NEWS RELEASE OppFi Reports Record Quarterly Revenue and Adjusted Net Income and Increases Full Year Revenue and Adjusted Net Income Guidance 2025-08-06 GAAP net income decreased 58.5% year over year to $11.5 million Adjusted net income1 increased 59.0% year over year to $39.4 million, a Company record for any quarter Total revenue increased 12.8% year over year to $142.4 million, a Company record for any quarter Average yield, annualized increased by 130 basis points year over year to 136.1%, a Company record for any quarter Net charge-o� rate as a percentage of total revenue decreased 60 basis points year over year to 31.9% Revenue guidance for the full year 2025 increased to $578 million to $605 million, from a previous range of $563 million to $594 million Adjusted net income1 guidance for the full year 2025 increased to $125 million to $130 million, from $106 million to $113 million CHICAGO, Aug. 6, 2025 /PRNewswire/ -- OppFi Inc. (NYSE: OPFI) ("OppFi" or the "Company"), a tech-enabled digital �nance platform that partners with banks to o�er �nancial products and services to everyday Americans, today reported �nancial results for the second quarter ended June 30, 2025. 1

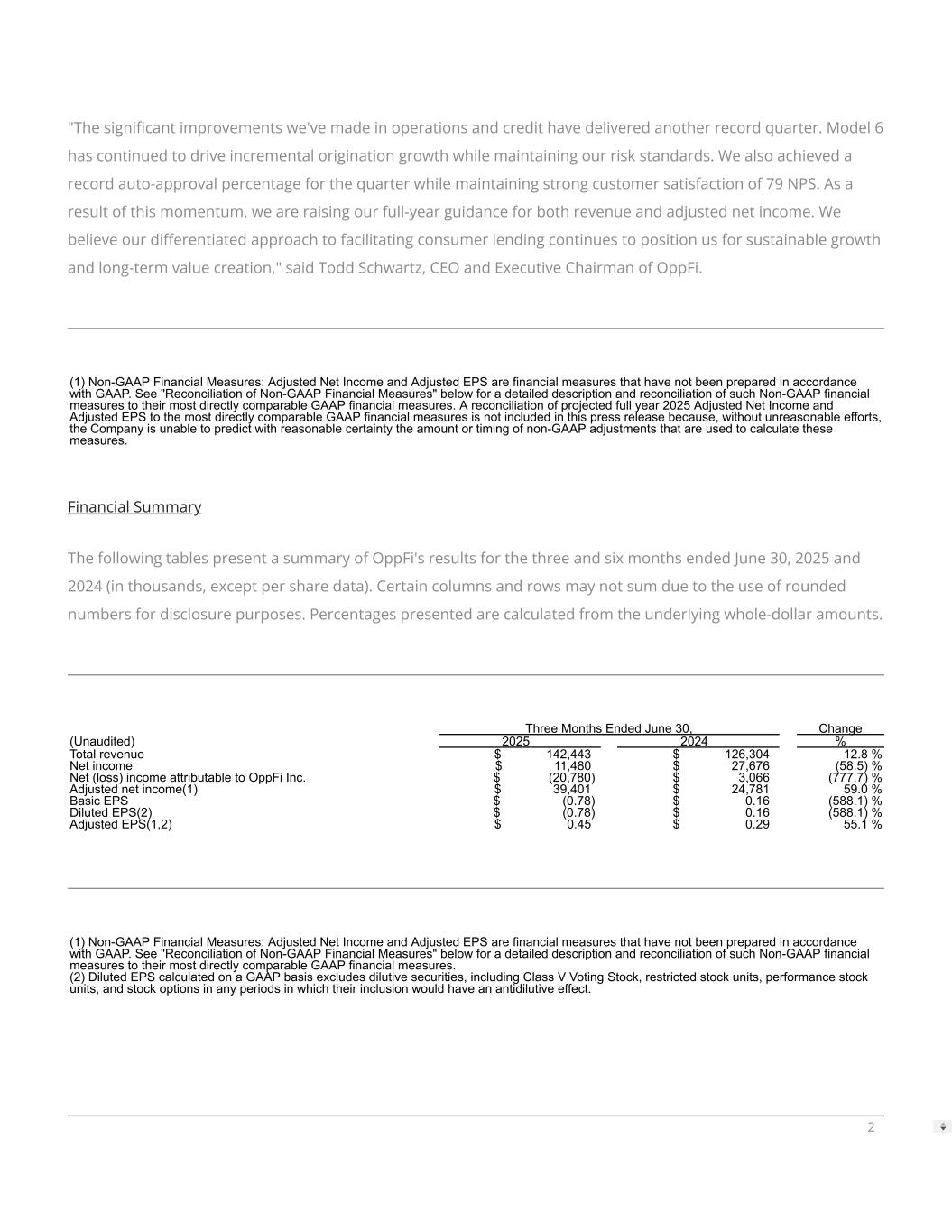

"The signi�cant improvements we've made in operations and credit have delivered another record quarter. Model 6 has continued to drive incremental origination growth while maintaining our risk standards. We also achieved a record auto-approval percentage for the quarter while maintaining strong customer satisfaction of 79 NPS. As a result of this momentum, we are raising our full-year guidance for both revenue and adjusted net income. We believe our di�erentiated approach to facilitating consumer lending continues to position us for sustainable growth and long-term value creation," said Todd Schwartz, CEO and Executive Chairman of OppFi. (1) Non-GAAP Financial Measures: Adjusted Net Income and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See "Reconciliation of Non-GAAP Financial Measures" below for a detailed description and reconciliation of such Non-GAAP financial measures to their most directly comparable GAAP financial measures. A reconciliation of projected full year 2025 Adjusted Net Income and Adjusted EPS to the most directly comparable GAAP financial measures is not included in this press release because, without unreasonable efforts, the Company is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these measures. Financial Summary The following tables present a summary of OppFi's results for the three and six months ended June 30, 2025 and 2024 (in thousands, except per share data). Certain columns and rows may not sum due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole-dollar amounts. Three Months Ended June 30, Change (Unaudited) 2025 2024 % Total revenue $ 142,443 $ 126,304 12.8 % Net income $ 11,480 $ 27,676 (58.5) % Net (loss) income attributable to OppFi Inc. $ (20,780) $ 3,066 (777.7) % Adjusted net income(1) $ 39,401 $ 24,781 59.0 % Basic EPS $ (0.78) $ 0.16 (588.1) % Diluted EPS(2) $ (0.78) $ 0.16 (588.1) % Adjusted EPS(1,2) $ 0.45 $ 0.29 55.1 % (1) Non-GAAP Financial Measures: Adjusted Net Income and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See "Reconciliation of Non-GAAP Financial Measures" below for a detailed description and reconciliation of such Non-GAAP financial measures to their most directly comparable GAAP financial measures. (2) Diluted EPS calculated on a GAAP basis excludes dilutive securities, including Class V Voting Stock, restricted stock units, performance stock units, and stock options in any periods in which their inclusion would have an antidilutive effect. 2

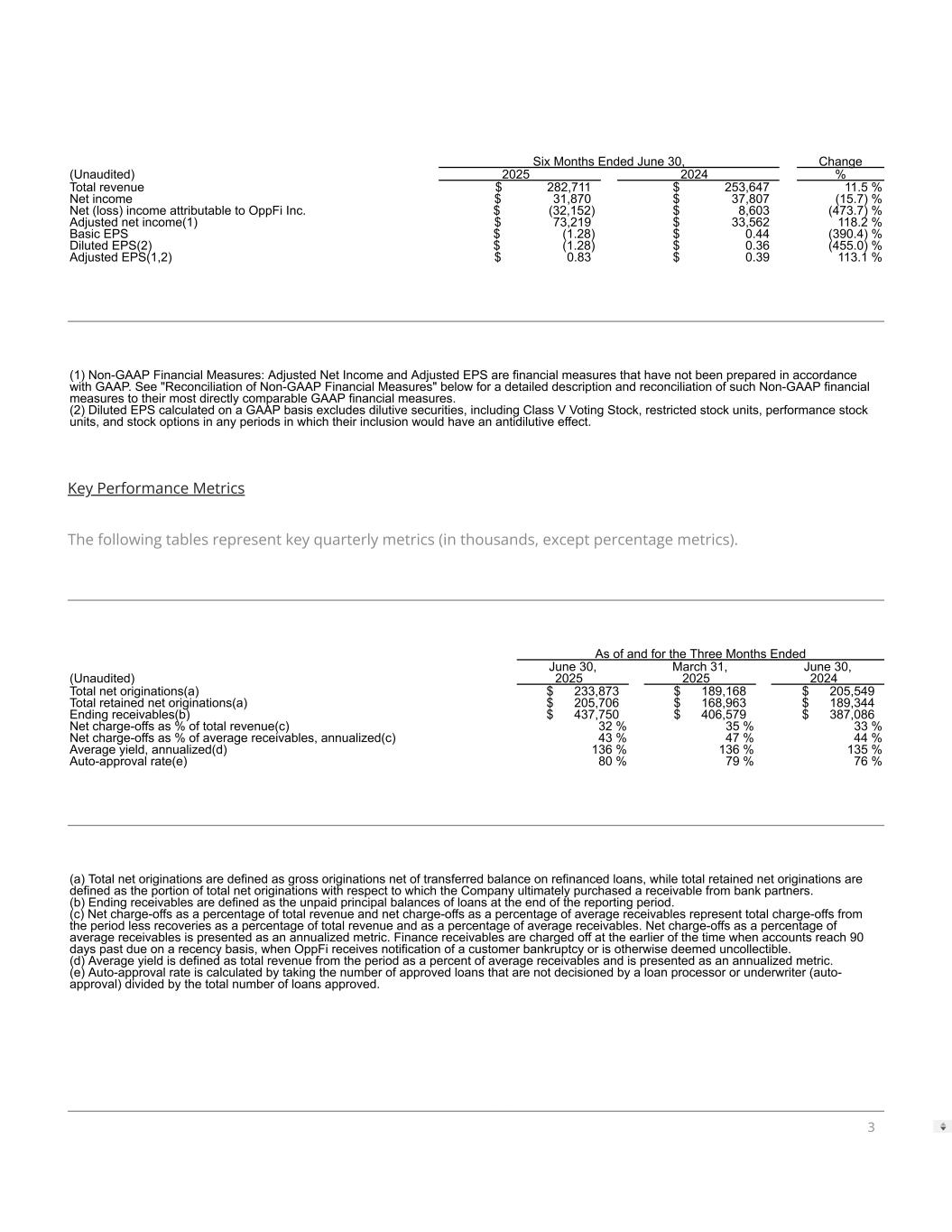

Six Months Ended June 30, Change (Unaudited) 2025 2024 % Total revenue $ 282,711 $ 253,647 11.5 % Net income $ 31,870 $ 37,807 (15.7) % Net (loss) income attributable to OppFi Inc. $ (32,152) $ 8,603 (473.7) % Adjusted net income(1) $ 73,219 $ 33,562 118.2 % Basic EPS $ (1.28) $ 0.44 (390.4) % Diluted EPS(2) $ (1.28) $ 0.36 (455.0) % Adjusted EPS(1,2) $ 0.83 $ 0.39 113.1 % (1) Non-GAAP Financial Measures: Adjusted Net Income and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See "Reconciliation of Non-GAAP Financial Measures" below for a detailed description and reconciliation of such Non-GAAP financial measures to their most directly comparable GAAP financial measures. (2) Diluted EPS calculated on a GAAP basis excludes dilutive securities, including Class V Voting Stock, restricted stock units, performance stock units, and stock options in any periods in which their inclusion would have an antidilutive effect. Key Performance Metrics The following tables represent key quarterly metrics (in thousands, except percentage metrics). As of and for the Three Months Ended June 30, March 31, June 30, (Unaudited) 2025 2025 2024 Total net originations(a) $ 233,873 $ 189,168 $ 205,549 Total retained net originations(a) $ 205,706 $ 168,963 $ 189,344 Ending receivables(b) $ 437,750 $ 406,579 $ 387,086 Net charge-offs as % of total revenue(c) 32 % 35 % 33 % Net charge-offs as % of average receivables, annualized(c) 43 % 47 % 44 % Average yield, annualized(d) 136 % 136 % 135 % Auto-approval rate(e) 80 % 79 % 76 % (a) Total net originations are defined as gross originations net of transferred balance on refinanced loans, while total retained net originations are defined as the portion of total net originations with respect to which the Company ultimately purchased a receivable from bank partners. (b) Ending receivables are defined as the unpaid principal balances of loans at the end of the reporting period. (c) Net charge-offs as a percentage of total revenue and net charge-offs as a percentage of average receivables represent total charge-offs from the period less recoveries as a percentage of total revenue and as a percentage of average receivables. Net charge-offs as a percentage of average receivables is presented as an annualized metric. Finance receivables are charged off at the earlier of the time when accounts reach 90 days past due on a recency basis, when OppFi receives notification of a customer bankruptcy or is otherwise deemed uncollectible. (d) Average yield is defined as total revenue from the period as a percent of average receivables and is presented as an annualized metric. (e) Auto-approval rate is calculated by taking the number of approved loans that are not decisioned by a loan processor or underwriter (auto- approval) divided by the total number of loans approved. 3

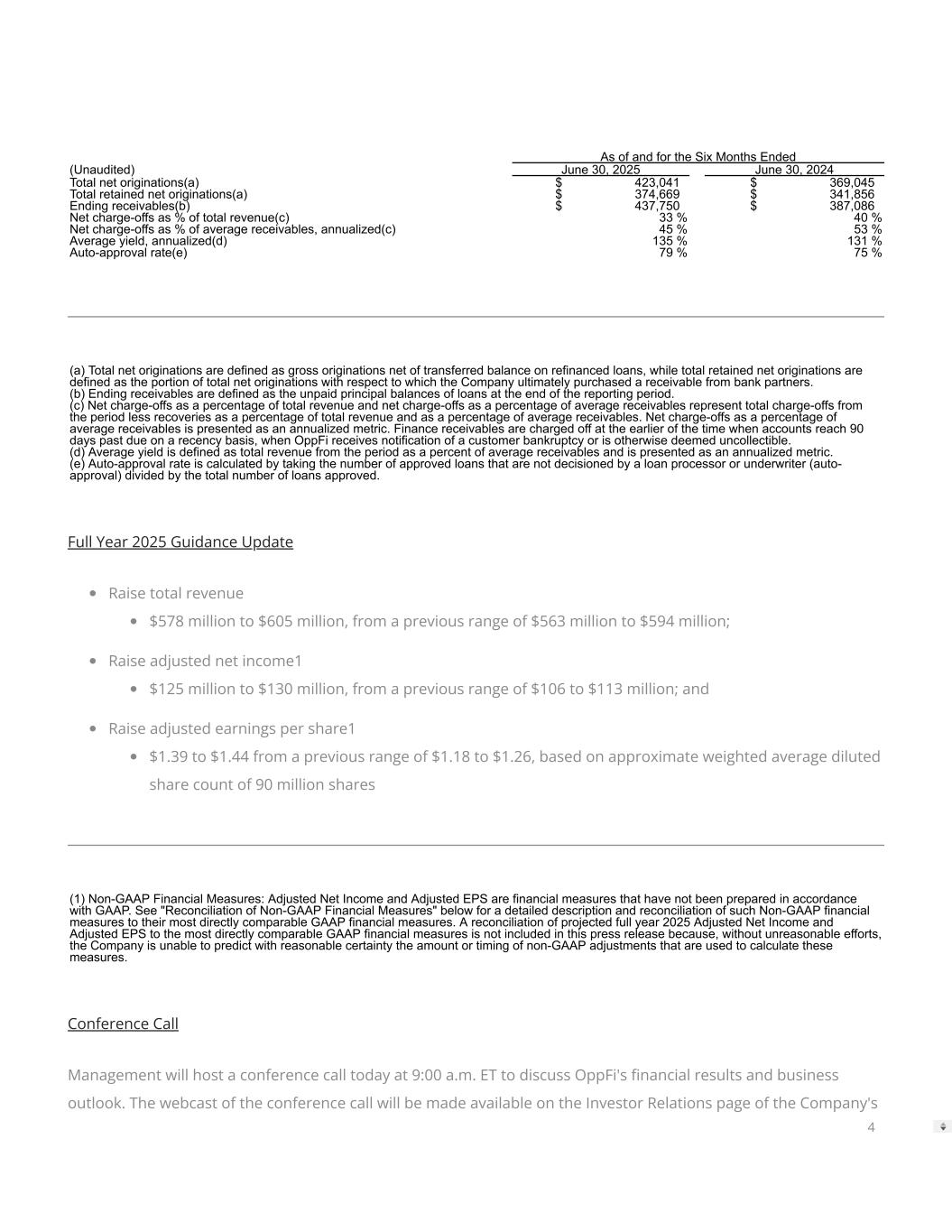

As of and for the Six Months Ended (Unaudited) June 30, 2025 June 30, 2024 Total net originations(a) $ 423,041 $ 369,045 Total retained net originations(a) $ 374,669 $ 341,856 Ending receivables(b) $ 437,750 $ 387,086 Net charge-offs as % of total revenue(c) 33 % 40 % Net charge-offs as % of average receivables, annualized(c) 45 % 53 % Average yield, annualized(d) 135 % 131 % Auto-approval rate(e) 79 % 75 % (a) Total net originations are defined as gross originations net of transferred balance on refinanced loans, while total retained net originations are defined as the portion of total net originations with respect to which the Company ultimately purchased a receivable from bank partners. (b) Ending receivables are defined as the unpaid principal balances of loans at the end of the reporting period. (c) Net charge-offs as a percentage of total revenue and net charge-offs as a percentage of average receivables represent total charge-offs from the period less recoveries as a percentage of total revenue and as a percentage of average receivables. Net charge-offs as a percentage of average receivables is presented as an annualized metric. Finance receivables are charged off at the earlier of the time when accounts reach 90 days past due on a recency basis, when OppFi receives notification of a customer bankruptcy or is otherwise deemed uncollectible. (d) Average yield is defined as total revenue from the period as a percent of average receivables and is presented as an annualized metric. (e) Auto-approval rate is calculated by taking the number of approved loans that are not decisioned by a loan processor or underwriter (auto- approval) divided by the total number of loans approved. Full Year 2025 Guidance Update Raise total revenue $578 million to $605 million, from a previous range of $563 million to $594 million; Raise adjusted net income1 $125 million to $130 million, from a previous range of $106 to $113 million; and Raise adjusted earnings per share1 $1.39 to $1.44 from a previous range of $1.18 to $1.26, based on approximate weighted average diluted share count of 90 million shares (1) Non-GAAP Financial Measures: Adjusted Net Income and Adjusted EPS are financial measures that have not been prepared in accordance with GAAP. See "Reconciliation of Non-GAAP Financial Measures" below for a detailed description and reconciliation of such Non-GAAP financial measures to their most directly comparable GAAP financial measures. A reconciliation of projected full year 2025 Adjusted Net Income and Adjusted EPS to the most directly comparable GAAP financial measures is not included in this press release because, without unreasonable efforts, the Company is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these measures. Conference Call Management will host a conference call today at 9:00 a.m. ET to discuss OppFi's �nancial results and business outlook. The webcast of the conference call will be made available on the Investor Relations page of the Company's 4

website. The conference call can also be accessed with the following dial-in information: Domestic: (800) 343-4136 International: (203) 518-9843 Conference ID: OPPFI An archived version of the webcast will be available on OppFi's website. About OppFi OppFi (NYSE: OPFI) is a tech-enabled digital �nance platform that partners with banks to o�er �nancial products and services to everyday Americans. Through this transparent and responsible platform, which emphasizes �nancial inclusion and exceptional customer experience, the Company assists consumers who are underserved by traditional �nancing options in building improved �nancial health. OppLoans by OppFi maintains a 4.5/5.0 star rating on Trustpilot based on over 4,900 reviews, positioning the Company among the top consumer-rated �nancial platforms online. OppFi also holds a 35% equity interest in Bitty Holdings, LLC ("Bitty"), a credit access company that provides revenue-based �nancing and other working capital solutions to small businesses. For additional information, please visit opp�.com. Contacts: Investor Relations: Mike Gallentine Head of Investor Relations mgallentine@opp�.com Media Relations: media@opp�.com Forward-Looking Statements This press release includes "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. OppFi's actual results may di�er from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," 5

"intend," "plan," "may," "will," "could," "should," "believes," "predicts," "potential," "possible," "continue," and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, without limitation, OppFi's expectations with respect to its full year 2025 guidance, the future performance of OppFi's platform, and expectations for OppFi's growth and future �nancial performance. These forward-looking statements are based on OppFi's current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These forward-looking statements involve signi�cant risks and uncertainties that could cause the actual results to di�er materially from the expected results. Most of these factors are outside OppFi's control and are di�cult to predict. Factors that may cause such di�erences include, but are not limited to: the impact of general economic conditions, including economic slowdowns, in�ation, interest rate changes, recessions, the impact of tari�s, and tightening of credit markets on OppFi's business; the impact of challenging macroeconomic and marketplace conditions; the impact of stimulus or other government programs; whether OppFi will be successful in obtaining declaratory relief against the Commissioner of the Department of Financial Protection and Innovation for the State of California; whether OppFi will be subject to AB 539; whether OppFi's bank partners will continue to lend in California and whether OppFi's �nancing sources will continue to �nance the purchase of participation rights in loans originated by OppFi's bank partners in California; OppFi's ability to scale and grow the Bitty business; the impact that events involving �nancial institutions or the �nancial services industry generally, such as actual concerns or events involving liquidity, defaults, or non- performance, may have on OppFi's business; risks related to any material weakness in OppFi's internal controls over �nancial reporting; the ability of OppFi to grow and manage growth pro�tably and retain its key employees; risks related to new products; risks related to evaluating and potentially consummating acquisitions; concentration risk; risks related to OppFi's ability to comply with various covenants in its corporate and warehouse credit facilities; risks related to potential litigation; changes in applicable laws or regulations, including, but not limited to, impacts from the One Big Beautiful Bill Act; the possibility that OppFi may be adversely a�ected by other economic, business, and/or competitive factors; risks related to management transitions; and other risks and uncertainties indicated from time to time in OppFi's �lings with the United States Securities and Exchange Commission, in particular, contained in the section or sections captioned "Risk Factors." OppFi cautions that the foregoing list of factors is not exclusive, and readers should not place undue reliance upon any forward-looking statements, which speak only as of the date made. OppFi does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to re�ect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Non-GAAP Financial Measures This press release includes certain non-GAAP �nancial measures that are unaudited and do not conform to GAAP, such as Adjusted EBT, Adjusted Net Income, and Adjusted EPS. Adjusted EBT is de�ned as Net Income, adjusted for 6

(1) income tax expense; (2) change in fair value of warrant liabilities; (3) other adjustments, net; and (4) other income. Adjusted Net Income is de�ned as Adjusted EBT as de�ned above, adjusted for taxes assuming a tax rate for each period presented that re�ects the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with other publicly traded companies. Adjusted EPS is de�ned as Adjusted Net Income as de�ned above, divided by weighted average diluted shares outstanding, which represents shares of both classes of common stock outstanding and includes the impact of dilutive securities, such as restricted stock units, performance stock units, and stock options. The earnout units were not earned pursuant to the earnout provisions of the Business Combination Agreement on or prior to July 21, 2024, the third anniversary of the closing date of the Company's business combination. Accordingly, on such date the earnout units and associated Class V Voting Stock were forfeited. These non-GAAP �nancial measures have not been prepared in accordance with accounting principles generally accepted in the United States and may be di�erent from non-GAAP �nancial measures used by other companies. OppFi believes that the use of these non-GAAP �nancial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. These non-GAAP measures with comparable names should not be considered in isolation from, or as an alternative to, �nancial measures determined in accordance with GAAP. See "Reconciliation of Non-GAAP Financial Measures" below for reconciliations for OppFi's non-GAAP �nancial measures to the most directly comparable GAAP �nancial measures. A reconciliation of projected full year 2025 Adjusted Net Income and Adjusted EPS to the most directly comparable GAAP �nancial measures is not included in this press release because, without unreasonable e�orts, the Company is unable to predict with reasonable certainty the amount or timing of non-GAAP adjustments that are used to calculate these measures. First Quarter Results of Operations Consolidated Statements of Operations The following tables present consolidated results of operations for the three and six months ended June 30, 2025 and 2024 (in thousands, except share and per share data). Certain columns and rows may not sum due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole- dollar amounts. Comparison of the three months ended June 30, 2025 and 2024 Three Months Ended June 30, Change (Unaudited) 2025 2024 $ % Interest and loan related income $ 141,144 $ 125,076 $ 16,068 12.8 % Other revenue 1,299 1,228 71 5.8 Total revenue 142,443 126,304 16,139 12.8 7

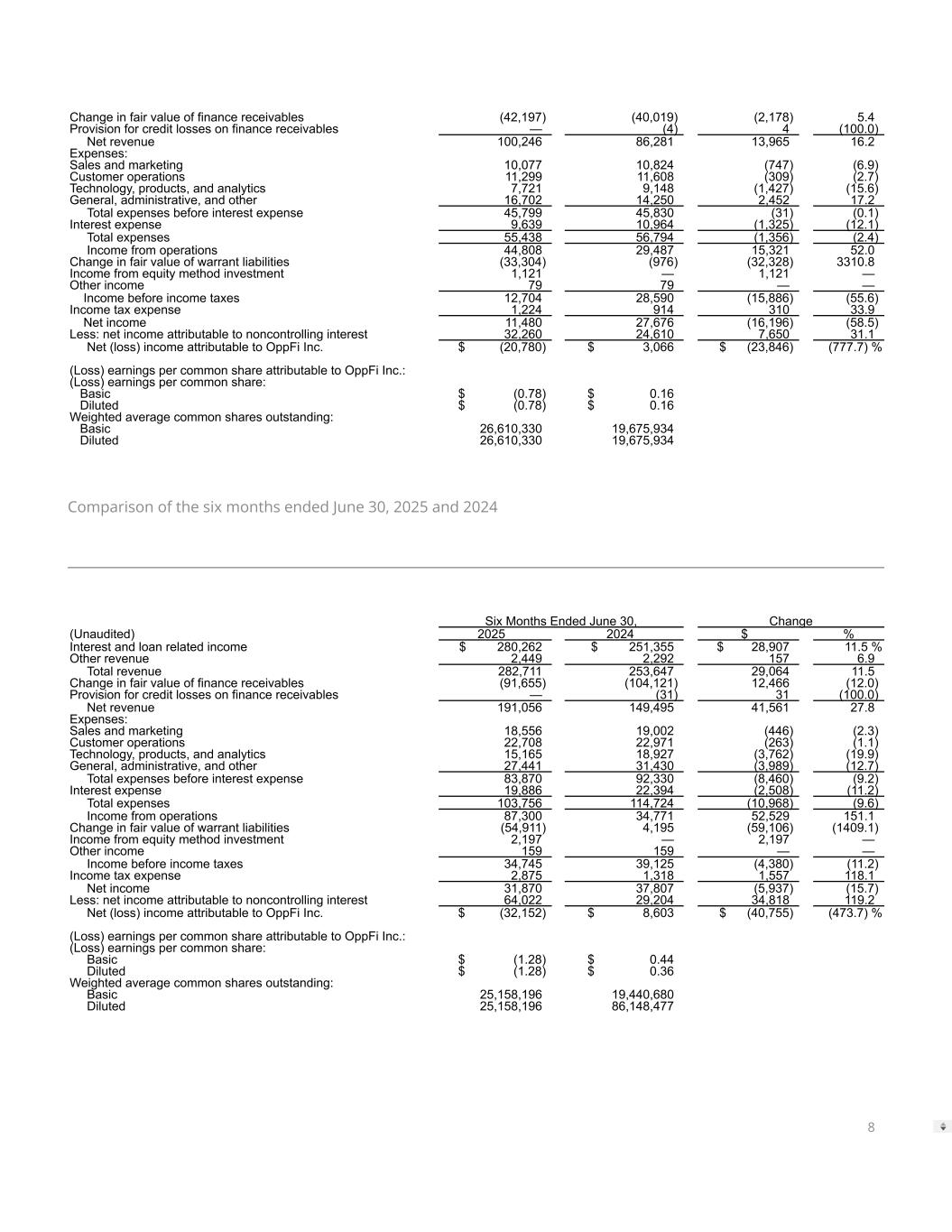

Change in fair value of finance receivables (42,197) (40,019) (2,178) 5.4 Provision for credit losses on finance receivables — (4) 4 (100.0) Net revenue 100,246 86,281 13,965 16.2 Expenses: Sales and marketing 10,077 10,824 (747) (6.9) Customer operations 11,299 11,608 (309) (2.7) Technology, products, and analytics 7,721 9,148 (1,427) (15.6) General, administrative, and other 16,702 14,250 2,452 17.2 Total expenses before interest expense 45,799 45,830 (31) (0.1) Interest expense 9,639 10,964 (1,325) (12.1) Total expenses 55,438 56,794 (1,356) (2.4) Income from operations 44,808 29,487 15,321 52.0 Change in fair value of warrant liabilities (33,304) (976) (32,328) 3310.8 Income from equity method investment 1,121 — 1,121 — Other income 79 79 — — Income before income taxes 12,704 28,590 (15,886) (55.6) Income tax expense 1,224 914 310 33.9 Net income 11,480 27,676 (16,196) (58.5) Less: net income attributable to noncontrolling interest 32,260 24,610 7,650 31.1 Net (loss) income attributable to OppFi Inc. $ (20,780) $ 3,066 $ (23,846) (777.7) % (Loss) earnings per common share attributable to OppFi Inc.: (Loss) earnings per common share: Basic $ (0.78) $ 0.16 Diluted $ (0.78) $ 0.16 Weighted average common shares outstanding: Basic 26,610,330 19,675,934 Diluted 26,610,330 19,675,934 Comparison of the six months ended June 30, 2025 and 2024 Six Months Ended June 30, Change (Unaudited) 2025 2024 $ % Interest and loan related income $ 280,262 $ 251,355 $ 28,907 11.5 % Other revenue 2,449 2,292 157 6.9 Total revenue 282,711 253,647 29,064 11.5 Change in fair value of finance receivables (91,655) (104,121) 12,466 (12.0) Provision for credit losses on finance receivables — (31) 31 (100.0) Net revenue 191,056 149,495 41,561 27.8 Expenses: Sales and marketing 18,556 19,002 (446) (2.3) Customer operations 22,708 22,971 (263) (1.1) Technology, products, and analytics 15,165 18,927 (3,762) (19.9) General, administrative, and other 27,441 31,430 (3,989) (12.7) Total expenses before interest expense 83,870 92,330 (8,460) (9.2) Interest expense 19,886 22,394 (2,508) (11.2) Total expenses 103,756 114,724 (10,968) (9.6) Income from operations 87,300 34,771 52,529 151.1 Change in fair value of warrant liabilities (54,911) 4,195 (59,106) (1409.1) Income from equity method investment 2,197 — 2,197 — Other income 159 159 — — Income before income taxes 34,745 39,125 (4,380) (11.2) Income tax expense 2,875 1,318 1,557 118.1 Net income 31,870 37,807 (5,937) (15.7) Less: net income attributable to noncontrolling interest 64,022 29,204 34,818 119.2 Net (loss) income attributable to OppFi Inc. $ (32,152) $ 8,603 $ (40,755) (473.7) % (Loss) earnings per common share attributable to OppFi Inc.: (Loss) earnings per common share: Basic $ (1.28) $ 0.44 Diluted $ (1.28) $ 0.36 Weighted average common shares outstanding: Basic 25,158,196 19,440,680 Diluted 25,158,196 86,148,477 8

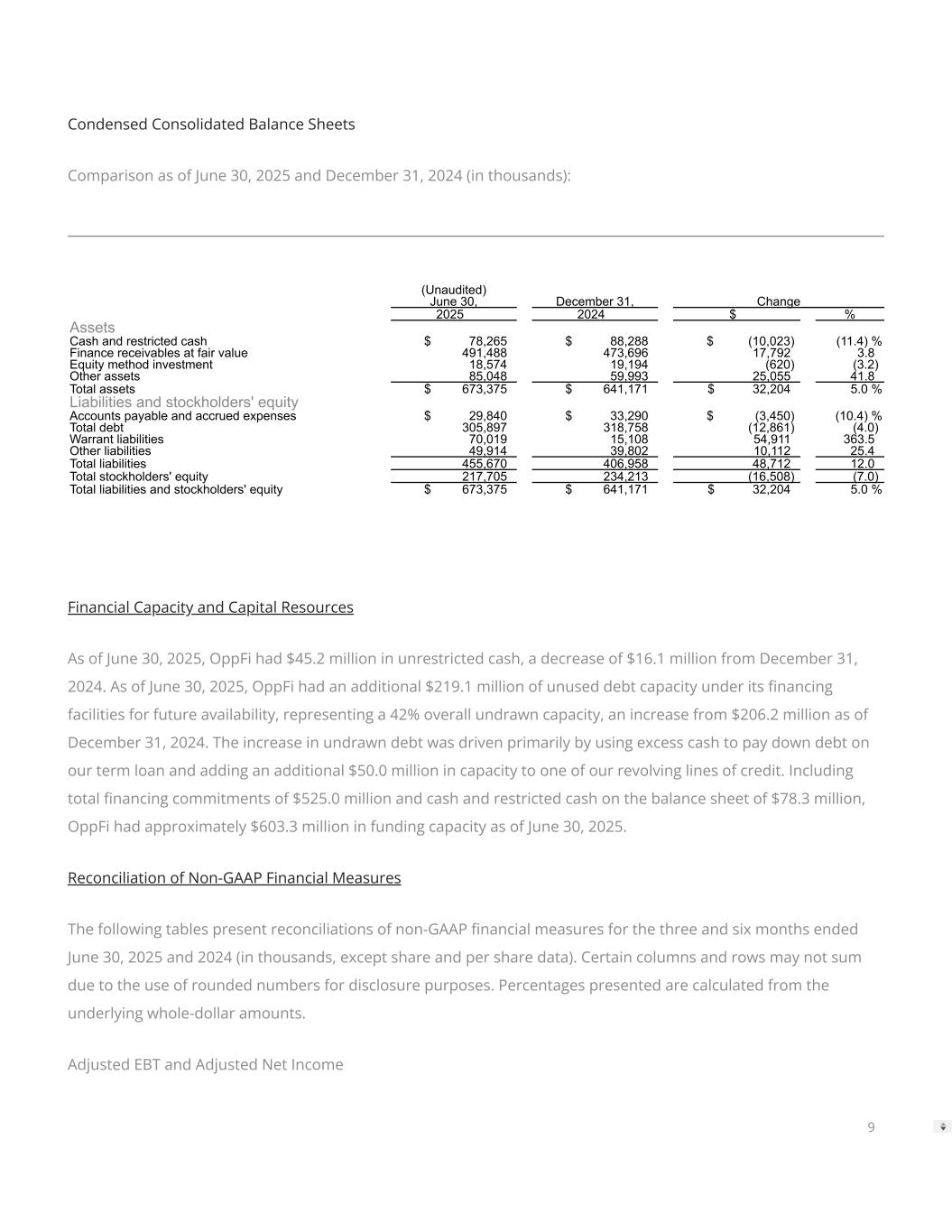

Condensed Consolidated Balance Sheets Comparison as of June 30, 2025 and December 31, 2024 (in thousands): (Unaudited) June 30, December 31, Change 2025 2024 $ % Assets Cash and restricted cash $ 78,265 $ 88,288 $ (10,023) (11.4) % Finance receivables at fair value 491,488 473,696 17,792 3.8 Equity method investment 18,574 19,194 (620) (3.2) Other assets 85,048 59,993 25,055 41.8 Total assets $ 673,375 $ 641,171 $ 32,204 5.0 % Liabilities and stockholders' equity Accounts payable and accrued expenses $ 29,840 $ 33,290 $ (3,450) (10.4) % Total debt 305,897 318,758 (12,861) (4.0) Warrant liabilities 70,019 15,108 54,911 363.5 Other liabilities 49,914 39,802 10,112 25.4 Total liabilities 455,670 406,958 48,712 12.0 Total stockholders' equity 217,705 234,213 (16,508) (7.0) Total liabilities and stockholders' equity $ 673,375 $ 641,171 $ 32,204 5.0 % Financial Capacity and Capital Resources As of June 30, 2025, OppFi had $45.2 million in unrestricted cash, a decrease of $16.1 million from December 31, 2024. As of June 30, 2025, OppFi had an additional $219.1 million of unused debt capacity under its �nancing facilities for future availability, representing a 42% overall undrawn capacity, an increase from $206.2 million as of December 31, 2024. The increase in undrawn debt was driven primarily by using excess cash to pay down debt on our term loan and adding an additional $50.0 million in capacity to one of our revolving lines of credit. Including total �nancing commitments of $525.0 million and cash and restricted cash on the balance sheet of $78.3 million, OppFi had approximately $603.3 million in funding capacity as of June 30, 2025. Reconciliation of Non-GAAP Financial Measures The following tables present reconciliations of non-GAAP �nancial measures for the three and six months ended June 30, 2025 and 2024 (in thousands, except share and per share data). Certain columns and rows may not sum due to the use of rounded numbers for disclosure purposes. Percentages presented are calculated from the underlying whole-dollar amounts. Adjusted EBT and Adjusted Net Income 9

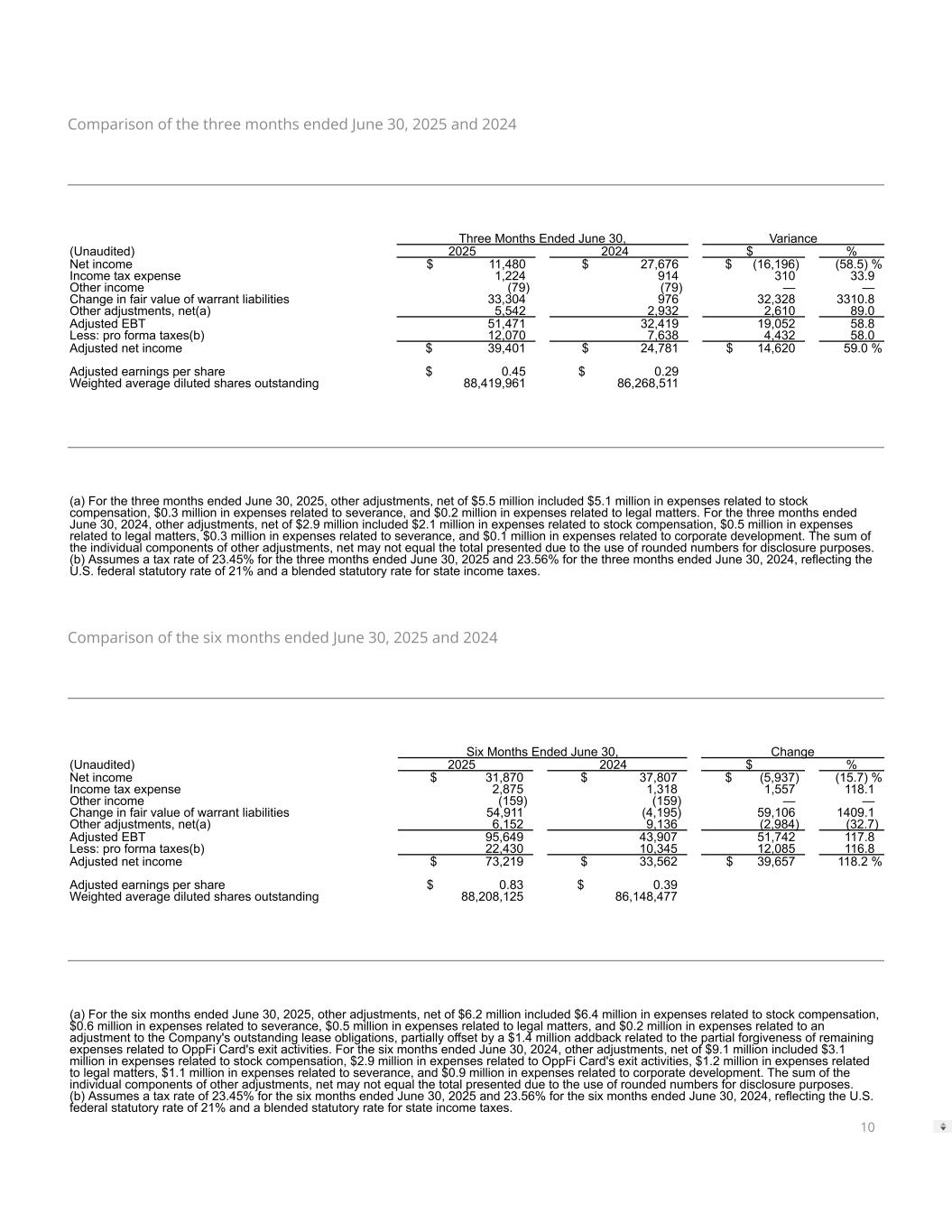

Comparison of the three months ended June 30, 2025 and 2024 Three Months Ended June 30, Variance (Unaudited) 2025 2024 $ % Net income $ 11,480 $ 27,676 $ (16,196) (58.5) % Income tax expense 1,224 914 310 33.9 Other income (79) (79) — — Change in fair value of warrant liabilities 33,304 976 32,328 3310.8 Other adjustments, net(a) 5,542 2,932 2,610 89.0 Adjusted EBT 51,471 32,419 19,052 58.8 Less: pro forma taxes(b) 12,070 7,638 4,432 58.0 Adjusted net income $ 39,401 $ 24,781 $ 14,620 59.0 % Adjusted earnings per share $ 0.45 $ 0.29 Weighted average diluted shares outstanding 88,419,961 86,268,511 (a) For the three months ended June 30, 2025, other adjustments, net of $5.5 million included $5.1 million in expenses related to stock compensation, $0.3 million in expenses related to severance, and $0.2 million in expenses related to legal matters. For the three months ended June 30, 2024, other adjustments, net of $2.9 million included $2.1 million in expenses related to stock compensation, $0.5 million in expenses related to legal matters, $0.3 million in expenses related to severance, and $0.1 million in expenses related to corporate development. The sum of the individual components of other adjustments, net may not equal the total presented due to the use of rounded numbers for disclosure purposes. (b) Assumes a tax rate of 23.45% for the three months ended June 30, 2025 and 23.56% for the three months ended June 30, 2024, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes. Comparison of the six months ended June 30, 2025 and 2024 Six Months Ended June 30, Change (Unaudited) 2025 2024 $ % Net income $ 31,870 $ 37,807 $ (5,937) (15.7) % Income tax expense 2,875 1,318 1,557 118.1 Other income (159) (159) — — Change in fair value of warrant liabilities 54,911 (4,195) 59,106 1409.1 Other adjustments, net(a) 6,152 9,136 (2,984) (32.7) Adjusted EBT 95,649 43,907 51,742 117.8 Less: pro forma taxes(b) 22,430 10,345 12,085 116.8 Adjusted net income $ 73,219 $ 33,562 $ 39,657 118.2 % Adjusted earnings per share $ 0.83 $ 0.39 Weighted average diluted shares outstanding 88,208,125 86,148,477 (a) For the six months ended June 30, 2025, other adjustments, net of $6.2 million included $6.4 million in expenses related to stock compensation, $0.6 million in expenses related to severance, $0.5 million in expenses related to legal matters, and $0.2 million in expenses related to an adjustment to the Company's outstanding lease obligations, partially offset by a $1.4 million addback related to the partial forgiveness of remaining expenses related to OppFi Card's exit activities. For the six months ended June 30, 2024, other adjustments, net of $9.1 million included $3.1 million in expenses related to stock compensation, $2.9 million in expenses related to OppFi Card's exit activities, $1.2 million in expenses related to legal matters, $1.1 million in expenses related to severance, and $0.9 million in expenses related to corporate development. The sum of the individual components of other adjustments, net may not equal the total presented due to the use of rounded numbers for disclosure purposes. (b) Assumes a tax rate of 23.45% for the six months ended June 30, 2025 and 23.56% for the six months ended June 30, 2024, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes. 10

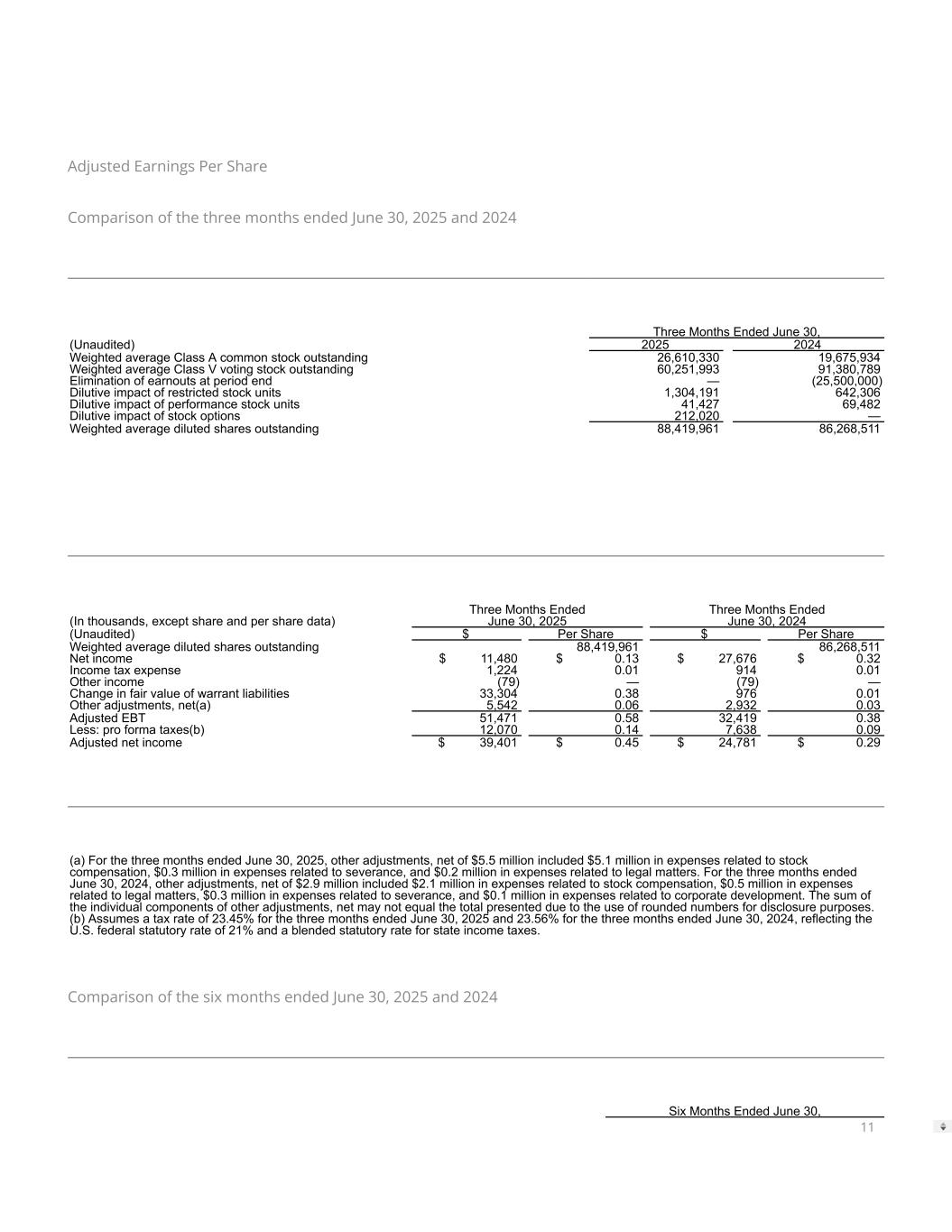

Adjusted Earnings Per Share Comparison of the three months ended June 30, 2025 and 2024 Three Months Ended June 30, (Unaudited) 2025 2024 Weighted average Class A common stock outstanding 26,610,330 19,675,934 Weighted average Class V voting stock outstanding 60,251,993 91,380,789 Elimination of earnouts at period end — (25,500,000) Dilutive impact of restricted stock units 1,304,191 642,306 Dilutive impact of performance stock units 41,427 69,482 Dilutive impact of stock options 212,020 — Weighted average diluted shares outstanding 88,419,961 86,268,511 Three Months Ended Three Months Ended (In thousands, except share and per share data) June 30, 2025 June 30, 2024 (Unaudited) $ Per Share $ Per Share Weighted average diluted shares outstanding 88,419,961 86,268,511 Net income $ 11,480 $ 0.13 $ 27,676 $ 0.32 Income tax expense 1,224 0.01 914 0.01 Other income (79) — (79) — Change in fair value of warrant liabilities 33,304 0.38 976 0.01 Other adjustments, net(a) 5,542 0.06 2,932 0.03 Adjusted EBT 51,471 0.58 32,419 0.38 Less: pro forma taxes(b) 12,070 0.14 7,638 0.09 Adjusted net income $ 39,401 $ 0.45 $ 24,781 $ 0.29 (a) For the three months ended June 30, 2025, other adjustments, net of $5.5 million included $5.1 million in expenses related to stock compensation, $0.3 million in expenses related to severance, and $0.2 million in expenses related to legal matters. For the three months ended June 30, 2024, other adjustments, net of $2.9 million included $2.1 million in expenses related to stock compensation, $0.5 million in expenses related to legal matters, $0.3 million in expenses related to severance, and $0.1 million in expenses related to corporate development. The sum of the individual components of other adjustments, net may not equal the total presented due to the use of rounded numbers for disclosure purposes. (b) Assumes a tax rate of 23.45% for the three months ended June 30, 2025 and 23.56% for the three months ended June 30, 2024, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes. Comparison of the six months ended June 30, 2025 and 2024 Six Months Ended June 30, 11

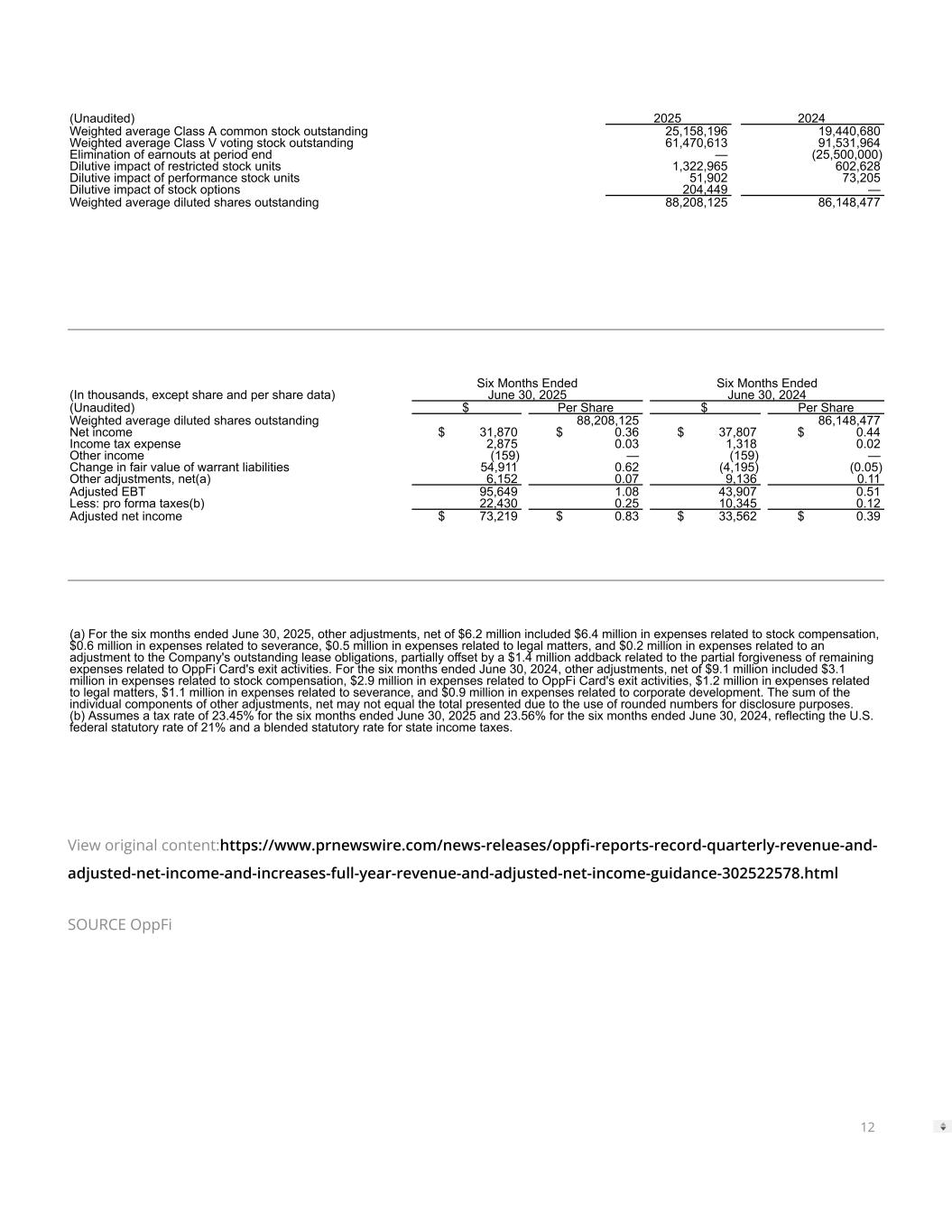

(Unaudited) 2025 2024 Weighted average Class A common stock outstanding 25,158,196 19,440,680 Weighted average Class V voting stock outstanding 61,470,613 91,531,964 Elimination of earnouts at period end — (25,500,000) Dilutive impact of restricted stock units 1,322,965 602,628 Dilutive impact of performance stock units 51,902 73,205 Dilutive impact of stock options 204,449 — Weighted average diluted shares outstanding 88,208,125 86,148,477 Six Months Ended Six Months Ended (In thousands, except share and per share data) June 30, 2025 June 30, 2024 (Unaudited) $ Per Share $ Per Share Weighted average diluted shares outstanding 88,208,125 86,148,477 Net income $ 31,870 $ 0.36 $ 37,807 $ 0.44 Income tax expense 2,875 0.03 1,318 0.02 Other income (159) — (159) — Change in fair value of warrant liabilities 54,911 0.62 (4,195) (0.05) Other adjustments, net(a) 6,152 0.07 9,136 0.11 Adjusted EBT 95,649 1.08 43,907 0.51 Less: pro forma taxes(b) 22,430 0.25 10,345 0.12 Adjusted net income $ 73,219 $ 0.83 $ 33,562 $ 0.39 (a) For the six months ended June 30, 2025, other adjustments, net of $6.2 million included $6.4 million in expenses related to stock compensation, $0.6 million in expenses related to severance, $0.5 million in expenses related to legal matters, and $0.2 million in expenses related to an adjustment to the Company's outstanding lease obligations, partially offset by a $1.4 million addback related to the partial forgiveness of remaining expenses related to OppFi Card's exit activities. For the six months ended June 30, 2024, other adjustments, net of $9.1 million included $3.1 million in expenses related to stock compensation, $2.9 million in expenses related to OppFi Card's exit activities, $1.2 million in expenses related to legal matters, $1.1 million in expenses related to severance, and $0.9 million in expenses related to corporate development. The sum of the individual components of other adjustments, net may not equal the total presented due to the use of rounded numbers for disclosure purposes. (b) Assumes a tax rate of 23.45% for the six months ended June 30, 2025 and 23.56% for the six months ended June 30, 2024, reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes. View original content:https://www.prnewswire.com/news-releases/opp�-reports-record-quarterly-revenue-and- adjusted-net-income-and-increases-full-year-revenue-and-adjusted-net-income-guidance-302522578.html SOURCE OppFi 12