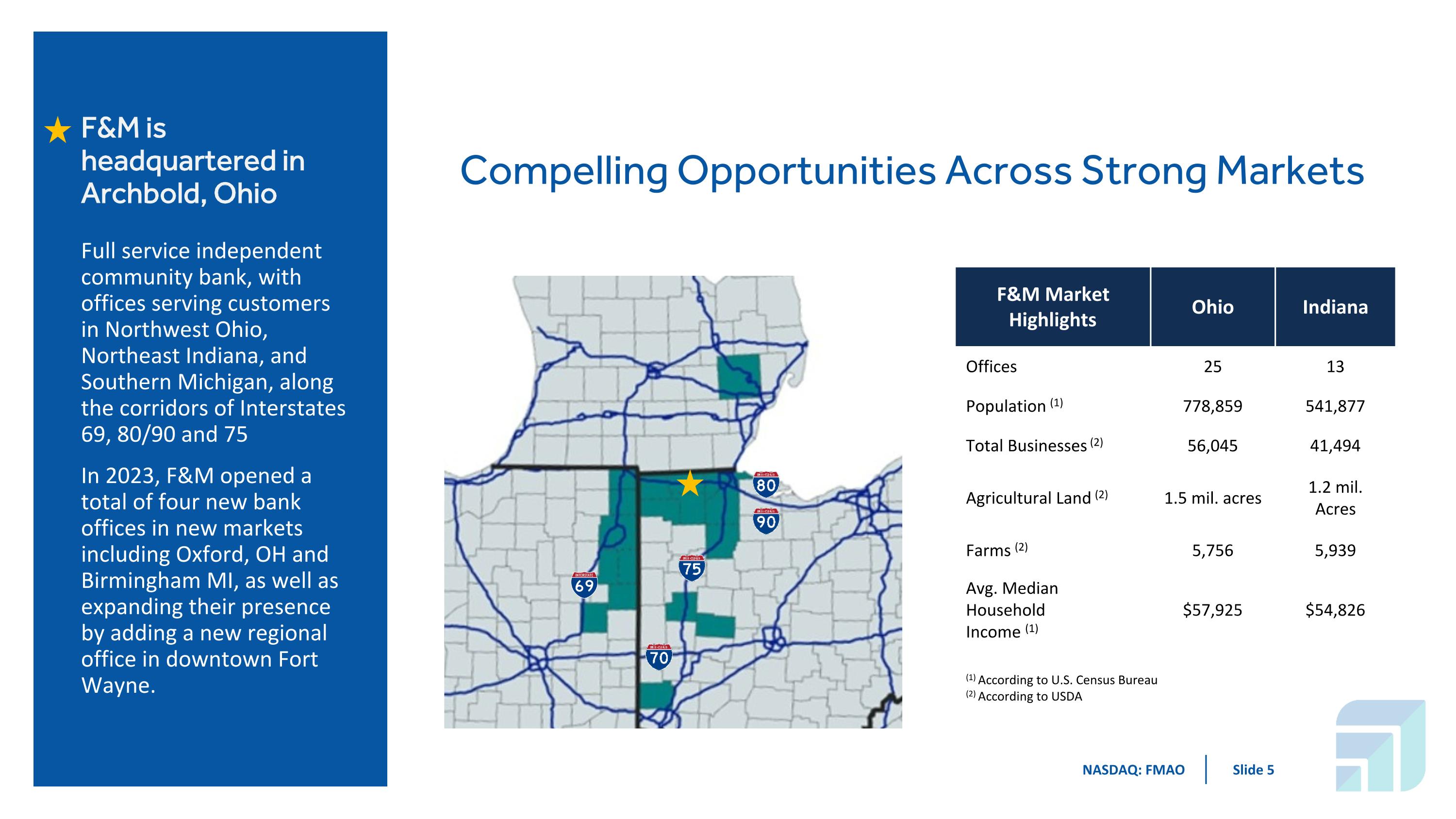

Compelling Opportunities Across Strong Markets Full service independent community bank, with offices serving customers in Northwest Ohio, Northeast Indiana, and Southern Michigan, along the corridors of Interstates 69, 80/90 and 75 In 2023, F&M opened a total of four new bank offices in new markets including Oxford, OH and Birmingham MI, as well as expanding their presence by adding a new regional office in downtown Fort Wayne. F&M is headquartered in Archbold, Ohio F&M Market Highlights Ohio Indiana Offices 25 13 Population (1) 778,859 541,877 Total Businesses (2) 56,045 41,494 Agricultural Land (2) 1.5 mil. acres 1.2 mil. Acres Farms (2) 5,756 5,939 Avg. Median Household Income (1) $57,925 $54,826 (1) According to U.S. Census Bureau (2) According to USDA NASDAQ: FMAO Slide 5

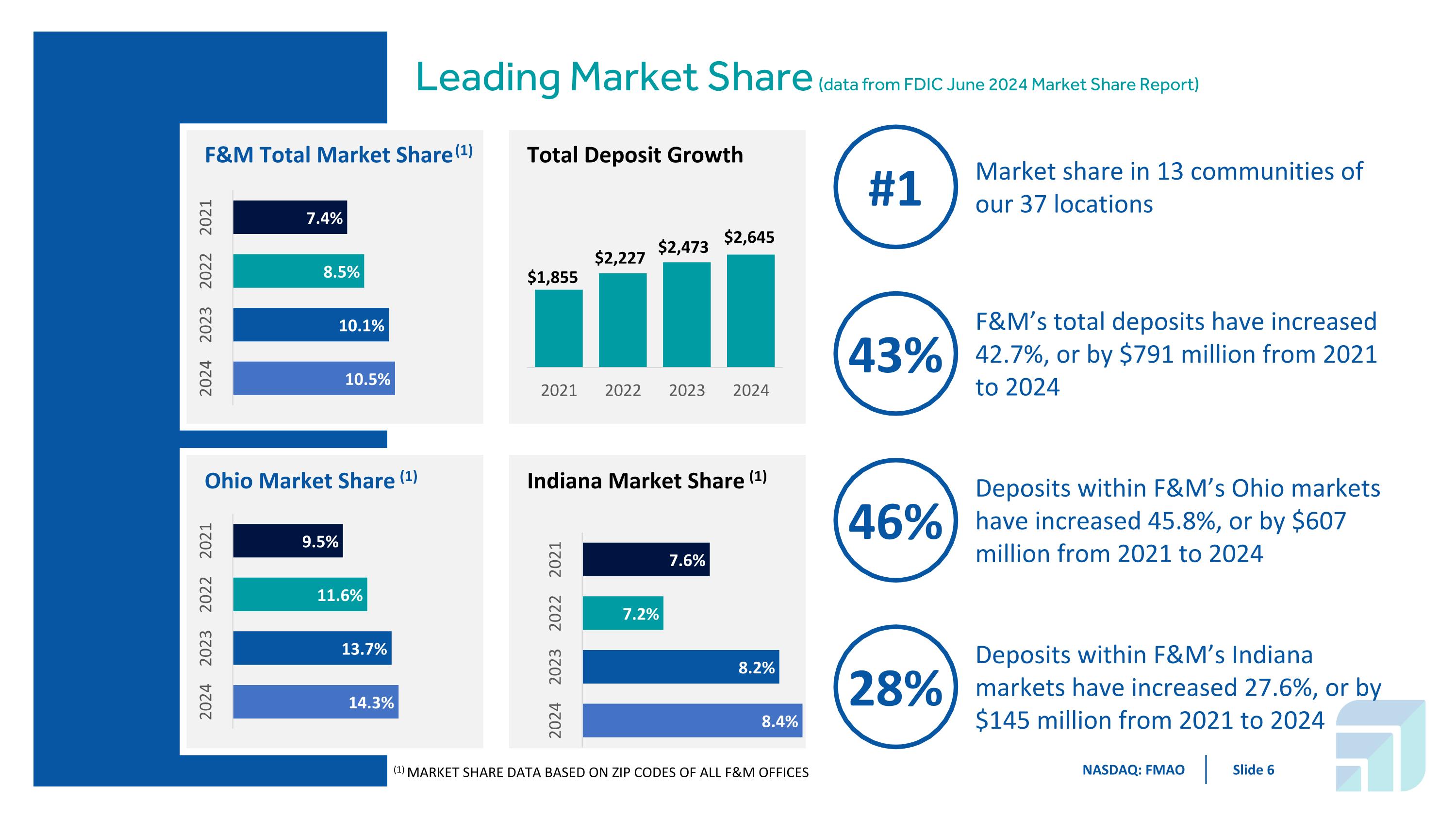

Leading Market Share (data from FDIC June 2024 Market Share Report) F&M Total Market Share (1) Total Deposit Growth Ohio Market Share (1) Indiana Market Share (1) NASDAQ: FMAO Slide 6 $1,855 $2,227 $2,473 (1) MARKET SHARE DATA BASED ON ZIP CODES OF ALL F&M OFFICES F&M’s total deposits have increased 42.7%, or by $791 million from 2021 to 2024 Deposits within F&M’s Indiana markets have increased 27.6%, or by $145 million from 2021 to 2024 Deposits within F&M’s Ohio markets have increased 45.8%, or by $607 million from 2021 to 2024 43% 46% 28% $2,645 #1 Market share in 13 communities of our 37 locations

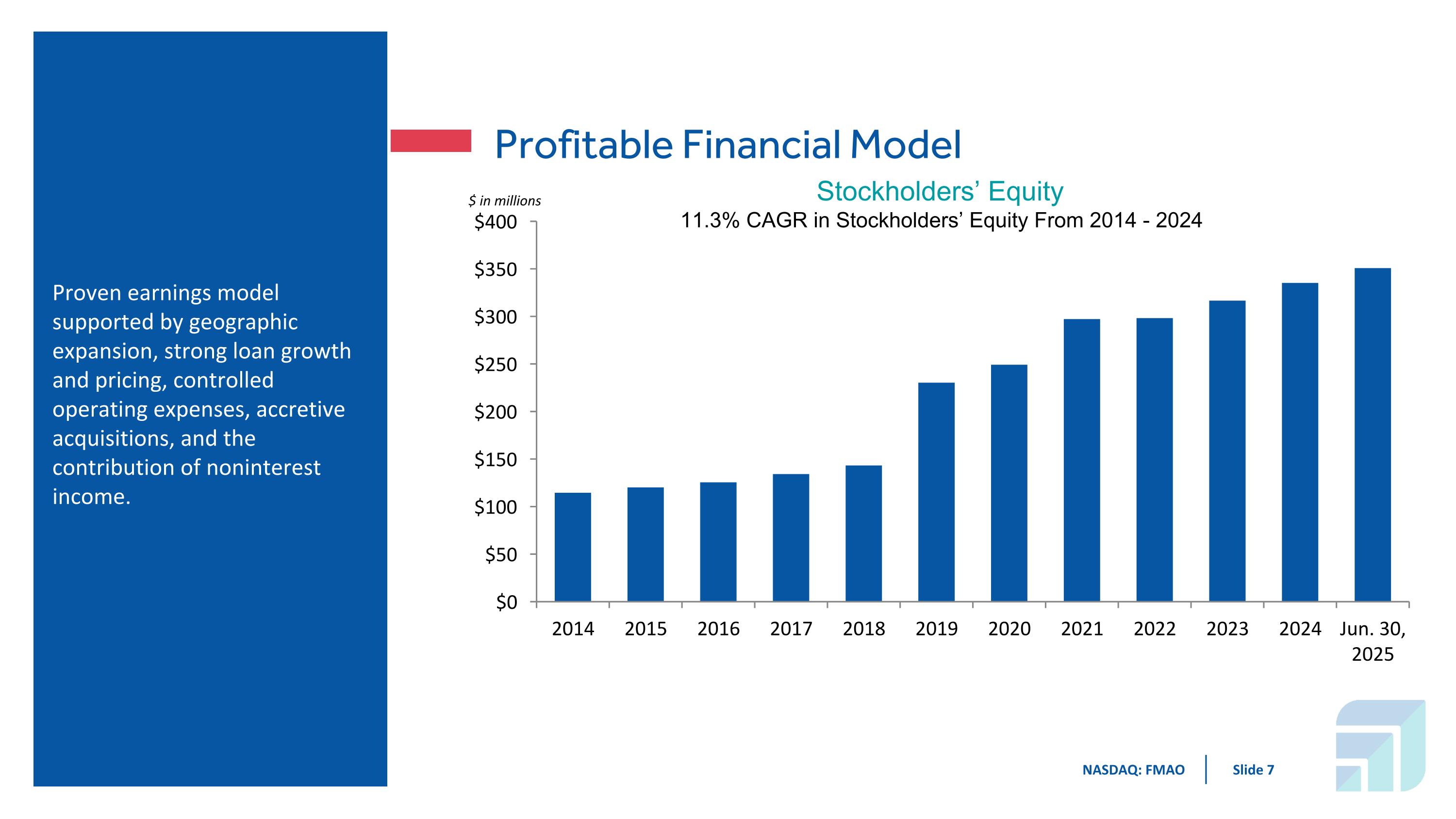

Profitable Financial Model Proven earnings model supported by geographic expansion, strong loan growth and pricing, controlled operating expenses, accretive acquisitions, and the contribution of noninterest income. NASDAQ: FMAO Slide 7 $ in millions Stockholders’ Equity 11.3% CAGR in Stockholders’ Equity From 2014 - 2024

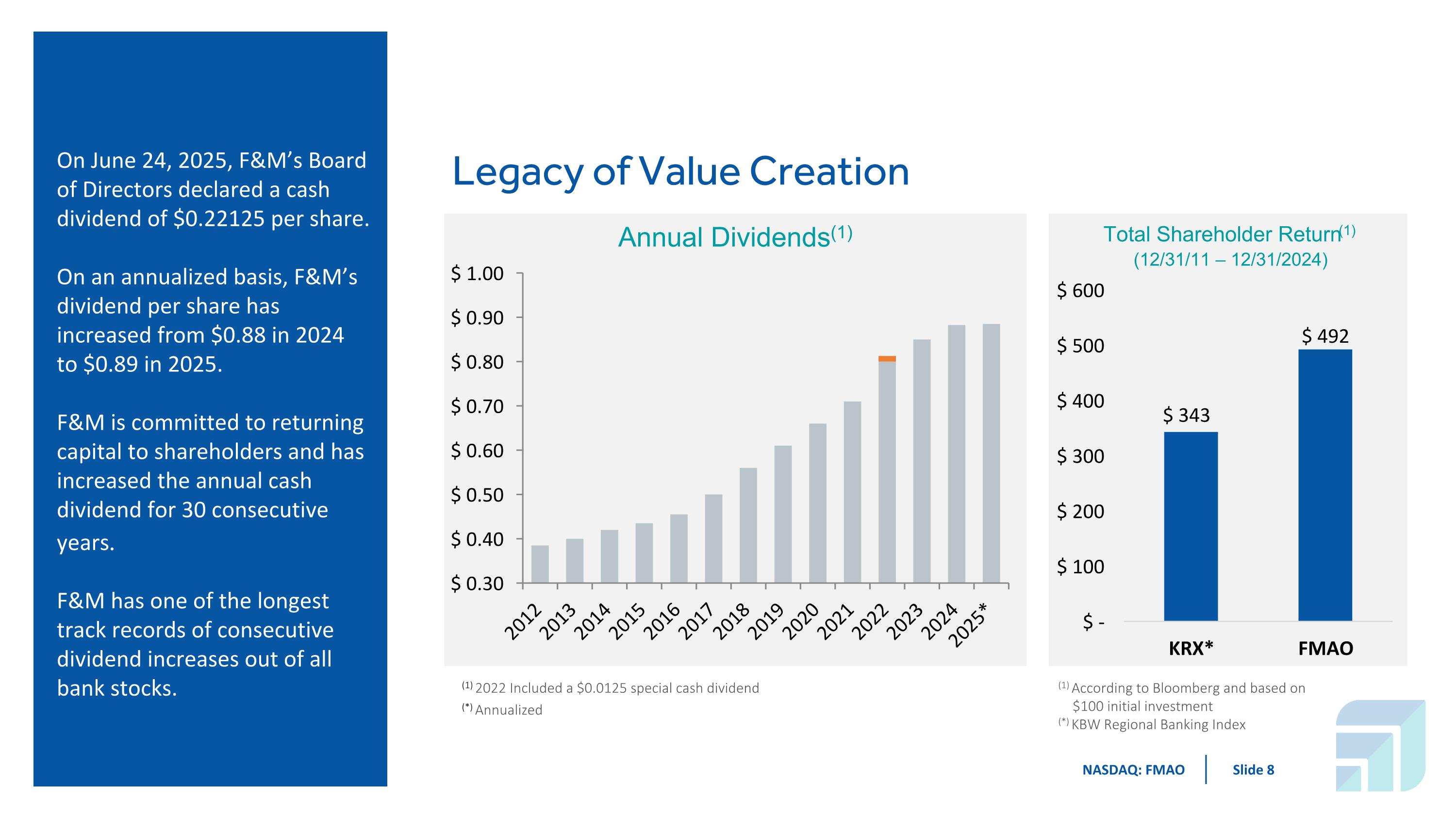

Legacy of Value Creation On June 24, 2025, F&M’s Board of Directors declared a cash dividend of $0.22125 per share. On an annualized basis, F&M’s dividend per share has increased from $0.88 in 2024 to $0.89 in 2025. F&M is committed to returning capital to shareholders and has increased the annual cash dividend for 30 consecutive years. F&M has one of the longest track records of consecutive dividend increases out of all bank stocks. (1) 2022 Included a $0.0125 special cash dividend (1) According to Bloomberg and based on $100 initial investment (*) KBW Regional Banking Index NASDAQ: FMAO Slide 8 (*) Annualized

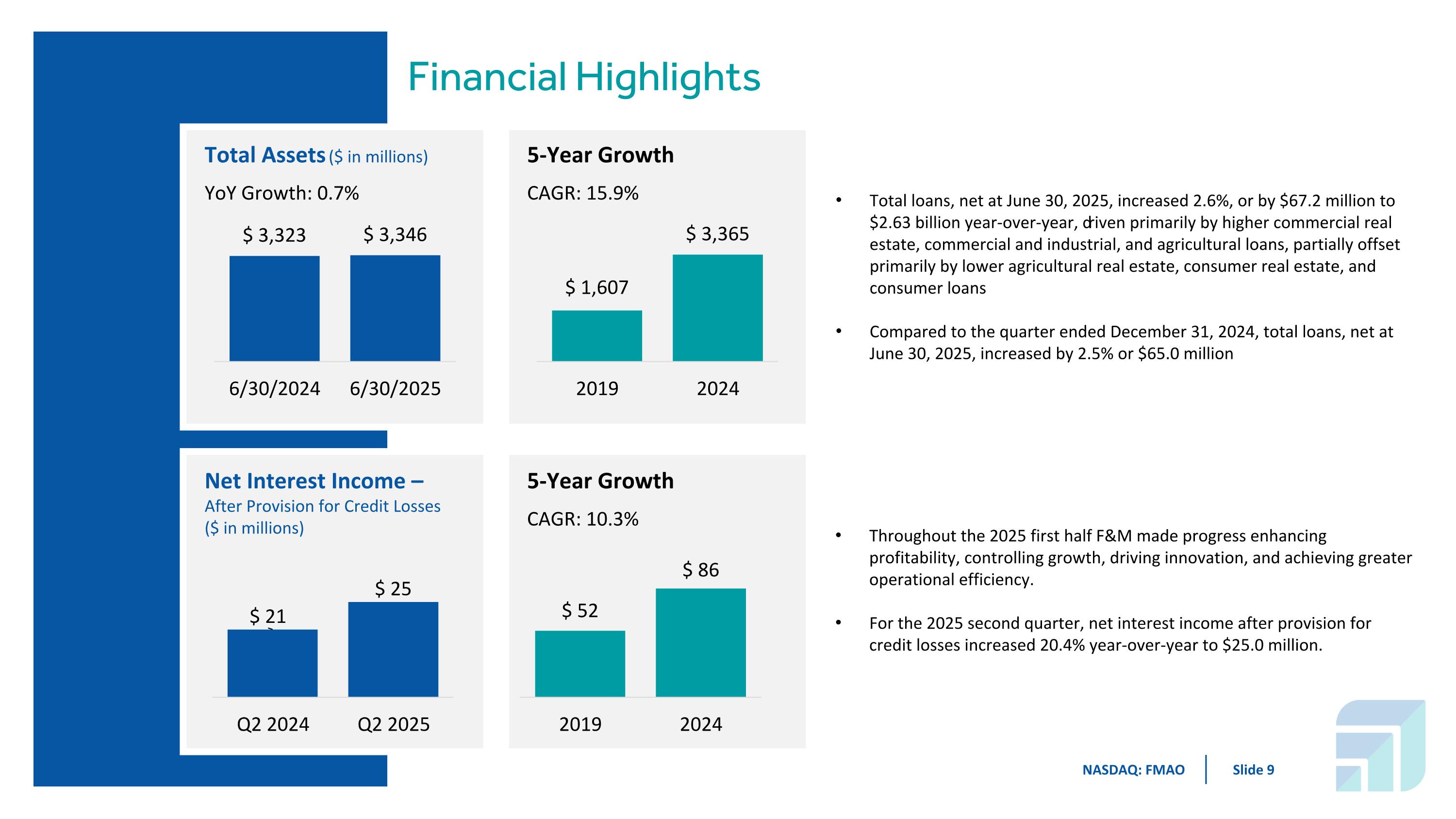

Financial Highlights Total loans, net at June 30, 2025, increased 2.6%, or by $67.2 million to $2.63 billion year-over-year, driven primarily by higher commercial real estate, commercial and industrial, and agricultural loans, partially offset primarily by lower agricultural real estate, consumer real estate, and consumer loans Compared to the quarter ended December 31, 2024, total loans, net at June 30, 2025, increased by 2.5% or $65.0 million Throughout the 2025 first half F&M made progress enhancing profitability, controlling growth, driving innovation, and achieving greater operational efficiency. For the 2025 second quarter, net interest income after provision for credit losses increased 20.4% year-over-year to $25.0 million. Total Assets ($ in millions) YoY Growth: 0.7% 5-Year Growth CAGR: 15.9% Net Interest Income – After Provision for Credit Losses ($ in millions) 5-Year Growth CAGR: 10.3% NASDAQ: FMAO Slide 9

Executing our Strategic Plan Leveraging Investments and Optimizing Platform New offices opened in 2023 in Fort Wayne, IN, Birmingham, MI, Toledo, OH and Oxford, OH added $53.9 million of new deposits and $80.5 million in new loans during 2024 Optimizing key vendor agreements during 2024 Continue to make strategic investments to expand operations, capabilities, and team Continual Talent Development Adding proven bankers from outside of the organization Investing in training Structured leadership development programs Actively Pursue Accretive Acquisitions Four successful bank acquisitions closed since 2019 Completed an asset purchase of investment advisor in 2020 Improve Market Share, Customer Acquisition and Retention At June 30, 2025, deposits increased 2.6% YoY to $2.71 billion One of the largest banks based on deposits in F&M’s Ohio and Indiana markets combined Accelerate Digital Transformation and Growth 2024 growth across multiple KPIs including: a 27.26% increase in mobile customers, a 13.92% increase in ACH originators, and an 8.39% increase in RDC customers Diversify Revenue by Increasing Noninterest Income Streams Added Treasury Management products Renegotiated card rails fee contract More emphasis and use of SWAPs NASDAQ: FMAO Slide 10

Growth Oriented Strategy Invest in Infrastructure and Capabilities to Support Expansion Pursue Purposeful M&A Strategy Accelerate Digital Transformation and Growth Diversify Revenue by Increasing Noninterest Income Streams Increase Market Share and Improve Core Funding Strategy F&M is following a new 3-year strategic plan focused on growing earnings and creating value for its shareholders After successfully completing its prior strategic plan and growing assets to over $3 billion, in 2022 F&M developed a new three-year plan to guide the next phase of F&M’s evolution. NASDAQ: FMAO Slide 11

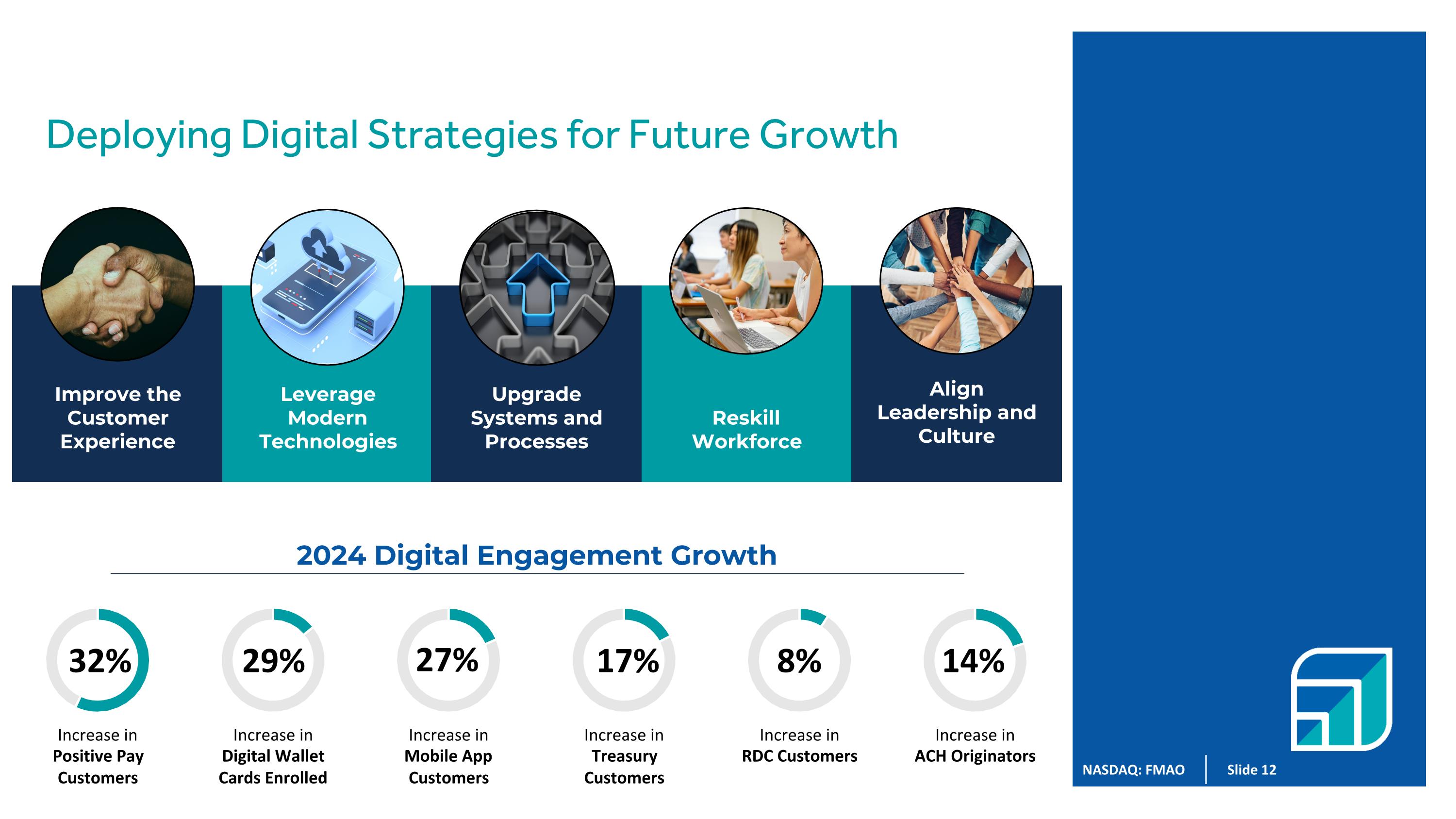

27% Deploying Digital Strategies for Future Growth Reskill Workforce Align Leadership and Culture Improve the Customer Experience Leverage Modern Technologies Upgrade Systems and Processes 2024 Digital Engagement Growth Increase in Increase in Increase in Digital Wallet Cards Enrolled Increase in RDC Customers Treasury Customers ACH Originators 8% 29% 14% 17% NASDAQ: FMAO Slide 12 Increase in Positive Pay Customers 32% Mobile App Customers Increase in

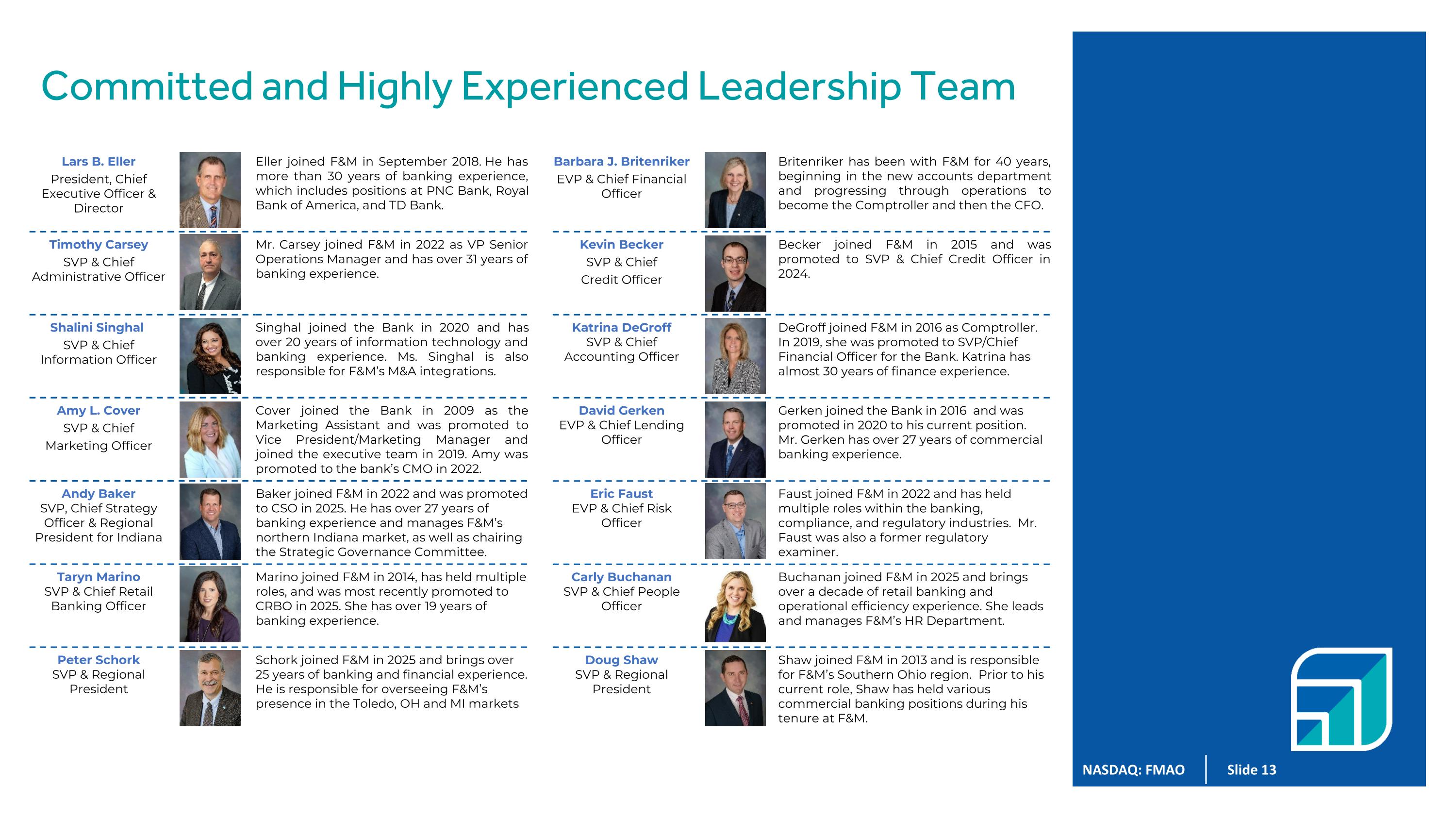

Committed and Highly Experienced Leadership Team Barbara J. Britenriker EVP & Chief Financial Officer Britenriker has been with F&M for 40 years, beginning in the new accounts department and progressing through operations to become the Comptroller and then the CFO. Kevin Becker SVP & Chief Credit Officer Becker joined F&M in 2015 and was promoted to SVP & Chief Credit Officer in 2024. Katrina DeGroff SVP & Chief Accounting Officer DeGroff joined F&M in 2016 as Comptroller. In 2019, she was promoted to SVP/Chief Financial Officer for the Bank. Katrina has almost 30 years of finance experience. David Gerken EVP & Chief Lending Officer Gerken joined the Bank in 2016 and was promoted in 2020 to his current position. Mr. Gerken has over 27 years of commercial banking experience. Eric Faust EVP & Chief Risk Officer Faust joined F&M in 2022 and has held multiple roles within the banking, compliance, and regulatory industries. Mr. Faust was also a former regulatory examiner. Carly Buchanan SVP & Chief People Officer Buchanan joined F&M in 2025 and brings over a decade of retail banking and operational efficiency experience. She leads and manages F&M’s HR Department. Doug Shaw SVP & Regional President Shaw joined F&M in 2013 and is responsible for F&M’s Southern Ohio region. Prior to his current role, Shaw has held various commercial banking positions during his tenure at F&M. Lars B. Eller President, Chief Executive Officer & Director Eller joined F&M in September 2018. He has more than 30 years of banking experience, which includes positions at PNC Bank, Royal Bank of America, and TD Bank. Timothy Carsey SVP & Chief Administrative Officer Mr. Carsey joined F&M in 2022 as VP Senior Operations Manager and has over 31 years of banking experience. Shalini Singhal SVP & Chief Information Officer Singhal joined the Bank in 2020 and has over 20 years of information technology and banking experience. Ms. Singhal is also responsible for F&M’s M&A integrations. Amy L. Cover SVP & Chief Marketing Officer Cover joined the Bank in 2009 as the Marketing Assistant and was promoted to Vice President/Marketing Manager and joined the executive team in 2019. Amy was promoted to the bank’s CMO in 2022. Andy Baker SVP, Chief Strategy Officer & Regional President for Indiana Baker joined F&M in 2022 and was promoted to CSO in 2025. He has over 27 years of banking experience and manages F&M’s northern Indiana market, as well as chairing the Strategic Governance Committee. Taryn Marino SVP & Chief Retail Banking Officer Marino joined F&M in 2014, has held multiple roles, and was most recently promoted to CRBO in 2025. She has over 19 years of banking experience. Peter Schork SVP & Regional President Schork joined F&M in 2025 and brings over 25 years of banking and financial experience. He is responsible for overseeing F&M’s presence in the Toledo, OH and MI markets NASDAQ: FMAO Slide 13

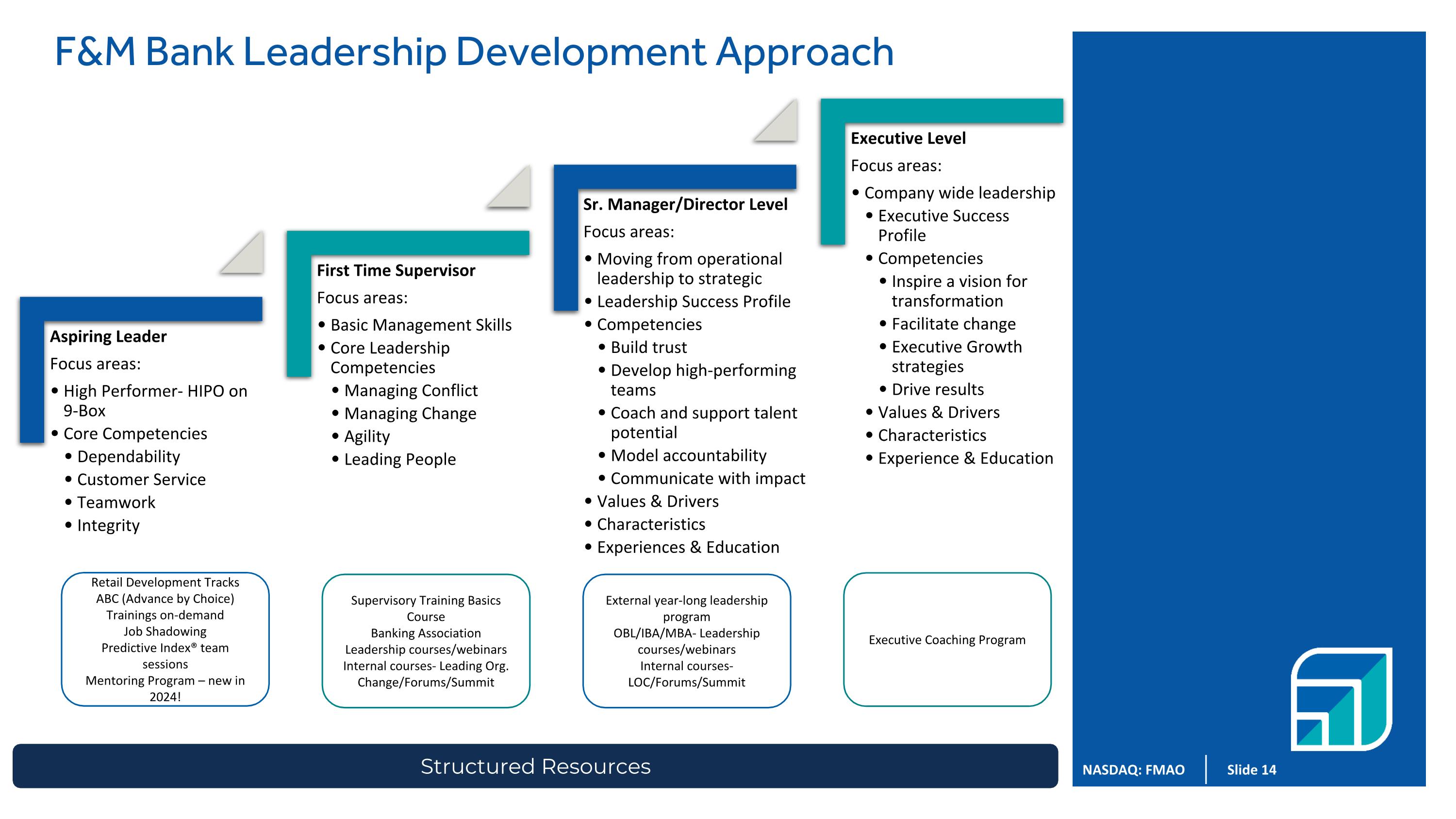

Aspiring Leader Focus areas: High Performer- HIPO on 9-Box Core Competencies Dependability Customer Service Teamwork Integrity First Time Supervisor Focus areas: Basic Management Skills Core Leadership Competencies Managing Conflict Managing Change Agility Leading People Sr. Manager/Director Level Focus areas: Moving from operational leadership to strategic Leadership Success Profile Competencies Build trust Develop high-performing teams Coach and support talent potential Model accountability Communicate with impact Values & Drivers Characteristics Experiences & Education Executive Level Focus areas: Company wide leadership Executive Success Profile Competencies Inspire a vision for transformation Facilitate change Executive Growth strategies Drive results Values & Drivers Characteristics Experience & Education Supervisory Training Basics Course Banking Association Leadership courses/webinars Internal courses- Leading Org. Change/Forums/Summit External year-long leadership program OBL/IBA/MBA- Leadership courses/webinars Internal courses- LOC/Forums/Summit Executive Coaching Program Structured Resources Retail Development Tracks ABC (Advance by Choice) Trainings on-demand Job Shadowing Predictive Index® team sessions Mentoring Program – new in 2024! F&M Bank Leadership Development Approach NASDAQ: FMAO Slide 14

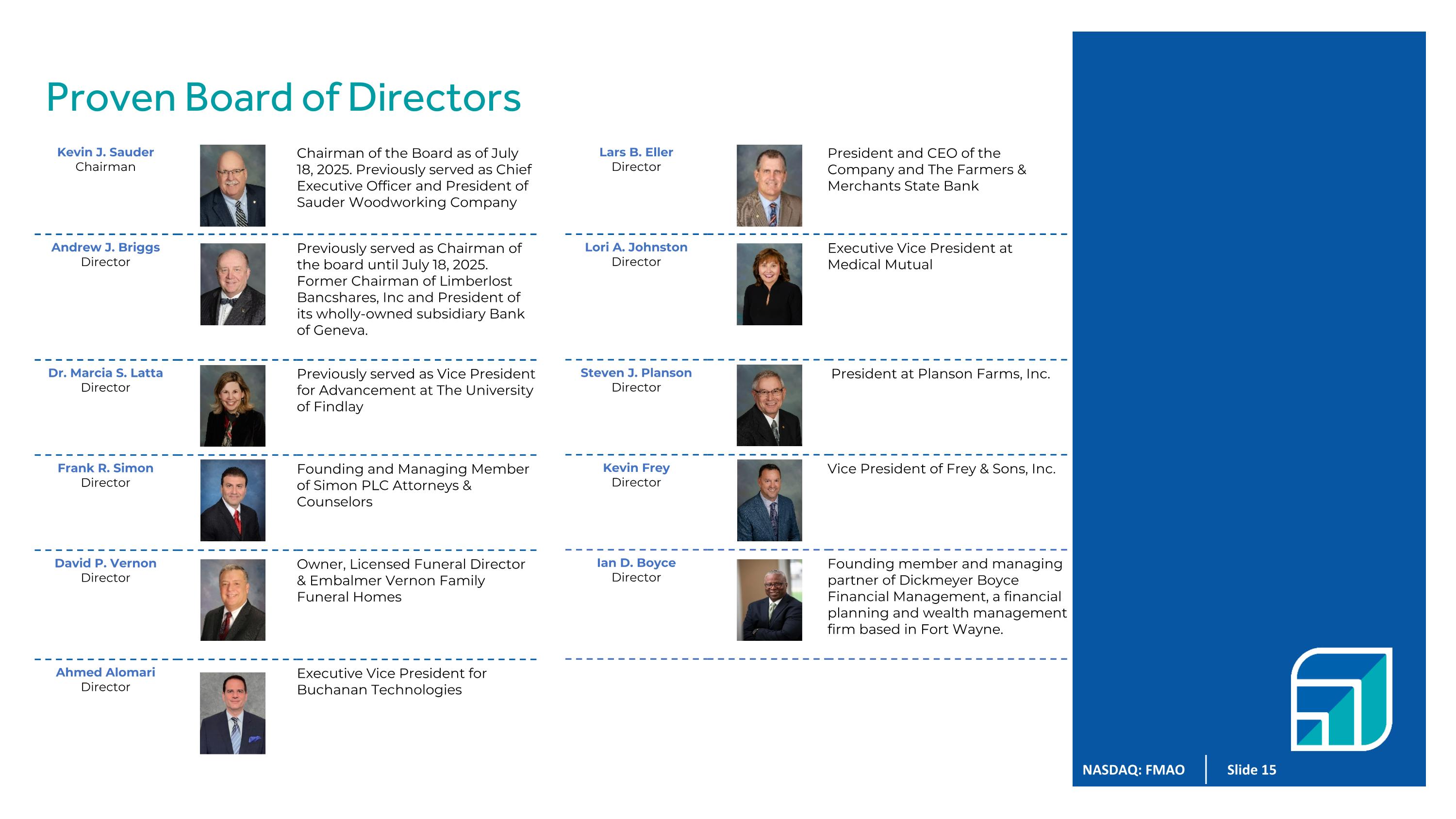

Proven Board of Directors Lars B. Eller Director President and CEO of the Company and The Farmers & Merchants State Bank Lori A. Johnston Director Executive Vice President at Medical Mutual Steven J. Planson Director President at Planson Farms, Inc. Kevin Frey Director Vice President of Frey & Sons, Inc. Ian D. Boyce Director Founding member and managing partner of Dickmeyer Boyce Financial Management, a financial planning and wealth management firm based in Fort Wayne. Kevin J. Sauder Chairman Chairman of the Board as of July 18, 2025. Previously served as Chief Executive Officer and President of Sauder Woodworking Company Andrew J. Briggs Director Previously served as Chairman of the board until July 18, 2025. Former Chairman of Limberlost Bancshares, Inc and President of its wholly-owned subsidiary Bank of Geneva. Dr. Marcia S. Latta Director Previously served as Vice President for Advancement at The University of Findlay Frank R. Simon Director Founding and Managing Member of Simon PLC Attorneys & Counselors David P. Vernon Director Owner, Licensed Funeral Director & Embalmer Vernon Family Funeral Homes Ahmed Alomari Director Executive Vice President for Buchanan Technologies NASDAQ: FMAO Slide 15

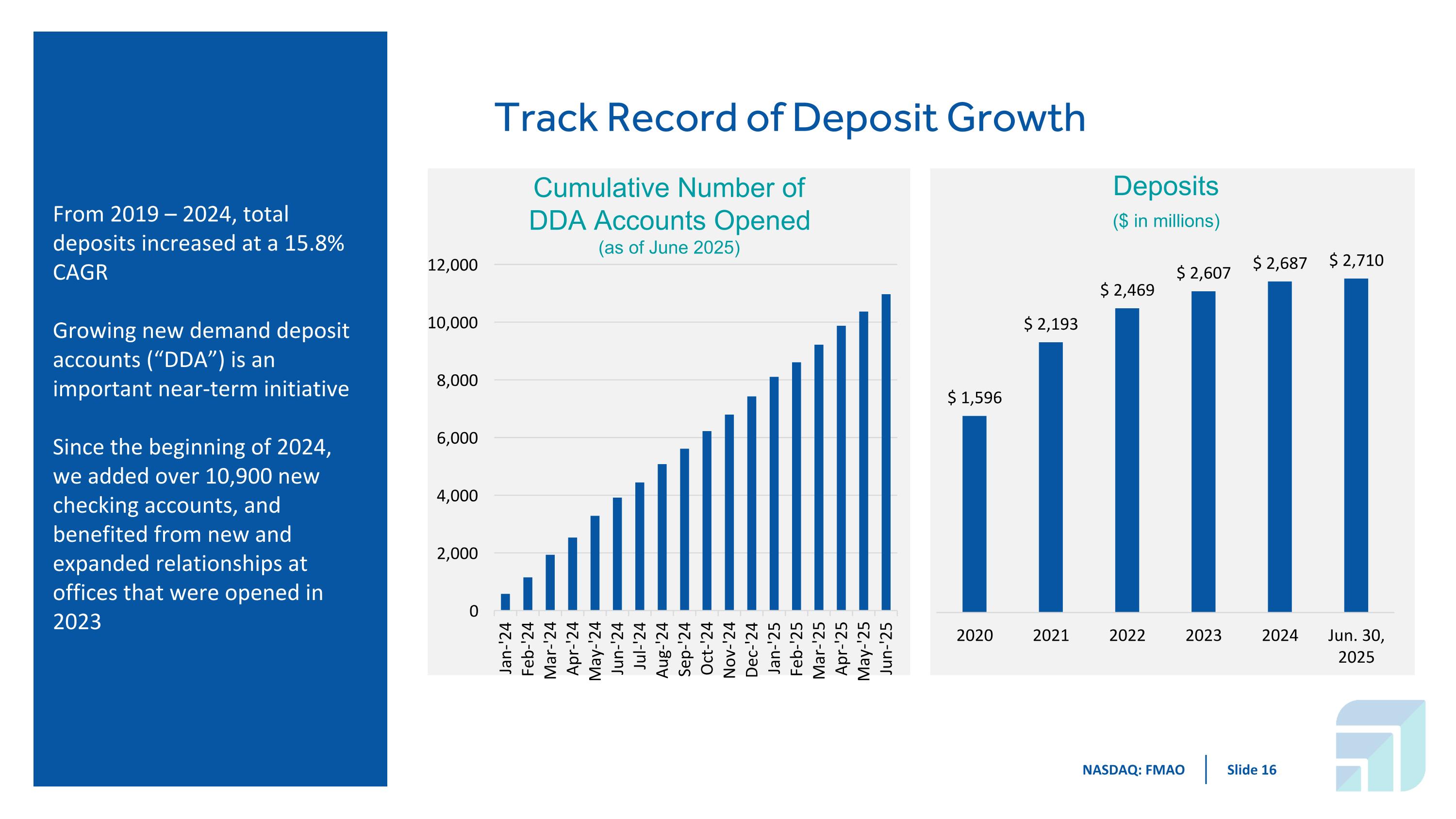

Track Record of Deposit Growth From 2019 – 2024, total deposits increased at a 15.8% CAGR Growing new demand deposit accounts (“DDA”) is an important near-term initiative Since the beginning of 2024, we added over 10,900 new checking accounts, and benefited from new and expanded relationships at offices that were opened in 2023 NASDAQ: FMAO Slide 16 Cumulative Number of DDA Accounts Opened (as of June 2025)

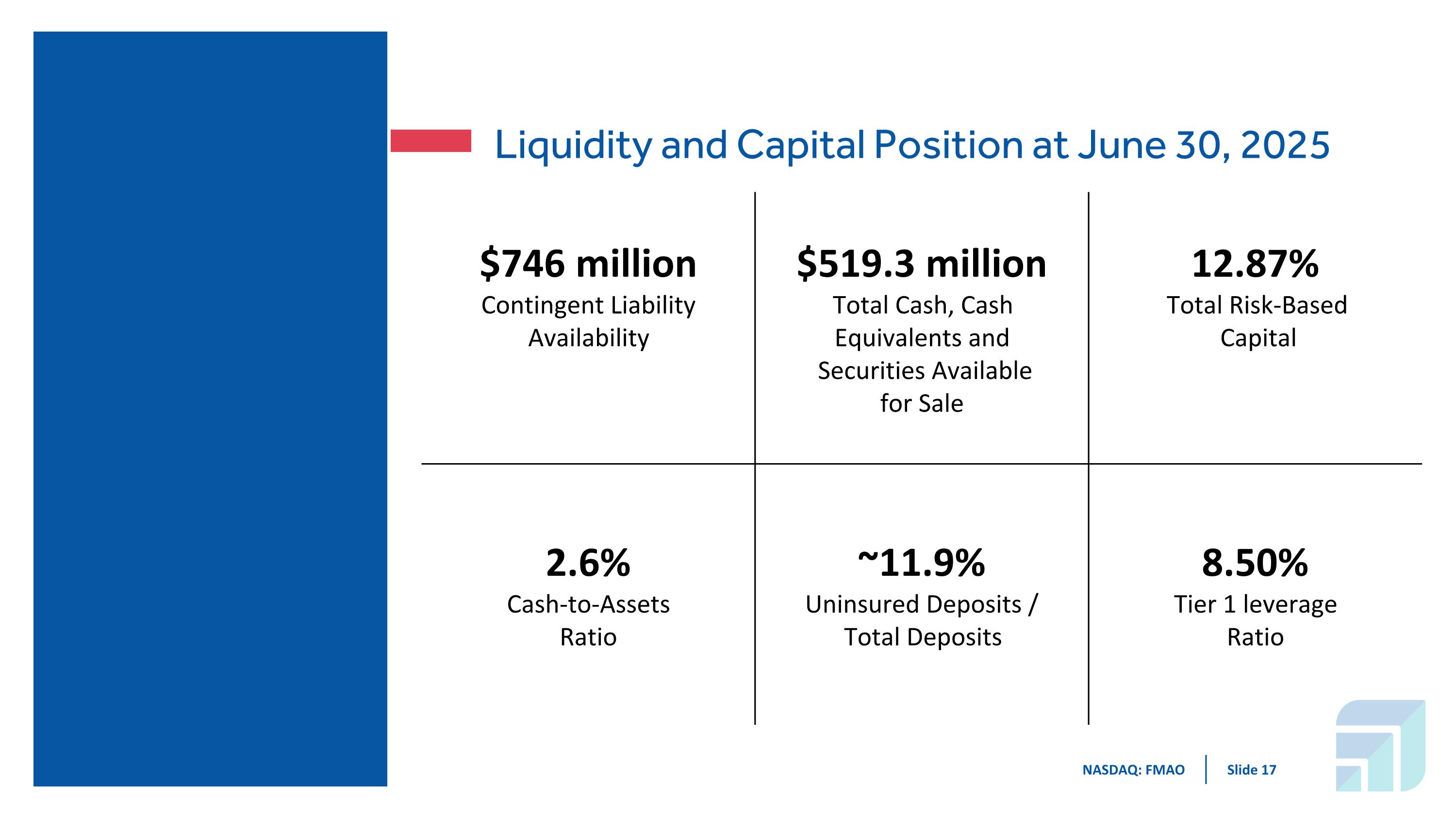

Liquidity and Capital Position at June 30, 2025 NASDAQ: FMAO Slide 17 $746 million Contingent Liability Availability $519.3 million Total Cash, Cash Equivalents and Securities Available for Sale 12.87% Total Risk-Based Capital 2.6% Cash-to-Assets Ratio ~11.9% Uninsured Deposits / Total Deposits 8.50% Tier 1 leverage Ratio

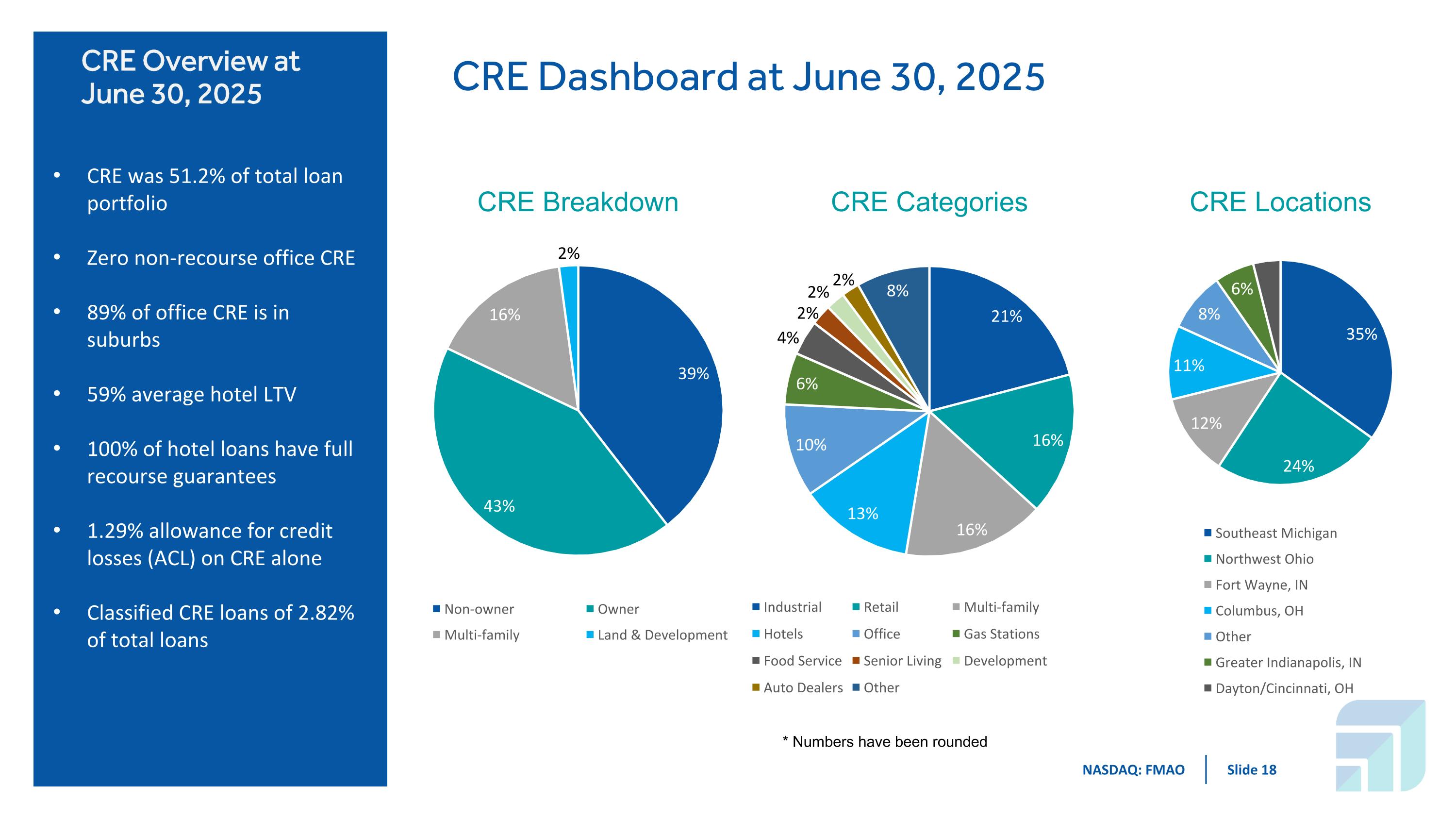

CRE Dashboard at June 30, 2025 CRE Overview at June 30, 2025 CRE was 51.2% of total loan portfolio Zero non-recourse office CRE 89% of office CRE is in suburbs 59% average hotel LTV 100% of hotel loans have full recourse guarantees 1.29% allowance for credit losses (ACL) on CRE alone Classified CRE loans of 2.82% of total loans NASDAQ: FMAO Slide 18 * Numbers have been rounded CRE Breakdown CRE Categories CRE Locations

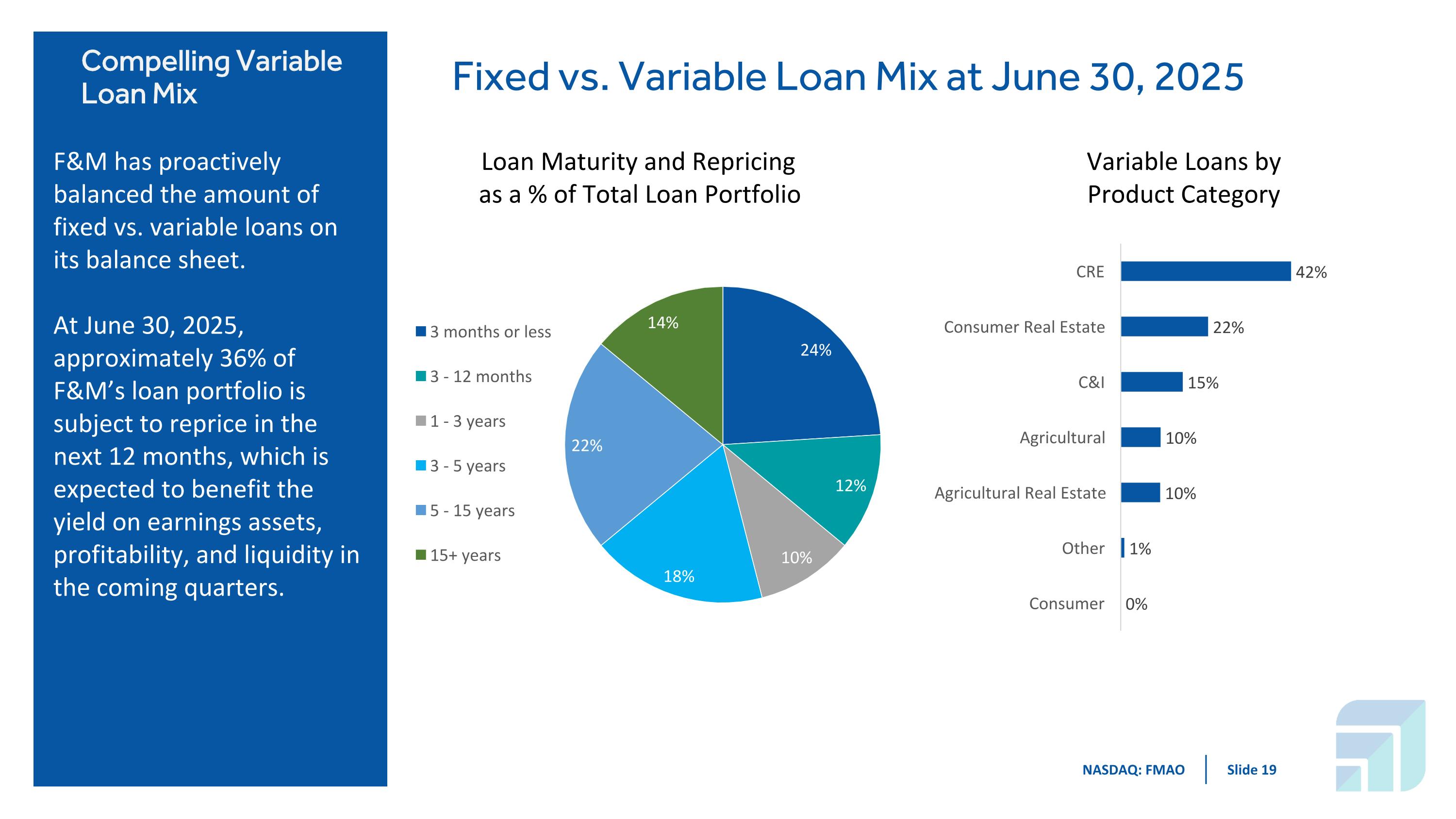

Fixed vs. Variable Loan Mix at June 30, 2025 Compelling Variable Loan Mix Loan Maturity and Repricing as a % of Total Loan Portfolio Variable Loans by Product Category F&M has proactively balanced the amount of fixed vs. variable loans on its balance sheet. At June 30, 2025, approximately 36% of F&M’s loan portfolio is subject to reprice in the next 12 months, which is expected to benefit the yield on earnings assets, profitability, and liquidity in the coming quarters. NASDAQ: FMAO Slide 19

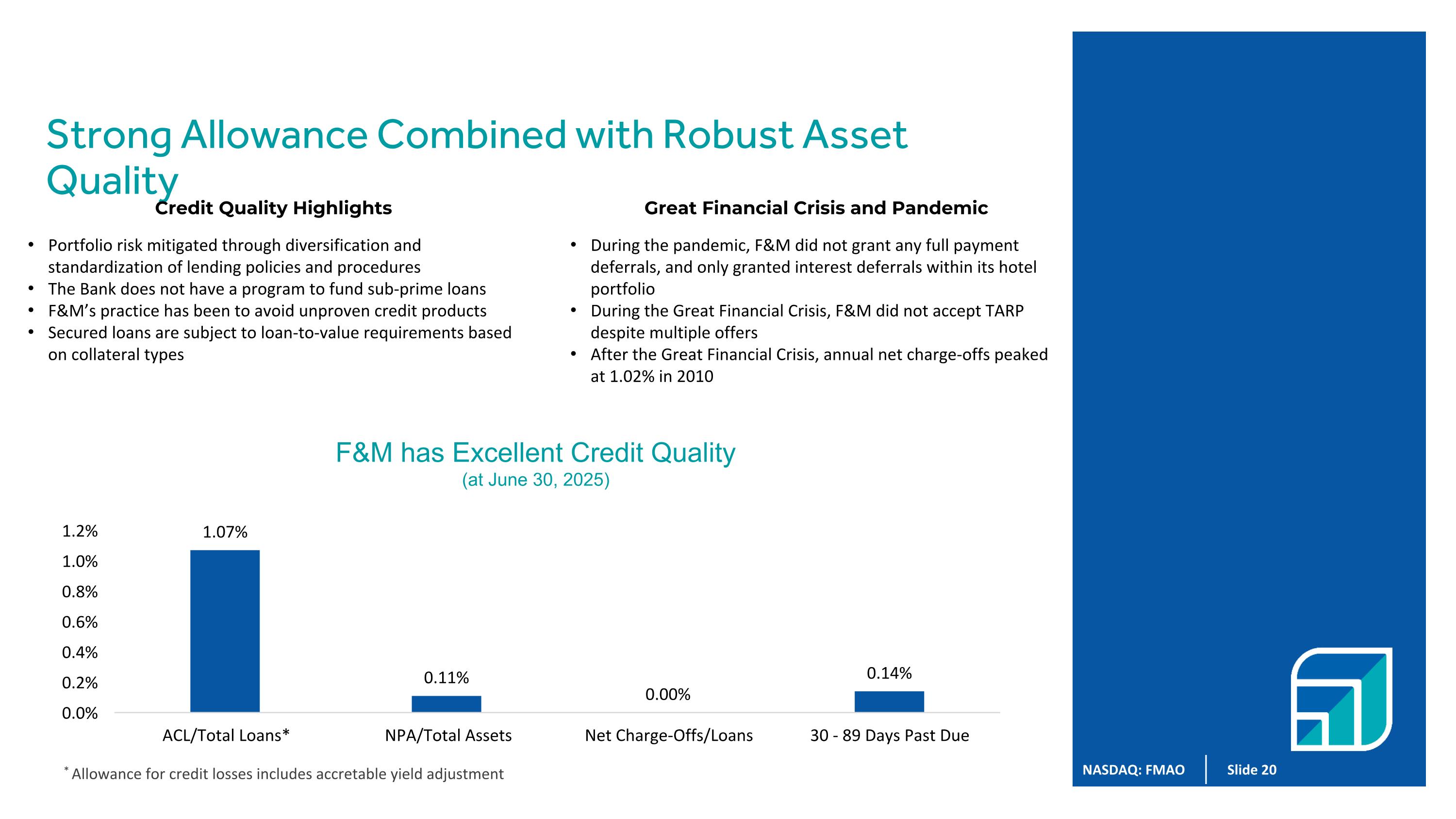

Strong Allowance Combined with Robust Asset Quality Credit Quality Highlights Great Financial Crisis and Pandemic Portfolio risk mitigated through diversification and standardization of lending policies and procedures The Bank does not have a program to fund sub-prime loans F&M’s practice has been to avoid unproven credit products Secured loans are subject to loan-to-value requirements based on collateral types During the pandemic, F&M did not grant any full payment deferrals, and only granted interest deferrals within its hotel portfolio During the Great Financial Crisis, F&M did not accept TARP despite multiple offers After the Great Financial Crisis, annual net charge-offs peaked at 1.02% in 2010 F&M has Excellent Credit Quality (at June 30, 2025) NASDAQ: FMAO Slide 20 * Allowance for credit losses includes accretable yield adjustment

Supporting Our Communities PPP Lending F&M funded in a two-year period $142.3 million in PPP loans, including $53.8 million in 2021 PPP Lending by F&M is estimated to have impacted more than 18,000 jobs in our communities Community Involvement Provided $511,525 of charitable donations to support organizations throughout Ohio, Indiana and Michigan in 2024. F&M’s annual Wauseon and Fort Wayne golf outings raised record amounts in 2024 F&M team members are encouraged to volunteer at organizations across F&M’s markets Supporting Agricultural Customers Each year, F&M provides lunches to more than 50 grain elevators in our communities during Fall Harvest season NASDAQ: FMAO Slide 21

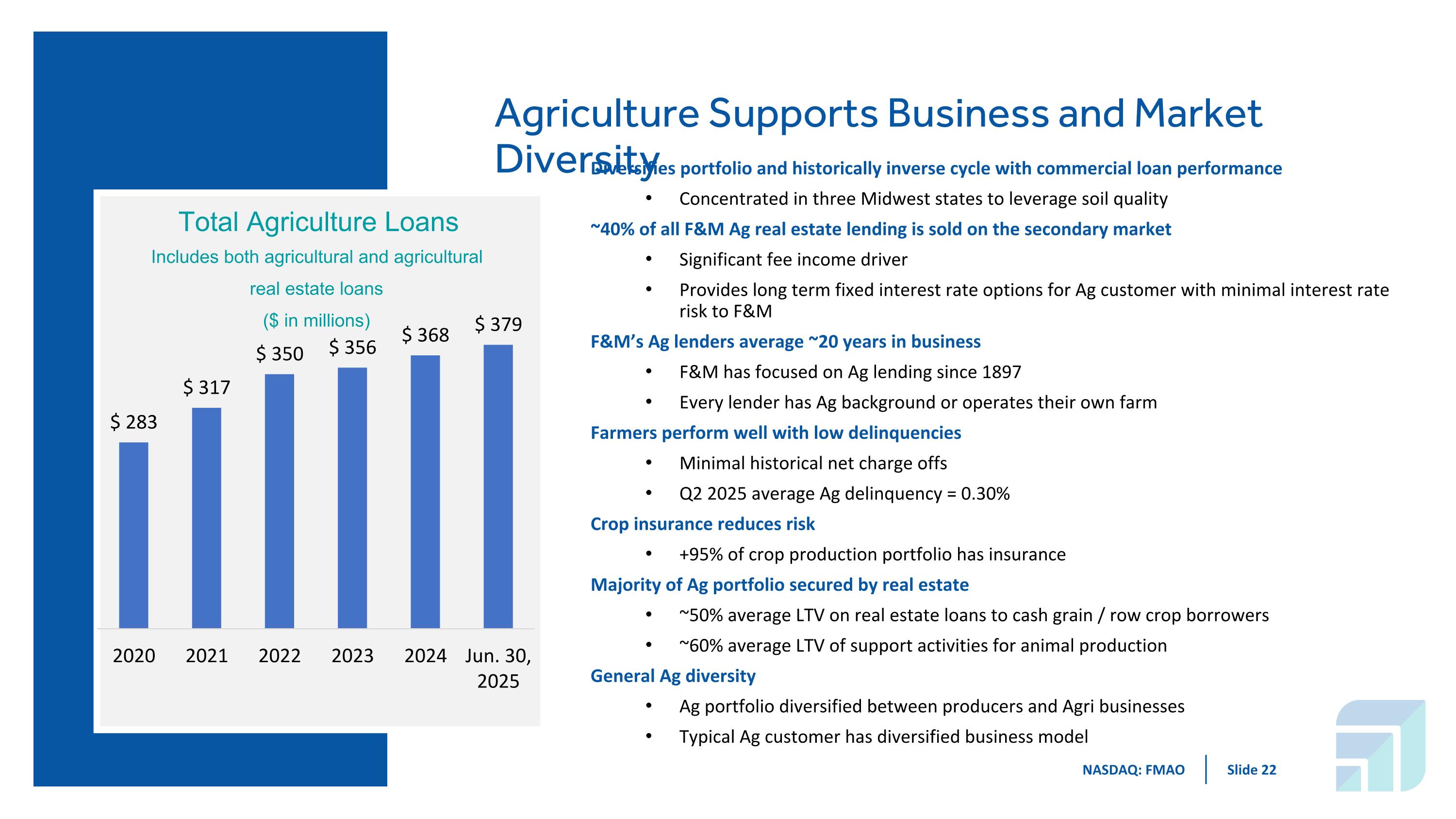

Agriculture Supports Business and Market Diversity Diversifies portfolio and historically inverse cycle with commercial loan performance Concentrated in three Midwest states to leverage soil quality ~40% of all F&M Ag real estate lending is sold on the secondary market Significant fee income driver Provides long term fixed interest rate options for Ag customer with minimal interest rate risk to F&M F&M’s Ag lenders average ~20 years in business F&M has focused on Ag lending since 1897 Every lender has Ag background or operates their own farm Farmers perform well with low delinquencies Minimal historical net charge offs Q2 2025 average Ag delinquency = 0.30% Crop insurance reduces risk +95% of crop production portfolio has insurance Majority of Ag portfolio secured by real estate ~50% average LTV on real estate loans to cash grain / row crop borrowers ~60% average LTV of support activities for animal production General Ag diversity Ag portfolio diversified between producers and Agri businesses Typical Ag customer has diversified business model NASDAQ: FMAO Slide 22

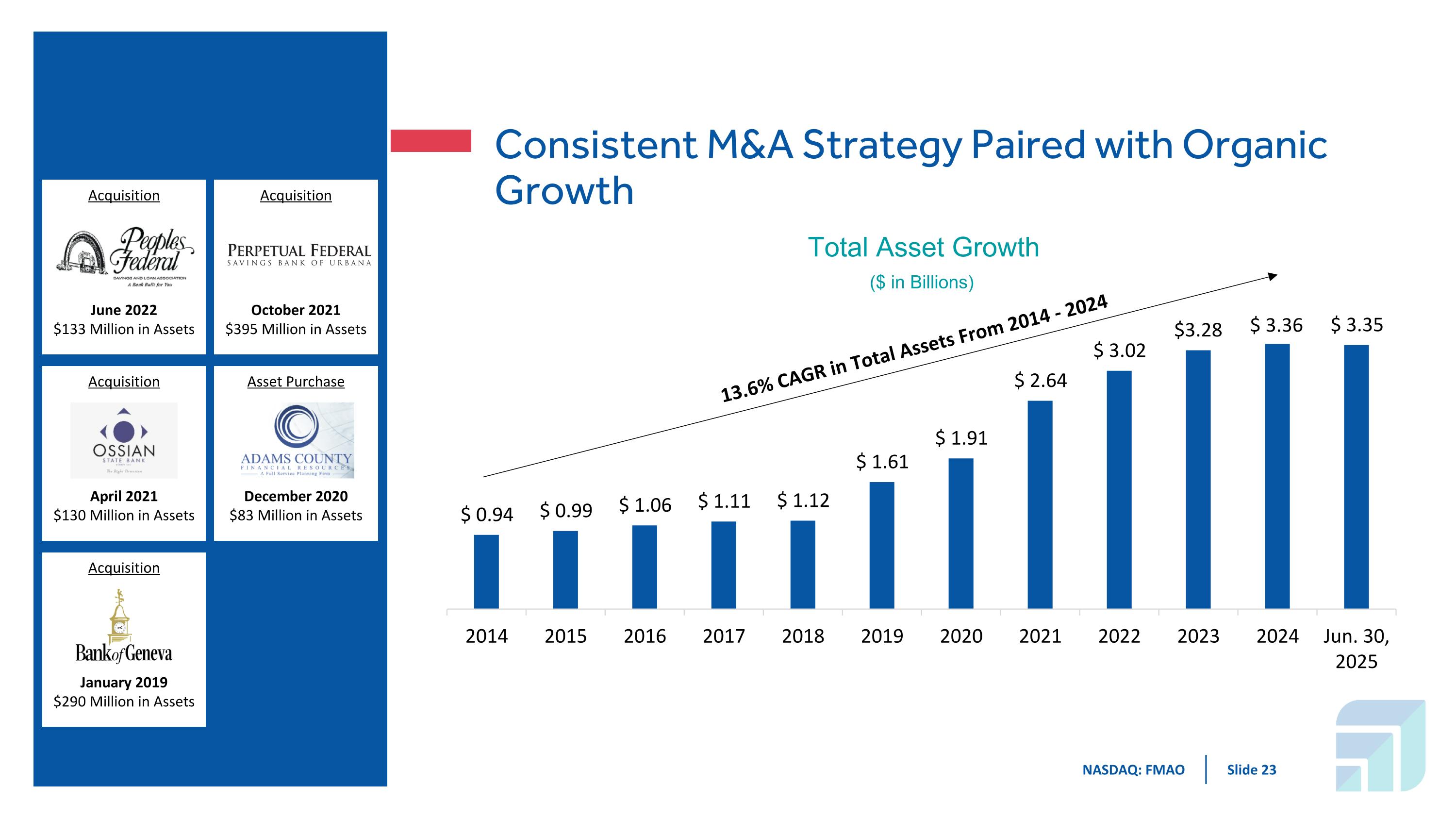

Consistent M&A Strategy Paired with Organic Growth Acquisition June 2022 $133 Million in Assets Acquisition October 2021 $395 Million in Assets Acquisition April 2021 $130 Million in Assets Asset Purchase December 2020 $83 Million in Assets Acquisition January 2019 $290 Million in Assets 13.6% CAGR in Total Assets From 2014 - 2024 NASDAQ: FMAO Slide 23

2025 Priorities NASDAQ: FMAO Slide 24 Control Growth Focus on growing low-cost deposits Prudent underwriting and risk management to drive controlled loan growth Continually Innovate Enhance customer experience with new account opening software Utilize new automated and digital solutions Pursue new products Optimize checking lineup Enhance Profitability Leverage prior year investments Accelerate new office productivity Benefits of loan repricing Operational Efficiency Optimize loan processes Upgrade online account opening experience Execute shared services model Create data governance function